UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ______________

Commission

file number:

(Exact name of registrant as specified in its charter)

| State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization | Identification Number) |

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The

|

Securities registered pursuant to section 12(g) of the Act: NONE

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ||

| ☒ | Smaller reporting company | ||||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

The

aggregate market value of the registrant’s common stock, par value $0.00001 per share, held by non-affiliates of the registrant,

as computed by reference to the June 30, 2023 closing price reported by Nasdaq, was approximately $

The number of shares outstanding of the registrant’s common stock on March 20, 2024, was

Shuttle Pharmaceuticals Holdings, Inc.

TABLE OF CONTENTS

| 2 |

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K (including the section regarding Management’s Discussion and Analysis and Results of Operations, the “Annual Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements are based on our management’s beliefs and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. All statements other than statements of historical facts contained in this Form 10-K are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “could,” “will,” “would,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “intend,” “predict,” “seek,” “contemplate,” “project,” “continue,” “potential,” “ongoing” or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about:

| ● | the initiation, timing, progress and results of our research and development programs, preclinical studies, any clinical trials and INDs, NDAs other regulatory submissions; | |

| ● | our expected dependence on third party collaborators for developing, obtaining regulatory approval for and commercializing product candidates; | |

| ● | our receipt and timing of any milestone payments or royalties under any research collaboration and license agreement we enter into; | |

| ● | our ability to identify and develop product candidates; | |

| ● | our or a collaborator’s ability to obtain and maintain regulatory approval of any of our product candidates; | |

| ● | the rate and degree of market acceptance of any approved products candidates; | |

| ● | the commercialization of any approved product candidates; | |

| ● | our ability to establish and maintain additional collaborations and retain commercial rights for our product candidates subject to collaborations; | |

| ● | the implementation of our business model and strategic plans for our business, technologies and product candidates; | |

| ● | our estimates of our expenses, ongoing losses, future revenue and capital requirements; | |

| ● | our ability to obtain additional funds for our operations; | |

| ● | our ability to obtain and maintain intellectual property protection for our technologies and product candidates and our ability to operate our business without infringing the intellectual property rights of others; | |

| ● | our reliance on third parties to conduct our preclinical studies or any future clinical trials; | |

| ● | our reliance on third party supply and manufacturing partners to supply the materials and components for, and manufacture, our research and development, preclinical and clinical trial drug supplies; | |

| ● | our ability to attract and retain qualified key management and technical personnel; | |

| ● | our use of net proceeds received by us from our initial public offering, or IPO, or any subsequent private placement; | |

| ● | our expectations regarding the time during which we will be an emerging growth company under the JOBS Act; | |

| ● | our financial performance; and | |

| ● | developments relating to our competitors or our industry. |

You should not place undue reliance on forward-looking statements, because they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed in the reports we filed with the Securities and Exchange Commission (the “SEC”). Actual events or results may vary significantly from those implied or projected by the forward-looking statements due to these risk factors. No forward-looking statement is a guarantee of future performance. You should read this Annual Report, the documents that we reference in this Annual Report and the documentation we have filed as exhibits thereto with the SEC, with the understanding that our actual future results and circumstances may be materially different from what we expect.

Unless the context otherwise requires, the terms “the Company,” “Shuttle Pharma,” “we,” “us,” and “our” in this Annual Report refer to Shuttle Pharmaceuticals Holdings, Inc.

| 3 |

PART I

Item 1. Business

We are a clinical stage pharmaceutical company leveraging our proprietary technology to develop novel therapies designed to cure cancers. Our goal is to extend the benefits of cancer treatments with surgery, radiation therapy, chemotherapy and immunotherapy. Radiation therapy (“RT”) is one of the most effective modalities for treating cancers. We are developing a pipeline of products designed to address the limitations of the current cancer therapies as well as to extend to the new applications of RT. We believe that our product candidates will enable us to deliver cancer treatments that are safer, more reliable and at a greater scale than that of the current standard of care.

Our product candidates include Ropidoxuridine, Extended Bio-availability Ropidoxuridine (IPdR/TPI), and a platform of HDAC inhibitors (SP-1-161, SP-2-225 and SP-1-303). In December 2023, we submitted an Investigational New Drug (“IND”) application with the U.S. Food and Drug Administration (“FDA”) to support the next phase of development of Ropidoxuridine. In January 2024, we received the ‘Safe to Proceed’ letter from the FDA for our IND application for the Phase II study of Ropidoxuridine (IPdR) as a radiation sensitizing agent during radiotherapy in patients with newly diagnosed IDH-wildtype glioblastoma with unmethylated MGMT promoter. Receipt of the letter allows us to commence the Phase II study of Ropidoxuridine (IPdR). We have applied for and received FDA approval of Orphan designation for Ropidoxuridine and RT for treating brain cancer (glioblastoma). We believe our management team’s expertise in radiation therapy, combined modality cancer treatment and immuno-oncology will help drive the development and, if approved, the commercialization of these potentially curative therapies for patients with aggressive cancers.

Radiation Oncology has gone through transformative technological innovation over the last several years to better define tumors, allow improved shaping of radiation delivery and support dose escalation with shorter courses of treatment. Furthermore, achieving higher dose distributions within tumor volumes has reached a practical plateau, since cancers are frequently integrated with or surrounded by more sensitive normal tissues and further dose escalation increases risks of tissue necrosis. To increase cancer cures at maximally tolerated radiation doses, pharmacological and biological modifications of cells are needed to sensitize cancers, protect normal tissues, and stimulate the immune system to react against antigens produced by irradiated, damaged cancer cells. Drugs that show sensitizing properties, or the ability to make cancer cells more sensitive to radiation, offer a solution to this problem. Currently, such drugs are chemotherapy agents used off-label, and many have inherent toxicities since they were designed for direct cancer treatments and not for sensitization.

We are developing our products with the goal of addressing the unmet need in cancer treatment for a commercially marketable radiation response modifier solution that leads to greater sensitivity of cancer cells to ionizing radiation therapy. The goal of our products is to increase the therapeutic index for patients receiving radiation and to decrease radiation-related toxicities in patients with solid tumors. Our products operate across three areas related to the treatment of cancer with RT:

| 1. | Sensitization of growing cancer cells, rendering them more susceptible to the effects of radiation therapy. | |

| 2. | Activation of the DNA damage response pathway to kill cancer cells and protect adjacent normal cells. | |

| 3. | Activation of the immune system to kill any remaining cells after RT. |

Our platform technology allows for the creation of an inventory of products for radiation sensitizing, immune modulation, and protection of healthy tissue.

| 4 |

Our Pipeline

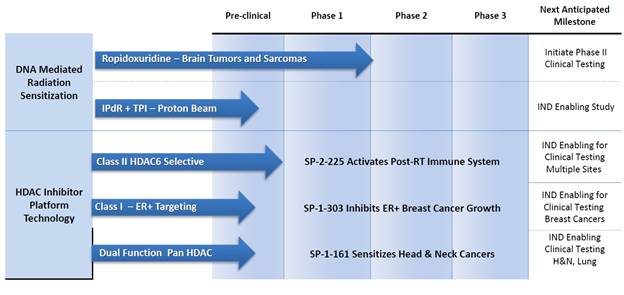

We are currently developing a pipeline of small molecule radiation sensitizers and immune response regulating drugs. Our most advanced product candidate is Ropidoxuridine, an orally available halogenated pyrimidine with strong cancer radiation sensitizing properties in preclinical studies. In addition, we have a pipeline of complimentary product candidates that we are developing to address a host of solid tumor cancer indications. Our pipeline is represented in the diagram below:

Timeline for clinical phase (Ropidoxuridine) and pre-clinical phase (HDAC inhibitors) pipeline.

Our lead product candidates include:

| ● | Ropidoxuridine (IPdR) is our lead candidate radiation sensitizer for use in combination with RT to treat brain tumors (glioblastoma) and sarcomas. Phase I clinical trial results supported by Shuttle Pharma and the NCI (CTEP) were reported in the medical journal, Clinical Cancer Research, in July 2019, by our SBIR subcontractor. Eighteen patients completed dose escalations to 1,800 mg/day for 30 days, establishing the maximum tolerated dose (MTD) of 1,200 mg/day in combination with RT. Four partial responses, nine stable disease and one progressive disease in target lesions were reported. Four patients did not have measurable disease and, as a result, were not evaluable. These Phase I trial results demonstrate oral bioavailability and an MTD of 1,200 mg per day for 28 days for use in combination with radiation for Phase II clinical trials that we propose to perform in brain tumors and in sarcomas. The brain tumor, glioblastoma multiforme (GB) is eligible for orphan disease designations. Shuttle Pharma has advanced drug manufacture and formulation and prepared a clinical protocol of a “Phase 2 Single-Arm Study of IPdR as a Radiation Sensitizing Agent During Radiotherapy in Patients with Newly Diagnosed IDH-Wildtype MGMT Unmethylated Glioblastoma Multiforme.” In December 2023, we submitted an IND application with the FDA to support the next phase of development of Ropidoxuridine. In January 2024, we received the ‘Safe to Proceed’ letter from the FDA for our IND application for the Phase II study of Ropidoxuridine (IPdR) as a radiation sensitizing agent during radiotherapy in patients with newly diagnosed IDH-wildtype glioblastoma with unmethylated MGMT promoter. Receipt of the letter allows us to commence the Phase II study of Ropidoxuridine (IPdR). |

| 5 |

| ● | Ropidoxuridine and Tipiracil (IPdR/TPI) is a new combination formulation demonstrating extended bioavailability after oral administration in an animal model system. The IPdR/TPI formulation will undergo preclinical development for use as a radiation sensitizer of rectal cancers after the Phase II brain tumor clinical trial has been initiated. | |

| ● | SP-1-161 is Shuttle Pharma’s pre-clinical candidate lead HDAC inhibitor, radiation sensitizing candidate product. This pan HDAC inhibitor initiates the mutated in ataxia-telangiectasia (ATM) response pathway. Using rational drug design, we discovered dual function molecules, HDAC inhibitors and ATM activators capable of sensitizing cancer cells to radiation and protecting normal cells. The drug candidate may serve as a direct chemotherapeutic agent or as radiation sensitizers for treating cancers. | |

| ● | SP-2-225 is Shuttle Pharma’s pre-clinical class IIb selective HDAC inhibitor that selectively affects histone deacetylase HDAC6. SP-2-225 has effects on the regulation of the immune system. The interactions of RT with the immune response for cancer treatment are of great current interest, offering insight into potential mechanisms for primary site and metastatic cancer treatment. For this reason, Shuttle Pharma has selected SP-2-225 as the candidate lead HDAC inhibitor for preclinical development. We have contracted with investigators at Georgetown University to perform preclinical studies of immune activation after radiation therapy in an animal tumor model. Requests for proposals for advancing drug manufacture and IND-enabling studies have been submitted and are under review to enable drug development to a Phase I clinical trial in 2024. With the introduction of check-point inhibitors, CAR-T therapies and personalized medicine in cancer, regulation of the immune response following RT is of significant clinical and commercial interest. | |

| ● | SP-1-303 is Shuttle Pharma’s pre-clinical selective Class I HDAC inhibitor that preferentially affects histone deacetylases HDAC1 and HDAC3 members of the class I HDAC family of enzymes. SP-1-303 data show direct cellular toxicity in ER positive breast cancer cells. Furthermore, SP-1-303 increases PD-L1 expression. A manuscript reporting completed preclinical in vitro studies is in preparation. We plan to seek collaborations to complete SP-1-303 pre-clinical development in 2024. |

Our Approach

We believe that we have established a leadership position in radiation sensitizer discovery and development. Over approximately seven years of research, we have identified two clinical phase product candidates and discovered new pre-clinical molecules using our proprietary platform technologies to increase the therapeutic index for patients receiving radiation for treatment of solid tumors. Our development strategy has four key pillars: (1) to improve the efficacy of RT by demonstrating improved disease-free survival rates in patients who undergo radiation therapy, (2) reduce the amount of radiation needed for a favorable tumor response, thereby limiting the potential for radiation related toxicities to healthy cells, (3) decrease the extent of surgery needed to remove cancers and improve quality of life, and (4) leverage our next generation technologies to create drugs that regulate the immune response assisting immune checkpoint and CAR-T therapies and other personalized medicines targeting cancers.

We propose to perform Phase I and Phase II clinical trials to advance our clinical product candidates. In addition, candidate HDAC inhibitor molecules will be tested in animal models, and IND-enabling studies will be performed to prepare for Phase I clinical trials.

| 6 |

To date, we have been awarded three SBIR contracts from the NIH to:

| ● | Develop IPdR as a radiation sensitizer for the treatment of gastro-intestinal cancers, in combination with radiation therapy. This funding provided partial support for the Phase I clinical trial of Ropidoxuridine and RT. | |

| ● | Develop prostate cancer cell cultures from African-American men, with donor matched normal prostate cells, establishing 50 pairs for accelerating research to reduce prostate cancer health disparities in African-American men. This project was funded under “Moonshot” designation and Shuttle Pharma is eligible to submit an application for additional SBIR (Phase IIb) funding to establish the infrastructure required to expand and distribute cells for research purposes. Cells from African-American patients are distributed to investigators who are conducting health disparities research. | |

| ● | Develop predictive biomarkers for determining outcomes for prostate cancer patients following treatment with SBRT. This SBIR-funded project was completed on March 15, 2022 and Shuttle Pharma is eligible to apply for additional funding through the SBIR (Phase IIb) mechanism The Phase IIb SBIR grant mechanism is designed to de-risk clinical validation to develop the predictive biomarkers to commercialization. Shuttle Pharma has licensed the intellectual property for the prostate cancer predictive biomarker test from Georgetown University and will seek additional investment from the public market to advance clinical development through its Shuttle Diagnostics entity. |

All three SBIR funded projects have been completed. The Company is eligible to apply for SBIR Phase IIb funding to “bridge” the funding gap should Shuttle Pharma elect to advance the “Moonshot” health disparities or the predictive biomarker project. The NIH SBIR program is designed to encourage small businesses to engage in Federal Research/Research and Development (“R/R&D”) that has the potential for commercialization.

Our Strategy

Our goal is to maintain and build upon our leadership position in radiation sensitization. We plan to develop Ropidoxuridine and the HDAC6 inhibitor (SP-2-225) and, if approved by the FDA, commercialize our product candidates for the treatment of cancers. While this process may require years to complete, we believe achieving this goal could result in new radiation sensitizer and immunotherapy products. Key elements of our strategy include:

| ● | Capitalize on Ropidoxuridine as an orally available, small molecule radiation sensitizer. To date, there is one drug (Cetuximab, a monoclonal antibody) approved by the FDA specifically as a radiation sensitizer. If we are successful in developing Ropidoxuridine and obtaining FDA approval, a small molecule sensitizer would then be enabled for clinical applications for radiation sensitization indications. | |

| ● | Expand our leadership position within radiation sensitizers. In addition to our traditional radiation sensitizers, we plan to advance our near-term pipeline to include radiation sensitizers for proton therapy. Proton Therapy is growing worldwide as a form of radiation therapy due to its unique beam shaping characteristics. As a result, this new technology offers a major opportunity for Shuttle Pharma to strive to develop an innovative and well-tolerated drug for proton therapy sensitization. | |

| ● | Execute a disciplined business development strategy to strengthen our portfolio of product candidates. We have built our current product pipeline through in-house discovery, development, partnerships with leading academic institutions and through in-licensing. We will continue to evaluate new in-licensing opportunities and collaboration agreements with leading academic institutions and other biotechnology companies around programs that seek to address areas of high unmet need and for which we believe there is a high probability of clinical success, including programs beyond our target franchise areas and current technology footprint. |

| ● | Invest in our HDAC platform technology and maximize its utility across cancer therapies. We are initially applying the platform to develop drugs for cancer radiation sensitization, normal tissue radiation protection and post radiation immune stimulation. Based on the data we have obtained thus far, these drugs are immune regulatory. We intend to invest to develop other properties of our platform technology, as well. | |

| ● | Enter into collaborations to realize the full potential of our platform. The breadth of our HDAC technology platform enables other therapeutic applications, including radiation sensitization and immune therapy. We intend to seek collaborations centered on our platform to maximize applications for cancer treatment. |

| 7 |

Radiation Therapy

Radiation Oncologists use Radiation Therapy (RT) to treat cancers that cannot be completely removed by surgery but have not yet spread to distant sites within the body. RT has been a mainstay for the treatment of cancer malignancies for more than half a century. The combination treatment of radiation therapy and chemotherapy has involved the use of cytotoxic drugs, targeted biologic agents and targeted external beam radiation to increase the destruction of tumor cells and cure or delay cancer progression. The low number of drugs and biologic agents under investigation as radiation sensitizing agents highlights an unmet need for new approaches and agents that provide greater effectiveness, increased quality and better tolerability for patients.

Currently, “chemo-radiation” treatments are established in cancers of the head and neck, esophagus, lung, stomach, breast, brain, pancreas, rectum and uterine cervix. The ideal radiation sensitizer would reach the tumor in adequate concentrations and act selectively in the tumor, as compared to surrounding normal tissues. It would have predictable pharmacokinetics for timing with radiation therapy and could be administered with every radiation treatment approach. The ideal radiation sensitizer would have minimal toxicity or manageable enhancement of radiation toxicity.

The U.S. market for radiation sensitizing agents is experiencing dynamic growth through development of new radiation technology, the introduction of new agents, growth in the number of diagnosed patients in a variety of cancers and changes in treatment patterns. New agents have been introduced, including bevacizumab (Avastin®, Roche), panitumumab (Vectibix®, Amgen), temozolomide (Temodar®, Merck) and cetuximab (Erbitux®, Eli Lilly/Imclone), with potential as radiation sensitizing agents (though all but cetuximab are used off label); and all are recommended by the NCCN® (National Comprehensive Cancer Network) in clinical practice guidelines for use in combination with established therapies such as FOLFOX (leucovorin, 5-FU, oxaliplatin), CapeOX (capecitabine, oxaliplatin) and FOLFIRI (leucovorin, 5-FU, irinotecan).

The growth in the number of patients with cancers is being driven by an aging population and improved diagnostic tools. According to the National Cancer Institute (NCI), more than half (~50 - 60%) of all cancer patients undergo some type of radiotherapy during the course of their treatment. Confirming the patient estimate from the NCI, the American Society for Therapeutic Radiology and Oncology (ASTRO) factsheet states approximately 67% of approximately 1.25 million cancer patients are treated with radiation therapy annually, either one or more times. In addition, in a study published by the Journal of Clinical Oncology in 2016, it is estimated that the number of cancer patients needing radiation therapy will increase by 22% in the next 10 years. (See “The Future of Radiation Oncology in the United States From 2010 to 2020: Will Supply Keep Pace With Demand?” Benjamin D. Smith, Bruce G. Haffty, Lynn D. Wilson, Grace L. Smith, Akshar N. Patel, and Thomas A. Buchholz Journal of Clinical Oncology 2010 28:35, 5160-5165).

The American Society of Clinical Oncology (ASCO) estimates more than 80% of cancers in the U.S. occur in people in the age group of 50 and above with over 60% of cancers occurring in those 65 and over. (See, 2018 Clinical Cancer Advances Report, American College of Clinical Oncology, 2018). For example, according to the American Cancer Society (ACS), more than 90% of colorectal cancer patients are individuals aged 50 years and older, with approximately 40% of all cases occurring in patients aged 75 years and over. The Colon Cancer Alliance estimates that 90% of new cases and 95% of deaths from colorectal cancers occur in people aged 50 or older. Also, the U.S. Census estimates that the age group of 65-84 will grow by 23% within the next five years, indicating a likely increase in the overall number of cancer patients in the U.S.

| 8 |

The table below details the number of cancers estimated in the United States in 2024:

Estimated New Cancer Cases in the U.S.

| Male | Female | |||||||||||||||||

| Prostate | 299,010 | 27 | % | Breast | 310,720 | 31 | % | |||||||||||

| Lung & bronchus | 116,310 | 12 | % | Lung & bronchus | 118,270 | 13 | % | |||||||||||

| Colon & rectum | 81,540 | 8 | % | Colon & rectum | 71,270 | 8 | % | |||||||||||

| Urinary bladder | 118,330 | 6 | % | Uterine corpus | 67,880 | 7 | % | |||||||||||

| Melanoma of the skin | 59,170 | 6 | % | Melanoma of the skin | 41,470 | 5 | % | |||||||||||

| Kidney & renal pelvis | 52,380 | 5 | % | Thyroid | 31,520 | 3 | % | |||||||||||

| Non-Hodgkin lymphoma | 44,590 | 4 | % | Non-Hodgkin lymphoma | 36,030 | 4 | % | |||||||||||

| Oral cavity & pharynx | 41,510 | 4 | % | Kidney & renal pelvis | 29,230 | 3 | % | |||||||||||

| Leukemia | 36,450 | 4 | % | Pancreas | 31,910 | 3 | % | |||||||||||

| Pancreas | 34,530 | 3 | % | Leukemia | 26,320 | 3 | % | |||||||||||

| All sites | 983,160 | All sites | 934,870 | |||||||||||||||

ACS Facts & Figures, 2024

The U.S. estimated incidence, deaths and five-year survival rate of cancer patients responsive to radiation therapy is significant (ACS Facts & Figures, 2024). The top cancers responsive to radiation are shown, based on the number of newly diagnosed patients. The incidence rates for some cancers are increasing by approximately 1-2% per year in the U.S. The number of newly diagnosed patients is significant and growing due to the aging of the population and improved diagnostic techniques.

The cancers listed above illustrate the opportunity presented for radiation sensitizers. Of note is the low five-year survival of pancreas, brain, lung and esophagus cancers—all are candidates for Shuttle Pharma’s pipeline of radiation sensitizing compounds. Cancers with low survival rates are of interest since they show a high unmet need for new therapeutics and an opportunity for Shuttle Pharma to gain significant uptake of their pipeline compounds.

Factors that present challenges and may restrict growth in the radiation sensitizer market include the safety and tolerability of many of the newer agents with radiation sensitizing properties; a regulatory environment that engenders greater levels of scrutiny of clinical practice issues; the high cost of newer agents; and the changing (and more restrictive) reimbursement environment in radiation oncology through CMS (Center for Medicare and Medicaid Services) and private payors. These factors may negatively impact the potential for growth in the U.S. market.

Many of the drugs used “off-label” as radiation sensitizers currently require close scrutiny of their potential for side effects that can affect the safety and tolerability of their use with patients. All of the current agents carry significant potential for side effects that can affect patients’ therapies and quality of life. Radiation sensitizing agents can cause both acute and chronic side effects in patients. Side effects can vary from person to person depending on age, sex, type of cancer, dose given per day, total dose given, and the patient’s general medical condition. Some common side effects of currently used radiation sensitizers include leukopenia, skin damage, hair loss, fatigue, bladder problems, nausea, fibrosis, memory loss, infertility, and enhanced risk of developing a second cancer, which may arise as a result of the patient’s weakened immune system due to cytotoxic drugs used in treatment or when newer biologic agents cause the over-production of specific cytokines or proteins, which can lead to developing secondary cancers.

Over the past five years, the FDA has taken an increasingly conservative approach to the approval of new agents for oncology treatment. There is greater scrutiny of results from clinical trials regarding progression free survival, overall survival, and safety and tolerability of new agents. Restrictions such as black box warnings and REMS (Risk Evaluation and Migration Strategies) are being applied to more new products over the past five years compared to the previous five years. These restrictions require physicians to be more careful in evaluating the use of newer agents and newer diagnostic tools to select the most appropriate patients for newer approved agents.

Many of the new agents are molecularly targeted therapies that are biologic in their development and manufacturing. The cost of the newer agents can be significant. For example, the cost for Avastin for one treatment course as a radiation sensitizer is estimated at $9,000-12,000 according to one Key Opinion Leader in the U.S. (Carl Schmidt, Consultant, Shuttle Pharmaceuticals Holdings, Inc., Business Plan 2018). Recently, a CAR-T gene therapy from Novartis was launched with a yearly cost of $475,000. Further, as many private payors scrutinize the cost and appropriate use of newer drugs, they require physicians to provide justification through prior authorization requests, use of step therapy and guidelines that delay treatment, increase administrative costs and limit the therapeutic choices for physicians and hospitals.

| 9 |

Public payors for radiation oncology therapies such as CMS have instituted reimbursement reductions that potentially affect the overall cost of therapy and can limit the acceptance of newer agents. With CMS announced reductions in reimbursement for radiation oncology, there is increased pressure to find a more potent radiation sensitizer agent with reduced side effects, and greater cost-effectiveness.

Escalating healthcare spending is adding pressure on government and commercial payors to contain drug costs. While the oncology space is arguably not as tightly managed by payors as other therapeutic areas, utilization management of costly cancer therapeutics has become an increasing priority for U.S. payors, especially with the advent of biologics. Payors (and market access agencies in the EU) will most often restrict high-cost drugs, drugs with limited or no survival benefits, and drugs deemed to be at high risk for widespread off-label use.

Beyond efforts at cost containment by insurers (which often require patients to first be prescribed lower cost drugs to determine effectiveness prior to allowing for reimbursements for more expensive (or less cost effective) drugs), payors are also looking toward implementing clinical pathways as a way to maintain or improve health outcomes while lowering costs. Clinical pathways are designed to address the limitations of prior authorization and of reduced fee schedules, offering more durable cost containment to payors. These pathways may lead to cost savings by encouraging the use of generics, streamlining treatment choices, and reducing side effects while maintaining outcomes.

Engineered Radiation Sensitizers

The market for radiation sensitizers in selected cancer types is defined by the need to improve local-regional tumor control. Treatment regimens have been developed to address patient needs for tumor control and quality of life. Since the initial applications of Ropidoxuridine and selective HDAC inhibitors are as adjuncts to the standard of care for the treatment of radiation responsive cancers, the unmet needs of the market lie in the potential for the following:

| ● | Improvement in efficacy of radiation treatments as determined by overall survival, progression free survival and response rates in comparison to currently used “off-label” sensitizer drugs. | |

| ● | Reduction in radiation doses needed to affect a positive clinical response for the patient. | |

| ● | Reduction in the surgical extent that is needed to remove residual cancer. | |

| ● | Improvement in quality-of-life outcomes. |

Various sources have estimated that more than 800,000 patients in the U.S. are treated with radiation therapy for their cancers. According to the American Cancer Society, about 50% are treated for curative purposes and the balance for palliative care. The market opportunity for radiation sensitizers lies with the 400,000 patients treated for curative purposes. The number of patients being treated with RT is expected to grow by more than 22% over the next five years. Based on a rough estimate of a course of radiation sensitizing brand drug therapy (off label at this time) of $12,000 per patient—the market size would exceed $4.0 billion. This would represent about 4% of the annual cost of cancer care in the U.S.

In the past two decades, developments in the field of oncology have resulted in an increase in the number of clinical trials of marketed products that exhibit radiation sensitizing properties. The following are a few examples of recently approved products that exhibit radiation sensitizing properties: topotecan (Hycamtin®) was approved for ovarian and small-cell lung cancer and also in cervical cancer when used in combination with cisplatin. Irinotecan (Camptosar®) is used for metastatic colorectal carcinoma, trastuzumab (Hercepetin®) for breast cancer, and gefitinib (Iressa®) for locally advanced non-small-cell lung cancer. However, the claims on radiation sensitization are anecdotal in the scientific literature.

| 10 |

In addition, clinical trials are in progress to develop novel molecules (such as poly (ADP-ribose) polymerase (PARP) inhibitors (such as Lynparza (olaparib)), histone deacetylase (HDAC) inhibitors (such Zolinza® (vorinostat) and heat-shock protein 90 (hsp90) inhibitors with potential to increase the therapeutic use of compounds with radiation sensitizing properties for other cancers. Several drugs with radiation sensitizing properties are currently in Phase III clinical trials, such as nimorazole (for head and neck cancer), motexafin gadolinium (for brain metastases), and cisplatin (for cervical cancer); though none are likely to apply for a radiosensitizing claim with the FDA since the radiosensitizing element in their clinical trials are not primary endpoints. While additional drugs with radiation sensitizing properties are expected to be launched in the future, thereby driving the radiation sensitizers market further, to date, there is no indication that any drug in development is expected to be approved specifically as a radiation sensitizer.

The competitive environment for “off-label” radiation sensitizers for solid tumor cancers is anticipated to become predominantly generic. Avastin, Erbitux, Camptosar and Xeloda have or will lose patent protection in the next three years. Newer products under investigation or approved, such as Vectibix® (panitumumab) from Amgen will be promoted as having radiation sensitizing properties, along with indications for treatment for specific cancers. The high cost of these new therapies coupled with limited efficacy compared to current standard of care will be constrained by both public and private payors. Other new agents are in development but will face similar challenges.

We anticipate that new products launching into the cancer market with anecdotal claims for use as radiation sensitizers with improved effectiveness, quality and tolerability will initially be limited in their growth until they have been added to established clinical pathways and guidelines. If their effectiveness, quality and tolerability are demonstrated clinically, as determined by the FDA, it is anticipated the National Comprehensive Cancer Network (NCCN), the leading authority in oncology drug evaluation for treatment guidelines, would issue a recommendation and addition to standard of care within approximately six to twelve months after launch. An NCCN recommendation would positively impact the growth potential for a new product entering the market. Also, payors, both public and private, would add the new product to their approved drug lists and provide reimbursement giving providers incentive to use the product as neoadjuvant and adjuvant therapy to standard of care.

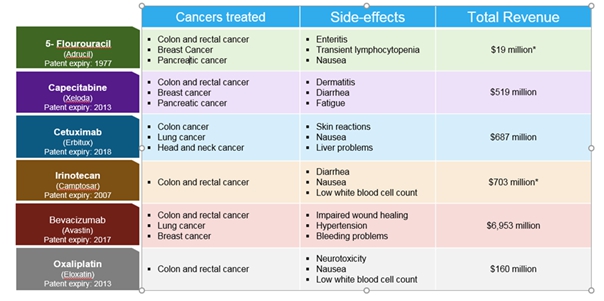

As with many cancer therapies, side effects can often have a distinct impact on quality of life and influence the potential for market growth. Patients increasingly have a stronger voice in the decision-making process for the appropriate therapies and costs to treat their cancers. As payors are increasingly placing more of the financial burden of the cost of therapy directly on patients, patients are voicing their opinions to their physicians and payors which have a direct effect on which products are selected. Many of the current therapies have significant side effects:

Private insurers are expected to have more restrictive formularies and medical benefits in which patients will be expected to carry more of the burden of the cost of drugs. Also, it is anticipated that increased application of third party developed treatment guidelines, such as those from the NCCN (National Comprehensive Cancer Network), are expected to be used by private payors to limit the access to products for specific conditions through prior authorizations and implementation of step therapy or increased out of pocket cost approaches. As many of the current drugs used as radiation sensitizers are expensive and not approved for use as radiation sensitizers (thus, such treatment is “off label”), and as many of the products in clinical trials are expected to be at the current or higher price levels, new products that may be specifically approved for an indication as the only approved product as a radiation sensitizer will have increased consideration for reimbursement.

CMS is increasingly moving many patients to private insurance through Medicare Advantage and ACOs. Medicare Advantage plans are capitation HMO and PPO plans offered through private insurers to Medicare patients. ACOs are being developed to increase quality of care for their patients. Most of the new ACOs are initially positioned for Medicare patients with over 400 approved by CMS. Several studies from the Center for Health Strategies, 2017, Journal of American Medical Association, 2018 and the Brookings Institute, 2015 estimated that almost 1000 ACOs for Medicare and non-Medicare patient populations would be approved by CMS or developed by a variety of healthcare entities to begin operating under the ACA in 2017. We expect the growth in ACOs to continue, regardless of any changes that may be made to the ACA going forward. In early 2017, Health Affairs, a magazine tracking ACOs, estimated that over 22 million patients are enrolled in Medicare and private ACOs. To address the quality of care measures designated by CMS and to gain additional incentives, use of clinical pathways or treatment guidelines is anticipated to be increasingly instituted to manage patient care. The impact on the uptake of new products in this environment can be profound if the new product is first in class and is included in national guidelines from organizations such as the NCCN and/or approval by the regional CMS contracting groups.

| 11 |

ROPIDOXURIDINE

The halogenated thymidine (TdR) analogs, bromodeoxyuridine (BUdR) and iododeoxyuridine (IUdR), are a class of pyrimidine analogs that have been recognized as potent radiosensitizing agents since the early 1960s. (See Kinsella TJ. An Approach to the Radiosensitization of Human Tumors. Cancer J Sci Am. Jul-Aug 1996:2(4); 184-193). Their cellular uptake and metabolism are dependent on the TdR salvage pathway where they are initially phosphorylated to the monophosphate derivative by the rate-limiting enzyme, thymidine kinase (TK). (See Shewach DS, Lawrence TS. Antimetabolite radiosensitizers. J Clin Oncol, Sep 10 2007; 25(26):4043-4050). After sequential phosphorylation to triphosphates, they are then used in DNA replication, in competition with deoxythymidine triphosphate (dTTP), by DNA polymerase. DNA incorporation is a prerequisite for radiosensitization of human tumors by the halogenated TdR analogs, and the extent of radiosensitization correlates directly with the percentage TdR replacement in DNA. (See Lawrence TS, Davis MA, Maybaum J, Stetson PL, Ensminger WD. The Dependence of Halogenated Pyrimidine Incorporation and Radiosensitization on the Duration of Drug Exposure. International Journal of radiation oncology, biology, physics. Jun 1990; 18(6);1393-1398). The molecular mechanisms of radiosensitization are most likely the result of increased susceptibility of TdR analog-substituted DNA to the generation of highly reactive uracil free radicals by ionizing radiation (IR), which may also damage unsubstituted complementary-strand DNA. Repair of IR damage may also be reduced by pre-IR exposure to these analogs.

The rationale for using Ropidoxuridine as a radiation sensitizer is based on prior clinical studies with the active metabolite IUdR; identified in NIH laboratories as a potent radiation sensitizer. Ropidoxuridine is an orally available prodrug of IUdR. In the body, Ropidoxuridine is metabolized in the liver into IUdR. IUdR is incorporated into the DNA of actively growing cells and when cells are exposed to ionizing radiation, DNA strand breaks are generated, resulting in more cell death and radiation sensitization. (See Gurkan E, Schupp JE, Aziz MA, Kinsella TJ, Loparo KA. Probabilistic modeling of DNA mismatch repair effects on cell cycle dynamics and iododeoxyuridine-DNA incorporation. Cancer Res. Nov 15 2007; 67(22):10993-11000).

Most of the clinical efficacy data were obtained from NIH supported studies performed with IUdR, the active metabolite of Ropidoxuridine. However, IUdR requires constant infusion over six weeks of therapy which creates a significant compliance issue for patients. Ropidoxuridine can be given as a capsule for oral administration, resulting in greater ease of medication delivery and potentially improved compliance and fewer complications.

Over the last 20 years, there has been renewed interest in these halogenated TdR analogs as experimental radiation sensitizers in selected cancer patient groups. These analogs are rapidly metabolized in both rodents and humans, principally with cleavage of deoxyribose and subsequent dehalogenation by hepatic and extrahepatic metabolism, when given as a bolus infusion with a plasma half-life of <5 min. Consequently, prolonged continuous or repeated intermittent drug infusions over several weeks before and during irradiation are necessary, based on in vivo human tumor kinetics, to maximize the proportion of tumor cells that incorporate these analogs into DNA during the S phase of the cell cycle. (See Fowler JF, Kinsella TJ. The Limiting Radiosensitization of Tumors by S-phase Sensitizers. Br J Cancer. 1996;74 (Suppl)(27):294-296). Phase I and Phase II trials using prolonged continuous or repeated intermittent intravenous infusions of BUdR or IUdR before and during radiation therapy (RT) have focused principally on patients with high-grade brain tumors. These clinically radiation resistant tumors can have a rapid proliferation rate (potential tumor doubling times of 5–15 days) and are surrounded by non-proliferating normal brain tissues that show little to no DNA incorporation of the TdR analogs. As such, high-grade brain tumors are ideal targets for this approach to radiation sensitization. In Phase I/Phase II clinical trials, prolonged survival outcomes were observed compared to RT alone in patients with anaplastic astrocytomas and in patients with glioblastoma multiforme IUdR continuous IV infusion (1000 mg/m2/ day/ 14 days), Total 39 patients (F. Sullivan, et al. Int J Radiat Oncol Biol Phys. 1994; 30(3):583-90.) A therapeutic gain in clinical radiation sensitization using these halogenated TdR analogs was proposed for other types of poorly responsive (radiation resistant) cancers, including locally advanced cervical cancer, head and neck cancers, unresectable hepatic metastases from colorectal cancers, and locally advanced sarcomas, based on the results of other Phase I/Phase II clinical trials.

Target Indication: Glioblastoma, Sarcomas and Rectal Cancers

After completion of the Phase I clinical trial of Ropidoxuridine and RT in advanced GI cancers, we proposed to perform Phase II efficacy clinical trials in brain tumors (glioblastoma), soft tissue sarcomas, and rectal cancers. Glioblastoma multiforme is a deadly malignancy of the brain with no known cure. Radiation therapy provides delay of disease progression and is standard of care following surgical resection or biopsy. Radiation therapy is combined with Temodar, a drug that has shown activity (~ four months survival benefit) in treating brain tumors. Preliminary data using radiation therapy in combination with IUdR resulted in a delay of disease progression of up to six months. We propose to test IPdR in combination with radiation therapy in the Phase II clinical trial. Similarly, delay in disease progression has been observed following treatment of sarcomas by the combination of IUdR and RT. Based on the Phase I data of our clinical trial we know that therapeutic levels of IUdR are reached by administering the orally available prodrug, IPdR.

| 12 |

Clinical Data

The Phase I results of the clinical trial supported by an SBIR contract to Shuttle Pharma and a sub-contract to the Brown University Oncology Group (BrUOG) at the LifeSpan/Rhode Island Hospital were reported by the subcontractor at the 30th EORTC-NCI-AACR Symposium in November 2018 and in the medical journal, Clinical Cancer Research, in 2019. Eighteen patients completed dose escalation to 1800 mg/day for 30 days, establishing the maximum tolerated dose (MTD) of 1,200 mg/day in combination with RT. Therapeutic blood levels of IUdR were achieved. Four patients were scored as partial responses, nine patients had stable disease and one patient progressed in the target lesions. These data support advancing IPdR and RT to clinical trials for the FDA to determine efficacy.

Development Plan

A key to driving the Ropidoxuridine product forward is the development of a clinical plan with aggressive timelines and support within the radiation oncology community to participate in clinical trials with the appropriate patients to ensure a comprehensive NDA dossier for each product. Initially, the plan is focused on the Phase I and Phase II clinical trials. Upon completion of Phase II studies, we will determine whether to extend the Phase II study to a randomized Phase II, or to perform a randomized Phase III clinical trial. Such determination will be based on results of the initial clinical trials and the end of a Phase II meeting with the FDA. Shuttle Pharmaceuticals requested and received FDA orphan drug status for Ropidoxuridine as a clinical radiation sensitizer for treatment of glioblastoma and pre-operative treatment of soft tissue sarcomas. As a result, the application for “orphan” designation for Ropidoxuridine with RT for glioblastoma has been approved. The application for sarcomas, however, was not approved and will require addressing certain FDA comments and resubmission. The IPdR/TPI formulation clinical plan will focus on resectable stage II and III rectal cancer patients.

Our clinical plan for Ropidoxuridine development as implemented to date, includes:

| ● | GMP manufacture and formulation of 24 kg of Ropidoxuridine for use in clinical trials has been completed. | |

| ● | The IND for a Phase II clinical trial of Ropidoxuridine and RT in glioblastoma has been approved for the study to proceed. | |

| ● | The contract research organizations (CRO), Theradex Oncology has been engaged to assist in the performance the Phase II clinical trial. | |

| ● | Completion of the Phase II clinical trial in glioblastomas to determine appropriate dosing, effectiveness and tolerability of the treatment. |

The data obtained from the NIH/NCI SBIR funded Phase I clinical trial supported efforts to raise capital to enable performing the Phase II clinical trials of Ropidoxuridine. We aim to conduct and complete the Phase II clinical trial so that we may present data to the FDA for its determination of efficacy. We believe this will support our efforts to raise the additional required capital to complete Phase II and to fund the Phase III clinical trials and seek FDA approval of an NDA with “orphan” designation.

The clinical plan for the IPdR/TPI formulation will focus on resectable Stage II and Stage III rectal cancer patients and on recurrent glioblastoma treated with proton therapy. Nonetheless, we cannot guarantee the successful completion of any of these trials. Our inability to meet any of the aforementioned milestones in the Phase II or Phase III clinical trials will cause us to be unable to proceed with our present efforts and will likely cause us to be unable to raise additional funds.

| 13 |

Our HDAC Small Molecule Delivery Platform

General

Since the founding of Shuttle Pharma, our discovery research and development efforts have been focused on our small molecule technology delivery platform which uses HDAC inhibitors, designed to target cancer cells, while protecting healthy tissue.

HDACs are a class of enzymes that regulate gene expression through chemical modification of histones and non-histone proteins. Increased HDAC activity leads to a more condensed chromatin (which is a protein complex consisting of DNA and other proteins), decreased gene expression and loss of key gene products, including tumor suppressor gene function. Inhibition of HDAC activity leads to a more open chromatin and increased expression of the key gene products. This chromatin modification underlies the epigenetic cellular regulatory system and is an area of intense investigation.

Our research and development efforts to date have focused on the discovery of novel, dual functional molecules for potential use in cancer treatment as radiation sensitizers of cancers, protectors of normal tissues, and activators of the immune responses to antigens expressed by irradiated cancer cells. To date, we have produced three candidate molecules:

| ● | SP-1-161, a candidate lead of compounds demonstrating activation of the “ATM” gene product (mutated in Ataxia-Telangiectasia). Ataxia-Telangiectasia is a human genetic disease characterized by neurological, immunological and radiobiological clinical features. | |

| ● | SP-2-225, a candidate lead of compounds demonstrating Class II (HDAC6) selective inhibition. HDAC6 is a molecule integral to the presentation of antigens by macrophages to T-lymphocytes. | |

| ● | SP-1-303 is a candidate Class I HDAC inhibitor with preferential efficacy against ER positive cancers. |

SP-1-161 - A Dual Functional Agent

SP-1-161 is an HDAC inhibitor of the hydroxamate chemical class of compounds and an ATM activator of the indole chemical class. HDACs modify histones and non-histone proteins, which are key components of the chromatin structure, gene expression regulation, and cell growth. HDAC inhibitors inhibit cell proliferation, angiogenesis and immunity. Eighteen human HDACs have been identified, subdivided into four classes based on sequence and functional homology. In cancer cells, HDAC activity silences tumor suppressor genes important for cell growth regulation and to chromosomal instability. Abnormal HDAC activity is also associated with tumor cell growth, invasion, metastasis and resistance to therapy. Therefore, inhibitors of HDACs have emerged as anti-cancer agents for cancer therapy. Vorinostat and romidepsin have been approved by the FDA for treatment of patients with relapsed or refractory T-cell lymphomas. In addition, panobinostat received FDA approval for treatment of recurrent multiple myeloma in combination with bortezomib and dexamethasone.

In preclinical studies, SP-1-161 inhibited the activity of pan-HDACs and activated the ATM gene product. ATM is a critical protein for the activation of the cell stress response for cellular recovery from radiation exposure in normal cells, but not in cancer cells. ATM activates the P53 protein, referred to as the “guardian of the genome,” and serves as a tumor suppressor critical for normal cell function and activation of programmed cell death in cancer cells.

In preclinical studies, SP-1-161 protected normal breast epithelial cells (184A1) following exposure to ionizing radiation while increasing sensitivity of breast cancer cells (MCF7). SP-1-161 provides this dual function in a single molecule and this molecule is differentiated from other HDAC inhibitors by treatment of cancers while protecting normal cells. (See Grindrod S, Brown M, Jung M. “Development of dual Function Small Molecules as Therapeutic Agents for Cancer Research,” Poster presentation #A178, American Association of Cancer Research Oct 2017).

| 14 |

SP-2-225

SP-2-225 is a selective HDAC inhibitor that affects histone deacetylase (HDAC6) and is a member of the class IIb HDAC family. Class II HDACs play important roles in cancer motility, invasion, neurological diseases, and immune checkpoint. HDAC6 inhibition has been most extensively studied for its role in the treatment of hematological cancers. HDAC6 is unique among HDAC enzymes in having two active catalytic domains and a unique physiological function. In addition to the modification of histones, HDAC6 targets specific substrates including α-tubulin and HSP90, and are involved in protein trafficking and degradation, cell shape and migration. Selective HDAC6 inhibitors are an emerging class of pharmaceuticals due to the involvement of HDAC6 in pathways related to neurodegenerative diseases, cancer and immunology. Specifically, its potential to affect regulation of the immune system and enhance the immune response in cancer is of great interest. With the introduction of check-point inhibitors, CAR-T therapies and personalized medicine in cancer, regulation of the immune response to this therapy is of significant clinical and commercial interest. (See Noonepalle SKR, Grindrod S, Aghdam N, Li X, Gracia-Hernandez M, Zevallos-Delgado C, Jung M, Villagra A, Dritschilo A. Radiotherapy-induced Immune Response Enhanced by Selective HDAC6 Inhibition. Mol Cancer Ther. 2023 Dec 1;22(12):1376-1389. doi: 10.1158/1535-7163.)

Selective inhibition of HCAC6 reduces dose limiting side effects associated with non-selective HDAC inhibitors. Selective HDAC6 inhibitors may be combined with other cytotoxic agents. Shuttle’s discovery of selective HDAC inhibitors has yielded several HDAC6 selective candidate molecules including SP-2-225. HDAC6 inhibitors are under investigation for roles in the treatment of diseases such as multiple myeloma.

SP-1-303 - Target Indication: Breast Cancer

Histone deacetylase inhibitors sensitize cancers to the effects of radiation, protect normal tissues from radiation injury and activate the immune system. SP-1-303 is a selective Class I HDAC inhibitor that inhibits HDAC1, 3 and 6 and has direct cellular toxicity in ER positive breast cancer cells. Furthermore, SP-1-303 increases the PD-L1 expression level in a time-dependent manner, support combination of SP-1-303 with an immune checkpoint blocker to enhance the therapeutic benefits. We are currently conducting preclinical efficacy studies of these molecules.

Development Plan

The HDAC inhibitor platform of candidate molecules will require pre-clinical evaluation, completion of IND-enabling studies and the lead drug candidates will be tested in Phase I clinical trials for pharmacokinetics and MTD determination. We have three lead candidates for potential development for the treatment of solid tumors, including breast cancer, lung cancer and multiple myeloma.

The results of Phase I and Phase II clinical trials will determine further drug development and Shuttle will seek to establish collaborative partnerships with other pharmaceutical companies to complete pre-clinical and clinical development, drug manufacturing and marketing of our product candidates. In the event we are unsuccessful in completing our clinical trials at any stage, or in the event we obtain negative results, we will likely be unable to raise additional funding related to our HDAC studies or will have to change direction of our research efforts regarding the HDAC inhibitor platform of candidate molecules.

Our Manufacturing Strategy

We have no manufacturing facilities that are owned or operated by us. We have performed laboratory scale synthesis and testing in our research laboratories in Gaithersburg, Maryland. GMP synthesis of API, drug formulation and human dosage preparation will be performed under contracts with third-party manufacturers.

| 15 |

Strategic Agreements

We have developed important strategic agreements with academic institutions for access to resources such as intellectual property, core facilities and contracting relationships. In addition, we have established an agreement with Propagenix for intellectual property in-licensing. Our current and ongoing relationships include:

| ● | Georgetown University |

| ○ | Sub-contractor for the SBIR supported African American prostate cancer patient health disparities project (completed). The conditional reprogramming of cells (CRC) technology was invented at Georgetown University and Georgetown University owns the intellectual property. Propagenix holds the license for the intellectual property for the CRC technology from Georgetown University. The intellectual property for cells derived from African American patients under the Georgetown University subcontract belong to Shuttle Pharmaceuticals, Inc. based on our sub-licensing agreement with Propagenix. | |

| ○ | Sub-contractor for the SBIR supported metabolomic predictive biomarker project (completed). The metabolomic biomarker intellectual property belongs to Georgetown University and Shuttle Pharma holds an exclusive option to license the intellectual property. | |

| Exclusive licensing agreement with Georgetown University pursuant to which Georgetown University agreed to license the intellectual property known as “Predictive Biomarkers for Adverse Effects of Radiation Therapy” (U.S. Patent Application No. 17/476,184, filed on September 15, 2021) (the “Patent Rights”), which was developed by Dr. Anatoly Dritschilo, the Company’s Chief Executive Officer, Dr. Scott Grindrod, the Company’s Principal Scientist, and Drs. Amrita Cheema and Yaoxiang Li, employees of Georgetown. The Patent Rights will be available for the Company’s use worldwide. | ||

| Shuttle Pharma entered into a research agreement (the “Research Agreement”) with Georgetown University for testing small molecule radiation sensitizers and immune activation candidates discovered and developed by Shuttle Pharma in cell-based and animal xenograft models. | ||

| ○ | In conjunction with the Research Agreement, Shuttle Pharma also entered into a material transfer agreement (the “MTA”), dated March 21, 2023, with Georgetown University. Under the MTA, Shuttle Pharma agreed to transfer research quantities of candidate drug molecules to Georgetown University, which materials will be used by Georgetown University solely to carry out additional research for Shuttle Pharma and which materials shall at all times remain the property of Shuttle Pharma. |

| ● | Brown University |

| ○ | Sub-contractor of the SBIR supported Phase I clinical trial of IPdR and RT (completed). |

| ● | University of Virginia |

| ○ | Research collaboration to develop heavy oxygen molecules for proton radiation sensitizer applications. |

| ● | George Washington University |

| ○ | Material transfer agreement for testing HDAC inhibitor effects in immune model systems | |

| ○ | The material transfer agreement that protects our HDAC inhibitor intellectual property is with George Washington University, transferring drugs for research purposes and sharing authorship on publications. There is no transfer of funds related to such activities. |

| ● | Propagenix, Inc. |

| ○ | License agreement for “conditional re-programmed cell” (CRC) technology. The cells established by Shuttle Pharma scientists at Georgetown University belong to us, based on the sublicense from Propagenix, Inc. An up-front licensing fee of $25,000 was paid to Propagenix. No other future milestone or royalty payments owed related to the Propagenix agreement. |

| 16 |

Competition “Off-Label” Use

Drugs with radiation sensitizing properties.

Our Product Candidates

We are advancing a clinical stage product candidate, Ropidoxuridine, that we believe will target cancer cells while protecting healthy tissue when used in conjunction with RT.

Ropidoxuridine

Ropidoxuridine, an orally available halogenated pyrimidine with strong cancer radiation sensitizing properties, is our lead “clinical phase” product candidate. Halogenated pyrimidines are incorporated into DNA by rapidly growing cancer cells and become more sensitive to the effects of RT. We have received an SBIR contract from the NIH to fund a Phase I clinical trial in collaboration with Brown University at the Lifespan/Rhode Island Hospital to determine the maximum tolerated dose in patients with advanced gastrointestinal cancers. In connection with the trial, NCI approved the Phase I clinical protocol and provided drug and clinical data management support to Rhode Island Hospital. The Phase I clinical trial has been completed and the results support advancing Ropidoxuridine to Phase II clinical trials of brain tumors, sarcomas and other tumors.

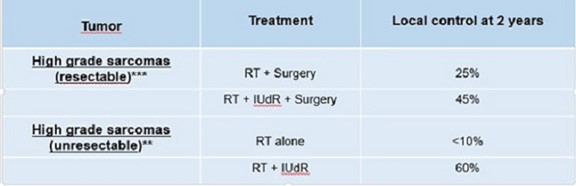

The following tables provide data from reported clinical trials of Iododeoxyuridine and RT therapy in brain cancers (glioblastoma multiforme) and high-grade sarcomas. Our primary strategy for Ropidoxuridine and RT therapy is to provide oral drug delivery to effect radiation sensitization of cancers and validate effectiveness in glioblastoma and sarcoma, potential “Orphan” indications.

| 17 |

Brain Cancer Treatment

Efficacy compared to historical RT-alone controls for treatment

of high-grade primary brain tumors (RTOG*, NCI** trials)

| ** | IUdR continuous IV infusion (1000 mg/m2/ day/ 14 days), Total of 39 patients (F. Sullivan, et al. Int J Radiat Oncol Biol Phys. 1994; 30(3):583-90) |

| * | IUdR continuous IV infusion (2000 mg/m2/ 4 day infusion/ 6 week treatment), Total of 21 patients (R. Urtasun, et al. Int J Radiat Oncol Biol Phys. 1996;36(5):1163-7.) |

Sarcoma Treatment

Efficacy compared to historical RT-alone controls for treatment

of high-grade sarcomas (University of Michigan*** trials)

| *** | 16 patients were treated with continuous infusion (1000-1600 mg/m2/day) plus RT (J.M. Robertson, et al. Int J Radiat Oncol Biol Phys. 1995; 31(1):87-92). |

In addition to our primary product candidate, we are developing and planning to develop other cancer radiation sensitizers and radiation protectors, which target protecting normal tissue during the administration of RT, and other products utilizing our HDAC small molecule technology platform.

SBIR Contracts

The SBIR Program

The Small Business Innovation Research program, as developed by Congress under the Small Business Innovation Development Act of 1982, is designed to encourage domestic small businesses to engage in Federal Research/Research and Development (“R/R&D”) that has the potential for commercialization. Through a competitive awards-based program, SBIR enables small businesses to explore their technological potential and provides the incentive to profit from its commercialization. Some of the SBIR’s program goals include stimulating technological innovation, meeting Federal research and development needs and encouraging participation in innovation and entrepreneurship.

| 18 |

The SBIR program is a three-phase program. Phase 1 is to establish the technical merit and commercial potential of the proposed R/R&D efforts. Phase 2 is to continue the R/R&D efforts initiated in Phase 1 and funding is based on the results achieved in Phase 1. Phase 3 allows for the small business to pursue commercialization objectives resulting from the Phase 1 and 2 R/R&D activities. In addition, companies that have successfully completed Phases I and II are also eligible to apply for Phase IIb funding.

In addition to the SBIR contract to fund our Phase I clinical study on Ropidoxuridine in combination with RT for treatment of advanced gastrointestinal cancers, we have also received awards of SBIR contracts from the NIH to address prostate cancer health disparities and prostate cancer radiation biomarker development.

As of the date of this Annual Report, all SBIR contracts received by the Company have been completed. The Company submitted a final report for SBIR contract # 75N81018C00031 on March 28, 2022. The following summary of terms for the three Phase II SBIR contracts is provided below.

Summary of SBIR Contracts

| ● | SBIR contract #261201400013C: Phase I ($191,971) and Phase II ($1,428,117) for Clinical Development of IPdR for Radiosensitization, dates September 19, 2014 through August 3, 2017. Subcontract to Brown University/LifeSpan Rhode Island Hospital. No related intellectual property. | |

| ● | SBIR contracts # HHSN261201600038C; Phase I ($224,687) and #261201800016C: Cell-Based Models for Prostate Cancer Health Disparity Research - Moonshot Project (Phase II), award amount $1,484,350, dates September 19, 2016 through September 16, 2021. Subcontract to Georgetown University. Intellectual property consists of cell cultures and is property of Shuttle Pharmaceuticals, Inc. via licensing agreement. | |

| ● | SBIR contracts #HHSN261201600027C ($299,502) and #75N81018C00031: Predictive Biomarkers of Prostate Cancer Patient Sensitivity for Radiation Late Effects, award amount $1,903,015, dates September 16, 2019 through March 15, 2022. Subcontract to Georgetown University. Intellectual property is owned by subcontractor Georgetown University with option to license to Shuttle Pharmaceuticals, Inc. |

Prostate Cancer Studies to Address Health Disparities

Prostate cancer health disparities studies have shown that African American men are at higher risk for developing prostate cancer, as well as at higher risk of cancer specific death rates as compared to Caucasian American men. The causes of disparities have been attributed to socioeconomic differences, environmental exposures and biological factors. Most disparities studies have been population based, in part, due to the lack of relevant in vitro and in vivo models to support biological studies.

Shuttle Pharma has been awarded Phase I and II SBIR contracts entitled “Cell-based models for prostate cancer health disparity research” to develop African American prostate cancer cell lines with donor matched normal prostate epithelial cell lines from African American men.

The commercialization of the prostate cells will require additional support through the SBIR funding mechanism. Companies that have completed Phase I and II SBIR awards are eligible to apply for Phase IIb SBIR funding. These awards are intended to de-risk a project by providing up to $4 million of matching funding for product development to commercialization. We intend to apply for such government funding to advance laboratory facilities and to expand the availability of the cell cultures. We did not raise capital through our IPO for the health disparities project. Should we not be successful with SBIR IIb funding, we will pause and may have to terminate this project.

Prostate Cancer Biomarker Development

Patients treated for prostate cancer may experience treatment related late effects that adversely affect quality of life and may prove life-threatening. Shuttle Pharma has been awarded a Phase I SBIR contract entitled “Predictive biomarkers for prostate cancer patient sensitivity for radiation late effects” to determine the technical and commercial feasibility of a biomarker panel predictive of radiation mediated late effects in patients treated for prostate cancer.

Through collaboration with Georgetown University, patients treated with SBRT for prostate cancers were analyzed for urinary and rectal symptoms and their blood was analyzed by mass spectroscopy for predictive biomarkers. The discovery and validation of metabolite panels to serve as a predictive biomarker of patient outcomes following radiation therapy and supports future development and commercialization of a diagnostic product through a Phase 2 SBIR effort.

| 19 |

The development to commercialization of the metabolite predictive biomarker panel requires additional support through the SBIR funding mechanism. We will be eligible to apply for Phase IIb SBIR funding the next round of solicitation. A Phase IIb will help de-risk the project by providing up to $4 million of matching funds for performing the clinical validation trial for product development to commercialization. We intend to apply for such government funding to advance this project. We also intend to raise capital through the public market for predictive biomarker development through the Shuttle Diagnostics entity. We do not intend to use the funds raised through our IPO for the health disparities project. Should we not be successful for SBIR IIb funding, we will terminate this project.

Collaborative Arrangements

While we intend to enter into selective collaborative arrangements to further develop our drug candidates in the future, at present we have not entered into any collaborative arrangements with third parties to develop our drug candidates as we are still completing clinical trials and, as a result, there can be no assurance that we will be able to do so on commercially reasonable terms or otherwise.

Intellectual Property

We invest significant amounts of funds in research and development. Our research and development expenses before contract reimbursements were $3,517,093 and $1,360,167 for the fiscal years ended December 31, 2023 and 2022 respectively. After reimbursements for contracts of $0 and $211,455 for the fiscal years ended December 31, 2023 and 2022, net research and development expenses were $3,517,093 and $1,148,712, respectively.

We are seeking multifaceted protection for our intellectual property that includes licenses, confidentiality and non-disclosure agreements, copyrights, patents, trademarks and common law rights, such as trade secrets. We enter into confidentiality and proprietary rights agreements with our employees, consultants, collaborators, subcontractors and other third parties and generally control access to our documentation and proprietary information.

As of the date of this Annual Report, we have filed five patent applications with the USPTO with respect to various aspects of our HDAC small molecule delivery platform and Ropidoxuridine, our lead product candidate. The following is the status of the patent applications Shuttle has filed to date:

| 20 |

Summary of Shuttle Pharma’s Intellectual Property Portfolio

Morgan, Lewis & Bockius LLP prepared patent applications related to Ropidoxuridine (IPdR) and HDAC inhibitors, and, in the fourth quarter of 2018, found no freedom to operate (FTO) issue for Ropidoxuridine used as radiosensitizer and used with tipiracil, and HDAC inhibitors SP-1-161 and SP-2-225.

Our strategy around protection of our proprietary technology, including any innovations and improvements, is to obtain worldwide patent coverage with a focus on jurisdictions that represent significant global pharmaceutical markets. Generally, patents have a term of twenty years from the earliest priority date, assuming that all maintenance fees are paid, no portion of the patent has been terminally disclaimed and the patent has not been invalidated. In certain jurisdictions, and in certain circumstances, patent terms can be extended or shortened. We are obtaining worldwide patent protection for at least novel molecules, composition of matter, pharmaceutical formulations, methods of use, including treatment of disease, methods of manufacture and other novel uses for the inventive molecules originating from our research and development efforts. We continuously assess whether it is strategically more favorable to maintain confidentiality for the “know-how” regarding a novel invention rather than pursue patent protection. For each patent application that is filed we strategically tailor our claims in accordance with the existing patent landscape around a particular technology.

There can be no assurance that an issued patent will remain valid and enforceable in a court of law through the entire patent term. Should the validity of a patent be challenged, the legal process associated with defending the patent can be costly and time consuming. Issued patents can be subject to oppositions, interferences and other third-party challenges that can result in the revocation of the patent limit patent claims such that patent coverage lacks sufficient breadth to protect subject matter that is commercially relevant. Competitors may be able to circumvent our patents. Development and commercialization of pharmaceutical products can be subject to substantial delays and it is possible that at the time of commercialization any patent covering the product has expired or will be in force for only a short period of time following commercialization. We cannot predict with any certainty if any third-party U.S. or foreign patent rights or other proprietary rights will be deemed infringed by the use of our technology. Nor can we predict with certainty which, if any, of these rights will or may be asserted against us by third parties. Should we need to defend ourselves and our partners against any such claims, substantial costs may be incurred. Furthermore, parties making such claims may be able to obtain injunctive or other equitable relief, which could effectively block our ability to develop or commercialize some or all of our products in the U.S. and abroad and could result in the award of substantial damages. In the event of a claim of infringement, we or our partners may be required to obtain one or more licenses from a third party. There can be no assurance that we can obtain a license on a reasonable basis should we deem it necessary to obtain rights to an alternative technology that meets our needs. The failure to obtain a license may have a material adverse effect on our business, results of operations and financial condition.

| 21 |

We also rely on trade secret protection for our confidential and proprietary information. No assurance can be given that we can meaningfully protect our trade secrets on a continuing basis. Others may independently develop substantially equivalent confidential and proprietary information or otherwise gain access to our trade secrets.