tw-2023123100017587302023FYFALSETradeweb Markets Inc.P3YP4YP1Y335050http://fasb.org/us-gaap/2023#OtherLiabilities0.518230000017587302023-01-012023-12-3100017587302023-06-30iso4217:USD0001758730us-gaap:CommonClassAMember2024-02-02xbrli:shares0001758730us-gaap:CommonClassBMember2024-02-020001758730us-gaap:CommonClassCMember2024-02-020001758730tw:CommonClassDMember2024-02-0200017587302023-12-3100017587302022-12-31iso4217:USDxbrli:shares0001758730us-gaap:CommonClassAMember2022-12-310001758730us-gaap:CommonClassAMember2023-12-310001758730us-gaap:CommonClassBMember2022-12-310001758730us-gaap:CommonClassBMember2023-12-310001758730us-gaap:CommonClassCMember2022-12-310001758730us-gaap:CommonClassCMember2023-12-310001758730tw:CommonClassDMember2023-12-310001758730tw:CommonClassDMember2022-12-310001758730tw:TransactionFeeRevenueMember2023-01-012023-12-310001758730tw:TransactionFeeRevenueMember2022-01-012022-12-310001758730tw:TransactionFeeRevenueMember2021-01-012021-12-310001758730tw:SubscriptionFeeRevenueMember2023-01-012023-12-310001758730tw:SubscriptionFeeRevenueMember2022-01-012022-12-310001758730tw:SubscriptionFeeRevenueMember2021-01-012021-12-310001758730tw:MarketDataRevenueMember2023-01-012023-12-310001758730tw:MarketDataRevenueMember2022-01-012022-12-310001758730tw:MarketDataRevenueMember2021-01-012021-12-310001758730us-gaap:FinancialServiceOtherMember2023-01-012023-12-310001758730us-gaap:FinancialServiceOtherMember2022-01-012022-12-310001758730us-gaap:FinancialServiceOtherMember2021-01-012021-12-3100017587302022-01-012022-12-3100017587302021-01-012021-12-310001758730us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-12-310001758730us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-12-310001758730us-gaap:CommonStockMemberus-gaap:CommonClassCMember2020-12-310001758730tw:CommonClassDMemberus-gaap:CommonStockMember2020-12-310001758730us-gaap:AdditionalPaidInCapitalMember2020-12-310001758730us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001758730us-gaap:RetainedEarningsMember2020-12-310001758730us-gaap:NoncontrollingInterestMember2020-12-3100017587302020-12-310001758730us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001758730us-gaap:RetainedEarningsMember2021-01-012021-12-310001758730us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001758730us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001758730us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-12-310001758730us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-12-310001758730us-gaap:CommonStockMemberus-gaap:CommonClassCMember2021-12-310001758730tw:CommonClassDMemberus-gaap:CommonStockMember2021-12-310001758730us-gaap:AdditionalPaidInCapitalMember2021-12-310001758730us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001758730us-gaap:RetainedEarningsMember2021-12-310001758730us-gaap:NoncontrollingInterestMember2021-12-3100017587302021-12-310001758730us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001758730us-gaap:RetainedEarningsMember2022-01-012022-12-310001758730us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001758730us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001758730us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310001758730us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-12-310001758730us-gaap:CommonStockMemberus-gaap:CommonClassCMember2022-12-310001758730tw:CommonClassDMemberus-gaap:CommonStockMember2022-12-310001758730us-gaap:AdditionalPaidInCapitalMember2022-12-310001758730us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001758730us-gaap:RetainedEarningsMember2022-12-310001758730us-gaap:NoncontrollingInterestMember2022-12-310001758730us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001758730us-gaap:RetainedEarningsMember2023-01-012023-12-310001758730us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001758730us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001758730us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-12-310001758730us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-12-310001758730us-gaap:CommonStockMemberus-gaap:CommonClassCMember2023-12-310001758730tw:CommonClassDMemberus-gaap:CommonStockMember2023-12-310001758730us-gaap:AdditionalPaidInCapitalMember2023-12-310001758730us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001758730us-gaap:RetainedEarningsMember2023-12-310001758730us-gaap:NoncontrollingInterestMember2023-12-310001758730tw:AdjustedForRefinitivTransactionMember2023-01-012023-12-310001758730tw:AdjustedForRefinitivTransactionMember2022-01-012022-12-310001758730tw:AdjustedForRefinitivTransactionMember2021-01-012021-12-310001758730tw:TradeWebMarketsLlcMember2023-12-31xbrli:pure0001758730tw:TradeWebMarketsLlcMember2022-12-310001758730tw:YieldbrokerMember2023-08-312023-08-31iso4217:AUD0001758730tw:PublicInvestorsMemberus-gaap:CommonClassAMembertw:TradewebMarketsIncMember2023-12-310001758730tw:PublicInvestorsMembertw:TradewebMarketsIncMember2023-12-310001758730tw:PublicInvestorsMembertw:TradeWebMarketsLlcMember2023-12-310001758730tw:RefinitivMemberus-gaap:CommonClassBMembertw:TradewebMarketsIncMember2023-12-310001758730tw:RefinitivMembertw:TradewebMarketsIncMemberus-gaap:CommonClassCMember2023-12-310001758730tw:RefinitivMembertw:CommonClassDMembertw:TradewebMarketsIncMember2023-12-310001758730tw:RefinitivMembertw:TradewebMarketsIncMember2023-12-310001758730tw:RefinitivMembertw:TradeWebMarketsLlcMember2023-12-310001758730tw:BankStockholdersMembertw:CommonClassDMembertw:TradewebMarketsIncMember2023-12-310001758730tw:ClassCAndClassDCommonStockMembertw:BankStockholdersMembertw:TradewebMarketsIncMember2023-12-310001758730tw:TradewebMarketsLLCMembertw:OtherStockholdersMembertw:CommonClassDMember2023-12-310001758730srt:RevisionOfPriorPeriodReclassificationAdjustmentMembersrt:AffiliatedEntityMember2022-12-310001758730srt:MinimumMembertw:FurnitureEquipmentAndPurchasedSoftwareMember2023-12-310001758730srt:MaximumMembertw:FurnitureEquipmentAndPurchasedSoftwareMember2023-12-310001758730tw:FurnitureEquipmentAndPurchasedSoftwareMember2023-12-310001758730tw:FurnitureEquipmentAndPurchasedSoftwareMember2022-12-310001758730tw:FurnitureEquipmentAndPurchasedSoftwareMember2023-01-012023-12-310001758730tw:FurnitureEquipmentAndPurchasedSoftwareMember2022-01-012022-12-310001758730tw:FurnitureEquipmentAndPurchasedSoftwareMember2021-01-012021-12-310001758730us-gaap:SoftwareDevelopmentMember2023-12-310001758730tw:NFIAcquisitionMemberus-gaap:SoftwareDevelopmentMember2023-12-310001758730tw:YieldbrokerAcquisitionMemberus-gaap:SoftwareDevelopmentMember2023-12-310001758730us-gaap:SoftwareDevelopmentMember2023-01-012023-12-31tw:reporting_unit00017587302023-10-012023-10-010001758730srt:MinimumMember2023-12-310001758730srt:MaximumMember2023-12-310001758730us-gaap:ForeignExchangeForwardMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310001758730us-gaap:ForeignExchangeForwardMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001758730us-gaap:ForeignExchangeForwardMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001758730us-gaap:ForeignExchangeOptionMemberus-gaap:OtherOperatingIncomeExpenseMember2023-01-012023-12-310001758730tw:YieldbrokerMember2023-10-012023-12-310001758730tw:YieldbrokerMember2023-12-310001758730tw:YieldbrokerMemberus-gaap:SoftwareDevelopmentMember2023-12-310001758730tw:YieldbrokerMemberus-gaap:CustomerRelationshipsMember2023-12-310001758730tw:YieldbrokerMemberus-gaap:TradeNamesMember2023-12-310001758730tw:YieldbrokerMember2023-08-312023-12-310001758730tw:YieldbrokerMemberus-gaap:SoftwareDevelopmentMember2023-08-310001758730tw:YieldbrokerMemberus-gaap:TradeNamesMember2023-08-310001758730tw:YieldbrokerMemberus-gaap:CustomerRelationshipsMember2023-08-310001758730tw:YieldbrokerMembertw:ProfessionalFeesMember2023-01-012023-12-310001758730tw:YieldbrokerMemberus-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-31tw:acquisition0001758730tw:NFIAcquisitionMembertw:ProfessionalFeesMember2021-01-012021-12-310001758730us-gaap:ForeignExchangeOptionMember2023-06-010001758730us-gaap:ForeignExchangeOptionMember2023-08-252023-08-250001758730tw:R8FINMember2023-11-162023-11-160001758730tw:R8FINMemberus-gaap:SubsequentEventMember2024-01-192024-01-190001758730tw:RefinitivMemberus-gaap:SoftwareDevelopmentMember2023-12-310001758730tw:RefinitivMemberus-gaap:SoftwareDevelopmentMember2022-12-310001758730us-gaap:SoftwareDevelopmentMember2022-12-310001758730tw:NFIAcquisitionMemberus-gaap:SoftwareDevelopmentMember2021-12-310001758730tw:YieldbrokerMember2023-01-012023-12-310001758730tw:YieldbrokerMember2022-01-012022-12-310001758730tw:RefinitivMember2023-12-310001758730tw:RefinitivMember2022-12-310001758730tw:RefinitivMemberus-gaap:LicenseMember2023-12-310001758730tw:RefinitivMemberus-gaap:LicenseMember2022-12-310001758730us-gaap:TradeNamesMembertw:RefinitivMember2023-12-310001758730us-gaap:TradeNamesMembertw:RefinitivMember2022-12-310001758730tw:RefinitivMemberus-gaap:CustomerRelationshipsMember2022-12-310001758730tw:RefinitivMemberus-gaap:CustomerRelationshipsMember2023-12-310001758730us-gaap:CustomerRelationshipsMember2023-12-310001758730us-gaap:CustomerRelationshipsMember2022-12-310001758730us-gaap:MediaContentMember2023-12-310001758730tw:RefinitivMemberus-gaap:MediaContentMember2023-12-310001758730tw:RefinitivMemberus-gaap:MediaContentMember2022-12-310001758730us-gaap:TradeNamesMember2022-12-310001758730us-gaap:TradeNamesMember2023-12-310001758730us-gaap:RevolvingCreditFacilityMember2022-12-310001758730us-gaap:RevolvingCreditFacilityMember2023-12-310001758730tw:TransactionFeeRevenueMembertw:VariablePricingMember2023-01-012023-12-310001758730tw:TransactionFeeRevenueMemberus-gaap:FixedPriceContractMember2023-01-012023-12-310001758730tw:TransactionFeeRevenueMembertw:VariablePricingMember2022-01-012022-12-310001758730tw:TransactionFeeRevenueMemberus-gaap:FixedPriceContractMember2022-01-012022-12-310001758730tw:TransactionFeeRevenueMembertw:VariablePricingMember2021-01-012021-12-310001758730tw:TransactionFeeRevenueMemberus-gaap:FixedPriceContractMember2021-01-012021-12-310001758730tw:SubscriptionFeeAndMarketDataRevenueMembertw:VariablePricingMember2023-01-012023-12-310001758730us-gaap:FixedPriceContractMembertw:SubscriptionFeeAndMarketDataRevenueMember2023-01-012023-12-310001758730tw:SubscriptionFeeAndMarketDataRevenueMembertw:VariablePricingMember2022-01-012022-12-310001758730us-gaap:FixedPriceContractMembertw:SubscriptionFeeAndMarketDataRevenueMember2022-01-012022-12-310001758730tw:SubscriptionFeeAndMarketDataRevenueMembertw:VariablePricingMember2021-01-012021-12-310001758730us-gaap:FixedPriceContractMembertw:SubscriptionFeeAndMarketDataRevenueMember2021-01-012021-12-310001758730tw:MarketDataRevenueMembertw:VariablePricingMember2023-01-012023-12-310001758730us-gaap:FixedPriceContractMembertw:MarketDataRevenueMember2023-01-012023-12-310001758730tw:MarketDataRevenueMembertw:VariablePricingMember2022-01-012022-12-310001758730us-gaap:FixedPriceContractMembertw:MarketDataRevenueMember2022-01-012022-12-310001758730tw:MarketDataRevenueMembertw:VariablePricingMember2021-01-012021-12-310001758730us-gaap:FixedPriceContractMembertw:MarketDataRevenueMember2021-01-012021-12-310001758730us-gaap:FinancialServiceOtherMembertw:VariablePricingMember2023-01-012023-12-310001758730us-gaap:FixedPriceContractMemberus-gaap:FinancialServiceOtherMember2023-01-012023-12-310001758730us-gaap:FinancialServiceOtherMembertw:VariablePricingMember2022-01-012022-12-310001758730us-gaap:FixedPriceContractMemberus-gaap:FinancialServiceOtherMember2022-01-012022-12-310001758730us-gaap:FinancialServiceOtherMembertw:VariablePricingMember2021-01-012021-12-310001758730us-gaap:FixedPriceContractMemberus-gaap:FinancialServiceOtherMember2021-01-012021-12-310001758730tw:VariablePricingMember2023-01-012023-12-310001758730us-gaap:FixedPriceContractMember2023-01-012023-12-310001758730tw:VariablePricingMember2022-01-012022-12-310001758730us-gaap:FixedPriceContractMember2022-01-012022-12-310001758730tw:VariablePricingMember2021-01-012021-12-310001758730us-gaap:FixedPriceContractMember2021-01-012021-12-310001758730us-gaap:DomesticCountryMember2023-01-012023-12-310001758730us-gaap:ForeignCountryMember2023-01-012023-12-310001758730us-gaap:DomesticCountryMember2023-12-310001758730us-gaap:StateAndLocalJurisdictionMember2023-12-310001758730us-gaap:ForeignCountryMember2023-12-310001758730tw:RefinitivDirectOwnerMember2019-04-082019-04-080001758730tw:RefinitivDirectOwnerMemberus-gaap:CommonClassBMember2019-04-080001758730us-gaap:AccountsPayableAndAccruedLiabilitiesMember2023-12-310001758730us-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-12-310001758730srt:AffiliatedEntityMembertw:ReceivableAndDueFromAffiliatesMember2023-12-310001758730srt:AffiliatedEntityMembertw:ReceivableAndDueFromAffiliatesMember2022-12-310001758730us-gaap:CommonClassCMember2023-01-012023-12-31tw:vote0001758730us-gaap:CommonClassAMember2023-01-012023-12-310001758730tw:CommonClassDMember2019-04-032019-04-030001758730us-gaap:CommonClassBMember2019-04-032019-04-030001758730us-gaap:CommonClassBMember2023-01-012023-12-310001758730tw:CommonClassDMember2023-01-012023-12-310001758730tw:TradeWebMarketsLlcMember2023-01-012023-12-310001758730us-gaap:CommonStockMember2020-12-310001758730us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-01-012021-12-310001758730us-gaap:CommonStockMemberus-gaap:CommonClassCMember2021-01-012021-12-310001758730tw:CommonClassDMemberus-gaap:CommonStockMember2021-01-012021-12-310001758730us-gaap:CommonStockMember2021-01-012021-12-310001758730us-gaap:CommonStockMember2021-12-310001758730us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-012022-12-310001758730us-gaap:CommonStockMemberus-gaap:CommonClassCMember2022-01-012022-12-310001758730tw:CommonClassDMemberus-gaap:CommonStockMember2022-01-012022-12-310001758730us-gaap:CommonStockMember2022-01-012022-12-310001758730us-gaap:CommonStockMember2022-12-310001758730us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-12-310001758730us-gaap:CommonStockMemberus-gaap:CommonClassCMember2023-01-012023-12-310001758730tw:CommonClassDMemberus-gaap:CommonStockMember2023-01-012023-12-310001758730us-gaap:CommonStockMember2023-01-012023-12-310001758730us-gaap:CommonStockMember2023-12-310001758730us-gaap:CommonClassAMembertw:A2021ShareRepurchaseProgramMember2021-02-040001758730us-gaap:CommonClassAMembertw:A2021ShareRepurchaseProgramMember2022-01-012022-12-310001758730us-gaap:CommonClassAMembertw:A2021ShareRepurchaseProgramMember2021-01-012021-12-310001758730us-gaap:CommonClassAMembertw:A2021ShareRepurchaseProgramMember2022-12-310001758730tw:A2022ShareRepurchaseProgramMemberus-gaap:CommonClassAMember2022-12-050001758730tw:A2022ShareRepurchaseProgramMemberus-gaap:CommonClassAMember2023-01-012023-12-310001758730tw:A2022ShareRepurchaseProgramMemberus-gaap:CommonClassAMember2022-01-012022-12-310001758730tw:TradeWebMarketsLlcMember2023-01-012023-12-310001758730tw:TradeWebMarketsLlcMember2022-01-012022-12-310001758730tw:Omnibus2019EquityIncentivePlanMember2023-12-310001758730tw:Omnibus2019EquityIncentivePlanMember2023-01-012023-12-310001758730srt:ChiefExecutiveOfficerMember2022-02-162022-02-160001758730srt:ChiefExecutiveOfficerMember2022-12-310001758730srt:ChiefExecutiveOfficerMember2022-01-012022-12-310001758730srt:ChiefExecutiveOfficerMember2023-01-012023-12-310001758730srt:MinimumMember2022-01-012022-12-310001758730srt:MaximumMember2022-01-012022-12-310001758730tw:PerformanceSharesSettledWithEquityMember2022-01-012022-12-310001758730srt:MaximumMember2023-01-012023-12-310001758730tw:PerformanceSharesSettledWithEquityMember2022-12-310001758730tw:PerformanceSharesSettledWithEquityMember2023-01-012023-12-310001758730tw:PerformanceSharesSettledWithEquityMember2023-12-310001758730tw:PerformanceSharesSettledWithEquityMember2021-01-012021-12-310001758730us-gaap:PhantomShareUnitsPSUsMember2023-01-012023-12-310001758730srt:MinimumMemberus-gaap:PhantomShareUnitsPSUsMember2023-01-012023-12-310001758730srt:MaximumMemberus-gaap:PhantomShareUnitsPSUsMember2023-01-012023-12-310001758730us-gaap:PhantomShareUnitsPSUsMember2022-12-310001758730us-gaap:PhantomShareUnitsPSUsMember2023-12-310001758730us-gaap:PhantomShareUnitsPSUsMember2022-01-012022-12-310001758730us-gaap:PhantomShareUnitsPSUsMember2021-01-012021-12-310001758730us-gaap:PhantomShareUnitsPSUsMember2023-03-152023-03-150001758730us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001758730us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001758730us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001758730us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001758730us-gaap:ShareBasedPaymentArrangementNonemployeeMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001758730us-gaap:RestrictedStockUnitsRSUMember2022-12-310001758730us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001758730us-gaap:RestrictedStockUnitsRSUMember2023-12-310001758730us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001758730us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001758730us-gaap:EmployeeStockOptionMember2022-12-310001758730us-gaap:RestrictedStockUnitsRSUMember2021-12-310001758730us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001758730us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001758730srt:AffiliatedEntityMember2023-12-310001758730srt:AffiliatedEntityMember2022-12-310001758730srt:AffiliatedEntityMembertw:SubscriptionFeeRevenueMember2023-01-012023-12-310001758730srt:AffiliatedEntityMembertw:SubscriptionFeeRevenueMember2022-01-012022-12-310001758730srt:AffiliatedEntityMembertw:SubscriptionFeeRevenueMember2021-01-012021-12-310001758730srt:AffiliatedEntityMembertw:MarketDataRevenueMember2023-01-012023-12-310001758730srt:AffiliatedEntityMembertw:MarketDataRevenueMember2022-01-012022-12-310001758730srt:AffiliatedEntityMembertw:MarketDataRevenueMember2021-01-012021-12-310001758730srt:AffiliatedEntityMemberus-gaap:FinancialServiceOtherMember2023-01-012023-12-310001758730srt:AffiliatedEntityMemberus-gaap:FinancialServiceOtherMember2022-01-012022-12-310001758730srt:AffiliatedEntityMemberus-gaap:FinancialServiceOtherMember2021-01-012021-12-310001758730srt:AffiliatedEntityMember2023-01-012023-12-310001758730srt:AffiliatedEntityMember2022-01-012022-12-310001758730srt:AffiliatedEntityMember2021-01-012021-12-310001758730us-gaap:FairValueInputsLevel1Member2023-12-310001758730us-gaap:FairValueInputsLevel2Member2023-12-310001758730us-gaap:FairValueInputsLevel3Member2023-12-310001758730us-gaap:FairValueInputsLevel1Member2022-12-310001758730us-gaap:FairValueInputsLevel2Member2022-12-310001758730us-gaap:FairValueInputsLevel3Member2022-12-310001758730us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2023-12-310001758730us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2022-12-310001758730us-gaap:ForeignExchangeOptionMemberus-gaap:OtherOperatingIncomeExpenseMember2022-01-012022-12-310001758730us-gaap:ForeignExchangeOptionMemberus-gaap:OtherOperatingIncomeExpenseMember2021-01-012021-12-310001758730us-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001758730us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001758730us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001758730us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001758730us-gaap:FairValueInputsLevel12And3Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001758730us-gaap:FairValueMeasurementsNonrecurringMember2022-12-310001758730us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001758730us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2022-12-310001758730us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2022-12-310001758730us-gaap:FairValueInputsLevel12And3Memberus-gaap:FairValueMeasurementsNonrecurringMember2022-12-310001758730us-gaap:MeasurementInputDiscountRateMember2023-12-310001758730tw:MeasurementInputPerpetualGrowthRateMember2023-12-3100017587302021-03-012021-03-31tw:class_action_case0001758730us-gaap:RevolvingCreditFacilityMember2023-11-212023-11-210001758730us-gaap:RevolvingCreditFacilityMember2023-11-210001758730us-gaap:RevolvingCreditFacilityMember2023-03-310001758730us-gaap:LetterOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-11-210001758730us-gaap:RevolvingCreditFacilityMemberus-gaap:BridgeLoanMember2023-11-210001758730us-gaap:RevolvingCreditFacilityMembertw:OneMonthSecuredOvernightFinancingRateMember2023-11-212023-11-210001758730srt:MinimumMemberus-gaap:RevolvingCreditFacilityMembertw:OneMonthSecuredOvernightFinancingRateMember2023-11-212023-11-210001758730srt:MaximumMemberus-gaap:RevolvingCreditFacilityMembertw:OneMonthSecuredOvernightFinancingRateMember2023-11-212023-11-210001758730tw:SecuredOvernightFinancingRateMemberus-gaap:RevolvingCreditFacilityMember2023-11-212023-11-210001758730us-gaap:RevolvingCreditFacilityMembertw:EURIBORMember2023-11-212023-11-210001758730srt:MinimumMemberus-gaap:RevolvingCreditFacilityMembertw:EURIBORMember2023-11-212023-11-210001758730srt:MaximumMemberus-gaap:RevolvingCreditFacilityMembertw:EURIBORMember2023-11-212023-11-210001758730us-gaap:RevolvingCreditFacilityMemberus-gaap:FederalFundsEffectiveSwapRateMember2023-11-212023-11-210001758730tw:LimitedLiabilityCompanyUnitsMember2023-01-012023-12-310001758730tw:LimitedLiabilityCompanyUnitsMember2022-01-012022-12-310001758730tw:LimitedLiabilityCompanyUnitsMember2021-01-012021-12-310001758730tw:TradewebLlcMember2023-12-310001758730tw:TradewebLlcMember2022-12-310001758730tw:DealerwebMember2023-12-310001758730tw:DealerwebMember2022-12-310001758730tw:TradewebDirectLlcMember2023-12-310001758730tw:TradewebDirectLlcMember2022-12-310001758730tw:TradewebEuropeLimitedMember2023-12-310001758730tw:TradewebEuropeLimitedMember2022-12-310001758730tw:TradewebJapanKkMember2023-12-310001758730tw:TradewebJapanKkMember2022-12-310001758730tw:TradewebEuBvMember2023-12-310001758730tw:TradewebEuBvMember2022-12-310001758730tw:TradewebExecutionServicesLimitedMember2023-12-310001758730tw:TradewebExecutionServicesLimitedMember2022-12-310001758730tw:TradewebExecutionServicesBVMember2023-12-310001758730tw:TradewebExecutionServicesBVMember2022-12-310001758730tw:YieldbrokerMember2023-12-310001758730tw:YieldbrokerMember2022-12-310001758730tw:TDIFCMember2023-12-310001758730tw:TDIFCMember2022-12-310001758730tw:TwSefLlcMember2023-12-310001758730tw:TwSefLlcMember2022-12-310001758730tw:DwSefLlcMember2023-12-310001758730tw:DwSefLlcMember2022-12-310001758730tw:InstitutionalClientSectorMember2023-01-012023-12-310001758730tw:InstitutionalClientSectorMember2022-01-012022-12-310001758730tw:InstitutionalClientSectorMember2021-01-012021-12-310001758730tw:WholesaleClientSectorMember2023-01-012023-12-310001758730tw:WholesaleClientSectorMember2022-01-012022-12-310001758730tw:WholesaleClientSectorMember2021-01-012021-12-310001758730tw:RetailClientSectorMember2023-01-012023-12-310001758730tw:RetailClientSectorMember2022-01-012022-12-310001758730tw:RetailClientSectorMember2021-01-012021-12-310001758730tw:MarketDataClientSectorMember2023-01-012023-12-310001758730tw:MarketDataClientSectorMember2022-01-012022-12-310001758730tw:MarketDataClientSectorMember2021-01-012021-12-310001758730country:US2023-01-012023-12-310001758730country:US2022-01-012022-12-310001758730country:US2021-01-012021-12-310001758730us-gaap:NonUsMember2023-01-012023-12-310001758730us-gaap:NonUsMember2022-01-012022-12-310001758730us-gaap:NonUsMember2021-01-012021-12-310001758730country:US2023-12-310001758730country:US2022-12-310001758730us-gaap:NonUsMember2023-12-310001758730us-gaap:NonUsMember2022-12-310001758730us-gaap:CommonClassBMemberus-gaap:SubsequentEventMember2024-02-022024-02-020001758730us-gaap:SubsequentEventMemberus-gaap:CommonClassAMember2024-02-022024-02-020001758730tw:TWMLLCMemberus-gaap:SubsequentEventMember2024-02-0200017587302023-10-012023-12-310001758730tw:DouglasFriedmanMember2023-10-012023-12-310001758730tw:DouglasFriedmanMembertw:DouglasFriedmanRuleTradingArrangementStockOptionsMember2023-12-310001758730tw:DouglasFriedmanRuleTradingArrangementVestingOfRestrictedStockUnitsPreviouslyAwardedMembertw:DouglasFriedmanMember2023-12-310001758730tw:DouglasFriedmanRuleTradingArrangementRestrictedStockUnitsAccruedDuringVestingPeriodOfMarch152021ThroughMarch152024Membertw:DouglasFriedmanMember2023-12-310001758730tw:JustinPetersonMember2023-10-012023-12-310001758730tw:JustinPetersonRuleTradingArrangementStockOptionsMembertw:JustinPetersonMember2023-12-310001758730tw:JustinPetersonRuleTradingArrangementVestingOfPreviouslyAwardedPerformanceBasedRestrictedStockUnitsMembertw:JustinPetersonMember2023-12-310001758730tw:JustinPetersonMembertw:JustinPetersonRuleTradingArrangementPerformanceBasedRestrictedStockUnitsAccruedDuringVestingPeriodOfMarch152021ThroughJanuary12024Member2023-12-310001758730tw:JustinPetersonMembertw:JustinPetersonRuleTradingArrangementRestrictedStockUnitsMember2023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________

FORM 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-38860

TRADEWEB MARKETS INC.

(Exact name of registrant as specified in its charter)

___________________________________________

| | | | | | | | |

| Delaware | | 83-2456358 |

| (State of other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

1177 Avenue of the Americas New York, New York | | 10036 |

| (Address of principal executive offices) | | (Zip Code) |

(646) 430-6000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A common stock, par value $0.00001 | | TW | | Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ | | Non-accelerated filer | ☐ |

| Smaller reporting company | ☐ | | Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Indicate by check mark whether the registrant has filed a report on and attestation of the effectiveness of its internal control over financial reporting under Section 404(b) of Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by registered public accounting firm that prepared or issued its audit report ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price of the Class A common stock on the NASDAQ Global Select Market on June 30, 2023, was approximately $16.1 billion.

| | | | | | | | |

| Class of Stock | | Shares Outstanding as of February 2, 2024 |

| Class A Common Stock, par value $0.00001 per share | | 115,738,944 | |

| Class B Common Stock, par value $0.00001 per share | | 96,933,192 | |

| Class C Common Stock, par value $0.00001 per share | | 18,000,000 | |

| Class D Common Stock, par value $0.00001 per share | | 5,077,973 | |

| | | | | | | | |

| Documents Incorporated by Reference |

Part III of this Annual Report on Form 10-K incorporates by reference portions of the Registrant’s Proxy Statement for its 2024 Annual Meeting of Stockholders.

The Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2023.

TRADEWEB MARKETS INC.

FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

INTRODUCTORY NOTE

Basis of Presentation

The financial statements and other disclosures contained in this Annual Report on Form 10-K include those of Tradeweb Markets Inc., which is the registrant, and those of its consolidating subsidiaries, including Tradeweb Markets LLC, which became the principal operating subsidiary of Tradeweb Markets Inc. on April 4, 2019 in a series of reorganization transactions (the “Reorganization Transactions”) that were completed in connection with Tradeweb Markets Inc.’s initial public offering (the “IPO”), which closed on April 8, 2019.

As a result of the Reorganization Transactions completed in connection with the IPO, Tradeweb Markets Inc. became a holding company whose only material assets consist of its equity interest in Tradeweb Markets LLC and related deferred tax assets. As the sole manager of Tradeweb Markets LLC, Tradeweb Markets Inc. operates and controls all of the business and affairs of Tradeweb Markets LLC and, through Tradeweb Markets LLC and its subsidiaries, conducts its business. As a result of this control, and because Tradeweb Markets Inc. has a substantial financial interest in Tradeweb Markets LLC, Tradeweb Markets Inc. consolidates the financial results of Tradeweb Markets LLC and its subsidiaries.

As used in this Annual Report on Form 10-K, unless the context otherwise requires, references to:

•“We,” “us,” “our,” the “Company,” “Tradeweb” and similar references refer: (i) on or prior to the completion of the Reorganization Transactions to Tradeweb Markets LLC, which we refer to as “TWM LLC,” and, unless otherwise stated or the context otherwise requires, all of its subsidiaries and any predecessor entities, and (ii) following the completion of the Reorganization Transactions to Tradeweb Markets Inc., and, unless otherwise stated or the context otherwise requires, TWM LLC and all of its subsidiaries and any predecessor entities.

•“Bank Stockholders” refer collectively to entities affiliated with the following clients: Barclays Capital Inc., BofA Securities, Inc. (a subsidiary of Bank of America Corporation), Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC, Deutsche Bank Securities Inc., Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC, RBS Securities Inc., UBS Securities LLC and Wells Fargo Securities, LLC, which, prior to the completion of the IPO, collectively held a 46% ownership interest in Tradeweb. Subsequent to August 2022, there were no LLC Interests (as defined below) held by Bank Stockholders.

•“Continuing LLC Owners” refer collectively to (i) those Original LLC Owners (as defined below), including Refinitiv (as defined below), certain of the Bank Stockholders and members of management, that continued to own LLC Interests after the completion of the IPO and Reorganization Transactions and that received shares of our Class C common stock, shares of our Class D common stock or a combination of both, as the case may be, in connection with the completion of the Reorganization Transactions, (ii) any subsequent transferee of any Original LLC Owner that has executed a joinder agreement to TWM LLC’s limited liability company agreement (the “TWM LLC Agreement”) and (iii) solely with respect to the Tax Receivable Agreement (as defined below), (x) those Original LLC Owners, including certain of the Bank Stockholders, that disposed of all of their LLC Interests for cash in connection with the IPO and (y) any party that has executed a joinder agreement to the Tax Receivable Agreement in accordance with the Tax Receivable Agreement.

•“Investor Group” refer to certain investment funds affiliated with The Blackstone Group Inc. (f/k/a The Blackstone Group L.P.), an affiliate of Canada Pension Plan Investment Board, an affiliate of GIC Special Investments Pte. Ltd. and certain co-investors, which prior to the LSEG Transaction (as defined below) collectively held indirectly a 55% ownership interest in Refinitiv.

•“LLC Interests” refer to the single class of common membership interests of TWM LLC. LLC Interests, other than those held by Tradeweb Markets Inc., are redeemable or exchangeable in accordance with the TWM LLC Agreement for shares of Class A common stock or Class B common stock, as the case may be, on a one-for-one basis.

•“LSEG Transaction” refer to the acquisition of the Refinitiv business by London Stock Exchange Group plc, in an all share transaction, which closed on January 29, 2021. The Refinitiv business was rebranded by the London Stock Exchange Group plc as LSEG Data & Analytics during the fourth quarter of 2023.

•“LSEG” refer to London Stock Exchange Group plc, and unless otherwise stated or the context otherwise requires, all of its direct and indirect subsidiaries.

•“Original LLC Owners” refer to the owners of TWM LLC prior to the Reorganization Transactions.

•“Refinitiv,” prior to the LSEG Transaction, refer to Refinitiv Holdings Limited, and unless otherwise stated or the context otherwise requires, all of its direct and indirect subsidiaries, and subsequent to the LSEG Transaction, refer to Refinitiv Parent Limited, and unless otherwise stated or the context otherwise requires, all of its subsidiaries. Refinitiv owns substantially all of the former financial and risk business of Thomson Reuters (as defined below), including, prior to and following the completion of the Reorganization Transactions, an indirect majority ownership interest in Tradeweb, and was controlled by the Investor Group prior to the LSEG Transaction.

•“Refinitiv Transaction” refer to the transaction pursuant to which Refinitiv indirectly acquired on October 1, 2018 substantially all of the financial and risk business of Thomson Reuters and Thomson Reuters indirectly acquired a 45% ownership interest in Refinitiv.

•“Thomson Reuters” or “TR” refer to Thomson Reuters Corporation, which prior to the LSEG Transaction indirectly held a 45% ownership interest in Refinitiv.

Numerical figures included in this Annual Report on Form 10-K have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them. In addition, we round certain percentages presented in this Annual Report on Form 10-K to the nearest whole number. As a result, figures expressed as percentages in the text may not total 100% or, when aggregated, may not be the arithmetic aggregation of the percentages that precede them.

Market and Industry Data

This Annual Report on Form 10-K includes estimates regarding market and industry data. Unless otherwise indicated, information concerning our industry and the markets in which we operate, including our general expectations, market position, market opportunity and market size, are based on our management’s knowledge and experience in the markets in which we operate, together with currently available information obtained from various sources, including publicly available information, industry reports and publications, surveys, our clients, trade and business organizations and other contacts in the markets in which we operate. Certain information is based on management estimates, which have been derived from third-party sources, as well as data from our internal research, and are based on certain assumptions that we believe to be reasonable. In particular, to calculate our market position, market opportunity and market size we derived the size of the applicable market from a combination of management estimates, public filings and statements of competitors and public industry sources, including FINRA’s Trade Reporting and Compliance Engine (“TRACE”), the Securities Industry and Financial Markets Association (“SIFMA”), the International Swaps and Derivatives Association (“ISDA”), Clarus Financial Technology, TRAX, the Federal Reserve Bank of New York, Flow Traders, Coalition Greenwich, the Association for Financial Markets in Europe (“AFME”), the Japan Securities Deal Association, the China Foreign Exchange Trade System (“CFETS”) and the Emerging Markets Trade Association (“EMTA”). In calculating the size of certain markets, we omitted products for which there is no publicly available data, and, as a result, the actual markets for certain of our asset classes may be larger than those presented herein.

In presenting this information, we have made certain assumptions that we believe to be reasonable based on such data and other similar sources and on our knowledge of, and our experience to date in, the markets in which we operate. While we believe the estimated market and industry data included in this Annual Report on Form 10-K are generally reliable, such information, which is derived in part from management’s estimates and beliefs, is inherently uncertain and imprecise. Market and industry data are subject to change and may be limited by the availability of raw data, the voluntary nature of the data gathering process and other limitations inherent in any statistical survey of such data. In addition, projections, assumptions and estimates of the future performance of the markets in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Cautionary Note Regarding Forward-Looking Statements” and Part I, Item 1A. – “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us. Accordingly, you are cautioned not to place undue reliance on such market and industry data or any other such estimates. We cannot guarantee the accuracy or completeness of this information, and we have not independently verified any third-party information and data from our internal research has not been verified by any independent source.

Certain Trademarks, Trade Names and Service Marks

This Annual Report on Form 10-K includes trademarks and service marks owned by us. This Annual Report on Form 10-K also contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this Annual Report on Form 10-K may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, trade names and service marks. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

USE OF NON-GAAP FINANCIAL MEASURES

This Annual Report on Form 10-K contains “non-GAAP financial measures,” which are financial measures that are not calculated and presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

The Securities and Exchange Commission (“SEC”) has adopted rules to regulate the use of non-GAAP financial measures in filings with the SEC and in other public disclosures. These rules govern the manner in which non-GAAP financial measures are publicly presented and require, among other things:

•a presentation with equal or greater prominence of the most comparable financial measure or measures calculated and presented in accordance with GAAP; and

•a statement disclosing the purposes for which the registrant’s management uses the non-GAAP financial measure.

Specifically, we make use of the non-GAAP financial measures “Free Cash Flow,” “Adjusted EBITDA,” “Adjusted EBITDA margin,” “Adjusted EBIT,” “Adjusted EBIT margin,” “Adjusted Net Income” and “Adjusted Diluted EPS,” as well as the change in revenue, Adjusted EBITDA margin and Adjusted EBIT margin on a constant currency basis, in evaluating our historical results and future prospects. For the definition of Free Cash Flow and a reconciliation to cash flow from operating activities, its most directly comparable financial measure presented in accordance with GAAP, see Part II, Item 7. – “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Financial Measures.” For the definitions of Adjusted EBITDA, Adjusted EBIT and Adjusted Net Income and reconciliations to net income, and net income attributable to Tradeweb Markets Inc., as applicable, their most directly comparable financial measures presented in accordance with GAAP, see Part II, Item 7. – “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Financial Measures.” For the definition of constant currency revenue change, see Part II, Item 7. – “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Results of Operations.” Adjusted EBITDA margin and Adjusted EBIT margin are defined as Adjusted EBITDA and Adjusted EBIT, respectively, divided by revenue for the applicable period. For the definition of constant currency change in Adjusted EBITDA margin and Adjusted EBIT margin, see Part II, Item 7. – “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Financial Measures.” Adjusted Diluted EPS is defined as Adjusted Net Income divided by the diluted weighted average number of shares of Class A common stock and Class B common stock outstanding for the applicable period (including the effect of potentially dilutive securities determined using the treasury stock method), plus the weighted average number of other participating securities reflected in earnings per share using the two-class method, plus the assumed full exchange of all outstanding LLC Interests held by non-controlling interests for shares of Class A common stock or Class B common stock.

We present Free Cash Flow because we believe it is a useful indicator of liquidity that provides information to management and investors about the amount of cash generated from our core operations after expenditures for capitalized software development costs and furniture, equipment and leasehold improvements.

We present Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBIT and Adjusted EBIT margin because we believe they assist investors and analysts in comparing our operating performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. Management and our board of directors use Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBIT and Adjusted EBIT margin to assess our financial performance and believe they are helpful in highlighting trends in our core operating performance, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which we operate and capital investments. Further, our executive incentive compensation program is based in part on components of Adjusted EBITDA and Adjusted EBITDA margin.

We use constant currency measures as supplemental metrics to evaluate our underlying performance between periods by removing the impact of foreign currency fluctuations. We believe that providing certain percentage changes on a constant currency basis provide useful comparisons of our performance and trends between periods.

We use Adjusted Net Income and Adjusted Diluted EPS as supplemental metrics to evaluate our business performance in a way that also considers our ability to generate profit without the impact of certain items. Each of the normal recurring adjustments and other adjustments described in the definition of Adjusted Net Income helps to provide management with a measure of our operating performance over time by removing items that are not related to day-to-day operations or are non-cash expenses.

Free Cash Flow, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBIT, Adjusted EBIT margin, Adjusted Net Income, Adjusted Diluted EPS and constant currency measures have limitations as analytical tools, and you should not consider such measures either in isolation or as substitutes for analyzing our results as reported under GAAP. Some of these limitations include the following:

•Free Cash Flow, Adjusted EBITDA, Adjusted EBIT, Adjusted Net Income and Adjusted Diluted EPS do not reflect every expenditure, future requirements for capital expenditures or contractual commitments;

•Adjusted EBITDA, Adjusted EBIT, Adjusted Net Income and Adjusted Diluted EPS do not reflect changes in our working capital needs;

•Adjusted EBITDA and Adjusted EBIT do not reflect any interest expense, or the amounts necessary to service interest or principal payments on any debt obligations;

•Adjusted EBITDA and Adjusted EBIT do not reflect income tax expense, which is a necessary element of our costs and ability to operate;

•although depreciation and amortization are eliminated in the calculation of Adjusted EBITDA, and the depreciation and amortization related to acquisitions and the Refinitiv Transaction are eliminated in the calculation of Adjusted EBIT, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA and Adjusted EBIT do not reflect any costs of such replacements;

•Adjusted EBITDA, Adjusted EBIT, Adjusted Net Income and Adjusted Diluted EPS do not reflect the noncash component of certain employee compensation expense or payroll taxes associated with certain option exercises;

•Adjusted EBITDA, Adjusted EBIT, Adjusted Net Income and Adjusted Diluted EPS do not reflect the impact of earnings or charges resulting from matters we consider not to be indicative, on a recurring basis, of our ongoing operations;

•Constant currency measures do not reflect the impact of foreign currency fluctuations; and

•other companies in our industry may calculate Free Cash Flow, Adjusted EBITDA, Adjusted EBIT, Adjusted Net Income, Adjusted Diluted EPS, constant currency measures or similarly titled measures differently than we do, limiting their usefulness as comparative measures.

We compensate for these limitations by relying primarily on our GAAP results and using Free Cash Flow, Adjusted EBITDA, Adjusted EBIT, Adjusted Net Income, Adjusted Diluted EPS and constant currency measures only as supplemental information.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). You can generally identify forward-looking statements by our use of forward-looking terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “projection,” “seek,” “should,” “will” or “would,” or the negative thereof or other variations thereon or comparable terminology. In particular, statements about the markets in which we operate, including our expectations about market trends, our market opportunity and the growth of our various markets, our expansion into new markets, any pending acquisitions or other strategic transactions, any potential tax savings we may realize as a result of our organizational structure, our dividend policy, our share repurchase program and our expectations, beliefs, plans, strategies, objectives, prospects or assumptions regarding future events, our performance or otherwise, contained in this Annual Report on Form 10-K under Part I, Item 1. – “Business,” Part I, Item 1A. – “Risk Factors” and Part II, Item 7. – “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements.

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors, including those discussed in this Annual Report on Form 10-K under Part I, Item 1. – “Business,” Part I, Item 1A. – “Risk Factors” and Part II, Item 7. – “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” may cause our actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements, or could affect our stock price.

Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements include:

•changes in economic, political, social and market conditions and the impact of these changes on trading volumes;

•our failure to compete successfully;

•our failure to adapt our business effectively to keep pace with industry changes;

•consolidation and concentration in the financial services industry;

•our dependence on dealer clients;

•design defects, errors, failures or delays with our platforms or solutions;

•our dependence on third parties for certain market data and certain key functions;

•our inability to achieve our environmental, social and governance goals;

•our ability to implement our business strategies profitably;

•our ability to successfully integrate any acquisition or to realize benefits from any strategic alliances, partnerships or joint ventures;

•our inability to maintain and grow the capacity of our trading platforms, systems and infrastructure;

•systems failures, interruptions, delays in services, cybersecurity incidents, catastrophic events and any resulting interruptions;

•inadequate protection of our intellectual property;

•extensive regulation of our industry;

•our ability to retain the services of our senior management team;

•limitations on operating our business and incurring additional indebtedness as a result of covenant restrictions under our $500.0 million senior unsecured revolving credit facility (the “2023 Revolving Credit Facility”) with Citibank, N.A., as administrative agent, and the other lenders party thereto;

•our dependence on distributions from TWM LLC to fund our expected dividend payments and to pay our taxes and expenses, including payments under the tax receivable agreement (the “Tax Receivable Agreement”) entered into in connection with the IPO;

•our ability to realize any benefit from our organizational structure;

•Refinitiv’s, and indirectly LSEG’s, control of us and our status as a controlled company; and

•other risks and uncertainties, including those listed under Part I, Item 1A. – “Risk Factors.”

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements contained in this Annual Report on Form 10-K are not guarantees of future events or performance and future events, our actual results of operations, financial condition or liquidity, and the development of the industry and markets in which we operate, may differ materially from the forward-looking statements contained in this Annual Report on Form 10-K. In addition, even if future events, our results of operations, financial condition or liquidity, and events in the industry and markets in which we operate, are consistent with the forward-looking statements contained in this Annual Report on Form 10-K, they may not be predictive of events, results or developments in future periods.

Any forward-looking statement that we make in this Annual Report on Form 10-K speaks only as of the date of such statement. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this Annual Report on Form 10-K.

PART I

ITEM 1. BUSINESS.

Overview

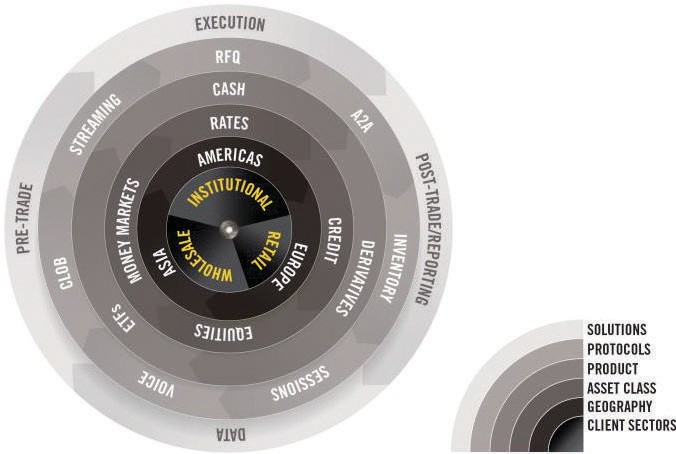

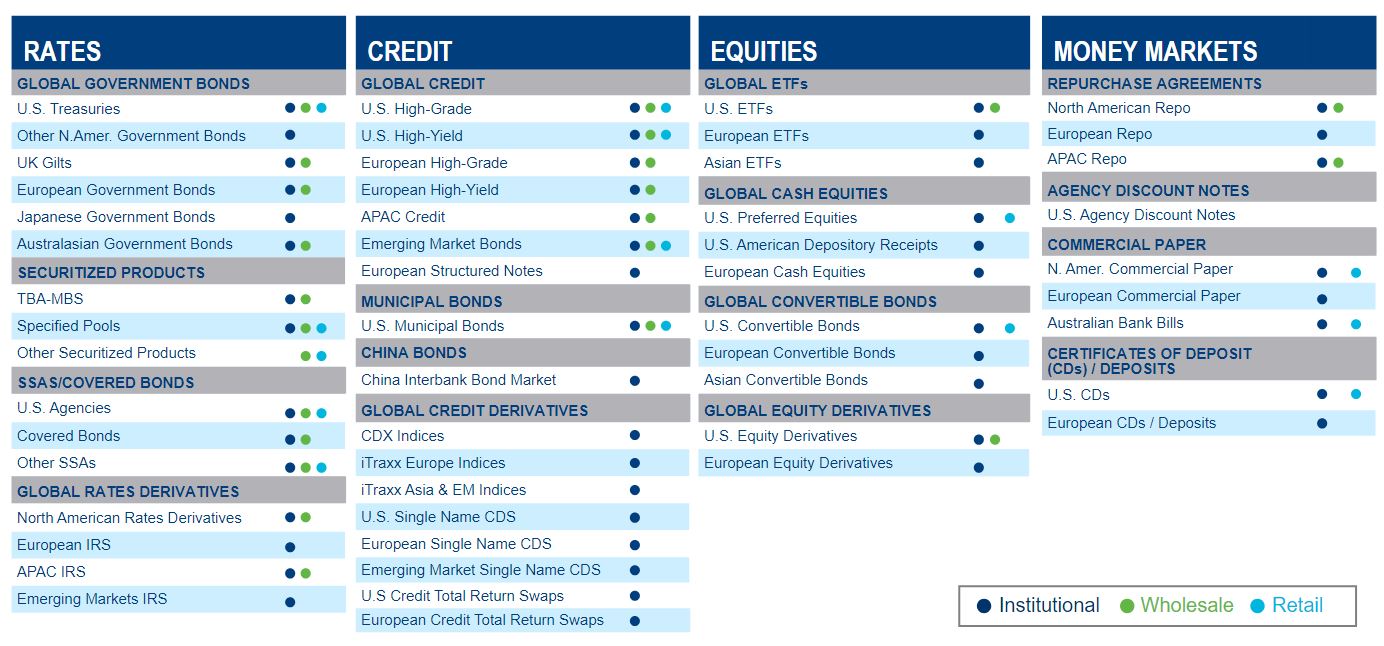

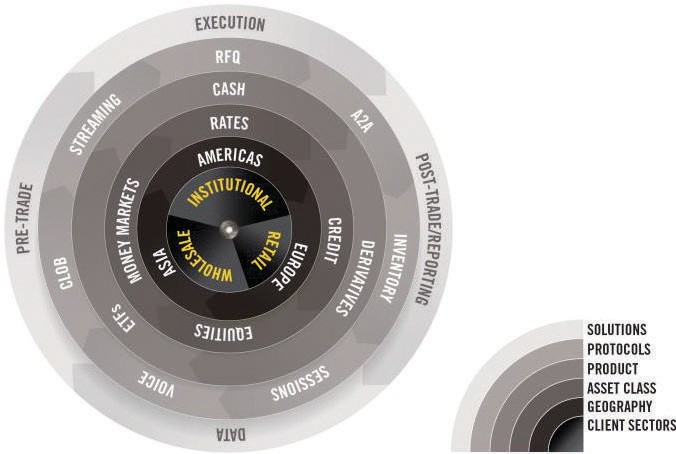

We are a leader in building and operating electronic marketplaces for our global network of clients across the financial ecosystem. Our network is comprised of clients across the institutional, wholesale and retail client sectors, including many of the largest global asset managers, hedge funds, insurance companies, central banks, banks and dealers, proprietary trading firms and retail brokerage and financial advisory firms, as well as regional dealers. Our marketplaces facilitate trading across a range of asset classes, including rates, credit, equities and money markets. We are a global company serving clients in over 70 countries with offices in North America, Europe, Asia, Australia and the Middle East. We believe our proprietary technology and culture of collaborative innovation allow us to adapt our offerings to enter new markets, create new platforms and solutions and adjust to regulations quickly and efficiently. We support our clients by providing solutions across the trade lifecycle, including pre-trade, execution, post-trade and data.

There are multiple key dimensions to the electronic marketplaces that we build and operate to provide deep pools of liquidity. Foundationally, these begin with our clients and then expand through and across multiple client sectors, geographic regions, asset classes, product groups, trading protocols and trade lifecycle solutions.

Our markets are large and growing. Electronic trading continues to increase in the markets in which we operate as a result of market demand for greater transparency, higher execution quality, operational efficiency and lower costs, as well as regulatory changes. We believe our deep client relationships, asset class breadth, geographic reach, regulatory knowledge and scalable technology position us to continue to be at the forefront of the evolution of electronic trading. Our platforms provide transparent, efficient, cost-effective and compliant trading solutions across multiple products, regions and regulatory regimes. As market participants seek to trade across multiple asset classes, reduce their costs of trading and increase the effectiveness of their trading, including through the use of data and analytics, we believe the demand for our platforms and electronic trading solutions will continue to grow.

We have a powerful network of more than 2,500 clients across the institutional, wholesale and retail client sectors. Our clients include leading global asset managers, hedge funds, insurance companies, central banks, banks and dealers, proprietary trading firms and retail brokerage and financial advisory firms, as well as regional dealers. As our network continues to grow across client sectors, we will generate additional transactions and data on our platforms, driving a virtuous cycle of greater liquidity and value for our clients.

Our technology supports multiple asset classes, trading protocols and geographies, and as a result, we are able to provide a broad spectrum of solutions and cost savings to our clients. We have built, and continue to invest in, a scalable, flexible and resilient proprietary technology architecture that enables us to remain agile and evolve with market structure. This allows us to partner closely with our clients to develop customized solutions for their trading and workflow needs. Our technology is deeply integrated with our clients’ risk and order management systems, clearinghouses, trade repositories, middleware providers and other important links in the trading value chain. These qualities allow us to be quick to market with new offerings, to constantly enhance our existing platforms and solutions and to collect a robust set of data and analytics to support our marketplaces.

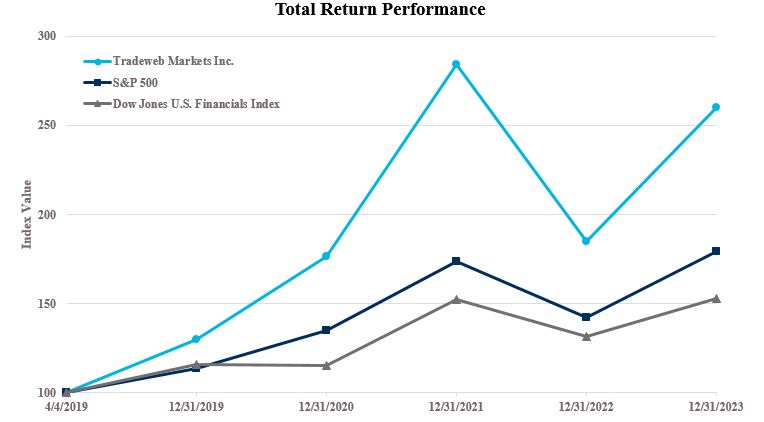

We are focused on balancing revenue growth and margin expansion to create long-term value and we have a track record of growth and financial performance. By expanding the scope of our platforms and solutions, building scale and integration across marketplaces and benefiting from broader network effects, we have been able to grow both our transaction volume and subscription-based revenues.

Our Evolution

We were founded in 1996 and set out to solve for inefficiencies in the institutional U.S. Treasury trading workflows, including limited price transparency, weak connectivity among market participants and error-prone manual processes. Our first electronic marketplace went live in 1998, and for more than 25 years we have leveraged our technology and expertise to expand into additional rates products and other asset classes, including credit, equities and money markets. Market demand for better trading workflows globally also was increasing and we initiated a strategy of rolling out our existing products to new geographies and adding local products. We expanded to Europe in 2000, initially offering U.S. fixed income products and soon thereafter added a marketplace for European government bonds. We expanded to Asia in 2004, where our first local product was Japanese government bonds. We have since continued to expand our product and client base in Europe, Asia and most recently in Australia, Africa, South America and the Middle East.

We identified an opportunity to complement our offerings to the wholesale and retail client sectors based on our existing relationships with dealers and our strong market position. We developed our wholesale platform through the acquisitions of Hilliard Farber & Co. in 2008 and Rafferty Capital Markets in 2011, and developed technology to facilitate the migration of inefficient wholesale voice markets to more efficient and transparent electronic markets. We entered the retail market through our acquisition of LeverTrade in 2006, scaled our market position through our acquisition of BondDesk in 2013, and have continued to leverage our market and technology expertise to enhance our platform serving that client sector. In June 2021, we acquired Nasdaq’s U.S. fixed income electronic trading platform. The addition of this fully-electronic CLOB (central limit order book) offers a flexible, efficient approach to trading in the wholesale U.S. Treasury market. In August 2023, we acquired Tradeweb Australia Pty Ltd (formerly Yieldbroker Pty Limited) (“Yieldbroker”), a leading Australian trading platform for Australian and New Zealand government bonds and interest rate derivatives covering the institutional and wholesale client sectors. This acquisition combines Australia and New Zealand’s highly attractive, fast-growing markets with Tradeweb’s international reach and scale. In January 2024, we acquired R8FIN Holdings LP (together with its subsidiaries, “r8fin”), a technology provider that specializes in algorithmic-based execution for U.S. Treasuries and interest rate futures that complement our other offerings, creating a valuable and broad-based approach to trading.

Throughout our evolution we have developed many new innovations that have provided greater pre-trade price transparency, better execution quality and seamless post-trade solutions. Such innovations include the introduction of pre-trade composite pricing for multi-dealer-to-customer (“D2C”) trading, the Request-for-Quote (“RFQ”) trading protocol across all of our asset classes, the blast all-to-all (“A2A”) trading protocol across our global credit marketplaces and portfolio trading. We have also integrated our trading platforms with our proprietary post-trade systems as well as many of our clients’ order management and risk systems for efficient post-trade processing. In addition, because large components of the market remain relationship-driven, we continue to focus on introducing technology solutions to solve inefficiencies in voice markets, such as electronic voice processing, which allows our clients to use Tradeweb technology to process voice trades. We expect to continue to leverage our success to expand into new products, asset classes and geographies, while growing our powerful network of clients.

While our cornerstone products continue to be some of the first products we launched, including U.S. Treasuries, European government bonds and To-Be-Announced mortgage-backed securities (“TBA MBS”), we have continued to solve trading inefficiencies by adding new products across our rates, credit, equities and money markets asset classes. As a result of expanding our offerings, we have increased our opportunities in related addressable markets, where estimated average daily trading volumes have grown from approximately $0.6 trillion in 1998 to $8.8 trillion through December 31, 2023, according to industry sources and management estimates.

Our Competitive Strengths

Our Network of Clients, Products, Geographies and Protocols

Our clients continue to use our trading venues because of our large network and deep pools of liquidity, which result in better and more efficient trade execution. We expand our relationships through our integrated technology and new offerings made available to our growing network of clients. As an electronic trading marketplace for key asset classes and products, we benefit from a virtuous cycle of liquidity — trading volumes growing together and re-enforcing each other. We expect our existing clients to trade more volume on our trading venues and to attract new users to our already powerful network, as liquidity on our marketplaces continues to grow and we offer more products and value-added solutions. The breadth of our network, products, global presence and embedded scalable technology offers us unique insights and an established platform to swiftly enter additional markets and offer new value-added solutions. This is supported by more than 25 years of successful innovation and long trusted relationships with our clients.

We are a leader in making trading and the associated workflow more efficient for market participants. Based on industry sources and management estimates, we believe that we are a market leader in electronic trading for the following products: U.S. Treasuries, U.S. High-Grade credit, TBA MBS, European government bonds, global interest rate swaps, ETP-traded Yen-denominated interest rate swaps and European exchange traded funds (“ETFs”). We cover all major client sectors participating in electronic trading, including the institutional, wholesale and retail client sectors. In addition, we provide a full spectrum of trading protocols including voice, sweeps (session-based trading), RFQ, CLOB, A2A and portfolio trading, among others.

We believe the breadth of our offerings, experience and client relationships provides us unique market feedback and enables us to enter new markets with higher probabilities of success and greater speed. Many of our markets are interwoven and we provide participants trading capabilities across multiple products through a single relationship. We cover our global clients through offices in North America, Europe, Asia, Australia and the Middle East and a global trading network that is distributed throughout the world.

Culture of Collaborative Innovation

We have developed trusted client relationships through a culture of collaborative innovation where we work alongside our clients to solve their evolving workflow needs. We have a long track record of working with clients to solve both industry-level challenges and client-specific issues. We have had a philosophy of collaboration since our founding, when we worked with certain clients to improve U.S. Treasury trading for the institutional client sector.

More recently, we introduced Tradeweb’s Rematch, an industry-exclusive solution, offering institutional investors trading within AllTrade previously unavailable access to hundreds of millions of dollars in unmatched risk from dealers’ sessions, opening the door to a significantly larger pool of liquidity. We were also the first trading platform to offer portfolio trading for corporate bonds, creating a new and efficient way for participants to move risk. We helped make trading in credit markets more efficient by partnering with major dealers to improve liquidity and reduce the cost of net spotting the U.S. Treasury in connection with a corporate bond trade. This net spotting functionality allows our credit clients to spot multiple bonds at the same time using our multi-dealer net spotting tool to net their interest rate risk simultaneously using one spot price. We have also worked side-by-side with clients and federal agencies to customize solutions for their particular needs in the TBA MBS market. For example, in direct collaboration with our leading TBA MBS clients we developed our Round Robin functionality to help resolve the issue of systemic fails on TBA MBS trades and reduce the operational risk and costs associated with delivery failures that often plague the TBA MBS market. In conjunction with Freddie Mac, we developed a direct-to-Freddie Mac exchange path for institutional clients related to the single security initiative, paving the way for a combined Freddie Mac and Fannie Mae TBA market of Uniform Mortgage-Backed Securities. Through collaborative endeavors like these, we have become deeply integrated into our clients’ workflow and become a partner of choice for new innovations.

Scalable and Flexible Technology

We consistently use our proprietary technology to find new ways for our clients to trade more effectively and efficiently. Our core software solutions span multiple components of the trading lifecycle and include pre-trade data and analytics, trade execution and post-trade data, analytics and reporting, integration, connectivity and straight-through processing. Our systems are built to be scalable, flexible and resilient. Our internet-based, thin client technology is readily accessible and enables us to quickly access the market with easily distributed new solutions. For example, we were the first to offer web-based electronic multi-dealer trading to the institutional U.S. Treasury market and have subsequently automated the market structure of additional markets globally. We have also created new trading protocols and developed additional solutions for our clients that are translated and built by our highly experienced technology and business personnel working together to solve a client workflow problem. Our 2024 acquisition of the r8fin technology will help us reach a new and differentiated level of intelligent execution through a powerful combination of algorithmic technology and cross-market connectivity. We believe pairing r8fin’s sophisticated technology with our global network will open up a range of new possibilities for clients engaged in relative value or macro trades spanning multiple asset classes. Going forward, we expect our technology platform, and ongoing investments in technology and new product offerings, to help us stay at the forefront of the evolution of electronic trading.

Our Global Regulatory Footprint and Domain Expertise

We are regulated (as necessitated by jurisdiction and applicable law) or have necessary legal clearance to offer our platforms and solutions in major markets globally, and our experience provides us credibility when we enter new markets and facilitates our ability to comply with additional regulatory regimes. With extensive experience in addressing existing and pending regulatory changes in our industry, we offer clients a central source of expertise and thought leadership in our markets and assist them through the myriad of regulatory requirements. We then provide our clients with trading platforms that meet regulatory requirements and enable connectivity to pre- and post-trade systems necessary to comply with their regulatory obligations.

Platforms and Solutions Empowered by Data and Analytics

Our data and analytics enhance the value proposition of our trading venues and improve the trading experience of our clients. We support our clients’ core trading functions by offering trusted pre- and post-trade services, value-added analytics and predictive insights informed by our deep understanding of how market participants interact. Our data and analytics help clients make better trading decisions, benefitting our current clients and attracting new market participants to our network. For example, data powers our Automated Intelligent Execution (“AiEX”) functionality which allows traders to automatically execute trades according to pre-programmed rules and automatically sends completed or rejected order details to internal order management systems. By allowing traders to automate and execute their smaller, low touch trades more efficiently, AiEX helps traders focus their attention on larger, more nuanced trades. During the year ended December 31, 2023, the percentage of trades executed by our institutional clients using our AiEX functionality was over 35% of total institutional trades, up from 6% in 2015, and we are seeing demand for AiEX continue to grow across some of our key products, including U.S. Treasuries, European government bonds, global swaps, U.S. corporate bonds and global ETFs.

Our over 25 year operating history has allowed us to build comprehensive and unique datasets across our markets and, as we add new products to our platforms, we will continue to create new datasets that may be monetized in the future. Our marketplaces generate valuable data, processing on average over 130,000 trades and significantly more pre-trade price updates daily, that we collect centrally and use as inputs to our pre-trade indicative pricing and analytics. We maintain a full history of inquiries and transactions, which means, for example, we have over 25 years of U.S. Treasury data. With markets becoming more electronic, clients increasingly turn to our composite data for its transparency and to help improve execution, further increasing the value proposition of our data. For example, in October 2023, we signed an amended and restated two-year market data license agreement with an affiliate of LSEG (formerly referred to as Refinitiv), pursuant to which LSEG will continue to distribute certain of our data directly to LSEG customers through its flagship financial platforms, LSEG Workspace, Datascope, LSEG Pricing Service and Tick History. The 2023 agreement, which was effective on November 1, 2023, replaced an existing agreement that was initiated in 2010 and most recently renewed in 2018, and provides us with increased revenue and flexibility in growing our market data offering. We will seek to further monetize our data over time both through potential expansion of our existing market data license agreement with LSEG and through distributing additional datasets, derived data and analytics offerings through our own network or through other third-party networks. For example, in October 2023, we also announced a strategic partnership with FTSE Russell which will seek to develop the next generation of fixed income pricing and index trading products. Fixed income closing prices will be administered as benchmarks by FTSE Russell and be derived from trading activity on our platform. The partnership aims to extend pricing coverage to most constituents featured in the FTSE Fixed Income Index universes and explore incorporating new Tradeweb pricing sets into FTSE Fixed Income Indices.

We are also continuously developing new offerings and solutions to meet the changing needs of our clients. For example, in 2023, we launched a new market data service to calculate real-time indicative net asset values (“iNAVs”) for ETFs. Our breadth of product coverage, depth of price contributions and timeliness of quotes help position Tradeweb iNAVs to become the market’s preferred solution for intraday ETF evaluation, which could ultimately boost trading confidence in the ETF market. Our offerings also include Automated Intelligent Pricing (“Ai-Price”), an innovative bond pricing engine that applies data science to help make markets more efficient and delivers reliable reference pricing for U.S. corporate and municipal bonds, regardless of how frequently a bond trades. Clients leverage the service to power their AiEX auto-trading, portfolio trading, and Transaction Cost Analysis (“TCA”).

Experienced Management Team

Our focus and decades of experience have enabled us to accumulate the knowledge and capabilities needed to serve complex, dynamic and highly regulated markets, and oversee our expansion into new markets and geographies while managing ongoing strategic initiatives including our significant technology investments. Our management team is composed of executives with an average of over 25 years of relevant industry experience including an average of over 10 years working together at Tradeweb under different ownership structures and through multiple market cycles, with a combination of veteran Tradeweb employees such as Mr. Billy Hult, who has been at the Company for over 20 years and took over as our Chief Executive Officer effective January 1, 2023 and new executives, including Mr. Thomas Pluta, who became our President effective as of January 1, 2023. Management has fostered a culture of collaborative innovation with our clients, which combined with management’s focus and experience, has been an important contributor to our success. We have been thought leaders and contributors to the public dialogue on key issues and regulations affecting our markets and industry, including congressional testimony, public roundtables, regulatory committees and industry panels.

Our Growth Strategies

Throughout our history, we have operated with agility to address the evolving needs of our clients. We have been guided by our core principles, which are to build better marketplaces, to forge new relationships and to create trading solutions that position us as a strategic partner to the clients that we serve. We seek to advance our leadership position by focusing our efforts on the following growth strategies:

Continue to Grow Our Existing Markets

We believe there are significant opportunities to generate additional revenue from secular and cyclical tailwinds in our existing markets:

Growth in Our Underlying Asset Classes

The underlying volumes in our asset classes continue to increase due to increased government and corporate issuance. In addition, the government bond market is foundational to and correlative to virtually every asset class in the cash and derivatives fixed income markets. Select products that we believe have a high growth potential due to current market trends include global government bonds, global interest rate swaps, ETFs and credit cash products.

Growth in Our Market Share

Our clients represent most of the largest institutional, wholesale and retail market participants. The global rates, credit, equities and money markets asset classes continue to evolve electronically, and we seek to increase our market share by continuing to innovate to electronify workflows. We intend to continue to increase our market share by growing our client base and increasing the percentage of our clients’ overall trading volume transacted in those asset classes on our platforms, including by leveraging our voice solutions to win more electronic trading business from electronic voice processing clients in our rates and credit asset classes. In particular, across many of our products, we are implementing an integrated approach to grow our market share — serving all three of our client sectors across all trade sizes, from odd-lot to block trades, through a variety of protocols. Many of our asset manager, hedge fund, insurance, central bank/sovereign entity and regional dealer clients actively trade multiple products on our platforms. In addition, our global dealer clients trade in most asset classes across all three client sectors. We also see a growing appetite for multi-asset trading to reduce cost and duration risk.

Electronification of Our Markets