UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number No. 333-229310

| United World Holding Group Ltd. |

| (Exact name of Registrant as specified in its charter) |

British Virgin Islands

(Jurisdiction of incorporation or organization)

c/o United Culture Exchange (Beijing) Co., Ltd.

48 Guang’an Men South Street

Building No. 1, Suite 4008

Xichen District, Beijing, PRC 100054

(Address of principal executive offices)

Lilly Alexandria Lee

4540 Center Boulevard, Suite 3111,

Long Island City, NY 11109

(917) 828-1567

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act: None

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: 22,354,793 ordinary shares as of December 31, 2019.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Non-accelerated filer | ☒ |

| Accelerated filer | ☐ | Emerging growth company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ | ||

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). ☐ Yes ☒ No

|

|

|

| Page |

|

|

|

|

| ||

|

| 5 |

| ||

|

| 5 |

| ||

|

| 5 |

| ||

|

| 18 |

| ||

|

| 36 |

| ||

|

| 36 |

| ||

|

| 40 |

| ||

|

| 43 |

| ||

|

| 46 |

| ||

|

| 46 |

| ||

|

| 46 |

| ||

|

| 49 |

| ||

|

| 49 |

| ||

|

|

|

|

|

|

|

|

|

|

| |

|

| 50 |

| ||

| Material Modifications to the Rights of Security Holders and Use of Proceeds |

| 50 |

| |

|

| 50 |

| ||

|

| 51 |

| ||

|

| 51 |

| ||

|

| 51 |

| ||

|

| 51 |

| ||

|

| 51 |

| ||

|

| 52 |

| ||

| Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

| 52 |

| |

|

| 52 |

| ||

|

| 53 |

| ||

|

| 53 |

| ||

|

|

|

|

|

|

|

|

|

|

| |

|

| 54 |

| ||

|

| 54 |

| ||

|

| 54 |

|

| 2 |

Conventions Used in this Annual Report

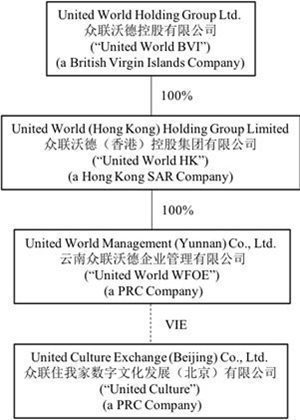

Except where the context otherwise requires and for purposes of this annual report on Form 20-F only, “we,” “us,” “our company,” “Company,” “our” and “United World” refer to:

|

| ● | United World Holding Group Ltd. (“United World BVI” when individually referenced) (also referred to as 众联沃德控股有限公司 in China), a British Virgin Islands company; |

|

| ● | United World (Hong Kong) Holding Group Limited (“United World HK”) (also referred to as 众联沃德(香港)控股集团有限公司 in China), a limited liability company incorporated in Hong Kong and a wholly-owned subsidiary of United World BVI; |

|

| ● | Yunnan United World Enterprise Management Co., Ltd. (“United World WFOE”) (also referred to as 云南众联沃德企业管理有限公司 in China), a wholly foreign-owned enterprise (“WFOE”) formed under the laws of the People’s Republic of China (the “PRC”) and a wholly-owned subsidiary of United World HK; |

|

| ● | United Culture Exchange (Beijing) Co., Ltd. (“United Culture”) (also referred to as 众联住我家数字文化发展(北京)有限公司 in China), a company formed under the laws of PRC and a variable interest entity (“VIE”) contractually controlled by United World WFOE; |

|

| ● | United World WFOE and United Culture are collectively referred to as the “PRC entities.” |

This annual report contains translations of certain RMB amounts into U.S. dollar amounts at a specified rate solely for the convenience of the reader. All reference to “U.S. dollars”, “USD”, “US$” or “$” are United States dollars. The exchange rates in effect as of December 31, 2020, 2019 and 2018 were US $1.00 for RMB 6.5306, RMB 6.9632 and RMB 6.8785, respectively. We use period-end exchange rates for assets and liabilities and average exchange rates for revenue and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred. Any discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

We obtained the industry and market data used in this annual report or any document incorporated by reference from industry publications, research, surveys and studies conducted by third parties and our own internal estimates based on our management’s knowledge and experience in the markets in which we operate. We did not, directly or indirectly, sponsor or participate in the publication of such materials. We have sought to provide current information in this annual report and believe that the statistics provided in this annual report remain up-to-date and reliable.

| 3 |

| Table of Contents |

SPECIAL CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Certain matters discussed in this report may constitute forward-looking statements for purposes of the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. The words “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” and similar expressions are intended to identify such forward-looking statements. Our actual results may differ materially from the results anticipated in these forward-looking statements due to a variety of factors, including, without limitation, those discussed under “Item 3—Key Information—Risk Factors,” “Item 4—Information on the Company,” “Item 5—Operating and Financial Review and Prospects,” and elsewhere in this report, as well as factors which may be identified from time to time in our other filings with the Securities and Exchange Commission (the “SEC”) or in the documents where such forward-looking statements appear. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by these cautionary statements.

The forward-looking statements contained in this report reflect our views and assumptions only as of the date this report is signed. Except as required by law, we assume no responsibility for updating any forward-looking statements.

| 4 |

| Table of Contents |

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable for annual reports on Form 20-F.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable for annual reports on Form 20-F.

A. Selected Financial Data

The following table presents the selected consolidated financial information for our company. The selected consolidated statements of comprehensive income data for the fiscal years ended December 31, 2020, 2019, and 2018 and the selected consolidated balance sheets data as of December 31, 2020, 2019, and 2018 have been derived from our audited consolidated financial statements, which are included in this annual report beginning on page F-1. Our historical results do not necessarily indicate results expected for any future periods. The selected consolidated financial data should be read in conjunction with, and are qualified in their entirety by reference to, our audited consolidated financial statements and related notes and “Item 5. Operating and Financial Review and Prospects” below. Our audited consolidated financial statements are prepared and presented in accordance with US GAAP.

(All amounts in thousands of U.S. dollars, except Shares outstanding)

|

|

| For the Years Ended December 31, |

| |||||||||

|

|

| 2020 |

|

| 2019 |

|

| 2018 |

| |||

| Statement of operation data: |

|

|

|

|

|

|

|

|

| |||

| Total revenue |

| $ | 1,010,435 |

|

| $ | 919,172 |

|

| $ | 1,085,454 |

|

| Gross profit (loss) |

| $ | 580,990 |

|

| $ | (241,010 | ) |

| $ | 347,912 |

|

| Operating expenses |

| $ | 1,022,812 |

|

| $ | (1,947,734 | ) |

| $ | (188,326 | ) |

| Income (loss) from operations |

| $ | (441,822 | ) |

| $ | (2,188,744 | ) |

| $ | 159,586 |

|

| Total other income (expenses), net |

| $ | (249 | ) |

| $ | (646,007 | ) |

| $ | 649 |

|

| Provision for income taxes (benefits) |

| $ | - |

|

| $ | - |

|

| $ | 19 |

|

| Net income (loss) |

| $ | (442,071 | ) |

| $ | (2,834,751 | ) |

| $ | 160,216 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average Ordinary Shares outstanding |

|

| 22,354,793 |

|

|

| 22,354,793 |

|

|

| 20,161,287 |

|

| Earnings (loss) per share |

| $ | (0.02 | ) |

| $ | (0.13 | ) |

| $ | 0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance sheet data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Current assets |

| $ | 3,343,428 |

|

| $ | 3,481,933 |

|

| $ | 4,559,337 |

|

| Total assets |

| $ | 3,425,741 |

|

| $ | 3,626,324 |

|

| $ | 4,568,913 |

|

| Current liabilities |

| $ | 261,638 |

|

| $ | 154,750 |

|

| $ | 634,419 |

|

| Total liabilities |

| $ | 261,638 |

|

| $ | 217,897 |

|

| $ | 634,419 |

|

| Total equity |

| $ | 3,164,103 |

|

| $ | 3,408,427 |

|

| $ | 3,934,494 |

|

B. Capitalization and Indebtedness

Not applicable for annual reports on Form 20-F.

C. Reasons for the Offer and Use of Proceeds

Not applicable for annual reports on Form 20-F.

| 5 |

| Table of Contents |

D. Risk Factors

Risks Related to Our Business and Industry

We are susceptible to general economic conditions, natural catastrophic events and public health crises, and travel restrictions, quarantines, and changes in consumer behavior as a result thereof could adversely affect our operating results.

Our operating results will be subject to fluctuations based on general economic conditions, in particular those conditions that impact event planning and hotel industry. Deterioration in economic conditions could cause decreases in business volume and reduce and/or negatively impact our short-term ability to grow revenues. Further, any decreased collectability of accounts receivable or early termination of agreements due to deterioration in economic conditions could negatively impact our results of operations.

Furthermore, our business is subject to the impact of natural catastrophic events such as earthquakes, floods or power outages, political crises such as terrorism or war, and public health crises such as disease outbreaks, epidemics, or pandemics in China, which is our primary markets and business locations. Currently, the rapid spread of coronavirus (COVID-19) globally has resulted in increased travel restrictions, disruption and shutdown of businesses. We may experience impacts from quarantines, market downturns and changes in customer behavior related to pandemic fears and impacts on our workforce if the virus becomes widespread in any of our markets. We provide event planning and lodging services to our customers, including business conferences, wedding planning and other cultural events. This industry is particularly vulnerable to any pandemic event. One or more of our customers, distribution partners, service providers or suppliers may experience financial distress, file for bankruptcy protection, go out of business, or suffer disruptions in their business due to the coronavirus outbreak; as a result, our operation revenues may be impacted. The extent to which the coronavirus impacts our results will depend on future developments, which are highly uncertain and will include emerging information concerning the severity of the coronavirus and the actions taken by governments and private businesses to attempt to contain the coronavirus, but is likely to result in a material adverse impact on our business, results of operations and financial condition at least for the near term.

Our limited operating history makes evaluating our business difficult.

We launched our business in October 2016, secured the first event planning contract in January 2017, and started generating revenue in June of the same year. Thus, our limited operating history may not provide a meaningful basis for you to evaluate our business, financial performance and prospects. We are, and expect for the foreseeable future to be, subject to all the risks and uncertainties, inherent in a new business. Accordingly, you should consider our prospects in light of the costs, uncertainties, delays and difficulties frequently encountered by companies with a limited operating history. In particular, you should consider that there is a significant risk that we may not be able to:

|

| ● | restore and maintain profitability; |

|

|

|

|

|

| ● | acquire and retain customers; |

|

|

|

|

|

| ● | attract, train, motivate and retain qualified personnel; |

|

|

|

|

|

| ● | keep up with evolving industry standards and market developments; |

|

|

|

|

|

| ● | successfully implement our marketing and growth strategies; |

|

|

|

|

|

| ● | respond to competitive market conditions; |

|

|

|

|

|

| ● | maintain adequate control of our expenses; or |

|

|

|

|

|

| ● | manage our relationships with our suppliers and customers. |

If we are unsuccessful in addressing any of these risks, our business may be materially and adversely affected.

| 6 |

| Table of Contents |

We have incurred losses in the past and may incur losses in the future.

While we generated $1,010,435 in revenue and incurred a net loss of $442,071 for the fiscal year ended December 31, 2020, we generated $919,172 in revenue and incurred a net loss of $2,834,751 during the year ended December 31, 2019, and we produced a net income of $160,216 during year ended December 31, 2018. If our costs increase as we start expanding our business and operations, we may continue to incur losses in the future.

Our possible lack of internal controls over financial reporting may affect the market for and price of our ordinary shares.

Our disclosure and internal controls over financial reporting may not be effective. We may not have the financial resources or personnel to develop or implement systems that would provide us with the necessary information on a timely basis so as to be able to implement financial controls. In addition, we may have difficulty in hiring and retaining a sufficient number of qualified employees. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records, and instituting business practices that meet Western standards. We may have made and may in the future make mistakes in the financial statements that are included or will be included in our public filings, such as a registration statement, due to lack of internal controls over financial reporting.

The COVID-19 outbreak has adversely affected, and may continue to adversely affect, our financial and operating performance.

In December 2019, COVID-19 was reported to have surfaced in Wuhan, China, which subsequently spread throughout China. In addition, after COVID-19 was declared by the World Health Organization as a Public Health Emergency of International Concern on January 31, 2020, many foreign countries issued travel bans to China which further harmed the travel industry in China. The Chinese government has also implemented strict nationwide containment measures against COVID-19, including travel restrictions, lock-downs of certain cities and temporary closures of certain businesses. The travel and entertainment industry has been severely affected by the outbreak of COVID-19 in 2020. These measures could slow down the development of the Chinese economy and adversely affect global economic conditions and financial markets. Such containment measures and reduced traveler traffic negatively affected our event planning business.

The overall impact of COVID-19 on our business, liquidity and results of operations is unknown at this time. Moreover, COVID-19 may not be eliminated and such outbreak may recur. The potential downturn brought by and the duration of the COVID-19 pandemic may be difficult to assess or predict where actual effects will depend on many factors beyond our control. Please see “Impact of the COVID-19 Pandemic” in this report.

Our business is sensitive to Chinese economic conditions. A severe or prolonged downturn in the Chinese economy could materially and adversely affect our revenues and results of operations.

Our business and operations are primarily based in China. We depend on domestic businesses and leisure travel customers in China for a significant majority of our revenues. Accordingly, our financial results have been, and we expect will continue to be, affected by developments in the economies and travel industries primarily of China.

As the travel industry is highly sensitive to business and personal discretionary spending levels, it tends to decline during general economic downturns. The growth rate of China’s GDP decreased from 2012 to 2016, and from 2018 to 2020. It is uncertain whether the growth of the Chinese economy will continue to slow down in the future. Additionally, the Chinese economy has been negatively impacted as a result of the strict nationwide containment measures in China against COVID-19, including travel restrictions, lock-downs of certain cities and temporary closures of certain businesses. These measures could slow down the development of the Chinese economy and adversely affect global economic conditions and financial markets. A prolonged slowdown in the Chinese economy could erode consumer confidence which could result in changes to consumer spending patterns for travel and lodging-related products and services.

China’s economic growth rate may materially decline in the near future, which may have adverse effects on our financial condition and results of operations. Risk of a material slowdown in China’s economic growth rate is based on several current or emerging factors including: (i) overinvestment by the government and businesses and excessive credit offered by banks; (ii) a rudimentary monetary policy; (iii) excessive privileges to state-owned enterprises at the expense of private enterprises; (iv) the increases in labor costs; (v) a decrease in exports due to weaker overseas demand; (vi) failure to boost domestic consumption; and (vii) challenges resulting from international and geopolitical situations, especially the US-China trade war and the overall tension between such two nations.

| 7 |

| Table of Contents |

Our success depends substantially on the continued retention of certain key personnel and our ability to hire and retain qualified personnel in the future to support our growth and execute our business strategies.

If one or more of our senior executives or other key personnel are unable or unwilling to continue in their present positions, our business may be disrupted and our financial condition and results of operations may be materially and adversely affected. While we depend on the abilities and participation of our current management team generally, we rely particularly upon Hong Wang, our CEO and CFO, who is responsible for the development and implementation of our business plans. The loss of the service of Hong Wang for any reason could significantly and adversely impact our business and results of operations. Competition for senior management in the PRC is intense and the pool of qualified candidates is limited. We cannot assure you that the services of our senior executive and other key personnel will continue to be available to us, or that we will be able to find a suitable replacement for them if they were to leave.

The event planning industry and hospitality industry in China are highly competitive and growing rapidly in the past few years; if we are unable to compete successfully, our financial condition and results of operations may be harmed.

The event planning industry in China has been developing rapidly and become very competitive in recent years. As it is relatively easy to enter the market, there are many event planners providing service of various qualities across China. Competition is mainly based on rates, brand recognition, turnaround time, quality of venue and service levels. Our business and individual customers may change their budgets and preferences and choose event planners that offer lower rates or have access to venues and facilities that we do not have access to, which may have an adverse effect on our competitive position, results of operations and financial condition.

The hospitality industry in China is also intensively competitive. We are competing not only with hotels, resorts, but also with a growing number of B&B inns where the competition is mainly based on location, room rates, entertainment facilities, brand recognition, the quality of accommodations and service levels. According to the 2020 B&B Industry Development Research Report published by the China Tourism Association, there are approximately 3 million B&B inns in China, an increase of more than 25% from 2019. Our typical business customers and leisure travelers may change their travel, spending and consumption patterns and choose hotels or B&B inns in different segments. New and existing competitors may offer more competitive rates, more comprehensive accommodation packages, greater convenience and services, or superior facilities, which could result in a decrease in occupancy and average daily rates of our B&B inns. Any of these factors may have an adverse effect on our competitive position, results of operations and financial condition.

Our financial and operating performance may be adversely affected by epidemics, natural disasters and other catastrophes.

Our financial and operating performance may be adversely affected by epidemics, natural disasters and other catastrophes, particularly in the locations where we plan to operate the B&B inns.

Our business could be materially and adversely affected by the outbreak of swine influenza, avian influenza, severe acute respiratory syndrome (“SARS”), or other epidemics. During such epidemic outbreak, China adopted certain hygiene measures, including quarantining visitors from places where any of the contagious diseases were rampant. Those restrictive measures adversely affected the performance of the tourism and hospitality industries during that period. Any prolonged restrictive measures in order to control the contagious disease or other adverse public health developments in China or our targeted markets may have a material and adverse effect on our business operations.

| 8 |

| Table of Contents |

Similarly, natural disasters, wars (including the potential of war), terrorist activity (including threats of terrorist activity), social unrest and heightened travel security measures instituted in response, and travel-related accidents, as well as geopolitical uncertainty and international conflict, will affect travel volume and may in turn have a material adverse effect on our business and results of operations. In addition, we may not be adequately prepared in contingency planning or recovery capability in relation to a major incident or crisis, and as a result, our operational continuity may be adversely and materially affected, which in turn may harm our reputation.

If we are unable to access funds to maintain our B&B inns condition and appearance as planned, the attractiveness of our B&B inns and our reputation could suffer and our occupancy rates may decline.

In order to maintain outstanding condition and appearance of our B&B inns, ongoing renovations and other leasehold improvements, including periodic replacement of furniture, fixtures and equipment, will be required. Such investments and expenditures require ongoing funding and, to the extent we cannot fund these expenditures from our existing cash or cash flow generated from operations, we must borrow or raise capital through financing. We may not be able to access capital or willing to spend available capital when other higher prioritized projects require the investment. If we fail to make investments necessary to maintain or improve the properties that we operate, our B&B inns’ attractiveness and reputation could deteriorate; we could lose our market share to our competitors and our B&B inns occupancy rates and revenues generated per available room (“Rev PAR”) may decline.

We are subject to various hospitality, hygiene, safety and environmental laws and regulations that may subject us to liability.

Our B&B inns are subject to various compliance and operational requirements under the PRC laws and regulations, some of which are still evolving and are subject to change. See “Regulation - Regulations on Hotel Operation.” Furthermore, new regulations may be adopted in the future to increase our compliance efforts at significant costs. If we were not in full compliance with any of the applicable requirements, such as environmental, health and safety laws, we might be subject to potentially significant monetary damages and fines or the suspension of operations and development activities.

The growth of third-party online and other hotel reservation intermediaries may adversely affect our margins and profitability.

As our B&B rooms can also be booked through our cooperating travel agencies or third-party online reservation intermediaries whom we have profit sharing arrangements with or pay commissions to, if the reservation volume of any travel intermediary becomes substantial, it may be on a better bargaining position to negotiate a higher profit percentage or commission, or other significant concession from us. As a result, the growth and importance of these travel intermediaries may adversely affect our ability to control the supply and cost of our B&B business, which would in turn adversely affect our margins and profitability.

The legal rights of us to use certain leased properties could be challenged by property owners or other third parties, which could prevent us from operating the affected B&B inns or increase the costs associated with operating these B&B inns.

For all of our leased-and-operated B&B inns, we do not hold property ownership with respect to the premises under which those B&B inns are operated. Instead, we rely on leases or contracted management arrangements with the property owners. Our general practice requires us to examine the title certificates of the property owners as part of our due diligence before entering into a lease or a management agreement with them. If we fail to identify encumbrance on the titles, our leases of such properties may be challenged or even invalidated by government authority or relevant dispute resolution institution. As a result, the development or operations of our B&B inns on such properties could be adversely affected.

In addition, we are subject to the risks of other potential disputes with property owners and to the forced closure of B&B inns. Such disputes and forced closures, whether resolved in the favor of us, may divert our management attention, harm our reputation, or otherwise disrupt and adversely affect our business.

| 9 |

| Table of Contents |

Our employment practices may be adversely impacted under the labor law of the PRC.

The PRC National People’s Congress promulgated the labor law which became effective on January 1, 2008 and was amended on December 28, 2012, and the State Council promulgated implementing rules for the labor law on September 18, 2008. The labor law and the implementing rules impose requirements concerning, among others, the execution of written contracts between employers and employees, the time limits for probationary periods, and the length of employment contracts. The interpretation and implementation of these regulations are still evolving. Consequently, our employment practices may violate the labor law and related regulations and we could be subject to penalties, fines or legal fees as a result. If we are subject to severe penalties or incur significant legal fees in connection with labor law disputes or investigations, our business, financial condition and results of operations may be adversely affected.

In accordance with the PRC Social Insurance Law, the Regulations on the Administration of Housing Fund and other relevant laws and regulations, China establishes a social insurance system and other employee benefits including basic pension insurance, basic medical insurance, work-related injury insurance, unemployment insurance, maternity insurance, and housing fund, or collectively the Employee Benefits. An employer shall pay the Employee Benefits for its employees in accordance with the rates provided under relevant regulations and shall withhold the social insurance and other Employee Benefits that should be assumed by the employees. For example, an employer that has not made social insurance contributions at a rate based on an amount prescribed by the law, or at all, may be ordered to rectify the non-compliance and pay the required contributions within a stipulated deadline and be subject to a late fee of up to 0.05% or 0.2% per day, as the case may be. If the employer still fails to rectify the failure to make social insurance contributions within the stipulated deadline, it may be subject to a fine ranging from one to three times the amount overdue.

Under the Regulations on the Administration of Housing Fund, PRC companies must register with applicable housing fund management centers and establish a special housing fund account in an entrusted bank. Both companies and their employees are required to contribute to the housing funds. According to Regulations on Management of Housing Fund issued in 2016 by the Beijing Housing Provident Fund Management Committee (the “Beijing Regulation”), the following entities are required to establish housing fund account for their employees: (i) State government, (ii) State-owned enterprises, town/township collective enterprises, foreign-investment enterprises, town/township private enterprises and other town/township enterprises, (iii) institutions, (iv) non-enterprise private entities, and (v) social organization. All other entities can establish housing fund account on a voluntary basis. Our company is not one of the entities required by Beijing Regulation to establish housing fund. As of the date of this report, we have not made contributions to the housing funds. If we are subject to investigations related to possible non-compliance with housing fund regulations and are imposed penalties or incur legal fees in connection with housing fund disputes or investigations, our business, financial condition and results of operations may be adversely affected.

We rely on a limited number of suppliers for our event planning and B&B business.

We rely on a limited number of suppliers for our event planning and B&B business, and we may not be able to find replacements or immediately transition to alternative suppliers should we need to do so. When industry supply is constrained, our suppliers may allocate resources away from us and to our competitors. If we lose one or more of the suppliers, our operation may be disrupted, and our results of operations may be adversely and materially impacted.

Risks Relating to Our Corporate Structure

We rely on contractual arrangements with our VIE and its shareholders for our business operations, which may not be as effective as direct ownership in providing operational control.

We have relied and expect to continue to rely on contractual arrangements with United Culture and its shareholders to operate our business in China. These contractual arrangements may not be as effective as direct ownership in providing us with control over our VIE. For example, our VIE and its shareholders could breach their contractual arrangements with us by, among other things, failing to conduct their operations in an acceptable manner or taking other actions that are detrimental to our interests. The revenues contributed by our VIE constituted all of our revenues in 2020, 2019 and 2018.

| 10 |

| Table of Contents |

If we had direct ownership of our VIE, we would be able to exercise our rights as a shareholder to effect changes in the board of directors of our VIE, which, in turn, could implement changes, subject to any applicable fiduciary obligations, at the management and operational level. However, under the current contractual arrangements, we rely on the performance by our VIE and its shareholders of their respective obligations under the contracts to exercise control over our VIE. The shareholders of our VIE may not act in the best interests of our Company or may not perform their obligations under these contracts. Such risks exist throughout the period in which we intend to operate certain portion of our business through the contractual arrangements with our VIE and its shareholders. If any dispute relating to these contracts remains unresolved, we will have to enforce our rights under these contracts through the operations of the PRC laws and arbitration, litigation or other legal proceedings, and therefore will be subject to uncertainties in the PRC legal system. See “— Any failure by our VIE or its shareholders to perform their obligations under our contractual arrangements with them would have a material and adverse effect on our business.” Therefore, our contractual arrangements with our VIE and its shareholders may not be as effective in controlling our business operations as direct ownership.

Any failure by our VIE or its shareholders to perform their obligations under our contractual arrangements with them would have a material and adverse effect on our business.

If our VIE or its respective shareholders fail to perform their respective obligations under the contractual arrangements, we could be limited in our ability to enforce the contractual arrangements that give us effective control over our business operations in the PRC, and may have to incur substantial costs and expend additional resources to enforce such arrangements. We may also have to rely on legal remedies under the PRC laws, including seeking specific performance or injunctive relief and claiming damages, which, we cannot assure, will be effective under the PRC laws. For example, if the shareholders of our VIE refuse to transfer their equity interest in our VIE to our PRC subsidiary or its designee after we exercise the purchase option pursuant to these contractual arrangements, or if they otherwise act in bad faith or fail to fulfill their contractual obligations, we may have to take legal actions to compel them to perform their contractual obligations. In addition, if there are any disputes or governmental proceedings involving any interest in such shareholders’ equity interests in our VIE, our ability to exercise shareholders’ rights or foreclose the equity pledges according to the contractual arrangements may be impaired. If these disputes or proceedings are to impair our control over our VIE, we may not be able to continue to consolidate our VIE’s financial results, which would result in a material adverse effect on our business, operations and financial condition.

All the agreements under our contractual arrangements are governed by the PRC laws and provide for the resolution of disputes through arbitration in China. Accordingly, these contracts would be interpreted in accordance with the PRC laws, and any disputes would be resolved in accordance with the PRC legal procedures.

All the agreements under our contractual arrangements are governed by PRC law and provide for the resolution of disputes through arbitration in China. Accordingly, these contracts would be interpreted in accordance with the PRC laws and any disputes would be resolved in accordance with the PRC legal procedures. Uncertainties in the PRC legal system could limit our ability to enforce these contractual arrangements. Meanwhile, there are very few precedents and little formal guidance as to how contractual arrangements in the context of a VIE should be interpreted or enforced under the PRC laws. There remain significant uncertainties regarding the ultimate outcome of such arbitration should legal action become necessary. In addition, under the PRC laws, rulings by arbitrators are final, parties cannot appeal the arbitration results in courts, and if the losing parties fail to carry out the arbitration awards within a prescribed time limit, the prevailing parties may only enforce the arbitration awards in PRC courts through arbitration award recognition proceedings, which would require additional expenses and delay. In the event we are unable to enforce these contractual arrangements and suffer significant delay or other obstacles in the process of enforcing these contractual arrangements, we may not be able to exert effective control over our VIE, and our ability to conduct our business may be negatively affected.

We may lose the ability to use, or otherwise benefit from, the licenses, permits and assets held by our VIE.

As part of our contractual arrangements with our VIE, our VIE holds certain assets, licenses and permits that are material to our business operations. The contractual arrangements contain terms that specifically obligate our VIE’s shareholders to ensure the valid existence of the VIE and restrict the disposal of material assets of the VIE. However, in the event the VIE’s shareholders breach the terms of these contractual arrangements and voluntarily liquidate our VIE, or our VIE declares bankruptcy and all or part of its assets become subject to liens or rights of third-party creditors or are otherwise disposed of without our consent, we may be unable to conduct some or all of our business operations or otherwise benefit from the assets held by the VIE, which could have a material adverse effect on our business, financial condition and results of operations.

| 11 |

| Table of Contents |

Risks Related to Doing Business in China

Adverse changes in the political and economic policies of China could have a material and adverse effect on the overall economic growth of China, which could adversely affect our competitive position.

Although the Chinese economy is no longer a planned economy, it still differs from the economies of most developed countries in many respects, including the level of governmental involvement, growth rate and control of foreign exchange rates. For instance, the Chinese government exercises significant control over its economic growth through direct allocation of resources, establishment of monetary policy, control of incurrence and payment of foreign currency-denominated obligations, and provision of preferential treatment to particular industries. We operate our business in China. Accordingly, our business, results of operations, financial condition and prospects are subject to political, legal and economic developments in China. Changes in any of these policies, laws and regulations could adversely affect the overall economy in China, including the hospitality industry in which we operate.

While the Chinese economy has grown significantly in the past forty years, the growth rate may not be sustainable. Recently, Chinese economy is going through a restructuring. In response to the economic restructuring, the Chinese government has adopted certain policies to stimulate the economic growth in China. We cannot assure you that any of the various monetary policies and economic stimulus actions adopted by the Chinese government will be effective to bring back the Chinese economy on a fast growth track as it was. If the Chinese policies fail to achieve any of the goals or any aspect of the policies limits the growth of our industries, our business, growth rate or results of operations could be adversely affected.

We may be exposed to liabilities under the U.S. Foreign Corrupt Practices Act (“FCPA”) and Chinese anti-corruption law.

We are subject to the FCPA and other laws that prohibit improper payments or offers of payments to foreign governments, foreign government officials and political parties by U.S. persons as defined by the statute for purposes of obtaining or retaining businesses. We are also subject to the Chinese anti-corruption law, which strictly prohibits bribes to government officials. We may have agreements with third parties who may make sales in China and U.S., during the process of which we may be exposed to corruption. Activities in China create the risk of unauthorized payments or offers of payments by an employee, consultant or agent of the Company, because these parties are not always subject to our control.

Although we believe to date we have complied in all material aspects with the provisions of the FCPA and Chinese anti-corruption law, our existing safeguards and any future improvements may prove to be less than effective and any of our employees, consultants or agents may engage in corruptive conduct for which we might be held responsible. Violations of the FCPA or Chinese anti-corruption law may result in severe criminal or civil sanctions against the Company and individuals, and therefore could negatively affect our business, operating results and financial condition.

If we become directly subject to the recent scrutiny, criticism and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matters. Any unfavorable results from the investigations could harm our business operations and our reputation.

Recently, U.S. public companies that have substantially all of their operations in China have been subjects of intense scrutiny, criticism and negative publicity by investors, financial commentators and regulatory agencies, such as the SEC. Much of the scrutiny, criticism and negative publicity has centered on financial and accounting irregularities, lack of effective internal control over financial accounting, inadequate corporate governance and ineffective implementation thereof and, in many cases, allegations of fraud. As a result of enhanced scrutiny, criticism and negative publicity, the publicly traded stocks of many U.S. listed Chinese companies have sharply decreased in value and, in some cases, have become virtually worthless or illiquid. Many of these companies are now subject to shareholder lawsuits and SEC enforcement actions and are conducting internal and external investigations into the allegations. It is not clear what effects the sector-wide investigations will have on our Company and our business. If we become a subject of any unfavorable allegations, whether such allegations are proven to be true or untrue, we will have to expend significant resources to investigate such allegations and defend the Company. If such allegations were not proven to be groundless, the Company and our business operations would be severely hampered and our stock price could decline substantially. If such allegations were proven to be groundless, the investigation might significantly distract our management’s attention.

| 12 |

| Table of Contents |

We are exposed to currency exchange risk, and we cannot predict the effect of future exchange rate fluctuations on our business and operating results.

All of our business operations are in China. We have exposure to currency fluctuations because our sales and purchases are denominated in RMB. We cannot assure you that the effect of currency exchange fluctuations will not materially affect our revenues and net incomes in the future.

Certain judgments obtained against us by our shareholders may not be enforceable.

We are an exempted company incorporated under the laws of the British Virgin Islands. We conduct all of our operations in China and all of our assets are located in China. In addition, our current director and executive officer resides within China, and most of the assets of such person are located within China. As a result, it may be difficult, impractical or impossible for you to effect service of process within the United States upon us or such individual, or to bring an action against us or against these individuals in the United States in the event that you believe your rights have been infringed under the U.S. federal securities laws. Even if you are successful in bringing an action of this kind, the laws of the British Virgin Islands and of the PRC may render you unable to enforce a judgment against our assets or the assets of our director and officer.

The United States and the British Virgin Islands do not have a treaty providing for reciprocal recognition and enforcement of judgments of courts of the United States in civil and commercial matters, and a final judgment for the payment of money rendered by any federal or state court in the United States based on civil liability, whether or not predicated solely upon the U.S. federal securities laws, may not be enforceable in the British Virgin Islands. A final and conclusive judgment obtained in U.S. federal or state courts under which a sum of money is payable as compensatory damages (i.e., not being a sum claimed by a revenue authority for taxes or other charges of a similar nature by a governmental authority, or in respect of a fine or penalty or punitive damages) may be the subject of an action on a debt in the court of the British Virgin Islands.

The recognition and enforcement of foreign judgments are provided for under the PRC Civil Procedures Law. PRC courts may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based either on treaties between China and the country where the judgment is made or on principles of reciprocity between jurisdictions. China does not have any treaties or other forms of reciprocity with the United States that provide for the reciprocal recognition and enforcement of foreign judgments. In addition, according to the PRC Civil Procedures Law, the PRC courts will not enforce a foreign judgment against us or our director and officer if they decide that the judgment violates the basic principles of PRC laws or national sovereignty, security or public interest. As a result, it is uncertain whether and on what basis a PRC court would enforce a judgment rendered by a court in the United States.

Under the PRC Enterprise Income Tax Law (the “EIT Law”), we may be classified as a PRC resident enterprise, which could result in unfavorable tax consequences to us and our shareholders, and adversely affect our results of operations and the value of your investment.

Under the PRC EIT Law, an enterprise established outside China with “de facto management bodies” within China is considered a “resident enterprise” for PRC enterprise income tax purposes and is generally subject to a uniform 25% enterprise income tax rate on its worldwide income. In 2009, the State Administration of Taxation, or the SAT, issued the Notice Regarding the Determination of Chinese-Controlled Offshore Incorporated Enterprises as PRC Tax Resident Enterprises on the Basis of De Facto Management Bodies, or SAT Circular 82, which provides certain specific criteria for determining whether the “de facto management body” of a PRC-controlled enterprise, that is incorporated offshore, is considered as located in China. Further to SAT Circular 82, the SAT issued the Administrative Measures for Enterprise Income Tax of PRC-Controlled Offshore Incorporated Resident Enterprises (Trial), or SAT Bulletin 45, effective in 2011, to provide more guidance on the implementation of SAT Circular 82. SAT Bulletin 45 clarified certain issues in the areas of resident status determination, post-determination administration and competent tax authorities’ procedures.

| 13 |

| Table of Contents |

Although SAT Circular 82 and SAT Bulletin 45 only apply to offshore incorporated enterprises controlled by PRC enterprises or PRC enterprise groups and not those controlled by PRC individuals or foreigners, the determination criteria set forth may reflect the SAT’s general position on how the term “de facto management body” could be applied in determining the tax resident status of offshore enterprises, regardless of whether they are controlled by PRC enterprises, individuals or foreigners.

In addition, the SAT issued the Announcement of the State Administration of Taxation on Issues Concerning the Determination of Resident Enterprises Based on the Standards of Actual Management Institutions in January 2014 to provide more guidance on the implementation of SAT Circular 82. This bulletin further provides that, among other things, an entity that is classified as a “resident enterprise” in accordance with the circular shall file the application for classifying its status of residential enterprise with the local tax authorities where its main domestic investors are registered. From the year in which the entity is determined to be a “resident enterprise,” any dividend, profit and other equity investment gain shall be taxed in accordance with the EIT Law and its implementing rules.

If the PRC tax authorities determine that we or our non-PRC subsidiary is a PRC resident enterprise for PRC enterprise income tax purposes, then we or such non-PRC subsidiary could be subject to PRC tax at a rate of 25% on its world-wide income, which could materially affect our financial performance. In addition, we will also be subject to PRC enterprise income tax reporting obligations. If the PRC tax authorities determine that the Company is a PRC resident enterprise for PRC enterprise income tax purposes, gains realized on the sale or other disposition of ordinary shares may be subject to PRC tax, at a rate of 10% in the case of non-PRC enterprises or 20% in the case of non-PRC individuals (in each case, subject to the provisions of any applicable tax treaty), if such gains are deemed to be from PRC sources. Any such tax may reduce the returns on your investment.

Risks Related to Our Ordinary Shares

The highly concentrated ownership and voting power of the Company may impact shareholders’ interests in the Company.

As of the date of this annual report, Mr. Hong Wang owned approximately 89.47% of our ordinary shares and the voting power of the Company. It is anticipated that Mr. Hong Wang will continue to own a majority of ordinary shares of the Company and, correspondingly, will have the majority of the voting power of the Company. As such, you may not be able to influence the strategies, management or policies of the Company as you could at a company where the equity ownership is widely distributed.

There is a limited public market for our ordinary shares, an active trading market for our ordinary shares may not develop, and you may not be able to resell our ordinary shares at or above the price you pay for them, or at all.

Our ordinary shares are not listed on any national securities exchange. Accordingly, investors may find it more difficult to buy and sell our shares than if our ordinary shares were traded on an exchange. Although our ordinary shares are quoted on the OTC Pink, it is an unorganized, inter-dealer, over-the-counter market which provides significantly less liquidity than the Nasdaq Stock Markets or other national securities exchange. These factors may have an adverse impact on the trading and price of our ordinary shares.

As of the date of this annual report, there has been a limited public market for our ordinary shares. An active public market for our ordinary shares may not develop or be sustained, in which case the market price and liquidity of our ordinary shares may be materially and adversely affected. Shareholders may not be able to resell their ordinary shares at or above the purchase price, or at all. And our ordinary shares may be less attractive for margin loans, for investments by financial institutions, for consideration in future capital raising transactions or for other purposes.

| 14 |

| Table of Contents |

We will incur increased costs as a result of being a public company, particularly after we cease to qualify as an “emerging growth company.”

We are a public company and incur significant legal, accounting and other expenses that we do not incur as a private company. The Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the SEC, imposes various requirements on the corporate governance practices of public companies. As an “emerging growth company” pursuant to the JOBS Act, we may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. We expect these rules and regulations to increase our legal and financial compliance costs and to make some corporate activities more time-consuming and costlier. After we are no longer an “emerging growth company,” we expect to incur significant additional expenses and devote substantial management effort toward ensuring compliance with increased disclosure requirements.

Our ordinary shares may be considered a “penny stock” which is subject to restrictions on marketability, so you may not be able to sell your shares.

The SEC has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share or an exercise price of less than $5.00 per share, subject to specific exemptions. Although there has not been a public market for our ordinary shares and such a public market may never develop, our ordinary shares may have a market price of less than $5.00 per share and therefore will be designated as a “penny stock” according to SEC rules. This designation requires any broker or dealer selling these securities to disclose some information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. These rules may restrict the ability of brokers or dealers to sell the ordinary shares and may affect the ability of investors to sell their ordinary shares. These regulations may likely have the effect of limiting the trading activity of our ordinary shares and reducing the liquidity of an investment in our ordinary shares. In addition, investors may find it difficult to obtain accurate quotations of the ordinary shares and may experience a lack of buyers to purchase our ordinary shares or a lack of market makers to support the stock price.

If our ordinary shares become tradable in the secondary market, we will be subject to the penny stock rules adopted by the SEC that require brokers to provide extensive disclosure to their customers prior to executing trades in penny stocks. These disclosure requirements may cause a reduction in the trading activity of our ordinary shares, which in all likelihood would make it difficult for our shareholders to sell their shares.

If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud.

Effective internal controls over financial reporting are necessary for us to provide reliable financial reports and, together with adequate disclosure controls and procedures, are designed to prevent fraud. Any failure to implement required new or improved controls, or difficulties encountered in their implementation could cause us to fail to meet our reporting obligations. In addition, any testing by us conducted in connection with Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), or the subsequent testing by our independent registered public accounting firm, if and when required, may reveal additional deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses or that may require prospective or retroactive changes to our consolidated financial statements or identify other areas for further attention or improvement. If in the future we identify new material weaknesses in our internal control over financial reporting, including at some of our acquired companies, if we are unable to comply with the requirements of Section 404 in a timely manner or assert that our internal control over financial reporting is effective, or if and when applicable, our independent registered public accounting firm is unable to express an opinion as to the effectiveness of our internal control over financial reporting, investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our ordinary shares could be negatively affected, and we could become subject to investigations by the stock exchange on which our securities are then listed, the SEC, or other regulatory authorities, which could require additional financial and management resources. Inferior internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our ordinary shares.

| 15 |

| Table of Contents |

The market price for the ordinary shares may be volatile.

The market price for the ordinary shares may be volatile and subject to wide fluctuations in response to factors including the following:

|

| ● | actual or anticipated fluctuations in our quarterly operating results; |

|

|

|

|

|

| ● | changes in financial estimates by securities research analysts; |

|

|

|

|

|

| ● | conditions and restrictions in the event planning and hospitality industries; |

|

|

|

|

|

| ● | changes in the economic performance or market valuations of other event planning and lodging companies; |

|

|

|

|

|

| ● | announcements by us or our competitors of new products, acquisitions, strategic partnerships, joint ventures or capital commitments; |

|

|

|

|

|

| ● | addition or departure of key personnel; |

|

|

|

|

|

| ● | fluctuations of exchange rates between RMB and U.S. dollar or other foreign currencies; |

|

|

|

|

|

| ● | potential litigation or administrative investigations; |

|

|

|

|

|

| ● | sales of ordinary shares in large volumes by the Selling Shareholders; and |

|

|

|

|

|

| ● | release of transfer restrictions on the outstanding ordinary shares or sales of additional ordinary shares. |

In addition, the securities market has from time to time experienced significant price and volume fluctuations that are not related to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our ordinary shares.

We may need additional capital, and the sale of additional ordinary shares or other equity securities could result in additional dilution to the shareholders and the incurrence of indebtedness could increase our debt obligations.

We can give no assurance that our current cash and cash equivalents and anticipated cash flow from operations will be sufficient to meet our anticipated cash needs for the foreseeable future. We may require additional cash resources due to changed business conditions or other future developments, including any investments or acquisitions we may decide to pursue. If our resources are insufficient to satisfy our capital requirements, we may seek to sell additional equity securities or obtain a credit facility. The sale of additional equity and equity-linked securities could result in additional dilution to our shareholders. The incurrence of indebtedness would cause increased debt service obligations and result in operating and financing covenants that could restrict our operations. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all, particularly in the aftermath of global economic crisis.

Future sales or issuances, or perceived future sales or issuances, of substantial amounts of our ordinary shares could adversely affect the price of the ordinary shares.

Sales, or perceived potential sales, by our existing shareholders might make it more difficult for us to issue new equity or equity-related securities in the future at a time and place we deem appropriate. The ordinary shares that have been registered with the SEC are eligible for immediate resale in the public market without restrictions, and the remaining ordinary shares may also be sold in the public market in the future subject to the restrictions contained in Rule 144 and Rule 701 under the Securities Act. If any existing shareholders sell a substantial amount of ordinary shares in the future, the prevailing market price for the ordinary shares could be adversely affected.

Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our shareholders have limited protections against interested director transactions, conflicts of interest and similar matters.

The Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York Stock Exchange and the Nasdaq Stock Market, as a result of Sarbanes-Oxley, requires the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and securities markets and apply to securities which are listed on those exchanges. Because we are not presently required to comply with many of the corporate governance provisions, we have not yet adopted these measures.

| 16 |

| Table of Contents |

We do not currently have independent audit or compensation committees. As a result, our director has the ability, among other things, to determine the level of compensation. Until we comply with such corporate governance measures, the absence of such standards of corporate governance may leave our shareholders without protections against interested director transactions, conflicts of interest and similar matters, and investors may be reluctant to provide us with funds necessary to expand our operations.

The Company’s ordinary shares represent equity interests and are subordinate to future indebtedness.

Our ordinary shares represent equity interests in our Company and, as such, rank junior to any indebtedness of our Company created in the future, as well as to the rights of any preferred shares that may be issued in the future. In the future, we may incur substantial amounts of debt and other obligations that will rank senior to our ordinary shares or to which our ordinary shares will be structurally subordinated.

Because we do not expect to pay dividends in the foreseeable future, you must rely on price appreciation of our ordinary shares for return on your investment.

We currently intend to retain most, if not all, of our available funds and any future earnings to fund the development and growth of our business. As a result, we do not expect to pay any cash dividends in the foreseeable future. Therefore, you should not rely on an investment in our ordinary shares as a source for any future dividend income.

Our director has complete discretion as to whether to distribute dividends, subject to certain requirements of the British Virgin Islands laws. Under the BVI laws, a BVI company may pay a dividend out of either profit or share premium account, provided that in no circumstances may a dividend be paid if this would result in the company being unable to pay its debts as they fall due in the ordinary course of business. Even if our director decides to declare and pay dividends, the timing, amount and form of future dividends will depend on, among other things, our future results of operations and cash flow, our capital requirements and surplus, the amount of distributions, if any, received by us from our subsidiaries, our financial condition, contractual restrictions and other factors deemed relevant by our director. Accordingly, the return on your investment in our ordinary shares will likely depend entirely upon any future price appreciation of our ordinary shares. We cannot guarantee that our ordinary shares will appreciate in value or even maintain the price at which you purchased the ordinary shares. You may not realize a return on your investment in our ordinary shares and you may even lose your entire investment in our ordinary shares.

| 17 |

| Table of Contents |

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

United World BVI was incorporated under the laws of British Virgin Islands on July 5, 2018. Under our Memorandum and Article of Association, we are authorized to issue 500,000,000 ordinary shares of a single class, par value $0.0001 per ordinary share. In July and August 2018, we issued a total of 20,000,000 ordinary shares to our founders, Hong Wang who is the sole director, Chief Executive Officer and Chief Financial Officer, and his spouse. In December 2018, we sold through a Regulation S offering a total of 2,354,793, ordinary shares to 58 shareholders, at a price of $1.00 per share for an aggregate purchase price of $2,354,793.

United World HK was incorporated on July 8, 2018 under the laws of Hong Kong SAR, with 100% of the equity interest held by United World BVI. As a result, United World HK is our wholly-owned subsidiary. United World HK is currently not engaging in any active business and merely acting as a holding company.

United World WFOE was incorporated on September 13, 2018 in Yunnan Province under the laws of the PRC. It is a wholly-owned subsidiary of United World HK and a wholly foreign-owned entity under the PRC laws. The registered principal activities of United World WFOE include corporate planning; corporate management information; hotel management services; conference services; and cultural and artistic activity exchange and planning. United World WFOE has entered into contractual arrangements with United Culture and its shareholders.

United Culture was incorporated on October 31, 2016 in Beijing under the laws of the PRC. United Culture’s registered capital is RMB 23,000,000 and paid-in-capital is RMB 23,000,000. The registered principal activities of the Company include organizing culture and art exchange activities; literary and artistic creation; hosting exhibitions; conference services; film and television planning; translation services; technology development, promotion, transfer, consultation and services; computer system services; basic software services; application software services, development and consulting; cultural consulting; sports consulting; public relationship services; corporate planning and design; advertisement, production and agency; market research; and data processing. Currently, United Culture is a variable interest entity (the “VIE”) of the Company that provides the cultural event planning and B&B lodging services.

We conduct our business through United Culture, our VIE entity, which we effectively control through a series of contractual arrangements. These contractual arrangements allow us to:

|

| ● | exercise effective control over United Culture; |

|

|

|

|

|

| ● | receive substantially all of the economic benefits of United Culture; and |

|

|

|

|

|

| ● | have an exclusive option to purchase all or part of the equity interests in the VIE when and to the extent permitted by the PRC laws. |

As a result of these contractual arrangements, we have become the primary beneficiary of United Culture and we treat it as our variable interest entity under U.S. GAAP. We have consolidated the financial results of United Culture in our consolidated financial statements in accordance with U.S. GAAP.

The following is a summary of the currently effective contractual arrangements by and among our wholly-owned subsidiary, United World WFOE, our consolidated variable interest entity, United Culture and all shareholders of United Culture.

| 18 |

| Table of Contents |

Agreements that Provide Us Effective Control over the VIE

Equity Pledge Agreements

Pursuant to the equity pledge agreements, the shareholders who collectively owned all of United Culture pledge all of the equity interests in United Culture to United World WFOE as collateral to secure the obligations of United Culture under the exclusive consulting services and operating agreement. These shareholders may not transfer or assign the pledged equity interests, or incur or allow any encumbrance that would jeopardize United World WFOE’s interests, without United World WFOE’s prior approval. In the event of default, United World WFOE, as the pledgee, will be entitled to certain rights and entitlements, including the priority in receiving payments from the auction or sale of whole or part of the pledged equity interests of United Culture. The agreement will terminate on the date these shareholders have transferred all of their pledged equity interests pursuant to the equity option agreement.

Voting Rights Proxy and Financial Supporting Agreements

Pursuant to the voting rights proxy and financial supporting agreements, the shareholders of United Culture give United World WFOE an irrevocable proxy to act on their behalf on all matters pertaining to United Culture and to exercise all of their rights as shareholders of United Culture, including the right to attend shareholders meeting, to exercise voting rights, and to transfer all or a part of their equity interests in United Culture. In consideration of such granted rights, United World WFOE agrees to provide the necessary financial support to United Culture whether or not United Culture incurs loss, and agrees not to request repayment if United Culture is unable to do so. The agreements shall remain in effect for 30 years until November 4, 2048.

Agreement that Allows Us to Receive Economic Benefits and Absorb Losses from the VIE

Consultation and Services Agreement

Pursuant to the consultation and services agreement between United World WFOE and United Culture, United World WFOE is engaged as exclusive provider of management consulting services to United Culture. For such services, United Culture agrees to pay service fees based on all of its net incomes to United World WFOE, or United World WFOE has obligation to absorb all of the losses of United Culture.

The consultation and services agreement remains in effect for 30 years until November 4, 2048. The agreement can be extended only if United World WFOE gives its written consent of extension of the agreement before its expiration, and United Culture may then extend without reservation.

Agreements that Provide Us with the Option to Purchase the Equity Interest in the VIE

Equity Option Agreements

Pursuant to the equity option agreements among United World WFOE, United Culture and all shareholders of United Culture. United Culture’s shareholders jointly and severally grant United World WFOE an option to purchase their equity interests in United Culture. The purchase price shall be the lowest price then permitted under the applicable PRC laws. If the purchase price is greater than the registered capital of United Culture, these shareholders of United Culture are required to immediately return any amount in excess of the registered capital to United World WFOE or its designee. United World WFOE may exercise such option at any time until it has acquired all equity interests of United Culture, and may transfer the option to any third party. The agreements will terminate on the date on which all of these shareholders’ equity interests of United Culture have been transferred to United World WFOE or its designee.

| 19 |

| Table of Contents |

B. Business Overview

United World Holding Group Ltd. (“United World BVI”) was incorporated in the British Virgin Island in 2018, and primarily conducts business through its variable interest entity (“VIE”), United Culture Exchange (Beijing) Co., Ltd. (“United Culture”). United Culture was incorporated under the laws of PRC in October 2016 with a registered capital of RMB 23 million. We started cultural event planning business since inception and launched culture-themed bed and breakfast (B&B) inns business in June 2019. We are domestically oriented and have a global ambition. We operate our business based on the principle to build cultural confidence and make ecological progress. Our strategies are to be light in asset, to develop soft power, to diversify operation and to build cross-boundary cooperation.

We thrive to create cultural experience for our customers. With the daily exposure to vast amount of information, people’s attention has been constantly diverted to the newest and fastest technological development. Culture and tradition have been neglected and are slowly fading away from everyday life.

With this market observation, our Company was founded to introduce cultural components into our social lives and business activities. Since inception, we have been keen on promoting and bringing to people’s attention culture and tradition in our daily life. After research and analysis, we found a way to implement our mission in the existing industry and introduced to the market place two lines of business services, cultural event planning and B&B lodging. While the event planning business began to generate income in June 2017, the B&B inns business will restart to bring in revenue after the pandemic situation settles down.

Impact of the COVID-19 Pandemic