UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23410

FROST FAMILY OF FUNDS

(Exact name of registrant as specified in charter)

One Freedom Valley Drive

Oaks, PA 19456

(Address of Principal Executive Offices, Zip code)

Michael Beattie

c/o SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: 1-877-713-7678

Date of fiscal year end: July 31, 2024

Date of reporting period: January 31, 2024

Item 1. Reports to Stockholders.

| (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto. |

Frost Family of Funds Semi- Annual Report JANUARY 31, 2024 FROST GROWTH EQUITY FUND FROST TOTAL RETURN BOND FUND FROST CREDIT FUND FROST LOW DURATION BOND FUND FROST MUNICIPAL BOND FUND Investment Adviser: Frost Investment Advisors, LLC

| Page | ||||

| 1 | ||||

| 22 | ||||

| 23 | ||||

| 25 | ||||

| 28 | ||||

| 30 | ||||

| 33 | ||||

| 46 | ||||

| 51 | ||||

The Funds file their complete schedule of investments of portfolio holdings with the Securities and Exchange Commission (“Commission”) for the first and third quarters of each fiscal year on Form N-PORT within sixty days after period end. The Funds’ Forms N-PORT are available on the Commission’s website at https://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-877-71-FROST; and (ii) on the Commission’s website at https://www.sec.gov.

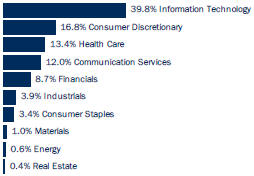

SECTOR WEIGHTINGS†

† Percentages are based on total investments.

| Description | Shares | Value | ||||||

| COMMON STOCK§ — 98.9% |

||||||||

| Communication Services — 11.9% |

||||||||

| Alphabet, Cl A * |

54,419 | $ | 7,624,102 | |||||

| Alphabet, Cl C * |

47,058 | 6,672,824 | ||||||

| Meta Platforms, Cl A * |

18,228 | 7,111,472 | ||||||

| Netflix * |

3,934 | 2,219,209 | ||||||

| Spotify Technology * |

8,305 | 1,788,482 | ||||||

|

|

|

|||||||

| 25,416,089 | ||||||||

|

|

|

|||||||

| Consumer Discretionary — 16.6% |

||||||||

| Airbnb, Cl A * |

9,233 | 1,330,845 | ||||||

| Amazon.com * |

97,603 | 15,147,986 | ||||||

| Booking Holdings * |

666 | 2,335,975 | ||||||

| Chipotle Mexican Grill, Cl A * |

1,400 | 3,372,278 | ||||||

| Floor & Decor Holdings, Cl A * |

6,249 | 628,399 | ||||||

| Home Depot |

8,579 | 3,028,044 | ||||||

| Lululemon Athletica * |

3,027 | 1,373,713 | ||||||

| NIKE, Cl B |

10,667 | 1,083,020 | ||||||

| O’Reilly Automotive * |

2,792 | 2,856,356 | ||||||

| Starbucks |

13,356 | 1,242,509 | ||||||

| Tesla * |

9,414 | 1,763,148 | ||||||

| TJX |

15,661 | 1,486,385 | ||||||

|

|

|

|||||||

| 35,648,658 | ||||||||

|

|

|

|||||||

| Consumer Staples — 3.3% |

||||||||

| Coca-Cola |

26,063 | 1,550,488 | ||||||

| Costco Wholesale |

4,276 | 2,971,307 | ||||||

| Monster Beverage * |

47,733 | 2,626,269 | ||||||

|

|

|

|||||||

| 7,148,064 | ||||||||

|

|

|

|||||||

| Energy — 0.6% |

||||||||

| Hess |

8,919 | 1,253,387 | ||||||

|

|

|

|||||||

| Financials — 8.6% |

||||||||

| Cboe Global Markets |

9,745 | 1,791,618 | ||||||

| Mastercard, Cl A |

13,850 | 6,221,836 | ||||||

| Moody’s |

8,023 | 3,145,337 | ||||||

| Visa, Cl A |

26,631 | 7,277,187 | ||||||

|

|

|

|||||||

| 18,435,978 | ||||||||

|

|

|

|||||||

| Health Care — 13.2% |

||||||||

| Abbott Laboratories |

7,657 | 866,390 | ||||||

| AbbVie |

18,512 | 3,043,373 | ||||||

| Boston Scientific * |

38,054 | 2,407,296 | ||||||

| Charles River Laboratories International * |

4,246 | 918,325 | ||||||

| Description | Shares | Value | ||||||

| Danaher |

11,121 | $ | 2,668,039 | |||||

| Edwards Lifesciences * |

13,467 | 1,056,756 | ||||||

| Eli Lilly |

11,361 | 7,334,775 | ||||||

| Humana |

3,990 | 1,508,459 | ||||||

| Intuitive Surgical * |

6,128 | 2,317,732 | ||||||

| Merck |

8,963 | 1,082,551 | ||||||

| UnitedHealth Group |

7,657 | 3,918,393 | ||||||

| Zoetis, Cl A |

6,638 | 1,246,683 | ||||||

|

|

|

|||||||

| 28,368,772 | ||||||||

|

|

|

|||||||

| Industrials — 3.9% |

||||||||

| Canadian Pacific Kansas City |

30,035 | 2,416,916 | ||||||

| Fortive |

15,585 | 1,218,435 | ||||||

| Uber Technologies * |

44,409 | 2,898,576 | ||||||

| Union Pacific |

7,982 | 1,947,049 | ||||||

|

|

|

|||||||

| 8,480,976 | ||||||||

|

|

|

|||||||

| Information Technology — 39.4% |

||||||||

| Accenture, Cl A |

3,622 | 1,317,973 | ||||||

| Adobe * |

6,400 | 3,953,792 | ||||||

| Advanced Micro Devices * |

20,562 | 3,448,042 | ||||||

| Apple |

94,783 | 17,477,985 | ||||||

| Globant * |

7,700 | 1,815,737 | ||||||

| Intuit |

2,800 | 1,767,724 | ||||||

| Lam Research |

303 | 250,027 | ||||||

| Marvell Technology |

33,542 | 2,270,794 | ||||||

| Microsoft |

72,825 | 28,953,763 | ||||||

| NVIDIA |

21,032 | 12,940,359 | ||||||

| QUALCOMM |

9,003 | 1,337,036 | ||||||

| ServiceNow * |

5,898 | 4,514,329 | ||||||

| Snowflake, Cl A * |

4,577 | 895,444 | ||||||

| Workday, Cl A * |

12,332 | 3,589,475 | ||||||

|

|

|

|||||||

| 84,532,480 | ||||||||

|

|

|

|||||||

| Materials — 1.0% |

||||||||

| Sherwin-Williams |

7,112 | 2,164,750 | ||||||

|

|

|

|||||||

| Real Estate — 0.4% |

||||||||

| American Tower ‡ |

4,009 | 784,361 | ||||||

|

|

|

|||||||

| Total Common Stock |

212,233,515 | |||||||

|

|

|

|||||||

| Total Investments — 98.9% |

$ | 212,233,515 | ||||||

|

|

|

|||||||

Percentages are based on Net Assets of $214,559,815.

| * | Non-income producing security. |

| § | Narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting. |

| ‡ | Real Estate Investment Trust |

As of January 31, 2024, all of the Fund’s investments in securities were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For more information on valuation inputs, see Note 2—Significant Accounting Policies in the Notes to Financial Statements.

See “Glossary” for abbreviations.

The accompanying notes are an integral part of the financial statements.

| 1 |

SECTOR WEIGHTINGS †

| U.S. Treasury Obligation |

28.8% | |||||

| Mortgage-Backed Security |

22.5% | |||||

| Corporate Obligation |

22.2% | |||||

| Consumer Discretionary | 3.8% | |||||

| Consumer Staples | 0.3% | |||||

| Energy | 6.0% | |||||

| Financials | 7.8% | |||||

| Industrials | 1.3% | |||||

| Information Technology | 1.9% | |||||

| Materials | 0.2% | |||||

| Real Estate | 0.2% | |||||

| Utilities | 0.7% | |||||

| Asset-Backed Security |

13.2% | |||||

| Collateralized Loan |

||||||

| Obligation |

6.9% | |||||

| U.S. Government Agency |

||||||

| Obligation |

2.1% | |||||

| Common Stock |

1.6% | |||||

| Municipal Bond |

1.5% | |||||

| Repurchase Agreement |

0.7% | |||||

| Sovereign Debt |

0.3% | |||||

| Commercial Paper |

0.2% |

† Percentages are based on total investments.

| Description | Face Amount | Value | ||||||

| U.S. TREASURY OBLIGATIONS — 28.6% |

|

|||||||

| U.S. Treasury Bonds |

|

|||||||

| 4.750%, 11/15/43 |

$ | 5,000,000 | $ | 5,292,969 | ||||

| 4.375%, 08/15/43 |

105,000,000 | 105,754,687 | ||||||

| 4.125%, 08/15/53 |

5,000,000 | 4,916,406 | ||||||

| 4.000%, 11/15/42 to 11/15/52 |

135,000,000 | 129,639,844 | ||||||

| 3.875%, 05/15/43 |

85,000,000 | 79,979,688 | ||||||

| 3.625%, 02/15/53 |

25,000,000 | 22,445,313 | ||||||

| 3.250%, 05/15/42 |

125,000,000 | 108,237,305 | ||||||

| 0.000%, 08/15/43 (A) |

25,000,000 | 10,742,717 | ||||||

| U.S. Treasury Notes |

||||||||

| 4.625%, 02/28/25 |

65,000,000 | 64,956,836 | ||||||

| 4.250%, 12/31/24 |

40,000,000 | 39,803,125 | ||||||

| 4.125%, 09/30/27 |

130,000,000 | 130,792,187 | ||||||

| 4.000%, 01/31/31 |

25,000,000 | 25,128,906 | ||||||

| 3.875%, 08/15/33 |

70,000,000 | 69,584,375 | ||||||

| 3.750%, 12/31/30 |

40,000,000 | 39,593,750 | ||||||

|

|

|

|||||||

| Total U.S. Treasury Obligations |

836,868,108 | |||||||

|

|

|

|||||||

| MORTGAGE-BACKED SECURITIES — 22.4% |

|

|||||||

| Agency Mortgage-Backed Obligation — 11.8% |

|

|||||||

| FHLMC |

|

|||||||

| 6.000%, 08/01/53 to 09/01/53 |

50,138,307 | 51,006,155 | ||||||

| FHLMC STRIPS, Ser 2012-293, Cl IO, IO |

||||||||

| 4.000%, 11/15/32 |

454,868 | 40,861 | ||||||

| FHLMC, Ser 2012-3996, Cl QL |

||||||||

| 4.000%, 02/15/42 |

4,943,292 | 4,705,342 | ||||||

| FHLMC, Ser 2012-4029, Cl LI, IO |

||||||||

| 3.000%, 01/15/27 |

542,265 | 6,944 | ||||||

| FHLMC, Ser 2012-4077, Cl AI, IO |

||||||||

| 3.000%, 01/15/27 |

83,511 | 44 | ||||||

| FHLMC, Ser 2012-4106, Cl YI, IO |

||||||||

| 2.500%, 09/15/27 |

790,042 | 24,614 | ||||||

| Description | Face Amount | Value | ||||||

| FHLMC, Ser 2012-4116, Cl MI, IO |

||||||||

| 4.000%, 10/15/42 |

$ | 11,332,485 | $ | 1,525,409 | ||||

| FHLMC, Ser 2012-4116, Cl PI, IO |

||||||||

| 4.000%, 10/15/42 |

3,638,909 | 685,671 | ||||||

| FHLMC, Ser 2012-4134, Cl BI, IO |

||||||||

| 2.500%, 11/15/27 |

2,252,262 | 70,032 | ||||||

| FHLMC, Ser 2012-4136, Cl PI, IO |

||||||||

| 3.000%, 11/15/32 |

6,816,006 | 628,886 | ||||||

| FHLMC, Ser 2012-4148, Cl LI, IO |

||||||||

| 2.500%, 12/15/27 |

1,639,618 | 53,963 | ||||||

| FHLMC, Ser 2013-4213, Cl IG, IO |

||||||||

| 4.000%, 06/15/43 |

5,761,442 | 946,701 | ||||||

| FHLMC, Ser 2014-4349, Cl KI, IO |

||||||||

| 3.000%, 04/15/33 |

3,308,747 | 169,578 | ||||||

| FHLMC, Ser 2015-4457, Cl EI, IO |

||||||||

| 3.500%, 02/15/45 |

244,473 | 36,736 | ||||||

| FHLMC, Ser 2017-4675, Cl VE |

||||||||

| 3.500%, 08/15/37 |

4,707,000 | 4,515,717 | ||||||

| FHLMC, Ser 2019-4908, Cl AS, IO |

||||||||

| 0.641%, SOFR30A + 5.986%, 01/25/45 (B) |

9,220,391 | 1,246,282 | ||||||

| FHLMC, Ser 2021-5085, Cl IG, IO |

||||||||

| 2.500%, 03/25/51 |

20,361,311 | 2,577,039 | ||||||

| FHLMC, Ser 2022-5202, Cl KI, IO |

||||||||

| 3.500%, 06/25/49 |

14,974,064 | 2,498,445 | ||||||

| FNMA |

||||||||

| 6.500%, 11/01/53 |

45,369,777 | 46,458,270 | ||||||

| 6.000%, 09/01/53 |

19,752,207 | 19,914,823 | ||||||

| 5.500%, 05/01/44 to 01/01/54 |

23,099,994 | 23,245,658 | ||||||

| 5.000%, 07/01/53 |

19,842,263 | 19,592,007 | ||||||

| 4.500%, 08/01/41 |

1,853,540 | 1,844,518 | ||||||

| 3.000%, 11/01/46 |

3,710,146 | 3,314,801 | ||||||

| 2.180%, 01/01/27 |

5,000,000 | 4,688,152 | ||||||

| FNMA STRIPS, Ser 2009-397, Cl 2, IO |

||||||||

| 5.000%, 09/25/39 |

1,032,482 | 186,840 | ||||||

| FNMA STRIPS, Ser 2009-400, Cl 2, IO |

||||||||

| 4.500%, 11/25/39 |

784,921 | 124,666 | ||||||

| FNMA STRIPS, Ser 2010-404, Cl 2, IO |

||||||||

| 4.500%, 05/25/40 |

1,435,489 | 250,833 | ||||||

| FNMA STRIPS, Ser 2011-407, Cl 2, IO |

||||||||

| 4.000%, 03/25/41 |

1,430,256 | 232,441 | ||||||

| FNMA STRIPS, Ser 2012-410, Cl C5, IO |

||||||||

| 3.500%, 05/25/27 |

1,683,956 | 43,083 | ||||||

| FNMA STRIPS, Ser 2015-421, Cl C1, IO |

||||||||

| 3.000%, 05/25/30 |

1,678,600 | 107,908 | ||||||

| FNMA, Ser 2011-103, Cl GI, IO |

||||||||

| 3.500%, 10/25/26 |

377,697 | 7,043 | ||||||

| FNMA, Ser 2011-146, Cl AY |

||||||||

| 3.500%, 01/25/32 |

1,893,914 | 1,836,731 | ||||||

| FNMA, Ser 2012-61, Cl KI, IO |

||||||||

| 4.000%, 12/25/41 |

2,435,757 | 165,820 | ||||||

| FNMA, Ser 2012-68, Cl GY |

||||||||

| 3.000%, 07/25/32 |

5,000,000 | 4,725,559 | ||||||

| FNMA, Ser 2013-104, Cl TI, IO |

||||||||

| 3.000%, 08/25/32 |

888,244 | 32,742 | ||||||

The accompanying notes are an integral part of the financial statements.

| 2 |

| Description | Face Amount | Value | ||||||

| FNMA, Ser 2014-40, Cl GI, IO |

||||||||

| 3.000%, 06/25/33 |

$ | 3,756,474 | $ | 345,784 | ||||

| FNMA, Ser 2017-52, Cl DI, IO |

||||||||

| 4.500%, 07/25/47 |

6,384,629 | 1,001,431 | ||||||

| FNMA, Ser 2019-44, Cl CI, IO |

||||||||

| 4.000%, 08/25/59 |

5,325,008 | 1,103,323 | ||||||

| FNMA, Ser 2019-44, Cl PI, IO |

||||||||

| 4.000%, 08/25/49 |

4,446,340 | 695,004 | ||||||

| FNMA, Ser 2020-44, Cl MI, IO |

||||||||

| 2.500%, 01/25/57 |

11,942,132 | 1,894,557 | ||||||

| GNMA, Ser 2013-170, Cl QI, IO |

||||||||

| 3.089%, 11/20/43 (B) |

6,871,493 | 779,105 | ||||||

| GNMA, Ser 2013-42, Cl MI, IO |

||||||||

| 3.500%, 04/20/41 |

183,176 | 883 | ||||||

| GNMA, Ser 2013-62, Cl NI, IO |

||||||||

| 4.000%, 08/20/40 |

2,035,904 | 98,130 | ||||||

| GNMA, Ser 2014-32, Cl CI, IO |

||||||||

| 4.000%, 03/20/43 |

1,800,075 | 132,797 | ||||||

| GNMA, Ser 2014-44, Cl IO, IO |

||||||||

| 4.000%, 11/16/26 |

1,559,316 | 24,562 | ||||||

| GNMA, Ser 2015-103, Cl CI, IO |

||||||||

| 4.000%, 07/20/45 |

9,603,032 | 1,550,925 | ||||||

| GNMA, Ser 2015-17, Cl JI, IO |

||||||||

| 3.500%, 05/20/28 |

1,377,147 | 24,369 | ||||||

| GNMA, Ser 2016-99, Cl ID, IO |

||||||||

| 4.500%, 04/16/44 |

14,086,201 | 3,045,809 | ||||||

| GNMA, Ser 2017-137, Cl DI, IO |

||||||||

| 3.000%, 02/20/47 |

774,006 | 15,350 | ||||||

| GNMA, Ser 2020-189, Cl IJ, IO |

||||||||

| 2.500%, 12/20/50 |

19,421,747 | 2,224,369 | ||||||

| GNMA, Ser 2020-191, Cl CT |

||||||||

| 1.250%, 12/20/50 |

3,853,648 | 2,990,742 | ||||||

| GNMA, Ser 2021-8, Cl IG, IO |

||||||||

| 2.500%, 01/20/51 |

26,011,732 | 3,262,979 | ||||||

| GNMA, Ser 2022-182, Cl PO, PO |

||||||||

| 0.000%, 10/20/52 (A)(C) |

33,565,299 | 23,968,017 | ||||||

| GNMA, Ser 2023-122, Cl G |

||||||||

| 5.500%, 05/20/46 |

10,788,032 | 10,857,717 | ||||||

| GNMA, Ser 2023-151, Cl PO, PO |

||||||||

| 0.000%, 10/20/53 (A)(C) |

34,344,916 | 28,478,818 | ||||||

| GNMA, Ser 2023-163, Cl B |

||||||||

| 6.000%, 02/20/48 |

21,790,162 | 22,461,992 | ||||||

| GNMA, Ser 2023-163, Cl LB |

||||||||

| 6.000%, 02/20/48 |

10,000,000 | 10,335,359 | ||||||

| GNMA, Ser 2023-59, Cl G |

||||||||

| 6.000%, 03/20/50 |

18,155,781 | 18,455,748 | ||||||

| GNMA, Ser 2023-93, Cl B |

||||||||

| 5.500%, 12/20/44 |

12,525,975 | 12,664,591 | ||||||

|

|

|

|||||||

| 343,922,675 | ||||||||

|

|

|

|||||||

| Commercial Mortgage-Backed Obligation — 7.0% |

|

|||||||

| 280 Park Avenue Mortgage Trust, Ser 280P, Cl F |

||||||||

| 8.467%, TSFR1M + 3.127%, 09/15/34 (B)(D) |

12,500,000 | 11,248,752 | ||||||

| Bear Stearns Commercial Mortgage Securities Trust, Ser 2007-T26, Cl AJ |

||||||||

| 5.566%, 01/12/45 (B) |

100,295 | 97,551 | ||||||

| Benchmark Mortgage Trust, Ser 2020-B18, Cl E |

||||||||

| 2.250%, 07/15/53 (D) |

8,000,000 | 4,036,394 | ||||||

| Description | Face Amount | Value | ||||||

| Benchmark Mortgage Trust, Ser 2020-B21, Cl D |

||||||||

| 2.000%, 12/17/53 (D) |

$ | 13,000,000 | $ | 7,658,347 | ||||

| Benchmark Mortgage Trust, Ser 2020-IG3, Cl A4 |

||||||||

| 2.437%, 09/15/48 (D) |

10,000,000 | 8,153,188 | ||||||

| BX Commercial Mortgage Trust, Ser 2020-VIV3, Cl B |

||||||||

| 3.662%, 03/09/44 (B)(D) |

8,000,000 | 7,116,032 | ||||||

| BXMT, Ser 2020-FL2, Cl A |

||||||||

| 6.346%, TSFR1M + 1.014%, 02/15/38 (B)(D) |

7,315,922 | 6,981,958 | ||||||

| CAFL Issuer, Ser 2023-RTL1, Cl A2 |

||||||||

| 9.300%, 12/28/30 (D)(E) |

15,000,000 | 15,039,961 | ||||||

| CAFL, Ser 2022-RTL1, Cl A1 |

||||||||

| 4.250%, 05/28/29 (E) |

7,000,000 | 6,722,458 | ||||||

| CF Hippolyta Issuer, Ser 2020-1, Cl A2 |

||||||||

| 1.990%, 07/15/60 (D) |

5,249,855 | 4,520,559 | ||||||

| Citigroup Commercial Mortgage Trust, Ser 2015-GC31, Cl C |

||||||||

| 4.169%, 06/10/48 (B) |

5,000,000 | 3,499,182 | ||||||

| Commercial Mortgage Trust, Ser 2014-LC15, Cl D |

||||||||

| 4.645%, 04/10/47 (B)(D) |

9,500,000 | 8,441,225 | ||||||

| Commercial Mortgage Trust, Ser 2014-UBS6, Cl C |

||||||||

| 4.581%, 12/10/47 (B) |

4,000,000 | 3,539,622 | ||||||

| Commercial Mortgage Trust, Ser 2015-DC1, Cl D |

||||||||

| 4.417%, 02/10/48 (B)(D) |

9,000,000 | 6,478,932 | ||||||

| Credit Suisse First Boston Mortgage Securities, Ser 2005- C2, Cl AMFL |

||||||||

| 5.696%, TSFR1M + 0.364%, 04/15/37 (B) |

24,619 | 24,537 | ||||||

| Credit Suisse First Boston Mortgage Securities, Ser 2005- C2, Cl AMFX |

||||||||

| 4.877%, 04/15/37 |

2,200 | 2,171 | ||||||

| CSMC Trust, Ser 2019-AFC1, Cl A1 |

||||||||

| 3.573%, 07/25/49 (D)(E) |

2,197,282 | 2,039,315 | ||||||

| DROP Mortgage Trust, Ser 2021- FILE, Cl D |

||||||||

| 8.198%, TSFR1M + 2.864%, 10/15/43 (B)(D) |

15,000,000 | 10,976,665 | ||||||

| FHLMC Military Housing Bonds Resecuritization Trust Certificates, Ser 2015-R1, Cl C3 |

||||||||

| 6.007%, 11/25/52 (B)(D) |

32,350,715 | 27,990,065 | ||||||

| Fontainebleau Miami Beach Trust, Ser 2019-FBLU, Cl A |

||||||||

| 3.144%, 12/10/36 (D) |

10,000,000 | 9,722,194 | ||||||

| FREMF Mortgage Trust, Ser 2016- K54, Cl C |

||||||||

| 4.191%, 04/25/48 (B)(D) |

5,000,000 | 4,840,437 | ||||||

| FREMF Mortgage Trust, Ser 2016- K57, Cl C |

||||||||

| 4.052%, 08/25/49 (B)(D) |

8,840,000 | 8,472,150 | ||||||

| Hudson Yards Mortgage Trust, Ser 2019-30HY, Cl B |

||||||||

| 3.380%, 07/10/39 (B)(D) |

2,500,000 | 2,209,748 | ||||||

The accompanying notes are an integral part of the financial statements.

| 3 |

| Description | Face Amount | Value | ||||||

| JPMDB Commercial Mortgage Securities Trust, Ser 2016-C2, Cl C |

||||||||

| 3.479%, 06/15/49 (B) |

$ | 4,328,000 | $ | 3,215,565 | ||||

| JPMorgan Chase Commercial Mortgage Securities, Ser 2007- LD12, Cl AJ |

||||||||

| 6.561%, 02/15/51 (B) |

521,818 | 515,980 | ||||||

| JPMorgan Chase Commercial Mortgage Securities, Ser 2007- LD12, Cl J |

||||||||

| 5.994%, 02/15/51 (B)(F) |

1,000,000 | — | ||||||

| LStar Commercial Mortgage Trust, Ser 2016-4, Cl AS |

||||||||

| 3.188%, 03/10/49 (D) |

3,000,000 | 2,811,581 | ||||||

| MFA Trust, Ser 2022-INV1, Cl A3 |

||||||||

| 4.250%, 04/25/66 (B)(D) |

4,000,000 | 3,368,762 | ||||||

| Morgan Stanley Bank of America Merrill Lynch Trust, Ser 2016- C29, Cl C |

||||||||

| 4.874%, 05/15/49 (B) |

2,413,000 | 2,226,662 | ||||||

| TRTX Issuer, Ser 2021-FL4, Cl C |

||||||||

| 7.846%, TSFR1M + 2.514%, 03/15/38 (B)(D) |

10,000,000 | 9,224,250 | ||||||

| Wells Fargo Commercial Mortgage Trust, Ser 2016-C32, Cl C |

||||||||

| 4.886%, 01/15/59 (B) |

5,000,000 | 4,682,441 | ||||||

| Wells Fargo Commercial Mortgage Trust, Ser 2016-C32, Cl D |

||||||||

| 3.788%, 01/15/59 (B)(D) |

2,000,000 | 1,704,179 | ||||||

| Wells Fargo Commercial Mortgage Trust, Ser 2016-C34, Cl B |

||||||||

| 4.089%, 06/15/49 |

5,000,000 | 4,617,859 | ||||||

| Wells Fargo Commercial Mortgage Trust, Ser 2018-AUS, Cl A |

||||||||

| 4.194%, 08/17/36 (B)(D) |

5,000,000 | 4,687,127 | ||||||

| WFRBS Commercial Mortgage Trust, Ser 2014-C25, Cl D |

||||||||

| 3.803%, 11/15/47 (B)(D) |

7,310,000 | 6,674,874 | ||||||

|

|

|

|||||||

| 203,540,723 | ||||||||

|

|

|

|||||||

| Non-Agency Residential Mortgage-Backed Obligation — 3.6% |

| |||||||

| 510 Asset Backed Trust, Ser 2021- NPL1, Cl A2 |

||||||||

| 3.967%, 06/25/61 (D)(E) |

20,000,000 | 17,843,986 | ||||||

| 510 Asset Backed Trust, Ser 2021- NPL2, Cl A2 |

||||||||

| 4.090%, 06/25/61 (D)(E) |

7,000,000 | 6,914,749 | ||||||

| Angel Oak Mortgage Trust, Ser 2021-4, Cl A3 |

||||||||

| 1.446%, 01/20/65 (B)(D) |

2,026,338 | 1,648,561 | ||||||

| Brean Asset Backed Securities Trust, Ser 2023-RM7, Cl A1 |

||||||||

| 4.500%, 03/25/78 (B)(D) |

9,000,000 | 8,188,619 | ||||||

| CAFL, Ser 2021-RTL1, Cl A1 |

||||||||

| 2.239%, 03/28/29 (D)(E) |

2,000,000 | 1,894,875 | ||||||

| FirstKey Mortgage Trust, Ser 2015- 1, Cl A3 |

||||||||

| 3.500%, 03/25/45 (B)(D) |

774,834 | 704,190 | ||||||

| Galton Funding Mortgage Trust, Ser 2019-1, Cl A22 |

||||||||

| 4.000%, 02/25/59 (B)(D) |

96,261 | 89,973 | ||||||

| Description | Face Amount | Value | ||||||

| Galton Funding Mortgage Trust, Ser 2019-2, Cl A21 |

||||||||

| 4.000%, 06/25/59 (B)(D) |

$ | 1,253,384 | $ | 1,138,440 | ||||

| PRET, Ser 2021-NPL3, Cl A2 |

||||||||

| 3.721%, 07/25/51 (D)(E) |

4,755,000 | 4,178,225 | ||||||

| PRET, Ser 2021-NPL5, Cl A2 |

||||||||

| 4.704%, 10/25/51 (D)(E) |

7,000,000 | 6,558,675 | ||||||

| PRET, Ser 2021-RN3, Cl A1 |

||||||||

| 1.843%, 09/25/51 (D)(E) |

6,281,235 | 6,001,745 | ||||||

| PRET, Ser 2021-RN4, Cl A2 |

||||||||

| 5.194%, 10/25/51 (B)(D) |

6,000,000 | 5,734,537 | ||||||

| Pretium Mortgage Credit Partners I, Ser 2021-NPL1, Cl A2 |

||||||||

| 4.213%, 09/27/60 (D)(E) |

9,000,000 | 8,205,313 | ||||||

| Pretium Mortgage Credit Partners I, Ser 2021-NPL2, Cl A2 |

||||||||

| 3.844%, 06/27/60 (D)(E) |

2,750,000 | 2,448,885 | ||||||

| PRPM, Ser 2021-10, Cl A2 |

||||||||

| 4.826%, 10/25/26 (D)(E) |

8,000,000 | 7,833,670 | ||||||

| PSMC Trust, Ser 2020-2, Cl A2 |

||||||||

| 3.000%, 05/25/50 (B)(D) |

552,712 | 491,331 | ||||||

| RCO VI Mortgage, Ser 2022-1, Cl A2 |

||||||||

| 5.250%, 01/25/27 (D)(E) |

5,000,000 | 4,783,774 | ||||||

| Sequoia Mortgage Trust, Ser 2013-4, Cl AIO1, IO |

||||||||

| 0.844%, 04/25/43 (B)(D) |

45,976,759 | 1,080,123 | ||||||

| Sequoia Mortgage Trust, Ser 2017- CH1, Cl A2 |

||||||||

| 3.500%, 08/25/47 (B)(D) |

62,290 | 56,901 | ||||||

| Toorak Mortgage, Ser 2021-1, Cl M1 |

||||||||

| 8.805%, 06/25/24 (D)(E) |

15,000,000 | 14,632,125 | ||||||

| VOLT CIII, Ser 2021-CF1, Cl A2 |

||||||||

| 3.967%, 08/25/51 (D)(E) |

3,303,000 | 2,768,241 | ||||||

| VOLT, Ser 2021-CF2, Cl A2 |

||||||||

| 5.316%, 11/27/51 (D)(E) |

4,000,000 | 3,357,912 | ||||||

|

|

|

|||||||

| 106,554,850 | ||||||||

|

|

|

|||||||

| Total Mortgage-Backed Securities |

654,018,248 | |||||||

|

|

|

|||||||

| CORPORATE OBLIGATIONS — 22.0% |

|

|||||||

| Consumer Discretionary — 3.7% |

|

|||||||

| Airswift Global |

||||||||

| 14.123%, SOFRRATE + 8.762%, 05/12/25(B)(D) |

7,000,000 | 7,254,557 | ||||||

| Choice Hotels International |

||||||||

| 3.700%, 12/01/29 |

8,000,000 | 7,116,180 | ||||||

| 3.700%, 01/15/31 |

3,000,000 | 2,612,982 | ||||||

| Hyundai Capital America |

||||||||

| 5.300%, 01/08/29(D) |

5,000,000 | 5,071,332 | ||||||

| JBS USA LUX |

||||||||

| 7.250%, 11/15/53(D) |

4,863,000 | 5,288,864 | ||||||

| 6.750%, 03/15/34(D) |

10,000,000 | 10,525,200 | ||||||

| 6.500%, 12/01/52 |

5,000,000 | 4,991,682 | ||||||

| MajorDrive Holdings IV |

||||||||

| 6.375%, 06/01/29(D) |

26,393,000 | 22,325,066 | ||||||

| NES Fircroft Bondco |

||||||||

| 11.750%, 09/29/26(D) |

2,750,000 | 2,838,540 | ||||||

| Nissan Motor Acceptance |

||||||||

| 7.050%, 09/15/28(D) |

2,000,000 | 2,098,803 | ||||||

The accompanying notes are an integral part of the financial statements.

| 4 |

| Description | Face Amount | Value | ||||||

| STL Holding |

||||||||

| 8.750%, 02/15/29(D) |

$ | 8,000,000 | $ | 8,000,000 | ||||

| 7.500%, 02/15/26(D) |

16,460,000 | 16,739,985 | ||||||

| TransJamaican Highway |

||||||||

| 5.750%, 10/10/36(D) |

1,361,940 | 1,178,078 | ||||||

| VistaJet Malta Finance |

||||||||

| 7.875%, 05/01/27(D) |

14,863,000 | 12,414,023 | ||||||

| 6.375%, 02/01/30(D) |

2,000,000 | 1,447,600 | ||||||

| William Marsh Rice University |

||||||||

| 2.598%, 05/15/50 |

1,810,000 | 1,211,400 | ||||||

|

|

|

|||||||

| 111,114,292 | ||||||||

|

|

|

|||||||

| Consumer Staples — 0.3% |

||||||||

| J M Smucker |

||||||||

| 6.200%, 11/15/33 |

5,000,000 | 5,411,724 | ||||||

| Philip Morris International |

||||||||

| 5.125%, 02/15/30 |

2,500,000 | 2,541,193 | ||||||

|

|

|

|||||||

| 7,952,917 | ||||||||

|

|

|

|||||||

| Energy — 6.1% |

||||||||

| Apache |

||||||||

| 7.750%, 12/15/29 |

4,138,000 | 4,489,275 | ||||||

| Banco Santander |

||||||||

| 9.625%, H15T5Y + 5.298%, 02/21/72(B) |

5,000,000 | 5,362,500 | ||||||

| Barclays |

||||||||

| 9.625%, USISSO05 + 5.775%, 03/15/72(B) |

5,000,000 | 5,149,715 | ||||||

| 6.692%, SOFRRATE + 2.620%, 09/13/34(B) |

2,000,000 | 2,131,267 | ||||||

| Cantor Fitzgerald |

||||||||

| 7.200%, 12/12/28(D) |

1,000,000 | 1,033,598 | ||||||

| Colonial Pipeline |

||||||||

| 8.375%, 11/01/30(D) |

500,000 | 576,117 | ||||||

| New England Power |

||||||||

| 2.807%, 10/06/50(D) |

5,000,000 | 3,148,919 | ||||||

| Paratus Energy Services |

||||||||

| 10.000% PIK, 07/15/26(D) |

90,830,719 | 89,277,366 | ||||||

| 10.000% PIK, 07/15/26 |

24,586,317 | 24,165,851 | ||||||

| Petroleos Mexicanos |

||||||||

| 10.000%, 02/07/33 |

2,000,000 | 1,977,894 | ||||||

| Puffin Finance Sarl |

||||||||

| 15.000%, 09/11/25 |

14,000,000 | 14,376,105 | ||||||

| Transocean |

||||||||

| 11.500%, 01/30/27(D) |

17,500,000 | 18,287,500 | ||||||

| Waldorf Energy Finance |

||||||||

| 12.000%, 03/02/26 |

4,000,000 | 3,176,000 | ||||||

|

|

|

|||||||

| 173,152,107 | ||||||||

|

|

|

|||||||

| Financials — 7.8% |

||||||||

| BAC Capital Trust XIV |

||||||||

| 6.046%, TSFR3M + 0.662%, 09/15/72(B) |

9,870,000 | 8,252,094 | ||||||

| Bank of Ireland Group |

||||||||

| 6.253%, H15T1Y + 2.650%, 09/16/26(B)(D) |

7,000,000 | 7,072,783 | ||||||

| Barclays |

||||||||

| 8.000%, H15T5Y + 5.431%, 12/15/72(B) |

30,250,000 | 29,261,167 | ||||||

| Charles Schwab |

||||||||

| 4.000%, H15T10Y + 3.079%, 03/01/72(B) |

2,000,000 | 1,660,305 | ||||||

| Citigroup |

||||||||

| 6.174%, SOFRRATE + 2.661%, 05/25/34(B) |

5,000,000 | 5,186,260 | ||||||

| Description | Face Amount | Value | ||||||

| Comerica |

||||||||

| 5.982%, SOFRRATE + 2.155%, 01/30/30(B) |

$ | 2,000,000 | $ | 1,994,002 | ||||

| 4.000%, 02/01/29 |

13,300,000 | 12,209,715 | ||||||

| Comerica Bank |

||||||||

| 7.875%, 09/15/26 |

24,790,000 | 25,347,453 | ||||||

| Credit Suisse Group |

||||||||

| 5.100%, H15T5Y + 3.293%, 07/24/72 (F) |

10,000,000 | 1,000,000 | ||||||

| Credit Suisse NY |

||||||||

| 4.750%, 08/09/24 |

15,000,000 | 14,918,912 | ||||||

| Deutsche Bank |

||||||||

| 7.500%, USISDA05 + 5.003%, 04/30/72(B) |

4,000,000 | 3,860,265 | ||||||

| Deutsche Bank NY |

||||||||

| 7.146%, SOFRRATE + 2.520%, 07/13/27(B) |

4,000,000 | 4,142,883 | ||||||

| 7.079%, SOFRRATE + 3.650%, 02/10/34(B) |

5,000,000 | 5,102,383 | ||||||

| 3.742%, SOFRRATE + 2.257%, 01/07/33(B) |

2,000,000 | 1,637,154 | ||||||

| Enova International |

||||||||

| 8.500%, 09/15/25(D) |

3,007,000 | 2,973,145 | ||||||

| Farmers Exchange Capital |

||||||||

| 7.200%, 07/15/48(D) |

3,000,000 | 2,773,295 | ||||||

| 7.050%, 07/15/28(D) |

11,075,000 | 11,242,486 | ||||||

| HAT Holdings I |

||||||||

| 8.000%, 06/15/27‡(D) |

100,000 | 103,561 | ||||||

| Horace Mann Educators |

||||||||

| 7.250%, 09/15/28 |

5,000,000 | 5,415,105 | ||||||

| Intesa Sanpaolo MTN |

||||||||

| 4.000%, 09/23/29(D) |

5,000,000 | 4,597,906 | ||||||

| KeyBank MTN |

||||||||

| 5.000%, 01/26/33 |

5,000,000 | 4,660,172 | ||||||

| 4.700%, 01/26/26 |

20,750,000 | 20,337,620 | ||||||

| KeyCorp MTN |

||||||||

| 4.100%, 04/30/28 |

7,113,000 | 6,781,852 | ||||||

| Royal Bank of Canada MTN |

||||||||

| 5.500%, 04/28/33 |

10,000,000 | 9,711,763 | ||||||

| 5.200%, 01/31/33 |

3,000,000 | 2,973,023 | ||||||

| SBL Holdings |

||||||||

| 7.000%, H15T5Y + 5.580%, 05/13/72(B)(D) |

2,500,000 | 1,687,451 | ||||||

| 6.500%, H15T5Y + 5.620%, 11/13/72(B)(D) |

14,492,000 | 9,167,328 | ||||||

| Synchrony Bank |

||||||||

| 5.400%, 08/22/25 |

8,144,000 | 8,081,566 | ||||||

| Synovus Bank |

||||||||

| 5.625%, 02/15/28 |

8,000,000 | 7,849,928 | ||||||

| US Bancorp |

||||||||

| 5.836%, SOFRRATE + 2.260%, 06/12/34(B) |

4,000,000 | 4,127,992 | ||||||

| 3.700%, H15T5Y + 2.541%, 01/15/73(B) |

3,273,000 | 2,821,992 | ||||||

|

|

|

|||||||

| 226,951,561 | ||||||||

|

|

|

|||||||

| Industrials — 1.2% |

||||||||

| AerCap Ireland Capital DAC |

||||||||

| 6.450%, 04/15/27(D) |

3,662,000 | 3,788,966 | ||||||

| AmeriTex HoldCo Intermediate |

||||||||

| 10.250%, 10/15/28(D) |

3,450,000 | 3,542,839 | ||||||

| Boeing |

||||||||

| 2.950%, 02/01/30 |

3,344,000 | 2,981,539 | ||||||

The accompanying notes are an integral part of the financial statements.

| 5 |

| Description | Face Amount | Value | ||||||

| Brundage-Bone Concrete Pumping Holdings |

||||||||

| 6.000%, 02/01/26(D) |

$ | 3,100,000 | $ | 3,053,717 | ||||

| Burlington Northern Santa Fe |

||||||||

| 7.290%, 06/01/36 |

5,000,000 | 6,035,333 | ||||||

| Flowserve |

||||||||

| 3.500%, 10/01/30 |

4,000,000 | 3,564,983 | ||||||

| Hawaiian Airlines 2013-1 Class A Pass Through Certificates |

||||||||

| 3.900%, 01/15/26 |

932,588 | 873,448 | ||||||

| Leidos |

||||||||

| 2.300%, 02/15/31 |

3,291,000 | 2,743,168 | ||||||

| nVent Finance Sarl |

||||||||

| 5.650%, 05/15/33 |

3,000,000 | 3,079,144 | ||||||

| Regal Rexnord |

||||||||

| 6.300%, 02/15/30(D) |

4,500,000 | 4,625,504 | ||||||

| TWMA Group |

||||||||

| 13.000%, 02/08/27 |

3,500,000 | 3,500,000 | ||||||

|

|

|

|||||||

| 37,788,641 | ||||||||

|

|

|

|||||||

| Information Technology — 1.8% |

||||||||

| Apple |

||||||||

| 4.850%, 05/10/53 |

7,000,000 | 7,069,461 | ||||||

| 3.850%, 05/04/43 |

10,000,000 | 8,846,590 | ||||||

| Avnet |

||||||||

| 3.000%, 05/15/31 |

7,000,000 | 5,892,339 | ||||||

| Kyndryl Holdings |

||||||||

| 4.100%, 10/15/41 |

14,581,000 | 11,084,411 | ||||||

| Motorola Solutions |

||||||||

| 4.600%, 05/23/29 |

21,435,000 | 21,262,201 | ||||||

|

|

|

|||||||

| 54,155,002 | ||||||||

|

|

|

|||||||

| Materials — 0.2% |

||||||||

| Mineral Resources |

||||||||

| 8.125%, 05/01/27(D) |

6,336,000 | 6,399,360 | ||||||

| Nacional del Cobre de Chile |

||||||||

| 3.150%, 01/15/51(D) |

500,000 | 310,062 | ||||||

|

|

|

|||||||

| 6,709,422 | ||||||||

|

|

|

|||||||

| Real Estate — 0.2% |

||||||||

| GLP Capital |

||||||||

| 3.250%, 01/15/32‡ |

750,000 | 630,758 | ||||||

| Invitation Homes Operating Partnership |

||||||||

| 2.000%, 08/15/31‡ |

2,000,000 | 1,582,071 | ||||||

| Sabra Health Care |

||||||||

| 3.200%, 12/01/31‡ |

3,920,000 | 3,202,758 | ||||||

| 5,415,587 | ||||||||

| Utilities — 0.7% |

||||||||

| Pacific Gas and Electric |

||||||||

| 4.500%, 07/01/40 |

11,000,000 | 9,471,550 | ||||||

| 3.750%, 08/15/42 |

5,000,000 | 3,750,504 | ||||||

| Sempra |

||||||||

| 6.000%, 10/15/39 |

6,000,000 | 6,310,594 | ||||||

|

|

|

|||||||

| 19,532,648 | ||||||||

|

|

|

|||||||

| Total Corporate Obligations |

642,772,177 | |||||||

|

|

|

|||||||

| ASSET-BACKED SECURITIES — 13.2% |

|

|||||||

| Automotive — 8.8% |

||||||||

| ACC Auto Trust, Ser 2021-A, Cl D |

||||||||

| 6.100%, 06/15/29 (D) |

13,000,000 | 12,840,187 | ||||||

| Description | Face Amount | Value | ||||||

| American Credit Acceptance Receivables Trust, Ser 2023-1, Cl C |

||||||||

| 5.590%, 04/12/29 (D) |

$ | 5,000,000 | $ | 4,991,034 | ||||

| American Credit Acceptance Receivables Trust, Ser 2023-2, Cl D |

||||||||

| 6.470%, 08/13/29 (D) |

4,000,000 | 4,017,392 | ||||||

| American Credit Acceptance Receivables Trust, Ser 2023-3, Cl D |

||||||||

| 6.820%, 10/12/29 (D) |

5,000,000 | 5,071,859 | ||||||

| American Credit Acceptance Receivables Trust, Ser 2023-4, Cl D |

||||||||

| 7.650%, 09/12/30 (D) |

15,000,000 | 15,584,256 | ||||||

| American Credit Acceptance Receivables Trust, Ser 2024-1, Cl C |

||||||||

| 5.630%, 01/14/30 (D) |

10,000,000 | 10,002,726 | ||||||

| Avid Automobile Receivables Trust, Ser 2023-1, Cl E |

||||||||

| 11.140%, 05/15/29 (D) |

5,595,000 | 5,801,518 | ||||||

| CarNow Auto Receivables Trust, Ser 2021-2A, Cl E |

||||||||

| 4.450%, 02/15/28 (D) |

4,000,000 | 3,645,241 | ||||||

| CarNow Auto Receivables Trust, Ser 2023-1A, Cl E |

||||||||

| 12.040%, 04/16/29 (D) |

5,000,000 | 4,784,160 | ||||||

| Centerline Logistics, Ser 2023-1, Cl A2 |

||||||||

| 9.750%, 12/15/27 (D) |

12,000,000 | 12,000,000 | ||||||

| Chase Issuance Trust, Ser 2023- A2, Cl A |

||||||||

| 5.080%, 09/15/30 |

7,000,000 | 7,191,075 | ||||||

| CIG Auto Receivables Trust, Ser 2021-1A, Cl E |

||||||||

| 4.450%, 05/12/28 (D) |

7,000,000 | 6,675,363 | ||||||

| CPS Auto Receivables Trust, Ser 2019-B, Cl F |

||||||||

| 7.480%, 06/15/26 (D) |

6,055,000 | 6,053,180 | ||||||

| CPS Auto Receivables Trust, Ser 2019-D, Cl E |

||||||||

| 3.860%, 10/15/25 (D) |

4,182,838 | 4,163,626 | ||||||

| DT Auto Owner Trust, Ser 2021- 3A, Cl D |

||||||||

| 1.310%, 05/17/27 (D) |

5,500,000 | 5,161,249 | ||||||

| First Investors Auto Owner Trust, Ser 2020-1A, Cl E |

||||||||

| 4.630%, 06/16/26 (D) |

5,510,000 | 5,492,526 | ||||||

| First Investors Auto Owner Trust, Ser 2020-1A, Cl F |

||||||||

| 7.070%, 06/15/27 (D) |

5,300,000 | 5,289,775 | ||||||

| First Investors Auto Owner Trust, Ser 2022-1A, Cl E |

||||||||

| 5.410%, 06/15/29 (D) |

2,280,000 | 2,128,668 | ||||||

| First Investors Auto Owner Trust, Ser 2023-1A, Cl D |

||||||||

| 7.740%, 01/15/31 (D) |

9,000,000 | 9,297,219 | ||||||

| Flagship Credit Auto Trust, Ser 2020-1, Cl E |

||||||||

| 3.520%, 06/15/27 (D) |

7,931,000 | 7,490,774 | ||||||

The accompanying notes are an integral part of the financial statements.

| 6 |

| Description | Face Amount | Value | ||||||

| Flagship Credit Auto Trust, Ser 2020-2, Cl E |

||||||||

| 8.220%, 09/15/27 (D) |

$ | 8,000,000 | $ | 8,012,007 | ||||

| Ford Credit Auto Lease Trust, Ser 2023-B, Cl C |

||||||||

| 6.430%, 04/15/27 |

5,000,000 | 5,115,410 | ||||||

| Foursight Capital Automobile Receivables Trust, Ser 2022-1, Cl E |

||||||||

| 4.690%, 08/15/29 (D) |

4,230,000 | 3,695,417 | ||||||

| GLS Auto Receivables Issuer Trust, Ser 2019-3A, Cl D |

||||||||

| 3.840%, 05/15/26 (D) |

5,924,203 | 5,901,510 | ||||||

| GLS Auto Receivables Issuer Trust, Ser 2020-1A, Cl D |

||||||||

| 3.680%, 11/16/26 (D) |

5,000,000 | 4,926,917 | ||||||

| GLS Auto Receivables Issuer Trust, Ser 2022-1A, Cl E |

||||||||

| 5.640%, 05/15/29 (D) |

4,000,000 | 3,797,563 | ||||||

| GLS Auto Receivables Issuer Trust, Ser 2022-3A, Cl E |

||||||||

| 8.350%, 10/15/29 (D) |

1,990,000 | 1,987,129 | ||||||

| Hertz Vehicle Financing, Ser 2021- 1A, Cl D |

||||||||

| 3.980%, 12/26/25 (D) |

10,000,000 | 9,717,982 | ||||||

| Mercury Financial Credit Card Master Trust, Ser 2022-1A, Cl A |

||||||||

| 2.500%, 09/21/26 (D) |

3,000,000 | 2,924,310 | ||||||

| Octane Receivables Trust, Ser 2021-2A, Cl B |

||||||||

| 2.020%, 09/20/28 (D) |

3,000,000 | 2,829,561 | ||||||

| Santander Consumer Auto Receivables Trust, Ser 2020-AA, Cl F |

||||||||

| 10.120%, 01/16/29 (D) |

27,740,000 | 27,914,790 | ||||||

| Santander Consumer Auto Receivables Trust, Ser 2020-BA, Cl F |

||||||||

| 7.030%, 08/15/28 (D) |

6,250,000 | 6,259,267 | ||||||

| Tricolor Auto Securitization Trust, Ser 2022-1A, Cl F |

||||||||

| 9.800%, 07/16/29 (D) |

4,000,000 | 3,899,188 | ||||||

| Tricolor Auto Securitization Trust, Ser 2023-1A, Cl F |

||||||||

| 16.000%, 06/17/30 (D) |

11,910,000 | 11,989,380 | ||||||

| United Auto Credit Securitization Trust, Ser 2022-2, Cl D |

||||||||

| 6.840%, 01/10/28 (D) |

5,389,000 | 5,094,228 | ||||||

| Veros Auto Receivables Trust, Ser 2021-1, Cl C |

||||||||

| 3.640%, 08/15/28 (D) |

4,320,000 | 4,170,041 | ||||||

| VFI ABS, Ser 2023-1A, Cl B |

||||||||

| 7.780%, 08/24/29 (D) |

10,000,000 | 10,209,100 | ||||||

|

|

|

|||||||

| 256,125,628 | ||||||||

|

|

|

|||||||

| Credit Card — 0.2% |

||||||||

| Capital One Multi-Asset Execution Trust, Ser 2023-A1, Cl A |

||||||||

| 4.420%, 05/15/28 |

4,000,000 | 3,984,342 | ||||||

| Mercury Financial Credit Card Master Trust, Ser 2022-1A, Cl C |

||||||||

| 5.200%, 09/21/26 (D) |

1,780,000 | 1,779,590 | ||||||

|

|

|

|||||||

| 5,763,932 | ||||||||

|

|

|

|||||||

| Description | Face Amount | Value | ||||||

| Other Asset-Backed Securities — 4.2% |

|

|||||||

| Amur Equipment Finance Receivables IX, Ser 2021-1A, Cl D |

||||||||

| 2.300%, 11/22/27 (D) |

$ | 1,250,000 | $ | 1,205,042 | ||||

| Amur Equipment Finance Receivables XI, Ser 2022-2A, Cl E |

||||||||

| 9.320%, 10/22/29 (D) |

2,600,000 | 2,552,667 | ||||||

| BHG Securitization Trust, Ser 2022-B, Cl D |

||||||||

| 6.690%, 06/18/35 (D) |

5,993,367 | 5,785,713 | ||||||

| CAL Funding IV, Ser 2020-1A, Cl B |

||||||||

| 3.500%, 09/25/45 (D) |

1,218,333 | 1,105,860 | ||||||

| Carrington Mortgage Loan Trust, Ser 2007-FRE1, Cl M8 |

||||||||

| 2.461%, US0001M + 2.250%, 02/25/37 (B)(F) |

1,000,000 | — | ||||||

| CIFC Funding, Ser 2018-1A, Cl A |

||||||||

| 6.560%, TSFR3M + 1.262%, 04/18/31 (B)(D) |

9,188,859 | 9,202,091 | ||||||

| CIFC Funding, Ser 2022-2A, Cl A1 |

||||||||

| 6.630%, TSFR3M + 1.320%, 04/19/35 (B)(D) |

4,500,000 | 4,475,344 | ||||||

| CIFC Funding, Ser 2022-2A, Cl B |

||||||||

| 7.160%, TSFR3M + 1.850%, 04/19/35 (B)(D) |

9,125,000 | 9,105,646 | ||||||

| CP EF Asset Securitization I, Ser 2022-1A, Cl A |

||||||||

| 5.960%, 04/15/30 (D) |

1,961,692 | 1,948,708 | ||||||

| Global SC Finance VII Srl, Ser 2020-1A, Cl A |

||||||||

| 2.170%, 10/17/40 (D) |

2,508,659 | 2,314,724 | ||||||

| JG Wentworth XXI LLC, Ser 2010- 2A, Cl B |

||||||||

| 7.450%, 01/15/50 (D) |

859,135 | 858,567 | ||||||

| JGWPT XXVI LLC, Ser 2012-2A, Cl B |

||||||||

| 6.770%, 10/17/61 (D) |

1,268,225 | 1,296,740 | ||||||

| Kapitus Asset Securitization, Ser 2022-1A, Cl A |

||||||||

| 3.382%, 07/10/28 (D) |

8,000,000 | 7,689,883 | ||||||

| LCM Loan Income Fund I Income Note Issuer, Ser 2018-27A, Cl A1 |

||||||||

| 6.656%, TSFR3M + 1.342%, 07/16/31 (B)(D) |

11,005,001 | 11,012,605 | ||||||

| Libra Solutions, Ser 2023-1A, Cl A |

||||||||

| 7.000%, 02/15/35 (D) |

2,881,018 | 2,880,945 | ||||||

| Libra Solutions, Ser 2023-1A, Cl B |

||||||||

| 10.250%, 02/15/35 (D) |

4,180,933 | 4,178,427 | ||||||

| Marlette Funding Trust, Ser 2020- 1A, Cl D |

||||||||

| 3.540%, 03/15/30 (D) |

288,247 | 285,755 | ||||||

| Mosaic Solar Loan Trust, Ser 2020-2A, Cl B |

||||||||

| 2.210%, 08/20/46 (D) |

2,472,179 | 2,017,180 | ||||||

| OHA Credit Funding 7, Ser 2022- 7A, Cl AR |

||||||||

| 6.610%, TSFR3M + 1.300%, 02/24/37 (B)(D) |

25,000,000 | 25,022,775 | ||||||

The accompanying notes are an integral part of the financial statements.

| 7 |

| Description | Face Amount | Value | ||||||

| Oportun Issuance Trust, Ser 2022- A, Cl C |

||||||||

| 7.400%, 06/09/31 (D) |

$ | 3,000,000 | $ | 2,926,458 | ||||

| Orange Lake Timeshare Trust, Ser 2019-A, Cl C |

||||||||

| 3.610%, 04/09/38 (D) |

929,361 | 898,827 | ||||||

| Orange Lake Timeshare Trust, Ser 2019-A, Cl D |

||||||||

| 4.930%, 04/09/38 (D) |

153,347 | 146,696 | ||||||

| Pawneee Equipment Receivables, Ser 2021-1, Cl C |

||||||||

| 2.300%, 07/15/27 (D) |

4,700,000 | 4,436,805 | ||||||

| Pawneee Equipment Receivables, Ser 2022-1, Cl C |

||||||||

| 6.010%, 07/17/28 (D) |

4,000,000 | 3,924,534 | ||||||

| PRPM, Ser 2021-5, Cl A2 |

||||||||

| 3.721%, 06/25/26 (D)(E) |

5,000,000 | 4,786,276 | ||||||

| Sapphire Aviation Finance I, Ser 2018-1A, Cl B |

||||||||

| 5.926%, 03/15/40 (D) |

1,529,565 | 917,739 | ||||||

| Textainer Marine Containers VII, Ser 2020-2A, Cl B |

||||||||

| 3.340%, 09/20/45 (D) |

1,354,871 | 1,234,679 | ||||||

| Triton Container Finance VIII, Ser 2020-1A, Cl B |

||||||||

| 3.740%, 09/20/45 (D) |

716,667 | 650,495 | ||||||

| VR Funding, Ser 2020-1A, Cl A |

||||||||

| 2.790%, 11/15/50 (D) |

5,805,409 | 5,209,751 | ||||||

| VR Funding, Ser 2020-1A, Cl C |

||||||||

| 6.420%, 11/15/50 (D) |

3,707,500 | 3,428,175 | ||||||

|

|

|

|||||||

| 121,499,107 | ||||||||

|

|

|

|||||||

| Student Loan — 0.0% |

||||||||

| Commonbond Student Loan Trust, Ser 2017-AGS, Cl A1 |

||||||||

| 2.550%, 05/25/41 (D) |

1,051,368 | 990,166 | ||||||

|

|

|

|||||||

| Total Asset-Backed Securities |

384,378,833 | |||||||

|

|

|

|||||||

| COLLATERALIZED LOAN OBLIGATIONS — 6.9% |

|

|||||||

| AMMC CLO 26, Ser 2023-26A, Cl B1 |

||||||||

| 7.764%, TSFR3M + 2.450%, 04/15/36 (B)(D) |

7,500,000 | 7,525,095 | ||||||

| Battalion CLO 17, Ser 2021-17A, Cl B |

||||||||

| 7.179%, TSFR3M + 1.862%, 03/09/34 (B)(D) |

5,000,000 | 5,018,340 | ||||||

| BCC Middle Market CLO, Ser 2018-1A, Cl A1A |

||||||||

| 7.129%, TSFR3M + 1.812%, 10/20/30 (B)(D) |

9,031,888 | 8,991,867 | ||||||

| Benefit Street Partners CLO VIII, Ser 2018-8A, Cl A1AR |

||||||||

| 6.679%, TSFR3M + 1.362%, 01/20/31 (B)(D) |

350,681 | 351,177 | ||||||

| BlueMountain CLO, Ser 2021-2A, Cl A2R2 |

||||||||

| 7.329%, TSFR3M + 1.962%, 08/20/32 (B)(D) |

10,000,000 | 10,047,500 | ||||||

| Description | Face Amount | Value | ||||||

| Carlyle Global Market Strategies, Ser 2018-3A, Cl A1A2 |

||||||||

| 6.756%, TSFR3M + 1.442%, 01/14/32 (B)(D) |

$ | 24,855,641 | $ | 24,846,718 | ||||

| Carlyle Global Market Strategies, Ser 2018-3RA, Cl A1A |

||||||||

| 6.631%, TSFR3M + 1.312%, 07/27/31 (B)(D) |

12,815,121 | 12,839,355 | ||||||

| Carlyle Global Market Strategies, Ser 2018-5A, Cl A1RR |

||||||||

| 6.716%, TSFR3M + 1.402%, 07/15/31 (B)(D) |

14,641,124 | 14,655,106 | ||||||

| Elmwood CLO 20, Ser 2022-7A, Cl B1 |

||||||||

| 8.067%, TSFR3M + 2.750%, 10/17/34 (B)(D) |

5,625,000 | 5,619,375 | ||||||

| Golub Capital Partners, Ser 2017-21A, Cl AR |

||||||||

| 7.056%, TSFR3M + 1.732%, 01/25/31 (B)(D) |

8,452,911 | 8,442,108 | ||||||

| Golub Capital Partners, Ser 2017-22A, Cl AR |

||||||||

| 6.759%, TSFR3M + 1.442%, 01/20/31 (B)(D) |

7,233,822 | 7,240,781 | ||||||

| Golub Capital Partners, Ser 2017-23A, Cl AR |

||||||||

| 6.779%, TSFR3M + 1.462%, 01/20/31 (B)(D) |

15,784,459 | 15,786,322 | ||||||

| Golub Capital Partners, Ser 2017-24A, Cl AR |

||||||||

| 7.134%, TSFR3M + 1.862%, 11/05/29 (B)(D) |

7,200,680 | 7,182,095 | ||||||

| Golub Capital Partners, Ser 2021-19RA, Cl B1R2 |

||||||||

| 7.129%, TSFR3M + 1.812%, 04/20/34 (B)(D) |

20,000,000 | 19,935,680 | ||||||

| Invesco CLO, Ser 2022-3A, Cl B |

||||||||

| 8.068%, TSFR3M + 2.750%, 10/22/35 (B)(D) |

6,000,000 | 6,017,034 | ||||||

| Oaktree CLO, Ser 2021-3A, Cl BR |

||||||||

| 7.329%, TSFR3M + 2.012%, 10/20/34 (B)(D) |

13,500,000 | 13,493,912 | ||||||

| Texas Debt Capital CLO, Ser 2023-1A, Cl A |

||||||||

| 7.118%, TSFR3M + 1.800%, 04/20/36 (B)(D) |

4,000,000 | 4,027,676 | ||||||

| Venture 37 CLO, Ser 2021-37A, Cl BR |

||||||||

| 7.326%, TSFR3M + 2.012%, 07/15/32 (B)(D) |

10,000,000 | 9,951,910 | ||||||

| Venture XIX, Ser 2018-19A, Cl ARR |

||||||||

| 6.836%, TSFR3M + 1.522%, 01/15/32 (B)(D) |

19,250,000 | 19,269,385 | ||||||

|

|

|

|||||||

| Total Collateralized Loan Obligations |

201,241,436 | |||||||

|

|

|

|||||||

| U.S. GOVERNMENT AGENCY OBLIGATIONS — 2.1% |

|

|||||||

| FFCB |

||||||||

| 6.490%, 11/15/38 |

2,000,000 | 2,020,367 | ||||||

| 6.250%, 07/26/38 |

2,000,000 | 2,000,102 | ||||||

| 6.080%, 04/28/33 |

5,000,000 | 5,000,545 | ||||||

| 6.050%, 08/22/31 |

3,000,000 | 3,023,064 | ||||||

The accompanying notes are an integral part of the financial statements.

| 8 |

| Description | Face Amount | Value | ||||||

| 5.980%, 12/27/33 |

$ | 2,500,000 | $ | 2,498,089 | ||||

| 5.940%, 01/08/44 |

7,500,000 | 7,514,271 | ||||||

| 5.930%, 03/28/33 |

3,000,000 | 2,983,495 | ||||||

| 5.490%, 09/22/42 |

1,000,000 | 986,137 | ||||||

| 5.360%, 06/16/33 |

2,000,000 | 1,994,218 | ||||||

| FHLB |

||||||||

| 6.500%, 09/13/38 |

2,500,000 | 2,508,963 | ||||||

| 6.230%, 12/28/37 |

2,000,000 | 2,000,179 | ||||||

| 6.110%, 12/21/32 |

12,000,000 | 11,988,289 | ||||||

| 6.050%, 07/19/38 |

2,000,000 | 1,986,457 | ||||||

| 6.000%, 04/12/38 |

3,000,000 | 2,977,219 | ||||||

| 5.940%, 04/20/43 |

2,000,000 | 1,980,503 | ||||||

| 2.150%, 09/23/36 |

1,500,000 | 1,086,143 | ||||||

| FHLMC |

||||||||

| 7.000%, 10/30/43 |

1,000,000 | 1,015,468 | ||||||

| Tennessee Valley Authority |

||||||||

| 4.250%, 09/15/52 |

7,521,000 | 6,842,321 | ||||||

|

|

|

|||||||

| Total U.S. Government Agency Obligations |

|

60,405,830 | ||||||

|

|

|

|||||||

| Shares | ||||||||

| COMMON STOCK — 1.6% |

||||||||

| Energy — 1.6% |

||||||||

| Paratus Energy Services *(F) |

27,666 | 47,723,350 | ||||||

|

|

|

|||||||

| Total Common Stock |

47,723,350 | |||||||

|

|

|

|||||||

| Face Amount | ||||||||

| MUNICIPAL BONDS — 1.4% |

||||||||

| Board of Regents of the University of Texas System, Build America Bonds, Ser D, Cl D, RB |

||||||||

| 5.134%, 08/15/42 |

3,000,000 | 3,081,587 | ||||||

| GDB Debt Recovery Authority of Puerto Rico, RB |

||||||||

| 7.500%, 08/20/40 |

6,154,558 | 5,769,898 | ||||||

| Mission, Economic Development, RB |

||||||||

| 8.550%, 12/01/21(F)(G) |

2,125,000 | 21,250 | ||||||

| Mission, Economic Development, RB |

||||||||

| 10.875%, 12/01/28(F)(G) |

3,315,000 | 33,150 | ||||||

| 9.750%, 12/01/25(F)(G) |

3,045,000 | 30,450 | ||||||

| North Texas Tollway Authority, RB |

||||||||

| 8.410%, 02/01/30 |

1,959,000 | 2,157,599 | ||||||

| Northwest Independent School District, Ser A, GO, PSF-GTD |

||||||||

| 1.776%, 02/15/31 |

2,000,000 | 1,688,732 | ||||||

| 1.836%, 02/15/32 |

1,890,000 | 1,557,890 | ||||||

| Rhode Island State, Health & Educational System, Providence Public Schools, Ser A, Cl A, RB, CITY APPROP ST AID WITHHLDG |

||||||||

| 8.000%, 05/15/29 |

5,000,000 | 5,009,652 | ||||||

| State of Illinois, Ser A, GO |

||||||||

| 3.140%, 10/01/24 |

5,000,000 | 4,935,237 | ||||||

| Texas State, Transportation Commission State Highway Fund, RB |

||||||||

| 4.000%, 10/01/33 |

3,000,000 | 2,899,950 | ||||||

| Texas State, Transportation Commission State Highway Fund, Ser B-BUILD, RB |

||||||||

| 5.178%, 04/01/30 |

3,980,000 | 4,090,638 | ||||||

| Description | Face Amount | Value | ||||||

| USAFA Visitor's Center Business Improvement District, Ser B, RB |

||||||||

| 6.750%, 12/01/42(D) |

$ | 12,570,000 | $ | 10,895,937 | ||||

|

|

|

|||||||

| Total Municipal Bonds |

42,171,970 | |||||||

|

|

|

|||||||

| SOVEREIGN DEBT — 0.3% |

||||||||

| Colombia Government International Bond |

||||||||

| 3.250%, 04/22/32 |

5,000,000 | 3,913,672 | ||||||

| Kenya Government International Bond |

||||||||

| 7.250%, 02/28/28 (D) |

3,000,000 | 2,685,000 | ||||||

| Provincia de Buenos Aires |

||||||||

| 6.375%, 09/01/24 (D)(E) |

333,959 | 129,883 | ||||||

| Ukraine Government International Bond |

||||||||

| 7.750%, 09/01/24 |

5,000,000 | 1,446,650 | ||||||

|

|

|

|||||||

| Total Sovereign Debt |

8,175,205 | |||||||

|

|

|

|||||||

|

|

||||||||

| Shares | ||||||||

| COMMERCIAL PAPER — 0.2% |

||||||||

| American Electric Power |

||||||||

| 0.000%, 02/13/24 (D)(H) |

500,000 | 498,935 | ||||||

| Barton Capital |

||||||||

| 5.382%, 02/15/24 (D)(H) |

1,000,000 | 997,773 | ||||||

| Keurig Dr Pepper |

||||||||

| 0.000%, 02/15/24 (D)(H) |

316,000 | 315,230 | ||||||

| Philip Morris International |

||||||||

| 5.469%, 02/16/24 (D)(H) |

2,000,000 | 1,995,197 | ||||||

| Walgreens Boots Alliance |

||||||||

| 0.000%, 02/14/24 (D)(H) |

2,000,000 | 1,994,890 | ||||||

|

|

|

|||||||

| Total Commercial Paper |

5,802,025 | |||||||

|

|

|

|||||||

| REPURCHASE AGREEMENT(I) — 0.7% |

|

|||||||

| Tri Party Overnight 5.150%, dated 01/31/2024, to be repurchased on 02/01/2024, repurchase price $20,002,861 (collateralized by various Government Obligations, ranging in par value $903,753 - $55,000,000, 0.000% - 4.280%, 08/14/2041 - 01/20/2054, with a total market value of $21,896,999) |

20,000,000 | 20,000,000 | ||||||

|

|

|

|||||||

| Total Repurchase Agreement |

20,000,000 | |||||||

|

|

|

|||||||

| Total Investments — 99.4% |

$ | 2,903,557,182 | ||||||

|

|

|

|||||||

| Percentages are based on Net Assets of $2,921,824,523. |

| |||||||

The accompanying notes are an integral part of the financial statements.

| 9 |

| * | Non-income producing security. |

| ‡ | Real Estate Investment Trust |

| (A) | Zero coupon security. The rate reported on the Schedule of Investments is the effective yield at the time of purchase. |

| (B) | Variable or floating rate security. The rate shown is the effective interest rate as of period end. The rates on certain securities are not based on published reference rates and spreads and are either determined by the issuer or agent based on current market conditions; by using a formula based on the rates of underlying loans; or by adjusting periodically based on prevailing interest rates. |

| (C) | Securities sold within terms of a private placement memorandum, exempt from registration under Section 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “accredited investors.” |

| The total value of such securities at January 31, 2024 was $1,138,637,783 and represents 39.0% of Net Assets. |

| (D) | Step Bonds — The rate reflected on the Schedule of Investments is the effective yield on January 31, 2024. The coupon on a step bond changes on a specific date. |

| (E) | PO - Principal Only |

| (F) | Level 3 security in accordance with fair value hierarchy. |

| (G) | Security in default on interest payments. |

| (H) | Interest rate represents the security’s effective yield at the time of purchase. |

| (I) | Tri-Party Repurchase Agreement. |

The following is a summary of the level of inputs used as of January 31, 2024, in valuing the Fund’s investments carried at value:

| Investments in Securities |

Level 1 | Level 2 | Level 3(1) | Total | ||||||||||||

| U.S. Treasury |

||||||||||||||||

| Obligations |

$ | — | $ | 836,868,108 | $ | — | $ | 836,868,108 | ||||||||

| Mortgage-Backed |

||||||||||||||||

| Securities |

— | 654,018,248 | —^ | 654,018,248 | ||||||||||||

| Corporate Obligations |

— | 641,772,177 | 1,000,000 | 642,772,177 | ||||||||||||

| Asset-Backed |

||||||||||||||||

| Securities |

— | 384,378,833 | —^ | 384,378,833 | ||||||||||||

| Collateralized Loan |

||||||||||||||||

| Obligations |

— | 201,241,436 | — | 201,241,436 | ||||||||||||

| U.S. Government |

||||||||||||||||

| Agency Obligations |

— | 60,405,830 | — | 60,405,830 | ||||||||||||

| Common Stock |

— | — | 47,723,350 | 47,723,350 | ||||||||||||

| Municipal Bonds |

— | 42,087,120 | 84,850 | 42,171,970 | ||||||||||||

| Sovereign Debt |

— | 8,175,205 | — | 8,175,205 | ||||||||||||

| Commercial Paper |

— | 5,802,025 | — | 5,802,025 | ||||||||||||

| Repurchase |

||||||||||||||||

| Agreement |

— | 20,000,000 | — | 20,000,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities | $ | — | $ | 2,854,748,982 | $ | 48,808,200 | $ | 2,903,557,182 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

^ This category includes securities with a value of $0.

(1) Of the $48,808,200 in Level 3 securities as of January 31, 2024, $48,808,200 or 100.0% are not valued via third party pricing vendors and broker quotes. If significant, the disclosure of the unobservable inputs and the interrelationships and sensitivity between these inputs is required for those Level 3 securities that are not valued by third party vendors or broker quotes.

The following is a reconciliation of the investments in which significant unobservable inputs (Level 3) were used in determining value as of January 31, 2024:

| Asset-Backed Securities |

Mortgage- Backed Securities |

Corporate Obligations |

Municipal Bonds | Common Stock | Total | |||||||||||||||||||

| Balance as of July 31, 2023 |

$ | — | ^ | $ | — | ^ | $ | — | $ | 84,850 | $ | 15,106,308 | $ | 15,191,158 | ||||||||||

| Accrued discounts/premiums |

— | — | — | — | — | — | ||||||||||||||||||

| Realized gain/(loss) |

— | — | — | — | — | — | ||||||||||||||||||

| Change in unrealized appreciation/(depreciation) |

— | — | — | — | 32,617,042 | 32,617,042 | ||||||||||||||||||

| Purchases |

— | — | — | — | — | — | ||||||||||||||||||

| Sales |

— | — | — | — | — | — | ||||||||||||||||||

| Net transfer into Level 3 |

— | — | 1,000,000 | — | — | 1,000,000 | ||||||||||||||||||

| Net transfer out of Level 3 |

— | — | — | — | — | — | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Ending Balance as of January 31, 2024 |

$ | — | ^ | $ | — | ^ | $ | 1,000,000 | $ | 84,850 | $ | 47,723,350 | $ | 48,808,200 | ||||||||||

|

|

|

|||||||||||||||||||||||

| Change in unrealized gains/(losses) included in earnings related to securities still held at reporting date |

$ | — | $ | — | $ | — | $ | — | $ | 32,617,042 | $ | 32,617,042 | ||||||||||||

|

|

|

|||||||||||||||||||||||

^ This category includes securities with a value of $0.

The accompanying notes are an integral part of the financial statements.

| 10 |

The following table summarizes the quantitative inputs and assumptions used for items categorized as recurring Level 3 assets as of January 31, 2024. The following disclosures also include information on the sensitivity of the fair value measurements to changes in the significant unobservable inputs.

The unobservable inputs used to determine fair value of recurring Level 3 assets may have similar or diverging impacts on valuation. Significant increases and decreases in these inputs in isolation and interrelationships between those inputs could result in significantly higher or lower fair value measurement.

| Category | Market Value at January 31, 2024 |

Valuation Technique |

Unobservable Inputs |

Range Input Value(s) | ||||

| Common Stock |

$47,723,350 | Residual equity value | Equity multiple | 1 | ||||

| Municipal Bonds |

84,850 | Estimated liquidation value | Liquidation value | $0.01 | ||||

| Corporate Obligations |

1,000,000 | Broker/Dealer price | $0.10 | |||||

Amounts designated as “—“ are $0 or have been rounded to $0.

For more information on valuation inputs, see Note 2—Significant Accounting Policies in the Notes to Financial Statements.

See “Glossary” for abbreviations.

The accompanying notes are an integral part of the financial statements.

| 11 |

SECTOR WEIGHTINGS †

| Corporate Obligation |

45.3% | |||||

| Communication Services | 3.6% | |||||

| Consumer Discretionary | 13.2% | |||||

| Consumer Staples | 3.5% | |||||

| Energy | 2.1% | |||||

| Financials | 6.9% | |||||

| Industrials | 10.6% | |||||

| Information Technology | 2.9% | |||||

| Materials | 0.2% | |||||

| Real Estate | 1.9% | |||||

| Utilities | 0.4% | |||||

| Asset-Backed Security |

23.3% | |||||

| Collateralized Loan |

||||||

| Obligation |

16.3% | |||||

| Mortgage-Backed Security |

7.9% | |||||

| Repurchase Agreement |

6.2% | |||||

| Commercial Paper |

1.0% | |||||

| Preferred Stock |

0.0% | |||||

| Common Stock |

0.0% | |||||

† Percentages are based on total investments.

| Description | Face Amount | Value | ||||||

| CORPORATE OBLIGATIONS — 44.7% |

|

|||||||

| Communication Services — 3.6% |

||||||||

| ANGI Group |

$ | 2,000,000 | $ | 1,719,826 | ||||

| LCPR Senior Secured Financing DAC |

||||||||

| 6.750%, 10/15/27(A) |

900,000 | 866,935 | ||||||

| T-Mobile USA |

||||||||

| 3.500%, 04/15/31 |

3,000,000 | 2,732,611 | ||||||

| Warnermedia Holdings |

||||||||

| 4.279%, 03/15/32 |

1,750,000 | 1,602,318 | ||||||

|

|

|

|||||||

| 6,921,690 | ||||||||

|

|

|

|||||||

| Consumer Discretionary — 13.1% |

||||||||

| Airswift Global |

||||||||

| 14.123%, SOFRRATE + 8.762%, 05/12/25(A)(B) |

2,000,000 | 2,072,731 | ||||||

| American Axle & Manufacturing |

1,000,000 | 875,443 | ||||||

| APX Group |

3,000,000 | 2,849,083 | ||||||

| Beazer Homes USA |

1,000,000 | 1,004,490 | ||||||

| Bloomin’ Brands |

2,500,000 | 2,325,000 | ||||||

| Choice Hotels International |

2,000,000 | 1,779,045 | ||||||

| Dillard’s |

500,000 | 517,100 | ||||||

| Imperial Brands Finance |

500,000 | 513,954 | ||||||

| JBS USA LUX |

2,000,000 | 2,105,040 | ||||||

| MajorDrive Holdings IV |

3,000,000 | 2,537,612 | ||||||

| NES Fircroft Bondco |

500,000 | 516,098 | ||||||

| Nissan Motor Acceptance |

1,000,000 | 1,049,402 | ||||||

| STL Holding |

2,000,000 | 2,000,000 | ||||||

| Description | Face Amount | Value | ||||||

| 7.500%, 02/15/26(A) |

$ | 2,000,000 | $ | 2,034,020 | ||||

| Tractor Supply |

500,000 | 508,198 | ||||||

| Upbound Group |

1,000,000 | 953,420 | ||||||

| VistaJet Malta Finance |

2,500,000 | 2,088,075 | ||||||

|

|

|

|||||||

| 25,728,711 | ||||||||

|

|

|

|||||||

| Consumer Staples — 3.4% |

||||||||

| J M Smucker |

2,000,000 | 2,259,749 | ||||||

| Philip Morris International |

2,000,000 | 2,032,954 | ||||||

| Walgreens Boots Alliance |

3,000,000 | 2,531,081 | ||||||

|

|

|

|||||||

| 6,823,784 | ||||||||

|

|

|

|||||||

| Energy — 2.0% |

||||||||

| Borr IHC |

1,200,000 | 1,241,654 | ||||||

| Colonial Pipeline |

1,500,000 | 1,728,352 | ||||||

| Puffin Finance Sarl |

1,000,000 | 1,026,865 | ||||||

|

|

|

|||||||

| 3,996,871 | ||||||||

|

|

|

|||||||

| Financials — 6.8% |

||||||||

| Athene Holding |

500,000 | 516,676 | ||||||

| Charles Schwab |

||||||||

| 4.000%, H15T10Y + 3.079%, 03/01/72(B) |

2,500,000 | 2,075,381 | ||||||

| Deutsche Bank NY |

||||||||

| 7.146%, SOFRRATE + 2.520%, 07/13/27(B) |

1,000,000 | 1,035,721 | ||||||

| Discover Financial Services |

2,000,000 | 2,094,942 | ||||||

| Golub Capital BDC |

800,000 | 829,251 | ||||||

| Huntington National Bank |

||||||||

| 5.699%, SOFRRATE + 1.215%, 11/18/25(B) |

1,500,000 | 1,491,915 | ||||||

| Royal Bank of Canada MTN |

1,000,000 | 991,008 | ||||||

| UBS |

1,500,000 | 1,491,750 | ||||||

| UBS Group |

||||||||

| 6.373%, SOFRRATE + 3.340%, 07/15/26(A)(B) |

1,000,000 | 1,011,224 | ||||||

| US Bancorp |

||||||||

| 5.836%, SOFRRATE + 2.260%, 06/12/34(B) |

1,000,000 | 1,031,998 | ||||||

| Westpac Banking |

||||||||

| 2.894%, H15T5Y + 1.350%, 02/04/30(B) |

1,000,000 | 970,099 | ||||||

|

|

|

|||||||

| 13,539,965 | ||||||||

|

|

|

|||||||

| Industrials — 10.5% |

||||||||

| AmeriTex HoldCo Intermediate |

1,000,000 | 1,026,910 | ||||||

| Boeing |

||||||||

| 5.150%, 05/01/30 |

2,000,000 | 2,004,419 | ||||||

| 2.196%, 02/04/26 |

1,000,000 | 941,831 | ||||||

The accompanying notes are an integral part of the financial statements.

| 12 |

| Description | Face Amount | Value | ||||||

| Brundage-Bone Concrete Pumping Holdings |

||||||||

| 6.000%, 02/01/26(A) |

$ | 4,103,000 | $ | 4,041,742 | ||||

| Concentrix |

||||||||

| 6.850%, 08/02/33 |

2,000,000 | 2,031,673 | ||||||

| Flowserve |

||||||||

| 3.500%, 10/01/30 |

2,000,000 | 1,782,492 | ||||||

| Icahn Enterprises |

||||||||

| 9.750%, 01/15/29(A) |

1,000,000 | 1,026,250 | ||||||

| 4.750%, 09/15/24 |

1,000,000 | 994,279 | ||||||

| Lockheed Martin |

||||||||

| 5.250%, 01/15/33 |

1,500,000 | 1,571,003 | ||||||

| Masco |

||||||||

| 7.750%, 08/01/29 |

1,088,000 | 1,223,214 | ||||||

| nVent Finance Sarl |

||||||||

| 5.650%, 05/15/33 |

1,000,000 | 1,026,381 | ||||||

| Regal Rexnord |

||||||||

| 6.300%, 02/15/30(A) |

1,500,000 | 1,541,835 | ||||||

| TWMA Group |

||||||||

| 13.000%, 02/08/27 |

1,500,000 | 1,500,000 | ||||||

|

|

|

|||||||

| 20,712,029 | ||||||||

|

|

|

|||||||

| Information Technology — 2.8% |

|

|||||||

| Apple |

||||||||

| 3.850%, 05/04/43 |

2,000,000 | 1,769,318 | ||||||

| Consensus Cloud Solutions |

||||||||

| 6.000%, 10/15/26(A) |

1,000,000 | 947,305 | ||||||

| Kyndryl Holdings |

||||||||

| 4.100%, 10/15/41 |

3,829,000 | 2,910,788 | ||||||

|

|

|

|||||||

| 5,627,411 | ||||||||

|

|

|

|||||||

| Materials — 0.2% |

||||||||

| Mineral Resources |

||||||||

| 8.125%, 05/01/27 (A) |

420,000 | 424,200 | ||||||

|

|

|

|||||||

| Real Estate — 1.9% |

||||||||

| GLP Capital |

||||||||

| 3.250%, 01/15/32‡ |

2,500,000 | 2,102,527 | ||||||

| Sabra Health Care |

||||||||

| 3.200%, 12/01/31‡ |

2,000,000 | 1,634,060 | ||||||

|

|

|

|||||||

| 3,736,587 | ||||||||

|

|

|

|||||||

| Utilities — 0.4% |

||||||||

| Pacific Gas and Electric |

||||||||

| 4.500%, 07/01/40 |

1,000,000 | 861,050 | ||||||

|

|

|

|||||||

| Total Corporate Obligations |

88,372,298 | |||||||

|

|

|

|||||||

| ASSET-BACKED SECURITIES — 23.0% |

|

|||||||

| Automotive — 14.5% |

||||||||

| ACC Auto Trust, Ser 2021-A, Cl D |

|

|||||||

| 6.100%, 06/15/29 (A) |

1,000,000 | 987,707 | ||||||

| American Credit Acceptance Receivables Trust, Ser 2021-4, Cl E |

||||||||

| 3.120%, 02/14/28 (A) |

1,500,000 | 1,442,226 | ||||||

| American Credit Acceptance Receivables Trust, Ser 2022-1, Cl F |

||||||||

| 4.870%, 11/13/28 (A) |

2,600,000 | 2,480,090 | ||||||

| American Credit Acceptance Receivables Trust, Ser 2023-2, Cl D |

||||||||

| 6.470%, 08/13/29 (A) |

1,000,000 | 1,004,348 | ||||||

| Description | Face Amount | Value | ||||||

| American Credit Acceptance Receivables Trust, Ser 2023-3, Cl D |

||||||||

| 6.820%, 10/12/29 (A) |

$ | 1,000,000 | $ | 1,014,372 | ||||

| American Credit Acceptance Receivables Trust, Ser 2023-4, Cl D |

||||||||

| 7.650%, 09/12/30 (A) |

1,000,000 | 1,038,950 | ||||||

| Amur Equipment Finance Receivables XIII, Ser 2024-1A, Cl E |

||||||||

| 9.660%, 04/20/32 (A) |

1,550,000 | 1,552,008 | ||||||

| Avid Automobile Receivables Trust, Ser 2021-1, Cl F |

||||||||

| 5.160%, 10/16/28 (A) |

2,000,000 | 1,850,577 | ||||||

| CarNow Auto Receivables Trust, Ser 2021-2A, Cl E |

||||||||

| 4.450%, 02/15/28 (A) |

1,000,000 | 911,310 | ||||||

| Carvana Auto Receivables Trust, Ser 2021-N2, Cl E |

||||||||

| 2.900%, 03/10/28 (A) |

1,927,492 | 1,799,375 | ||||||

| CIG Auto Receivables Trust, Ser 2021-1A, Cl E |

||||||||

| 4.450%, 05/12/28 (A) |

1,590,000 | 1,516,261 | ||||||

| CPS Auto Receivables Trust, Ser 2019-B, Cl F |

||||||||

| 7.480%, 06/15/26 (A) |

500,000 | 499,850 | ||||||

| DT Auto Owner Trust, Ser 2019-4A, Cl E |

||||||||

| 3.930%, 10/15/26 (A) |

2,000,000 | 1,989,190 | ||||||

| DT Auto Owner Trust, Ser 2020-3A, |

||||||||

| 3.620%, 10/15/27 (A) |

1,500,000 | 1,461,759 | ||||||

| Exeter Automobile Receivables Trust, Ser 2022-2A, Cl E |

||||||||

| 6.340%, 10/15/29 (A) |

1,443,000 | 1,391,052 | ||||||

| Foursight Capital Automobile Receivables Trust, Ser 2022-1, Cl E |

||||||||

| 4.690%, 08/15/29 (A) |

1,000,000 | 873,621 | ||||||

| GLS Auto Receivables Issuer Trust, Ser 2021-4A, Cl E |

||||||||

| 4.430%, 10/16/28 (A) |

1,500,000 | 1,400,282 | ||||||

| GoldenTree Loan Management US CLO 19, Ser 2024-19A, Cl B |

||||||||

| %, TSFR3M + 1.900%, |

3,000,000 | 3,000,000 | ||||||

| SAFCO Auto Receivables Trust, Ser 2024-1A, Cl E |

||||||||

| 10.850%, 01/18/30 (A) |

500,000 | 501,952 | ||||||

| Tricolor Auto Securitization Trust, Ser 2022-1A, Cl F |

||||||||

| 9.800%, 07/16/29 (A) |

1,000,000 | 974,797 | ||||||

| Tricolor Auto Securitization Trust, Ser 2023-1A, Cl F |

||||||||

| 16.000%, 06/17/30 (A) |

1,000,000 | 1,006,665 | ||||||

|

|

|

|||||||

| 28,696,392 | ||||||||

|

|

|

|||||||

| Credit Card — 1.0% |

||||||||

| Mercury Financial Credit Card Master Trust, Ser 2022-1A, Cl C |

||||||||

| 5.200%, 09/21/26 (A) |

2,000,000 | 1,999,540 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

| 13 |

| Description | Face Amount | Value | ||||||

| Other Asset-Backed Securities — 7.5% |

| |||||||

| Amur Equipment Finance Receivables X, Ser 2022-1A, Cl E |

||||||||

| 5.020%, 12/20/28 (A) |

$ | 1,348,000 | $ | 1,241,359 | ||||

| Audax Senior Debt 6, Ser 2021- 6A, Cl B |

||||||||

| 7.529%, TSFR3M + 2.212%, 10/20/33 (A)(B) |

1,000,000 | 961,166 | ||||||

| BHG Securitization Trust, Ser 2022-B, Cl D |

||||||||

| 6.690%, 06/18/35 (A) |

998,895 | 964,285 | ||||||

| CIFC Funding, Ser 2018-1A, Cl C |

||||||||

| 7.310%, TSFR3M + 2.012%, 04/18/31 (A)(B) |

500,000 | 494,582 | ||||||

| CP EF Asset Securitization I, Ser 2022-1A, Cl A |

||||||||

| 5.960%, 04/15/30 (A) |

392,338 | 389,742 | ||||||

| Credibly Asset Securitization II, Ser 2021-1A, Cl B |

||||||||

| 3.380%, 04/15/26 (A) |

524,000 | 515,662 | ||||||

| Kapitus Asset Securitization, Ser 2022-1A, Cl A |

||||||||

| 3.382%, 07/10/28 (A) |

1,500,000 | 1,441,853 | ||||||

| LCM XXII, Ser 2018-22A, Cl BR |

||||||||

| 7.579%, TSFR3M + 2.262%, 10/20/28 (A)(B) |

1,500,000 | 1,483,512 | ||||||

| Libra Solutions, Ser 2023-1A, Cl B |

||||||||

| 10.250%, 02/15/35 (A) |

576,204 | 575,858 | ||||||

| Mosaic Solar Loans, Ser 2017-2A, |

||||||||

| 4.770%, 06/22/43 (A) |

176,870 | 161,215 | ||||||

| NMEF Funding, Ser 2021-A, Cl D |

||||||||

| 5.780%, 12/15/27 (A) |

1,300,000 | 1,281,234 | ||||||

| Orange Lake Timeshare Trust, Ser 2019-A, Cl C |

||||||||

| 3.610%, 04/09/38 (A) |

371,744 | 359,531 | ||||||

| OZLM Funding IV, Ser 2017-4A, Cl BR |

||||||||

| 7.779%, TSFR3M + 2.462%, 10/22/30 (A)(B) |

2,000,000 | 1,995,934 | ||||||

| Pawneee Equipment Receivables, Ser 2021-1, Cl E |

||||||||

| 5.210%, 05/15/28 (A) |

353,000 | 329,271 | ||||||

| Pawneee Equipment Receivables, Ser 2022-1, Cl C |

||||||||

| 6.010%, 07/17/28 (A) |

1,000,000 | 981,134 | ||||||

| Sapphire Aviation Finance I, Ser 2018-1A, Cl B |

||||||||