Table of Contents

| Title of each class |

Trading Symbol |

Name of each exchange on which registered | ||

1 Series A share, with no par value |

* |

Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission. |

| ☒ |

☐ No |

| ☐ Yes |

☒ |

| ☒ |

☐ No |

| ☒ |

☐ No |

Large Accelerated Filer |

☐ | Accelerated Filer |

☒ | |||||

Non-Accelerated Filer |

☐ | Emerging Growth Company |

|

|||||

| U.S. GAAP |

|

Other | ||||||

| by the International Accounting Standards Board | ☒ |

| ☐ Item 17 |

☐ Item 18 |

| ☐ Yes |

No |

Table of Contents

TABLE OF CONTENT

| Item 1. |

Identity of Directors, Senior Management and Advisers | 9 | ||||

| Item 2. |

Offer Statistics and Expected Timetable | 9 | ||||

| Item 3. |

Key Information | 9 | ||||

| Item 4. |

Information on the Company | 48 | ||||

| Item 5. |

Operating and Financial Review and Prospects | 115 | ||||

| Item 6. |

Directors, Senior Management and Employees | 145 | ||||

| Item 7. |

Major Shareholder and Related Party Transactions | 154 | ||||

| Item 8. |

Financial Information | 156 | ||||

| Item 9. |

The Offer and Listing | 157 | ||||

| Item 10. |

Additional Information | 163 | ||||

| Item 11. |

Quantitative and Qualitative Disclosures about Market Risk | 205 | ||||

| Item 12. |

Description of Securities Other Than Equity Securities | 206 | ||||

| Item 13. |

Defaults, Dividend Arrearages and Delinquencies | 207 | ||||

| Item 14. |

Material Modifications to the Rights of Security Holders and Use of Proceeds | 207 | ||||

| Item 15. |

Controls and Procedures | 208 | ||||

| Item 16. |

Reserved | 209 | ||||

| Item 17. |

Financial Statements | 213 | ||||

| Item 18. |

Financial Statements | 213 | ||||

| Item 19. |

Exhibits | 213 |

Table of Contents

PRESENTATION OF INFORMATION

This document comprises the annual report of Vista Energy, S.A.B. de C.V. (“Vista”) on Form 20-F for the year ended December 31, 2022.

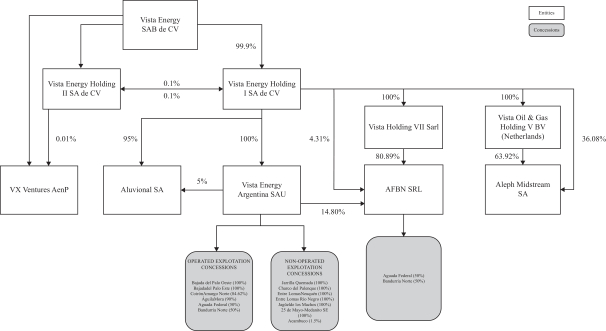

References

Unless otherwise indicated or the context otherwise requires, (i) the terms “Vista,” “Company,” “we,” “us,” and “our,” refer to Vista Energy, S.A.B. de C.V. (formerly known as Vista Oil & Gas, S.A.B. de C.V.), a corporation (sociedad anónima bursátil de capital variable) organized under the laws of Mexico, and its consolidated subsidiaries, (ii) the term “Issuer” refers to Vista exclusive of its subsidiaries, (iii) the term “Vista Argentina” refers to Vista Energy Argentina S.A.U. (formerly known as Vista Oil & Gas Argentina S.A.U., prior thereto as Vista Oil & Gas Argentina S.A., and prior thereto, as Petrolera Entre Lomas S.A.); (iv) the term “PELSA” refers to Petrolera Entre Lomas S.A. (or following the change of its corporate name, Vista Argentina); (v) the term “Vista Holding I” refers to Vista Energy Holding I, S.A. de C.V. (formerly known as Vista Oil & Gas Holding I, S.A. de C.V.); (vi) the term “Vista Holding II” refers to Vista Energy Holding II, S.A. de C.V. (formerly known as Vista Oil & Gas Holding I, S.A. de C.V.); (vii) the term “APCO International” refers to APCO Oil & Gas S.A.U. (formerly known as APCO Oil and Gas International, Inc. before its re-domiciliation to Argentina, which was merged into Vista Argentina pursuant to a corporate reorganization and is no longer in existence as of the date of this annual report; and (viii) the term “APCO Argentina” refers to APCO International’s subsidiary APCO Argentina S.A. (which was merged into Vista Argentina pursuant to a corporate reorganization and is no longer in existence as of the date of this annual report. See “Item 4—Information on the Company—History and Development of the Company.”

References to “series A shares” refer to shares of our series A common stock, no par value, and references to “ADSs” are to American Depositary Shares, each representing one series A share, except where the context requires otherwise.

In addition, the term “Mexico” refers to the United Mexican States, the term “United States” refers to the United States of America, and the term “Argentina” refers to the Argentine Republic. Moreover, the phrase “Mexican government” refers to the federal government of Mexico, the phrase “U.S. government” refers to the federal government of the United States, and the phrase “Argentine government” refers to the federal government of Argentina.

Accounting terms have the definitions set forth under International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”).

Financial Statements and Information

The consolidated financial statements included in this annual report have been prepared on a historical basis in accordance with IFRS, as described herein.

We maintain our books and records in U.S. Dollars, which is the presentation currency for our financial statements and also the functional currency of our operations.

The financial information contained, or referred to, in this annual report includes the audited consolidated financial statements as of December 31, 2022 and 2021 and for the years ended December 31, 2022, 2021 and 2020, and the notes thereto (the “Audited Financial Statements”).

The Audited Financial Statements have been prepared in accordance with IFRS as issued by the IASB and are presented in U.S. Dollars.

Presentation of Currencies and Rounding

All references to “$,” “US$,” “U.S. Dollars” and “Dollars” are to U.S. Dollars, the lawful currency of the United States of America, references to “Mexican Pesos” and “Ps.” are to Mexican Pesos, the lawful currency of Mexico and “ARS,” “Argentine Pesos” and “AR$” are to Argentine Pesos, the lawful currency of Argentina. The Audited Financial Statements are presented in U.S. Dollars.

1

Table of Contents

Certain figures included in this annual report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

Emerging Growth Company Status

We qualify as an “emerging growth company” pursuant to the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include exemption from the auditor attestation requirement under Section 404 of the Sarbanes-Oxley Act of 2002, or Section 404, in the assessment of the emerging growth company’s internal control over financial reporting. This annual report does not include an attestation report of our independent registered public accounting firm related to management’s assessment of internal control over financial reporting. The JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act and Section 102(b)(2)(B) of the JOBS Act, for complying with new or revised accounting standards. However, we have elected to “opt out” of this provision that would have allowed us to take advantage of an extended transition period and, as a result, we will comply with new or revised accounting standards as required. This decision to opt out of the extended transition period under the JOBS Act is irrevocable.

See “Item 3—Key Information—Risk Factors—Detailed Risk Factors—Risks Related to our Series A shares and the ADSs—As a foreign private issuer and an “emerging growth company,” we have different disclosure and other requirements than U.S. domestic registrants and non-emerging growth companies.”

Public Company in Mexico

Because we are a public company in Mexico, investors can access our historical financial statements published in Spanish on the Mexican Stock Exchange’s (Bolsa Mexicana de Valores, S.A.B. de C.V.), the CNBV’s (Comisión Nacional Bancaria y de Valores) and our websites at www.bmv.com.mx, www.gob.mx/cnbv and www.vistaenergy.com, respectively. The information found on the Mexican Stock Exchange’s, the CNBV’s and our websites is not a part of this annual report.

Non-IFRS Financial Measures

In this annual report, we present ROACE (as defined below), Net Debt, Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Net Income, which are non-IFRS financial measures. A non-IFRS financial measure is generally defined as a numerical measure of a registrant’s historical or future financial performance, financial position or cash flows that: (i) excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with IFRS in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or (ii) includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented.

We define Adjusted EBITDA as (loss)/profit for the year plus income tax expense, financial results, net, depreciation, depletion and amortization, transaction costs related to business combinations, restructuring and reorganization expenses, bargain purchase on business combination and gain from asset disposals and impairment (recovery) of long- lived assets. We believe that the nature of the restructuring and reorganization expenses were such that they are not reasonably likely to recur within two years as they are mainly related to permanent reductions in our workforce derived from our business combinations, and that restructuring and reorganization expenses and transaction expenses are not normal, recurring operating expenses. We believe that by excluding restructuring and reorganization expenses and transaction costs related to business combinations, we are able to provide supplemental information for our management and investors to analyze our core operating performance on a consistent basis from period to period. In addition, the impairment (recovery) of long-lived assets was excluded from the determination of our Adjusted EBITDA because it corresponds to an adjustment to the valuation of our fixed assets which charge is similar in nature to the depreciation of property, plant and equipment. This metric allows management and investors to analyze our operating performance on a consistent basis from period to period. In this regard, we note that the elimination of these costs and expenses does not result in a reduction of operating expenses necessary to conduct our business. In light of the foregoing factors, our management excludes restructuring and reorganization expenses, transaction costs from business combinations and impairment (recovery) of long-lived assets from our Adjusted EBITDA to facilitate reviews of operational performance and as a basis for strategic planning. Our management believes that excluding such items will allow investors to supplement their understanding of our short-term and long-term financial trends.

2

Table of Contents

We define Adjusted Net Income as net income plus deferred income taxes, changes in fair value of warrants and impairment loss/recoveries. Deferred income taxes were excluded as they relate to recognition of temporary differences between the tax bases of assets and liabilities and the carrying amounts in the financial statement using the liability method. Changes in the fair value of warrants were excluded because they correspond to an adjustment valuation of financial liabilities assumed by the Company, likewise impairment (recovery) of long-lived assets were excluded from the determination of our adjusted net income because they correspond to an adjustment to the valuation of our long-lived assets. Our management believes that excluding such items will allow investors to facilitate the comparison performance from period to period by removing these identified non-cash items that are mainly driven by external factors and that affect (benefit) the Company’s net income.

We define Net Debt as current and non-current borrowings minus cash, bank balances and other short-term investments. We define Adjusted EBITDA Margin as the ratio of Adjusted EBITDA to revenue from contracts with customers.

We define return on average capital employed (“ROACE”) as Adjusted EBITDA minus depreciation, depletion and amortization, divided by the sum of the average total debt and average total shareholders’ equity. For purposes of this definition, total debt is comprised of current borrowings, non-current borrowings, current lease liabilities and non-current lease liabilities. Our management believes ROACE measures the efficiency of the utilization of the capital we employ.

We present Adjusted EBITDA, Adjusted EBITDA Margin, Net Debt, Adjusted Net Income and ROACE because we believe they provide investors with supplemental measures of the financial condition and performance of our core operations that facilitate period to period comparisons on a consistent basis. Our management uses Net Debt, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and ROACE, among other measures, for internal planning and performance measurement purposes. Net debt, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and ROACE are not measures of liquidity or operating performance under IFRS and should not be construed as alternatives to net profit, operating profit, or cash flow provided by operating activities (in each case, as determined in accordance with IFRS). Net Debt, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and ROACE, as calculated by us, may not be comparable to similarly titled measures reported by other companies. For a reconciliation of Net Debt, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and ROACE to the most directly comparable IFRS financial measure, see “Item 5A—Operating and Financial Review and Prospects—Operating Results.”

Market and Industry Data

This annual report includes market share, ranking, industry data and forecasts that we obtained from industry publications and surveys, public filings, and internal company sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, including Wood Mackenzie Ltd. (“Wood Mackenzie”), SdE and EIA, but there can be no assurance as to the accuracy or completeness of included information.

We have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. We believe data regarding the size of our markets and market share are inherently imprecise, but generally indicate size and position and market share within our markets. While we are not aware of any misstatements regarding our industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed in the section titled “Risk Factors.”

3

Table of Contents

Presentation of Oil and Gas Information

The Company’s Oil and Gas Reserves Information

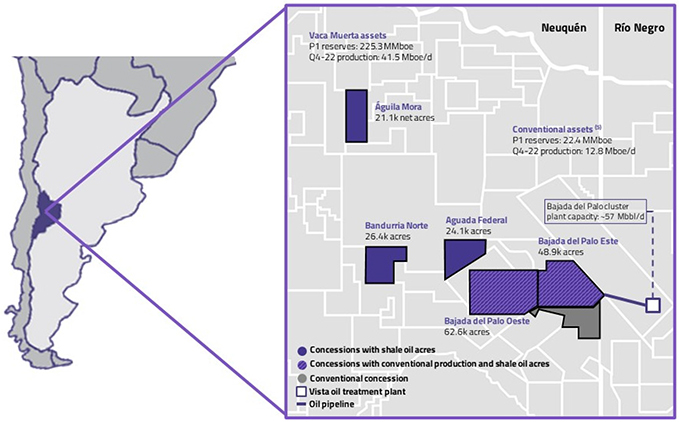

The information included in this annual report regarding estimated quantities of proved reserves is derived from estimates of the proved reserves as of December 31, 2022. The proved reserves estimates are derived from the report dated February 1, 2023, prepared by DeGolyer and MacNaughton (“D&M”), for our concessions located in Argentina and Mexico (the “2022 Reserves Report”). The 2022 Reserves Report is included as Exhibit 99.1 to this annual report. D&M is an independent reserves engineering consultant. The 2022 Reserves Report prepared by D&M is based on information provided by us and present an appraisal as of December 31, 2022, of oil and gas reserves located in the Entre Lomas Río Negro, Entre Lomas Neuquén, Bajada del Palo Oeste, Bajada del Palo Este, Charcho del Palenque, Jarilla Quemada, Coirón Amargo Norte, Acambuco, Jagüel de los Machos, 25 de Mayo-Medanito, Aguada Federal, Bandurria Norte concessions in Argentina, and of our oil and gas reserves located in the CS-01 concession in Mexico.

Argentina and Mexico Oil and Gas Reserves Information

The information included in “Item 4—Information on the Company—Industry and Regulatory Overview” of this annual report regarding Argentina’s and Mexico’s proved reserves has been prepared based on official and publicly available information of the Argentine Secretariat of Energy (“SdE”) and Mexico’s National Hydrocarbon Commission (“CNH”). References to the “proved reserves” of Argentina and Mexico follow the definition of “proved reserves” as set forth in the guidelines published by the SdE and CNH, as applicable. However, the information regarding Vista’s proved reserves included elsewhere in this annual report has been prepared according to the definitions of Rule 4-10(a) of Regulation S-X or the Society of Petroleum Engineers’ Petroleum Resources Management System, which may differ from the relevant guidelines published by the Argentine and Mexican authorities. For more information, see “Item 4—Information on the Company—Industry and Regulatory Overview —Oil and Gas Regulatory Framework in Argentina—Reserves and Resources Certification in Argentina” and “Item 4—Information on the Company—Industry and Regulatory Overview —Oil and Gas Regulatory Framework in Mexico—Reserves and Resources Certification in Mexico.”

Certain Definitions

“ADR” means American Depositary Receipt.

“ADS” means American Depositary Share.

“Argentine Constitution” means the Argentine National Constitution (Constitución Nacional de la República Argentina).

“Argentine Executive Branch” means the Argentine federal executive branch.

“Argentine Secretariat of Energy” or “SdE” means the current Argentine Secretaría de Energía under the supervision of the Ministry of Productive Development (the Argentine Ministerio de Desarrollo Productivo), and/or any of its predecessors (the Argentine Ministry of Energy and the Argentine Ministry of Energy and Mining), and/or any other Argentine federal governmental agency that oversees the enforcement of the Hydrocarbons Law (as defined below) in the future, as applicable.

“BCRA” means the Argentine Central Bank (Banco Central de la República Argentina).

“CNH” means the Mexican National Hydrocarbon Commission (Comisión Nacional de Hidrocarburos).

“EIA” means the U.S. Energy Information Administration.

“ESG” means Environmental, Social and Governance.

“Executive Team” means the Company’s management team that is comprised of Miguel Galuccio, Pablo Vera Pinto, Juan Garoby and Alejandro Cherñacov.

4

Table of Contents

“GHG emissions” or “GSGs” means greenhouse gas emissions. Scope 1 emissions are direct emissions that occur from sources that are controlled by the Company. Scope 2 emissions are indirect GHG emissions associated with the purchase or generation of electricity.

“IEA” means the International Energy Agency.

“Initial Business Combination” means the acquisition by Vista of certain assets from Pampa Energia S.A. and Pluspetrol Resources Corporation on April 4, 2018. For more information, please see “Presentation of Information—The Initial Business Combination” in Vista’s Form 20-F filed with the SEC on April 30, 2020.

“LNG” means liquefied natural gas.

“LPG” means liquefied petroleum gas (includes butane and propane).

“Mexican Constitution” means the Mexican Political Constitution (Constitución Política de los Estados Unidos Mexicanos).

“MMBtu” means million British thermal units.

“NGL” means natural gas liquids.

“NOLs” means Net Operating Losses.

“OPEC” means Organization of Petroleum Exporting Countries.

“Pemex” means the Mexico’s national oil company (Petróleos Mexicanos).

“production” when used with respect to (i) our gas production, it excludes flared gas, injected gas and gas consumed in our operations and (ii) our NGL production, consists only of LPG.

“Proved developed reserves” means those proved reserves that can be expected to be recovered through existing wells and facilities and by existing operating methods.

“Proved reserves” means those quantities of oil and natural gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs, and under existing economic conditions, operating methods and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time. For a complete definition of “proved oil and natural gas reserves,” refer to the SEC’s Regulation S-X, Rule 4, 10(a)(22).

“Proved undeveloped reserves” means those proved reserves that are expected to be recovered from future wells and facilities, including future improved recovery projects which are anticipated with a high degree of certainty in reservoirs which have previously shown favorable response to improved recovery projects. For a complete definition of “proved undeveloped oil and natural gas reserves,” refer to the SEC’s Regulation S-X, Rule 4, 10(a)(31).

“RNV” means the Mexican National Securities Registry (Registro Nacional de Valores).

“ROACE” means return on average capital employed, which we measure as adjusted EBITDA minus depreciation, depletion and amortization, divided by the sum of the average total debt and average total shareholders’ equity. For purposes of this definition, total debt is comprised of current borrowings, non-current borrowings, current lease liabilities and non-current lease liabilities.

“SdE” means the Argentine Secretariat of Energy.

5

Table of Contents

“SENER” means Secretaría de Energía, or Energy Secretariat, in Mexico.

“TRIR” means total recordable incident rate, calculated as the number of recordable incidents multiplied by 1,000,000 divided by total number of hours worked.

“UTs” or “Unidades de Trabajo” means the base unit used as reference to state and evaluate the fulfillment of the activities provided under (i) a minimum work commitment program assumed by a contractor under a hydrocarbons exploration and production contract, (ii) the increase in the activities of such program, as well as (iii) any other additional work commitments undertaken for any given phase of the exploration and production contract not included in the commitment program.

Measurements, Oil and Natural Gas Terms and Other Data

In this annual report, we use the following measurements:

| • | “m” or “meter” means one meter, which equals approximately 3.28084 feet; |

| • | “km” means one kilometer, which equals approximately 0.621371 miles; |

| • | “km2” means one square kilometer, which equals approximately 247.1 acres; |

| • | “ha” means one hectare, which equals approximately 2.47 acres; |

| • | “m3” means one cubic meter; |

| • | “bbl” “bo,” or “barrel of oil” means one stock tank barrel, which is equivalent to approximately 0.15898 cubic meters; |

| • | “boe” means one barrel of oil equivalent, which equals approximately 158.9873 cubic meters of natural gas; |

| • | “cf” means one cubic foot; |

| • | “Bcf” means one billion cubic feet; |

| • | “M,” when used before bbl, bo, boe or cf, means one thousand bbl, bo, boe or cf, respectively; |

| • | “MM,” when used before bbl, bo, boe or cf, means one million bbl, bo, boe or cf, respectively; |

| • | “Bn,” when used before bbl, bo, boe or cf, means one billion bbl, bo, boe or cf, respectively; |

| • | “T,” when used before bbl, bo, boe or cf, means one trillion bbl, bo, boe or cf, respectively; |

| • | “/d,” or “pd” when used after bbl, bo, boe or cf, means per day; |

| • | “CO2e” means Carbon dioxide equivalent; and |

| • | “Tn” means a metric ton. |

6

Table of Contents

FORWARD-LOOKING STATEMENTS

This annual report contains estimates and forward-looking statements, principally in “Item 3—Key Information—Risk Factors,” “Item 4—Information on the Company—Business Overview” and “Item 5—Operating and Financial Review and Prospects.” Some of the matters discussed herein concerning our business operations and financial performance include estimates and forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended (the “Securities Act”) and the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The words such as “believes,” “expects,” “anticipates,” “intends,” “should,” “seeks,” “estimates,” “future,” “may,” “could,” “would,” “likely” or similar expressions are included with the intention of identifying statements about the future. We have based these forward-looking statements on numerous assumptions, including our current beliefs, expectations and projections about present and future events and financial trends affecting our business. These expectations and projections are subject to significant known and unknown risks and uncertainties which may cause our actual results, performance or achievements, or industry results, to be materially different from any expected or projected results, performance or achievements expressed or implied by such forward-looking statements. Many important factors, in addition to those discussed elsewhere in this annual report, could cause our actual results, performance or achievements to differ materially from those expressed or implied in our forward-looking statements, including, among other things:

| • | uncertainties relating to future government concessions and exploration permits; |

| • | adverse outcomes in litigation that may arise in the future; |

| • | general political, economic, social, demographic and business conditions in Argentina, Mexico, in other countries in which we operate; |

| • | the impact of political developments and uncertainties relating to political and economic conditions in Argentina, including the policies of the government in Argentina; |

| • | significant economic or political developments in Mexico and the United States; |

| • | uncertainties relating to future election results in Argentina and Mexico; |

| • | changes in law, rules, regulations and interpretations and enforcements thereto applicable to the Argentine and Mexican energy sectors, including changes to the regulatory environment in which we operate and changes to programs established to promote investments in the energy industry; |

| • | any unexpected increases in financing costs or an inability to obtain financing and/or additional capital pursuant to attractive terms; |

| • | any changes in the capital markets in general that may affect the policies or attitude in Argentina and/or Mexico, and/or Argentine and Mexican companies with respect to financings extended to or investments made in Argentina and Mexico or Argentine and Mexican companies; |

| • | fines or other penalties and claims by the authorities and/or customers; |

| • | any future restrictions on the ability to exchange Mexican or Argentine Pesos into foreign currencies or to transfer funds abroad; |

| • | the revocation or amendment of our respective concession agreements by the granting authority; |

| • | our ability to implement our capital expenditures plans or business strategy, including our ability to obtain financing when necessary and on reasonable terms; |

| • | government intervention, including measures that result in changes to the Argentine and Mexican, labor markets, exchange markets or tax systems; |

| • | continued and/or higher rates of inflation and fluctuations in exchange rates, including the devaluation of the Mexican Peso or Argentine Peso; |

| • | any force majeure events, or fluctuations or reductions in the value of Argentine public debt; |

| • | changes to the demand for energy; |

7

Table of Contents

| • | uncertainties relating to the effects of the COVID-19 outbreak and its different variants; |

| • | the effects of a pandemic or epidemic and any subsequent mandatory regulatory restrictions or containment measures; |

| • | environmental, health and safety regulations and industry standards that are becoming more stringent; |

| • | energy markets, including the timing and extent of changes and volatility in commodity prices, and the impact of any protracted or material reduction in oil prices from historical averages; |

| • | changes in the regulation of the energy and oil and gas sector in Argentina and Mexico, and throughout Latin America; |

| • | our relationship with our employees and our ability to retain key members of our senior management and key technical employees; |

| • | the ability of our directors and officers to identify an adequate number of potential acquisition opportunities; |

| • | our expectations with respect to the performance of our recently acquired businesses; |

| • | our expectations for future production, costs and crude oil prices used in our projections; |

| • | uncertainties inherent in making estimates of our oil and gas reserves, including recently discovered oil and gas reserves; |

| • | increased market competition in the energy sectors in Argentina and Mexico; |

| • | potential changes in regulation and free trade agreements as a result of U.S., Mexican or other Latin American political conditions; |

| • | environmental regulations and internal policies to achieve global climate targets; |

| • | the ongoing conflict involving Russia and Ukraine; and |

| • | additional matters identified in “Risk Factors.” |

Forward-looking statements speak only as of the date on which they were made, and we undertake no obligation to release publicly any updates or revisions to any forward-looking statements contained herein after we distribute this annual report because of new information, future events or other factors. In light of these limitations, undue reliance should not be placed on forward-looking statements contained in this annual report.

8

Table of Contents

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

Capitalization and Indebtedness

Not applicable.

Reasons for the Offer and Use of Proceeds

Not applicable.

RISK FACTORS

You should carefully consider the following risk factors in evaluating us and our business before investing in Vista. In particular, you should consider the risks related to an investment in companies operating in Argentina, Mexico and Latin America generally, for which we have included information in these risk factors to the extent that information is publicly available. In general, investing in the securities of issuers whose operations are located in emerging market countries such as Mexico and stand-alone countries such as Argentina involve a higher degree of risk than investing in the securities of issuers whose operations are located in the United States or other more developed countries. If any of the risks discussed in this annual report actually occur, alone or together with additional risks and uncertainties not currently known to us, or that we do not presently consider material, our business, financial condition, results of operations and prospects may be materially adversely affected. If this were to occur, the value of our series A shares or ADSs may decline and you may lose all or part of your investment. When determining whether to invest, you should also refer to the other information contained in this annual report, including the Audited Financial Statements and the related notes thereto. Our actual results could differ materially and adversely from those anticipated in this annual report.

Risk Factor Summary

The following summarizes the main risks to which we are subject. You should carefully consider all of the information discussed below in “—Detailed Risk Factors” for a comprehensive description of these and other risks.

Risks Related to Our Business and Industry:

As an oil and gas company, our business and industry is subject to particular risks, such as exploration, drilling, completion, production, equipment and resources, gathering, treatment and transportation risks; risks related to natural hazards, weather conditions, and mechanical difficulties; fluctuations and regulation of international and domestic oil prices; the availability of financial resources for our business plan and its corresponding costs; inflation; government regulation; and contractions in demand of crude oil and natural gas or any of their by-products. Additional risks exist in light of the conflict involving Russia and Ukraine, and the associated economic and trade sanctions and restrictions that have been imposed or may be imposed in the future. Additionally, as a company which primarily operates in Argentina and Mexico, our business may be affected by changes in those markets.

Our business operations require significant and long-term capital investments and maintenance costs. Our liquidity, business activities, profitability and ability to compete in the market may be adversely affected if we are not able to acquire and correctly use necessary new technologies in connection with future drilling projects, obtaining financing for such projects, obtain and maintain and/or partners to develop and maintain our business activities.

The enhanced focus on climate change and the transition to lower carbon energy sources on the part of the international community, governments, and investors, promote an increase in the use of energy from renewable sources. This energy transition could significantly impact our industry and business, resulting in increased operating costs, reduced demand for the oil and natural gas we produce, and reputational risks in connection with our business activities. If we fail to meet the pace and extent of society’s changing demands for lower carbon energy as the energy transition unfolds, we could fail in sustaining and developing our business. Further, adverse climate conditions may adversely affect our results of operations and our ability to conduct drilling operations. Additionally, adverse climate conditions could negatively impact the Argentine economy, which could in turn affect our results of operations.

9

Table of Contents

Risks Related to our Company:

Most of our producing properties and total estimated proved reserves are geographically concentrated in Argentina. The results of our planned development programs in new or emerging shale development areas and formations may be subject to more uncertainties than programs in more established areas and formations. As such, we may fail to fully identify problems with any properties we acquire, and as such, assets we acquire may prove to be worth less than we paid because of uncertainties in evaluating recoverable reserves and potential liabilities. We may not be able to acquire, develop or exploit new reserves, which could decrease the volume of our reserves over time and could, in turn, adversely affect our financial condition and our results of operations.

The oil and gas industry is competitive and our ability to achieve our strategic objectives depends on our ability to successfully compete in the market.

We may also be parties to labor, commercial, civil, tax, criminal, environmental and administrative proceedings that, either alone or in combination with other proceedings, could, if resolved in whole or in part adversely to us, result in the imposition of material costs, fines, judgments or other losses. Additionally, we are subject to Mexican, Argentine and other nations’anti-corruption, anti-bribery, anti-money laundering and economic sanctions laws and regulations. Our failure to comply with these laws could result in penalties, which could harm our reputation and have an adverse effect on our reputation, business, financial condition and results of operations. Our operations may pose risks to the environment, and any climate change legislation or regulations restricting emissions of greenhouse gases and legal frameworks promoting an increase in the participation of energies from renewable sources could significantly impact our industry and result in increased operating costs and reduced demand for the oil and natural gas we produce.

Risks Related to the Argentine and Mexican Economic and Regulatory Environments:

Investors may be faced with risks inherent to investing in a company operating in stand-alone and emerging markets, such as Argentina and Mexico. For example, some of these risks may include, among others, the economic and political conditions in Argentina and Mexico, Argentina’s ability to obtain financing from international markets, changing regulation in the countries in which we operate, direct and indirect restrictions on imports and exports under Argentine law, current or potential Argentine exchange controls, the imposition of export duties and other taxes, inflation, significant fluctuations in the value of the Argentine Peso, criminal activity in Mexico, and joint and several tax liability.

Risks Related to our series A shares and the ADSs:

The series A shares and ADSs are traded in more than one market, and this may result in price variations. Also, if securities or industry analysts do not publish research reports about our business, or publish negative reports about our business, the price and trading volume of our series A shares and the ADS could decline.

As a foreign private issuer and an “emerging growth company,” we have different disclosure and other requirements than U.S. domestic registrants and non-emerging growth companies. We are also permitted to rely on exemptions from certain NYSE corporate governance standards applicable to U.S. issuers, including the requirement that a majority of an issuer’s directors consist of independent directors. This may afford less protection to holders of our ADSs.

ADS holders may also be subject to additional risks related to holding ADSs rather than series A shares. For example, ADS holders may be unable to exercise voting rights with respect to the shares underlying the ADSs at our shareholders’ meetings, and preemptive rights may be unavailable to non-Mexican holders of ADSs. Additionally, our bylaws, in compliance with Mexican law, restrict the ability of non-Mexican shareholders to invoke the protection of their governments with respect to their rights as shareholders. Our bylaws also contain provisions aimed at restricting the acquisition of our shares and restricting the execution of voting agreements among our shareholders. ADSs holders may not be entitled to a jury trial with respect to claims arising under the deposit agreement, which could result in less favorable outcomes to the plaintiff(s) in any such action.

10

Table of Contents

Dividend distributions to holders of our series A shares will be made in Mexican Pesos

If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud.

Detailed Risk Factors

Risks Related to Our Business and Industry

The oil and gas industry is subject to particular operational and economic risks.

Oil and gas exploration and production (“E&P”) activities are subject to particular economic and industry-specific operational risks, some of which are beyond our control, such as drilling, completion, production, equipment, gathering, treatment and transportation risks, as well as natural hazards and other uncertainties, including those relating to the physical characteristics of onshore and offshore oil or natural gas fields. Our operations may be curtailed, delayed or canceled due to bad weather conditions, mechanical difficulties, shortages or delays in the delivery of equipment or the construction of roads to access drilling sites, works related to third party vendors, road blocks, compliance with governmental requirements (including any delays in obtaining the relevant permits), fire, explosions, blow-outs, pipe failure, abnormally pressured formations, supply chain bottlenecks, lockdown restrictions on the general population and reduced hydrocarbons demand due to a pandemic, such as COVID-19, and environmental hazards, such as oil spills, gas leaks, ruptures or discharges of toxic gases or natural disasters preventing us from accessing the drilling sites. Drilling may be unprofitable, not only with respect to dry wells, but also with respect to wells that are productive but do not produce sufficient revenues to return a profit after drilling, operating and other costs are considered.

We are exposed to the effects of fluctuations and regulation of international and domestic oil prices. In addition, limitations on local pricing of our products in Argentina may adversely affect our results of operations.

Most of our revenues in Argentina and Mexico are derived from sales from oil and natural gas. During 2022, 44% of our oil production volumes were exported, and we expect to continue exporting a substantial portion of our volumes in the future. We are, therefore, exposed to pricing risk in both the international and domestic markets, especially the Argentine domestic market.

International and domestic oil and gas prices have fluctuated significantly in recent years and are likely to continue fluctuating in the future. Factors affecting international prices for crude oil are: political developments in crude oil producing regions, particularly in the Middle East, the ongoing conflict involving Russia and Ukraine, the ability of the OPEC and other crude oil producing nations to set and maintain crude oil production levels and prices; macroeconomic conditions, including inflation; global and regional supply and demand for crude oil, gas and related products; investment in new projects to bring new oil production volumes to the market; global supply chain disruptions, and shipping bottlenecks, competition from other energy sources, the effects of a pandemic (such as COVID-19) or epidemic and any subsequent mandatory regulatory restrictions or containment measures, domestic and foreign government regulations, weather conditions, and global and local conflicts, war, or acts of terrorism. We cannot predict how these factors will influence oil and related oil products prices and we have no control over them. Price volatility curtails the ability of industry participants to adopt long-term investment decisions given that returns on investments become unpredictable.

Secondly, the domestic price of crude oil has fluctuated in the past in Argentina and Mexico not only due to international prices and the risks outlined above, but also due to local taxation, regulations affecting commercialization in the domestic and export markets, macroeconomic conditions, the impact of a pandemic on general economic activity and therefore crude oil demand and refining margins. The domestic price of crude oil is also subject to local price limitations imposed by the Argentine and Mexican governments. In recent months the Argentine government indirectly intervened in the market to keep local crude oil prices artificially low in order to avoid a further increase in inflation. The average Brent price in 2022 was $99.0/bbl, and export parity price was approximately $92.7/bbl on average, but our average realization price in the domestic market was $62.9/bbl, implying a discount to export parity of 32%. This de-coupling affected most or all producers in Argentina, generating lower revenues than if the average crude oil price in the domestic market had traded at a lower discount to

11

Table of Contents

Brent. The determination by the Argentine and Mexican governments to fix, or indirectly intervene to generate, local crude oil prices at values below export parity could have an adverse effect on our results of operations, financial condition, and cash flows. In the event that local prices are reduced through any of the factors described above, which we cannot control, could affect the economic performance of our existing and future projects, generating a loss of reserves as a result of changes in our development plans, our assumptions and our estimates, and consequently affect the recovery value of certain assets.

A decline in realized crude oil prices for an extended period of time (or if prices for certain products fail to keep pace with cost increases) could adversely affect both the economic viability of our drilling projects and, consequently, our ability to meet our operational and financial targets. These price declines could result in changes to our development plans, reduced capital expenditures, failure of our joint venture partners to approve investment projects, a loss of proved developed reserves and proved undeveloped reserves, an adverse effect on our ability to improve our hydrocarbon recovery rates, find new reserves, develop unconventional resources, carry out certain of our other capital expenditure plans, meet our long-term targets and service our financial debt. A decline in realized crude oil prices could also lead to a deterioration in our financial coverage ratios, impairment charges and cause us to exceed the financial covenants agreed upon in the Credit Agreement. We cannot predict whether, or to what extent, the potential consequences of such actions could affect our business, impact our production, or affect our financial condition and results of operations.

Our business could be adversely affected by a decline in general economic conditions or a weakening of the broader energy industry, and inflation may adversely affect our financial position and operating results.

A prolonged economic slowdown or recession, adverse events relating to the energy industry, or regional, national, or global economic conditions and factors, particularly a slowdown in the E&P industry, could negatively impact our operations and therefore adversely affect our results. The risks associated with our business are more acute during periods of economic slowdown or recession because such periods may be accompanied by decreased demand for oil and natural gas, and decreased prices for oil and natural gas.

Supply chain pressures in global production, trade and logistics resulting from the COVID-19 pandemic and subsequent strong pick-up in demand have fueled price inflation in a number of sectors, including energy and other commodities. Inflationary factors, such as increases in the labor costs, material costs, and overhead costs, may also adversely affect our financial position and operating results. In 2022, we faced and we continue to face effects including cost inflation with both labor and materials, driven by the appreciation of the Argentine Peso in real terms, general inflation impacting the price formula of different services, and the result of collective bargaining agreements on unionized personnel in our company and contractors which could offset any price increases for our products and services.

We are exposed to contractions in demand of crude oil and natural gas and contractions in demand of any of their by-products.

Demand for our crude oil and gas products is largely influenced by the economic activity and growth in Argentina, Mexico and globally. For example, the efforts of the Federal Reserve of the United States and other Central Banks globally to contain inflation through increase in interest rates, could lead to lower economic growth, and even economic recession in certain economies, or at a global level. This could have an adverse effect on the demand for crude oil and crude oil prices, and therefore impact negatively on our business. Although demand increased in the past, it has recently contracted significantly (in part, due to the COVID-19 pandemic) and is subject to volatility in the future. Demand for crude oil by-products, such as gasoline, may also contract under certain conditions, particularly during economic downturns, or due to changes in consumer preferences following from the energy transition currently underway.

A contraction of the demand of our products would adversely affect our revenues, causing economic losses to our Company. In addition, contraction of demand and pricing of our products can impact the valuation of our reserves and, in periods of lower commodity prices, we may curtail production and capital spending or may defer or delay drilling wells because of lower cash generation. Continuous poor economic performance could eventually impair our ability to repay our financial debt, lead to a deterioration in our financial coverage ratios, impairment charges and cause us to exceed the financial covenants agreed upon in the Credit Agreement (as defined below). A contraction of crude oil demand could also affect us financially, including our ability to pay our suppliers for their services, which could, in turn, lead to further operational distress.

12

Table of Contents

The conflict involving Russia and Ukraine, and the associated new, additional, and/or enhanced economic and trade sanctions and restrictions that have been imposed by various countries, could have a material adverse effect on our business, financial condition and results of operations.

The conflict involving Russia and Ukraine has recently had, and will likely continue to have, significant global economic effects, including an impact on commodity prices, especially with regard to international crude oil and gas prices which have increased significantly in February and March 2022. Furthermore, the conflict has resulted in the imposition of economic and trade sanctions and restrictions targeting Russia and certain Russian economic sectors and companies by the United States, the European Union, the United Kingdom and other major countries. The severity of these sanctions may increase and could contribute to a shortage of raw materials and commodities, which could, in turn, generate greater levels of inflation and create interruptions in the global supply chain. Interruptions in the global supply chain could particularly affect the energy sector and could create supply chain difficulties in local markets.

Due to the uncertainties inherent to the scale and duration of the conflict and its direct and indirect effects, it is not reasonably possible to estimate the impact this conflict will have on the global economy and financial markets, on the economies of the countries in which we operate and, consequently, our business, financial condition and results of operations.

Also, our revenues and our profitability are heavily dependent on the prices we receive from our sales of oil and natural gas. Oil prices are particularly sensitive to actual and perceived threats to global political stability and to changes in oil production in, and oil supply from, various key countries, including Russia. The conflict has led to an increase in international oil prices, which creates transitory increases in the revenues of upstream companies around the globe. In addition, it has also led to increased volatility in global commodities in general and hydrocarbon prices. We cannot predict whether such volatility will lead to further price increases or, on the contrary, lead to a general downturn in economic activity or oil and gas prices, and therefore adversely affect our profitability. Recent increases in oil prices could accelerate the transition to other sources of energy and led to an unpredictable drop in pricing in the medium to long-term, which in turn could adversely affect our business, financial condition and results of operations. Such price increases could also lead to energy shortages and an increasing amount of the global population, including in Argentina and Mexico, without access to energy supplies. It could also lead to new regulation by the Argentine and/or Mexican governments to further de-couple domestic energy pricing from international energy pricing or restrict energy-related exports from Argentina or Mexico, which would affect our business. Additionally, changes to worldwide oil prices and demand could cause turmoil in the global financial system, and in turn materially affect our business, financial condition and results of operations.

We benefit from natural gas subsidies to natural gas producers that may be limited or eliminated in the future.

We currently benefit from certain subsidies granted to natural gas producers, such as the Argentine Plan for the Promotion of Natural Gas Production – Supply and Demand Scheme 2020-2024 (Plan de Promoción de la Producción de Gas Natural Argentino – Esquema de Oferta y Demanda 2020-2024) known as “Gas Plan IV”. This subsidy program was approved by the Argentine government by means of Decree No. 892/2020 (recently modified by Decree No. 730/2022) to provide economic incentives aimed at increasing the domestic production of natural gas. In this regard, the government issued a series of complementary regulations to execute Gas Plan IV. See “Item 4—Information on the Company—Industry and Regulatory Overview– Oil and Gas Regulatory Framework in Argentina – Gas Market.” On December 15, 2020, the SdE issued Resolution No. 391/2020, awarding the volumes and prices tendered under Gas Plan IV. The base volume awarded to Vista under the tender was 0.86 MMm3/d (30.4 million cubic feet/day) at an average annual price of US$3.29 per million BTU for a four-year term as of January 1, 2022.

On December 29, 2020, the SdE issued Resolution No. 447/2020, modifying certain aspects of Resolution 391/2020. The base volume awarded to Vista under the tender was modified to 0.85 MMm3/d, maintaining the average annual price.

13

Table of Contents

We cannot assure you that any changes to Gas Plan IV, or additional regulation would not adversely affect our results of operations. The restriction or withdrawal of subsidies would adversely affect the selling price of our products and therefore result in a decrease in our revenues.

Our business requires significant and long-term capital investments and maintenance cost.

The oil and gas industry is a capital-intensive industry. We make and expect to continue to make substantial capital expenditures related to development and acquisition of oil and gas resources and in order to maintain or increase the amount of our hydrocarbon reserves and production.

We have funded, and we expect that we will continue to fund, our capital expenditures with cash generated by existing operations, debt and our existing cash. However, under certain scenarios (for example, in low realized oil price scenarios), our financing needs may require us to alter or increase our capitalization substantially through the issuance of debt or equity securities or the sale of assets. In such case, we cannot guarantee that we will be able to maintain our current production levels, generate sufficient cash flow or that we will have access to sufficient borrowing or other financing alternatives to continue our exploration, exploitation and production activities at current or higher levels.

Additionally, the incurrence of additional indebtedness would require that a portion of our cash flow from operations be used for the payment of interest and principal on our indebtedness, thereby reducing our ability to use cash flow from operations to fund working capital, capital expenditures and acquisitions. The actual amount and timing of our future capital expenditures may differ materially from our estimates as a result of various factors. We may decrease our actual capital expenditures in response to lower commodity prices, which would negatively impact our ability to increase production.

If our revenues decrease, we may have limited ability to obtain the capital necessary to sustain our operations at current levels. If additional capital is needed, we may not be able to obtain debt or equity financing on terms acceptable to us, if at all. If cash flow generated by our operations are not sufficient to meet our capital requirements, the failure to obtain additional financing could result in a curtailment of our operations relating to development of our properties. This, in turn, could lead to a decline in production, and could materially and adversely affect our business, financial condition and results of operations, and the market value of our series A shares or ADSs may decline.

We may not be able to acquire, develop or exploit new reserves, which could decrease the volume of our reserves over time and could, in turn, adversely affect our financial condition and the results of our operations.

The production of oil and gas reservoirs decreases as reserves drain with the range of decrease depending on the characteristics of the reservoir. Additionally, the available amount of reserves decreases as the reserves are produced and consumed. Therefore, our results of operations largely depend on our ability to produce oil and gas from existing reserves, to discover additional oil and gas reserves, and to economically exploit oil and gas from these reserves. Unless we are successful in our exploration of oil and gas reserves and their development, in replacing our existing oil and gas reserves or in acquiring new reserves, the production of oil and gas and the volume of our reserves will decrease over time. While we have geological reports evaluating certain proved, contingent and prospective reserves in our blocks, there is no assurance that we will continue to be successful in the exploration, appraisal, development and commercialization of oil and gas.

Drilling activities are also subject to numerous risks and may involve unprofitable efforts, not only with respect to dry wells but also with respect to wells that are productive but do not produce enough net income to derive profit after covering drilling costs and other operating costs. The construction of a well does not assure a return on investment or recovery of the costs of drilling, completion and operating costs. Lower oil and natural gas prices could also affect our growth, including future and pending acquisitions.

We may not be able to identify commercially exploitable reservoirs or implement our capital investment program to complete or produce more oil and gas reserves, and the wells we plan to drill may not result in the discovery or production of oil or natural gas. If we are unable to replace our production with new reserves, or acquire new reserves, our reserves will decline and our financial condition, results of operations, cash flow and market value of our series A shares and ADSs could be negatively affected.

14

Table of Contents

The oil and gas reserves that we estimate are based on assumptions that could be inaccurate.

Our oil and gas reserves are estimates based on certain assumptions that could be inaccurate. Reserve estimates depend on the quality of engineering and geological data at the date of the estimate and the manner in which they are interpreted. The accuracy of estimates of proved reserves depends on a number of factors, many of which are beyond our control and are subject to change over time. In addition, reserve engineering is a subjective process for estimating oil and gas accumulations that cannot be accurately measured, and the estimates of other engineers may differ materially. A number of assumptions and uncertainties are inherent in estimating the amounts that make up the proven reserves of oil and gas (including, but not limited to production forecasts, the time and amount of development expenditures, testing and production after the date of the estimates, among others), many of which are beyond our control and are subject to change over time.

Consequently, measures of reserves are not precise and are subject to revision. Any downward revision in our estimated quantities of proved reserves could adversely impact our financial condition and results of operations, and ultimately have a material adverse effect on the market value of our series A shares or ADSs. In addition, the estimation of “proved oil and natural gas reserves” based on Argentine SdE Resolution No. 324/2006 and Secretariat of Hydrocarbon Resources Resolution No. 69-E/2016 may differ from the standards required by SEC’s regulations.

As a result, reserve estimates could be materially different from the amounts that are ultimately extracted, and if such amounts are significantly lower than the initial reserves estimates it could result in a material adverse effect on our financial performance, operating results and the market value of our series A shares and ADSs. See “Item 4—Information on the Company—Industry and Regulatory Overview —Oil and Gas Regulatory Framework in Argentina—Reserves and Resources Certification in Argentina” and the 2022 Reserves Report attached hereto as Exhibit 99.1.

Our business operations rely heavily on our production facilities.

A material portion of our revenues depends on our oil and gas facilities, which are key to producing, transporting, treating and injecting oil and gas in transportation infrastructure for sale. While we believe that we maintain adequate insurance coverage and appropriate security measures in respect of such facilities, any material damage to, accident at, or other disruption at such production facilities could have a material adverse effect on our production capacity, financial condition and results of operations.

The lack of availability of transport may limit our possibility of increasing hydrocarbon production and may adversely affect our financial condition and results of operations.

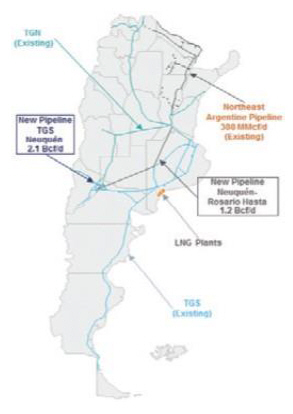

Our capacity to exploit our hydrocarbon reserves largely depends upon the availability of transport infrastructure on commercially acceptable terms to transport the produced hydrocarbons to the markets in which they are sold. Typically, oil is transported by pipelines and tankers to refineries, and gas is usually transported by pipeline to customers. The lack of oil transportation storage or loading infrastructure, as well as the lack of vessels for maritime oil transportation, may adversely affect our financial condition and results of operations. The lack of gas transportation infrastructure may also adversely affect our financial condition and results of operations.

In particular, most of our crude oil production is transported from the Neuquina Basin through the Oldelval pipeline system to the south of the Province of Buenos Aires, from where it is sent to refineries or port facilities at Puerto Rosales for exports. This Oldelval pipeline system is currently working close to full capacity. Additionally, the export facilities at Puerto Rosales, owned by Oiltanking Ebytem, are also working close to full capacity. Although Oldelval and Oiltanking Ebytem are executing a projects to expand their capacity, if Vaca Muerta production grows at a greater pace than its capacity expands, a potential lack of transportation capacity may limit our production and therefore adversely affect our financial condition and results of operations.

Developments in the oil and gas industry and other factors may result in substantial write-downs of the carrying amount of our assets, which could adversely affect our financial condition and results of operations.

Changes in the economic, regulatory, business or political environment in Argentina, Mexico or other markets where we operate, such as price controls over crude oil or crude oil by-products or the significant decline in international crude oil and gas prices in recent years, among other factors, may result in the recognition of impairment charges in certain of our assets.

15

Table of Contents

We evaluate the carrying amount of our assets for possible impairment on an annual basis, or more frequently where the circumstances require. Our impairment tests are performed by a comparison of the carrying amount of an individual asset or a cash- generating unit with its recoverable amount. Whenever the recoverable amount of an individual asset or cash-generating unit is less than its carrying amount, an impairment loss is recognized to reduce the carrying amount to the recoverable amount. Substantial write-downs of the carrying amount of our assets could adversely affect our financial condition and results of operations.

Exploration and development drilling may not result in commercially productive reserves.

Drilling involves numerous risks, including the risk that no commercially productive oil or gas reservoirs will be encountered. The cost of drilling, completing and operating wells is often uncertain, and drilling operations may be curtailed, delayed or canceled, or become costlier, as a result of a variety of factors, including (i) unexpected drilling conditions; (ii) unexpected pressure or irregularities in formations; (iii) equipment failures or accidents; (iv) construction delays; (v) hydraulic stimulation accidents or failures; (vi) adverse weather conditions; (vii) restricted access to land for drilling or laying pipelines; (viii) title defects; (ix) lack of available gathering, transportation, processing, fractionation, storage, refining or export facilities; (x) lack of available capacity on interconnecting transmission pipelines; (xi) access to, and the cost and availability of, the equipment, services, resources and personnel required to complete our drilling, completion and operating activities; and (xii) delays imposed by or resulting from compliance with environmental and other governmental or regulatory requirements.

Our future drilling activities may not be successful and, if unsuccessful, our proved reserves and production would decline, which could have an adverse effect on our future results of operations and financial condition. While all drilling, whether development, extension or exploratory, involves these risks, exploratory and extension drilling involves greater risks of dry holes or failure to find commercial quantities of hydrocarbons. If we are not successful in our exploration or extension drilling activities, we might not be able to replace the reserves consumed as a result of our production and therefore our production will decline over time, which could adversely affect our financial condition and results of operations.

Our operations are substantially dependent upon the availability of water and our ability to dispose of produced water gathered from drilling and production activities. Restrictions on our ability to obtain water or dispose of produced water may have a material adverse effect on our financial condition, results of operations and cash flows.

Water is an essential component of both the drilling, completion and hydrocarbon production activities. Limitations or restrictions on our ability to secure sufficient amounts of water (including limitations resulting from natural causes such as drought), could materially and adversely impact our operations. Severe drought conditions can result in local water districts taking steps to restrict the use of water in their jurisdiction for drilling and hydraulic stimulation in order to protect the local water supply. If we are unable to obtain water to use in our operations from local sources, it may need to be obtained from new sources and transported to drilling sites, or other facilities, resulting in increased costs, which could have a material adverse effect on our financial condition, results of operations and cash flows.

Our operations may pose risks to the environment.

Some of our operations are subject to environmental risks which could materialize unexpectedly and could have a material adverse impact on our financial condition and results of operations. These include the risk of leaks or spills of hydrocarbons, contamination of soil or water sources, fire and explosions, damages to infrastructure or the general population. There can be no assurance that future environmental issues will not result in cost increases, civil liability or administrative action, which could lead to a material adverse effect on our financial condition and results of operations.

16

Table of Contents

Any climate change legislation or regulations restricting emissions of greenhouse gases (“GHGs”) could result in increased operating costs.

Due to concern over the risk of climate change, a number of countries have adopted, or are considering the adoption of, new regulatory requirements to reduce greenhouse gas emissions, such as carbon taxes, increased efficiency standards or the adoption of cap-and-trade regimes. More stringent environmental regulations can result in the imposition of costs associated with GHG emissions, either through environmental agency requirements relating to mitigation initiatives, compliance costs and operational restrictions, and/or through other regulatory measures such as GHG emissions taxation and market creation of limitations on GHG emissions that have the potential to increase our operating costs. We expect that a growing share of our GHG emissions could be subject to regulation, resulting in increased compliance costs and operational restrictions. Regulators may seek to limit certain oil and gas projects or make it more difficult to obtain required permits. Additionally, climate activists around the globe are challenging the grant of new and existing regulatory permits. We expect that these challenges are likely to continue and could delay or prohibit operations in certain cases.

Compliance with legal and regulatory changes relating to climate change set out by the Argentine and Mexican governments, including those resulting from the implementation of international treaties (see “Item 4—Information on the Company—Business Overview—Argentine Regulatory Framework”), may in the future increase our costs to operate and maintain our facilities, install new emission controls on our facilities and administer and manage any GHG emissions program. Revenue generation and strategic growth opportunities may also be adversely affected.

In addition, environmental laws that may be implemented in the future could increase litigation risks and have a material adverse effect on us. For example, in 2019, the Argentine Congress enacted Law No. 27,520 on Minimal Standards on Global Climate Change Adaptation and Mitigation, which focused on implementing policies, strategies, actions, programs and projects that can prevent, mitigate or minimize the damages or impacts associated with climate change (see “Item 4—Information on the Company—Business Overview—Argentine Regulatory Framework”). If additional requirements were adopted in Argentina, these requirements could add to our litigation costs and impact adversely on our results of operations.

We cannot predict the overall impact that the enactment of new environmental laws or regulations could have on our financial results, results of operations, and cash flows and the market value of our series A shares and ADSs.

The energy transition could result in reduced demand for the oil and gas we produce, negatively impact our long term plans, and lead to opposition from certain stakeholders

We expect that actions by customers to reduce their emissions will continue to lower demand for hydrocarbons and their by-products, and potentially affect prices for oil and gas, for example if households continue switching to electric vehicles, if public transport switches to electricity or other renewable fuels, if power generation continues to migrate to renewable sources, or if hydrogen or alternative sources of green energy are adopted on a massive scale. This could be a factor contributing to additional provisions for our assets and result in lower earnings, cancelled projects, reduced access to capital, and potential impairment of certain assets.

Regulations and regimes promoting alternative energy resources may also lead to a decline in demand for crude oil and natural gas, or any of their by-products, in the long-term. In addition, increased regulation of GHG may create greater incentives for the use of alternative energy sources. Any long-term material adverse effect on the oil industry could adversely affect the financial and operational aspects of our business, which we cannot predict with certainty as of the date of this annual report.

There are other risks associated with climate change, such as increasing conflictivity with landowners and local communities, difficulties in hiring and retaining staff, and increased difficulty accessing technology. Moreover, certain investors have also decided to divest their investments in fossil fuel companies and stakeholder groups are also putting pressure on commercial and investment banks to stop financing fossil fuel companies. According to press reports, some financial institutions have started to limit their exposure to fossil fuel projects. Accordingly, our ability to access financing for future projects may be adversely affected. These factors could have a negative impact on the demand for our products and services and may jeopardize or even impair the implementation and operation of our business, adversely impacting our operating and financial results and limiting our growth opportunities.

17

Table of Contents

If we fail to meet the pace and extent of society’s changing demands for lower carbon energy as the energy transition unfolds, we could fail in sustaining and developing our business.

The pace and extent of the energy transition could pose a risk to the company if our own transition towards decarbonisation moves at a different speed than society’s. If we are slower than society, either because we do not invest enough funds, or invest in technologies that fail to reduce our carbon footprint or does not allow us to reach our ambition to become net zero, our reputation may suffer and customers may prefer a different supplier which would adversely impact demand for our hydrocarbon products, including the market value of our non-conventional acreage and associated resources we expect to develop in the future. Our failure to time the transition of our production to address climate-change related concerns could have a material adverse effect on our earnings, cash flows and financial condition.

Adverse climate conditions may adversely affect our results of operations and our ability to conduct drilling operations. Additionally, adverse climate conditions could negatively impact the Argentine economy.

The physical effects of climate change such as, but not limited to, heat waves, storms, hail, increases in temperature and sea levels, extensive droughts affecting the river basins where we operate, and fluctuations in sea levels could adversely affect our operations and supply chains. Such adverse climate conditions may lead to, among others, cost increases, drilling delays, power outages, production stoppages, and difficulties in transporting the oil and gas produced by us. Any decrease in our oil and gas production could have a material adverse effect on our business, financial condition or results of operations.

In addition, adverse climatic conditions could negatively affect Argentina’s economy. The consequences of the 2022/2023 drought in Argentina have significantly affected agricultural production. Soybean, corn and wheat production is expected to decline by approximately 40% year-on-year, resulting in an expected GDP contraction of 3% to 3.5% during 2023, according to several economic analysts. In addition, the reduction in foreign exchange inflows is expected to be approximately $16 billion, due to lower exports. Tax revenues will also be affected, due to lower export taxes (according to several economic analysts, the current estimate is approximately $5 billion less tax revenues, or 1% of GDP). This could have a negative impact on the Argentine macroeconomy (which already had high levels of inflation and poverty prior to the drought), and therefore could negatively affect our operations and financial results if the worsening macro situation leads to an economic crisis.

Our activities are subject to social and reputational risks, including negative media attention and the potential for protests by members of the local communities in the places where we operate.

Although we are committed to operating in a socially responsible manner, we may face opposition from local communities and negative media attention. For example, several of our operations are carried out in the Province of Neuquén, Argentina. Local communities, including indigenous communities, have engaged in various forms of protest against business activities in general, including oil and gas. Although we consider our relationship with local communities, including indigenous communities to be good, we cannot assure you that any blockade will not impact our operations. Any such action could have an adverse effect on our reputation, financial condition and results of operations.

Our industry has become increasingly dependent on digital technologies to carry out daily operations and is subject to increasing cybersecurity threats.