EXHIBIT 99.1

IMPORTANT NOTICE

This Technical Report was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) for Equinox Gold Corp. (Equinox) by AGP Mining Consultants Inc. (AGP) and Equity Exploration Consultants Ltd. (Equity) collectively the Report Authors. The quality of information, conclusions, and estimates contained herein is consistent with the level of effort involved in the Report Authors’ services, based on i) information available at the time of preparation of the report, ii) data supplied by outside sources, and iii) the assumptions, conditions, and qualifications set forth in this report. This report is intended for use by Equinox subject to the terms and conditions of their contracts with the Report Authors. Those contracts permit Equinox to file this report as a Technical Report with Canadian Securities Regulatory Authorities pursuant to NI 43-101. Except for the purposes legislated under applicable Canadian provincial, territorial, and federal securities laws, any other use of this report by any third party is at that party’s sole risk.

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

Contents

| 1 | Summary | 1-1 |

| 1.1 | Introduction | 1-1 |

| 1.2 | Property Location, Accessibility, and Infrastructure | 1-1 |

| 1.3 | Property Ownership | 1-2 |

| 1.4 | Climate, Local Resources, and Physiography | 1-3 |

| 1.5 | History | 1-3 |

| 1.6 | Geological Setting and Mineralization | 1-4 |

| 1.7 | Exploration and Drilling | 1-5 |

| 1.7.1 | Exploration | 1-5 |

| 1.7.2 | Drilling | 1-5 |

| 1.8 | Sample Preparation and Data Verification | 1-5 |

| 1.8.1 | Sample Preparation, Analyses, and Security | 1-5 |

| 1.8.2 | Data Verification | 1-6 |

| 1.9 | Mineral Resource Estimate | 1-6 |

| 1.10 | Mineral Processing and Metallurgical Testing | 1-9 |

| 1.11 | Mineral Reserves Estimate | 1-10 |

| 1.12 | Mining | 1-11 |

| 1.13 | Processing | 1-15 |

| 1.14 | Property Infrastructure | 1-15 |

| 1.15 | Environmental and Community | 1-16 |

| 1.16 | Capital and Operating Costs | 1-17 |

| 1.17 | Financial Analysis | 1-19 |

| 1.18 | Conclusions | 1-21 |

| 1.18.1 | Geology and Exploration | 1-21 |

| 1.18.2 | Mining and Geotechnical | 1-22 |

| 1.18.3 | Metallurgy and Infrastructure | 1-23 |

| 1.18.4 | Costs and Financial Model | 1-23 |

| 1.19 | Recommendations | 1-23 |

| 2 | Introduction | 2-1 |

| 2.1 | Issuer and Purpose | 2-1 |

| 2.2 | Site Visits and Scope of Personal Inspection | 2-3 |

| 2.3 | Effective Dates | 2-3 |

| 2.4 | Information Sources and References | 2-3 |

| 2.5 | Previous Technical Reports | 2-3 |

| 2.6 | Units of Measure | 2-5 |

| 2.7 | Terms of Reference (Abbreviations & Acronyms) | 2-6 |

| T O C | 1-1 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| 3 | Reliance on Other Experts | 3-1 |

| 3.1 | Ownership, Mineral Tenure and Surface Rights | 3-1 |

| 3.2 | Environmental Liabilities and Permitting | 3-1 |

| 3.3 | Taxation | 3-1 |

| 4 | Property Description and Location | 4-1 |

| 4.1 | Property and Title in Maranhão, Brazil | 4-1 |

| 4.2 | Brazilian Mining Rights | 4-1 |

| 4.3 | Equinox’s Mining Rights at Aurizona Project | 4-1 |

| 4.4 | Surface Rights | 4-5 |

| 4.5 | Royalties and Encumbrances | 4-5 |

| 4.6 | Property Agreements | 4-6 |

| 4.7 | Permits | 4-6 |

| 4.8 | Environmental Liabilities | 4-6 |

| 4.9 | Social License | 4-7 |

| 4.10 | Significant Risk Factors | 4-7 |

| 5 | Accessibility, Climate, Local Resources, Infrastructure, and Physiography | 5-1 |

| 5.1 | Accessibility | 5-1 |

| 5.2 | Climate | 5-1 |

| 5.3 | Local Resources and Infrastructure | 5-1 |

| 5.3.1 | Mining Personnel | 5-2 |

| 5.3.2 | Power | 5-2 |

| 5.3.3 | Water | 5-2 |

| 5.3.4 | Processing Plant | 5-2 |

| 5.3.5 | Waste and Tailings Storage Facilities | 5-3 |

| 5.3.6 | Physiography | 5-3 |

| 5.4 | Surface Rights | 5-3 |

| 6 | History | 6-1 |

| 6.1 | Property Ownership Changes | 6-1 |

| 6.2 | Exploration by Previous Owners | 6-2 |

| 6.2.1 | Cesbra-Gencor Unamgen JV (1991 - 1995) | 6-2 |

| 6.2.2 | Cesbra-Eldorado Unamgen JV (1996 - 2007) | 6-3 |

| 6.3 | Historical Mineral Resource Estimates | 6-4 |

| 6.4 | Historical Production | 6-4 |

| 7 | Geological Setting and Mineralization | 7-1 |

| 7.1 | Regional Geology | 7-1 |

| 7.2 | Project Geology | 7-3 |

| 7.2.1 | Lithology | 7-3 |

| 7.2.2 | Structure | 7-6 |

| 7.2.3 | Regolith Profile | 7-7 |

| 7.3 | Property Mineralization | 7-9 |

| T O C | 1-2 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| 7.3.1 | Piaba | 7-9 |

| 7.3.2 | Boa Esperança | 7-10 |

| 7.3.3 | Tatajuba | 7-11 |

| 7.3.4 | Genipapo | 7-11 |

| 7.3.5 | Touro | 7-12 |

| 7.4 | Prospects/Exploration Targets | 7-12 |

| 7.4.1 | Micote | 7-12 |

| 7.4.2 | Mestre Chico | 7-13 |

| 8 | Deposit Types | 8-1 |

| 9 | Exploration | 9-1 |

| 9.1 | Grids and Surveys | 9-4 |

| 9.2 | Geological Mapping and Rock Sampling | 9-5 |

| 9.3 | Geochemical Sampling | 9-6 |

| 9.4 | Geophysics | 9-6 |

| 9.4.1 | Airborne Geophysical Surveys | 9-6 |

| 9.4.2 | Ground Geophysical Surveys | 9-7 |

| 9.5 | Pits and Trenches | 9-8 |

| 10 | Drilling | 10-1 |

| 10.1 | Exploration Drilling | 10-3 |

| 10.1.1 | Drill Responsibilities | 10-3 |

| 10.1.2 | Diamond Drilling | 10-4 |

| 10.1.3 | RC Drilling | 10-4 |

| 10.1.4 | Piaba Drilling | 10-5 |

| 10.2 | Grade Control Drilling | 10-5 |

| 10.3 | Regional Exploration Drilling | 10-6 |

| 10.4 | Auger Drilling | 10-7 |

| 10.5 | Data Adequacy | 10-7 |

| 11 | Sample Preparation, Analyses, and Security | 11-1 |

| 11.1 | Historic Sampling Methods | 11-1 |

| 11.1.1 | Assaying | 11-1 |

| 11.1.2 | Quality Assurance/Quality Control | 11-1 |

| 11.2 | Equinox Sampling Methods | 11-2 |

| 11.2.1 | Sample Security & Transport | 11-2 |

| 11.3 | Equinox Analytical and Test Laboratories | 11-3 |

| 11.4 | Equinox Sample Preparation and Analysis | 11-3 |

| 11.4.1 | Sample Preparation | 11-3 |

| 11.4.2 | Assay | 11-3 |

| 11.5 | Quality Assurance/Quality Control | 11-5 |

| 11.6 | Density Determinations | 11-6 |

| 11.7 | Grade Control | 11-8 |

| 11.8 | Auger | 11-9 |

| T O C | 1-3 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| 11.9 | Databases | 11-9 |

| 11.10 | Data Adequacy | 11-10 |

| 12 | Data Verification | 12-1 |

| 12.1 | Site Visit | 12-1 |

| 12.2 | Resource Data | 12-1 |

| 12.2.1 | Drill Hole Location Verification | 12-1 |

| 12.2.2 | Geological Data Verification and Interpretation | 12-1 |

| 12.3 | Drillhole Assay Verification | 12-2 |

| 12.3.1 | Performance of Exploration QA/QC Samples | 12-2 |

| 12.3.2 | Performance of Piaba & Boa Esperança Grade Control QA/QC Samples | 12-8 |

| 12.3.3 | Performance of Tatajuba Exploration & Auger QA/QC Samples | 12-11 |

| 12.4 | Density Determinations | 12-11 |

| 12.5 | Data Adequacy | 12-11 |

| 13 | Mineral Processing and Metallurgical Testing | 13-1 |

| 13.1 | Introduction | 13-1 |

| 13.2 | Metallurgical Testing on Tatajuba | 13-1 |

| 13.2.1 | Sample Selection | 13-1 |

| 13.2.2 | Tatajuba Test Work Summary Results | 13-3 |

| 13.2.3 | Comminution Tests | 13-3 |

| 13.2.4 | Gravity Tests | 13-4 |

| 13.2.5 | CIL Tests | 13-4 |

| 13.2.6 | Overall Tatajuba Gold Recoveries | 13-6 |

| 13.3 | Metallurgical Testing on Piaba Underground | 13-7 |

| 13.3.1 | Sample Selection | 13-7 |

| 13.3.2 | Piaba Underground Test Work Summary Results | 13-9 |

| 13.3.3 | Comminution Tests | 13-11 |

| 13.3.4 | Gravity Tests | 13-11 |

| 13.3.5 | CIL Tests | 13-11 |

| 13.3.6 | Overall Piaba Gold Recoveries | 13-12 |

| 13.3.7 | Piaba Test Work Recommendations | 13-13 |

| 13.4 | Test Work Conclusions | 13-13 |

| 14 | Mineral Resource Estimates | 14-1 |

| 14.1 | Methodology and Data Sources | 14-1 |

| 14.1.1 | Software | 14-1 |

| 14.1.2 | Regolith Model | 14-1 |

| 14.1.3 | Editing of the Block Models | 14-1 |

| 14.1.4 | Reasonable Prospects of Eventual Economic Extraction | 14-2 |

| 14.2 | Factors That May Affect the Mineral Resource Estimate | 14-5 |

| 14.3 | Piaba | 14-5 |

| 14.3.1 | Drill Hole Database | 14-5 |

| 14.3.2 | Geological Models | 14-6 |

| 14.3.3 | Grade Capping | 14-13 |

| 14.3.4 | Compositing | 14-19 |

| T O C | 1-4 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| 14.3.5 | Variography | 14-21 |

| 14.3.6 | Gold Grade Estimation | 14-21 |

| 14.3.7 | Validation of Grade Estimates | 14-23 |

| 14.3.8 | Classification of Mineral Resources | 14-31 |

| 14.3.9 | Density | 14-33 |

| 14.3.10 | Mineral Resource Statement | 14-33 |

| 14.4 | Boa Esperança | 14-37 |

| 14.4.1 | Drill Hole Database | 14-37 |

| 14.4.2 | Geological Models | 14-37 |

| 14.4.3 | Grade Capping | 14-39 |

| 14.4.4 | Compositing | 14-41 |

| 14.4.5 | Exploratory Data Analysis | 14-42 |

| 14.4.6 | Variography | 14-43 |

| 14.4.7 | Gold Grade Estimation | 14-43 |

| 14.4.8 | Validation of Grade Estimates | 14-44 |

| 14.4.9 | Classification of Mineral Resources | 14-47 |

| 14.4.10 | Density | 14-48 |

| 14.4.11 | Mineral Resource Statement | 14-48 |

| 14.5 | Tatajuba | 14-51 |

| 14.5.1 | Drill Hole Database | 14-51 |

| 14.5.2 | Geological Models | 14-51 |

| 14.5.3 | Composites | 14-53 |

| 14.5.4 | Exploratory Data Analysis | 14-53 |

| 14.5.5 | Grade Capping | 14-54 |

| 14.5.6 | Declustering | 14-55 |

| 14.5.7 | Variography | 14-56 |

| 14.5.8 | Boundary Analysis | 14-57 |

| 14.5.9 | Gold Grade Estimation | 14-58 |

| 14.5.10 | Validation of Grade Estimates | 14-58 |

| 14.5.11 | Classification of Mineral Resources | 14-61 |

| 14.5.12 | Density | 14-61 |

| 14.5.13 | Mineral Resource Statement | 14-62 |

| 14.6 | Genipapo | 14-65 |

| 14.6.1 | Drill Hole Database | 14-65 |

| 14.6.2 | Geological Models | 14-65 |

| 14.6.3 | Grade Capping | 14-69 |

| 14.6.4 | Composites | 14-70 |

| 14.6.5 | Exploratory Data Analysis | 14-70 |

| 14.6.6 | Variography | 14-72 |

| 14.6.7 | Boundary Analysis | 14-73 |

| 14.6.8 | Gold Grade Estimation | 14-76 |

| 14.6.9 | Validation of Grade Estimates | 14-77 |

| 14.6.10 | Classification of Mineral Resources | 14-79 |

| 14.6.11 | Density | 14-79 |

| 14.6.12 | Mineral Resource Statement | 14-80 |

| 14.7 | Touro | 14-82 |

| 14.7.1 | Drill Hole Database | 14-82 |

| T O C | 1-5 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| 14.7.2 | Geological Models | 14-83 |

| 14.7.3 | Grade Capping | 14-86 |

| 14.7.4 | Composites | 14-86 |

| 14.7.5 | Exploratory Data Analysis | 14-86 |

| 14.7.6 | Variography | 14-88 |

| 14.7.7 | Gold Grade Estimation | 14-89 |

| 14.7.8 | Validation of Grade Estimates | 14-90 |

| 14.7.9 | Classification of Mineral Resources | 14-93 |

| 14.7.10 | Density | 14-94 |

| 14.7.11 | Mineral Resource Statement | 14-94 |

| 14.8 | Summary of Aurizona Mineral Resource Estimates | 14-96 |

| 15 | Mineral Reserve Estimates | 15-1 |

| 15.1 | Mining Method and Mining Costs | 15-2 |

| 15.1.1 | Geotechnical Considerations | 15-2 |

| 15.1.2 | Economic Pit Shell Development | 15-2 |

| 15.1.3 | Cut-off Grade | 15-4 |

| 15.1.4 | Dilution | 15-5 |

| 15.2 | Mine Design | 15-6 |

| 15.2.1 | Open Pit | 15-6 |

| 15.2.2 | Underground | 15-7 |

| 15.3 | Mine Reserves Statement - By Area | 15-7 |

| 16 | Mining Methods | 16-1 |

| 16.1 | Introduction | 16-1 |

| 16.2 | Geologic Models | 16-1 |

| 16.3 | Geotechnical Information | 16-2 |

| 16.3.1 | Open Pit and Waste Dumps | 16-2 |

| 16.3.2 | Piaba, Piaba East | 16-3 |

| 16.3.3 | Boa Esperança | 16-10 |

| 16.3.4 | Tatajuba, Genipapo North and South | 16-10 |

| 16.3.5 | Waste Dumps | 16-12 |

| 16.3.6 | Underground | 16-14 |

| 16.3.7 | Hydrogeology | 16-19 |

| 16.3.8 | Water Quality | 16-21 |

| 16.3.9 | Inflow Estimates - Underground | 16-21 |

| 16.4 | Open Pit Economic Pit Shell Development | 16-22 |

| 16.5 | Open Pit Design | 16-33 |

| 16.5.1 | Open Pit Cut-off Grade | 16-33 |

| 16.5.2 | Open Pit Dilution Calculation | 16-33 |

| 16.5.3 | Open Pit Design | 16-34 |

| 16.5.4 | Waste Dump Design | 16-53 |

| 16.5.5 | Open Pit Mine Equipment | 16-56 |

| 16.5.6 | Open Pit Blasting and Explosives | 16-56 |

| 16.5.7 | Grade Control | 16-56 |

| 16.6 | Underground Design | 16-57 |

| 16.6.1 | Mining Method Selection | 16-57 |

| T O C | 1-6 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| 16.6.2 | Portal Location | 16-60 |

| 16.6.3 | Exploration Decline | 16-61 |

| 16.6.4 | Stope Design | 16-63 |

| 16.6.5 | Development Design | 16-65 |

| 16.6.6 | Recovery of Pillars | 16-69 |

| 16.6.7 | Stope Optimisation Check Analyses | 16-71 |

| 16.6.8 | Backfill | 16-72 |

| 16.6.9 | Ventilation | 16-74 |

| 16.6.10 | Safety | 16-77 |

| 16.6.11 | Mine Infrastructure | 16-78 |

| 16.7 | Mine Schedule | 16-84 |

| 16.8 | Mine Plan Sequence | 16-88 |

| 17 | Recovery Methods | 17-1 |

| 17.1 | Overview | 17-1 |

| 17.2 | Process Description | 17-5 |

| 17.2.1 | Primary Crushing | 17-5 |

| 17.2.2 | Mill Feed System | 17-5 |

| 17.2.3 | Grinding | 17-5 |

| 17.2.4 | Gravity Circuit | 17-6 |

| 17.2.5 | Intensive Leaching - Acacia | 17-6 |

| 17.2.6 | Pre-Leach Thickening and CIL | 17-6 |

| 17.2.7 | Elution and Carbon Regeneration | 17-6 |

| 17.2.8 | Carbon Reactivation | 17-7 |

| 17.2.9 | Electrowinning Circuit and Gold Room | 17-7 |

| 17.2.10 | Cyanide Detoxification and Tailings Disposal | 17-7 |

| 17.2.11 | Reagents | 17-7 |

| 17.2.12 | Water and Air Supply | 17-8 |

| 17.3 | Assay and Metallurgical Laboratory | 17-8 |

| 18 | Project Infrastructure | 18-1 |

| 18.1 | Power Supply and Distribution | 18-1 |

| 18.2 | Water Supply and Management | 18-1 |

| 18.3 | Roads | 18-3 |

| 18.3.1 | Community Access Road | 18-3 |

| 18.3.2 | Mine Roads | 18-3 |

| 18.4 | Mine Facilities | 18-3 |

| 18.5 | Tailings Storage Facility | 18-3 |

| 18.6 | Waste Rock Storage Facilities (WRSF) | 18-8 |

| 18.7 | Camp | 18-9 |

| 19 | Market Studies and Contracts | 19-1 |

| 19.1 | Markets | 19-1 |

| 19.2 | Contracts | 19-1 |

| 20 | Environmental Studies, Permitting, and Social or Community Impact | 20-1 |

| 20.1 | Status of Current Permits | 20-2 |

| T O C | 1-7 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| 20.2 | Potential Environmental Impacts and Mitigation Measures | 20-5 |

| 20.2.1 | Monitoring Locations | 20-5 |

| 20.2.2 | Air Quality Monitoring | 20-7 |

| 20.2.3 | Noise Analysis | 20-7 |

| 20.2.4 | Effluent Quality and Quantity Monitoring | 20-8 |

| 20.2.5 | Groundwater Level and Monitoring | 20-8 |

| 20.2.6 | Cyanide Management | 20-9 |

| 20.3 | Water Management | 20-9 |

| 20.4 | Future Permitting Requirements | 20-10 |

| 20.4.1 | Piaba | 20-12 |

| 20.4.2 | Tatajuba | 20-12 |

| 20.4.3 | Genipapo | 20-12 |

| 20.4.4 | Road Upgrades | 20-12 |

| 20.5 | ARD Waste Monitoring and Management | 20-13 |

| 20.6 | Social and Community Engagement | 20-13 |

| 20.7 | Mine Closure Requirements and Reclamation Costs | 20-15 |

| 20.7.1 | Closure Objectives and Assumptions | 20-16 |

| 20.7.2 | Post-Closure Land Use | 20-16 |

| 20.7.3 | Water Management | 20-17 |

| 20.7.4 | Piaba, Boa Esperança, Tatajuba, Genipapo Pits | 20-17 |

| 20.7.5 | Piaba Underground | 20-18 |

| 20.7.6 | Waste Rock Storage Facilities (WRSF) | 20-18 |

| 20.7.7 | Tailings Storage Facility (TSF) | 20-19 |

| 20.7.8 | Process Plant | 20-20 |

| 20.7.9 | Buildings and Infrastructure | 20-20 |

| 20.7.10 | Monitoring | 20-21 |

| 20.7.11 | Closure Management and Security | 20-21 |

| 20.7.12 | Mine Closure Schedule | 20-21 |

| 20.7.13 | Relinquishment | 20-21 |

| 21 | Capital and Operating Costs | 21-22 |

| 21.1 | Summary | 21-22 |

| 21.2 | Capital Cost Estimates | 21-22 |

| 21.2.1 | Summary | 21-22 |

| 21.2.2 | Open Pit Mine Capital Costs | 21-23 |

| 21.2.3 | Underground Mine Capital Costs | 21-23 |

| 21.2.4 | Processing Capital Costs | 21-25 |

| 21.2.5 | Infrastructure Capital Costs | 21-25 |

| 21.2.6 | Environmental Capital Costs | 21-26 |

| 21.2.7 | Contingency | 21-26 |

| 21.3 | Operating Cost Estimates | 21-27 |

| 21.3.1 | Open Pit Operating Costs | 21-27 |

| 21.3.2 | Underground Mining Operating Costs | 21-30 |

| 21.3.3 | Process Operating Costs | 21-37 |

| 21.3.4 | General and Administrative Operating Costs | 21-40 |

| T O C | 1-8 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| 22 | Economic Analysis | 22-1 |

| 22.1 | Introduction | 22-1 |

| 22.2 | Summary Economic Analysis | 22-1 |

| 22.3 | Mine Production Statistics | 22-2 |

| 22.4 | Plant Production Statistics | 22-3 |

| 22.5 | Marketing Terms | 22-3 |

| 22.6 | Capital Expenditures | 22-3 |

| 22.6.1 | Capital | 22-3 |

| 22.6.2 | Salvage Value | 22-5 |

| 22.6.3 | Reclamation/Closure Costs | 22-5 |

| 22.7 | Net Revenue | 22-5 |

| 22.8 | Royalties | 22-6 |

| 22.9 | Operating Cost | 22-6 |

| 22.10 | Taxation | 22-6 |

| 22.10.1 | Applicable Taxes | 22-7 |

| 22.10.2 | Depreciation / Depletion | 22-9 |

| 22.11 | Project Financial Indicators | 22-9 |

| 22.11.1 | Sensitivity Analysis | 22-14 |

| 23 | Adjacent Properties | 23-1 |

| 24 | Other Relevant Data and Information | 24-1 |

| 24.1 | Aurizona Mine Expansion Timeline | 24-1 |

| 25 | Interpretation and Conclusions | 25-1 |

| 25.1 | Geology and Exploration | 25-1 |

| 25.2 | Mining | 25-2 |

| 25.3 | Metallurgy and Processing | 25-2 |

| 25.4 | Infrastructure and Site Layout | 25-2 |

| 25.5 | Capital and Operating Costs | 25-2 |

| 25.6 | Economic Analysis | 25-2 |

| 26 | Recommendations | 26-1 |

| 26.1 | Geology | 26-1 |

| 26.1.1 | Laboratory | 26-1 |

| 26.1.2 | Exploration Drilling | 26-1 |

| 26.1.3 | Geologic Modelling | 26-2 |

| 26.2 | Geotechnical | 26-2 |

| 26.2.1 | Open Pit | 26-2 |

| 26.2.2 | Underground | 26-2 |

| 26.2.3 | Hydrogeology | 26-3 |

| 26.3 | Mining | 26-4 |

| 26.3.1 | All Pits | 26-4 |

| 26.3.2 | Piaba | 26-4 |

| T O C | 1-9 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| 26.3.3 | Tatajuba and Genipapo | 26-5 |

| 26.3.4 | Underground | 26-5 |

| 26.4 | Metallurgy | 26-5 |

| 26.5 | Infrastructure | 26-6 |

| 26.6 | Environmental | 26-6 |

| 27 | References | 27-1 |

| 28 | Certificate of Authors | 28-1 |

| 28.1 | Eleanor Black, P.Geo. | 28-1 |

| 28.2 | Trevor Rabb, P. Geo. | 28-2 |

| 28.3 | Gordon Zurowski, P. Eng. | 28-3 |

| 28.4 | Neil Lincoln, P. Eng. | 28-4 |

Tables

| Table 1-1: Consolidated Mineral Resource Statement Exclusive of Reserves for Aurizona Property, Maranhão, Brazil | 1-7 |

| Table 1-2: Pit Optimisation Parameters for Open Pit Resources | 1-8 |

| Table 1-3: Pit Optimisation Parameters for Piaba, Boa Esperança, Tatajuba, Genipapo, and Touro | 1-9 |

| Table 1-4: Underground Mining Assumptions | 1-9 |

| Table 1-5: Aurizona Mine - Proven and Probable Reserves - June 30, 2021 | 1-11 |

| Table 1-6: Life of Mine Schedule | 1-14 |

| Table 1-7: Aurizona Mine Capital Cost Estimate | 1-18 |

| Table 1-8: Aurizona Mine Operating Cost Estimate | 1-18 |

| Table 1-9: Aurizona Mine - Discounted Cashflow Financial Summary | 1-20 |

| Table 1-10: After-Tax Sensitivity | 1-21 |

| Table 1-11: Estimate of Recommended Feasibility Budgets | 1-23 |

| Table 2-1: Aurizona Mine Technical Report Qualified Persons and Areas of Responsibility | 2-2 |

| Table 2-2: Dates of Site Visits | 2-3 |

| Table 2-3 Technical Report Table and Figure Sources | 2-3 |

| Table 2-4: Summary of Technical Reports on the Aurizona Project | 2-4 |

| Table 2-5: Units of Measure | 2-5 |

| Table 2-6: Terms of Reference | 2-6 |

| Table 2-7: Conversions for Common Units | 2-11 |

| Table 4-1: Annual Tax per Hectare (TAH) rates as of January 2020 | 4-1 |

| Table 4-2: Summary of Aurizona Tenure | 4-3 |

| Table 4-3: NSR Agreement between Sandstorm and Equinox | 4-5 |

| Table 6-1: Summary of Operators and Exploration Activities to 2007 | 6-1 |

| Table 6-2: Historical Piaba Deposit Mineral Resources (non-compliant - for information purposes only) | 6-4 |

| Table 6-3: Aurizona Mine Production from the Piaba Deposit from 2010 to 2021 | 6-5 |

| Table 7-1: Overview of Main Volcano-sedimentary and Intrusive Units Comprising the São Luís Craton | 7-3 |

| Table 7-2: Summary of Lithology Codes used on the Aurizona Project | 7-6 |

| Table 7-3: Summary of the Piaba Regolith Profile Thickness and Geochemistry | 7-7 |

| Table 9-1: Summary of Exploration Activities to April 2021 | 9-2 |

| Table 10-1: Summary of Aurizona Drilling by Deposit and Drill Type | 10-1 |

| Table 10-2: Summary of Drilling by Operator | 10-2 |

| T O C | 1-10 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| Table 10-3: Summary of the Piaba Grade Control Drilling | 10-5 |

| Table 10-4: Summary of Regional Aurizona Exploration Drilling by Area | 10-6 |

| Table 10-5: Summary of Auger Drilling on the Aurizona Property | 10-7 |

| Table 11-1: Assay Labs Used by Equinox | 11-3 |

| Table 11-2: Summary of Analysis | 11-4 |

| Table 11-3: Sample Summary for Diamond and RC Exploration Drilling | 11-6 |

| Table 11-4: Bulk Density Measurement for Deposit Targets | 11-7 |

| Table 11-5: Sample Summary of Grade Control Drilling | 11-9 |

| Table 11-6: Resource Database Delivery | 11-10 |

| Table 12-1: CV AVR(%) Best & Acceptable Practise Values for Coarse to Medium Grained Gold | 12-2 |

| Table 12-2: CRM Performance for Exploration Samples | 12-3 |

| Table 12-3: Summary of Quality Assurance Samples and Performance for Piaba Exploration | 12-5 |

| Table 12-4: Duplicate Pair Statistics for Exploration Samples | 12-6 |

| Table 12-5: Summary of Quality Assurance Samples & Performance for Grade Control | 12-8 |

| Table 12-6: CRM Performance for Grade Control Samples (2018-2020) | 12-9 |

| Table 12-7: Duplicate Pair Statistics for Exploration Samples | 12-11 |

| Table 12-8: CRM Performance for Tatajuba Auger QA | 12-11 |

| Table 13-1: Tatajuba Test Work Summary Results | 13-3 |

| Table 13-2: Summary of Composites | 13-9 |

| Table 13-3: Piaba U/G Test Work Summary Results | 13-10 |

| Table 14-1: Pit Optimisation Parameters for Open Pit Resources | 14-3 |

| Table 14-2: Pit Optimisation Mining Cost and Recovery Assumptions | 14-4 |

| Table 14-3: Underground Mining Assumptions | 14-5 |

| Table 14-4: Piaba Drill Hole Database Summary | 14-6 |

| Table 14-5: Piaba Open Pit Estimation Domains | 14-10 |

| Table 14-6: Piaba High-grade Domains | 14-10 |

| Table 14-7: Piaba Fault Nomenclature and Impact to Resource Model | 14-12 |

| Table 14-8: Summary of Top Cut Analysis for Piaba Gold Zone & Waste | 14-14 |

| Table 14-9: Summary of Top Cut Analysis for Piaba High-grade Domains | 14-15 |

| Table 14-10: Piaba Composite | 14-21 |

| Table 14-11: Variogram Model Parameters for Piaba Gold Zone (PGZ) | 14-21 |

| Table 14-12: Piaba Open Pit Block Model Index | 14-22 |

| Table 14-13: Piaba Search Interpolation Parameters | 14-22 |

| Table 14-14: Comparison of Average Block Estimates versus Composite Samples within a Block for Piaba | 14-30 |

| Table 14-15: Comparison of Different Estimation Techniques for Piaba | 14-30 |

| Table 14-16: Reconciliation of Current Resource Model to 2020 Production | 14-31 |

| Table 14-17: Piaba Open Pit and Underground Resource Classification Criteria | 14-32 |

| Table 14-18: Summary of Bulk Density Values and Number of Samples for Each Piaba Domain | 14-33 |

| Table 14-19: Mineral Resource Statement (Exclusive of Reserves) for Piaba deposit, Maranhão, Brazil, Equity Exploration Consultants, effective date June 30, 2021 | 14-34 |

| Table 14-20: Boa Esperança Drill Hole Database Summary | 14-37 |

| Table 14-21: Boa Esperança Resource Domains | 14-39 |

| Table 14-22: Summary of Boa Esperança Capping Values by Resource Domain | 14-40 |

| Table 14-23: Boa Esperança Composite Sample Summary | 14-42 |

| Table 14-24: Boa Grade Control Domain Variogram Model Parameters | 14-43 |

| Table 14-25: Boa Esperança Block Model Index | 14-43 |

| Table 14-26: Search Interpolation Parameters for Boa Esperança Resource Model | 14-44 |

| Table 14-27: Comparison of Average Block Estimates versus Composite Samples within a Block for Boa Esperança | 14-47 |

| T O C | 1-11 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| Table 14-28: Comparison of Different Estimation Techniques for Boa Esperança Grade Control Domain | 14-47 |

| Table 14-29: Boa Esperança Resource Classification Criteria | 14-48 |

| Table 14-30: Summary of Bulk Density Values used for Boa Esperança Resource Domains | 14-48 |

| Table 14-31: Mineral Resource Statement (Exclusive of Reserves) for Boa Esperança deposit, Maranhão, Brazil Equity Exploration Consultants, effective date June 30, 2021. | 14-49 |

| Table 14-32: Tatajuba Drill Hole Database Summary | 14-51 |

| Table 14-33: Tatajuba Resource Domains | 14-53 |

| Table 14-34: Summary of Capping Values for Tatajuba | 14-55 |

| Table 14-35: Summary of Boundary Analysis for Tatajuba | 14-57 |

| Table 14-36: Tatajuba Block Model Index | 14-58 |

| Table 14-37: Search Interpolation Parameters for Tatajuba Resource Model | 14-58 |

| Table 14-38: Summary of Composite Sample Average and Block Estimate Average for Tatajuba | 14-59 |

| Table 14-39: Tatajuba Resource Classification Criteria | 14-61 |

| Table 14-40: Summary of Bulk Density Values Used for Tatajuba Resource Domains | 14-62 |

| Table 14-41: Mineral Resource Statement (Exclusive of Reserves) for Tatajuba deposit, Maranhão, Brazil Equity Exploration Consultants, effective date June 30, 2021 | 14-63 |

| Table 14-42: Genipapo Drill Hole Database Summary | 14-65 |

| Table 14-43: Genipapo Ore Domains by Regolith | 14-69 |

| Table 14-44: Summary of Genipapo Capping Values by Resource Domain | 14-70 |

| Table 14-45: Geostatistical Variogram Model Parameters for Genipapo Gold Zones (GGZ) | 14-73 |

| Table 14-46: Genipapo North Block Model Index | 14-76 |

| Table 14-47: Genipapo South Block Model Index | 14-76 |

| Table 14-48: Search Interpolation Parameters for Genipapo North Resource Model | 14-76 |

| Table 14-49: Search Interpolation Parameters for Genipapo South Resource Model | 14-77 |

| Table 14-50: Summary of Composite Sample Average and Block Estimate Average for Genipapo | 14-77 |

| Table 14-51: Genipapo North and South Resource Classification Criteria | 14-79 |

| Table 14-52: Summary of Bulk Density Values used for Genipapo Resource Domains | 14-80 |

| Table 14-53: Mineral Resource Statement (Exclusive of Reserves) for Genipapo deposit, Maranhão, Brazil Equity Exploration Consultants, effective date June 30, 2021 | 14-80 |

| Table 14-54: Touro Drill Hole Database Summary | 14-83 |

| Table 14-55: Touro Resource Domains | 14-86 |

| Table 14-56: Summary of Touro Capping Values by Resource Domain | 14-86 |

| Table 14-57: Geostatistical Variogram Model Parameters for Touro Gold Zones (TGZ) | 14-89 |

| Table 14-58: Touro Block Model Index | 14-89 |

| Table 14-59: Search Interpolation Parameters for Touro Resource Model | 14-90 |

| Table 14-60: Comparison of Different Estimation Techniques for Touro Gold Zone | 14-93 |

| Table 14-61: Comparison of Average Block Estimates versus Composite Samples within a Block for Touro | 14-93 |

| Table 14-62: Touro Resource Classification Criteria | 14-93 |

| Table 14-63: Summary of Bulk Density Values used for Touro Resource Domains | 14-94 |

| Table 14-64: Mineral Resource Statement (Exclusive of Reserves) for Touro deposit, Maranhão, Brazil Equity Exploration Consultants, effective date June 30, 2021 | 14-95 |

| Table 14-65 Resources Exclusive of Reserves for Aurizona | 14-97 |

| Table 14-66 Resources Inclusive of Reserves for Aurizona | 14-98 |

| Table 15-1: Aurizona Mine - Proven and Probable Reserves - June 30, 2021 | 15-1 |

| Table 15-2: Open Pit Optimization Parameters | 15-3 |

| Table 15-3: Aurizona Mine Reserve Cut-off Grades - Gold Grade (g/t) | 15-4 |

| Table 15-4: Dilution Percentage by Pit Area | 15-5 |

| Table 15-5: Underground Dilution and Modifying Factors | 15-6 |

| T O C | 1-12 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| Table 15-6: Aurizona Proven and Probable Reserves - by Area (June 30, 2021) | 15-7 |

| Table 16-1: MinePlan Model Framework and File Names | 16-1 |

| Table 16-2: Model Importation Comparison - Piaba Detail | 16-2 |

| Table 16-3: Model Importation Comparisons - All Models Summary | 16-2 |

| Table 16-4: Summary of Hydraulic Conductivity Values from Packer Tests and Pumping Tests | 16-20 |

| Table 16-5: Open Pit Optimization Parameters | 16-25 |

| Table 16-6: Pit Optimization Pit Slopes - Piaba | 16-27 |

| Table 16-7: Aurizona Mine Open Pit Cut-off Grades - Gold Grade (g/t) | 16-33 |

| Table 16-8: Dilution Percentage by Pit Area | 16-34 |

| Table 16-9: Piaba Pit Phase Design - Pit Shell Ranking | 16-36 |

| Table 16-10: Piaba Pit Tonnage and Grades by Phase | 16-43 |

| Table 16-11: Piaba East - Tonnes and Grade | 16-44 |

| Table 16-12: Boa Esperança - Tonnes and Grade | 16-45 |

| Table 16-13: Tatajuba - Tonnages and Grades by Phase | 16-47 |

| Table 16-14: Genipapo North - Tonnes and Grade | 16-48 |

| Table 16-15: Genipapo South - Tonnes and Grade | 16-49 |

| Table 16-16: Crown Pillar - Tonnage and Grades | 16-53 |

| Table 16-17: Final Design - Phase Tonnes and Grades | 16-53 |

| Table 16-18: Pit Area Waste Volumes | 16-54 |

| Table 16-19: Waste Dump Capacities | 16-54 |

| Table 16-20: Contractor Mining Fleet | 16-56 |

| Table 16-21: Comparison of LHwPRP and LHwC Design Aspects | 16-60 |

| Table 16-22: Comparison of the Mineral Reserve Generated by DSO and the PFS Manual Methodology | 16-72 |

| Table 16-23: CRF Mix Specifications | 16-73 |

| Table 16-24: Life of Mine Rockfill Requirements | 16-74 |

| Table 16-25: Maximum Mine Air Quantity Requirements (2028) | 16-75 |

| Table 16-26: Velocity Limits | 16-75 |

| Table 16-27: Modelled Air Velocity | 16-76 |

| Table 16-28: Estimated Mine Water Inflow | 16-79 |

| Table 16-29: Pump Station Designs | 16-81 |

| Table 16-30: Mine Production 2021 - 2032 | 16-85 |

| Table 17-1: Process Plant Performance Summary (2019-H1 2021) | 17-1 |

| Table 17-2: Consumption Rates for Main Consumables and Reagents | 17-8 |

| Table 18-1: Waste Rock Storage Facilities | 18-8 |

| Table 20-1: Environmental Permits Matrix | 20-3 |

| Table 20-2: Parameter Monitoring | 20-5 |

| Table 20-3: Aurizona Mine: Air Quality Analysis | 20-7 |

| Table 20-4: Aurizona Mine: Noise Analysis | 20-8 |

| Table 20-5: Aurizona Open Doors Yearly Engagement | 20-14 |

| Table 20-6: Post Closure Land Use | 20-17 |

| Table 20-7: Preliminary Mine Closure Schedule | 20-21 |

| Table 21-1: Aurizona Mine Capital Cost Estimate | 21-22 |

| Table 21-2: Aurizona Mine Operating Cost Estimate | 21-22 |

| Table 21-3: Open Pit Capitalized Stripping Cost ($M) | 21-23 |

| Table 21-4: LOM Underground Capital Costs ($M) | 21-24 |

| Table 21-5: Infrastructure Capital - Major Categories | 21-25 |

| Table 21-6: PFS Contingency Percentages and Value | 21-26 |

| Table 21-7: Mine Operating Costs ($/tonne Moved) | 21-29 |

| T O C | 1-13 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| Table 21-8: Effective Working Hours | 21-31 |

| Table 21-9: Hourly Paid Labour Requirements | 21-32 |

| Table 21-10: Staff Requirements | 21-33 |

| Table 21-11: Mobile Equipment List | 21-34 |

| Table 21-12: Equipment Fleet Requirements | 21-35 |

| Table 21-13: Underground Mine LOM Operating Costs | 21-37 |

| Table 21-14: Process Operating Costs - $/tonne Ore Processed | 21-38 |

| Table 21-15: Aurizona Mill Annual Process Unit Cost | 21-39 |

| Table 21-16: General and Administrative Costs (G&A) - LOM | 21-40 |

| Table 22-1: Aurizona Project - Discounted Cash Flow Financial Summary | 22-2 |

| Table 22-2: Mill Feed, Waste and Metal Grades | 22-3 |

| Table 22-3: Aurizona Project Capital Costs (US$) | 22-4 |

| Table 22-4: Royalties Summary | 22-6 |

| Table 22-5: Operating Cost Summary | 22-6 |

| Table 22-6: Depreciation and Depletion | 22-9 |

| Table 22-7: Detailed Financial Model | 22-10 |

| Table 22-8: After Tax Sensitivity | 22-14 |

| Table 22-9: Fresh Rock Recovery Sensitivity - After Taxes | 22-15 |

| Table 26-1: Estimate of Recommended Feasibility Budgets | 26-1 |

Figures

| Figure 1-1: Aurizona Mine Location | 1-2 |

| Figure 1-2: Overall Site Plan (End of Mine Life) | 1-16 |

| Figure 1-3: Recovered Gold versus AISC (includes H1 2021 Actuals) | 1-21 |

| Figure 4-1: Aurizona Project Tenure Map | 4-2 |

| Figure 7-1: Regional Geology of the Aurizona Project Area | 7-2 |

| Figure 7-2: Geology of the Aurizona Project | 7-4 |

| Figure 7-3: Cross Section of the Lithological Model through the Piaba Deposit | 7-5 |

| Figure 7-4: Cross Section of the Weathering Profile of the Piaba Deposit | 7-8 |

| Figure 7-5: Geology of the Piaba Deposit | 7-10 |

| Figure 9-1: Map of Exploration Targets, Gold Deposits, and Artisanal Workings | 9-3 |

| Figure 9-2: Map of Regional Exploration Targets, Gold Deposits, and Artisanal Workings | 9-4 |

| Figure 9-3: Litho-Structural Interpretation of the Aurizona Property | 9-5 |

| Figure 9-4: Total Magnetic Intensity Map from 2017 Regional Airborne Magnetic Survey | 9-7 |

| Figure 10-1: Map of Aurizona Deposit Drilling | 10-2 |

| Figure 10-2: Map of Regional Drilling | 10-6 |

| Figure 11-1: Box and Whisker Plot of the Bulk Density by Modelled Lithology for Piaba Deposit | 11-7 |

| Figure 11-2: Box and Whisker Plot of the Bulk Density by Modelled Weathering for Piaba Deposit | 11-8 |

| Figure 12-1: Shewart Performance Chart for Gold in S Series CRMs from the Exploration Datasets | 12-4 |

| Figure 12-2: Shewart Performance Chart for Gold in O Series CRMs from the Exploration Datasets | 12-4 |

| Figure 12-3: Blank Performance Chart for Gold in with the Exploration Datasets | 12-5 |

| Figure 12-4: RMA Duplicate Plot for Exploration Sample Pulp Duplicates | 12-6 |

| Figure 12-5: RMA Duplicate Plot for Exploration Sample Preparation Duplicates | 12-7 |

| Figure 12-6: RMA Duplicate Plot for Exploration Sample Twin Sample Duplicates | 12-7 |

| Figure 12-7: Shewart Performance Chart for Gold in S Series CRMs from the Grade Control Datasets | 12-10 |

| Figure 12-8: Blank Performance Chart for Gold in with the Grade Control Datasets | 12-10 |

| Figure 13-1: Tatajuba Sample Selection Locations | 13-2 |

| T O C | 1-14 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| Figure 13-2: CIL Gold Extraction of Tatajuba Gravity Tailings Samples | 13-5 |

| Figure 13-3: Overall Tatajuba Gold Recoveries | 13-6 |

| Figure 13-4: Overall Tatajuba Gold Recoveries vs % Sulphur | 13-7 |

| Figure 13-5: Piaba Sample Locations - Underground Mine | 13-8 |

| Figure 13-6: CIL Gold Extraction of Piaba Gravity Tailings Samples | 13-12 |

| Figure 13-7: Overall Piaba Gold Recoveries | 13-13 |

| Figure 14-1: Isometric View of Piaba Lithology Model | 14-7 |

| Figure 14-2: Isometric View of Piaba Silicification Model | 14-7 |

| Figure 14-3: Isometric View of Piaba Sulphide Mineralization Model | 14-8 |

| Figure 14-4: Isometric View of Piaba and Piaba West Gold Zones Resource Domains | 14-8 |

| Figure 14-5: Piaba Underground Central and Footwall High-grade Gold Zones | 14-9 |

| Figure 14-6: Piaba Underground Hangingwall High-grade Gold Zones | 14-9 |

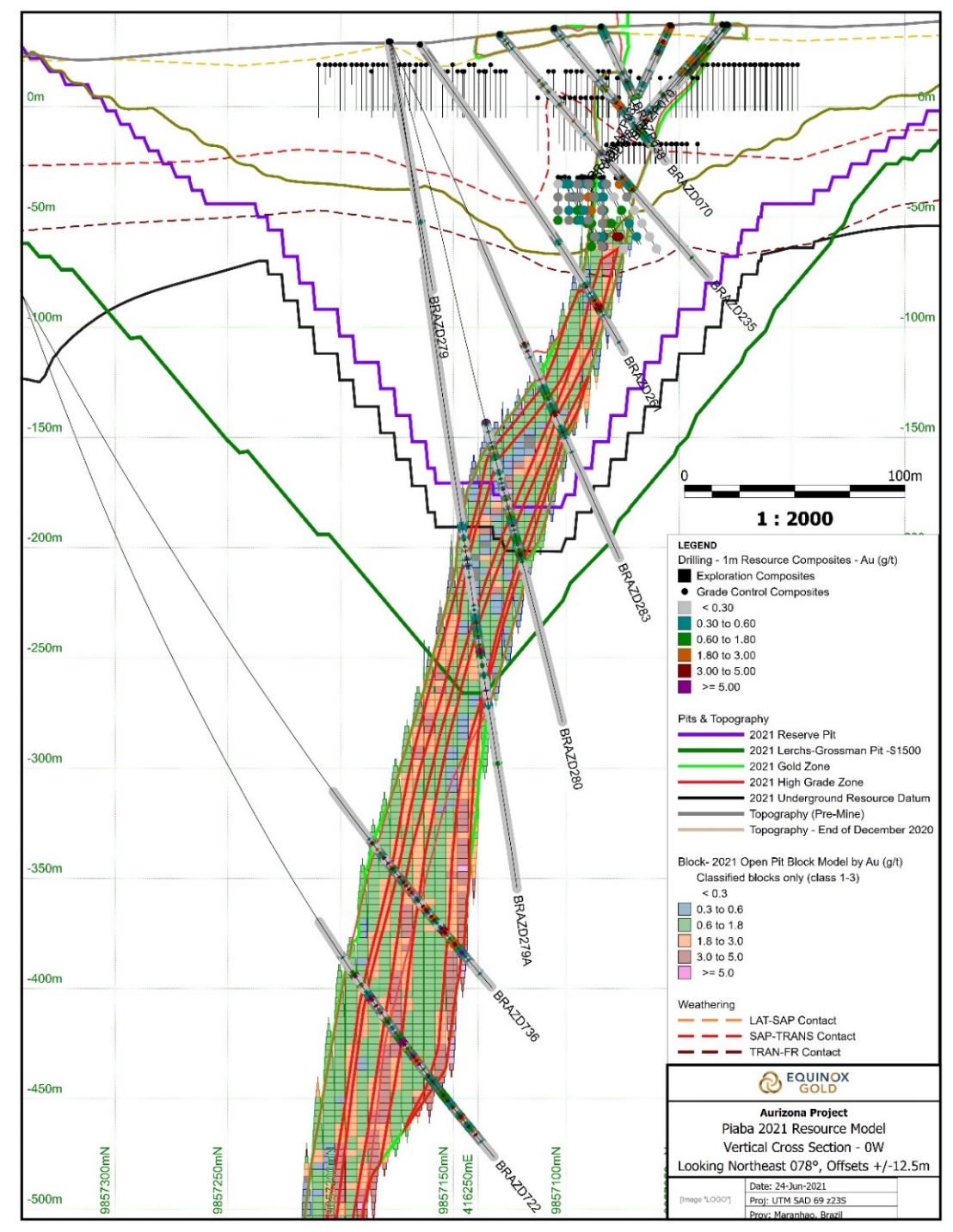

| Figure 14-7: Piaba Cross Section 100W Looking East (078°) Showing Drill Holes and Regolith Model | 14-11 |

| Figure 14-8: Isometric View of Piaba Gold Zone Showing Fault Model | 14-13 |

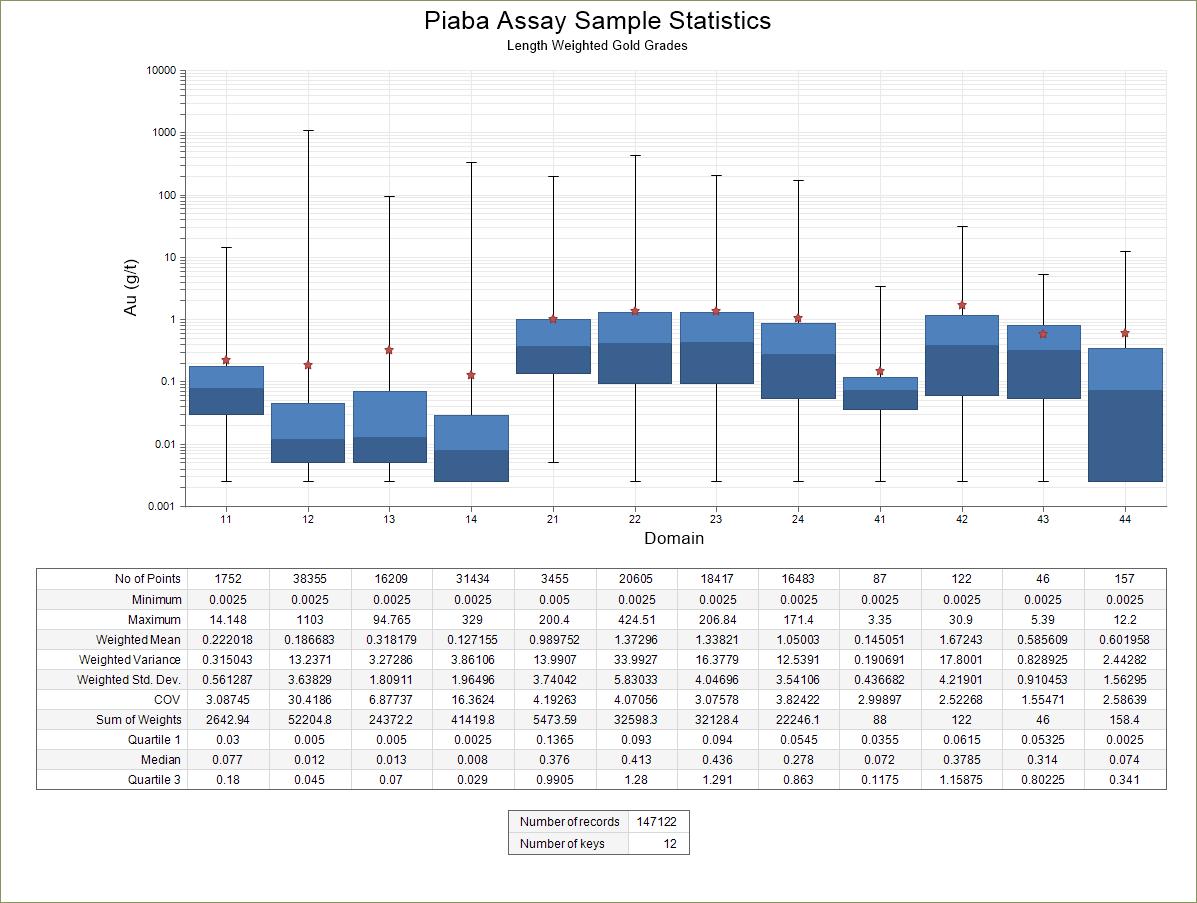

| Figure 14-9: Boxplot of Piaba Assay Sample Statistics | 14-16 |

| Figure 14-10: Boxplot of Piaba High-grade Domain Assay Sample Statistics | 14-17 |

| Figure 14-11: Boxplot of Piaba Capped Composite Sample Statistics | 14-18 |

| Figure 14-12: Boxplot of Piaba High-grade Domain Capped Composite Sample Statistics | 14-19 |

| Figure 14-13: Original Sample Lengths for Drill Hole and Grade Control Sample for Piaba | 14-20 |

| Figure 14-14: Vertical and Oriented Swath Plots of Piaba Gold Zone Domains | 14-24 |

| Figure 14-15: Vertical and Oriented Swath Plots of Piaba Gold Zone Domain 24 and High-grade Domains | 14-28 |

| Figure 14-16 Cross Section of the Piaba Open Pit Block Model | 14-36 |

| Figure 14-17: Plan and Northwest Perspective View of Boa Esperança Gold Zone Resource Domains | 14-38 |

| Figure 14-18: Original Sample Lengths for Drill Hole and Grade Control Sample for Piaba | 14-41 |

| Figure 14-19: Boxplots of Composite Samples for Boa Esperança Resource Domains | 14-42 |

| Figure 14-20: Easting Swath Plots for Boa Esperança Gold Zone Resource Domains | 14-45 |

| Figure 14-21: Vertical Swath Plots for Boa Esperança Gold Zone Resource Domains | 14-46 |

| Figure 14-22: Cross Section of the Boa Esperança Open Pit Block Model | 14-50 |

| Figure 14-23: Tatajuba Lithology Model | 14-52 |

| Figure 14-24: Tatajuba Gold Zones Resource Domains | 14-52 |

| Figure 14-25: Boxplot of 2 m Composite Samples for Tatajuba Deposit Area | 14-54 |

| Figure 14-26: Box and Whisker Plots and Summary Statistics for Declustered 2 m Capped Composite Samples for Tatajuba | 14-56 |

| Figure 14-27: Omnidirectional Semi Variograms | 14-57 |

| Figure 14-28 Boundary Analysis of Tatajuba Gold Zone Domains | 14-57 |

| Figure 14-29: Swath Plots Comparing Block Estimates, Nearest Neighbor, and Composite Samples | 14-60 |

| Figure 14-30 Cross Section of the Tatajuba Open Pit Block Model | 14-64 |

| Figure 14-31: Genipapo Lithology Model of North and South Zones in of Plan View | 14-66 |

| Figure 14-32: Genipapo Mineralization Model of North and South Zones in Plan View | 14-67 |

| Figure 14-33: Plan and Northeast Perspective view of Genipapo North and South Gold Zone Domains | 14-68 |

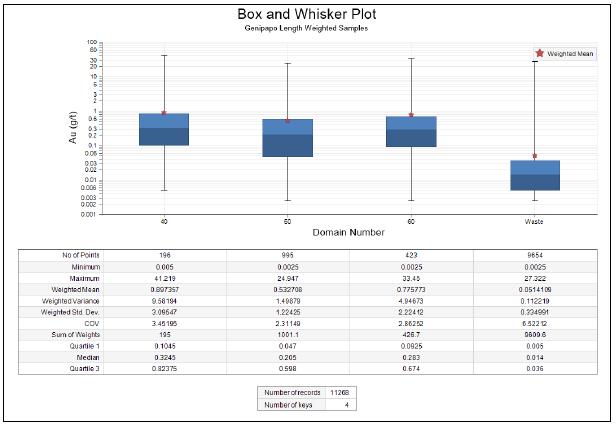

| Figure 14-34: Boxplot of uncapped length weighted Samples for Genipapo Deposit Area | 14-71 |

| Figure 14-35: Boxplot of Capped 1 m Composite Samples for Genipapo Deposits | 14-72 |

| Figure 14-36 Boundary Analysis of Genipapo North Gold Zone Regolith Domains | 14-74 |

| Figure 14-37 Boundary Analysis of Genipapo Gold Zone Domains | 14-75 |

| Figure 14-38: Swath Plots for Genipapo North and South Resource Models | 14-78 |

| Figure 14-39: Cross Section of the Genipapo South Open Pit Block Model | 14-81 |

| Figure 14-40: Cross Section of the Genipapo North Open Pit Block Model | 14-82 |

| Figure 14-41: Isometric View of Touro Lithology Model | 14-84 |

| T O C | 1-15 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| Figure 14-42: Isometric View of Touro Mineralization Model | 14-85 |

| Figure 14-43: Boxplot of uncapped length weighted Samples for Touro Deposit Area | 14-87 |

| Figure 14-44: Boxplot of Capped 1 m Composite Samples for Touro Deposit Area | 14-88 |

| Figure 14-45: Northeast Swath Plots for Touro | 14-91 |

| Figure 14-46: Vertical Swath Plots for Touro | 14-92 |

| Figure 14-47 Cross Section of the Touro Open Pit Block Model | 14-96 |

| Figure 16-1: Piaba and Piaba East Design Sectors | 16-4 |

| Figure 16-2: Piaba Pit Wall Slope Parameters | 16-6 |

| Figure 16-3: Piaba Pit - August 2021 (Looking West) | 16-7 |

| Figure 16-4: Piaba East Wall - August 2021 (Looking West) | 16-8 |

| Figure 16-5: General Instrumentation - Aurizona Mine | 16-9 |

| Figure 16-6: Tatajuba - Longitudinal Cross-section looking South | 16-11 |

| Figure 16-7: Tatajuba - August 2021 (Looking East) | 16-12 |

| Figure 16-8: Piaba Pit Optimization Shells - Net Profit vs Tonnes | 16-28 |

| Figure 16-9: Boa Esperança Pit Optimization Shells - Net Profit vs Tonnes | 16-29 |

| Figure 16-10: Tatajuba Pit Optimization Shells - Net Profit vs Tonnes | 16-30 |

| Figure 16-11: Genipapo North Pit Optimization Shells - Net Profit vs Tonnes | 16-31 |

| Figure 16-12: Genipapo South Pit Optimization Shells - Net Profit vs Tonnes | 16-32 |

| Figure 16-13: Piaba Pit Phase Analysis | 16-36 |

| Figure 16-14: Piaba Pit Phase Conceptualization | 16-37 |

| Figure 16-15: Piaba Pit Phases | 16-38 |

| Figure 16-16: Phase 4 Design | 16-38 |

| Figure 16-17: Phase 5 Design | 16-39 |

| Figure 16-18: Phase 5 Sub-phases | 16-40 |

| Figure 16-19: Phase 5C and Existing Road | 16-41 |

| Figure 16-20: Phase 6 Design | 16-42 |

| Figure 16-21: Phase 7 Design | 16-43 |

| Figure 16-22: Piaba East Pit Design | 16-44 |

| Figure 16-23: Boa Esperança Pit Design | 16-45 |

| Figure 16-24: Tatajuba Pit Design - Phase 1 | 16-46 |

| Figure 16-25: Tatajuba Pit Design - Phase 2 | 16-47 |

| Figure 16-26: Genipapo North Design | 16-48 |

| Figure 16-27: Genipapo South Design | 16-49 |

| Figure 16-28: Piaba Pit - Crown Pillar Locations (Looking Northwest) | 16-51 |

| Figure 16-29: Crown Pillar - Area A Design | 16-52 |

| Figure 16-30: Crown Pillar - Area B Design | 16-52 |

| Figure 16-31: Ultimate Aurizona Mine Pit and Waste Management Facilities | 16-55 |

| Figure 16-32: Long hole with Permanent Rib Pillar (LHwPRP) | 16-58 |

| Figure 16-33: Long hole with Cement Fill (LHwC) | 16-59 |

| Figure 16-34: Portal and Service Raise Locations with Exploration Decline | 16-61 |

| Figure 16-35: Exploration Decline Layout | 16-62 |

| Figure 16-36: Long Section of Stoping Methods by Zone and Ore Reserves | 16-64 |

| Figure 16-37: Access Development Relative to Metasediments | 16-66 |

| Figure 16-38: Piaba Development Design - Looking Southeast | 16-68 |

| Figure 16-39: Typical Level Access | 16-69 |

| Figure 16-40: Crown Pillar Long Section | 16-71 |

| Figure 16-41: Year 2026 to 2027 Ventilation (Looking South) | 16-77 |

| Figure 16-42: Water Inflow for Design Purposes | 16-80 |

| T O C | 1-16 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| Figure 16-43: Plant Feed - Open Pit and Underground | 16-86 |

| Figure 16-44: Total Tonnages by Open Pit Area | 16-87 |

| Figure 16-45: End of 2021 | 16-89 |

| Figure 16-46: End of 2022 | 16-90 |

| Figure 16-47: End of 2025 | 16-91 |

| Figure 16-48: End of 2028 | 16-92 |

| Figure 16-49: Open Pit End of 2032 | 16-93 |

| Figure 16-50: Underground Mine - End of 2022 (Looking South) | 16-94 |

| Figure 16-51: Underground Mine - End of 2023 (Looking South) | 16-94 |

| Figure 16-52: Underground Mine - End of 2024 (Looking South) | 16-95 |

| Figure 16-53: Underground Mine - End of 2025 (Looking South) | 16-95 |

| Figure 16-54: Underground Mine - End of 2026 (Looking South) | 16-96 |

| Figure 16-55: Underground Mine - End of 2027 (Looking South) | 16-96 |

| Figure 16-56: Underground Mine - End of 2028 (Looking South) | 16-97 |

| Figure 16-57: Underground Mine - End of 2029 (Looking South) | 16-97 |

| Figure 16-58: Underground Mine - End of 2030 (Looking South) | 16-98 |

| Figure 16-59: Underground Mine - End of 2031 (Looking South) | 16-98 |

| Figure 16-60: Underground Mine - End of 2032 (Looking South) | 16-99 |

| Figure 17-1: Plant Process Flowsheet | 17-3 |

| Figure 18-1: Overall Site Plan | 18-2 |

| Figure 18-2: Vené Dam Typical Cross-Section | 18-5 |

| Figure 18-3: Vené 2 First Phase Construction | 18-6 |

| Figure 18-4: Vené 2 Second Phase Construction | 18-7 |

| Figure 18-5: Vené 2 Final Phase Construction | 18-7 |

| Figure 18-6: Vené 3 with South Dump at End of Mine Life | 18-8 |

| Figure 20-1: Monitoring Locations | 20-6 |

| Figure 20-2: Project Permitting Timeline | 20-11 |

| Figure 21-1: Utilised Power | 21-36 |

| Figure 22-1: Aurizona Project Capital Cost by Year | 22-5 |

| Figure 22-2: Recovered Gold versus AISC (Includes H1 2021 Actuals) | 22-13 |

| Figure 22-3: Aurizona PFS Cashflow - Post Tax | 22-13 |

| Figure 22-4: Net Revenue versus Operating Cost, Capital Cost and Taxes | 22-14 |

| Figure 22-5: Sensitivity Analysis - NPV @ 5% | 22-15 |

| Figure 24-1: PFS Mine Development Timeline | 24-2 |

| T O C | 1-17 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

Forward Looking Statements

This Technical Report, including the economics analysis, contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian securities laws. While these forward-looking statements are based on expectations about future events as at the effective date of this Report, the statements are not a guarantee of Equinox Gold Corp’s future performance and are subject to risks, uncertainties, assumptions, and other factors, which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such risks, uncertainties, factors, and assumptions include, amongst others but not limited to metal prices, Mineral Resources, Mineral Reserves, capital and operating cost forecasts, economic analyses, smelter terms, labour rates, consumable costs, and equipment pricing. There can be no assurance that any forward-looking statements contained in this Report will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.

| T O C | 1-18 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

| 1 | Summary |

| 1.1 | Introduction |

Equinox Gold Corp. (Equinox or the Company) retained independent consultants to prepare a Technical Report (the Report) for a Prefeasibility Study (PFS) to include an underground mining operation of the Piaba gold deposit at the existing Piaba open pit plus additional open pits at Piaba East, Boa Esperança, Tatajuba and Genipapo.

The Report also is an update to the Aurizona Mine (the mine or the Property) Mineral Resources and Mineral Reserves. The Aurizona Mine Mineral Resources and Mineral Reserves include the Piaba, Boa Esperança, Tatajuba, and Genipapo gold deposits and the Mineral Resources for the Touro gold deposit in northern Brazil. The Aurizona Mine, is considered an active open pit operation presently mining the Piaba and Piaba East deposits. Equinox, through its indirect wholly-owned subsidiary Mineração Aurizona S.A. (MASA), holds a 100% interest in the Property.

Equinox is an intermediate gold producer. Equinox operates seven mines: Los Filos and Mercedes in Mexico, Mesquite and Castle Mountain (Phase 1) in USA, and Aurizona, Fazenda, and RDM in Brazil. Additional Equinox development stage projects include the Los Filos expansion in Mexico, Castle Mountain (Phase 2) in the USA and Santa Luz in Brazil.

The following consultants were the primary contributors to this study:

| • | AGP Mining Consultants Inc. (AGP) |

| • | Equity Exploration Consultants Ltd. (Equity) |

| • | Knight Piésold Ltd. (KP) |

| 1.2 | Property Location, Accessibility, and Infrastructure |

The Aurizona Property is located in the state of Maranhão in northeastern Brazil between the cities of São Luis and Belém. The Property is centered at approximately 01°18’ south latitude and 45°45’ west longitude.

The Property is on the Atlantic coast of northern Brazil and is accessed by regularly maintained laterite road 16 km from the town of Godofredo Viana, which is connected by State highways MA-101 and MA-206 to BR316. Year-round road access is available from the state capital cities of Belém, Pará (400 km), and São Luis, Maranhão (320 km), the latter requiring a ferry transfer from São Luis island to the mainland or a longer bypass by road on land. The main federal highway connecting both capitals has been resurfaced in both states and is in good condition. A state highway connects the federal highway with the town of Godofredo Viana, from which the Property is accessed by 16 km of a regularly maintained eight-metre-wide laterite road (Figure 1-1).

The existing Aurizona Mine site includes the open pit operation and infrastructure such as camp facilities, tailings storage areas, waste disposal areas, power, water, and the processing plant. The Aurizona process plant currently treats the ore via a conventional crushing, griding and cyanidation process.

| P a g e | 1-1 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

Figure 1-1: Aurizona Mine Location

| 1.3 | Property Ownership |

The Property includes one active mining license totaling 9,982 ha and twelve exploration licenses totaling approximately 97,042 ha for a total land package of approximately 107,023 ha.

All thirteen licenses are 100% held by Equinox via its wholly owned subsidiaries MASA and Luna Gold Pesquisa Mineral LTDA (Luna Gold). The Piaba and Boa Esperança deposits, as well as several near-mine exploration targets are covered by the mining licence. There are two mining license applications that cover Tatajuba, Genipapo and Touro deposits.

Equinox, through its indirect wholly-owned subsidiary MASA., owns all surface rights required for the operation of the Aurizona Mine.

Royalties on the Property are held by the Brazilian government and Sandstorm Gold Royalties Ltd. (Sandstorm). The Mining License is subject to a government royalty of 1.5% which is applied to gross revenue from sales payable to the Brazilian government. Previously, Aurizona was subject to a 17% gold stream payable to Sandstorm. This gold stream has been terminated and replaced by two net smelter return (NSR) royalties (the Aurizona Property NSR and the Greenfields NSR) and a convertible debenture in favour of Sandstorm dated January 3, 2018 (the Sandstorm Debenture).

| P a g e | 1-2 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

The Aurizona Property NSR covers the mining license and the four brownfield exploration licenses including all the Mineral Resource estimates presented in this Report, and any future resources from these properties that would be processed through the Aurizona mill net of third-party refining costs. The Aurizona Property NSR is a sliding scale royalty based on the price of gold as follows:

| • | 3% if the price of gold is less than or equal to $1,500/oz |

| • | 4% if the price of gold is between $1,500 and $2,000/oz |

| • | 5% if the price of gold is greater than $2,000/oz |

The Greenfields NSR covers the other eight exploration licences on the Property and are subject to a 2% royalty. Sandstorm holds a right of first refusal on any future streams or royalties on the licences covered in the Aurizona Property NSR or Greenfields NSR.

| 1.4 | Climate, Local Resources, and Physiography |

The Property experiences a dry-summer tropical savanna climate bordering on a tropical monsoon climate. There is a dry season from August to December and a wet season from January to July. Average daily highs and lows (for the state capital of São Luis) range between 31˚C and 23˚C for the entire year, with ≤2˚C variance for the hottest and coldest months.

Precipitation data has been collected from the Mineração Aurizona S.A (MASA) meteorological stations in the area of the camp, the dam, and the mine since 2010. Monthly rainfall from 2010 to 2019 varied from 0 mm during the dry season, up to 1,110 mm during the rainy season. Annual precipitation over that period ranged from 1,692 to 3,319 mm with an average of 2,482 mm. Annual evaporation is estimated at approximately 1,650 mm.

Mining personnel comprise a combination of a local workforce for the operation and support services, along with select technical experts from throughout Brazil. Many local workers are based in the village of Aurizona (population 2,100) and town of Godofredo Viana (population 5,370), <1 km and 16 km away from the mine site, respectively. Both towns offer a limited range of services and supplies.

The Property lies on a peneplain near the Atlantic Ocean and is characterized by rounded flat knolls and wide estuaries. Elevation ranges from 0 - 90 m above mean sea level (amsl) with the Aurizona Mine located approximately 10 - 40 m above sea level (asl). The isthmus that joins the Aurizona Peninsula to the mainland consists of low-lying flats that are subject to mild flooding at high neap tide, although this does not affect project access or operations.

Vegetation consists of mangrove swamp near the coastline, giving way inland to low-lying grassland with dense tropical vegetation on the low rounded hills.

| 1.5 | History |

The Property has a long history of artisanal gold production dating back to the arrival of Jesuit missionaries in the 17th century.

| P a g e | 1-3 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

In 1978, subsidiary companies of Brascan Recursos Naturais S.A.(Brascan) started exploration programs in alluvium that lasted through to 1985. In 1988 MASA, a subsidiary of Brascan, received a license to mine in what is now the Aurizona mining license (800256/1978).

From 1991 to 2007, extensive development work including geophysical and geochemical surveys were carried out near the Piaba deposit, along with geological mapping and drilling. The regional infrastructure improved markedly in this time frame in terms of road access, telecommunications, and grid power availability.

In January 2007, Luna Gold completed a purchase agreement (the Purchase Agreement) to acquire all outstanding shares of Aurizona Goldfields Corporation (AGC) from Brascan and Eldorado, with AGC owning 100% of MASA and the Aurizona Project (Luna Gold Corp, 2006). In July 2011, all obligations were satisfied regarding the Purchase Agreement and Luna Gold assumed 100% ownership of the Project.

In March 2017, JDL Gold Corp. merged with Luna Gold to form Trek Mining Inc. (Trek) after which Trek merged with NewCastle Gold Ltd. and Anfield Gold Corp. to form Equinox

Production from the Aurizona Mine for the period 2010 to 2021 is all from the Piaba deposit. The mine has produced 594,000 oz (recovered) from 16.0 Mt of laterite, saprolite, and transition ore with an average gold grade of 1.31 g/t and overall gold recovery of 89%.

| 1.6 | Geological Setting and Mineralization |

The Aurizona Property mineralization is characterized as a greenstone-hosted orogenic gold system. Mineralization occurs as structurally-controlled gold deposits including the Piaba deposit, which is currently being mined. Piaba, Boa Esperança, Tatajuba and Genipapo deposits are on and adjacent to the Aurizona Shear Zone (ASZ), a regional northeast-striking structure. Touro is 16 km southwest of the Aurizona Mine which hosts gold mineralization within an intrusive unit. These deposits are hosted by Paleoproterozoic volcano-sedimentary and intrusive rocks of the São Luis Craton, an eastern extension of the Guyana Shield which contains several major Proterozoic gold deposits including Las Cristinas, Omai, and Rosebel, extending from Venezuela to Brazil.

The Property geology is dominated by volcano-sedimentary sequences of the 2.23-2.24 Ga Aurizona Group (Klein et al, 2015), and granitoids of the Tromaí Intrusive Suite. The Aurizona Group is comprised of felsic, intermediate, and mafic volcanic and volcaniclastic rocks, as well as metasedimentary rocks. The bedrock units are covered by Phanerozoic sedimentary basin deposits and recent coastal sediments.

Gold mineralization at Piaba and the other deposits is generally associated with subvertical tabular zones of intense shearing and hydrothermal alteration consisting of quartz-carbonate-sericite±chlorite. Quartz±carbonate shear veins are the primary host for gold mineralization with flat to shallow dipping quartz±carbonate extensional veins also carrying gold. Pyrite is the dominant sulphide with lesser arsenopyrite or pyrrhotite, except at Tatajuba and Touro where arsenopyrite mineralization is commonly observed. Native gold is observed within the grey shear veins, commonly occurring along vein margins.

| P a g e | 1-4 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

An aerially extensive regolith profile has developed across the Property with distinct effects on geochemical dispersion and physical properties within each regolith domain type. The regolith profile overprints mineralization and can extend to vertical depths of more than 60 m, and is underlain by fresh, sulphide-bearing rocks that host primary gold mineralization.

| 1.7 | Exploration and Drilling |

| 1.7.1 | Exploration |

In 2020, MASA completed drilling on numerous targets including Piaba, Boa Esperança, Genipapo and Touro. A total of 29,543 m of drilling in 65 diamond drill holes (DD) was executed in support of the Piaba underground resource for the Pre-feasibility Study herein. The Boa Esperança deposit was reverse circulation (RC) drilled for grade control purposes with 495 holes for a total of 15,919 m. Additional drilling on the Genipapo and Touro contributed to the datasets that support inaugural resource statements for these deposits.

| 1.7.2 | Drilling |

There are five deposit areas within this Report including the Piaba, Boa Esperança, Tatajuba, Genipapo and Touro deposits, which have a total of 178,943 m of drilling in 1,182 holes. The dominant drilling method for the deposit areas was HQ sized, DD with a total meterage of 152,049 m in 744 holes. RC was also utilized for 438 holes with 26,896 m. Drilling is typically oriented to the southeast or to the south to intersect steeply dipping, northeast to east-west striking mineralized zones. Grade control drilling in the Piaba open pit and at Boa Esperança is executed with RC drilling methods. There is an additional 26,567 m in 278 holes of regional diamond and RC drilling on the Property. Auger drilling has been used to delineate trends and for condemnation of site infrastructure.

| 1.8 | Sample Preparation and Data Verification |

| 1.8.1 | Sample Preparation, Analyses, and Security |

Equinox maintains a Quality Assurance/Quality Control (QA/QC) sampling program, including insertion and review of coarse blanks, certified reference materials (CRM), and duplicates. Blanks, CRMs, and quarter core duplicates are included with routine samples at a 3-4% insertion rate per material type.

Sample intervals are a nominal 1 m and range from 0.3 m to 4.0 m length and can cross geological and regolith boundaries. Core is consistently sampled on the same side and the remaining half of the core is stored in the core box for reference.

RC samples are collected at the drill rig by the contracted drilling personnel. The entire sample representing a 1 m run length is collected at the drill site. RC samples are not processed or split prior to shipment. Entire RC samples are shipped to the commercial assay laboratory where they are dried and split before analysis. Blanks and CRMs are inserted in a similar manner as with drill core samples.

After the cutting and bagging of individual samples, sample shipments are prepared in sealed rice sacks. Sample shipments are transported by a commercial transport company directly from the core facility to the preparation laboratory. The chain of custody procedures includes long term storage of records documenting transport to and receipt of sample shipments at the laboratory. The sample shipments are prepared by MASA staff and have adequate security and tracking measures employed during preparation, packing and transport.

| P a g e | 1-5 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

Equinox has used ALS Global (ALS) as its primary independent laboratory since 2008, and ACME Analytical Laboratories Ltd (ACME, now Bureau Veritas) in 2007 and late in 2011. A variety of laboratory locations have been used to prepare and assay samples, all of which of follow ISO procedures.

From 2007 to 2016 all drilling samples were analysed by fire assay with atomic absorption spectroscopy (AAS) finish and samples returning greater than 10 g/t gold were automatically re-analysed via fire assay with gravimetric finish. In 2017, the procedure was modified to include assay of samples that return greater than 10 g/t gold by screen fire assay to address the presence of coarse gold.

The QA/QC materials are appropriately matched to the mineralization at Property. The results are reviewed on a batch by batch basis to monitor the accuracy and precision of the results. A series of rules are followed to audit the QA/QC results and possible failures and subsequent follow up actions are taken as required. The sample preparation, analysis and security procedures demonstrate that the resultant dataset is adequate for use in Mineral Resource estimation and preparation of Mineral Reserves.

| 1.8.2 | Data Verification |

The data used in the resource models and resource estimation was reviewed for critical errors and to evaluate the quality of the analytical data. Location data for the collars and downhole survey measurements were checked for gross errors. Measured physical property values were used to recalculate and verify the in-situ bulk density values being used. The assay data was checked for ranking accuracy and the QA/QC results were evaluated statistically and plotted for visual evaluation. The results of the data verification demonstrate the data is adequate for use in Mineral Resource estimation and preparation of Mineral Reserves.

| 1.9 | Mineral Resource Estimate |

The current Mineral Resource estimate of the Aurizona Property comprises the Piaba, Boa Esperança, Tatajuba, Genipapo and Touro deposits. The resource estimate is an update of the previous Mineral Resource estimates with effective dates of December 31, 2019, for Piaba and Boa Esperança, and effective date of February 28, 2020, for Tatajuba. The Mineral Resource estimates for Genipapo and Touro are presented for the first time. The Mineral Resources from the Piaba, Boa Esperança, Tatajuba, Genipapo and Touro deposits presented herein have an effective date of June 30, 2021 and are shown in Table 1-1.

| P a g e | 1-6 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

Table 1-1: Consolidated Mineral Resource Statement Exclusive of Reserves for Aurizona Property, Maranhão, Brazil

| Deposit | Area | Category | Cut-Off Grade | Tonnes | Gold | Gold |

| Gold (g/t) | (kt) | (g/t) | (koz) | |||

| Piaba | Open Pit | Measured | 0.3 | 2,438 | 1.21 | 95 |

| Indicated | 3,114 | 1.19 | 121 | |||

| Inferred | 53 | 0.77 | 1 | |||

| Boa Esperança | Open Pit | Measured | 0.3 | 66 | 0.60 | 1 |

| Indicated | 0.3 | 427 | 1.03 | 14 | ||

| Inferred | 438 | 1.11 | 16 | |||

| Genipapo | Open Pit | Indicated | 0.3 | 249 | 0.84 | 7 |

| Inferred | 6 | 0.76 | 0 | |||

| Tatajuba | Open Pit | Indicated | 0.3 | 181 | 1.39 | 8 |

| Touro | Open Pit | Indicated | 0.3 | 2,965 | 0.78 | 75 |

| Inferred | 1,763 | 0.72 | 41 | |||

| Total Open Pit | M&I | 0.3 | 9,441 | 0.80 | 320 | |

| Inferred | 2,260 | 0.80 | 58 | |||

| Piaba | Underground | Measured | 1.0 | 1,000 | 2.10 | 67 |

| Indicated | 7,212 | 1.96 | 454 | |||

| Inferred | 9,448 | 2.46 | 747 | |||

| Tatajuba | Underground | Indicated | 1.0 | 464 | 1.73 | 26 |

| Inferred | 981 | 2.84 | 90 | |||

| Total Underground | M&I | 1.0 | 8,676 | 1.96 | 547 | |

| Inferred | 10,430 | 2.50 | 837 | |||

| Total Aurizona Resource | M&I | 18,117 | 1.49 | 868 | ||

| Inferred | 12,689 | 2.19 | 895 | |||

| Notes: |

| 1. | Mineral Resources are reported exclusive of reserves. |

| 2. | The Open Pit Mineral Resource is constrained using an optimized pit that has been generated using Lerchs-Grossman pit optimisation algorithm with parameters outlined in Table 1-3 |

| 3. | The Underground Mineral Resources are constrained using a 1.00 g/t gold grade shell occurring the lower of 20 m below the transition-fresh rock contact, or 20 m below the Reserve pit. |

| 4. | Mineral Resources are based on the Mineral Resource statements for each respective deposit and area, and have been prepared by Trevor Rabb, P.Geo who is a qualified person as defined by NI 43-101. |

| 5. | Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. |

| 6. | The Mineral Resource statement has been prepared in accordance with NI43-101 Standards of Disclosure for Mineral Projects (May 2016) and the CIM Definition Standards for Mineral Resources and Mineral Reserves (May 2014). |

| 7. | Any discrepancies in the totals are due to rounding effects. |

| 8. | Mineral Resources presented herein have an effective date of June 30, 2021. |

Mineral Resources are reported using a cut-off grade of 0.30 g/t gold for open pit resources and 1.00 g/t gold for underground resources, based on assumptions presented in The Mineral Resources presented conform with the most recent CIM Definition Standards (CIM, 2014), and have been prepared according to CIM Best Practice Guidelines (CIM, 2019).

| P a g e | 1-7 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

To sufficiently test the reasonable prospects for eventual economic extraction by an open pit, AGP used MinePlan’s pit optimiser with input parameters to evaluate the portions of the block model that could be extracted economically. The pit optimization parameters are summarised in Table 1-2, Table 1-3, and Table 1-4 . The results of the pit optimisation are used to constrain the Mineral Resource with respect to the CIM Definition Standards and does not constitute an attempt to estimate reserves. The open pit resources are restricted to blocks contained within the optimised pit, and above a datum that is the lower of 20 m below the reserve pit or 20 m below the fresh rock – transition contact.

Block model quantities and grade estimates were classified in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves by Trevor Rabb, P.Geo. (Equity). Geologic interpretations were performed by MASA and Equity in Datamine Studio and Micromine software. Interpretations were imported into Leapfrog software to assist with generating final resource domains. Estimation of Mineral Resources was completed using Micromine software. The databases were provided by Equinox and validated for adequacy by Eleanor Black, P.Geo. (Equity).

Table 1-2 The Mineral Resources presented conform with the most recent CIM Definition Standards (CIM, 2014), and have been prepared according to CIM Best Practice Guidelines (CIM, 2019).

To sufficiently test the reasonable prospects for eventual economic extraction by an open pit, AGP used MinePlan’s pit optimiser with input parameters to evaluate the portions of the block model that could be extracted economically. The pit optimization parameters are summarised in Table 1-2, Table 1-3, and Table 1-4 . The results of the pit optimisation are used to constrain the Mineral Resource with respect to the CIM Definition Standards and does not constitute an attempt to estimate reserves. The open pit resources are restricted to blocks contained within the optimised pit, and above a datum that is the lower of 20 m below the reserve pit or 20 m below the fresh rock – transition contact.

Block model quantities and grade estimates were classified in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves by Trevor Rabb, P.Geo. (Equity). Geologic interpretations were performed by MASA and Equity in Datamine Studio and Micromine software. Interpretations were imported into Leapfrog software to assist with generating final resource domains. Estimation of Mineral Resources was completed using Micromine software. The databases were provided by Equinox and validated for adequacy by Eleanor Black, P.Geo. (Equity).

Table 1-2: Pit Optimisation Parameters for Open Pit Resources

| Metal Prices | |

| Gold Price (US$ per Au oz) | $1,500 |

| Payability (% ) | 99.9% |

| Refining/Transportation (US$ per Au oz) | $23.52 |

| Royalty (%) | 3% |

| Wall Slopes (Overall Angle in Degrees) | |

| Laterite | 33° |

| Saprolite | 45° |

| Transition | 39° |

| Rock | 60° |

| P a g e | 1-8 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

Table 1-3: Pit Optimisation Parameters for Piaba, Boa Esperança, Tatajuba, Genipapo, and Touro

| Waste Mining Costs (US$/t moved) | Piaba | Boa | Tatajuba | Genipapo | Touro |

| Laterite/Saprolite | $1.90 | $1.90 | $1.91 | $1.91 | $1.91 |

| Hard Saprolite/Transition | $2.40 | $2.40 | $2.27 | $2.27 | $2.27 |

| Rock | $2.52 | $2.52 | $3.49 | $3.49 | $3.49 |

| Ore Mining Costs (US$/t/6 m Bench) | Piaba | Boa | Tatajuba | Genipapo | Touro |

| Laterite/Saprolite | $2.32 | $2.32 | $4.53 | $2.53 | $8.53 |

| Hard Saprolite/Transition | $3.18 | $3.18 | $5.06 | $3.06 | $9.06 |

| Rock | $3.55 | $3.55 | $5.49 | $3.49 | $9.49 |

| Incremental Mining Costs (US$/t/6 m Bench) | Piaba | Boa | Tatajuba | Genipapo | Touro |

| Laterite/Saprolite | $0.01 | $0.01 | $0.01 | $0.01 | $0.01 |

| Hard Saprolite/Transition | $0.01 | $0.01 | $0.00 | $0.00 | $0.00 |

| Rock | $0.01 | $0.01 | $0.00 | $0.00 | $0.00 |

| Process Costs (US$/t processed) | Piaba | Boa | Tatajuba | Genipapo | Touro |

| Laterite/Saprolite | $7.57 | $7.57 | $7.75 | $7.57 | $7.57 |

| Hard Saprolite/Transition | $7.75 | $7.75 | $7.75 | $7.75 | $7.75 |

| Rock | $9.34 | $9.34 | $9.34 | $9.34 | $9.34 |

| G&A Costs | $4.89 | $4.89 | $4.89 | $4.89 | $4.89 |

| Process Recovery (%) | Piaba | Boa | Tatajuba | Genipapo | Touro |

| Laterite | 93.1% | 91.8% | 91.4% | 91.4% | 91.4% |

| Saprolite | 93.1% | 91.8% | 91.4% | 91.4% | 91.4% |

| Transition | 94.1% | 97.1% | 91.4% | 91.4% | 91.4% |

| Fresh | 90.0% | 90.0% | 91.4% | 91.4% | 91.4% |

Table 1-4: Underground Mining Assumptions

| Ta | Unit Cost | Amount |

| Gold Price | US$ per oz | $1,500 |

| Payability | % | 100 |

| Refining/Transportation | US$ per oz | $19.50 |

| Royalty | % | 4 |

| Mining Costs | US$ /t | $32.92 |

| Process Costs | US$/t processed | $9.34 |

| Process Recovery | % | 90 |

| 1.10 | Mineral Processing and Metallurgical Testing |

Significant metallurgical test work has been completed on ore samples from various parts of the Aurizona deposit. Metallurgical test work has historically been completed on laterite, saprolite, transition and fresh rock types from the various deposits. Detailed summaries of previous metallurgical test work programs can be found in previous technical reports such as Lycopodium et al, 2017.

| P a g e | 1-9 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

Recent metallurgical test work has been completed on samples of Tatajuba ore and Piaba underground ore relevant to the subject of this technical report. The Piaba metallurgical test work program is still on-going at the time of this report publishing. In general, the ore samples tested from Tatajuba and Piaba underground resulted in a similar metallurgical response of previous ore tested and fall within the expected ranges of historical test work results and are not expected to result in significant flowsheet or operational changes to the existing process plant.

| 1.11 | Mineral Reserves Estimate |

The Proven and Probable Mineral Reserves at the Aurizona Mine have been classified in accordance with the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves. Mineral Reserves are defined within a mine plan, with open pit phase designs guided by Lerchs-Grossmann optimized pit shells.

The Mineral Reserve estimate for the Aurizona Mine, effective June 30, 2021, is summarized in Table 1-5.

| P a g e | 1-10 |

| 04/11/2021 |

| TECHNICAL REPORT ON THE AURIZONA GOLD MINE EXPANSION PRE-FEASIBILITY STUDY |  |

Table 1-5: Aurizona Mine - Proven and Probable Reserves - June 30, 2021

| Proven | Probable | Total | |||||||

| Ore Type | Tonnes (kt) | Gold Grade (g/t) | Gold (koz) | Tonnes (kt) |

Gold Grade (g/t) |

Gold (koz) | Tonnes (kt) | Gold Grade (g/t) | Gold (koz) |

| Laterite | 23 | 0.71 | 1 | 448 | 0.87 | 12 | 471 | 0.86 | 13 |

| Saprolite | 1,525 | 1.28 | 63 | 2,342 | 1.23 | 92 | 3,867 | 1.25 | 155 |

| Transition | 2,435 | 1.08 | 84 | 853 | 0.90 | 25 | 3,288 | 1.03 | 109 |

| Rock | 12,598 | 1.46 | 592 | 12,106 | 2.03 | 791 | 24,704 | 1.74 | 1,383 |

| Total | 16,581 | 1.39 | 740 | 15,749 | 1.82 | 920 | 32,330 | 1.60 | 1,660 |

| Note: |

| 1. | This Mineral Reserve estimate is as of June 30, 2021 and is based on the Mineral Resource estimates for Piaba, Boa Esperança, Tatajuba, and Genipapo all dated June 30, 2021 by Equity Exploration. The Mineral Reserve calculation was completed under the supervision of Gordon Zurowski, P.Eng. of AGP., who is a Qualified Person as defined under NI 43-101. Mineral Reserves are stated within the final design pits based on a $1,350/oz gold price. |

| 2. | The gold cut-off grades used were: |

| • | Piaba Open Pit - 0.35 g/t (laterite, saprolite, transition), 0.41 g/t (rock) |

| • | Tatajuba Open Pit - 0.43 g/t (laterite, saprolite, transition), 0.47 g/t (rock) |

| • | Boa Esperança, Genipapo Open Pit - 0.36 g/t (laterite, saprolite) |

| • | Piaba Underground - 1.80 g/t (rock) |

| 3. | Open pit mining costs varied by area but averaged $2.25/t mined and included an extra $2/t for ore haulage to the process plant from Tatajuba. |

| 4. | Underground Mining costs averaged $32.78/t ore mined. |

| 5. | Processing costs averaged $11.52/t ore based on variable costs by material type of $7.84/t for laterite/saprolite, $8.08/t for transition and $12.63/t for fresh rock. |

| 6. | G&A was $6.47/t ore processed. |

| 7. | LOM gold recovery is 90.5%. Recoveries varied by area and material type. |

| 1.12 | Mining |

The Aurizona Mine is an open pit operation using conventional mining equipment. Open pit mining is being completed by a local Brazilian contractor. The Life-of-Mine (LOM) plan includes the addition of underground mining beneath the Piaba pit that assists in extending the mine life to 2032.

The mine schedule is based on 2021 reserves using the Piaba, Piaba East, Boa Esperança, Tatajuba, and Genipapo pit areas plus the Piaba Underground. It totals 32.3 Mt of proven and probable ore grading 1.60 g/t gold to the process plant over a current design life of 11 years. The ore tonnage is made up of 16.6 Mt of proven reserves grading 1.39 g/t gold and 15.7 Mt of probable reserves grading 1.82 g/t gold and includes 0.3 Mt of proven ore at 0.92 g/t gold currently in the stockpile from 2021 mining activity.