As filed with the Securities and Exchange Commission on February 1, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| 3841 | Not Applicable | |||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

| G Medical Innovations Holdings Ltd. | G Medical Innovations USA Inc. | |

| Tel: | Tel: | |

| (Address, including zip code, and telephone number, including | (Name, address, including zip code, and telephone | |

| area code, of registrant’s principal executive offices) | number, including area code, of agent for service) |

Copies to:

| Oded Har-Even, Esq. | David Huberman, Esq. | |

| Eric Victorson, Esq. | Gary Emmanuel, Esq. | |

| Sullivan & Worcester LLP | One Azrieli Center | |

| 1633 Broadway | Round Tower, 30th floor | |

| New York, NY 10019 | 132 Menachem Begin Rd | |

| Tel: 212.660.3000 | Tel Aviv, Israel 6701101 | |

| Telephone: +972 (0) 3.636.6033 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date hereof.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company

If an emerging growth company that prepares its financial statements

in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards † provided pursuant to Section 7(a)(2)(B) of the Securities Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED FEBRUARY 1, 2023 |

Up to 3,330,000 Ordinary Shares

Up to 3,330,000 Pre-Funded Warrants to Purchase Ordinary Shares

G Medical Innovations Holdings Ltd.

This is a firm commitment offering of up to 3,330,000 ordinary shares, par value $3.15 per share (the “Ordinary Shares”). This offering may be subject to the approval of our Capital Reduction (as defined below) by the Grand Court of the Cayman Islands. See “Prospectus Summary—Recent Financing and Developments—Capital Reduction” for more information.

We are also offering to each purchaser, if any, whose purchase of Ordinary Shares in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99%, or, at the election of the purchaser, 9.99% of our outstanding Ordinary Shares immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded warrants (the “Pre-Funded Warrants”), in lieu of Ordinary Shares that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99%, or, at the election of the purchaser, 9.99% of our outstanding Ordinary Shares. Each Pre-Funded Warrant will be immediately exercisable for one Ordinary Share and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. The purchase price of each Pre-Funded Warrant will equal the price per share at which the Ordinary Shares are being sold to the public in this offering, minus $0.001, the exercise price of each Pre-Funded Warrant. For each Pre-Funded Warrant we sell, the number of Ordinary Shares we are offering will be decreased on a one-for-one basis. This offering also relates to the Ordinary Shares issuable upon exercise of any Pre-Funded Warrants sold in this offering. See “Description of the Offered Securities” for more information.

We refer to the Ordinary Shares being offered hereby, as well as the Pre-Funded Warrants, if any, collectively, as the Securities.

Our Ordinary Shares are listed on the Nasdaq Capital Market under the symbol “GMVD”. On January 30, 2023, the last reported sale price of our Ordinary Shares on Nasdaq was $5.41 per share.

We have assumed a public offering price of $5.41 per Ordinary Share. The actual offering price per Ordinary Share, including the price of any Pre-Funded Warrant, will be negotiated between us and the underwriters based on, among other things, the trading of our Ordinary Shares prior to the offering and may be at a discount to the current market price. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price. In addition, there is no established public trading market for our Pre-Funded Warrants and we do not expect a market to develop. We do not intend to apply for a listing of the Pre-Funded Warrants on any national securities exchange.

We are an “emerging growth company”, as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and a “foreign private issuer”, as defined in Rule 405 of the U.S. Securities Act of 1933, as amended, or the Securities Act, and are eligible for reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 10. Neither the Securities and Exchange Commission, or the SEC, nor any state or other foreign securities commission has approved nor disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per

Ordinary Share | Per Pre-Funded Warrant | Total | ||||||||||

| Public offering price | $ | $ | $ | |||||||||

| Underwriting discounts and commissions(1) | $ | $ | $ | |||||||||

| Proceeds to us (before expenses) | $ | $ | $ | |||||||||

| (1) | Underwriting discounts and commissions do not include a non-accountable expense allowance equal to 1.0% of the public offering price payable to the underwriters. We refer you to “Underwriting” beginning on page 140 for additional information regarding underwriters’ compensation. |

We have granted the underwriters an option exercisable within 45-days from the date of this prospectus to purchase up to 499,500 additional Ordinary Shares on the same terms set forth above solely to cover over-allotments, if any. If the underwriters exercise this option in full, the total underwriting discounts and commissions payable by us will be $1.7 million, and the total proceeds to us, before expenses, will be $20.7 million. In addition, we will issue to the representative of the underwriters warrants, or the Underwriter’s Warrants, to purchase a number of Ordinary Shares equal to an aggregate of 5.0% of the Ordinary Shares and/or Pre-Funded Warrants sold in the offering. See “Underwriting”.

The underwriters expect to deliver the Securities to purchasers on or about , 2023.

ThinkEquity

The date of this prospectus is , 2023.

TABLE OF CONTENTS

i

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not authorized anyone to provide you with information that is different. We are offering to sell the Securities, and seeking offers to buy the Securities, only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the Securities. Our business, financial condition, results of operations and prospects may have changed since such date.

For investors outside of the United States: Neither we nor the underwriter has done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

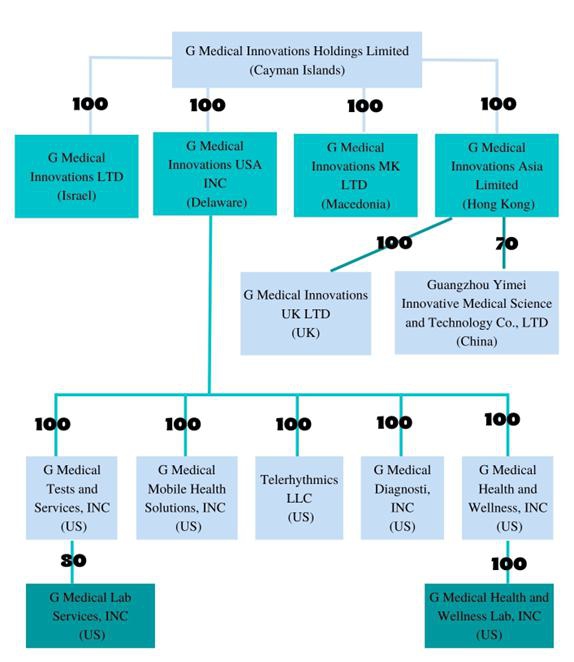

In this prospectus, “we,” “us,” “our,” the “Company” and “G Medical Innovations Holdings” refer to G Medical Innovations Holdings Ltd., a Cayman Islands exempted company, and its subsidiaries: G Medical Innovations Ltd., an Israeli corporation, G Medical Innovations USA Inc., a Delaware corporation, G Medical Health and Wellness, Inc, a Delaware corporation, G Medical Health and Wellness Lab, Inc., a Delaware corporation, G Medical Innovations MK Ltd., a Macedonian corporation, G Medical Innovations Asia Limited, a Hong Kong corporation, G Medical Diagnostic Services, Inc. , a Texas corporation, G Medical Mobile Health Solutions, Inc., an Illinois corporation, Telerhythmics, LLC , a company formed under the laws of the state of Tennessee, G Medical Tests and Services, Inc., a Delaware corporation, G Medical Lab Services, Inc. a Delaware corporation, G Medical Innovations UK Ltd., a UK corporation, all of which are wholly-owned subsidiaries, G-Medical Lab Services Inc., a Delaware corporation and 80%-owned subsidiary, and Guangzhou Yimei Innovative Medical Science and Technology Co., Ltd., or G Medical China, a 70%-owned subsidiary of G Medical Innovations Asia Limited.

Our reporting currency and functional currency is the U.S. dollar. Unless otherwise expressly stated or the context otherwise requires, references in this prospectus to “dollars” or “$” mean U.S. dollars, and references to “A$” are to Australian dollars. Unless derived from our consolidated financial statements or otherwise indicated, U.S. dollar translations of A$ amounts presented in this prospectus are translated using the rate of A$0.6864 to $1.00, based on the exchange rates certified for customs purposes by the Federal Reserve Bank of New York on January 9, 2023.

This prospectus includes statistical, market and industry data and forecasts which we obtained from publicly available information and independent industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the information. Although we believe that these sources are reliable, we have not independently verified the information contained in such publications.

We report under International Financial Reporting Standards, as issued by the International Accounting Standards Board (the “IASB”). None of the financial statements were prepared in accordance with generally accepted accounting principles in the United States.

Our shareholders have approved three reverse stock splits since 2020: on October 29, 2020, our shareholders approved, at an extraordinary general shareholders meeting, a one-for-18 consolidation (the “October 2020 Reverse Stock Split”) of our Ordinary Shares pursuant to which holders of our Ordinary Shares received one Ordinary Share for every 18 Ordinary Shares held; on March 25, 2021, our shareholders approved, at an extraordinary general shareholders meeting, a one-for-five consolidation (the “March 2021 Reverse Stock Split”) of our Ordinary Shares pursuant to which holders of our Ordinary Shares received one Ordinary Share for every five Ordinary Shares held; and on November 15, 2022, our shareholders approved, at an extraordinary general shareholders meeting, a 35-for-one consolidation of our Ordinary Shares pursuant to which holders of our Ordinary Shares received one Ordinary Share for every 35 Ordinary Shares held which took effect on November 16, 2022 (the “November 2022 Reverse Stock Split”). Unless the context expressly dictates otherwise, all reference to share and per share amounts referred to herein reflect the October 2020 Reverse Stock Split, the March 2021 Reverse Stock Split and the November 2022 Reverse Stock Split.

ii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Securities. Before you decide to invest in our Securities, you should read the entire prospectus carefully, including the “Risk Factors” section starting on page 10 of this prospectus, as well the financial statements and related notes and other information found elsewhere in this prospectus.

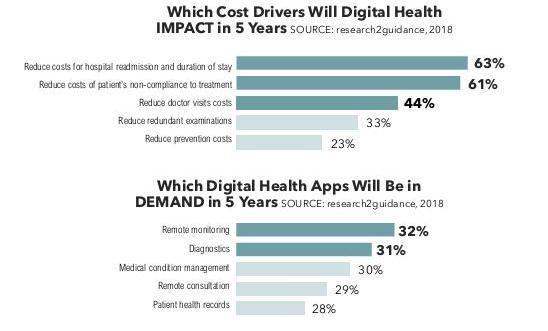

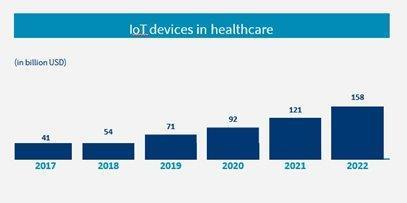

Our Company

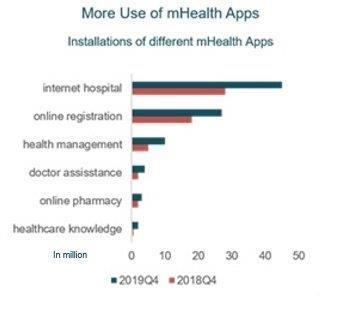

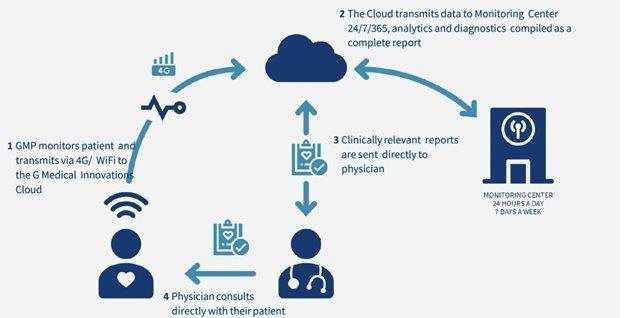

We are a next-generation mobile health, or mHealth, and digital health company that develops and markets clinical and consumer medical-grade health monitoring solutions and offers end-to-end support for remote monitoring and telemedicine projects. With extensive experience in the field of medical devices, digital health and patients monitoring, we are committed to raising the global level of healthcare by empowering caregivers and patients to better monitor, manage and improve clinical and personal health outcomes. We believe that we are at the forefront of the digital health revolution in developing the next generation of mobile technologies and services that are designed to empower consumers, patients, and providers to better monitor, manage and improve clinical and personal health outcomes, especially for those who suffer from cardiovascular disease, or CVD, pulmonary disease and diabetes. Our business and future revenue stream can be broken down into two business areas: monitoring services and home collection kits for lab testing.

Monitoring Services

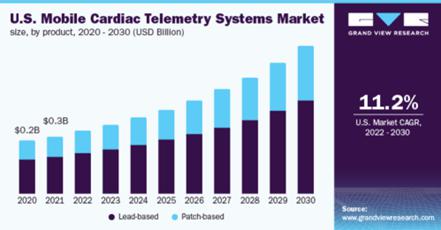

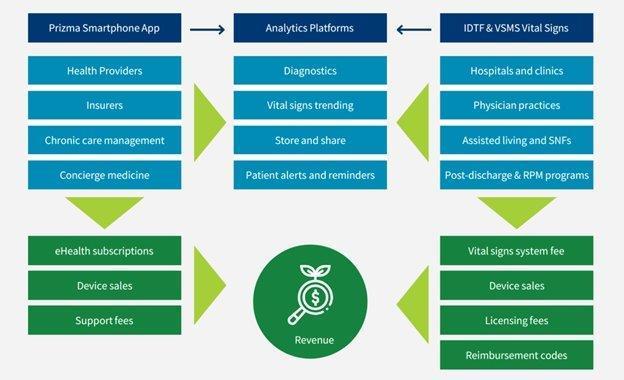

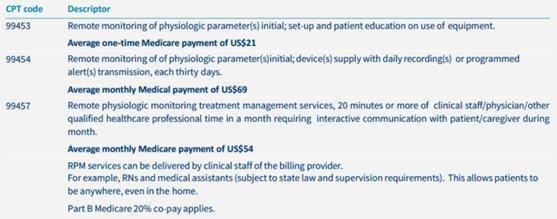

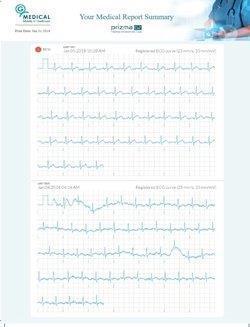

We possess innovative Mobile Cardiac Telemetry, or MCT, monitors that utilize sophisticated Deep Neural Network based Artificial Intelligence (AI) backend electrocardiogram processing software--Cardiologs, which is used as a powerful secondary analysis tool. This dual analysis approach is not offered by most of our competitors. Further, we have two U.S. Centers for Medicare & Medicaid Services, or CMS, -approved independent diagnostic testing facilities, or IDTFs, each staffed with experienced clinical staff and billing teams, nationwide insurance contracts, and a full portfolio of diagnostic monitoring tools, including extended holter (AECG), mobile cardiac telemetry (MCT), and remote patient monitoring (RPM).

As medicine and technology become integrated, we believe we are well positioned to capture market share and grow in this business area. Our product line consists of our Prizma medical device, a clinical grade device that can transform a smartphone into a medical monitoring device, enabling both healthcare providers and individuals to monitor, manage and share a wide range of vital signs and biometric indicators. In addition, we are developing a Wireless Vital Signs Monitoring System, which is expected to provide full, continuous, and real time monitoring of a wide range of vital signs and biometrics. The monitoring services include IDTF monitoring services and private monitoring services.

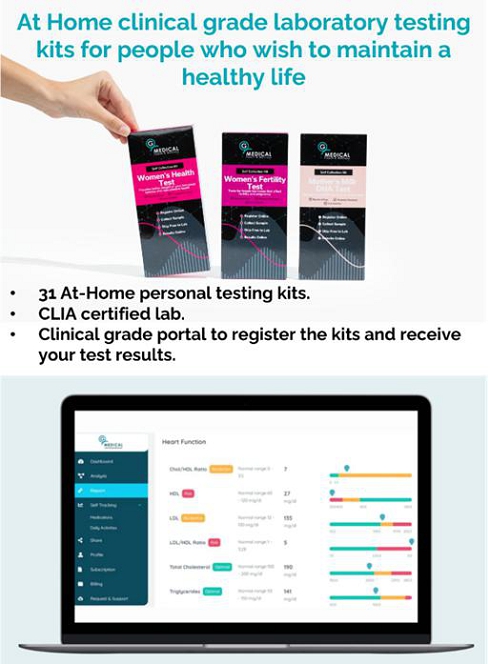

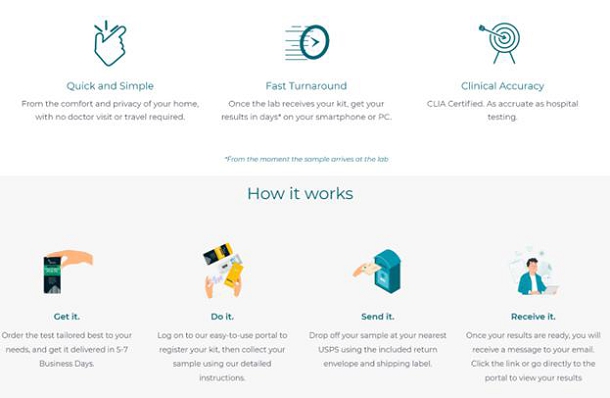

Home Collection Kits for Lab Testing

In the second half of 2022, we took a strategic decision to divert to more comprehensive home testing solutions as an expansion of our patient services and as part of our vision to move towards a home-based health care system. On July 13, 2022, we announced that our wholly owned subsidiary, G Medical Health and Wellness, Inc., has developed seven different at-home tests to collect samples of blood, saliva, stool, urine or a vaginal swab each of which we expect will be available to be purchased privately by the user in a retail store or online. Once purchased, the user collects the sample in the privacy and comfort of his or her home and sends the sample to our Clinical Laboratory Improvement Amendments, or CLIA, certified lab for analysis. Once it arrives at the lab, the sample is analyzed, and results are typically available to the customer within days in our secured and HIPAA compliant portal. In addition, on October 6, 2022, we introduced a Monkeypox consumer home health test kit, along with 23 additional new direct to consumer home collection kits with 24 to 48 hours results, all of which are expected to be available to consumers the third quarter of 2023 through popular big-box retail sites, pharmacies and online. The collection kits are developed for testing health issues related to hormones, sexual transferred disease, nutrition, colon cancer, food sensitivity, and allergies, with results going directly to the user within days. Our pipeline includes development of additional kits for drug detection, heavy metal, and toxicology. The entire data, from both vital signs and laboratory tests, is collected, and managed under one database and give the user the ability to create, manage and control their medical data, or EMR, with the ability to retrieve and share it with third parties anywhere and anytime.

1

During the first half of 2022, we operated six locations performing point-of-care tests in communities in Southern and Northern California. The volume of COVID-19 testing has decreased significantly since April 2022. Given the decrease in COVID-19 cases, in the second half of fiscal year 2022 we decided to discontinue our COVID-19 related business activities. We expect to write off inventory related to our COVID-19 business for the fiscal year ended December 31, 2022.

Our management team is led by individuals with over 25 years of experience in developing mobile embedded medical sensors and software, algorithms and ambulatory medical devices, and with over 48 medical devices approved by the U.S. Food and Drug Administration (the “U.S. FDA”), including devices approved when the members of our management team were employed at other companies. Our management has proven their ability to execute our go-to-market strategy as described below, with over 30 years of medical device development and commercialization experience in the United States, China, Europe, Australia, South Africa, Japan, the Asia Pacific region and Brazil.

Recent Financing and Developments

September 2022 At-the-Market Offering

On September 16, 2022, we entered into a sales agreement, the Sales Agreement, with A.G.P./Alliance Global Partners, or the Agent, pursuant to which we could offer and sell, from time to time, our Ordinary Shares, through the Agent in an “at-the-market” offering, as defined in Rule 415(a)(4) promulgated under the Securities Act, for an aggregate offering price of up to $3 million. The Agent will be entitled to compensation at a commission rate of 3.0% of the gross sales price per share sold pursuant to the terms of the Sales Agreement. We are not obligated to make any sales of Ordinary Shares under the Sales Agreement and no assurance can be given that we will sell any additional Ordinary Shares under such agreement, or, if we do, as to the price or number of such shares that we will sell or the dates on which any such sales will take place. As of January 15, 2023, we have received net proceeds of approximately $2.9 under this “at-the-market” offering.

October 2022 Private Placement

On October 20, 2022, we entered into an agreement with Jonathan B. Rubini, or the Investor, in connection with a private placement investment for 79,365 post reverse split Ordinary Shares and 79,366 post reverse split warrants exercisable at $6.30 to purchase 79,366 Ordinary Shares with price of $6.30 per share and associated warrant, for aggregate consideration of $500,000. The warrants are exercisable at any time beginning 30 days after issuance with a term of five years from issuance. In connection with this private placement, we agreed, inter alia, to amend the applicable interest rate and conversion price adjustment date of the 10% convertible debenture, originally dated April 7, 2021, as amended and restated on June 1, 2022.

Shareholder Financing Commitment

On October 6, 2022, our major shareholder, Chief Executive Officer Dr. Yacov Geva, committed to finance our operations for the next 12 months and until November 30, 2023, under the following conditions: (1) he continues to be a controlling shareholder; (2) we cannot be financed externally from any other sources; and/or (3) until a sum of $10 million is received by us for our operations in 2023, whichever is earlier. In exchange for providing this commitment, Dr. Geva was issued 71,428 Ordinary Shares and 71,429 warrants to purchase Ordinary Shares (cashless) at an exercise price of $7.70. On January 30, 2023, our major shareholder and Chief Executive Officer, Dr. Yacov Geva, extended his commitment to finance our operations up to February 28, 2024.

2

On December 29, 2022, our Board of Directors approved a loan agreement, dated December 21, 2022 (the “Loan Agreement”), between the Company and Dr. Geva. Under the terms of the Loan Agreement, the total amount of the loan provided by Dr. Geva to the Company is $999,552, with an annual interest rate of 12%. The following installments have been made under the terms of the Loan Agreement and advanced to the Company: $198,582 on September 9, 2022; $85,106 on October 11, 2022; $252,596 on November 10, 2022; $175,000 on December 1, 2022 (which is attributed to waived compensation to which Dr. Geva was entitled as Chief Executive Officer of the Company); and $288,268 on December 20, 2022. In addition, (i) Dr. Geva was granted 515,233 Ordinary Shares of the Company and (ii) Dr. Geva will be granted certain warrants to purchase Ordinary Shares of the Company on terms to be determined by the board of directors by March 10, 2023.

Reverse Share Split

On November 15, 2022, our shareholders approved a 35-for-1 consolidation (hereinafter referred to as the “reverse stock split”) of the Ordinary Shares, par value $0.09 per share, pursuant to which holders of the Ordinary Shares received one Ordinary Share of par value $3.15 for every 35 Ordinary Shares held. The Company’s shareholders also approved an increase in the Company’s share capital by 42,857,143 Ordinary Shares such that the Company’s total authorized share capital will be 100,000,000 Ordinary Shares going forward. All Ordinary Shares (issued and unissued) will be consolidated on the basis that every 35 Ordinary Shares of par value $0.09 will be consolidated into one Ordinary Share of par value $3.15 such that the authorized Ordinary Share capital of the Company following such consolidation is $315,000,000 divided into 100,000,000 Ordinary Shares of a par value of $3.15 each. The November 2022 Reverse Stock Split took effect on November 16, 2022.

New Patents and Notice of Issuance

On December 5, 2022, we announced that we were granted two patents from the U.S. Patent and Trademark Office, or USPTO, for our monitoring products marketed in the U.S. market, including our Prizma medical device. The granted patents include “Method, Device and System for Non-Invasively Monitoring Physiological Parameters” and “Jacket for Medical Module.” The patent for monitoring physiological parameters integrates the sensing mechanism that allows the monitoring system to analyze the sensing condition (pressure, ambient temperature, light, conductivity, etc.) prior to performing and during continuous monitoring of physiological signals from the body. This allows higher and more accurate sensing that results in reducing false positive readings, including false alarms. The patent for the medical module jacket takes the harness that is traditionally used for smartphone cases and converts it to a medical case allowing consumers and patients to carry their smartphones and monitoring devices together, ensuring the ability of monitoring vital signs and other parameters, anywhere, anytime.

On January 30, 2023, we announced that we received a patent issue notification from the USPTO for a patent, expected to be issued on February 7, 2023, called “Method and System for Vital Signs Monitoring with Earpiece”, which covers the vital signs monitoring system that we are developing using multiple sensing mechanisms to be used on different body locations. This vital sign monitoring system will potentially provide physicians more versatility in patients’ monitoring and would simplify in and out-patients’ monitoring. These three patents join the growing list of the Company’s patents. The Company has three more patents applications which were submitted with and are waiting approval by the United States Patent and Trademark Office, or the USPTO.

We believe that these patents will strengthen our position in the market with our unique technologies and services and that obtaining these patents places us at the forefront of the industry and provides us with a significant advantage over our competitors, specifically with regards to accurate monitoring of patients. This will potentially allow us to increase the market size for its products and its monitoring services.

3

Capital Reduction

Under the Cayman Islands law, we may not issue Ordinary Shares at a price under the par value for our Ordinary Shares except in accordance with the provisions of the Companies Act (as revised) of the Cayman Islands (which, amongst other things, requires a sanction of the Grand Court of the Cayman Islands). Our Amended and Restated Memorandum and Articles of Association permit us to reduce our share capital in any way, including by reducing the par value of our issued share capital, cancelling any paid-up share capital which is lost or unrepresented by available assets, and extinguishing or reducing the liability of any of our shares, by way of special resolution and by order from the Grand Court of the Cayman Islands confirming such reduction.

On December 23, 2022, we called an extraordinary general meeting of shareholders to effect a reduction of our share capital. Due to a lack of an effective quorum, this meeting was then adjourned to December 28, 2022. At the adjourned meeting, all resolutions proposed, as described herein, were passed. Namely, shareholders approved to reduce the issued share capital of the Company by the cancellation of $3.1499 paid up capital on each issued share so that each issued share shall be treated as one fully paid-up share of $0.0001 each in the capital of the Company, or the Capital Reduction. The Capital Reduction is subject to (i) the approval of the Grand Court of the Cayman Islands, which may impose any condition in relation to the Capital Reduction, (ii) compliance with any conditions which the Court may impose in relation to the Capital Reduction, and (iii) the registration by the Registrar of Companies of the Cayman Islands of the order of the Grand Court of the Cayman Islands confirming the Capital Reduction and the minutes approved by the Grand Court of the Cayman Islands containing the particulars required under the Companies Act (as revised) of the Cayman Islands with respect to the Capital Reduction; until such conditions are met and/or satisfied, we cannot issue Ordinary Shares for less than $3.15 per share.

Following the meeting, it became apparent that the notice calling the general meeting on December 23, 2022 was only posted to shareholders on December 19, 2022 and shareholders may not have received sufficient notice of that meeting. In order for there to be sufficient notice under our Amended and Restated Memorandum and Articles of Association, there needs to be five days’ clear notice of the meeting. The result of this procedural irregularity is that the adjourned meeting on December 28, 2022 and the resolutions passed at that meeting are considered to have a defect. To cure the irregularity, on January 24, 2023, we called a further general meeting for our shareholders to reconsider and, if thought fit, re-approve the matters set out in the December 28, 2022 meeting and certain other matters (including amendments to our Amended and Restated Memorandum and Articles of Association). This meeting has been scheduled for February 9, 2023.

Summary Risk Factors

Our business is subject to numerous risks, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary. You should read these risks before you invest in the Securities. In particular, our risks include, but are not limited to, the following:

| ● | we have a limited operating history on which to assess the prospects for our business, have generated little revenue from sales of our products, have incurred losses since inception and we anticipate that we will continue to incur significant losses until we are able to successfully commercialize our products and services globally; | |

| ● | we expect that we will need to raise substantial additional funding before we can expect to become profitable from sales of our products and services and this additional financing may not be available on acceptable terms, or at all; | |

| ● | raising additional capital would cause dilution to holders of our equity securities, and may affect the rights of existing holders of equity securities; | |

| ● | we may not succeed in completing the development and commercialization of our products and services and generating significant revenues; | |

| ● | the expansion of our home testing kit business presents important challenges to our ability to manage our business; | |

| ● | our success depends upon market acceptance of our products and services, our ability to develop and commercialize new products and services and generate revenues and our ability to identify new markets for our technology; | |

| ● | medical device development is costly and involves continual technological change which may render our current or future products obsolete; | |

| ● | we will be dependent upon success in our customer acquisition strategy and successfully integrating acquired companies and technology; | |

| ● | we have recently invested significant capital in our COVID-19 related services, including the purchase of COVID-19 testing kits, however, the future of COVID-19 related services is uncertain and we have stopped operations in our COVID-19 testing related business, which will lead to the write off of inventory and fixed assets in our fiscal year ended December 31, 2022; |

4

| ● | we are dependent upon third-party manufacturers and suppliers making us vulnerable to supply shortages and problems and price fluctuations, which could harm our business, and we have no timely ability to replace our current manufacturing capabilities; | |

| ● | we have limited manufacturing history on which to assess the prospects for our business, and we anticipate that we will incur significant losses once we initiate our in-house manufacturing until we are able to successfully commercialize our products globally; | |

| ● | we have applied for various patents, but there is a risk that our patent applications will not be granted or that we will receive enforceable patent rights, which could leave us at a competitive disadvantage; | |

| ● | we face intense competition in the market, and as a result we may be unable to effectively compete in our industry; | |

| ● | the level of our commercial success will depend in part on our ability to generate and grow sales with our sales and marketing team, strategies and partnerships, and we may be unsuccessful in these efforts; | |

| ● | if third-party payors do not provide adequate coverage and reimbursement for the use of our products and services, our revenue will be negatively impacted; | |

| ● | we may not be able to obtain the necessary clearance(s) or approval(s) of the U.S. FDA or any applicable state equivalents, or similar foreign regulatory agencies, such as European Economic Area (or EEA) Notified Bodies, or the NMPA or may not be able to obtain such approvals in a timely fashion; | |

| ● | the operation of our monitoring centers is subject to rules and regulations governing IDTF and state licensure requirements; failure to comply with these rules could prevent us from receiving reimbursement from Medicare and some commercial payors; | |

| ● | changes in the regulatory environment may constrain or require us to restructure our operations, which may delay or prevent us from marketing our products and services and as a result harming our revenue and operating results; | |

| ● | we may be party to or target of lawsuits, investigations and proceedings arising out of claims alleging negligence, product liability, breach of warranty or malpractice that may involve large claims and significant defense costs whether or not such liability is imposed. Such potential claims may be costly to defend, could consume management resources and could adversely affect our reputation and business; | |

| ● | we are a Cayman Islands exempted company with limited liability. The rights of our shareholders may be different from the rights of shareholders governed by the laws of U.S. jurisdictions. In addition, our shareholders may face difficulties in protecting their interests because we are a Cayman Islands exempted company and United States civil liabilities and certain judgments obtained against us by our shareholders may not be enforceable; | |

| ● | failure to meet Nasdaq’s continued listing requirements could result in the delisting of our Ordinary Shares, negatively impact the price of our Ordinary Shares and negatively impact our ability to raise additional capital; | |

| ● | our principal manufacturing facility is located in China and we plan to operate in the Chinese market. Changes in the Chinese government’s macroeconomic policies or its public policy could have a negative effect on our business and results of operations. The Chinese government exerts substantial influence over the manner in which we must conduct our business activities. In addition, uncertainties with respect to the Chinese legal system could adversely affect us; | |

| ● | we maintain material operations in Israel. It may be difficult to enforce a judgment of a U.S. court against us and our officers and directors and the Israeli experts named in this prospectus in Israel or the United States, to assert U.S. securities laws claims in Israel or to serve process on our officers and directors and these experts. In addition, potential political, economic and military instability in the State of Israel, where our management team and our research and development facilities are located, may adversely affect our results of operations; and | |

| ● | we may be required to pay monetary remuneration to our Israeli employees for their inventions, even if the rights to such inventions have been duly assigned to us. |

5

Corporate Information

We are a company incorporated and registered in the Cayman Islands and were incorporated in 2014. Our Cayman Islands address is P.O. Box 10008, Willow House, Cricket Square Grand Cayman, KY1-1001, Cayman Islands and our principal executive offices are located at 5 Oppenheimer St. Rehovot 7670105, Israel. Our telephone number is +972.8.679.9861. Our website address is https://gmedinnovations.com/. The information contained on, or that can be accessed through, our website is not part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act as modified by the JOBS Act. As such, we are eligible to, and intend to, take advantage of certain exemptions from various reporting requirements applicable to other public companies that are not “emerging growth companies” such as not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). We could remain an “emerging growth company” for up to five years, or until the earliest of (a) the last day of the first fiscal year in which our annual gross revenue exceeds $1.235 billion, (b) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”) which would occur if the market value of our Ordinary Shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (c) the date on which we have issued more than $1 billion in nonconvertible debt during the preceding three-year period.

Implications of being a “Foreign Private Issuer”

We are subject to the information reporting requirements of the Exchange Act that are applicable to “foreign private issuers,” and under those requirements, we file reports with the SEC. As a foreign private issuer, we are not subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we are subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For example, we are not required to issue quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We also have four months after the end of each fiscal year to file our annual report with the SEC and are not required to file current reports as frequently or promptly as U.S. domestic reporting companies. Our officers, directors, and principal shareholders are exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we are not subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. In addition, as a foreign private issuer, we are permitted to follow certain home country corporate governance practices instead of those otherwise required under the Nasdaq Stock Market rules for domestic U.S. issuers and are not required to be compliant with all Nasdaq Stock Market rules as of the date of our initial listing on Nasdaq as would domestic U.S. issuers. These exemptions and leniencies will reduce the frequency and scope of information and protections available to you in comparison to those applicable to a U.S. domestic reporting company. We intend to take advantage of the exemptions available to us as a foreign private issuer during and after the period we qualify as an “emerging growth company.”

6

THE OFFERING

| Ordinary Shares currently issued and outstanding | 1,963,768 Ordinary Shares | |

| Ordinary Shares offered by us | Up to 3,330,000 Ordinary Shares in the aggregate, consisting of Ordinary Shares or Ordinary Shares issuable upon exercise of Pre-Funded Warrants. | |

|

Option to purchase additional shares

|

We have granted the underwriters an option exercisable within 45-days from the date of this prospectus to purchase up to 499,500 additional Ordinary Shares, less underwriting discounts and commissions, solely to cover over-allotments, if any. | |

| Pre-Funded Warrants | We are offering to certain purchasers whose purchase of Ordinary Shares in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Ordinary Shares immediately following the closing of this offering, the opportunity to purchase, if such purchasers so choose, Pre-Funded Warrants, in lieu of Ordinary Shares that would otherwise result in any such purchaser’s beneficial ownership, together with its affiliates and certain related parties, exceeding 4.99% (or, at the election of such purchaser, 9.99%) of our outstanding Ordinary Shares immediately following the consummation of this offering. The purchase price of each Pre-Funded Warrant is equal to the purchase price of the Ordinary Shares in this offering minus $0.001, the exercise price of each Pre-Funded Warrant. Each Pre-Funded Warrant is immediately exercisable and may be exercised at any time until it has been exercised in full. For each Pre-Funded Warrant we sell, the number of Ordinary Shares we are offering will be decreased on a one-for-one basis. This offering also relates to the Ordinary Shares issuable upon exercise of any Pre-Funded Warrants sold in this offering. | |

| Ordinary Shares to be issued and outstanding after this offering | Up to 5,293,768 Ordinary Shares assuming no sales of Pre-Funded Warrants which, if sold, would reduce the number of Ordinary Shares that we are offering on a one-for-one basis (or 5,793,268 Ordinary Shares if the underwriters exercise in full their option to purchase additional Ordinary Shares). | |

| Use of proceeds |

We expect to receive approximately $16.4 million in net proceeds from the sale of Securities offered by us in this offering (approximately $18.9 million if the underwriter exercises its over-allotment option in full), based upon an assumed public offering price of $5.41 per Ordinary Share, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds from the sale of Securities under this prospectus for general corporate purposes, which include financing our operations, capital expenditures and business development.

The amounts and schedule of our actual expenditures will depend on multiple factors. As a result, our management will have broad discretion in the application of the net proceeds of this offering. See “Use of Proceeds” on page 43 of this prospectus. | |

| Risk factors | Investing in our securities involves a high degree of risk. You should read the “Risk Factors” section starting on page 10 of this prospectus for a discussion of factors to consider carefully before deciding to invest in the Securities. | |

| Nasdaq Capital Market symbol: | Our Ordinary Shares are listed on the Nasdaq Capital Market under the symbol “GMVD”. |

7

The number of the Ordinary Shares to be issued and outstanding immediately after this offering as shown above assumes that all of the Ordinary Shares offered hereby are sold and is based on 1,963,768 Ordinary Shares issued and outstanding as of the date of this prospectus. This number excludes:

| ● | 632,517 Ordinary Shares issuable upon the exercise of warrants outstanding as of such date, at exercise prices ranging from $6.3 to A$1,231.65 (approximately $845.41), at a weighted average exercise price of $52.16, all of which vested as of such date; |

| ● | 98,698 Ordinary Shares issuable upon the exercise of tradable warrants outstanding at an exercise price of $218.75 which were issued as part of the units in our Initial Public Offering; |

| ● | 132,421 Ordinary Shares issuable upon the exercise of options to directors, employees and consultants under our Global Plan outstanding as of such date, at a weighted average exercise price of $58.68, of which 28,586 were vested as of such date; |

| ● | 5,200 Ordinary Shares issuable upon conversion of a convertible debenture at a conversion price of $140 per share; |

| ● | 8,590 Ordinary Shares reserved for future issuance under our Global Plan; and |

| ● | 117,289 Ordinary Shares issuable pursuant to performance rights. |

Unless otherwise indicated, all information in this prospectus assumes or gives effect to:

| ● | no exercise of the underwriter’s over-allotment option; |

| ● | no exercise of the Pre-Funded Warrants; and | |

| ● | no exercise of the Underwriter’s Warrants. |

8

SUMMARY CONSOLIDATED FINANCIAL INFORMATION

The following tables set forth our summary consolidated financial information as of and for the periods ended on the dates indicated below. We have derived the following statements of operations data for the years ended December 31, 2021 and 2020 from our audited consolidated financial statements included elsewhere in this prospectus and the following statements of operations data for the six months ended June 30, 2022 and 2021 from our unaudited interim condensed consolidated financial statements included elsewhere in this prospectus. We have derived the following summary balance sheet data as of December 31, 2021 from our audited consolidated financial statements included elsewhere in this prospectus and the following summary balance sheet data as of June 30, 2022 from our unaudited interim condensed consolidated financial statements included elsewhere in this prospectus. We have prepared the unaudited consolidated financial information on the same basis as our audited consolidated financial statements. Interim results are not necessarily indicative of the results that may be achieved in an entire fiscal year. Our historical results are not necessarily indicative of the results that may be expected in the future. See “Risk Factors” beginning on page 10 of this prospectus. The following summary consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included elsewhere in this prospectus.

Our consolidated financial statements included in this prospectus were prepared in accordance with IFRS, as issued by the IASB.

| Year Ended December 31, |

Six Months Ended June 30, |

|||||||||||||

| U.S. dollars in thousands | 2021 | 2020 | 2022 | 2021 | ||||||||||

| (Unaudited) | ||||||||||||||

| Revenues | ||||||||||||||

| Services | 5,008 | 4,859 | 2,224 | 2,875 | ||||||||||

| Products | 50 | 41 | - | 50 | ||||||||||

| Total revenues | 5,058 | 4,900 | 2,224 | 2,925 | ||||||||||

| Cost of revenues | ||||||||||||||

| Cost of services | 3,490 | 3,835 | 7,096 | 1,726 | ||||||||||

| Cost of sales of products | 66 | 398 | 45 | 58 | ||||||||||

| Total cost of revenues | 3,556 | 4,233 | 7,141 | 1,784 | ||||||||||

| Gross profit (loss) | 1,502 | 667 | (4,917 | ) | 1,141 | |||||||||

| Operating expenses: | ||||||||||||||

| Research and development expenses | 1,680 | 1,315 | 1,189 | 619 | ||||||||||

| Selling, general and administrative expenses | 11,091 | 11,652 | 14,475 | 4,532 | ||||||||||

| Operating loss | 11,269 | 12,300 | 20,789 | 4,273 | ||||||||||

| Financial (expenses) income, net | (3,622 | ) | (406 | ) | 7,515 | (503 | ) | |||||||

| Loss before taxes on income | 14,891 | 12,706 | 13,274 | 4,776 | ||||||||||

| Income tax benefit (expenses), net | 3 | 18 | (13 | ) | 5 | |||||||||

| Other comprehensive income | - | - | ||||||||||||

| Net comprehensive loss | 14,888 | 12,688 | 13,287 | 4,771 | ||||||||||

| Net comprehensive loss for the period attributable to: | ||||||||||||||

| Non-controlling interests | 130 | 152 | 266 | 77 | ||||||||||

| The Company’s shareholders | 14,758 | 12,536 | 13,021 | 4,694 | ||||||||||

| 14,888 | 12,688 | 13,287 | 4,771 | |||||||||||

| Basic and diluted loss per share attributable to the Company’s shareholders in USD | (45.5)(1) | (59.5)(1) | (25.31 | ) | (17.85 | ) | ||||||||

| (1) | After giving effect to the November 2022 Reverse Stock Split. |

| As of June 30, 2022 | ||||||||

| Actual | As Adjusted(1) | |||||||

| U.S. dollars in thousands | (Unaudited) | |||||||

| Consolidated Balance Sheet Data: | ||||||||

| Cash and cash equivalents | $ | 1,509 | $ | 17,903 | ||||

| Total assets | 10,278 | 26,672 | ||||||

| Long term debt | 905 | 905 | ||||||

| Accumulated deficit | 103,655 | 103,655 | ||||||

| Total shareholders’ equity (deficit) | (1,240 | ) | 15,154 | |||||

| (1) | As adjusted data gives effect to the issuance and sale of Ordinary Shares in this offering, assuming no sale of any Pre-Funded Warrants, at an assumed public offering price of $5.41 per share, which was the last reported sale price of our Ordinary Shares on Nasdaq on January 30, 2023, after deducting underwriting discounts and commissions and estimated offering expenses, as if the sale of the Ordinary Shares had occurred on June 30, 2022. |

9

RISK FACTORS

An investment in our Securities involves a high degree of risk. We operate in a dynamic and rapidly changing industry that involves numerous risks and uncertainties. You should consider carefully the risk factors described below before deciding whether to invest in the Securities. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business operations. If any of these risks actually occur, our business, financial condition, operating results or cash flows could be materially adversely affected. This could cause the trading price of the Securities to decline, and you may lose all or part of your investment.

Risks Related to Our Financial Condition and Capital Requirements

We have a limited operating history on which to assess the prospects for our business, have generated little revenue from sales of our products, and have incurred losses since inception. We anticipate that we will continue to incur significant losses until we are able to successfully commercialize our products and services globally.

Since inception, we have devoted substantially all of our financial resources to develop our products and their related services. We have financed our operations primarily through the issuance of equity securities and loans, have incurred losses since inception including net losses of $14.9 million in 2021, $12.7 million in 2020 and $15.5 million in 2019. Our accumulated deficit as of June 30, 2022 was $103.7 million. We have financed our operations primarily through the issuance of equity securities. We have generated little revenue from the sale of our products to date and have incurred significant losses. The amount of our future net losses will depend, in part, on on-going development of our products and their related services, the success of our new home testing kit related business, the rate of our future expenditures and our ability to obtain funding through the issuance of our securities, strategic collaborations or grants. We expect to continue to incur significant losses until we are able to successfully commercialize our products and services globally. We anticipate that our expenses will increase substantially if and as we:

| ● | continue the development of our products and services, including with respect to our new home testing kit business; |

| ● | establish a sales, marketing and distribution infrastructure to commercialize our products and services; |

| ● | seek to identify, assess, acquire, license and/or develop other products and services and subsequent generations of our current products and services; |

| ● | seek to maintain, protect and expand our intellectual property portfolio; |

| ● | seek to attract and retain skilled personnel; and |

| ● | continue to support our operations as a public company, our product development and planned future commercialization efforts. |

| Our ability to generate future revenue from product and service sales depends heavily on our success in many areas, including but not limited to: |

| ● | Successfully establishing and our ability to manage our home testing kit business; |

| ● | addressing any competing technological and market developments; |

10

| ● | negotiating favorable terms in any collaboration, licensing or other arrangements into which we may enter; |

| ● | establishing and maintaining resale and distribution relationships with third-parties that can provide adequate (in amount and quality) infrastructure to support market demand for our products; |

| ● | launching and commercializing current and future products and services, either directly or with a collaborator or distributor; and |

| ● | maintaining, protecting and expanding our portfolio of intellectual property rights, including patents, trade secrets and know-how. |

We expect that we will need to raise substantial additional funding before we can expect to become profitable from sales of our products and services. This additional financing may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations.

As of June 30, 2022, we had approximately $1.5 million in cash and cash equivalents and an accumulated deficit of $103.7 million. Based upon our currently expected level of operating expenditures, we expect that our current existing cash and cash equivalents, future fund raisings and the Company’s major shareholder commitment to continue and support the Company’s ongoing operation for the foreseeable future (if other sources of funding would not be available to the Company and under certain conditions) will be sufficient to fund our current operations for the foreseeable future. We will require substantial additional capital to fund our current operation and to grow our business and commercialize our products and services. In addition, our operating plans may change as a result of many factors that may currently be unknown to us, and we may need to seek additional funds sooner than planned.

We cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights of our stockholders and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our Ordinary Shares to decline. The incurrence of indebtedness could result in increased fixed payment obligations, and we may be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required to seek funds through arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be desirable, and we may be required to relinquish rights to some of our technologies or products or otherwise agree to terms unfavorable to us, any of which may have a material adverse effect on our business, operating results and prospects. Even if we believe that we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations.

Raising additional capital would cause dilution to holders of our equity securities, and may affect the rights of existing holders of equity securities.

We may seek additional capital through a combination of private and public equity offerings, debt financings and collaborations and strategic and licensing arrangements. To the extent that we raise additional capital through the issuance of equity or convertible debt securities, your ownership interest will be diluted, and the terms may include liquidation or other preferences that adversely affect your rights as a holder of the Ordinary Shares.

11

Risks Related to Our Business

We may not succeed in completing the development and commercialization of our products and services and generating significant revenues.

While we recently expanded our business to provide home test kits related services, including hormones, sexual transferred diseases, nutrition, colon cancer, food sensitivity and allergies testing, since commencing our operations, we have focused on the research and development and limited clinical trials of our products and services. Some of our products and services are not approved for commercialization and have never generated any revenues. Our ability to generate revenues and achieve profitability depends on our ability to successfully complete the development of these products and services, obtain regulatory approvals and generate significant revenues. The future success of our business cannot be determined at this time, and we do not anticipate generating revenues from some of our products and services for the foreseeable future. In addition, we have limited experience in commercializing our products and services and we may face several challenges with respect to our commercialization efforts, including, among others, that:

| ● | we may not have adequate financial or other resources to complete the development of our products or services associated with a given product; |

| ● | we may not have adequate financial or other resources to complete the development of our lab and the equipment and materials associated with the ongoing operation of such lab, including tests analysis, physician network costs and other unforeseen expenses; |

| ● | we may not be able to manufacture our products in commercial quantities, at an adequate quality or at an acceptable cost; |

| ● | we may not be able to establish adequate sales, marketing and distribution channels; |

| ● | healthcare professionals and patients may not accept our products or fully utilize our products’ services; |

| ● | we may not be aware of possible complications from the continued use of our products or services since we have limited clinical experience with respect to the actual use of our products and services; |

| ● | technological breakthroughs in the mobile and e-health solutions and services may reduce the demand for our products; |

| ● | changes in the market for mobile and e-health solutions and services, new alliances between existing market participants and the entrance of new market participants may interfere with our market penetration efforts; |

| ● | third-party payors may not agree to reimburse patients for any or all of the purchase price of our products, which may adversely affect patients’ willingness to purchase our products; |

| ● | uncertainty as to market demand may result in inefficient pricing of our products and services; |

| ● | we may face third-party claims of intellectual property infringement; and |

| ● | we may fail to obtain or maintain regulatory approvals for our products or services in our target markets or may face adverse regulatory or legal actions relating to our products or services even if regulatory approval is obtained. |

If we are unable to meet any one or more of these challenges successfully, our ability to effectively commercialize our products and services could be limited, which in turn could have a material adverse effect on our business, financial condition and results of operations.

The expansion of our home testing kit business presents important challenges to our ability to manage our business.

In July 2022, we launched our home testing kit related business with seven types of at home testing kits. In October 2022, we expanded our business to offer an additional 24 different at-home health tests kits. Since the COVID-19 pandemic, there has been an increase in home testing for medical conditions and there is existing competition in the home testing kit market and we expect new entrants to enter the market, and these competitors may cause price declines or reduced market share for us. We expect this competition to intensify in the future. We face competition from a variety of sources, including, among others, an increasing number of companies seeking to develop and commercialize, or who have developed and commercialized home testing kit services, such as specialty and reference laboratories, and established and emerging healthcare, information technology and service companies that may develop and sell competitive products or services. There can be no assurance that our investments in our home testing kit business and capabilities will result in desirable returns, and if our operating results continue to decline as a result of decreased demand, our stock price could decline.

12

We may be subject to liability and our insurance may not be sufficient to cover damages.

Our business exposes us to potential liability risks that are inherent in the marketing and sale of testing kits and diagnostics. The use of our products may expose us to professional and product liability claims and possible adverse publicity. We may be subject to claims resulting from incorrect results of analysis with respect to our products and services. Litigation of such claims could be costly. Further, if a court were to require us to pay damages to a plaintiff, the amount of such damages could be significant and severely damage our financial condition. Although we have public and product liability insurance coverage under broad form liability and professional indemnity policies, the level or breadth of our coverage may not be adequate to fully cover any potential liability claims. In addition, we may not be able to obtain additional liability coverage in the future at an acceptable cost. A successful claim or series of claims brought against us in excess of our insurance coverage and the effect of professional and/or product liability litigation upon the reputation and marketability of our technology and products, together with the diversion of the attention of key personnel, could negatively affect our business.

Our success depends upon market acceptance of our products and services, our ability to develop and commercialize new products and services and generate revenues and our ability to identify new markets for our technology.

We have developed, and are engaged in the development of, mobile and e-health solutions and services using our suite of devices and software solutions. Our success will depend on the acceptance of our products and services in the healthcare market. We are faced with the risk that the marketplace will not be receptive to our products and services over competing products and that we will be unable to compete effectively. Factors that could affect our ability to successfully commercialize our current and any potential future products and services include:

| ● | the challenges of developing (or acquiring externally) technology solutions that are adequate and competitive in meeting the requirements of next-generation design challenges; |

| ● | our ability to successfully complete the validation process of each home test kit to be able to launch it to the market. Delays in launching kits might affect our ability to meet the sales forecast; |

| ● | the dependence upon physicians’ acceptance of our products and their willingness to prescribe our product to their patients for the sale of our products and provision of our services; and |

| ● | retailer acceptance of our products and their interest in selling it in their stores. There might be cases that due to private labelling of home testing kits by the retailer, the retailers won’t be interested in promoting our product but its own product, or in case a retailer signed an exclusive agreement with a large competitor, we might receive a negative response to our interest to work with a retailer in a specific area or stores. |

We cannot assure that our current products or any future products, and services, will gain broad market acceptance. If the market for our current products in development fails to develop or develops more slowly than expected, or if any of the services and standards supported by us do not achieve or sustain market acceptance, our business and operating results would be materially and adversely affected.

Medical device development is costly and involves continual technological change which may render our current or future products obsolete.

The market for monitoring services and products is characterized by rapid technological change, medical advances, changing consumer requirements, short device lifecycles and evolving industry standards. Any one of these factors could reduce the demand for our services and devices or require substantial resources and expenditures for research, design and development to avoid technological or market obsolescence.

Our success will depend on our ability to enhance our current technology, services and systems and develop or acquire and market new technologies to keep pace with technological developments and evolving industry standards, while responding to changes in customer needs. A failure to adequately develop or acquire device enhancements or new devices that will address changing technologies and customer requirements adequately, or to introduce such devices on a timely basis, may have a material adverse effect on our business, financial condition and results of operations.

We might have insufficient financial resources to improve existing devices, advance technologies and develop new devices at competitive prices. Technological advances by one or more competitors or future entrants into the field may result in our present services or devices becoming non-competitive or obsolete, which may decrease revenues and profits and adversely affect our business and results of operations.

We will encounter significant competition across our product lines and in each market in which we will sell our products and services from various companies, some of which may have greater financial and marketing resources than we do. Our primary competitors include Biotelemetry, Inc., iRhythm Technologies, Preventice Solutions, Inc., Bardy Diagnostics, Inc. and other arrhythmia service providers, as well as a wide range of medical device companies that sell a single or limited number of competitive products and services, such as Teledoc Health, Inc., DarioHealth Corp. and Itamar Medical, Inc., or participate in only a specific market segment.

13

We will be dependent upon success in our customer acquisition strategy.

Our business will be dependent upon success in our customer acquisition strategy. If we fail to maintain a high quality of service or a high quality of device technology, we may fail to retain existing users or add new users. If users decrease their level of engagement, our revenue, financial results and business may be significantly harmed. Our future success depends upon building a commercial operation in the United States and China, as well as entering additional markets to commercialize our products and services. We believe that our expanded growth will depend on the further development, regulatory approval and commercialization of our products and services, which we anticipate that can be used by nearly all targeted individuals. If we fail to expand the use of our product and services in a timely manner, we may not be able to expand our markets or to grow our revenue, and our business may be adversely impacted. The size of our user base and our users’ level of engagement are critical to our success. Our financial performance will be significantly determined by our success in adding, retaining and engaging active users. If people do not perceive our products or services to be useful, reliable and trustworthy, we may not be able to attract or retain users or otherwise maintain or increase the frequency and duration of their engagement. A decrease in user retention, growth or engagement could render less attractive to developers, which may have a material and adverse impact on our revenue, business, financial condition and results of operations.

Any number of factors could negatively affect user retention, growth and engagement, including:

| ● | users increasingly engaging with competing products; |

| ● | users not actively using the services associated with each of our respective services; |

| ● | failure to introduce new and improved products and services; |

| ● | inability to successfully balance efforts to provide a compelling user experience with the decisions made with respect to the added value services provided; |

| ● | inability to continue to develop products for mobile devices that users find engaging, that work with a variety of mobile operating systems and networks and that achieve a high level of market acceptance; |

| ● | changes in user sentiment about the quality or usefulness of our products and services or concerns related to privacy and sharing, safety, security or other factors; |

| ● | inability to manage and priorities information to ensure users are presented with content that is interesting, useful and relevant to them; |

| ● | adverse changes in our products that are mandated by legislation or regulatory agencies, both in the United States and across the globe; or |

| ● | technical or other problems preventing us from delivering products or services in a rapid and reliable manner or otherwise affecting the user experience. |

We have recently invested significant capital in our COVID-19 related services, including the purchase of COVID-19 testing kits, however, the future of COVID-19 related services is uncertain and we have stopped operations in our COVID-19 testing related business, which will lead to the write off of inventory and fixed assets in our fiscal year ended December 31, 2022.

In December 2021 we launched our COVID-19 testing business, which entailed a significant investment of capital, including, among others, to establish several of testing facilities and laboratories throughout the state of California and the purchase of COVID-19 testing kits. We also entered into various agreements and arrangements regarding our COVID-19 testing business. The level of demand for COVID-19 testing has varied depending on, among other things, changes in the number of reported cases of COVID-19, discoveries of new variants or subvariants of the virus, different COVID-19 mitigation efforts and policies adopted by various governments or businesses, all of which are subject to change and beyond our control. Moreover, the future of COVID-19 related services may be dependent on changes to laws and regulations governing healthcare service providers, including measures to control costs, or reductions in reimbursement levels from government payors or insurance companies. These changes are difficult to predict and may also impact our revenue recognition or collecting accounts receivables. We currently have no expectations to open any new COVID-19 testing centers as the volume of COVID-19 testing has decreased significantly since April 2022. Given the decrease in COVID-19 cases, we have decided to stop our COVID-19 testing related business and have closed all the locations performing point-of-care tests in communities in Southern and Northern California. We intend to write off our COVID-19 test inventory and fixed assets in our audited financial statements for the year ended December 31, 2022.

14

If we are unable to successfully integrate acquired companies and technology, we may not realize the benefits anticipated and our future growth may be adversely affected.

We have grown through acquisitions of companies and technology, including our acquisitions of CardioStaff, in November 2017 and Telerhythmics in November 2018. Acquisitions bring risks associated with our assumption of the liabilities of an acquired company, which may be liabilities that we were or are unaware of at the time of the acquisition, potential write-offs of acquired assets and potential loss of the acquired company’s key employees or customers. Physician, patient and customer satisfaction or performance problems with an acquired business, technology, service or device could also have a material adverse effect on our reputation. Additionally, potential disputes with the seller of an acquired business or its employees, suppliers or customers could adversely affect our business, operating results and financial condition. If we fail to properly evaluate and execute acquisitions, our business may be disrupted and our operating results and prospects may be harmed.

Furthermore, integrating acquired companies or new technologies into our business may prove more difficult than we anticipate. We may encounter difficulties in successfully integrating our operations, technologies, services and personnel with that of the acquired company, and our financial and management resources may be diverted from our existing operations. Offices in multiple states create a strain on our ability to effectively manage our operations and key personnel. If we elect to consolidate our facilities, we may lose key personnel unwilling to relocate to the consolidated facility, may have difficulty hiring appropriate personnel at the consolidated facility and may have difficulty providing continuity of service through the consolidation.

We are dependent upon third-party manufacturers and suppliers making us vulnerable to supply shortages and problems and price fluctuations, which could harm our business.

We do not manufacture our products in-house. Rather, we rely on a limited number of third parties to manufacture and assemble our products. Our suppliers and manufacturers may encounter problems during manufacturing for a variety of reasons, including, for example, failure to follow specific protocols and procedures, failure to comply with applicable legal and regulatory requirements, equipment malfunction and environmental factors, failure to properly conduct their own business affairs, and infringement of third-party intellectual property rights, any of which could delay or impede their ability to meet our requirements. Our reliance on these third-party suppliers also subjects us to other risks that could harm our business, including:

| ● | we are not a major customer of many of our suppliers and manufacturers, and these third parties may therefore give other customers’ needs higher priority than ours; |

| ● | third parties may threaten or enforce their intellectual property rights against our suppliers, which may cause disruptions or delays in shipment, or may force our suppliers to cease conducting business with us; |

| ● | we may not be able to obtain an adequate supply in a timely manner or on commercially reasonable terms; |

| ● | our suppliers and manufacturers, especially new suppliers and manufacturers, may make errors in manufacturing that could negatively affect the efficacy or safety of our products or cause delays in shipment; |

| ● | we may have difficulty locating and qualifying alternative suppliers and manufacturers; |

15

| ● | switching components, suppliers or manufacturers may require product redesign and possibly submission to the U.S. FDA, the European Medicines Agency, EEA Notified Bodies, and the Chinese National Medical Products Administration (or NMPA) or other similar foreign regulatory agencies, which could significantly impede or delay our commercial activities; |

| ● | the occurrence of a fire, natural disaster or other catastrophe impacting one or more of our suppliers and manufacturers may affect their ability to deliver products to us in a timely manner; and |

| ● | our suppliers and manufacturers may encounter financial or other business hardships unrelated to our demand, which could inhibit their ability to fulfill our orders and meet our requirements. |

We expect that our Prizma device and Extended Holter Patch System will be primarily manufactured by a third party in China. However, due to the current complexities of traveling to China as a result of the COVID-19 pandemic, we use a contract manufacturer in Israel to meet our manufacturing requirements. Manufacturers in Israel are generally more expensive that in China. Additionally, certain components of our COVID-19 testing kits are acquired from China and we cannot be sure that we will be able to continue to source these components from China, in part due to the complexities of the COVID-19 pandemic, including travel restrictions and changing policies related to COVID-19 in China. In the future, we may not be able to quickly establish additional or alternative suppliers and manufacturers if necessary, in part because we may need to undertake additional activities to establish such suppliers as required by the regulatory approval process. Any interruption or delay in obtaining products from our third-party suppliers, or our inability to obtain products from qualified alternate sources at acceptable prices in a timely manner, could impair our ability to meet the demand of our customers and cause them to switch to competing products.