Table of Contents

As filed with the Securities and Exchange Commission on December 18, 2018

Registration No. 333-228472

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

To

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Gateway Casinos & Entertainment Limited

(Exact Name of Registrant as Specified in its Charter)

Not Applicable

(Translation of Registrant’s Name into English)

| Canada | 7011 | Not Applicable | ||

| (State or other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

4331 Dominion Street

Burnaby, BC V5G 1C7

(604) 412-0166

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Cogency Global Inc.

10 E. 40th Street, 10th floor

New York, NY 10016

(800) 221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| Christopher D. Lueking, Esq. Zachary Judd, Esq. Latham & Watkins LLP 330 North Wabash Avenue Suite 2800 Chicago, Illinois 60611 (312) 876-7700 |

Alexander D. Lynch, Esq. Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, New York 10153 (212) 310-8163 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) | ||

| Common shares, no par value per share |

$100,000,000 | $12,120 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for purpose of calculating the amount of registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Includes the aggregate offering price of additional common shares that may be acquired by the underwriters. |

| (3) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued , 2018

Shares

GATEWAY CASINOS & ENTERTAINMENT LIMITED

COMMON SHARES

This is the initial public offering of Gateway Casinos & Entertainment Limited and no public market exists for our common shares. We are not selling any common shares in the offering. The common shares are being offered by investment funds managed by The Catalyst Capital Group Inc. and Tennenbaum Capital Partners, LLC, which we refer to herein as the selling shareholders. We will not receive any proceeds from the sale of common shares by the selling shareholders in this offering.

We anticipate that the initial public offering price will be between US$ and US$ per share.

We have applied to list our common shares on the New York Stock Exchange, or NYSE, under the symbol “GTWY”.

Upon the closing of this offering, we will be a “controlled company” within the meaning of the corporate governance rules of the NYSE and will be exempt from certain corporate governance requirements. See “Management—Director Independence”.

We are an “emerging growth company” and a “foreign private issuer” under applicable Securities and Exchange Commission rules and, as such, will be eligible for reduced public company disclosure requirements. See “Prospectus Summary—Implications of Being an Emerging Growth Company and a Foreign Private Issuer” and Management—Foreign Private Issuer Status”.

Investing in the common shares involves risks. See “Risk Factors” beginning on page 59.

PRICE US$ PER SHARE

| Price to Public |

Underwriting and Commissions(1) |

Proceeds to Selling |

||||||||||

| Per share |

US$ | US$ | US$ | |||||||||

| Total |

US$ | US$ | US$ | |||||||||

| (1) | We have also agreed to reimburse the underwriter for certain FINRA-related expenses. See “Underwriters”. |

The selling shareholders have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase up to an additional common shares at the initial public offering price less the underwriting discount.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common shares against payment on or about , 2018.

| Morgan Stanley | Credit Suisse | Goldman Sachs & Co. LLC | ||

| CIBC Capital Markets | Macquarie Capital | SunTrust Robinson Humphrey | ||

, 2018

Table of Contents

We are responsible for the information contained in this prospectus and in any free writing prospectus we prepare or authorize. Neither we, the selling shareholders nor any of the underwriters have authorized anyone to provide you with different information, and neither we, the selling shareholders nor any of the underwriters take responsibility for any other information others may give you. We and the selling shareholders are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information in this prospectus is only accurate as of the date of this prospectus. You should not assume that the information contained in this prospectus is accurate as of any date other than its date. Our business, financial condition, results of operations and prospects may have changed since that date.

i

Table of Contents

Unless otherwise indicated, information contained in this prospectus concerning our industry and the regions in which we operate, including our general expectations and market position, market opportunity, market share and other management estimates, is based on information obtained from various independent publicly available sources and reports provided to us (including reports from the British Columbia Lottery Corporation, or BCLC, the Alberta Gaming, Liquor and Cannabis Commission, or AGLC, the Alcohol and Gaming Commission of Ontario, the AGCO, the Statistics Canada, the central statistical agency of the Province of British Columbia, or BC Stats, the Conference Board of Canada, or the CBC, the Canadian Gaming Association, Tourism British Columbia, Tourism Vancouver, Edmonton Tourism, Destination BC, the Ontario Lottery and Gaming Corporation, or the OLG, HLT Advisory Inc., or HLT, Oxford Economics, Asia Pacific Foundation of Canada, Edmonton Economic Development Corporation, Alberta Culture and Tourism, the University of Las Vegas Center for Gaming Research, or UNLV, and other industry publications, surveys and forecasts). We also commissioned a report from The Innovation Group in relation to the Central Bundle landscape and other matters pertaining to that gaming market. Neither we, the selling shareholders nor any of the underwriters have independently verified the accuracy or completeness of any third-party information. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based upon our management’s knowledge of the industry, have not been independently verified. While we believe that the market data, industry forecasts and similar information included in this prospectus are generally reliable, such information is inherently imprecise. In addition, assumptions and estimates of our future performance and growth objectives and the future performance of its industry and the markets in which it operates are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those discussed under the heading “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus.

ii

Table of Contents

As used in this prospectus, “casino” means a gaming property with slot machines and/or table games and “CGC” means a community gaming center property in British Columbia with slot machines and/or bingo. References to the number of “slot machines” and revenue generated from “slot machines” in this prospectus include video lottery terminals, or VLTs, and electronic table games. References to the number of “table games” and revenue generated from “table games” in this prospectus include touch bet roulette and poker tables.

Additionally, as used in this prospectus, the following terms have the meanings set forth below:

| • | “Net Win” means the aggregate of Slot Win and the Table Win less free play and loyalty points redeemed; |

| • | “Poker Rake” means the commission we earn from poker tables and is calculated as a fixed percentage of the amount wagered by our customers, up to a predetermined maximum amount, on every hand of poker played; |

| • | “Slot Coin-in” means the aggregate amount of money customers have wagered on slots and other electronic gaming machines; |

| • | “Slot Win” means the amount of Slot Coin-in retained and recorded as casino revenue; |

| • | “Slot Win %” means the ratio of Slot Win divided by Slot Coin-in; |

| • | “Table Drop” means the aggregate amount of money customers deposit to purchase casino chips to wager on table games, and is commonly computed as the aggregate amount of money counted in the table games’ drop boxes. Generally, the Table Drop is an indicator of our gaming business; however, over the short-term, the Table Drop is subject to shifts in customer behavior around buying, retaining and cashing-in of casino chips; |

| • | “Table Win” means the amount of Table Drop retained and recorded as casino revenue; and |

| • | “Table Win %” means the ratio of the Table Win divided by the Table Drop, which fluctuates with the statistical variations or volatility inherent in casino games, as well as with changes in customer behavior around buying, retaining and cashing-in of casino chips. |

iii

Table of Contents

PRESENTATION OF FINANCIAL MATTERS AND OTHER INFORMATION

IFRS

This prospectus includes our audited annual consolidated financial statements as well as our unaudited condensed consolidated interim financial statements, or the Financial Statements. Our audited consolidated financial statements for the years ended December 31, 2017 and 2016 were prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB, the independent, private-sector body that develops and approves IFRS. None of the financial statements were prepared in accordance with generally accepted accounting principles in the United States.

Unless indicated otherwise, our financial information in this prospectus has been prepared on a basis consistent with IFRS as issued by the International Accounting Standards Board. In making an investment decision, investors must rely on their own examination of our results and consult with their own professional advisors.

Historical Financial Data Provided for the Ontario Properties

The audited historical financial information and results of the Southwest Ontario and North Ontario properties for their fiscal years ended March 31, 2017 and 2016 and the audited historical financial information and results of the Central Ontario properties for their fiscal years ended March 31, 2018 and 2017 are included in this prospectus and were prepared or provided by the OLG and consist solely of audited combined schedules of revenue and direct expenses. The unaudited interim financial data for the Southwest Ontario and North Ontario properties for the period of January 1, 2017 to May 8, 2017, and to May 29, 2017, respectively, and the unaudited interim financial data for the Central Ontario properties for the period of January 1, 2018 to July 17, 2018 are included in this prospectus under the heading “Selected Summary Historical Financial Information—Pro Forma Financial Data”. See “Risk Factors—Risks Related to Our Business—The historical financial information for the Ontario properties prior to our acquisition thereof was prepared or provided by the OLG and consists of audited combined schedules of revenue and direct expenses only and does not represent complete financial statements; care should be taken when relying upon such information”.

Non-IFRS Financial Measures

This prospectus refers to certain non-IFRS measures including financial measures commonly used by financial analysts in evaluating the financial performance of companies, including companies in the gaming industry. These measures are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations from management’s perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS.

We use non-IFRS measures including “Adjusted EBITDA”, “Adjusted EBITDA Margin”, “Adjusted Property EBITDA”, “Adjusted Property EBITDA Margin”, “EBITDA”, “Free Cash Flow” and “Free Cash Flow Conversion”, which we collectively refer to as the Non-IFRS Financial Measures. For purposes of this prospectus, these terms are defined as follows:

| • | “Adjusted EBITDA” means EBITDA plus (i) share-based compensation (recovery), (ii) change in fair value of embedded derivatives, (iii) change in fair value of cross currency interest rate swaps, (iv) loss on debt extinguishment, (v) loss on debt modification, (vi) (gain) / loss on foreign exchange, (vii) gain on sale of property and equipment, (viii) non-cash deferred rent, (ix) tax adjustment for prior periods, (x) business acquisition, transaction, site pre-opening, restructuring and other, and (xi) write-down of non-financial assets. |

iv

Table of Contents

| • | “Adjusted EBITDA Margin” means the ratio of Adjusted EBITDA to total revenue. |

| • | “Adjusted Property EBITDA” means the Adjusted EBITDA for each reporting segment or property, as applicable, excluding corporate costs. |

| • | “Adjusted Property EBITDA Margin” means the ratio of Adjusted Property EBITDA for a reporting segment to total revenue of the reporting segment. |

| • | “EBITDA” means, unless otherwise noted or the context otherwise indicates, income (loss) and comprehensive income (loss) for the period plus (i) amortization of intangible assets, (ii) depreciation of property and equipment, (iii) interest expense, net, less (iv) expense or recovery of income taxes. |

| • | “Free Cash Flow” means Adjusted EBITDA less maintenance capital expenditures, interest expense, current taxes paid and mandatory debt principal repayments. |

| • | “Free Cash Flow Conversion” means Free Cash Flow divided by Adjusted EBITDA. |

These Non-IFRS Financial Measures are used to provide investors with supplemental measures of our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS measures. Certain of the above Non-IFRS Financial Measures also remove the impact of certain non-routine, non-recurring, and/or non-cash items to enable management, investors and analysts to gain a clearer understanding of the underlying our financial performance and help to provide a more complete understanding of factors and trends impacting our business. We also believe that securities analysts, investors and other interested parties frequently use these Non-IFRS Financial Measures in the evaluation of issuers similar to us. In particular, EBITDA, Adjusted EBITDA, Adjusted Property EBITDA and Adjusted EBITDA Margin are non-IFRS financial measures commonly used by financial analysts in evaluating the financial performance of companies, including companies in the gaming industry. We believe Free Cash Flow and Free Cash Flow Conversion are non-IFRS measures that are meaningful to investors as they are useful measures of performance and we use these measures as an indication of the strength of our business model and our ability to generate cash. Our management also uses these Non-IFRS Financial Measures in order to facilitate operating performance comparisons on a consistent basis from period to period, to provide a more complete understanding of factors and trends affecting our business, to prepare annual operating budgets and forecasts and to determine components of management compensation. As there is no generally accepted method of calculating the Non-IFRS Financial Measures, the Non-IFRS Financial Measures as used herein are not necessarily comparable to similarly titled measures of other companies. The items excluded from EBITDA are significant in assessing our operating results and liquidity. The Non-IFRS Financial Measures have limitations as analytical tools and should not be considered in isolation from, or as an alternative to, net income, cash flow from operations or other data prepared in accordance with IFRS. Therefore, readers are cautioned that the Non-IFRS Financial Measures do not have a standardized meaning and should not be used in isolation or as a substitute for net (loss) income, cash flows from operating activities or other income or cash flow statement data prepared in accordance with IFRS.

For a presentation and reconciliation of the foregoing Non-IFRS Financial Measures to their most directly comparable measures under IFRS, see “Selected Summary Historical Financial Information”.

v

Table of Contents

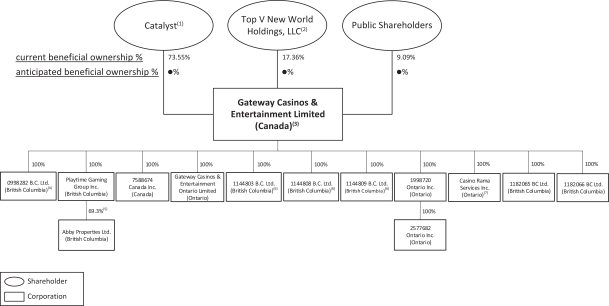

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to the terms “Gateway,” the “Company,” “we,” “us” and “our” refer to Gateway Casinos & Entertainment Limited, together with its subsidiaries.

We publish our consolidated financial statements in Canadian dollars. In this prospectus, unless otherwise specified, all monetary amounts are in Canadian dollars, all references to “$” and “C$” mean Canadian dollars and all references to “US$,” “USD” and “dollars” mean United States dollars.

This prospectus includes our audited consolidated financial statements as of and for the years ended December 31, 2017, 2016 and 2015 presented in Canadian dollars and prepared in accordance with IFRS as issued by the IASB. This prospectus includes our unaudited condensed consolidated financial statements for the nine months ended September 30, 2018 and 2017 presented in Canadian dollars and prepared in accordance with IAS 34. None of the financial statements were prepared in accordance with generally accepted accounting principles in the United States. As a result of the acquisition of the North and Southwest Bundles from the OLG (each as defined herein), the year ended December 31, 2017 may not be comparable to the years ended December 31, 2016 and 2015.In addition, as a result of the acquisition of the Central Bundle (as defined herein) from the OLG in July 2018, the nine months ended September 30, 2018 may not be comparable to the nine months ended September 30, 2017.

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

vi

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that relate to our current expectations and views of future events. These forward-looking statements are contained principally in the sections entitled “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business,” “Property Highlights” and “Our Growth Strategies.” These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “could,” “project,” “expect,” “aim,” “project,” “budget,” “estimate,” “intend,” “plan,” “goal,” “forecast,” “target,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions and the negative of such expressions.

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the factors discussed under the headings “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business,” “Property Highlights” and “Our Growth Strategies”; our estimates regarding future revenue, expenses and needs for additional financing; and our ability to keep and retain key employees. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition or operating results.

The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results or performance may be materially different from what we expect.

vii

Table of Contents

This prospectus includes trademarks, such as “Grand Villa Casino,” “Starlight Casino,” “Cascades Casino,” “Lake City Casinos,” “Playtime,” “Halley’s Club,” ”Nova Bar,” “MATCH Eatery & Public House,” “Atlas Steak + Fish,” “Personas + Patio + Restaurant + Lounge,” “The Buffet” and “CHOW Lucky Noodle Bar,” which are protected under applicable intellectual property laws and are our property. Solely for convenience, our trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbol, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. All other trademarks used in this prospectus are the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

viii

Table of Contents

This summary highlights principal features of the Offering and certain information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common shares. You should read this entire prospectus carefully, including the information presented under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes appearing elsewhere in this prospectus, before making an investment decision. Please refer to “Meaning of Certain References” above for a list of defined terms used herein, including certain industry terminology.

OUR BUSINESS

Company Overview

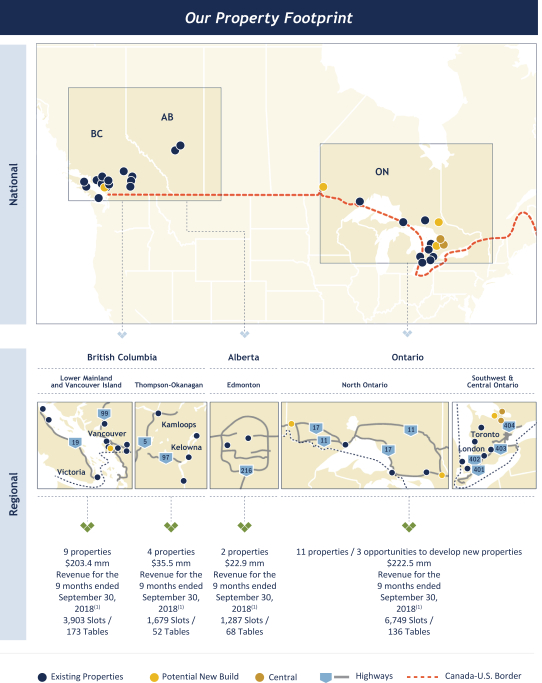

We are one of the largest and most diversified gaming and entertainment companies in Canada, based on both number of properties and number of gaming positions. Our operations are currently comprised of 26 gaming properties in British Columbia, Ontario and Edmonton, Alberta, with 13,618 slot machines, 429 table games, including 48 poker tables, 561 hotel rooms, 80 food and beverage, or F&B, outlets and 8,500 employees. We have demonstrated a track record of successfully operating, developing and acquiring gaming properties and contributing to the communities in which we live and work.

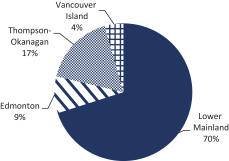

We have a leading market position in each of the markets in which we operate. In British Columbia, we are one of the most diversified gaming and entertainment companies based on both the number of properties and gaming positions. Our British Columbia properties include 41% of all slot machines and 40% of all table games in the province. We provide operational services at six of the 14 properties in the Lower Mainland of British Columbia, or the Lower Mainland, a region encompassing the Sea-to-Sky Corridor, the Fraser Valley and British Columbia’s largest market, the Greater Vancouver Regional District, or the GVRD (recently renamed the Metro Vancouver Regional District). We also provide operational services at three of the nine gaming properties on Vancouver Island and are the only service provider with casinos in the Thompson-Okanagan region of British Columbia, where we provide operational services at properties located in Kelowna, Vernon, Penticton and Kamloops. In Alberta, we are one of the largest gaming operators in the Edmonton region, where we operate two properties in prime, high-traffic entertainment districts.

In May 2017, we became the exclusive service provider in the OLG’s North Ontario gaming bundle, or the North Bundle, and Southwest Ontario gaming bundle, or the Southwest Bundle. With these acquisitions, we added nine properties and two new property development opportunities to our portfolio, diversifying our operations into Canada’s largest gaming market and establishing a significant platform for future growth. On July 18, 2018, we became the exclusive service provider for a third gaming bundle, located in Central Ontario, or the Central Bundle, containing two existing gaming properties and the opportunity to build a third additional property. As part of our Ontario expansion plan, we expect to develop two additional gaming properties in North Bay and the Kenora area in the North Bundle, which, along with the development of a third property in Wasaga Beach in the Central Bundle, the anticipated acquisition of a gaming facility in British Columbia and a proposed new build in Delta, British Columbia, would bring our total number of properties to 30.

1

Table of Contents

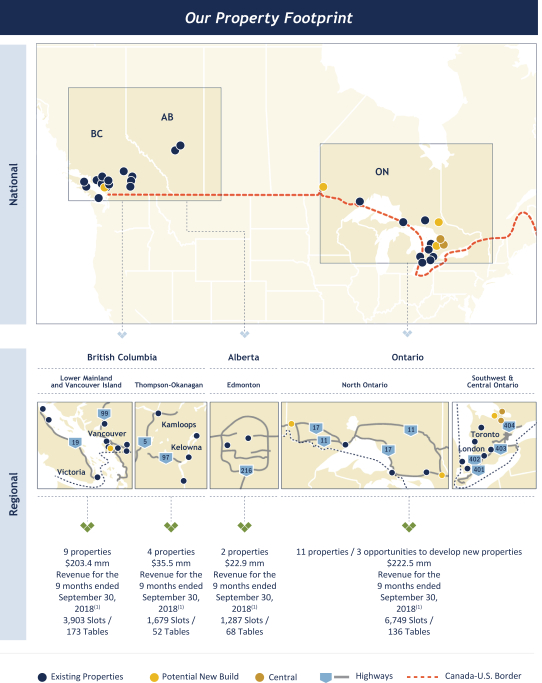

The following map presents our property footprint and key operating and financial highlights across British Columbia, Alberta and Ontario:

| Note: (1) | The financial information has been derived from our financial statements for the nine months ended September 30, 2018. |

2

Table of Contents

We have developed four principal casino brands: Grand Villa, Starlight, Cascades and Playtime. In March 2018, we launched our first Playtime property and are in the process of rebranding smaller properties into the Playtime brand. Each brand offers a distinct experience to our customers. We have also developed five proprietary F&B brands: Atlas Steak + Fish, or Atlas, MATCH Eatery & Public House, or MATCH, CHOW Lucky Noodle Bar, or CHOW, and The Buffet, and in 2018, we launched Halley’s Supper Club, our new supper club concept. Our properties are generally branded according to market size, market growth potential and local community character, with proximity to our other brands also playing a key role in the decision process. This proprietary branding strategy is meant to associate our properties with exciting local entertainment experiences, which serves to attract new customers and drive increased visitation and loyalty from existing customers. This branding strategy has been implemented at most of our British Columbia and Alberta properties and we are targeting full implementation in Ontario by 2020.

The figures below outline our principal casino and F&B brands, along with key characteristics of each brand:

Our Principal Casino Brands

|

|

|

|

| |||

| • Focused in urban markets • Premium • Stylish |

• Focused in urban markets • Contemporary • High energy |

• Community focused • Casual • Approachable |

• Community focused • Neighbourly • Relaxed |

Our Principal F&B Brands

|

|

|

|

|

| ||||

| • Modern steakhouse • Elevated • Memorable |

• Creative pub food • Lively sports bar • Welcoming |

• Authentic Asian flavours • Exciting • Interactive |

• Variety • Great value • Casual |

• Modern supper club • Showcase theatre • Vintage cabaret |

For the nine months ended September 30, 2018, we generated total revenue of $484.3 million, income and comprehensive income of $156.2 million and Adjusted EBITDA of $122.6 million. For the year ended December 31, 2017, we generated total revenue of $478.8 million, a loss and comprehensive loss of $65.1 million and Adjusted EBITDA of $144.2 million. For a reconciliation of Income (Loss) and Comprehensive Income (Loss) to Adjusted EBITDA and Schedules of Adjustments, see “Summary—Selected Summary Historical Financial Information”.

PROPERTY HIGHLIGHTS

Current Properties Overview

In total, our current properties (including properties leased by us) have over one million square feet of gaming space in which we offer 13,618 slot machines, 429 table games, including 48 poker tables, and 866 bingo seats. Together with our business partners, we offer a wide range of amenities at or adjoining our properties to support our gaming operations and which differentiate us from our competition, including four hotels and convention centers (three of which we own), 80 F&B outlets and 26 venues which feature live entertainment. We actively look for opportunities to expand and enhance our existing properties and to acquire and develop additional properties.

The chart below summarizes some of the key attributes of each of our current gaming properties and the expiration date of the operating agreements that we have entered into with the BCLC and OLG and licenses from

3

Table of Contents

the AGLC. Excluding the anticipated acquisition of a gaming facility in British Columbia, expected to close in January 2019, and the proposed new builds in Delta, BC, the Kenora area in Ontario, North Bay, Ontario and Wasaga Beach, Ontario, we operate in 20 casinos, five of which are owned and 15 of which are leased. We also operate in six CGC properties, three of which are owned and three of which are leased.

See “Risk Factors—Risks Related to Our Business—Renewal of lease agreements for our properties may not be obtained or if obtained, may be on less favorable terms.”

| Property Name |

Year Built/ Latest Renovation |

Description(1) |

Total Land Area (Acres) |

No. of Slot Machines(2) |

No. of Table Games(3) |

Operating Agreement or Licence Expiration(4) |

Properties Owned / Leased(5) |

|||||||||||||||||||

| Grand Villa Casino Burnaby(6) |

2018 | Approximately 301,600 total square feet / 93,100 square feet of gaming space, Delta hotel and conference center and a show lounge and nine F&B outlets. | 6.1 | 1,200 | 81 | Apr. 2038 | Leased | |||||||||||||||||||

| Cascades Casino Langley(7) |

2018 | Approximately 155,200 total square feet / 54,100 square feet of gaming space, a 420-seat theatre, Coast Hotel and convention center and four F&B outlets. | 9.3 | 984 | 33 | Apr. 2038 | Leased | |||||||||||||||||||

| Starlight Casino New Westminster |

2015 | Approximately 164,700 total square feet / 103,700 square feet of gaming space, a newly renovated VIP area including private salons and five F&B outlets. | 23.1 | 934 | 59 | Apr. 2038 | Leased | |||||||||||||||||||

| Total |

3,118 | 173 | ||||||||||||||||||||||||

| Thompson-Okanagan |

||||||||||||||||||||||||||

| Cascades Casino Kamloops |

2015 | Approximately 66,100 total square feet / 33,900 square feet of gaming space and four F&B outlets. | 6.0 | 442 | 16 | Apr. 2038 | Owned | |||||||||||||||||||

| Playtime Casino Kelowna(8) |

2018 | Approximately 36,800 total square feet / 26,000 square feet of gaming space and three F&B outlets. | N/A | 437 | 16 | Apr. 2038 | Leased | |||||||||||||||||||

| Cascades Casino Penticton |

2017 | Approximately 57,600 total square feet / 32,500 square feet of gaming space and four F&B outlets. | 1.7 | 400 | 11 | Apr. 2038 | Leased | |||||||||||||||||||

| Lake City Casino Vernon |

2014 | Approximately 32,000 total square feet / 24,200 square feet of gaming space and three F&B outlets. | 3.4 | 400 | 9 | Apr. 2038 | Owned | |||||||||||||||||||

| Total |

1,679 | 52 | ||||||||||||||||||||||||

| CGCs |

||||||||||||||||||||||||||

| Chances Mission |

2010 | Approximately 11,100 total square feet / 8,400 square feet of gaming space and one F&B outlet. | 2.6 | 125 | — | Apr. 2038 | Leased | |||||||||||||||||||

| Chances Squamish |

2013 | Approximately 25,000 total square feet / 14,200 square feet of gaming space and two F&B outlets. | 2.8 | 99 | — | Apr. 2038 | Leased | |||||||||||||||||||

4

Table of Contents

| Property Name |

Year Built/ Latest Renovation |

Description(1) |

Total Land Area (Acres) |

No. of Slot Machines(2) |

No. of Table Games(3) |

Operating Agreement or Licence Expiration(4) |

Properties Owned / Leased(5) |

|||||||||||||||||||

| Chances Abbotsford Abbotsford, British Columbia |

2012 | Approximately 22,400 total square feet / 16,800 square feet of gaming space and two F&B outlets. | 5.0 | 211 | — | Apr. 2038 | Owned(14) | |||||||||||||||||||

| Chances Campbell River(9) Campbell River, British Columbia |

2018 | Approximately 19,100 total square feet / 13,700 square feet of gaming space and two F&B outlets. | 2.0 | 150 | — | Apr. 2038 | Owned | |||||||||||||||||||

| Chances Courtenay(10) Courtenay, British Columbia |

2018 | Approximately 19,100 total square feet / 13,700 square feet of gaming space and two F&B outlets. | 2.9 | 200 | — | Apr. 2038 | Owned | |||||||||||||||||||

| Playtime Gaming Victoria(11) Victoria, British Columbia |

1994 | Approximately 13,600 total square feet / 9,500 square feet of gaming space, electronic and traditional bingo centers and one F&B outlet. | 1.9 | — | — | Dec. 31, 2018 | Leased | |||||||||||||||||||

| Total |

785 | — | ||||||||||||||||||||||||

| Ontario |

||||||||||||||||||||||||||

| Western Fair District London Slots London, Ontario |

2002 | Approximately 78,100 total square feet / 54,300 square feet of gaming space and two F&B outlets. | N/A | 767 | — | Mar. 2037 | Leased | |||||||||||||||||||

| Point Edward Casino(12) Point Edward, Ontario |

2018 | Approximately 78,600 total square feet / 54,300 square feet of gaming space and two F&B outlets. | 7.9 | 484 | 13 | Mar. 2037 | Owned | |||||||||||||||||||

| Woodstock Raceway Slots Woodstock, Ontario |

2001 | Approximately 14,000 total square feet / 12,300 square feet of gaming space and one F&B outlet. | N/A | 224 | — | Mar. 2037 | Leased | |||||||||||||||||||

| Dresden Raceway Slots Dresden, Ontario |

2001 | Approximately 14,000 total square feet / 11,600 square feet of gaming space and one F&B outlet. | N/A | 154 | — | Mar. 2037 | Leased | |||||||||||||||||||

| Clinton Raceway Slots Clinton, Ontario |

2000 | Approximately 14,700 total square feet / 12,000 square feet of gaming space, a racetrack and one F&B outlet. | N/A | 123 | — | Mar. 2037 | Leased | |||||||||||||||||||

| Hanover Raceway Slots Hanover, Ontario |

2001 | Approximately 15,000 total square feet / 13,600 square feet of gaming space and two F&B outlets. | 28.9 | 189 | — | Mar. 2037 | Leased | |||||||||||||||||||

| Thunder Bay Casino Thunder Bay, Ontario |

2000 | Approximately 46,500 total square feet / 37,700 square feet of gaming space and two F&B outlets. | 3.7 | 450 | 11 | Mar. 2037 | Owned | |||||||||||||||||||

| Sault Ste. Marie Casino Sault Ste. Marie, Ontario |

1999 | Approximately 61,800 total square feet / 51,700 square feet of gaming space and two F&B outlets. | 13.8 | 425 | 11 | Mar. 2037 | Owned | |||||||||||||||||||

| Sudbury Raceway Slots Chelmsford, Ontario |

1999 | Approximately 45,600 total square feet / 33,000 square feet of gaming space and one F&B outlet. | 158.0 | 427 | — | Mar. 2037 | Leased | |||||||||||||||||||

5

Table of Contents

| Property Name |

Year Built/ Latest Renovation |

Description(1) |

Total Land Area (Acres) |

No. of Slot Machines(2) |

No. of Table Games(3) |

Operating Agreement or Licence Expiration(4) |

Properties Owned / Leased(5) | |||||||

| Gateway Innisfil Innisfil, Ontario |

2001 | Approximately 87,000 total square feet / 29,500 square feet of gaming space and two F&B outlet. | N/A | 989 | — | Jul. 2041 | Leased | |||||||

| Casino Rama Resort Orillia, Ontario |

1996 | Approximately 813,000 total square feet / 172,000 square feet of gaming space and nine F&B outlets. | N/A | 2,517 | 101 | Jul. 2041 | Leased | |||||||

| Total |

6,749 | 136 | ||||||||||||

| Edmonton |

||||||||||||||

| Grand Villa Casino Edmonton Edmonton, Alberta |

2016 | Approximately 62,600 total square feet / 39,600 square feet of gaming space and seven F&B outlets. | N/A | 522 | 28 | Aug. 2022 | Leased | |||||||

| Starlight Casino Edmonton(13) Edmonton, Alberta |

2018 | Approximately 123,100 total square feet / 68,200 square feet of gaming space and six F&B outlets. | N/A | 765 | 40 | Aug. 2022 | Leased | |||||||

| Total |

1,287 | 68 | ||||||||||||

| Grand Total: |

13,618 | 429 | ||||||||||||

|

|

|

|||||||||||||

| Notes: (1) | Gaming square footage includes back of house areas and excludes F&B and common areas and/or administrative and staff areas, as applicable. |

| (2) | Number of slot machines includes VLTs and electronic table games, and relates to the count as at September 30, 2018. We provide operational services to the AGLC and the BCLC; however, the AGLC and the BCLC own or lease all of our slot machines, provide certain table game equipment and are responsible for most of the related capital expenditures. See “Regulatory and Licensing Matters”. |

| (3) | Number of table games includes touch bet roulette and relates to the count as at September 30, 2018. Because live table games typically have six gaming positions, six touch bet roulette terminals are represented as one table game for the purpose of the table game count. |

| (4) | See “Business—Regulatory and Licensing Matters”. |

| (5) | See “Business—Our Properties”. |

| (6) | Expansions to our Grand Villa Casino Burnaby were completed in 2017 and a refresh of the Delta hotel was completed in 2018. |

| (7) | An expansion of the MATCH patio at our Cascades Casino Langley was completed in the first quarter of 2018. The addition of an Atlas restaurant, refresh and addition of gaming space, and a refresh of the Coast hotel is currently underway and is expected to be completed in phases beginning this year through to the second quarter of 2019. |

| (8) | The Playtime Casino Kelowna is located within the Delta Hotels Grand Okanagan Resort. We recently added a MATCH restaurant at this location that opened in the first quarter of 2018. |

| (9) | A MATCH restaurant was recently completed at Chances Campbell River. |

| (10) | A MATCH restaurant was recently completed at Chances Courtenay. |

| (11) | We expect that our operational services for bingo at this location will cease on December 31, 2018 upon the formal termination of our Bingo Operational Services Agreement, or BOSA. |

| (12) | We completed renovations at our Point Edward Casino in the fourth quarter of 2018. As at November 30, 2018, this property has 491 slot machines, 25 table games, including three poker tables, and three F&B outlets. |

| (13) | The redeveloped and rebranded Starlight Casino Edmonton (formerly the Palace Casino Edmonton) was completed in September 2018. |

| (14) | On December 23, 2015, we acquired 69.3% of the Abby Joint Venture. Abby Properties Ltd. is the registered owner of the lands and premises upon which the Chances Playtime Abbotsford is located and was appointed bare trustee to hold legal title on behalf of PT Abbotsford Enterprises Ltd. (a predecessor of Playtime Gaming Group) and 0752529 B.C. Ltd., together as beneficial owners (pursuant to a joint venture agreement between Abby Properties Ltd., 0752729 B.C. Ltd. and PT Abbotsford Enterprises Ltd.), pursuant to a nominee agreement between all three parties. |

6

Table of Contents

Grand Villa Casino Burnaby

The Grand Villa Casino Burnaby is our flagship property and has been in operation since 2008. Located in Burnaby, British Columbia and styled as a modern take on an “Italian Villa”, the Grand Villa Casino Burnaby is designed to provide customers with an inclusive, comfortable and exciting atmosphere. With approximately $218.5 million invested since 2001 (as of September 30, 2018), the Grand Villa Casino Burnaby is one of our largest contributors based on EBITDA. The Grand Villa Casino Burnaby has a wide array of gaming and non-gaming amenities, including hotel accommodations, meeting space, multi-function entertainment facilities, and multiple F&B outlets. The property includes the Delta Hotel, part of the Marriott International hotel chain, and benefits from its central location in the GVRD, which is in close proximity to Vancouver and surrounding suburban areas. The approximately 301,600 square foot casino contains approximately 93,100 square feet of gaming space and 1,200 slot machines, including a high-limit slot machine room and 81 table games, including 11 poker tables. We expect that the Grand Villa Casino Burnaby will continue to be the most significant contributor to our business in the GVRD. Under the Sale and Leaseback Transactions (as defined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Sale and Leaseback Transactions”), one of our subsidiaries entered into a 20-year lease for the lands and premises constituting the Grand Villa Casino Burnaby, with one 10-year renewal term plus three 10-year option terms pursuant to an option agreement.

We have invested the majority of an approximately $14.2 million allocated to the expansion of the Grand Villa Casino Burnaby premises. We have completed the addition of 47 slot machines, up to ten table games (including four high-limit tables, four poker tables and two regular table games), an Atlas (replacing the EBO restaurant), the Bistro restaurant and a CHOW, along with improvements to the hotel.

We have a 10-year contract with Delta Hotels Limited to manage the Delta Hotel and Conference Centre located at the Grand Villa Casino Burnaby, or the Management Agreement, which expires in December 2019 and has two five-year renewal options. Under the Management Agreement, Delta Hotels Limited operates the hotel and manages the staff of the hotel. In addition, Delta Hotels Limited provides a reservation service and engages in various marketing activities. Pursuant to the terms of the Management Agreement, we pay a management fee for these services. We are in the process of negotiating an agreement to become a franchised property once a definitive franchise agreement is negotiated and takes effect.

Cascades Casino Langley

The Cascades Casino Langley is located in downtown Langley, British Columbia. With approximately $86.5 million invested since it was built in 2005 (as of September 30, 2018), the property offers a variety of gaming and non-gaming amenities, including several of our signature F&B amenities, hotel and spa accommodations and a convention space. Serving a growing area with a combined population of over 924,000 according to BC Stats, Cascades Casino Langley is situated 40 kilometers east of downtown Vancouver and within 16 kilometers of the Canada–U.S. border. Under the Sale and Leaseback Transactions, one of our subsidiaries entered into a 20-year lease for the lands and premises constituting the Cascades Casino Langley, with one 10-year renewal term plus three 10-year option terms pursuant to an option agreement.

The approximately 155,200 square foot Cascades Casino Langley offers approximately 54,100 square feet of gaming space, featuring 984 slot machines and 33 table games, including five poker tables, and 185 bingo seats.

In 2014, we completed a floor refresh and reinvention of our F&B offerings at Cascades Casino Langley that included, among other things, the addition of MATCH. During 2018, we expanded the MATCH patio and began an expansion of the property to increase gaming space and add an Atlas. The expansion is expected to be completed by the end of the second quarter of 2019.

7

Table of Contents

Cascades Casino Langley Coast Hotel & Convention Centre

We have a franchise agreement in place with Coast Hotels for the hotel located at the Cascades Casino Langley, or the Franchise Agreement. Under the Franchise Agreement, Coast Hotels provides franchise services, including identifying the hotel on its website, toll-free reservation services and participation in Coast Hotel marketing initiatives. However, unlike our arrangement with Delta Hotels Limited, the management of the hotel remains our exclusive responsibility. On October 12, 2015, the Franchise Agreement was automatically renewed on the same terms and conditions for an additional five years ending October 13, 2020. The Franchise Agreement will automatically renew for a further period of five years, provided that we are in compliance with terms of the Franchise Agreement and neither party elects to terminate the Franchise Agreement.

During 2018, we completed a refresh of the convention center and expect to complete hotel renovations in the fourth quarter of 2018.

Starlight Casino New Westminster

The Starlight Casino New Westminster features the latest gaming options in a contemporary property. As of September 30, 2018, approximately $138.7 million has been invested in the property since 2001 and we have completed various upgrades, including renovations to our high-limit table area in 2011 and 2014, and improvements to our onsite restaurants between 2014 and 2016. The Starlight Casino New Westminster is easily visible and accessible as it is situated 24 kilometers southeast of downtown Vancouver, beside the interchange of a major provincial highway and is in close proximity to Richmond, British Columbia (that has a high demographic of Asian patrons) and surrounding suburban areas. Under the Sale and Leaseback Transactions, one of our subsidiaries entered into a 20-year lease for the lands and premises constituting the Starlight Casino New Westminster, with one 10-year renewal term plus three 10-year option terms pursuant to an option agreement.

The approximately 164,700 square foot Starlight Casino New Westminster offers approximately 103,700 square feet of gaming space, which features best-in-class gaming equipment and entertainment amenities, and contains 934 slot machines and 59 table games, as well as several F&B outlets, including MATCH, The Buffet and the Red Bar Lounge.

Thompson-Okanagan Casinos

Cascades Casino Kamloops

The Cascades Casino Kamloops is located in Kamloops, British Columbia, the second largest city in the British Columbia interior according to BC Stats. Previously operating under the Lake City brand name, the Cascades Casino Kamloops was rebranded and relocated to its current location off Highway 1 in 2015. In its new location, the Cascades Casino Kamloops is part of a $51.0 million gaming and entertainment destination in Kamloops. The approximately 66,100 square foot property has approximately 33,900 square feet of gaming space, 442 slot machines and 16 table games, including two poker tables, as well as four F&B outlets (a MATCH, The Buffet, an Atlas and a Glacier Bar).

Playtime Casino Kelowna

The Playtime Casino Kelowna, formerly the Lake City Casino Kelowna, is located within the 257-room Delta Hotels Grand Okanagan Resort in Kelowna, British Columbia. According to BC Stats, Kelowna is the largest city in the British Columbia interior, and boasts a thriving tourism sector. In addition to its desirable location in the Grand Okanagan Resort, the Playtime Casino Kelowna benefits from its proximity to the Prospera Place, a 6,886 seat multi-purpose sporting and entertainment facility in downtown Kelowna. The approximately

8

Table of Contents

36,800 square foot property has approximately 26,000 square feet of gaming space, 437 slot machines and 16 table games, including four poker tables, as well as three F&B outlets and a Prestige Beach House hotel nearby. In March 2018, we completed an approximately $4.1 million renovation and F&B expansion, including a MATCH and The Buffet, and rebranded as a Playtime casino. The current lease at this site is due to expire on May 31, 2029 and has two five-year extension options.

Cascades Casino Penticton

The Cascades Casino Penticton, formerly the Lake City Casino Penticton, was relocated to the South Okanagan Events Centre in 2017. Construction on the new property started in May 2016, and the property opened in April 2017. The new, approximately 57,600 square foot property has approximately 32,500 square feet of gaming space, includes four F&B outlets (including MATCH and The Buffet), 400 slot machines and 11 table games, including one poker table. The current land lease at this site is due to expire on May 3, 2036 and has two approximately 10-year extension options.

Lake City Casino Vernon

The Lake City Casino Vernon is located in Vernon, British Columbia. The Lake City Casino Vernon was relocated to its current location in 2009, significantly increasing its size. In January 2014, we purchased the land on which the Lake City Casino Vernon is located. The current property is situated across the street from Vernon’s main shopping center and has good visibility and accessibility from Vernon’s principal highway. The approximately 32,000 square foot property consists of approximately 24,200 square feet of gaming space and includes 400 slot machines, 9 table games and three F&B outlets (a MATCH, The Buffet and a grab & go outlet).

CGCs

Our CGCs provide alternative gaming options, mainly in the form of slot machines, in smaller communities without casinos. In the Lower Mainland, we provide operational services for Chances Mission (Mission, British Columbia), Chances Squamish (Squamish, British Columbia), and Chances Abbotsford (Abbotsford, British Columbia). In the Vancouver Island region we provide operational services for Chances Campbell River (Campbell River, British Columbia), Chances Courtenay (Courtenay, British Columbia) and Playtime Gaming Victoria (Victoria, British Columbia). In total, our CGCs offer approximately 110,300 total square feet of space and 76,300 square feet of gaming space, accommodating 785 slot machines and 681 bingo seats.

We lease the premises for Chances Mission, which lease expires on September 30, 2019 with one remaining five-year extension option. Chances Squamish opened in January 2010. We lease the premises for Chances Squamish, which lease expires on January 30, 2030 and has two 20-year extension options. We lease the premises for Playtime Gaming Victoria, which lease expires on December 31, 2018. We expect that our operational services for bingo at the Playtime Gaming Victoria location will cease on December 31, 2018 upon the formal termination of our BOSA.

We invested approximately $7.5 million to expand Chances Courtenay and Chances Campbell River to add a MATCH and refresh the gaming floors.

Ontario Casinos

Western Fair District London Slots

The Western Fair District London Slots property is a slots property attached to a racetrack situated in London, Ontario, 190 kilometers from Windsor, Ontario (to the west) and the Greater Toronto Area (to the east). The approximately 78,100 square foot Western Fair District London Slots property is equipped with a new gaming management system, or GMS, 767 slot machines and approximately 54,300 square feet of gaming space.

9

Table of Contents

The large, open casino floor includes two F&B outlets (a full service casual Getaway Restaurant and a casino bar). The Western Fair District London Slots property also has over 220,000 square feet of convention space, a sports complex with four ice surfaces and a Yuk Yuks comedy club. Additionally, the Western Fair District hosts several large concert events in the racetrack facilities and is home of “The Western Fair”.

Pending OLG and the necessary government approvals, we have significant plans for investment in the London market. We expect to invest approximately $80.0 million to develop a new facility at a site we identified within the City of London. Based on management’s estimates, this full service entertainment property is expected to host over 40,000 square feet of gaming space (excluding back of house) with over 900 slot machines and 46 table games. Non-gaming amenities are expected to include a MATCH, an Atlas, The Buffet and a large casino bar. The lease at the current Western Fair site is due to expire on March 31, 2020 and has two five-year extension options.

Point Edward Casino

The Point Edward Casino is one of our four casinos in the Province of Ontario and is currently the only site in the Southwest Bundle that offers live table games. It is situated on the banks of the St. Clair River, across the U.S. border from Port Huron, Michigan, and is just three kilometers from downtown Sarnia, Ontario. As of September 30, 2018, the approximately 78,600 square foot Point Edward Casino has approximately 54,300 square feet of gaming space and is equipped with 484 slot machines, 13 table games, including two poker tables.

We invested approximately $25.9 million in the Point Edward market and major renovations of this property, which were recently completed. This site was rebranded as Starlight Casino Point Edward and a MATCH was opened in July 2018. Completed in November 2018, this full service entertainment property now hosts an expanded 24,000 square feet of gaming space (excluding back of house) with approximately 491 slot machines and 25 table games, including 3 poker tables. There are now three F&B outlets at the Point Edward Casino: MATCH, The Buffet and Nova Bar. A new GMS has been installed at the property.

Woodstock Raceway Slots

The Woodstock Raceway Slots property is a slots property attached to a racetrack, situated approximately 55 kilometers east of London, Ontario and 140 kilometers west of the Greater Toronto Area. The approximately 14,000 square foot property is equipped with a recently installed new GMS, 224 slot machines and approximately 12,300 square feet of gaming space and includes a small grab and go F&B outlet called The Getaway Express.

There is very little investment planned for this location in the immediate future. It is expected that this site will be rebranded as a Playtime Casino and the property will undergo minor renovations. The current lease at this site is due to expire on March 31, 2021.

Dresden Raceway Slots

The Dresden Raceway Slots property is a slots property attached to a racetrack, situated approximately 115 kilometers west of London, Ontario and 110 kilometers east of Windsor, Ontario. The approximately 14,000 square foot property is equipped with 154 slot machines and approximately 11,600 square feet of gaming space and includes a small grab and go F&B outlet called The Getaway Express.

We plan to relocate the existing gaming property within the same Municipality of Chatham-Kent, from Dresden to a newly built gaming and entertainment property, in an up-and-coming entertainment district with new restaurants, and a hotel and convention center. We expect to invest approximately $36.1 million in the new

10

Table of Contents

property. This site will be rebranded as the Cascades Casino Chatham and is expected to have over 17,400 square feet of gaming space (excluding back of house) with approximately 330 slot machines, based on management’s estimates, and table games along with a new GMS. Non-gaming amenities at this property are expected to include a MATCH, The Buffet, a grab & go outlet and a casino bar. Development of the new property began in July 2018 and is expected to be completed in the third quarter of 2019. The current lease at this site is due to expire on March 31, 2019.

Clinton Raceway Slots

The Clinton Raceway Slots property is a slots property attached to a racetrack, situated 80 kilometers northwest of London, Ontario. The approximately 14,700 square foot property is equipped with 123 slot machines and approximately 12,000 square feet of gaming space and includes a small grab and go F&B outlet called The Getaway Express.

It is expected that this site will be rebranded as a Playtime Casino. A new GMS system was installed in July 2018 and the property is currently undergoing a floor renovation and product refresh. The current lease at this site is due to expire on March 31, 2020 and has two five-year extension options.

Hanover Raceway Slots

The Hanover Raceway Slots property is a slots property attached to a racetrack, situated 105 kilometers northwest of Kitchener, Ontario and 60 kilometers south of Owen Sound, Ontario. The approximately 15,000 square foot property is equipped with 189 slot machines and approximately 13,600 square feet of gaming space. There are two F&B outlets, including the Coachman Restaurant and a casino bar.

Subject to OLG and the necessary government approvals, we plan to relocate the existing gaming property to an adjacent building. It is expected that this site will be rebranded as a Playtime Casino, a new GMS was installed in July 2018 and the property is currently undergoing renovations. We expect to invest approximately $18.0 million in the Hanover Raceway Slots. Work on the project began in July 2018 and is expected to be completed by the first quarter of 2019. The current lease at this site is due to expire on March 31, 2020.

Thunder Bay Casino

The Thunder Bay Casino, along with the Sault Ste. Marie Casino, is currently one of two sites in the North Ontario bundle that offers live table games. The approximately 46,500 square foot property is equipped with a recently installed new GMS, 450 slot machines and 11 table games, including two poker tables, and approximately 37,700 square feet of gaming space. There are two F&B outlets, including the full service casual Getaway Restaurant and a casino bar.

There is very little investment planned for this location in the immediate future. It is expected that this site will be rebranded as a Cascades Casino and the property will undergo minor renovations. Future plans may include conversion of the existing F&B outlet to a MATCH.

Sault Ste. Marie Casino

The Sault Ste. Marie Casino is one of our four casinos in the Province of Ontario and, along with the Thunder Bay Casino, is currently one of two sites in the North Ontario bundle that offers live table games. It is situated on the banks of the St. Mary’s River, minutes away from the shores of Lake Superior. The approximately 61,800 square foot property is equipped with 425 slot machines and 11 table games, including three poker tables, and approximately 51,700 square feet of gaming space. There are two F&B outlets, including the full service casual Getaway Restaurant and a casino bar.

11

Table of Contents

There is very little investment planned for this location in the immediate future. It is expected that this site will be rebranded as a Playtime Casino, a new GMS will be installed and the property will undergo minor renovations.

Sudbury Downs Slots

The Sudbury Downs Slots property is a slots property attached to a racetrack, situated 23 kilometers northwest of downtown Sudbury, Ontario in a small town called Chelmsford. The approximately 45,600 square foot property is equipped with 427 slot machines and approximately 33,000 square feet of gaming space and includes a small grab and go F&B outlet.

The lease at the current site is due to expire on March 31, 2020. In June 2017, we began the planning and approvals process for a multi-step, $55.5 million redevelopment and relocation of this property. We intend to relocate the existing gaming operation to a newly built gaming entertainment property located in Greater Sudbury and are in discussions with a landowner in Sudbury in respect of the acquisition and development of lands, which, subject to OLG and the necessary governmental approvals, will be located in the up-and-coming True North Strong entertainment district. While we have received initial municipal approval for the relocation of this property, an appeal of that decision has been filed in the Local Planning Appeal Tribunal by certain individuals and community groups which, if successful, would delay the proposed relocation pending further appeals or court challenges. Subject to extension by the tribunal, a first hearing is expected in summer 2019 with a decision due (at the earliest) by September 2019. There is no certainty over whether these individuals and community groups will be partially or wholly successful in obtaining the relief sought.

If relocation to the proposed site is approved, it is expected that this property will be branded as a Starlight Casino and have over 32,000 square feet of gaming space (excluding back of house) with approximately 600 slot machines and 21 table games along with a new GMS. Non-gaming amenities at this new Starlight Casino are expected to include a MATCH, a The Buffet, an Atlas and a casino bar.

See “Risk Factors—Risks Related to Acquisitions and Capital Projects—The expansion, rebranding and/or relocation of the Cascades Casino Langley, Chances Mission, Dresden Raceway Slots, Western Fair District London Slots, Sudbury Downs Slots, Hanover Raceway Slots and Gateway Innisfil may not be completed on a timely basis, on anticipated terms or at all.”

Gateway Innisfil

Located in the community of Innisfil, Ontario, approximately 15 kilometers south of Barrie, Ontario, the approximately 87,000 square foot Gateway Innisfil property, formerly the OLG Slots at Georgian Downs, opened in November 2001 and currently offers approximately 29,500 square feet of gaming space, featuring 989 slot machines, live harness racing, simulcast wagering and two F&B outlets. Gateway Innisfil is the smaller of the two existing properties in the Central Bundle; however, the maximum allowable positions for slots and table games is expected to increase to 1,200 and 100, respectively, pursuant to the OLG’s modernization plan.

Subject to OLG and necessary government approvals, we intend to renovate and rebrand the Gateway Innisfil property as a Cascades Casino, eventually increasing slot machines to over 1,100 later in the year and adding approximately 26 table games, based on management’s estimates. We also plan to upgrade the current GMS system at the site. Construction began in the fourth quarter of 2018 and is expected to be completed in the first quarter of 2019. Total capital expenditure at Gateway Innisfil is expected to be approximately $5.0 million, based on management’s estimates.

12

Table of Contents

Casino Rama Resort

Casino Rama Resort is the larger of the two existing Central Ontario properties. It is located on reserve lands of the Chippewas of Rama First Nation, approximately five kilometers from the Trans-Canada Highway 12 (north of Lake Simcoe, Ontario). The Casino Rama Resort property opened in July 1996. The approximately 813,000 square foot property currently offers approximately 172,000 square feet of gaming space, featuring 2,517 slot machines and 101 table games, including 10 poker tables. In addition to gaming operations, Casino Rama Resort has a 289-room hotel with amenities, a 5,000-seat entertainment venue and nine F&B outlets. A new GMS will be installed at the property.

We intend to maintain the Casino Rama Resort brand.

Edmonton Casinos

Grand Villa Casino Edmonton

The Grand Villa Casino Edmonton is located in the new ICE District (which is expected to include over 1,300 multi-family units in three preliminary residential towers by 2020) and is the sole casino in downtown Edmonton, Alberta. Adjacent to Rogers Place and accessible by light rail transit, we have invested approximately $38.2 million in this property to enhance our gaming and entertainment amenities. The approximately 62,600 square foot Grand Villa Casino Edmonton offers approximately 39,600 square feet of gaming space, including 522 slot machines and 28 table games. It has several F&B outlets, including MATCH and Atlas. The current lease at this site is due to expire on September 30, 2036.

Starlight Casino Edmonton

The Starlight Casino Edmonton is situated in the West Edmonton Mall located in Edmonton, Alberta. The West Edmonton Mall is one of the world’s largest shopping centers with 30.8 million visitors annually and 24,000 employees, which drives considerable gaming traffic to the Starlight Casino Edmonton.

In September of 2018, we completed a $69.9 million rebranding and redevelopment of the Starlight Casino Edmonton (formerly the Palace Casino Edmonton). The redeveloped Starlight Casino Edmonton is approximately 123,100 square feet, including an expanded gaming floor of approximately 68,200 square feet, and feature 765 slot machines, 40 table games, including eight poker tables, and an electronic table game area with 47 gaming positions, in addition to entertainment and six F&B outlets. The current lease at this site is due to expire on August 31, 2037.

Our Proposed New Builds

Delta, British Columbia

The BCLC announced on September 7, 2017 that we were authorized to relocate our existing license in Newton to a new casino in Delta, British Columbia, subject to municipal approval. The Delta city council held a number of public hearings on the matter, and the proposed project received final municipal approval in August 2018. In conjunction with a third-party hotel contractor, we expect to jointly invest approximately $75.0 million in the project, with us investing approximately $55.0 million. Based on management’s estimates, construction is expected to start in the first quarter of 2019, following final approval from the BCLC, and be completed in late 2020. Subject to BCLC final approval, the new property is expected to have approximately 40,000 square feet of gaming space, include multiple F&B outlets, approximately 500–600 slot machines and 30 table games, including six poker tables. We expect to engage a third party to build and operate a hotel at the property. The Delta property is expected to be branded a Cascades casino. We have entered into an option to lease and plan to enter into a 30-year lease with three 10-year renewal options that will commence once the construction starts.

13

Table of Contents

Kenora, Ontario

The City of Kenora is located in the far northwest corner of Ontario near the Manitoba border. There are no existing casinos within this market area. There are two major access routes to the area, Trans-Canada Highway 17 traversing through Kenora and King’s Highway 17A (Kenora By-Pass). Given Kenora’s unique location on the north shore of Lake of the Woods, it is also positioned to capture existing tourism to the region. Known as the premier boating community in North America, the Kenora District attracts over 700,000 visitors annually and 20,000 cottagers who are seasonal residents in the region in addition to approximately 15,000 full-time residents.

Subject to OLG, and necessary government approvals, we plan to build a new 19,000 square foot Playtime Casino in the Kenora area (Playtime Casino Kenora), with 6,200 square feet of gaming space, including 200 slot machines. We plan to install a MATCH overlooking the gaming floor. Playtime Kenora is anticipated to open in January 2020, with total capital expenditure expected to be approximately $21.0 million based on management’s estimates.

North Bay, Ontario

The City of North Bay, which does not have an existing gaming property, is the eastern-most location in the North Ontario bundle. It is located 125 kilometers from the property being proposed in Sudbury, Ontario and it is anticipated that the two properties will share a certain portion of their respective databases. Located 330 kilometers north of Toronto, Ontario, North Bay is situated on the north shore of Lake Nipissing. The City of North Bay contains approximately 56,000 eligible adult gamers, comprising 81% of the overall population.

Subject to OLG, and the necessary government approvals, we plan to construct a new 37,000 square foot Cascades Casino in North Bay, with approximately 14,100 square feet of gaming space, including 300 slot machines and 10 table games. We plan to install a MATCH, as well as a bar and The Buffet. Cascades North Bay is anticipated to open in the first quarter of 2020, with total capital expenditure expected to be approximately $31.3 million.

Wasaga Beach

There is currently no gaming property located in the Wasaga Beach gaming zone. The gaming zone covers parts or all of the communities of Collingwood, Ontario, Wasaga Beach, Ontario, Springwater, Ontario and Clearview, Ontario, with a combined regional adult population of approximately 33,000. Pursuant to the OLG’s modernization plan, allowable slot machine and table game positions for this gaming region are 300 and 120, respectively.

Subject to OLG and necessary government approvals, we intend to construct a Playtime property in Wasaga Beach, on the southern edge of Georgian Bay, including an expected 10,560 square foot gaming floor, 273 slot machines and 10 table games. Based on management’s estimates, the proposed Wasaga Beach property is also expected to include a MATCH and The Buffet. Management expects construction to begin in the first quarter of 2019 and the new property is expected to become operational in the third quarter of 2020. Based on management’s estimates, the total capital expenditure for our proposed Wasaga Beach property is expected to be approximately $30.0 million.

The preceding property descriptions discuss current and projected acquisitions. See “Risk Factors—Risks Related to Acquisitions and Capital Projects—While we intend to complete the gaming properties in Kenora, North Bay, Delta and Wasaga Beach on schedule, these properties may not be completed on a timely basis, on anticipated terms or at all due to unforeseen factors.”

14

Table of Contents

Our Anticipated Acquisitions

In the next six months, we expect to announce a share purchase agreement for the acquisition of entities holding title to, and providing operational and F&B services at, a gaming facility in British Columbia. The consideration payable under the share purchase agreement is expected to be $21.5 million, subject to standard adjustments. Subject to final approval from the BCLC and GPEB, the acquisition is expected to close in January 2019.

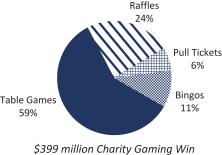

OUR INDUSTRY

The Canadian gaming market is comprised of casino gaming, lottery, online gaming and horse racing. We operate in the casino gaming segment, which consists of slots, table games and bingo. The casino gaming market in Canada is characterized by several unique features.

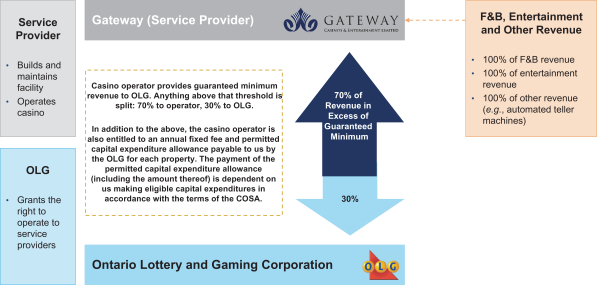

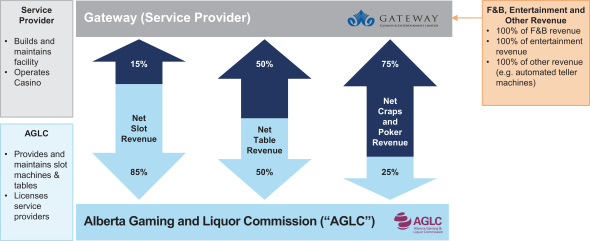

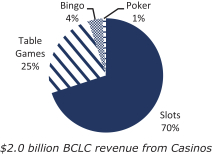

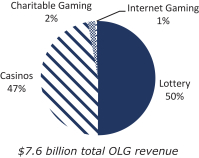

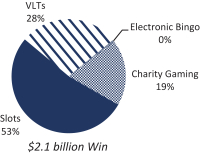

Public-Private Relationships Create a Stable Regulated Environment

In British Columbia, Ontario and Alberta, provincial Crown corporations (the BCLC, OLG and AGLC, which we collectively refer to as the Gaming Authorities) and regulatory bodies (the British Columbia Gaming Policy and Enforcement Branch, or GPEB, AGCO and AGLC, which we collectively refer to as the Gaming Regulators) oversee the gaming industry and license private service providers to operate casinos within each of their respective provinces. Casino gaming generates considerable revenue for the provinces and supports a wide range of local volunteer and community-based initiatives. As a result, provincial governments are significant stakeholders in the Canadian casino gaming industry, creating a mutually beneficial and collaborative relationship between public and private sector participants. During the fiscal year ended March 31, 2018, the provincial governments in British Columbia, Ontario, and Alberta earned the following profits from casino gaming operations:

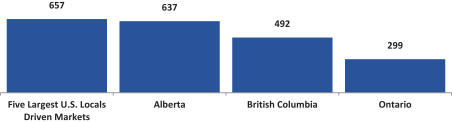

Casino Gaming Profits Attributable to the Province(1)

(in $ millions)

Source: BCLC, OLG & AGLC.

| Note: (1) | Represents BCLC net income for casino and community gaming segment (British Columbia), OLG net income plus Win contribution for Resort Casinos Segment and Slots and Casinos Segment (Ontario) which later became the Land-based Gaming Segment (Ontario) and AGLC gaming net operating result / contribution to the Alberta Lottery Fund (Alberta). |

In British Columbia and Alberta, the BCLC and AGLC, respectively, are responsible for providing and maintaining slot machines located within each private gaming service provider’s properties. To maximize revenue from these machines, policies have been created and implemented to manage competition between gaming properties. In Alberta, the AGLC has declared an indefinite moratorium on granting new casino licenses. In British Columbia, the BCLC, in conjunction with host local governments, controls the implementation of new gaming positions to ensure that markets are neither over saturated nor under served. In Ontario, the OLG manages competition by delineating geographic gaming zones in which only a single gaming property may be operated.

15

Table of Contents

These gaming zones have been grouped together into larger gaming bundles, where one service provider is granted the exclusive right to provide gaming services. New casino properties must also be approved at the municipal level. This process involves considerable consultation with the public, including one or more public hearings.

Long-Term Operating Agreements and Licenses Provide Visibility into Stable Future Operating Environment

The long-term operating agreements (in British Columbia and Ontario) and licenses (in Alberta) under which service providers are engaged by the Gaming Authorities are mutually beneficial for Gaming Authorities and service providers. Gaming Authorities benefit from long-term partnerships with reliable and experienced service providers that maintain high quality gaming properties and the ability to expand them to meet increases in market demand. Service providers benefit from a stable, long-term operating environment, which reduces property investment risk. The terms of the licenses and operating agreements also provide service providers with basic information necessary to forecast future gaming taxes, commissions and competitive conditions, which can be analyzed to develop effective future operating and investment strategies.

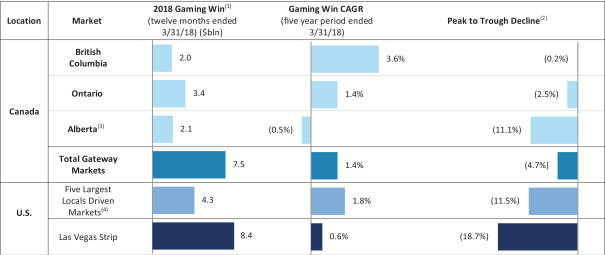

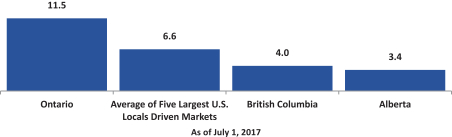

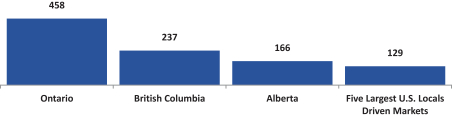

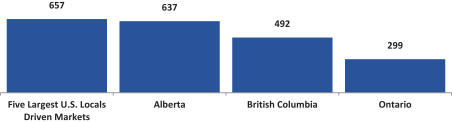

Gaming Markets in Canada Are Attractive and Resilient