As filed with the U.S. Securities and Exchange Commission on February 5, 2020.

Registration No. 333-235949

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________

East Stone Acquisition Corporation

(Exact name of registrant as specified in its charter)

____________________

|

British Virgin Islands |

6770 |

N/A |

||

|

(State or other jurisdiction of |

(Primary Standard Industrial |

(I.R.S. Employer |

25 Mall Road, Suite 330

Burlington, MA 01803

(781) 202 9128

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

____________________

Xiaoma (Sherman) Lu

130 Worthen Road

Lexington, MA 02421

(617) 991-5173

(Name, address, including zip code, and telephone number, including area code, of agent for service)

____________________

Copies to:

|

Barry Grossman, Esq. |

Simon Schilder |

Ralph V. De Martino |

____________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. £

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer £ |

Accelerated filer £ |

|||

|

Non-accelerated filer S |

Smaller reporting company S |

|||

|

Emerging growth company S |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. £

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Security Being Registered |

Amount Being |

Proposed |

Proposed |

Amount of |

||||||||

|

Units, each consisting of one ordinary share of no par value, one Right entitling the holder to receive one-tenth (1/10) of one ordinary share and one redeemable Warrant entitling the holder to purchase one-half (1/2) of one ordinary share(2)(3) |

11,500,000 |

$ |

10.00 |

$ |

115,000,000 |

$ |

14,927 |

|

||||

|

Ordinary Shares of no par value, included as part of the Units(3) |

11,500,000 |

|

— |

|

— |

|

— |

(4) |

||||

|

Rights included as part of the Units |

11,500,000 |

|

— |

|

— |

|

— |

(4) |

||||

|

Shares underlying Rights included as part of the Units |

1,150,000 |

|

— |

|

— |

|

— |

(4) |

||||

|

Redeemable Warrants included as part of the Units(3) |

11,500,000 |

|

— |

|

— |

|

— |

(4) |

||||

|

Representative’s Warrants |

575,000 |

$ |

12.00 |

$ |

6,900,000 |

$ |

895.62 |

|

||||

|

Representative’s Shares |

86,250 |

$ |

10.00 |

$ |

862,500 |

$ |

111.95 |

|

||||

|

Total |

|

$ |

122,762,500 |

$ |

15,934.57 |

|

||||||

____________

(1) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

(2) Includes 1,500,000 units, consisting of 1,500,000 ordinary shares, 1,500,000 rights and 1,500,000 redeemable warrants, which may be issued on exercise of a 30-day option granted to the Underwriters to cover over-allotments, if any.

(3) Pursuant to Rule 416, there are also being registered an indeterminable number of additional securities as may be issued to prevent dilution resulting from stock splits, stock dividends or similar transactions.

(4) No fee pursuant to Rule 457(i) under the Securities Act of 1933, as amended.

____________________

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION, FEBRUARY 5, 2020 |

$100,000,000

East Stone Acquisition Corporation

10,000,000 Units

East Stone Acquisition Corporation is a blank check company incorporated in the British Virgin Islands as a business company and formed for the purpose of acquiring, engaging in a share exchange, share reconstruction and amalgamation with, purchasing all or substantially all of the assets of, entering into contractual arrangements with, or engaging in any other similar business combination with one or more businesses or entities, which we refer to throughout this prospectus as our initial business combination. For purposes of consummating an initial business combination, we intend to focus on businesses primarily operating in the financial technology (Fintech in short) space in North America and Asia-Pacific.

This is an initial public offering of our securities. We are offering 10,000,000 units at an offering price of $10.00 per unit. Each unit consists of one ordinary share, one right and one redeemable warrant, which we refer to throughout this prospectus as “public warrants”. Each right entitles the holder thereof to receive one-tenth (1/10) of one ordinary share upon the consummation of an initial business combination, as described in more detail in this prospectus. Each warrant entitles the holder thereof to purchase one-half (1/2) of one ordinary share. We will not issue fractional shares. As a result, you must exercise warrants in multiples of two warrants, at an exercise price of $11.50 per full share, subject to adjustment as described in this prospectus to validly exercise your warrants, and you must have ten (10) rights to receive a share at the closing of the business combination. Each warrant will become exercisable on the later of the completion of an initial business combination and 12 months from the date of this prospectus and will expire five years after the completion of an initial business combination, or earlier upon redemption.

We have also granted I-Bankers, the representative of the underwriters, a 30-day option to purchase up to an additional 1,500,000 units (over and above the 10,000,000 units referred to above) solely to cover over-allotments, if any.

We will provide our public shareholders with the opportunity to redeem their ordinary shares upon the consummation of our initial business combination at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account described below, including interest (net of taxes payable), divided by the number of then outstanding ordinary shares that were sold as part of the units in this offering, which we refer to as our “public shares.”

We have 15 months from the closing of this offering (or up to 21 months from the closing of this offering if we extend the period of time to consummate a business combination, as described in more detail in this prospectus) to consummate our initial business combination. Pursuant to the terms of our amended and restated memorandum and articles of association and the trust agreement to be entered into between us and Continental Stock Transfer & Trust Company, LLC on the date of this prospectus, in order to extend the time available for us to consummate our initial business combination, our initial shareholders or their affiliates or designees, upon five days advance notice prior to the applicable deadline, must deposit into the trust account for each three months extension, $1,000,000, or $1,150,000 if the underwriters’ over-allotment option is exercised in full ($0.10 per share in either case), on or prior to the date of the applicable deadline. If we are unable to consummate our initial business combination within the above time period, we will distribute the aggregate amount then on deposit in the trust account, net of taxes payable, and less up to $50,000 of interest to pay liquidation expenses, pro rata to our public shareholders by way of the redemption of their shares and to cease all operations except for the purposes of winding up of our affairs, as further described herein. In such event, the rights and warrants will expire and be worthless.

Our sponsor, Double Ventures Holdings Limited, which we refer to throughout this prospectus as our “sponsor,” I-Bankers, and individuals Hua Mao and Cheng Zhao, have committed that they or their designees will purchase from us an aggregate of 323,750 (or 350,000 if the over-allotment is exercised in full) units, or “private units,” at $10.00 per unit. Of such amount, 167,000 units, or the “insider units,” will be purchased by our sponsor (and/or its designees), an aggregate of 108,000 units, or “anchor units”, will be purchased by Hua Mao and Cheng Zhao separately and not together, and 48,750 (or 75,000 if the over-allotment is exercised in full) units, or the “representative units,” will be purchased by I-Bankers (and/or its designees). We refer to Messrs. Mao and Zhao collectively as our “anchor investors” throughout this prospectus. All of these purchases will take place on a private placement basis simultaneously with the consummation of this offering and the over-allotment option, as applicable. All of the proceeds we receive from these purchases will be placed in the trust account described below.

There is presently no public market for our units, ordinary shares, rights or warrants. We have applied to have our units listed on the Nasdaq Capital Market, or Nasdaq, under the symbol “ESSCU.” We expect that our units will be listed on the Nasdaq Capital Market on or promptly after the date of this prospectus. We cannot guarantee that our securities will be approved for listing on Nasdaq. The securities comprising the units will begin separate trading on the 90th day following the date of this prospectus unless I-Bankers informs us of its decision to allow earlier separate trading, subject to our filing a Current Report on Form 8-K with the Securities and Exchange Commission, or the SEC, containing an audited balance sheet reflecting our receipt of the gross proceeds of this offering and issuing a press release announcing when such separate trading will begin. Once the securities comprising the units begin separate trading as described in this prospectus, we expect the ordinary shares, rights and warrants will be traded on Nasdaq under the symbols “ESSC,” “ESSCR” and “ESSCW,” respectively. We cannot assure you that our securities will be approved for listing and, if approved, will continue to be listed on Nasdaq after this offering.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 and will therefore be subject to reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 22 for a discussion of information that should be considered in connection with an investment in our securities.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus does not constitute, and there will not be, an offering of securities to the public in the British Virgin Islands.

|

Price to Public |

Underwriting |

Proceeds, |

|||||||

|

Per Unit |

$ |

10.00 |

$ |

0.175 |

$ |

9.825 |

|||

|

Total |

$ |

100,000,000 |

$ |

1,750,000 |

$ |

98,250,000 |

|||

____________

(1) The underwriters will receive compensation in addition to the underwriting discount. Please see the section titled “Underwriting” for further information relating to the underwriting arrangements agreed to between us and the underwriters in this offering.

(2) Excludes $0.275 per unit, or $2,750,000 (or up to $3,162,500 if the underwriters’ over-allotment option is exercised in full) in the aggregate payable to I-Bankers for advisory services relating to the initial business combination, which amounts will be paid out of the trust account to I-Bankers only on completion of an initial business combination, in an amount equal to $0.275 per unit sold in this offering, subject to adjustment as described in this prospectus.

Upon consummation of the offering, $10.00 per unit sold to the public in this offering (whether or not the over-allotment option has been exercised in full or part), subject to increase of up to an additional approximately $0.20 per share in the event that our sponsor elects to extend the period of time to consummate a business combination, as described in more detail in this prospectus, will be deposited into a United States-based trust account at JPMorgan Chase Bank, N.A. with Continental Stock Transfer & Trust Company acting as trustee. Except as described in this prospectus, these funds will not be released to us until the earlier of (1) the completion of our initial business combination within the required time period; (2) our redemption of 100% of the outstanding public shares if we have not completed an initial business combination in the required time period; and (3) the redemption of any public shares properly tendered in connection with a shareholder vote to amend our memorandum and articles of association (A) to modify the substance or timing of our obligation to redeem 100% of our public shares if we do not complete our initial business combination within the required time period or (B) with respect to any other provision relating to shareholders’ rights or pre-business combination activity.

The underwriters are offering the units on a firm commitment basis. The underwriters expect to deliver the units to purchasers on or about , 2020.

Sole Book-Running Manager

I-Bankers Securities, Inc.

Co-Manager

EarlyBirdCapital, Inc.

, 2020

TABLE OF CONTENTS

|

1 |

||

|

21 |

||

|

22 |

||

|

53 |

||

|

54 |

||

|

57 |

||

|

58 |

||

|

60 |

||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

61 |

|

|

66 |

||

|

90 |

||

|

100 |

||

|

103 |

||

|

105 |

||

|

114 |

||

|

123 |

||

|

125 |

||

|

NOTES REGARDING OUR CHOICE OF BRITISH VIRGIN ISLANDS AND THE ENFORCEABILITY OF CIVIL LIABILITIES |

135 |

|

|

138 |

||

|

146 |

||

|

146 |

||

|

146 |

||

|

F-1 |

i

This summary only highlights the more detailed information appearing elsewhere in this prospectus. As this is a summary, it does not contain all of the information that you should consider in making an investment decision. You should read this entire prospectus carefully, including the information under “Risk Factors” and our financial statements and the related notes included elsewhere in this prospectus, before investing. Unless otherwise stated in this prospectus:

• references to “we,” “us” or “our company” refer to East Stone Acquisition Corporation, a BVI business company with limited liability;

• references to our “anchor investors” refer to Hua Mao and Cheng Zhao, who are purchasing our anchor units;

• references to our “anchor units” refer to an aggregate of 108,000 units we are selling privately to the anchor investors simultaneously with the closing of this offering;

• references to the “BVI” refer to the British Virgin Islands;

• references to the “representative units” refer to the 48,750 units (or 75,000 if the over-allotment is exercised in full) we are selling privately to I-Bankers and/or its designees simultaneously with the closing of this offering;

• references to the “Companies Act” and the “Insolvency Act” refer to the BVI Business Companies Act, 2004 and the Insolvency Act, 2003 of the British Virgin Islands, respectively and in each case as amended;

• references to “founder shares” refer to the 2,875,000 ordinary shares currently held by the initial shareholders (as defined below), which include up to an aggregate of 375,000 ordinary shares subject to forfeiture by our sponsor to the extent that the underwriters’ over-allotment option is not exercised in full or in part;

• references to our “initial shareholders” refer to our sponsor (as defined below), Navy Sail International Limited, a BVI business company with limited liability, of which our Chairman and Chief Financial Officer, Mr. Chunyi (Charlie) Hao, is the sole director, and any of our officers or directors that hold founder shares;

• references to our “insider units” refer to the 167,000 units we are selling privately to our sponsor and/or its designees simultaneously with the closing of this offering;

• references to our “management” or our “management team” refer to our officers and directors;

• references to “private units” refer to the insider units, the anchor units and the I-Bankers units;

• references to “ordinary shares” refer to the ordinary shares of no par value in the company;

• references to “private shares,” “private rights” and “private warrants” refer to the ordinary shares, rights and warrants, respectively, included within the private units;

• references to “public rights” refer to the rights sold as part of the units in this offering (whether they are subscribed for in this offering or in the open market);

• references to our “public shares” refer to ordinary shares which are being sold as part of the units in this offering (whether they are purchased in this offering or thereafter in the open market) and references to “public shareholders” refer to the holders of our public shares, including our initial shareholders to the extent our initial shareholders purchase public shares, provided that their status as “public shareholders” shall exist only with respect to such public shares;

• references to our “public warrants” refer to the redeemable warrants which are being sold as part of the units in this offering (whether they are subscribed for in this offering or in the open market);

1

• references to “public units” refer to the units in this offering (whether they are subscribed for in this offering or in the open market);

• references to our “rights” refers to the rights which are being sold as part of the units in this offering as well as the concurrent private placement;

• references to our “sponsor” refer to Double Ventures Holdings Limited, a BVI business company with limited liability, the sole director of which is Chunyi (Charlie) Hao, our Chairman and Chief Financial Officer; and

• references to our “warrants” refer to our redeemable warrants, which includes the public warrants as well as the private warrants and warrants underlying units issued upon conversion of working capital loans to the extent they are no longer held by the initial purchasers of the private warrants or members of our management team (or their permitted transferees), in each case after our initial business combination.

In January 2020, we performed a share split whereby each ordinary share was sub-divided into two shares, resulting in our initial shareholders holding an aggregate of 2,875,000 founder shares (up to 375,000 shares of which are subject to forfeiture depending on the extent to which the underwriters’ over-allotment option is exercised). Unless otherwise indicated, all amounts in this prospectus are expressed on a post-split basis. No fractional warrants will be issued upon separation of the units and only whole warrants will trade. Accordingly, unless you purchase at least two units, you will not be able to receive or trade a whole warrant. Except as specifically provided otherwise, the information in this prospectus assumes that the underwriters will not exercise their over-allotment option.

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with different information. We are not, and the underwriters are not, making an offer of these securities in any jurisdiction where the offer is not permitted.

General

We are a blank check company incorporated in the British Virgin Islands as a business company with limited liability (meaning that our shareholders have no liability, as members of our company, for the liabilities of our company over and above the amount already paid for their shares) and formed for the purpose of acquiring, engaging in a share exchange, share reconstruction and amalgamation with, purchasing all or substantially all of the assets of, entering into contractual arrangements with, or engaging in any other similar business combination with one or more businesses or entities, which we refer to throughout this prospectus as our initial business combination. Although we are not limited to a particular industry or geographic region for purposes of consummating an initial business combination, we intend to focus on businesses primarily operating in the financial services industry or businesses providing technological services to the financial industry, commonly known as “fintech businesses” in the region of North America and Asia-Pacific. We have not identified any acquisition target and we have not, nor has anyone on our behalf, initiated any discussions to identify any acquisition target. From the date of our formation through the date of this prospectus, there have been no communications or discussions between any of our officers, directors or our sponsor and any of their contacts or relationships regarding a potential initial business combination with our company. Additionally, we have not engaged or retained any agent or other representative to identify or locate any suitable acquisition candidate, to conduct any research or take any measures, directly or indirectly, to locate or contact a target business.

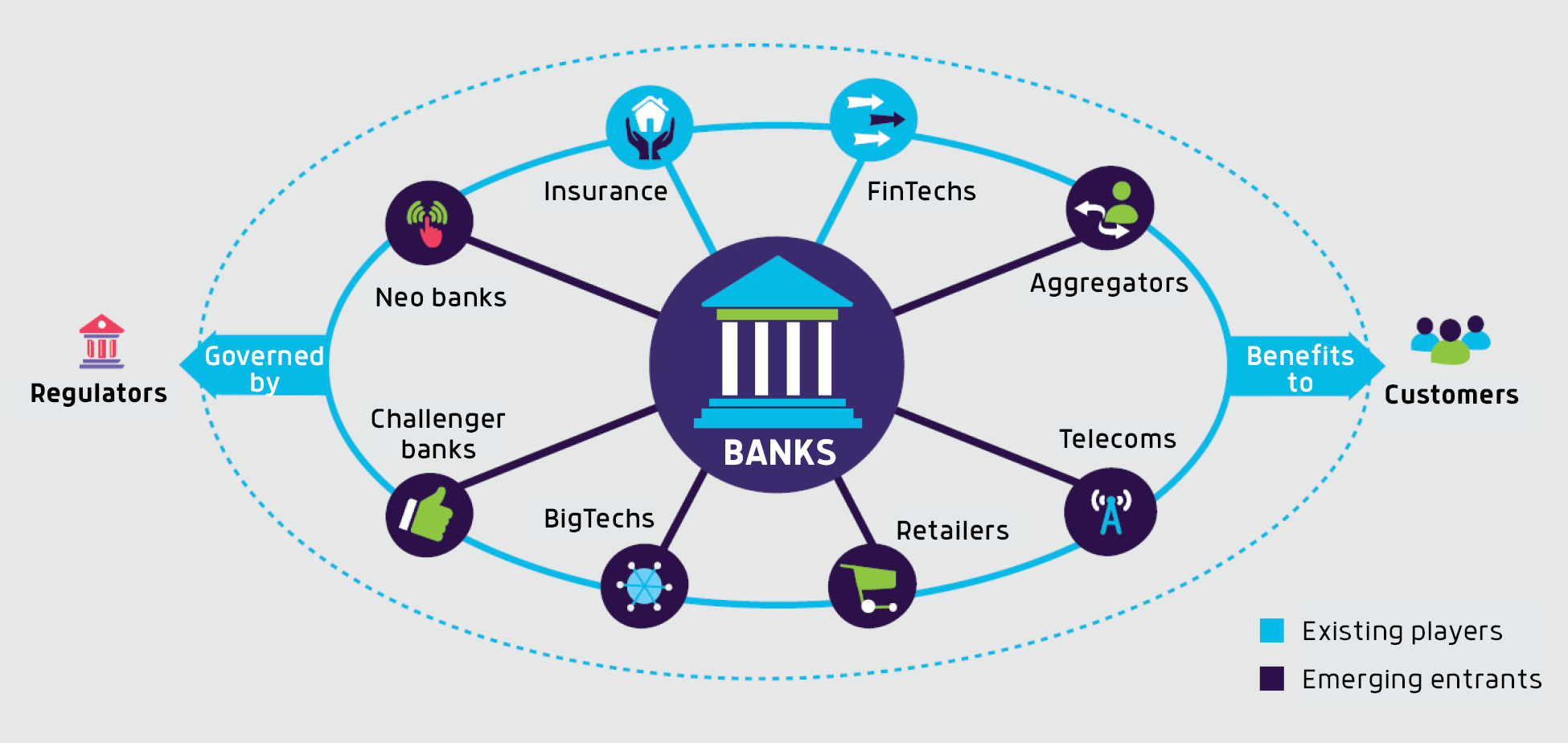

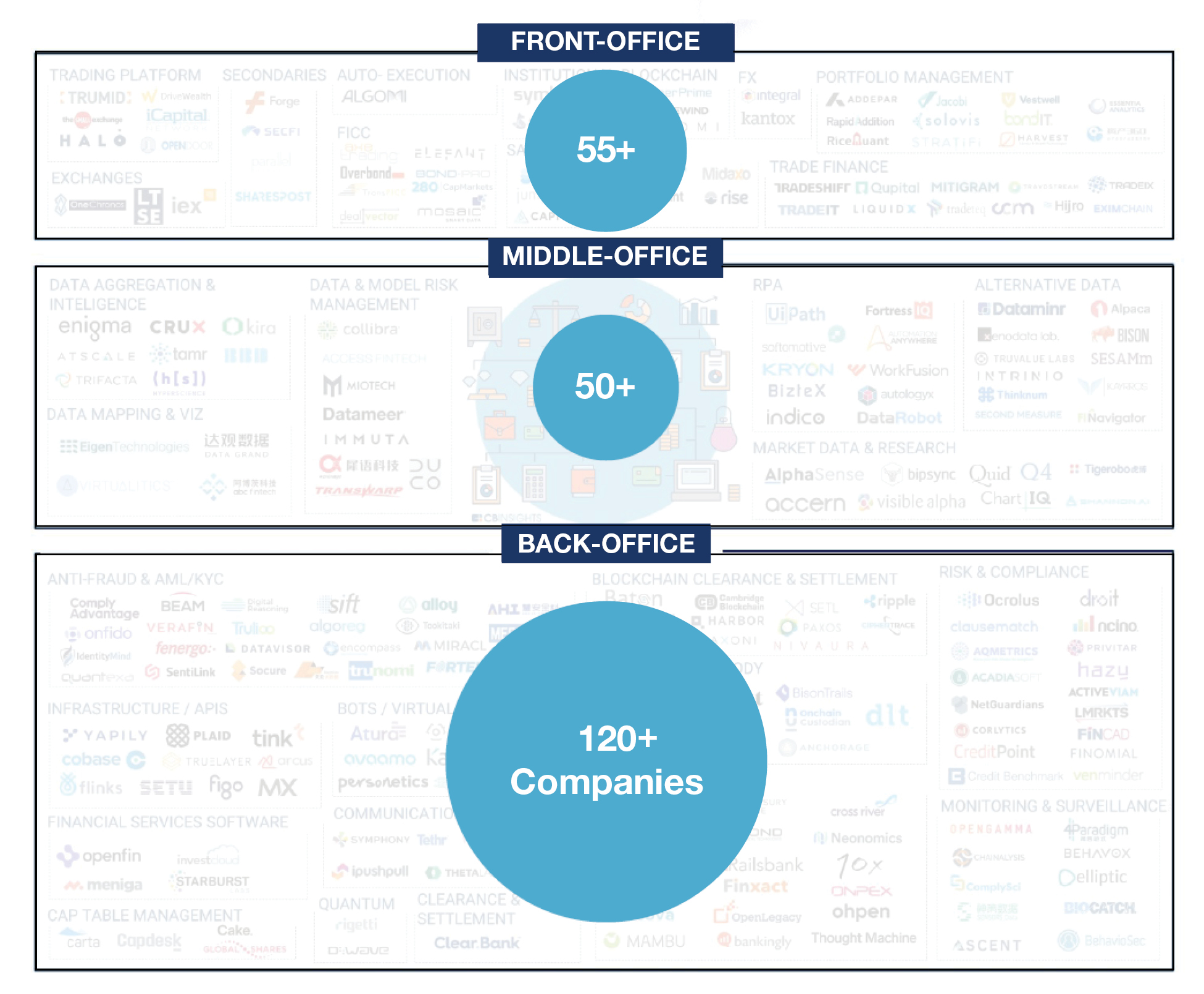

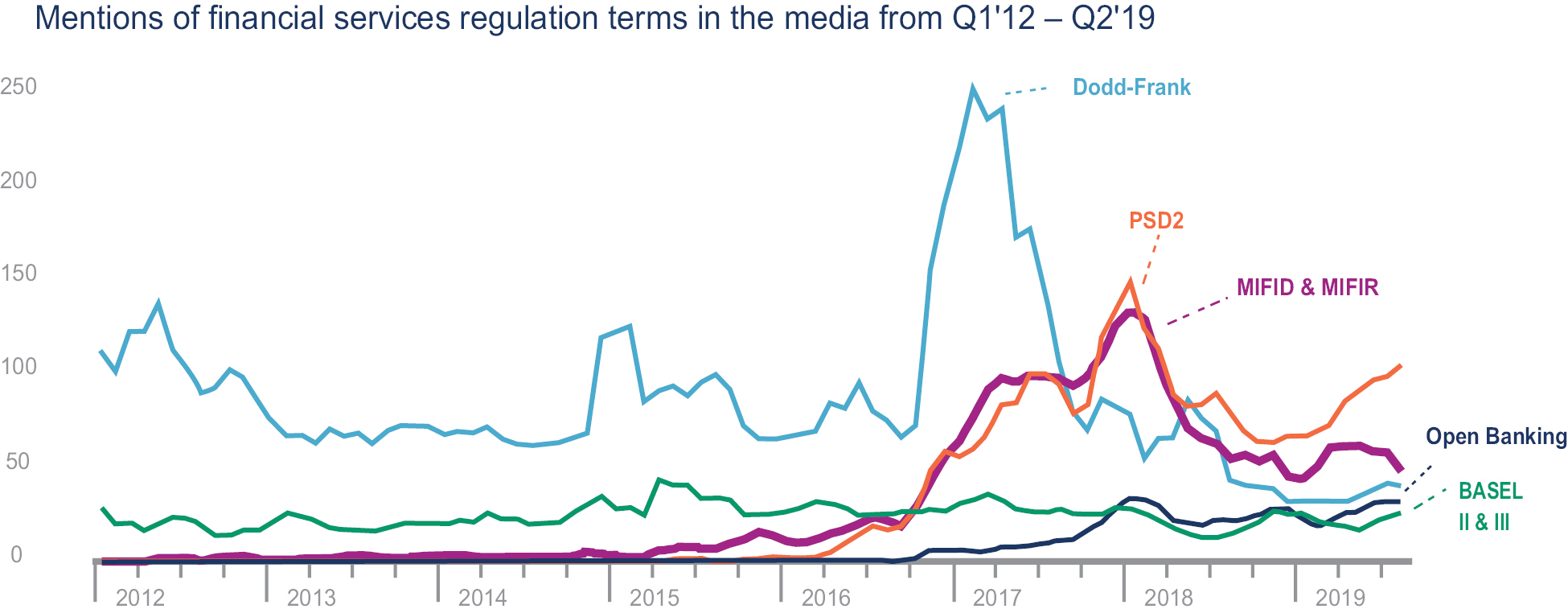

We believe the financial services industry has experienced significant amount of change over the last several years as new companies providing technology, software, and digital platforms have entered the market. Fintech companies exist across many industries within financial services, including banking technology, digital payment, financial transaction and processing, capital markets, wealth management, insurance, and financial management systems. We believe that fintech companies have proven to be successful with multiple business models and strategic objectives. The objective of fintech companies can range from improving the efficiency of traditional financial services companies, to introducing new products and creating new markets, to those focused on disrupting traditional financial services companies with competitive products.

2

We intend to employ a pro-active acquisition strategy focused on identifying potential business combination targets in the fintech industry serving the financial industries in commercial lending, retail lending, insurance, mutual fund management, money market and securities trading that are fundamentally sound, where we believe we can be a catalyst to accelerating growth. We believe the financial services industry is evolving at a rapid pace due to the entrance of technology focused service providers, and we believe that there are attractive opportunities to acquire and merge with either rapidly growing fintech companies or traditional financial services companies that are at a strategic inflection point. Among the fintech businesses, we are intent on identifying companies with disruptive technology that have allowed them to grow quickly and that we believe are positioned to sustain a robust growth trajectory through the addition of new capital, access to public markets, operational or strategic expertise. Among the traditional financial services companies, we are seeking combination targets that have new or evolving opportunities to respond to changes in the market place through the addition of new capital, access to public markets, operational or strategic expertise. We believe strongly in our management team’s ability to add value from both an operating and a financing perspective has been a key driver of past performance and we believe will continue to be central to its differentiated acquisition strategy.

Business Strategy

Our business strategy is to utilize our management team’s past to identify and complete our initial business combination with a company that our management believes, with proper utilization of our network and experience, has compelling potential for value creation.

We believe our management team and members of our board have experience in:

• Operating companies, setting and changing strategies, and identifying, mentoring and recruiting exceptional talent;

• Developing and growing companies, both organically and through strategic transactions and acquisitions, and expanding the product range and geographic footprint of a number of target businesses;

• Investing in leading private and public technology companies to accelerate their growth and maturation; and

• Accessing the capital markets, including financing businesses and helping companies transition to public ownership.

Market Opportunity

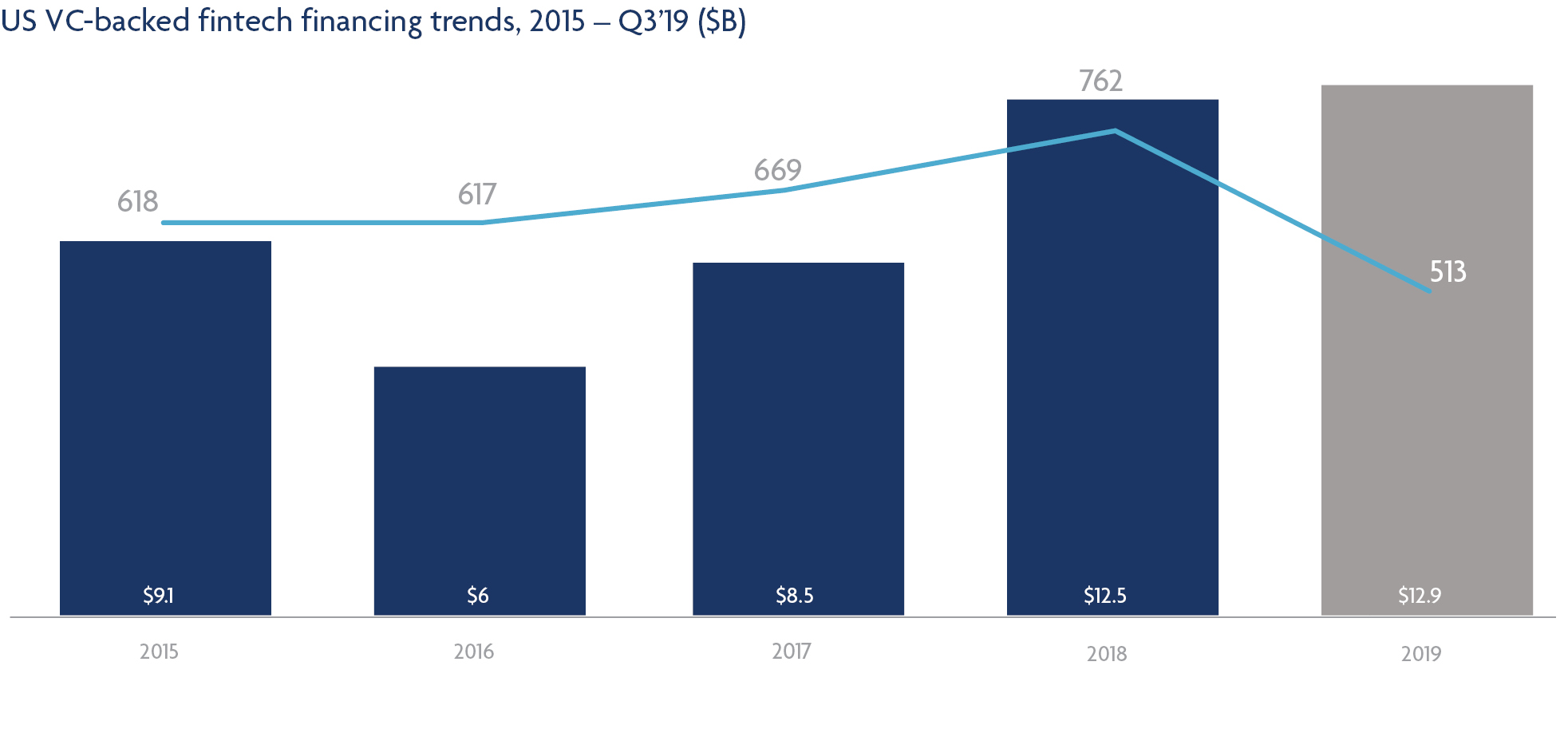

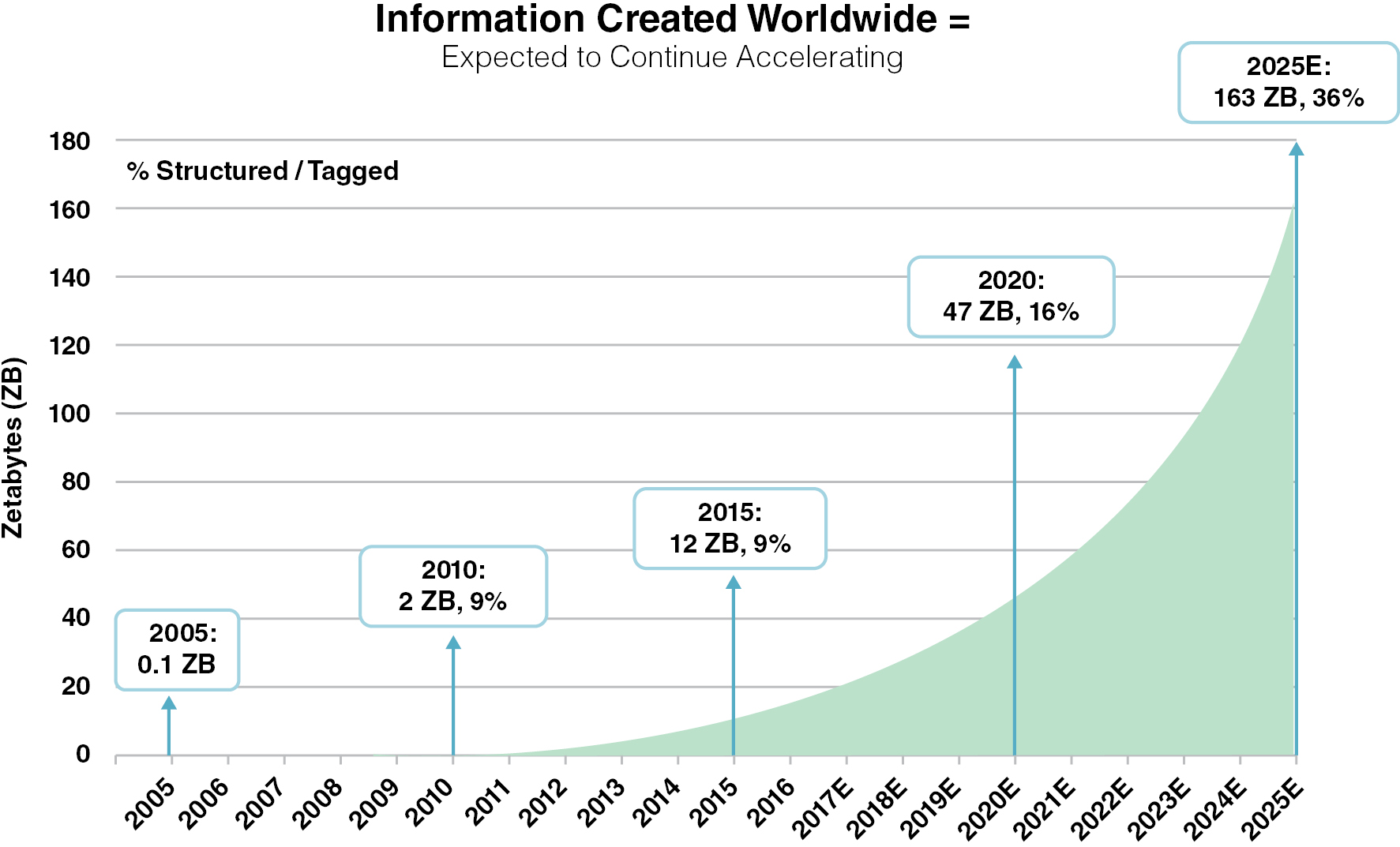

Although we are not limited to a particular industry or geographic region for purposes of consummating an initial business combination, we intend to focus on businesses within the fintech business space in North America and Asia-Pacific with an overall transaction value between $300 million and $1.0 billion. According to a report titled “The Win-Win Proposition — Why APAC’s Fintech Momentum is Driven by Partnerships,” published by the consulting firm Accenture in March 2019, the number of fintech investments worldwide in 2018 increased 19% to 3,251, up from 2,743 in 2017, totaling $55.3 billion, up 120% from $26.7 billion in 2017; the value of investment out of Asia-Pacific in 2018 rose to $29.8 billion, up from $6.9 billion in 2017. As provided in CB Insight’s “Global Intech Report Q3 2019” (the “CB Report”), the total venture capital (“VC”) investment in fintech sector in the third quarter of 2019 exceeded $8.9 billion, which represents a year-over-year increase of 41.3% from $6.3 billion for the comparative period in 2018. North America and Asia are the leading geographies for the fintech sector as indicated by the large amount of investment. According to the CB Report, in the third quarter of 2019, a total of $4.3 billion VC-backed equity funding was made across 182 fintech transactions in North America and $1.8 billion was invested in 152 transactions in Asia. As shown in the chart below, U.S. VC-backed fintech funding topped $12.9 billion through the third quarter of 2019, which has surpassed 2018’s annual record.

3

Source: Global Intech Report Q3 2019 by CB Insight

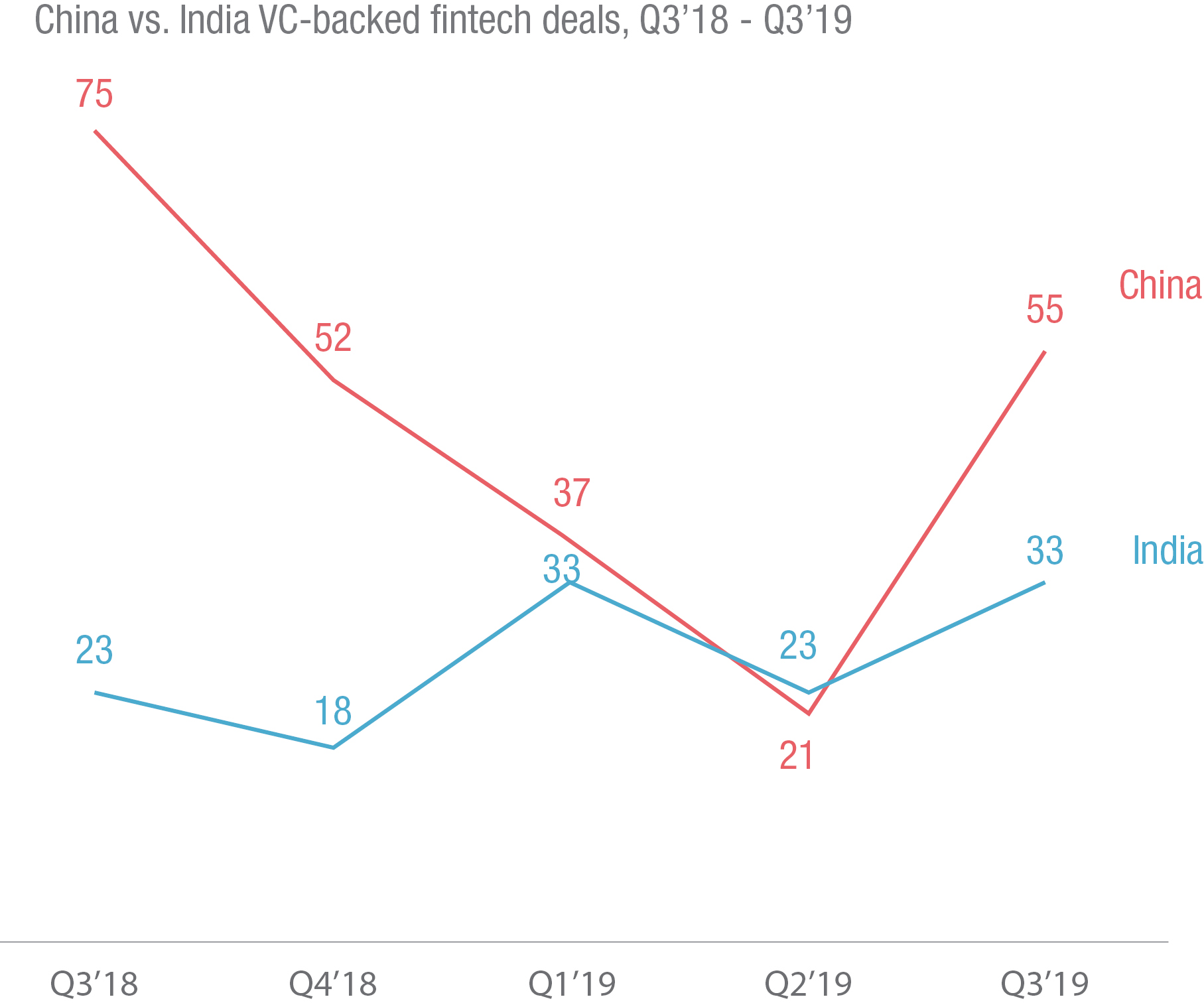

According to the CB Report, China regained the lead as the top market in Asia for fintech deals in the third quarter of 2019 with a total number of 55 deals.

Source: Global Intech Report Q3 2019 by CB Insight

4

We believe the fintech business are well posed for exponential growth and we believe that the sector represents attractive target markets given the size, breadth and prospects for growth. We have not narrowed our business combination target in any particular fintech business, however, we do believe the following areas:

Online Lending. Online lending based on big data analytics has grown where traditional bank lending fails to cover or under covers. According to an Accenture analysis in its May 2017 report titled “Fintech — Did Someone Cancel the Revolution,” around 2 billion people worldwide are unbanked, ignored or technically not accessible by traditional banks or mainstream financial services companies. Those who are ignored or out of reach by traditional financial services are being served by advanced digital lending technologies.

Big Data, Cloud Computing and Credit Analytics. Big data powered by cloud computing provides financial lenders the power to enhance credit rating and credit risk control. Bid data opens up a frontier to financial institutions to service those unbanked and/or underbanked customers.

Mobile Phone Payment. Mobile phone payment has been deployed quickly where cash payment can be eliminated creating fast and efficient transactions. However, smart phone payment is regulated differently in different countries by their respective financial authorities causing deployment of the technology unevenly worldwide.

Smart Contract. Smart contract utilizes computer programs, often in block chain, to automatically execute contracts between two or more parties in a variety of business in financial services, commercial transactions, B to B services, or B to C services, in lending, loan repayment, mortgaging, reducing costs in the conventional flow of documents and enhancing accuracy and security of the flow of documents.

Insurtech. Insurtech is short for “insurance technology.” It represents the emergence of new technologies that are transforming the insurance industry by reducing costs for consumers and insurance companies, improving efficiency, and enhancing customer satisfaction. Insurtech is seen to be a disruptor to the property and casualty homogenous insurance segment. Mass computing ability, scenario-based setting and growth are key strengths of Insurtech companies. Insurtech incorporates artificial intelligence (“AI”) and online-to-offline (O2O) integration by tapping into property and casualty (“P&C”) homogeneous-like auto insurance and health insurance segments.

Insurtech has been applied in areas such as AI-powered anti-fraud solutions for the P&C insurance industry. Insurtech provides a digitized platform, allowing customers to acquire all of their P&C in one place, suitable to small businesses. This digitalized market place is designed to improve insurance agency processes and efficiency.

According to KPMG’s March 2019 report titled “Insurtech 10: Trends for 2019,” insurtech trends in the areas of digital risk reduction, digitizing customers, behaviorial science, AI and machine learning, vehicle-focused coverage (as opposed to driver-focused insurance), and big data.

As reported in an article titled “Insurtech Investments Break New Records in Q1” published by Insurance Journal in May 2019, more than $1 billion was invested in 85 insurtech deals in the first quarter of 2019.

Investment Criteria

We will seek to identify companies that have compelling market presence, growth potential and a combination of the following characteristics. We will use these criteria and guidelines in evaluating acquisition opportunities, but we may decide to enter our initial business combination with a target business that does not meet these criteria and guidelines. We intend to acquire companies or assets that we believe have the following attributes:

• Middle-market businesses. We intend to seek target businesses with a total enterprise value between $300 million and $1 billion. We believe there are a considerable number of potential target businesses within this valuation range that can benefit from new capital for scalable operations to generate substantial revenue and earnings growth.

• Strong and noticeable presence in its market. We intend to focus on investment in an industry segment that has a noticeable presence in its market;

• First mover in its niche market. When pursuing our business combination, we will look for targets that are early leaders in their niche market and which set trends in their products and/or services;

• Differentiated products or services. A company with differentiated products or services offers investors a long-term investment opportunity and we will certainly spend time and resources to assess our business combination in this regard;

5

• Seasoned management team. We will spend significant time assessing a company’s leadership and personnel and evaluating what we can do to augment and/or upgrade the team over time if needed;

• Widely-applicable technology & scalable model offering appealing growth potential. Our management believes that technology-driven solutions that are widely applicable and scalable have a unique window of opportunity to create advantages that will grow with the industry;

• Stable and reputable customer base. We will seek target businesses that have a stable and reputable customer base, with systematic advantages which are generally able to employ risk management measures to endure economic downturns, industry consolidation, changing business preferences and other unfavorable business environments that may negatively impact their customers, suppliers and competitors.

These criteria are not intended to be exhaustive. Any evaluation relating to the merits of a particular initial business combination may be based, to the extent relevant, on these general guidelines as well as other considerations, factors and criteria that our management may deem relevant.

Initial Business Combination

We will have until 15 months from the closing of this offering to consummate our initial business combination. However, if we anticipate that we may not be able to consummate our initial business combination within 15 months, we may, by resolution of our board if requested by our initial shareholders, extend the period of time to consummate a business combination up to two times, each by an additional three months (for a total of up to 21 months to complete a business combination), subject to the sponsor depositing additional funds into the trust account as set out below. Pursuant to the terms of our amended and restated memorandum and articles of association and the trust agreement to be entered into between us and Continental Stock Transfer & Trust Company, LLC on the date of this prospectus, in order to extend the time available for us to consummate our initial business combination, our initial shareholders or their affiliates or designees, upon five days advance notice prior to the applicable deadline, must deposit into the trust account for each three-month extension, $1,000,000, or $1,150,000 if the underwriters’ over-allotment option is exercised in full ($0.10 per share in either case) on or prior to the date of the applicable deadline, up to an aggregate of $2,000,000 (or $2,300,000 if the underwriters’ over-allotment option is exercised in full), or approximately $0.20 per share. In the event that we receive notice from our sponsor five days prior to the applicable deadline of its wish for us to effect an extension, we intend to issue a press release announcing such intention at least three days prior to the applicable deadline. In addition, we intend to issue a press release the day after the applicable deadline announcing whether or not the funds had been timely deposited. Our sponsor and its affiliates or designees are not obligated to fund the trust account to extend the time for us to complete our initial business combination. If we are unable to consummate our initial business combination within the applicable time period, we will, as promptly as reasonably possible but not more than five business days thereafter, redeem the public shares for a pro rata portion of the funds held in the trust account and as promptly as reasonably possible following such redemption, subject to the approval of our remaining shareholders and our board of directors, dissolve and liquidate, subject in each case to our obligations under British Virgin Islands law to provide for claims of creditors and the requirements of other applicable law. In such event, the rights and warrants will be worthless.

Nasdaq rules require that our initial business combination must occur with one or more target businesses that together have an aggregate fair market value of at least 80% of the assets held in the trust account (excluding advisory fees and taxes payable on the income earned on the trust account) at the time of the agreement to enter into the initial business combination. If our board is not able to independently determine the fair market value of the target business or businesses, we will obtain an opinion from an independent investment banking firm or an independent accounting firm with respect to the satisfaction of such criteria. We do not intend to purchase multiple businesses in unrelated industries in connection with our initial business combination.

We anticipate structuring our initial business combination so that the post-transaction company in which our public shareholders own shares will own or acquire substantially all of the equity interests or assets of the target business or businesses. We may, however, structure our initial business combination such that the post-transaction company owns or acquires less than substantially all of such interests or assets of the target business in order to meet certain objectives of the target management team or shareholders or for other reasons, but we will only complete such business combination if the post-transaction company owns or acquires 50% or more of the outstanding voting securities of the target or otherwise acquires a controlling interest in the target sufficient for it not to be required to register as an investment company under the Investment Company Act of 1940, as amended (the “Investment Company Act”). Even

6

if the post-transaction company owns or acquires 50% or more of the voting securities of the target, our shareholders prior to the initial business combination may collectively own a minority interest in the post-transaction company, depending on valuations ascribed to the target and us in the business combination transaction. For example, we could pursue a transaction in which we issue a substantial number of new shares in exchange for all of the outstanding capital stock of a target. In this case, we would acquire a 100% controlling interest in the target. However, as a result of the issuance of a substantial number of new shares, our shareholders immediately prior to our initial business combination could own less than a majority of our outstanding shares subsequent to our initial business combination. If less than 100% of the equity interests or assets of a target business or businesses are owned or acquired by the post-transaction company, the portion of such business or businesses that is owned or acquired is what will be valued for purposes of the 80% of net assets test. If the initial business combination involves more than one target business, the 80% of net assets test will be based on the aggregate value of all of the target businesses even if the acquisitions of the target businesses are not closed simultaneously.

Although we believe that the net proceeds of this offering will be sufficient to allow us to consummate a business combination, because we have not yet identified any prospective target business, we cannot ascertain the capital requirements for any particular transaction. If the net proceeds of this offering prove to be insufficient, either because of the size of the business combination, the depletion of the available net proceeds in search of a target business, or because we become obligated to redeem a significant number of our public shares upon consummation of our initial business combination, we will be required to seek additional financing, in which case we may issue additional securities or incur debt in connection with such business combination. Furthermore, we may issue a substantial number of additional ordinary or preferred shares to complete our initial business combination or under an employee incentive plan upon or after consummation of our initial business combination (although our memorandum and articles of association will provide that we may not issue securities that can vote with ordinary shareholders on matters related to our pre-initial business combination activity). We do not have a maximum debt leverage ratio or a policy with respect to how much debt we may incur. The amount of debt we will be willing to incur will depend on the facts and circumstances of the proposed business combination and market conditions at the time of the potential business combination. At this time, we are not party to any arrangement or understanding with any third party with respect to raising additional funds through the sale of our securities or the incurrence of debt. Subject to compliance with applicable securities laws, we would only consummate such financing simultaneously with the consummation of our initial business combination.

Our Acquisition Process

We believe that conducting comprehensive due diligence on prospective investments is particularly important to achieve a successful business combination. We will utilize the diligence, rigor, and expertise of available resources of the network of our management team and the members of our board to evaluate potential targets’ strengths, weaknesses, and opportunities to identify the relative risk and return profile of any potential target for our initial business combination. Given our management team’s extensive tenure in evaluating investment opportunities and due diligence from past working experiences. We will often be familiar with the prospective target’s end-market, competitive landscape and business model. We certainly will empower third parties to assist us when needed.

In evaluating a prospective target for an initial business combination, we expect to conduct a thorough diligence review that will encompass, among other things, meetings with incumbent management and employees, document reviews, inspection of facilities, financial analyses and technology reviews, as well as a review of other information that will be made available to us.

We are not prohibited from pursuing an initial business combination with a company affiliated with our sponsor, our officers, or our directors, subject to certain approvals and consents. In the event we seek to complete our initial business combination with a company that is affiliated with our sponsor, officers or directors, we, or a committee of independent directors, will obtain an opinion from an independent investment banking firm which is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”) or an independent accounting firm that our initial business combination is fair to us from a financial point of view. Currently, we are not aware of an affiliate of our sponsor, officers or directors that would make a suitable target for our initial business combination.

We currently do not have any specific targets for an initial business combination selected. Our officers and directors have not contacted nor had any discussions with possible target businesses in which they directly or indirectly proposed or encouraged a potential target to consider a possible combination with us. We have not (nor has anyone

7

on our behalf) contacted any prospective target business or had any discussions, formal or otherwise, with respect to a business combination transaction with any prospective target business. We have not (nor have any of our agents or affiliates) been approached by any candidates (or representative of any candidates) with respect to a possible business combination with us.

Each of our officers and directors presently has, and any of them in the future may have additional, fiduciary or contractual obligations to other entities pursuant to which such officer or director is or will be required to present a business combination opportunity. Accordingly, if any of our officers or directors becomes aware of a business combination opportunity which is suitable for an entity to which he or she has then-current fiduciary or contractual obligations, he or she will honor his or her fiduciary or contractual obligations to present such opportunity to such entity. Our amended and restated memorandum and articles of association will provide that we renounce our interest in any corporate opportunity offered to any director or officer unless such opportunity is expressly offered to such person solely in his or her capacity as a director or officer of our company and such opportunity is one we are legally and contractually permitted to undertake and would otherwise be reasonable for us to pursue.

Emerging Growth Company Status and Other Information

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We intend to take advantage of the benefits of this extended transition period.

We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our ordinary shares that are held by non-affiliates exceeds $700 million on the last day of the second fiscal quarter of any given fiscal year, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period. References herein to emerging growth company shall have the meaning associated with it in the JOBS Act.

Corporate Information

Our executive offices are located at 25 Mall Road, Suite 330, Burlington, MA 01803 and our telephone number is (617) 991-5173.

8

The Offering

In making your decision on whether to invest in our securities, you should take into account not only the backgrounds of the members of our management team, but also the special risks we face as a blank check company and the fact that this offering is not being conducted in compliance with Rule 419 promulgated under the Securities Act of 1933, as amended, or the Securities Act. You will not be entitled to protections normally afforded to investors in Rule 419 blank check offerings. You should carefully consider these and the other risks set forth in the section below entitled “Risk Factors” beginning on page 22 of this prospectus.

|

Securities offered |

10,000,000 units, at $10.00 per unit, each unit consisting of: • one ordinary share, • one right to receive one-tenth (1/10) of one ordinary share upon the consummation of an initial business combination; and • one redeemable warrant, each warrant exercisable to purchase one-half (1/2) of one ordinary share at a price of $11.50 per full share, subject to adjustment as described in this prospectus. |

|

|

Listing of our securities and proposed symbols |

|

|

|

Each of the ordinary shares, rights and warrants may trade separately on the 90th day after the date of this prospectus unless I-Bankers determines that an earlier date is acceptable. I-Bankers has advised that, generally, it will not allow earlier separate trading of the units until it is confident, based on market conditions, that the units will not fall below the initial public offering price. In no event will I-Bankers allow separate trading of the ordinary shares, rights and warrants until we file an audited balance sheet reflecting our receipt of the gross proceeds of this offering and the sale of the public units. |

||

|

Once the ordinary shares, rights and warrants commence separate trading, holders will have the option to continue to hold units or separate their units into the component pieces. Holders will need to have their brokers contact our transfer agent in order to separate the units into ordinary shares, rights and warrants. |

||

|

We will file a Current Report on Form 8-K with the SEC, including an audited balance sheet, promptly upon the consummation of this offering, which is anticipated to take place two business days from the date the units commence trading. The audited balance sheet will reflect our receipt of the proceeds from the exercise of the over-allotment option if the over-allotment option is exercised on the date of this prospectus. If the over-allotment option is exercised after the date of this prospectus, we will file an amendment to the Current Report on Form 8-K or a new Current Report on Form 8-K to provide updated financial information to reflect the exercise of the over-allotment option. We will also include in the Current Report, or amendment thereto, or in a subsequent Current Report on Form 8-K, information indicating if I-Bankers has allowed separate trading of the ordinary shares, rights and warrants prior to the 90th day after the date of this prospectus. |

9

|

Ordinary shares: |

||

|

Number of issued and outstanding before this offering |

|

|

|

Number to be issued and outstanding |

|

|

|

Rights: |

||

|

Number outstanding before this offering |

0 |

|

|

Number of rights to be outstanding after this offering and the private placement |

10,323,750 |

|

|

Redeemable Warrants: |

||

|

Number outstanding before this offering |

0 warrants |

|

|

Number to be outstanding after this |

|

|

|

Exercisability |

Each warrant is exercisable for one-half (1/2) of one ordinary share. Because the warrants may only be exercised for whole numbers of shares, only an even number of warrants may be exercised at any given time. |

|

|

Exercise price |

$11.50 per share, subject to adjustment as described in this prospectus. No public warrants will be exercisable for cash unless we have an effective and current registration statement covering the issuance of the ordinary shares issuable upon exercise of the warrants and a current prospectus relating to such ordinary shares. It is our current intention to have an effective and current registration statement covering the issuance of the ordinary shares issuable upon exercise of the warrants and a current prospectus relating to such ordinary shares in effect promptly following consummation of an initial business combination. Notwithstanding the foregoing, if a registration statement covering the issuance of the ordinary shares issuable upon exercise of the public warrants is not effective within 90 days following the consummation of our initial business combination, public warrant holders may, until such time as there is such an effective registration statement and during any period when we shall have failed to maintain such an effective registration statement, exercise warrants on a cashless basis pursuant to an available exemption from registration under the Securities Act. In such event, each holder would pay the exercise price by surrendering the warrants for that number of ordinary shares equal to the quotient obtained by dividing (x) the product of the number of ordinary shares underlying the warrants, multiplied by the difference between the exercise price of the warrants and the “fair market value” (defined below) by (y) the fair market value. The “fair market value” shall mean the average reported last sale price of the ordinary shares for the 10 trading days ending on the trading day prior to the date of |

10

|

exercise. For example, if a holder held 300 warrants to purchase 150 shares and the fair market value on the trading date prior to exercise was $15.00, that holder would receive 35 shares without the payment of any additional cash consideration. If an exemption from registration is not available, holders will not be able to exercise their warrants on a cashless basis. |

||

|

In addition, if (x) we issue additional ordinary shares or equity-linked securities for capital raising purposes in connection with the closing of our initial business combination at an issue price or effective issue price of less than $9.50 per ordinary share (with such issue price or effective issue price to be determined in good faith by our board of directors), (y) the aggregate gross proceeds from such issuances represent more than 60% of the total equity proceeds, and interest thereon, available for the funding of our initial business combination, and (z) the volume weighted average trading price of our ordinary shares during the 20 trading day period starting on the trading day prior to the day on which we consummate our initial business combination (such price, the “Market Price”) is below $9.50 per share, the exercise price of the warrants will be adjusted (to the nearest cent) to be equal to 115% of the Market Price, and the $18.00 per share redemption trigger price described above will be adjusted (to the nearest cent) to be equal to 180% of the Market Price. |

||

|

Exercise period |

The warrants will become exercisable on the later of the completion of an initial business combination and 12 months from the date of this prospectus. The warrants will expire at 5:00 p.m., Eastern Time, on the fifth anniversary of our completion of an initial business combination, or earlier upon redemption. |

|

|

Redemption of warrants |

We may redeem the outstanding warrants (excluding the private warrants, any outstanding Representative’s Warrants issued to I-Bankers and/or its designees and any warrants underlying units issued to our sponsor, initial shareholders, officers, directors or their affiliates in payment of working capital loans made to us), in whole and not in part, at a price of $0.01 per warrant: |

|

|

• at any time while the warrants are exercisable, |

||

|

• upon a minimum of 30 days’ prior written notice of redemption, |

||

|

• if, and only if, the last sales price of our ordinary shares equals or exceeds $18.00 (as adjusted for stock splits, stock dividends, reorganizations and recapitalizations) for any 20 trading days within a 30 trading day period ending three trading days before we send the notice of redemption, and |

||

|

• if, and only if, there is a current registration statement in effect with respect to the issuance of the ordinary shares underlying such warrants at the time of redemption and for the entire 30-day trading period referred to above and continuing each day thereafter until the date of redemption. |

||

|

If the foregoing conditions are satisfied and we issue a notice of redemption, each warrant holder can exercise his, her or its warrant prior to the scheduled redemption date. However, the price of the ordinary shares may fall below the $18.00 trigger price (as adjusted) as well as the $11.50 warrant exercise price (as adjusted) after the redemption notice is issued. |

11

|

The redemption criteria for our warrants have been established at a price which is intended to provide warrant holders a reasonable premium to the initial exercise price and provide a sufficient differential between the then-prevailing share price and the warrant exercise price so that if the share price declines as a result of our redemption call, the redemption will not cause the share price to drop below the exercise price of the warrants. If and when the warrants become redeemable by us, we may not exercise our redemption right if the issuance of ordinary shares upon exercise of the warrants is not exempt from registration or qualification under applicable state blue sky laws or we are unable to effect such registration or qualification. We will use our best efforts to register or qualify such ordinary shares under the blue sky laws of the state of residence in those states in which the warrants were offered by us in this offering. If we call the warrants for redemption as described above, our management will have the option to require all holders that wish to exercise warrants to do so on a “cashless basis.” In such event, each holder would pay the exercise price by surrendering the warrants for that number of ordinary shares equal to the quotient obtained by dividing (x) the product of the number of ordinary shares underlying the warrants, multiplied by the difference between the exercise price of the warrants and the “fair market value” (defined below) by (y) the fair market value. The “fair market value” shall mean the average reported last sale price of the ordinary shares for the 10 trading days ending on the third trading day prior to the date on which the notice of redemption is sent to the holders of warrants. Whether we will exercise our option to require all holders to exercise their warrants on a “cashless basis” will depend on a variety of factors including the price of our ordinary shares at the time the warrants are called for redemption, our cash needs at such time and concerns regarding dilutive share issuances. None of the private placement warrants will be redeemable by us so long as they are held by our sponsor, anchor investors, I-Bankers, and/or their respective designees or permitted transferees. If the private placement warrants are held by holders other than the sponsor or its permitted transferees, the private placement warrants will be redeemable by us and exercisable by the holders on the same basis as the warrants included in the units being sold in this offering. |

||

|

Term of the Rights |

Each holder of a right will receive one-tenth (1/10) of an ordinary share upon consummation of our initial business combination. In the event we will not be the survivor upon completion of our initial business combination, each holder of a right will be required to affirmatively convert his, her or its rights in order to receive the 1/10 share underlying each right (without paying any additional consideration) upon consummation of the business combination. If we are unable to complete an initial business combination within the required time period and we liquidate the funds held in the trust account, holders of rights will not receive any of such funds for their rights and the rights will expire worthless. No fractional shares will be issued upon conversion of any rights. Any fractional shares will be rounded down to the nearest whole share, and any rounding down and extinguishment may be done with or without any in lieu cash payment or other compensation being made to the holder of the relevant rights. |

12

|

Private units |

Our sponsor, anchor investors and I-Bankers have committed to purchase an aggregate of 323,750 private units, of which 167,000 will be purchased by our sponsor and/or its designees, 108,000 will be purchased by our anchor investors, and 48,750 will be purchased by I-Bankers (or 350,000 private units if the underwriter’s over-allotment is exercised in full, of which 275,000 to be purchased by our sponsor, anchor investors and/or its designees and 75,000 to be purchased by I-Bankers) at $10.00 per unit ($3,237,500 in the aggregate or $3,500,000 at the maximum aggregate amount) in a private placement that will close simultaneously with the closing of this offering. Each private unit will consist of one ordinary share, one right (“private right”) entitling holder to receive one-tenth (1/10) of one ordinary share, and one warrant (“private warrant”), each warrant exercisable to purchase one-half (1/2) of one ordinary share at an exercise price of $11.50 per full share (subject to adjustment). |

|

|

The purchase price of the private units will be added to the net proceeds from this offering to be held in the trust account. If we do not complete our initial business combination within 15 months from the closing of this offering (or up to 21 months from the closing of this offering if we extend the period of time to consummate a business combination, as described in more detail in this prospectus), the proceeds of the sale of the private units held in the trust account will be used to fund the redemption of our public shares (subject to the requirements of applicable law) and the private units will expire worthless. |

||

|

Offering proceeds to be held in the trust account |

|

13

|

Except as set forth below, the proceeds held in the trust account will not be released until the earlier of: (1) the completion of our initial business combination within the required time period; (2) our redemption of 100% of the outstanding public shares if we have not completed an initial business combination in the required time period; and (3) the redemption of any public shares properly tendered in connection with a shareholder vote to amend our memorandum and articles of association (A) to modify the substance or timing of our obligation to redeem 100% of our public shares if we do not complete our initial business combination within the required time period or (B) with respect to any other provision relating to shareholders’ rights or pre-business combination activity. Therefore, unless and until our initial business combination is consummated, the proceeds held in the trust account will not be available for our use for any expenses related to this offering or expenses which we may incur related to the investigation and selection of a target business and the negotiation of an agreement to acquire a target business. |

||

|

Notwithstanding the foregoing, there can be released to us from the trust account any interest earned on the funds in the trust account that we need to pay our income or other tax obligations. With these exceptions, expenses incurred by us may be paid prior to an initial business combination only from the net proceeds of this offering not held in the trust account of approximately $700,000; provided, however, that in order to meet our working capital needs following the consummation of this offering if the funds not held in the trust account are insufficient, our initial shareholders, officers and directors or their affiliates may, but are not obligated to, loan us funds, from time to time or at any time, in whatever amount they deem reasonable in their sole discretion. Each loan would be evidenced by a promissory note. The notes would either be paid upon consummation of our initial business combination, without interest, or, at the lender’s discretion, up to $1,500,000 of the notes may be converted upon consummation of our initial business combination into additional private units at a price of $10.00 per unit (which, for example, would result in the holders being issued 150,000 ordinary shares if $1,500,000 of notes were so converted, as well as 150,000 rights to receive 15,000 ordinary shares and 150,000 warrants to purchase 75,000 shares). Our shareholders have approved the issuance of the units (and underlying ordinary shares, rights and warrants) upon conversion of such notes, to the extent the holder wishes to so convert them at the time of the consummation of our initial business combination. If we do not complete an initial business combination, the loans will only be repaid with funds not held in the trust account, and only to the extent available. |

||

|

Ability to extend time to complete business combination |

|

14

|

the trust account for each three-month extension, $1,000,000, or $1,150,000 if the underwriters’ over-allotment option is exercised in full ($0.10 per share in either case) on or prior to the date of the applicable deadline, up to an aggregate of $2,000,000 (or $2,300,000 if the underwriters’ over-allotment option is exercised in full), or approximately $0.20 per share. Any such payments would be made in the form of a loan. The terms of the promissory note to be issued in connection with any such loans have not yet been negotiated. If we complete our initial business combination, we would repay such loaned amounts out of the proceeds of the trust account released to us. If we do not complete a business combination, we will not repay such loans. Furthermore, the letter agreement with our initial shareholders contains a provision pursuant to which our sponsor has agreed to waive its right to be repaid for such loans in the event that we do not complete a business combination. Our sponsor and its affiliates or designees are not obligated to fund the trust account to extend the time for us to complete our initial business combination. |

||

|

Limited payments to insiders |

There will be no fees, reimbursements or other cash or non-cash payments paid to our sponsor, officers, directors or their affiliates prior to, or for any services they render in order to effectuate, the consummation of our initial business combination (regardless of the type of transaction that it is) other than the following payments, none of which will be made from the proceeds of this offering and the sale of the private units held in the trust account prior to the consummation of our initial business combination: |

|

|

• repayment at the closing of this offering of non-interest bearing loans and/or advances in an aggregate amount of $166,621 (as of the date of this prospectus) made by our initial shareholders; |

||

|

• payment to an affiliate of our executive officers of a total of $10,000 per month (up to $120,000 in the aggregate) for office space, utilities and secretarial and administrative services commencing on the date that our securities are first listed on Nasdaq; |

||

|

• reimbursement of out-of-pocket expenses incurred by them in connection with certain activities on our behalf, such as identifying and investigating possible business targets and business combinations; and |

||

|

• repayment upon consummation of our initial business combination of any loans which may be made by our initial shareholders or their affiliates or our officers and directors to finance transaction costs in connection with an intended initial business combination. |

||

|

There is no limit on the amount of out-of-pocket expenses reimbursable by us; provided, however, that to the extent such expenses exceed the available proceeds not deposited in the trust account, such expenses would not be reimbursed by us unless we consummate an initial business combination. Our audit committee will review and approve all reimbursements and payments made to our sponsor or member of our management team, or our or their respective affiliates, and any reimbursements and payments made to members of our audit committee will be reviewed and approved by our Board of Directors, with any interested director abstaining from such review and approval. |

15

|

Manner of conducting redemptions |

We will provide our public shareholders with the opportunity to redeem all or a portion of their public shares upon the completion of our initial business combination either (i) in connection with a shareholder meeting called to approve such business combination or (ii) by means of a tender offer. |

|

|

In connection with any proposed initial business combination, we may seek shareholder approval of such initial business combination at a meeting called for such purpose at which shareholders may seek to redeem their shares, regardless of whether they vote for or against the proposed business combination. In such case, we will consummate our initial business combination so long as (after redemption) our net tangible assets will be at least $5,000,001 prior to or upon such consummation and a majority of the outstanding ordinary shares voted are voted in favor of the business combination. |

||

|

We chose our net tangible asset threshold of $5,000,001 to ensure that we would avoid being subject to Rule 419 promulgated under the Securities Act. However, if we seek to consummate an initial business combination with a target business that imposes any type of working capital closing condition or requires us to have a minimum amount of funds available from the trust account upon consummation of such initial business combination, our net tangible asset threshold may limit our ability to consummate such initial business combination (as we may be required to have a lesser number of shares redeem) and may force us to seek third party financing which may not be available on terms acceptable to us or at all. As a result, we may not be able to consummate such initial business combination and we may not be able to locate another suitable target within the applicable time period, if at all. |

||

|

Our initial shareholders have agreed (A) to vote their founder shares, private shares and any public shares held by them in favor of any proposed initial business combination, (B) not to propose any amendment to our memorandum and articles of association (i) to modify the substance or timing of our obligation to redeem 100% of our public shares if we do not complete our initial business combination within 15 months (or up to 21 months) from the closing of this offering or (ii) with respect to any other provision relating to shareholders’ rights or pre-initial business combination activity, unless we provide our public shareholders with the opportunity to redeem their public shares upon approval of any such amendment at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of taxes payable), divided by the number of then outstanding public shares, (C) not to redeem any shares (including the founder shares) and private units (and underlying securities) into the right to receive cash from the trust account in connection with a shareholder vote to approve our proposed initial business combination (or to sell any shares in a tender offer in connection with a proposed business combination if we do not seek shareholder approval in connection therewith) or a vote to amend the provisions of our memorandum and articles of association relating to shareholders’ rights or pre-business combination activity and (D) that the founder shares and private units (and underlying securities) shall not participate in any liquidating distribution upon winding up if a business combination is not consummated, until all of the claims of any redeeming shareholders and creditors are fully satisfied (and then only from funds held outside the trust account). None of our initial shareholders or their affiliates has indicated any current intention to purchase units in this offering or any units or ordinary shares in the open market or in private transactions. However, if a significant number of shareholders |

16

|

vote, or indicate an intention to vote, against a proposed business combination, our initial shareholders, officers, directors or their affiliates could make such purchases in the open market or in private transactions (other than I-Bankers and its affiliates engaging in broker-dealer activities in the ordinary course of business) in order to influence the vote. Our initial shareholders, officers, directors and their affiliates could purchase sufficient shares so that the initial business combination may be approved without the majority vote of public shares held by non-affiliates. Notwithstanding the foregoing, our officers, directors, initial shareholders and their affiliates will not make purchases of ordinary shares if the purchases would violate Section 9(a)(2) or Rule 10b-5 of the Exchange Act, which are rules designed to stop potential manipulation of a company’s stock. |

||

|

If a shareholder vote is not required and we do not decide to hold a shareholder vote for business or other legal reasons, we will, pursuant to our amended and restated memorandum and articles of association: |

||

|

• conduct the redemptions pursuant to Rule 13e-4 and Regulation 14E of the Exchange Act, which regulate issuer tender offers, and |

||

|

• file tender offer documents with the SEC prior to completing our initial business combination which contain substantially the same financial and other information about the initial business combination and the redemption rights as is required under Regulation 14A of the Exchange Act, which regulates the solicitation of proxies. |

||

|

In the event we conduct redemptions pursuant to the tender offer rules, our offer to redeem will remain open for at least 20 business days, in accordance with Rule 14e-1(a) under the Exchange Act, and we will not be permitted to complete our initial business combination until the expiration of the tender offer period. In addition, the tender offer will be conditioned on public shareholders not tendering more than a specified number of public shares, which number will be based on the requirement that we may not redeem public shares in an amount that would cause our net tangible assets to be less than $5,000,001 prior to or upon the consummation of our initial business combination (so that we are not subject to the SEC’s “penny stock” rules) or any greater net tangible asset or cash requirement which may be contained in the agreement relating to our initial business combination. If public shareholders tender more shares than we have offered to purchase, we will withdraw the tender offer and not complete such initial business combination although we may seek an alternative initial business combination. |

||

|

Redemption rights |

At any meeting called to approve an initial business combination, any public shareholder voting either for or against such proposed business combination will be entitled to demand that his ordinary shares be redeemed for a pro rata portion of the amount then in the trust account (initially $10.00 per share, subject to increase of up to an additional approximately $0.20 per ordinary share in the event that our sponsor elects to extend the period of time to consummate a business combination, as described in more detail in this prospectus, plus any pro rata interest earned on the funds held in the trust account less amounts necessary to pay our taxes). The per-share amount we will distribute to investors who properly redeem their shares will not be reduced by the advisory fees we will pay to the underwriters. |

17

|