Exhibit (a)(2)(i)

These materials are important and require your immediate attention. They require shareholders of Nuvei Corporation to make important decisions. If you are in doubt about how to make such decisions, please contact your financial, legal, tax or other professional advisors. If you are a shareholder of Nuvei Corporation and have any questions regarding the information contained in this Circular or require assistance in completing your form of proxy or voting instruction form, please contact Kingsdale Advisors, our strategic advisor by telephone at 1 (888) 327-0819 (toll-free in North America) or at (416) 623-4173 (outside of North America), or by email at contactus@kingsdaleadvisors.com. Questions on how to complete the letter of transmittal or your form of proxy or voting instruction form should be directed to Nuvei Corporation’s depositary, TSX Trust Company, at 1 (800) 387-0825 (toll-free in North America) or at (416) 682-3860 (outside of North America).

Shareholders in the United States should read the section “Notice to Shareholders in the United States” on page (iii) of the accompanying management proxy circular.

ARRANGEMENT

INVOLVING

NUVEI CORPORATION

AND

AN AFFILIATE OF ADVENT INTERNATIONAL, L.P.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

to be held on June 18, 2024 at 10:00 a.m. (Eastern Time), in a virtual only

format at the following link: https://web.lumiagm.com/432819058

AND

MANAGEMENT PROXY CIRCULAR

The Board of Directors (excluding interested directors) unanimously

recommends that you vote

IN FAVOUR

of the Arrangement Resolution

NEITHER THE U.S. SECURITIES AND EXCHANGE COMMISSION NOR THE SECURITIES REGULATORY AUTHORITY IN ANY STATE IN THE UNITED STATES HAS APPROVED OR DISAPPROVED OF THE ARRANGEMENT OR PASSED UPON THE FAIRNESS OR MERITS OF THE ARRANGEMENT, NOR HAS THE U.S. SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES REGULATORY AUTHORITIES OF ANY STATE IN THE UNITED STATES PASSED ON THE ADEQUACY OR ACCURACY OF THIS CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE. IN ADDITION, NEITHER THE TORONTO STOCK EXCHANGE NOR ANY CANADIAN SECURITIES REGULATORY AUTHORITY HAS IN ANY WAY PASSED UPON THE MERITS OF THE TRANSACTION DESCRIBED IN THIS CIRCULAR, AND ANY REPRESENTATION OTHERWISE IS AN OFFENCE.

May 13, 2024

May 13, 2024

Dear Shareholders:

You have an opportunity to receive a significant cash premium in exchange for your investment in Nuvei Corporation (“Nuvei” or the “Company”). This letter and the accompanying materials set out the background to the proposed transaction, the recommendation of the board of directors of Nuvei (the “Board”) and the steps required for you to take advantage of this opportunity. Please read these materials carefully and vote your shares FOR the proposed transaction.

The Board cordially invites you to attend a special meeting (the “Meeting”) of the holders (the “Shareholders”) of subordinate voting shares (the “Subordinate Voting Shares”) and multiple voting shares (the “Multiple Voting Shares” and together with the Subordinate Voting Shares, the “Shares”) of the Company, to be held as a virtual only meeting via a live webcast on June 18, 2024 at 10:00 a.m. (Eastern time) at https://web.lumiagm.com/432819058.

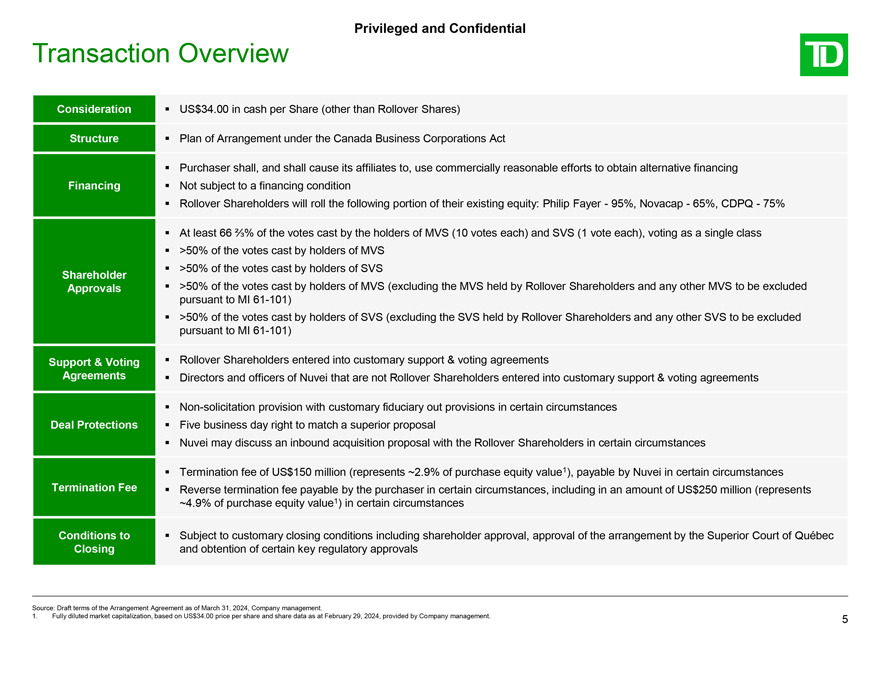

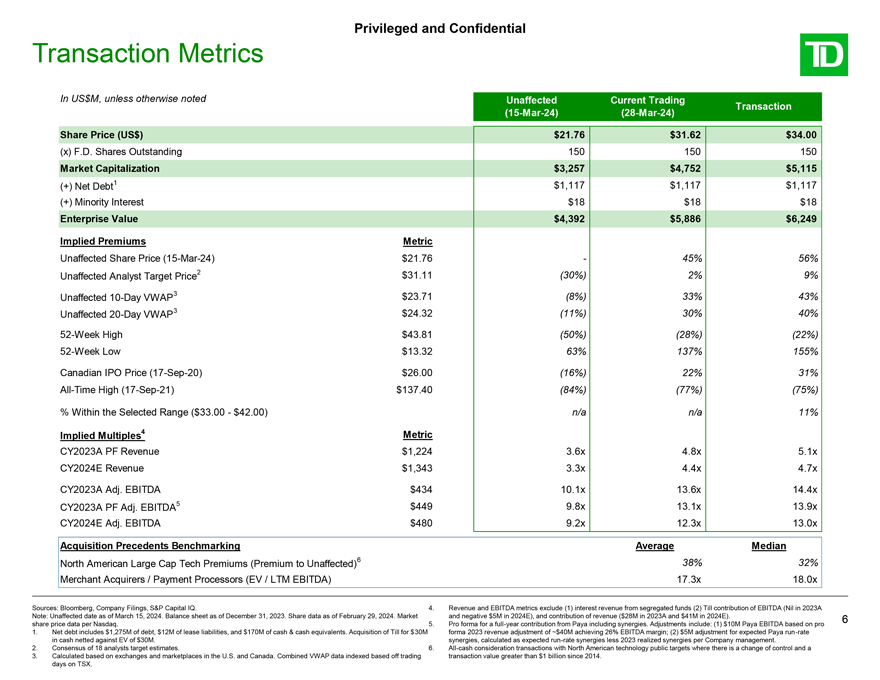

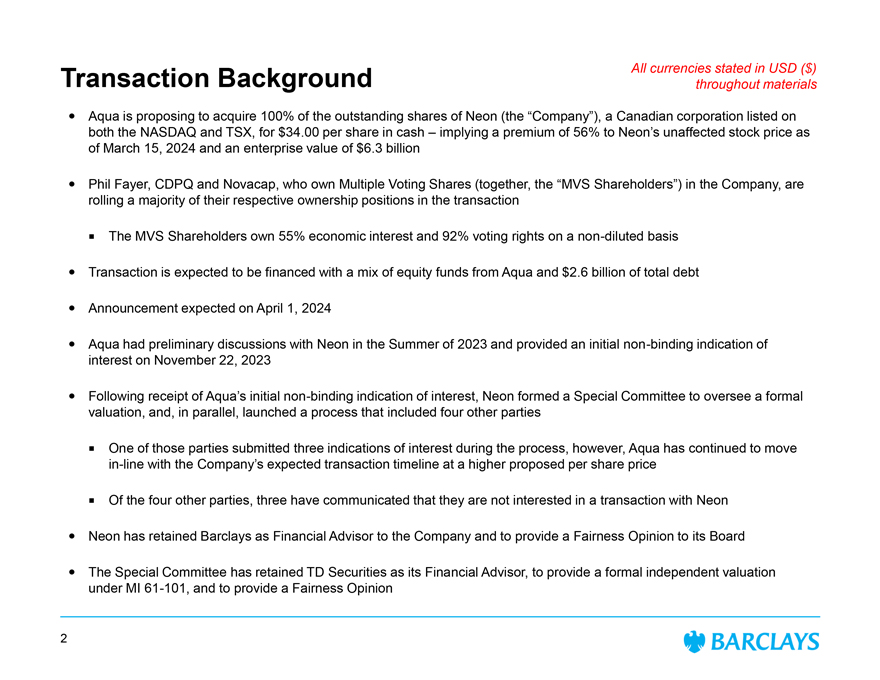

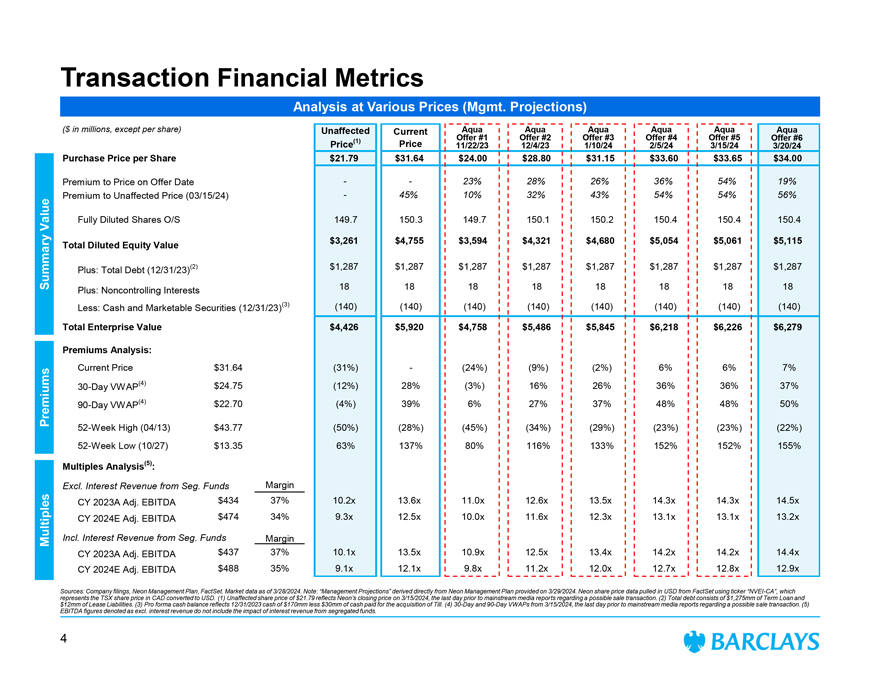

At the Meeting, pursuant to the interim order (the “Interim Order”) of the Superior Court of Québec (Commercial Division) (the “Court”) as same may be amended, the Shareholders will be asked to consider, and if deemed advisable, to pass, with or without variation, a special resolution approving a statutory plan of arrangement (the “Arrangement”) involving the Company and Neon Maple Purchaser Inc. (the “Purchaser”), a newly-formed entity controlled by Advent International, L.P. (“Advent”), one of the world’s largest and most experienced global private equity investors, pursuant to the provisions of the Canada Business Corporations Act. Pursuant to the Arrangement, the Purchaser will acquire all the issued and outstanding Shares that are not Rollover Shares (as defined below). These Shares will be acquired for a price of US$34.00 per Share, in cash (the “Consideration”).

Premium Consideration

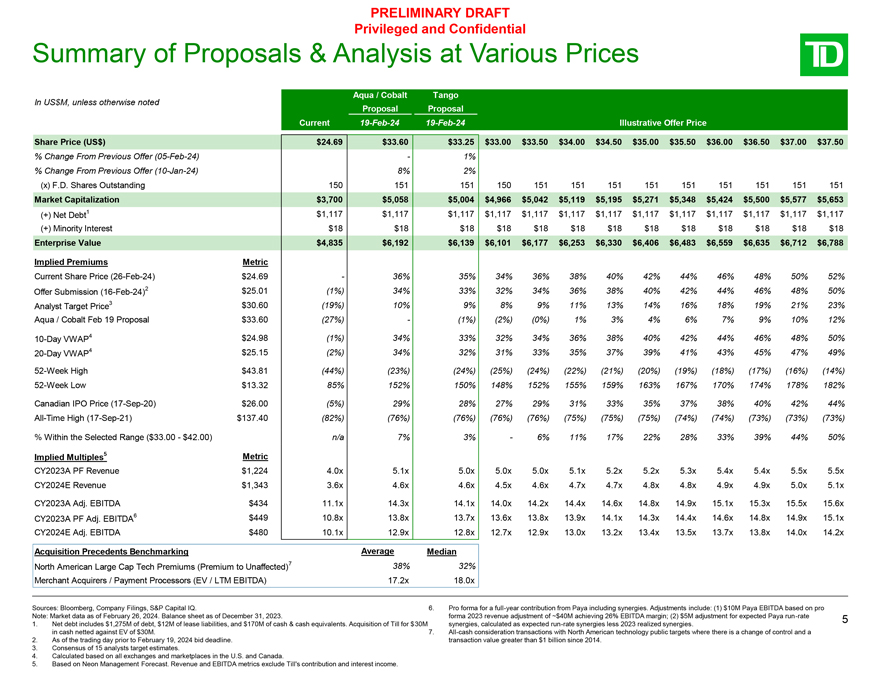

The price of US$34.00 per Share in cash represents a significant and attractive premium of approximately 56% to the closing price of the Subordinate Voting Shares on the Nasdaq Global Select Market (“Nasdaq”) on March 15, 2024, the last trading day prior to media reports regarding a potential transaction involving the Company, and a premium of approximately 48% to the 90-day volume weighted average trading price1 per Subordinate Voting Share as of such date, valuing Nuvei at an enterprise value of approximately $6.3 billion.

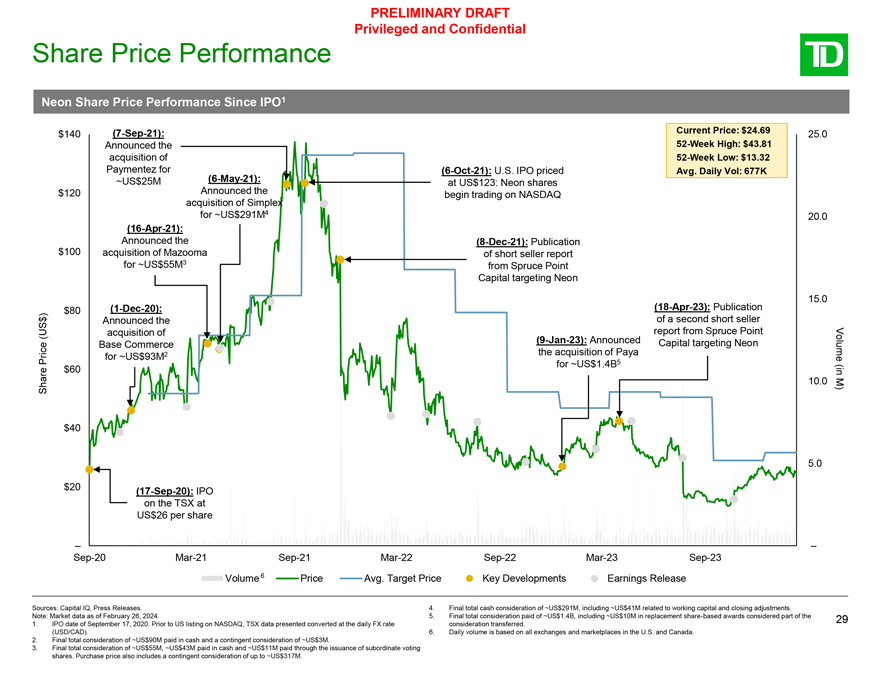

In addition, as of the date hereof, the Consideration is approximately 150% above the 52-week low for the Subordinate Voting Shares on the Nasdaq, and approximately 15% below the 52-week high for the Subordinate Voting Shares on the Nasdaq.

Recommendation of the Board

After taking into consideration, among other things, the recommendation of a Special Committee of the Board comprised of Timothy A. Dent (Chair), Daniela Mielke and Coretha Rushing, each an independent director of the Company (the “Special Committee”), the Board (excluding interested directors) has unanimously concluded that the Arrangement is in the best interest of the Company and is fair to the Shareholders (except the Rollover Shareholders (as defined below)). The Board (excluding interested

| 1 | Based on Canadian composite (Toronto Stock Exchange and all Canadian marketplaces) and U.S. composite (Nasdaq and all U.S. marketplaces). |

directors) unanimously recommends that Shareholders vote in favour of the Arrangement Resolution (as defined below).

The Board notes that Philip Fayer, the Chair and Chief Executive Officer of the Company, Pascal Tremblay and David Lewin abstained from voting on these matters because of the potential for a conflict of interest as they each may have an interest, directly or indirectly, in the Arrangement.

The recommendation of the Board is based on factors and considerations set out in detail in the accompanying Circular (as defined below), including notably:

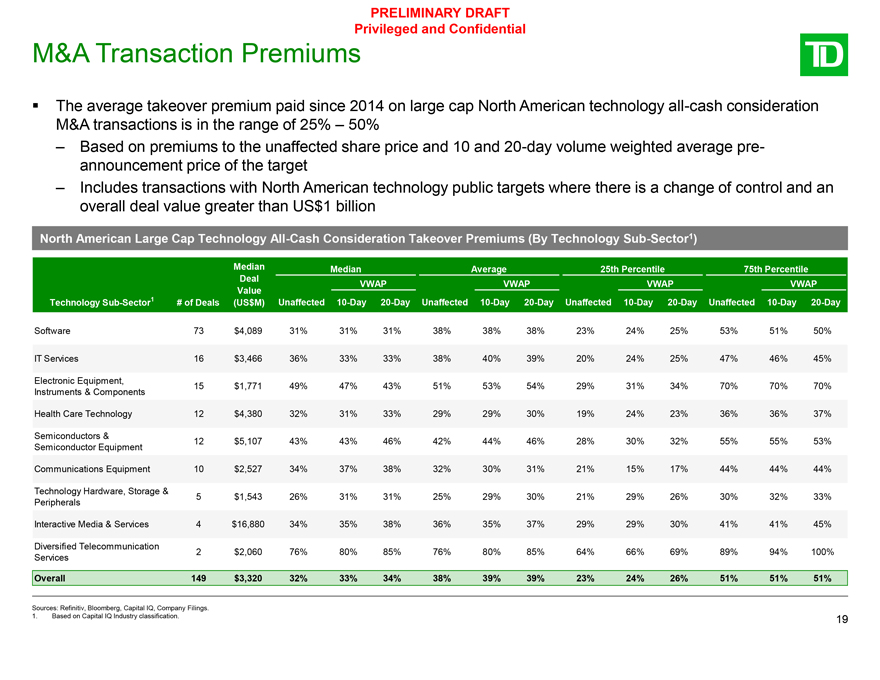

| • | Attractive Premium to Shareholders. The Consideration represents a significant and attractive premium of approximately 56% to the closing price of the Subordinate Voting Shares on the Nasdaq on March 15, 2024, the last trading day prior to media reports regarding a potential transaction involving the Company, and a premium of approximately 48% to the 90-day volume weighted average trading price2 per Subordinate Voting Share as of such date. |

| • | Maximum Consideration. The Special Committee concluded, after extensive negotiations with the Purchaser, that the Consideration, which represents an increase of approximately 42% from the consideration initially proposed by it, was the highest price that could be obtained from the Purchaser and that further negotiation could have caused the Purchaser to withdraw its proposal, having regard, notably, to the fact that the Purchaser indicated that the Consideration was its “best and final” offer, which would have deprived the Shareholders of the opportunity to evaluate and vote in respect of the Arrangement. |

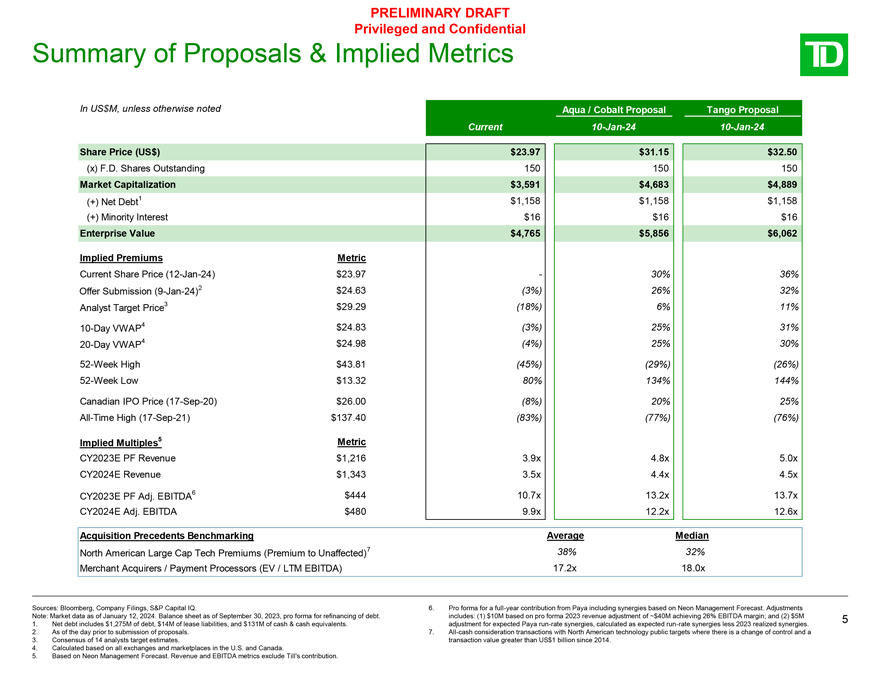

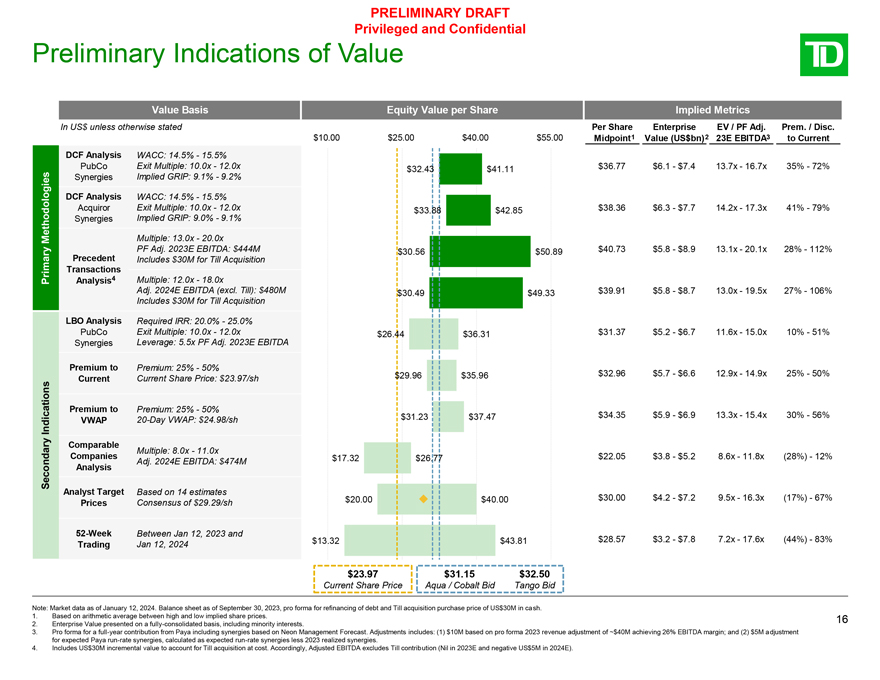

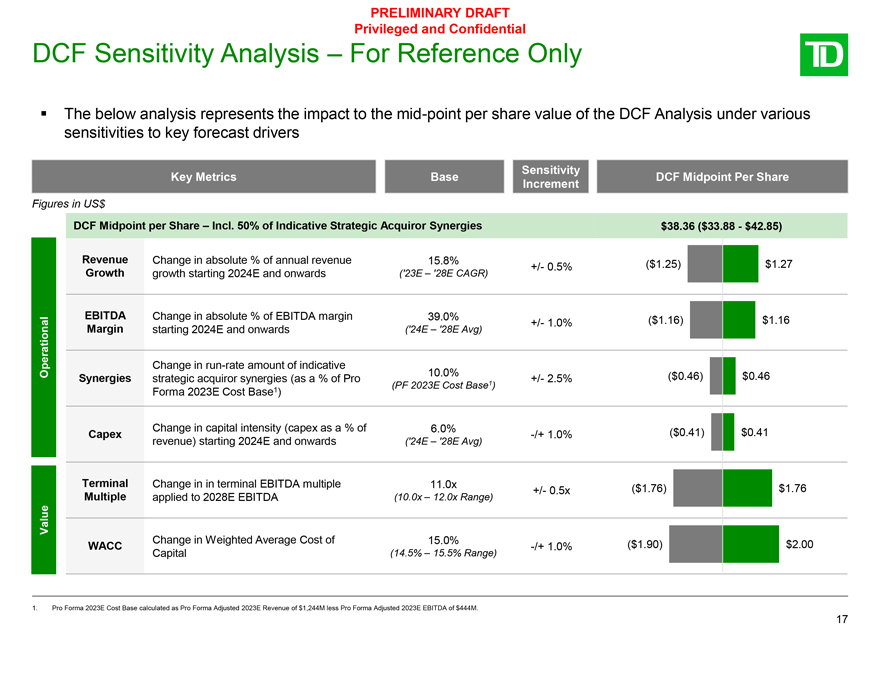

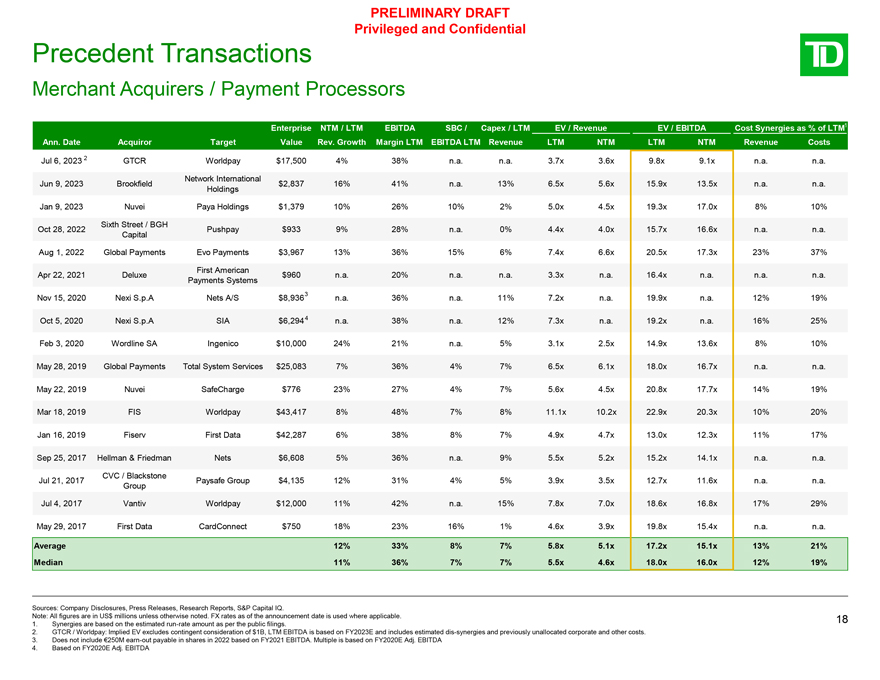

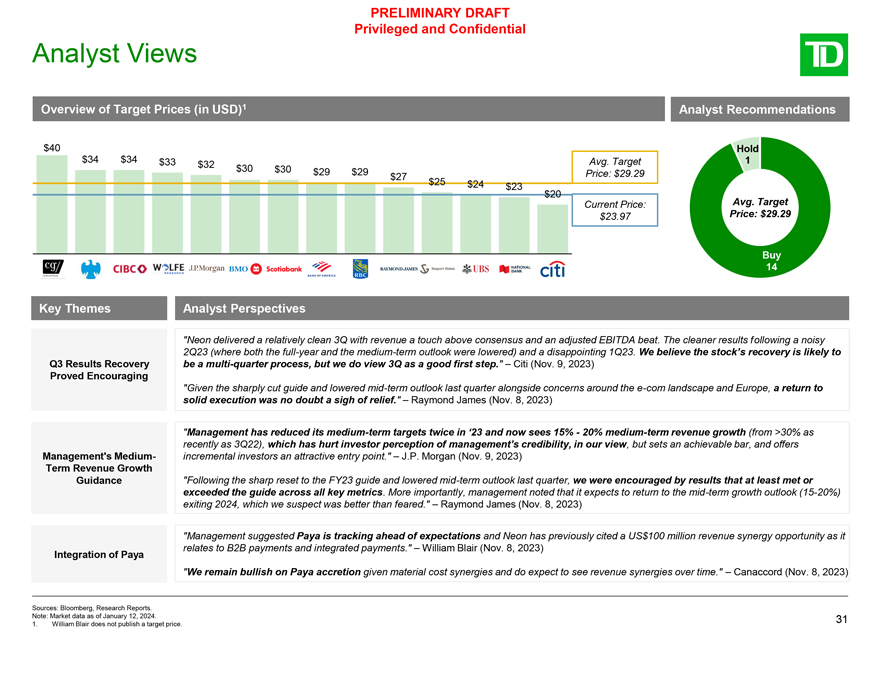

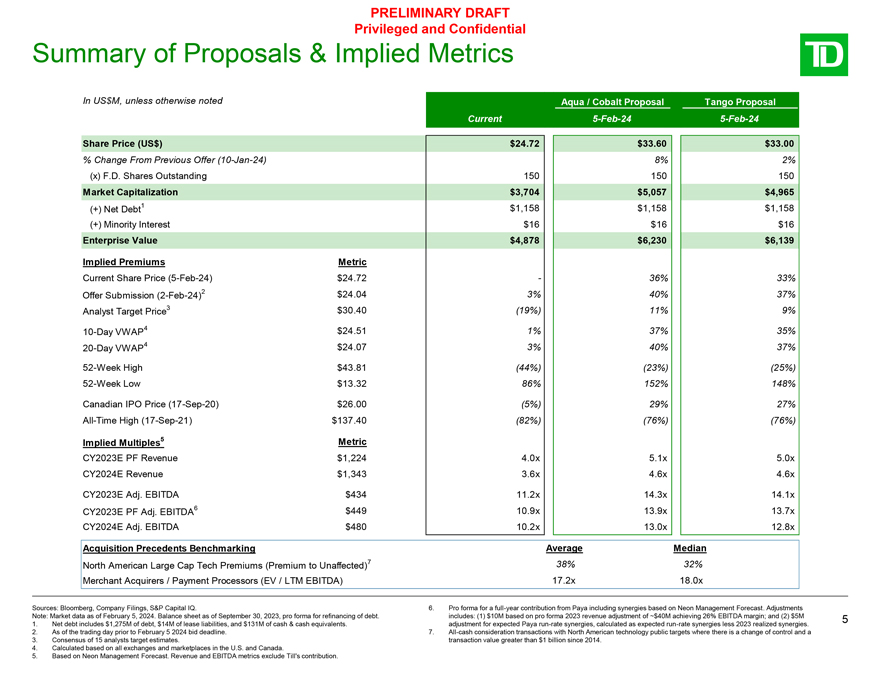

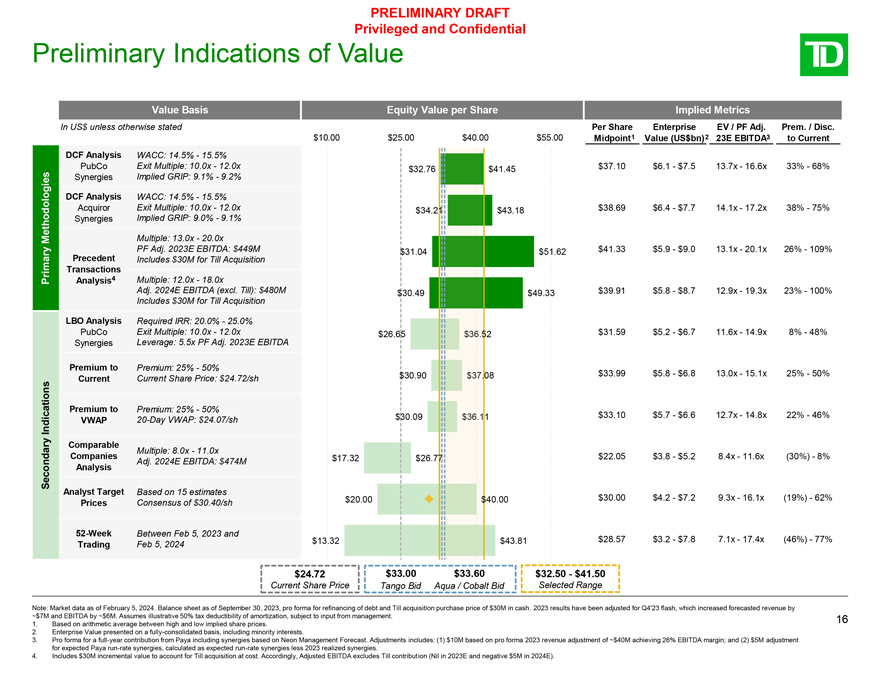

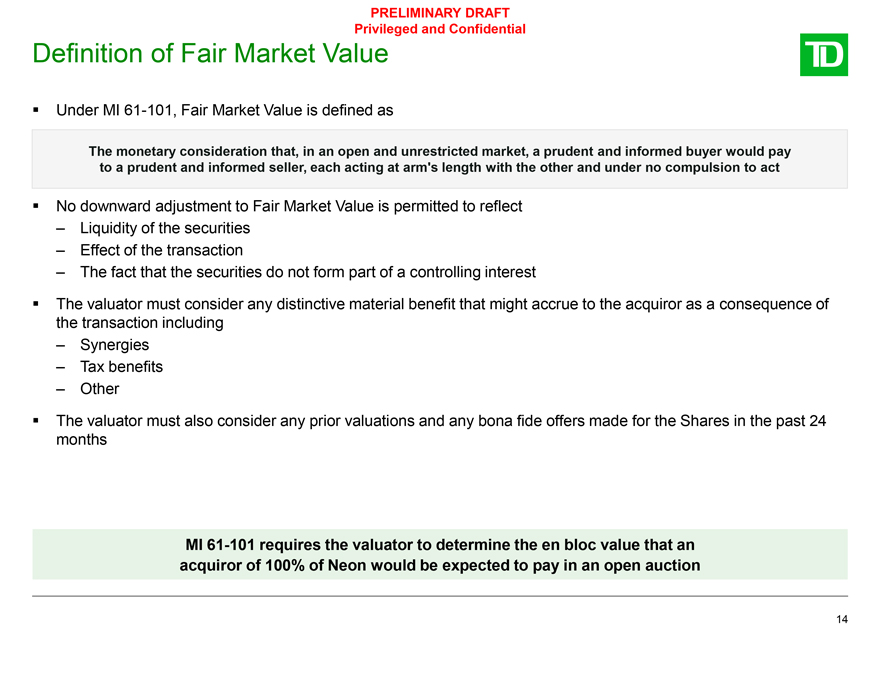

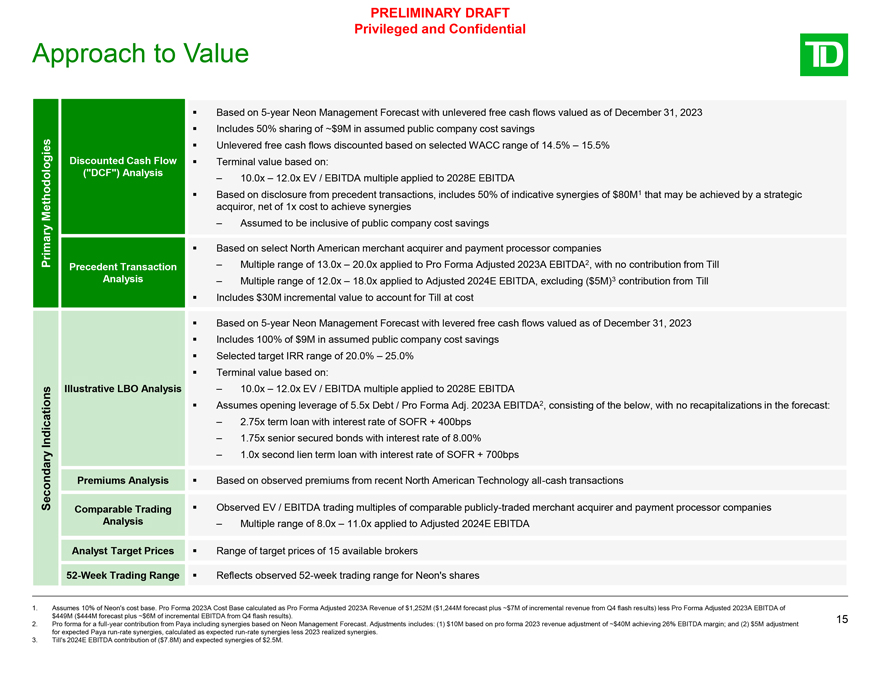

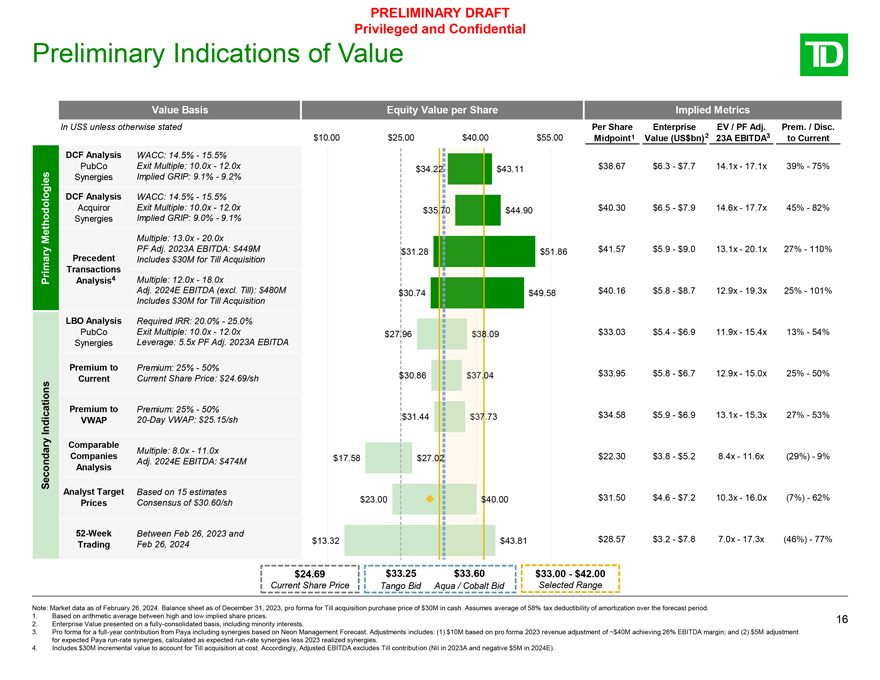

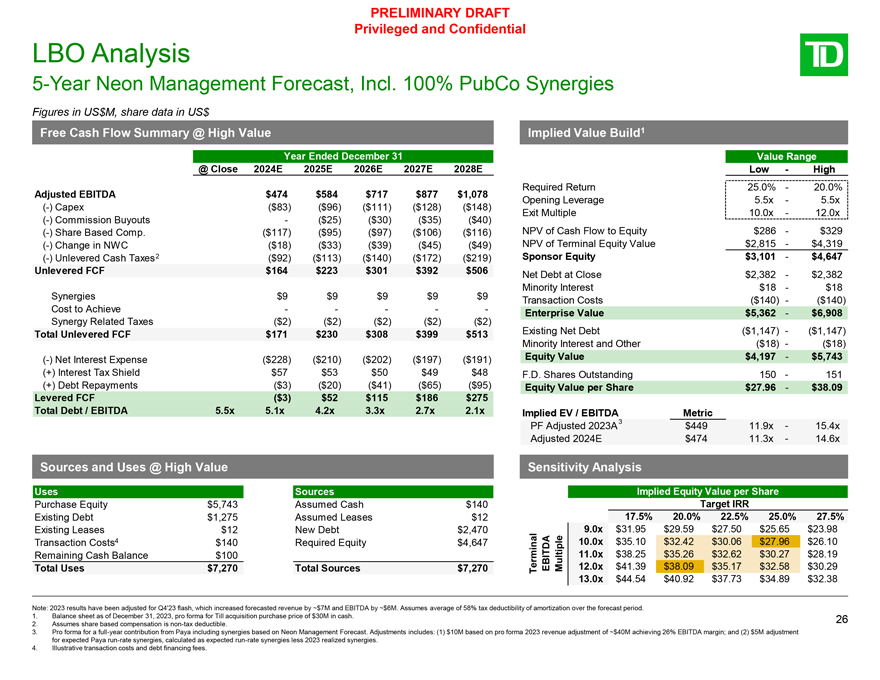

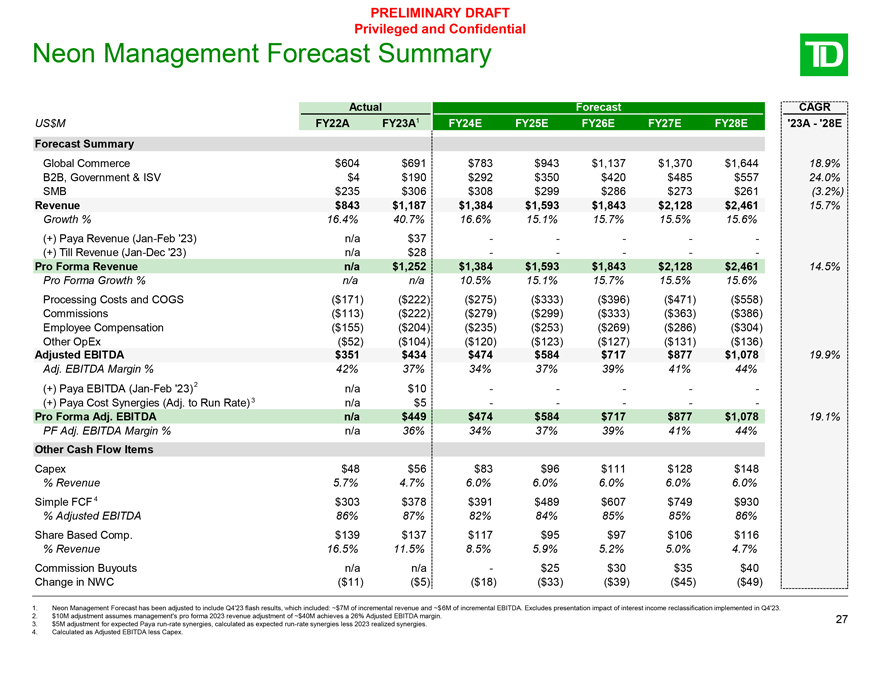

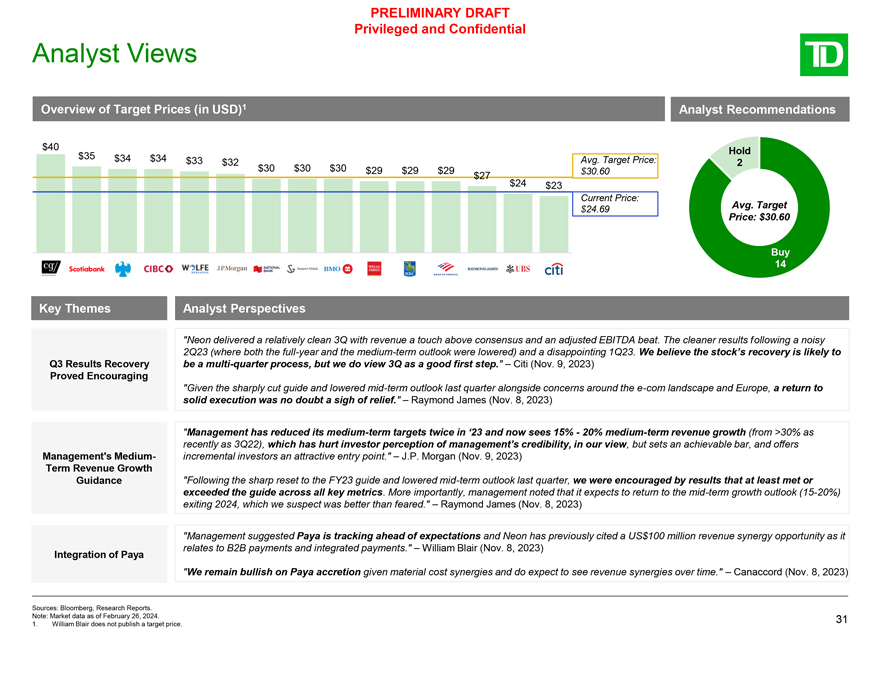

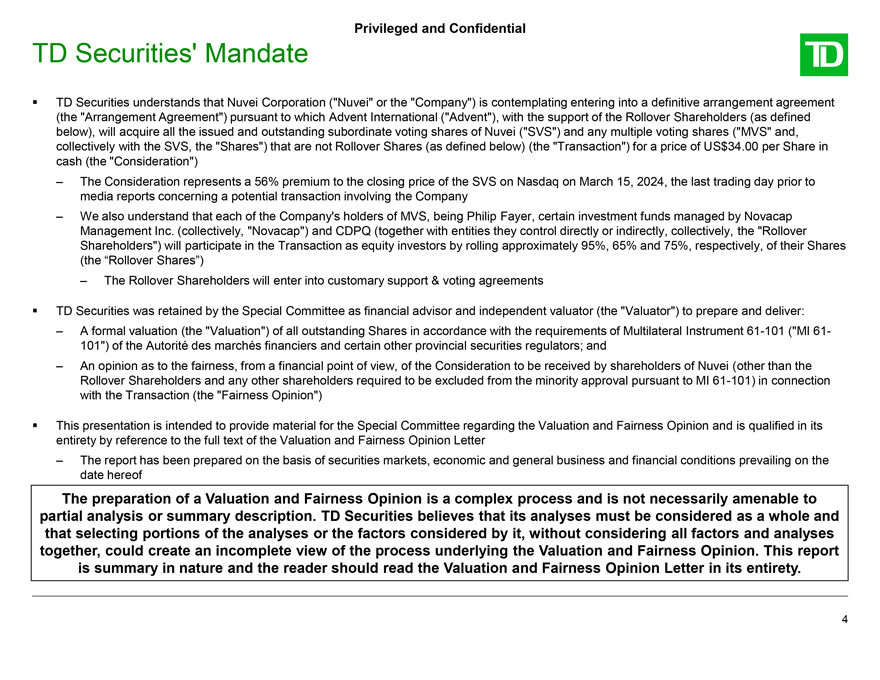

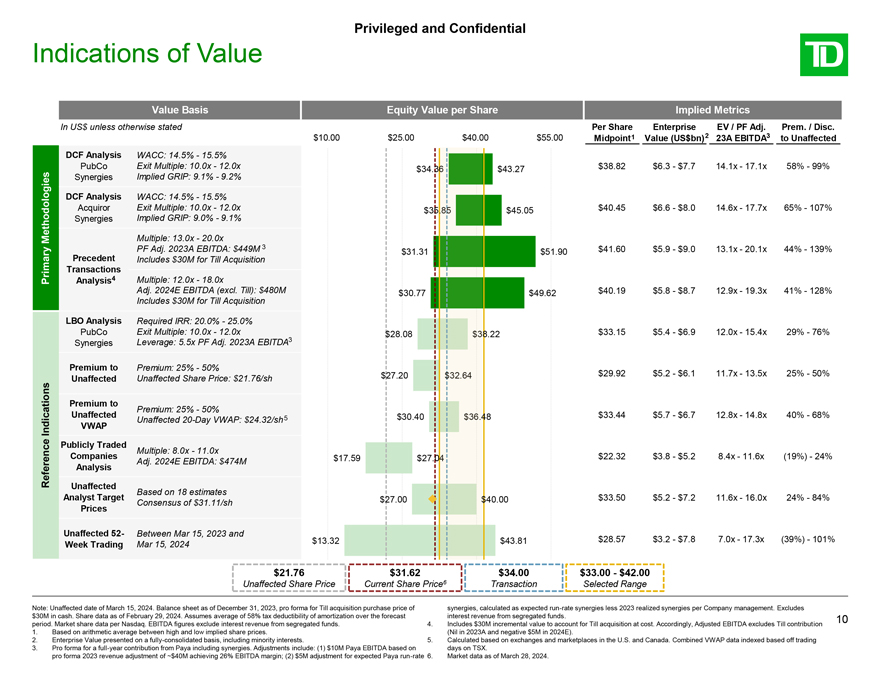

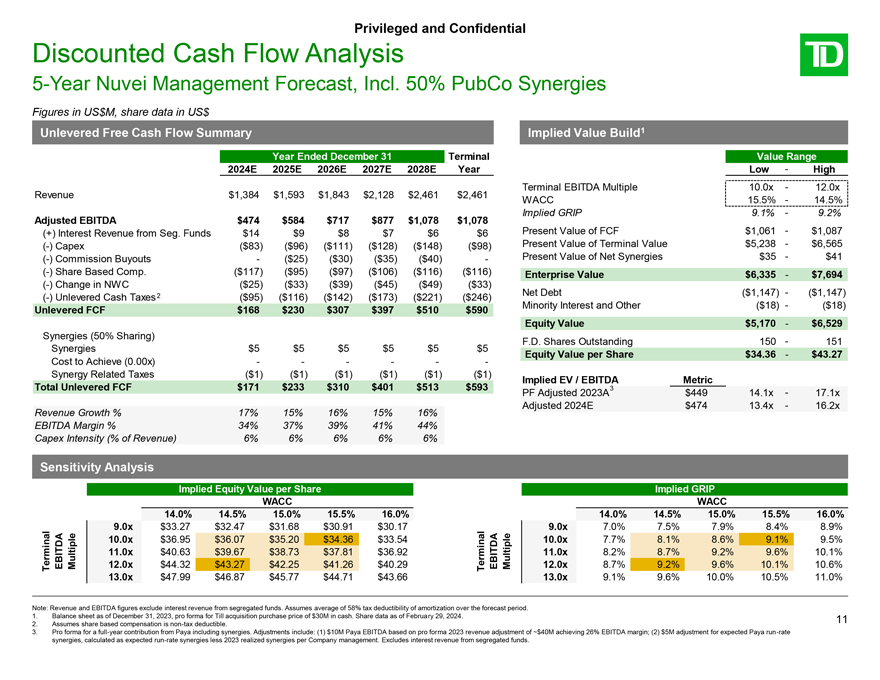

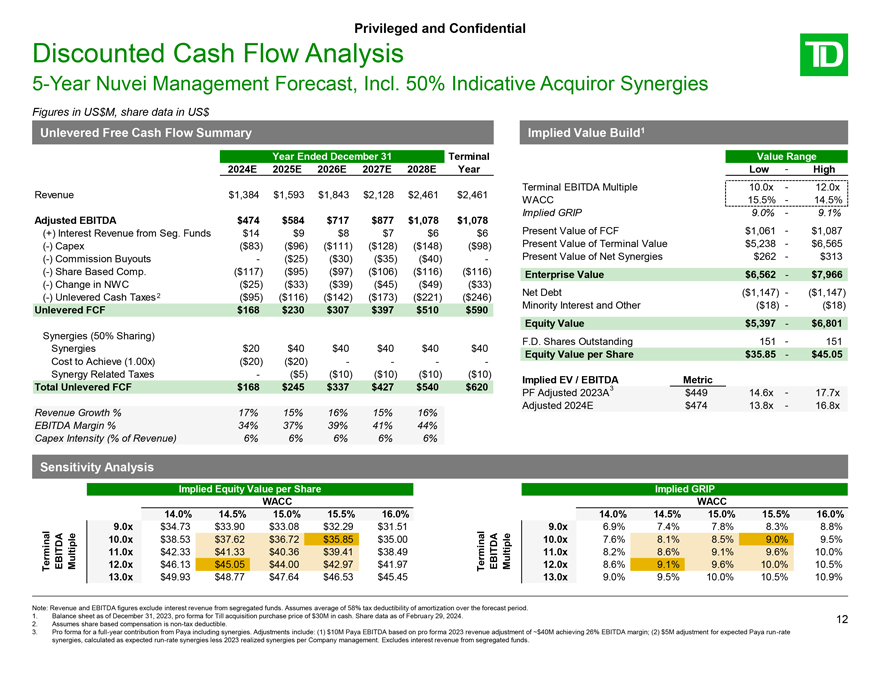

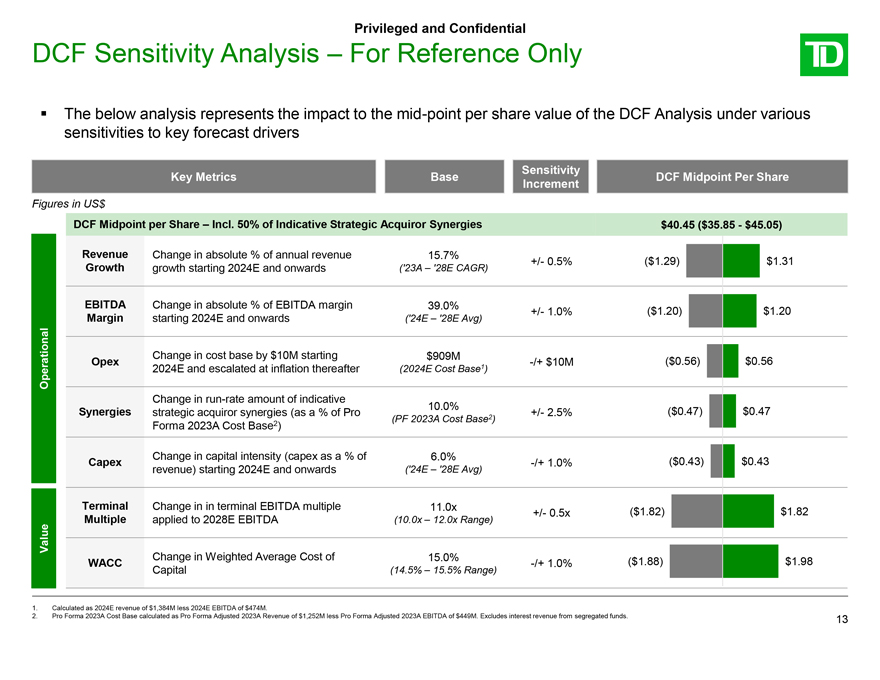

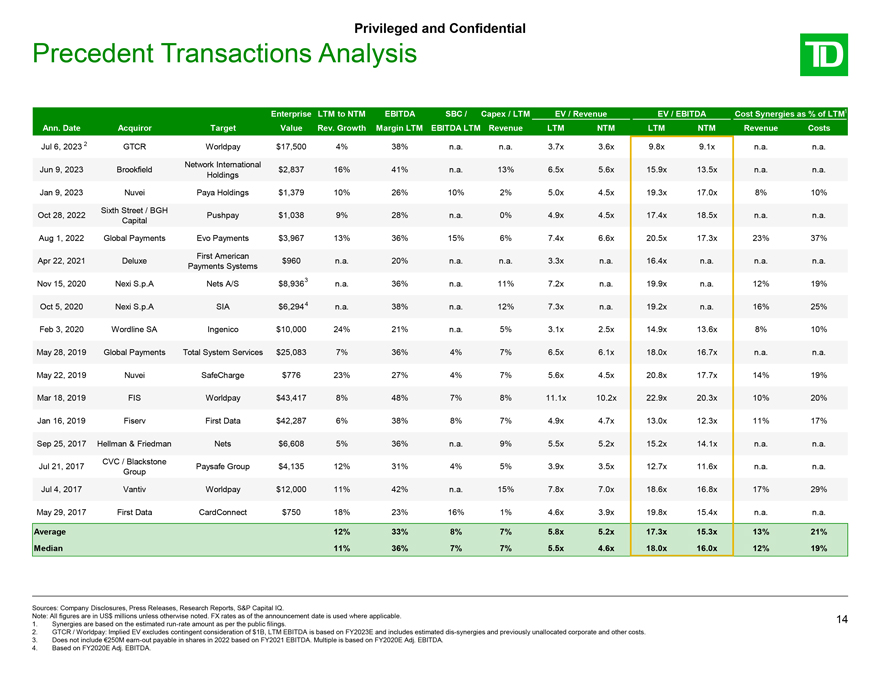

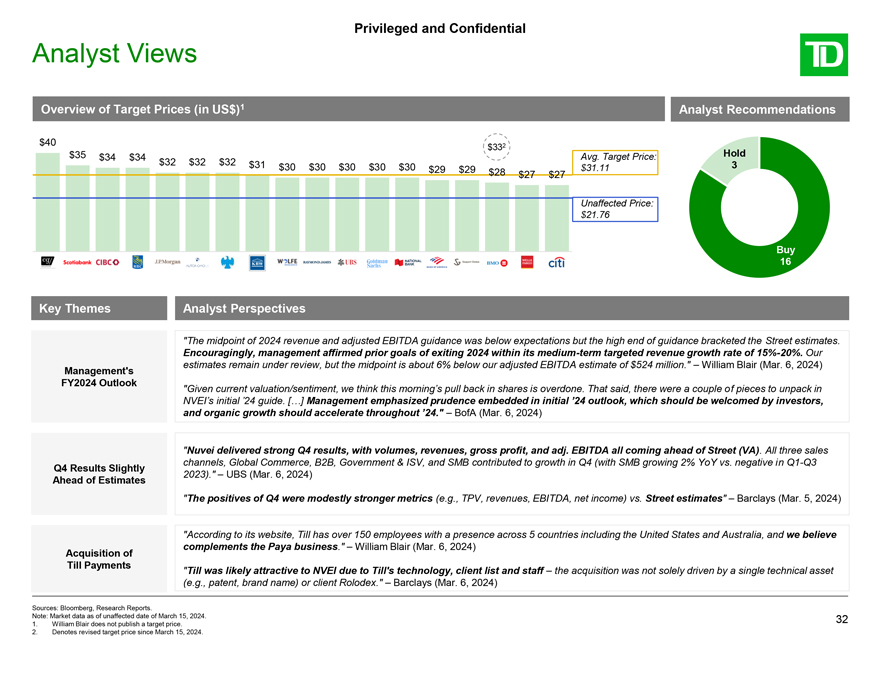

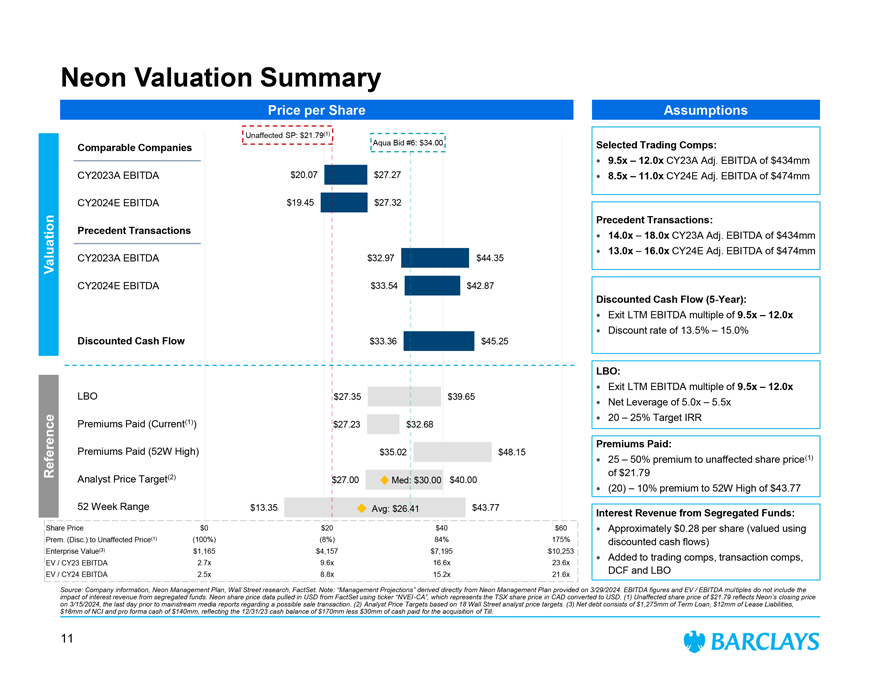

| • | Consideration within the Valuation Range. The Consideration is within the range of the fair market value of the Shares as determined by TD Securities Inc. (“TD Securities”) in its formal valuation. |

| • | TD Securities Fairness Opinion. TD Securities, independent valuator and financial advisor to the Special Committee, orally delivered (which is customary) to the Special Committee its fairness opinion (the “TD Securities Fairness Opinion”), subsequently confirmed in writing, to the effect that, as of April 1, 2024, and subject to the assumptions, qualifications and limitations communicated to the Special Committee by TD Securities and set forth in TD Securities’ written fairness opinion, the Consideration to be received by the Shareholders (other than the Rollover Shareholders and any other Shareholders required to be excluded from the minority approval pursuant to MI 61-101 (as defined below)) pursuant to the Arrangement is fair, from a financial point of view, to such Shareholders. |

| • | Barclays Fairness Opinion. The Special Committee was advised that Barclays Capital Inc. (“Barclays”), financial advisor to the Company, would provide the Board with the Barclays Fairness Opinion to the effect that, based upon and subject to the assumptions, limitations and qualifications set out therein, the Consideration to be received by the Shareholders (other than the Rollover Shareholders in respect of their Rollover Shares) pursuant to the Arrangement is fair, from a financial point of view, to such Shareholders, which opinion was delivered to the Board on April 1, 2024). |

| • | Form of Consideration. The Consideration will be paid to the Shareholders entirely in cash, which provides Shareholders (other than the Rollover Shareholders) with certainty of value and immediate liquidity (and without incurring brokerage and other costs typically associated with market sales). |

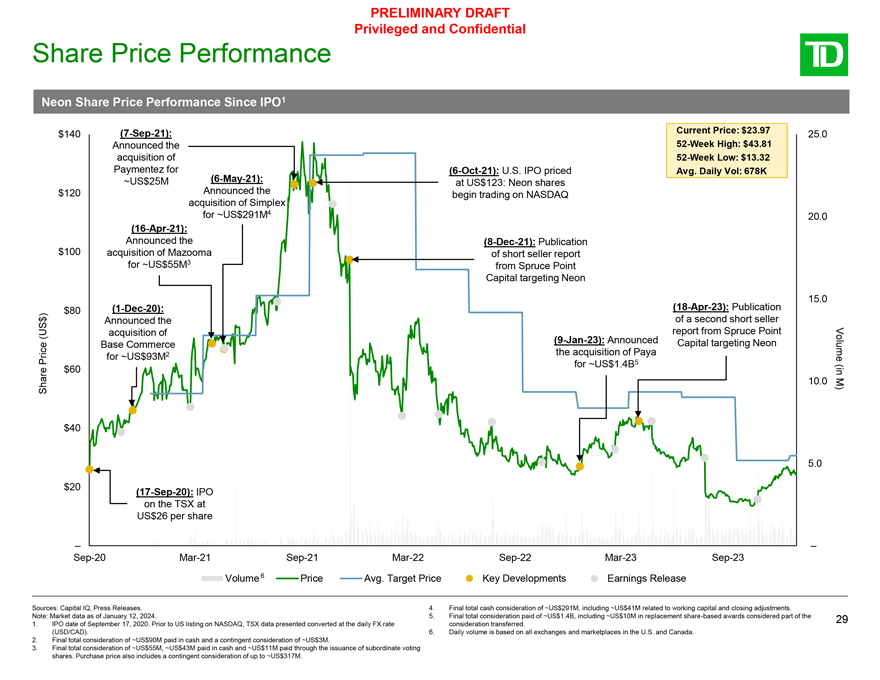

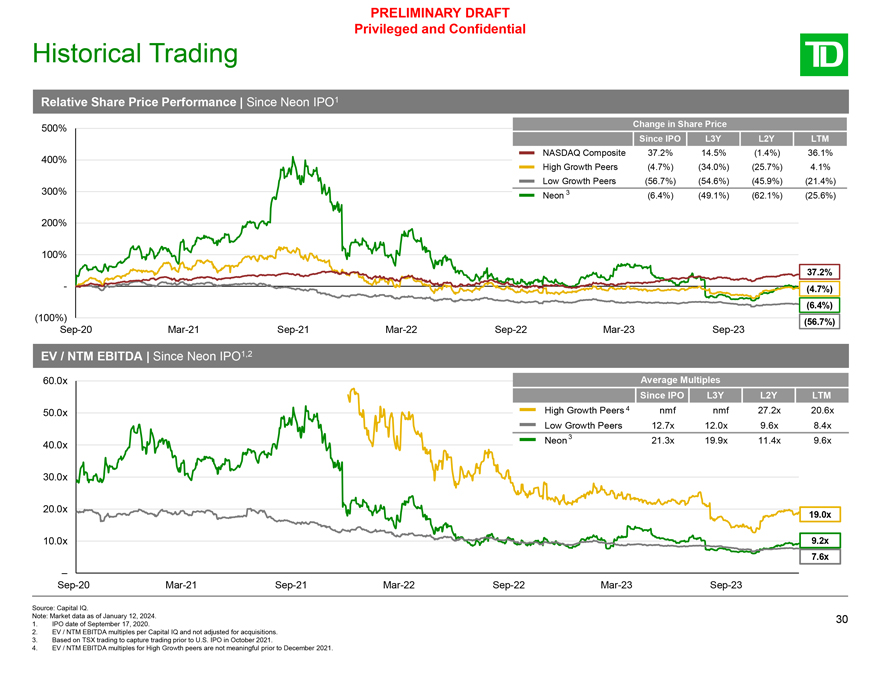

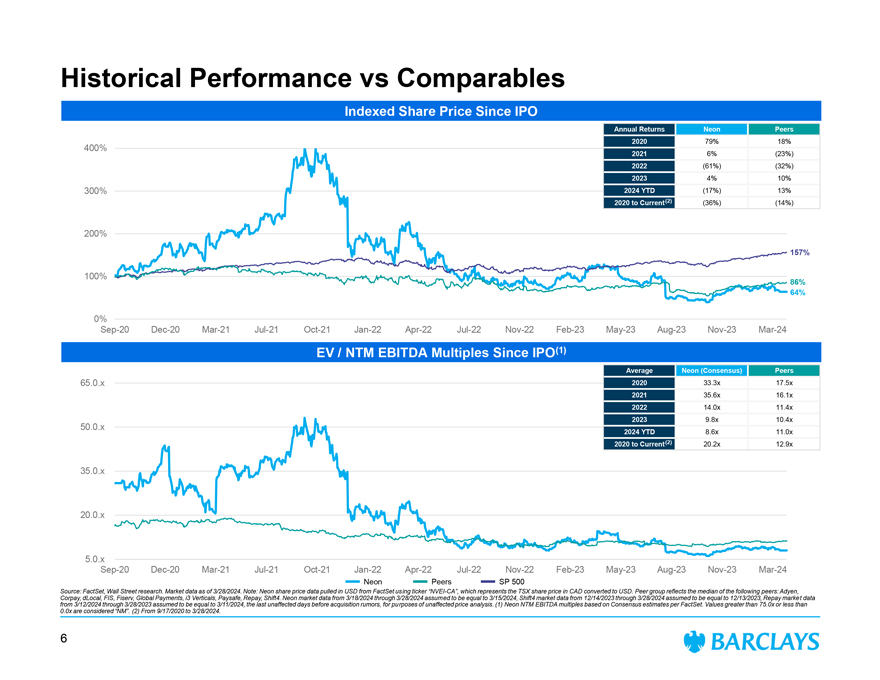

| • | Economic and Market Conditions. Consideration of current industry, economic and market conditions and trends, which have resulted in significantly lower share price performance for many technology companies. For instance, the payments sector is sensitive to changes in consumer |

| 2 | Based on Canadian composite (Toronto Stock Exchange and all Canadian marketplaces) and U.S. composite (Nasdaq and all U.S. marketplaces). |

| activity and the broader macroeconomic environment. Nuvei as a private company will no longer be exposed to share price volatility and the associated constraints, allowing Management to focus on the business. |

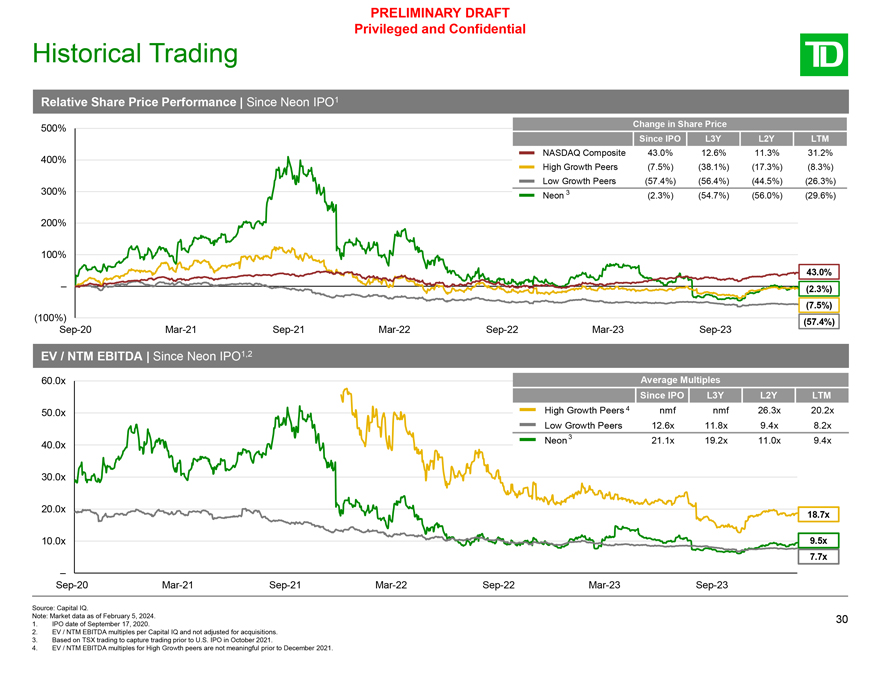

| • | Historical Market Price and Volatility. Consideration of the historical volatility of the price and liquidity of the Subordinate Voting Shares and the underlying financial results of the Company, including the fact that the Subordinate Voting Shares have historically traded at a discount to those of the Company’s peers and at the time of entering into the Arrangement Agreement traded at a large discount to their previous trading levels; as well as the Special Committee’s assessment that there is no immediately foreseeable catalyst for reversing these trends apart from the execution of management’s strategic plan with its inherent risks, rendering the all-cash consideration offered by the Purchaser attractive for the Shareholders (other than the Rollover Shareholders), which includes the “unaffiliated security holders” as defined in Rule 13e-3 under the United States Securities Exchange Act of 1934, as amended. |

| • | Purchaser. The anticipated benefits to the Company from the Purchaser’s and its affiliates’ significant resources, operational, and payments sector expertise, as well as the capacity for investment provided by the Purchaser to support the Company’s ongoing development. |

The Special Committee believes that the Arrangement is procedurally fair to Shareholders (other than the Rollover Shareholders), including the unaffiliated security holders, for the following reasons:

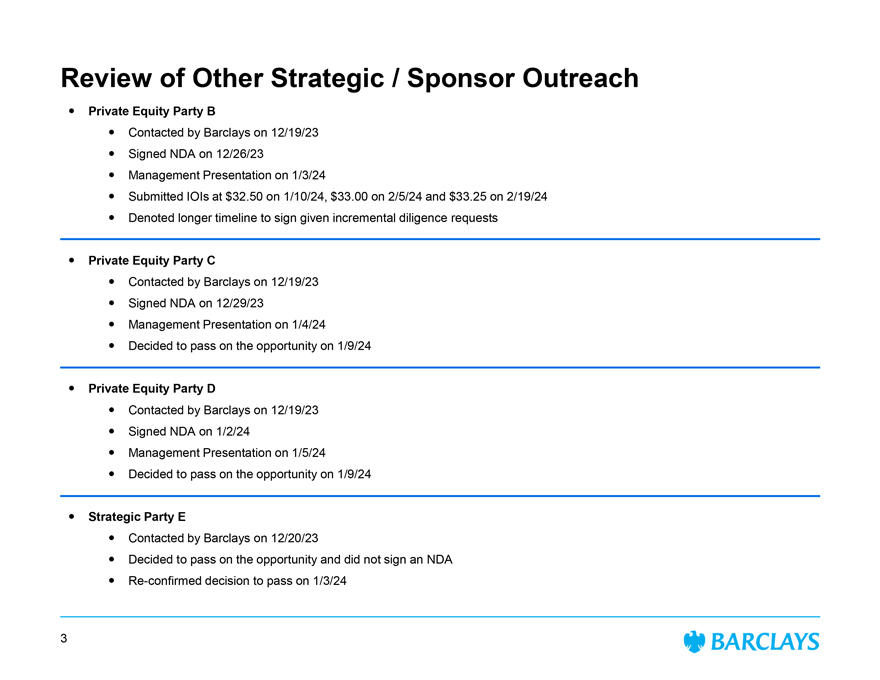

| • | Targeted Pre-Signing Market Check. A targeted pre-signing market check with six (6) of the most likely strategic and financial purchasers for the Company was conducted, and the Special Committee determined that a broader solicitation process or market check was unlikely to yield a higher price for the Shares, considering, notably, that there is a limited number of potential strategic purchasers that are likely to be interested in pursuing a transaction with the Company, having regard to the Fayer Group’s intention to not sell a significant portion of its shareholdings in the Company (which currently represent approximately 33.8% of the outstanding voting rights and approximately 20.0% of the issued and outstanding Shares of the Company), as well as the size, technology suite and platforms of the Company, and Novacap’s and CDPQ’s (each such term as defined below) shareholdings in the Company (controlling approximately 37.1% and 21.4%, respectively, of the outstanding voting rights and approximately 21.8% and 12.6%, respectively, of the outstanding Shares of the Company). |

| • | Competitive Process. The Purchaser and Bidder B (as defined in the Circular) were engaged for several weeks in a competitive process that generated numerous rounds of bidding, following which the final proposal from the Purchaser emerged as the highest and best proposal. The proposals submitted by two third parties (the Purchaser, on the one hand, and Bidder B, on the other hand) were comparable, suggesting that both parties had a similar view on the value of the Company following extensive due diligence of the Company. |

| • | Detailed Review and Negotiation. The Special Committee oversaw the conduct of a robust negotiation process that was undertaken between the Special Committee, the Company and their respective advisors, on the one hand, and the Purchaser and its advisors, on the other hand. The Special Committee had the authority to make recommendations to the Board as to whether or not to pursue the Arrangement, or any other transaction or maintaining the status quo of the Company. The Special Committee held over 30 formal meetings and the compensation of its members was in no way contingent on their approving the Arrangement Agreement or taking the other actions described herein. The Special Committee was comprised solely of independent directors and was advised by highly experienced and qualified financial and legal advisors. The advice received by the Special Committee included detailed financial advice from a highly qualified financial advisor, including with respect to the Company remaining a publicly traded company and continuing to pursue its business plan on a stand-alone basis, as well as the Formal Valuation. |

| • | Rollover Shareholders’ Participation. Novacap and CDPQ have both decided to effectively sell a significant portion of their Shares (approximately 35% and 25% of their current holdings, respectively) in connection with the Arrangement to benefit from the certainty of value and liquidity event that is the Arrangement, which the Special Committee believes suggests that Novacap and CDPQ both consider the Consideration to also be attractive from a Shareholder’s perspective. |

| • | Approval Thresholds. The Shareholders will have an opportunity to vote on the Arrangement, which will require the Required Shareholder Approval to be obtained for the Arrangement to be completed, including not less than a simple majority of the votes cast by the disinterested holders of Subordinate Voting Shares virtually present or represented by proxy at the Meeting, voting separately as a class. |

| • | Court Approval. The Arrangement is subject to a determination of the Court that the Arrangement is fair and reasonable, both procedurally and substantively, to the Shareholders. |

| • | Superior Proposals. Pursuant to the Arrangement Agreement, the Board will have the ability, notwithstanding the non-solicitation provisions of the Arrangement Agreement, to engage in or participate in discussions or negotiations with a third-party making an unsolicited Acquisition Proposal that the Board determines in good faith, after consultation with its financial advisors and outside legal counsel, constitutes or could reasonably be expected to constitute or lead to, a Superior Proposal, and, in certain circumstances, to consider, accept and enter into a definitive agreement with respect to such Superior Proposal, provided that the Company concurrently pays the Termination Fee in the amount of $150 million to the Purchaser and subject to a customary right for the Purchaser to match such Superior Proposal. |

| • | Termination Fee. The Special Committee, after consultation with its experienced, qualified and independent legal advisors, is of the view that the Termination Fee would not preclude a third party from making a potential unsolicited Superior Proposal. |

| • | Reverse Termination Fee. The Company is entitled to receive the Reverse Termination Fee in the amount of $250 million if the Arrangement Agreement is terminated in the event of (i) the failure by the Purchaser to consummate closing in certain circumstances, (ii) a breach of representations and warranties or covenants by the Purchaser in certain circumstances; and (iii) the occurrence of the Outside Date, if at the time of termination the Company could have terminated the Arrangement Agreement pursuant to (i) or (ii) above. |

| • | Dissent Rights. Registered Shareholders may, upon compliance with certain conditions and in certain circumstances, exercise their dissent rights in respect of their Shares and, if ultimately successful, receive fair value for their Shares as determined by the Court. See “Dissenting Shareholders’ Rights.” |

The arrangement agreement (the “Arrangement Agreement”) was the result of a robust negotiation process with Advent that was undertaken with the supervision and involvement of the Special Committee comprised solely of independent directors and which was advised by experienced, qualified and independent financial and legal advisors.

Shareholders should review the accompanying Circular, which describes, among other things, the background to the Arrangement as well as the reasons for the determinations and recommendations of the Special Committee and the Board. The Circular contains a detailed description of the Arrangement and includes additional information to assist you in considering how to vote at the Meeting. You are urged to read this information carefully and, if you require assistance, you are urged to consult your financial, legal, tax or other professional advisors.

To be effective, the Arrangement must be approved by a special resolution (the “Arrangement Resolution”), the full text of which is outlined in Appendix A of the accompanying management proxy

circular (the “Circular”), passed by: (i) at least 662⁄3% of the votes cast by the holders of Multiple Voting Shares and Subordinate Voting Shares virtually present or represented by proxy at the Meeting, voting together as a single class (with each Subordinate Voting Share being entitled to one vote and each Multiple Voting Share being entitled to ten votes); (ii) not less than a simple majority of the votes cast by holders of Multiple Voting Shares virtually present or represented by proxy at the Meeting; (iii) not less than a simple majority of the votes cast by holders of Subordinate Voting Shares virtually present or represented by proxy at the Meeting; (iv) not less than a simple majority of the votes cast by holders of Subordinate Voting Shares virtually present or represented by proxy at the Meeting (excluding the Subordinate Voting Shares held by the Rollover Shareholders and the persons required to be excluded pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”)); and (v) not less than a simple majority of the votes cast by holders of Multiple Voting Shares virtually present or represented by proxy at the Meeting (excluding the Multiple Voting Shares held by the Rollover Shareholders and the persons required to be excluded pursuant to MI 61-101). In the Interim Order, the Court declared that the vote set out in clause (v) of the preceding sentence is satisfied as there are no holders of Multiple Voting Shares who are eligible to cast a vote thereunder, as all holders of Multiple Voting Shares are “interested parties” within the meaning of MI 61-101 and must be excluded from such vote.

The Arrangement must also be approved by the Court, which will consider, among other things, the fairness and reasonableness of the Arrangement.

If the required Shareholder and Court approvals are obtained and all other conditions to the Arrangement are satisfied, including receipt of key regulatory approvals, it is anticipated that the Arrangement will be completed in late 2024 or the first quarter of 2025. Further details of the Arrangement are set out in the accompanying Circular.

In connection with the proposed Arrangement, each director and member of Senior Management of Nuvei and each Rollover Shareholder has entered into a customary support and voting agreement pursuant to which such individual has agreed, subject to the terms thereof, to vote all of their Shares in favour of the Arrangement Resolution. Consequently, holders of approximately 0.3% of the Subordinate Voting Shares and holders of 100% of the Multiple Voting Shares, representing approximately 92% of the total voting power attached to all of the Shares (and who, as a result of their holdings of Multiple Voting Shares, would effectively be able to veto any alternative transaction), have agreed to vote their Shares in favour of the Arrangement Resolution. The 124,986 Subordinate Voting Shares beneficially owned by Philip Fayer, representing approximately 0.20% of the Subordinate Voting Shares, and all of the issued and outstanding Multiple Voting Shares, will be excluded for purposes of the “minority approvals” required under MI 61-101.

Specifically, Philip Fayer, certain investment funds managed by Novacap Management Inc. (collectively, “Novacap”) and Caisse de dépôt et placement du Québec (“CDPQ”) (together with entities they control directly or indirectly, collectively, the “Rollover Shareholders”) have agreed to sell all of their Shares (the “Rollover Shares”) to the Purchaser for a combination of cash and shares in the capital of the Purchaser, effectively rolling approximately 95%, 65% and 75%, respectively, of their Shares, and are expected to receive in aggregate approximately US$563 million in cash for the Shares sold on closing3. Philip Fayer, Novacap and CDPQ are expected to hold or exercise control or direction over, directly or indirectly, approximately 24%, 18% and 12%, respectively, of the common equity in the resulting private company.

Vote Today FOR the Arrangement Resolution

Your vote is important regardless of the number of Shares you own. If you are unable to be virtually present at the Meeting, we encourage you to take the time now to complete, sign, date and return the enclosed form of proxy or voting instruction form, as applicable, so that your Shares can be voted at

| 3 | Percentages and amount of expected cash proceeds are based on current assumed cash position and are subject to change as a result of cash generated before closing. |

the Meeting in accordance with your instructions. Your votes must be received by Nuvei’s transfer agent, TSX Trust Company, no later than 10:00 a.m. (Eastern time) on June 14, 2024 or, if the Meeting is adjourned or postponed, at least 48 hours (excluding Saturdays and holidays) prior to the commencement of the reconvened Meeting. The time limit for deposit of proxies may be waived or extended by the chair of the Meeting at his or her discretion, without notice.

Non-registered Shareholders who hold their Shares through a broker, investment dealer, bank, trust company, custodian, nominee or other intermediary should carefully follow the instructions of their intermediary to ensure that their Shares are voted at the Meeting in accordance with such Shareholder’s instructions, to arrange for their Intermediary to complete the necessary transmittal documents and to ensure that they receive payment for their Shares if the Arrangement is completed. If you are a registered Shareholder, we also encourage you to complete, sign, date and return the enclosed letter of transmittal, which will help the Company arrange for the prompt payment for your Shares if the Arrangement is completed.

If you have any questions about the information contained in this Circular or require assistance in completing your form of proxy or voting instruction form, please contact Kingsdale Advisors, our strategic advisor by telephone at 1 (888) 327-0819 (toll-free in North America) or at (416) 623-4173 (outside of North America), or by email at contactus@kingsdaleadvisors.com. To keep current and obtain information about voting your Shares, please visit www.NuveiPOA.com. Questions on how to complete the letter of transmittal should be directed to the Company’s depositary, TSX Trust Company, at 1 (800) 387-0825 (toll-free in North America) or at (416) 682-3860 (outside of North America).

On behalf of the Board, we would like to take this opportunity to thank you for the support you have shown as Shareholders of the Company.

Yours very truly,

| (signed) Timothy A. Dent |

| Timothy A. Dent Chair of the Special Committee and Director |

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

Montréal, Québec, May 13, 2024

NOTICE IS HEREBY GIVEN that, in accordance with an interim order of the Superior Court of Québec dated May 13, 2024 (the “Interim Order”), a special meeting (the “Meeting”) of the holders (the “Shareholders”) of subordinate voting shares (the “Subordinate Voting Shares”) and multiple voting shares (the “Multiple Voting Shares” and collectively with the Subordinate Voting Shares, the “Shares”) of Nuvei Corporation (“Nuvei” or the “Company”) will be held on June 18, 2024 at 10:00 a.m. (Eastern time) exclusively in virtual format at https://web.lumiagm.com/432819058, for the following purposes:

| 1. | to consider, and, if deemed advisable, to pass, with or without variation, a special resolution (the “Arrangement Resolution”), the full text of which is outlined in Appendix A of the accompanying management proxy circular (the “Circular”), to approve an arrangement (the “Arrangement”) pursuant to section 192 of the Canada Business Corporations Act (the “CBCA”) involving the Company and Neon Maple Purchaser Inc. (the “Purchaser”), a newly-formed entity controlled by Advent International, L.P. (“Advent”), the whole as described in the Circular; and |

| 2. | to transact such other business as may properly come before the Meeting or any adjournment or postponement(s) thereof. |

The Circular provides additional information relating to the matters to be addressed at the Meeting, including the Arrangement.

Shareholders are reminded to review the accompanying Circular carefully before voting because it has been prepared to help you make an informed decision.

Participating at the Meeting

The Company is holding the Meeting as a virtual-only meeting, which will be conducted via live webcast. All Shareholders regardless of geographic location and equity ownership will have an equal opportunity to participate at the Meeting and engage with management. Shareholders will not be able to attend the Meeting in person. The Company views the use of technology-enhanced shareholder communications as a method to facilitate individual investor participation, making the Meeting more accessible and engaging for all involved, by permitting a broader base of shareholders to participate in the Meeting. Registered shareholders and duly appointed proxyholders will be able to attend, participate and vote at the Meeting online at https://web.lumiagm.com/432819058 (meeting ID: 432-819-058). Non-registered Shareholders (being Shareholders who hold their Shares through a broker, investment dealer, bank, trust company, custodian, nominee or other intermediary) who have not duly appointed themselves as proxyholder will not be able to participate, vote or ask questions at the Meeting but will be able to attend the Meeting as guests.

Shareholders who are participating in the Meeting must be connected to the internet throughout the entire Meeting in order to be able to vote. Participants must ensure that they have a good connection throughout the Meeting and set aside enough time to connect to the Meeting and follow the procedure described in this section.

You will require the most recent version of the browsers Chrome, Safari, Edge or Firefox. Make sure your browser is compatible by connecting in advance. PLEASE DO NOT USE INTERNET EXPLORER. Internal networks, firewalls, as well as VPNs (virtual private networks) may block the webcast or access to the virtual platform for the Meeting. If you experience issues, make sure your VPN is deactivated or that you are not using a computer connected to an enterprise network.

Appointment of Proxyholders

Shareholders who wish to appoint a person other than the management nominees identified in the form of proxy or voting instruction form, including non-registered (beneficial) Shareholders who wish to appoint themselves as proxyholder, must carefully follow the instructions in the Circular and on their form of proxy or voting instruction form.

Additionally, each Shareholder or its duly appointed proxyholder MUST complete the additional step of registering the proxyholder by either calling the Transfer Agent at 1-866-751-6315 (in North America) or 416-682-3860 (outside of North America) or by completing the electronic form available at https://www.tsxtrust.com/control-number-request by no later than 10:00 a.m. (Eastern time) on June 14, 2024 (or, if the Meeting is adjourned or postponed, at least 48 hours (excluding Saturdays and holidays) prior to the commencement of the reconvened Meeting). If you are a non-registered shareholder located in the United States and wish to appoint yourself as a proxyholder in order to attend, participate or vote at the Meeting, you MUST also obtain a valid legal proxy from your intermediary and submit it to the Transfer Agent. Failing to register your proxyholder online will result in the proxyholder not receiving a control number, which is required to vote at the Meeting. Non-registered shareholders who have not duly appointed themselves as proxyholders will not be able to vote at the Meeting but will be able to attend the Meeting as guests.

The board of directors of the Company (the “Board” or the “Board of Directors”) has set the close of business on May 9, 2024 as the record date (the “Record Date”) for determining the Shareholders who are entitled to receive notice of, and to vote their Shares at, the Meeting. Only persons who are shown on the register of Shareholders at the close of business on the Record Date, or their duly appointed proxyholders, will be entitled to attend the Meeting and vote on the Arrangement Resolution.

As of the Record Date, there were 63,965,523 Subordinate Voting Shares and 76,064,619 Multiple Voting Shares issued and outstanding. The Subordinate Voting Shares are “restricted securities” within the meaning of such term under applicable Securities Laws in that they do not carry equal voting rights with the Multiple Voting Shares. With respect to the matters to be voted on at the Meeting, being the approval of the Arrangement Resolution, each Subordinate Voting Share entitles its holder to one (1) vote and each Multiple Voting Share entitles its holder to ten (10) votes. In aggregate, the voting rights associated with the Subordinate Voting Shares and the Multiple Voting Shares represented, respectively, as at the Record Date, 8% and 92% of the voting rights attached to all of the issued and outstanding Shares of the Company.

In order to become effective, the Arrangement must be approved by (i) at least 662⁄3% of the votes cast by the holders of Multiple Voting Shares and Subordinate Voting Shares virtually present or represented by proxy at the Meeting, voting together as a single class (with each Subordinate Voting Share being entitled to one vote and each Multiple Voting Share being entitled to ten votes); (ii) not less than a simple majority of the votes cast by holders of Multiple Voting Shares virtually present or represented by proxy at the Meeting; (iii) not less than a simple majority of the votes cast by holders of Subordinate Voting Shares virtually present or represented by proxy at the Meeting; (iv) not less than a simple majority of the votes cast by holders of Subordinate Voting Shares virtually present or represented by proxy at the Meeting (excluding the Subordinate Voting Shares held by the Rollover Shareholders and the persons required to be excluded pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”)); and (v) not less than a simple majority of the votes cast by holders of Multiple Voting Shares virtually present or represented by proxy at the Meeting (excluding the Multiple Voting Shares held by the Rollover Shareholders and the persons required to be excluded pursuant to MI 61-101). The 124,986 Subordinate Voting Shares beneficially owned by Philip Fayer, representing approximately 0.20% of the Subordinate Voting Shares, and all of the issued and outstanding Multiple Voting Shares, will be excluded for purposes of such “minority approvals” required under MI 61-101. In the Interim Order, the Court declared that the vote set out in clause (v) of the first sentence of this paragraph is satisfied as there are no holders of Multiple Voting Shares who are eligible to cast a vote thereunder, as all holders of Multiple Voting Shares are “interested parties” within the meaning of MI 61-101 and must be excluded from such vote.

Accompanying this notice of meeting are the Circular, a proxy form and a letter of transmittal (for registered Shareholders) (the “Letter of Transmittal”). The accompanying Circular provides information relating to the matters to be addressed at the Meeting and is incorporated into this notice of meeting. Any adjourned or postponed meeting resulting from an adjournment or postponement of the Meeting will be held at a time and place to be specified either by the Company before the Meeting or at the discretion of the Chair of the Meeting at the Meeting.

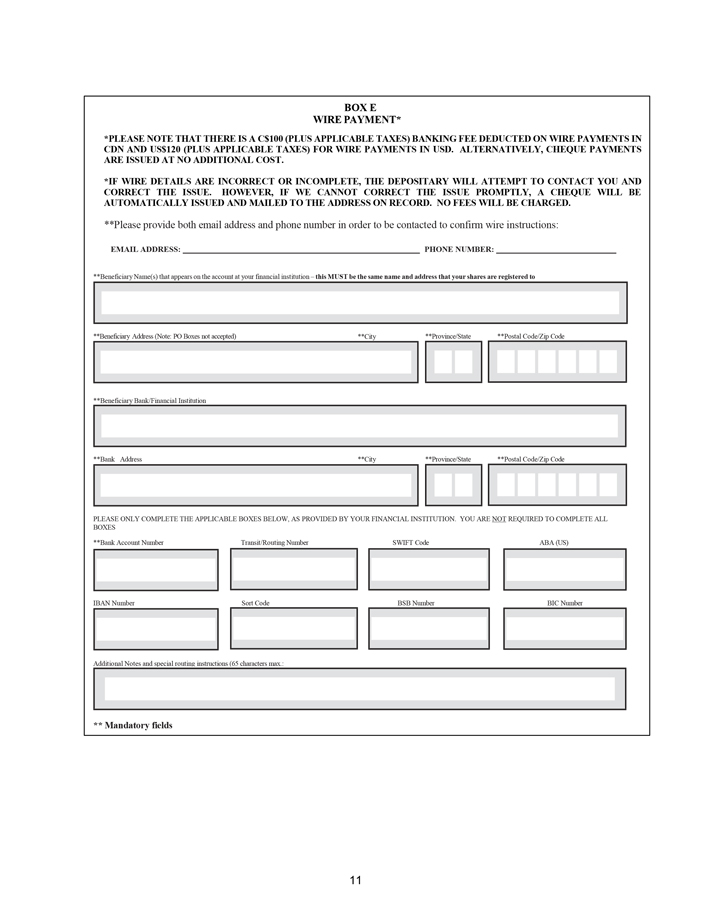

For a registered holder of Shares (other than a dissenting Shareholder and any holder of Rollover Shares) to receive the consideration of $34.00 in cash per Share (the “Consideration”) to which they are entitled upon the completion of the Arrangement, they must complete, sign and return the Letter of Transmittal together with their Share certificate(s) and/or Direct Registration System advice(s), as applicable, and any other required documents and instruments to the depositary named in the Letter of Transmittal, in accordance with the procedures set out therein.

Whether or not you are able to attend the Meeting, the Board and the management of the Company (the “Management”) urge you to participate in the Meeting and vote your Shares. If you cannot attend the Meeting online to vote your Shares, please vote in one of the following four ways:

| i. | by following the instructions for internet voting in the accompanying proxy form; OR |

| ii. | by following the instructions for telephone voting in the accompanying proxy form; OR |

| iii. | by completing and signing the accompanying proxy form and returning it in the enclosed envelope, postage prepaid so that is received by the Transfer Agent by 10:00 a.m. (Eastern time) on June 14, 2024 (or, if the Meeting is adjourned or postponed, at least 48 hours (excluding Saturdays and holidays) prior to the commencement of the reconvened Meeting); OR |

| iv. | by appointing someone as a proxy to participate in the Meeting and vote your Shares for you. |

To be valid, proxies must be received by the Transfer Agent by no later than 10:00 a.m. (Eastern time) on June 14, 2024 (or, if the Meeting is adjourned or postponed, at least 48 hours (excluding Saturdays and holidays) prior to the commencement of the reconvened Meeting). The Company reserves the right to accept late proxies and to extend or waive the proxy cut off at its discretion, with or without notice, subject to the terms of the Arrangement Agreement.

If you are a beneficial (non-registered) Shareholder, please refer to the section in the Circular entitled “Information Concerning the Meeting and Voting—Non-Registered Shareholders” for information on how to vote your Shares. Beneficial (non-registered) Shareholders who hold their Shares through a broker, investment dealer, bank, trust company, custodian, nominee or another intermediary (an “Intermediary”), should carefully follow the instructions of their Intermediary to ensure that their Shares are voted at the Meeting in accordance with such Shareholders’ instructions and, as applicable, to arrange for their Intermediary to complete the necessary transmittal documents and to ensure that they receive payment of the Consideration for their Shares if the Arrangement is completed.

Dissent Rights

Pursuant to the Interim Order, registered Shareholders of the Company have the right to dissent with respect to the Arrangement Resolution and, if the Arrangement becomes effective, to be paid the fair value of their Shares in accordance with the provisions of section 190 of the CBCA (the “Dissent Rights”), as modified by the Interim Order and the plan of arrangement pertaining to the Arrangement (the “Plan of Arrangement”). A registered Shareholder wishing to exercise Dissent Rights with respect to the Arrangement must send to the Company a Dissent Notice (as defined below), which the Company must receive, c/o Lindsay Matthews, General Counsel and Corporate Secretary, at 1100 René-Lévesque Boulevard West, 9th Floor, Montréal, Québec H3B 4N4, with a copy to:

| (i) | Stikeman Elliott LLP, 1155 René-Lévesque Boulevard West, 41st Floor, Montréal, Québec H3B 3V2, Attention: Warren Katz and Amélie Métivier, email: wkatz@stikeman.com and ametivier@stikeman.com; and |

| (ii) | Blake, Cassels & Graydon LLP, 199 Bay Street, Suite 4000, Toronto, Ontario M5L 1A9, Attention: Shlomi Feiner and Catherine Youdan, email: shlomi.feiner@blakes.com and catherine.youdan@blakes.com; |

by no later than 5:00 p.m. (Eastern time) on June 14, 2024 (or on the date that is two (2) Business Days prior to the commencement of the reconvened Meeting if the Meeting is adjourned or postponed) (the “Dissent Notice”), and must otherwise strictly comply with the dissent procedures described in this Circular. A registered Shareholder wishing to exercise Dissent Rights may exercise such rights with respect to all Shares registered in the name of such Shareholder only if such Shareholder exercised all the voting rights attached to those Shares against the Arrangement Resolution.

Anyone who is a beneficial owner of Shares registered in the name of an Intermediary and who wishes to exercise Dissent Rights should be aware that only registered Shareholders are entitled to exercise Dissent Rights. Some, but not all, of the Shares have been issued in the form of a global certificate registered in the name of CDS & Co. and, as such, CDS & Co. is the registered Shareholder of those Shares. Accordingly, a non-registered Shareholder who wishes to exercise Dissent Rights must make arrangements for the Shares beneficially owned by such holder to be registered in the name of such holder through their Intermediary prior to the time the Dissent Notice is required to be received by the Company or, alternatively, make arrangements for the registered Shareholder of such Shares to exercise Dissent Rights on behalf of such Shareholder. It is recommended that you seek independent legal advice if you wish to exercise Dissent Rights.

The Dissent Rights are more particularly described in the Circular, and copies of the Plan of Arrangement, the Interim Order and the text of section 190 of the CBCA are set forth in Appendix B, Appendix E and Appendix G, respectively, of the Circular. Failure to strictly comply with the requirements set forth in section 190 of the CBCA, as modified by the Interim Order and the Plan of Arrangement, may result in the loss of any right of dissent.

Questions

If you are a Shareholder and have any questions regarding the information contained in this Circular or require assistance in completing your form of proxy or voting instruction form, please contact Kingsdale Advisors, our strategic advisor by telephone at 1 (888) 327-0819 (toll-free in North America) or at (416) 623-4173 (outside of North America), or by email at contactus@kingsdaleadvisors.com. To keep current with and obtain information about voting your Shares, please visit www.NuveiPOA.com. Questions on how to complete the letter of transmittal or your form of proxy or voting instruction form should be directed to Nuvei Corporation’s depositary, TSX Trust Company, at 1 (800) 387-0825 (toll-free in North America) or at (416) 682-3860 (outside of North America).

By order of the Board of Directors,

| (signed) Lindsay Matthews |

| Lindsay Matthews |

| General Counsel and Corporate Secretary |

| Montréal, Québec, this 13th of May, 2024 |

NUVEI CORPORATION

MANAGEMENT PROXY CIRCULAR

This management proxy circular (“Circular”) is provided in relation to the solicitation of proxies by the management of Nuvei Corporation (“we,” “us,” “Nuvei” and the “Company”) for use at the special meeting (the “Meeting”) of holders (the “Shareholders”) of subordinate voting shares (the “Subordinate Voting Shares”) and multiple voting shares (the “Multiple Voting Shares” and collectively with the Subordinate Voting Shares, the “Shares”) of the Company to be held on June 18, 2024 at 10:00 a.m. (Eastern time) exclusively in a virtual format and at any adjournment or postponement thereof.

All capitalized terms used in this Circular but not otherwise defined herein have the meanings set forth in the “Glossary of Terms” starting on page 189 of this Circular. In this Circular, unless otherwise specified or the context otherwise indicates, reference to the singular shall include the plural and vice versa; the masculine shall include the feminine and vice versa.

Currency and Exchange Rates

Unless otherwise indicated, all amounts in this Circular are expressed in U.S. dollars. On May 9, 2024, the daily average exchange rates as reported by the Bank of Canada were: C$1.00 = $0.7304 and $1.00 = C$1.3692.

Cautionary Statements

Unless otherwise indicated, the information provided in this Circular is provided as of May 9, 2024.

We have not authorized any person to give any information or make any representation regarding the Arrangement or any other matters to be considered at the Meeting other than those contained in this Circular. If any such information or representation is given or made to you, you should not rely on it as being authorized or accurate.

This Circular does not constitute an offer to buy, or a solicitation of an offer to sell, any securities, or the solicitation of a proxy, by any person in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such an offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such an offer or solicitation. The delivery of this Circular will not, under any circumstances, create any implication or be treated as a representation that there has been no change in the information set out herein since the date of this Circular.

Your proxy is being solicited by Nuvei’s Management. Management requests that you sign and return the form of proxy or VIF so that your votes are exercised at the Meeting. The solicitation of proxies will be conducted primarily by mail but may also be made by telephone, fax transmission or other electronic means of communication or in person by the directors, officers and employees of the Company. The cost of such solicitation will be borne by the Company. The Company has retained Kingsdale Advisors to provide a broad array of strategic advisory, governance, strategic communications, digital and investor campaign services on a global retainer basis in addition to certain fees accrued during the life of the engagement upon the discretion and direction of the Company. The Company may also reimburse brokers and other persons holding Shares in their name, or in the name of nominees for their costs incurred in sending proxy materials to their principals to obtain their proxies.

Shareholders should not construe the contents of this Circular as legal, tax or financial advice and are urged to consult with their own legal, tax, financial or other professional advisors as to the relevant legal, tax, financial or other matters in connection herewith.

(i)

The information contained in this Circular concerning the Purchaser, Philip Fayer, Novacap, CDPQ and their respective associates and affiliates, including such information under the heading “Special Factors –Background to the Arrangement,” has been provided by the Purchaser, Philip Fayer, Novacap and CDPQ, respectively, for inclusion in this Circular. Although the Company has no knowledge that any statement contained herein taken from, or based on, such information and records or information provided by the Purchaser, Philip Fayer, Novacap or CDPQ is untrue or incomplete, the Company assumes no responsibility for the accuracy of the information contained in such documents, records or information or for any failure by the Purchaser, Philip Fayer, Novacap or CDPQ to disclose events which may have occurred or may affect the significance or accuracy of any such information but which are unknown to the Company.

All summaries of, and references to, the Plan of Arrangement and the Arrangement Agreement in this Circular are qualified in their entirety by the complete text of the Plan of Arrangement and the Arrangement Agreement. Shareholders should refer to the full text of each of the Plan of Arrangement and the Arrangement Agreement for complete details of such documents. The Plan of Arrangement is attached as Appendix B to this Circular, and a copy of the Arrangement Agreement is available under Nuvei’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. You are urged to read the full text of the Plan of Arrangement and the Arrangement Agreement carefully.

NO CANADIAN SECURITIES REGULATORY AUTHORITY NOR THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION HAS PASSED UPON THE ACCURACY OR ADEQUACY OF THIS CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS AN OFFENCE.

Forward-Looking Information

This Circular contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking information”) within the meaning of applicable securities laws. Such forward-looking information may include, without limitation, information with respect to our objectives and the strategies to achieve these objectives, as well as information with respect to our beliefs, plans, expectations, anticipations, estimates and intentions. This forward-looking information is identified by the use of terms and phrases such as “may,” “would,” “should,” “could,” “expect,” “intend,” “estimate,” “anticipate,” “plan,” “foresee,” “believe,” or “continue,” the negative of these terms and similar terminology, including references to assumptions, although not all forward-looking information contains these terms and phrases. Particularly, this Circular contains forward-looking statements and information regarding: the anticipated benefits of the Arrangement for the Company, the Purchaser and their respective shareholders; the reasons for the Purchaser Filing Parties in pursuing the Arrangement; the Shareholder and Court approvals; the required Key Regulatory Approvals, the likelihood of, and timing for, obtaining such approvals; and the anticipated timing of the completion of the Arrangement.

In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding future events or circumstances.

Forward-looking information is based on management’s beliefs and assumptions and on information currently available to management, regarding, among other things, general economic conditions and the competitive environment within our industry. Unless otherwise indicated, forward-looking information does not give effect to the potential impact of any mergers, acquisitions, divestitures or business combinations that may be announced or closed after the date hereof. Although the forward-looking information contained herein is based upon what we believe are reasonable assumptions, investors are cautioned against placing undue reliance on this information since actual results may vary from the forward-looking information.

Forward-looking information involves known and unknown risks and uncertainties, many of which are beyond our control, that could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking information. These risks and uncertainties include, but are not limited to,

(ii)

the failure of the parties to obtain the necessary Shareholder, Court and regulatory approvals or to otherwise satisfy the conditions to the completion of the Arrangement; failure of the parties to obtain such approvals or satisfy such conditions in a timely manner; significant transaction costs or unknown liabilities; failure to realize the expected benefits of the Arrangement; general economic conditions; and other risks and uncertainties identified under “Risk Factors” and “Information concerning Nuvei.” Failure to obtain the necessary Shareholder, Court and regulatory approvals, or the failure of the parties to otherwise satisfy the conditions to the completion of the Arrangement or to complete the Arrangement, may result in the Arrangement not being completed on the proposed terms, or at all. In addition, if the Arrangement is not completed, and the Company continues as a publicly-traded company, there are risks that the announcement of the Arrangement and the dedication of substantial resources of the Company to the completion of the Arrangement could have an impact on its business and strategic relationships (including with future and prospective employees, customers, suppliers and partners), operating results and activities in general, and could have a material adverse effect on its current and future operations, financial condition and prospects. Furthermore, pursuant to the terms of the Arrangement Agreement, the Company may, in certain circumstances, be required to pay a fee to the Purchaser, the result of which could have an adverse effect on its financial position. Although the Company has attempted to identify important risk factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other risk factors not presently known to the Company or that it presently believes are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking information. If any of these risks materialize, or if any of the assumptions underlying forward-looking statements prove incorrect, actual results and developments may differ materially from those made in or suggested by the forward-looking statements contained herein.

Consequently, all of the forward-looking information contained herein is qualified by the foregoing cautionary statements, and there can be no guarantee that the results or developments that we anticipate will be realized or, even if substantially realized, that they will have the expected consequences or effects on our business, financial condition or results of operation. Unless otherwise noted or the context otherwise indicates, the forward-looking information contained herein represents our expectations as of the date hereof or as of the date it is otherwise stated to be made, as applicable, and is subject to change after such date. However, we disclaim any intention or obligation or undertaking to update or amend such forward-looking information whether as a result of new information, future events or otherwise, except as may be required by applicable law.

This list is not exhaustive of the factors that may affect any of the forward-looking statements of Nuvei. The risks and uncertainties that could affect forward-looking statements are described further under the heading “Risk Factors.” Additional risks are further discussed in Nuvei’s Annual Information Form for the year ended December 31, 2023, and the Management’s Discussion and Analysis of Financial Condition and Results of Operations for the year ended December 31, 2023, as well as the Management’s Discussion and Analysis of Financial Condition and Results of Operations for the three months ended March 31, 2024, which are incorporated by reference and have been filed under Nuvei’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Copies of these documents can also be obtained, free of charge by any Shareholder, by directing a request to the Corporate Secretary of the Company by email at corporatesecretary@nuvei.com or by written request to 1100 René-Lévesque Boulevard West, 9th Floor, Montréal, Québec, Canada H3B 4N4.

Notice to Shareholders in the United States

The transactions contemplated herein constitute a “going private” transaction under Rule 13e-3 promulgated under the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”). In connection with these transactions, the Company and the Purchaser Filing Parties have filed with the U.S. Securities and Exchange Commission (the “SEC”) a transaction statement (the “Schedule 13E-3”) pursuant to Section 13(e) of the U.S. Exchange Act and Rule 13e-3 thereunder, which incorporates by reference this Circular. Copies of the Schedule 13E-3 are, and any other documents

(iii)

filed by the Company in connection with the Arrangement will be, available under Nuvei’s profile on EDGAR at www.sec.gov.

Shareholders are advised to read this Circular and the Schedule 13E-3 in their entirety, including the appendices and exhibits hereto or thereto, because they contain important information.

Nuvei Corporation is a corporation existing under the federal laws of Canada and is a “foreign private issuer” within the meaning of the rules promulgated under the U.S. Exchange Act. Section 14(a) of the U.S. Exchange Act and related proxy rules are not applicable to the Company nor to this solicitation and, therefore, this solicitation is not being effected in accordance with such laws. The solicitation of proxies and the transactions contemplated herein involve securities of a Canadian issuer and are being effected in accordance with (1) Canadian corporate laws and Canadian Securities Laws, which differ from disclosure requirements in the United States, and (2) the requirements of Rule 13e-3 under the U.S. Exchange Act.

The unaudited interim financial statements and audited historical financial statements of Nuvei and other financial information included or incorporated by reference in this Circular for Nuvei have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB), and thus may differ from the U.S. generally accepted accounting principles. Shareholders that are United States taxpayers are advised to consult their independent tax advisors regarding the United States federal, state, local and foreign tax consequences to them by participating in the Arrangement.

The enforcement by investors of civil liabilities under United States federal and state securities laws may be affected adversely by the fact that Nuvei is organized under the laws of a jurisdiction other than the United States, that some (or all) of its respective officers and directors are residents of countries other than the United States, that some or all of the experts named in this Circular may be residents of countries other than the United States, or that all or a substantial portion of the assets of Nuvei and such directors, officers and experts may be located outside the United States. As a result, it may be difficult or impossible for Shareholders resident in the United States to effect service of process within the United States upon Nuvei and its respective officers and directors or the experts named herein, or to realize against them on judgments of courts of the United States. In addition, Shareholders resident in the United States should not assume that the courts of Canada: (a) would enforce judgments of United States courts obtained in actions against such persons predicated upon civil liabilities under United States federal or state securities laws; or (b) would enforce, in original actions, liabilities against such persons predicated upon civil liabilities under United States federal or state securities laws.

The Company’s head office is located at 1100 René-Lévesque Boulevard West, 9th Floor, Montréal, Québec H3B 4N4, telephone: (514) 313-1190.

(iv)

TABLE OF CONTENTS

| QUESTIONS AND ANSWERS ABOUT THE MEETING AND THE ARRANGEMENT |

1 | |||||

|

|

Questions Relating to the Arrangement |

1 | ||||

| Questions Relating to the Special Meeting of Shareholders |

8 | |||||

| SUMMARY |

13 | |||||

| The Meeting |

13 | |||||

| Record Date |

13 | |||||

| Purpose of the Meeting |

13 | |||||

| Summary of the Arrangement |

13 | |||||

| Parties to the Arrangement |

14 | |||||

| Arrangement Agreement |

15 | |||||

| Background to the Arrangement |

15 | |||||

| Recommendation of the Special Committee |

15 | |||||

| Recommendation of the Board |

15 | |||||

| Reasons for the Recommendations |

16 | |||||

| The Purchaser Filing Parties’ Purpose and Reasons for the Arrangement |

22 | |||||

| Position of the Purchaser Filing Parties as to the Fairness of the Arrangement |

23 | |||||

| Required Shareholder Approval |

24 | |||||

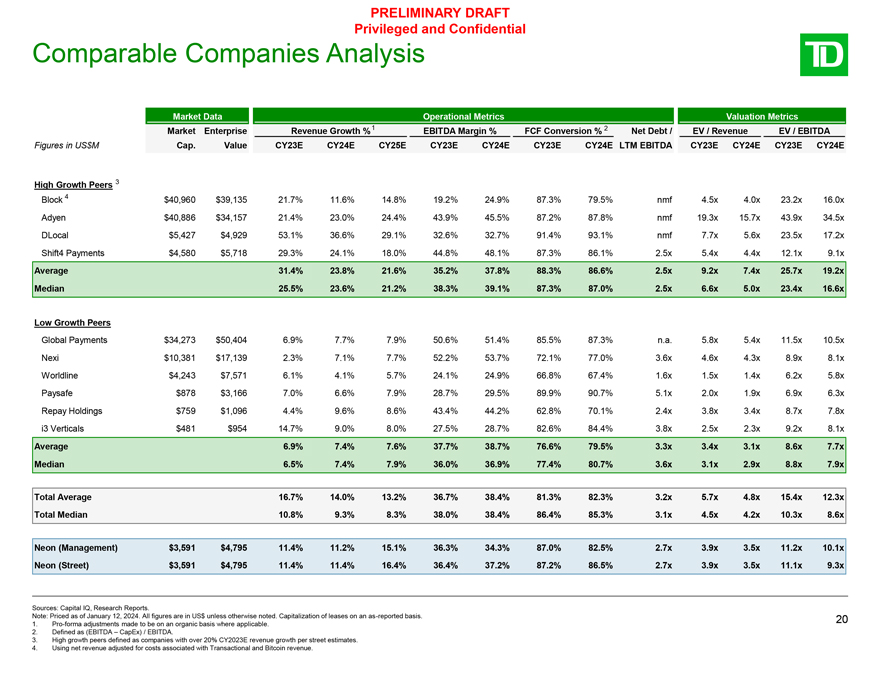

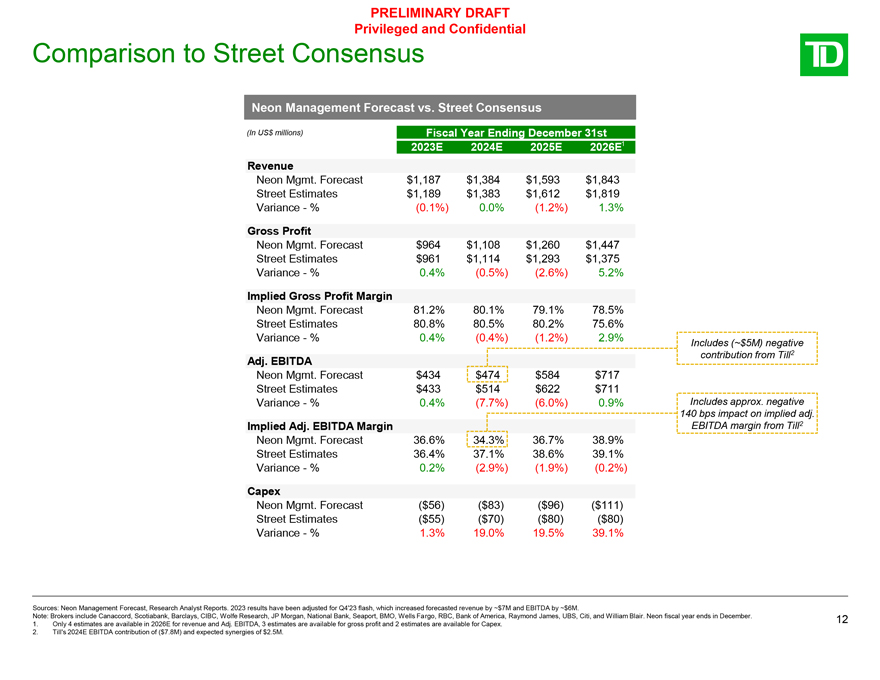

| Formal Valuation and TD Securities Fairness Opinion |

24 | |||||

| Barclays Fairness Opinion |

25 | |||||

| MI 61-101 Requirements |

25 | |||||

| Implementation of the Arrangement |

25 | |||||

| Procedural Safeguards for Shareholders |

26 | |||||

| Support and Voting Agreements |

26 | |||||

| Rollover Agreements |

26 | |||||

| Certain Canadian Federal Income Tax Considerations |

27 | |||||

| Certain United States Federal Income Tax Considerations |

27 | |||||

| Dissent Rights |

27 | |||||

| Depositary |

28 | |||||

| Stock Exchange Delisting and Reporting Issuer Status |

28 | |||||

| Risks Associated With the Arrangement |

28 | |||||

| Notice to Shareholders in the United States |

28 | |||||

| INFORMATION CONCERNING THE MEETING AND VOTING |

30 | |||||

| Purpose of the Meeting |

30 | |||||

| Date, Time and Place of Meeting |

30 | |||||

| Voting at the Meeting |

30 | |||||

| Voting by Proxy |

31 | |||||

| Join the Meeting as a Guest |

33 | |||||

(v)

| Non-Registered Shareholders |

33 | |||||

|

|

Solicitation of Proxies |

35 | ||||

|

Notice-and-Access |

35 | |||||

| Voting Shares |

35 | |||||

| Principal Shareholders |

36 | |||||

| Other Business |

36 | |||||

| SPECIAL FACTORS |

37 | |||||

| Background to the Arrangement |

37 | |||||

| Position of the Special Committee as to Fairness |

49 | |||||

| Recommendation of the Special Committee |

56 | |||||

| Position of the Board as to Fairness |

56 | |||||

| Recommendation of the Board |

56 | |||||

| Voting by the Company’s Directors and Officers |

57 | |||||

| The Purchaser Filing Parties’ Purpose and Reasons for the Arrangement |

58 | |||||

| Position of the Purchaser Filing Parties as to the Fairness of the Arrangement |

59 | |||||

| Certain Effects of the Arrangement |

63 | |||||

| Effects on Nuvei if the Arrangement Is Not Completed |

67 | |||||

| Compensation of the Special Committee |

67 | |||||

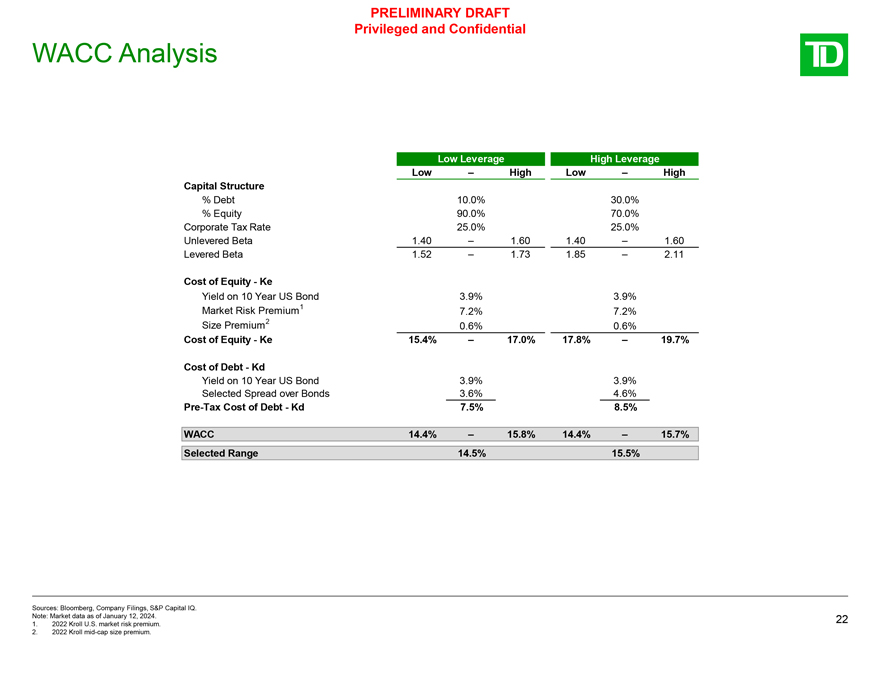

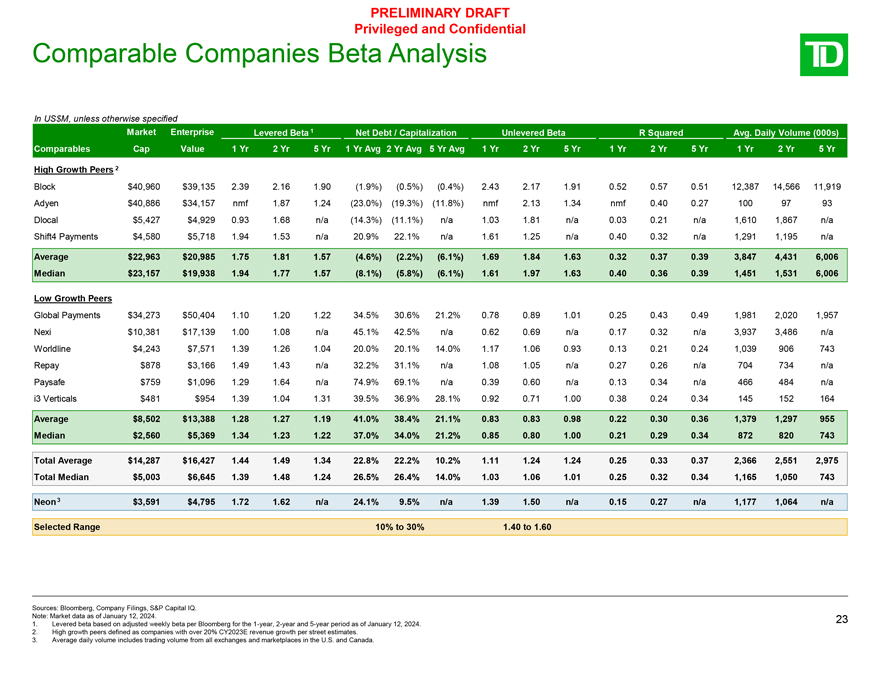

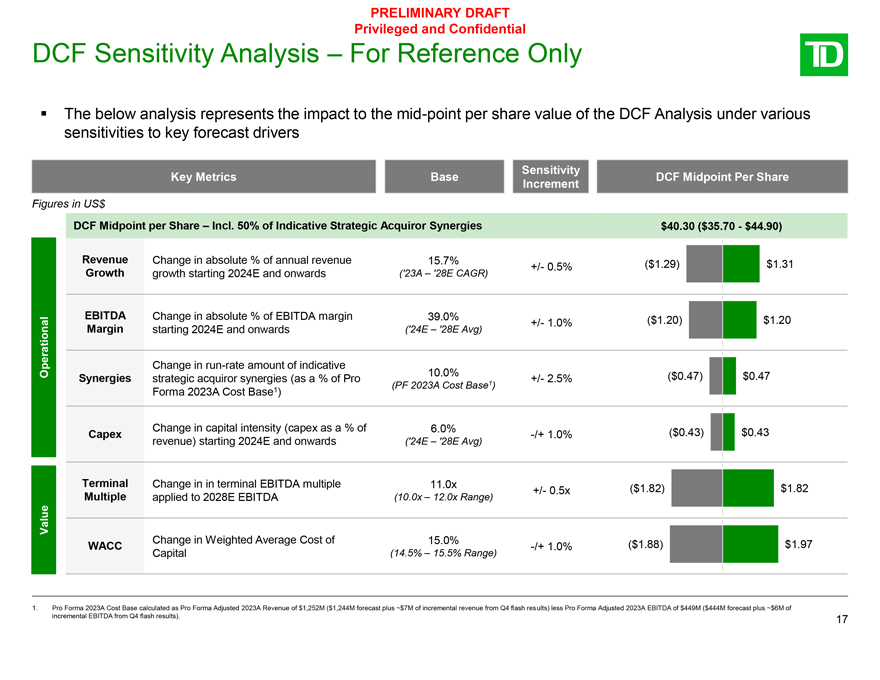

| Formal Valuation and TD Securities Fairness Opinion |

68 | |||||

| Barclays Fairness Opinion |

87 | |||||

| THE ARRANGEMENT |

96 | |||||

| Overview |

96 | |||||

| Required Shareholder Approval |

96 | |||||

| Support and Voting Agreements |

97 | |||||

| Rollover Agreements |

102 | |||||

| Implementation of the Arrangement |

103 | |||||

| Effective Date |

109 | |||||

| Procedure for Exchange of Share Certificates by Shareholders |

109 | |||||

| Payment of Consideration |

110 | |||||

| Expenses of the Arrangement |

112 | |||||

| Sources of Funds for the Arrangement |

112 | |||||

| Interests of Certain Persons in the Arrangement |

115 | |||||

| Intentions of Directors and Executive Officers |

123 | |||||

| Accounting Treatment of the Arrangement |

123 | |||||

| Arrangements between Nuvei and Security Holders |

124 | |||||

| INFORMATION CONCERNING THE PURCHASER FILING PARTIES |

124 | |||||

| The Purchaser |

124 | |||||

| Philip Fayer and WPF |

124 | |||||

| Novacap |

124 | |||||

(vi)

|

|

CDPQ |

125 | ||||

| INFORMATION CONCERNING NUVEI |

125 | |||||

| General |

125 | |||||

| Description of Share Capital |

125 | |||||

| Dividend Policy |

131 | |||||

| Ownership of Securities |

132 | |||||

| Commitments to Acquire Securities of Nuvei |

135 | |||||

| Previous Purchases and Sales |

135 | |||||

| Previous Distributions |

136 | |||||

| Trading in Subordinate Voting Shares |

137 | |||||

| Interest of Informed Persons in Material Transactions |

138 | |||||

| Material Changes in the Affairs of the Company |

137 | |||||

| Independent Auditors |

138 | |||||

| Selected Historical Financial Information |

138 | |||||

| Additional Information |

144 | |||||

| ARRANGEMENT AGREEMENT |

145 | |||||

| Covenants |

146 | |||||

| Additional Covenants Regarding Non-Solicitation |

153 | |||||

| Representations and Warranties |

158 | |||||

| Conditions to Closing |

159 | |||||

| Termination of the Arrangement Agreement |

161 | |||||

| Termination Fees |

163 | |||||

| Expenses |

164 | |||||

| Amendments |

164 | |||||

| Governing Law |

164 | |||||

| CERTAIN LEGAL MATTERS |

165 | |||||

| Implementation of the Arrangement and Timing |

165 | |||||

| Court Approval and Completion of the Arrangement |

165 | |||||

| Securities Law Matters |

166 | |||||

| Key Regulatory Approvals |

170 | |||||

| RISK FACTORS |

174 | |||||

| Risks Relating to Nuvei |

174 | |||||

| Risks Related to the Arrangement |

174 | |||||

| CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS |

178 | |||||

| Holders Resident in Canada |

179 | |||||

| Holders Not Resident in Canada |

180 | |||||

| CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS |

181 | |||||

| PROVISIONS FOR UNAFFILIATED SHAREHOLDERS |

184 | |||||

| DISSENTING SHAREHOLDERS’ RIGHTS |

184 | |||||

| DEPOSITARY |

188 | |||||

(vii)

| QUESTIONS AND FURTHER ASSISTANCE |

188 | |||||

| GLOSSARY OF TERMS |

189 | |||||

| CONSENT OF TD SECURITIES INC. |

210 | |||||

| CONSENT OF BARCLAYS CAPITAL INC. |

211 | |||||

| APPENDIX A ARRANGEMENT RESOLUTION |

A-1 | |||||

| APPENDIX B PLAN ARRANGEMENT |

B-1 | |||||

| APPENDIX C FORMAL VALUATION AND TD SECURITIES FAIRNESS OPINION |

C-1 | |||||

| APPENDIX D BARCLAYS FAIRNESS OPINION |

D-1 | |||||

| APPENDIX E INTERIM ORDER |

E-1 | |||||

| APPENDIX F NOTICE OF PRESENTATION FOR THE FINAL ORDER |

F-1 | |||||

| APPENDIX G SECTION 190 OF THE CANADA BUSINESS CORPORATIONS ACT |

G-1 | |||||

| APPENDIX H DIRECTORS AND EXECUTIVE OFFICERS OF THE COMPANY AND EACH PURCHASER FILING PARTY |

H-1 | |||||

(viii)

QUESTIONS AND ANSWERS ABOUT

THE MEETING AND THE ARRANGEMENT

Your vote is important. The following are key questions that you as a Shareholder may have regarding the Arrangement to be considered at the Meeting. These questions and answers do not provide all of the information relating to the Meeting or the matters to be considered at the Meeting and are qualified in their entirety by the more detailed information contained elsewhere in this Circular, the attached Appendices, the form of Proxy and the Letter of Transmittal, all of which are important and should be reviewed carefully. You are urged to carefully read the remainder of this Circular in its entirety before making a decision related to your Shares. See the “Glossary of Terms” starting on page 189 of this Circular for the meaning assigned to capitalized terms used below and elsewhere in this Circular that are not otherwise defined in these questions and answers.

Q: Why did I receive this document?

A: This document is a management information circular that has been mailed in advance of the Meeting. This Circular describes, among other things, the background to the Arrangement as well as the reasons for the determinations and recommendations of the Special Committee and the Board. This Circular contains a detailed description of the Arrangement, including certain risk factors relating to the completion of the Arrangement. If you are a Shareholder, a form of Proxy or VIF, as applicable, accompanies this Circular.

On April 1, 2024, the Company and the Purchaser entered into the Arrangement Agreement, pursuant to which it was agreed, among other things, to implement the Arrangement in accordance with and subject to the terms and conditions contained therein and in the Plan of Arrangement. See “Arrangement Agreement” for a summary of the Arrangement Agreement. The full text of the Arrangement Agreement is available under the Company’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. The full text of the Plan of Arrangement is attached as Appendix B to this Circular.

As a Shareholder as of the Record Date, you are entitled to receive notice of, and to vote at, the Meeting or any adjournment or postponement thereof. Management is soliciting your proxy, or vote, and providing this Circular in connection with that solicitation.

If you are a holder of Options, RSUs, PSUs and/or DSUs, but are not a Shareholder as of the Record Date, you received this Circular to provide you with notice and information with respect to the treatment of Options, RSUs, PSUs and/or DSUs under the Arrangement. See “The Arrangement – Implementation of the Arrangement.” Only Shareholders as of the Record Date are entitled to vote their Shares at the Meeting and holders of only Options, RSUs, PSUs or DSUs, as the case may be, are not entitled to vote at the Meeting.

Questions Relating to the Arrangement

Q: What is the proposed Arrangement?

A: The purpose of the Arrangement is to effect the acquisition of the Company by the Purchaser by way of a statutory plan of arrangement under section 192 of the CBCA. Pursuant to the Arrangement, the Purchaser, a newly-formed entity controlled by Advent, proposes to acquire all of the issued and outstanding Shares, other than the Rollover Shares, for $34.00 in cash per Share, without interest. The Purchaser will acquire the Rollover Shares pursuant to the Rollover Agreements and the Plan of Arrangement. As a consequence of the Arrangement, the Purchaser will own all of the issued and outstanding Shares following completion of the Arrangement. See “The Arrangement.”

The price of $34.00 per Share in cash represents a significant and attractive premium of approximately 56% to the closing price of the Subordinate Voting Shares on the Nasdaq on March 15, 2024, the last trading day prior to media reports

1

regarding a potential transaction involving the Company, and a premium of approximately 48% to the 90-day volume weighted average trading price4 per Subordinate Voting Share as of such date.

Q: What is the background and reasons for the proposed Arrangement?

A: The Arrangement Agreement is the result of extensive negotiations between the Special Committee, the Purchaser and their respective advisors.

See “Special Factors – Background to the Arrangement” for a summary of certain relevant background information that informed the Special Committee’s deliberations as well as the principal events leading to the execution of the Arrangement Agreement and the public announcement of the Arrangement.

In determining that the Arrangement is in the best interests of the Company and fair to Shareholders (other than the Rollover Shareholders), the Special Committee, with the assistance of the Company’s Management and the Special Committee’s legal and financial advisors, carefully reviewed the Arrangement and the terms and conditions of the Arrangement Agreement and related agreements and documents and considered and relied upon a number of substantive factors, including those set out under “Special Factors – Position of the Special Committee as to Fairness.”

Q: Does the Special Committee support the Arrangement?

A: Yes. The Special Committee, after, among other things, receiving experienced, qualified and independent legal and financial advice in evaluating the Arrangement, including the Formal Valuation and the TD Securities Fairness Opinion, and careful consideration of various matters, unanimously determined that the Arrangement and the entering into of the Arrangement Agreement is in the best interests of the Company, that the Arrangement is fair to Shareholders (other than the Rollover Shareholders), which includes the unaffiliated security holders, and unanimously recommended that the Board approve the Arrangement and recommends that the Shareholders vote IN FAVOUR of the Arrangement Resolution.

See “Special Factors – Recommendation of the Special Committee.”

Q: Does the Board support the Arrangement?

A: Yes. The Board of Directors (with Philip Fayer, Pascal Tremblay and David Lewin, as interested directors, abstaining from voting), on the unanimous recommendation of the Special Committee and after, among other things, receiving experienced and qualified legal and financial advice in evaluating the Arrangement, including the Formal Valuation and the Fairness Opinions, and careful consideration of various matters, unanimously determined that the Arrangement and the entering into of the Arrangement Agreement is in the best interests of the Company, that the Arrangement is fair to Shareholders (other than the Rollover Shareholders) and unanimously recommended (with Philip Fayer, Pascal Tremblay and David Lewin, as interested directors, abstaining from voting) that the Shareholders vote IN FAVOUR of the Arrangement Resolution.

See “Special Factors – Recommendation of the Board.”

Q: Who has agreed to support the Arrangement?

A: Each director and member of the Senior Management of Nuvei and each Rollover Shareholder has entered into a Support and Voting Agreement pursuant to which they have agreed, subject to the terms thereof, to support and vote all of their Shares in favour of the Arrangement Resolution and against any other resolution that is inconsistent with the Arrangement. Consequently, holders of approximately 0.3% of the Subordinate Voting Shares and holders of 100% of the Multiple Voting Shares, representing approximately 92% of the total voting power attached to all of the Shares (and who, as a result of their

| 4 | Based on Canadian composite (Toronto Stock Exchange and all Canadian marketplaces) and U.S. composite (Nasdaq and all U.S. marketplaces). |

2

holdings of Multiple Voting Shares, would effectively be able to veto any alternative transaction), have agreed to vote their Shares in favour of the transaction.

See “The Arrangement – Support and Voting Agreements.”

Q: What approvals are required by Shareholders at the Meeting?

A: The Arrangement Resolution must be approved by: (i) at least 662⁄3% of the votes cast by the holders of Multiple Voting Shares and Subordinate Voting Shares virtually present or represented by proxy at the Meeting, voting together as a single class (with each Subordinate Voting Share being entitled to one vote and each Multiple Voting Share being entitled to ten votes); (ii) not less than a simple majority of the votes cast by holders of Multiple Voting Shares virtually present or represented by proxy at the Meeting; (iii) not less than a simple majority of the votes cast by holders of Subordinate Voting Shares virtually present or represented by proxy at the Meeting; (iv) not less than a simple majority of the votes cast by holders of Subordinate Voting Shares virtually present or represented by proxy at the Meeting (excluding the Subordinate Voting Shares held by the Rollover Shareholders and the persons required to be excluded pursuant to MI 61-101); and (v) not less than a simple majority of the votes cast by holders of Multiple Voting Shares virtually present or represented by proxy at the Meeting (excluding the Multiple Voting Shares held by the Rollover Shareholders and the Persons required to be excluded pursuant to MI 61-101). The 124,986 Subordinate Voting Shares beneficially owned by Philip Fayer, representing approximately 0.20% of the Subordinate Voting Shares, and all of the issued and outstanding Multiple Voting Shares, will be excluded for purposes of such “minority approvals” required under MI 61-101. In the Interim Order, the Court declared that the vote set out in clause (v) of the first sentence of this paragraph is satisfied as there are no holders of Multiple Voting Shares who are eligible to cast a vote thereunder, as all holders of Multiple Voting Shares are “interested parties” within the meaning of MI 61-101 and must be excluded from such vote.

See “The Arrangement – Required Shareholder Approval.”

Q: What other approvals are required for the Arrangement?

A: The Arrangement requires approval by the Court under Section 192 of the CBCA. Prior to the mailing of this Circular, the Company obtained an Interim Order from the Superior Court of Québec (Commercial Division) on May 13, 2024, providing for the calling and holding of the Meeting and other procedural matters. The Company will apply to the Court for a Final Order if the Shareholders approve the Arrangement at the Meeting. The Court will consider, among other things, the procedural and substantive fairness of the Arrangement. In addition, approvals from certain regulatory authorities in Canada and other jurisdictions are conditions to the completion of the Arrangement.

See “Certain Legal Matters – Court Approval and Completion of the Arrangement” and “Certain Legal Matters – Key Regulatory Approvals.”

Q: How will I know when all required approvals have been obtained?

A: If all the necessary approvals have been received and conditions to the completion of the Arrangement have been satisfied or waived, other than conditions that, by their terms, cannot be satisfied until the Effective Date, then Nuvei will issue a press release disclosing such fact.

Q: When will the Arrangement become effective?

A: It is currently anticipated that the Effective Date will occur in late 2024 or the first quarter of 2025, based on the assumption that the Required Shareholder Approval and Court approval are obtained and all other conditions to the Arrangement are satisfied or waived prior to such date. It is not possible, however, to state with certainty whether or when the Effective Date will occur. The Effective Date could be earlier than anticipated or delayed for a number of reasons, including an objection before the Court at the hearing of the application for the Final Order. As provided under the Arrangement Agreement, the Company will

3

file the Articles of Arrangement as soon as reasonably practicable and in any event within three (3) Business Days after the satisfaction or, where not prohibited, waiver of the conditions to the completion of the Arrangement. If the Arrangement is not completed on or prior to the Outside Date, the parties will be permitted to terminate the Arrangement Agreement.

See “The Arrangement – Implementation of the Arrangement and Timing.”

Q: If the Arrangement is approved by Shareholders at the Meeting, when will the Shares cease to be traded on the TSX and Nasdaq and cease public reporting?

A: The Company and the Purchaser have agreed to cooperate in taking, or causing to be taken, all actions necessary to enable the Shares to be delisted from the TSX and Nasdaq promptly, with effect as of the Effective Date or as promptly as practicable after the Effective Date. Following the Effective Date, it is expected that the Purchaser will cause the Company to apply to cease to be a reporting issuer under the securities legislation under which it is currently a reporting issuer (or equivalent) or take or cause to be taken such other measures as may be appropriate to ensure that the Company is not required to prepare and file continuous disclosure documents.

Following the consummation of the Arrangement, the registration of the Subordinate Voting Shares under the U.S. Exchange Act will be terminated.

See “Certain Legal Matters – Securities Law Matters.”

Q: What will I receive for my Shares under the Arrangement?