As filed with the Securities and Exchange Commission

on

Registration No. 333-264059

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Amendment No. 1)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| 5900 | ||||

| (State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Ross D. Carmel, Esq.

Carmel, Milazzo & Feil LLP

55 West 39th Street, 18th Floor, New York, NY 10018

(212) 658-0458

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| With copies to: | |

| Ross D. Carmel, Esq. | Joseph Lucosky, Esq. |

| Philip Magri, Esq. | Lawrence Metelitsa, Esq. |

| Carmel, Milazzo & Feil LLP | Lucosky Brookman LLP |

| 55 West 39th Street, 18th Floor | 101 Wood Avenue South |

| New York, NY 10018 | Woodbridge, NJ 08830 |

| Tel: (212) 658-0458 | Tel: (732) 395-4400 |

| Fax: (646) 838-1314 | Fax: (732) 395-4401 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided to Section 7(a)(2)(B) of the Securities Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated May 19, 2022

PRELIMINARY PROSPECTUS

NOCERA, INC.

2,000,000 Units

Each Consisting of One Share of Common Stock and One Warrant

We are offering 2,000,000 units, each unit consisting of one share of the Company’s common stock, $0.001 par value per share and one warrant to purchase two shares of common stock. The units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The shares of common stock and the warrants comprising the units are immediately separable and will be issued separately in this offering. Each warrant is immediately exercisable on the date of issuance and will expire five years from the date of issuance.

This offering also includes the shares of common stock issuable upon the exercise of the warrants. The warrants will be issued in book-entry form pursuant to a warrant agent agreement between us and Mountain Share Transfer, LLC (the “Warrant Agent Agreement”), who will be acting as the warrant agent.

We currently estimate that the offering price will be between $4.00 and $5.00 per unit and the exercise price per warrant will be between $4.40 and $5.50 (110% of the offering price per unit). The final offering price of the units and exercise price of the warrants will be determined by us and Spartan Capital Securities, LLC and Revere Securities LLC, the joint representatives of the underwriters in connection with this offering, or the Representatives, taking into consideration several factors as described between the underwriters and us at the time of pricing, including our historical performance and capital structure, prevailing market conditions, and overall assessment of our business, and will not be based upon the price of our common stock quoted on the OTC pink sheets. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the actual public offering price for our common stock and the warrants. See “Underwriting.”

The Company’s common stock is quoted on the OTC pink sheets under the symbol “NCRA.” The closing price of our common stock on May 18, 2022 was $4.28 per share ($6.42 as adjusted for the 2-for-3 reverse stock split). There is currently a limited public trading market for our common stock.

We have applied to have our common stock listed on the Nasdaq Capital Market under the symbol “NCRA,” which listing is a condition to this offering. No assurance can be given that our application will be approved or, if we receive approval, that a trading market will develop, if developed, that it will be sustained or that the trading prices of our common stock on the OTC will be indicative of the prices of our common stock if traded on the Nasdaq Capital Market. We cannot assure you that our common stock will become eligible for trading on any exchange or market. We will not commence with this offering if our common stock is not approved for listing on the Nasdaq Capital Market. We do not intend to apply for listing of the warrants on any exchange or market.

Unless otherwise noted and other than in our financial statements and the notes thereto, the share and per share information in this prospectus reflects a proposed 2-for-3 reverse stock split of our outstanding common stock to occur concurrently with the effective date of the registration statement of which this prospectus is a part and prior to the closing of this offering.

On December 2, 2021, the U.S. Securities and Exchange Commission (the “SEC”) adopted final amendments implementing the disclosure and submission requirements under the Holding Foreign Companies Accountable Act (the “HFCAA”), pursuant to which the SEC will identify a “Commission-Identified Issuer” if an issuer has filed an annual report containing an audit report issued by a registered public accounting firm that the Public Company Accounting Oversight Board (the “PCAOB”) has determined it is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction, and will then impose a trading prohibition on an issuer after it is identified as and remains a Commission-Identified Issuer for three consecutive years. On December 16, 2021, the PCAOB issued a report on its determinations that it is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, because of positions taken by one or more authorities in such jurisdictions. Since the Company’s auditor is located in Hong Kong, the Company’s auditor is included on a list of audit firms the PCAOB determined it is unable to inspect or investigate completely because of a position taken by one or more authorities in Hong Kong, and is therefore subject to the PCAOB’s determination. In May 2022, the Company was added to the SEC’s conclusive lists of issuers identified under the HFCAA, or a Commission-Identified Issuer. Therefore, the Company will be delisted and its securities will be prohibited from being traded “over-the-counter” if it remains identified as a Commission-Identified Issuer for three consecutive years. If the Company’s securities are unable to be listed on another securities exchange by then, such a delisting or prohibition of trading would substantially impair your ability to sell or purchase the Company’s securities when you wish to do so, and the risk and uncertainty associated with a potential delisting or prohibition of trading would have a negative impact on the price of the Company’s securities. The Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”), passed by the U.S. Senate and if enacted, would require Commission-Identified Issuers to comply with the PCAOB audits within two consecutive years instead of three consecutive years. In light of the PRC government’s recent expansion of authority in Hong Kong, there are risks and uncertainties which the Company cannot foresee for the time being, and rules and regulations in China can change quickly with little or no advance notice. See “Risk Factors – If the Company remains identified as a Commission-Identified Issuer for three consecutive years (or if the AHFCAA is enacted, two years), the Company’s securities will be delisted or prohibited from trading “over-the-counter” under the Holding Foreign Companies Accountable Act. The delisting or the cessation of trading “over-the-counter” of the Company’s securities, or the threat of their being delisted or prohibited, may materially and adversely affect the value and/or liquidity of your investment. Additionally, the inability of the PCAOB to conduct full inspections or investigations of the Company’s auditor deprives the Company’s investors of the benefits of such inspections or investigations.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 12 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| 3 |

We are an “emerging growth company” under applicable SEC rules and will be subject to reduced public company reporting requirements.

| Per Unit | Total | |||||||

| Public offering price | $ | [ ·] | $ | [ ·] | ||||

| Underwriting discounts and commissions (1) | $ | [ ·] | $ | [ ·] | ||||

| Proceeds, before expenses, to us (2) | $ | [ ·] | $ | [ ·] |

| (1) | We have also agreed to issue the Representatives warrants to purchase shares of our common stock (the “Representative Warrants”), and to reimburse the underwriters for certain expenses. See “Underwriting” on page 91 for additional information regarding total underwriter compensation. |

| (2) | The amount of offering proceeds to us presented in this table does not give effect to any exercise of the: (i) Underwriters’ over-allotment option we have granted to the underwriters as described below and (ii) the Representative Warrants. |

We have granted a 45-day option to the underwriters, exercisable one or more times in whole or in part, to purchase up to an additional 300,000 units at the public offering price per unit, less the underwriting discounts payable by us, in any combination solely to cover over-allotments, if any.

The underwriters expect to deliver the securities against payment to the investors in this offering on or about ______________, 2022.

Joint Book-Running Managers

|

|

Prospectus dated __________________, 2022

Table of Contents

Through and including __________________, 2022 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriter and with respect to their unsold allotments or subscriptions.

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment. Neither we, nor the underwriters, have authorized any other person to provide you with information that is different from, or adds to, that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should assume that the information contained in this prospectus or any free writing prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of any securities in any jurisdiction in which such offer is unlawful.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our securities or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this public offering and the distribution of this prospectus applicable to that jurisdiction.

| i |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “anticipate,” “predict,” “project,” “forecast,” “potential,” and “continue” or the negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees of future performance. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements. You are cautioned to not place undue reliance on these forward-looking statements, which speak only as of their dates.

We cannot predict all the risks and uncertainties that may impact our business, financial condition or results of operations. Accordingly, the forward-looking statements in this prospectus should not be regarded as representations that the results or conditions described in such statements will occur or that our objectives and plans will be achieved, and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this prospectus and include information concerning possible or projected future results of our operations, including statements about potential acquisition or merger targets, strategies or plans; business strategies; prospects; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results; and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to a variety of factors and risks, including, but not limited to, those set forth under “Risk Factors” starting on page 12 of this prospectus.

Many of those risks and factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. Considering these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus. All subsequent written and oral forward-looking statements concerning other matters addressed in this prospectus and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this prospectus.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

Market Data

Market data and certain industry data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, publicly available information, reports of governmental agencies and industry publications and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy and completeness of such information is not guaranteed. To our knowledge, certain third-party industry data that includes projections for future periods does not take into account the effects of the worldwide coronavirus pandemic. Accordingly, those third-party projections may be overstated and should not be given undue weight. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth were used in preparing the forecasts we cite. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

| ii |

ABOUT THIS PROSPECTUS

Throughout this prospectus, unless otherwise designated or the context suggests otherwise,

| · | all references to the “Company,” “Nocera,” the “registrant,” “we,” “our,” or “us” in this prospectus mean Nocera, Inc., a Nevada corporation, and its subsidiaries, including its variable interest entity (“VIE”); | |

| · | assumes a public offering price of $4.50 per unit, which is the midpoint of the $4.00 to $5.00 range of the offering price per unit, a $4.95 per share exercise price for the warrants underlying the units; | |

| · | “year” or “fiscal year” means the Company’s fiscal year ending December 31st; | |

| · | all dollar or $ references refer to United States dollars; and | |

| · | all NT dollar references refer to Taiwan’s New Taiwan dollar. |

TRADEMARKS

Solely for convenience, our trademarks and tradenames referred to in this prospectus, may appear without the ® or ™ symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights to these trademarks and tradenames. All other trademarks, service marks and trade names included or incorporated by reference into this prospectus or the accompanying prospectus are the property of their respective owners.

| iii |

PROSPECTUS SUMMARY

This summary provides a brief overview of the key aspects of our business and our securities. The reader should read the entire prospectus carefully, especially the risks of investing in our securities discussed under “Risk Factors.” Some of the statements contained in this prospectus, including statements under “Offering Summary” and “Risk Factors” as well as those noted in the documents incorporated herein by reference, are forward-looking statements and may involve a number of risks and uncertainties. Our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus.

Overview

Nocera, Inc. was incorporated in the State of Nevada on February 1, 2002, with operations based in New Taipei City, Taiwan. Our primary business operations currently consist of designing, developing and producing large scale recirculating aquaculture systems (“RASs”) for fish farms along with providing consulting, technology transfer and aquaculture project management services to new and existing aquaculture management business services.

RASs operate by filtering water from the fish (or shellfish) tanks so it can be reused within the tank. This dramatically reduces the amount of water and space required to intensively produce seafood products. The steps in RASs include solids removal, ammonia removal, Co2 removal and oxygenation. Prior to 2021, Nocera was initially focused on the Chinese market due to opportunities presented by changes to regulations governing water use for fish production in China. As of October 2020, we had delivered 551 fish tank systems to six separate Chinese-based fish farms, and two fish tank systems to our Taiwan showroom.

In October 2020, the government of Taiwan began supporting the Green Power and Solar Sharing Fish Farms initiative. In view of the opportunities resulting from this initiative, in October 2020, Nocera ceased all of its operations in China and moved all of its technology and back-office operations to Taiwan. The Company now only operates out of Taiwan.

Our current mission is to provide consulting services and solutions in aquaculture projects to reduce water pollution and decrease the disease problems of fisheries. Our goal is to become a global leader in the land-based aquaculture business. The Company is now poised to grow its existing operations in Taiwan and expand into the development and management of land-based fish farms in Taiwan and North and South America. The Company does not currently have any intentions of conducting operations in China or Hong Kong.

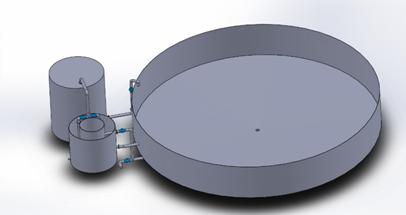

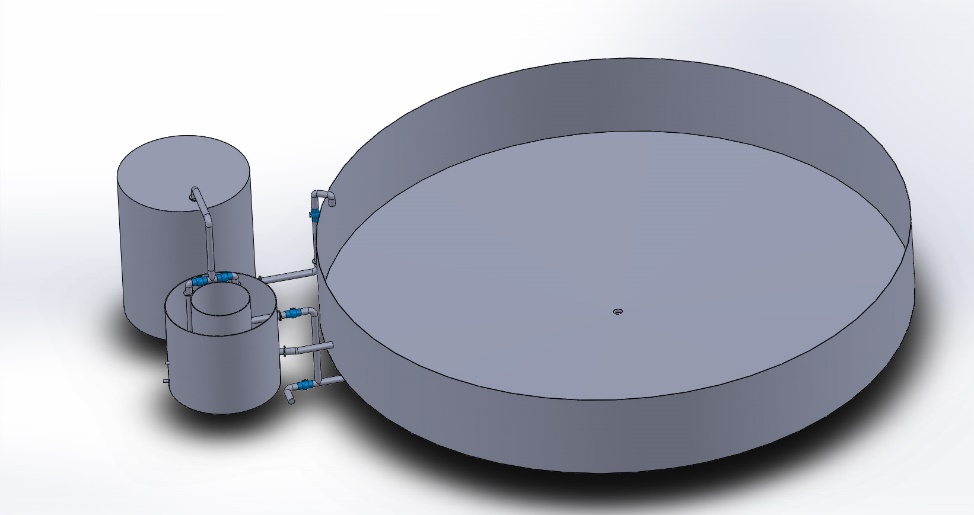

Nocera Recirculating Aquaculture System

Fig 1. Nocera Recirculating Aquaculture System

| 1 |

Corporate Structure

We conduct our operations through (i) Xin Feng Construction Co., Ltd, a Taiwan limited liability company (“XFC”); and (ii) Nocera Taiwan Branch, an unincorporated division of the Company (“NTB”). The Company’s other subsidiaries, Grand Smooth Inc. Limited, a Hong Kong limited company (“GSI”), which wholly-owns Guizhou Grand Smooth Technology Ltd., a People’s Republic of China (PRC) corporation (“GZ GST”), are dormant and currently do not have any operations. The Company intends to keep such entities dormant and not conduct any operations in the PRC or Hong Kong.

We acquired GSI in a reverse merger on December 31, 2018. Prior to the merger, we were a “shell company” as defined under Rule 12b-2 of the Exchange Act. GSI is the parent holding company of GZ GST, which was incorporated on November 13, 2018, as a wholly foreign-owned enterprise established in the PRC. Both GSI and GZ GZT are currently dormant and do not conduct any operations. The Company currently does not conduct any operations in China or Hong Kong.

In December 2020, Nocera added Xin-Feng Construction Co. Ltd, a variable interest entity (“VIE”). Under the laws of Taiwan, foreign investments are typically restricted or prohibited with respect to the operation of certain businesses in Taiwan (e.g., construction). As a result, it was necessary for us to add XFC as a VIE in order to obtain a Class A construction license to construct indoor RASs and solar sharing fish farms. Without this license, we would not be able to conduct this critical part of our business in Taiwan. XFC has obtained a Class A construction license in Taiwan and we plan to use XFC for the investment in, and the construction of, indoor RASs and solar sharing fish farms. The Company is now looking for opportunities to expand into the U.S. by building fish farms or transforming existing ones into high-tech and solar sharing enterprises.

NTB was established on January 14, 2021 in Taiwan. In October 2021, Nocera began its eel trading business in response to domestic demands created by the COVID-19 lockdown. NTB currently procures and sells eel in Taiwan and plans to trade other types of seafood, such as tilapia and milkfish, in the near future.

The Company and its management have invested more than $2 million in the development of the Company’s business operations to date and intend to use proceeds from this offering to expand operations in Taiwan and enter into the U.S. market.

Market Opportunity

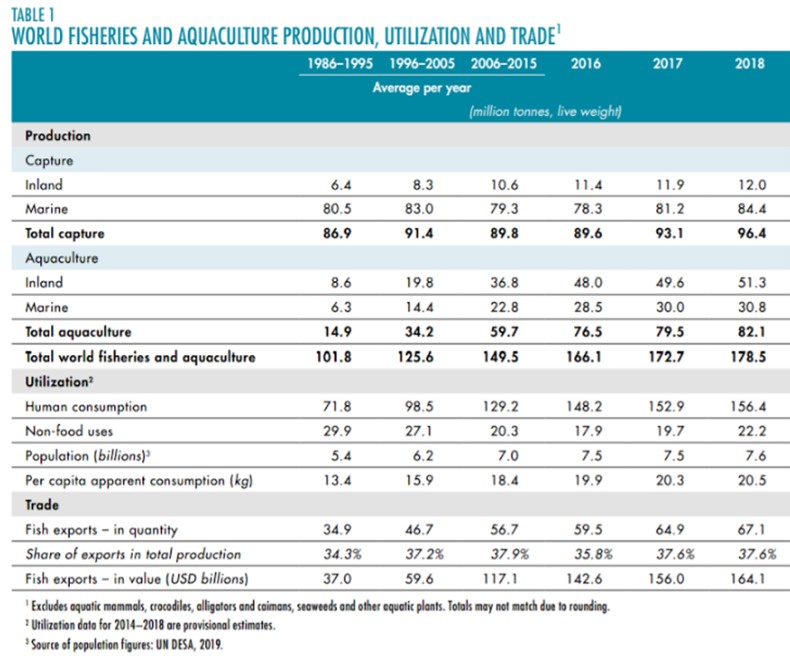

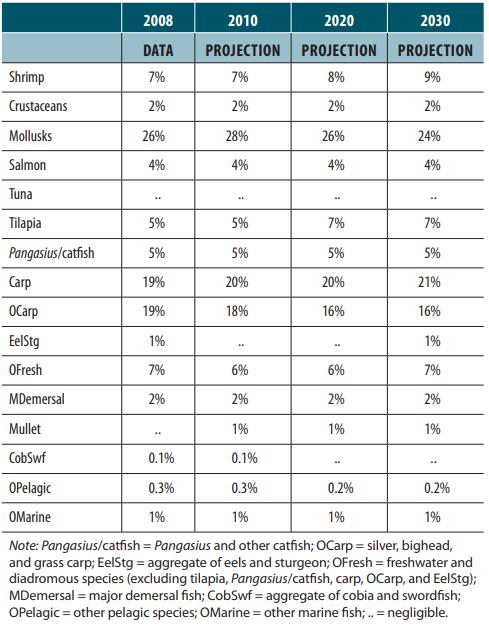

Global fish consumption has long been on the rise at a rate higher than any other source of animal protein, and the trend is expected to continue. With overfishing already threatening the earth’s marine ecosystem, it is anticipated that a significantly larger proportion of fish consumption would be farm-raised instead of wild-caught in the future.

Also, the trade conflict between the U.S. and China has led to a greater demand for non-Chinese origin seafood products from the U.S. market.

On a broader perspective, as the world rapidly begins a transition towards net zero carbon emissions in response to the ever-more pressing threat of climate change, it is foreseeable that solar energy will be the go-to option for many countries as a new source of green energy.

We believe that the RAS, with its proven advantage in producing more fish in a more cost-effective and environmentally friendly manner while offering greater location flexibility and the potential for a “solar-fish sharing mode,” is a perfect solution to address the opportunities highlighted above.

Consulting Services

We also provide consulting services and solutions for aquaculture projects. We currently provide such services in Taiwan and intend to expand into other international markets and the United States to increase revenues and operate more efficiently. Our consultants use their RASs expertise to help customers increase production and operate more strategically by branching into new diversified aquaculture species, and importantly, reducing water pollution and decreasing the disease problems of fisheries.

| 2 |

The Company plans to provide the following service offerings:

| · | for qualified investors or investment groups who are interested in capitalizing on the potential of the aquaculture industry and want to develop or take part in commercial fish farming or shrimp farming but lack the experience, design, installation, build and management of aquaculture projects to meet these interests; |

| · | a full range of pilot and management services to aquaculture companies and new aquaculture projects throughout Taiwan and potentially the rest of the world, providing tailored solutions to meet customer needs and to fulfill our commitment, to encourage and support clean water and clean fish products from the fish farm to the table; and |

| · | select equipment and materials from suppliers to provide unique service offerings structured to generate higher profit margins. |

We believe our experience from working closely with our clients in the aquaculture industry in Taiwan gives us a competitive advantage in providing innovative aquaculture management solutions that will generate positive results for us and our client companies. However, there can be no assurance we will be successful in capitalizing on market opportunities or geographically expanding our business.

Strategy

We plan to focus on countries with a growing population and growing demand for food. By 2050, we will need to double the global food supply to feed the world’s growing population[1]. There is a growing need for new ways to produce high-quality local fish without putting more pressure on our natural ecosystems. Like Taiwan, there are also many countries with a growing population and growing demand for high-protein food. We plan to go global through building demo sites promoting our RASs and selling our price-competitive systems in these countries to meet their demand for food and to satisfy their desire for a greener environment.

In January 2021, we moved our operation and market focus from China to Taiwan. In 2021, we established a Nocera Taiwan Branch to focus on customers in a variety of sectors, such as individual investors, government supported or funded companies, and international customers. We have received interest from areas like Japan, Thailand, Jordan, South Africa and the United States.

Our revenues for the three months ended March 31, 2022 and 2021 were $2,919,045 and $1,579,486, respectively, and during the years ended December 31, 2021 and 2020, net sales were approximately $9.9 million and approximately $1.2 million, respectively.

Suppliers

We intend to purchase raw materials and parts and equipment from third parties locally in Taiwan and build and sell them to customers. We are not directly involved in the production or manufacturing of readily available equipment, and we do not take a risk in the repair and maintenance of the equipment because of the manufacturer’s maintenance policy. We have identified and sourced multiple suppliers in Taiwan, and our relationships with suppliers are generally good. We expect that our suppliers will be able to meet the anticipated demand for our products in the foreseeable future. There can be no assurance that our suppliers will continue to meet our needs, particularly as we ramp up our expansion into the U.S. and other markets around the world.

Corporate History and Information

Nocera, Inc. was incorporated in the State of Nevada on February 1, 2002, and is based in New Taipei City, Taiwan. Our principal executive offices are located at 3F (Building B), No. 185, Sec. 1, Datong Rd., Xizhi Dist., New Taipei City 221, Taiwan. Our telephone number is 886-910-163-358. Our corporate website address is located at https://www.nocera.company/. The contents of our website are not incorporated by reference into this prospectus.

__________

[1] Ranganathan et al, How to Sustainably Feed 10 Billion People by 2050, in 21 Charts, WORLD RESOURCES INSTITUTE (Dec. 5, 2018); https://www.wri.org/insights/how-sustainably-feed-10-billion-people-2050-21-charts#:~:text= How%20to%20Sustainably%20Feed%2010%20Billion%20People%20by%202050%2C%20in%2021%20Charts,-December%205%2C%202018&text=There%20is%20a%20big%20shortfall,than%20there%20were%20in%202010.

| 3 |

Listing on the Nasdaq Capital Market

Our common stock is currently quoted on the OTC pink sheets under the symbol “NCRA.” In connection with this offering, we have applied to have our common stock listed on the Nasdaq Capital Market under the symbol “NCRA.” If approved, we expect to list our common stock on Nasdaq upon consummation of this offering, at which point our common stock will cease to be traded on the OTC. No assurance can be given that our listing application will be approved. This offering will occur only if Nasdaq or another securities exchange approves the listing of our common stock. If Nasdaq or another U.S. securities exchange does not approve the listing of our common stock, we will not proceed with this offering. There can be no assurance that our common stock will be listed on the Nasdaq or another securities exchange. We do not intend to apply for listing of the warrants on any exchange or market.

Reverse Stock Split

We intend to effect a reverse stock split of our common stock at a ratio of 2-for-3 at the time of the effectiveness of the registration statement of which this prospectus forms a part and prior to the closing of this offering. No fractional shares will be issued in connection with the reverse stock split and all such fractional interests will be rounded up to the nearest whole number of shares of common stock. The conversion or exercise prices of our issued and outstanding convertible securities, stock options and warrants will be adjusted accordingly. All information presented in this prospectus other than in our consolidated financial statements and the notes thereto assumes a 2-for-3 reverse stock split of our outstanding shares of common stock, and unless otherwise indicated, all such amounts and corresponding conversion price or exercise price data set forth in this prospectus have been adjusted to give effect to such assumed reverse stock split.

Holding Foreign Companies Accountable Act

On December 16, 2021, Public Company Accounting Oversight Board (PCAOB) issued a report on its determinations that the PCAOB is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, a Special Administrative Region of the PRC, because of positions taken by the PRC authorities in those jurisdictions. The PCAOB made these determinations pursuant to PCAOB Rule 6100, which provides a framework for how the PCAOB fulfills its responsibilities under the Holding Foreign Companies Accountable Act. The report further listed in its Appendix A and Appendix B, Registered Public Accounting Firms Subject to the Mainland China Determination and Registered Public Accounting Firms Subject to the Hong Kong Determination, respectively. The audit report included in this registration statement for the year ended December 31, 2021, was issued by Centurion ZD CPA & Co. (“CZD CPA”), an audit firm headquartered in Hong Kong, a jurisdiction that the PCAOB has determined that the PCAOB is unable to conduct inspections or investigate auditors. Our auditors, CZD CPA, is among those registered public accounting firms listed by the PCAOB Hong Kong Determination, a determination announced by the PCAOB on December 16, 2021, which the PCAOB is unable to inspect or investigate completely due to the fact it is headquartered in Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. As a result, we and the investors in our securities are deprived of the benefits of such PCAOB inspections, which could cause investors in our securities to lose confidence in our reported financial information and the quality of our financial statements. Also, in May 2022, the Company was added to the SEC’s conclusive lists of issuers identified under the HFCAA, or a Commission-Identified Issuer. Therefore, the Company will be delisted and its securities will be prohibited from being traded “over-the-counter” if it remains identified as a Commission-Identified Issuer for three consecutive years. Furthermore, on June 22, 2021, the U.S. Senate passed the AHFCAA, which, if enacted, would amend the HFCAA and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchange or in the OTC trading market in the U.S. if the issuer remains identified as a Commission-Identified Issuer for two consecutive years instead of three. In the future, if we do not engage an auditor that is subject to regular inspection by the PCAOB for a period of three years, or two years if the AHFCAA is enacted, our securities will be prohibited from being traded on a U.S. securities exchange or over-the-counter market, which would make it difficult for you to sell your common stock. See “Risk Factors – If the Company remains identified as a Commission-Identified Issuer for three consecutive years (or if the AHFCAA is enacted, two years), the Company’s securities will be delisted or prohibited from trading “over-the-counter” under the Holding Foreign Companies Accountable Act. The delisting or the cessation of trading “over-the-counter” of the Company’s securities, or the threat of their being delisted or prohibited, may materially and adversely affect the value and/or liquidity of your investment. Additionally, the inability of the PCAOB to conduct full inspections or investigations of the Company’s auditor deprives the Company’s investors of the benefits of such inspections or investigations.”

The HFCAA became law on December 18, 2020 and requires, among other things, for the SEC to identify public companies that have retained a registered public accounting firm to issue an audit report where the firm has a branch or office that: (1) is located in a foreign jurisdiction, and (2) PCAOB has determined that it is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

| 4 |

Effects of COVID-19 Outbreak

In December 2019, a novel strain of coronavirus was reported to have surfaced in Wuhan, China, which has and is continuing to spread throughout China and other parts of the world, including the United States. On January 30, 2020, the World Health Organization declared the outbreak of the coronavirus disease (COVID-19) a “Public Health Emergency of International Concern.” On January 31, 2020, U.S. Health and Human Services Secretary Alex M. Azar II declared a public health emergency for the United States to aid the U.S. healthcare community in responding to COVID-19, and on March 11, 2020, the World Health Organization characterized the outbreak as a “pandemic.” A significant outbreak of COVID-19 and other infectious diseases could result in a widespread health crisis that could adversely affect the economies and financial markets worldwide.

We are monitoring the global outbreak and spread of COVID-19 and taking steps in an effort to identify and mitigate the adverse impacts on, and risks to, our business posed by its spread and the governmental and community reactions thereto. The current outbreak of COVID-19 has globally resulted in loss of life, business closures, restrictions on travel, and widespread cancellation of social gatherings. The extent to which the COVID-19 pandemic impacts our business will depend on future developments, which are highly uncertain and cannot be predicted at this time, including:

| · | new information which may emerge concerning the severity of the disease in Taiwan; |

| · | the duration and spread of the outbreak; |

| · | the severity of travel restrictions imposed by geographic areas in which we operate, mandatory or voluntary business closures; |

| · | regulatory actions taken in response to the pandemic, which may impact our offerings; |

| · | other business disruptions that affect our workforce; |

| · | the impact on capital and financial markets; and |

| · | actions taken throughout the world, including in markets in which we operate, to contain the COVID-19 outbreak or treat its impact. |

In addition, the current outbreak of COVID-19 has resulted in a widespread global health crisis and adversely affected global economies and financial markets, and similar public health threats could do so in the future.

The spread of COVID-19 has caused us to modify our business practices, including employee travel, employee work locations in certain cases, and cancellation of physical participation in certain meetings, events and conferences and further actions may be taken as required or recommended by government authorities or as we determine are in the best interests of our employees, customers and other business partners. We are monitoring the global outbreak of the pandemic in Taiwan, and are taking steps in an effort to identify and mitigate the adverse impacts on, and risks to, our business posed by its spread and the governmental and community reactions thereto. See “Risk Factors - Our business may be materially adversely affected by the coronavirus (COVID-19) outbreak.”

| 5 |

Summary Risk Factors

Our business is subject to a number of risks. You should be aware of these risks before making an investment decision. These risks are discussed more fully in the section of this prospectus titled “Risk Factors,” which begins on page 12 of this prospectus. Risks include, among others, that:

| · | We have a limited operating history in an evolving industry, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful; |

| · | The Company’s failure to successfully market its brand and products could result in adverse financial consequences; |

| · | We are subject to certain risks by virtue of our international operations; |

| · | Natural disasters or other catastrophic events could harm our operations; |

| · | The primary substantial portion of our revenues will be derived from Taiwan; |

| · | Currency fluctuations may adversely affect our business and, if the NT dollar were to decline in value, that would reduce our revenue in U.S. dollar terms; |

| · | We may be subject to product liability claims if people or properties are harmed by the services provided or products sold by us; |

| · | Our business may be materially adversely affected by continuation of the coronavirus (COVID-19) outbreak; |

| · | We must comply with the Foreign Corrupt Practices Act while many of our competitors do not; |

| · | Third parties may assert that our employees or consultants have wrongfully used or disclosed confidential information or misappropriated trade secrets; |

| · | Relations between the PRC and Taiwan could negatively affect our business and financial status and therefore the market value of your investment; |

| · | If the Company remains identified as a Commission-Identified Issuer for three consecutive years (or if the AHFCAA is enacted, two years), the Company’s securities will be delisted or prohibited from trading “over-the-counter” under the Holding Foreign Companies Accountable Act. The delisting or the cessation of trading “over-the-counter” of the Company’s securities, or the threat of their being delisted or prohibited, may materially and adversely affect the value and/or liquidity of your investment. Additionally, the inability of the PCAOB to conduct full inspections or investigations of the Company’s auditor deprives the Company’s investors of the benefits of such inspections or investigations; |

| · |

Our contractual arrangements may not be as effective in providing operational control as direct ownership and our VIE shareholders may fail to perform their obligations under our contractual arrangements;

| |

| · |

We may lose the ability to use, or otherwise benefit from licenses and assets held by our VIE, which could render us unable to conduct some or all of our business operations and constrain our growth;

| |

| · |

The speculative nature of warrants; and

| |

| · | Provisions in the warrants may discourage a third party from acquiring us. |

| 6 |

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jobs Act. We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (ii) the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will remain an emerging growth company for the foreseeable future but cannot retain our emerging growth company status indefinitely and will no longer qualify as an emerging growth company on or before the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are not emerging growth companies.

These exemptions include:

| · | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| · | not being required to comply with the requirement of auditor attestation of our internal controls over financial reporting; |

| · | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| · | reduced disclosure obligations regarding executive compensation; and |

| · | not being required to hold a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We have taken advantage of certain reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

An emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption of such standards is required for other public reporting companies.

We are also a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act, and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies.

| 7 |

OFFERING SUMMARY

| Issuer: | Nocera, Inc., a Nevada corporation | |

| Offered Securities (1): |

2,000,000 units, each unit consisting of one share of common stock and one warrant to purchase two shares of common stock.

The units will not be certificated or issued in stand-alone form. The shares of our common stock and the warrants comprising the units are immediately separable upon issuance and will be issued separately in this offering.

The warrants will be issued in book-entry form pursuant to the Warrant Agent Agreement between us and Mountain Share Transfer, LLC, who will be acting at the warrant agent. | |

| Offering Price per Unit (assumed): | $4.50 per unit, the midpoint of the estimated $4.00 - $5.00 price range per unit in this offering. | |

| Over-Allotment Option: | We have granted the underwriters a 45-day option to purchase up to an aggregate of 300,000 units at the public offering price, less, in each case, underwriting discounts and commissions, on the same terms as set forth in this prospectus, solely to cover over-allotments, if any. | |

| Description of Warrants: |

Each warrant will be exercisable from the date of issuance until the fifth anniversary date of issuance date for $4.40 to $5.50 per share (110% of the public offering price of one unit), subject to adjustment in the event of stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our common stock as described herein.

The exercise price shall be decreased to the reset price, which means the greater of (i) 50% of the exercise price and (ii) 100% of the last volume weighted average price immediately preceding the 90th calendar day following the initial exercise date if, on the date that is 90 calendar days immediately following the initial exercise date, the exercise price is less than the reset price.

The Company may at any time, subject to the prior written consent of the holder, reduce the then current exercise price to any amount and for any period of time deemed appropriate by the Board of Directors (“Board”) subject to the rules and regulations of the trading market.

A holder may not exercise any portion of a warrant to the extent that the holder, together with its affiliates and any other person or entity acting as a group, would own more than 4.99% of the outstanding common stock after exercise, as such percentage ownership is determined in accordance with the terms of the warrants, except that upon notice from the holder to us, the holder may waive such limitation up to a percentage, not in excess of 9.99%. |

| 8 |

| The Company reserves the right to redeem all or a portion, on a pro rata basis, the outstanding warrants, at any time and from time to time prior to their exercise, with a notice of redemption in writing to the holders (the “Redemption Notice”), giving not less than thirty (30) days’ notice of such redemption at any time during which the warrants are exercisable (the “Notice Period”) if the ten (10)-day average variable weighted average price (VWAP) of the common stock is at or above 250% of the exercise price, as adjusted pursuant to the terms of the warrant, and the shares of common stock issuable upon exercise of the warrant have been registered pursuant to an effective registration statement with the SEC. The redemption price of the warrant shall be equal to 250% of the exercise price. | ||

Neither the Company nor any of its subsidiaries shall, directly or indirectly, issue, offer, sell, grant any option or right to purchase, or otherwise dispose of (or announce any issuance, offer, sale, grant of any option or right to purchase or other disposition of) any equity security or any equity-linked or related security (including, without limitation, any “equity security” (as that term is defined under Rule 405 promulgated under the Securities Act)), any convertible securities, any debt, any preferred shares or any purchase rights (any such issuance, offer, sale, grant, disposition or announcement is referred to as a “Subsequent Placement”) unless the Company shall have first delivered to each holder that beneficially owns at least [•] warrants as of the time the Company engaged in a Subsequent Placement a written notice notifying the holder of his, her or its rights to participate in the Subsequent Placement pursuant to the terms of the warrant. | ||

| See “Description of Securities – Warrants Issued in this Offering.” | ||

| Common Stock Outstanding Before Offering (2): | 7,138,100 shares | |

| Common Stock Outstanding After Offering (2) (3): | 9,138,100 shares, or 9,438,100 shares if the underwriters exercise their over-allotment option in full. | |

| Use of Proceeds: |

We estimate that we will receive net proceeds from this offering of approximately $7.8 million, or approximately $9.1 million if the underwriters exercise the over-allotment option in full, assuming an initial public offering price of $4.50 per unit, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

We currently intend to use the net proceeds from this offering, together with our existing cash to invest and build RASs, acquire land in the United States to build a fish farm, and for general working capital purposes. See “Use of Proceeds.” | |

| Underwriters Compensation: | In connection with this offering, the underwriters will receive an underwriting discount equal to 8% of the gross proceeds from the sale of units in the offering. We will also reimburse the underwriters for certain out-of-pocket actual expenses related to the offering. See “Underwriting.” | |

| Proposed Nasdaq Capital Market Listing: | Our common stock currently trades on the OTC pink sheets under the symbol “NCRA.” We have applied to have our common stock listed on the Nasdaq Capital Market under the symbol “NCRA.” The listing of the common stock on Nasdaq or another securities exchange is a condition to this offering. No assurance can be given that such listing will be approved or that a trading market will develop for our common stock. We do not intend to apply for listing of the warrants on any exchange or market. |

| 9 |

| Lock-Up Agreements: | Our executive officers and directors and any holder of 5% or more of the outstanding shares of common stock of the Company have agreed with the underwriters not to sell, transfer or dispose of any shares or similar securities for 18 months following the effective date of the registration statement for this offering. For additional information regarding our arrangement with the underwriters, please see “Underwriting.” | |

| Reverse Split: | We intend to effectuate a 2-for-3 reverse split of our common stock immediately following the effective date of the registration statement for this offering but prior to the closing of this offering. Unless otherwise stated and other than in our financial statements and the notes thereto, all share and per share information in this prospectus reflects a reverse stock split. | |

| Dividend Policy: | We have not historically paid dividends on our common stock and do not anticipate paying dividends on our common stock for the foreseeable future. | |

| Transfer Agent: | Mountain Share Transfer, LLC, who has also agreed to serve as the warrant agent. | |

| Risk Factors: | An investment in our securities involves a high degree of risk. You should read this prospectus carefully, including the section entitled “Risk Factors” starting on page 12 of this prospectus and the consolidated financial statements and the related notes to those statements included in this prospectus, before deciding to invest in our securities. | |

| (1) | The actual number of units we will offer and the actual price per unit will be determined based on the actual public offering. | |

| (2) | Does not include: | |

| · | 53,334 shares of common stock issuable upon the conversion of 80,000 shares of Series A Preferred Stock; | |

| · | 2,666,667 shares of common stock issuable upon the exercise of Series A Warrants for $0.75 per share; | |

| · | 676,667 shares of common stock issuable upon the exercise of outstanding Class A Warrants for $0.75 per share; | |

| · | 433,334 shares of common stock issuable upon the exercise of outstanding Class B Warrants for $1.50 per share; | |

| · | 626,667 shares of common stock issuable upon the exercise of outstanding Class C Warrants for $3.75 per share; | |

| · | 626,667 shares of common stock issuable upon the exercise of outstanding Class D Warrants for $7.50 per share; and | |

| · | 6,666,667 shares of common stock reserved for issuance under our 2018 Stock Option and Award Incentive Plan. | |

| (3) | Does not include: | |

| · | the securities listed under footnote (2); | |

| · | 4,000,000 shares of common stock issuable upon the exercise of the warrants underlying the units; | |

| · | 600,000 shares of common stock issuable upon the exercise of the warrants underlying the Underwriters’ over-allotment option; and | |

| · | 100,000 shares of common stock issuable upon the exercise of the Representative Warrants. | |

Except as otherwise indicated, all information in this prospectus assumes that:

| · | a public offering price of $4.50 per unit, which is the midpoint of the range of the offering price per unit, a $4.95 per share exercise price for the warrants underlying the units; | |

| · | none of the warrants underlying the units in this offering have been exercised; | |

| · | no shares of common stock have been issued pursuant to any outstanding shares of preferred stock or warrants; | |

| · | no shares of common stock or warrants have been issued pursuant to the Underwriters’ over-allotment option; | |

| · | no shares of common stock have been issued pursuant to the Representative Warrants; and | |

| · | no awards have been granted under the Company’s 2018 Equity Incentive Plan. |

| 10 |

SUMMARY FINANCIAL DATA

The following tables summarize our financial data. We derived the summary financial statement data for the years ended December 31, 2021 and 2020 set forth below from our audited financial statements and related notes contained in this prospectus, and the summary financial statement data for the three months ended March 31, 2022 and March 31, 2021 set forth below from our unaudited financial statements and related notes contained in this prospectus. The unaudited interim consolidated financial statements were prepared on a basis consistent with our audited consolidated financial statements and include, in management’s opinion, all adjustments, consisting only of normal recurring adjustments, that we consider necessary for a fair statement of the financial information set forth in those statements. Our historical results are not necessarily indicative of the results that may be expected in the future. You should read the information presented below together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our financial statements, the notes to those statements and the other financial information contained in this prospectus.

Summary of Operations in U.S. Dollars

Fiscal Year Ended December 31, |

Three Months Ended March 31, (Unaudited) | |||||||||||||||

| 2021 | 2020 | 2022 | 2021 | |||||||||||||

| Net Sales | $ | 9,945,325 | $ | 1,170,156 | $ | 2,919,045 | $ | 1,579,486 | ||||||||

| OPERATING EXPENSES | ||||||||||||||||

| General and administrative | (10,419,684 | ) | (1,325,696 | ) | (860,953 | ) | (235,235 | ) | ||||||||

| Sales and marketing | ||||||||||||||||

| Professional fees | ||||||||||||||||

| Loss (gain) on foreign exchange | – | – | – | – | ||||||||||||

| (Loss) Income from operations | (9,475,092 | ) | (681,883 | ) | (805,711 | ) | 113,409 | |||||||||

| OTHER INCOME (LOSS) | (4,055 | ) | 36 | – | (1,759 | ) | ||||||||||

| NET LOSS | $ | (9,619,079 | ) | $ | (639,070 | ) | $ | (805,720 | ) | $ | 49,490 | |||||

| Loss per common share | ||||||||||||||||

| Basic | $ | (1.0500 | ) | $ | (0.0538 | ) | $ | (0.00755 | ) | $ | 0.0054 | |||||

| Diluted | $ | (1.0500 | ) | $ | (0.0538 | ) | $ | (0.00755 | ) | $ | 0.0036 | |||||

Balance Sheet in U.S. Dollars

Fiscal Year Ended December 31, | Three Months Ended March 31, (Unaudited) | |||||||||||||||

| 2021 | 2020 | 2022 | 2021 | |||||||||||||

| Cash | $ | 2,444,009 | $ | 1,023,531 | 1,961,777 | 607,452 | ||||||||||

| Total Current Assets | 6,397,875 | 4,081,283 | 6,225,857 | 4,382,090 | ||||||||||||

| Total Assets | 6,870,649 | 4,924,941 | 6,674,287 | 5,244,175 | ||||||||||||

| Total Current Liabilities | 2,100,685 | 2,374,549 | 1,974,657 | 2,542,807 | ||||||||||||

| Total Liabilities | 2,100,685 | 2,374,549 | 1,974,657 | 2,545,807 | ||||||||||||

| Working Capital | 2,444,009 | 1,023,531 | 1,961,777 | 607,452 | ||||||||||||

| Additional paid-in capital | 14,472,705 | 2,692,973 | 15,078,760 | 2,796,128 | ||||||||||||

| Total Stockholders’ Equity | 4,769,964 | $ | 2,550,392 | 4,699,630 | 2,701,368 | |||||||||||

| 11 |

RISK FACTORS

Our business is subject to many risks and uncertainties, which may affect our future financial performance. If any of the events or circumstances described below occur, our business and financial performance could be adversely affected, our actual results could differ materially from our expectations, and the price of our securities could decline. The risks and uncertainties discussed below are not the only ones we face. There may be additional risks and uncertainties not currently known to us or that we currently do not believe are material that may adversely affect our business and financial performance. You should carefully consider the risks described below, together with all other information included in this prospectus including our financial statements and related notes, before making an investment decision. The statements contained in this prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our securities could decline, and investors in our securities may lose all or part of their investment.

Risks Related to Our Business

Our business may be materially adversely affected by the coronavirus (COVID-19) outbreak.

The current outbreak of COVID-19 has globally resulted in loss of life, business closures, restrictions on travel, and widespread cancellation of social gatherings. The extent to which the COVID-19 pandemic impacts our business will depend on future developments, which are highly uncertain and cannot be predicted at this time, including:

| · | new information which may emerge concerning the severity of the disease; | |

| · | the duration and spread of the outbreak; | |

| · | the severity of travel restrictions imposed by geographic areas in which we operate, mandatory or voluntary business closures; | |

| · | regulatory actions taken in response to the pandemic, which may impact merchant operations, consumer and merchant pricing, and our product offerings; | |

| · | other business disruptions that affect our workforce; | |

| · | the impact on capital and financial markets; and | |

| · | actions taken throughout the world, including in markets in which we operate, to contain the COVID-19 outbreak or treat its impact. |

In addition, the current outbreak of COVID-19 has resulted in a widespread global health crisis and adversely affected global economies and financial markets, and similar public health threats could do so in the future.

Substantially all our revenues are concentrated in Taiwan pending expansion into other international markets. Consequently, our results of operations will likely be adversely, and may be materially affected, to the extent that the COVID-19 pandemic or any epidemic harms Taiwan’s economy and society and the global economy in general. Any potential impact to our results will depend on, to a large extent, future developments and new information that may emerge regarding the duration and severity of the COVID-19 pandemic and the actions taken by government authorities and other entities to contain the COVID-19 pandemic or treat its impact, almost all of which are beyond our control. If the disruptions posed by the COVID-19 pandemic or other matters of global concern continue for an extensive period of time, the operations of our business may be materially adversely affected.

| 12 |

To the extent the COVID-19 pandemic or a similar public health threat has an impact on our business, it is likely to also have the effect of heightening many of the other risks described in this “Risk Factors” section.

We have a limited operating history in an evolving industry, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful.

The Company has a limited operating history on which to base an evaluation of its business and prospects. The Company is subject to all the risks inherent in a small company seeking to develop, market and distribute new services, particularly companies in evolving markets. The likelihood of the Company’s success must be considered, in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with the development, introduction, marketing and distribution of new products and services in a competitive environment.

Such risks for the Company include, but are not limited to, dependence on the success and acceptance of the Company’s services and the management of growth. In view of the Company’s limited operating history, the Company believes that period-to-period comparisons of its operating results are not necessarily meaningful and should not be relied upon as an indication of future performance.

The Company is therefore subject to many of the risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources and lack of revenues.

If we fail to raise capital when needed it will have a material adverse effect on the Company’s business, financial condition and results of operations.

The Company has limited revenue-producing operations and will require the proceeds from this offering to execute its full business plan. The Company believes the proceeds from this offering will be sufficient to further its full business plan. However, the Company can give no assurance that all, or even a significant portion of these units will be sold or, that the monies raised will be sufficient to execute the entire business plan of the Company. Further, no assurance can be given if additional capital is needed as to how much additional capital will be required or that additional financing can be obtained, or if obtainable, that the terms will be satisfactory to the Company, or that such financing would not result in a substantial dilution of stockholder’s interest. A failure to raise capital when needed would have a material adverse effect on the Company’s business, financial condition and results of operations. In addition, debt and other debt financing may involve a pledge of assets and may be senior to interests of equity holders. Any debt financing secured in the future could involve restrictive covenants relating to capital raising activities and other financial and operational matters, which may make it more difficult for the Company to obtain additional capital or to pursue business opportunities, including potential acquisitions. If adequate funds are not obtained, the Company may be required to reduce, curtail or discontinue operations.

Our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

| · | investors’ perception of, and demand for, our securities; |

| · | conditions of the U.S. and other capital markets in which we may seek to raise funds; and |

| · | our future results of operations, financial condition and cash flow. |

| 13 |

The Company’s failure to successfully market its brands could result in adverse financial consequences.

The Company believes that continuing to strengthen its brands is critical to achieving widespread acceptance of the Company, particularly in light of the competitive nature of the Company’s market in which it operates. Promoting and positioning its brands will depend largely on the success of the Company’s marketing efforts and the ability of the Company to provide high quality services. There can be no assurance that brand promotion activities will yield increased revenues or that any such revenues would offset the expenses incurred by the Company in building its brand. If the Company fails to promote and maintain its brand or incurs substantial expenses in an attempt to promote and maintain its brand or if the Company’s existing or future strategic relationships fail to promote the Company’s brand or increase brand awareness, the Company’s business, results of operations and financial condition would be materially adversely affected.

We may not generate the same level of revenues from general construction projects.

Our revenues for the three months ended March 31, 2022 and 2021 were approximately $2,919,045 and $1,579,486, respectively, and for the years ended December 31, 2021 and 2020 were approximately $9.9 million and $1.2 million, respectively. There were three customers who represented 97% of the Company’s total revenue for the three months ended March 31, 2022, and two customers who represented 98% of the Company’s total revenue for the three months ended March 31, 2021. Also, there was one customer, The Fifth District Management Office of Taiwan Water Corporation, who represented approximately 58% of the Company’s total revenue for the year ended December 31, 2021, and two customers (JC Development Co., Ltd (“JCD”) and Pan Li) who represented 96% of the Company’s total revenue for the prior year period. These customers are not located in mainland China or Hong Kong. Our future plan of operations is to shift away from general construction services to the construction of fish and solar power farms. There can be no guarantee that such shift in operations will generate the same levels of revenues previously generated through our VIE.

There is no assurance that the Company will be profitable.

There is no assurance that we will earn profits in the future, or that profitability will be sustained. There is no assurance that future revenues will be sufficient to generate the funds required to continue our business development and marketing activities. If we do not have sufficient capital to fund our operations, we may be required to reduce our sales and marketing efforts or forego certain business opportunities.

The Company may not have the ability to manage its growth.

The Company anticipates that significant expansion will be required to address potential growth in its customer base and market opportunities. The Company’s anticipated expansion is expected to place a significant strain on the Company’s management, operational and financial resources. To manage any material growth of its operations and personnel, the Company may be required to improve existing operational and financial systems, procedures and controls and to expand, train and manage its employee base. There can be no assurance that the Company’s planned personnel, systems, procedures and controls will be adequate to support the Company’s future operations, that management will be able to hire, train, retain, motivate and manage required personnel or that the Company’s management will be able to successfully identify, manage and exploit existing and potential market opportunities. If the Company is unable to manage growth effectively, its business, prospects, financial condition and results of operations may be materially adversely affected.

We will need additional financing in order to grow our business.

From time to time, in order to expand operations to meet customer demand, the Company will need to incur additional capital expenditures. These capital expenditures are intended to be funded from third party sources, including the incurring of debt and/or the sale of additional equity securities. In addition to requiring additional financing to fund capital expenditures, the Company may require additional financing to fund working capital, research and development, sales and marketing, general and administrative expenditures, and operating losses. The incurrence of debt creates additional financial leverage and therefore an increase in the financial risk of the Company’s operations. The sale of additional equity securities will be dilutive to the interests of current equity holders. In addition, there can be no assurance that such additional financing, whether debt or equity, will be available to the Company or that it will be available on acceptable commercial terms. Any inability to secure such additional financing on appropriate terms could have a materially adverse impact on the business, financial condition and operating results of the Company.

| 14 |

We rely on our executive officers.

The Company’s success is dependent on our current executive officers. The Company’s success also depends in large part on the continued service of its key operational and management personnel. The Company faces intense competition from its competitors, customers and other companies throughout the industry. The loss of any our executive officers, specifically Mr. Yin-Chieh (Jeff) Cheng, our CEO, or any failure on the Company’s part to hire, train and retain a sufficient number of qualified professionals could impair the business of the Company.

We rely on the performance of highly skilled personnel, and if we are unable to attract, retain and motivate well-qualified employees, our business could be harmed.

The Company is, and will be, heavily dependent on the skill, acumen and services of the management and other employees of the Company. Our future success depends on our continuing ability to attract, develop, motivate and retain highly qualified and skilled employees. Qualified individuals are in high demand, and we may incur significant costs to attract them. In addition, the loss of any of our senior management or key employees could materially adversely affect our ability to execute our business plan, and we may not be able to find adequate replacements. We cannot ensure that we will be able to retain the services of any members of our senior management or other key employees. If we do not succeed in attracting well-qualified employees or retaining and motivating existing employees, our business could be harmed.

We may have inadvertently violated Section 13(k) of the Exchange Act (implementing Section 402 of the Sarbanes-Oxley Act of 2002) and may be subject to sanctions as a result.

Section 13(k) of the Exchange Act provides that it is unlawful for a company that has a class of securities registered under Section 12 of the Exchange Act to, directly or indirectly, including through any subsidiary, extend or maintain credit in the form of a personal loan to or for any director or executive officer of the Company. In 2019, the Company did not have a corporate bank account established in Hong Kong or the U.S., and certain funds that were supposed to be deposited into such corporate bank account were instead deposited into the personal bank account of our principal stockholder as well as Chairman of the Board, President, Chief Executive Officer and Director, Yin-Chieh Cheng, which was considered to be a personal loan made by the Company to Yin-Chieh Cheng and may have violated Section 13(k) of the Exchange Act. The receivable was repaid to us in January 2020. Issuers that are found to have violated Section 13(k) of the Exchange Act may be subject to civil sanctions, including injunctive remedies and monetary penalties, as well as criminal sanctions. The imposition of any of such sanctions on us could have a material adverse effect on our business, financial position, results of operations or cash flows.

Future acquisitions may have an adverse effect on our ability to manage our business.

Selective acquisitions currently form part of our strategy to further expand our business. If we are presented with appropriate opportunities, we may acquire additional businesses, services or products that are complementary to our core business. Future acquisitions and the subsequent integration of new companies into ours would require significant attention from our management. Future acquisitions would also expose us to potential risks, including risks associated with the assimilation of new operations, services and personnel, unforeseen or hidden liabilities, the diversion of resources from our existing businesses and technologies, the inability to generate sufficient revenue to offset the costs and expenses of acquisitions and potential loss of, or harm to, relationships with employees as a result of integration of new businesses. The diversion of our management’s attention and any difficulties encountered in any integration process could have a material adverse effect on our ability to manage our business.

The value of seafood which the Company sells (e.g., eel) is subject to fluctuation which may result in volatility of our results of operations and the value of an investment in the Company.

Our business is partly dependent upon the sale of eel which value is subject to fluctuation and which value greatly fluctuates. Our net sales and operating results vary significantly due to the volatility of the value of eel and any other seafood that we sell which may result in the volatility of the market price of our common stock.

| 15 |

We are highly susceptible to changes in market demand for the types of seafood for which our recirculating aquaculture systems are used.

A significant portion of our revenues are derived from constructing recirculating aquaculture systems for fish farming. We therefore are highly susceptible to changes in market demand for the seafood for which our systems are used, which may be impacted by factors over which we have limited or no control. Factors that could lead to a decline in market demand for seafood in general and specifically the type of fish farmed using our systems include economic conditions and evolving consumer preferences. A substantial downturn in market demand for such seafood may have a material adverse effect on our business and on our results of operations.