CENTOGENE Reports First-Quarter 2020 Financial Results and Corporate Progress

Cambridge, MA, USA & Rostock/Berlin, Germany, June 15, 2020 (GLOBE NEWSWIRE) — Centogene N.V. (Nasdaq: CNTG), a commercial-stage company focused on rare diseases that transforms real-world clinical and genetic data into actionable information for patients, physicians, and pharmaceutical companies, today provided an update on its corporate progress and reported its financial results for the three months ended March 31, 2020.

· €12.1 million in revenues, an increase of 13% compared to three months ended March 31, 2019

· Continued expansion of global proprietary rare disease platform with approximately 3.0 billion weighted data points from over 530,000 patients representing 120 different countries as of March 31, 2020

· Over 60 biomarker programs, with over 25 biomarker programs (covering more than 22 diseases) having completed the first validation with mass spectrometry as of March 31, 2020

· Expansion of our COVID-19 testing, and commencement of production and distribution of a sample collection kit, CentoSwab™, to support global efforts to address the pandemic

Prof. Arndt Rolfs, CEO of CENTOGENE, said, “During the first quarter of 2020, we continued our focus on our core business of providing precise medical diagnosis of and accelerating drug development for rare hereditary diseases, while taking important steps to operate our business effectively during COVID-19 and support broader efforts to address this pandemic. We are pleased to report a growth of revenues by 13% for the first quarter 2020, driven by the continuous improvement in businesses of both our Pharma and Diagnostics segments.”

Prof. Arndt Rolfs continued, “As we continue to operate in a COVID-19 environment, it is our pleasure to report that while our quick, initial actions enabled 75% of employees to work from home, we have recently been able to bring back nearly all of our staff into the office by implementing regular testing. Additionally, we have further leveraged our diagnostic expertise to develop and offer a SARS-CoV-2 testing solution for patients around the world — beginning with the sampling system ‘CentoSwab™’ and ending with the CENTOGENE-developed app for patient registration and medical reporting. We expect this diagnostic solution will help global communities begin to return to a new normal and prevent a further outbreak. With COVID-19 pandemic continued spreading across the globe, we have started to see its negative impact to our incumbent business, but expect our commercial COVID-19 testing will help offsetting such negative impact.”

Nimble Response to COVID-19 and Continued Rare Disease Diagnostic Operations

Spearheading Sustainable COVID-19 Testing Capabilities

In March 2020, CENTOGENE announced the commencement of its COVID-19 testing. Starting with employees and essential workers in Rostock, Germany, the Company further expanded the test offering to the nursing homes as well as to the high school students throughout Germany. Since May 2020, the Company is offering its tests to the rest of the world. In addition, CENTOGENE secured necessary reagents and supplies, such as CentoSwab™, to support the logistics and fast diagnosis of COVID-19 since April 2020.

Acquisition of Hamburg Laboratory to Expand Testing Capacities

In April 2020, CENTOGENE announced the opening of a new laboratory in Hamburg, Germany to increase its testing capacity for the COVID-19 virus. The Rostock laboratory will continue to focus on the Company’s core business in rare hereditary diseases and its research efforts in biomarker development.

Three Months Ended March 31, 2020 Financial Highlights

Cash and Cash Equivalents

Cash and cash equivalents as of March 31, 2020 were €33.4 million, compared to €41.1 million as of December 31, 2019.

Revenue

Our revenue is principally derived from the provision of pharmaceutical solutions and diagnostic tests enabled by our knowledge and interpretation-based platform.

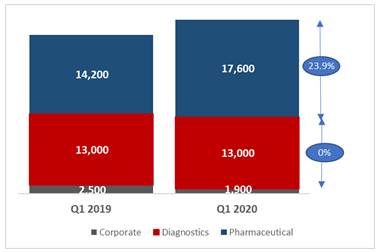

Revenue for the three months ended March 31, 2020 was €12.1 million, an increase of approximately €1.4 million, or 13% as compared to the three months ended March 31, 2019. Revenue from our pharmaceutical segment was €4.6 million for the three months ended March 31, 2020, an increase of approximately €0.4 million, or 10.2% as compared to that of the prior period, while the revenue from our diagnostics segment was €7.5 million for the three months ended March 31, 2020, an increase of approximately €1 million, or 14.7% as compared to that of the prior period.

Pharmaceutical segment

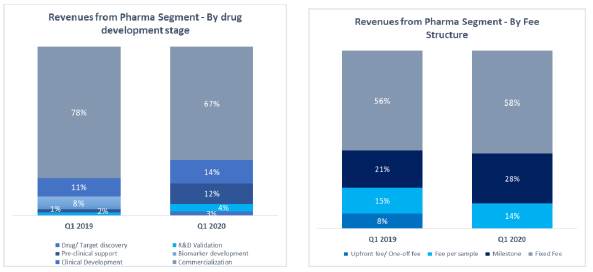

Our pharmaceutical segment provides a variety of services to our pharmaceutical partners, including target discovery, early patient recruitment and identification, epidemiological and patient population sizing insights, biomarker discovery and patient monitoring and follow-up. Our information platforms, our access to rare diseases patients and their biomaterials and our ability to develop proprietary technologies including biomarkers enable us to provide services to our pharmaceutical partners in all phases of the drug development process as well as post-commercialization.

We have been successful in entering into collaborations with pharmaceutical partners in the early stages of drug development, which puts us in a position to provide more support to the development process and increases our potential to secure further collaborations for the same drugs.

Revenues in our pharmaceutical segment are generated primarily from collaboration agreements with our pharmaceutical partners, which are structured on a fee per sample basis, milestone basis, fixed fee basis, royalty basis or a combination of these.

The graphs below show our revenues for the three months ended March 31, 2020 and 2019 resulting from our collaborations with our pharmaceutical partners split between drug development stage, as well as split between different fee structure:

Biomarkers are key in orphan drug development, as they can be used to support a diagnosis, demonstrate the efficacy of a treatment and to monitor the progress of rare disease patients. Biomarkers can also be used to enhance treatment solutions and guide dose titration. As of March 31, 2020, we have over 60 biomarker programs, with over 25 biomarker programs (covering more than 22 diseases) completed the first validation with mass spectrometry. Out of these biomarker programs, 33 biomarkers were used in connection with our active pharmaceutical collaborations as of March 31, 2020, as compared to 28 in March 31, 2019.

Diagnostics segment

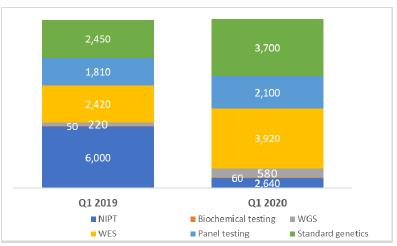

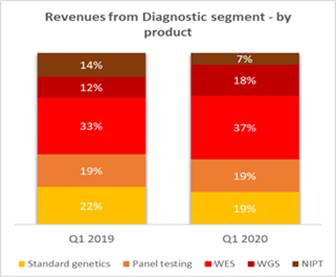

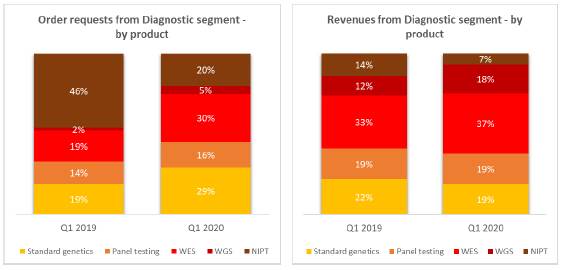

Our clinical diagnostics segment provides targeted genetic sequencing and diagnostics services to patients through our distribution partners or our clients, who are typically physicians, labs or hospitals. The increase in revenue from our diagnostics segment for the three months ended March 31, 2020, as compared to the same period of 2019, is mainly driven by an increase in order requests for whole exome sequencing (WES) and whole genome sequencing (WGS).

For the three months ended March 31, 2020, we received approximately 13,000 test requests by our diagnostics segment, similar to the prior period. However, if we exclude the test requests for non-invasive prenatal testing (NIPT), a non-core diagnostics product, the test requests received in the three months ended March 31, 2020 by our diagnostics segment would amount to over 10,300, representing approximately 49.3% increase as compared to prior period. The graphs below show our order requests revenues split between testing products for the three months ended March 31, 2020 and 2019:

We anticipate the proportion of WES and WGS as a percentage of total test requests in the future will continue to increase. The data collected from our diagnostics services, together with the biomaterials, allow us to continue to grow our global biorepository and our rare disease platform repository.

Research and development expenses (“R&D”)

Our R&D expenses for the three months ended March 31, 2020 were €2.7 million, an increase of approximately €1 million, or 58.2% as compared to the prior period. The increase is primarily attributable to expenses associated with the expansion of our proprietary information platform, as well as development of new products and solutions.

General administrative expenses (“G&A”)

Our G&A expenses for the three months ended March 31, 2020 were €7.9 million, an increase of approximately €2 million, or 33.6% as compared to the prior period. The increase is primarily due to an increase in personnel costs and operating expenses as a result of the expansion of the business. The increase was also due to costs associated with operating as a public company, such as additional legal, accounting, corporate governance and investor relations expenses, and higher directors’ and officers’ insurance premiums. The general administrative expenses also included share-based compensation expenses of €1.1 million for the three months ended March 31, 2020, as compared to €2.1 million for the three months ended March 31, 2019.

Other operating expenses

Considering the impact of the COVID-19 pandemic to the global economy and the unforeseeable potential magnitude of the ultimate disruptions to different businesses, we have taken this into consideration when assessing the credit risk, in particular regarding the MENA region for the diagnostic segment as it represents the majority of that segment’s revenue. Such assessment resulted in an additional credit loss of €1.2 million for the three months ended March 31, 2020. The amount of credit loss made for the three months ended March 31, 2019 amounted to €0.3 million.

Comprehensive loss attributable to equity holders

The comprehensive loss attributable to equity holders for the three months ended March 31, 2020 was €8.6 million or €0.43 per share, as compared to €5.2 million or €0.33 per share for the prior year.

Basic and diluted loss per share is calculated by dividing loss for the year attributable to equity holders of the Group by the weighted average number of shares outstanding of 19,861,340 and 15,861,340 during the three months ended March 31, 2020 and 2019 respectively.

Additional information regarding these financials is included in the notes to the unaudited interim condensed consolidated financial statements as of and for the three months ended March 31, 2020 attached as Exhibit 99.2 to this Form 6-K, which can be found by visiting EDGAR on the U.S. Securities and Exchange Commission website at www.sec.gov.

Centogene N.V.

for the three months ended March 31, 2019 and 2020

Consolidated statements of comprehensive loss

|

|

|

For the three months ended March 31, |

| ||

|

|

|

2019 |

|

2020 |

|

|

|

|

(unaudited, € in thousands, except for loss per share) |

| ||

|

Consolidated statement of comprehensive loss: |

|

|

|

|

|

|

Revenue |

|

10,715 |

|

12,105 |

|

|

Cost of sales |

|

6,744 |

|

7,018 |

|

|

Gross profit |

|

3,971 |

|

5,087 |

|

|

Research and development expenses |

|

1,701 |

|

2,691 |

|

|

General administrative expenses |

|

5,910 |

|

7,898 |

|

|

Selling expenses |

|

2,011 |

|

2,326 |

|

|

Other operating income |

|

1,098 |

|

945 |

|

|

Other operating expenses |

|

342 |

|

1,275 |

|

|

Operating loss |

|

(4,895 |

) |

(8,158 |

) |

|

Interest and similar income |

|

8 |

|

— |

|

|

Interest and similar expense |

|

220 |

|

449 |

|

|

Finance costs, net |

|

(212 |

) |

(449 |

) |

|

Loss before taxes |

|

(5,107 |

) |

(8,607 |

) |

|

Income tax expenses |

|

174 |

|

129 |

|

|

Loss for the year |

|

(5,281 |

) |

(8,736 |

) |

|

Other comprehensive income |

|

2 |

|

76 |

|

|

Total comprehensive loss for the period |

|

(5,279 |

) |

(8,660 |

) |

|

Total comprehensive loss for the period attributable to the equity holders of the parent |

|

(5,210 |

) |

(8,599 |

) |

|

|

|

|

|

|

|

|

Loss per share — Basic and diluted (in €) |

|

(0.33 |

) |

(0.43 |

) |

Centogene N.V.

for the three months ended March 31, 2019 and 2020

Supplemental selected segment information

|

|

|

For the three months ended March 31, |

| ||

|

|

|

2019 |

|

2020 |

|

|

|

|

(€ in thousands) |

| ||

|

Revenue by Segment |

|

|

|

|

|

|

Pharmaceutical |

|

4,130 |

|

4,550 |

|

|

Diagnostics |

|

6,585 |

|

7,555 |

|

|

Total Revenue |

|

10,715 |

|

12,105 |

|

|

|

|

For the three months ended |

| ||

|

|

|

2019 |

|

2020 |

|

|

|

|

(€ in thousands) |

| ||

|

Segment Adjusted EBITDA |

|

|

|

|

|

|

Pharmaceutical |

|

2,944 |

|

2,608 |

|

|

Diagnostics |

|

11 |

|

87 |

|

|

Total segment Adjusted EBITDA |

|

2,955 |

|

2,695 |

|

|

Reconciliation of segment Adjusted EBITDA to |

|

For the three months ended |

| ||

|

Group loss for the period |

|

2019 |

|

2020 |

|

|

|

|

(€ in thousands) |

| ||

|

Reported Segment Adjusted EBITDA |

|

2,955 |

|

2,695 |

|

|

Corporate expenses |

|

(3,820 |

) |

(7,712 |

) |

|

|

|

(865 |

) |

(5,017 |

) |

|

Share-based payment expenses |

|

(2,633 |

) |

(1,057 |

) |

|

Depreciation and amortization |

|

(1,397 |

) |

(2,084 |

) |

|

Operating loss |

|

(4,895 |

) |

(8,158 |

) |

|

Finance costs, net |

|

(212 |

) |

(449 |

) |

|

Income tax expenses |

|

(174 |

) |

(129 |

) |

|

Loss for the period |

|

(5,281 |

) |

(8,736 |

) |

Centogene N.V.

As at December 31, 2019 and March 31, 2020

Consolidated statements of financial position

|

Assets |

|

Dec 31, 2019 |

|

Mar 31, 2020 |

|

|

|

|

(unaudited, € in thousands) |

| ||

|

Non-current assets |

|

|

|

|

|

|

Intangible assets |

|

14,145 |

|

14,518 |

|

|

Property, plant and equipment |

|

8,376 |

|

8,709 |

|

|

Right-of-use assets |

|

24,932 |

|

24,710 |

|

|

Other assets |

|

1,948 |

|

2,098 |

|

|

|

|

49,401 |

|

50,035 |

|

|

Current assets |

|

|

|

|

|

|

Inventories |

|

1,809 |

|

5,849 |

|

|

Trade receivables |

|

16,593 |

|

14,646 |

|

|

Other assets |

|

8,612 |

|

8,890 |

|

|

Cash and cash equivalents |

|

41,095 |

|

33,381 |

|

|

|

|

68,109 |

|

62,766 |

|

|

|

|

117,510 |

|

112,801 |

|

|

Equity and liabilities |

|

Dec 31, 2019 |

|

Mar 31, 2020 |

|

|

Equity |

|

|

|

|

|

|

Issued capital |

|

2,383 |

|

2,383 |

|

|

Capital reserve |

|

98,099 |

|

99,156 |

|

|

Retained earnings and other reserves |

|

(40,622 |

) |

(49,221 |

) |

|

Non-controlling interests |

|

(938 |

) |

(731 |

) |

|

|

|

58,922 |

|

51,587 |

|

|

Non-current liabilities |

|

|

|

|

|

|

Non-current loans |

|

1,578 |

|

768 |

|

|

Lease liabilities |

|

18,069 |

|

18,826 |

|

|

Deferred tax liabilities |

|

— |

|

121 |

|

|

Government grants |

|

9,941 |

|

9,773 |

|

|

|

|

29,588 |

|

29,488 |

|

|

Current liabilities |

|

|

|

|

|

|

Government grants |

|

1,348 |

|

1,364 |

|

|

Current loans |

|

3,688 |

|

3,852 |

|

|

Lease liabilities |

|

3,635 |

|

3,625 |

|

|

Trade payables |

|

8,554 |

|

10,173 |

|

|

Other liabilities |

|

11,775 |

|

12,712 |

|

|

|

|

29,000 |

|

31,726 |

|

|

|

|

117,510 |

|

112,801 |

|

Centogene N.V.

for the three months ended March 31, 2019 and 2020

Consolidated statements of cashflow

|

|

|

For the three months |

| ||

|

|

|

2019 |

|

2020 |

|

|

|

|

(unaudited, € in thousands) |

| ||

|

Loss before taxes |

|

(5,107 |

) |

(8,607 |

) |

|

Amortization and depreciation |

|

1,397 |

|

2,084 |

|

|

Interest income |

|

(8 |

) |

— |

|

|

Interest expense |

|

220 |

|

449 |

|

|

Expected credit loss allowances on trade receivables |

|

340 |

|

1,174 |

|

|

Share-based payment expenses |

|

2,633 |

|

1,057 |

|

|

Other non-cash items |

|

(268 |

) |

(192 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Inventories |

|

(275 |

) |

(4,040 |

) |

|

Trade receivables |

|

(2,073 |

) |

773 |

|

|

Other assets |

|

(967 |

) |

(234 |

) |

|

Trade payables |

|

507 |

|

1,619 |

|

|

Other liabilities |

|

328 |

|

1,751 |

|

|

Cash flow used in operating activities |

|

(3,273 |

) |

(4,166 |

) |

|

|

|

|

|

|

|

|

Cash paid for investments in intangible assets |

|

(1,113 |

) |

(1,191 |

) |

|

Cash paid for investments in property, plant and equipment |

|

(441 |

) |

(644 |

) |

|

Grant received for investment in property, plant and equipment |

|

— |

|

207 |

|

|

Interest received |

|

8 |

|

— |

|

|

Cash flow used in investing activities |

|

(1,546 |

) |

(1,628 |

) |

|

|

|

|

|

|

|

|

Cash received from loans |

|

1,864 |

|

414 |

|

|

Cash repayment of loans |

|

(451 |

) |

(1,060 |

) |

|

Cash repayments of lease liabilities |

|

(461 |

) |

(1,044 |

) |

|

Interest paid |

|

(220 |

) |

(230 |

) |

|

Cash flow generated from/(used) in financing activities |

|

732 |

|

(1,920 |

) |

|

|

|

|

|

|

|

|

Changes in cash and cash equivalents |

|

(4,087 |

) |

(7,714 |

) |

|

Cash and cash equivalents at the beginning of the period |

|

9,222 |

|

41,095 |

|

|

Cash and cash equivalents at the end of the period |

|

5,135 |

|

33,381 |

|

Call Instructions

Centogene will host a conference call to discuss its financial results for the three months ended March 31, 2020 on Monday, June 15, 2020 at 8 a.m. Eastern Time. The call on June 15, 2020 can be accessed by dialing U.S. toll free +1 877 870 9135 or U.K. +44 (0) 800 279 6619 up to 10 minutes prior to the start of the call and providing the conference ID number 4799325. A presentation and webcast of the conference call can be accessed on the Investor Relations page of our website at http://investors.centogene.com.

About CENTOGENE

CENTOGENE engages in diagnosis and research around rare diseases transforming real-world clinical and genetic data into actionable information for patients, physicians, and pharmaceutical companies. Our goal is to bring rationality to treatment decisions and to accelerate the development of new orphan drugs by using our extensive rare disease knowledge, including epidemiological and clinical data, as well as innovative biomarkers. CENTOGENE has developed a global proprietary rare disease platform based on our real-world data repository with approximately 3.0 billion weighted data points from over 530,000 patients representing over 120 different countries as of March 31, 2020.

The Company’s platform includes epidemiologic, phenotypic, and genetic data that reflects a global population, and also a biobank of these patients’ blood samples. CENTOGENE believes this represents the only platform that comprehensively analyzes multi-level data to improve the understanding of rare hereditary diseases, which can aid in the identification of patients and improve our pharmaceutical partners’ ability to bring orphan drugs to the market. As of March 31, 2020, the Company collaborated with 39 pharmaceutical partners covering over 45 different rare diseases.

Important Notice and Disclaimer

This press release contains statements that constitute “forward looking statements” as that term is defined in the United States Private Securities Litigation Reform Act of 1995, including statements that express the Company’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results, in contrast with statements that reflect historical facts. Examples include discussion of our strategies, financing plans, growth opportunities and market growth. In some cases, you can identify such forward-looking statements by terminology such as “anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,” “project” or “expect,” “may,” “will,” “would,” “could” or “should,” the negative of these terms or similar expressions. Forward looking statements are based on management’s current beliefs and assumptions and on information currently available to the Company. However, these forward-looking statements are not a guarantee of our performance, and you should not place undue reliance on such statements. Forward-looking statements are subject to many risks, uncertainties and other variable circumstances, such as negative worldwide economic conditions and ongoing instability and volatility in the worldwide financial markets, the effects of the COVID-19 pandemic on our business and results of operations, possible changes in current and proposed legislation, regulations and governmental policies, pressures from increasing competition and consolidation in our industry, the expense and uncertainty of regulatory approval, including from the U.S. Food and Drug Administration, our reliance on third parties and collaboration partners, including our ability to manage growth and enter into new client relationships, our dependency on the rare disease industry, our ability to manage international expansion, our reliance on key personnel, our reliance on intellectual property

protection, fluctuations of our operating results due to the effect of exchange rates or other factors. Such risks and uncertainties may cause the statements to be inaccurate and readers are cautioned not to place undue reliance on such statements. Many of these risks are outside of the Company’s control and could cause its actual results to differ materially from those it thought would occur. The forward-looking statements included in this press release are made only as of the date hereof. The Company does not undertake, and specifically declines, any obligation to update any such statements or to publicly announce the results of any revisions to any such statements to reflect future events or developments, except as required by law.

For further information, please refer to the Risk Factors section in our Annual Report for the year ended December 31, 2019 on Form 20-F filed with the SEC on April 23, 2020 and other current reports and documents filed with the U.S. Securities and Exchange Commission (SEC). You may get these documents by visiting EDGAR on the SEC website at www.sec.gov.

CENTOGENE Contact:

Sun Kim

Chief Strategy and Investor Relations Officer

investors.relations@centogene.com

Media Contact:

Bridie Lawlor

FTI Consulting

+1.917.929.5684

bridie.lawlor@fticonsulting.com