An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

PART II - OFFERING CIRCULAR

Dated October 20, 2021

PURSUANT TO REGULATION A

OF THE SECURITIES ACT OF 1933

Stratus Capital Corp.

8480 East Orchard Road, Suite 1100

Greenwood Village, Colorado 80111

(720) 214-5000

$15,000,000

1,500,000 Series B Preferred 10% Cumulative Dividend Convertible Stock

at $10.00 per Share

Minimum Investment: 2,500 Shares ($25,000)

FORM 1-A: TIER 2

(AMENDMENT NO. 6 )

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A For general information on investing, we encourage you to refer to www.investor.gov.

| Price to public | Commissions (1 ) (2) | Proceeds to Company (2) | |

| Per share | $ 10.00 | $0.60 | $ 9.40 |

| Total (3): | $15,000,000 | $600,000 | $14,400,000 |

The minimum investment amount is 2,500 shares or $25,000. The offering has been made and initially is expected to continue to be made directly to investors on a best-efforts basis. In the future, the shares may be offered through broker-

dealers who are registered with the Financial Industry Regulatory Authority (“FINRA”), or through other independent referral sources. This offering will terminate on October 20, 2022 , unless extended by us for up to an additional 90 days or terminated sooner by us in our discretion regardless of the amount of capital raised (the “Sales Termination Date”). There is no minimum capital required from this offering and therefore no subscription escrow account will be established for it. The proceeds of this offering may be deposited directly into the Company’s operating account for immediate use by it, with no obligation to refund subscriptions.

___________________________

| (1) | The shares are offered on a “best-efforts” basis by our officers, directors and employees; however, we may engage broker-dealers who are registered with the Financial Industry Regulatory Authority (“FINRA”). No commissions or other compensation will be paid to our officers, directors or employees. On February 23, 2021, we engaged CIM Securities, LLC (“CIM”) to assist us in the Offering by acting as our placement agent. As of August 25, 2021, the Company and CIM entered into a Placement Agent Fee Agreement which replaced the earlier engagement. Under such agreement CIM is to receive a 6% commission and a 2% non-accountable expense allowance with respect to the subscriptions we accept that were solicited by CIM. Upon conclusion of the Offering, we will issue to CIM (or its designees) warrants to purchase Series B Preferred shares at a price of $12 (120% of the offering price) as additional compensation for its services. The number of shares purchasable under such warrants will equal to 6% of the number of shares issued in the placement pursuant to the solicitation of CIM. The warrants will not become exercisable until 180 days after issuance and will expire four (4) years from date of commencement of the Offering. We may engage additional broker-dealers, who are registered with FINRA, or CIM may appoint as sub-agents other FINRA member firms to solicit subscriptions in the Offering. We will indemnify participating broker-dealers and other parties with respect to disclosures made in the Offering Circular. |

| (2) | The commissions will only be paid to FINRA member firms engaged by us or CIM and the Total commissions of $600,000 assumes that we accept $10,000,000 in subscriptions solicited by such FINRA member firms. The amounts shown are before deducting organization and offering costs to us, which include legal, accounting, printing, due diligence, marketing, consulting, referral fees, selling and other costs incurred in the offering of the shares. See “USE OF PROCEEDS” and “PLAN OF DISTRIBUTION.” |

| (3) | The shares are being offered pursuant to Regulation A of Section 3(b) of the Securities Act of 1933, as amended, for Tier 2 offerings. The shares are only issued to purchasers who satisfy the requirements set forth in Regulation A. We have the option in our sole discretion to accept less than the minimum investment from a limited number of subscribers. “TERMS OF THE OFFERING.” |

THIS OFFERING CIRCULAR IS NOT KNOWN TO CONTAIN AN UNTRUE STATEMENT OF A MATERIAL FACT, NOR TO OMIT MATERIAL FACTS WHICH IF OMITTED, WOULD MAKE THE STATEMENTS HEREIN MISLEADING. IT CONTAINS A FAIR SUMMARY OF THE MATERIAL TERMS OF DOCUMENTS PURPORTED TO BE SUMMARIZED HEREIN. ACCORDINGLY, REFERENCE SHOULD BE MADE TO THE CERTIFICATION OF RIGHTS, PREFERENCES AND PRIVILEGES AND OTHER DOCUMENTS REFERRED TO HEREIN, COPIES OF WHICH ARE ATTACHED HERETO OR WILL BE SUPPLIED UPON REQUEST, FOR THE EXACT TERMS OF SUCH AGREEMENTS AND DOCUMENTS.

_____________________________________

ii

THIS OFFERING CIRCULAR DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS CONCERNING THE COMPANY OTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR, AND IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON.

_____________________________________

PROSPECTIVE INVESTORS ARE NOT TO CONSTRUE THE CONTENTS OF THIS OFFERING CIRCULAR, OR OF ANY PRIOR OR SUBSEQUENT COMMUNICATIONS FROM THE COMPANY OR ANY OF ITS EMPLOYEES, AGENTS OR AFFILIATES, AS INVESTMENT, LEGAL, FINANCIAL OR TAX ADVICE. EACH INVESTOR SHOULD CONSULT HIS OR HER OWN COUNSEL, ACCOUNTANT AND OTHER PROFESSIONAL ADVISORS AS TO LEGAL, TAX AND OTHER RELATED MATTERS CONCERNING HIS OR HER INVESTMENT.

JURISDICTIONAL (NASAA) LEGENDS

FOR RESIDENTS OF ALL STATES: THE PRESENCE OF A LEGEND FOR ANY GIVEN STATE REFLECTS ONLY THAT A LEGEND MAY BE REQUIRED BY THAT STATE AND SHOULD NOT BE CONSTRUED TO MEAN AN OFFER OR SALE MAY BE MADE IN A PARTICULAR STATE. IF YOU ARE UNCERTAIN AS TO WHETHER OR NOT OFFERS OR SALES MAY BE LAWFULLY MADE IN ANY GIVEN STATE, YOU ARE HEREBY ADVISED TO CONTACT THE COMPANY. THE SECURITIES DESCRIBED IN THIS OFFERING CIRCULAR HAVE NOT BEEN REGISTERED UNDER ANY STATE SECURITIES LAWS (COMMONLY CALLED "BLUE SKY" LAWS).

iii

The purchase of shares of our Series B Preferred 10% Cumulative Dividend Convertible Stock involves substantial risks. Each prospective investor should carefully consider the following risk factors, in addition to any other risks associated with this investment and should consult with his own legal and financial advisors.

Cautionary Statements

The discussions and information in this Offering Circular may contain both historical and forward-looking statements. To the extent that the Offering Circular contains forward-looking statements regarding the financial condition, operating results, business prospects, or any other aspect of our business, please be advised that our actual financial condition, operating results, and business performance may differ materially from that projected or estimated by us in forward-looking statements. We have attempted to identify, in context, certain of the factors we currently believe may cause actual future experience and results to differ from our current expectations. The differences may be caused by a variety of factors, including but not limited to:

| · | Lack of market acceptance of our Company. |

| · | Inability to finance the Company due to a lack of private capital and cash flow. |

| · | Delays in obtaining critical components from suppliers. |

| · | Intense competition, including entry of new competitors. |

| · | Lack of demand real estate and land development company. |

| · | Adverse federal, state, and local government regulation. |

| · | Contraction of the market due to government policy or consumer preference. |

| · | Unexpected costs and operating deficits. |

| · | Lower sales and revenue than forecast. |

| · | Default on leases or other indebtedness. |

| · | Loss of suppliers and supply. |

| · | Price increases for capital, supplies and materials. |

| · | Inadequate capital and financing. |

| · | Failure to obtain customers, loss of customers and failure to obtain new customers. |

| · | The risk of litigation and administrative proceedings involving us or our employees. |

| · | Loss of or inability to obtain government licenses and permits. |

| · | Adverse publicity and news coverage. |

| · | Inability to carry out marketing and sales plans. |

| · | Loss of key executives. |

| · | Losses from theft that cannot be recovered. |

| · | Other specific risks that may be alluded to in this Offering Circular or in other reports issued by us or third-party publishers. |

| · | Our operating history makes it difficult to evaluate our future business prospects and to make decisions based on our historical performance. |

| · | We may not be successful in implementing important strategic initiatives, which may have a material adverse impact on our business and financial results. |

| · | Effectively managing our growth into new geographic areas will be challenging. |

| · | Key employees are essential to growing our business. |

| · | Insiders have substantial control over us, and they could delay or prevent a change in our corporate control even if our other stockholders wanted it to occur. |

| · | There may not be sufficient liquidity in the market for our securities in order for investors to sell their securities. |

| 1 |

The following summary is qualified in its entirety by the more detailed information and financial statements appearing elsewhere or incorporated by reference in this Offering Circular.

Stratus Capital Corp.

A maximum of $15,000,000

(1,500,000 shares of Series B Preferred 10% Cumulative Dividend Convertible Stock @ $10.00 per share)

OFFERING PERIOD: October 20, 2021 to October 20, 2022

| The Issuer ………………………... |

Stratus Capital Corp., a Delaware corporation, was incorporated in Delaware on April 13, 2018. Our principal executive offices are located at 8480 East Orchard Road, Suite 1100, Greenwood Village, Colorado 80111 and our telephone number is (720) 214-5000. We maintain a website at www.StratusCap.com, which website is not incorporated herein or a part of this filing.

|

| Business………………………… |

We intend to be engaged in the real estate and land development business in the United States. We intend to develop a portfolio of development opportunities in various stages along with opportunistic acquisitions and partnerships in our core-markets. See the “Business Overview” herein for more details.

|

| Securities Offered (the “Offering”)……………. |

A Maximum of 1,500,000 shares of Series B Preferred 10% Cumulative Dividend Convertible Stock @ $10.00 per share ($15,000,000). Dividends may be paid in cash or in registered common stock at the market price on the date of the dividend accrual. The Company shall pay a Project Participation Dividend to the Series B Preferred Stock record holders (pro rata to the holder’s ownership of the Series B Preferred Stock) in cash computed based upon 3% of the net sales of the real estate projects of the Company, computed annually by March 1 of the following year for the previous year, for so long as the Series B Preferred Stock is outstanding.

The subscribed shares will be “restricted securities” as defined in Rule 144 of the Securities and Exchange Commission.

The discussion in this Memorandum for the Offering pertains to the Series B Preferred Stock of the Company, and the Certificate Of Designations, Preferences and Rights of Series B Preferred Stock 10% Cumulative Annual Dividend is incorporated herein by this reference, and the terms of the Certificate shall take precedence over any discussions herein contained and shall govern in the event of any conflict with the terms discussed in this document. Investors are advised to review the terms of the Certificate in detail to understand the nature of the investment and its parameters.

|

| Offering Period ……………. |

The Offering will remain open from date hereof until October 20 , 2022 unless the Company’s Board of Directors authorizes ending this Offering.

|

| 2 |

| Registration and Trading Status……………………... |

Our common stock is currently quoted on the OTC Pink under the symbol “SRUS.”

The Company's common stock is registered with the Securities and Exchange Commission (“SEC”). www.sec.gov

The Series B Preferred Stock offered hereby is NOT registered under either Securities Act of 1933 or Section 12(g) under the Securities Exchange Act of 1934 and is NOT quoted or traded in any venue.

|

| Stratus Capital Corp. Background…………………… | Stratus Capital Corp., a Delaware corporation, was incorporated in Delaware on April 13, 2018, which was a result of a Delaware holding company reorganization from a predecessor corporation, Ashcroft Homes Corporation, formerly a Colorado corporation which was merged into a subsidiary and thereupon divested. |

Offering Size ……………. |

At Stratus’s sole discretion, this Offering can raise up to a maximum of $15,000,000. Stratus Capital Corp. reserves the right to discontinue the offering at any time it, in the sole discretion of management, and/or deem it has raised sufficient funds to implement their business plan (see Use of Proceeds). |

| Closings…………………… |

No minimum number of Series B shares need be sold in order for the Company to close on the sale of any of the Series B shares. The Company may close in multiple closings at the discretion of the Company, and proceeds will be immediately available to the Company.

|

| Use of Proceeds……………… |

The Company intends to use the proceeds of this Offering for those purposes shown on page 8 under “Use of Proceeds”, as well as support of general and administrative expenses and general working capital.

|

| Commissions……… |

The Company is using Placement Agents, licensed Broker-Dealers, and paying commissions on this Offering up to the amount of $1,500,000 (6% of the amount raised by such Placement Agent plus 2% non-accountable expenses).

|

| Placement Agent………………… |

CIM Securities, LLC

|

| Placement Agent Fees……… |

The shares are offered on a “best-efforts” basis by our officers, directors and employees; however, we may engage broker-dealers who are registered with the Financial Industry Regulatory Authority (“FINRA”). No commissions or other compensation will be paid to our officers, directors or employees. On February 23, 2021, we engaged CIM Securities, LLC (“CIM”) to assist us in the Offering by acting as our placement agent. As of August 25, 2021, the Company and CIM entered into a Placement Agent Fee Agreement which replaced the earlier engagement. Under such agreement CIM is to receive a 6% commission and a 2% non-accountable expense allowance with respect to the subscriptions we accept that were solicited by CIM.)

Upon conclusion of the Offering, we will and issue to CIM (or its designees) warrants to purchase its Series B Preferred shares at a price of $12 (120% of the offering price) as additional compensation for its services. The number of shares purchasable under such warrants will equal to 6% of the number of shares issued in the placement pursuant to the solicitation of CIM. The warrants will not become exercisable until 180 days after issuance and will expire four (4) years from date of commencement of the Offering. We may engage additional broker-dealers, who are registered with FINRA, or CIM may appoint as sub-agents other FINRA member firms to solicit subscriptions in the Offering. We will indemnify participating broker-dealers and other parties with respect to disclosures made in the Offering Circular. See “PLAN OF DISTRIBUTION.”

|

| 3 |

| Investor Suitability……………… | The Offering will be made to persons who are both non-accredited and accredited investors (defined under Rule 501(a) of Regulation D promulgated under the Securities Act).

|

|

Capitalization of the Company…………………… |

Common Stock -

As of October 20 , 2021, we had authorized 25,000,000 shares of Common Stock with a par value of $0.0001, of which 21,525,481 common shares are issued and outstanding. The Company intends to amend its Articles of Incorporation in the next 45 days to increase the authorized common shares to 500,000,000. Series A Preferred Stock -

In 2019, the Company previously authorized (10,000,000) Series A Super Majority Voting Preferred Stock. On December 20, 2020, the Company authorized an amendment to the Certificate of Designation whereby the authorized amount is one million (1,000,000) Series A Super Majority Voting Preferred Stock which has the following features: The shares of Series A Super Majority Voting Preferred Stock carry super majority voting rights such that they can vote the equivalent of 60% of common stock at all times. The shares of Series A Super Majority Voting Preferred Stock have no dividend rights or liquidation preferences over our common stock. Effective January 17, 2019, we issued 1,000,000 shares of Series A Super Majority Voting Preferred Stock, valued by an independent third-party valuation firm using a market approach at $85,500, to one of our directors and a former officer who was also our principal shareholder (Richard O. Dean), for cash consideration of $10,000 and services rendered of $75,500. On October 28, 2020, Mr. Richard Dean and his wife Reagan Dean entered into a Securities Purchase Agreement with Willamette Group Trust, of which Mr. Pedro Gonzalez is Trustee, and agreed to sell a majority of their shares. Subsequently, the Securities Purchase Agreement has been amended to reflect an effective date of January 10, 2021. As a result, Mr. Gonzalez (current CEO) currently has beneficial ownership of the 1,000,000 shares of Series A Super Majority Voting Preferred Stock. |

|

Series B Preferred Stock – On December 15, 2020, the Company designated five million (5,000,000) shares of Preferred Stock as Series B Convertible Preferred Stock. The Series B 10% Cumulative Dividend Convertible Preferred Stock has the following features:

(i) 10% Cumulative Annual Dividends payable on the purchase value in cash or common stock of the Company at the discretion of the Board and payment is also at the discretion of the Board, which may decide to cumulate to future years; (ii) Any time after 18 months from issuance an option to convert to common stock at the election of the holder @ 75% of the 10-day average market closing price (for previous 10 business days) divided into $10.00; (iii) Automatic conversion of the Series B Preferred Stock shall occur without consent of holders upon any national exchange listing approval and the registration effectiveness of common stock underlying the conversion rights. The automatic conversion to common from Series B Preferred shall be on a one for one basis, which shall be post-reverse split as may be necessary for any Exchange listing; (iv) Liquidation Rights - $10.00 per share plus any accrued unpaid dividends – subordinate to Series A Preferred Stock receiving full liquidation under the terms of such series.; (v) The Company shall pay a Project Participation Dividend to the Series B Preferred Stock record holders (pro rata to the holder’s ownership of the Series B Preferred Stock) in cash computed based upon 3% of the net sales of the real estate projects of the Company, computed annually by March 1 of the following year for the previous year, for so long as the Series B Preferred Stock is outstanding; and (vi) The Company has redemption rights for the three years following the Issuance Date to redeem all or part of the principal amount of the Series B Preferred Stock at between 110% and 130%.

Expanded details of material terms can be found on pages 40-46.

If all of the $15,000,000 in Series B Preferred Stock in this offering were subscribed for, the Company would have 1,500,000 Series B Preferred Stock issued.

Stock Option and Award Plan

Effective May 7, 2019, we adopted the 2019 Stratus Capital Corp. Stock Option and Award Incentive Plan (the "Plan"). The Plan provides for grants of nonqualified stock options and other stock awards, including warrants, to designated employees, officers, directors, advisors and independent contractors. A maximum of 4,000,000 shares of our common stock were reserved for options and other stock awards under the Plan.

|

| 4 |

| Voting Rights…………………. | Holders of Series B Preferred Stock shall vote as a single Class on any matter that would alter the rights and privileges of the Series B Preferred Stock and together with the Common Stock on an as-converted basis as computed on the date of the meeting notice (excluding the automatic conversion) on other matters. Our Chief Executive Officer, Mr. Gonzalez, through his ownership of the Series A Preferred Stock which guarantees no less than 60% ownership upon exercise, will continue to hold voting control of the Company after this Offering even assuming the maximum number of shares of this Offering are sold. |

| Anti-Dilution Provisions…… | None. |

| Automatic Conversion………… |

The Series B Shares shall automatically convert into shares of Common Stock upon the Company’s consummation of listing on a National Exchange on the basis discussed under “Capitalization.”

|

| Optional Conversion……….. |

The holder may convert at any time after 18 months from issuance to common stock based upon $10.00 divided by 75% of the 10-day average market closing price to result in number of common shares issued. As of the date of this Offering, given the closing market value for the previous 10 days, 75% of the average market value would be approximately $0.0248 and the issuable common shares upon conversion assuming of all Series B Preferred Shares were outstanding would be approximately 604,838,710 if the full offering were sold. This may have a significant dilutive effect on the existing common shareholders.

|

| Piggyback Registration…… |

Whenever the Company proposes to register any shares of its Common Stock under the Securities Act (other than a registration effected solely to implement an employee benefit plan or a transaction to which Rule 145 of the Securities Act is applicable, or a Registration Statement on Form S-4, S-8 or any successor form thereto or another form not available for registering the Registrable Securities for sale to the public or an S-1 or 1-A Offering Statement for current or new shareholders), whether for its own account or for the account of one or more stockholders of the Company and the form of Registration Statement or Offering Statement to be used may be used for any registration or offering of Registrable Securities (a “Piggyback Registration or Offering”), the Company shall include in such registration (or 1-A Offering Statement) all Registrable Securities. The Company may postpone or withdraw the filing or the effectiveness of a Piggyback Registration or Offering at any time in its sole discretion.

|

|

Optional Redemption…… |

The Company will have the right, at the Company’s option, to redeem all or any portion of the shares of Series B Preferred Stock, exercisable on not more than three (3) Trading Days (as defined herein) prior written notice to the Holders, in full payment as follows:

1. (130%) The period beginning on the date of the issuance of shares of Series B Preferred Stock (the “Issuance Date”) and ending on the date which is one year following the Issuance Date.

2. (120%) The period beginning on the date which is one year and one day following the Issuance Date and ending on the date which is two years following the Issuance Date.

3. (110%) The period beginning on the date which is two years and one day following the Issuance Date and ending on the date which is three years following the Issuance Date.

4. (100%) The period beginning on the date that is three years and one day from the Issuance Date and ending ten years following the Issuance Date.

|

| 5 |

| Dividends.…….….. |

Dividends to be paid to investors are at the discretion of the Company. The Company currently intends to retain all future earnings for the operation and expansion of its business and will not pay dividends on common stock. Any payment of cash dividends on Series B Preferred Stock will depend upon results of operations, earnings, capital requirements, financial condition, future prospects, contractual restrictions and other factors deemed relevant by the Board of Directors. Therefore, you should not expect to receive dividend income from shares of the Company’s Series B Preferred Stock.

|

| Financial Statements.…….….. | Condensed Unaudited Financial Statements for the three and six months ended June 30 , 2021 and 2020 are attached and begin on page F-1. The Audited Financial Statements of Stratus Capital Corp. for the years ended December 31, 2020 and 2019 are attached hereto and begin on page F-15 .

|

| Forward-Looking Statements… | The information associated with this Offering (and oral statements made from time to time by Stratus Capital Corp.’s representatives concerning information contained herein) contains so-called “forward-looking statements.” These statements can be identified by introductory words such as “expects,” “plans,” “will,” “estimates,” “forecasts,” “projects,” “shall,” “intends,” or words of similar meaning, and by the fact that they do not relate strictly to historical or current facts. Forward-looking statements frequently are used in discussing Stratus Capital Corp.’s planned growth strategy, operating and financial goals, regulatory submissions and approvals and development programs. Many factors may cause actual results to differ from Stratus Capital Corp.’s forward-looking statements, including inaccurate assumptions and a broad variety of risks and uncertainties, some of which are known and others of which are not. No forward-looking statement is a guarantee of future results or events, and one should avoid placing undue reliance on such statements. |

| 6 |

Investment Analysis

Management believes that we have strong economic prospects by virtue of the following dynamics of the industry and us:

- Management believes that the trends for growth in the real estate and land development industry are favorable and is expected to continue to be popular.

| 2. | Management believes that demand for its products and services will increase in the future. |

| 3. | We intend to offer and develop a portfolio of development opportunities in various stages along with opportunistic acquisitions and partnerships in our core-markets. |

There is no assurance that we will be profitable, or that the industry’s favorable dynamics will not be outweighed in the future by unanticipated losses, adverse regulatory developments and other risks. Investors should carefully consider the various risk factors before investing in the shares. Commerce in the real estate and development industry is extremely competitive, inherently speculative and highly regulated. See “RISK FACTORS.”

The Offering

| Series B Preferred 10% Cumulative Dividend Convertible Stock offered by us | 1,500,000 shares |

| Common Stock outstanding as of June 30 , 2021 | 21,525,481 shares |

| Common Stock to be outstanding after the offering (1) | 21,525,481 shares |

____________

| (1) | There are no common shares being sold in this offering. |

The maximum gross proceeds from the sale of the shares of our Series B Preferred 10% Cumulative Dividend Convertible Stock are $15,000,000. The proceeds from the total offering are expected to be approximately $15,000,000, including offering costs of approximately $75,000 for payment of offering costs including printing, mailing, legal and accounting costs, filing fees, (excluding potential selling commissions), and expense reimbursements that may be incurred. The estimate of the budget for offering costs is an estimate only and the actual offering costs may differ from those expected by management. The estimated use of the net proceeds of this offering is as follows, assuming 100%, 75%, 50% and 25% of this offering is subscribed, as illustrated in the following table for different levels of total capital from this offering:

Summarized Estimated Use of Net Proceeds

| 100 | % | 75 | % | 50 | % | 25 | % | |||||||||

| Real estate (1) | $ | 10,500,000 | $ | 7,875,000 | $ | 5,300,000 | $ | 2,625,000 | ||||||||

| Debt payoff | 300,000 | 225,000 | 150,000 | 125,000 | ||||||||||||

| Acquisitions of land | 1,200,000 | 875,000 | 600,000 | 200,000 | ||||||||||||

| General & Administrative | 600,000 | 500,000 | 350,000 | 250,000 | ||||||||||||

| Working capital | 825,000 | 600,000 | 300,000 | 150,000 | ||||||||||||

| Commissions and non-accountable expenses | 1,500,000 | 1,125,000 | 750,000 | 375,000 | ||||||||||||

| Placement costs | 75,000 | 50,000 | 50,000 | 25,000 | ||||||||||||

| Total Offering Proceeds | $ | 15,000,000 | $ | 11,250,000 | $ | 7,500,000 | $ | 3,750,000 |

| (1) | Acquisition costs and development for projects (including infrastructure). |

We may reallocate the estimated use of proceeds among the various categories or for other uses if management deems such a reallocation to be appropriate. We cannot assure that the capital budget will be sufficient to satisfy our operational needs, or that we will have sufficient capital to fund our business. See “BUSINESS” and “RISK FACTORS.”

| 7 |

GENERAL

The following is a summary of some of the information contained in this document. Unless the context requires otherwise, references in this document to “our Company,” “us,” “we,” “our,” “Stratus,” or the “Company” are to Stratus Capital Corp.

DESCRIPTION OF BUSINESS

Stratus Capital Corp., a Delaware corporation, was incorporated in Delaware on April 13, 2018, which was a result of a Delaware holding company reorganization from a predecessor corporation, Ashcroft Homes Corporation, formerly a Colorado corporation which was merged into a subsidiary and thereupon divested. Our principal executive offices are located at 8480 East Orchard Road, Suite 1100, Greenwood Village, Colorado 80111 and the telephone number is (720) 214-5000. We maintain a website at www.StratusCap.com, which website is not incorporated herein or a part of this filing.

Reports to Security Holders

We are subject to the reporting requirements of Section 12(g) of the Exchange Act, and as such, we intend to file all required disclosures.

You may read and copy any materials we file with the SEC in the SEC’s Public Reference Section, Room 1580, 100 F Street N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Section by calling the SEC at 1-800-SEC-0330. Additionally, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, which can be found at http://www.sec.gov.

Jumpstart Our Business Startups Act

We qualify as an “emerging growth company” as defined in Section 101 of the Jumpstart our Business Startups Act (“JOBS Act”) as we did not have more than $1,000,000,000 in annual gross revenue and did not have such amount as of December 31, 2019, our last fiscal year.

We may lose our status as an emerging growth company on the last day of our fiscal year during which (i) our annual gross revenue exceeds $1,000,000,000 or (ii) we issue more than $1,000,000,000 in non-convertible debt in a three-year period. We will lose our status as an emerging growth company if at any time we are deemed to be a large accelerated filer. We will lose our status as an emerging growth company on the last day of our fiscal year following the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement.

As an emerging growth company, we may take advantage of specified reduced reporting and other burdens that are otherwise applicable to generally reporting companies. These provisions include:

| - | A requirement to have only two years of audited financial statement and only two years of related Management Discussion and Analysis Disclosures: |

| - | Reduced disclosure about the emerging growth company’s executive compensation arrangements; and |

| - | No non-binding advisory votes on executive compensation or golden parachute arrangements. |

As an emerging growth company, we are exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002 and Section 14A(a) and (b) of the Securities Exchange Act of 1934. Such sections are provided below:

Section 404(b) of the Sarbanes-Oxley Act of 2002 requires a public company’s auditor to attest to, and report on, management’s assessment of its internal controls.

Sections 14A(a) and (b) of the Securities and Exchange Act, implemented by Section 951 of the Dodd-Frank Act, require companies to hold shareholder advisory votes on executive compensation and golden parachute compensation.

| 8 |

We have already taken advantage of these reduced reporting burdens in this Form 10-K, which are also available to us as a smaller reporting company as defined under Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

As long as we qualify as an emerging growth company, we will not be required to comply with the requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002 and Section 14A(a) and (b) of the Securities Exchange Act of 1934.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards. We are choosing to irrevocably opt in to the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the JOBS Act.

CURRENT BUSINESS

We intend to be engaged in the real estate and land development business in the United States. We intend to develop a portfolio of development opportunities in various stages along with opportunistic acquisitions and partnerships in our core-markets. We operate solely under Stratus Capital Corp. We have historical presence and management experience in the mid-west and south-east regions. We plan to organize our business into the following operating segments:

- Early Stage Land Development

- In-fill Development of Single-Family Attached and Multi-Family Product Commercial and Industrial

- Opportunistic Joint-Ventures, Partnerships, and Lending

Organizational Structure

| Stratus Capital Corporation | |||||||

| Organizational Structure | |||||||

| LAND DEVELOPMENT | COMMERCIAL, RESIDENTIAL & MIXED-USE DEVELOPMENT | JOINT-VENTURES, PARTNERSHIPS AND LENDING | |||||

| ENTITLEMENT | SINGLE & MULTI FAMILY PRODUCT | INFILL JOINT-VENTURES | |||||

| ASSET REPOSITIONING | SENIOR HOUSING | STRATEGIC PARTNERSHIPS | |||||

| DEVELOPMENT | CONSTRUCTION SERVICES | STRATEGIC LENDING | |||||

Current Projects

We may add or delete real estate projects or substitute projects in the event that the economics, timing or financing of one or more of the projects, proves to be infeasible under the circumstances. Management will have sole discretion in making those judgments.

Our procedure for contracting for projects:

The identified projects are sought and generated by Peter Gonzalez, our CEO, through his experience and network within in each market. He generally takes an option or purchase contract personally or through an entity he controls, for a period of time during which he performs due diligence on the market, zoning, potential costs, the market absorption projections, local subcontractors and any environmentally issues. If the Company is able to achieve funding sufficient to buy and build any project or projects, Mr. Gonzalez will assign the option or contract positions to the Company, in full, and at no additional consideration or markup so there is no additional cost to the Company. The Company, as it exists with its current funding, is unable to participate in any project until funding under this Offering has been achieved. At this time, there are no pending contracts or agreements in the Company due to the uncertainty of funding.

| 9 |

Accordingly, there are no contracts for real estate or development under which the Company is obligated in any way to participate or incur any costs, at this time. Mr. Gonzalez has committed, under our conflicts policy, to first offer all projects that meet the consideration criteria, to the Company on the terms that can be negotiated with the sellers and with no markups, and no additional consideration to Mr. Gonzalez.

Project Criteria:

The Company cannot predict or project any profits on any project as it has no history of development. Our project consideration criteria involve three primary elements:

1. Market projections during construction and product marketing period for the project locale.

2. Targeted yield of 24+% on cash cost-there is no assurance that this can be attained-it is a project qualification criteria.

3. Timely availability of financing for the project costs-equity, bank funding, or a combination, in many instances.

Of course, there are many other subordinate considerations such as zoning, utilities, product selection and design, environmental, marketing strategies, that are somewhat variable to individual projects, and cannot be uniformly predicted, or estimated.

We are seeking funding through a Regulation A offering currently filed with the SEC on Form 1-A through CIM Securities. The offering is not yet qualified under Regulation A.

Summary of current development projects under consideration:

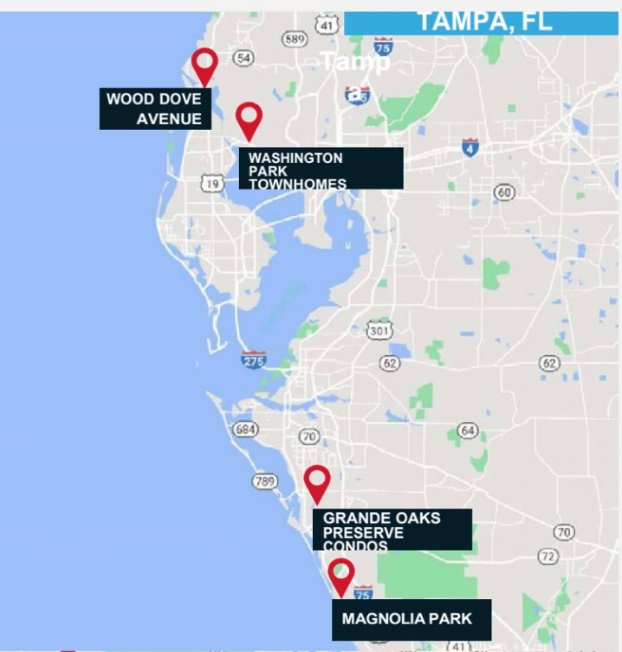

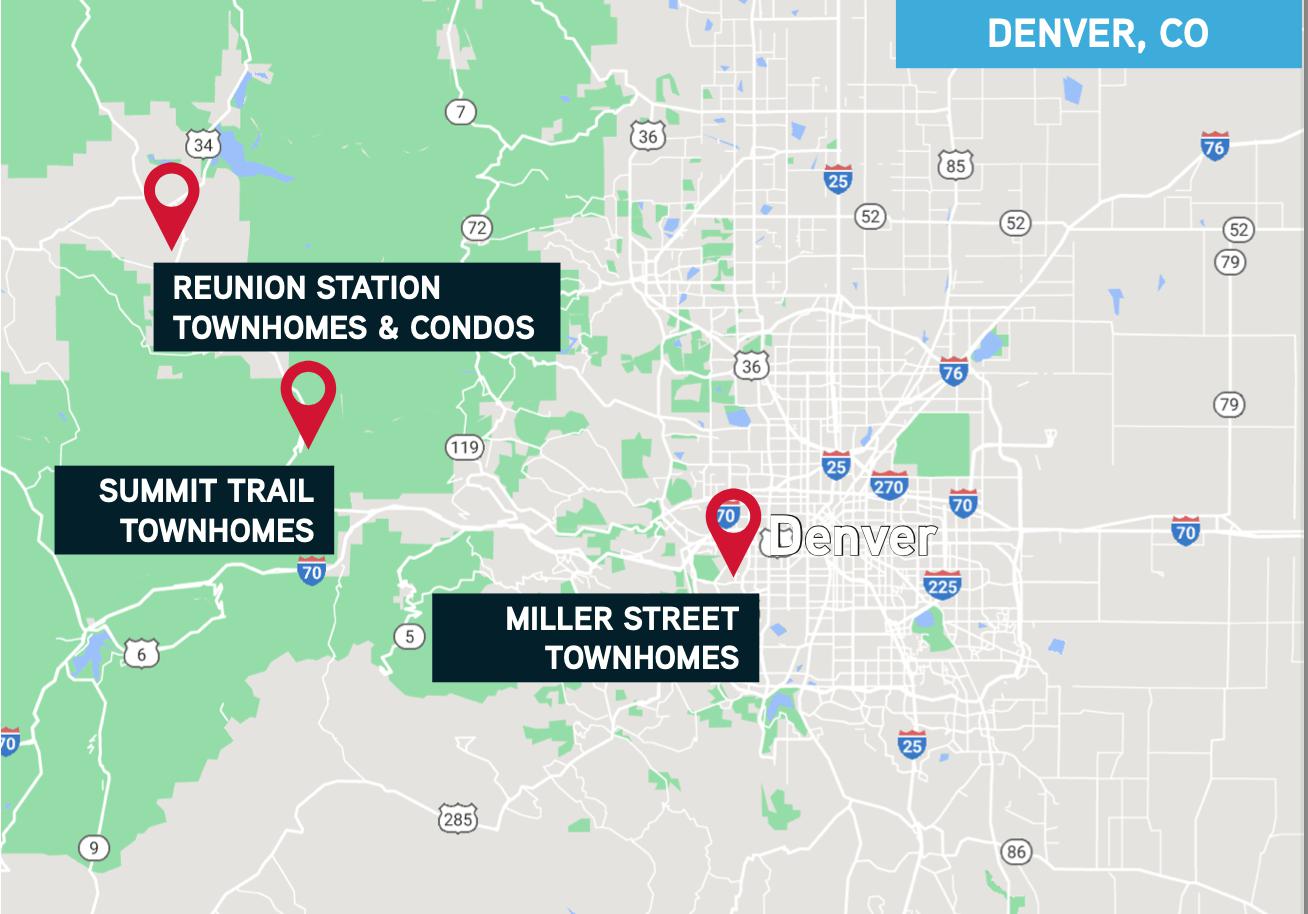

Washington Park Townhomes, Magnolia Park Condos, Grande Oaks Preserve Condos, Miller Street Station Townhomes and Summit Trail Townhomes. All projects are located in the Gulf Coast of Florida and Denver, CO markets which are experiencing continuing expansion in employment, residential and commercial development, population growth and resulting housing demand.

|

|

| 10 |

Washington Park Townhomes are under contract to our CEO, Mr. Gonzalez, but not closed. All other projects listed are closed by our Mr. Gonzalez but are not assigned to the Company until funding is available.

The proposed contract closing dates are:

( 1 ) Washington Park Townhomes – December 30, 2021 – Purchase Price $800,000 cash

( 2 ) Magnolia Park Condos – December 30, 2021 – Acquisition price $300,000 cash

( 3 ) Grand Oaks Preserve Condos – March 30, 2022 – Acquisition price $2,200,000 cash

( 4 ) Miller Street Station Townhomes – December 30, 2021 – Acquisition price $1,250,000 cash

( 5 ) Summit Trail Townhomes – December 30, 2021 – Acquisition price $1,260,000 cash

All projects are for a cash purchase price which includes the costs of the land and any planning engineering architectural or development expenditures to the date of closing. All other projects are owned by Mr. Gonzalez and have no required closing date.

PROJECT # 1 (WASHINGTON PARK TOWNHOMES)

Washington Park is located in Oldsmar, Florida, a 2-acre lot located within residential development in between downtown Oldsmar and the Veterans Park and Mobbly Bay at 412 Washington Avenue, Oldsmar FL 34677.

This project is a total of 13 townhomes. The site plan is approved and construction documents are in planning stages. The townhome product will be a modified version existing plans within the partially completed community. Subject to financing, construction can begin in the 3rd quarter of 2021 with an estimated 24-month project delivery and sales timeline.

Project costs are $800,000 for land and estimated $3,700,000 for construction and soft costs. Our target sales price for the units range from $225-$245psf.

| 11 |

PROJECT # 2 (MAGNOLIA PARK CONDOS)

Magnolia Park is located in Venice, Florida, a fully developed lot located within the existing development of Magnolia Park Condominiums West of downtown Venice at 300 Gardens Edge Drive, Venice, FL 34285.

This project is a 12 unit condo building and the last of 3 buildings we are completing within the development. The site plan is approved and construction documents are in planning stages. Subject to financing, construction can begin in the 4th quarter of 2021 with an estimated 12-month project delivery and sales timeline.

Project costs are $300,000 for land and estimated $2,600,000 for construction and soft costs. Our target sales price for the units range from $220-$240psf.

PROJECT # 3 (GRANDE OAKS PRESERVE CONDOS)

Grande Oaks Preserve is located in Sarasota, Florida, a 2-acre multi-family site in the University Town Center area of Sarasota, an active development and commercial submarket area East of downtown Sarasota and West of I-75 located at 5130 Desoto Road, Sarasota, FL 34235.

This project is a total of 48 condos built within two 24-unit buildings within the existing development of Grande Oaks Preserve, a 20-acre low-density site with excellent access to UTC, Downtown Sarasota, Siesta Key and I-75. Site plan approval is in process after which construction documents will be finalized for building permit approval of two identical buildings. Subject to financing construction can begin in the 4th quarter of 2021 with an estimated 12-month project delivery with disposition from deliver date and continuing for 9 months thereafter.

Project costs are $2,200,000 for land and estimated $8,400,000 for construction and soft costs. Our target sales price for the units range from $230-$240psf.

Management believes that the project will be sold with a combination of pre-construction, product delivery and final sales continuing for 9 months thereafter.

| 12 |

PROJECT # 4 (MILLER STREET STATION TOWNHOMES)

Miller Street Station Townhomes is located in Lakewood Colorado, a 1-acre lot located on West Colfax Avenue within the Oak Street Station light rail TOD overlay and designated Opportunity Zone redevelopment area West Colfax Avenue located at 1445 Miller Street, Lakewood CO 80215.

This project is a total of 18 townhomes built within two 9-unit buildings. The site plan is approved and construction documents are being finalized for building permit approval. Subject to financing, construction can begin in the 3rd quarter of 2021 with an estimated 12-month project delivery with disposition from deliver date and continuing for 6 months thereafter.

Project costs are $1,250,000 for land and estimated $5,300,000 for construction and soft costs. Our target sales price for the units range from $300-$325psf. Management believes that the project will be sold with a combination of pre-construction, product delivery and final sales continuing for 6 months thereafter.

PROJECT # 5 (SUMMIT TRAIL TOWNHOMES)

|

|

Summit Trail is located in Fraser, Colorado.

This project is a total of 22 townhome condos built within the existing development of Summit Trail Lodge a low-density site in Fraser Colorado. Site planning and construction documents are in process for initial lot start in 4Q 2021. Subject to financing, construction can begin in the 4th quarter of 2021 with an estimated 24-month project delivery with disposition from deliver date and continuing for 6 months thereafter.

Project costs are $1,260,000 for land and estimated $9,000,000 for construction and soft costs. Our target sales price for the units range from $380-425psf.

| 13 |

Business Strategy

Our long-term strategy:

• Pursuing opportunities within our core markets;

• Developing high-quality relationships with our asset partners;

• Maintaining a cost-efficient culture; and

• Appropriately balancing risk and opportunity.

We are committed to improving the communities we work within and enhancing the lifestyle of our neighborhoods. Delivering on this involves thoughtful planning to accommodate the needs of our various customers, homeowners and the surrounding community. We engage unaffiliated civil and architectural firms to develop and augment existing plans in order to ensure that our developments reflect current market updates to complement our surrounding communities.

We intend to acquire our assets in core locations where we can target maximizing long-term shareholder value and operate our business to capitalize on market appreciation and mitigate risks from economic downturns as we recognize the cyclical nature of the national real estate market. We intend to regularly assess our capital allocation strategy to drive shareholder return. We also take advantage of joint venture opportunities, partnerships and lending opportunities as they arise in order to secure asset allocations to share risk and maximize returns.

We intend to execute this strategy by:

• Increasing our existing land supply through expanding market presence;

• Combining land acquisition and development expertise with development operations;

• Maintaining an efficient capital structure;

• Selectively investing in joint-ventures, partnerships and lending opportunities; and

• Employing and retaining a highly experienced management team with a strong operating track record.

Land and Development Strategies

Community development includes the acquisition and development of communities, which may include obtaining significant planning and entitlement approvals and completing construction of off-site and on-site utilities and infrastructure. We intend to generally operate as small community developers, but in some communities, we operate solely as merchant builders, in which case, we acquire fully planned and entitled lots and may construct on-site improvements or in-fill opportunities.

In order to maximize our expected risk-adjusted return, the allocation of capital for land investment is performed in the discretion of our management (2 persons) at the corporate level with a disciplined approach to overall portfolio management. Macro and micro indices, including but not limited to employment, housing starts, new home sales, re-sales and foreclosures, along with market related shifts in competition, land availability and consumer preferences, are carefully analyzed to determine our land and homebuilding strategy. Our long-term plan is compared on an ongoing basis to current conditions in the marketplace as they evolve and is adjusted to the extent necessary.

Community Integration

We intend to complement each community or neighborhood and governing municipality we interact with, beginning with an overall community master plan and then determining the specific asset opportunity to maximize returns for our shareholders and the stakeholders of the area. After necessary governmental and other approvals have been obtained, we intend to improve the assets as planned.

| 14 |

The life cycle of an asset generally ranges from two to five years, commencing with the acquisition or investment in the asset and continuing through the development phase, concluding with the sale, construction or delivery of product types. The actual life cycle will vary based on the asset type, the development cycle and the general market conditions.

Sources and Availability of Raw Materials

When we commence our business plan of development, based on local market practices, we either directly, or indirectly through our subcontractors, intend to purchase drywall, cement, steel, lumber, insulation and the other building materials necessary to construct the various residential product asset classes we develop. While these materials are generally widely available from a variety of sources, from time to time we may experience material shortages on a localized basis which can substantially increase the price for such materials and our construction process can be slowed. We have multiple sources for the materials we intend to purchase, which will decrease the likelihood that we would experience significant delays due to unavailability of necessary materials.

Trades and Labor

Our construction, land and purchasing teams will coordinate subcontracting services and supervise all aspects of construction work and quality control. We intend to act as a general contractor for residential projects.

Subcontractors perform construction and land development scopes of work, generally under fixed-price contracts. The availability of labor, specifically as it relates to qualified tradespeople, at reasonable prices can be challenging in some markets as the supply chain responds to uneven industry growth and other economic factors that affect the number of people in the workforce.

Procurement and Construction

We plan to have a comprehensive procurement program that leverages our size and regional presence to achieve efficiencies and cost savings. Our procurement objective is to maximize cost and process efficiencies to ensure consistent utilization of established contractual arrangements.

Sales and Marketing

Our marketing program will be built out utilizing a balanced approach of corporate support and local expertise to attract potential lot buyers or homebuyers in a focused, efficient and cost-effective manner. Our sales and marketing teams will provide a generalized marketing framework across our regional operations. We hope to maintain product and price level differentiation through market and customer research to meet the need of our homebuilders and homebuyers.

The central element of our marketing platform is our web presence at www.StratusCap.com. The main purpose of this website is to connect with potential customers.

Competition

The land development and homebuilding business is highly competitive and fragmented. We compete with numerous national and local competitors of varying sizes, most of which have greater sales and financial resources than us. We compete primarily on the basis of location, lot availability, product design, quality, service, price and reputation.

In order to maximize our sales volumes, profitability and product strategy, we strive to understand our competition and their pricing, product and sales volume strategies and results. Competition among residential land developers and homebuilders of all sizes is based on a number of interrelated factors, including location, lot sizes, reputation, amenities, floor plans, design, quality and price.

Seasonality

We expect to experience variability in our results on a quarterly basis therefore our results may fluctuate significantly on a quarterly basis, and we must maintain sufficient liquidity to meet short-term operating requirements. Factors expected to contribute to these fluctuations include, but are not limited to:

• the timing of the introduction and start of construction of new projects;

| 15 |

• the timing of sales;

• the timing of closings of homes, lots and parcels;

• the timing of receipt of regulatory approvals for development and construction;

• the condition of the real estate market and general economic conditions in the areas in which we operate;

• Joint-venture, partnerships and loan and investment opportunities;

• construction timetables;

• the cost and availability of materials and labor; and

• weather conditions in the markets in which we develop and build.

Regulation, Environmental, Health and Safety Matters

Regulatory

We are subject to various local, state and federal statutes, ordinances, rules and regulations concerning zoning, building design, construction and similar matters, including local regulations that impose restrictive zoning and density requirements in order to limit the number of homes that can eventually be built within the boundaries of a particular property or locality. In a number of our markets, there has been an increase in state and local legislation requiring the dedication of land as open space. In addition, we are subject to various licensing, registration and filing requirements in connection with the construction, advertisement and sale of homes in our communities. The impact of these laws has been to increase our overall costs and may delay the opening of communities or cause us to conclude that development of particular communities would not be economically feasible, even if any or all necessary governmental approvals are obtained. We also may be subject to periodic delays or may be precluded entirely from developing communities due to building moratoriums in one or more of the areas in which we operate, including development of building lots for clients. Generally, such moratoriums relate to insufficient water, power, drainage or sewage facilities or inadequate road capacity.

In order to secure certain approvals in some areas, we may be required to provide affordable housing at below market sales prices of residential product or price certain percentage of building lots to meet these requirements. In addition, local and state governments have broad discretion regarding the imposition of development fees for projects under their jurisdictions, as well as requiring concessions or that the developer or builder construct certain improvements to public places such as parks and streets or fund schools. The impact of these requirements on us depends on how the various state and local governments in the areas in which we engage, or intend to engage, in development implement their programs. To date, these restrictions have not had a material impact on us.

We are subject to various state and federal statutes, rules and regulations, including those that relate to licensing, lending operations and other areas of mortgage origination and financing. The impact of those statutes, rules and regulations can increase our homebuyers’ cost of financing, increase our cost of doing business, as well as restrict our homebuyers’ access to some types of loans. Certain requirements provided for by the Dodd-Frank Wall Street Reform and Consumer Protection Act ("Dodd-Frank Act") have not yet been finalized or fully implemented. The effect of such provisions on our financial services business will depend on the rules that are ultimately enacted. The title and settlement services provided by Inspired Title are subject to various regulations, including regulation by state banking and insurance regulators.

In order for our homebuyers to finance their home purchases with FHA-insured, Veterans Administration-guaranteed or U.S. Department of Agriculture-guaranteed mortgages, we are required to build such homes in accordance with the regulatory requirements of those agencies.

Some states have statutory disclosure requirements or other pre-approval requirements or limitations governing the marketing and sale of new homes. These requirements vary widely from state to state.

Some states require us to be registered as a licensed contractor, a licensed real estate broker and in some markets our sales agents are additionally required to be registered as licensed real estate agents.

| 16 |

Environmental

We also are subject to a variety of local, state and federal statutes, ordinances, rules and regulations concerning protection of public health and the environment (collectively, “environmental laws”). For example, environmental laws may affect: how we manage storm water runoff, wastewater discharges, and dust; how we develop or operate on properties on or affecting resources such as wetlands, endangered species, cultural resources, or areas subject to preservation laws; and how we address contamination. The particular environmental laws that apply to any given community vary greatly according to the location and environmental condition of the site and the present and former uses of the site. Complying with these environmental laws may result in delays, may cause us to incur substantial compliance and other costs, and/or may prohibit or severely restrict development in certain environmentally sensitive regions or areas. Noncompliance with environmental laws could result in fines and penalties, obligations to remediate, permit revocation, and other sanctions; and contamination or other environmental conditions at or in the vicinity of our developments could result in claims against us for personal injury, property damage, or other losses.

As part of the land acquisition due diligence process, we intend to utilize environmental assessments to identify environmental conditions that may exist on potential acquisition properties.

We intend to manage compliance with environmental laws at the division level with assistance from the local consultants.

Health and Safety

We are committed to maintaining high standards in health and safety at all of our sites. Key areas of focus are on site conditions meeting exacting health and safety standards, and on subcontractor performance throughout our operating areas meeting or exceeding expectations.

Intellectual Property

We own certain logos and trademarks that are important to our overall branding and sales strategy. Our consumer logos are designed to draw on our recognized homebuilding heritage while emphasizing a customer-centric focus.

Employees, Subcontractors and Consultants

As of October 20 , 2021, we employ no persons except our officers serve on a part-time basis. Of these, all are engaged in land development, administration and construction operations, senior management facilitate joint-ventures, partnerships or loan investments. As of this date we were not subject to collective bargaining agreements. We consider our employee relations to be good.

We will act as a general contractor at times, or as project manager engaging local general contractors with all construction operations. We will use independent consultants and contractors for land planning, civil engineering, architectural, advertising and legal services.

Revenue

We did not record any revenue during the year ended December 31, 2020 or from January 1, 2021 through the date of this filing.

Investment Company Act 1940

Although we will be subject to regulation under the Securities Act of 1933, as amended, and the 1934 Act, we believe we will not be subject to regulation under the Investment Company Act of 1940 (the “1940 Act”) insofar as we will not be engaged in the business of investing or trading in securities. In the event we engage in business combinations that result in us holding passive investment interests in a number of entities, we could be subject to regulation under the 1940 Act. In such event, we would be required to register as an investment company and incur significant registration and compliance costs. We have obtained no formal determination from the SEC as to our status under the 1940 Act and, consequently, any violation of the 1940 Act would subject us to material adverse consequences. We believe that, currently, we are exempt under Regulation 3a-2 of the 1940 Act.

| 17 |

Factors Effecting Future Performance

The factors affecting our future performance are listed and explained below under the section “Risk Factors” below.

Description of Properties/Assets

Real Estate - None

Oil and Gas Properties - None

Patents - None

Trademarks – None

Plan of Operations

Our plan of operations is to raise debt and/or equity to meet our ongoing operating expenses with opportunities for growth in return for shares of our common stock to create value for our shareholders. There can be no assurance that we will successfully complete this series of transactions. In particular, there is no assurance that any stockholder will realize any return on their shares after such a transaction. Any merger or acquisition completed by us can be expected to have a significant dilutive effect on the percentage of shares held by our current stockholders.

Our intended general and administrative budget for the next twelve months is as follows:

| Q4 | Q1 | Q2 | Q3 | Total | ||||||||||||||||

| 2021 | 2022 | 2022 | 2022 | |||||||||||||||||

| Accounting | $ | 8,500 | $ | 4,500 | $ | 4,500 | $ | 4,500 | $ | 22,000 | ||||||||||

| Legal | 8,500 | 2,250 | 8,500 | 2,250 | 21,500 | |||||||||||||||

| Other fees | 3,498 | 3,498 | 3,498 | 3,498 | 13,992 | |||||||||||||||

| Insurance | 6,000 | 6,000 | 6,000 | 6,000 | 24,000 | |||||||||||||||

| Travel | 4,500 | 4,500 | 4,500 | 4,500 | 18,000 | |||||||||||||||

| Office expenses | 3,600 | 3,600 | 3,600 | 3,600 | 14,400 | |||||||||||||||

| Miscellaneous | 450 | 450 | 450 | 450 | 1,800 | |||||||||||||||

| Salaries | 0 | 19,500 | 34,500 | 57,000 | 111,000 | |||||||||||||||

| Equity Compensation | 5,096 | 5,096 | 5,096 | 5,096 | 20,384 | |||||||||||||||

| Total operating costs | $ | 40,144 | $ | 49,394 | $ | 70,644 | $ | 86,894 | $ | 247,076 | ||||||||||

At this time, we have minimal cash on hand and no committed resources of debt or equity to fund these losses and will rely, potentially, on advances from our principal shareholder or our directors and officers. There can be no guarantee that we will be able to obtain sufficient funding from these sources.

The Company may change any or all of the budget categories in the execution of its business model. None of the line items are to be considered fixed or unchangeable. The Company will need substantial additional capital to support its budget. We have not recognized revenues from our planned operational activities.

We have minimal current cash reserves as of this date. Our CEO, Pedro Gonzalez, intends to advance capital as loans as necessary to maintain the Company operations. We intend to offer a private placement of shares to investors in order to achieve at least $100,000 in funding in the next year. We intend to commence this offering in early July of 2021. If we are unable to generate enough revenue, to cover our operational costs, we will need to seek additional sources of funds. Currently, we have no committed source for any funds as of the date hereof. No representation is made that any funds will be available when needed. In the event funds cannot be raised if and when needed, we may not be able to carry out our business plan and could fail in business as a result of these uncertainties.

The independent registered public accounting firm’s report on our financial statements as of December 31, 2020, includes a “going concern” explanatory paragraph that expresses substantial doubt about our ability to continue as a going concern.

| 18 |

Reports to Securities Holders

We provide an annual report that includes audited financial information to our shareholders. We will make our financial information equally available to any interested parties or investors through compliance with the disclosure rules for a small business issuer under the Securities Exchange Act of 1934. We are subject to disclosure filing requirements including filing Form 10K annually and Form 10Q quarterly. In addition, we will file Form 8K and other proxy and information statements from time to time as required. We do not intend to voluntarily file the above reports in the event that our obligation to file such reports is suspended under the Exchange Act. The public may read and copy any materials that we file with the Securities and Exchange Commission, (“SEC”), at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

The purchase of shares of our Series B Preferred 10% Cumulative Dividend Convertible Stock involves substantial risks. Each prospective investor should carefully consider the following risk factors, in addition to any other risks associated with this investment and should consult with his own legal and financial advisors.

Cautionary Statements

The discussions and information in this Offering Circular may contain both historical and forward-looking statements. To the extent that the Offering Circular contains forward-looking statements regarding the financial condition, operating results, business prospects, or any other aspect of our business, please be advised that our actual financial condition, operating results, and business performance may differ materially from that projected or estimated by us in forward-looking statements. We have attempted to identify, in context, certain of the factors we currently believe may cause actual future experience and results to differ from our current expectations. The differences may be caused by a variety of factors, including but not limited to adverse economic conditions, lack of market acceptance, unrecoverable losses from theft, intense competition for customers, supplies, and government grants, including entry of new competitors, adverse federal, state, and local government regulation, unexpected costs and operating deficits, lower sales and revenues than forecast, default on leases or other indebtedness, loss of suppliers, loss of supply, loss of distribution and service contracts, price increases for capital, supplies and materials, inadequate capital, inability to raise capital or financing, failure to obtain customers, loss of customers and failure to obtain new customers, the risk of litigation and administrative proceedings involving us or our employees, loss of government licenses and permits or failure to obtain them, higher than anticipated labor costs, the possible acquisition of new businesses or products that result in operating losses or that do not perform as anticipated, resulting in unanticipated losses, the possible fluctuation and volatility of our operating results and financial condition, adverse publicity and news coverage, the failure of business acquisitions to be successful or profitable, inability to carry out marketing and sales plans, loss of key executives, changes in interest rates, inflationary factors, and other specific risks that may be alluded to in this Offering Circular or in other reports issued us or third party publishers.

RISKS RELATED TO STRATUS CAPITAL CORP. BUSINESS

We have incurred significant losses and anticipate future losses.

As of June 30, 2021, we had an accumulated deficit of $407,106 and a total stockholders’ deficit of $414,032 . During the year ended December 31, 2020 we incurred losses of $134,185, resulting in an accumulated deficit of $319,062 and a stockholders’ deficit of $325,988.

Future losses are likely to occur as, until we have opportunities for growth in return for shares of our common stock to create value for our shareholders as we have no sources of income to meet our operating expenses. As a result of these, among other factors, we received from our registered independent public accountants in their report for the financial statements for the year ended December 31, 2020, an explanatory paragraph stating that there is substantial doubt about our ability to continue as a going concern.

| 19 |

Our existing financial resources are insufficient to meet our ongoing operating expenses,

We have no sources of income at this time and no existing cash balances to meet our ongoing operating expenses. In the short term, unless we are able to raise additional debt and/or equity we shall be unable to meet our ongoing operating expenses. On a longer-term basis, we intend to raise the debt and/or equity to meet our ongoing operating expenses and merge with another entity with experienced management and opportunities for growth in return for shares of our common stock to create value for our shareholders. There can be no assurance that this series of events will be successfully completed.

We may be negatively affected by adverse general economic conditions.

Current conditions in domestic and global economies are extremely uncertain. Adverse changes may occur as a result of softening global economies, wavering consumer confidence caused by the threat of terrorism and war, and other factors capable of affecting economic conditions. Such changes could have a material adverse effect on our business, financial condition, and results of operations.

Our directors may have conflicts of interest which may not be resolved favorably to us.

Certain conflicts of interest may exist between our directors and us. Our Directors have other business interests to which they devote their attention and may be expected to continue to do so although management time should be devoted to our business. As a result, conflicts of interest may arise that can be resolved only through exercise of such judgment as is consistent with fiduciary duties to us.

We may depend upon outside advisors who may not be available on reasonable terms and as needed.

To supplement the business experience of our officers and directors, we may be required to employ accountants, technical experts, appraisers, attorneys, or other consultants or advisors. Our Board without any input from stockholders will make the selection of any such advisors. Furthermore, it is anticipated that such persons may be engaged on an "as needed" basis without a continuing fiduciary or other obligation to us. In the event we consider it necessary to hire outside advisors, we may elect to hire persons who are affiliates, if they are able to provide the required services.

We may not be able to meet the filing and internal control reporting requirements imposed by the SEC which may result in a decline in the price of our common shares and an inability to obtain future financing.

As directed by Section 404 of the Sarbanes-Oxley Act, as amended by SEC Release No. 33-8934 on June 26, 2008, the SEC adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. In addition, the independent registered public accounting firm auditing a company’s financial statements may have to also attest to and report on management’s assessment of the effectiveness of the company’s internal controls over financial reporting. We may be required to include a report of management on its internal control over financial reporting. The internal control report must include a statement

| · | Of management’s responsibility for establishing and maintaining adequate internal control over its financial reporting; |

| · | Of management’s assessment of the effectiveness of its internal control over financial reporting as of year-end; and |

| · | Of the framework used by management to evaluate the effectiveness of our internal control over financial reporting. |

Furthermore, our independent registered public accounting firm may be required to file its attestation on whether it believes that we have maintained, in all material respects, effective internal control over financial reporting.

| 20 |

Reporting requirements under the exchange act and compliance with the Sarbanes-Oxley act of 2002, including establishing and maintaining acceptable internal controls over financial reporting, are costly and may increase substantially.

The rules and regulations of the SEC require a public company to prepare and file periodic reports under the Exchange Act, which will require that the Company engage legal, accounting, auditing and other professional services. The engagement of such services is costly. Additionally, the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) requires, among other things, that we design, implement and maintain adequate internal controls and procedures over financial reporting. The costs of complying with the Sarbanes-Oxley Act and the limited technically qualified personnel we have may make it difficult for us to design, implement and maintain adequate internal controls over financial reporting. In the event that we fail to maintain an effective system of internal controls or discover material weaknesses in our internal controls, we may not be able to produce reliable financial reports or report fraud, which may harm our overall financial condition and result in loss of investor confidence and a decline in our share price.

As a public company, we will be subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act, the Dodd-Frank Act of 2010 and other applicable securities rules and regulations. Despite recent reforms made possible by the JOBS Act, compliance with these rules and regulations will nonetheless increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and increase demand on our systems and resources, particularly after we are no longer an “emerging growth company.” The Exchange Act requires, among other things, that we file annual, quarterly, and current reports with respect to our business and operating results.

We are working with our legal, accounting and financial advisors to identify those areas in which changes should be made to our financial and management control systems to manage our growth and our obligations as a public company. These areas include corporate governance, corporate control, disclosure controls and procedures and financial reporting and accounting systems. We have made, and will continue to make, changes in these and other areas. However, we anticipate that the expenses that will be required in order to adequately prepare for being a public company could be material. We estimate that the aggregate cost of increased legal services; accounting and audit functions; personnel, such as a chief financial officer familiar with the obligations of public company reporting; consultants to design and implement internal controls; and financial printing alone will be a few hundred thousand dollars per year and could be several hundred thousand dollars per year. In addition, if and when we retain independent directors and/or additional members of senior management, we may incur additional expenses related to director compensation and/or premiums for directors’ and officers’ liability insurance, the costs of which we cannot estimate at this time. We may also incur additional expenses associated with investor relations and similar functions, the cost of which we also cannot estimate at this time. However, these additional expenses individually, or in the aggregate, may also be material.

In addition, being a public company could make it more difficult or more costly for us to obtain certain types of insurance, including directors’ and officers’ liability insurance, and we may be forced to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. The impact of these events could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, our board committees or as executive officers.

The increased costs associated with operating as a public company may decrease our net income or increase our net loss and may cause us to reduce costs in other areas of our business or increase the prices of our products or services to offset the effect of such increased costs. Additionally, if these requirements divert our management’s attention from other business concerns, they could have a material adverse effect on our business, financial condition and results of operations.

We have a material weakness in our controls and procedures.

We have conducted an evaluation of our internal control over financial reporting based on the framework in “Internal Control Integrated Framework” issued by the Committee of Sponsoring Organizations for the Treadway Commission (“COSO”) and published in 2013, and subsequent guidance prepared by COSO specifically for smaller public companies. Based on that evaluation, management concluded that our internal control over financial reporting was not sufficient as of December 31, 2020 for the reasons discussed below:

A significant deficiency is a deficiency, or combination of deficiencies in internal control over financial reporting, that adversely affects the entity’s ability to initiate, authorize, record, process, or report financial data reliably in accordance with generally accepted accounting principles such that there is more than a remote likelihood that a misstatement of the entity’s financial statements that is more than inconsequential will not be prevented or detected by the entity’s internal control.