UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _________

Commission file no: 001-38903

POSTAL REALTY TRUST, INC.

(Exact name of registrant as specified in its charter)

| Maryland | 83-2586114 | |

| (State or other jurisdiction of | (IRS Employer | |

| incorporation or organization) | Identification No.) |

75 Columbia Avenue

Cedarhurst, NY 11516

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (516) 295-7820

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||

| Class A Common Stock, par value $0.01 per share | PSTL | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2020, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s Class A common stock held by non-affiliates of the registrant was approximately $71.8 million, based on the closing sales price of $15.95 per share as reported on the New York Stock Exchange.

As of March 30, 2021, the registrant had 13,326,514 shares of Class A common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement for the 2021 Annual Meeting of Shareholders (to be filed with the Securities and Exchange Commission no later than 120 days after the end of the registrant’s fiscal year end) are incorporated by reference in this Annual Report on Form 10-K in response to Part II, Item 5 and Part III, Items 10, 11, 12, 13 and 14.

POSTAL

REALTY TRUST, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2020

TABLE OF CONTENTS

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of federal securities laws. These forward-looking statements are included throughout this Annual Report on Form 10-K, including in the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and “Certain Relationships and Related Person Transactions,” and relate to matters such as our industry, business strategy, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, financial condition, liquidity, capital resources, cash flows, results of operations and other financial and operating information. We have used the words “approximately,” “anticipate,” “assume,” “believe,” “budget,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “future,” “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will” and similar terms and phrases to identify forward-looking statements in this Annual Report on Form 10-K.

In addition, important factors that could cause actual results to differ materially from such forward-looking statements include the risk factors in Item 1A. “Risk Factors” and elsewhere in this Annual Report on Form 10-K. New risks and uncertainties arise from time to time, and we cannot predict those events or how they might affect us. We assume no obligation to update any forward-looking statements after the date of this Annual Report on Form 10-K, except as required by applicable law. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results.

When we use the terms “we,” “us,” “our,” the “Company,” “Postal” and “our company” in this Annual Report on Form 10-K, we are referring to Postal Realty Trust, Inc., a Maryland corporation, together with our consolidated subsidiaries, including Postal Realty LP, a Delaware limited partnership of which we are the sole general partner and which we refer to as “our Operating Partnership.”

All of our forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we are expecting, including:

| ● | change in the status of the United States Postal Service, or USPS, as an independent agency of the executive branch of the U.S. federal government; |

| ● | change in the demand for postal services delivered by the USPS; |

| ● | the solvency and financial health of the USPS; |

| ● | defaults on, early terminations of or non-renewal of leases by the USPS; |

| ● | the competitive market in which we operate; |

| ● | changes in the availability of acquisition opportunities; |

| ● | our inability to successfully complete real estate acquisitions or dispositions on the terms and timing we expect, or at all; |

| ● | our failure to successfully operate developed and acquired properties; |

| ● | adverse economic or real estate developments, either nationally or in the markets in which our properties are located; |

| ● | decreased rental rates or increased vacancy rates; |

| ● | change in our business, financing or investment strategy or the markets in which we operate; |

| ● | fluctuations in mortgage rates and increased operating costs; |

ii

| ● | changes in the method pursuant to which reference rates are determined and the elimination of the London Inter-Bank Offered Rate, or LIBOR, after 2023; |

| ● | general economic conditions; |

| ● | financial market fluctuations; |

| ● | our failure to generate sufficient cash flows to service our outstanding indebtedness; |

| ● | our failure to obtain necessary outside financing on favorable terms or at all; |

| ● | failure to hedge effectively against interest rate changes; |

| ● | our reliance on key personnel whose continued service is not guaranteed; |

| ● | the outcome of claims and litigation involving or affecting us; |

| ● | changes in real estate, taxation, zoning laws and other legislation and government activity and changes to real property tax rates and the taxation of real estate investment trusts, or “REITs” in general; |

| ● | operations through joint ventures and reliance on or disputes with co-venturers; |

| ● | cybersecurity threats; |

| ● | environmental uncertainties and risks related to adverse weather conditions and natural disasters; |

| ● | governmental approvals, actions and initiatives, including the need for compliance with environmental requirements; |

| ● | lack or insufficient amounts of insurance; |

| ● | limitations imposed on our business in order to qualify and maintain our status as a REIT and our failure to qualify or maintain such status; |

| ● | public health threats such as COVID-19; |

| ● | our ability to come to an agreement with the USPS regarding new leases; and |

| ● | additional factors discussed under the sections captioned “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” |

iii

General

We are an internally managed real estate corporation that owns properties leased primarily to the USPS. We believe that we are one of the largest owners and managers, measured by net leasable square footage, of properties that are leased to the USPS.

We were organized in the state of Maryland on November 19, 2018 and commenced operations upon completion of our initial public offering, or IPO, on May 17, 2019 and the related formation transactions, or the Formation Transactions. Our Class A common stock trades on the New York Stock Exchange, or the NYSE, under the symbol “PSTL”. We elected to be taxed as a REIT for U.S. federal income tax purposes, commencing with our short tax year ended December 31, 2019. We conduct our business through a traditional UPREIT structure in which our properties are owned by our Operating Partnership directly or through limited partnerships, limited liability companies or other subsidiaries. We are the sole general partner of our Operating Partnership through which our postal properties are directly or indirectly owned. As of December 31, 2020, we owned approximately 76.9% of the outstanding common units of limited partnership interest in our Operating Partnership (each, an “OP Unit,” and collectively, the “OP Units”) including long term incentive units of our Operating Partnership (each, an “LTIP Unit” and collectively, the “LTIP Units). Our Board of Directors oversees our business and affairs. We make reference to the public reports of the USPS with the Postal Regulatory Commission, including the audited financial statements of the USPS, available at www.usps.com or www.prc.gov.

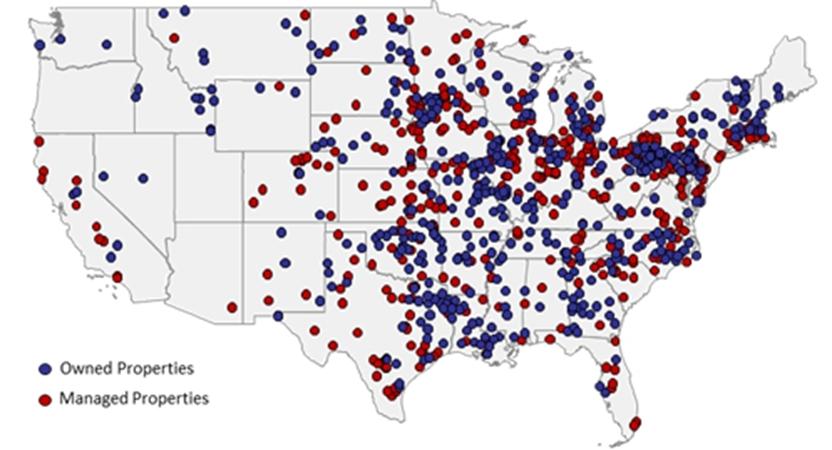

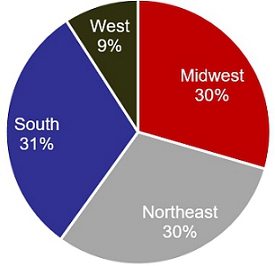

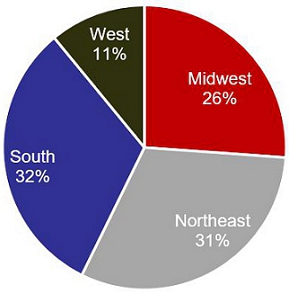

Real Estate Investments

As of December 31, 2020, we had investments of approximately $259.8 million in 726 real estate properties (including one property accounted for as a financing lease). The properties are located in 47 states, totaling approximately 2.7 million net leasable interior square feet in the aggregate and were 100% leased as of December 31, 2020 with a weighted average remaining lease term of approximately 3.7 years. As of December 31, 2020, we manage, through our taxable REIT subsidiary, or TRS, an additional 400 properties owned by affiliates of our chief executive officer, Andrew Spodek. We have a right of first offer to purchase 251 of our 400 managed properties.

The majority of our leases are modified double-net leases, whereby the USPS is responsible for utilities and routine maintenance and reimburses the landlord for property taxes, while the landlord is responsible for insurance, roof and structure. We believe this structure helps insulate us from increases in certain operating expenses and provides a more predictable cash flow. We believe the overall opportunity for consolidation that exists within the postal logistics network is attractive, and we continue to execute our strategy to acquire and consolidate postal properties that we believe will generate strong earnings for our stockholders.

2020 Highlights

| ● | We collected 100% of our rents and maintained 100% occupancy. |

| ● | We acquired 261 properties primarily leased to the USPS totaling approximately 1.2 million net leasable interior square feet, for approximately $130 million. |

| ● | In January 2020, we exercised a portion of the accordion feature on our senior revolving credit facility or the Credit Facility, increasing our permitted borrowing capacity up to $150.0 million. We further amended the credit agreement, as amended, the Credit Agreement, with People’s United Bank, National Association, as described under Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Factors that may Influence Future Results of Operations— Indebtedness and Interest Expense. In addition, we obtained approximately $44.0 million of fixed rate mortgage financing at a weighted average rate of 3.25% and a weighted average term of 12.9 years as of December 31, 2020. |

| ● | We completed a follow-on offering of 3.5 million shares of our Class A common stock on July 20, 2020, raising $52.2 million in gross proceeds. In addition, we filed a $500 million shelf registration statement and entered into a $50 million at the market common stock offering program, or ATM program. |

1

Dividends

| ● | We have increased our quarterly dividend from $0.17 for the fourth quarter 2019 dividend to $0.2175 for the fourth quarter 2020 dividend. Our dividend per share has increased for the past six consecutive quarters and, although we expect to continue our policy of paying regular dividends, we cannot guarantee that we will maintain our current level of dividends, that we will continue our recent pattern of increasing dividends per share or what our actual dividend yield will be in any future period. |

Tenant Concentration

We acquire and manage postal properties and report our business as a single reportable segment. As of December 31, 2020, all of our properties are leased to a single tenant, the USPS, other than the multi-tenant industrial facility located in Warrendale, PA. The USPS occupies 73% of this property as a distribution facility. See the discussions under Item 1A–Risk Factors under the caption –Risks Related to the USPS.

Government Regulations

Compliance with various governmental regulations has an impact on our business, including our capital expenditures, earnings, and competitive position. The impact of these governmental regulations can be material to our business. We incur costs to monitor and take action to comply with governmental regulations that are applicable to our business, which include, among others: federal securities laws and regulations; REIT and other tax laws and regulations; environmental and health and safety laws and regulations; local zoning, usage and other regulations relating to real property; and the Americans with Disabilities Act of 1990, as amended, or the ADA.

Our properties must comply with Title III of the ADA to the extent that such properties are “public accommodations” as defined by the ADA. The ADA may require removal of structural barriers to access by persons with disabilities in certain public areas of our properties where such removal is readily achievable. We believe the existing properties are in substantial compliance with the ADA and that we will not be required to make substantial capital expenditures to address the requirements of the ADA. However, noncompliance with the ADA could result in imposition of fines or an award of damages to private litigants. The obligation to make readily achievable accommodations is an ongoing one, and we will continue to assess our properties and to make alterations as appropriate in this respect.

Human Capital Resource Management

As of December 31, 2020, we employed 25 full-time employees. All of our employees are employed by our corporate office in Cedarhurst, New York. Our employees are not members of any labor union, and we consider our relations with our employees to be satisfactory.

As of December 31, 2020, 24% of our employees, 20% of our named executive officers and key employees (defined as all employees with a title of vice president and higher) and 20% of the members of our Board of Directors were female.

We endeavor to maintain workplaces that are free from discrimination or harassment on the basis of color, race, sex, national origin, ethnicity, religion, age, disability, sexual orientation, gender identification or expression or any other status protected by applicable law. The basis for recruitment, hiring, development, training, compensation and advancement at the Company is qualifications, performance, skills and experience. We believe our employees are fairly compensated, and compensation and promotion decisions are made without regard to gender, race and ethnicity. Employees are routinely recognized for outstanding performance.

2

Covid-19 Health and Safety

In response to the COVID-19 pandemic, we promptly transitioned all of our employees to remote working, without significant impact to productivity. We organized training programs to ensure that all employees were prepared to complete tasks remotely. At our corporate office, we provide cleaning supplies and facial coverings to all employees and visitors who chose to work in the office, among other safety measures to help reduce the potential transmission of the disease.

Environmental Matters

Under various federal, state and local laws, ordinances and regulations, as a current or former owner of real property, we may be liable for costs of the removal or remediation of certain hazardous substances, waste, or petroleum products at, on, in, under the properties that we own, including costs for investigation or remediation, natural resource damages, or third-party liability for personal injury or property damage. These laws often impose liability without regard to fault including whether the owner or operator knew of, or were responsible for, the presence or release of such materials. Some of our properties may be impacted by contamination arising from current or prior uses of the property or adjacent properties for commercial, industrial or other purposes.

Changes in laws increasing the potential liability for environmental conditions existing on properties or increasing the restrictions on discharges or other conditions may result in significant unanticipated expenditures or may otherwise adversely affect the operations of the tenants of our properties, which could materially and adversely affect us. We maintain an insurance policy for environmental liabilities at all of our properties. However, any potential or existing environmental contamination liabilities may be in excess of the coverage limits of, or not covered by, such insurance policy. As a result, we may not be aware of all potential or existing environmental contamination liabilities at the properties in our portfolio. As a result, we could potentially incur material liability for these issues.

In addition, some of our buildings may contain lead-based paint or asbestos containing materials or may contain or develop harmful mold or suffer from other indoor air quality issues, which could lead to liability for adverse health effects or property damage or costs for remediation. Indoor air quality issues can also stem from inadequate ventilation, chemical contamination from indoor or outdoor sources and other biological contaminants such as pollen, viruses and bacteria. Indoor exposure to lead, asbestos, or airborne toxins or irritants above certain levels can be alleged to cause a variety of adverse health effects and symptoms, including allergic or other reactions. As a result, the presence of lead, asbestos, mold or other airborne contaminants at any of our properties could require us to undertake a costly remediation program to contain or remove the mold or other airborne contaminants from the affected property or increase indoor ventilation. In addition, the presence of lead, asbestos, mold or other airborne contaminants could expose us to liability from our sole tenant, employees of our sole tenant or others if property damage or personal injury occurs. We are not presently aware of any material adverse indoor air quality issues at our properties.

Availability of Reports Filed with the Securities and Exchange Commission

A copy of this Annual Report on Form 10-K, as well as our quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to such reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are available, free of charge, on our Internet website (www.postalrealty.com). All of these reports are made available on our website as soon as reasonably practicable after they are electronically filed with or furnished to the Securities and Exchange Commission (the “SEC”). Our Governance Guidelines and Code of Business Conduct and Ethics and the charters of the Audit, Compensation, and Corporate Governance Committees of our Board of Directors are also available on our website at https://investor.postalrealtytrust.com/govdocs, and are available in print to any stockholder upon written request to Postal Realty Trust, Inc. c/o Investor Relations, 75 Columbia Avenue, Cedarhurst, New York 11516. Our telephone number is (516) 295-7820. The information on or accessible through our website is not, and shall not be deemed to be, a part of this report or incorporated into any other filing we make with the SEC.

3

Risk Factor Summary

Risks Related to the USPS

| ● | Our business is substantially dependent on the demand for leased postal properties. | |

| ● | The USPS’s inability to meet its financial obligations may have a material adverse effect on our business. | |

| ● | The USPS has a substantial amount of indebtedness. | |

| ● | The USPS is subject to congressional oversight and regulation by the Postal Regulatory Commission or the PRC and other agencies. | |

| ● | The business and results of operations of the USPS are significantly affected by competition from both competitors in the delivery marketplace as well as substitute products and digital communication. | |

| ● | The USPS’s potential insolvency, inability to pay rent or bankruptcy may have a material adverse effect on our business. | |

| ● | Our properties may have a higher risk of terrorist attacks. | |

| ● | The ongoing COVID-19 pandemic and measures being taken to prevent its spread, including government-imposed travel related limitations, could negatively impact the USPS, which could have a material adverse effect on our business. | |

| ● | Changes in leadership, structure, operations and strategy within the USPS may disrupt our business. | |

| ● | Litigation involving the USPS, including related to changes in the USPS’s operations, may disrupt our business. |

Risks Related to Our Business Operations

| ● | We may be unable to acquire and/or manage additional USPS-leased properties at competitive prices or at all. | |

| ● | We currently have a concentration of postal properties in Pennsylvania, Wisconsin, Texas, Maine, Oklahoma and Illinois and are exposed to changes in regional or local conditions in these states. | |

| ● | We may be unable to renew leases or sell vacated properties on favorable terms, or at all, as leases expire. | |

| ● | Property vacancies could result in significant capital expenditures and illiquidity. | |

| ● | As of March 30, 2021, the leases at 11 of our properties were expired and the USPS is occupying such properties as a holdover tenant. | |

| ● | Our use of OP Units as consideration to acquire properties could result in stockholder dilution and/or limit our ability to sell such properties. | |

| ● | Postal properties are illiquid. | |

| ● | Our real estate taxes for properties where we are not reimbursed could increase. | |

| ● | Increases in mortgage rates or unavailability of mortgage debt may make it difficult for us to finance or refinance our debt. | |

| ● | Mortgage debt obligations expose us to the possibility of foreclosure. | |

| ● | Changes in the method pursuant to which the reference rates are determined and the phasing out of LIBOR after June 2023 may affect our financial results. | |

| ● | Failure to comply with covenants in our debt agreements could adversely affect our financial condition. | |

| ● | Failure to hedge effectively against interest rate changes may have a material adverse effect on our business. | |

| ● | Our success depends on key personnel whose continued service is not guaranteed. | |

| ● | Joint venture investments could be adversely affected by our lack of sole decision-making authority, our reliance on co-venturers’ financial condition and disputes between us and our co-venturers. | |

| ● | Our growth depends on external sources of capital that are outside of our control and may not be available to us on commercially reasonable terms or at all. | |

| ● | We could incur significant costs and liabilities related to environmental matters. | |

| ● | Our properties may contain or develop harmful mold or suffer from other air quality issues. | |

| ● | We are subject to risks from natural disasters, such as earthquakes and severe weather, and the risks associated with the physical effects of climate change. | |

| ● | Our properties may be subject to impairment charges. | |

| ● | Our title insurance policies may not cover all title defects. | |

| ● | We may incur significant costs complying with various federal, state and local laws, regulations and covenants applicable to our properties. | |

| ● | We have acquired and may continue to acquire properties that are (i) leased to both the USPS and non-postal tenants, (ii) leased solely to non-postal tenants or (iii) in markets that are new to us., and we may not be able to adapt to these new business models. |

4

Risks Related to Our Organizational Structure

| ● | Mr. Spodek and his affiliates own, directly or indirectly, a substantial beneficial interest in our company on a fully diluted basis and have the ability to exercise significant influence on our company and our operating partnership. | |

| ● | Conflicts of interest may exist or could arise in the future between the interests of our stockholders and the interests of holders of units in our operating partnership. | |

| ● | Our charter contains certain provisions restricting the ownership and transfer of our stock that may delay, defer or prevent a change of control transaction. | |

| ● | We could increase the number of authorized shares of stock, classify and reclassify unissued stock and issue stock without stockholder approval. | |

| ● | Certain provisions of the Maryland General Corporation Law, or MGCL could inhibit changes of control, which may discourage third parties from conducting a tender offer or seeking other change of control transactions. | |

| ● | Certain provisions in the partnership agreement of our operating partnership may delay or prevent unsolicited acquisitions of us. | |

| ● | Tax protection agreements may limit our ability to sell or otherwise dispose of certain properties and may require our Operating Partnership to maintain certain debt levels that otherwise would not be required. | |

| ● | Our Board of Directors may change our strategies, policies and procedures without stockholder approval, and we may become more highly leveraged, which may increase our risk of default under our debt obligations. | |

| ● | Our rights and the rights of our stockholders to take action against our directors and officers are limited. | |

| ● | We are a holding company with no direct operations, and the interests of our stockholders are structurally subordinated to all liabilities and obligations of our operating partnership and its subsidiaries. | |

| ● | Our operating partnership may issue additional OP Units to third parties without the consent of our stockholders. |

Risks Related to Our Status as a REIT

| ● | Failure to remain qualified as a REIT would cause us to be taxed as a regular corporation. | |

| ● | Even if we qualify as a REIT, we may face other tax liabilities that reduce our cash flows. | |

| ● | Failure to make required distributions would subject us to federal corporate income tax. | |

| ● | Complying with REIT requirements may cause us to forego certain opportunities or investments. | |

| ● | The prohibited transactions tax may limit our ability to dispose of our properties. | |

| ● | We could be affected by tax liabilities or earnings and profits of our Predecessor. | |

| ● | There are uncertainties relating to the estimate of the accumulated earnings and profits attributable to UPH. | |

| ● | A sale of assets acquired as part of the merger between us and UPH within five years after the merger would result in corporate income tax. | |

| ● | The ability of our Board of Directors to revoke our REIT qualification without stockholder approval. | |

| ● | Our transactions with our TRS will cause us to be subject to a 100% penalty tax on certain income or deductions if those transactions are not conducted on arm’s-length terms. | |

| ● | You may be restricted from acquiring or transferring certain amounts of our Class A common stock. | |

| ● | Dividends payable by REITs generally do not qualify for the reduced tax rates on dividend income from regular corporations. | |

| ● | If our operating partnership failed to qualify as a partnership for federal income tax purposes, we would cease to qualify as a REIT. | |

| ● | To maintain our REIT status, we may be forced to borrow funds during unfavorable market conditions or on unfavorable terms at desired times. | |

| ● | Covenants in our agreements for our credit facilities or other borrowings may restrict our ability to pay distributions. | |

| ● | New legislation or administrative or judicial action, in each instance potentially with retroactive effect, could adversely affect us or our stockholders. |

General Risk Factors

| ● | An increase in market interest rates may have an adverse effect on the market price of our securities. | |

| ● | Future offerings of equity securities may adversely affect the market price of our Class A common stock. | |

| ● | The market price of our Class A common stock has been, and may continue to be, volatile and has declined, and may continue to decline. | |

| ● | Future sales of our Class A common stock, preferred stock, or securities convertible into or exchangeable or exercisable for our Class A common stock could depress the market price of our Class A common stock. | |

| ● | We face cybersecurity risks and risks associated with security breaches. |

5

The following risk factors may adversely affect our overall business, financial condition, results of operations, and cash flows; our ability to make distributions to our stockholders; our access to capital; or the market price of our Class A common stock, as further described in each risk factor below. In addition to the information set forth herein, in this Annual Report on Form 10-K, one should carefully review and consider the information contained in our other reports and periodic filings that we make with the SEC. Those risk factors could materially affect our overall business, financial condition, results of operations and cash flows; our ability to make distributions to our stockholders; our access to capital; or the market price of our Class A common stock. The risks that we describe in our public filings are not the only risks that we face. Additional risks and uncertainties not presently known to us, or that we currently consider immaterial, also may materially adversely affect our business, financial condition, and results of operations. Additional information regarding forward-looking statements is included herein.

Risks Related to the USPS

Our business is substantially dependent on the demand for leased postal properties.

Any significant decrease in the demand for leased postal properties could have an adverse effect on our business. The number of retail postal locations nationwide has been decreasing over the prior decade. Additionally, on March 23, 2021, Postmaster General Louis DeJoy released a ten-year plan entitled Delivering for America: Our Vision and Ten-Year Plan to Achieve Financial Sustainability and Service Excellence (the “Ten-Year Plan”), which includes evaluating the facility consolidations that were deferred in 2015 and potentially consolidating the facilities that remain underutilized. Consolidation of our postal properties would materially adversely affect our operations. Further reductions in the number of postal properties could result in entering into leases with the USPS in the future on less favorable terms than current leases, the failure of the USPS to renew leases for our properties and the reduction of the number of acquisition opportunities available to us. The level of demand for postal properties may be impacted by a variety of factors outside of our control, including changes in U.S. federal government and USPS policies or funding, changes in population density, the health and sustainability of local, regional and national economies, the existence of epidemics and pandemics, such as the ongoing COVID-19 pandemic, and the demand and use of the USPS. Moreover, technological innovations, such as autonomous delivery devices, may decrease the need for hand delivery or in-person pick up, thereby decreasing the demand for retail post offices. In addition, package delivery service providers, such as FedEx, Amazon, UPS and DHL, begun implementing autonomous delivery devices to assist retail companies with same-day and last-mile deliveries, in addition to publicly stating their intention to expand their last-mile delivery capabilities. The development, implementation and broad adoption of these devices may decrease the demand for postal services.

The USPS is facing legislative constraints that are hindering the USPS ‘s ability to maintain adequate liquidity to sustain its current operations. If the USPS’s revenues decrease due to reduced demand for postal services, then the USPS may reduce its number of post office locations.

The USPS’s inability to meet its financial obligations may render it insolvent or increase the likelihood of Congressional or regulatory reform of the USPS, which may have a material adverse effect on our business and operations.

A significant portion of the USPS’s liabilities consist of unfunded fixed benefits, such as pensions and healthcare, to retired USPS workers. Although Congress regularly debates the future of the USPS, the USPS is unlikely to be able to retire its existing liabilities without regulatory or Congressional relief. If the USPS becomes unable to meet its financial obligations, many of our leases may be vacated by the USPS, which would have a material adverse effect on our business and operations. Any Congressional or regulatory action that decreases demand by the USPS for leased postal properties would also have a material adverse effect on our business and operations. We cannot predict whether any currently contemplated reforms or any reforms pursued by the Biden administration will ultimately take effect and, if so, how such reforms would specifically affect us.

The USPS has a substantial amount of indebtedness.

On April 1, 1999, the USPS entered into a Note Purchase Agreement, as amended, the NPA, with the Federal Financing Bank (the “FFB”) for the purpose of obtaining debt financing. Under the NPA, FFB is required to purchase notes from the USPS meeting specified conditions, up to the established maximum amounts, within five business days of delivery. The amount that the USPS borrows under the NPA varies from year to year depending upon the needs of the organization. Historically, all of the USPS’s outstanding debt has been obtained through the NPA. The most recent extension to the NPA, however, expired on August 31, 2019. If the USPS cannot reach acceptable terms with FFB on an extension of the NPA, the USPS would need to seek debt financing through other means, either through individual agreements with FFB (on terms that may differ from those set forth in the NPA) or from other sources. There can be no assurance that the USPS will be able to extend the term of the NPA or obtain alternative debt financing on the terms or timing that it expects, if at all. If the USPS is unable to extend the NPA with the FFB, the USPS may not be able to refinance debt with the FFB in the future at comparable terms to those currently available.

6

The USPS has significant outstanding debt obligations to the FFB. and a significant underfunded Postal Service Retiree Health Benefit Fund, or the PSRHBF, liability, which the USPS is required to fund in future periods. Additionally, the USPS has underfunded retirement benefits amortization payable to the Civil Service Retirement System, or CSRS, and Federal Employees Retirement System, or FERS, funds, which the USPS is required to fund in future periods. The USPS’s significant indebtedness and unpaid retirement and retiree health obligations could require the USPS to dedicate a substantial portion of its future cash flow from operations to payments on debt and retirement and retiree healthcare obligations, thus reducing the availability of cash flow to fund operating expenses, including lease payments, working capital, capital expenditures and other business activities.

The USPS is subject to congressional oversight and regulation by the PRC and other government agencies.

The USPS has a wide variety of stakeholders whose interests and needs are sometimes in conflict. The USPS operates as an independent establishment of the executive branch of the U.S. government and, as a result, is subject to a variety of regulations and other limitations applicable to federal agencies. The ability of the USPS to raise rates for its products and services is subject to the regulatory oversight and approval of the PRC. Limitations on the USPS’s ability to take action could adversely affect its operating and financial results, and as a result, reduce demand for leasing postal properties.

Furthermore, a change in the structure, mission, or leasing requirements of the USPS, a significant reduction in the USPS’s workforce, a relocation of personnel resources, other internal reorganization or a change in the post offices occupying our properties, would affect our lease renewal opportunities and have a material adverse effect on our business, financial condition and results of operations. In addition, any change in the federal government’s treatment of the USPS as an independent agency, including, but not limited to, the privatization of all or a portion of the USPS business operations, may have a material adverse effect on our business.

The business and results of operations of the USPS are significantly affected by competition from both competitors in the delivery marketplace as well as substitute products and digital communication.

Failure of the USPS to compete effectively and operate efficiently, grow marketing mail and package delivery services, and increase revenue and contribution from other sources, will adversely impact the USPS’s financial condition and this adverse impact will become more substantial over time. The USPS’s marketplace competitors include both local and national providers of package delivery services. The USPS’s competitors have different cost structures and fewer regulatory restrictions and are able to offer differing services and pricing, which may hinder the USPS’s ability to remain competitive in these service areas. In addition, most of the USPS’s competitors have access to capital markets, which allows them greater flexibility in the financing and expansion of their business. Customer usage of postal services continues to shift to substitute products and digital communication. The use of e-mail and other forms of electronic communication have reduced first class mail volume, as have electronic billing and payment. Marketing mail has recently experienced declines due to mailers’ growing use of digital advertising including digital mobile advertising. The volume of periodicals services continues to decline as consumers increasingly use electronic media for news and information. The growth in the USPS’s competitive service volumes is largely attributable to certain of the USPS’s largest customers, UPS, FedEx and Amazon. Each of these customers is building delivery capability that could enable it to divert volume away from the USPS over time. If these customers divert significant volume away from the USPS, the growth in the USPS’s competitive service volumes may not continue, and there may be reduced demand for leasing postal properties by the USPS.

The USPS’s potential insolvency, inability to pay rent or bankruptcy would have a material adverse effect on our financial condition, results of operations, cash flow, cash available for distribution, and our ability to service our debt obligations and could result in our inability to continue as a going concern.

Default by the USPS is likely to cause a significant or complete reduction in the operating cash flow generated by our properties. There can be no assurance that the USPS will be able to avoid insolvency, make timely rental payments or avoid defaulting under its leases. If the USPS defaults, we may experience delays in enforcing our rights as landlord and may incur substantial costs in protecting our investment. Because we depend on rental payments from the USPS, the inability of the USPS to make its lease payments could adversely affect us and our ability to make distributions to you.

Although we do not believe that bankruptcy protection under the United States bankruptcy code is available to the USPS, the law is unclear. If the USPS were to file for bankruptcy, we would become a creditor, but we may not be able to collect all or any of the pre-bankruptcy amounts owed to owe us by the USPS. In addition, if the USPS were to file for bankruptcy protection, it potentially could terminate its leases with us under federal law, in which event we would have a general unsecured claim against the USPS that would likely be worth less than the full amount owed to us for the remainder of the lease term. This would have a severe adverse effect on our business, financial condition and results of operations.

7

Implementation of the Ten-Year Plan proposed by Mr. DeJoy could have a material adverse effect on our operations, financial position and results of operations.

Mr. DeJoy has published his Ten-Year Plan to address the challenges of the shift from traditional letter-mail to package delivery, underperformance in processing, transportation, delivery and retail operations, failure to meet service performance standards and a perilous and worsening financial situation that has resulted in losses over the last fourteen years of $87 billion. The strategic initiatives are designed to reverse a projected $160 billion in losses over the next ten years and to operate at a positive net income beginning in 2023 or 2024. Retail revenue has decreased substantially since 2015. The Ten-Year Plan includes realignment, procurement of new facilities, expansion of existing facilities and consolidation of underused facilities as well as modernization of retail lobbies to enable expanded digital, small, medium-sized business and government services, which could affect our operations if our postal properties are consolidated. The Ten-Year Plan also includes a request for Congress to relieve pre-funding obligations of the PSRHBF and to require the integration of Medicare with postal service-specific health plan.

The extent to which the implementation of this Ten-Year Plan will affect, our business, liquidity, financial condition, and results of operations, will depend on numerous factors that we may not be able to accurately predict or assess. Portions of the Ten-Year Plan require Congressional approval, which we cannot predict at this time and there will be additional conversations with stakeholders about implementation and changes to the Ten-Year Plan. USPS’s failure to implement the Ten-Year Plan or get Congressional approval may affect its ability to maintain adequate liquidity to sustain its current operations, which may result in the USPS reducing its number of postal locations and adversely affecting our business and results of operations.

Because the USPS is an independent agency of the U.S. federal government, our properties may have a higher risk of terrorist attacks than similar properties leased to non-governmental tenants.

Terrorist attacks may materially adversely affect our operations, as well as directly or indirectly damage our assets, both physically and financially. Because the USPS is, and is expected to continue to be, an independent agency of the U.S. federal government, our properties are presumed to have a higher risk of terrorist attack than similar properties that are leased to non-governmental affiliated tenants. Terrorist attacks, to the extent that these properties are uninsured or underinsured, could have a material adverse effect on our business, financial condition and results of operations.

The ongoing COVID-19 pandemic and measures being taken to prevent its spread, including government-imposed travel related limitations, could negatively impact demand for USPS services and postal properties which could have a material adverse effect on our business, results of operations and financial condition.

The ongoing COVID-19 pandemic and measures being taken to prevent its spread has resulted in a reduction in foot traffic in many public places, including postal properties. A continued reduction in the use of in-person services may reduce the demand for postal properties by the USPS and our results of operations could decline as a result. The ongoing COVID-19 pandemic has also caused a decline in mail volume, particularly in advertising conducted through the mail, which may adversely affect the USPS’s financial condition, and therefore the demand for postal properties. Continued reduction or permanent changes to mail volume could reduce demand for postal properties and materially adversely affect our result of operations.

Further, although the Coronavirus Aid, Relief, and Economic Security (CARES) Act, as amended by Public Law 116-260, the Consolidated Appropriations Act of 2021, includes a $10 billion loan to the USPS, there can be no assurances that this financing will be sufficient to sustain USPS operations in light of current shortfalls resulting from reduced mail volumes. As of the date of this report, the USPS has not received any portion of the $10 billion loan. Moreover, two related bills proposed to provide the USPS with alternate funding in the amounts of $25 billion or $10 billion failed to pass in the third quarter of 2020.

In addition, the USPS is dependent on the efforts of its employees, many of whom come into contact with a large number of individuals on a daily basis. If USPS employees are unwilling or unable to report to work regularly because of the ongoing COVID-19 pandemic or USPS services are otherwise diminished as a result of governmental response to the pandemic, the demand for USPS services or the reputation of the USPS may suffer, leading to a reduced need for postal properties and adversely affecting our business and results of operations.

Furthermore, given the dislocation and government-imposed travel related limitations as a consequence of the pandemic: (i) we have permitted certain employees to work from home, which previously slowed, and may in the future slow, certain routine processes; and (ii) we were, and may in the future be, impacted by delays in communications with, and operations of, various counterparties. Although the effectiveness of our work from home practices have improved since implementation, the continued and future improvement of such practices, as well as communications with, and the operations of, various counterparties, is highly uncertain and cannot be predicted.

8

Changes in leadership, structure, operations and strategy within the USPS, may disrupt our business, which could have a material effect on our operations, financial position and results of operations.

In May 2020, the USPS Board of Governors unanimously appointed Louis DeJoy as the Postmaster General. Mr. DeJoy took office on June 15, 2020. Since Mr. DeJoy’s appointment, the USPS reassigned or displaced at least twenty-three postal executives including two executives overseeing day-to-day operations. The USPS also implemented a management hiring freeze and requested future Voluntary Early Retirement Authority from the Office of Personnel Management for certain employees not represented by a collective bargaining agreement. On February 24, 2021, President Joseph Biden nominated two Democrats and an Independent to the USPS Board of Governors that if confirmed would lead to four Democrats, four Republicans and an Independent on the Board.

Recently, Mr. DeJoy has announced a modified organizational structure for the USPS, which is designed to focus on three business operating units: (i) retail and delivery; (ii) logistics and processing; and (iii) commerce and business solutions. As part of the modified organizational structure, logistics and mail processing operations will report into the new Logistics and Processing Operations organization separate from existing area and district reporting structures. This includes all mail processing facilities and local transportation network offices. These changes are being made in an effort to reduce costs and it is possible that the USPS will implement additional changes to reduce expenses.

The extent to which these changes, among others, will affect our business, liquidity, financial condition, and results of operations, will depend on numerous evolving factors that we may not be able to accurately predict or assess. The USPS is subject to legislative and other constraints which may affect its ability to maintain adequate liquidity to sustain its current operations, which may result in the USPS reducing its number of postal locations and adversely affecting our business and results of operations.

Litigation involving the USPS, including those related to changes in the USPS’s operations, the 2020 presidential election and mail-in voting, may disrupt our business, which could have a material effect on our operations, financial position and results of operations.

As a result of (i) the proposed and executed operational, managerial and strategic changes within the USPS and (ii) the ongoing COVID-19 pandemic, which significantly increased the number of absentee ballots utilized for the 2020 presidential election, the USPS is the focal point of recent litigation. As of the date of this report, several lawsuits have been filed and remain pending against Mr. DeJoy, the USPS and former President Donald Trump pertaining to operational change at the USPS, mail delays and mail-in voting for the 2020 presidential election.

If, as a result of any backlogs, political rhetoric or litigation, the USPS suffers reputational or financial harm or an increase in regulatory scrutiny, the demand for USPS services may decline, which may lead to reduced demand for USPS properties. The results of these changes or any future changes could lead to additional delays or financing shortfalls for the USPS.

Risks Related to Our Business and Operations

We may be unable to acquire and/or manage additional USPS-leased properties at competitive prices or at all.

A significant portion of our business plan is to acquire additional properties that are leased to the USPS. There are a limited number of such properties, and we will have fewer opportunities to grow our investments than REITs that purchase properties that are leased to a variety of tenants or that are not leased when they are acquired. In addition, the current ownership of properties leased to the USPS is highly fragmented with the overwhelming majority of owners holding a single property. As a result, we may need to expend resources to complete our due diligence and underwriting process on many individual properties, thereby increasing our acquisition costs and possibly reducing the amount that we are able to pay for a particular property. Accordingly, our plan to grow our business largely by acquiring additional properties that are leased to the USPS and managing properties leased to the USPS by third parties may not succeed. In addition, because of our public profile as the only publicly traded REIT dedicated to USPS properties, our operations may generate new interest in USPS-leased properties from other REITs, real estate companies and other investors with more resources than we have that did not previously focus on investment opportunities with USPS-leased properties.

We currently have a concentration of postal properties in Pennsylvania, Wisconsin, Maine, Texas, Oklahoma and Illinois and are exposed to changes in regional or local conditions in these states.

Our business may be adversely affected by regional or local conditions and events in the areas in which we operate, particularly in Pennsylvania, Wisconsin, Maine, Texas, Oklahoma and Illinois where many of our postal properties are concentrated. Factors that may affect our occupancy levels, our rental revenues, our funds from operations or the value of our properties include the following, among others:

| ● | downturns in global, national, regional and local economic conditions; |

| ● | unforeseen events beyond our control, including, among others, terrorist attacks and travel related health concerns including pandemics and epidemics; |

9

| ● | possible reduction of the USPS workforce; and |

| ● | economic conditions that could cause an increase in our operating expenses, insurance and routine maintenance. |

We may be unable to renew leases or sell vacated properties on favorable terms, or at all, as leases expire, which could materially adversely affect us, including our financial condition, results of operations, cash flow, cash available for distribution and our ability to service our debt obligations.

We cannot assure you that any leases will be renewed or that vacated properties will be sold on favorable terms, or at all. As of the date of this report, the USPS has notified us of its intent to vacate one property in our portfolio. If rental rates for our properties decrease, our existing tenant does not renew their leases or we do not sell vacated properties on favorable terms, our financial condition, results of operations, cash flow, cash available for distributions and our ability to service our debt obligations could be materially adversely affected.

Property vacancies could result in significant capital expenditures and illiquidity.

The loss of a tenant through lease expiration may require us to spend significant amounts of capital to renovate the property before it is suitable for a new tenant. Substantially all of the properties we acquire are specifically suited to the particular business of the USPS and, as a result, if the USPS does not renew its lease, we may be required to renovate the property at substantial costs, decrease the rent we charge or provide other concessions in order to lease the property to another tenant. In the event we are required or elect to sell the property, we may have difficulty selling it to a party other than the USPS. This potential illiquidity may limit our ability to quickly modify our portfolio in response to changes in economic or other conditions, which may materially and adversely affect us.

As of March 30, 2021, the leases at 11 of our properties were expired and the USPS is occupying such properties as a holdover tenant. If we are not successful in renewing these expired leases, we will likely experience reduced occupancy, rental income and net operating income, which could have a material adverse effect on our financial condition, results of operations and ability to make distributions to stockholders.

As of March 30, 2021, the leases at 11 of our properties (consisting of one property for which the lease expired on December 31, 2020 which we acquired in February 2021, and ten properties for which leases expired to date in 2021) were expired and the USPS is occupying such properties as a holdover tenant, aggregating approximately 24,000 interior square feet and $0.2 million in annualized rental income. When a lease expires, the USPS becomes a holdover tenant on a month-to-month basis, typically paying the greater of estimated market rent or the rent amount under the expired lease. Due to the fact that the USPS is occupying 11 of our properties as a holdover tenant, such properties are currently excluded from being part of the borrowing base under our Credit Facility.

We anticipate that we will execute new leases for all properties that have expired or will expire, and the addendum discussed herein, as applicable. However, there can be no guarantee that any new leases that we enter into with the USPS will reflect our expectations with respect to terms or timing.

We might not be successful in renewing the leases that are in holdover status or that are scheduled to expire in 2021, obtaining positive rent renewal spreads, or renewing the leases on terms comparable to those of the expiring leases. If we are able to renew these expired leases, the lease terms may not be comparable to those of the previous leases. If we are not successful, we will likely experience reduced occupancy, rental income and net operating income, as well as diminished borrowing capacity which could have a material adverse effect on our financial condition, results of operations and ability to make distributions to stockholders.

Our use of OP Units as consideration to acquire properties could result in stockholder dilution and/or limit our ability to sell such properties, which could have a material adverse effect on us.

We may acquire properties or portfolios of properties through tax deferred contribution transactions in exchange for OP Units, which may result in stockholder dilution. This acquisition structure may have the effect of, among other things, reducing the amount of tax depreciation we could deduct over the tax life of the acquired properties, and may require that we agree to protect the contributors’ ability to defer recognition of taxable gain through restrictions on our ability to dispose of the acquired properties and/or the allocation of partnership debt to the contributors to maintain their tax bases. These restrictions could limit our ability to sell properties at a time, or on terms, that would be favorable absent such restrictions.

10

Illiquidity of postal properties could significantly impede our ability to respond to adverse changes in the performance of our properties and harm our financial condition.

Our ability to promptly sell one or more postal properties in our portfolio in response to changing economic, financial and investment conditions may be limited. Certain types of real estate and in particular, post offices, may have limited alternative uses and thus are relatively illiquid. Return of capital and realization of gains, if any, from an investment generally will occur upon disposition or refinancing of the underlying property. We may be unable to realize our investment objectives by sale, other disposition or refinancing at attractive prices within any given period of time or may otherwise be unable to complete any exit strategy. In particular, our ability to dispose of one or more postal properties within a specific time period is subject to certain limitations imposed by our tax protection agreements, as well as weakness in or even the lack of an established market for a property, changes in the financial condition or prospects of prospective purchasers, changes in national or international economic conditions and changes in laws, regulations or fiscal policies of jurisdictions in which the property is located.

In addition, the Internal Revenue Code of 1986, as amended, or the Code, imposes restrictions on a REIT’s ability to dispose of properties that are not applicable to other types of real estate companies. In particular, the tax laws applicable to REITs effectively require that we hold our properties for investment, rather than primarily for sale in the ordinary course of business.

Our real estate taxes for properties where we are not reimbursed could increase due to property tax rate changes or reassessment, which could negatively impact our cash flows, financial condition, results of operations, per share market price of our Class A common stock, our ability to satisfy our principal and interest obligations and our ability to make distributions to our stockholders.

Even though we currently qualify as a REIT for U.S. federal income tax purposes, we are required to pay state and local taxes on some of our properties. The real property taxes on our properties may increase as property tax rates change or as our properties are assessed or reassessed by taxing authorities. Therefore, the amount of property taxes we pay in the future may increase substantially from what we have paid in the past. If the property taxes we pay increase, our financial condition, results of operations, cash flows, per share trading price of our Class A common stock and our ability to satisfy our principal and interest obligations and to make distributions to our stockholders could be adversely affected.

Increases in mortgage rates or unavailability of mortgage debt may make it difficult for us to finance or refinance our debt, which could have a material adverse effect on our financial condition, growth prospects and our ability to make distributions to stockholders.

If mortgage debt is unavailable to us at reasonable rates or at all, we may not be able to finance the purchase of additional properties or refinance existing debt when it becomes due. If interest rates are higher when we refinance our properties, our income and cash flow could be reduced, which would reduce cash available for distribution to our stockholders and may hinder our ability to raise more capital by issuing more stock or by borrowing more money. In addition, to the extent we are unable to refinance our debt when it becomes due, we will have fewer debt guarantee opportunities available to offer under our tax protection agreements, which could trigger an obligation to indemnify the protected parties under the tax protection agreements.

Mortgage debt obligations expose us to the possibility of foreclosure, which could result in the loss of our investment in a property or group of properties subject to mortgage debt.

Mortgage and other secured debt obligations increase our risk of property losses because defaults on indebtedness secured by properties may result in foreclosure actions initiated by lenders and ultimately our loss of the property securing any loans for which we are in default. Any foreclosure on a mortgaged property or group of properties could adversely affect the overall value of our portfolio of properties. For tax purposes, a foreclosure on any of our properties that is subject to a nonrecourse mortgage loan would be treated as a sale of the property for a purchase price equal to the outstanding balance of the debt secured by the mortgage. If the outstanding balance of the debt secured by the mortgage exceeds our tax basis in the property, we would recognize taxable income on foreclosure, but would not receive any cash proceeds, which could hinder our ability to meet the REIT distribution requirements imposed by the Code. Foreclosures could also trigger our tax indemnification obligations under the terms of our tax protection agreements with respect to the sales of certain properties.

11

The elimination of LIBOR after June 2023 may affect our financial results.

On March 5, 2021, the United Kingdom Financial Conduct Authority, or FCA, which regulates LIBOR, announced that all LIBOR tenors relevant to us will cease to be published or will no longer be representative after June 30, 2023. The FCA's announcement coincides with the March 5, 2021, announcement of LIBOR's administrator, the ICE Benchmark Administration Limited, or IBA, indicating that, as a result of not having access to input data necessary to calculate LIBOR tenors relevant to us on a representative basis after June 30, 2023, IBA would have to cease publication of such LIBOR tenors immediately after the last publication on June 30, 2023. These announcements mean that any of our LIBOR-based borrowings that extend beyond June 30, 2023 will need to be converted to a replacement rate. In the United States, the Alternative Reference Rates Committee, or ARRC, a committee of private sector entities with ex-officio official sector members convened by the Federal Reserve Board and the Federal Reserve Bank of New York, has recommended the Secured Overnight Financing Rate (“SOFR”) plus a recommended spread adjustment as LIBOR's replacement. There are significant differences between LIBOR and SOFR, such as LIBOR being an unsecured lending rate while SOFR is a secured lending rate, and SOFR is an overnight rate while LIBOR reflects term rates at different maturities. If our LIBOR-based borrowings are converted to SOFR, the differences between LIBOR and SOFR, plus the recommended spread adjustment, could result in interest costs that are higher than if LIBOR remained available, which could have a material adverse effect on our operating results. Although SOFR is the ARRC's recommended replacement rate, it is also possible that lenders may instead choose alternative replacement rates that may differ from LIBOR in ways similar to SOFR or in other ways that would result in higher interest costs for us. It is not yet possible to predict the magnitude of LIBOR's end on our borrowing costs given the remaining uncertainty about which rates will replace LIBOR.

Covenants in our debt agreements could adversely affect our financial condition.

Our Credit Agreement contains customary restrictions, requirements and other limitations on our ability to incur indebtedness. We must maintain certain ratios, including a maximum of total indebtedness to total asset value, a maximum of secured indebtedness to total asset value, a minimum of quarterly adjusted EBITDA to fixed charges, a minimum net operating income from unencumbered properties to unsecured interest expense and a maximum of unsecured indebtedness to unencumbered asset value. Our ability to borrow under our Credit Agreement is subject to compliance with our financial and other covenants.

Failure to comply with any of the covenants under our Credit Agreement or other debt instruments could result in a default under one or more of our debt instruments. In particular, we could suffer a default under a secured debt instrument that could exceed a cross-default threshold under our Credit Agreement, causing an event of default under the Credit Agreement. Under those circumstances, other sources of capital may not be available to us or be available only on unattractive terms. In addition, if we breach covenants in our debt agreements, the lenders can declare a default and, if the debt is secured, take possession of the property securing the defaulted loan.

Alternatively, even if a secured debt instrument is below the cross-default threshold for non-recourse secured debt under our Credit Agreement a default under such secured debt instrument may still cause a cross default under our Credit Agreement because such secured debt instrument may not qualify as “non-recourse” under the definition in our Credit Agreement. Another possible cross default could occur between our Credit Agreement and any senior unsecured notes that we issue. Any of the foregoing default or cross-default events could cause our lenders to accelerate the timing of payments and/or prohibit future borrowings, either of which would have a material adverse effect on our business, operations, financial condition and liquidity.

12

Failure to hedge effectively against interest rate changes may adversely affect our financial condition, results of operations, cash flow, cash available for distribution and our ability to service our debt obligations.

Subject to maintaining our qualification as a REIT, we may enter into hedging transactions to protect us from the effects of interest rate fluctuations on floating rate debt. Our hedging transactions may include entering into interest rate cap agreements or interest rate swap agreements. These agreements involve risks, such as the risk that such arrangements would not be effective in reducing our exposure to interest rate changes or that a court could rule that such an agreement is not legally enforceable. In addition, interest rate hedging can be expensive, particularly during periods of rising and volatile interest rates. Hedging could increase our costs and reduce the overall returns on our investments. In addition, while hedging agreements would be intended to lessen the impact of rising interest rates on us, they could also expose us to the risk that the other parties to the agreements would not perform, we could incur significant costs associated with the settlement of the agreements or that the underlying transactions could fail to qualify as highly-effective cash flow hedges under Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC, Topic 815, Derivatives and Hedging.

Our success depends on key personnel whose continued service is not guaranteed, and the loss of one or more of our key personnel could adversely affect our ability to manage our business and to implement our growth strategies, or could create a negative perception of our company in the capital markets.

Our continued success and our ability to manage anticipated future growth depend, in large part, upon the efforts of key personnel, particularly Messrs. Spodek, Garber and Klein who have extensive market knowledge and relationships and exercise substantial influence over our operational and financing activity. Among the reasons that these individuals are important to our success is that each has a national or regional industry reputation that attracts business and investment opportunities and assists us in negotiations with lenders, the USPS and owners of postal properties. If we lose their services, such relationships could diminish or be adversely affected. Our employment agreements with Messrs. Spodek, Garber and Klein do not guarantee their continued employment with us.

Many of our other senior executives also have extensive experience and strong reputations in the real estate industry, which aid us in identifying opportunities, having opportunities brought to us and negotiating. The loss of services of one or more members of our senior management team, or our inability to attract and retain highly qualified personnel, could adversely affect our business, diminish our investment opportunities and weaken our relationships with lenders, business partners, existing and prospective tenants and industry participants, which could materially adversely affect our financial condition, results of operations, cash flow and the per share trading price of our Class A common stock.

We may be subject to on-going or future litigation, including existing claims relating to the entities that owned the properties previously and otherwise in the ordinary course of business, which could have a material adverse effect on our financial condition, results of operations, cash flow and the per share trading price of our Class A common stock.

We may be subject to litigation, including existing claims relating to the entities that owned the properties previously and otherwise in the ordinary course of business. Some of these claims may result in significant defense costs and potentially significant judgments against us, some of which are not, or cannot be, insured against. We generally intend to vigorously defend ourselves. However, we cannot be certain of the ultimate outcomes of any currently asserted claims or of those that may arise in the future. Resolution of these types of matters against us may result in our having to pay significant fines, judgments, or settlements, which, if uninsured, or if the fines, judgments, and settlements exceed insured levels, could adversely impact our earnings and cash flows, thereby having an adverse effect on our financial condition, results of operations, cash flow, cash available for distribution and our ability to service our debt obligations. Certain litigation or the resolution of certain litigation may affect the availability or cost of some of our insurance coverage, which could materially adversely affect our results of operations and cash flows, expose us to increased risks that would be uninsured and/or adversely impact our ability to attract officers and directors.

We may not be able to rebuild our existing properties to their existing specifications if we experience a substantial or comprehensive loss of such properties.

In the event that we experience a substantial or comprehensive loss of one of our properties, we may not be able to rebuild such property to its existing specifications. Further, reconstruction or improvement of such a property would likely require significant upgrades to meet zoning and building code requirements

13

Joint venture investments could be adversely affected by our lack of sole decision-making authority, our reliance on co-venturers’ financial condition and disputes between us and our co-venturers.

In the future, we may co-invest with third parties through partnerships, joint ventures or other entities, acquiring non-controlling interests in and managing the affairs of a property, partnership, joint venture or other entity. With respect to any such arrangement or any similar arrangement that we may enter into in the future, we may not be in a position to exercise sole decision-making authority regarding the development, property, partnership, joint venture or other entity. Investments in partnerships, joint ventures or other entities may, under certain circumstances, involve risks not present where a third party is not involved, including the possibility that partners or co-venturers might become bankrupt or fail to fund their share of required capital contributions. Partners or co-venturers may have economic or other business interests or goals which are inconsistent with our business interests or goals and may be in a position to take actions contrary to our policies or objectives, and they may have competing interests in our markets that could create conflicts of interest. Such investments may also have the potential risk of impasses on decisions, such as a sale or financing, because neither we nor the partner(s) or co-venturer(s) would have full control over the partnership or joint venture. In addition, a sale or transfer by us to a third party of our interests in the joint venture may be subject to consent rights or rights of first refusal, in favor of our joint venture partners, which would in each case restrict our ability to dispose of our interest in the joint venture. Where we are a limited partner or non-managing member in any partnership or limited liability company, if such entity takes or expects to take actions that could jeopardize our status as a REIT or require us to pay tax, we may be forced to dispose of our interest in such entity. We may, in certain circumstances, be liable for the actions of a partner, and the activities of a partner could adversely affect our ability to maintain our qualification as a REIT or our exclusion or exemption from registration under the Investment Company Act, even if we do not control the joint venture. Disputes between us and partners or co-venturers may result in litigation or arbitration that would increase our expenses and prevent our officers and directors from focusing their time and effort on our business. Consequently, actions by or disputes with partners or co-venturers might result in subjecting properties owned by the partnership or joint venture to additional risk. In addition, we may in certain circumstances be liable for the actions of our third-party partners or co-venturers. Our joint ventures may be subject to debt and, during periods of volatile credit markets, the refinancing of such debt may require equity capital calls.

Competition for skilled personnel could increase our labor costs.

We compete intensely with various other companies in attracting and retaining qualified and skilled personnel. We depend on our ability to attract and retain skilled management personnel in order to successfully manage the day-to-day operations of our company. Competitive pressures may require that we enhance our pay and benefits package to compete effectively for such personnel. We may not be able to offset such added costs by increasing the rates we charge the USPS. If there is an increase in these costs or if we fail to attract and retain qualified and skilled personnel, our business and operating results could be harmed.

Our growth depends on external sources of capital that are outside of our control and may not be available to us on commercially reasonable terms or at all, which could limit our ability to, among other things, meet our capital and operating needs or make the cash distributions to our stockholders necessary to qualify and maintain our qualification as a REIT.