sft-202112310001762322FALSEFY202171400.11865560.1512859P4YP0Y00017623222021-01-012021-12-3100017623222021-06-30iso4217:USD00017623222022-03-14xbrli:shares00017623222021-12-3100017623222020-12-31iso4217:USDxbrli:shares0001762322sft:EcommerceRevenueMember2021-01-012021-12-310001762322sft:EcommerceRevenueMember2020-01-012020-12-310001762322us-gaap:ProductAndServiceOtherMember2021-01-012021-12-310001762322us-gaap:ProductAndServiceOtherMember2020-01-012020-12-310001762322sft:WholesaleVehicleRevenueMember2021-01-012021-12-310001762322sft:WholesaleVehicleRevenueMember2020-01-012020-12-3100017623222020-01-012020-12-310001762322srt:ScenarioPreviouslyReportedMember2019-12-310001762322us-gaap:CommonStockMembersrt:ScenarioPreviouslyReportedMember2019-12-310001762322us-gaap:AdditionalPaidInCapitalMembersrt:ScenarioPreviouslyReportedMember2019-12-310001762322us-gaap:RetainedEarningsMembersrt:ScenarioPreviouslyReportedMember2019-12-310001762322srt:RestatementAdjustmentMember2019-12-310001762322srt:RestatementAdjustmentMemberus-gaap:CommonStockMember2019-12-310001762322srt:RestatementAdjustmentMemberus-gaap:AdditionalPaidInCapitalMember2019-12-3100017623222019-12-310001762322us-gaap:CommonStockMember2019-12-310001762322us-gaap:AdditionalPaidInCapitalMember2019-12-310001762322us-gaap:RetainedEarningsMember2019-12-310001762322us-gaap:CommonStockMember2020-01-012020-12-310001762322us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001762322us-gaap:CommonStockMembersft:ShiftSeriesCWarrantMember2020-01-012020-12-310001762322us-gaap:AdditionalPaidInCapitalMembersft:ShiftSeriesCWarrantMember2020-01-012020-12-310001762322sft:ShiftSeriesCWarrantMember2020-01-012020-12-310001762322sft:LithiaWarrantsMemberus-gaap:CommonStockMember2020-01-012020-12-310001762322us-gaap:AdditionalPaidInCapitalMembersft:LithiaWarrantsMember2020-01-012020-12-310001762322sft:LithiaWarrantsMember2020-01-012020-12-310001762322sft:PublicAndPlacementWarrantsMemberus-gaap:CommonStockMember2020-01-012020-12-310001762322sft:PublicAndPlacementWarrantsMemberus-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001762322sft:PublicAndPlacementWarrantsMember2020-01-012020-12-310001762322us-gaap:RetainedEarningsMember2020-01-012020-12-310001762322us-gaap:CommonStockMember2020-12-310001762322us-gaap:AdditionalPaidInCapitalMember2020-12-310001762322us-gaap:RetainedEarningsMember2020-12-310001762322us-gaap:CommonStockMembersft:PublicWarrantsMember2021-01-012021-12-310001762322us-gaap:AdditionalPaidInCapitalMembersft:PublicWarrantsMember2021-01-012021-12-310001762322sft:PublicWarrantsMember2021-01-012021-12-310001762322us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001762322us-gaap:CommonStockMember2021-01-012021-12-310001762322us-gaap:RetainedEarningsMember2021-01-012021-12-310001762322us-gaap:CommonStockMember2021-12-310001762322us-gaap:AdditionalPaidInCapitalMember2021-12-310001762322us-gaap:RetainedEarningsMember2021-12-31sft:segment00017623222020-10-132020-10-1300017623222020-03-272020-12-310001762322sft:OneRetailLendingInstitutionMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-31xbrli:pure0001762322us-gaap:AccountsReceivableMembersft:ThreeEntitiesMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001762322srt:MinimumMemberus-gaap:EquipmentMember2021-01-012021-12-310001762322srt:MaximumMemberus-gaap:EquipmentMember2021-01-012021-12-310001762322us-gaap:FurnitureAndFixturesMember2021-01-012021-12-310001762322us-gaap:ComputerSoftwareIntangibleAssetMember2021-01-012021-12-31sft:mile0001762322sft:CommonStockWarrantsMember2020-12-240001762322sft:PublicWarrantsMember2020-12-240001762322us-gaap:MeasurementInputOptionVolatilityMemberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:FairValueInputsLevel3Member2021-10-130001762322us-gaap:MeasurementInputOptionVolatilityMember2020-12-310001762322sft:LithiaWarrantsMember2021-01-012021-12-310001762322sft:LithiaWarrantsMember2020-01-012020-12-310001762322sft:EscrowSharesMember2021-01-012021-12-310001762322sft:EscrowSharesMember2020-01-012020-12-310001762322sft:PublicAndPlacementWarrantsMember2021-12-310001762322srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-01-012021-12-3100017623222019-01-012019-12-310001762322us-gaap:AccountingStandardsUpdate201602Memberus-gaap:SubsequentEventMember2022-01-010001762322sft:WholesaleVehicleRevenueMembersft:LithiaMotorsIncMember2021-01-012021-12-3100017623222020-10-130001762322us-gaap:CommonClassAMember2020-10-130001762322us-gaap:CommonClassBMember2020-10-130001762322us-gaap:PrivatePlacementMember2020-10-132020-10-130001762322us-gaap:PrivatePlacementMember2020-10-130001762322sft:InsuranceAcquisitionCorpMember2020-10-130001762322sft:InsuranceAcquisitionCorpMember2020-01-012020-12-310001762322sft:InsuranceAcquisitionCorpMember2020-10-132020-10-130001762322sft:InsuranceAcquisitionCorpMembersft:DerivativeInstrumentPeriodOneMember2020-10-132020-10-130001762322sft:InsuranceAcquisitionCorpMembersft:DerivativeInstrumentPeriodOneMember2021-10-13sft:trading_day0001762322sft:InsuranceAcquisitionCorpMembersft:DerivativeInstrumentPeriodOneMember2020-10-130001762322sft:InsuranceAcquisitionCorpMembersft:DerivativeInstrumentPeriodTwoMember2020-10-132020-10-130001762322sft:InsuranceAcquisitionCorpMembersft:DerivativeInstrumentPeriodTwoMember2020-10-130001762322sft:DerivativeInstrumentPeriodThreeMembersft:InsuranceAcquisitionCorpMember2020-10-132020-10-130001762322sft:DerivativeInstrumentPeriodThreeMembersft:InsuranceAcquisitionCorpMember2020-10-130001762322sft:InsuranceAcquisitionCorpMember2021-10-1300017623222021-10-132021-10-130001762322us-gaap:EquipmentMember2021-12-310001762322us-gaap:EquipmentMember2020-12-310001762322us-gaap:FurnitureAndFixturesMember2021-12-310001762322us-gaap:FurnitureAndFixturesMember2020-12-310001762322us-gaap:LeaseholdImprovementsMember2021-12-310001762322us-gaap:LeaseholdImprovementsMember2020-12-310001762322sft:ReconditioningFacilitiesMember2021-01-012021-12-310001762322sft:ReconditioningFacilitiesMember2020-01-012020-12-310001762322sft:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2021-05-270001762322sft:DebtInstrumentConvertiblePeriodOneMembersft:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2021-05-270001762322sft:DebtInstrumentConvertiblePeriodOneMembersft:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2021-05-272021-05-2700017623222021-05-240001762322sft:ConvertibleSeniorNotesDue2026Membersft:DebtInstrumentConvertibleTriggerOptionOneMemberus-gaap:ConvertibleDebtMember2021-05-272021-05-270001762322sft:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMembersft:DebtInstrumentConvertibleTriggerOptionTwoMember2021-05-272021-05-27sft:business_day0001762322sft:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2021-05-272021-05-270001762322sft:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2021-12-310001762322sft:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2021-01-012021-12-310001762322us-gaap:EstimateOfFairValueFairValueDisclosureMembersft:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2021-12-310001762322us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersft:AllyFlooringLineOfCreditMember2021-12-090001762322us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:PrimeRateMembersft:AllyFlooringLineOfCreditMember2021-12-092021-12-090001762322us-gaap:PrimeRateMember2021-12-310001762322us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersft:AllyFlooringLineOfCreditMember2021-12-310001762322us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersft:AllyFlooringLineOfCreditMember2021-12-092021-12-090001762322us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersft:FlooringLineOfCreditFacilityMember2018-10-110001762322us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersft:FlooringLineOfCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2018-10-112018-10-110001762322us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersft:FlooringLineOfCreditFacilityMember2021-09-300001762322us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersft:FlooringLineOfCreditFacilityMember2021-01-012021-09-300001762322us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersft:FlooringLineOfCreditFacilityMember2021-12-310001762322us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersft:FlooringLineOfCreditFacilityMember2020-12-310001762322us-gaap:SecuredDebtMembersft:DelayedDrawTermLoanDDTLAgreementMember2019-11-292020-07-31sft:debt_intrument0001762322us-gaap:SecuredDebtMembersft:TermLoanAMember2019-09-300001762322sft:TermLoanBMemberus-gaap:SecuredDebtMember2019-09-300001762322sft:TermLoanBMemberus-gaap:SecuredDebtMember2020-06-122020-06-120001762322us-gaap:SecuredDebtMemberus-gaap:LondonInterbankOfferedRateLIBORMembersft:TermLoanAMember2019-11-292019-11-290001762322us-gaap:SecuredDebtMembersft:TermLoanAMember2019-12-012019-12-310001762322sft:TermLoanBMemberus-gaap:SecuredDebtMember2020-07-012020-07-310001762322us-gaap:LoansPayableMembersft:PaycheckProtectionProgramCARESActMember2020-04-220001762322us-gaap:LoansPayableMembersft:PaycheckProtectionProgramCARESActMember2020-04-222020-04-220001762322sft:DebtInstrumentConvertiblePeriodTwoMembersft:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2021-05-272021-05-270001762322us-gaap:CallOptionMember2021-05-272021-05-270001762322us-gaap:CallOptionMember2021-12-310001762322us-gaap:CallOptionMember2021-01-012021-12-310001762322sft:PublicWarrantsAssumedInAcquisitionMember2019-03-220001762322sft:PublicWarrantsMember2020-12-282020-12-280001762322sft:PlacementWarrantsMember2020-12-282020-12-280001762322sft:PlacementWarrantsMember2020-12-270001762322sft:PublicAndPlacementWarrantsMember2020-12-282020-12-280001762322sft:PublicAndPlacementWarrantsMember2020-12-280001762322sft:PublicWarrantsMember2021-01-142021-01-140001762322srt:MinimumMembersft:StockOptionPlan2014Memberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001762322srt:MaximumMembersft:StockOptionPlan2014Memberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001762322sft:StockOptionPlan2014Memberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001762322sft:StockOptionPlan2014Member2021-01-012021-12-310001762322sft:OmnibusEquityCompensationPlan2020Memberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001762322sft:OmnibusEquityCompensationPlan2020Member2021-01-012021-12-310001762322sft:StockOptionPlan2014AndOmnibusEquityCompensationPlan2020Member2021-12-310001762322sft:OmnibusEquityCompensationPlan2020Member2021-12-310001762322sft:OmnibusEquityCompensationPlan2020Memberus-gaap:SubsequentEventMember2022-01-012022-01-010001762322us-gaap:ShareBasedCompensationAwardTrancheOneMember2021-01-012021-12-310001762322srt:MinimumMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-01-012021-12-310001762322srt:MaximumMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-01-012021-12-310001762322us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001762322srt:MinimumMemberus-gaap:EmployeeStockOptionMember2020-01-012020-12-310001762322srt:MaximumMemberus-gaap:EmployeeStockOptionMember2020-01-012020-12-310001762322us-gaap:EmployeeStockOptionMember2021-12-310001762322us-gaap:EmployeeStockOptionMember2020-12-310001762322us-gaap:EmployeeStockOptionMember2021-10-012021-12-310001762322us-gaap:EmployeeStockOptionMember2020-10-012020-12-310001762322sft:OneSidedMarketplaceOSMAgreementMembersft:LithiaMotorsIncMembersrt:AffiliatedEntityMember2021-01-012021-12-310001762322sft:OneSidedMarketplaceOSMAgreementMembersft:LithiaMotorsIncMembersrt:AffiliatedEntityMember2020-01-012020-12-310001762322sft:LithiaMotorsIncMembersrt:AffiliatedEntityMember2021-12-310001762322sft:LithiaMotorsIncMembersrt:AffiliatedEntityMember2020-12-310001762322sft:VehicleSalesMembersft:LithiaMotorsIncMembersrt:AffiliatedEntityMember2021-12-310001762322sft:VehicleSalesMembersft:LithiaMotorsIncMembersrt:AffiliatedEntityMember2020-12-310001762322sft:LithiaMotorsIncMembersft:LithiaMotorsIncMasterAgreementWithUSBankCommissionsMembersrt:AffiliatedEntityMember2021-12-310001762322sft:LithiaMotorsIncMembersft:LithiaMotorsIncMasterAgreementWithUSBankCommissionsMembersrt:AffiliatedEntityMember2020-12-310001762322sft:WarrantSharesMembersft:LithiaMotorsIncMembersrt:AffiliatedEntityMember2018-09-30sft:tranche0001762322sft:LithiaMotorsIncMembersft:WarrantSharesClassifiedAsDerivativesMembersrt:AffiliatedEntityMember2018-09-302018-09-300001762322sft:WarrantSharesMembersft:LithiaMotorsIncMembersrt:AffiliatedEntityMember2018-09-302018-09-300001762322sft:LithiaMotorsIncMembersft:FlooringLineOfCreditFacilityMembersrt:AffiliatedEntityMember2018-09-302018-09-300001762322sft:LithiaMotorsIncMembersft:FlooringLineOfCreditFacilityMembersrt:AffiliatedEntityMember2018-09-300001762322sft:LithiaMotorsIncMembersft:DelayedDrawTermLoanDDTLAgreementMembersrt:AffiliatedEntityMember2018-09-300001762322sft:LithiaMotorsIncMembersft:FlooringLineOfCreditFacilityMembersrt:AffiliatedEntityMember2021-01-012021-12-310001762322sft:LithiaMotorsIncMembersft:FlooringLineOfCreditFacilityMembersrt:AffiliatedEntityMember2020-01-012020-12-310001762322sft:LithiaMotorsIncMembersft:DelayedDrawTermLoanDDTLAgreementMembersrt:AffiliatedEntityMember2018-09-302018-09-300001762322sft:LithiaMotorsIncMembersft:DelayedDrawTermLoanDDTLAgreementMembersrt:AffiliatedEntityMember2020-01-012020-12-310001762322sft:LithiaMotorsIncMembersrt:AffiliatedEntityMember2018-09-302018-09-300001762322sft:LithiaMotorsIncMembersft:SubstanceUpfrontPaymentMembersrt:AffiliatedEntityMember2018-09-300001762322sft:WarrantSharesTrancheFiveMember2019-10-012019-10-310001762322sft:LithiaMotorsIncMembersrt:AffiliatedEntityMembersft:SubstanceUpfrontPaymentRecordedInOtherNonCurrentAssetsMember2018-09-300001762322sft:LithiaMotorsIncMembersrt:AffiliatedEntityMember2018-09-300001762322sft:LithiaMotorsIncMembersrt:AffiliatedEntityMember2021-01-012021-12-310001762322sft:LithiaMotorsIncMembersrt:AffiliatedEntityMember2020-01-012020-12-310001762322sft:LithiaMotorsIncMembersft:LicenseAndServicesAgreementMembersrt:AffiliatedEntityMember2021-01-012021-12-310001762322sft:LithiaMotorsIncMembersft:LicenseAndServicesAgreementMembersrt:AffiliatedEntityMember2020-01-012020-12-310001762322sft:LithiaMotorsIncMembersft:FlooringLineOfCreditFacilityMembersrt:AffiliatedEntityMember2019-02-012019-02-280001762322sft:LithiaMotorsIncMembersft:DelayedDrawTermLoanDDTLAgreementMembersrt:AffiliatedEntityMember2019-12-272019-12-270001762322sft:LithiaMotorsIncMembersft:DelayedDrawTermLoanDDTLAgreementMembersrt:AffiliatedEntityMember2020-07-022020-07-020001762322sft:LithiaMotorsIncMembersft:DelayedDrawTermLoanDDTLAgreementMembersrt:AffiliatedEntityMember2020-11-102020-11-100001762322sft:EmployeeLoansMembersrt:AffiliatedEntityMember2018-07-302018-07-300001762322sft:EmployeeLoansMembersrt:AffiliatedEntityMember2019-04-042019-04-040001762322sft:EmployeeLoansMembersrt:AffiliatedEntityMember2019-01-142019-01-140001762322us-gaap:OperatingSegmentsMembersft:RetailSegmentMember2021-01-012021-12-310001762322sft:WholesaleSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001762322us-gaap:OperatingSegmentsMembersft:RetailSegmentMember2020-01-012020-12-310001762322sft:WholesaleSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001762322us-gaap:OperatingSegmentsMember2021-01-012021-12-310001762322us-gaap:OperatingSegmentsMember2020-01-012020-12-310001762322sft:WarrantsClassifiedAsDerivativesLiabilitiesMember2021-01-012021-12-310001762322sft:WarrantsClassifiedAsDerivativesLiabilitiesMember2020-01-012020-12-310001762322us-gaap:ConvertibleDebtSecuritiesMember2021-01-012021-12-310001762322us-gaap:ConvertibleDebtSecuritiesMember2020-01-012020-12-310001762322us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001762322us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001762322us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001762322us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001762322sft:ShareBasedPaymentArrangementDeferredCompensationOptionMember2021-01-012021-12-310001762322sft:ShareBasedPaymentArrangementDeferredCompensationOptionMember2020-01-012020-12-310001762322us-gaap:WarrantMember2021-01-012021-12-310001762322us-gaap:WarrantMember2020-01-012020-12-310001762322us-gaap:DomesticCountryMember2021-12-310001762322us-gaap:StateAndLocalJurisdictionMember2021-12-310001762322us-gaap:DomesticCountryMember2020-12-310001762322us-gaap:CaliforniaFranchiseTaxBoardMemberus-gaap:StateAndLocalJurisdictionMember2021-12-310001762322us-gaap:CaliforniaFranchiseTaxBoardMemberus-gaap:StateAndLocalJurisdictionMember2020-12-310001762322sft:OregonDepartmentOfRevenueMemberus-gaap:StateAndLocalJurisdictionMember2021-12-310001762322sft:OregonDepartmentOfRevenueMemberus-gaap:StateAndLocalJurisdictionMember2020-12-310001762322sft:VirginiaDepartmentOfRevenueMemberus-gaap:StateAndLocalJurisdictionMember2021-12-310001762322sft:VirginiaDepartmentOfRevenueMemberus-gaap:StateAndLocalJurisdictionMember2020-12-310001762322sft:OtherTaxAuthorityMemberus-gaap:StateAndLocalJurisdictionMember2021-12-310001762322sft:OtherTaxAuthorityMemberus-gaap:StateAndLocalJurisdictionMember2020-12-310001762322sft:AssetPurchaseAgreementWithFairFinancialCorpAndSoftBankGroupCorpMembersrt:ScenarioForecastMemberus-gaap:SubsequentEventMember2022-01-012022-12-310001762322sft:SeniorUnsecuredNotesMembersrt:ScenarioForecastMembersft:SoftBankGroupCorpMemberus-gaap:SeniorNotesMemberus-gaap:SubsequentEventMember2022-12-310001762322sft:SeniorUnsecuredNotesMembersrt:ScenarioForecastMembersft:SoftBankGroupCorpMemberus-gaap:SeniorNotesMemberus-gaap:SubsequentEventMember2022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

| (Mark One) |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2021 |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _______ to _______ |

Commission file number: 001-38839

Shift Technologies, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 82-5325852 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| |

290 Division Street, Suite 400, San Francisco, California 94103-4893 (Address of principal executive offices) |

Registrant's telephone number, including area code: (855) 575-6739

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A common stock, par value $0.0001 per share | | SFT | | Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

Large accelerated filer | ☐ | | Accelerated filer | ☒ |

Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

Emerging growth company | ☒ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant's common stock held by non-affiliates of the registrant (without admitting that any person whose shares are not included in such calculation is an affiliate), computed by reference to the price at which the common stock was last sold on June 30, 2021, the last business day of the registrant’s most recently completed second fiscal quarter, was $555,669,449.

As of March 14, 2022 the registrant had 82,945,120 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its annual meeting of stockholders to be held in 2022 (the “2022 Annual Meeting”), to be filed with the Securities and Exchange Commission (the “SEC”) within 120 days after the end of the fiscal year to which this Annual Report on Form 10-K relates, are incorporated herein by reference where indicated. Except with respect to information specifically incorporated by reference in this Annual Report on Form 10-K, such proxy statement is not deemed to be filed as part hereof.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements contained in this Annual Report on Form 10-K that reflect our current views with respect to future events and financial performance, business strategies, and expectations for our business constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Our forward-looking statements include, but are not limited to, statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would,” “will,” “approximately,” “shall”, the negative of any of these and any similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Annual Report that reflect our current views with respect to future events and financial performance, business strategies, and expectations for our business constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Our forward-looking statements include, but are not limited to, statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would,” “will,” “approximately,” “shall”, the negative of any of these and any similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

Some factors that could cause actual results to differ include, but are not limited to:

•general business and economic conditions and risks related to the larger automotive ecosystem;

•competition, and the ability of the Company to grow and manage growth profitably;

•our history of losses and ability to achieve or maintain profitability in the future;

•our ability to sustain our current rate of growth;

•our ability to establish our software as a platform to be used by automotive dealers;

•risks relating to our inspection, reconditioning and storage hubs;

•impacts of COVID-19 and other pandemics;

•our reliance on third-party carriers for transportation:

•our current geographic concentration where we provide reconditioning services and store inventory;

•cyber-attacks or other privacy or data security incidents;

•the impact of copycat websites;

•failure to adequately protect our intellectual property, technology and confidential information;

•our reliance on third-party service providers to provide financing;

•the impact of federal and state laws related to financial services on our third-party service providers;

•the impact of federal, state and local laws on our ability to obtain and maintain necessary dealer and financing licenses in the states in which we do business;

•our ability to timely secure and maintain cost effective real estate locations in connection with the expansion of our business;

•risks that impact the quality of our customer experience, our reputation, or our brand;

•changes and ambiguity in the prices of new and used vehicles;

•our ability to correctly appraise and price vehicles;

•access to desirable vehicle inventory;

•our ability to expeditiously sell inventory;

•our ability to expand product offerings;

•changes in applicable laws and regulations and our ability to comply with applicable laws and regulations;

•access to additional debt and equity capital;

•changes in technology and consumer acceptance of such changes;

•our reliance on internet search engines, vehicle listing sites and social networking sites to help drive traffic to our website;

•any restrictions on the sending of emails or messages or an inability to timely deliver such communications;

•seasonal and other fluctuations in our quarterly results of operations;

•competition in the markets in which we operate;

•changes in the auto industry and conditions affecting automotive manufacturers;

•natural disasters, adverse weather events and other catastrophic events;

•our dependence on key personnel;

•our ability to rapidly hire and retain qualified personnel necessary to grow our business as anticipated;

•increases in labor costs;

•our reliance on third-party technology and information systems;

•our use of open-source software;

•claims asserting that our employees, consultants or advisors have wrongfully used or disclosed alleged trade secrets of their current or former employers;

•significant disruptions in service on our platform;

•impairment charges;

•changes in interest rates;

•volatility in the price of our common stock;

•issuances of our common stock and future sales of our common stock;

•our ability to establish and maintain effective internal control over financial reporting; and

•other economic, business and/or competitive factors, risks and uncertainties, including those described in “Item 1A. Risk Factors.”

We do not undertake, and expressly disclaim, any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. We caution you not to place undue reliance on the forward-looking statements, which speak only as of the date of this filing.

Part I

Item 1. Business

Overview

Shift is a leading end-to-end ecommerce platform transforming the used car industry with a technology-driven, hassle-free customer experience.

Shift’s mission is to make car purchase and ownership simple — to make buying or selling a used car fun, fair, and accessible to everyone. Shift provides comprehensive, technology-driven solutions throughout the car ownership lifecycle:

•finding the right car,

•having a test drive brought to you before buying the car,

•a seamless digitally-driven purchase transaction including financing and vehicle protection products,

•an efficient, fully-digital trade-in/sale transaction,

•and a vision to provide high-value support services during car ownership.

Each of these steps is powered by Shift’s software solutions, mobile transactions platform, and scalable logistics, combined with the Company’s centralized inspection, reconditioning and storage centers, called hubs.

Shift’s vision is to provide a comprehensive experience for car owners, driven by technology at every step of the consumer lifecycle. Our continued investments in our research and discovery functionality create a platform that draws customers to engage with the Shift website and provide a seamless search experience.

There are three ways to purchase a car from Shift:

•On-demand test drive: Shift conveniently brings the customer's desired car to the customer’s desired location for a no-obligation, contactless test drive, usually at their home or work. If the customer chooses to purchase the vehicle, a Shift concierge staff can process the transaction on-the-spot via a mobile app.

•Buy online: Customers can buy a car sight-unseen without a test drive and have it delivered to their home quickly with the same seven-day return policy as is offered on cars bought in person.

•Hub test drive: Customers may come to one of Shift’s hub locations to see and test drive multiple cars. When they arrive, customers can scan a QR code on each car to immediately view all relevant details, including ownership & service history, inspection reports, vehicle history reports, and most importantly, dynamic pricing and market price comparisons. This immediate access to all relevant information — without having to rely on a salesman — puts customers in control.

Launched in 20141, Shift operates nine vehicle inventory inspection, reconditioning and storage centers, with six spanning the West Coast from San Diego to Seattle and three new facilities in Austin, San Antonio and Dallas, Texas launched in 2021. The Company is also acquiring inventory in the Houston and Las Vegas markets. Once fully launched, each region is supported by one hub location that acts as the central point for inspection, reconditioning and vehicle storage that also enables customers to browse inventory onsite. By targeting urban, densely populated markets, Shift has used direct-to-consumer digital marketing and a responsive ecommerce sales approach to grow its market penetration. With hub locations in only four states, Shift has significant runway for continued geographic expansion.

Shift’s differentiated strategy offers a wide variety of vehicles across the entire spectrum of model, price, age, and mileage to provide the right car for buyers regardless of interest, need, budget, or credit. Shift offers a fully omni-channel fulfillment model, led by Shift’s patented system for managing on-demand test drives brought to customers at their preferred location, such as their home.

Regardless of the approach chosen by the customer, they will be supported by friendly Shift Concierge and Advisor team members. For all ecommerce buyers, Shift offers a full suite of options to consumers to finance and protect their vehicle through our mobile point-of-sale solution. Through our platform, we connect customers to various lending partners for a completely digital end-to-end process for financing and service products. A customer can also complete a short online prequalification form and immediately see a filtered view of cars that meet their budget based on the financing options for which they are likely to be able to qualify. Customers can also get approved for financing before they even test drive a car, making it much more likely that the customer will purchase a car from us.

Shift focuses on unit economics driven by direct vehicle acquisition channels, optimized inventory mix and ancillary product offerings, combined with streamlined inventory onboarding, controlled fulfillment costs, and centralized software. For the year ended December 31, 2021, Shift sourced 94% of its inventory from consumer-sellers and partners driving improved margins and customer acquisition cost. Our data-driven vehicle evaluations help ensure acquisition of the right inventory at the right price to reduce days to sale. We believe that a differentiated ability to purchase vehicles directly from consumer-sellers as compared to our competitors, who purchase a higher percentage through the wholesale market, provides Shift access to a deeper pool of scarce, highly desirable inventory.

___________________________________________

1Incorporated December 9, 2013 in the state of Delaware

Sellers are able to go to Shift.com, submit information on their car, and get a quote instantly. Shift uses a proprietary algorithm for pricing that utilizes current market information about market conditions, demand and supply, and car option data, among other factors. Using proprietary pricing and Shift-built mobile diagnostic tools, Shift provides an immediate quote for a customer’s trade-in vehicle, and will schedule an on-demand evaluation at the customer’s location by a member of Shift’s concierge staff. Shift provides selling customers with information on market rates and, when a customer is ready to sell their car, we can digitally initiate e-contracting and an ACH transfer and conveniently take the car on the seller’s behalf so the seller doesn’t even have to leave his or her home to sell their car.

Over time, we intend to expand our machine learning-enabled recommendation engine to better help customers find the cars best suited to them. Customer response to the Shift experience is extremely positive, resulting in a 70 Net Promoter Score (“NPS”) in 2020, an order of magnitude higher score than traditional auto retailers. These positive experiences are expected to allow Shift to serve customers over the entire lifecycle of vehicle ownership and retain customers for repeat sales and purchases. By continuing to invest in services that benefit the customer throughout the ownership phase of the lifecycle (for example, vehicle maintenance plans), we will continue to establish a long-term customer base that will return for future transactions.

Technology Platform

We provide a superior consumer experience that is powered by technology throughout. By using technology, we can enable a Shift Concierge with limited exposure to the used auto market to perform as well as or better than used auto professionals with decades of experience at traditional retailers while creating a better customer experience. Machine learning helps to optimize customer conversion by helping the customer find the right vehicle at the right price with the right financing and service options. With only basic information, we work to predict which cars will be most appealing and what financing options will be available for a customer. If a customer pre-qualifies for financing, conversion rates dramatically improve.

Approximately 97% of consumer auto purchases involve online research. These consumers have historically been forced to go offline to purchase a car because there are so few options for completing a car purchase online. Our technology allows a consumer to complete the car buying process that they begin by shopping online without having to set foot in a dealership. Our technology platform enables a fully mobile digital transaction experience:

•from at-home car searching

•to scheduling an on-demand test drive with the push of a button;

•to purchasing at home or at the preferred site of a test drive; and

•with the financing and services products expected from an industry-leading experience.

This provides a convenient, no-haggle, and streamlined transaction that customers enjoy and trust.

Likewise, the Shift technology platform for selling a car provides a seamless consumer experience. Customers go online, enter in information about their car, and get an instant online quote. The machine learning-driven acquisition engine predicts the price we will pay for the vehicle, the price at which we can resell the vehicle, the level of reconditioning required to determine impact on margin and operations, and the likelihood that consumers will purchase ancillary products in connection with the sale of the vehicle. Upon completion, a member of the Shift concierge staff comes to the customer’s house, conducts a transaction in person, including an electronic transfer of the funds paid to the seller of the car, and then takes away the vehicle.

Our operations are fully powered by technology throughout all stages of the selling and buying processes. A proprietary app empowers Shift concierges to conduct evaluations, accept payment, and execute transactions onsite and in real time electronically. The Shift app empowers mechanics by displaying a step-by-step guide for inspection and reconditioning, while tracking this data in a cloud database for real-time analytics and decision engine processing to provide optimized reconditioning standards.

Our technology suite is critical to our scalability as it allows us to accelerate employee development and decreases required training time, while providing a communication channel to interact with the customer and also providing a responsive and enjoyable customer experience. It is also the first mobile point of sale for the used car marketplace and it allows a customer to complete real-time applications for loan and service contracts, and as a result, receive the instant results needed to complete e-contracting and transfer payment.

Industry and Market Opportunity

The U.S. used automotive market is massive, fragmented, and ripe for disruption as consumers remain dissatisfied with the traditional purchase experience and overall consumer preferences increasingly are shifting to online transactions.

•Massive market: According to the Edmunds Used Vehicle Report 2019, in 2019 the U.S. used automotive market generated $841 billion in sales from over 40 million vehicle purchases.

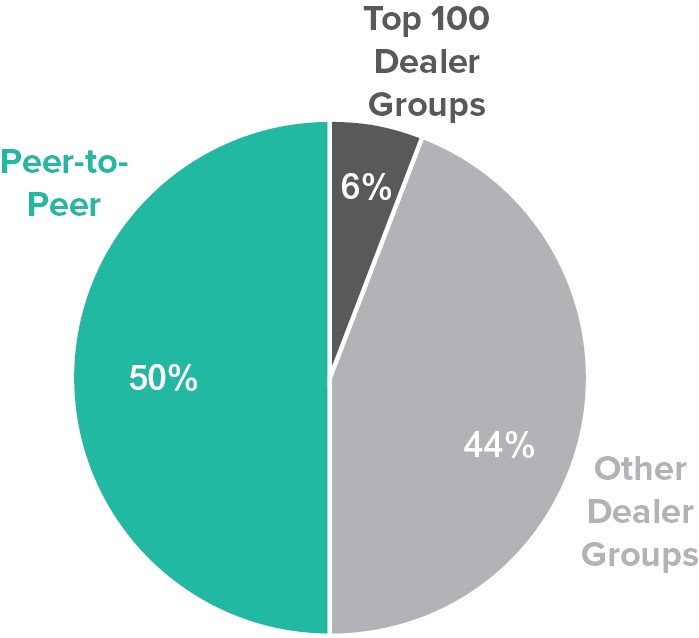

•Highly fragmented: Market share in the U.S. is extremely fragmented with the largest 100 dealer groups representing only 6% of used auto unit sales according to Automotive News. According to the Manheim 2018 Used Car Market Report & Outlook, the peer-to-peer market represents 50% of used auto sales.

U.S. Used Vehicle Unit Sales

•Ripe for disruption: The used car buying process suffers from poor overall consumer experience — highlighted by low NPS2 scores throughout the used auto retail industry — which is attributable to opaque pricing, high pressure sales tactics, inventory of questionable and widely varying quality, and a generally arduous and lengthy sales process. Additionally, brick-and-mortar retailers are plagued by elevated overhead costs and capital expenditures that must be passed on to the customer. The peer-to-peer market has even greater challenges for consumers including lack of transparency including the possibility of fraud, logistical challenges, limited or no ability to test drive or return vehicles, lack of financing or warranty options, and perception of dishonesty and aggressive tactics in the sales process.

_____________________________________________

2Customer Guru: Auto Retailer NPS of 9 calculated as average NPS of Rush Enterprises, Avis, Sonic Automotive, CarMax, Asbury Automotive Group, Penske Automotive Group, AutoNation and Group 1 Automotive.

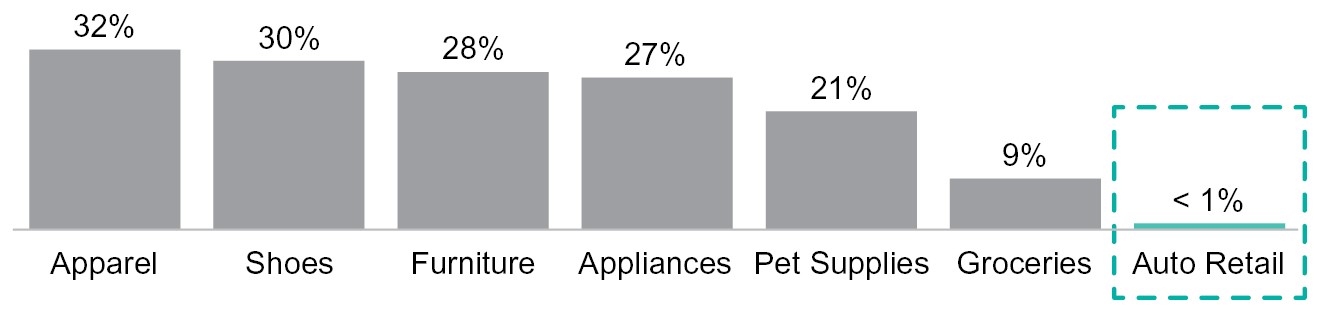

•Limited ecommerce penetration: The used automotive market remains among the least penetrated ecommerce markets in the U.S. with the three largest players (Shift, Carvana, and Vroom) capturing less than 1% of all sales in 2019 according to the 2019 Automotive Ecommerce Report from Digital Commerce 360. There is significant opportunity for increased penetration as that report noted 49% of consumers reported a willingness to purchase a vehicle online.

U.S. ecommerce Penetration % by Industry3

•COVID-19 pandemic: Although the ultimate impacts of COVID-19 remain uncertain and consumer demand for autos may be impacted in a recessionary environment, a recent survey published by Capgemini found that 46% of U.S. adults surveyed plan to use their cars more often and public transportation less often in the future. Additionally, the pandemic is accelerating trends of online shopping more broadly as consumers seek to avoid physical retail locations.

We are focused on the largest segment of the used car market, which comprises inventory between 3 and 10 years of age — a category that makes up approximately 84% of all used vehicle transactions based on a 2019 NIADA report. We believe this makes us well positioned to take market share from legacy auto retailers as its inventory is most heavily concentrated in the deepest pool of demand in the used auto market. In mid-2019, to address a perceived need in the lower price point market, we classified our inventory into two categories, Shift Value and Shift Certified. Shift Value inventory is made up of cars that are over 8 years old or have more than 80,000 miles. Shift Certified inventory consists of vehicles less than 8 years old with less than 80,000 miles. While all vehicles are subjected to the same 150+ point inspection and our high mechanical and safety standards, this segmentation allows us to focus sales and marketing strategies, as well as optimize cosmetic reconditioning costs, for cars with a lower overall purchase price. Consumers seeking Shift Value vehicles are generally less concerned with cosmetic deficiencies; therefore, we have focused our reconditioning on these vehicles to safety and longevity issues, passing on savings to customers while also increasing profitability. This strategy allows us to effectively sell selected older and higher-mileage inventory.

| | |

| Used Car Industry Sales by Age of Car |

__________________________________________

3Based on a 2018 survey by UBS Evidence Lab

Providing test drives is critical to optimizing customer conversion for Shift Value cars which customers typically prefer to test drive as compared to newer vehicles where it is less critical. In-house reconditioning provides better control of timing and greater efficiency, especially amongst Shift Value vehicles, and provides the ability to customize standards by distinct categories. Test drive-led omni-channel sales allow customers to experience the individual used car prior to purchase, which can be particularly important to customers for older used vehicles. Customer service is led by Shift Concierges that focus on providing an enjoyable experience as well as a centralized, inside Shift Advisor team powered by data to identify customer propensity to purchase and tailor the customer experience. Combined with unique customer-sourced inventory acquired through proprietary software, this creates a compelling business model that is designed to scale efficiently and difficult to replicate.

As the U.S. used automotive market follows other industries in moving consumer transactions online and away from traditional brick-and-mortar retail, mobile ecommerce represents an even higher growth opportunity than broader ecommerce. Consumer preferences increasingly demand the convenience of on-demand and at-home personalized experiences. These tailwinds present a compelling opportunity as we provide a test drive-led omni-channel platform and an end-to-end mobile-first ecommerce experience that leverages data to predict preferences and suggest our deeper inventory of scarce consumer sourced vehicles, with such tailored service to consumers facilitated by our knowledgeable team of concierges.

We have a highly efficient capital-light business model that provides service to a much broader geographic area as compared to traditional retailers. We have a repeatable playbook for expansion to new urban markets. We have demonstrated the effectiveness of our new market entry process, led by our technology suite, which replicates across markets and brings on staff rapidly through the simplicity and effectiveness of our software tools.

We continue to drive penetration in existing markets. Expanding share in existing markets represents a massive opportunity for growth in itself and, coupled with new market expansion, poises us for significant revenue expansion.

We source the most desirable cars by acquiring unique and scarce inventory directly from consumers and from third-party partners.

•Consumers: We source the majority of our cars directly from consumers utilizing proprietary software, which predicts real-time market-based demand and establishes a profitable market clearing price for vehicles.

•Third-Party: Acquiring cars from consumer facing partners and fleet operators provides additional scarce inventory to efficiently supplement growth while maintaining high-quality inventory.

Competition

The used vehicle market in the United States is highly fragmented, with over 42,000 dealers nationwide as well as a large number of transactions occurring in the peer-to-peer market. Competitors in the used vehicle market include:

•traditional new and used car dealerships;

•the peer-to-peer market, utilizing sites such as Facebook, Craigslist, OfferUp, eBay Motors and Nextdoor;

•used car ecommerce businesses or online platforms, mainly Carvana and Vroom; and

•sales by rental car companies directly to consumers of used vehicles which were previously utilized in rental fleets, such as Hertz Car Sales and Enterprise Car Sales.

Our primary competitors, traditional brick-and-mortar used auto dealers, are operating under an outdated business model, which relies on a lack of transparency, high pressure sales tactics, limited inventory, and scarce physical locations to which the customer must travel. These drawbacks in the traditional retail model have allowed ecommerce competitors to rapidly gain share of the used car dealer market in recent years. Additionally, we are well-positioned to gain share from the peer-to-peer market given our focus on acquiring inventory from consumers rather than auctions.

Our Competitive Strengths

•Purpose-built ecommerce platform: The Shift platform was built to be an end-to-end online auto solution for consumers who yearn for a differentiated, simple and efficient transaction. The streamlined nature of our business allows for scalability and efficiency in costs compared to our competitors in the auto retail industry, and technology creates a better overall experience for the consumer.

•Industry-leading technology: Our technology enhances the auto shopping experience while making the process fun and easy compared to the poorly rated experience of dealing with a brick-and-mortar dealer. Most customers begin their car search online and spend most of their car-shopping experience online. Therefore, we believe the best way to enhance the overall process is to provide a digitally driven omni-channel approach to not only begin, but seamlessly complete, the car-buying experience online.

•Unique customer-driven offerings: We are the only pure-play ecommerce used car platform that gives customers the option to test drive a vehicle before completing their purchase. By offering customers this ability either on-demand through the proprietary Shift app or via contactless test drive at one of our Hubs, we are able to cover more ground with fewer locations as compared to traditional competitors and offer a service that our ecommerce peers do not provide. Our test-drive strategy decreases our cost to penetrate a new market, while offering customers the benefit of driving before they buy.

•Broad Inventory Selection Including the Shift Value Segment and Test Drives: Our unique ecommerce-driven test-drive strategy allows us to offer inventory that includes a wide spectrum of ages and price, rather than focusing exclusively on newer and more expensive cars. Our vehicle acquisition technology also results in broader, more desirable inventory than would result from the traditional focus on the auction and OEM sourcing. We focus on vehicle models over five years old, with an average selling price of approximately $23,000. We also have a differentiated “Shift Value” segment of vehicles which are over eight years old or have more than 80,000 miles. This category of inventory is highly desirable to a large market segment, and counter-cyclical, with demand increasing in poor economic conditions. Our inventory is thus diverse enough and better positioned to weather a down economy and shifting consumer preferences. We believe to be successful in the value segment, it is critical to own the reconditioning process and offer consumers a test drive option during the purchase process.

Our Strategy

•Increase Market Penetration by Creating a Customer-Centered Purchase Experience: Shift was born from a dissatisfaction with the traditional used car-buying experience, which can feel time-consuming, stressful, and dishonest. Our goal is to turn what is generally regarded as a burdensome necessity into a delightful experience. We achieve this by offering customers no-haggle pricing, and a “partner not push” buying experience. Customers may arrange for test drives managed by a Shift Concierge, not a traditional used car salesman; unlike many traditional used car dealers, we don’t employ pushy salespeople. In addition to performing a 150+ point inspection on all of our vehicles, we offer customers a seven-day, 200 mile return policy. As a result, our Net Promoter Score in 2020 (a measure of customer satisfaction) of 70 is consistently higher than traditional auto retailers.

•Geographic Expansion: We operate nine centralized inspection, reconditioning and storage centers that service broad areas in our geographic footprint. Our technology and logistics network allow it to cover a broader area than traditional dealers, with an average radius of service from a Shift hub location of two hours' driving time for on-demand at home test drives, and an even wider radius for online purchases. We intend to continue to capitalize on the lower capital costs that this network makes available to expand to additional geographic areas, primarily targeting urban, densely populated markets

•Deliver Ownership Support Throughout the Entire Lifecycle and Capitalize on Ancillary Product Offering: We are building the capability to support the entire lifecycle of vehicle ownership, including service, maintenance and repair. We seek to become the single company consumers think of every time they want to do anything with a car — buy, sell, service or protect — to make car ownership simple.

•Leverage Scalable Proprietary Marketplace and Logistics Platform: Not only do we use our technology to buy, sell, and maintain the cars we sell through our own Hubs, but we have also built modular, scalable proprietary technology solutions for a logistics management and mobile transactions platform that can be leveraged by other car sellers including other dealers. Our vision is to evolve into a true platform marketplace that lists and fulfills third-party inventory, enabling traditional dealers to modernize through its platform and those who might otherwise build a traditional dealership channel to make use of the Shift platform instead. By becoming the online destination for consumers who want to buy or sell a car, we also plan to become the platform for dealers who want to transact with those consumers.

•Accelerate Growth Through Strategic M&A of Third-Party Inventory Sources & Development of Our Omni-Channel Platform: The market for used cars is highly fragmented. We intend to consider acquisitions that further our strategy of developing an omni-channel distribution platform, combining digital delivery and strategic retail presence.

Marketing

We believe our customer base is representative of the overall market for used cars as our vehicles cover the full spectrum of used car price points. Our sales and marketing efforts utilize a multi-channel approach, built on a seasonality-adjusted, market-based model budget. We direct marketing to both buyers and sellers, which is part of why we are able to acquire a majority of our inventory directly from customers. We believe our strong customer focus ensures customer loyalty which will drive both repeat purchases and referrals. In addition to our paid channels, we intend to attract new customers through enhancing our earned media and public relations efforts as well as via increased brand marketing spend.

•Buyer Marketing: We drive buyer traffic to the Shift platform with search engine optimization and paid digital advertising such as Google, Facebook, and third-party affiliate channels.

•Seller Marketing: Advertising to sellers through similar channels as buyers is part of what allows us to acquire a significant portion of inventory directly from customers, which we believe is a competitive advantage.

•Brand Marketing: In 2021, we began investing in Shift's brand awareness with a new marketing strategy and campaign. This brand marketing has allowed us to accelerate growth as consumers become increasingly aware of the Shift experience.

Service Providers

We utilize several third-party partners to finance purchases of our vehicles by customers who desire or need such financing. We also offer value-added products to our customers through third-party partners, including vehicle service contracts, GAP waiver protection and wheel and tire coverage. None of these third-party partners are individually significant to our operations.

Seasonality

We expect our quarterly results of operations, including our revenue, gross profit, profitability, if any, and cash flow to vary significantly in the future, based in part on, among other things, consumers’ car buying patterns. We have typically experienced higher revenue growth rates in the second and third quarters of the calendar year than in each of the first or fourth quarters of the calendar year. We believe these results are due to seasonal buying patterns driven in part by the timing of income tax refunds, which we believe are an important source of car buyer down payments on used vehicle purchases. We believe that continued investments in growth, including effective marketing and new market entry, will allow us to maintain sales growth through seasonality. However, we recognize that in the future our revenues may be affected by these seasonal trends (including any disruptions to normal seasonal trends arising from the COVID-19 pandemic), as well as cyclical trends affecting the overall economy, specifically the automotive retail industry.

Intellectual Property

The protection of our technology and other intellectual property is an important aspect of our business. We seek to protect our intellectual property through patent, trademark, trade secret and copyright law, as well as confidentiality agreements, other contractual commitments and security procedures. We generally enter into confidentiality agreements and invention assignment agreements with our employees and consultants to control access to, and clarify ownership of, our technology and other proprietary information.

We own one issued U.S. patent and have one pending U.S. patent application. We also have an application pending to register Shift™ as a trademark in the United States. We regularly review our technology development efforts and branding strategy to identify and assess the protection of new intellectual property.

Intellectual property laws, contractual commitments and security procedures provide only limited protection, and any of our intellectual property rights may be challenged, invalidated, circumvented, infringed or misappropriated. Further, intellectual property laws vary from country to country, and we have not sought patents or trademark registrations outside of the United States. Therefore, in other jurisdictions, we may be unable to protect certain of our proprietary technology, brands, or other intellectual property.

Government Regulation

Our business is and will continue to be subject to extensive U.S. federal, state and local laws and regulations. The advertising, sale, purchase, financing and transportation of used vehicles are regulated by every state in which we operate and by the U.S. federal government. We also are subject to state laws related to titling and registration and wholesale vehicle sales, and our sale of value-added products is subject to state licensing requirements, as well as federal and state consumer protection laws. These laws can vary significantly from state to state. In addition, we are subject to regulations and laws specifically governing the internet and ecommerce and the collection, storage and use of personal information and other customer data. We are also subject to federal and state consumer protection laws, including the Equal Credit Opportunities Act and prohibitions against unfair or deceptive acts or practices. The federal governmental agencies that regulate our business and have the authority to enforce such regulations and laws against us include the FTC, the U.S. Department of Transportation, the U.S. Occupational Health and Safety Administration, the U.S. Department of Justice and the U.S. Federal Communications Commission. For example, the FTC has jurisdiction to investigate and enforce our compliance with certain consumer protection laws and has brought enforcement actions against auto dealers relating to a broad range of practices, including the sale and financing of value-added or add-on products. Additionally, we are subject to regulation by individual state dealer licensing authorities, state consumer protection agencies and state financial regulatory agencies. We also are subject to audit by such state regulatory authorities.

State dealer licensing authorities regulate the purchase and sale of used vehicles by dealers within their respective states. The applicability of these regulatory and legal compliance obligations to our ecommerce business is dependent on evolving interpretations of these laws and regulations and how our operations are, or are not, subject to them. We are licensed as a dealer in California, Oregon, Texas and Washington and all of our vehicle transactions are conducted under our California, Oregon, Texas, and Washington licenses. We believe that our activities in other states are not currently subject to their vehicle dealer licensing laws, however if we determine that obtaining a license in another state is necessary, either due to expansion or otherwise, we may not be able to obtain such a license within the timeframe we expect or at all.

Some states regulate retail installment sales, including setting a maximum interest rate, caps on certain fees or maximum amounts financed. In addition, certain states require that retail installment sellers file a notice of intent or have a sales finance license or an installment sellers license in order to solicit or originate installment sales in that state. All of our installment sale transactions are currently conducted under our California, Oregon, Texas, or Washington dealer licenses. However, as we seek to expand to other states, we may be required to obtain additional licenses and our ability to do so cannot be assured.

In addition to these laws and regulations that apply specifically to the sale and financing of used vehicles, our facilities and business operations are subject to laws and regulations relating to environmental protection, occupational health and safety, and other broadly applicable business regulations. We also are subject to laws and regulations involving taxes, tariffs, privacy and data security, anti-spam, pricing, content protection, electronic contracts and communications, mobile communications, consumer protection, information-reporting requirements, unencumbered internet access to our platform, the design and operation of websites and internet neutrality. In connection with the closing of the merger, we are also now subject to laws and regulations affecting public companies, including securities laws and exchange listing rules.

For a discussion of the various risks we face from regulation and compliance matters, see “Item 1A. Risk Factors.”

Insurance

We maintain insurance policies to cover directors’ and officers’ liability, fiduciary, crime, property, workers’ compensation, automobile, cyber, general liability and umbrella insurance.

All of our insurance policies are with third-party carriers and syndicates with financial ratings of A or better. We and our global insurance broker regularly review our insurance policies and believe the premiums, deductibles, coverage limits and scope of coverage under such policies are reasonable and appropriate for our business.

Employees

During the year ended December 31, 2021, we had an average of approximately 1,037 employees. As of March 14, 2022 we had approximately 1360 employees. All of our employees are W-2 employees and none of our employees are represented by a labor union. We consider our relationships with our employees to be good and have not experienced any interruptions of operations due to labor disagreements.

Available Information

Our website is www.shift.com. The Company files annual, quarterly and current reports, proxy statements and other information with the SEC under the Exchange Act. The Company makes available, free of charge, on its website its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the SEC. The Company's reports filed with, or furnished to, the SEC are also available on the SEC's website at www.sec.gov.

In addition, we have posted on our website the charters for our (i) Audit Committee and (ii) Leadership Development, Compensation and Governance Committee, as well as our Code of Business Conduct and Ethics and Corporate Governance Guidelines. We will provide a copy of these documents without charge to stockholders upon written request to Investor Relations, Shift Technologies, Inc., 290 Division Street, Fourth Floor San Francisco, California 94103-4234. Our website and information included in or linked to our website are not part of this Form 10-K.

Item 1A. Risk Factors

Described below are certain risks to our business and the industry in which we operate. Our business, prospects, financial condition or operating results could be harmed by any of these risks, as well as other risks not currently known to us or that we currently consider immaterial. You should carefully consider the risks described below, together with the financial and other information contained in this Annual Report on Form 10-K and in our other public disclosures. The trading price of our securities could decline due to any of these risks, and, as a result, you may lose all or part of your investment. Before deciding whether to invest in our securities you should also refer to the other information contained in this annual report.

Summary of Risk Factors

The following is a summary of the key risks and uncertainties described below that we believe are material to us at this time:

•general business and economic conditions and risks related to the larger automotive ecosystem

•competition, and the ability of the Company to grow and manage growth profitably;

•our history of losses and ability to achieve or maintain profitability in the future;

•our ability to sustain our current rate of growth;

•our ability to establish our software as a platform to be used by automotive dealers;

•risks relating to our inspection and reconditioning hubs;

•impacts of COVID-19 and other pandemics;

•our reliance on third-party carriers for transportation:

•our current geographic concentration where we provide reconditioning services and store inventory;

•cyber-attacks or other privacy or data security incidents;

•the impact of copycat websites;

•failure to adequately protect our intellectual property, technology and confidential information;

•our reliance on third-party service providers to provide financing;

•the impact of federal and state laws related to financial services on our third-party service providers;

•risks that impact the quality of our customer experience, our reputation, or our brand;

•changes in the prices of new and used vehicles;

•our ability to correctly appraise and price vehicles;

•access to desirable vehicle inventory;

•our ability to expeditiously sell inventory;

•our ability to expand product offerings;

•risks that impact the affordability and availability of consumer credit;

•changes in applicable laws and regulations and our ability to comply with applicable laws and regulations;

•risks related to income taxes and examinations by tax authorities;

•access to additional debt and equity capital;

•potential dilution resulting from future sales or issuances of our equity securities;

•risks related to compliance with NASDAQ listing standards;

•risks related to compliance with the Telephone Consumer Protection Act;

•changes in government regulation of ecommerce;

•changes in technology and consumer acceptance of such changes;

•risks related to online payment methods;

•risks related to our marketing and branding efforts;

•our reliance on internet search engines, vehicle listing sites and social networking sites to help drive traffic to its website;

•any restrictions on the sending of emails or messages or an inability to timely deliver such communications;

•our reliance on Lithia Motors for certain support services;

•seasonal and other fluctuations in our quarterly results of operations;

•changes in the auto industry and conditions affecting automotive manufacturers;

•customers choosing not to shop online;

•natural disasters, adverse weather events and other catastrophic events;

•adequacy and availability of insurance coverage;

•our dependence on key personnel;

•increases in labor costs and compliance with labor laws;

•our reliance on third-party technology and information systems;

•our use of open-source software;

•claims asserting that our employees, consultants or advisors have wrongfully used or disclosed alleged trade secrets of their current or former employers;

•significant disruptions in service on our platform;

•impairment charges;

•our level of indebtedness, changes in interest rates, and reliance on our Flooring Line of Credit with Ally Bank;

•volatility in the price of our common stock;

•issuances of our common stock and future sales of our common stock;

•anti-takeover provisions in Delaware corporate law;

•risks related to our financial guidance and coverage by securities analysts; and

•our ability to establish and maintain effective internal control over financial reporting.

Risks Relating to Our Business

General business and economic conditions, and risks related to the larger automotive ecosystem, including consumer demand, could adversely affect the market for used cars, which could reduce our sales and profitability.

The market for used cars in the United States is affected by general business and economic conditions. The United States economy often experiences periods of instability, and this volatility may result in reduced demand for our vehicles and value-added products, reduced spending on vehicles, the inability of customers to obtain credit to finance purchases of vehicles, and decreased consumer confidence to make discretionary purchases. Consumer purchases of vehicles generally decline during recessionary periods and other periods in which disposable income is adversely affected.

Purchases of used vehicles are largely discretionary for consumers and have been, and may continue to be, affected by negative trends in the economy and other factors, including rising interest rates, the cost of energy and gasoline, the availability and cost of consumer credit, reductions in consumer confidence and fears of recession, stock market volatility, increased regulation and increased unemployment. Increased environmental regulation has made, and may in the future make, the used vehicles that we sell more expensive and less desirable for consumers.

In the event of a sustained revenue decline suffered by participants in the automotive markets, our competitors may attempt to increase their sales by reducing prices or increasing marketing expenditures, car manufacturers may increase incentives to stimulate new car sales, and rental car companies may seek to reduce the sizes of their rental car fleets by selling vehicles, each of which may depress used car values. Additionally, increases in unemployment rates may increase the number of loan and lease defaults, leading to repossessions, which are typically then re-sold by lenders in the wholesale market, which also may depress used car values. While lower used vehicle prices reduce our cost of acquiring new inventory, lower prices could lead to reductions in the value of inventory we currently hold, which could have a negative impact on gross profit. Moreover, any significant changes in retail prices due to scarcity or competition for used vehicles could impact our ability to source desirable inventory for our customers, which could have a material adverse effect on our results of operations and could result in fewer used-car sales and lower revenue. Furthermore, any significant increases in wholesale prices for used vehicles could have a negative impact on our results of operations by reducing wholesale margins.

In addition, changing trends in consumer tastes, negative business and economic conditions and market volatility may make it difficult for us to accurately forecast vehicle demand trends, which could cause us to increase our inventory carrying costs and could materially and adversely affect our business, financial condition and results of operations.

We participate in a highly competitive industry, and pressure from existing and new companies may adversely affect our business and results of operations.

As described in greater detail in “Description of Business,” our business is involved in the purchase and sale of used vehicles. Companies that provide listings, information, and lead generation, as well as car-buying and car-selling services designed to help potential customers and to enable dealers to reach these customers, produce significant competition to our business. Some of these companies include:

•traditional used vehicle dealerships, including those which may increase investment in their technology and infrastructure in order to compete directly with our digital business model;

•large, national car dealers, such as CarMax and AutoNation, which are expanding into online sales, including “omni-channel” offerings;

•used car dealers or marketplaces that currently have existing ecommerce businesses or online platforms, such as Carvana and Vroom;

•the peer-to-peer market, utilizing sites such as Facebook, Craigslist.com, eBay Motors and Nextdoor.com; and

•sales by rental car companies directly to consumers of used vehicles which were previously utilized in rental fleets, such as Hertz Car Sales and Enterprise Car Sales.

Internet and online automotive sites, such as Google, Amazon, AutoTrader.com, Edmunds.com, KBB.com, Autobytel.com, TrueCar.com, CarGurus, and Cars.com, could change their models to directly compete with us. In addition, automobile manufacturers such as General Motors, Ford, and Volkswagen could change their sales models to better compete with our model through technology and infrastructure investments. While such enterprises may change their business models and endeavor to compete with us, the purchase and sale of used vehicles through ecommerce presents unique challenges.

Our competitors also compete in the online market through companies that provide listings, information, lead generation and car buying services designed to reach customers and enable dealers to reach these customers and providers of offline, membership-based car buying services such as the Costco Auto Program. We also expect that new competitors will continue to enter the traditional and ecommerce automotive retail industry with competing brands, business models and products and services, which could have an adverse effect on our revenue, business and financial results. For example, traditional car dealers could transition their selling efforts to the internet, allowing them to sell vehicles across state lines and compete directly with our online offering and no-negotiating pricing model.

Our current and potential competitors may have significantly greater financial, technical, marketing and other resources than we have, and the ability to devote greater resources to the development, promotion and support of their businesses, platforms, and related products and services. Additionally, they may have more extensive automotive industry relationships, longer operating histories and greater name recognition than we have. As a result, these competitors may be able to respond more quickly to consumer needs with new technologies and to undertake more extensive marketing or promotional campaigns. If we are unable to compete with these companies, the demand for our used vehicles and value-added products could substantially decline.

In addition, if one or more of our competitors were to merge or partner with another of our competitors, the change in the competitive landscape could adversely affect our ability to compete effectively. We may not be able to compete successfully against current or future competitors, and competitive pressures may harm our business, financial condition and results of operations. Furthermore, if our competitors develop business models, products or services with similar or superior functionality to our platform, it may adversely affect our business. Additionally, our competitors could use their political influence and increase lobbying efforts to encourage new regulations or interpretations of existing regulations that would prevent us from operating in certain markets.

We have a history of losses and we may not achieve or maintain profitability in the future.

We have not been profitable since our inception in 2014 and had an accumulated deficit of approximately $440.7 million as of December 31, 2021. We incurred net losses of $166.3 million and $59.1 million for the years ended December 31, 2021 and December 31, 2020, respectively.

We expect to make significant marketing and capital investments to grow and innovate our business, and each initiative may not result in increased revenue or growth on a timely basis or at all. Such initiatives include increasing spending on marketing, both in our existing geographic markets and in new geographic markets, creating new logistics partnerships with dealers and vendors, investing in the expansion of our geographic footprint across the United States, including into new states where capital investment does not assure regulatory approval, attracting new customers, and further developing the technology used in our mobile application and organizational infrastructure. We may also continue to incur significant losses as we grow and innovate our business, if we are unable to grow without significantly increasing our expenses, to penetrate new and existing markets, and to attract new customers, among other challenges.

Our ability to become profitable in the future may also be impacted by outside forces, such as slowing demand for used cars, weakness in the automotive retail industry generally, deteriorating macroeconomic conditions impacting the United States and global economy, and increasing competition from new and existing services for the purchase and sale of used cars. We may also encounter unforeseen expenses, difficulties, complications, and delays that could adversely impact our ability to generate revenue and become profitable.

Our recent, rapid growth may not be indicative of our future growth and, if we continue to grow rapidly, we may not be able to manage our growth effectively.

Our revenue grew to $636.9 million for the year ended December 31, 2021 from $195.7 million for the year ended December 31, 2020. We expect that our rate of growth may decline in the future, even if our revenue continues to increase. If we do not successfully achieve the following, our business may grow at a slower pace or not at all:

•increase the number of unique visitors to our website, the number of qualified visitors to our website (i.e. those who have the intent and ability to transact), and the number of customers transacting on or through our platform;

•further enhance the quality of our vehicle offerings and value-added products, and introduce high quality new offerings and features on our platform;

•acquire sufficient high-quality inventory at an attractive cost to meet the increasing demand for our vehicles.