July 2023 Mirum Pharmaceuticals: Transforming Lives in Rare Disease Exhibit 99.2

Forward-Looking Statements This presentation contains "forward-looking" statements that are based on our management’s beliefs and assumptions and on information currently available to management. Forward-looking statements include all statements other than statements of historical fact contained in this presentation, including information concerning our business strategy, objectives and opportunities. Forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause our actual results, performance or achievements to differ materially and adversely from those anticipated or implied by our forward-looking statements, including, but not limited to: our plans and expectations for commercializing LIVMARLI in the United States and rest of world; the costs of our commercialization plans and development programs, and the financial impact or revenues from any commercialization we undertake; estimates of the number of patients impacted by ALGS, PFIC or related diseases and who are appropriate for treatment with LIVMARLI at optimal clinical doses; the potential benefits of LIVMARLI and our product candidates; the potential benefits of our business model and expected growth; our ability to obtain necessary regulatory approvals for our product candidates and, if and when approved, market acceptance of our products; our dependence on third-party clinical research organizations, manufacturers, suppliers and distributors; the design, implementation, timelines and outcomes of our clinical trials; the impact of competitive products and therapies; our ability to obtain necessary additional capital; our ability to attract and retain key employees; our ability to manage the growth and complexity of our organization; our ability to maintain, protect and enhance our intellectual property; and our ability to continue to stay in compliance with applicable laws and regulations. You should refer to the section entitled “Risk Factors” set forth in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings we make with the SEC from time to time for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. Neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update any forward-looking statements after the date of this presentation except as may be required by law. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Projections, assumptions and estimates of the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. The trademarks included herein are the property of the owners thereof and are used for reference purposes only.

Disclaimers This confidential presentation (“Presentation”) is for informational purposes only and is being provided to interested parties solely in their capacity as potential investors for the purpose of evaluating a potential private offering of securities to occur concurrently with a potential business transaction between Mirum Pharmaceuticals, Inc. (“Mirum”) and Travere Therapeutics, Inc. (“Travere”) (the “Proposed Transaction”) and a proposed investment in connection therewith (the “Purpose”). By accepting this Presentation, you acknowledge and agree that all of the information contained herein is confidential, that you will distribute, disclose, and use such information only for such Purpose and that you shall not distribute, disclose or use such information in any way detrimental to Mirum or Travere. The information contained herein does not purport to be all inclusive and neither Mirum nor Travere, nor any of their respective affiliates or respective control persons, officers, directors, employees or representatives makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision. This Presentation and any oral statements made in connection with this Presentation shall not constitute an offer to sell or the solicitation to buy any securities, nor the solicitation of a proxy, consent, or authorization in connection with the Proposed Transaction in any jurisdiction; nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any jurisdiction. ANY SECURITIES TO BE OFFERED IN ANY TRANSACTION CONTEMPLATED HEREBY HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR ANY APPLICABLE STATE OR FOREIGN SECURITIES LAW. ANY SECURITIES TO BE OFFERED IN ANY TRANSACTION CONTEMPLATED HEREBY HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES EXCHANGE COMMISSION (THE “SEC”), ANY STATE SECURITIES COMMISSION OR OTHER UNITED STATES OR FOREIGN REGULATORY AUTHORITY, AND WILL BE OFFERED AND SOLD SOLELY IN RELIANCE ON AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS PROVIDED BY THE SECURITIES ACT AND RULES AND REGULATIONS PROMULGATED THEREUNDER (INCLUDING REGULATION D OR REGULATION S UNDER THE SECURITIES ACT). THIS DOCUMENT DOES NOT CONSTITUTE, OR FORM A PART OF, AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY IN ANY STATE OR OTHER JURISDICTION TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE SUCH OFFER OR SOLICITATION. This Presentation is not a substitute for the registration statement or for any other document that Mirum may file with the SEC in connection with the Proposed Transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of other documents filed with the SEC by Mirum, when they become available, through the website maintained by the SEC at www.sec.gov.

Leader in Rare Liver Disease: 2023 Goals INDUSTRY LEADING TEAM, DELIVERING REMARKABLE TREATMENTS TO PATIENTS IN NEED WORLDWIDE Leverage IBAT Inhibition Expertise in Adult Cholestatic Liver Disease Establish LIVMARLI in Additional Pediatric Cholestatic Settings Expand Pipeline to Leverage Rare Disease and Commercial Expertise Build on US LIVMARLI ALGS Commercial Success Launch LIVMARLI Across International Markets

Potential Acquisition of Travere’s Bile Acid Product Portfolio $210 Million UPFRONT Plus up to $235 million sales milestones, tiered from $125 to $500 million annual sales $103 Million 2022 NET REVENUE Deal Terms Significant Revenue & Cash Flow Expected Travere Bile Acid Portfolio DEAL RATIONALE: Solidifies Mirum’s leadership on pediatric hepatology/GI Accelerates LIVMARLI growth Bile Acid portfolio addressing multiple high need settings Branded diagnostic: Mirum as a key partner from the start of patient journey Building size and scale to drive future growth in rare disease Combined Q1 2023 run rate revenue ~$220M Significant cash flow generation to fuel pipeline, expansion in rare disease Leverage strength of Mirum commercial capabilities Financed with a concurrent oversubscribed private placement of $210M $210 Million Committed PIPE Concurrent Financing

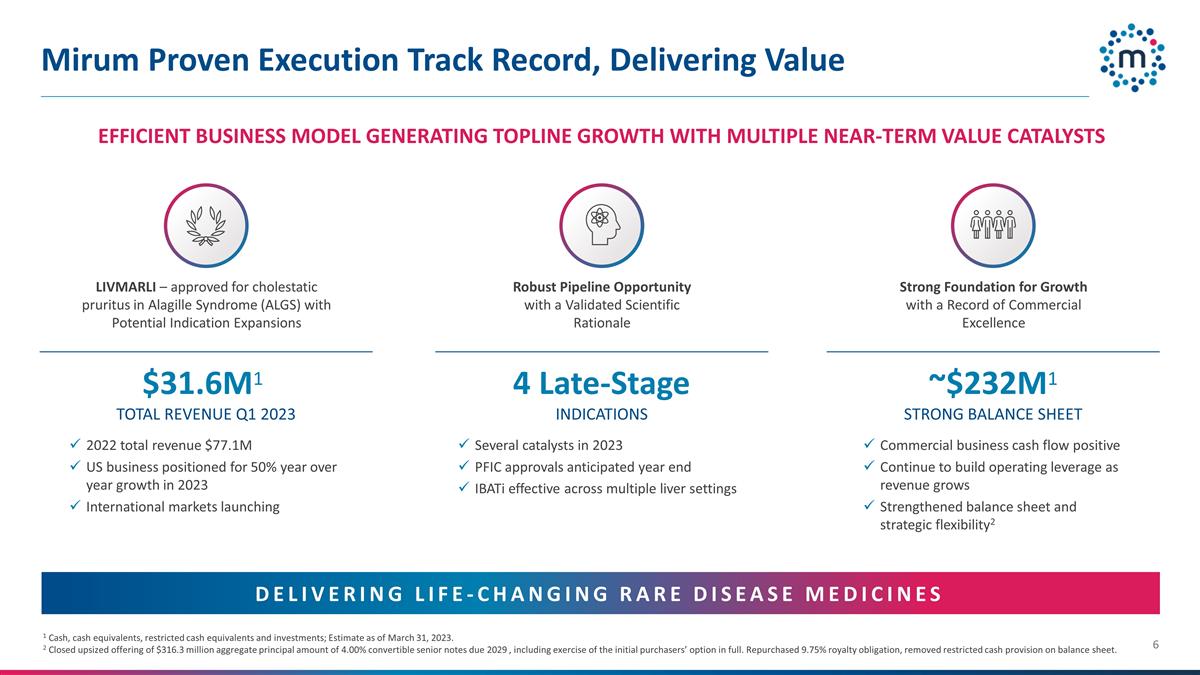

Mirum Proven Execution Track Record, Delivering Value 1 Cash, cash equivalents, restricted cash equivalents and investments; Estimate as of March 31, 2023. 2 Closed upsized offering of $316.3 million aggregate principal amount of 4.00% convertible senior notes due 2029 , including exercise of the initial purchasers’ option in full. Repurchased 9.75% royalty obligation, removed restricted cash provision on balance sheet. $31.6M1 TOTAL REVENUE Q1 2023 4 Late-Stage INDICATIONS DELIVERING LIFE-CHANGING RARE DISEASE MEDICINES Several catalysts in 2023 PFIC approvals anticipated year end IBATi effective across multiple liver settings 2022 total revenue $77.1M US business positioned for 50% year over year growth in 2023 International markets launching ~$232M1 STRONG BALANCE SHEET Commercial business cash flow positive Continue to build operating leverage as revenue grows Strengthened balance sheet and strategic flexibility2 EFFICIENT BUSINESS MODEL GENERATING TOPLINE GROWTH WITH MULTIPLE NEAR-TERM VALUE CATALYSTS LIVMARLI – approved for cholestatic pruritus in Alagille Syndrome (ALGS) with Potential Indication Expansions Strong Foundation for Growth with a Record of Commercial Excellence Robust Pipeline Opportunity with a Validated Scientific Rationale

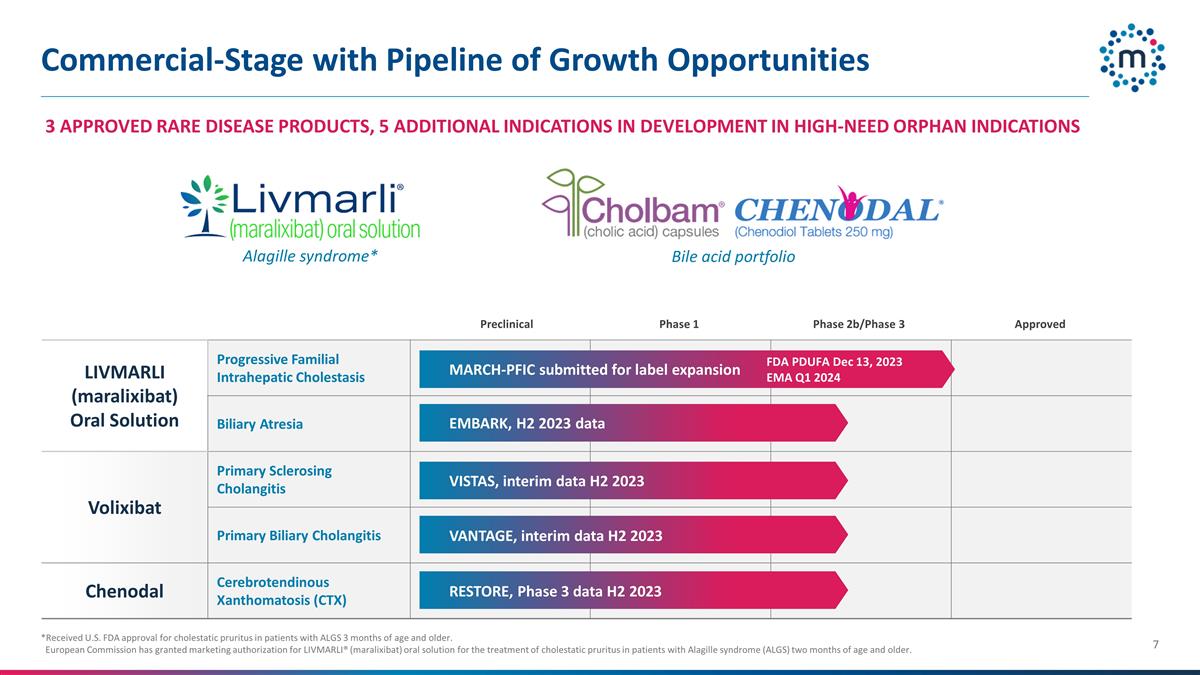

Commercial-Stage with Pipeline of Growth Opportunities *Received U.S. FDA approval for cholestatic pruritus in patients with ALGS 3 months of age and older. European Commission has granted marketing authorization for LIVMARLI® (maralixibat) oral solution for the treatment of cholestatic pruritus in patients with Alagille syndrome (ALGS) two months of age and older. LIVMARLI (maralixibat) Oral Solution Progressive Familial Intrahepatic Cholestasis Biliary Atresia Volixibat Primary Sclerosing Cholangitis Primary Biliary Cholangitis Chenodal Cerebrotendinous Xanthomatosis (CTX) EMBARK, H2 2023 data VISTAS, interim data H2 2023 VANTAGE, interim data H2 2023 RESTORE, Phase 3 data H2 2023 Phase 1 Approved Preclinical Phase 2b/Phase 3 MARCH-PFIC submitted for label expansion FDA PDUFA Dec 13, 2023 EMA Q1 2024 Alagille syndrome* 3 APPROVED RARE DISEASE PRODUCTS, 5 ADDITIONAL INDICATIONS IN DEVELOPMENT IN HIGH-NEED ORPHAN INDICATIONS Bile acid portfolio

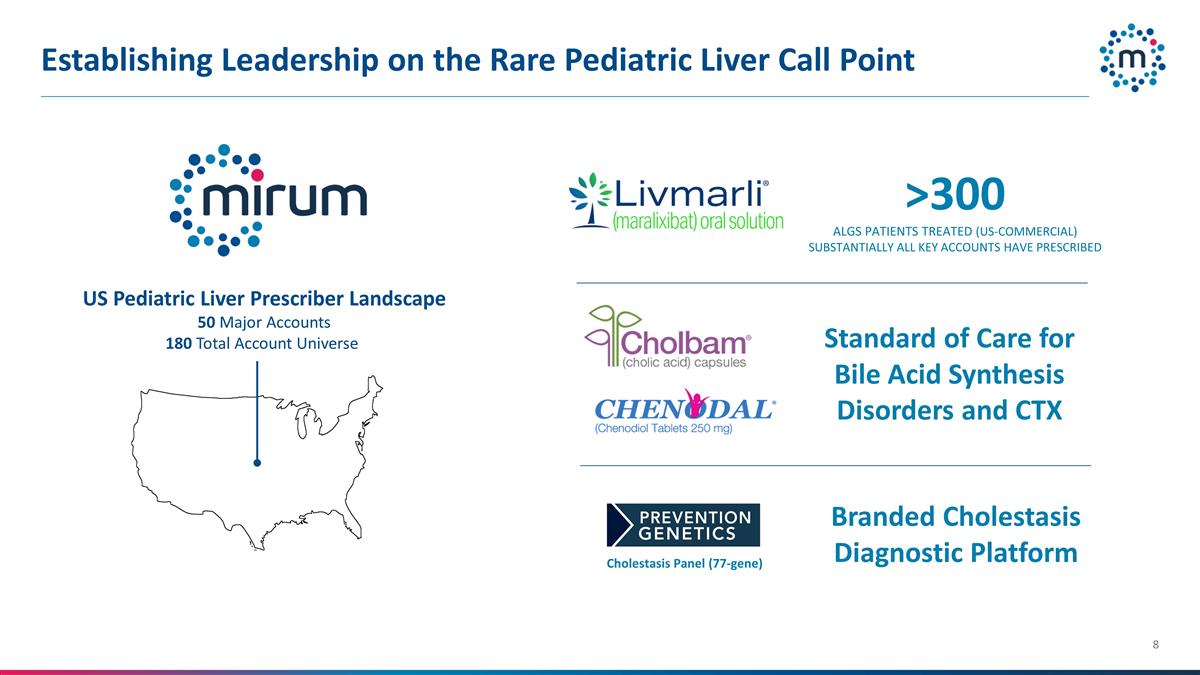

Establishing Leadership on the Rare Pediatric Liver Call Point >300 ALGS PATIENTS TREATED (US-COMMERCIAL) SUBSTANTIALLY ALL KEY ACCOUNTS HAVE PRESCRIBED US Pediatric Liver Prescriber Landscape 50 Major Accounts 180 Total Account Universe Branded Cholestasis Diagnostic Platform Cholestasis Panel (77-gene) Standard of Care for Bile Acid Synthesis Disorders and CTX

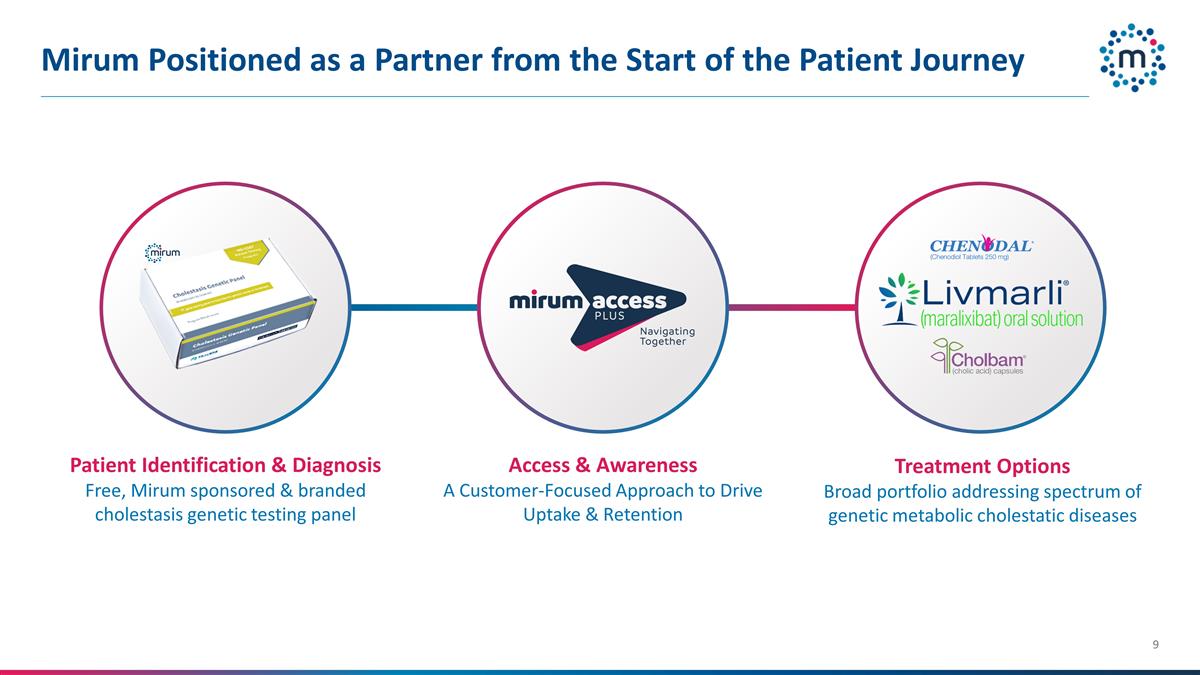

Mirum Positioned as a Partner from the Start of the Patient Journey Access & Awareness A Customer-Focused Approach to Drive Uptake & Retention Treatment Options Broad portfolio addressing spectrum of genetic metabolic cholestatic diseases Patient Identification & Diagnosis Free, Mirum sponsored & branded cholestasis genetic testing panel

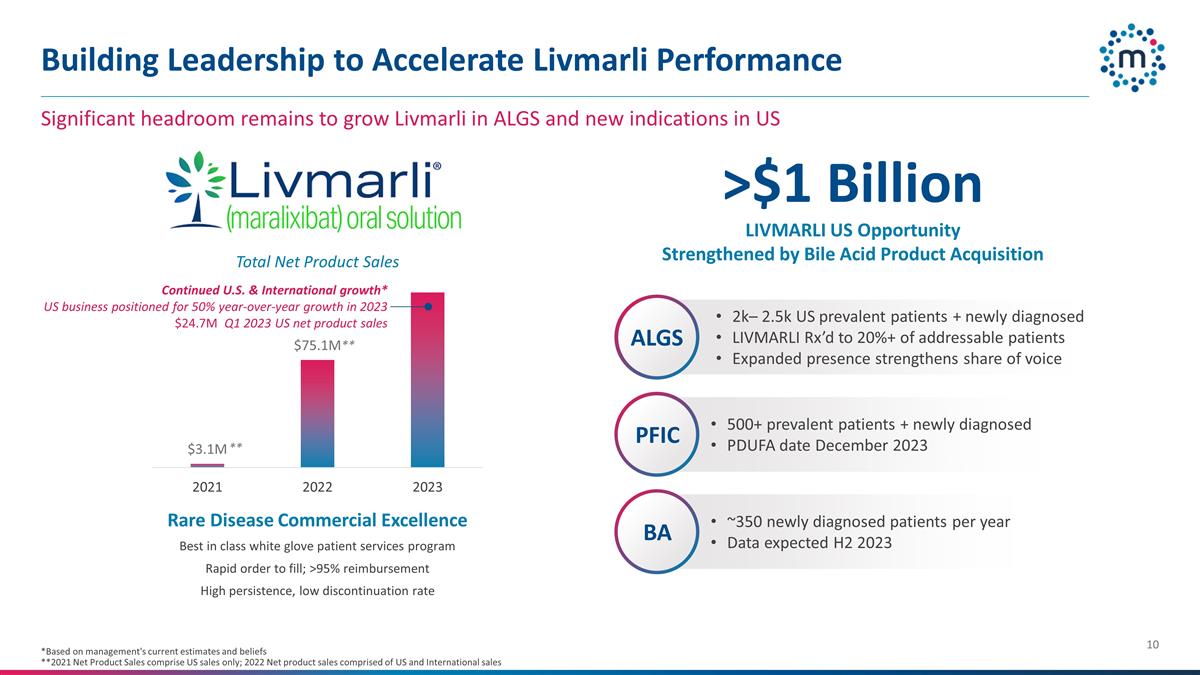

Building Leadership to Accelerate Livmarli Performance *Based on management's current estimates and beliefs **2021 Net Product Sales comprise US sales only; 2022 Net product sales comprised of US and International sales Total Net Product Sales Continued U.S. & International growth* US business positioned for 50% year-over-year growth in 2023 $24.7M Q1 2023 US net product sales >$1 Billion LIVMARLI US Opportunity Strengthened by Bile Acid Product Acquisition 2k– 2.5k US prevalent patients + newly diagnosed LIVMARLI Rx’d to 20%+ of addressable patients Expanded presence strengthens share of voice ALGS 500+ prevalent patients + newly diagnosed PDUFA date December 2023 PFIC ~350 newly diagnosed patients per year Data expected H2 2023 BA Significant headroom remains to grow Livmarli in ALGS and new indications in US Rare Disease Commercial Excellence Best in class white glove patient services program Rapid order to fill; >95% reimbursement High persistence, low discontinuation rate ** **

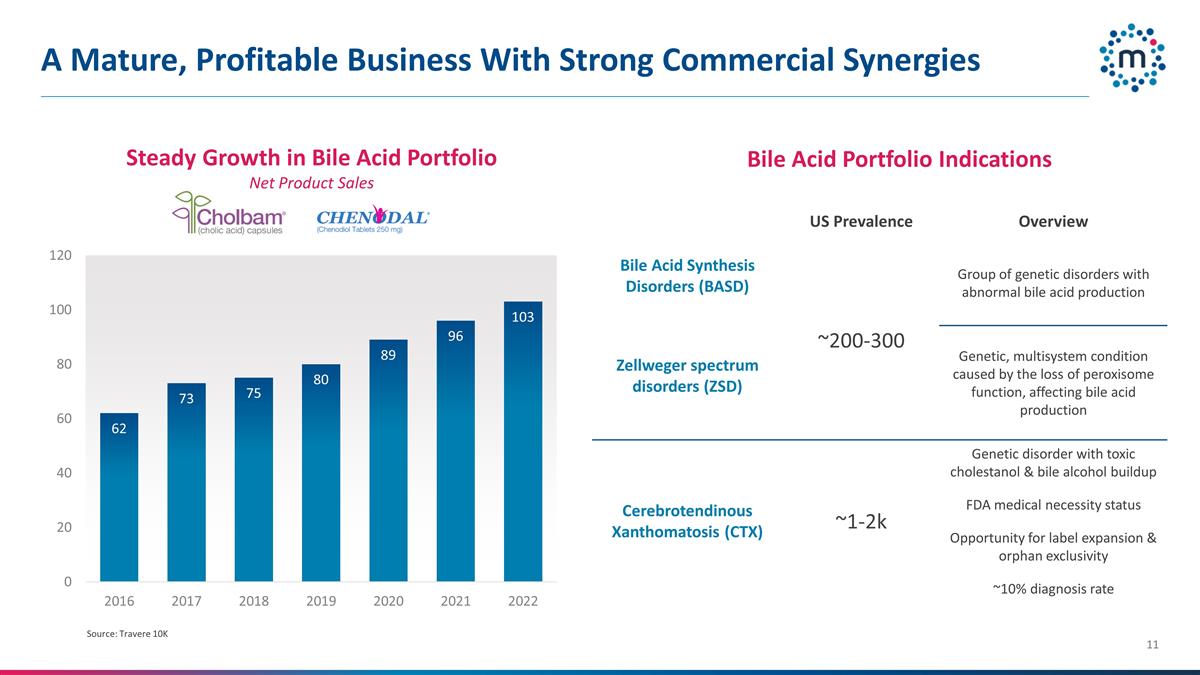

A Mature, Profitable Business With Strong Commercial Synergies Steady Growth in Bile Acid Portfolio Net Product Sales Bile Acid Portfolio Indications US Prevalence Overview Bile Acid Synthesis Disorders (BASD) ~200-300 Group of genetic disorders with abnormal bile acid production Zellweger spectrum disorders (ZSD) ~1k Genetic, multisystem condition caused by the loss of peroxisome function, affecting bile acid production Genetic, multisystem condition caused by the loss of peroxisome function, affecting bile acid production Cerebrotendinous Xanthomatosis (CTX) ~1-2k Genetic disorder with toxic cholestanol & bile alcohol buildup FDA medical necessity status Opportunity for label expansion & orphan exclusivity ~10% diagnosis rate Source: Travere 10K

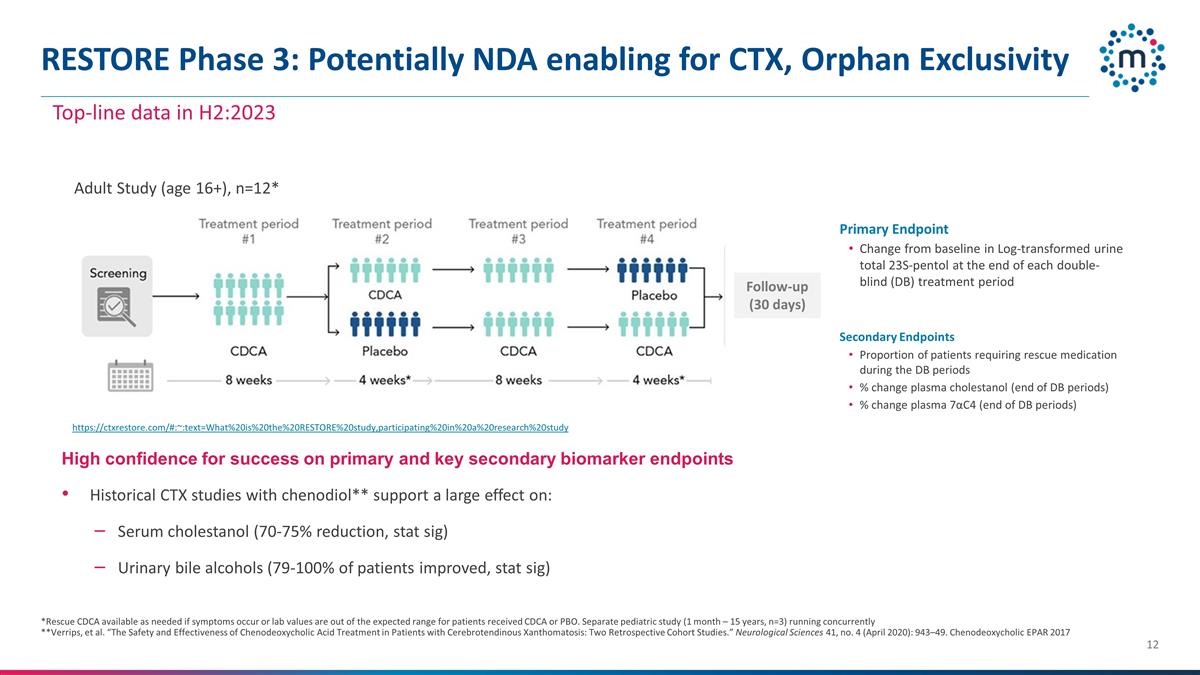

RESTORE Phase 3: Potentially NDA enabling for CTX, Orphan Exclusivity *Rescue CDCA available as needed if symptoms occur or lab values are out of the expected range for patients received CDCA or PBO. Separate pediatric study (1 month – 15 years, n=3) running concurrently **Verrips, et al. “The Safety and Effectiveness of Chenodeoxycholic Acid Treatment in Patients with Cerebrotendinous Xanthomatosis: Two Retrospective Cohort Studies.” Neurological Sciences 41, no. 4 (April 2020): 943–49. Chenodeoxycholic EPAR 2017 High confidence for success on primary and key secondary biomarker endpoints Historical CTX studies with chenodiol** support a large effect on: Serum cholestanol (70-75% reduction, stat sig) Urinary bile alcohols (79-100% of patients improved, stat sig) Top-line data in H2:2023 Primary Endpoint Change from baseline in Log-transformed urine total 23S-pentol at the end of each double-blind (DB) treatment period Secondary Endpoints Proportion of patients requiring rescue medication during the DB periods % change plasma cholestanol (end of DB periods) % change plasma 7αC4 (end of DB periods) Adult Study (age 16+), n=12* Follow-up (30 days) https://ctxrestore.com/#:~:text=What%20is%20the%20RESTORE%20study,participating%20in%20a%20research%20study

A Compelling Transaction to Reinforce Mirum’s Rare Disease Leadership Adds commercialized medicines for pediatric hepatology Enhances the growth of LIVMARLI Expands operating and financial scale ~$220M combined run rate revenue, expect cash flow break even New programs elevate and advance Mirum’s strategy

Thank you