UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-23384

(Exact name of registrant as specified in charter)

600 Steamboat Road, Suite 202

Greenwich, CT 06830

(Address of principal executive offices) (Zip code)

Thomas P. Majewski

c/o Eagle Point Income Company Inc.

600 Steamboat Road, Suite 202

Greenwich, CT 06830

(Name and address of agent for service)

Copies to

Thomas J. Friedmann

Philip

Hinkle

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston,

MA 02110

(617) 728-7120

Registrant’s telephone number, including area code: (203) 340-8500

Date of fiscal year end: December 31

Date

of reporting period:

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Report to Stockholders |

The Annual Report to stockholders of Eagle Point Income Company Inc. (the “Company”) for the year ended December 31, 2023 is filed herewith.

Eagle Point Income Company Inc.

Annual Report – December 31, 2023

Table of Contents

1

LETTER TO STOCKHOLDERS AND MANAGEMENT DISCUSSION OF COMPANY PERFORMANCE

February 22, 2024

Dear Fellow Stockholders:

We are pleased to provide you with the enclosed report of Eagle Point Income Company Inc. (“we,” “us,” “our” or the “Company”) for the fiscal year ended December 31, 2023.

The primary investment objective of the Company is to generate high current income, with a secondary objective to generate capital appreciation. We seek to achieve these objectives by investing primarily in junior debt tranches of collateralized loan obligations (“CLOs”) rated BB – including those rated BB+, BB or BB- – or their equivalent. In addition, the Company may invest up to 35% of its total assets in CLO equity securities and other securities and instruments that are consistent with our investment objectives.

The Company benefits from the specialized investment experience of Eagle Point Income Management LLC (“Eagle Point” or the “Adviser”), which applies its proprietary, private markets-style investment process to CLO investing. This process seeks to maximize returns while mitigating risks. We believe the scale and experience of our Adviser and its affiliates in CLO investing provides the Company with meaningful advantages.

The Company had an excellent 2023. The rising interest rate environment during the year was materially positive for our portfolio of mostly floating-rate CLO junior debt securities. For the year ended December 31, 2023, the Company had an increase in net assets resulting from operations (inclusive of unrealized mark-to-market gains) of $29.3 million, or $3.21 per weighted average common share.1 This represents a GAAP ROE of 25.93% during the year.2 From December 31, 2022 through December 31, 2023, the Company’s net asset value (“NAV”) per common share increased by 11% to $14.39 from $12.91.

As a result of our strong 2023 performance, the Company increased its monthly common distribution from $0.14 per share at the end of 2022 to $0.18 per share at the end of 2023. Additionally, the Company was pleased to increase its monthly common distribution again to $0.20 per share beginning in January 2024.

During 2023, we:

| ● | Generated strong GAAP net investment income (“NII”) less realized capital losses of $1.90 per weighted average common share in 2023. Excluding non-recurring items related to securities offerings and incurring Federal excise tax on our spillover income, our income of $2.08 per weighted average common share would have been above the $1.98 per share in regular monthly common distributions paid during the year. |

| ● | Increased our common distribution twice during the year to $0.18 per share. In addition, the Company declared an additional increase in our monthly common |

Past performance is not indicative of, or a guarantee of, future performance.

Please see page 11 for endnotes.

2

| distribution to $0.20 per share beginning in January 2024. Our current monthly distribution rate is equal to 250% of what was paid during the first quarter of 2021. |

| ● | Significantly increased recurring cash flows for the year to $29.0 million, or $3.17 per weighted average common share. This compares to recurring cash flows of $21.0 million, or $2.97 per weighted average common share, collected during 2022. Recurring cash flows received in 2023 exceeded our total expenses and regular common distributions by $0.17 per weighted average common share. |

| ● | Strengthened our balance sheet by issuing $34.3 million of 7.75% Series B Term Preferred Stock due in 2028 (the “Series B Term Preferred Stock”), with proceeds deployed opportunistically into new CLO debt and equity investments, as well as raising $42.5 million of additional common equity through our at-the-market (“ATM”) program and committed equity finance arrangement at a premium to NAV. |

While CLO junior debt remains a significant majority of the Company’s portfolio, the CLO equity exposure continued to help enhance the Company’s earnings ability. We believe CLOs, with their strong structural protections and self-correcting mechanisms, are well-positioned to weather periods of market volatility. In our view, the performance of our portfolio through volatility has demonstrated the resilience of the Company’s investment strategy.

Our portfolio’s strong performance in 2023 allowed the Company to pay cash distributions to shareholders of $1.98 per share, or 14.01% of our average stock price.

As of January 31, 2024, management’s unaudited estimate of the range of the Company’s NAV per common share was between $14.94 and $15.04. The midpoint of this range represents an increase of 4.2% compared to the NAV per common share as of December 31, 2023. As of February 15, 2024, we have $26.6 million in cash and available borrowing capacity on our balance sheet.

Company Overview

Common Stock

The Company’s common stock trades on the New York Stock Exchange (“NYSE”) under the symbol “EIC.” As of December 31, 2023, the NAV per share of the Company’s common stock was . The trading price of our common stock may, and often does, differ from NAV per share. The closing price per share of our common stock was on December 29, 2023, representing a premium to NAV per share as of year end.3

In connection with our at-the-market offering program and committed equity financing arrangement, the Company sold 3.1 million shares of common stock during the year for total net proceeds to the Company of approximately $42.5 million. The common stock issuance resulted in NAV accretion of $0.13 per share.

Past performance is not indicative of, or a guarantee of, future performance.

Please see page 11 for endnotes.

3

During 2023, through our usage of the ATM and committed equity financing programs, as well as the growth of our portfolio, we saw a significant enhancement in the liquidity of the Company’s common stock as the year progressed. This was evidenced by the increased average daily trading volume during the fourth quarter of 2023, which was nearly double the fourth quarter of 2022. With approximately 11 million outstanding common shares as of the end of 2023, the Company’s market cap as of December 31, 2023 of approximately $160 million was more than 40% greater than where it stood at the end of 2022.

The Company declared and paid nine monthly distributions of $0.16 per share of common stock from January 2023 through September 2023, and three monthly distributions of $0.18 per share of common stock from October 2023 through December 2023. The Company paid a total of $1.98 per common share of monthly distributions during 2023. Please note that the actual frequency, components and amount of such distributions are subject to variation over time.

At year-end, a shareholder who purchased common stock as part of our initial public offering (“IPO”) in July 2019 has received total cash distributions of $7.02 per share, over 35% of the IPO price. A portion of these distributions was comprised of a return of capital.4

As of January 31, 2024, the closing price per share of common stock was , reflecting a premium of compared to the midpoint of management’s unaudited and estimated NAV range of to as of January month-end.

We also highlight the Company’s dividend reinvestment plan (“DRIP”) for common stockholders. This plan allows common stockholders to have their distributions automatically reinvested into new shares of common stock. If the prevailing market price of our common stock exceeds our NAV per share, such reinvestment is at a discount (up to 5%) to the prevailing market price. If the prevailing market price of our common stock is less than our NAV per share, such reinvestment is at the prevailing market price, subject to the terms in the DRIP. We encourage all common stockholders to carefully review the terms of the plan. See “Dividend Reinvestment Plan” in the enclosed report.

Past performance is not indicative of, or a guarantee of, future performance.

Please see page 11 for endnotes.

4

Financing Solutions

In addition to our common stock, the Company has two preferred equity securities which trade on the NYSE, summarized below:

| Security | NYSE

Symbol |

Par

Amount Outstanding |

Rate | Payment

Frequency |

Callable | Maturity |

| EICA | $38.0 million | 5.00% | Monthly | Callable | October 2026 | |

| EICB | $34.3 million | 7.75% | Monthly | July 2025 | July 2028 |

The weighted average maturity on our preferred stock as of December 31, 2023 was approximately 3.7 years. In addition, all of our preferred stock financing is fixed rate, providing us with certainty in a dynamic rate environment.

As of December 31, 2023, we had $14.5 million in outstanding borrowings from the Company’s $25 million revolving credit facility. This, coupled with our preferred stock, represented leverage of 36% of total assets (less current liabilities). Over the long term, management expects the Company to operate under normal market conditions generally with leverage of between 25% and 35% of total assets (less current liabilities). Based on applicable market conditions at any given time, or should significant opportunities present themselves, the Company may incur leverage in excess of this amount, subject to applicable regulatory and contractual limits.

Past performance is not indicative of, or a guarantee of, future performance.

Please see page 11 for endnotes.

5

Portfolio Overview

2023 Portfolio Update

The secondary market was a key focus for our Adviser throughout 2023, as CLO secondary levels offered material discounts compared to most CLO primary opportunities. The Company benefited from an elevated rate environment as the base rates for floating rate CLO debt investments reached the highest levels observed in well over 15 years. As CLO prices appreciated throughout the year, the convexity in our CLO debt portfolio contributed significantly to the appreciation of the Company’s investments.

For the year ended December 31, 2023, the Company deployed $83.5 million in gross capital into CLO debt, CLO equity and other investments. The CLO debt had a weighted average expected yield (to maturity) of 12.47% at the time of purchase, while the CLO equity had a weighted average expected yield of 23.83% at the time of purchase.5 With essentially all of our CLO debt purchased at discounts, and due to the callable nature of most CLO debt tranches, there is potential for higher returns than the yield to maturity for most of those investments.

As of December 31, 2023, we had 91 CLO investments in our portfolio, the large majority of which are BB-rated (or the equivalent) CLO junior debt. At year-end, the weighted average effective yield on the aggregate portfolio of CLO debt and equity investments was 13.29%, based on amortized cost. This compares to 12.82% as of December 31, 2022.

During 2023, the Company received recurring cash flows of $29.0 million, or $3.17 per weighted average common share. This was a significant increase compared to our 2022 recurring cash flows, which totaled $21.0 million, or $2.97 per weighted average common share. Recurring cash flows received in 2023 exceeded total expenses and our regular common distribution by $0.17 per weighted average common share.

Included within the enclosed report, you will find detailed portfolio information, including certain look-through information related to the underlying collateral characteristics of the CLO investments that we held as of December 31, 2023.

Past performance is not indicative of, or a guarantee of, future performance.

Please see page 11 for endnotes.

6

Market Overview6

Loan Market

Despite a few periods of considerable volatility in 2023, the broadly syndicated loans (“BSL”) market capped off its strongest year since 2009. The Credit Suisse Leverage Loan Index7 (“CSLLI”) recorded a total return of 13.04% in 2023. Firming BSL prices, higher floating rate coupons, and below average loan default levels drove performance through most of the year, as demand from investors seeking yields amidst the higher-for-longer environment overshadowed intermittent risk-off periods during the year. From November into year-end, economic data pointed investors towards a “soft landing” – or even “no landing” – scenario, igniting a broad rally across debt markets, including broadly syndicated loans and CLOs.

Average BSL prices finished 2023 at 95.32. This is an increase from 91.89 at the beginning of the year, but still below pre-Ukraine war levels. As such, with a significant share of high-quality issuers still trading at discounted prices, we believe this represents a path to further upside. Additionally, markets like these allow CLO collateral managers to improve underlying loan portfolios through relative value swaps.

The trailing 12-month average default rate ended 2023 at 1.53%. This compares to 0.72% for 2022 but remains comfortably below the long-term average of 2.70%.8 The Fund’s underlying portfolio has a materially lower default exposure at only 0.55%. According to JP Morgan, default activity for December 2023 was the lowest since October 2022, highlighting that while higher costs are impacting many BSL issuers, their fundamentals are holding up well. Indeed, third quarter earnings show continued growth in issuers’ revenue and EBITDA, helping to offset the effects of rising rates.

Refinancing activity by BSL issuers increased on a year-over-year basis, accounting for over 58% of 2023’s new supply volume, compared to 26% in 2022. The 12-month trailing loan repayment rate increased to nearly 17.6% in December, its highest monthly level for the year. With only 7% of the outstanding loan market at year-end set to mature prior to 2026, the often-feared maturity wall has been pushed out: debt coming due in 2025 was cut down by 58% in 2023 to $83.1 billion, and 2026 maturities were reduced by 26% to $175 billion. Only 7.7% of the loan portfolios underlying our CLO equity positions mature prior to 2026.

For 2023, mutual funds and ETFs investing in U.S. leveraged loans experienced net outflows of $17 billion, compared to net outflows of $13 billion in 2022.9 The high-yield mutual fund/ETF market, by comparison, recorded $7 billion of net outflows in 2023 after recording $49 billion of net outflows in 2022. While these are significant sums of money, they represent a small fraction of the overall $1.4 trillion BSL market.

A notable dynamic that picked up steam during the second half of the year was the trend of stressed BSLs being prepaid and refinanced into new facilities from private credit funds and business development companies (“BDCs”). Due to the sheer amount of capital raised for private credit, we even saw CCC-rated loans getting paid off at par as companies refinanced their BSL debt in the private credit market. The prepayment of CCC-rated loans allows reinvesting CLOs

Past performance is not indicative of, or a guarantee of, future performance.

Please see page 11 for endnotes.

7

to redeploy capital into higher quality discounted loan issues. This has been a good trend for CLOs and if it continues into 2024, as we expect, the potential reduction of tail risk is net positive for CLOs. Overall, private credit managers refinanced around $16 billion of BSLs in 2023, according to LCD Pitchbook.

CLO Market

The CLO market saw $116 billion of new CLO issuance in 2023, according to LCD Pitchbook. Wide liability spreads and a generally unattractive CLO equity arbitrage did little to deter the less economically sensitive captive CLO funds from issuing CLOs. We believe due to the misalignment of incentive, many CLO issuers with captive CLO funds are willing to accept suboptimal CLO equity returns in order to generate new fee streams for themselves. Of the 208 new BSL CLOs issued during the year, we estimate over 80% were supported by captive CLO funds, while economically sensitive investors like our Adviser focused on the attractive opportunities in the secondary market.

CLO refinancing and reset volumes declined in 2023. Of the $24.6 billion in refinancings and resets across 57 transactions in 2023, $14.7 billion occurred in the last three months of the year, per LCD Pitchbook data, as CLO debt spreads tightened with the year-end rally.

By the end of 2023, CLO BB discount margins averaged approximately 783 basis points over the secured overnight financing rate (“SOFR”), a tightening of 148 basis points since the end of 2022. With average CLO BB prices at 92.5 points, we believe there continues to be further upside to the Company’s portfolio.

Additional Information

In addition to the Company’s regulatory requirement to file certain quarterly and annual portfolio information as described further in the enclosed report, the Company makes certain unaudited portfolio information available each month on its website in addition to making certain other unaudited financial information available on its website (www.eaglepointincome.com). This information includes (1) an estimated range of the Company’s NII and realized capital gains or losses per share of common stock for each calendar quarter end, generally made available within the first fifteen days after the applicable calendar month end, (2) an estimated range of the Company’s NAV per share of common stock for the prior month end and certain additional portfolio-level information, generally made available within the first fifteen days after the applicable calendar month end, and (3) during the latter part of each month, an updated estimate of the Company’s NAV per share of common stock, if applicable, and, with respect to each calendar quarter end, an updated estimate of the Company’s NII and realized capital gains or losses per share for the applicable quarter, if available.

Subsequent Developments

Management’s unaudited estimate of the range of the Company’s NAV per share of common stock was between $14.94 and $15.04 as of January 31, 2024. The midpoint of this range

Past performance is not indicative of, or a guarantee of, future performance.

Please see page 11 for endnotes.

8

represents an increase of 4.2% compared to the NAV per common share as of December 31, 2023.

On January 31, 2024, the Company paid a monthly distribution of $0.20 per common share to stockholders of record on January 11, 2024. Additionally, and as previously announced, the Company declared distributions of $0.20 per share of common stock payable on each of February 29, 2024 and March 28, 2024 to holders of record on February 9, 2024 and March 8, 2024, respectively. Additionally, on February 13, 2024, the Company declared three separate distributions of $0.20 per share on its common stock. The distributions are payable on each of April 30, 2024, May 31, 2024 and June 28, 2024 to holders of record as of April 10, 2024, May 13, 2024 and June 10, 2024, respectively.

On January 31, 2024, the Company paid a monthly distribution of $0.104167 per share of the Company’s 5.00% Series A Term Preferred Stock due 2026 (the “Series A Term Preferred Stock”) to holders of record on January 11, 2024. Additionally, and as previously announced, the Company declared distributions of $0.104167 per share on Series A Term Preferred Stock, payable on each of February 29, 2024 and March 28, 2024 to holders of record on February 9, 2024 and March 8, 2024, respectively. Additionally, on February 13, 2024, the Company declared three separate distributions of $0.104167 per share on its Series A Preferred Stock. The distributions are payable on each of April 30, 2024, May 31, 2024 and June 28, 2024 to holders of record as of April 10, 2024, May 13, 2024 and June 10, 2024, respectively.

On January 31, 2024, the Company paid a monthly distribution of $0.161459 per share of the Company’s Series B Term Preferred Stock to holders of record on January 11, 2024. Additionally, and as previously announced, the Company declared distributions of $0.161459 per share on Series B Term Preferred Stock, payable on each of February 29, 2024 and March 28, 2024 to holders of record on February 9, 2024 and March 8, 2024, respectively. Additionally, on February 13, 2024, the Company declared three separate distributions of $0.161459 per share on its Series B Preferred Stock. The distributions are payable on each of April 30, 2024, May 31, 2024 and June 28, 2024 to holders of record as of April 10, 2024, May 13, 2024 and June 10, 2024, respectively.

In the period from January 1, 2024 through February 15, 2024, the Company received cash distributions on its investment portfolio of $10.3 million. During that same period, the Company made net new investments totaling $8.9 million. As of February 15, 2024, the Company had $26.6 million of cash available for investment, inclusive of undrawn amounts on our revolving credit facility.

* * * * *

Management remains keenly focused on continuing to create value for our stockholders. We appreciate the trust and confidence our fellow stockholders have placed in the Company.

Past performance is not indicative of, or a guarantee of, future performance.

Please see page 11 for endnotes.

9

Thomas Majewski

Chairman and Chief Executive Officer

This letter is intended to assist stockholders in understanding the Company’s performance during the twelve months ended December 31, 2023. The views and opinions in this letter were current as of February 15, 2024. Statements other than those of historical facts included herein may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors. The Company undertakes no duty to update any forward-looking statement made herein. Information contained on our website is not incorporated by reference into this stockholder letter and you should not consider information contained on our website to be part of this stockholder letter or any other report we file with the Securities and Exchange Commission.

Past performance is not indicative of, or a guarantee of, future performance.

Please see page 11 for endnotes.

10

ABOUT OUR ADVISER

Eagle Point Income Management LLC is a specialist asset manager focused exclusively on investing in CLO securities and related investments. As of December 31, 2023, our Adviser has approximately $9.1 billion of assets under management (inclusive of undrawn capital commitments).10

Notes

| 1 | “Weighted average common share” is calculated based on the average daily number of shares of common stock outstanding during the period and “per common share” refers to per share of the Company’s common stock. |

| 2 | Return on our common equity reflects the Company’s cumulative monthly performance net of applicable expenses and fees measured against beginning capital adjusted for any common equity issued during the period. |

| 3 | An investment company trades at a premium when the market price at which its common shares trade is more than its net asset value per common share. Alternatively, an investment company trades at a discount when the market price at which its common shares trade is less than its net asset value per common share. |

| 4 | To date, a portion of common stock distributions has been estimated to be a return of capital as noted under the Tax Information section on the Company’s website. The actual components of the Company's distributions for U.S. tax reporting purposes can only be finally determined as of the end of each fiscal year of the Company and are thereafter reported on Form 1099-DIV. A distribution comprised in whole or in part by a return of capital does not necessarily reflect the Company’s investment performance and should not be confused with “yield” or “income”. Future distributions may consist of a return of capital. Not a guarantee of future distributions or yield. |

| 5 | Weighted average effective yield is based on an investment’s amortized cost and expected future cash flows whereas weighted average expected yield is based on an investment’s fair market value and expected future cash flows as of the applicable period end as disclosed in the Company’s financial statements, which is subject to change from period to period. |

| 6 | JPMorgan Chase & Co.; S&P Capital IQ; Pitchbook LCD; Credit Suisse |

| 7 | The CSLLI tracks the investable universe of the US dollar-denominated leveraged loan market. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. |

| 8 | “Par-weighted default rate” represents the rate of obligors who fail to remain current on their loans based on the par amount. |

| 9 | JPMorgan Chase & Co. North American Credit Research – JPM High Yield and Leveraged Loan Research (cumulative 2023 reports). |

| 10 | Calculated in the aggregate with its affiliate Eagle Point Credit Management LLC and certain other affiliated advisers. |

Past performance is not indicative of, or a guarantee of, future performance.

11

Page Intentionally Left Blank

12

Important Information about this Report and Eagle Point Income Company Inc.

This report is transmitted to the stockholders of Eagle Point Income Company Inc. (“we”, “us”, “our” or the “Company”) and is furnished pursuant to certain regulatory requirements. This report and the information and views herein do not constitute investment advice, or a recommendation or an offer to enter into any transaction with the Company or any of its affiliates. This report is provided for informational purposes only, does not constitute an offer to sell securities of the Company and is not a prospectus. From time to time, the Company may have a registration statement relating to one or more of its securities on file with the US Securities and Exchange Commission (“SEC”). Any registration statement that has not yet been declared effective by the SEC, and any prospectus relating thereto, is not complete and may be changed. Any securities that are the subject of such a registration statement may not be sold until the registration statement filed with the SEC is effective.

The information and its contents are the property of Eagle Point Income Management LLC (the “Adviser”) and/or the Company. Any unauthorized dissemination, copying or use of this presentation is strictly prohibited and may be in violation of law. This presentation is being provided for informational purposes only.

Investors should read the Company’s prospectus and SEC filings (which are publicly available on the EDGAR Database on the SEC website at http://www.sec.gov) carefully and consider their investment goals, time horizons and risk tolerance before investing in the Company. Investors should consider the Company’s investment objectives, risks, charges and expenses carefully before investing in securities of the Company. There is no guarantee that any of the goals, targets or objectives described in this report will be achieved.

An investment in the Company is not appropriate for all investors. The investment program of the Company is speculative, entails substantial risk and includes investment techniques not employed by traditional mutual funds. An investment in the Company is not intended to be a complete investment program. Shares of closed-end investment companies, such as the Company, frequently trade at a discount from their net asset value (“NAV”), which may increase investors’ risk of loss. Past performance is not indicative of, or a guarantee of, future performance. The performance and certain other portfolio information quoted herein represents information as of December 31, 2023. Nothing herein should be relied upon as a representation as to the future performance or portfolio holdings of the Company. Investment return and principal value of an investment will fluctuate, and shares, when sold, may be worth more or less than their original cost. The Company’s performance is subject to change since the end of the period noted in this report and may be lower or higher than the performance data shown herein.

Neither the Adviser nor the Company provide legal, accounting or tax advice. Any statement regarding such matters is explanatory and may not be relied upon as definitive advice. Investors should consult with their legal, accounting and tax advisors regarding any potential investment. The information presented herein is as of the dates noted herein and is derived from financial and other information of the Company, and, in certain cases, from third party sources and reports (including reports of third party custodians, CLO managers and trustees) that have not been independently verified by the Company. As noted herein, certain of this information is estimated and unaudited, and therefore subject to change. We do not represent that such information is accurate or complete, and it should not be relied upon as such.

Eagle Point Income Company Inc.

The following information in this annual report is a summary of certain changes during the fiscal year ended December 31, 2023. This information may not reflect all of the changes that have occurred since you purchased shares of our common stock.

During the applicable period, there have been: (i) no material changes to the Company’s investment objectives and policies that have not been approved by shareholders, (ii) no material changes to the Company’s principal risks, (iii) no changes to the persons primarily responsible for day-to-day management of the Company; and (iv) no changes to the Company’s charter or bylaws that would delay or prevent a change of control of the Company.

Investment Objectives and Strategies

We are an externally managed, diversified closed-end management investment company that has registered as an investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). We have elected to be treated, and intend to qualify annually, as a regulated investment company, or “RIC,” under Subchapter M of the Internal Revenue Code of 1986, as amended, or the “Code,” beginning with our tax year ended December 31, 2018. We were formed on September 28, 2018

13

as EP Income Company LLC, a Delaware limited liability company, and converted into a Delaware corporation on October 16, 2018.

Our primary investment objective is to generate high current income, with a secondary objective to generate capital appreciation. We seek to achieve our investment objectives by investing primarily in junior debt tranches of CLOs, that are collateralized by a portfolio consisting primarily of below investment grade U.S. senior secured loans with a large number of distinct underlying borrowers across various industry sectors. We focus on CLO debt tranches rated “BB” (e.g., BB+, BB or BB-, or their equivalent) by Moody’s Investors Service, Inc., or “Moody’s,” Standard & Poor’s, or “S&P,” or Fitch Ratings, Inc., or “Fitch,” and/or other applicable nationally recognized statistical rating organizations. We may also invest in other junior debt tranches of CLOs, loan accumulation facilities, senior debt tranches of CLOs and other related securities and instruments, including synthetic investments, such as significant risk transfer securities and credit risk transfer securities issued by banks or other financial institutions. In addition, we may invest up to 35% of our total assets (at the time of investment) in CLO equity securities. We expect our investments in CLO equity securities to primarily reflect minority ownership positions. We may also invest in other securities and instruments that the Adviser believes are consistent with our investment objectives such as securities issued by other securitization vehicles, such as collateralized bond obligations or “CBOs”. The amount that we will invest in other securities and instruments, which may include investments in debt and other securities issued by CLOs collateralized by non-U.S. loans or securities of other collective investment vehicles, will vary from time to time and, as such, may constitute a material part of our portfolio on any given date, all as based on the Adviser’s assessment of prevailing market conditions. The CLO securities in which we primarily seek to invest are rated below investment grade or, in the case of CLO equity securities, are unrated and are considered speculative with respect to timely payment of interest and repayment of principal. Below investment grade and unrated securities are also sometimes referred to as “junk” securities.

These investment objectives are not fundamental policies of ours and may be changed by our board of directors without prior approval of our stockholders.

Investment Restrictions

Our investment objectives and our investment policies and strategies, except for the eight investment restrictions designated as fundamental policies under this caption, are not fundamental and may be changed by the board of directors without stockholder approval.

The following eight investment restrictions are designated as fundamental policies and, as such, cannot be changed without the approval of the holders of a majority of our outstanding voting securities:

| 1. | We may not borrow money, except as permitted by (i) the 1940 Act, or interpretations or modifications by the SEC, SEC staff or other authority with appropriate jurisdiction, or (ii) exemptive or other relief or permission from the SEC, SEC staff or other authority with appropriate jurisdiction; |

| 2. | We may not engage in the business of underwriting securities issued by others, except to the extent that we may be deemed to be an underwriter in connection with the disposition of portfolio securities; |

| 3. | We may not purchase or sell physical commodities or contracts for the purchase or sale of physical commodities. Physical commodities do not include futures contracts with respect to securities, securities indices, currency or other financial instruments; |

| 4. | We may not purchase or sell real estate, which term does not include securities of companies which deal in real estate or mortgages or investments secured by real estate or interests therein, except that we reserve freedom of action to hold and to sell real estate acquired as a result of our ownership of securities; |

| 5. | We may not make loans, except to the extent permitted by (i) the 1940 Act, or interpretations or modifications by the SEC, SEC staff or other authority with appropriate jurisdiction, or (ii) exemptive or other relief or permission from the SEC, SEC staff or other authority with appropriate jurisdiction. For purposes of this investment restriction, the purchase of debt obligations (including acquisitions of loans, loan participations or other forms of debt instruments) shall not constitute loans by us; |

| 6. | We may not issue senior securities, except to the extent permitted by (i) the 1940 Act, or interpretations or modifications by the SEC, the SEC staff or other authority with appropriate jurisdiction, or (ii) exemptive or other relief or permission from the SEC, SEC staff or other authority with appropriate jurisdiction; |

| 7. | We may not invest in any security if as a result of such investment, 25% or more of the value of our total assets, taken at market value at the time of each investment, are in the securities of issuers in any particular industry or group of |

14

| industries except (a) securities issued or guaranteed by the U.S. government and its agencies and instrumentalities or tax-exempt securities of state and municipal governments or their political subdivisions (however, not including private purpose industrial development bonds issued on behalf of non-government issuers), or (b) as otherwise provided by the 1940 Act, as amended from time to time, and as modified or supplemented from time to time by (i) the rules and regulations promulgated by the SEC under the 1940 Act, as amended from time to time, and (ii) any exemption or other relief applicable to us from the provisions of the 1940 Act, as amended from time to time. For purposes of this restriction, in the case of investments in loan participations between us and a bank or other lending institution participating out the loan, we will treat both the lending bank or other lending institution and the borrower as “issuers.” For purposes of this restriction, an investment in a CLO, collateralized bond obligation, collateralized debt obligation or a swap or other derivative will be considered to be an investment in the industry or group of industries (if any) of the underlying or reference security, instrument or asset; and |

| 8. | We may not engage in short sales, purchases on margin, or the writing of put or call options, except as permitted by (i) the 1940 Act, or interpretations or modifications by the SEC, SEC staff or other authority with appropriate jurisdiction or (ii) exemptive or other relief or permission from the SEC, SEC staff or other authority with appropriate jurisdiction. |

The latter part of certain of our fundamental investment restrictions (i.e., the references to “except to the extent permitted by (i) the 1940 Act, or interpretations or modifications by the SEC, the SEC staff or other authority with appropriate jurisdiction, or (ii) exemptive or other relief or permission from the SEC, SEC staff or other authority with appropriate jurisdiction”) provides us with flexibility to change our limitations in connection with changes in applicable law, rules, regulations or exemptive relief. The language used in these restrictions provides the necessary flexibility to allow our board of directors to respond efficiently to these kinds of developments without the delay and expense of a stockholder meeting.

Whenever an investment policy or investment restriction set forth in this report or in our prospectus states a maximum percentage of assets that may be invested in any security or other asset, or describes a policy regarding quality standards, such percentage limitation or standard shall be determined immediately after and as a result of our acquisition of such security or asset. Accordingly, any later increase or decrease resulting from a change in values, assets or other circumstances or any subsequent rating change made by a rating agency (or as determined by the Adviser if the security is not rated by a rating agency) will not compel us to dispose of such security or other asset. Notwithstanding the foregoing, we must always be in compliance with the borrowing policies set forth above.

Use of Leverage and Leverage Risks

The use of leverage, whether directly through borrowing under a revolving credit facility with BNP Paribas (the “Credit Facility”) or the issuance of the Series A Term Preferred Stock and Series B Term Preferred Stock, or indirectly through investments such as CLO junior debt and equity securities that inherently involve leverage, may magnify our risk of loss. CLO junior debt and equity securities are very highly leveraged (with CLO equity securities typically being leveraged ten times), and therefore the CLO securities in which we invest are subject to a higher degree of loss since the use of leverage magnifies losses.

We have incurred leverage by issuing preferred stock and incurring indebtedness for borrowed money. We may incur additional leverage, directly or indirectly, through one or more special purpose vehicles, indebtedness for borrowed money, as well as leverage in the form of derivative transactions, additional shares of preferred stock, debt securities and other structures and instruments, in significant amounts and on terms that the Adviser and our board of directors deem appropriate, subject to applicable limitations under the 1940 Act. Such leverage may be used for the acquisition and financing of our investments, to pay fees and expenses and for other purposes. Such leverage may be secured and/or unsecured. The more leverage we employ, the more likely a substantial change will occur in our NAV. Accordingly, any event that adversely affects the value of an investment would be magnified to the extent leverage is utilized. The cumulative effect of the use of leverage with respect to any investments in a market that moves adversely to such investments could result in a substantial loss that would be greater than if our investments were not leveraged.

The following table is intended to illustrate the effect of the use of direct leverage on returns from an investment in our common stock assuming various annual returns, net of expenses. The calculations in the table below are hypothetical and actual returns may be higher or lower than those appearing in the table below.

15

| Assumed Return on Our Portfolio (Net of Expenses) | -10% | -5% | 0% | 5% | 10% |

| Corresponding return to common stockholder(1) | - |

- |

- |

| (1) |

Based on our assumed leverage described above, our investment portfolio would have been required to experience an annual return of at least 2.41% to cover annual interest payments on our outstanding indebtedness and preferred equity.

Principal Risk Factors

For a description of the principal risk factors associated with an investment in the Company, please refer to Note 3 to the Financial Statements, “Investments – Investment Risk Factors”).

Additional Information

The Company makes certain unaudited portfolio information available each month on its website in addition to making certain other unaudited financial information available on its website (www.eaglepointincome.com). This information includes (1) an estimated range of the Company’s net investment income (“NII”) and realized capital gains or losses per weighted average share of common stock for each calendar quarter end, generally made available within the first fifteen days after the applicable calendar month end, (2) an estimated range of the Company’s NAV per share of common stock for the prior month end and certain additional portfolio-level information, generally made available within the first fifteen days after the applicable calendar month end, and (3) during the latter part of each month, an updated estimate of NAV, if applicable, and, with respect to each calendar quarter end, an updated estimate of the Company’s NII and realized capital gains or losses for the applicable quarter, if available.

Information contained on our website is not incorporated by reference into this Annual Report and you should not consider information contained on our website to be part of this Annual Report or any other report we file with the SEC.

Forward-Looking Statements

This report may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical facts included in this report may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described in the Company’s filings with the SEC. The Company undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this report.

16

Performance Data1,2

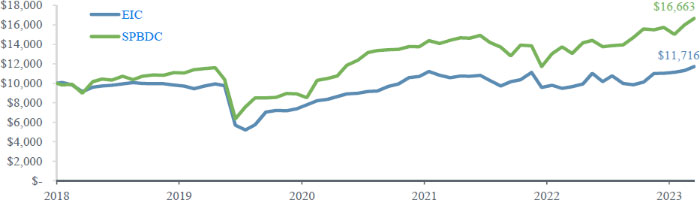

The following graph shows the market price performance of a $10,000 investment in the Company’s common shares for the period from October 16, 2018 (inception) through December 31, 2023. The performance calculation assumes the purchase of Company shares at net asset value for the beginning of the period (prior to the Company’s public listing) and the sale of Company shares at the market price at the end of the period. Ending value for each year are as of December 31 of the applicable year. As the Company’s IPO occurred in July 2019, the value used for the Company’s performance as of December 31, 2018 reflects the Company’s then-current net asset value per share. For comparative purposes, the performance of a relevant third-party securities market index, the S&P BDC Index, is shown. Distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Company’s dividend reinvestment plan. The performance does not reflect brokerage commissions in connection with the purchase or sale of Company shares, which if included would lower the performance shown. Returns do not reflect the deduction of taxes that a shareholder would pay on Company distributions or the sale of Company shares.

Past performance is not indicative of, or a guarantee of, future performance. Future results may vary and may be higher or lower than the data shown.

| Value of $10,000 Invested |

| Average Annualized Total Return | Cumulative Returns | |||

| 1 year | 5 year | Since Inception | Since Inception | |

| EIC | 21.37% | 5.09% | 3.09% | 17.16% |

| S&P BDC Index | 27.58% | 13.16% | 10.31% | 66.63% |

17

Summary of Certain Unaudited Portfolio Characteristics

The information presented below is on a look–through basis to the collateralized loan obligation, or “CLO”, investments held by the Company as of December 31, 2023 (except as otherwise noted) and reflects the aggregate underlying exposure of the Company based on the portfolios of those investments. The data is estimated and unaudited and is derived from CLO trustee reports received by the Company relating to December 2023 and from custody statements and/or other information received from CLO collateral managers, or other third party sources.

| Summary of Portfolio Investments (as of 12/31/2023)3 |

|

Cash and Borrowing Capacity: $11.4 million3 |

| Summary of Underlying Portfolio Characteristics (as of 12/31/2023)4 | |

| Number of Unique Underlying Loan Obligors | 1,419 |

| Largest Exposure to an Individual Obligor | 0.73% |

| Average Individual Loan Obligor Exposure | 0.07% |

| Top 10 Loan Obligors Exposure | 5.57% |

| Currency: USD Exposure | 100.00% |

| Indirect Exposure to Senior Secured Loans5 | 97.59% |

| Weighted Average OC Cushion Senior to the Security6 | 4.34% |

| Weighted Average Market Value of Loan Collateral | 96.25% |

| Weighted Average Stated Loan Spread | 3.76% |

| Weighted Average Loan Rating7 | B+/B |

| Weighted Average Loan Maturity | 4.2 years |

| Weighted Average Remaining CLO Reinvestment Period | 1.2 years |

18

| Top 10 Underlying Obligors4 |

| Obligor | % of Total |

| Asurion | 0.7% |

| Numericable | 0.6% |

| Cablevision | 0.6% |

| Ineos | 0.6% |

| Medline Industries | 0.6% |

| Virgin Media | 0.5% |

| Athenahealth | 0.5% |

| Centurylink | 0.5% |

| Transdigm | 0.5% |

| Ultimate Software Group | 0.5% |

| Total | 5.6% |

| Top 10 Industries of Underlying Obligors4,8,9 |

| Industry | % of Total | |

| Technology: Software & Services | 11.1% | |

| Media | 6.5% | |

| Health Care Providers & Services | 5.6% | |

| Hotels, Restaurants & Leisure | 4.3% | |

| Diversified Telecommunications Services | 4.0% | |

| Commercial Services & Supplies | 3.9% | |

| Diversified Financial Services | 3.8% | |

| Insurance | 3.4% | |

| Chemicals | 3.2% | |

| Technology: Hardware & Equipment | 3.0% | |

| Total | 48.8% | |

| Rating Distribution of Underlying Obligors4,7 |

|

| Maturity Distribution of Underlying Obligors4 |

|

19

Notes

| 1 | Based on the market price. Prices for October 16, 2018 (inception date) and December 31, 2018 represent the Net Asset Value (“NAV”) per share. |

| 2 | The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. The indices shown herein have not been selected to represent a benchmark for a strategy’s performance, but are instead disclosed to allow for comparison of the Company’s returns to that of known, recognized and/or similar indices. The S&P BDC Index is intended to measure the performance of all Business Development Companies (BDCs) that are listed on the NYSE or NASDAQ and satisfy market capitalization and other eligibility requirements. Although EIC is not a BDC, BDCs generally invest in high yielding credit investments, as does EIC. In addition, similar to EIC, BDCs generally elect to be classified as a regulated investment company under the U.S. Internal Revenue Code of 1986, as amended, which generally requires an investment company to distribute its taxable income to shareholders. |

| 3 | The summary of portfolio investments shown is based on the estimated fair value of the underlying positions as of December 31, 2023. Cash and borrowing capacity represents cash net of pending trade settlements and includes available capacity on the Company’s credit facility as of December 31, 2023. Borrowings under the credit facility are subject to applicable regulatory and contractual limits. |

| 4 | The information presented herein is on a look-through basis to the collateralized loan obligation, or “CLO,” and other related investments held by the Company as of December 31, 2023 (except as otherwise noted) and reflects the aggregate underlying exposure of the Company based on the portfolios of those investments. The data is estimated and unaudited and is derived from CLO trustee reports received by the Company relating to December 2023 and from custody statements and/or other information received from CLO collateral managers and other third-party sources. Information relating to the market price of underlying collateral is as of month end; however, with respect to other information shown, depending on when such information was received, the data may reflect a lag in the information reported. As such, while this information was obtained from third party data sources, December 2023 trustee reports and similar reports, other than market price, it does not reflect actual underlying portfolio characteristics as of December 31, 2023 and this data may not be representative of current or future holdings. The Weighted Average Remaining Reinvestment Period information is based on the fair value of CLO equity and debt investments held by the Company at the end of the reporting period. |

| 5 | Data represents aggregate indirect exposure. We obtain exposure in underlying senior secured loans indirectly through our CLO and related investments. |

| 6 | The weighted average OC cushion senior to the security is calculated using the BBB OC cushion for all BB-rated CLO debt securities in the portfolio and the BB OC cushion for all other securities in the portfolio, in each case as held on December 31, 2023. |

| 7 | Credit ratings shown are based on those assigned by Standard & Poor’s Rating Group, or “S&P,” or, for comparison and informational purposes, if S&P does not assign a rating to a particular obligor, the weighted average rating shown reflects the S&P equivalent rating of a rating agency that rated the obligor provided that such other rating is available with respect to a CLO or related investment held by us. In the event multiple ratings are available, the lowest S&P rating, or if there is no S&P rating, the lowest equivalent rating, is used. The ratings of specific borrowings by an obligor may differ from the rating assigned to the obligor and may differ among rating agencies. For certain obligors, no rating is available in the reports received by the Company. Such obligors are not shown in the graphs and, accordingly, the sum of the percentages in the graphs may not equal 100%. Ratings below BBB- are below investment grade. Further information regarding S&P’s rating methodology and definitions may be found on its website (www.standardandpoors.com). |

| 8 | Industry categories are based on the S&P industry categorization of each obligor as reported in CLO trustee reports to the extent so reported. Certain CLO trustee reports do not report the industry category of all of the underlying obligors and where such information is not reported, it is not included in the summary look-through industry information shown. As such, the Company’s exposure to a particular industry may be higher than that shown if industry categories were available for all underlying obligors. In addition, certain underlying obligors may be re-classified from time to time based on developments in their respective businesses and/or market practices. Accordingly, certain underlying borrowers that are currently, or were previously, summarized as a single borrower in a particular industry may in current or future periods be reflected as multiple borrowers or in a different industry, as applicable. |

| 9 | Certain CLO trustee reports do not provide the industry classification for certain underlying obligors. These obligors are not summarized in the look-through industry data shown; if they were reflected, they would represent 7.2%. |

20

Fees and Expenses (unaudited)

The following table is intended to assist you in understanding the costs and expenses that an investor in shares of the Company’s common stock will bear directly or indirectly. The expenses shown in the table under “Annual Expenses” are estimated based on historical fees and expenses incurred by the Company, as appropriate. In addition, such amounts are based on the Company’s pro forma assets as of December 31, 2023, which have been adjusted to reflect (i) the issuance in the Company’s “at-the-market” offering of 1.1 million shares of our common stock and 45,322 shares of our Series B Preferred Stock from January 1, 2024 through February 15, 2024, yielding net proceeds to the Company of approximately $16.9 million; (ii) the hypothetical borrowings of the full $25,000,000 available under the BNP Credit Facility, which would mean that the Company’s adjusted total assets are assumed to equal approximately $269.6 million. As of December 31, 2023, and pro forma for the issuances and assumed borrowings described above (excluding any regular monthly distributions paid after December 31, 2023), the Company’s leverage represented approximately 36.7% of the Company’s total assets (less current liabilities). Such expenses, and actual leverage incurred by the Company, may vary in the future. Whenever this report (or other Company disclosures, including the Company’s prospectus) contain a reference to fees or expenses paid by the Company, the Company’s common stockholders will indirectly bear such fees or expenses.

| Stockholder

Transaction Expenses ( |

| |

| Sales load | ||

| Offering expenses borne by the Company | ||

| Dividend reinvestment plan expenses | Up

to $ | |

| Total stockholder transaction expenses | —% |

| Annual Expenses (): | | |

| Management fee | ||

| Interest payments on borrowed funds | ||

| Other expenses | ||

| Total annual expenses |

| (1) |

| (2) |

| (3) |

| (4) |

| (5) | “Interest payments on borrowed funds” represents the Company’s annualized interest expense and includes dividends payable on the Series A Term Preferred Stock and Series B Term Preferred Stock, outstanding on December 31, 2023, and includes the pro forma effect of the Series B Preferred Stock issuance and assumed borrowings under the BNP Credit Facility described above, which, in the aggregate, have a weighted average interest rate of 6.60% per annum. The Company may issue additional shares of preferred stock. In the event that the Company were to issue additional shares of preferred stock, the Company’s borrowing costs, and correspondingly its total annual expenses, including, |

21

| in the case of such preferred stock, the base management fee as a percentage of the Company’s managed assets attributable to common stock, would increase. |

| (6) |

Example

The following example is furnished in response to the requirements of the SEC and illustrates the various costs and expenses that you would pay, directly or indirectly, on a $1,000 investment in shares of the Company’s common stock for the time periods indicated, assuming (1) total annual expenses of 7.17% of net assets attributable to the Company’s common stock and (2) a 5% annual return*:

| | | 1 year | | 3 years | | 5 years | | 10 years | | ||

| You would pay the following expenses on a $1,000 investment, assuming a 5% annual return | | $ |

| | $ |

| $ |

| $ |

| |

* The example should not be considered a representation of future returns or expenses, and actual returns and expenses may be greater or less than those shown. The example assumes that the estimated “other expenses” set forth in the Annual Expenses table are accurate, and that all dividends and distributions are reinvested at NAV. The Company’s actual rate of return may be greater or less than the hypothetical 5% return shown in the example.

22

Consolidated

Financial Statements for the Year Ended

December 31, 2023 (Audited)

23

Eagle Point Income Company Inc. and Subsidiaries

Consolidated Statement of Assets and Liabilities

As of December 31, 2023

(expressed in U.S. dollars)

| ASSETS | ||||

| Investments, at fair value (cost $254,810,654) | $ | 234,917,292 | ||

| Cash and cash equivalents | 944,060 | |||

| Interest receivable | 6,895,878 | |||

| Receivable for shares of common stock issued pursuant to the Company's dividend reinvestment plan | 144,528 | |||

| Excise tax refund receivable | 55,413 | |||

| Prepaid expenses | 770,872 | |||

| Total Assets | 243,728,043 | |||

| LIABILITIES | ||||

| 5.00% Series A Term Preferred Stock due 2026, at fair value under the fair value option (1,521,649 shares outstanding) (Note 6) | 35,241,087 | |||

| 7.75% Series B Term Preferred Stock due 2028, at fair value under the fair value option (1,372,482 shares outstanding) (Note 6) | 34,243,289 | |||

| Unamortized share issuance premium associated with 7.75% Series B Term Preferred Stock due 2028 | 2,932 | |||

| 7.75% Series B Term Preferred Stock due 2028, at fair value, plus associated unamortized share issuance premium | 34,246,221 | |||

| Borrowings under credit facility (less unamortized deferred financing costs of $33,333 (Note 9)) | 14,486,667 | |||

| Management fees payable | 706,349 | |||

| Tax expense payable | 228,480 | |||

| Professional fees payable | 149,039 | |||

| Interest expense payable | 143,803 | |||

| Directors' fees payable | 127,500 | |||

| Administration fees payable | 127,072 | |||

| Due to affiliates | 28,072 | |||

| Payable for securities purchased | 28,000 | |||

| Other expenses payable | 8,333 | |||

| Total Liabilities | 85,520,623 | |||

| COMMITMENTS AND CONTINGENCIES (Note 7) | ||||

| NET ASSETS applicable to 10,997,398 shares of $0.001 par value common stock outstanding | $ | 158,207,420 | ||

| NET ASSETS consist of: | ||||

| Paid-in capital (Note 5) | $ | 191,377,889 | ||

| Aggregate distributable earnings (losses) | (33,604,689 | ) | ||

| Accumulated other comprehensive income (loss) | 434,220 | |||

| Total Net Assets | $ | 158,207,420 | ||

| Net asset value per share of common stock | $ | 14.39 | ||

See accompanying notes to the consolidated financial statements

24

Eagle Point Income Company Inc. and Subsidiaries

Consolidated Schedule of Investments

As of December 31, 2023

(expressed in U.S. dollars)

| Issuer ⁽¹⁾ | Investment Description ⁽²⁾ ⁽³⁾ | Acquisition Date ⁽⁴⁾ | Principal Amount | Cost | Fair Value ⁽⁵⁾ | % of Net Assets | |||||||||||||

| Investments, at fair value | |||||||||||||||||||

| CLO Debt ⁽⁶⁾ | |||||||||||||||||||

| Structured Finance | |||||||||||||||||||

| AGL CLO 12 Ltd. | Secured Note - Class E, 11.83%, (3M SOFR + 6.41%, due 07/20/2034) | 08/18/2023 | $ | 1,500,000 | $ | 1,430,634 | $ | 1,444,800 | 0.91 | % | |||||||||

| AMMC CLO 24, Limitted | Secured Note - Class E, 12.25%, (3M SOFR + 6.83%, due 01/20/2035) | 07/26/2023 | 5,000,000 | 4,664,684 | 4,788,000 | 3.03 | % | ||||||||||||

| AMMC CLO 25, Limitted | Secured Note - Class E, 12.98%, (3M SOFR + 7.59%, due 04/15/2035) | 08/08/2023 | 5,000,000 | 4,735,950 | 4,885,500 | 3.09 | % | ||||||||||||

| Ares XXXIV CLO Ltd. | Secured Note - Class E-R, 12.51%, (3M SOFR + 7.11%, due 04/17/2033) | 08/08/2023 | 1,517,600 | 1,370,691 | 1,411,368 | 0.89 | % | ||||||||||||

| Ares XLV CLO Ltd. | Secured Note - Class E, 11.76%, (3M SOFR + 6.36%, due 10/15/2030) | 05/30/2019 | 800,000 | 790,180 | 752,960 | 0.48 | % | ||||||||||||

| Barings CLO Ltd. 2018-IV | Secured Note - Class E, 11.48%, (3M SOFR + 6.08%, due 10/15/2030) | 10/26/2018 | 840,000 | 836,476 | 772,296 | 0.49 | % | ||||||||||||

| Battalion CLO XII Ltd. | Secured Note - Class E, 11.72%, (3M SOFR + 6.35%, due 05/17/2031) | 10/04/2018 | 5,060,000 | 4,921,180 | 4,460,896 | 2.82 | % | ||||||||||||

| Battalion CLO XXI Ltd. | Secured Note - Class E, 12.12%, (3M SOFR + 6.72%, due 07/15/2034) | 06/08/2022 | 5,000,000 | 4,680,842 | 4,247,000 | 2.68 | % | ||||||||||||

| Black Diamond CLO 2016-1, Ltd. | Secured Note - Class D-R, 11.24%, (3M SOFR + 5.86%, due 04/26/2031) | 10/04/2018 | 1,050,000 | 1,002,793 | 900,165 | 0.57 | % | ||||||||||||

| Black Diamond CLO 2017-1, Ltd. | Secured Note - Class D, 12.26%, (3M SOFR + 6.86%, due 04/24/2029) | 10/04/2018 | 3,600,000 | 3,593,415 | 3,495,960 | 2.21 | % | ||||||||||||

| Carlyle US CLO 2017-1, Ltd. | Secured Note - Class D, 11.68%, (3M SOFR + 6.26%, due 04/20/2031) | 09/15/2020 | 2,000,000 | 1,720,927 | 1,744,200 | 1.10 | % | ||||||||||||

| Carlyle US CLO 2018-1, Ltd. | Secured Note - Class D, 11.43%, (3M SOFR + 6.01%, due 04/20/2031) | 10/04/2018 | 665,000 | 660,021 | 602,091 | 0.38 | % | ||||||||||||

| Carlyle US CLO 2018-2, Ltd. | Secured Note - Class D, 10.91%, (3M SOFR + 5.51%, due 10/15/2031) | 10/04/2018 | 5,500,000 | 5,337,175 | 4,985,750 | 3.15 | % | ||||||||||||

| Carlyle US CLO 2019-1, Ltd. | Secured Note - Class D, 12.38%, (3M SOFR + 6.96%, due 04/20/2031) | 08/19/2019 | 3,125,000 | 2,984,784 | 2,944,375 | 1.86 | % | ||||||||||||

| CIFC Funding 2015-I, Ltd. | Secured Note - Class E-RR, 11.67%, (3M SOFR + 6.26%, due 01/22/2031) | 10/04/2018 | 5,000,000 | 4,769,385 | 4,754,000 | 3.00 | % | ||||||||||||

| CIFC Funding 2018-II, Ltd. | Secured Note - Class D, 11.53%, (3M SOFR + 6.11%, due 04/20/2031) | 10/04/2018 | 1,225,000 | 1,196,576 | 1,181,880 | 0.75 | % | ||||||||||||

| CIFC Funding 2018-III, Ltd. | Secured Note - Class E, 11.16%, (3M SOFR + 5.76%, due 07/18/2031) | 08/16/2023 | 4,750,000 | 4,418,098 | 4,539,100 | 2.87 | % | ||||||||||||

| CIFC Funding 2018-IV, Ltd. | Secured Note - Class E, 13.36%, (3M SOFR + 7.96%, due 10/17/2031) | 05/22/2019 | 2,000,000 | 1,885,116 | 1,662,600 | 1.05 | % | ||||||||||||

| CIFC Funding 2019-II, Ltd. | Secured Note - Class E-R, 12.25%, (3M SOFR + 6.85%, due 04/17/2034) | 08/03/2023 | 2,650,000 | 2,603,625 | 2,650,000 | 1.68 | % | ||||||||||||

| CIFC Funding 2019-V, Ltd. | Secured Note - Class D-R, 12.44%, (3M SOFR + 7.04%, due 01/15/2035) | 08/03/2023 | 950,000 | 933,817 | 942,020 | 0.60 | % | ||||||||||||

| CIFC Funding 2021-III, Ltd. | Secured Note - Class E-1, 12.06%, (3M SOFR + 6.66%, due 07/15/2036) | 08/18/2023 | 3,750,000 | 3,651,563 | 3,704,250 | 2.34 | % | ||||||||||||

| Cook Park CLO, Ltd. | Secured Note - Class E, 11.06%, (3M SOFR + 5.66%, due 04/17/2030) | 10/04/2018 | 1,250,000 | 1,203,574 | 1,068,125 | 0.68 | % | ||||||||||||

| Dryden 37 Senior Loan Fund, Ltd. | Secured Note - Class E-R, 10.81%, (3M SOFR + 5.41%, due 01/15/2031) | 10/04/2018 | 500,000 | 486,553 | 408,100 | 0.26 | % | ||||||||||||

| Eaton Vance CLO 2018-1, Ltd. | Secured Note - Class E, 11.66%, (3M SOFR + 6.26%, due 10/15/2030) | 07/26/2023 | 750,000 | 661,506 | 684,525 | 0.43 | % | ||||||||||||

| First Eagle BSL CLO 2019-1 Ltd. | Secured Note - Class D, 13.38%, (3M SOFR + 7.96%, due 01/20/2033) | 12/17/2019 | 5,000,000 | 4,821,748 | 4,453,000 | 2.81 | % | ||||||||||||

| Gilbert Park CLO, Ltd. | Secured Note - Class E, 12.06%, (3M SOFR + 6.66%, due 10/15/2030) | 12/19/2023 | 5,327,000 | 5,109,772 | 5,115,518 | 3.23 | % | ||||||||||||

| Harbor Park CLO, Ltd. | Secured Note - Class E, 11.28%, (3M SOFR + 5.86%, due 01/20/2031) | 08/08/2023 | 2,250,000 | 2,125,238 | 2,167,875 | 1.37 | % | ||||||||||||

| KKR CLO 14 Ltd. | Secured Note - Class E-R, 11.81%, (3M SOFR + 6.41%, due 07/15/2031) | 12/20/2023 | 2,700,000 | 2,575,641 | 2,575,530 | 1.63 | % | ||||||||||||

| KKR CLO 22 Ltd. | Secured Note - Class E, 11.68%, (3M SOFR + 6.26%, due 07/20/2031) | 10/27/2021 | 3,950,000 | 3,799,266 | 3,814,120 | 2.41 | % | ||||||||||||

| KKR CLO 26 Ltd. | Secured Note - Class E-R, 12.81%, (3M SOFR + 7.41%, due 10/15/2034) | 08/08/2023 | 750,000 | 714,404 | 740,925 | 0.47 | % | ||||||||||||

| KKR CLO 29 Ltd. | Secured Note - Class F, NM, (3M SOFR + 9.26%, due 01/15/2032) | 12/14/2021 | 589,812 | — | — | 0.00 | % | ||||||||||||

| LCM XVIII, L.P. | Secured Note - Class E-R, 11.63%, (3M SOFR + 6.21%, due 04/20/2031) | 10/04/2018 | 600,000 | 598,753 | 452,700 | 0.29 | % | ||||||||||||

| Madison Park Funding XX, Ltd. | Secured Note - Class E-R, 10.95%, (3M SOFR + 5.56%, due 07/27/2030) | 10/20/2023 | 1,250,000 | 1,121,821 | 1,193,750 | 0.75 | % | ||||||||||||

| Madison Park Funding XXVII, Ltd. | Secured Note - Class D, 10.68%, (3M SOFR + 5.26%, due 04/20/2030) | 10/04/2018 | 3,050,000 | 2,883,163 | 2,857,850 | 1.81 | % | ||||||||||||

| Madison Park Funding XLII, Ltd. | Secured Note - Class E, 11.72%, (3M SOFR + 6.31%, due 11/21/2030) | 08/15/2019 | 1,875,000 | 1,773,839 | 1,816,313 | 1.15 | % | ||||||||||||

| Madison Park Funding LI, Ltd. | Secured Note - Class E, 11.93%, (3M SOFR + 6.53%, due 07/19/2034) | 10/28/2021 | 4,250,000 | 4,235,377 | 4,224,075 | 2.67 | % | ||||||||||||

| Marathon CLO IX, Ltd. | Secured Note - Class D, 11.71%, (3M SOFR + 6.31%, due 04/15/2029) | 10/04/2018 | 4,050,000 | 4,013,788 | 3,200,310 | 2.02 | % | ||||||||||||

| Marathon CLO XIII, Ltd. | Secured Note - Class D, 12.64%, (3M SOFR + 7.24%, due 04/15/2032) | 06/04/2019 | 3,500,000 | 3,370,696 | 2,850,050 | 1.80 | % | ||||||||||||

| Neuberger Berman Loan Advisers CLO 33, Ltd. | Secured Note - Class E-R, 11.91%, (3M SOFR + 6.51%, due 10/16/2033) | 07/24/2023 | 5,000,000 | 4,683,412 | 4,790,000 | 3.03 | % | ||||||||||||

| OZLM XXI, Ltd. | Secured Note - Class D, 11.22%, (3M SOFR + 5.80%, due 01/20/2031) | 10/04/2018 | 4,150,000 | 4,079,041 | 3,708,855 | 2.34 | % | ||||||||||||

| Octagon Investment Partners 37, Ltd. | Secured Note - Class D, 11.04%, (3M SOFR + 5.66%, due 07/25/2030) | 10/04/2018 | 2,575,000 | 2,407,733 | 2,230,980 | 1.41 | % | ||||||||||||

| Octagon Investment Partners 38, Ltd. | Secured Note - Class D, 11.38%, (3M SOFR + 5.96%, due 07/20/2030) | 10/04/2018 | 3,725,000 | 3,664,389 | 3,342,070 | 2.11 | % | ||||||||||||

| Octagon Investment Partners 39, Ltd. | Secured Note - Class E, 11.43%, (3M SOFR + 6.01%, due 10/20/2030) | 10/24/2018 | 1,550,000 | 1,500,932 | 1,434,835 | 0.91 | % | ||||||||||||

| Octagon Investment Partners 41, Ltd. | Secured Note - Class E-R, 12.79%, (3M SOFR + 7.39%, due 10/15/2033) | 09/24/2021 | 5,000,000 | 4,814,028 | 4,667,500 | 2.95 | % | ||||||||||||

| Palmer Square CLO 2018-1, Ltd. | Secured Note - Class D, 10.81%, (3M SOFR + 5.41%, due 04/18/2031) | 05/30/2019 | 1,120,000 | 1,054,020 | 1,078,896 | 0.68 | % | ||||||||||||

| Pikes Peak CLO 1 | Secured Note - Class E, 11.71%, (3M SOFR + 6.31%, due 07/24/2031) | 10/28/2021 | 3,500,000 | 3,415,309 | 3,256,750 | 2.06 | % | ||||||||||||

| RR 4 Ltd. | Secured Note - Class D, 11.51%, (3M SOFR + 6.11%, due 04/15/2030) | 10/28/2021 | 5,000,000 | 4,821,740 | 4,682,500 | 2.96 | % | ||||||||||||

| RR 7 Ltd. | Secured Note - Class D-1B, 11.89%, (3M SOFR + 6.50%, due 01/15/2037) | 08/10/2023 | 2,000,000 | 1,920,000 | 1,932,600 | 1.22 | % | ||||||||||||

| Rockford Tower CLO 2018-1, Ltd. | Secured Note - Class E, 11.48%, (3M SOFR + 6.11%, due 05/20/2031) | 09/30/2021 | 2,250,000 | 2,197,274 | 2,027,475 | 1.28 | % | ||||||||||||

| Rockford Tower CLO 2018-2, Ltd. | Secured Note - Class E, 11.68%, (3M SOFR + 6.26%, due 10/20/2031) | 10/04/2018 | 5,000,000 | 4,857,535 | 4,523,500 | 2.86 | % | ||||||||||||

| Rockford Tower CLO 2019-2, Ltd. | Secured Note - Class E, 11.68%, (3M SOFR + 6.31%, due 08/20/2032) | 01/13/2021 | 3,000,000 | 2,965,466 | 2,683,200 | 1.70 | % | ||||||||||||

| Rockford Tower CLO 2020-1, Ltd. | Secured Note - Class E, 12.58%, (3M SOFR + 7.16%, due 01/20/2032) | 12/04/2020 | 1,600,000 | 1,575,200 | 1,544,640 | 0.98 | % | ||||||||||||

| Rockford Tower CLO 2021-3, Ltd. | Secured Note - Class E, 12.40%, (3M SOFR + 6.98%, due 10/20/2034) | 10/17/2023 | 900,000 | 771,075 | 794,070 | 0.50 | % | ||||||||||||

| TCI-Symphony CLO 2016-1 Ltd. | Secured Note - Class E-R2, 12.41%, (3M SOFR + 7.01%, due 10/13/2032) | 01/13/2022 | 3,000,000 | 3,000,000 | 2,681,700 | 1.70 | % | ||||||||||||

| TICP CLO VIII, Ltd. | Secured Note - Class D-R, 12.38%, (3M SOFR + 6.96%, due 10/20/2034) | 07/27/2023 | 1,000,000 | 936,667 | 970,100 | 0.61 | % | ||||||||||||

| TICP CLO IX, Ltd. | Secured Note - Class E, 11.28%, (3M SOFR + 5.86%, due 01/20/2031) | 08/22/2019 | 2,500,000 | 2,379,219 | 2,464,750 | 1.56 | % | ||||||||||||

| TICP CLO XI, Ltd. | Secured Note - Class E, 11.68%, (3M SOFR + 6.26%, due 10/20/2031) | 10/29/2021 | 5,050,000 | 5,020,338 | 4,984,350 | 3.15 | % | ||||||||||||

| Venture 36 CLO, Limited | Secured Note - Class E, 12.60%, (3M SOFR + 7.18%, due 04/20/2032) | 01/21/2021 | 5,607,455 | 5,069,880 | 3,693,631 | 2.33 | % | ||||||||||||

| Venture 43 CLO, Limited | Secured Note - Class E, 12.81%, (3M SOFR + 7.41%, due 04/15/2034) | 11/02/2021 | 2,500,000 | 2,444,228 | 2,130,250 | 1.35 | % | ||||||||||||

| Vibrant CLO VI, Ltd. | Secured Note - Class E, 11.38%, (3M SOFR + 6.01%, due 06/20/2029) | 10/04/2018 | 4,350,000 | 3,843,656 | 3,876,720 | 2.45 | % | ||||||||||||

| Vibrant CLO VIII, Ltd. | Secured Note - Class D, 11.43%, (3M SOFR + 6.01%, due 01/20/2031) | 10/04/2018 | 1,750,000 | 1,712,774 | 1,377,250 | 0.87 | % | ||||||||||||

| Wellfleet CLO 2018-1, Ltd. | Secured Note - Class E, 11.16%, (3M SOFR + 5.76%, due 07/17/2031) | 10/27/2021 | 4,025,000 | 3,889,666 | 3,240,125 | 2.05 | % | ||||||||||||

| Wind River 2014-1 CLO Ltd. | Secured Note - Class E-R, 11.96%, (3M SOFR + 6.56%, due 07/18/2031) | 08/16/2021 | 2,550,000 | 2,396,744 | 1,645,515 | 1.04 | % | ||||||||||||

| Wind River 2021-3 CLO Ltd. | Secured Note - Class E, 12.28%, (3M SOFR + 6.86%, due 07/20/2033) | 10/28/2021 | 4,500,000 | 4,328,769 | 4,056,750 | 2.56 | % | ||||||||||||

| York CLO-2 Ltd. | Secured Note - Class E-R, 11.32%, (3M SOFR + 5.91%, due 01/22/2031) | 05/16/2019 | 2,855,000 | 2,534,215 | 2,781,627 | 1.76 | % | ||||||||||||

| 179,966,381 | 171,092,616 | 108.15 | % | ||||||||||||||||

| CLO Equity ⁽⁷⁾ ⁽⁸⁾ | |||||||||||||||||||

| Structured Finance | |||||||||||||||||||

| Ares XLIV CLO Ltd. | Subordinated Note (effective yield 12.84%, maturity 04/15/2034) | 06/08/2021 | 8,000,000 | 3,092,978 | 2,320,191 | 1.47 | % | ||||||||||||

| Ares LVIII CLO Ltd. | Subordinated Note (effective yield 16.82%, maturity 01/15/2035) | 06/17/2021 | 4,000,000 | 2,666,623 | 2,360,035 | 1.49 | % | ||||||||||||

| Bain Capital Credit CLO 2021-2, Limited | Subordinated Note (effective yield 29.67%, maturity 07/16/2034) | 08/09/2023 | 3,250,000 | 1,726,153 | 1,821,535 | 1.15 | % | ||||||||||||

| Bain Capital Credit CLO 2021-7, Limited | Subordinated Note (effective yield 28.28%, maturity 01/22/2035) | 09/05/2023 | 4,000,000 | 2,407,456 | 2,522,224 | 1.59 | % | ||||||||||||

| Bardin Hill CLO 2021-2 Ltd. | Subordinated Note (effective yield 27.0%, maturity 10/25/2034) ⁽⁹⁾ | 09/24/2021 | 5,000,000 | 3,317,212 | 3,089,013 | 1.95 | % | ||||||||||||

| Barings CLO Ltd. 2021-I | Subordinated Note (effective yield 16.72%, maturity 04/25/2034) | 11/03/2021 | 4,000,000 | 3,126,732 | 2,590,010 | 1.64 | % | ||||||||||||

| Barings CLO Ltd. 2021-III | Subordinated Note (effective yield 16.58%, maturity 01/18/2035) | 11/17/2021 | 5,000,000 | 3,749,041 | 2,881,547 | 1.82 | % | ||||||||||||

| Boyce Park CLO, Ltd. | Subordinated Note (effective yield 22.80%, maturity 04/21/2035) | 09/27/2023 | 3,000,000 | 2,154,956 | 2,162,491 | 1.37 | % | ||||||||||||

| Boyce Park CLO, Ltd. | Class M-2 Notes (effective yield 22.80%, maturity 04/21/2035) | 09/27/2023 | 3,214,286 | 67,051 | 65,134 | 0.04 | % | ||||||||||||

| Carlyle US CLO 2021-2, Ltd. | Subordinated Note (effective yield 14.27%, maturity 04/20/2034) | 10/28/2021 | 3,000,000 | 2,431,397 | 1,945,175 | 1.23 | % | ||||||||||||

| Carlyle US CLO 2021-5, Ltd. | Subordinated Note (effective yield 14.31%, maturity 07/20/2034) | 11/02/2021 | 5,000,000 | 3,952,294 | 3,144,341 | 1.99 | % | ||||||||||||

| Carlyle US CLO 2022-2, Ltd. | Subordinated Note (effective yield 21.94%, maturity 04/20/2035) | 08/15/2023 | 5,004,700 | 3,622,418 | 3,544,767 | 2.24 | % | ||||||||||||

| CIFC Funding 2019-VI, Ltd. | Subordinated Note (effective yield 19.84%, maturity 01/16/2033) | 12/02/2019 | 6,000,000 | 4,295,701 | 3,735,027 | 2.36 | % | ||||||||||||

| CIFC Funding 2022-IV, Ltd. | Subordinated Note (effective yield 20.19%, maturity 07/16/2035) | 10/23/2023 | 1,100,000 | 913,000 | 914,659 | 0.58 | % | ||||||||||||

| Clover CLO 2021-2, Ltd. | Subordinated Note (effective yield 21.42%, maturity 07/20/2034) | 08/09/2023 | 2,350,000 | 1,598,418 | 1,653,107 | 1.04 | % | ||||||||||||

| Elmwood CLO 21 Ltd. | Subordinated Note (effective yield 18.35%, maturity 10/20/2036) | 10/26/2023 | 5,000,000 | 3,417,500 | 3,400,776 | 2.15 | % | ||||||||||||

| Kings Park CLO, Ltd. | Subordinated Note (effective yield 28.47%, maturity 01/21/2035) | 04/27/2023 | 1,000,000 | 593,794 | 650,350 | 0.41 | % | ||||||||||||

| KKR CLO 29 Ltd. | Subordinated Note (effective yield 18.49%, maturity 01/15/2032) | 12/14/2021 | 5,500,000 | 4,124,223 | 3,589,738 | 2.27 | % | ||||||||||||

| Madison Park Funding XXXVII, Ltd. | Subordinated Note (effective yield 34.55%, maturity 07/15/2049) | 03/11/2020 | 4,000,000 | 2,344,416 | 2,528,547 | 1.60 | % | ||||||||||||

See accompanying notes to the consolidated financial statements

25

Eagle Point Income Company Inc. and Subsidiaries

Consolidated Schedule of Investments

As of December 31, 2023

(expressed in U.S. dollars)

| Issuer ⁽¹⁾ | Investment Description ⁽²⁾ ⁽³⁾ | Acquisition Date ⁽⁴⁾ | Principal Amount | Cost | Fair Value ⁽⁵⁾ | % of Net Assets | |||||||||||||

| CLO Equity ⁽⁷⁾ ⁽⁸⁾ (continued) | |||||||||||||||||||

| Structured Finance | |||||||||||||||||||

| Marathon CLO XIII, Ltd. | Subordinated Note (effective yield 13.02%, maturity 04/15/2032) | 06/04/2019 | 5,300,000 | 3,208,228 | 1,506,058 | 0.95 | % | ||||||||||||

| Octagon Investment Partners 37, Ltd. | Subordinated Note (effective yield 4.80%, maturity 07/25/2030) | 01/31/2020 | 6,000,000 | 3,054,254 | 1,893,737 | 1.20 | % | ||||||||||||

| Octagon Investment Partners 43, Ltd. | Income Note (effective yield 10.80%, maturity 10/25/2032) | 08/02/2019 | 5,750,000 | 4,050,799 | 2,510,526 | 1.59 | % | ||||||||||||

| Point Au Roche Park CLO, Ltd. | Subordinated Note (effective yield 15.82%, maturity 07/20/2034) | 02/02/2022 | 5,945,000 | 4,667,753 | 4,024,287 | 2.54 | % | ||||||||||||

| RR 23 LTD | Subordinated Note (effective yield 19.59%, maturity 10/15/2035) | 10/12/2023 | 5,000,000 | 3,062,500 | 3,133,790 | 1.98 | % | ||||||||||||

| Venture 37 CLO, Limited | Subordinated Note (effective yield 3.94%, maturity 07/15/2032) | 05/21/2019 | 5,200,000 | 3,199,684 | 1,741,821 | 1.10 | % | ||||||||||||