Exhibit 1

First Quarter 2023 Earnings Webcast April 26, 2023

02 About projections and forward-looking statements Additional information about Vista Energy, S.A.B. de C.V., a sociedad anónima bursátil de capital variable organized under the laws of Mexico (the “Company” or “Vista”) can be found in the “Investors” section on the website at www.vistaoilandgas.com. This presentation does not constitute an offer to sell or the solicitation of any offer to buy any securities of the Company, in any jurisdiction. Securities may not be offered or sold in the United States absent registration with the U.S. Securities Exchange Commission (“SEC”), the Mexican National Securities Registry held by the Mexican National Banking and Securities Commission (“CNBV”) or an exemption from such registrations. This presentation does not contain all the Company’s financial information. As a result, investors should read this presentation in conjunction with the Company’s consolidated financial statements and other financial information available on the Company’s website. All the amounts contained herein are unaudited. Rounding rounded figures, amounts but and on percentages: the basis of such Certain amounts amounts prior and topercentages rounding. For included this reason, in this certain presentation percentage haveamounts been rounded in thisfor presentation ease of presentation. may vary from Percentage those obtained figures included by performing in this presentation the same calculations have not in using all cases the figures been calculated in the financial on the statements. basis of such In This addition, presentation certain other contains amounts certain that metrics appear that in this do presentation not have standardized may not sum meanings due toor rounding. standard methods of calculation and therefore such measures may not be comparable to similar measures used by other companies. Such metrics have been included herein to provide readers with additional measures to evaluate the Company’s performance; however, such measures are not reliable indicators of the future performance of the Company and future performance may not compare to the performance in previous periods. No reliance may be placed for any purpose whatsoever on the information contained in this document or on its completeness. Certain information contained in this presentation has been obtained from published sources, which may not have been independently verified or audited. No representation or warranty, express or implied, is given or will be given by or on behalf of the Company, or any of its affiliates (within the meaning of Rule 405 under the Act, “Affiliates”), members, directors, officers or employees or any other person (the “Related Parties”) as to the accuracy, completeness or fairness of the information or opinions contained in this presentation or any other material discussed verbally, and any reliance you place on them will be at your sole risk. Any opinions presented herein are based on general information gathered at the time of writing and are subject to change without notice. In addition, no responsibility, obligation or liability (whether direct or indirect, in contract, tort or otherwise) is or will be accepted by the Company or any of its Related Parties in relation to such information or opinions or any other matter in connection with this presentation or its contents or otherwise arising in connection therewith. This presentation also includes certain non-IFRS (International Financial Reporting Standards) financial measures which have not been subject to a financial audit for any period. The information and opinions contained in this presentation are provided as at This the date presentation of this presentation includes “forward-looking and are subject to statements” verification,concerning completionthe andfuture. change The without words notice. such as “believes,” “thinks,” “forecasts,” “expects,” “anticipates,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions are included with the intention estimates of on identifying which forward-looking statements about statements the future. areFor based theare avoidance believedof by doubt, our management any projection, to be guidance reasonable or similar and based estimation on the about best the currently future available or future information, results, performance such forward-looking or achievements statements is a forward-looking are based onstatement. assumptions Although that arethe inherently assumptions subject and to significant uncertainties and contingencies, many of which are beyond our control. There will be differences between actual and projected results, and actual results may be materially greater or materially less than those contained in the projections. Projections related to production results as well as costs estimations – including Vista’s anticipated performance and guidance for 2022 included in this presentation – are based on information as of the date of this presentation and reflect numerous assumptions including assumptions with respect to type curves for new well designs and certain frac spacing expectations, all of which are difficult to predict and many of which are beyond our control and remain subject to several risks and uncertainties. The inclusion of the projected financial information in this document should not be regarded as an indication that we or our management considered or consider the projections to be a reliable prediction of future events. As such, no representation can be made as to the attainability of projections, guidances or other estimations of future results, performance or achievements. We have not warranted the accuracy, reliability, appropriateness or completeness of the projections to anyone. Neither our management nor any of our representatives has made or makes any representation to any person regarding our future performance compared to the information contained in the projections, and none of them intends to or undertakes any obligation to update or otherwise revise the projections to reflect circumstances existing after the date when made These or to reflect expectations the occurrence and projections of futureare events subject in the to event significant that any known or all and ofunknown the assumptions risks and underlying uncertainties the projections which mayare cause shown ourto actual be inresults, error. We performance may or may ornot achievements, refer back toor these industry projections results,in toour befuture materially periodic different reports from filed any under expected the Exchange or projected Act. results, performance or achievements expressed or implied by such forward-looking statements. Many important factors could cause our actual results, performance or achievements to differ materially from those expressed or implied in our forward-conditions looking statements, in Argentina, including, Mexico among and inother other things: countries uncertainties in which we relating operate; to future changes government in law, rules, concessions regulations andand exploration interpretations permits;and adverse enforcements outcomesthereto in litigation applicable that may to the arise Argentine in the future; and Mexican general political, energy sectors, economic, including social, demographic changes to the and regulatory business environment in which we operate and changes to programs established to promote investments in the energy industry; any unexpected increases in financing costs or an inability to obtain financing and/or additional capital pursuant to attractive terms; any changes in the capital markets in general that may affect the policies or attitude in Argentina and/or Mexico, and/or Argentine and Mexican companies with respect to financings extended to or investments made in Argentina and Mexico or Argentine and Mexican companies; fines or other penalties and claims by the authorities and/or customers; any future restrictions on the ability to exchange Mexican or Argentine Pesos into foreign currencies or to transfer funds abroad; the revocation or amendment of our respective concession agreements by the granting authority; our ability to implement our capital expenditures plans or business strategy, including our ability to obtain financing when necessary and on reasonable terms; government intervention, including measures that result in changes to the Argentine and Mexican, labor markets, exchange markets or tax systems; continued and/or higher rates of inflation and fluctuations in exchange rates, including the devaluation of the Mexican Peso or Argentine Peso; any force majeure events, or fluctuations or reductions in the value of Argentine public debt; changes to the demand for energy; uncertainties relating to the effects of the Covid-19 outbreak; environmental, health and safety regulations and industry standards that are becoming more stringent; energy markets, including the timing and extent of changes and volatility in commodity prices, and the impact of any protracted or material reduction in oil prices from historical employees; averages; changes the ability in the of our regulation directors ofand theofficers energy to and identify oil andan gas adequate sector in number Argentina of potential and Mexico, acquisition and throughout opportunities; Latinour America; expectations our relationship with respect with to our the employees performance and of our ourability recently to retain acquired key businesses; members of our our expectations senior management for futureand production, key technical costs and crude oil prices used in our projections; increased market competition in the energy sector

03 Consistently delivering strong operational and financial performance Q1 2023 - HIGHLIGHTS Production (1) Oil Production Revenues Lifting Cost (2) CAPEX (3) 52.2 Mboe/d 44.0 Mbbl/d 303 $MM 6.4 $/boe 162 $MM +19% y-o-y +24% y-o-y +46% y-o-y (18)% y-o-y +100% y-o-y Adj. EBITDA (4) Free Cash Flow (5) Net Leverage Ratio Adj. Net Income (6) Adj. EPS (7) 204 $MM 35 $MM 0.37x 72 $MM 0.8 $/sh +61% y-o-y +5% y-o-y (55)% y-o-y +84% y-o-y +82% y-o-y (2) (1) Includes Lifting cost natural includes gas production, liquids (NGL) transportation, and excludes flared treatment gas, injected and field gas support and gas services; consumed excludes in operations crude stock fluctuations, (5) conventional Free cash flow assets = Operating + Impairment activities (recovery) cash flow of long-lived + Investing assets activities + other cash adj. flow (3) depreciation, Property, plant royalties, and equipment direct taxes, additions commercial, exploration and G&A costs (6) Adjusted the transfer net of income/loss conventional = assets Net (loss)/profit + Other non-cash + Deferred costs income related tax to + Changes the transfer in fair of conventional value of warrants assets + Gain + imp re (4) Adj. depletion EBITDA and = amortization Net (loss) / profit + Transaction for the period costs + related Income to tax business (expense) combinations / benefit + Financial + Restructuring results, and net reorganization + Depreciation, (7) Adj. (recovery) EPS = of Adj. long-lived Net Income assets divided by weighted average number of ordinary shares expenses + Gain related to the transfer of conventional assets + Other non-cash costs related to the transfer of

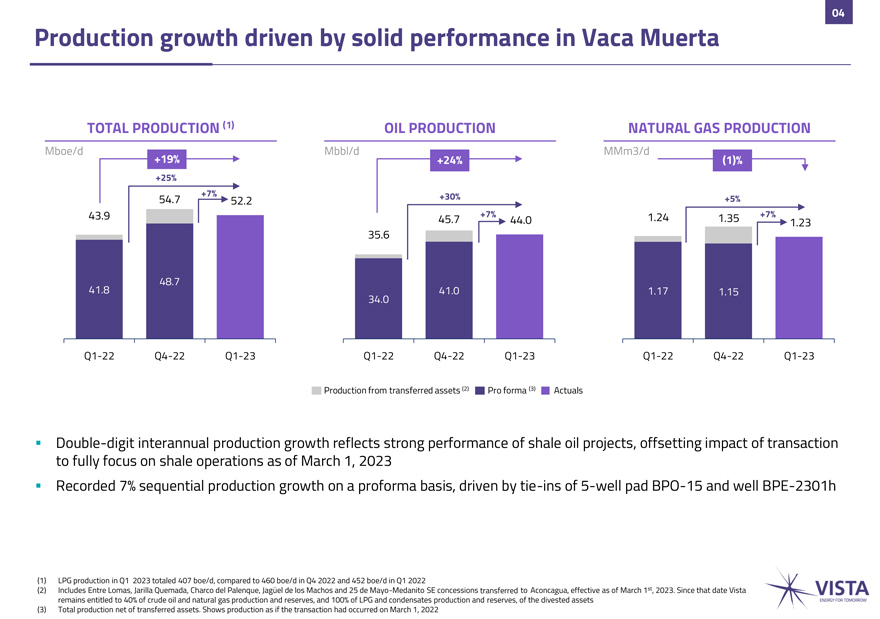

04 Production growth driven by solid performance in Vaca Muerta TOTAL PRODUCTION (1) OIL PRODUCTION NATURAL GAS PRODUCTION Mboe/d Mbbl/d MMm3/d +19% +24% (1)% +25% 54.7 +7% +30% +5% 52.2 43.9 45.7 +7% 44.0 1.24 1.35 +7% 1.23 35.6 48.7 41.8 41.0 1.17 1.15 34.0 Q1-22 Q4-22 Q1-23 Q1-22 Q4-22 Q1-23 Q1-22 Q4-22 Q1-23 Production from transferred assets (2) Pro forma (3) Actuals Double-digit interannual production growth reflects strong performance of shale oil projects, offsetting impact of transaction to fully focus on shale operations as of March 1, 2023 Recorded 7% sequential production growth on a proforma basis, driven by tie-ins of 5-well pad BPO-15 and well BPE-2301h (1) LPG production in Q1 2023 totaled 407 boe/d, compared to 460 boe/d in Q4 2022 and 452 boe/d in Q1 2022 (2) Includes Entre Lomas, Jarilla Quemada, Charco del Palenque, Jagüel de los Machos and 25 de Mayo-Medanito SE concessions transferred to Aconcagua, effective as of March 1st, 2023. Since that date Vista remains entitled to 40% of crude oil and natural gas production and reserves, and 100% of LPG and condensates production and reserves, of the divested assets (3) Total production net of transferred assets. Shows production as if the transaction had occurred on March 1, 2022

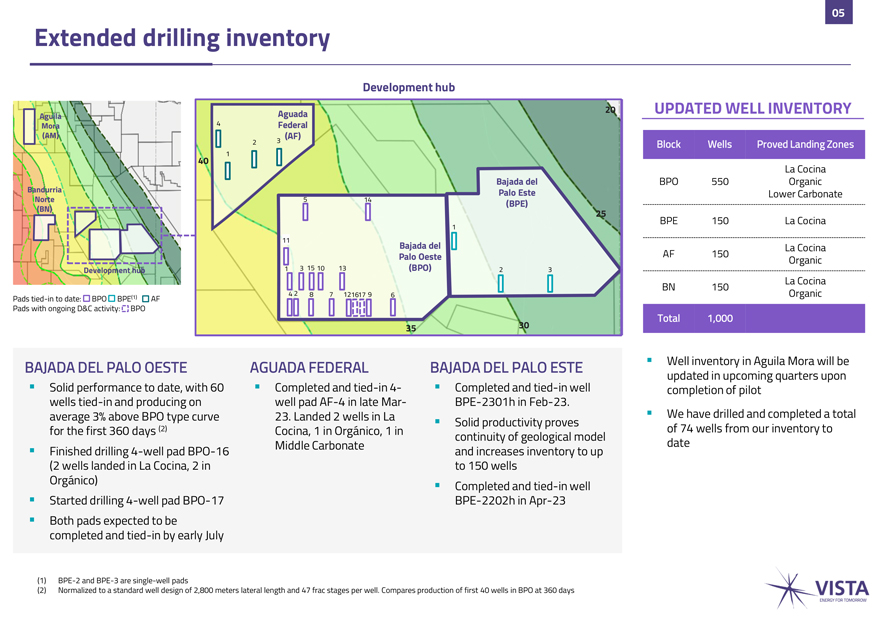

05 Extended drilling inventory Development hub Aguada 20 UPDATED WELL INVENTORY Aguila Mora 4 Federal (AM) (AF) 2 3 Block Wells Proved Landing Zones 1 40 La Cocina Bajada del BPO 550 Organic Bandurria Palo Este Lower Carbonate Norte 5 14 (BPE) (BN) 25 BPE 150 La Cocina 1 11 Bajada del La Cocina Palo Oeste AF 150 Organic Development hub 1 3 15 10 13 (BPO) 2 3 La Cocina BN 150 4 2 8 7 121617 9 6 Organic Pads tied-in to date: BPO BPE(1) AF Pads with ongoing D&C activity: BPO Total 1,000 35 30 BAJADA DEL PALO OESTE AGUADA FEDERAL BAJADA DEL PALO ESTE Well inventory in Aguila Mora will be updated in upcoming quarters upon Solid performance to date, with 60 Completed and tied-in 4- Completed and tied-in well completion of pilot wells tied-in and producing on well pad AF-4 in late Mar- BPE-2301h in Feb-23. average 3% above BPO type curve 23. Landed 2 wells in La We have drilled and completed a total Solid productivity proves for the first 360 days (2) Cocina, 1 in Orgánico, 1 in of 74 wells from our inventory to continuity of geological model date Finished drilling 4-well pad BPO-16 Middle Carbonate and increases inventory to up (2 wells landed in La Cocina, 2 in to 150 wells Orgánico) Completed and tied-in well Started drilling 4-well pad BPO-17 BPE-2202h in Apr-23 Both pads expected to be completed and tied-in by early July (1) BPE-2 and BPE-3 are single-well pads (2) Normalized to a standard well design of 2,800 meters lateral length and 47 frac stages per well. Compares production of first 40 wells in BPO at 360 days

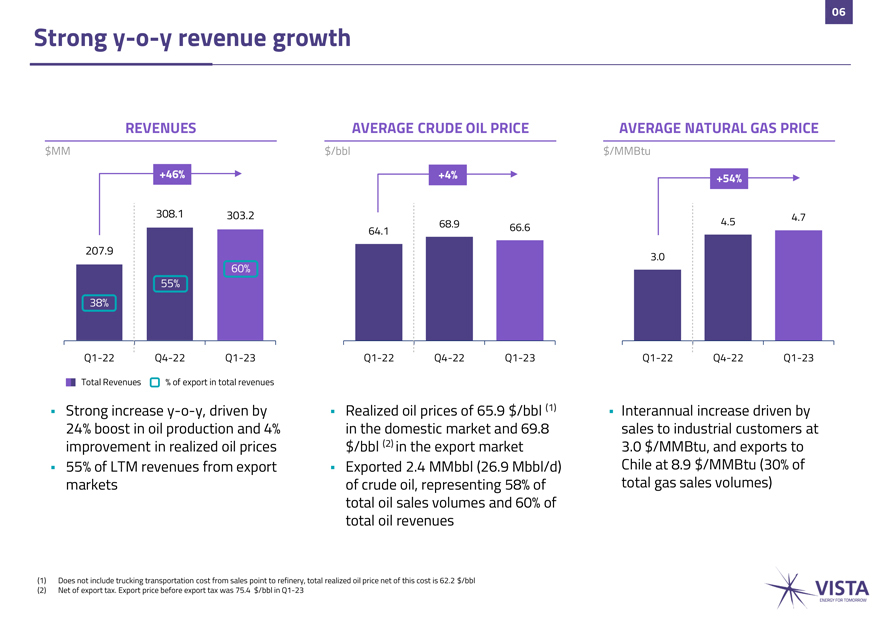

06 Strong y-o-y revenue growth REVENUES AVERAGE CRUDE OIL PRICE AVERAGE NATURAL GAS PRICE $MM $/bbl $/MMBtu +46% +4% +54% 308.1 303.2 4.7 68.9 66.6 4.5 64.1 207.9 3.0 60% 55% 38% Q1-22 Q4-22 Q1-23 Q1-22 Q4-22 Q1-23 Q1-22 Q4-22 Q1-23 Total Revenues % of export in total revenues Strong increase y-o-y, driven by Realized oil prices of 65.9 $/bbl (1) Interannual increase driven by 24% boost in oil production and 4% in the domestic market and 69.8 sales to industrial customers at improvement in realized oil prices $/bbl (2) in the export market 3.0 $/MMBtu, and exports to 55% of LTM revenues from export Exported 2.4 MMbbl (26.9 Mbbl/d) Chile at 8.9 $/MMBtu (30% of markets of crude oil, representing 58% of total gas sales volumes) total oil sales volumes and 60% of total oil revenues (1) Does not include trucking transportation cost from sales point to refinery, total realized oil price net of this cost is 62.2 $/bbl (2) Net of export tax. Export price before export tax was 75.4 $/bbl in Q1-23

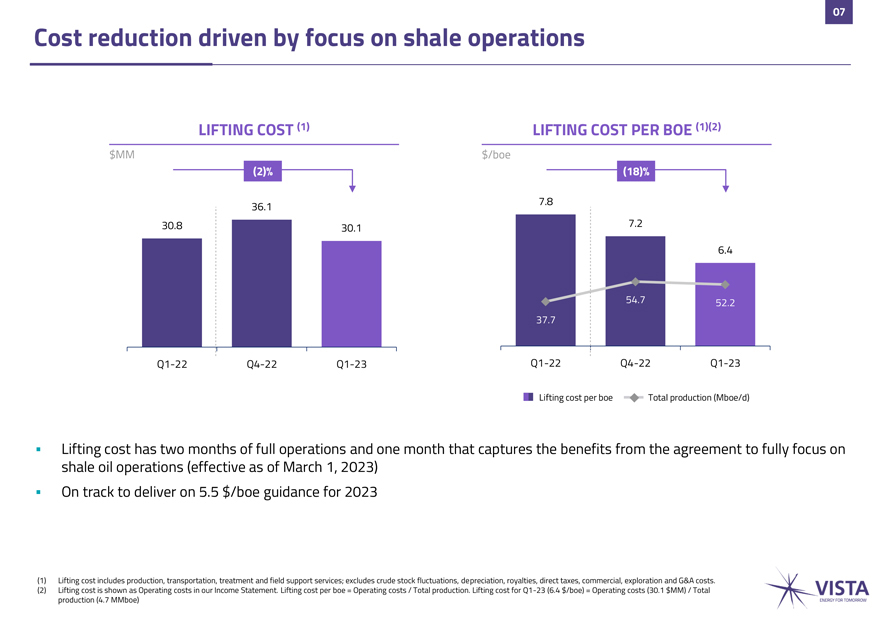

07 Cost reduction driven by focus on shale operations LIFTING COST (1) LIFTING COST PER BOE (1)(2) $MM $/boe (2)% (18)% 36.1 7.8 30.8 30.1 7.2 6.4 54.7 52.2 37.7 Q1-22 Q4-22 Q1-23 Q1-22 Q4-22 Q1-23 Lifting cost per boe Total production (Mboe/d) Lifting cost has two months of full operations and one month that captures the benefits from the agreement to fully focus on shale oil operations (effective as of March 1, 2023) On track to deliver on 5.5 $/boe guidance for 2023 (1) Lifting cost includes production, transportation, treatment and field support services; excludes crude stock fluctuations, depreciation, royalties, direct taxes, commercial, exploration and G&A costs. (2) Lifting cost is shown as Operating costs in our Income Statement. Lifting cost per boe = Operating costs / Total production. Lifting cost for Q1-23 (6.4 $/boe) = Operating costs (30.1 $MM) / Total production (4.7 MMboe)

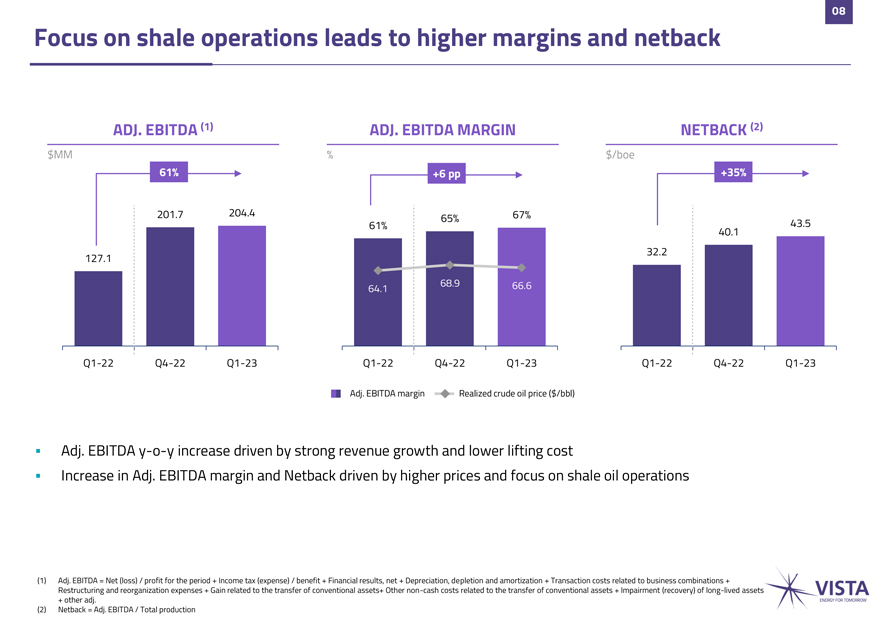

08 Focus on shale operations leads to higher margins and netback ADJ. EBITDA (1) ADJ. EBITDA MARGIN NETBACK (2) $MM % $/boe 61% +6 pp +35% 201.7 204.4 65% 67% 61% 43.5 40.1 32.2 127.1 64.1 68.9 66.6 Q1-22 Q4-22 Q1-23 Q1-22 Q4-22 Q1-23 Q1-22 Q4-22 Q1-23 Adj. EBITDA margin Realized crude oil price ($/bbl) Adj. EBITDA y-o-y increase driven by strong revenue growth and lower lifting cost Increase in Adj. EBITDA margin and Netback driven by higher prices and focus on shale oil operations (1) Adj. EBITDA = Net (loss) / profit for the period + Income tax (expense) / benefit + Financial results, net + Depreciation, depletion and amortization + Transaction costs related to business combinations + Restructuring and reorganization expenses + Gain related to the transfer of conventional assets+ Other non-cash costs related to the transfer of conventional assets + Impairment (recovery) of long-lived asset + other adj. (2) Netback = Adj. EBITDA / Total production

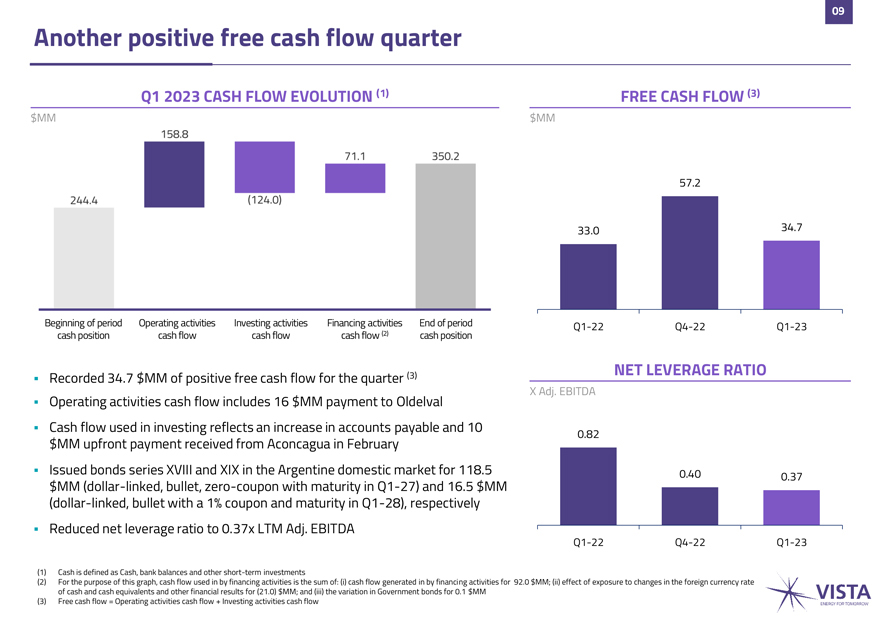

09 Another positive free cash flow quarter 9 Q1 2023 CASH FLOW EVOLUTION (1) FREE CASH FLOW (3) $MM 57.2 33.0 34.7 Beginning of period Operating activities Investing activities Financing activities End of period Q1-22 Q4-22 Q1-23 cash position cash flow cash flow cash flow (2) cash position Recorded 34.7 $MM of positive cash flow for the quarter (3) NET LEVERAGE RATIO free X Adj. EBITDA Operating activities cash flow includes 16 $MM payment to Oldelval Cash flow used in investing reflects an increase in accounts payable and 10 0.82 $MM upfront payment received from Aconcagua in February Issued bonds series XVIII and XIX in the Argentine domestic market for 118.5 0.40 0.37 $MM (dollar-linked, bullet, zero-coupon with maturity in Q1-27) and 16.5 $MM (dollar-linked, bullet with a 1% coupon and maturity in Q1-28), respectively Reduced net leverage ratio to 0.37x LTM Adj. EBITDA Q1-22 Q4-22 Q1-23 (1) Cash is defined as Cash, bank balances and other short-term investments (2) For the purpose of this graph, cash flow used in by financing activities is the sum of: (i) cash flow generated in by financing activities for 92.0 $MM; (ii) effect of exposure to changes in the foreign currency rate (3) of Free cash cash and flow cash = Operating equivalents activities and other cash financial flow + results Investing for activities (21.0) $MM; cash and flow (iii) the variation in Government bonds for 0.1 $MM

10 Closing remarks Strong execution Focus on shale oil Strong operational Shareholders in development operations drives and financial approved extension hub. Successful improvement in performance reflect of our share results in BPE lifting cost, netback that we are on track buyback plan from extend ready-to- and margins to meet our 2023 20 $MM to 50 $MM drill inventory objectives

THANKS! Q&A