Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2021

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-38961

Change Healthcare Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 82-2152098 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 424 Church Street, Suite 1400 Nashville, TN |

37219 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(615) 932-3000

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common Stock, par value $.001 per share | CHNG | The Nasdaq Stock Market LLC | ||

| 6.00% Tangible Equity Units | CHNGU | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | |||||||||

| Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of September 30, 2020, the aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates was $3,545,569,096.

Number of shares of common stock outstanding on May 14, 2021: 310,136,566

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2021 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of Contents

| PART I |

||||||

| Item 1. |

5 | |||||

| Item 1A. |

25 | |||||

| Item 1B. |

66 | |||||

| Item 2. |

66 | |||||

| Item 3. |

66 | |||||

| Item 4. |

66 | |||||

| PART II |

||||||

| Item 5. |

67 | |||||

| Item 6. |

68 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

68 | ||||

| Item 7A. |

84 | |||||

| Item 8. |

86 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosures |

151 | ||||

| Item 9A. |

151 | |||||

| Item 9B. |

152 | |||||

| Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

152 | ||||

| PART III |

||||||

| Item 10. |

152 | |||||

| Item 11. |

154 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

154 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

154 | ||||

| Item 14. |

154 | |||||

| PART IV |

||||||

| Item 15. |

155 | |||||

| Item 16. |

162 |

2

Table of Contents

Cautionary Notice Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of federal securities laws. Any statements made in this Annual Report that are not statements of historical fact, including statements about our beliefs and expectations, are forward-looking statements. Forward-looking statements include information concerning possible or assumed future results of operations, including descriptions of our business plans and strategies. These statements often include words such as “anticipate,” “expect,” “suggest,” “plan,” “believe,” “intend,” “estimate,” “target,” “project,” “should,” “could,” “would,” “may,” “will,” “forecast,” “outlook,” “potential,” “continues,” “seeks,” “predicts,” and the negatives of these words and other similar expressions. Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that factors affecting our actual financial results could cause actual results to differ materially from those expressed in the forward-looking statements, including those described below.

Summary of Material Risks

Our actual results may differ significantly from any results expressed or implied by any forward-looking statements. A summary of the principal risk factors that make investing in us risky and might cause our actual results to differ is set forth below. The following is only a summary of the principal risks that may materially adversely affect our business, financial condition and results of operations. Factors that could materially affect our financial results or such forward-looking statements include, among others, the following factors:

| • | the inability to complete the transactions contemplated by the Agreement and Plan of Merger (“UHG Agreement”) dated as of January 5, 2021 by and among Change Healthcare Inc., UnitedHealth Group Incorporated (“United Health Group”) and UnitedHealth Group’s wholly owned subsidiary Cambridge Merger Sub Inc. (the “UHG Transaction”) due to the failure to satisfy the conditions to the completion of the UHG Transaction, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the UHG Transaction; |

| • | risks related to disruption of management’s attention from business operations due to the UHG Transaction; |

| • | the effect of the announcement of the UHG Transaction on our relations with our customers, operations results and business generally; |

| • | the risk that the UHG Transaction will not be consummated in a timely manner, exceeding the expected costs of the UHG Transaction; |

| • | the occurrence of any event, change or other circumstances that could give rise to the termination of the UHG Agreement; |

| • | macroeconomic and industry trends and adverse developments in the debt, consumer credit and financial services markets; |

| • | uncertainty and risks related to the impact of the coronavirus (“COVID-19”) pandemic on the national and global economy, our business, suppliers, customers, and employees; |

| • | our ability to retain or renew existing customers and attract new customers; |

| • | our ability to connect a large number of payers and providers; |

| • | our ability to provide competitive services and prices while maintaining our margins; |

| • | further consolidation in our end-customer markets; |

| • | our ability to effectively manage our costs; |

| • | our ability to effectively develop and maintain relationships with our channel partners; |

| • | our ability to timely develop new services and improve existing solutions; |

| • | our ability to deliver services timely without interruption; |

3

Table of Contents

| • | a decline in transaction volume in the United States (U.S.) healthcare industry; |

| • | our ability to maintain our access to data sources; |

| • | our ability to maintain the security and integrity of our data; |

| • | our reliance on key management personnel; |

| • | our ability to manage and expand our operations and keep up with rapidly changing technologies; |

| • | the ability of our outside service providers and key vendors to fulfill their obligations to us; |

| • | risks related to our international operations; |

| • | our ability to protect and enforce our intellectual property, trade secrets and other forms of unpatented intellectual property; |

| • | our ability to defend our intellectual property from infringement claims by third parties; |

| • | government regulation and changes in the regulatory environment; |

| • | changes in local, state, federal and international laws and regulations, including related to taxation; |

| • | economic and political instability in the U.S. and international markets where we operate; |

| • | litigation or regulatory proceedings; |

| • | losses against which we do not insure; |

| • | our ability to make acquisitions and integrate the operations of acquired businesses; |

| • | our ability to make timely payments of principal and interest on our indebtedness; |

| • | our ability to satisfy covenants in the agreements governing our indebtedness; |

| • | our ability to maintain our liquidity; |

| • | our adoption of new, or amendments to existing, accounting standards; |

| • | the potential dilutive effect of future issuance of shares of our common stock, par value $.001 per share (our “common stock”); and |

| • | the impact of anti-takeover provisions in our organizational documents and under Delaware law, which may discourage or delay acquisition attempts. |

You should carefully consider the statements under Item 1A. Risk Factors and other sections of this report, which describe factors that could cause our actual results to differ from those set forth in the forward-looking statements.

Our forward-looking statements made herein speak only as of the date on which made. We expressly disclaim any intent, obligation or undertaking to update or revise any forward-looking statements made herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in this report.

4

Table of Contents

PART I

| ITEM 1. | BUSINESS |

Change Healthcare Inc. (the “Company”, “our” or “we”) is a leading healthcare technology company, focused on accelerating the transformation of the healthcare system through the power of our Change Healthcare platform. We provide data and analytics-driven solutions to improve clinical, financial, administrative, and patient engagement outcomes in the U.S. healthcare system.

Our platform and comprehensive suite of software, analytics, technology enabled services and network solutions drive improved results in the complex workflows of healthcare system payers and providers by enhancing clinical decision making, simplifying billing, collection and payment processes, and enabling a better patient experience.

Our Intelligent Healthcare Network, one of the strongest clinical and financial healthcare networks in the U.S., was created to facilitate the transfer of data among participants. With insights gained from our experience, applications and analytics portfolio, and our services operations, we have designed analytics solutions that include trusted, industry-leading franchises supported by extensive intellectual property and regularly updated content.

In addition to the advantages of scale, we offer the collaborative benefits of a mission-critical partner to the healthcare industry. We seek to establish and develop enduring relationships with each customer through solutions that deliver measurable results for their complex daily workflows. Our customer retention rate for our top 50 provider and top 50 payer customers was 99% for the fiscal year ended March 31, 2021. We believe our size, scale, expertise, and presence throughout the healthcare ecosystem help make us a preferred partner for technology companies and industry associations focused on driving innovation, standardization, and efficiencies in the healthcare industry.

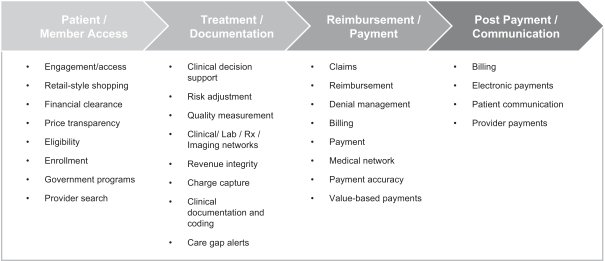

Our solutions play a mission-critical role in the following important areas of the healthcare system:

The U.S. healthcare system is undergoing massive changes at an unprecedented rate. Our mission is to help accelerate its transformation to a value-based care system from which everyone benefits. We deliver solutions and products that help increase efficiency, improve outcomes, and enhance consumer engagement throughout the consumer healthcare journey. That journey has three major stages:

| • | The Pre-Visit, which includes provider selection, scheduling an appointment, ensuring coverage and pre-authorization, medical record sharing and review, and understanding required payments. |

5

Table of Contents

| • | The Visit (or visits), during which financial clearance is provided, imaging and other clinical activities are managed, and medical necessity is ensured. |

| • | The Post-Visit, which typically requires the resolution of payment, claims remittance and processing, and on-going patient engagement. This stage is increasingly important today as the industry moves toward value-based care and payment models. |

Our mission to accelerate transformation of the healthcare system requires us to support all three stages with solutions that address the clinical, financial, and engagement requirements of the journey.

Our analytics-driven solutions are designed to improve delivery of care through better clinical decision-making, and to simplify billing and payment functions by reducing administrative errors and improving documentation. In addition, we seek to improve payers’ and providers’ relationships with consumers by offering solutions that enable price transparency and empower their decision-making and support. We believe that our solutions enable our customers to operate more efficiently and cost effectively. Our solutions have generated measurable financial and operational return on investment, improved quality of care, and a better patient experience. Examples include:

| • | Data Science as a Service (“DSaaS”): Provides de-identified claims and other novel data to healthcare stakeholders, providing unbiased insights into therapeutic effectiveness while ensuring regulatory compliance. Integrates patient-level claims data, including diagnoses and care prescriptions, with social determinants of health, behavioral health, and other novel data across the U.S. healthcare system. |

| • | Change Healthcare Enterprise Imaging Network™ Analytics: Allows immediate review and analysis of imaging data through a cloud-native platform that automates data acquisition and integrates complex data from multiple sources. |

| • | Electronic Clinical Data Retrieval (“eCDR”) service: Lets payers quickly and easily retrieve patient records from multiple electronic health record (“EHR”) systems, providing patient care data in an integrated, digital fashion. |

| • | MedRx™ COVID-19 service expansion: Helps consumers get COVID-19 testing at local pharmacies by allowing pharmacies to process and receive reimbursement for COVID-19 tests within their regular workflow. |

| • | SmartPay™ Payment: Integrates with Epic’s MyChart® and Hyperspace® so providers do not have to leave their normal workflow in order to collect patient payments or provide patient statements. |

| • | Shop Book and Pay™ Transparency Module: Lets consumers compare pricing for shoppable healthcare services across multiple providers, helping make the process of shopping for healthcare as easy as other retail shopping experiences. |

| • | Clearance Estimator Patient Direct: Helps providers comply with all of the transparency regulations for the Centers for Medicare & Medicaid Services (“CMS”) by empowering patients to view a hospital’s pricing data for all services, including visits, tests, and procedures. |

Innovation

We have a consistent track record of innovation. Our robust network connectivity and open Application Programming Interfaces (“API”), combined with our use of Artificial Intelligence (“AI”) and Machine Learning (“ML”), enables us to regularly improve our solutions and uncover new insights as our customers’ needs evolve.

Our ability to innovate is supported by approximately 1,500 technology professionals including PhDs, masters-level health policy experts, design professionals, data scientists, programmers and statisticians in our research and development centers located in key markets. We believe that our reach across the healthcare ecosystem and our history of commercializing innovations positions us to be a preferred partner for customers and leading healthcare and technology companies.

6

Table of Contents

We believe we are well positioned for growth across the markets we serve. Our growth strategy is to increase the breadth and depth of our capabilities. We continue to increase our business with a strong base of long-standing customers by expanding our enterprise relationships and positioning them for success in their markets. Our comprehensive end-to-end solutions can reduce the complexity of our customer’s environments, yet are modular to meet their specific needs. We believe we are in the early stages of growth related to these opportunities.

Examples of our new product development include:

| • | Vaccination Record: Enables pharmacies to give consumers secure digital access to their vaccination records, so they can return to normal life while protecting their data privacy and sharing information as they choose. |

| • | InterQual AutoReview™ solution: Uses AI and natural language processing to identify diagnostic information in unstructured EHR radiology reports, extract diagnostic data from the clinical notes, and reduce provider’s administrative burden by increasing efficiency of automated medical necessity reviews over 20%. |

| • | Connected Consumer Health™ Suite: Provides a modern, streamlined, retail-like digital consumer experience throughout the patient journey via a consumer and financial engagement platform for providers, developed in collaboration with Adobe and Microsoft. |

| • | Telehealth Medical Eligibility and Claims Management: Provides APIs for providers and digital health innovators to check eligibility, submit claims, and manage the entire claims lifecycle. |

| • | Telehealth Lab Orders, Results, and ePrescribe: Addresses connectivity challenges faced by telehealth vendors to order lab tests and prescribe medications. |

| • | COVID-19 Contact Tracing and Enhanced Services: Helps public sector, educational, and corporate organizations deploy effective contact tracing programs. Uses a scalable engagement platform, data and lab network connectivity, and Patient Access Center Services with medical and insurance eligibility expertise. |

Market Opportunity

We compete in the market for data and analytics-driven solutions that help ensure clinically appropriate care, increase efficiency and reduce waste in the healthcare industry. We believe the following trends impacting payers, providers and consumers represent a significant opportunity for us.

Wasteful spending amidst rising costs in the U.S. healthcare system.

Research cited by the Journal of the American Medical Association estimates that the estimated cost of waste in the US health care system ranged from $760 billion to $935 billion, accounting for approximately 25% of total health care spending in 2019. Examples of waste include failure to adhere to best care practices and lack of care coordination, which leads to unnecessary readmissions and inappropriate levels of care delivery. Wasteful spending includes significant variation among providers in the cost and quality of similar care from provider to provider, and market to market (not explained by geography alone), and also includes overtreatment, which is testing and care that is not medically beneficial.

Additionally, the U.S. healthcare system relies on many inefficient processes that are manual, complex, frequently changing, time consuming, prone to error, costly, and requiring undue amounts of clinicians’ and other professionals’ time. In addition, improper payments, according to the Office of Management and Budget, represented approximately 6% of all Medicare Fee-for-Service and 21% of Medicaid payments in 2020. Such improper payments and fraudulent billing create costly and labor-intensive follow-up. According to the CMS, U.S. healthcare spending is expected to grow from $3.8 trillion in 2019, or 18% of U.S. gross domestic product, to $6.2 trillion, or approximately 20% of U.S. gross domestic product, by 2028. This implies that healthcare

7

Table of Contents

spending is increasing at a 5.4% annual growth rate, or 3.4% higher than expected inflation over the same period. Given the significant and lasting financial burden of ongoing rising costs and wasteful spending, government, commercial payers, and providers are increasingly focused on reducing costs attributable to administrative complexity and errors; excessive manual labor; and uncoordinated, unproductive, or ineffective processes. As a result, we expect continued strong demand for solutions that can aid in reducing waste, improving efficiency, and help ensure delivery of clinically appropriate and value-based care.

Healthcare system exposure to growing chronically ill and higher risk populations.

While the overall U.S. population is expected to increase 6.8% from 2020 to 2030, the population of adults age 65 and older is expected to increase 30.5% over the same period, according to the U.S. Census Bureau. As the country’s elderly population continues to grow, and the healthcare system serves more chronically ill and higher risk populations, providers and payers will need tools to onboard and manage these populations. These include the ability to deliver appropriate care for medically complex patients, and the ability to document risk and outcomes to attain the appropriate reimbursement rates associated with these populations.

Increasing prevalence of value-based care and alternative reimbursement models.

The traditional fee-for-service reimbursement model is viewed as having facilitated growth in healthcare spending beyond the value provided from additional services. In response, both public and private sectors are shifting towards alternative payment models that are designed to incentivize value and quality throughout an “episode of care” and the care continuum overall, which encompass most or all of the services provided to a patient to diagnose, treat, and manage a clinical condition before, during, and after care is delivered. In recent years, the U.S. Department of Health and Human Services (“HHS”) has set quality and value targets for certain Medicare value-based alternative payment models, and commercial payers are accelerating their focus in a similar fashion. These payment models require a high level of documentation, robust data, sophisticated payment attribution capabilities, and advanced analytics that can adapt to new rules and goals to ensure compliance. Further, solutions seek to optimize the design, implementation, and monitoring of care delivery throughout an episode of care. Many payers and providers are still building the capabilities, expertise, and administrative processes to manage these changes adequately. They are increasingly partnering with third parties to demonstrate the achievement of the outcomes required under these value-based payment models, which require a fundamentally different skillset and toolset than what they have deployed historically.

Increasing patient financial responsibility and consumerism in healthcare.

As healthcare expenditures have continued to rise, employers and health plans have shifted costs to patients through increased adoption of high-deductible health plans. Enrollment in high deductible health plans with a savings option (HDHP/SO) has increased over the past five years, from 24% of covered workers in 2015 to 31% in 2020, according to the Kaiser Family Foundation. This trend is expected to continue. Increases in patient financial responsibility require providers to obtain payment from the patient before and after the point of care, which in turn requires more advanced billing and collection workflows. As providers become more consumer-oriented, they require increasingly sophisticated, dynamic, and personalized digital solutions, which generally necessitate scale for efficient implementation and cost-effectiveness. Likewise, as patient out-of-pocket costs continue to increase, they are becoming more quality- and cost-conscious consumers, likely to make more calculated decisions regarding their healthcare consumption. These empowered “healthcare consumers” are demanding price transparency, decision support, and access to medical records from their health plans to help them choose caregivers who deliver the highest quality care at the lowest price. Health plans are consequently partnering with third parties to provide their members with tools which enable them to assess quality and cost based on individual plan benefits. At the same time, providers seek to effectively communicate the quality and value of their services, determine patients’ upfront insurance eligibility, coverage, and ability to pay their portion of healthcare bills; and simplify the payment process to improve patient experience and satisfaction.

8

Table of Contents

Proliferation of healthcare data.

The U.S. government funded almost $40 billion of incentive payments to healthcare providers between 2011 and July 2018 to adopt EHR technology. This has resulted in 80% of physicians and 96% of hospitals in the U.S. having certified EHR systems as of 2017, according to the Office of the National Coordinator for Health Information Technology (“ONC”). These EHRs, other digitized healthcare data, and the increasing amount of personal health data generated from smartphones, wearables, and other devices have generated unprecedented amounts of healthcare data in the U.S. However, healthcare data is often siloed and unstructured, and has historically been difficult for all constituents to understand and use in a timely manner. Both healthcare professionals and consumers increasingly demand tools and solutions that standardize the transfer and collection of data, as well as the ability to mine and analyze it for actionable insights. Advancements in ML, AI, and data science are making it easier to cost-effectively utilize data at scale, in real-time, to identify actionable insights that help improve outcomes and decrease cost. As healthcare data can be used more effectively, we expect that leading technology companies will increasingly seek partners who can effectively develop new software and analytics solutions to help payers and providers improve workflows and deliver higher quality care at lower cost to consumers.

Responding to the weaknesses exposed by the COVID-19 pandemic.

The COVID-19 pandemic disrupted our economy and nearly brought the healthcare system to its knees. It exposed and exacerbated weaknesses in the U.S. healthcare system’s clinical, financial, and technical infrastructure, including significant issues with clinical guidelines; patient access and capacity management; revenue stability; social determinants of health and care inequity; clinical data interoperability; telehealth coverage, access, and payment; staffing safety and remote work; contact tracing; gaps in value-based payment models and the impact on claims management; and, now, a safe and orderly return to normal. The pandemic highlighted the criticality of accelerating the transformation of the U.S. healthcare system by making it simpler, more accessible, more integrated and streamlined, and digitized for everyone.

As a provider of data and analytics-driven solutions for the U.S. healthcare system, we help embed our customers with their end-to-end, mission-critical daily workflows.

Our solutions support our customers’ core business functions, including member enrollment, patient access, treatment, documentation, reimbursement and payment, claims and financial management, and post-payment and communication. We believe our collaborative and comprehensive approach, combined with modular capabilities, is important to our customers’ ability to operate efficiently and cost-effectively. We earn the loyalty of our customers with solutions designed to help them meet clinical, financial, and operational objectives and improve their recurring and evolving processes.

Financial Platform Supported by Clinical Insight.

The Change Healthcare Platform is at the center of everything we do. Over the last year, we have increased the maturity of our platform, facilitated adoption of platform services, enabled new revenue opportunities, and driven time-to-market benefits for products across our portfolio. All of this is designed to help our customers innovate faster and more effectively.

Scale makes us a preferred technology partner.

The ability of our solutions and network to fit within the workflows of our customers, and our breadth of industry relationships, position us to introduce best-in-class technologies to the healthcare industry at scale. Our customers take advantage of our innovations in AI, ML, robotic process automation (“RPA”), data science, and APIs to improve clinical, financial, and patient engagement outcomes. Our collaboration with technology leaders helps further broaden our scale with new, innovative solutions.

9

Table of Contents

Modular and flexible solutions designed to serve a diverse, extensive customer base.

We deploy our solutions through complementary software and analytics, technology enabled services, APIs, and a network delivery model with the power to help customers improve revenue opportunities and reduce operational costs. At the same time, our solutions are modular and flexible, providing us with the ability to address a customer’s trajectory of needs with either point solutions or an end-to-end suite of services. In addition, we have the ability to deliver integrated solutions throughout our business.

Proven ability to serve the evolving needs of our customers with industry-leading solution franchises.

During fiscal year 2021, we added a number of new solutions to our business platform through new product development. As a long-time leader in healthcare data interoperability, we provide open APIs based on Fast Healthcare Interoperability Resources and other industry standards, which help us innovate with customers and partners across the industry. The ability to quickly and accurately sort through massive amounts of data from multiple sources and determine relevant patient information is crucial to outcomes. Our Enterprise Imaging solutions house more than 41 petabytes of imaging data and one billion exams through our systems. In that area, we continue to enhance the only cloud-native enterprise imaging solution in the market, helping customers modernize their workflow infrastructure, reduce capital and operating costs, improve care coordination across specialties, and speed accurate clinical decisions.

Data stewardship and security.

As the amount of data in healthcare grows and the ability to use that data becomes more essential to effective delivery, management, and administration, we expect data security to become increasingly important for our customers. Our history of delivering solutions while prioritizing data security and fidelity enables us to be the platform of choice for large customers and partners. We have multiple certifications on multiple offerings and we implement security procedures and policies informed by applicable law and recommended practices. We also aim to drive industry maturity through appointed leadership roles with HITRUST Alliance and Healthcare Information Security and Analysis Center.

Predictable revenue profile and attractive, scalable model.

We have an attractive operating profile given the predictable, recurring nature of a significant portion of our revenue combined with a scalable financial model. Our revenue is largely derived from recurring transactional, monthly subscription, and per-click formats, as well as contingency-based or long-term contracts. We continue to streamline costs and have instituted cost improvement initiatives throughout the organization. We believe our recurring revenue will provide us with increasing flexibility to allocate and deploy our capital.

Growth Strategy

Develop, augment and commercialize capabilities at scale.

We work closely with our customers to integrate our offerings into their workflows and business processes. We develop new products and services, partner with industry-leading companies and selectively acquire complementary technologies and businesses to enhance our offerings. We introduce solutions through one of three methods: (i) internal development based on feedback from our customers, partners, and the analytical capabilities of our platform and suite of solutions, (ii) commercial partnerships that are expansive and flexible, ranging from limited scope sales relationships to arrangements in which we are a significant customer and (iii) strategic acquisitions that strengthen the value we deliver to our customers.

Maximize wallet share with customers through cross-selling.

We have significant opportunities to expand the suite of services that our long-tenured and loyal customer base purchases from us through focused cross-selling. While we seek to continually improve our product and

10

Table of Contents

service offerings, our sales force is focused on expanding the scope and depth of our customer relationships. Our omni-channel sales force covers medium and larger customers with direct field sales teams and uses inside sales for direct coverage of smaller customers. We leverage our communication with and feedback from our customers to identify and execute on opportunities which expand and deepen relationships, while increasing the benefits they receive through our connectivity, software, analytics, and services.

Deliver comprehensive, end-to-end, modular solutions to customers.

Our solutions are comprehensive in that they meet a significant portion of our customers’ clinical and administrative needs and are integrated to improve functionality and usability, yet modular to meet the specific needs of our customers. Our goal is to deliver offerings flexible enough to work with the legacy technologies still used by many of our customers, while also delivering more sophisticated and advanced solutions to customers as they upgrade their technology platforms.

Use our data assets to deliver tangible value to customers.

We continue to develop data-driven solutions to drive tangible returns for our customers. Through our data assets and associated analytics, we have created personalized, episodic, and population-based solutions for our customers to deliver high quality, low-cost solutions at scale.

Our Solutions

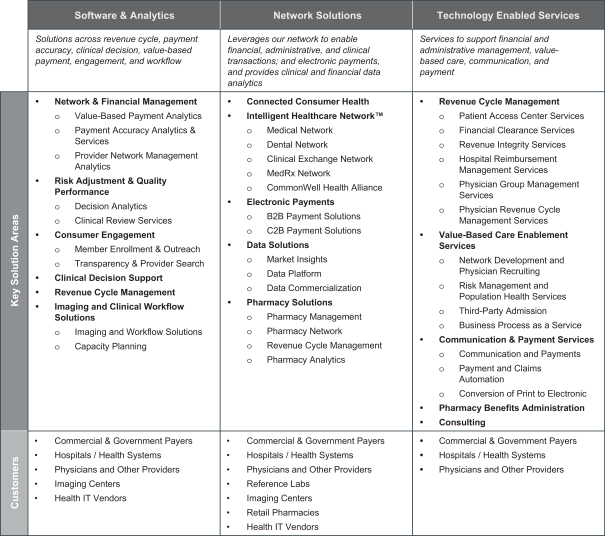

We offer clinical, financial, and patient engagement solutions in three business segments—Software and Analytics, Network Solutions, and Technology-Enabled Services—that facilitate significant collaboration and interoperability to create a stronger, better coordinated, increasingly collaborative, and more efficient healthcare system. A summary of our various products and solutions is included below.

Software and Analytics

Our software solutions seek to enable our customers to achieve financial performance, operational excellence, and payment and network optimization, ultimately helping them navigate the industry’s transition to value-based care. In the Software and Analytics segment, we provide solutions for revenue cycle management, provider network management, payment accuracy, value-based payments, clinical decision support, consumer engagement, risk adjustment and quality performance, and imaging and clinical workflow.

Network Solutions

We leverage our Intelligent Healthcare Network to enable and optimize connectivity and transactions among healthcare system participants. Through our Network Solutions segment, we provide solutions for financial, administrative, and clinical and pharmacy transactions, electronic payments and aggregation and analytics of clinical and financial data.

11

Table of Contents

Technology-Enabled Services

We provide expertise, resources, and scalability to allow our customers to streamline operations, optimize clinical and financial performance, and focus on patient care. Through our Technology-Enabled Services segment, we provide solutions for financial and administrative management, value-based care, communication and payment, pharmacy benefits administration and healthcare consulting.

Software and Analytics

| • | Network & Financial Management: We help commercial and government payers improve claims operations performance, payment model innovation, and provider network management through a comprehensive solution supporting payers across the entire payment continuum in the transition to value-based care and alternative payment models. |

| • | Value-Based Payment Analytics: We combine a cloud-based analytics platform with clinically validated, transparent Episodes of Care to coordinate Primary Care Providers and Specialists in the effective transition to alternative payment models. |

12

Table of Contents

| • | Payment Accuracy Analytics & Services: Our comprehensive suite of solutions is designed to help payers combat risk of fraud, waste, and abuse at every stage of the claim, from pre-submission to post-payment. |

| • | Risk Adjustment & Quality Performance: We help payers and risk-bearing providers improve financial performance by supporting reimbursement for government-sponsored health plans—including risk adjustment and quality measures, such as the National Committee for Quality Assurance’s (“NCQA”) Healthcare Effectiveness Data and Information Set (“HEDIS”)—for the Medicare, Medicaid, and Commercial Affordable Care Act markets. |

| • | Decision Analytics: We provide a comprehensive set of analytics-driven solutions for risk adjustment and quality performance that aligns with how government-sponsored plans are reimbursed. |

| • | Clinical Review Services: We provide solutions for medical records retrieval, coding, and abstraction for payers who want to increase incremental revenue and quality ratings for NCQA’s HEDIS and the Star Rating Program (a CMS system to help beneficiaries compare performance and quality). |

| • | Consumer Engagement: We help commercial and government payers adapt to the evolving needs of a more value-based, consumer-driven environment with consumer-facing tools used to support enrollment and ongoing health management processes. Our consumer engagement solutions help payers respond to many of the industry’s most pressing consumer engagement challenges, from addressing social determinants of health to engaging high-need populations, such as dual eligible individuals. |

| • | Member Enrollment & Outreach: We provide member-centric solutions for payers—focusing on Medicare and Medicaid programs—to improve revenue, increase member satisfaction, and improve engagement in maintaining or improving their health. We have helped Medicaid managed care payers add incremental revenue through dual enrollment. Additionally, our enrollment AI services pinpoint those individuals with the highest likelihood to qualify for full or partial Medicare and Medicaid dual eligibility. |

| • | Clinical Decision Support: Our clinical criteria, InterQual®, assists payers, providers and government organizations in making clinically appropriate medical utilization decisions to help determine the right care, at the right time, and at the right cost. |

| • | Revenue Cycle Management: We provide end-to-end revenue cycle management workflow and analytics to streamline reimbursement and time-to-revenue for hospitals, physician offices, laboratories, and other ancillary care providers by providing timely insights that reduce denials. |

| • | Imaging and Clinical Workflow Solutions: We help providers improve clinical, operational, and financial performance through enterprise imaging, care delivery, and capacity planning solutions for acute and post-acute care settings. We are building, from the ground up, cloud-native solutions to showcase the flexible nature of cloud services and delivery. The cloud-native network will enhance and optimize medical imaging data, enabling providers to improve clinical, financial, and operational outcomes. |

Network Solutions

| • | Connected Consumer Health: We help providers transform their patient engagement and access activities to meet consumer demand for digital interactions. Our solutions help providers acquire new patients and deliver a patient experience to assist with building loyalty. |

| • | Healthcare eCommerce: Our solutions help providers offer transparent pricing and deliver a retail-style shopping experience. Providers can enable public-facing pricing transparency in competitive markets or keep patients within their organization by offering an exclusive, in-network shopping experience. |

| • | Touchless Patient Access: Our solution assists providers with creating a touchless patient registration, check-in and form completion experience to help maintain social distancing requirements and reduce potential exposure to others. |

| • | Vaccination Record: A digital solution that empowers consumers to securely access their vaccination records anytime, anywhere, on any device, so they can access it easily as needed. |

13

Table of Contents

| • | Intelligent Healthcare Network: Our Intelligent Healthcare Network provides connectivity that benefits all major healthcare stakeholders, including commercial and governmental payers, employers, hospitals, physicians, laboratories, pharmacies, and consumers. |

| • | Medical Network: Our network provides support for healthcare financial and administrative transactions, including eligibility, claims, durable medical equipment, electronic remittance advice, claim status, pre-authorization, and medical attachments. Our Medical Network is integrated with our payments network, which allows payers and providers to reconcile consumer out-of-pocket cash and credit card payments with payer electronic funds transfer and check payments to settle bills and claims. |

| • | Dental Network: We provide eligibility, claims, electronic remittance advice, and payment solutions to dental practices primarily through software channel partners. Our solutions further simplify claims through our attachment technology, which tightly integrates claims processing workflows to ensure only essential attachments required by a payer are connected to a claim and delivered according to payer preferences. |

| • | Clinical Exchange Network: Our Clinical Exchange Network provides an efficient mechanism for EHRs and laboratories to connect with each other and maintain regulatory certifications without the cost of expensive and redundant direct connections. |

| • | MedRx Network: Our medical pharmacy network provides pharmacies with connectivity to commercial and government payers, supporting billing medical claims, such as durable medical equipment and immunizations, directly from the pharmacy management system. |

| • | CommonWell Health Alliance: As the national service provider for CommonWell Health Alliance, we support an industry-wide interoperability effort to make available silos of data that reside within care settings and disparate health IT systems. Our services for CommonWell members include: (i) registration and unique identification of each individual enrolled; (ii) record locator services; (iii) linking of each individual’s clinical records across the care continuum; and (iv) data query and retrieval to enable caregivers to search, select and receive data. |

| • | Electronic Payments: Our electronic payment solutions support both business-to-business (“B2B”) and consumer-to-business (“C2B”) payments. We believe we are well positioned to further drive the healthcare industry’s adoption of convenient and cost-saving payment processes through our comprehensive network of payers and providers. |

| • | B2B Payment Solutions: We offer payers and providers the ability to distribute and receive payments in the most efficient manner via electronic funds transfer, direct payment, card-based or check. We also assist our customers in automating these processes. |

| • | C2B Payment Solutions: We help providers efficiently bill consumers and offer consumer-friendly options to help reduce bad debt while enhancing the consumer billing and payment experience. |

| • | Data Solutions: We help payers, providers, life sciences companies, and commercial data providers address increasing demands for data to support analytical needs related to performance improvement, consumer engagement, and value-based care. |

| • | Data Platform: We enable our customers to acquire and aggregate clinical, financial, and operational data from across the care continuum, analyze the data and make it available through applications or via direct feeds to a customer’s existing enterprise data warehouse and other analytics systems. |

| • | Data Commercialization: We provide de-identified data feeds informed by regulatory compliant formats and create applications and tools directly for customers or via third party channel partners. |

| • | Data Science as a Service: We provide secure access to de-identified, patient-level claims data—including diagnoses and care prescriptions—along with social determinants of health, behavioral health, and other novel data for customers who want privacy-compliant healthcare analytics at scale. |

14

Table of Contents

| • | Pharmacy Solutions: We offer a comprehensive suite of end-to-end pharmacy solutions that help streamline operations and improve financial results for both independent and chain pharmacies. |

| • | Pharmacy Management: Our scalable pharmacy management system helps our customers quickly adapt to changing market and business requirements with configurable workflows and dispensing rules that streamline in-store processes and improve staff efficiency. |

| • | Pharmacy Network: Our network helps pharmacies submit claims to any third-party processor; perform custom claims; edit claims that suit unique pharmacy requirements; streamline eligibility checks with access to coverage information for more than 270 million individuals; and reduce the financial burden of co-pays and medication adherence while driving revenue. |

| • | Revenue Cycle Management: Our modular pharmacy revenue cycle management suite offers tools for third-party submission and reconciliation; outsourced “chasing claims”, contract management, appeal submission, and tracking services. |

| • | Pharmacy Analytics: We help pharmacies drive real-time, point-of-sale actions that enhance revenue with robust analytics that reveal insights into all areas of their business—from chain to individual store—with visualizations, dashboards, and reports for monitoring business operations, improving margins, minimizing costs/risks, and supporting health and wellness initiatives. |

Technology-Enabled Services

| • | Revenue Cycle Management: We have a demonstrated ability to help improve collections, optimize operational efficiency, and enhance patient experience. |

| • | Patient Access Services: We enable health systems and physician practices to provide a broad range of patient access services to their patients. We leverage call center technology with the flexibility to utilize EHR and practice management capabilities, providing a single source of accountability with reporting and continuous quality monitoring. |

| • | Revenue Integrity Services and Consulting: Our Revenue Integrity services help providers mitigate risk, and include charge audit services, coding augmentation, coding quality audit, clinical documentation improvement staffing, and compliance review. |

| • | Hospital Reimbursement Management Services and Physician Revenue Cycle Management Services: We deliver billing and accounts receivable management to address government, commercial, and self-pay payments for hospitals, health systems, independent and hospital-employed physician practices, fire and emergency medical service agencies, and other healthcare organizations, such as independent and hospital-employed laboratories. |

| • | Practice Management: We provide turnkey oversight and operations services for hospital-employed physicians and independent group practices handling a broad scope of administrative tasks including accounting, billing, collections, human resources, scheduling, finance, and managed care contracting. |

| • | Value-Based Care Enablement Services: We provide a broad scope of technologies, tools and services ranging from consulting and project support to full turn-key operations that enable providers, payers, accountable care organizations, and government agencies to succeed in the transition from fee-for-service reimbursement to payment models that reward high-quality and cost-effective care. |

| • | Network Development and Physician Recruiting: We help commercial payers and managed care organizations successfully develop, manage, and scale clinically integrated networks. |

| • | Risk Management and Population Health Services: We enable providers to drive growth and improve margin performance under all value-based payment models, ranging from capitation to shared savings programs. |

15

Table of Contents

| • | Third-Party Administration: We provide fully delegated, licensed third-party administration services that enable risk-bearing providers and payers to reduce the burden of foundational health plan administration, allowing for greater focus on strategic activities such as new product development and member engagement. |

| • | Business Process as a Service (“BPaaS”): At the core of our BPaaS solution is our CMS compliant, real-time benefits administration and claims processing platform for all lines of business built entirely on contemporary technology. Our platform offers unlimited flexibility in defining benefit plans, provider contracts, and core business processes using “healthcare business rules” language that can be read and written by non-technical people. |

| • | Communications and Payment Services: We provide communication and payment solutions for payers, providers, channel partners and other stakeholders in the healthcare system. |

| • | Communications and Payments: We help payers produce and distribute explanation of benefits, explanation of payments, checks, claims and correspondence. |

| • | Patient Payment Solutions: We offer providers patient-facing, digital payment solutions to collect patient self-pay obligations. |

| • | Patient Billing and Statements: For providers and channel partners, we manage patient statements and related correspondence, integrated with our digital payment solution. |

| • | Payment and Claims Automation: We provide payment and claims automation solutions that facilitate, expedite, and automate payment processing and posting activities. |

| • | Pharmacy Benefits Administration (“PBA”): Our PBA solutions provide healthcare management and other administrative services for pharmacy payers and state Medicaid programs, as well as claims processing and other administrative solutions, in real-time, according to customer benefit plan designs, and present a cost-effective alternative to an in-house pharmacy claims adjudication system. |

| • | Consulting: Our healthcare consulting solutions help healthcare customers analyze, develop and implement business and technology strategies that are designed to align with healthcare trends and overall business goals. |

Our Customers

We generally provide solutions to payer and provider customers on a per transaction, per document, per communication, per member per month, per provider per month, monthly flat-fee, contingent fee, or hourly fee, and software license, with recurring maintenance fee, basis. Our customer contracts are generally one to three years in term and automatically renew for successive annual terms unless terminated.

| • | Payers: The payer market primarily consists of national commercial insurers, regional private insurers, BlueCross Blue Shield plans, Medicare/Medicaid plans, provider-sponsored payers, third party administrators, emerging technology and data-driven health plans and other specialty health benefits insurers. We are directly connected to their workflows and administrative and clinical systems and provide products and services to nearly all payers. |

| • | Providers: The provider market is comprised of hospitals and health systems, physician practices, dentists, pharmacies, skilled nursing facilities, home health agencies, telehealth providers, senior care facilities, laboratories, and other healthcare providers. We currently have contractual or submitter relationships with these providers, directly or through our channel partners. |

16

Table of Contents

Our Competition

We compete on the basis of the breadth and functionality of the solutions we offer on both an integrated and modular basis, the return on investment realized by our customers from our solutions, the size and reach of our network, our value proposition and our pricing models. Our solutions compete with:

| • | Healthcare transaction processing companies, including those providing electronic data interchange (“EDI”) services and/or internet-based services and those providing services through other means, such as paper and fax; |

| • | Healthcare information system vendors that support providers or payers with their revenue and payment cycle management, imaging usage, retrieval and management, capacity and resource management, and clinical information exchange processes, including physician and dental practice management, hospital information, imaging and workflow solutions and EHR vendors; |

| • | IT and healthcare consulting service providers; |

| • | Healthcare insurance companies, pharmacy benefit management and pharmacy benefit administrator companies, hospital management companies and pharmacies that provide or are developing electronic transaction and payment distribution services for use by providers and/or by their members and customers; |

| • | Healthcare payments and communication solutions providers, including financial institutions and payment processors that have invested in healthcare data management assets, and print and mail vendors; |

| • | Healthcare eligibility and enrollment services companies; |

| • | Healthcare payment accuracy companies; |

| • | Healthcare engagement and transparency companies; |

| • | Healthcare billing and coding services companies; |

| • | Providers of other data products and data analytics solutions, including healthcare risk adjustment, quality, economic statistics and other data; and other data and analytics solutions; and |

| • | Licensors of de-identified healthcare information. |

In some cases, we also compete with certain of our customers who provide some of the same solutions that we offer, as well as with alliances formed by our competitors. In addition, certain major software, hardware, information systems and business process outsourcing companies, both with and without healthcare companies as their partners, offer or have announced their intention to offer competitive products or services.

Regulatory Matters

Substantially all of our business is directly or indirectly related to the healthcare industry and is affected by changes in the healthcare industry, including regulatory changes and fluctuations in healthcare spending. In the U.S. and other countries, the healthcare industry is highly regulated and subject to frequently changing political, legislative, regulatory and other influences. Although some regulatory requirements do not directly apply to our operations, these requirements affect the business of our payer and provider customers and the demand for our solutions. We also may be impacted by non-healthcare laws, requirements and industry standards. For example, banking and financial services industry regulations and privacy and data security regulations may impact our operations as a result of the electronic payment and remittance services we offer directly or through third-party vendors.

We are subject to a number of U.S. federal, state, local and foreign laws and regulations that involve matters central to our business. Failure to satisfy those legal and regulatory requirements, or the adoption of new laws or regulations, could have a significant negative impact on our results of operations, financial condition or liquidity. U.S. federal, state, local and foreign laws and regulations are evolving and can be subject to significant change.

17

Table of Contents

In addition, the application and interpretation of these laws and regulations are often uncertain. These laws are enforced by federal, state and local regulatory agencies in the jurisdictions where we operate, and in some instances also through private civil litigation. For a discussion of the risks and uncertainties affecting our business related to compliance with federal, state and other laws and regulations and other requirements, see “Risk Factors—Risks Related to Government Regulation and other Legal Risks—Recent and future developments in the healthcare industry could have a material adverse impact on our business, results of operations or financial condition,” “Risk Factors—Risks Related Government Regulation and other Legal Risks —Government regulation, industry standards and other requirements create risks and challenges with respect to our compliance efforts and our business strategies,” and “Risk Factors—Risks Related to Government Regulation and other Legal Risks —We are unable to predict what changes to laws, regulations and other requirements, including related contractual obligations, might be made in the future or how those changes could affect our business or the costs of compliance.”

Examples of the most significant of these laws include, but are not limited to, the following:

HIPAA Privacy and Security Requirements

There are numerous federal and state laws and regulations related to the privacy and security of health information. In particular, regulations promulgated pursuant to the Health Insurance Portability and Accountability Act (“HIPAA”) establish privacy and security standards that limit the use and disclosure of certain individually identifiable health information (known as “protected health information”) and require the implementation of administrative, physical and technological safeguards to protect the privacy of protected health information and ensure the confidentiality, integrity and availability of electronic protected health information. The privacy regulations established under HIPAA also provide patients with rights related to understanding and controlling how their protected health information is used and disclosed. As a provider of services to entities subject to HIPAA, we are directly subject to certain provisions of the regulations as a “Business Associate.” We are also directly subject to the HIPAA privacy and security regulations as a “Covered Entity” with respect to our operations as a healthcare clearinghouse and with respect to our clinical care visit services.

When acting as a Business Associate under HIPAA, to the extent permitted by applicable privacy regulations and contracts and associated Business Associate Agreements with our customers, we are permitted to use and disclose protected health information to perform our services and for other limited purposes, but other uses and disclosures, such as marketing communications, require written authorization from the patient or must meet an exception specified under the privacy regulations. To the extent we are permitted to de-identify protected health information and use de-identified information for our purposes, determining whether such protected health information has been sufficiently de-identified to comply with the HIPAA privacy standards and our contractual obligations may require complex factual and statistical analyses and may be subject to interpretation.

Other Privacy and Security Requirements

In addition to HIPAA, numerous other U.S. federal and state laws govern the collection, dissemination, use, access to and confidentiality of personal information. Certain federal and state laws protect types of personal information that may be viewed as particularly sensitive. For example, the Confidentiality of Substance Use Disorder Patient Records (42 C.F.R. Part 2) is a federal law that protects information that would reveal if an individual has or had a substance abuse disorder. Similarly, New York’s Public Health Law, Article 27-F protects information that could reveal confidential HIV-related information about an individual. Some states have enacted or are considering new laws and regulations that would further protect this information, such as the California Consumer Privacy Act of 2018, which builds upon and is more stringent in many respects than other state laws currently in effect in the U.S. In many cases, state laws are more restrictive than, and not preempted by, HIPAA, and may allow personal rights of action with respect to privacy or security breaches, as well as fines. State laws are contributing to increased enforcement activity and may also be subject to interpretation by various courts and

18

Table of Contents

other governmental authorities. Further, Congress and a number of states have considered prohibitions or limitations on the disclosure of personal and other information to individuals or entities located outside of the U.S. The U.S. Congress is also currently considering a generally applicable national privacy law that may supplant California’s and other states’ privacy laws.

There also are numerous international privacy and security laws that govern the collection, dissemination, use, access, retention, protection, transfer and confidentiality of personal information. For example, the General Data Protection Regulation (“GDPR”), which became effective on May 25, 2018, is more stringent than laws and regulations governing personal information in the U.S. Certain of our solutions involve the transmission and storage of customer data in various jurisdictions, which subjects the operation of that service to privacy or data protection laws and regulations in those jurisdictions.

Data Protection and Breaches

Most states require holders of personal information to maintain safeguards and take certain actions in response to a data breach, such as providing prompt notification of the breach to affected individuals or the state’s attorney general. In some states, these laws are limited to electronic data, but states increasingly are enacting or considering stricter and broader requirements. Additionally, HIPAA imposes certain notification requirements on both Covered Entities and Business Associates. In certain circumstances involving large breaches, requirements may even involve notification to the media. A non-permitted use or disclosure of protected health information is presumed to be a breach under HIPAA unless the Covered Entity or Business Associate establishes that there is a low probability the information has been compromised consistent with requirements enumerated in HIPAA.

Further, the Federal Trade Commission (“FTC”) has prosecuted certain data breach cases as unfair and deceptive acts or practices under the Federal Trade Commission Act. In addition, by regulation, the FTC requires creditors, which may include some of our customers, to implement identity theft prevention programs to detect, prevent and mitigate identity theft in connection with customer accounts. Although Congress passed legislation that restricts the definition of “creditor” and exempts many healthcare providers from complying with this identity theft prevention rule, we may be required to apply additional resources to our existing processes to assist our affected customers in complying with this rule.

HIPAA Transaction and Identifier Standards

HIPAA and our implementing regulations mandate format and data content standards and provider identifier standards (known as the National Provider Identifier) that must be used in certain electronic transactions, such as claims, payment advice and eligibility inquiries. HHS has established standards that health plans must use for electronic fund transfers with providers, has established operating rules for certain transactions, and is in the process of establishing operating rules to promote uniformity in the implementation of the remaining types of covered transactions. The Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010 (collectively, the “ACA”) also requires HHS to establish standards for health claims attachment transactions. HHS has modified the standards for electronic healthcare transactions (e.g., eligibility, claims submission and payment and electronic remittance) from Version 4010/4010A to Version 5010. Further, as of 2015, HHS requires the use of updated standard code sets for diagnoses and procedures. Enforcement of compliance with these standards falls under HHS and is carried out by CMS.

Anti-Kickback Laws and Anti-Referral Laws

A number of federal and state laws govern patient referrals, financial relationships with physicians and other referral sources and inducements to providers and patients, including restrictions contained in amendments to the Social Security Act, commonly known as the federal Anti-Kickback Statute (“AKS”). The AKS prohibits any person or entity from offering, paying, soliciting or receiving, directly or indirectly, anything of value with the

19

Table of Contents

intent of generating referrals of items or services covered by Medicare, Medicaid or other federal healthcare programs. Courts have interpreted the law to provide that a financial arrangement may violate this law if any one of the purposes of an arrangement is to encourage patient referrals or other federal healthcare program business, regardless of whether there are other legitimate purposes for the arrangement. Violation of the AKS is a felony, and penalties for AKS violations can be severe, and include imprisonment, criminal fines, civil penalties with treble damages (when the federal False Claims Act (“FCA”) is implicated) and exclusion from participation in federal healthcare programs. The ACA broadened the reach of the AKS by amending the intent requirement, such that a person or entity no longer needs to have actual knowledge of the AKS or specific intent to violate it in order to have committed a violation. In addition, as further discussed below, the ACA provided that the government may assert that a claim which includes items or services resulting from a violation of the AKS constitutes a false or fraudulent claim for purposes of the FCA, as well as restrictions contained in amendments to the Social Security Act, commonly known as the federal Civil Monetary Penalties Law (“CMP”). The AKS contains a limited number of exceptions, and the Office of the Inspector General (“OIG”) of HHS has created regulatory safe harbors to the AKS. Activities that comply with a safe harbor are deemed protected from prosecution under the AKS. Failure to meet a safe harbor does not automatically render an arrangement illegal under the AKS. The arrangement, however, does risk increased scrutiny by government enforcement authorities, based on our particular facts and circumstances. Our contracts and other arrangements may not meet an exception or a safe harbor. Additionally, many states have similar anti-kickback laws that are not necessarily limited to items or services for which payment is made by a federal or state healthcare program. In addition, federal laws restricting certain physician self-referrals (also known as the “Stark Law”), as well as state counterparts, may prohibit payment for patient referrals, patient brokering, remuneration of patients, or billing based on referrals between individuals or entities that have various financial, ownership, or other business relationships with physicians or other healthcare providers. The Stark Law is very complex, and state anti-referral laws vary widely. As noted below, to the extent we undertake billing and coding for designated health services, such activities may be subject to the Stark Law.

False or Fraudulent Claim Laws; Medical Billing and Coding

Medical billing, coding and collection activities are governed by numerous federal and state civil and criminal laws, regulations, and sub-regulatory guidance. We provide billing and coding services, claims processing and other solutions to providers that relate to, or directly involve, the reimbursement of health services covered by Medicare, Medicaid, other federal and state healthcare programs and private payers. In addition, as part of our data transmission and claims submission services, we may employ certain edits, using logic, mapping and defaults, when submitting claims to third-party payers. Such edits are utilized when the information received from providers is insufficient to complete individual data elements requested by payers. We also provide solutions including risk analytics, chart reviews, clinical care visits, payment accuracy, audit functions and enrollment and eligibility, to Medicaid and Medicare managed care plans, commercial plans and other entities. These solutions, which include identifying diagnosis codes with respect to hierarchical condition categories, impact the amounts paid by Medicare and Medicaid to managed care plans. In addition, some solutions we offer to customers enable customers to certify to compliance with certain requirements and standards, such as EHR Meaningful Use requirements. We rely on our customers to provide us with accurate and complete information and to appropriately use analytics, codes, reports and other information in connection with the solutions we provide to them, but they may not always do so. As a result of these aspects of our business, we may be subject to, or contractually required to comply with, numerous federal and state laws that prohibit false or fraudulent claims including but not limited to the FCA, the CMP, and state equivalents.

In addition, the FCA prohibits the knowing submission of false claims or statements to the federal government, including to the Medicare and Medicaid programs. The FCA also contains qui tam, or whistleblower provisions, which allow private individuals to sue on behalf of the federal government alleging that the defendant has defrauded the federal government.

20

Table of Contents

Exclusion from participation in government healthcare programs

We are also subject to the exclusion rules of the OIG whereby individuals and entities convicted of program-related crimes are excluded from participation in the Medicare and Medicaid programs. A company that employs or contracts with an OIG-excluded individual and submits a claim for reimbursement to a federal healthcare program, or causes such a claim to be submitted, may itself be excluded or may be subject to significant penalties under the CMP, plus treble damages, for each item or service furnished during the period in which the individual or entity was excluded. A company contracting with providers has an affirmative duty to check the exclusion status of individuals and entities prior to entering into employment or contractual relationships and periodically re-check thereafter, or run the risk of liability under the CMP.

FDA and International Regulation of Medical Software

Certain of our products are classified as medical devices and are subject to regulation by the Food and Drug Administration (“FDA”) and numerous other federal, state and foreign governmental authorities. In the U.S., the FDA permits commercial distribution of a new medical device after the device has received clearance under Section 510(k) of the Federal Food, Drug and Cosmetic Act (“FDCA”), or is the subject of an approved premarket approval application, unless the device is specifically exempt from those requirements. Moreover, the FDA has increasingly focused on the regulation of medical software and health information technology products as medical devices under the FDCA. For example, in February 2015, the FDA issued guidance to inform manufacturers and distributors of medical device data systems that it did not intend to enforce compliance with regulatory controls that apply to medical device data systems, medical image storage devices, and medical image communication devices. The Cures Act, enacted in December 2016, builds on the FDA’s efforts to limit the regulation of low-risk medical devices by exempting certain categories of software functions from the definition of “medical device” under the FDCA, including software functions intended for administrative support of a healthcare facility and certain functions related to the exchange and use of electronic medical records. However, a software function may not be excluded from the device definition if the FDA determines that use of the software function would be reasonably likely to have serious adverse health consequences.

Foreign governmental authorities that regulate the manufacture and sale of medical devices have become increasingly stringent and, where we sell our medical device solutions internationally, we are subject to international regulation regarding these medical device solutions. For example, in May 2017, the European Union (“EU”) Medical Devices Regulation (“MDR”) (Regulation 2017/745) was adopted and in May 2020 the MDR came into effect. The MDR repeals and replaces the EU Medical Devices Directive. Unlike directives, which must be implemented into the national laws of the EU Member States, the MDR is directly applicable in the EU Member States and on the basis of the European Economic Area (“EEA”) agreement in Iceland, Lichtenstein and Norway. The MDR, among other things, is intended to establish a uniform, transparent, predictable and sustainable regulatory framework across the EEA for medical devices and ensure a high level of safety and health while supporting innovation. The MDR, among other things:

| • | Strengthens the clinical data requirements related to medical devices; |

| • | Imposes additional scrutiny during the conformity assessment procedure for high risk medical devices; |

| • | Imposes on manufacturers and authorized representatives the obligation to have a person responsible for regulatory compliance continuously at their disposal; |

| • | Requires that authorized representatives be held legally responsible and liable for defective products placed on the EEA market jointly with the device manufacturers; |

| • | Reinforces post market surveillance requirements applicable to CE marked medical devices; |

| • | Improves the traceability of medical devices throughout the supply chain to the end-user or patient through a Unique Device Identification System; and |

21

Table of Contents

| • | Increases transparency. Information from several databases concerning economic operators, CE Certificates of Conformity, conformity assessment, clinical investigations, the Unique Device Identification system, adverse event reporting and market surveillance will be available to the public. |

Interoperability Requirements