| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| TRADEWEB BY THE NUMBERS

|

||||

| FY22 Revenues

$1.2B

(+10.4% YoY, +14.0% CC*)

|

FY22 Adjusted EBITDA Margin**

51.9%

(+111 bps YoY)

|

|||

|

|

||||

|

FY22 Adjusted Net Income**

$450.1M

(+15.7% YoY)

|

FY22 Free Cash Flow**

$572.7M

(+8.7% YoY)

|

|||

|

* “CC” means constant currency. Growth information presented on a “constant currency” basis is a non-GAAP financial measure and reflects growth for the period excluding the impact of foreign exchange currency fluctuations.

** Revenue growth on a constant currency basis, adjusted EBITDA margin, adjusted net income and free cash flow are non-GAAP financial measures used by the Company to supplement information in our financial results. A reconciliation of these non-GAAP financial measures may be found in our Form 8-K filed with the SEC on February 2, 2023 and our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 24, 2023. | ||||

| Dear Stockholder, |

||||

|

You are cordially invited to attend the Annual Meeting of Stockholders of Tradeweb Markets Inc., which will be held virtually at 12 p.m., Eastern Time, on Monday, May 15, 2023, at www.virtualshareholdermeeting.com/TW2023. The attached Notice of the Annual Meeting of Stockholders and Proxy Statement describes the formal business that we will transact at the virtual Annual Meeting. We have elected to take advantage of the rules of the U.S. Securities and Exchange Commission that allow us to furnish our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”), rather than a full paper set of the proxy materials, unless you previously requested to receive printed copies. The Notice contains details regarding the date, time and location of the meeting and the business to be conducted, as well as instructions on how to access our proxy materials on the Internet and for voting over the Internet. Whether or not you plan to virtually attend the Annual Meeting, please vote your shares promptly by following the voting instructions that you have received. Your vote is important regardless of the number of shares you own. Voting by proxy will not prevent you from voting virtually at the Annual Meeting, but will assure that your vote is counted if you cannot virtually attend. On behalf of the Board of Directors and the employees of Tradeweb Markets Inc., we thank you for your continued support and look forward to seeing you at the virtual Annual Meeting.

Sincerely yours,

BILLY HULT Chief Executive Officer March 23, 2023 |

| 2023 PROXY STATEMENT |

Notice of 2023 Virtual Annual Meeting of Stockholders

To Our Stockholders:

We are pleased to invite you to attend the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Tradeweb Markets Inc. (“Tradeweb” or the “Company”) that will be held virtually at 12 p.m., Eastern Time, on Monday, May 15, 2023, at www.virtualshareholdermeeting.com/TW2023 for the following purposes:

| 1. | To elect the four nominees for director named in the attached Proxy Statement as Class I directors, each to serve on the Board of Directors for a three-year term until the 2026 Annual Meeting of Stockholders or their respective successors are elected and qualified (Proposal 1); |

| 2. | To ratify the appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal 2); and |

| 3. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The Board of Directors unanimously recommends that you vote (i) “FOR ALL” of the director nominees named in the attached Proxy Statement and (ii) “FOR” the ratification of the appointment of Deloitte as our independent registered public accounting firm.

The Board of Directors has fixed March 17, 2023 as the record date for determining stockholders entitled to receive notice of, and to vote at, the virtual Annual Meeting or any adjournment or postponement thereof. Only stockholders of record at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting. Holders of outstanding shares of Class A common stock, Class B common stock, Class C common stock and Class D common stock vote together as a single class on all matters on which stockholders are entitled to vote generally (except as may be required by law). Each share of Class A common stock and Class C common stock entitles its holder to one vote on all matters presented to the Company’s stockholders generally. Each share of Class B common stock and Class D common stock entitles its holder to ten votes on all matters presented to the Company’s stockholders generally.

The Board of Directors has again determined to hold the Annual Meeting virtually. We believe that this is the right choice for Tradeweb as it provides expanded stockholder access regardless of the size of the Annual Meeting or resources available to stockholders, improves communication and allows participants to attend the Annual Meeting conveniently from any location at no additional cost. The Company has endeavored to provide stockholders attending the Annual Meeting with the same rights and opportunities to participate as they would at an in-person meeting.

You are cordially invited to virtually attend the Annual Meeting, conducted virtually via live audio webcast at www.virtualshareholdermeeting.com/TW2023 to vote on the proposals described in this Proxy Statement and submit questions during the meeting. Your vote is important. Regardless of whether or not you participate in the Annual Meeting, we hope that you vote as soon as possible. You may vote online or by phone, or, if you received paper copies of the proxy materials by mail, you may also vote by mail by following the instructions on the proxy card or voting instruction card. Voting online or by phone, written proxy or voting instruction card ensures your representation at the Annual Meeting regardless of whether you attend online. For additional details, see “Voting and Attendance at the Annual Meeting” below. This Proxy Statement provides detailed information about the Annual Meeting. We encourage you to read this Proxy Statement carefully and in its entirety.

By Order of the Board of Directors,

|

Douglas Friedman General Counsel and Secretary

New York, New York March 23, 2023 |

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY

The Notice, the Proxy Statement and the Company’s 2022 Annual

|

| TRADEWEB | ||

| 2023 PROXY STATEMENT |

Proxy Summary

MEETING INFORMATION

| Date: | Monday, May 15, 2023 | |

| Time: | 12:00 p.m. (Eastern Time) | |

| Virtual Meeting: | www.virtualshareholdermeeting.com/TW2023 | |

| Record Date: | March 17, 2023 |

HOW TO VOTE

Your vote is important. You may vote your shares in advance of the Annual Meeting via the Internet, by telephone or by mail, or during the meeting by attending and voting electronically. If you vote via the Internet, by telephone or plan to vote electronically during the Annual Meeting, you do not need to mail in a proxy card.

|

|

| ||

| INTERNET To vote before the meeting, visit To vote at the meeting, visit |

TELEPHONE If you received a paper copy of the proxy materials, dial toll-free 1-800-690-6903 or the instruction form. You will need |

If you received a paper copy of |

We first began sending our stockholders the Notice and made our proxy materials available on or about March 23, 2023.

PROPOSALS

| Proposal 1 Election of |

To elect the four director nominees named in this Proxy Statement as Class I directors of the Company, each to serve for a three-year term until the 2026 Annual Meeting or their respective successors are elected and qualified. | |

|

| ||

| Proposal 2 Auditor Ratification |

To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. | |

|

| ||

| TRADEWEB |

Proxy Summary

Our Board of Directors

| Committee Memberships | ||||||||||||||||

|

|

Name | Director Since |

Principal Occupation | Independent | Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee |

Other Current Public Company Boards | ||||||||

|

|

Jacques Aigrain |

2022 | Director, Clearwater Analytics Chairman, Lyondell Basell Industries N.V. |

|

|

|

2 | |||||||||

|

|

Balbir Bakhshi |

2021 | Chief Risk Officer, London Stock Exchange Group plc |

|||||||||||||

|

|

Steven Berns |

2020 | Former Chief Financial Officer & Chief Operating Officer |

|

|

1 | ||||||||||

|

|

Troy Dixon |

2023 | Founder and Chief Investment Officer, Hollis Park Partners LP |

|

||||||||||||

|

|

John Finley |

2019 | Chief Legal Officer, Blackstone |

|

|

|||||||||||

|

|

Scott Ganeles |

2019 | Senior Partner, WestCap Group, LLC |

|

|

|

||||||||||

|

|

Billy Hult |

2019 | Chief Executive Officer, Tradeweb Markets |

|||||||||||||

|

|

Paula B. Madoff |

2019 | Advisor, The Goldman Sachs Group Inc. |

|

|

|

|

4 | ||||||||

|

|

Lee Olesky |

2019 | Chairman of the Board and Former CEO, Tradeweb Markets |

|||||||||||||

|

|

Thomas Pluta |

2019 | President, Tradeweb Markets |

|||||||||||||

|

|

Murry Roos |

2021 | Group Director, Capital Markets, London Stock Exchange Group plc |

|||||||||||||

|

|

Rana Yared |

2022 | General Partner, Balderton Capital |

|

|

|||||||||||

Denotes Chairperson

Denotes Chairperson

| 2023 PROXY STATEMENT |

Proxy Summary

Our Board of Directors

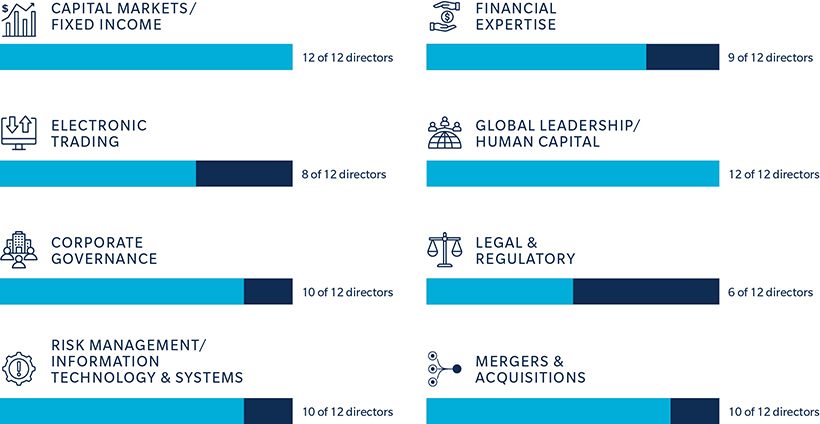

BOARD SKILLS AND QUALIFICATIONS

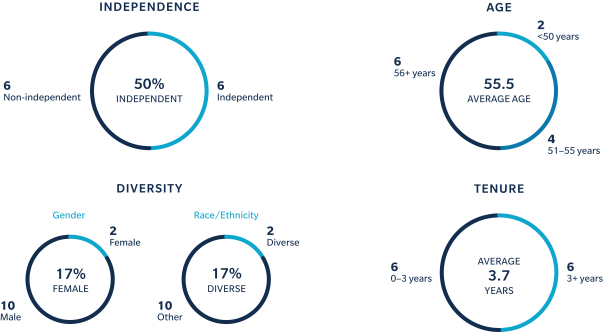

BOARD INDEPENDENCE, AGE, DIVERSITY AND TENURE*

| * | Does not include Catherine Johnson, as director nominee. Assuming Ms. Johnson is elected at the Annual Meeting, the Board will be 25% female. |

| TRADEWEB |

Proxy Summary

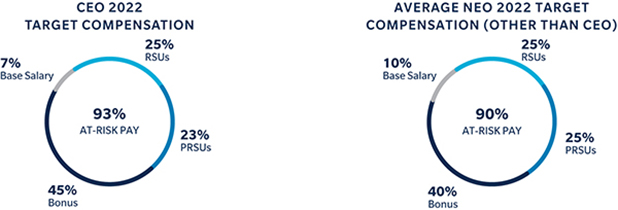

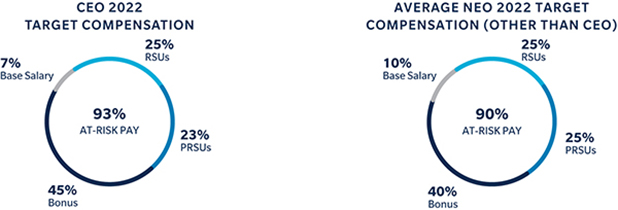

Executive Compensation Program Highlights

PHILOSOPHY AND OBJECTIVES

| Maintain a pay-for- |

Annual pay opportunities emphasize variable performance-based compensation, with metrics aligned to the Company’s financial results and business strategy, ensuring a high degree of performance orientation in our executive compensation program. | |

| Foster long-term alignment |

Outstanding equity awards in the form of annual restricted stock unit grants (including performance-based restricted stock unit grants) directly tie pay outcomes to value creation, aligning executive and stockholder interest. | |

| Attraction and retention |

Our executive compensation program provides overall target compensation that is intended to attract and retain high-caliber talent. In addition, our long-term incentive awards are granted on varying vesting schedules, continually ensuring that a portion of previously granted equity remains unvested. | |

| Reflect internal equity considerations |

Compensation decisions are made in the context of individual factors and pay equity, fostering growth and motivation through a flexible compensation design. | |

KEY ELEMENTS OF OUR FISCAL YEAR 2022 COMPENSATION PROGRAM

| What We Do | What We Don’t Do | |

| Pay-for-performance. Approximately 91% of our executive target compensation is at-risk, variable compensation. 66% of target annual equity grants and cash bonuses made to the NEOs in March 2022 were tied directly to company performance.1 |

Hedging/pledging of Company stock. We prohibit our officers and directors from hedging, margining, pledging, short-selling or publicly trading options in our stock. | |

| Encourage long-term outlook. Long-term equity awards have a three-year vesting period. In 2023, certain equity awards made to NEOs also included a three-year performance period (as described more fully under the heading “Compensation Discussion and Analysis—Fiscal 2023 Compensation Decisions”). |

Excise tax gross-ups. We do not pay excise tax gross-ups on change-in-control payments. | |

| Limited employment agreements. Currently, only our Chief Executive Officer is party to an employment agreement with the Company. |

Repricing or exchange of underwater options. Under our omnibus equity plan, we specifically prohibit share repricing without stockholder approval. | |

| Clawback policy. We maintain a robust clawback policy that allows the Company to recoup incentive compensation earned by executive officers or other employees in the event of a material restatement of |

Dividends and dividend equivalents on unearned equity awards. Dividend equivalent rights accrued on equity awards are not paid until the underlying award itself vests and becomes payable. | |

| Rigorous performance goals. The Company establishes rigorous performance goals related to its incentive-based compensation plans. |

||

| 1 | In December 2022, Mr. Olesky also received the CEO Substitution Award (as defined below), which award’s vesting terms were not directly tied to company performance. The CEO Substitution Award is excluded from the above calculation. Please see “Compensation Discussion and Analysis—Fiscal 2022 Compensation Program in Detail—Long-Term Equity Incentives” for further detail regarding this award. |

| 2023 PROXY STATEMENT |

Table of Contents

| TRADEWEB | ||

General Information

The enclosed proxy is solicited by the Board of Directors (the “Board”) of Tradeweb Markets Inc. (“Tradeweb” or the “Company”) for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held virtually at 12 p.m., Eastern Time, on Monday, May 15, 2023, at www.virtualshareholdermeeting.com/TW2023 and at any adjournment or postponement thereof. Our principal offices are located at 1177 Avenue of the Americas, New York, New York 10036. This Proxy Statement is first being made available to our stockholders on or about March 23, 2023.

Numerical figures included in this Proxy Statement have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

FORWARD-LOOKING STATEMENTS AND REFERENCES TO WEBSITES

This document includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, concerning expectations, beliefs, plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements that are other than statements of historical fact, including statements regarding our social, environmental and other sustainability plans and goals. Although we believe that the expectations and assumptions reflected in these statements are reasonable, there can be no assurance that these expectations will prove to be correct. Forward-looking statements are subject to many risks and uncertainties, including the risk factors that we identify in our Securities and Exchange Commission (“SEC”) filings, and actual results may differ materially from the results discussed in such forward-looking statements. We undertake no duty to update publicly any forward-looking statement that we may make, whether as a result of new information, future events or otherwise, except as may be required by applicable law, regulation or other competent legal authority. In addition, our environmental, social and governance goals are aspirational and may change. Statements regarding our goals are not guarantees or promises that they will be met. Information contained on our website, or any website that is linked to or otherwise referenced herein, is not incorporated into, or a part of, this Proxy Statement, and any such website references throughout this Proxy Statement are provided for convenience only.

OUTSTANDING SECURITIES AND QUORUM

Only holders of record of our Class A common stock, Class B common stock, Class C common stock and Class D common stock (each such designation having par value $0.00001 per share) at the close of business on March 17, 2023, the record date, will be entitled to notice of, and to vote at, the Annual Meeting. On that date, we had 111,032,801 shares of Class A common stock outstanding and entitled to vote, 96,933,192 shares of Class B common stock outstanding and entitled to vote, 3,251,177 shares of Class C common stock outstanding and entitled to vote and 23,087,623 shares of Class D common stock outstanding and entitled to vote. Holders of outstanding shares of Class A common stock, Class B common stock, Class C common stock and Class D common stock vote together as a single class on all matters on which stockholders are entitled to vote generally (except as may be required by law).

Each share of Class A common stock and Class C common stock entitles its holder to one vote on all matters presented to the Company’s stockholders generally. Each share of Class B common stock and Class D common stock entitles its holder to ten votes on all matters presented to the Company’s stockholders generally. The holders of Class C common stock and Class D common stock have no economic interests in the Company (where “economic interests” means the right to receive any dividends or distributions, whether cash or stock, in connection with common stock). These attributes are summarized in the following table:

| Class of Common Stock |

Par Value | Votes | Economic Rights | ||||||||||||

| Class A common stock |

$ | 0.00001 | 1 | Yes | |||||||||||

| Class B common stock |

$ | 0.00001 | 10 | Yes | |||||||||||

| Class C common stock |

$ | 0.00001 | 1 | No | |||||||||||

| Class D common stock |

$ | 0.00001 | 10 | No | |||||||||||

| 2023 PROXY STATEMENT |

|

General Information

All of the shares of our outstanding Class B common stock are currently held by an indirect subsidiary (the “Refinitiv Direct Owner”) of Refinitiv Parent Limited (“Refinitiv”). On January 29, 2021, the London Stock Exchange Group plc (“LSEG”) acquired the Refinitiv business. Following the consummation of such transaction, LSEG became the controlling stockholder of Refinitiv, and Refinitiv continues to be the controlling stockholder of Tradeweb, holding approximately 91.2% of the combined voting power of our Class A common stock, Class B common stock, Class C common stock and Class D common stock as of the record date. LSEG has advised us that it intends to vote all such shares for the election of each of the nominees to the Board named herein and the ratification of the appointment of our independent registered public accounting firm.

A majority of the voting power of Class A common stock, Class B common stock, Class C common stock and Class D common stock entitled to vote, present virtually or represented by proxy, constitutes a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be included in determining the presence of a quorum at the Annual Meeting.

INTERNET AVAILABILITY OF PROXY MATERIALS

We are furnishing proxy materials to some of our stockholders via the Internet by mailing a Notice of Internet Availability of Proxy Materials (the “Notice”), instead of mailing printed copies of those materials. The Notice directs stockholders to a website where they can access our proxy materials, including this Proxy Statement and our combined Annual Report to Stockholders and Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Annual Report”), and view instructions on how to vote via the Internet or by telephone. If you received a Notice and would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice. If you elect to receive our future proxy materials electronically, you will receive access to those materials via email unless and until you elect otherwise.

PROXY VOTING

Shares that are properly voted via the Internet or by telephone or for which proxy cards are properly executed and returned will be voted at the Annual Meeting in accordance with the directions given or, in the absence of directions, will be voted in accordance with the Board’s recommendations as follows: “FOR ALL” of the director nominees named in this Proxy Statement and “FOR” the ratification of the appointment of our independent registered public accounting firm. It is not expected that any additional matters will be brought before the Annual Meeting, but if other matters are properly presented, the persons named as proxies in the proxy card or their substitutes will vote in their discretion on such matters.

The manner in which your shares may be voted depends on how your shares are held. If you own shares of record, meaning that your shares are represented by certificates or book entries in your name so that you appear as a stockholder on the records of American Stock Transfer & Trust Company, LLC (“AST”), our stock transfer agent, you may vote by proxy, meaning you authorize individuals named in the proxy card to vote your shares. You may provide this authorization by voting via the Internet, by telephone or (if you have received paper copies of our proxy materials) by returning a proxy card. In these circumstances, if you do not vote by proxy or virtually at the Annual Meeting, your shares will not be voted. If you own shares in street name, meaning that your shares are held by a bank, brokerage firm, or other nominee, you may instruct that institution on how to vote your shares. You may provide these instructions by voting via the Internet, by telephone, or (if you have received paper copies of our proxy materials) by returning a voting instruction form received from that institution. In these circumstances, if you do not provide voting instructions, the institution may nevertheless vote your shares on your behalf with respect to the ratification of the appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, 2023, but cannot vote your shares on any other matters being considered at the Annual Meeting.

VOTING STANDARD

With respect to the election of directors (Proposal 1), a nominee for director shall be elected to the Board by a plurality of the votes cast in respect of the shares of common stock present virtually or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. A plurality vote requirement means that the four director nominees with the greatest number of votes cast “FOR” such nominees are elected as directors. You may

| 2

|

TRADEWEB |

General Information

vote “FOR ALL,” “WITHHOLD ALL” or “FOR ALL EXCEPT” a director nominee. Votes that are withheld are not considered votes cast for the foregoing purpose and will have no effect on the outcome of the election. Similarly, broker non-votes are not considered votes cast for the foregoing purpose, and will have no effect on the outcome of the election. Broker non-votes occur when a person holding shares in street name, such as through a brokerage firm, does not provide instructions as to how to vote those shares and the broker lacks the authority to vote uninstructed shares at its discretion. Under the stock exchange interpretations that govern broker non-votes, Proposal 1 is expected to be considered a non-discretionary matter, and a broker will lack the authority to vote uninstructed shares at its discretion on the proposal.

With respect to the ratification of the appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal 2), the affirmative vote of a majority of the voting power of common stock present virtually or represented by proxy and entitled to vote on the matter is required to approve the matter. With respect to Proposal 2 you may vote “FOR,” “AGAINST” or “ABSTAIN.” For this matter, abstentions are counted as present at the Annual Meeting and entitled to vote and will have the effect of a vote “AGAINST” the matter. Proposal 2 is expected to be considered a discretionary matter, and a broker may exercise its discretion to vote uninstructed shares on the proposal.

Whether a proposal is considered discretionary or non-discretionary is subject to stock exchange rules and final determination by the stock exchange. As mentioned above, even with respect to discretionary matters, some brokers may choose not to exercise discretionary voting authority. As a result, we urge you to direct your broker, bank or other nominee regarding how to vote your shares on all proposals to ensure that your vote is counted.

Voting via the Internet or by telephone helps save money by reducing postage and proxy tabulation costs.

|

VOTE BY INTERNET Shares Held of Record: www.proxyvote.com

Shares Held in Street Name: www.proxyvote.com 24 hours a day / 7 days a week

INSTRUCTIONS:

• Read this Proxy Statement. • Go to the website listed above. • Have your Notice, proxy card or voting instruction form in hand and follow the instructions.

|

VOTE BY TELEPHONE Shares Held of Record: 800-690-6903

Shares Held in Street Name: See Voting Instruction Form 24 hours a day / 7 days a week

INSTRUCTIONS:

• Read this Proxy Statement. • Call the applicable number noted above. • Have your Notice, proxy card or voting instruction form in hand

| |

We encourage you to register to receive all future stockholder communications electronically, instead of in print. This means that, after you register, access to the 2022 Annual Report, Proxy Statement, and other correspondence will be delivered to you via email.

VOTING AND ATTENDANCE AT THE ANNUAL MEETING

To attend the Annual Meeting, vote, submit questions, or view the list of registered stockholders during the Annual Meeting, stockholders of record will be required to visit the meeting website listed above and log in using their 16-digit control number included on their proxy card or Notice. Beneficial owners should review the proxy materials and their voting instruction form or Notice for how to vote in advance of, and how to participate in, the Annual Meeting. Specifically, if you are a beneficial owner and your voting instruction form or the Notice does not indicate that you may vote the shares through the http://www.proxyvote.com website, you should contact your bank, broker or other nominee (preferably at least 5 days before the Annual Meeting) and obtain a “legal proxy” (which will contain a 16-digit control number that will allow you to attend, participate in, or vote at the Annual Meeting).

We encourage you to vote your shares in advance of the Annual Meeting by one of the methods described above, even if you plan to virtually attend the Annual Meeting. If you have already voted prior to the Annual

| 2023 PROXY STATEMENT |

|

General Information

Meeting, you may nevertheless change or revoke your vote at the Annual Meeting as described below. Only stockholders as of the record date (March 17, 2023) are entitled to virtually attend the Annual Meeting. Each stockholder may appoint only one proxyholder or representative to virtually attend on the stockholder’s behalf. On the day of the Annual Meeting, if you experience technical difficulties either during the check-in process or during the Annual Meeting, please call the technical support number that will be posted on the virtual meeting platform log-in page. Stockholders may submit questions during the Annual Meeting on the Annual Meeting website. More information regarding the question and answer process, including the number and types of questions permitted, and how questions will be recognized and answered, will be available in the meeting rules of conduct, which will be posted on the Annual Meeting website.

REVOCATION

If you own common stock of record, you may revoke your proxy or change your voting instructions at any time before your shares are voted at the Annual Meeting by delivering to the Secretary of the Company a written notice of revocation or a duly executed proxy (via the Internet or telephone or by returning a proxy card) bearing a later date or by virtually attending the Annual Meeting and voting. A stockholder owning common stock in street name may revoke or change voting instructions by contacting the bank, brokerage firm, or other nominee holding the shares or by obtaining a legal proxy from such institution and voting virtually at the Annual Meeting.

| 4

|

TRADEWEB |

Proposal 1: Election of Directors

Our Board currently has twelve seats, divided into three classes: Class I, Class II and Class III. Each class consists of one-third of the total number of directors:

| • | Our Class I directors are Troy Dixon, John Finley, Scott Ganeles and Murray Roos, and their terms will expire at this Annual Meeting. John Finley has not been re-nominated to stand for re-election at this Annual Meeting and will depart from the Board upon the expiration of his current term and election of his successor. In connection with Mr. Finley’s departure and in accordance with the Stockholders Agreement (as defined below), the Nominating and Corporate Governance Committee nominated, and the Board designated, a new nominee, Catherine Johnson, to stand for election as a Class I director nominee to succeed Mr. Finley and to fill the vacancy created by his departure. |

| • | Our Class II directors are Jacques Aigrain, Balbir Bakhshi, Paula Madoff and Thomas Pluta, and their terms will expire at the 2024 Annual Meeting. |

| • | Our Class III directors are Steven Berns, William (“Billy”) Hult, Lee Olesky and Rana Yared, and their terms will expire at the 2025 Annual Meeting. |

The Board proposes that each of Troy Dixon, Scott Ganeles and Murray Roos be reelected as Class I directors for new terms of three years each, and that Catherine Johnson be elected to serve as a Class I director for a term of three years to fill the vacancy created by Mr. Finley’s departure. Each nominee for director will, if elected, continue in office until the 2026 Annual Meeting and until the director’s successor has been duly elected and qualified, or until the earlier of the director’s death, resignation, retirement, disqualification or removal. The proxy holders named on the proxy card intend to vote the proxy (if you are a stockholder of record) for the election of each of these nominees, unless you indicate on the proxy card that your vote should be cast against any of the nominees. Under SEC rules, proxies cannot be voted for a greater number of persons than the number of nominees named. Accordingly, proxies cannot be voted for greater than the four Class I seats open for election.

Each nominee has consented to be named as a nominee in this Proxy Statement and to serve if elected. If any nominee is not able to serve, proxies will be voted in favor of the other nominees and may be voted for a substitute nominee, unless the Board chooses to reduce the number of directors serving on the Board.

All of our current directors and director nominees were designated to serve on the Board by Refinitiv, our controlling stockholder, pursuant to Refinitiv’s director designation right as set forth in Section 2.1 of the Stockholders Agreement (as defined below). See “Certain Relationships and Related Person Transactions — Related Person Transactions Entered Into in Connection With the IPO — Stockholders Agreement” for additional information. Once designated by Refinitiv, the Nominating and Corporate Governance Committee evaluates the director nominee pursuant to our Director Qualification Standards set forth in our Corporate Governance Guidelines and then recommends the director nominee for approval by the full Board. Please see “Corporate Governance — Director Nominations and Diversity” for further information.

The Board of Directors recommends a vote “FOR ALL” of the director nominees.

BIOGRAPHICAL AND RELATED INFORMATION OF DIRECTOR NOMINEES AND CONTINUING DIRECTORS

The principal occupations and certain other information about our director nominees and our continuing directors (including the skills and qualifications that led to the conclusion that they should serve as directors) are set forth below. The age shown below for each director is as of May 15, 2023, which is the date of the Annual Meeting.

NOMINEES FOR DIRECTOR WHOSE TERMS WOULD EXPIRE AT THE 2026 ANNUAL MEETING

The Board has nominated four Class I director nominees to be elected at the Annual Meeting to serve for three-year terms ending with the 2026 Annual Meeting of Stockholders and until a successor is duly elected and qualified, or until the earlier of the director’s death, resignation, or removal. Each nominee has agreed to serve if elected. Other than Catherine Johnson, each nominee is currently a director of the Company. As mentioned above, John Finley has not been re-nominated to stand for re-election at this Annual Meeting and will depart from the Board upon the expiration of his current term. In connection with Mr. Finley’s departure and in accordance with the Stockholders Agreement, the Nominating and Corporate Governance Committee nominated, and the

| 2023 PROXY STATEMENT |

|

Proposal 1: Election of Directors

Board designated, Catherine Johnson to stand for election as a Class I director nominee to succeed Mr. Finley and to fill the vacancy created by his departure. The Company thanks Mr. Finley for his many years of thoughtful and dedicated service as a member of the Board.

As mentioned above:

Troy Dixon | Independent

|

Age: 51 |

Director Since: March 2023 | ||

|

Tradeweb Committees: None | ||||

|

Other current public company boards: None | ||||

Key Experience and Qualifications:

| • | Extensive business and management experience and thorough knowledge of our industry |

Troy Dixon is the Founder and Chief Investment Officer of Hollis Park Partners LP, an alternative asset manager that specializes in structured products, a position he has held since 2013. Mr. Dixon has nearly 30 years of industry experience, including leading residential mortgage-backed securities trading at Deutsche Bank from 2006 to 2013 and UBS Inc. from 2002 to 2006. Mr. Dixon serves as an independent board member and head of the Audit Committee of Lafayette Square Business Development Corporation. He also serves on the boards of Boys Hope Girls Hope and New Height Youth Inc. He received a Bachelor of Arts degree from College of the Holy Cross. Mr. Dixon is qualified to serve on our Board due to his deep knowledge of the trading industry.

Scott Ganeles | Independent

|

|

Age: 59 |

Director Since: March 2019 | ||

|

Tradeweb Committees: Audit Committee, Compensation Committee | ||||

|

Other current public company boards: None | ||||

Key Experience and Qualifications:

| • | Extensive business and management experience and thorough knowledge of our industry |

Mr. Ganeles has served as a Senior Partner at WestCap Group, LLC, a growth equity firm that invests in growth-stage technology businesses in the financial technology, real estate technology and healthcare technology industries as well as asset-light marketplace platforms, since April 2019. Prior to that, Mr. Ganeles was the Chief Executive Officer of i-Deal from December 2000 until it merged with Hemscott in 2006 to form Ipreo Holdings LLC. Mr. Ganeles became Chief Executive Officer of Ipreo after the merger and continued as Chief Executive Officer until August 2018. Prior to Ipreo Holdings LLC, Mr. Ganeles was President and Co-Founder of the Carson Group from June 1990 to September 2000. Mr. Ganeles received a B.A. in Political Science from Brown University. Mr. Ganeles is qualified to serve on our Board due to his extensive management, M&A and industry experience.

| 6

|

TRADEWEB |

Proposal 1: Election of Directors

Catherine Johnson

|

Age: 54 |

New Director Nominee | ||

|

Tradeweb Committees: None | ||||

|

Other current public company boards: None | ||||

Key Experience and Qualifications:

| • | Extensive international business, financial services, mergers and acquisitions and legal experience |

Catherine Johnson has served as the Group General Counsel of LSEG, a United Kingdom-based financial infrastructure company and our indirect controlling stockholder, since 2015. Ms. Johnson manages an international team of lawyers and compliance professionals and advises the LSEG board and other senior executives of LSEG on all aspects of the LSEG business. Prior to serving as Group General Counsel, Ms. Johnson held positions of increasing responsibility at LSEG beginning in 1996. She is a member of LSEG’s Executive Committee and the Chair of FTSE International Limited, an FCA regulated entity in the United Kingdom. Ms. Johnson holds a law and economics degree from Kings College, Cambridge, and qualified at Herbert Smith in 1993 in its corporate division. Ms. Johnson is qualified to serve on our Board due to her deep legal, regulatory and corporate governance experience.

Murray Roos

|

|

Age: 47 |

Director Since: March 2021 | ||

|

Tradeweb Committees: None | ||||

|

Other current public company boards: None | ||||

Key Experience and Qualifications:

| • | Global leadership experience across sales, trading and origination |

Mr. Roos has served as the Group Director, Capital Markets, and as a member of the Executive Committee, of LSEG, a United Kingdom-based financial infrastructure company and our indirect controlling stockholder, since April 2020. Prior to joining LSEG, Mr. Roos held several senior positions at Citigroup, a multinational investment bank and financial services corporation, from April 2015 to March 2020, including Global Co-Head of Equities, and previously led Citigroup’s Multi-Asset Structuring Group. Prior to that, Mr. Roos held various management and trading positions at Deutsche Bank, and was previously a trader at UBS. Mr. Roos received a BSc from the University of Cape Town. Mr. Roos is qualified to serve on our Board due to his deep experience in our industry.

| 2023 PROXY STATEMENT |

|

Proposal 1: Election of Directors

DIRECTORS WHOSE TERMS EXPIRE AT THE 2024 ANNUAL MEETING

Jacques Aigrain | Independent

|

|

Age: 68 |

Director Since: August 2022 | ||

|

Tradeweb Committees: Compensation Committee (Chair), Nominating and Corporate Governance Committee | ||||

|

Other current public company boards: Clearwater Analytics, LyondellBasell Industries N.V. | ||||

Key Experience and Qualifications:

| • | Significant investment, financial and leadership expertise |

Mr. Aigrain served as an advisor at Warburg Pincus LLC, a global private equity firm, from 2014 to December 2020. He previously spent nine years at Swiss Re, where he served as CEO from 2006 to 2009. Prior to Swiss Re he spent 20 years in global leadership roles at JP Morgan Chase & Co. in New York, London and Paris. Mr. Aigrain currently serves as chairman of the board of LyondellBasell Industries N.V., chairman of Singular Bank S.A.U. and a director of Clearwater Analytics. He previously held board positions at WPP plc, LSEG, LCH Clearnet Group Ltd, Lufthansa AG, Resolution Ltd, Swiss International Airlines AG, and the Qatar Financial Authority. He holds a doctorate in economics from Université Paris-Sorbonne and a master’s in economics from Université Paris Dauphine – PSL. Mr. Aigrain is qualified to serve on our Board due to his wide-ranging experience in global financial services, both as an executive and a board member.

Balbir Bakhshi

|

|

Age: 53 |

Director Since: July 2021 | ||

|

Tradeweb Committees: None | ||||

|

Other current public company boards: None | ||||

Key Experience and Qualifications:

| • | Extensive background in leadership, operations and risk management |

Mr. Bakhshi has served as the Chief Risk Officer and as a member of the Executive Committee, of LSEG, a United Kingdom-based financial infrastructure company and our indirect controlling stockholder, since January 2021. Prior to joining LSEG, Mr. Bakhshi was Group Head of Non-Financial Risk Management at Deutsche Bank, a multinational investment bank and financial services company, from January 2017 to December 2020 and served on the Supervisory Board of Deutsche Bank Luxembourg S.A. as the Chair of its Risk Committee. Prior to this, Mr. Bakhshi was Global Head of Operational Risk Management at Credit Suisse and previously held a variety of senior roles at Credit Suisse including UK Investment Banking Chief Risk Officer and Head of Market Risk. Mr. Bakhshi is also a board member of London Clearing House Limited. Mr. Bakhshi received a B.A. from the University of Westminster and an MSc from Brunel University. Mr. Bakhshi is qualified to serve on our Board due to his deep knowledge of risk management.

| 8

|

TRADEWEB |

Proposal 1: Election of Directors

Paula Madoff | Independent

|

|

Age: 55 |

Director Since: March 2019 | ||

|

Tradeweb Committees: Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee | ||||

|

Other current public company boards: Great-West Lifeco Inc., KKR Real Estate Finance Trust, Motive Capital Corp II, Power Corporation of Canada | ||||

Key Experience and Qualifications:

| • | Deep bench of knowledge and experience leading Goldman Sachs’ interest rate products and mortgages businesses |

| • | Significant service on boards and board committees |

Ms. Madoff has served as Tradeweb’s Lead Independent Director since February 2022. Ms. Madoff currently serves as an Advisor to Goldman Sachs (“Goldman”), a multinational investment bank and financial services company. She had been employed by Goldman for 28 years where she was most recently a Partner leading the Interest Rate Products and Mortgages businesses until her retirement from that role in August 2017. From August 2017 to April 2018, Ms. Madoff was employed as an Advisory Director at Goldman. She held several additional leadership positions at Goldman, including Co-Chair of the Retirement Committee, overseeing 401(k) and pension plan assets; Chief Executive Officer of Goldman Sachs Mitsui Marine Derivatives Products, L.P.; and was a member of its Securities Division Operating Committee and Firmwide New Activity Committee. Before joining Goldman, Ms. Madoff worked in Mergers and Acquisitions at Wasserstein Perella & Co. and in Corporate Finance at Bankers Trust. Ms. Madoff currently serves as a non-executive director on the boards of Great-West Lifeco Inc., KKR Real Estate Finance Trust Inc., Motive Capital Corp II and Power Corporation of Canada. She is also Chair of the ICE LIBOR Oversight Committee. Ms. Madoff is a David Rockefeller Fellow, an Executive Member of the Harvard Business School Alumni Board, a member of the Harvard Kennedy School Women’s Leadership Board, and a Director of Hudson River Park Friends. Ms. Madoff received a B.A. degree in Economics, cum laude, from Lafayette College and an M.B.A. from Harvard Business School. Ms. Madoff is qualified to serve on our Board due to her extensive experience in the financial services industry, as well as her significant experience in board service.

Thomas Pluta

|

|

Age: 56 |

Director Since: March 2019 | ||

|

Tradeweb Committees: None | ||||

|

Other current public company boards: None | ||||

Key Experience and Qualifications:

| • | Significant trading and management experience and deep knowledge of our industry |

| • | Operational expertise in our business that he has developed as our President |

Mr. Pluta has served as our President since January 1, 2023 and as President-elect from October 2022 to December 2022. Prior to the series of reorganization transactions that were completed on April 4, 2019 in connection with the Company’s initial public offering, which closed on April 8, 2019 (the “IPO”), whereby Tradeweb Markets LLC (“TWM LLC”) became the principal operating subsidiary of the Company (the “Reorganization Transactions”), Mr. Pluta served on the former board of managers of TWM LLC beginning in December 2017. Mr. Pluta served as Global Head of the Linear Rates Trading business at J.P. Morgan, a multinational financial services company, between July 2019 and October 2022. Prior to that, Mr. Pluta was Co-Head of Global Rates Trading between April 2015 and July 2019 and Global Head of Short Term Interest Rate Trading between January 2014 and April 2015 at J.P. Morgan. In addition to his 26-year career at J.P. Morgan managing trading teams across the Global Rates, Emerging Markets and Foreign Exchange businesses, he serves as the Corporate and Investment Bank lead for the firm-wide LIBOR Transition Program. A champion for advancing the people agenda at J.P. Morgan, Mr. Pluta has been actively engaged throughout his career, and holds leadership positions in various diversity & inclusion, recruiting, and culture-building efforts. He received a B.A. in Economics from Yale University and an M.B.A. in General Management from the Harvard Business School. Mr. Pluta is qualified to serve on our Board due to his extensive experience in our industry and deep knowledge of our business that he has developed in his role as President.

| 2023 PROXY STATEMENT |

|

Proposal 1: Election of Directors

DIRECTORS WHOSE TERMS EXPIRE AT THE 2025 ANNUAL MEETING

Steven Berns | Independent

|

|

Age: 58 |

Director Since: April 2020 | ||

|

Tradeweb Committees: Audit Committee (Chair) | ||||

|

Other current public company boards: Forum Merger IV Corp. | ||||

Key Experience and Qualifications:

| • | Extensive financial knowledge and expertise |

Mr. Berns served as the Chief Operating Officer and Chief Financial Officer of TripleLift, an advertising technology company, from May 2020 to December 2022, and previously served as Chief Financial Officer of GTT Communications, Inc., a multinational telecommunications and internet service provider (“GTT Communications”), from April 2020 to December 2020. GTT Communications filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code in October 2021, approximately 10 months after Mr. Berns resigned. Prior to GTT Communications, Mr. Berns served as Chief Financial Officer of Shutterstock, Inc. (“Shutterstock”), a provider of stock photography, stock footage, stock music and editing tools, from September 2015 to June 2019 and as Chief Operating Officer and Co-Chief Operating Officer of Shutterstock from March 2017 to March 2019 and March 2019 to June 2019, respectively. Prior to joining Shutterstock, Mr. Berns served as Executive Vice President and Chief Financial Officer of Tribune Media Company from 2013 to 2015, and Executive Vice President and Chief Financial Officer of Revlon, Inc. (“Revlon”) from 2009 to 2013. Prior to that, Mr. Berns served as the Chief Financial Officer of TWM LLC, the Company’s predecessor, and President, Chief Financial Officer and Director of MDC Partners, Inc. He previously held several senior financial positions at the Interpublic Group of Companies, Inc. and Revlon. Mr. Berns currently serves as a board member and Chair of the Audit Committee for Forum Merger IV Corp. and has previously served as a board member of Forum Merger Corp., LivePerson, Inc. and Shutterstock. Mr. Berns received a B.S. in Business and Economics from Lehigh University and an Executive MBA in Finance from New York University, Stern School of Business. Mr. Berns is qualified to serve on our Board due to his extensive experience holding key executive roles at many public companies, as well as his deep financial knowledge.

Billy Hult

|

|

Age: 53 |

Director Since: March 2019 | ||

|

Tradeweb Committees: None | ||||

|

Other current public company boards: None | ||||

Key Experience and Qualifications:

| • | Management and industry experience |

| • | Operational expertise in our business that he has developed as our Chief Executive Officer |

Mr. Hult has served as Tradeweb’s Chief Executive Officer since January 1, 2023, CEO-elect from February 2022 to December 2022 and as its President since its formation until February 2022. Mr. Hult has served as TWM LLC’s President since September 2008 and, prior to the Reorganization Transactions, served on the former board of managers of TWM LLC beginning in September 2008. Mr. Hult has played a pivotal role in Tradeweb’s evolution as a leading global operator of electronic marketplaces for rates, credit, equities and money markets. He has led the development of numerous innovations connecting liquidity providers and investors across retail, wholesale and institutional markets. Mr. Hult joined Tradeweb in July 2000 as a product manager and led the creation of its to-be-announced mortgage trading marketplace. In 2005, Mr. Hult went on to serve as the head of U.S. products overseeing the firm’s expansion into new asset classes and, in 2009, oversaw the launch of Dealerweb, its first electronic trading platform for wholesale market participants. Mr. Hult has also been instrumental in numerous acquisitions by Tradeweb, including Hilliard Farber in 2008, Rafferty Capital Markets in 2011, J.J. Kenny Drake in 2011 and Nasdaq’s former eSpeed platform for electronic bond trading in 2021. Prior to joining Tradeweb, Mr. Hult held a variety of trading positions at Société Générale from 1997 to 2000. He received a B.A. from Denison University. Mr. Hult is qualified to serve on our Board due to his extensive experience in our industry and deep knowledge of our business that he has developed in his role as Chief Executive Officer.

| 10

|

TRADEWEB |

Proposal 1: Election of Directors

Lee Olesky

|

|

Age: 61 |

Director Since: March 2019 | ||

|

Tradeweb Committees: None | ||||

|

Other current public company boards: None | ||||

Key Experience and Qualifications:

| • | Management and leadership experience |

| • | Operational expertise in our business that he has developed as our Co-Founder and former Chief Executive Officer |

Mr. Olesky is our co-founder and has served as Chairperson of Tradeweb’s Board since February 2022. Mr. Olesky served as Tradeweb’s Chief Executive Officer from its formation and as Chief Executive Officer of TWM LLC from September 2008, each until his retirement in December 2022. Mr. Olesky also served on the former board of managers of TWM LLC from 2008 until the date of the Reorganization Transactions. After being our founding Chairperson of the Board from 1996 to 1998, Mr. Olesky rejoined the Company in February 2002 in London as President, driving the Company’s expansion in Europe and into the global derivatives markets. He then led the expansion of Tradeweb into Asia, opening offices in Tokyo, Hong Kong and Singapore. Prior to returning to the Company, Mr. Olesky worked at Credit Suisse First Boston from 1993 to 1999 in a variety of management positions, ultimately as Chief Operating Officer for the Fixed Income Americas division. Following his time at Credit Suisse First Boston, from 1999 to 2002, he served as Chief Executive Officer of BrokerTec, an electronic brokerage platform that he co-founded. He received a B.A. from Tulane University and a J.D. from The George Washington University. Mr. Olesky is qualified to serve on our Board due to his extensive experience in our industry and deep knowledge of our business that he has developed in his role as our co-founder and former Chief Executive Officer.

Rana Yared | Independent

|

|

Age: 39 |

Director Since: August 2022 | ||

|

Tradeweb Committees: Audit Committee | ||||

|

Other current public company boards: None | ||||

Key Experience and Qualifications:

| • | Extensive financial and investment experience |

| • | Former member of the board of managers of TWM LLC |

Ms. Yared has served as a General Partner at Balderton Capital, a leading venture capital investor focused on European founders with global ambitions from seed to exit, since August 2020. Prior to the series of Reorganization Transactions that were completed on April 4, 2019 in connection with the Company’s IPO, Ms. Yared served on the former board of managers of TWM LLC from 2014 to 2019. Ms. Yared previously served as a Partner in the Principal Strategic Investments Group and later in GS Growth at Goldman Sachs, a multinational investment bank and financial services company, from 2006 to August 2020. Ms. Yared currently holds board positions at Wabash College, Ramp and Coro.net. She formerly served on the Penn Fund Board and the boards of NAV, Vestwell and SwapClear. She holds a Bachelor of Science from the Wharton School and a Bachelor of Arts in International Relations, both from the University of Pennsylvania, as well as a Master of Science from the London School of Economics. Ms. Yared is qualified to serve on our Board due to her knowledge of our business, having worked with the executive management team as a Board member for five years, and because of her exceptional experience helping companies to scale.

| 2023 PROXY STATEMENT |

|

Corporate Governance

CONTROLLED COMPANY EXEMPTION AND DIRECTOR INDEPENDENCE

Our Board has affirmatively determined that each of Mr. Aigrain, Mr. Berns, Mr. Dixon, Mr. Ganeles, Ms. Madoff and Ms. Yared is independent under the rules of the Nasdaq Global Select Market (“Nasdaq”) and SEC, including, with respect to members of each of the Audit Committee and Compensation Committee, those applicable to such committee service. In addition, the Board affirmatively determined that Mr. Von Hughes, who served as a director until September 30, 2022, was independent during the time he served on the Board.

In making its independence determinations with respect to our directors, the Board considered that Mr. Dixon is the founder, managing partner and Chief Investment Officer of Hollis Park Partners, LP, a client of the Company, that had paid de minimis fees to the Company for ordinary course services from the Company on terms that are substantially equivalent to those prevailing at the time for comparable transactions with other similarly situated customers. The transaction did not exceed 1% of the Company’s gross consolidated revenues or that of Hollis Park Partners, LP. Based on this review, the Board concluded that this transaction does not interfere with the ability of Mr. Dixon to exercise independent judgment in carrying out his Board responsibilities.

The Refinitiv Direct Owner and an indirect subsidiary of Refinitiv that, prior to the Reorganization Transactions, owned membership interests of TWM LLC and that continues to own common membership interests of TWM LLC (“LLC Interests”) after the completion of the IPO and Reorganization Transactions (the “Refinitiv LLC Owner,” and together with the Refinitiv Direct Owner, the “Refinitiv Owners”), who are parties to the Stockholders Agreement, hold Class B common stock and Class D common stock collectively representing a majority of the combined voting power of our total outstanding common stock. As a result, we are a “controlled company” within the meaning of the corporate governance standards of Nasdaq. Under these corporate governance standards, a company of which more than 50% of the voting power is held by an individual, a group or another company is a “controlled company” and may elect not to comply with certain corporate governance requirements, including:

| 1. | the requirement that a majority of our Board consist of independent directors; |

| 2. | the requirement that director nominations be made, or recommended to the full Board, by its independent directors or by a nominations committee that is composed entirely of independent directors; and |

| 3. | the requirement that the compensation committee be composed entirely of independent directors. |

We currently rely on the exemptions available to us as a controlled company from the requirement that our Board be comprised of a majority of independent directors and that our Nominating and Corporate Governance Committee and Compensation Committee be composed of entirely independent directors. Our Audit Committee is comprised solely of independent directors, as required under Nasdaq and SEC rules. If at any time we cease to be a controlled company, we will take all action necessary to comply with applicable SEC rules and regulations and Nasdaq rules, including appointing a majority of independent directors to our Board, subject to permitted “phase-in” periods under the Nasdaq rules.

We rely on all of the exemptions listed above. As a result, we do not have a majority of independent directors and our Nominating and Corporate Governance Committee and Compensation Committee do not consist entirely of independent directors. Accordingly, you will not have the same protections afforded to stockholders of companies that are subject to all of the applicable stock exchange rules.

KEY GOVERNANCE PRACTICES

| • | Strong Lead Independent Director role. |

| • | Annual Board and Committee evaluation process. |

| • | Director overboarding policy. |

| • | Inclusion and interview of gender and ethnically diverse candidates in any pool of candidates from which board of director nominees are chosen and Board Diversity Policy. |

| • | Annual disclosure of consolidated EEO-1 report. |

| • | Robust whistleblowing procedures and strict non-retaliation policy. |

| • | Board oversight of environmental, social and governance (“ESG”) initiatives and key risk matters. |

| • | No shareholder rights plan. |

| • | Active stockholder engagement. |

| • | Proactive Board and Committee refreshment with focus on diversity and the optimal mix of skills and experience. |

| 12

|

TRADEWEB |

Corporate Governance

BOARD LEADERSHIP

The Board directs and oversees the management of the business and affairs of the Company in a manner consistent with the best interests of the Company. The Board’s responsibility is one of oversight, and in performing its oversight role, the Board serves as the ultimate decision-making body of the Company, except for those matters reserved to or shared with our stockholders.

The Board selects its chairperson (“Chairperson”) and the Company’s Chief Executive Officer in the manner it considers to be in the best interests of the Company. Therefore, the Board does not have a policy on whether the roles of Chairperson and Chief Executive Officer should be separate or combined and, if it is to be separate, whether the Chairperson should be selected from the independent directors. Lee Olesky currently serves as Chairperson and Paula Madoff serves as Lead Independent Director. The Board believes that this structure provides strong independent oversight of management, as well as appropriate governance and risk oversight. Among other factors, the Board considered and evaluated: Mr. Olesky’s knowledge of the Company and its industry, including his former service as Chief Executive Officer of the Company; the quality of his leadership; and the meaningful responsibilities of the Lead Independent Director, as detailed below. Ms. Madoff has served as the Lead Independent Director since February 2022, and the independent directors believe that Ms. Madoff is well suited to serve as Lead Independent Director given her significant managerial and operational experience, as well as her experience in corporate governance.

Ms. Madoff, our Lead Independent Director, is a non-employee, independent director who has been elected by the Board to serve for a term of at least one year. Our Corporate Governance Guidelines provide that, to the extent there is a Lead Independent Director, such Lead Independent Director has clearly defined responsibilities as follows:

| • | presiding at meetings of the Board at which the Chairperson is not present, including executive sessions of the independent and non-management (if different) directors; |

| • | collaborating with the Chief Executive Officer and the Chairperson regarding the information sent to the Board; |

| • | coordinating with the Chairperson and the Chief Executive Officer regarding the agenda and schedule for the meetings of the Board to provide that there is sufficient time for discussion of all agenda items; |

| • | serving as liaison between the Chief Executive Officer and the Chairperson and the independent directors; |

| • | being available for consultation and communication with major stockholders upon request; and |

| • | having the authority to call executive sessions of the independent directors. |

The Board periodically reviews the Board’s leadership structure and its appropriateness given the needs of the Board and the Company at such time.

STOCKHOLDER ENGAGEMENT

Effective corporate governance includes regular, constructive conversations with our stockholders to proactively seek stockholder insights and to answer stockholder inquiries. We maintain an active dialogue with stockholders to ensure that we thoughtfully consider a diversity of perspectives on issues including strategy, business performance, risk, culture and workplace topics, compensation practices, and a broad range of ESG issues.

Our Investor Relations team regularly provides a summary of all relevant feedback to our Board. In fiscal year 2022, we engaged with a cross-section of stockholders owning over 70% of our Class A common stock (excluding index firms). To communicate broadly with our stockholders, we also seek to transparently share ESG information relevant to our stockholders through our Investor Relations website, our Annual Report, this Proxy Statement and our Corporate Sustainability Report.

Last year, the Company received a stockholder proposal requesting that the Company adopt a policy for improving board diversity by including qualified women and minority candidates in the pool of director candidates, which 7% of minority stockholders supported. The Company maintains a Board Diversity Policy in its Corporate Governance Guidelines that requires diversity to be considered, among other factors, when identifying, assessing and nominating candidates to serve on the Board. Taking into consideration the requirements of its

| 2023 PROXY STATEMENT |

|

Corporate Governance

Board Diversity Policy, the Company appointed one female director to the Board in August 2022 and one diverse director to the Board in March 2023. In addition, the Board, after both considering the stockholder vote on the proposal and feedback from stockholders as part of the Company’s engagement program on the topic, revised its Corporate Governance Guidelines in March 2023 to adopt the “Rooney Rule” in director searches (in addition to its current Board Diversity Policy). For details, please see “—Director Nominations and Diversity” below.

COMMUNICATIONS WITH DIRECTORS

Stockholders and other interested parties may communicate with the Board by writing to the General Counsel, Tradeweb Markets Inc., 1177 Avenue of the Americas, New York, New York 10036. Written communications may be addressed to the Chairperson of the Board, the Lead Independent Director, the chairperson of any of the Audit, Nominating and Corporate Governance and Compensation Committees, or to the non-management or independent directors as a group. The General Counsel will forward such communications to the appropriate party, subject to the next sentence. Each communication will be reviewed to determine whether it is appropriate for presentation to our Board or the applicable director(s). The purpose of this screening is to allow our Board (or the applicable individual director(s)) to avoid having to consider irrelevant or inappropriate communications, such as advertisements, solicitations, product inquiries or any offensive or otherwise inappropriate materials.

DIRECTOR NOMINATIONS AND DIVERSITY

The Nominating and Corporate Governance Committee identifies individuals believed to be qualified as candidates to serve on the Board and recommends that the Board select the nominees for all directorships to be filled by the Board or by our stockholders at an annual or special meeting (subject to the terms of the Stockholders Agreement, as applicable). In identifying candidates for membership on the Board, the Committee takes into account all factors it considers appropriate, which may include (a) individual qualifications, including strength of character, mature judgment, familiarity with the Company’s business and industry, independence of thought and an ability to work collegially, (b) the Board Diversity Policy, discussed in the paragraph below and (c) all other factors that the Committee considers appropriate, which may include existing commitments to other businesses, potential conflicts of interest with other pursuits, legal considerations such as antitrust issues, corporate governance background, various and relevant career experience, relevant technical skills, relevant business or government acumen, financial and accounting background, executive compensation background and the size, composition and combined expertise of the existing Board. The Committee also may consider the extent to which the candidate would fill a present need on the Board. When evaluating whether to renominate existing directors, the Committee considers matters relating to the retirement of current directors and performance during the prior year.

The Company recognizes and embraces the benefits of having a diverse Board to enhance the quality of its performance. With a view to achieving sustainable and balanced development, the Company sees diversity at the Board level as an essential element in supporting the attainment of its strategic objectives and its sustainable development. In designing the Board’s composition, Board diversity is considered among a number of aspects, including but not limited to gender, age, race, ethnicity, nationality, cultural and educational background, professional experience, skills, knowledge and length of service. The ultimate decision on all Board nominations is based on merit and contribution that the selected candidates will bring to the Board, having due regard for the benefits of diversity on the Board. Taking these factors into account, the Company appointed one female director to the Board in August 2022 and one diverse director to the Board in March 2023. Further, beginning in March 2023, as part of the search process for each new director, women and minority candidates will be included in the pool from which Board nominees are chosen and at least one woman and one minority candidate will be interviewed as part of the director search process. The Nominating and Corporate Governance Committee reviews the qualifications of director candidates and incumbent directors in light of the criteria approved by our Board and recommends the Company’s candidates to our Board for election by the Company’s stockholders at the applicable annual meeting. The Nominating and Corporate Governance Committee also assesses the qualifications and characteristics of our directors, including racial and ethnic diversity, and effectiveness of our Board Diversity Policy as part of our Board’s annual self-evaluation process.

| 14

|

TRADEWEB |

Corporate Governance

The Nominating and Corporate Governance Committee evaluates director candidates recommended by stockholders on a substantially similar basis as it considers other nominees. Any recommendation submitted to the Secretary should be in writing, should include any supporting material the stockholder considers appropriate in support of that recommendation and must include information that would be required under the rules of the SEC to be included in a proxy statement soliciting proxies for the election of such candidate and the written consent of the candidate to serve as one of our directors if elected. Stockholders wishing to propose a candidate for consideration may do so by submitting the above information to the attention of the Secretary, Tradeweb Markets Inc., 1177 Avenue of the Americas, New York, New York 10036. The recommendation should contain all of the information regarding the nominee required under the “advance notice” provisions of our Amended Restated Bylaws (the “Bylaws”) (which can be provided free of charge upon request by writing to our Secretary at the address listed above). All recommendations for nomination received by the Secretary that satisfy the requirements of our Bylaws relating to such director nominations will be presented to the Nominating and Corporate Governance Committee for its consideration. Please see the section titled “Proposals of Stockholders” for information regarding the advance notice provisions applicable to stockholder director nominations set forth in our Bylaws.

In addition, pursuant to the Stockholders Agreement, the Refinitiv Owners have the right to designate nominees to our Board subject to the maintenance of certain ownership requirements in us. See “Certain Relationships and Related Person Transactions—Related Person Transactions Entered Into in Connection With the IPO—Stockholders Agreement” for additional information. Upon designation, the Nominating and Corporate Governance Committee evaluates the director nominee pursuant to the standards set forth above, and then recommends the director nominee for approval by the full Board.

BOARD QUALIFICATIONS AND DIVERSITY MATRIX

The following charts show how certain skills, experience, characteristics and other criteria, including diversity of backgrounds and diversity with respect to gender and demographics, are currently represented on our Board. The chart summarizing skills is not intended to be an exhaustive list for each director, but instead intentionally focuses on the primary skillsets each director contributes. We believe the combination of the skills and qualifications shown below demonstrates how our Board is well-positioned to provide effective oversight and strategic advice to our management team.

We believe our Board possesses the following skills:

| • | Capital Markets/Fixed Income—Representation from Board members with deep capital markets industry knowledge, particularly in fixed income, is critical to our success. Practical and operational experience in our markets and an understanding of the current market landscape provide skills necessary to guide accelerated growth as we identify opportunities for future innovation. |

| • | Financial Expertise—A comprehensive knowledge of financial metrics, accounting and public reporting is essential to ensure proper oversight of our performance and future planning. |

| • | Electronic Trading—Experience working in existing, new or emerging technology is a critical perspective to have on the Board of a financial markets technology company, providing practical guidance and understanding of what is core to our business as an electronic trading operator. |

| • | Global Leadership/Human Capital—Experience leading a global team, or business, provides perspective necessary to guide our business as we operate across multiple countries and jurisdictions. Having members with global operational experience and strategic oversight of a business also provides valuable perspective for holistic corporate strategy, as well as a deep knowledge of human capital management and perspective on building strong teams and retaining top talent. |

| • | Corporate Governance—Current, or prior, experience on private and public company boards brings experience and insight into best-practices that will help to shape our practices. |

| • | Legal & Regulatory—Experience with legal requirements and regulatory compliance permits the Board to exercise oversight of the regulatory aspects of our business, as we operate in multiple jurisdictions and sometime through regulated legal entities. This perspective allows for critical assessment of risks across our global business. |

| 2023 PROXY STATEMENT |

|

Corporate Governance

| • | Risk Management/Information Technology and Systems—As a company at the intersection of financial markets and technology, it is critical to have experience and skills in risk management on our Board to help navigate a complex and evolving technology landscape, as well as to effectively identify and prioritize risks to our operations, including oversight of policies, procedures and practices that comprehensively plan for and mitigate against these risks. Knowledge of and experience in information technology and systems, including cyber security practices, is also essential on our Board given a need for heightened awareness, planning and defenses against evolving information security threats. |

| • | Mergers & Acquisitions—Growth by acquisition is a strategy that continues to shape the evolution of the Company, and experience in transactions and expansion through M&A is a valuable expertise to have on our Board. |

| Jacques Aigrain |

Balbir Bakhshi |

Steven Berns |

Troy Dixon |

John Finley |

Scott Ganeles |

Billy Hult |

Paula B. Madoff |

Lee Olesky |

Thomas Pluta |

Murray Roos |

Rana Yared |

|||||||||||||||||||||||||||||||||||||

| Knowledge, Skills and Experience |

|

|||||||||||||||||||||||||||||||||||||||||||||||

| Capital Markets/ Fixed Income |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

| Financial Expertise |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

| Electronic Trading |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

| Global Leadership/ Human Capital |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

| Corporate Governance |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

| Legal & Regulatory |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

| Risk Management/ Information Technology & Systems |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

| Mergers & Acquisitions |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

| Demographics |

|

|||||||||||||||||||||||||||||||||||||||||||||||

| RACE/ETHNICITY |

|

|||||||||||||||||||||||||||||||||||||||||||||||

| African American |

|

|||||||||||||||||||||||||||||||||||||||||||||||

| Asian/Pacific Islander |

|

|||||||||||||||||||||||||||||||||||||||||||||||

| White/ Caucasian |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

| Does Not Self-Identify |

|

|||||||||||||||||||||||||||||||||||||||||||||||

| GENDER | ||||||||||||||||||||||||||||||||||||||||||||||||

| Male |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

| Female |

|

|

||||||||||||||||||||||||||||||||||||||||||||||

| 16

|

TRADEWEB |

Corporate Governance

| Board Diversity Matrix (As of March 23, 2023) |

| |||||||||||||||||||

| Total Number of Directors: 12 | ||||||||||||||||||||

|

|

Female | Male | Non- Binary |

Did Not Disclose Gender | ||||||||||||||||

| Part I: Gender Identity |

||||||||||||||||||||

| Directors |

2 | 10 | — | — | ||||||||||||||||

| Part II: Demographic Background |

||||||||||||||||||||

| African American or Black |

— | 1 | — | — | ||||||||||||||||

| Alaskan Native or Native American |

— | — | — | — | ||||||||||||||||

| Asian |

— | 1 | — | — | ||||||||||||||||

| Hispanic or Latinx |

— | — | — | — | ||||||||||||||||

| Native Hawaiian or Pacific Islander |

— | — | — | — | ||||||||||||||||

| White |

1 | 8 | — | — | ||||||||||||||||

| Two or More Races or Ethnicities |

— | — | — | — | ||||||||||||||||

| LGBTQ+ |

— | — | — | — | ||||||||||||||||

| Did Not Disclose Demographic Background |

1 | |||||||||||||||||||

RISK OVERSIGHT