Table of Contents

British Columbia, Canada |

7372 |

Not applicable | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

| Marc J. Ross Avital Perlman Sichenzia Ross Ference LLP 1185 Avenue of the Americas, 31st Floor New York, NY 10036 Tel: (212) 930-9700 |

Brett Hanson Emily Humbert Fox Rothschild LLP 222 South Ninth Street, Suite 2000 Minneapolis, MN 55402 Tel: (612) 607-7000 |

| Emerging growth company |

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION |

DATED November 7, 2022 |

Per Share |

Per Related Twenty Five Warrants |

Total if Minimum Offering is Raised |

Total if Maximum Offering is Raised |

|||||||||||||

| Public offering price |

$ | 24.75 | $ | 0.25 | $ | 15,000,000 | $ |

35,000,000 |

| |||||||

| Placement agent fees (1) |

$ | 1.7325 | $ | 0.0175 | $ | 1,050,000 | $ | 2,450,000 | ||||||||

| Proceeds, before expenses, to us |

$ | 23.0175 | $ | 0.2325 | $ | 13,950,000 | $ | 32,550,000 | ||||||||

| (1) | See “Plan of Distribution” on page 129 of this prospectus for a description of all placement agent compensation payable in connection with this offering. |

| 1 | ||||

| 13 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 37 | ||||

| 42 | ||||

| 89 | ||||

| 101 | ||||

| 117 | ||||

| 118 | ||||

| 118 | ||||

| 124 | ||||

| 128 | ||||

| 128 | ||||

| 128 | ||||

| 133 | ||||

| 133 | ||||

| 133 | ||||

F-1 |

| • | HVAC units and refrigerators in commercial buildings; |

| • | control systems, heat exchangers, and compressors at process industry facilities; and |

| • | wind turbines generating renewable energy at onshore wind farms. |

| • | curbing wasted energy while improving occupant comfort in commercial facilities through AI-powered adaptive control; |

| • | maximizing asset availability and production yields of renewable energy sources through continuous performance assessment and predictive maintenance; and |

| • | optimizing the uptime and manage the operational risk of industrial process plants, including oil and gas facilities, through continuous AI-powered advisory and assistance to process operators in the field. |

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, |

| • | reduced disclosure obligations regarding executive compensation in periodic reports, proxy statements and registration statements, and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

| • | Quorum Requirement |

| • | Shareholder Approval Requirements |

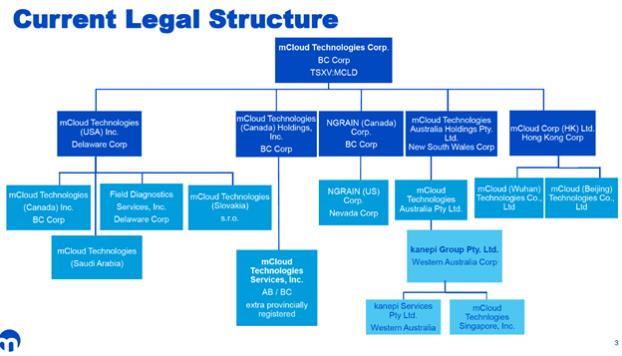

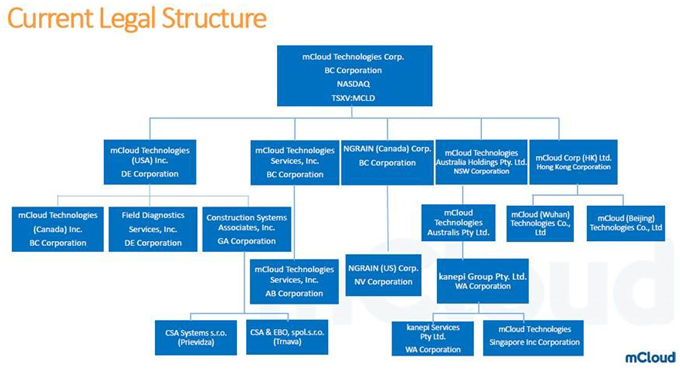

| • | Depending on the context, the terms “we,” “us,” “our company,” and “our” refer to mCloud Technologies Corp., and its consolidated subsidiaries: |

| • | “preferred shares” refer to our Series A Preferred Shares, no par value. |

| • | all references to “CAD”, “CAD$” and “Canadian dollar” are to the legal currency of Canada, and all references to “USD,” “$”, “US$” and “U.S. dollars” are to the legal currency of the United States. |

Series A Preferred Shares |

1,400,000 Series A Preferred Shares on a best efforts basis | |

Offering Price |

$25.00 per Series A Preferred Share and Warrant on a combined basis | |

Warrants |

Warrants to purchase up to 35,000,000 Common Shares, which are exercisable on the date of issuance and expire on November 29, 2026, at an exercise price per Common Share equal to $4.75. | |

Minimum and Maximum Offering Amount; Offering Period |

We do not intend to close this offering unless we sell at least a minimum number of Series A Preferred Shares and Warrants to result in gross proceeds equal to or greater than $15,000,000 (the “Minimum Amount”). Because this is a best efforts offering, the placement agent does not have an obligation to purchase any securities, and, as a result, there is a possibility that we may not be able to sell the minimum offering amount. We expect that the offering will end on the first to occur of (i) the sale of the maximum number of Series A Preferred Shares and Warrants resulting in gross proceeds of $35,000,000 and (ii) the conclusion of the 60 day offering period. Accordingly, we and the placement agent have made arrangements to place investor funds in a separate bank account to be held until the closing. Unless the Minimum Amount is subscribed for and accepted by the Company by the conclusion of the offering period, or waived by the Company, the offering will be terminated and all subscription proceeds will be returned to investors without interest or deduction. | |

Number of Series A Preferred Shares issued and outstanding before this offering |

0 | |

Number of Series A Preferred Shares outstanding after this offering |

1,400,000 shares, if the maximum number of Series A Preferred Shares are sold in this offering. | |

Number of Common Shares outstanding prior to offering |

16,224,788 shares. | |

| Liquidation Preference |

The liquidation preference of each Series A Preferred Share is $25.00 per share. Upon liquidation, holders of Series A Preferred Shares will be entitled to receive the liquidation preference with respect to their Series A Preferred Shares plus an amount equal to accumulated but unpaid dividends with respect to such shares. | |

Conversion |

The Series A Preferred Shares will be convertible into common Shares based on a conversion ratio of (i) the $25.00 per share liquidation preference divided by (ii) $1.00 (subject to adjustment for certain dilutive issuances). Therefore, each Series A Preferred Share is initially convertible into 25 Common Shares. Upon such a conversion, any declared but unpaid dividends shall be paid to the holder of Series A Preferred Shares in cash. In the event that the conversion would result in the issuance of fractional Common Shares, we will pay the holder the cash value of such fractional shares in lieu of such fractional shares based on a price per Common Share equal to the then current conversion price. | |

Dividends |

Subject to the preferential rights, if any, of the holders of any class or series of capital stock of the Company ranking senior to the Series A Preferred Shares as to dividends, the holders of the Series A Preferred Shares will be entitled to receive, when, as and if declared by the Board (or a duly authorized committee of the Board), only out of funds legally available for the payment of dividends, cumulative cash dividends at the annual rate of 9.0% of the $25.00 liquidation preference per year (equivalent to $2.25 per year) until the beginning of the fifth year, at which time the annual rate will increase 4.0% per calendar quarter until it reaches a maximum of 25.0%. Dividends on the Series A Preferred Shares will accumulate and be cumulative from, and including, the date of original issue by us of the Series A Preferred Shares. However, the Company will be entitled to defer the payment of any declared dividends on the Series A Preferred Shares until the occurrence of a liquidation or Board approved Change of Control of the Company. | |

Ranking |

The Series A Preferred Shares will rank, as to dividend rights and rights upon our liquidation, dissolution or winding up: (1) Senior to all classes or series of our common shares and to all other equity securities issued by us other than any equity securities issued with terms specifically providing that those equity securities rank on a parity with the Series A Preferred Shares; (2) Junior to any future equity securities issued by us with terms specifically providing that those equity securities rank senior to the Series A Preferred Shares with respect to the payment of dividends and the distribution of assets upon our liquidation, dissolution or winding up; and (3) Effectively junior to all our existing and future indebtedness (including indebtedness convertible into our common shares or preferred shares) and to the indebtedness and other liabilities of (as well as any preferred equity interests held by others in) our existing or future subsidiaries. | |

No Maturity Date |

The Series A Preferred Shares are perpetual and have no maturity date, and we are not required to redeem the Series A Preferred Shares. Accordingly, all Series A Preferred Shares will remain outstanding indefinitely, unless and until they are redeemed or converted in accordance with their terms. | |

Preemptive Rights |

Holders of Series A Preferred Shares will have no preemptive rights. | |

Voting Rights |

In any matter in which the Series A Preferred Shares may vote, as described below, each Series A Preferred Share shall be entitled to one vote per $25.00 of liquidation preference; provided that if the Series A Preferred Shares and any other stock ranking on parity to the Series A Preferred Shares as to dividend rights and rights as to the distribution of assets upon the Corporation’s liquidation, dissolution or winding up are entitled to vote together as a single class on any matter, the holders of each will vote in proportion to their respective liquidation preferences. So long as any Series A Preferred Shares remain outstanding, the Company will not, without the consent or the affirmative vote of the holders of at least two-thirds of the outstanding Series A Preferred Shares and each other class or series of preferred stock entitled to vote thereon (voting together as a single class), given in person or by proxy, either in writing without a meeting or by vote at any meeting called by the Company for the purpose:(i) authorize, create or issue, or increase the number of authorized or issued number of shares of, any class or series of capital stock ranking senior to the Series A Preferred Shares with respect to payment of dividends or the distribution of assets upon the liquidation, dissolution or winding up of the Company or reclassify any authorized capital stock of the Company into any such shares, or create, authorize or issue any obligation or security convertible into or evidencing the right to purchase any such shares; or (ii) amend, alter or repeal the provisions of the Articles of Incorporation, as amended, including the terms of the Series A Preferred Shares, whether by merger, consolidation, transfer or conveyance of all or substantially all of the Company’s assets or otherwise, so as to materially and adversely affect the rights, preferences, privileges or voting powers of the Series A Preferred Shares, taken as a whole. If any event described in paragraph (ii) above would materially and adversely affect the rights, preferences, privileges or voting powers of the Series A Preferred Shares, taken as a whole, disproportionately relative to any other class or series of voting preferred stock (as defined below), the affirmative vote of the holders of at least two-thirds of the outstanding shares of the Series A Preferred Shares, voting as a separate class, will also be required. Furthermore, if holders of shares of the Series A Preferred Shares receive the $25.00 per share of the Series A Preferred Shares liquidation preference plus all declared and unpaid dividends thereon or greater amounts pursuant to the occurrence of any of the events described in paragraph (ii) above, then such holders shall not have any voting rights with respect to the events described in such paragraph. As used herein, “voting preferred stock” means any other class or series of the Company’s preferred stock ranking equally with the Series A Preferred Shares as to dividends (whether cumulative or non-cumulative) and the distribution of the Company’s assets upon liquidation, dissolution or winding up and upon which like voting rights to the Series A Preferred Shares have been conferred and are exercisable. | |

Use of Proceeds |

We intend to use the proceeds from this offering for working capital and general corporate purposes, including retiring convertible debenture debt that was due June 30, 2022. See “Use of Proceeds” for more information. | |

Restrictions on Dividends, Redemption and Repurchases |

So long as any Series A Preferred Share remains outstanding, unless we also have either paid or declared and set apart for payment full cumulative dividends on the Series A Preferred Shares for all past completed dividend periods, we will not during any dividend period: (1) pay or declare and set apart for payment any dividends or declare or make any distribution of cash or other property on Common Shares or other capital stock that ranks junior to or on parity with the Series A Preferred Shares with respect to dividend rights and rights to the distribution of assets upon our voluntary or involuntary liquidation, dissolution or winding up (other than, in each case, (a) a dividend paid in Common Shares or other stock ranking junior to the Series A Preferred Shares with respect to dividend rights and rights to the distribution of assets upon our voluntary or involuntary liquidation, dissolution or winding up or (b) any declaration of a Common Share dividend in connection with any stockholders’ rights plan, or the issuance of rights, stock or other property under any stockholders’ rights plan, or the redemption or repurchase of rights pursuant to such plan); (2) redeem, purchase or otherwise acquire Common Shares or other capital stock that ranks junior to or on parity with the Series A Preferred Shares (other than the Series A Preferred Shares) with respect to dividend rights and rights to the distribution of assets upon our voluntary or involuntary liquidation, dissolution or winding up (other than (a) by conversion into or exchange for Common Shares or other capital stock ranking junior to the Series A Preferred Shares with respect to dividend rights and rights to the distribution of assets upon our voluntary or involuntary liquidation, dissolution or winding up, (b) the redemption of shares of capital stock pursuant to the provisions of our memorandum of articles, as amended, relating to the restrictions upon ownership and transfer of our capital stock, (c) a purchase or exchange offer made on the same terms to holders of all outstanding A Preferred Shares and any other capital stock that ranks on parity with the Series A Preferred Shares with respect to dividend rights and rights to the distribution of assets upon our voluntary or involuntary liquidation, dissolution or winding up, (d) purchases, redemptions or other acquisitions of shares of our capital stock ranking junior to the Series A Preferred Shares with respect to dividend rights and rights to the distribution of assets upon our voluntary or involuntary liquidation, dissolution or winding up pursuant to any employment contract, dividend reinvestment and stock purchase plan, benefit plan or other similar arrangement with or for the benefit of employees, officers, directors, consultants or advisors, (e) through the use of the proceeds of a substantially contemporaneous sale of stock ranking junior to the Series A Preferred Shares with respect to dividend rights and rights to the distribution of assets upon our voluntary or involuntary liquidation, dissolution or winding up, or (f) purchases or other acquisitions of shares of our capital stock pursuant to a contractually binding stock repurchase plan existing prior to the preceding Dividend Payment Date on which dividends were not paid in full); or (3) redeem, purchase or otherwise acquire Series A Preferred Shares (other than (a) by conversion into or exchange for Common Shares or other capital stock ranking junior to the Series A Preferred Shares with respect to dividend rights and rights to the distribution of assets upon our voluntary or involuntary liquidation, dissolution or winding up, (b) a purchase or exchange offer made on the same terms to holders of all outstanding Series A Preferred Shares or (c) with respect to redemptions, a redemption pursuant to which all Series A Preferred Shares are redeemed). |

Optional Redemption |

The Series A Preferred Shares are not redeemable prior to [ ], which is the first anniversary of the initial closing date of this offering, except for the circumstances described under “Special Optional Redemption.” On or after [ ], the Series A Preferred Shares may be redeemed at our option, in whole or in part, from time to time, at a redemption price of $25.00 per Series A Preferred Share, plus all dividends accumulated and unpaid (whether or not declared) on the Series A Preferred Shares up to, but not including, the date of such redemption, upon the giving of notice. | |

Special Optional Redemption |

Upon the occurrence of any Delisting Event, Change of Control, or $8 VWAP Event, whether before or after [ ], we may, at our option, redeem the Series A Preferred Stock, in whole or in part and within 90 days after the date of the Delisting Event, Change of Control or $8 VWAP Event, by paying $25.00 per share of Series A Preferred Stock, plus all dividends accumulated and unpaid (whether or not declared) on the Series A Preferred Stock up to, but not including, the date of such redemption. | |

| A “Delisting Event” occurs when, after the original issuance of Series A Preferred Stock, both (i) the shares of Series A Preferred Stock are no longer listed on Nasdaq, the New York Stock Exchange (the “NYSE”) or the NYSE American LLC (“NYSE AMER”), or listed or quoted on an exchange or quotation system that is a successor to Nasdaq, the NYSE or the NYSE AMER, and (ii) the Company not subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), but any Series A Preferred Stock is still outstanding. | ||

| A “Change of Control” occurs when, after the original issuance of the Series A Preferred Stock, the following have occurred and are continuing: (a) any person or persons acting together which would constitute a “group” for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), (other than the Company or any subsidiary of the Company) shall beneficially own (as defined in Rule 13d-3 of the Exchange Act), directly or indirectly, at least 25% of the total voting power of all classes of capital stock of the Company entitled to vote generally in the election of the Board; (b) Current Directors (as herein defined) shall cease for any reason to constitute at least a majority of the members of the Board (for this purpose, a “Current Director” shall mean any member of the Board as of the date hereof and any successor of a Current Director whose election, or nomination for election by the Company’s shareholders, was approved by at least a majority of the Current Directors then on the Board); (c) (i) the complete liquidation of the Company or (ii) the merger or consolidation of the Company, other than a merger or consolidation in which (x) the holders of the common stock of the Company immediately prior to the consolidation or merger have, directly or indirectly, at least a majority of the common stock of the continuing or surviving corporation immediately after such consolidation or merger or (y) the Board immediately prior to the merger or consolidation would, immediately after the merger or consolidation, constitute a majority of the board of directors of the continuing or surviving corporation, which liquidation, merger or consolidation has been approved by the shareholders of the Company; or (d) the sale or other disposition (in one transaction or a series of transactions) of all or substantially all of the assets of the Company pursuant to an agreement (or agreements) which has (have) been approved by the shareholders of the Company. |

| An “$8 VWAP Event” occurs when, after the original issuance of Series A Preferred Stock, the volume weighted average price of the Common Shares on the Nasdaq Capital Market for five consecutive trading days (as reported by Bloomberg L.P. based on a trading day from 9:30 a.m. to 4:02 p.m. (New York City time)) is at least $8.00. | ||

Redemption Upon Request of Holder in Connection with Change of Control: |

Upon the occurrence of a Board Approved Change of Control, holders of our Series A Preferred Shares may (i) require us to redeem their shares of our Series A Preferred Shares at a per share redemption price of $25.00, plus declared and unpaid dividends to, but excluding, the effective date of the Change of Control, or (ii) continue to hold our Series A Preferred Shares (subject to the Company’s option to redeem the Series A Preferred Shares as set forth above). | |

Anti-Dilution Adjustment |

If, at any time while the Series A Preferred Shares are outstanding, we sell or grant (or announce any offer, sale or grant) of any Common Shares or Common Share equivalents entitling any person to acquire our Common Shares at an effective price per share that is lower than the original $1.00 conversion price, then the conversion price will be reduced to equal such lower price (though not less than $0.20 or, for so long as the Common Shares are listed on the TSX Venture Exchange, not less than the “Market Price” as that term is defined in the policies of the TSX Venture Exchange). However, no conversion price adjustment will be made in respect of certain identified exempt issuances. | |

Segregated Dividend Payment Account |

The Company shall establish a segregated account that will be funded at closing of the offering with proceeds in an amount equal to nine (9) months of dividends on the maximum number of Series A Preferred Shares. The segregated account may only be used to pay dividends declared on the Series A Preferred Shares, when legally permitted, and may not be used for other corporate purposes. | |

Listing |

We are in the process of applying to have the Series A Preferred Shares listed on Nasdaq under the symbol “MCLDP.” There is no assurance that our listing application will be approved. Our Warrants will trade on the Nasdaq along with the Listed Warrants under the symbol “MCLDW.” Our Common Shares are listed on Nasdaq under the symbol “MCLD” and our Listed Warrants are listed under the symbol “MCLDW.” Our Common Shares are also listed on the TSXV under the symbol “MCLD”. | |

Best Efforts |

We have agreed to issue and sell the Series A Preferred Shares and Warrants offered hereby to the public through the placement agent, and the placement agent has agreed to offer and sell such securities on a “best efforts” basis. The placement agent is not required to sell any specific number or dollar amount of the securities offered hereby, but will use their best efforts to sell such securities. See “Plan of Distribution” on page 129. | |

Risk Factors |

Investing in these securities involves a high degree of risk. | |

Six months ended June 30, 2022 |

2021 Recast (1) |

Year ended December 31, 2020 Recast (1) |

2019 Recast (1) |

|||||||||||||

| Revenue |

$ | 6,698,629 | $ | 25,596,972 | $ | 26,928,439 | $ | 18,340,249 | ||||||||

| Cost of sales |

(3,865,798 | ) | (9,683,748 | ) | (10,281,922 | ) | (7,583,127 | ) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Gross profit |

$ | 2,832,831 | $ | 15,913,224 | $ | 16,646,517 | $ | 10,757,122 | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Expenses |

||||||||||||||||

| Salaries, wages and benefits |

10,373,584 | 21,691,774 | 20,885,044 | 10,313,803 | ||||||||||||

| Sales and marketing |

1,902,215 | 1,377,255 | 1,536,420 | 3,166,788 | ||||||||||||

| Research and development |

1,100,284 | 3,179,353 | 1,078,164 | 498,099 | ||||||||||||

| General and administration |

4,617,456 | 8,538,854 | 5,741,872 | 3,294,550 | ||||||||||||

| Professional and consulting fees |

6,736,389 | 9,085,436 | 8,886,341 | 4,351,812 | ||||||||||||

| Share-based compensation |

444,461 | 1,867,915 | 1,454,235 | 1,468,361 | ||||||||||||

| Depreciation and amortization |

3,769,628 | 8,924,812 | 6,778,100 | 4,044,143 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total expenses |

$ | 28,944,017 | $ | 54,665,399 | $ | 46,360,176 | $ | 27,137,556 | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Operating loss |

$ | 26,111,186 | $ | 38,752,175 | $ | 29,713,659 | $ | 16,380,434 | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Other expenses (income) |

||||||||||||||||

| Finance costs |

4,088,630 | 8,618,794 | 6,033,510 | 3,217,500 | ||||||||||||

| Foreign exchange (gain) loss |

(493,543 | ) | (267,294 | ) | 1,198,372 | 494,404 | ||||||||||

| Business acquisition costs and other expenses |

— | 346,420 | 1,811,682 | 9,880,170 | ||||||||||||

| Impairment |

— | — | — | 600,657 | ||||||||||||

| Fair value (gain) loss on derivatives |

(5,031,599 | ) | 6,040,121 | — | — | |||||||||||

| Other income |

(662,292 | ) | (7,126,097 | ) | (2,932,342 | ) | (167,913 | ) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Loss before tax |

$ | 24,012,382 | $ | 46,364,119 | $ | 35,824,881 | $ | 30,405,252 | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Current tax expense (recovery) |

104,682 | 157,303 | (295,709 | ) | 181,895 | |||||||||||

| Deferred tax (recovery) |

(1,482,234 | ) | (1,822,109 | ) | (668,209 | ) | (2,692,313 | ) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net loss for the period |

22,634,830 |

$ |

44,699,313 |

$ |

34,860,963 |

$ |

27,894,834 |

|||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Other comprehensive (income) loss |

||||||||||||||||

| Foreign subsidiary translation differences |

882,069 | 69,460 | (1,209,006 | ) | (607,302 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Comprehensive loss for the period |

$ |

23,516,899 |

$ |

44,768,773 |

$ |

33,651,957 |

$ |

27,287,532 |

||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net loss (income) for the period attributable to: |

||||||||||||||||

| mCloud Technologies Corp. shareholders |

17,829,232 | 44,762,700 | 36,447,551 | 28,484,890 | ||||||||||||

| Non-controlling interest |

4,805,598 | (63,387 | ) | (1,586,588 | ) | (590,056 | ) | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

$22,634,830 |

$44,699,313 |

$ 34,860,963 |

$27,894,834 |

|||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Comprehensive loss (income) for the period attributable to: |

||||||||||||||||

| mCloud Technologies Corp. shareholders |

18,764,690 | 44,970,815 | 35,398,294 | 28,054,299 | ||||||||||||

| Non-controlling interest |

4,752,209 | (202,042 | ) | (1,746,337 | ) | (766,767 | ) | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

$23,516,899 |

$44,768,773 |

$ 33,651,957 |

$27,287,532 |

|||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Loss per share attributable to mCloud shareholders – basic and diluted |

$ |

1.10 |

$ |

3.76 |

$ |

5.01 |

$ |

6.97 |

||||||||

| Weighted average number of common shares outstanding basic and diluted |

16,151,197 |

11,898,183 |

7,272,464 |

4,085,322 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (1) | See Note 2 of the Consolidated Financial Statements for the Years Ended December 31, 2021, 2020 and 2019. |

June 30, 2022 |

December 31, 2021 |

December 31, 2020 |

December 31, 2019 |

|||||||||||||

Recast (1) |

Recast (1) |

Recast (1) |

||||||||||||||

| ASSETS |

||||||||||||||||

| Current assets |

||||||||||||||||

| Cash and cash equivalents |

$ | 4,405,948 | $ | 4,588,057 | $ | 1,110,889 | 529,190 | |||||||||

| Trade and other receivables |

12,134,992 | 14,566,975 | 12,312,814 | 9,091,654 | ||||||||||||

| Current portion of prepaid expenses and other assets |

|

2,679,472 |

|

|

2,355,350 |

|

|

1,326,319 |

|

|

839,012 |

| ||||

| Current portion of long-term receivables |

|

390,398 |

|

|

397,060 |

|

|

445,213 |

|

|

378,221 |

| ||||

| |

|

|

|

|

|

|

|

|||||||||

| Total current assets |

$ | 19,610,810 | $ | 21,907,442 | $ | 15,195,235 | $ | 10,838,077 | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Non-current assets |

||||||||||||||||

| Prepaid expenses and other assets |

402,838 | 622,577 | 1,011,847 | 86,913 | ||||||||||||

| Long-term receivables |

318,360 | 343,371 | 2,091,059 | 1,586,429 | ||||||||||||

| Right-of-use assets |

7,298,424 | 916,028 | 3,660,717 | 4,206,808 | ||||||||||||

| Property and equipment |

518,185 | 649,403 | 506,387 | 710,552 | ||||||||||||

| Intangible assets |

17,429,695 | 20,585,833 | 27,766,839 | 23,671,089 | ||||||||||||

| Goodwill |

27,119,177 | 27,081,795 | 27,086,727 | 18,758,975 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total non-current assets |

53,086,679 | $ | 50,199,007 | $ | 62,123,576 | 49,020,766 | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total assets |

72,697,489 |

$ |

72,106,449 |

$ |

77,318,811 |

59,858,843 |

||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| LIABILITIES |

||||||||||||||||

| Current liabilities |

||||||||||||||||

| Bank indebtedness |

3,679,631 | $ | 3,460,109 | $ | 976,779 | 1,471,805 | ||||||||||

| Trade payables and accrued liabilities |

16,343,347 | 12,421,309 | 12,924,256 | 9,636,405 | ||||||||||||

| Deferred revenue |

4,813,199 | 2,811,408 | 1,771,120 | 1,138,281 | ||||||||||||

| Current portion of loans and borrowings |

|

10,399,574 |

|

|

12,447,939 |

|

|

3,431,251 |

|

|

3,004,717 |

| ||||

| Current portion of convertible debentures |

|

23,457,500 |

|

|

22,185,170 |

|

|

— |

|

|

— |

| ||||

| Warrant liabilities |

3,017,643 | 8,880,038 | 710,924 | 725,086 | ||||||||||||

| Current portion of lease liabilities |

554,895 | 410,674 | 835,472 | 720,457 | ||||||||||||

| Current portion of other liabilities |

— | — | 6,003,838 | |||||||||||||

| Current portion of business |

||||||||||||||||

| acquisition payable |

1,399,580 | 1,398,972 | 1,594,297 | 1,043,314 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total current liabilities |

63,665,369 |

$ |

64,015,619 |

$ |

28,247,937 |

17,740,065 |

||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Non-current liabilities |

||||||||||||||||

| Convertible debentures |

85,901 | 110,540 | 19,534,988 | 17,535,946 | ||||||||||||

| Lease liabilities |

7,123,723 | 634,798 | 3,109,604 | 3,641,627 | ||||||||||||

| Loans and borrowings |

19,586,233 | 767,662 | 9,721,049 | 10,968,338 | ||||||||||||

| Deferred income tax liabilities |

827,672 | 2,291,057 | 4,168,905 | 3,854,614 | ||||||||||||

| Other liabilities |

— | — | 232,577 | |||||||||||||

| Business acquisition payable |

— | — | 845,232 | — | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total liabilities |

91,288,088 |

$ |

67,819,676 |

$ |

65,860,292 |

53,740,590 |

||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| EQUITY |

||||||||||||||||

| Share capital |

118,327,722 | 118,195,363 | 83,120,611 | 45,368,745 | ||||||||||||

| Contributed surplus |

11,547,919 | 11,040,751 | 8,518,476 | 7,278,119 | ||||||||||||

| Accumulative other comprehensive income |

|

291,811 |

|

|

1,227,269 |

|

|

1,435,384 |

|

|

386,127 |

| ||||

| Deficit |

(146,501,130 | ) | (128,671,898 | ) | (83,909,198 | ) | (47,461,647 | ) | ||||||||

| Total shareholders’ equity (deficit) |

(16,333,678 | ) | $ | 1,791,485 | $ | 9,165,273 | 5,571,344 | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Non-controlling interest |

(2,256,921 | ) | 2,495,288 | 2,293,246 | 546,909 | |||||||||||

| Total equity (deficit) |

$ |

(18,590,599 |

) |

$ |

4,286,773 |

$ |

11,458,519 |

6,118,253 |

||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total liabilities and equity |

$ |

72,697,489 |

$ |

72,106,449 |

$ |

77,318,811 |

59,858,843 |

|||||||||

| |

|

|

|

|

|

|

|

|||||||||

| 1) | See Note 2 of the Consolidated Financial Statements for the Years Ended December 31, 2021, 2020 and 2019. |

| • | As a company primarily based outside of the United States, our business is subject to economic, political, regulatory and other risks associated with international operations. |

| • | mCloud may be unable to identify and complete suitable platform acquisitions and acquisitions in its existing vertical markets. |

| • | Potential acquisitions could be difficult to consummate and integrate into mCloud’s operations, and they and investment transactions could disrupt mCloud’s business, dilute stockholder value or impair mCloud’s financial results. |

| • | The loss of one or more of mCloud’s key personnel, or its failure to attract and retain other highly qualified personnel in the future, could harm its business. |

| • | We may acquire contingent liabilities through acquisitions that could adversely affect mCloud’s operating results. |

| • | Acquisitions, investments, joint ventures and other business ventures may negatively affect mCloud’s operating results. |

| • | We may not be able to protect our intellectual property rights, which could make us less competitive and cause us to lose market share. The loss of our rights to use technology currently licensed by third parties could increase operating expenses by forcing us to seek alternative technology and adversely affect our ability to compete. |

| • | If mCloud is not able to maintain and enhance the AssetCare brand, or if events occur that damage the AssetCare reputation and brand, mCloud’s ability to expand its base of users may be impaired, which could adversely affect mCloud’s business and financial results. |

| • | Because we are a corporation incorporated in British Columbia and some of our directors and officers are resident in Canada, it may be difficult for investors in the United States to enforce civil liabilities against us based solely upon the federal securities laws of the United States. Similarly, it may be difficult for Canadian investors to enforce civil liabilities against our directors and officers residing outside of Canada. |

| • | failure to realize anticipated returns on investment, cost savings and synergies; |

| • | difficulty in assimilating the operations, policies, and personnel of the acquired company; |

| • | unanticipated costs associated with acquisitions; |

| • | challenges in combining product offerings and entering into new markets in which we may not have experience; |

| • | distraction of management’s attention from normal business operations; |

| • | potential loss of key employees of the acquired company; |

| • | difficulty implementing effective internal controls over financial reporting and disclosure controls and procedures; |

| • | impairment of relationships with customers or suppliers; |

| • | possibility of incurring impairment losses related to goodwill and intangible assets; and |

| • | other issues not discovered in due diligence, which may include product quality issues or legal or other contingencies. |

| • | the usefulness, ease of use, performance, and reliability of mCloud’s products compared to its competitors; |

| • | the size and composition of mCloud’s user base; |

| • | the engagement of mCloud’s users with its products; |

| • | the timing and market acceptance of mCloud’s products, including developments and enhancements, or similar improvements by its competitors; |

| • | mCloud’s ability to monetize its products, including its ability to successfully monetize AssetCare; |

| • | customer service and support efforts; |

| • | marketing and selling efforts; |

| • | mCloud’s financial condition and results of operations; |

| • | changes mandated by legislation, regulatory authorities, or litigation, including settlements and consent decrees, some of which may have a disproportionate effect on mCloud; |

| • | acquisitions or consolidation within mCloud’s industry, which may result in more formidable competitors; |

| • | mCloud’s ability to attract, retain, and motivate talented employees, particularly computer engineers; |

| • | mCloud’s ability to cost-effectively manage and grow its operations; and |

| • | the mCloud reputation and brand strength relative to competitors. |

| • | actual or anticipated quarterly fluctuations in its financial results and financial condition; |

| • | changes in financial estimates or publication of research reports and recommendations by financial analysts with respect to it or other financial institutions; |

| • | reports in the press or investment community generally or relating to mCloud’s reputation or the industry in which it operates; |

| • | strategic actions by mCloud or its competitors, such as acquisitions, restructurings, dispositions, or financings; |

| • | fluctuations in the stock price and financial results of mCloud’s competitors; |

| • | future sales of mCloud’s equity or equity-related securities; |

| • | proposed or adopted regulatory changes or developments; |

| • | domestic and international economic factors unrelated to mCloud’s performance; and |

| • | general market conditions and, in particular, developments related to market conditions for the remote asset management industry. |

| • | the timing of the development of future services, |

| • | projections of revenue, earnings, capital structure and other financial items, |

| • | statements regarding the capabilities of our business operations, |

| • | statements of expected future economic performance, |

| • | statements regarding competition in our market, and |

| • | assumptions underlying statements regarding us or our business. |

Year Ended |

Period End |

|||

| December 31, 2019 |

$ | 1.2988 | ||

| December 31, 2020 |

$ | 1.2732 | ||

| December 31, 2021 |

$ | 1.2678 | ||

| June 30, 2022 |

$ | 1.2871 | ||

| • | On an actual basis, as determined in accordance with IFRS; and |

| • | On an as adjusted basis to give effect to (i) the issuance and sale of 600,000 Series A Preferred Shares and accompanying 15,000,000 Warrants at the Minimum Offering Amount, (ii) 1,400,000 Series A Preferred Shares and accompanying 35,000,000 Warrants at the Maximum Offering Amount, and (iii) total expenses of each offering amount, which include registration, filing and listing fees, printing fees and legal and accounting expenses amounting to $673,460 and the Placement Agent fee of 7% of the aggregate gross cash proceeds at each offering amount, assuming no exercise of the Warrants. |

June 30, 2022 (unaudited) |

Pro Forma As of June 30 2022 (unaudited) |

As adjusted (unaudited minimum offering) |

As adjusted (unaudited maximum offering) |

|||||||||||||

| Cash and cash equivalents |

$ | 4,405,948 | $ | 12,029,256 | $ | 12,029,256 | $ | 19,648,352 | ||||||||

| Current portion of loans and borrowings |

10,399,574 | 6,991,524 | 6,991,524 | 6,991,524 | ||||||||||||

| Current portion of convertible debentures |

23,457,500 | 23,457,500 | 10,980,904 | — | ||||||||||||

| Warrant liabilities |

3,017,643 | 2,866,753 | 2,866,753 | 2,866,753 | ||||||||||||

| Long term convertible debentures |

85,091 | 85,091 | 85,091 | 85,091 | ||||||||||||

| Loans and borrowings |

19,586,233 | 19,387,228 | 19,387,228 | 19,387,228 | ||||||||||||

| Equity |

||||||||||||||||

| Common shares, no par value; unlimited number of shares authorized shares issued and outstanding, actual unlimited number of shares authorized, 16,151,500 |

||||||||||||||||

| 9.0% Series A Cumulative Perpetual Preferred Shares of the Company, without par value; 1,400,000 shares issued and outstanding |

||||||||||||||||

| Equity share capital |

118,327,722 | 118,327,722 | 131,604,262 | 150,204,262 | ||||||||||||

| Contributed surplus |

11,547,919 | 11,547,919 | 11,547,919 | 11,547,919 | ||||||||||||

| Accumulated other comprehensive income |

291,811 | 461,504 | 461,504 | 461,504 | ||||||||||||

| Deficit |

(146,501,130 | ) | (143,126,641 | ) | (143,926,585 | ) | (143,926,585 | ) | ||||||||

| Total Shareholders (Deficit)/Equity |

(16,333,678 | ) | (12,789,496 | ) | (312,900 | ) | 18,287,100 | |||||||||

| Non-controlling interest |

(2,256,921 | ) | — | — | — | |||||||||||

| Total (Deficit /Equity |

(18,590,599 | ) | (12,789,496 | ) | (312,900 | ) | 18,287,100 | |||||||||

| (1) | The pro forma adjustment to cash and cash equivalents reflects the increase in cash after payment of the principal value of the convertible debenture and the related accrued interest at June 30, 2022. |

| (2) | The amount to be attributed to the warrants has not yet been determined and has been included in the amount attributed to Share capital. Upon issuance of the Series A Preferred Shares and Warrants, the total net proceeds will be allocated to Share Capital and Warrant Liabilities. |

| (3) | Assumes adoption of the Rights and Restrictions for 9.0% Cumulative Series A Preferred Shares, which was adopted prior to June 30, 2022. |

| The above discussion and table is based on 16,155,654 Common Shares outstanding as of June 30, 2022, and do not include, as of that date: |

| • | 3,551,132 Common Shares issuable upon exercise of Listed Warrants; |

| • | 5,094,965 Common Shares issuable upon exercise of Non-Listed Warrants; |

| • | 856,314 Common Shares issuable upon exercise of Options |

| • | 253,613 Common Shares issuable upon exercise of Restricted Share Units; |

| • | 15,750 Common Shares issuable upon exercise of Convertible Debt; and |

| • | a one-time payment of $5.68 million equal to the fair value of mCloud’s consideration receivable under the termination provisions of the Amended and Restated Royalty Agreement with Agnity, and |

| • | the settlement of $0.27 million in other net receivables due from Agnity. |

| i. | The accompanying notes to the unaudited pro forma condensed consolidated financial statements |

| ii. | The audited consolidated financial statements of the Company and its subsidiaries and the accompanying notes included in the Company’s Annual Report on Form 20-F/A filed with the SEC on August 22, 2022. |

| iii. | The unaudited condensed consolidated interim financial statements of the Company for the six months ended June 30, 2022, included in Form 6-K furnished with the SEC on August 16, 2022. |

| • | The loss of control of Agnity’s and associated derecognition of Agnity’s assets and liabilities. |

| • | Impact of the cash proceeds received in connection with the Transaction. |

| • | The elimination of Agnity’s royalty payment obligations to mCloud under the extinguished Amended and Restated Royalty Agreement and the inclusion of license payments from mCloud to Agnity in accordance with the Technology Continuation Agreement. |

| • | The recognition of transactions between mCloud and Agnity related to other intercompany sales activities, which were previously eliminated on consolidation for each period presented. |

| Historical Financial Statements as Reported |

Deconsolidation (a) |

Transaction (b) | Pro Forma | |||||||||||||

| Assets |

||||||||||||||||

| Current Assets: |

||||||||||||||||

| Cash and cash equivalents |

$ | 4,406 | $ | (16 | ) | $ | 7,640 | $ | 12,030 | |||||||

| Trade and other receivables |

12,135 | (8,602 | ) | — | 3,533 | |||||||||||

| Other current assets |

3,070 | (306 | ) | — | 2,764 | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total Current Assets |

$ | 19,611 | $ | (8,924 | ) | $ | 7,640 | $ | 18,327 | |||||||

| Intangible assets |

17,430 | (3,709 | ) | — | 13,721 | |||||||||||

| Goodwill |

27,119 | — | — | 27,119 | ||||||||||||

| Other assets |

8,853 | 3,724 | (4,266 | ) | 7,996 | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total assets |

$ |

72,698 |

$ |

(8,909 |

) |

$ |

3,374 |

$ |

67,163 |

|||||||

| |

|

|

|

|

|

|

|

|||||||||

| Liabilities |

||||||||||||||||

| Current Liabilities: |

||||||||||||||||

| Trade payables and accrued liabilities |

$ | 16,343 | $ | (5,319 | ) | 11,024 | ||||||||||

| Deferred revenue |

4,813 | (2,264 | ) | — | 2,549 | |||||||||||

| Loans and borrowings |

10,400 | (3,408 | ) | — | 6,992 | |||||||||||

| Warrant Liabilities |

3,018 | (151 | ) | — | 2,867 | |||||||||||

| Convertible debentures |

23,458 | — | — | 23,458 | ||||||||||||

| Other current liabilities |

5,633 | — | 5,633 | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total current liabilities |

$ | 63,665 | $ | (11,142 | ) | $ | $ | 52,523 | ||||||||

| Non-current liabilities: |

||||||||||||||||

| Lease liabilities |

7,124 | — | — | 7,124 | ||||||||||||

| Loans and borrowings |

19,586 | (199 | ) | — | 19,387 | |||||||||||

| Other liabilities |

913 | 5 | — | 918 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total liabilities |

$ | 91,288 | $ | (11,336 | ) | $ | $ | 79,952 | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Equity (Deficit) |

||||||||||||||||

| Share capital |

$ | 118,328 | $ | — | $ | — | $ | 118,328 | ||||||||

| Contributed surplus |

11,548 | — | — | 11,548 | ||||||||||||

| Accumulated other comprehensive income |

292 | 170 | — | 462 | ||||||||||||

| Deficit |

(146,501 | ) | — | 3,374 | (143,127 | ) | ||||||||||

| Non-controlling interest |

(2,257 | ) | 2,257 | — | — | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total shareholders’ equity |

$ | (18,590 | ) | $ | 2,427 | $ | 3,374 | $ | (12,789 | ) | ||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total liabilities and equity |

$ |

72,698 |

$ |

(8,909 |

) |

$ |

3,374 |

$ |

67,163 |

|||||||

| |

|

|

|

|

|

|

|

|||||||||

| Historical Financial Statements as Reported |

Deconsolidation (c) | Transaction (c) (d) | Pro Forma | |||||||||||||

| Revenue |

$ | 6,699 | $ | (1,685 | ) | $ | — | 5,013 | ||||||||

| Cost of sales |

3,866 | (1,218 | ) | 336 | 2,984 | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Gross Profit |

$ | 2,833 | $ | (468 | ) | $ | (336 | ) | 2,029 | |||||||

| Expenses |

||||||||||||||||

| Salaries, wages and benefits |

$ | 10,374 | $ | (1,344 | ) | $ | — | 9,030 | ||||||||

| General and administration |

4,617 | (141 | ) | — | 4,477 | |||||||||||

| Professional and consulting fees |

6,736 | (2,903 | ) | — | 3,833 | |||||||||||

| Depreciation and amortization |

3,770 | (1,039 | ) | — | 2,731 | |||||||||||

| Other |

3,447 | (106 | ) | — | 3,341 | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total expenses |

28,944 | (5,532 | ) | — | 23,412 | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Operating Loss |

$ | (26,111 | ) | $ | 5,064 | $ | — | (21,135 | ) | |||||||

| Other expense (income) |

||||||||||||||||

| Finance costs (income) |

$ | 4,089 | $ | (368 | ) | $ | — | 3,721 | ||||||||

| FV loss on derivatives |

(5,032 | ) | — | — | (5,032 | ) | ||||||||||

| Other income |

(1,156 | ) | 0 | (295 | ) | (1,451 | ) | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Gain (Loss) before tax |

$ | (24,012 | ) | $ | 5,432 | $ | (40 | ) | $ | (18,621 | ) | |||||

| Current tax expense |

105 | — | — | 105 | ||||||||||||

| Deferred tax (recovery) expense |

(1,482 | ) | 626 | — | (856 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net loss for the period |

$ | (22,635 | ) | $ | 4,806 | $ | (40 | ) | (17,869 | ) | ||||||

| Foreign subsidiary translation differences |

882 | (54 | ) | — | 828 | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Comprehensive loss for the period |

$ | (23,517 | ) | $ | 4,752 | $ | (40 | ) | (18,697 | ) | ||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net loss (income) for the period attributable to: |

||||||||||||||||

| mCloud Technologies Corp. Shareholders |

(17,829 | ) | — | (40 | ) | (17,869 | ) | |||||||||

| Non-controlling interest |

(4,806 | ) | 4,806 | — | — | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| $ | (22,635 | ) | $ | 4,806 | $ | (40 | ) | (17,869 | ) | |||||||

| |

|

|

|

|

|

|

|

|||||||||

| Comprehensive loss (income) for the period attributable to: |

||||||||||||||||

| mCloud Technologies Corp. Shareholders |

(18,765 | ) | — | (40 | ) | (18,805 | ) | |||||||||

| Non-controlling interest |

(4,752 | ) | 4,752 | — | — | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| $ | (23,517 | ) | 4,752 | (40 | ) | (18,805 | ) | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net Loss per common and potential common share: |

||||||||||||||||

| Loss per share attributed to mCloud shareholders - basic and diluted |

$ | (1.10 | ) | $ | (1.11 | ) | ||||||||||

| Weighted average number of common shares outstanding - basic and diluted |

16,151,197 | 16,151,197 | ||||||||||||||

| Historical Financial Statements as Reported |

Deconsolidation (a) |

Transaction (c)(d) |

Pro Forma | |||||||||||||

| Revenue |

$ | 25,597 | $ | (11,816 | ) | $ | — | $ | 13,781 | |||||||

| Cost of sales |

9,684 | (2,611 | ) | 550 | 7,623 | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Gross Profit |

$ | 15,913 | $ | (9,205 | ) | $ | (550 | ) | $ | 6,158 | ||||||

| Expenses |

||||||||||||||||

| Salaries, wages and benefits |

$ | 21,692 | $ | (2,050 | ) | $ | 19,642 | |||||||||

| General and administration |

8,539 | (810 | ) | 7,729 | ||||||||||||

| Professional and consulting fees |

9,085 | (4,175 | ) | 4,910 | ||||||||||||

| Depreciation and amortization |

8,925 | (2,172 | ) | 6,753 | ||||||||||||

| Other |

6,424 | (133 | ) | 6,291 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total expenses |

$ | 54,665 | $ | (9,340 | ) | $ | — | $ | 45,325 | |||||||

| |

|

|

|

|

|

|

|

|||||||||

| Operating Loss |

$ | (38,752 | ) | $ | 135 | $ | (550 | ) | $ | (39,167 | ) | |||||

| Other expense (income) |

||||||||||||||||

| Finance costs (income) |

$ | 8,619 | $ | (337 | ) | $ | — | $ | 8,281 | |||||||

| FV loss on derivatives |

6,040 | — | — | 6,040 | ||||||||||||

| Other (income)/loss |

(7,126 | ) | 402 | (150 | ) | (6,874 | ) | |||||||||

| Other expenses (income) |

79 | (116 | ) | — | (37 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Loss before tax |

$ | (46,364 | ) | $ | 186 | $ | (400 | ) | $ | (46,578 | ) | |||||

| Current tax expense |

157 | (372 | ) | — | (215 | ) | ||||||||||

| Deferred tax expense (recovery) |

(1,822 | ) | 621 | — | (1,201 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net loss for the period |

$ | (44,699 | ) | $ | (63 | ) | $ | (400 | ) | $ | (45,162 | ) | ||||

| Foreign subsidiary translation differences |

69 | 139 | 208 | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Comprehensive loss for the period |

$ | (44,768 | ) | $ | (202 | ) | $ | (400 | ) | $ | (45,370 | ) | ||||

| |

|

|

|

|

|

|

|

|||||||||

| Net loss (income) for the period attributable to: |

||||||||||||||||

| mCloud Technologies Corp. Shareholders |

(44,762 | ) | — | (400 | ) | (45,162 | ) | |||||||||

| Non-controlling interest |

63 | (63 | ) | — | — | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

$ |

(44,699 |

) |

$ |

(63 |

) |

$ |

(400 |

) |

$ |

(45,162 |

) | |||||

| |

|

|

|

|

|

|

|

|||||||||

| Comprehensive loss (income) for the period attributable to: |

||||||||||||||||

| mCloud Technologies Corp. Shareholders |

(44,970 | ) | (400 | ) | (45,370 | ) | ||||||||||

| Non-controlling interest |

202 | (202 | ) | — | 0 | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

$ |

(44,768 |

) |

$ |

(202 |

) |

$ |

(400 |

) |

$ |

(45,370 |

) | |||||

| |

|

|

|

|

|

|

|

|||||||||

| Net Loss per common and potential common share: |

||||||||||||||||

| Loss per share attributed to mCloud shareholders - basic and diluted |

$ | (3.76 | ) | $ | (3.80 | ) | ||||||||||

| Weighted average number of common shares outstanding - basic and diluted |

11,898,183 | 11,898,183 | ||||||||||||||

| a. | To recognize the loss of control of Agnity and associated deconsolidation of Agnity’s assets and liabilities. |

| b. | To recognize the receipt of $5.95 million (CAD$7.7 million) of cash as a result of the Transaction, the resulting extinguishment of the amounts receivable from and payable to Agnity and the $3.451 million gain from the changes to the carrying amounts of the receivable balances. |

| c. | To recognize the loss of control of Agnity and associated removal of Agnity’s operating results from the Statement of Loss and Comprehensive Loss, together with the recognition of intercompany revenue and expenses previously eliminated on consolidation. |

| d. | To eliminate income previously recognized by mCloud under the Amended Royalty Agreement and to recognize the license payments from mCloud to Agnity for ongoing access to CAS under the terms of the Technology Continuation Agreement. |

| • | An ineffective control environment resulting from an insufficient number of trained financial reporting and accounting, information technology (IT) and operational personnel with the appropriate skills and knowledge and with assigned responsibility and accountability related to the design, implementation and operating effectiveness of internal control over financial reporting. |

| • | The insufficient number of personnel described above contributed to an ineffective risk assessment process necessary to identify all relevant risks of material misstatement and to evaluate the implications of relevant risks on its internal control over financial reporting. |

| • | An ineffective information and communication process resulting from (i) insufficient communication of internal control information, including objectives and responsibilities, such as delegation of authority; and (ii) ineffective general IT controls and ineffective controls related to spreadsheets, resulting in insufficient controls to ensure the relevance, timeliness and quality of information used in control activities. |

| • | As a consequence of the above and as a result of inadequate segregation of duties and secondary review, the Company had ineffective control activities related to the design, implementation and operating effectiveness of process level and financial reporting controls which had a pervasive impact on the Company’s internal control over financial reporting. |

| • | An ineffective monitoring process resulting from the evaluation and communication of internal control deficiencies, including monitoring corrective actions, not being performed in a timely manner. |

| • | Identifying key positions necessary to support the Company’s initiatives related to internal controls over financial reporting and expanding its hiring efforts accordingly. |

| • | Hiring consultants to assist with process improvements and control remediation efforts in targeted accounting, IT and operations processes. |

| • | Formalizing its entity-wide risk assessment process and documenting internal ownership of risk monitoring and mitigation efforts, with improved risk monitoring activities and regular reporting to those charged with governance at an appropriate frequency. |

| • | Finalize a delegation of authority matrix to enforce desired limits of authority for key transactions, events, and commitments, and communicating these limits of authority to relevant personnel throughout the Company. |

| • | Further simplify and streamline its spreadsheet models to reduce the risk of errors in mathematical formulas and improve the ability to verify the logic of spreadsheets. |

| • | Hiring a consultant to assist management with process improvements and control remediation for general IT controls. |

| • | Continuing to perform scoping exercises and planning for an ERP implementation to streamline the number of applications used for financial reporting activities. |

| Years ended December 31 |

2021 |

2020 |

2019 |

|||||||||

| Revenues |

$ | 25.597 | $ | 26.928 | $ | 18.340 | ||||||

| Gross profit |

15.913 | 16.647 | $ | 10.757 | ||||||||

| Total expenses |

54.665 | 46.360 | $ | 27.138 | ||||||||

| Other expenses (income) |

5.947 | 5.148 | $ | 11.514 | ||||||||

| Net loss |

44.699 | 34.861 | $ | 27.895 | ||||||||

| Loss per share attributable to mCloud shareholders – basic and diluted (1) |

3.76 | $ | 5.01 | $ | 6.97 | |||||||

| Total assets |

72.106 | $ | 77.319 | $ | 59.859 | |||||||

| Total non-current financial liabilities |

1.513 | $ | 33.443 | $ | 32.146 | |||||||

(1) |

The Company has corrected loss per share attributable to mCloud shareholders basic and diluted. See Basis of Presentation in Note 2 to the Annual 2021 Financial Statements for further information. |

2021 |

2020 |

2019 |

2021 vs 2020 Change $ |

2021 vs 2020 Change % |

2020 vs 2019 Change $ |

2020 vs 2019 Change % |

||||||||||||||||||||||

| Revenue |

$ | 25.597 | $ | 26.928 | $ | 18.340 | $ | (1.331 | ) | (5 | )% | $ | 8.588 | 47 | % | |||||||||||||

| Cost of Sales |

(9.684 | ) | (10.282 | ) | (7.583 | ) | 0.598 | (6 | )% | (2.699 | ) | 36 | % | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Gross Profit |

$ |

15.913 |

$ |

16.647 |

$ |

10.757 |

$ |

(0.733 |

) |

(4 |

) % |

$ |

5.890 |

55 |

% | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Expenses |

||||||||||||||||||||||||||||

| Salaries, wages and benefits |

$ | 21.692 | $ | 20.885 | $ | 10.314 | $ | 0.807 | 4 | % | $ | 10.571 | 102 | % | ||||||||||||||

| Sales and marketing |

1.377 | 1.536 | 3.167 | (0.159 | ) | (10 | )% | (1.631 | ) | (51 | )% | |||||||||||||||||

| Research and development |

3.179 | 1.078 | 0.498 | 2.101 | 195 | % | 0.580 | 116 | % | |||||||||||||||||||

| General and administrative |

8.539 | 5.742 | 3.295 | 2.797 | 49 | % | 2.447 | 74 | % | |||||||||||||||||||

| Professional and consulting fees |

9.085 | 8.886 | 4.352 | 0.199 | 2 | % | 4.534 | 104 | % | |||||||||||||||||||

| Share-based compensation |

1.868 | 1.454 | 1.468 | 0.414 | 28 | % | (0.014 | ) | (1 | )% | ||||||||||||||||||

| Depreciation and amortization |

8.925 | 6.778 | 4.044 | 2.147 | 32 | % | 2.734 | 68 | % | |||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total expenses |

$ | 54.665 | $ | 46.360 | $ | 27.138 | $ | 8.305 | 18 | % | $ | 19.222 | 71 | % | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Operating loss |

$ |

38.752 |

$ |

29.714 |

$ |

16.380 |

$ |

9.039 |

30 |

% |

$ |

13.334 |

81 |

% | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Other Expenses (income) |

||||||||||||||||||||||||||||

| Finance costs |

$ | 8.619 | $ | 6.034 | $ | 3.218 | $ | 2.585 | 43 | % | $ | 2.816 | 88 | % | ||||||||||||||

| Foreign exchange loss (gain) |

(0.267 | ) | 1.198 | 0.494 | (1.466 | ) | (122 | )% | 0.704 | 143 | % | |||||||||||||||||

| Impairment |

— | — | 0.601 | (0.601 | ) | (100 | )% | |||||||||||||||||||||

| Business acquisition costs and other expenses |

0.346 | 1.812 | 9.880 | (1.465 | ) | (81 | )% | (8.068 | ) | (82 | )% | |||||||||||||||||

| Fair value loss on derivatives |

6.040 | — | — | 6.040 | 100 | % | — | — | % | |||||||||||||||||||

| Other income |

(7.126 | ) | (2.932 | ) | (0.168 | ) | (4.194 | ) | 143 | % | (2.764 | ) | 1645 | % | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Loss before tax |

$ |

46.364 |

$ |

35.825 |

$ |

30.405 |

$ |

10.539 |

29 |

% |

$ |

5.420 |

18 |

% | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Current tax expense (recovery) |

$ | 0.157 | $ | (0.296 | ) | $ | (0.182 | ) | $ | 0.453 | (153 | )% | $ | (0.114 | ) | 63 | % | |||||||||||

| Deferred tax (recovery) expense |

(1.822 | ) | (0.668 | ) | 2.692 | (1.154 | ) | 173 | % | (3.360 | ) | (125 | )% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net loss for the period |

$ |

44.699 |

$ |

34.861 |

$ |

27.895 |

$ |

9.838 |

28 |

% |

$ |

6.966 |

25 |

% | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Major Service Line |

2021 |

2020 |

2019 |

2021 vs 2020 Change $ |

2021 vs 2020 % |

2020 vs 2019 Change $ |

2020 vs 2019 % |

|||||||||||||||||||||

| AssetCare Initialization |

$ | 1.250 | $ | 7.689 | $ | 5.965 | $ | (6.439 | ) | (84 | )% | $ | 1.724 | 29 | % | |||||||||||||

| AssetCare Solutions |

23.462 | 12.809 | 2.940 | 10.653 | 83 | % | 9.869 | 336 | % | |||||||||||||||||||

| Engineering Services |

0.885 | 6.430 | 9.436 | (5.545 | ) | (86 | )% | (3.005 | ) | (32 | )% | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ |

25.597 |

$ |

26.928 |

$ |

18.340 |

$ |

(1.331 |

) |

(5 |

)% |

$ |

8.588 |

47 |

% | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Timing of revenue recognition |

2021 |

2020 |

2019 |

2021 vs 2020 Change $ |

2021 vs 2020 % |

2020 vs 2019 Change $ |

2020 vs 2019 % |

|||||||||||||||||||||

| Revenue recognized over time |

$ | 24.423 | $ | 18.551 | $ | 12.375 | $ | 5.872 | 32 | % | $ | 6.176 | 50 | % | ||||||||||||||

| Revenue recognized at point in time upon completion |

1.174 | 8.377 | 5.965 | (7.202 | ) | (86 | )% | 2.412 | 40 | % | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ |

25.597 |

$ |

26.928 |

$ |

18.340 |

$ |

(1.331 |

) |

(5 |

)% |

$ |

8.588 |

47 |

% | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Year ended December 31, | ||||||||||||

2021 |

2020 |

2019 |

||||||||||

| Canada |

$ | 10.734 | $ | 13.833 | $ | 10.890 | ||||||

| United States |

6.564 | 5.691 | 7.451 | |||||||||

| Japan |

5.850 | 6.447 | — | |||||||||

| Australia |

0.994 | 0.152 | — | |||||||||

| Other |

1.455 | 0.805 | — | |||||||||

| |

|

|

|

|

|

|||||||

| Total revenue |

$ |

25.597 |

$ |

26.928 |

$ |

18.341 |

||||||

| |

|

|

|

|

|

|||||||

2021 |

2020 |

2019 |

||||||||||

| Customer A |

Less than 10 | % | 13.6 | % | n/a | |||||||

| Customer B |

Less than 10 | % | 13.1 | % | 11.0 | % | ||||||

| Customer C |

11.3 | % | Less than 10 | % | 20.0 | % | ||||||

| Customer D |

10.7 | % | Less than 10 | % | n/a | |||||||

2021 |

2020 |

2019 |

2021 vs 2020 Change $ |

2021 vs 2020 % |

2020 vs 2019 Change $ |

2020 vs 2019 % |

||||||||||||||||||||||

| Cost of Sales |

$ | 9.684 | $ | 10.282 | $ | 7.583 | $ | (0.598 | ) | (6 | )% | $ | 2.699 | 36 | % | |||||||||||||

| Gross Profit |

15.913 | 16.647 | 10.757 | (0.733 | ) | (4 | )% | 5.890 | 55 | % | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Gross Margin % |

62.2 |

% |

61.8 |

% |

58.6 |

% |

1 |

% |

3 |

% | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Expenses |

2021 |

2020 |

2019 |

2021 vs 2020 Change $ |

2021 vs 2020 % |

2020 vs 2019 Change $ |

2020 vs 2019 % |

|||||||||||||||||||||

| Salaries, wages and benefits |

$ | 21.692 | $ | 20.885 | $ | 10.314 | $ | 0.807 | 4 | % | $ | 10.571 | 102 | % | ||||||||||||||

| Sales and marketing |

1.377 | 1.536 | 3.167 | (0.159 | ) | (10 | )% | (1.631 | ) | (51 | )% | |||||||||||||||||

| Research and development |

3.179 | 1.078 | 0.498 | 2.101 | 195 | % | 0.580 | 116 | % | |||||||||||||||||||

| General and administration |

8.539 | 5.742 | 3.295 | 2.797 | 49 | % | 2.447 | 74 | % | |||||||||||||||||||

| Professional and consulting fees |

9.085 | 8.886 | 4.352 | 0.199 | 2 | % | 4.534 | 104 | % | |||||||||||||||||||

| Share-based compensation |

1.868 | 1.454 | 1.468 | 0.414 | 28 | % | (0.014 | ) | — | % | ||||||||||||||||||

| Depreciation and amortization |

8.925 | 6.778 | 4.044 | 2.147 | 32 | % | 2.734 | 68 | % | |||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ |

54.665 |

$ |

46.360 |

$ |

27.138 |

$ |

8.305 |

18 |

% |

$ |

19.222 |

71 |

% | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| • | General and administration expenses, which typically consist of public company fees, bad debt expense, rent expense, and recruitment costs, increased by 49% or $2.797 million in 2021 compared to 2020, primarily due to an increase in the loss allowance of $1.162 million related to uncollectible receivables, and $1.000 million associated with the Company’s NASDAQ listing, combined with costs associated with a full year of the Company’s ownership of its kanepi subsidiary that were not present in the year ended December 31, 2020. General and administration expenses increased by 74% or $2.447 million for the year ended December 31, 2020, compared to the year ended December 31, 2019, primarily due to facilities and overhead costs associated with a full year of ownership of its subsidiaries including mCloud Technologies Services (“MTS”), acquired in Q3 2019, Construction Systems Associates, Inc. USA (“CSA”), acquired in Q1 2020, and kanepi, acquired in Q4 2020. |

| • | Depreciation and amortization expenses increased by 32% or $2.147 million in 2021 compared to 2020, attributable to a full year of amortization of intangibles acquired through business and asset acquisitions in Fiscal 2020. Depreciation and amortization expenses increased by 68% or $2.734 million in 2020 compared to 2019, due to amortization of intangibles assets acquired through acquisitions of Agnity, MTS and CSA. |

| • | The Company’s customers use its software to monitor their assets and rely on the Company to provide updates and releases as part of its software maintenance and support services. While the Company has not developed a formal research and development policy, the Company is and has been engaged with a number of research and development initiatives as a part of its ongoing effort to continually update its software and develop new products. Research and development expenses increased by $2.101 million in 2021 compared to 2020, due to ongoing development and investments in AssetCare Mobile, IAQ Badge and 3D technologies. Research and development expenses increased by $0.580 million in 2020 compared to 2019, due to the development of AssetCare project investments. |

| • | Professional and consulting expenses increased by $0.199 million in 2021 compared to 2020, due to the Company retaining more consultants for various accounting and professional service functions that were previously performed by employees in 2020, combined with the costs associated with a full year of the Company’s ownership of its kanepi subsidiary. Professional and consulting expenses increased by $4.534 million in 2020 compared to 2019, attributable to professional legal and advisory, as well as accounting and valuation services related to business acquisitions and financings completed during the year. |

| • | For the year ended December 31, 2021, salaries, wages and benefits were flat year over year, compared to the same period in 2020. Salaries, wages and benefits increased by 102% or $10.571 million in 2020 compared to 2019, due to higher headcount attributable to acquisitions of CSA and kanepi, combined with added personnel in the asset purchase of AirFusion. |

| • | The above noted increases were partially offset by a decrease in the Company’s sales and marketing costs by 10% or $0.159 million due to lower marketing spending early in 2021, as the pandemic curtailed industry activity and the Company elected to spend less. This decrease in spending was partially offset by the mCloud Connect event that took place in 2021. For the year ended December 31, 2020, sales and marketing decreased by 51% or $1.631 million compared to the same period in 2019, due to the curtailment of activities attributable to ongoing COVID-19 restrictions. |

| Other expenses (income) |

2021 |

2020 |

2019 |

2021 vs 2020 Change $ |

2021 vs 2020 % |

2020 vs 2019 Change $ |

2020 vs 2019 % |

|||||||||||||||||||||

| Finance costs |

$ | 8.619 | $ | 6.034 | $ | 3.218 | $ | 2.585 | 43 | % | $ | 2.816 | 88 | % | ||||||||||||||

| Foreign exchange loss (gain) |

(0.267 | ) | 1.198 | 0.494 | (1.465 | ) | (122 | )% | $ | 0.704 | 143 | % | ||||||||||||||||

| Impairment of intangible asset |

— | — | 0.601 | — | — | % | $ | (0.601 | ) | (100 | )% | |||||||||||||||||

| Business acquisition costs and other expenses |

0.346 | 1.812 | 9.880 | (1.466 | ) | (81 | )% | $ | (8.068 | ) | (82 | )% | ||||||||||||||||

| Fair value loss on derivatives |

6.040 | — | — | 6.040 | — | % | $ | — | — | % | ||||||||||||||||||

| Other income |

(7.126 | ) | (2.932 | ) | (0.168 | ) | (4.194 | ) | 143 | % | $ | (2.764 | ) | 1645 | % | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ | 7.612 | $ | 6.111 | $ | 14.025 | $ | 1.500 | 25 | % | $ | (7.914 | ) | 4713 | % | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| • | Finance costs increased by $2.585 million during the year ended December 31, 2021, compared to the same period in 2020, due to increased interest and transaction costs associated with the 2021 Convertible Debentures, which were converted in Q3 2021, along with interest and fees on new borrowings, partially offset by lower interest on repaid borrowings. Finance costs increased by $2.816 million for the year ended December 31, 2020, compared with the same period in 2019, due to higher interest expense on the 2019 Convertible Debentures, with the funds used for business acquisitions. |