As filed with the Securities and Exchange Commission on June 26, 2023.

Registration No. 333-_________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| (State or Other Jurisdiction of | (Primary Standard Industrial | (IRS Employer | ||

| Incorporation or Organization) | Classification Number) | Identification Number) |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Geoffrey Andersen

Chief Executive Officer

Opti-Harvest, Inc.

190 N Canon Dr., Suite 304

Beverly Hills, California 90210

(310) 788-0200

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Thomas E. Puzzo, Esq. Law Offices of Thomas E. Puzzo, PLLC 3823 44th Ave. NE Seattle, Washington 98105 (206) 522-2256 |

Andrew M. Tucker, Esq. Nelson Mullins Riley & Scarborough LLP 101 Constitution Avenue, NW, Suite 900 Washington, D.C. 20001 (202) 689-2933 |

Approximate date of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act.

Pursuant to Rule 429 under the Securities Act of 1933, as amended, the prospectus included in this Registration Statement is a combined prospectus and also relates to 2,000,000 shares of common stock previously registered and remaining unsold under the Registrant’s Registration Statement on Form S-1 (File No. 333-267203).

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note

Opti-Harvest, Inc. previously filed a Registration Statement on Form S-1 (File No. 333-267203) with the U.S. Securities and Exchange Commission (the “SEC”) on August 31, 2022, which was declared effective on February 13, 2023 (the “Prior Registration Statement”). The Prior Registration Statement registered up to 2,000,000 shares of our common stock, including 300,000 additional shares of common stock (equal to 15% of the shares of common stock sold in the offering) and the issuance of the representative’s warrants and 138,000 shares of common stock issuable upon exercise of the representative’s warrants.

Pursuant to Rule 429 under the Securities Act of 1933, the prospectus included in this Registration Statement is a combined prospectus and also relates to 2,000,000 shares of common stock registered and remaining unsold under the Prior Registration Statement. Accordingly, this Registration Statement, which is a new registration statement, also constitutes Post-Effective Amendment No. 1 to the Prior Registration Statement and is being filed to, among other things: (i) include audited financial statements for our fiscal year ended December 31, 2022 and to reflect additional information disclosed in our Annual Report on Form 10-K (the “Annual Report”) for our fiscal year ended December 31, 2022, filed with the SEC on April 17, 2023; and (ii) include unaudited interim financial statements for our three months ended March 31, 2023 and to reflect additional information disclosed in our Quarterly Report on Form 10-Q and our Current Report on Form 8-K filed with the SEC subsequent to our Annual Report.

Accordingly, this Registration Statement on Form S-1:

| (i) | carries forward from the Prior Registration Statement an aggregate of 2,219,500 shares of our common stock, to be included in 2,219,500 units being registered herein; | |

| (ii) | carries forward from the Prior Registration Statement an aggregate an aggregate 133,170 shares of common stock underlying the representative’s warrants; | |

| (iii) | registers 2,219,500 units, each unit consisting of one share of common stock, and a warrant to purchase one share of common stock, at an initial public offering price of $4.15 per unit; | |

| (iv) | registers 2,219,500 warrants included in the units; and | |

| (v) | registers 2,219,500 shares of common stock underlying the warrants included in the units. |

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 26, 2023

PRELIMINARY PROSPECTUS

1,930,000 Units

Each Unit Consisting of One Share of Common Stock and One Warrant to Purchase One Share of Common Stock

This is our initial public offering. We are offering 1,930,000 units, each unit consisting of one share of common stock, par value $0.0001 per share, and one warrant to purchase one share of common stock, at an initial public offering price of $4.15 per share (which is the midpoint of the estimated range of the initial public offering price set forth below). Each share of common stock is being sold together with one warrant to purchase one share of common stock. Each whole share exercisable pursuant to the warrants will have an exercise price of $4.15 per share. The warrants will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. The units will not be certificated. The shares of common stock and related warrants are immediately separable and will be issued separately, but must be purchased together as a unit in this offering.

Currently, there is no public market for our common stock. We have applied to list our common stock under the symbol “OPHV” and our warrants under the symbol “OPHVW”, both on the Nasdaq Capital Market. The closing of this offering is contingent upon the successful listing of our common stock on the Nasdaq Capital Market.

We have two classes of capital stock: common stock and Series A Preferred Stock. Our capital structure involving our Series A preferred stock differs significantly from those companies that have typical dual or multi-class capital structures. Each share of our common stock will entitle the holder to one vote. We also have one share of Series A preferred stock outstanding, owned by Jonathan Destler, our Founder and Head of Corporate Development, which share is the subject of a voting trust, which entitles our sole director Jeffrey Klausner, to vote a number of votes that is equal to 110% of the issued and outstanding shares of our common stock, as well as the right to appoint a director. This means that, for the foreseeable future, the control of our company will be concentrated with the trustee through his voting power over the Series A Preferred Stock and with Mr. Destler through his ownership of our Series A Preferred Stock, and even if Mr. Destler sells a significant portion of shares of our common stock that he owns directly or indirectly, he will still maintain greater than 50% of the voting power of us. The terms of Series A preferred stock also include protective provisions that require the consent of the Series A Preferred stockholder in order for us to make any fundamental change to our business or corporate structure. This means that changes to our board of directors or management, our Certificate of Incorporation, as amended, our Bylaws, our business direction, or any change in control, merger or other business combination, or takeover involving us may not occur without the consent of the trustee, as long as Mr. Destler owns his share of Series A Preferred Stock. See the section titled “Description of Capital Stock” for more information. The objective of the Series A Preferred Stock is to fortify control of our company with Mr. Destler.

Immediately following the completion of this offering, Mr. Destler will own approximately 59.8% of the voting power of our outstanding capital stock, assuming no exercise of the underwriters’ option to purchase additional shares and warrants, and we will be a “controlled company,” within the meaning of Nasdaq listing standards. Therefore, we will qualify for, and intend to rely on, exemptions from certain Nasdaq corporate governance requirements. See “Management Controlled Company Exception.”

We are an “emerging growth company” and a “smaller reporting company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements. See “Prospectus Summary—Implications of Being an Emerging Growth Company and a Smaller Reporting Company.”

Investing in shares of our common stock and warrants involves a high degree of risk. See “Risk Factors” beginning on page 14 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

| Per Unit | Total | |||||||

| Initial public offering price | $ | 4.15 | $ | 8,009,500 | ||||

| Underwriting discounts and commissions (1) | $ | 0.33 | $ | 640,760 | ||||

| Proceeds to us, before expenses | $ | 3.82 | $ | 7,368,740 | ||||

| (1) | Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to Westpark Capital, the representative of the underwriters. We have also agreed to issue warrants to the representative of the underwriters. The registration statement, of which this prospectus forms a part, also registers the issuance of the representative’s warrants and shares of common stock issuable upon exercise of the representative’s warrants. See “Underwriting” for additional information regarding underwriters’ compensation. |

We have granted a 45-day option to the underwriters, exercisable one or more times in whole or in part, to purchase up to an aggregate of 289,5000 additional shares of common stock and/or up to 289,500 additional warrants (equal to 15% of the shares of common stock and warrants underlying the units sold in the offering) in any combination thereof, to cover over-allotments, if any, from us at the initial public offering price, less underwriting discounts and commissions.

Neither the Securities and Exchange Commission, or the SEC, nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the units to purchasers on or before June , 2023.

WESTPARK CAPITAL

The date of this prospectus is June 26, 2023

| 2 |

TABLE OF CONTENTS

We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any related free writing prospectuses. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the units offered by this prospectus, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date. Our business, results of operations, financial condition, and prospects may have changed since that date.

For investors outside the United States: We have not, and the underwriters have not, done anything that would permit this offering or the possession or distribution of this prospectus or any free writing prospectus in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus outside the United States. See “Underwriting.”

| 3 |

PROSPECTUS SUMMARY

This summary highlights certain information appearing elsewhere in this prospectus. For a more complete understanding of this offering, you should read the entire prospectus carefully, including the information under “Risk Factors,” “Business,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in this prospectus before investing in our securities.

In this prospectus, unless otherwise stated or the context otherwise requires, references to “Company,” “we,” “us,” “our,” “Opti-Harvest” or similar references mean Opti-Harvest, Inc.

Overview

Opti-Harvest is an agricultural innovation company with products backed by a portfolio of patented and patent pending technologies focused on solving several critical challenges faced by agribusinesses: maximizing crop yield, accelerating crop growth, optimizing land and water resources, reducing labor costs and mitigating negative environmental impacts.

Our advanced agriculture technology (Opti-Filter™) and precision farming (Opti-View™) platforms, enable commercial growers and home gardeners to harness, optimize and better utilize sunlight, the planet’s most fundamental and renewable natural resource. Our sustainable agricultural technology solutions are powered by the sun, maximizing a free and renewable resource with no need for additional chemicals, fertilizers or labor.

We are developing revenue streams for the following product lines:

| ● | Opti-Filter™ Products; | |

| ● | ChromaGro™ Products; and | |

| ● | OptiView™ SaaS Licensing |

Recent Events

Litigation against Jonathan Destler, our former Chief Executive Officer and former director, and Don Danks, a former director

On September 30, 2022, a Complaint (the “Complaint”), captioned Securities and Exchange Commission vs. David Stephens, Donald Linn Danks, Jonathan Destler and Robert Lazarus, and Daniel Solomita and 8198381 Canada, Inc., as relief defendants, Case No. ‘22CV1483AJB DEB, was filed in the United States District Court, Southern District of California. In general, the Complaint alleges that Jonathan Destler, a co-founder and our former Chairman and Chief Executive Officer, and Donald Danks, a co-founder and a former director, and a current employee, were part of a control group that committed securities fraud in connection with the purchase and sale of securities of Loop Industries, Inc., a Nasdaq-listed company.

On November 22, 2022, an Indictment (the “Indictment”), captioned United States of America v. David Stephens, Donald Danks, Jonathan Destler and Robert Lazarus, Case No. ‘22CR2701 BAS, was filed in the United States District Court, Southern District of California. In general, the Indictment alleges that Mr. Destler and Mr. Danks conspired to and committed securities fraud, based on the same allegations in the Complaint. The indictment also alleges that Donald Danks engaged in money laundering.

Furthermore, the Complaint and the Indictment allege that Mr. Destler and Mr. Danks were part of a control group consisting of four other persons (David Stephens, Jonathan Destler, Don Danks and Robert Lazarus) who used a third person to make an unregistered offering of securities. The third person is a deceased former-stockholder of Opti-Harvest, whose Opti-Harvest shares are now held by his estate.

Transfer of Voting Control of Mr. Destler’s Opti-Harvest Shares to Opti-Harvest

Although Mr. Destler (and Mr. Danks, who on January 9, 2023, resigned as an employee of Opti-Harvest) have denied to Opti-Harvest the claims made against them in the Complaint and the Indictment, Mr. Destler agreed to resign his positions as a director, Chief Executive Officer, President and Secretary with Opti-Harvest, and transfer voting control (while retaining ownership) of his shares of common stock and Series A Preferred Stock, to the board of directors of Opti-Harvest. Accordingly, Jeffrey Klausner, Opti-Harvest’s, sole director is the sole trustee of a Voting Trust Agreement, dated December 23, 2022, by and among Opti-Harvest, Inc., Mr. Destler, entities Mr. Destler controls, Mr. Destler’s spouse, and Mr. Klausner, pursuant to which Mr. Klausner, on behalf of Opti-Harvest, votes Mr. Destler’s shares of common stock and Series A Preferred Stock.

It should be noted that the term “Trust” in the title “Voting Trust Agreement” is used for naming convention only, and no trust, as an entity, has been created in connection with the Voting Trust Agreement. Accordingly, Mr. Klausner, as the trustee under the Voting Trust, does not owe any fiduciary duty to Mr. Destler, his affiliated entities, or his spouse, under the Voting Trust Agreement. Mr. Klausner’s sole duty under the Voting Trust Agreement is to vote Mr. Destler’s beneficial ownership in Opti-Harvest securities.

Under the Voting Trust Agreement, Mr. Destler had agreed and consented to the appointment of any member of our board of directors to be appointed a trustee under the Voting Trust Agreement. Therefore, future members of our board of directors may become a trustee under the Voting Trust Agreement. Whether any future member of our board of directors may become a trustee under the Voting Trust Agreement would depend on whether any such new director would want to and agree to becoming a trustee under the Voting Trust Agreement.

The Voting Trust Agreement terminates on the first to occur of (i) final disposition of the proceedings related to the Complaint and the Indictment, or (ii) mutual agreement of Opti-Harvest and Mr. Destler.

Opti-Harvest Internal Investigation

The filing of the Complaint and the Indictment caused our board of directors to ask external legal counsel, who is also counsel to Opti-Harvest in this offering, to conduct an investigation to determine whether Mr. Destler and/or Mr. Danks have any plan, agreement, arrangement or understanding to commit any act which could be construed as securities fraud in connection with Opti-Harvest and this offering. Our legal counsel conducted an internal investigation into whether any officer, director or employee of Opti-Harvest has, or is aware of, any plan, agreement, arrangement or understanding to (i) manipulate the price or trading volume of common stock or other securities of Opti-Harvest, or (ii) publish or otherwise disseminate false, untrue, or misleading information, or information with material omissions of fact, about or otherwise regarding Opti-Harvest. Our legal counsel concluded, based verbal interviews with Mr. Destler, Mr. Danks, and each officer and director of Opti-Harvest, and based on written responses from each of officers, our director and our employees (including Mr. Destler and Mr. Danks), that there does not exist any plan, agreement, arrangement or understanding to (i) manipulate the price or trading volume of common stock or other securities of Opti-Harvest, or (ii) publish or otherwise disseminate false, untrue, or misleading information, or information with material omissions of fact, about or otherwise regarding Opti-Harvest.

Appointment of Geoffrey Andersen as Chief Executive Officer

In connection with the filing of the Complaint and the Indictment, and the agreement of Mr. Destler to transfer voting control of his voting securities of Opti-Harvest to Mr. Klausner under the Voting Trust Agreement, our board of directors appointed Jeffrey Andersen as our Chief Executive Officer, effective December 8, 2022. Mr. Andersen had previously, since July 14, 2021, served as a member of our Advisory Board. In his advisory capacity to us, Mr. Andersen worked closely with Opti-Harvest on all facets of growing our business and strategy, including government relations, building financial models, product development, technology development, marketing, and general business strategy, which allowed Mr. Andersen to not only garner a great deal of information about, and be part of, our business and operations, but to also be the lighting rod for our long-term business strategy. This and his 25-year career serving in multiple leadership and business development roles at agriculture-related businesses, led to the board of directors asking Mr. Andersen to serve as our Chief Executive Officer, which he has agreed to do, for a term of two years, stating that he believed in the viability of our business.

Our Technology and Products

We are building a global agriculture technology business providing advanced equipment and precision agriculture software and solutions.

Opti-Filter™

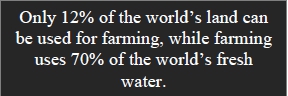

Opti-Filter products are designed to optimize land and water resources by utilizing sunlight in novel ways to accelerate growth in newly planted crops (Opti-Gro, Opti-Shield and ChromaGro products), and improve production in mature vineyards and orchards (Opti-Skylights and Opti-Panels products). Opti-Filter photo-selective technology turns sunlight into scattered, red-enriched light, maximizing the sun’s most productive rays and filtering out those that inhibit growth and production, which results in enhanced foliage activity, fruitfulness, shorter time to production, and substantial increases in marketable yield. These benefits are enhanced further by significant reductions in labor costs and other related expenses associated with conventional farming practices. Increasing outputs (yield, revenues) and lowering inputs (labor costs, resources) are age-old challenges for farmers. Our consumer product line (ChromaGro) is focused on the home garden market.

| 4 |

Opti-View

The Opti-Filter family of products is complimented by our Agricultural Intelligence™ technology which collects and processes critical environmental data from a variety of sensors and industry partners to provide predictive analytics and recommendations that are designed to enable growers to incorporate powerful data into their decision-making process. We believe this system will provide far greater insights than any single system could and will enable growers to collect and interpret crucial data from which to make better choices to improve yield and maximize resources including irrigation and labor.

Our products are marketed to two key markets: commercial agriculture and home garden and fall into three categories:

| ● | Advanced Farm Equipment (Opti-Filter family of products), | |

| ● | Home Garden Product (ChromaGro, powered by Opti-Filter), and | |

| ● | Precision Agriculture (Opti-View). |

We began commercializing our Opti-Gro and ChromaGro products in the first half of 2021, our Opti-Shield and Opti-Panel late in the first half of 2022, and we plan to commercialize our Opti-Skylight products in the first half of 2023. Our Opti-View product is currently in our research and development phase with an anticipated commercial offering in the second half of 2023.

Advanced Farm Equipment

Growth accelerating products for newly planted crops

1. Opti-Gro™ units function as individual plant-growth chambers that target multiple biological processes to naturally accelerate growth and shorten time to first crop and maturity in table and raisin grapes, and wine grape vines.

|

|

Opti-Gro units are applied soon after vine planting and typically left in place for one season only. However, their positive impacts last several seasons after their removal.

2. Opti-Shields™ are designed to fit newly planted fruit trees, nut trees and other crops.

|

|

| 5 |

Opti-Shields are applied soon after planting and kept for two years.

Products improving production in mature orchards and vineyards

1. Opti-Panels™ utilize Opti-Filter technology to reduce labor costs and improve production in mature vineyards and crops grown on trellis systems.

|

|

Opti-Panels are installed by retrofitting into current trellis systems, or along with initial construction, and remain in the vineyard or orchard for many years.

2. Opti-Skylight™ funnels penetrate the canopy of mature fruit and nut trees to improve production in mature tree crops.

Opti-Skylight is a parabolic collector which concentrates and directs sunlight to the inner canopy, while a translucent down tube delivers the production-enhancing effects of red enriched light throughout the canopy.

| 6 |

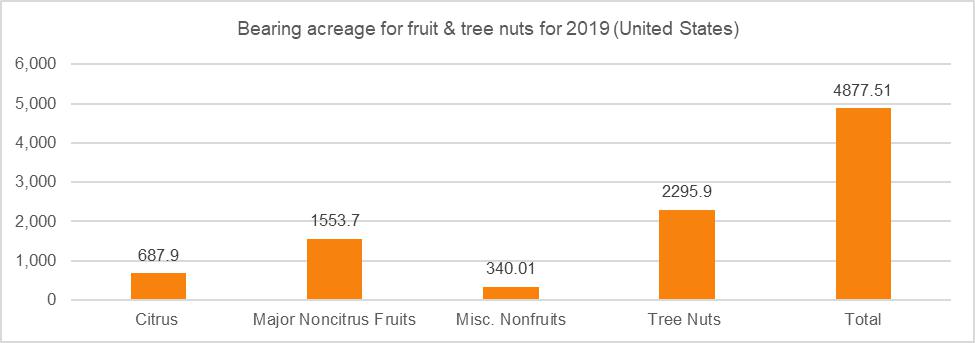

Home Garden Product

ChromaGro units are designed for use in home gardens in rural (backyards, professional gardens) and urban (patios, balconies and terraces) settings.

Precision Agriculture

Opti-View is a proprietary, high sophisticated, multi-vendor AI and machine learning precision agriculture platform for commercial agriculture. It integrates data from our own suite of sensors with data streams from strategic partners. It is designed to empower farmers with better data – by offering valuable insights from predictive analytics so they can better manage their crop yields and key inputs including water and labor. We call this Agricultural Intelligence™.

Our Competitive Strengths

We believe that we have several key strengths that provide us with a competitive advantage:

| ● | We have developed a transformative agricultural technology platform with multiple product applications: Our technology is patented, functional and proven with a growing number of customers across major markets in North America and around the world. We expect this trend to accelerate as our base of installations grows. | |

| ● | We have a strong intellectual property portfolio: Opti-Harvest owns five patent families, including two U.S. patents, one granted European patent, granted patents in each of Brazil, Chile, Peru, Israel, and Mexico, as well as at least one pending international (PCT) application and over thirty additional patent applications pending worldwide as of May 30, 2022. Opti-Harvest has 5 years of R&D experience, and continues to drive innovation. | |

| ● | We have a strong ecosystem of relationships: Through the course of the previous five years and over 65 field trials, Opti-Harvest has developed strong collaborative relationships with many leading growers in the commercial agriculture ecosystem; growers who are in the best position to recognize the multiple benefits our technology and products bring to their farming initiatives. These industry partnerships and collaborative relationships are key to our technical and economic success and are not easily replicated. | |

| ● | We are committed to ESG: Opti-Harvest has an authentic and overarching commitment to ESG, sustainability and social impact. We are committed to a broad set of stakeholders, including our employees, our community, our environment, our customers, and our stockholders. This commitment aligns with our mission to provide farmer-focused solutions to sustainably feed our world. We see opportunities in many areas of the agricultural value chain to address some of today’s most significant challenges including food security, farmer livelihood, and resource use efficiency. |

| 7 |

| ● | We are decarbonizing agriculture: Fresh produce accounts for roughly one-tenth of food related greenhouse gas (GHG emissions), or approximately 1% of GHG emissions in the U.S. (transportation accounts for 28% of that carbon footprint). We are committed to developing technologies that reduce CO₂ emissions across our installed and potential customer base and that reduce the agriculture’s contribution to climate change. GHG emissions associated with fresh produce production include on-farm inputs (applied water, biocides, direct electricity use, direct fuel use and other materials and resources) as well as upstream GHG emissions associated with the production and supply of these inputs. We believe our technologies reduce consumption of several of these GHG inputs by improving production, operational efficiencies, and resource utilization. | |

| ● | We are conserving resources: An important physiological response to our technology includes as much as 50% mitigation of plant daily water stress, more efficient uptake of water and soil nutrients as well as increased photosynthetic uptake of carbon dioxide from the atmosphere. | |

| ● | We have an experienced leadership and scientific team: Opti-Harvest has built an experienced multi-disciplinary leadership and scientific team with a strong track record of driving scientific and product innovation and revenue growth in several technology businesses. Each member of our leadership team has decades of experience in their respective area of expertise. | |

| ● | We continue to drive innovation. By continuing to focus on innovation and enhancement of our product offerings, we believe we can build significant market share, product usage and customer satisfaction. Our research and development, engineering, marketing and executive leadership teams bring expertise from a variety of fields including horticultural science, agronomy, optical physics, materials science, electronics and networking, product design, software development, machine learning and AI. |

Our Growth Strategy

Each of the growth initiatives outlined below depends on our ability to develop broad acceptance of our products. We continuously work to market our products and believe we will have acceptance of our products in both the consumer grower and commercial agriculture segments through the execution of the following strategies:

| ● | Sales and Marketing: Opti-Harvest’s growth and success depend upon developing and implementing go-to-market strategies that ensure superior customer satisfaction, retention, and expansion. As Opti-Harvest transitions from field trials to comprehensive commercialization initiatives, opportunities for industry partnerships and/or developing marketing, sales and distribution capabilities internally will be evaluated and piloted to ensure all aspects of customer and product support are validated. Our initial commercialization strategy is focused on marketing our products that use Opti-Filter technology. The introduction of our Opti-View solution represents an important opportunity to expand revenues from both installed Opti-Filter customers as well as a stand-alone solution to commercial customers. | |

| ● | Expansion into New Geographies: Opti-Harvest intends to initially derive the majority of its revenues from select markets in North America. We anticipate significant growth opportunities to expand our business in additional regions in North America and in international markets around the world. | |

| ● | Finance / Lease Model: We intend to establish finance partners that will allow us to offer financial terms to commercial agriculture customers and establish sales velocity and scale. |

Selected Risks Associated with Our Business

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this summary. These risks include, but are not limited to, the following:

| ● | There is uncertainty regarding our ability to continue as a going concern, indicating the possibility that we may be required to curtail or discontinue our operations in the future. If we discontinue our operations, you may lose all of your investment. |

| 8 |

| ● | We are an early-stage agricultural technology business, with no experience in the market, and failure to successfully compensate for this inexperience may adversely impact our operations and financial position. | |

| ● | Our technology and agricultural growth products have only been developed in the last several years, and we have had only limited opportunities to deploy and assess their performance in the field at full scale. | |

| ● | Our failure to protect our intellectual property may significantly impair our competitive advantage. | |

| ● | We rely on a limited number of suppliers, manufacturers, and logistics partners for our products. A loss of any of these partners could negatively affect our business. | |

| ● | Upon termination of the Voting Trust Agreement, Jonathan Destler, our Founder and Head of Corporate Development, will be able to control all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. | |

| ● | We are a “controlled company” within the meaning of the Nasdaq rules and, as a result, qualify for, and will rely on, exemptions from certain corporate governance requirements that provide protection to stockholders of other companies. | |

| ● | An active trading market for our common stock and warrants may not develop, and you may not be able to resell your shares at or above the initial public offering price. |

Patent Purchase Agreement

On April 7, 2017, we and DisperSolar LLC (“DisperSolar”) entered into a Patent Purchase Agreement (the “Agreement”) pursuant to which we acquired certain patents (intellectual property) of DisperSolar. DisperSolar developed the patents for harvesting, transmission, spectral modification and delivery of sunlight to shaded areas of plants.

Under the Agreement, we agreed to pay the following for the acquisition DisperSolar’s intellectual property:

| (i) | Initial Payment: $150,000 deposited into the Seller Account within 10 days of the Effective Date (the “Initial Payment”). | |

| (ii) | Initial Milestone Payments: Additional payments in the aggregate combined amount up to $450,000 upon reaching defined milestones (the “Milestone Payments”). As of the date of this prospectus, no remaining milestone payment obligations remain. | |

| (iii) | Earnout Payments: $800,000 paid on the on-going basis at a rate of 50% of gross margin and/or License Revenue from the date of the first commercial sale of a Covered Product or the first receipt by Purchaser of License Revenue, until the aggregate combined Gross Margin and License Revenue reach $1.6 million. As of the date of his prospectus, we recorded no earnout payment obligations as no gross margin was realized. |

We will pay to DisperSolar royalties as follows:

| (i) | Following the recognition by us of the first $1.6 million in aggregate combined gross margin and license revenue, and until we pay to DisperSolar an aggregate amount in royalties of $30 million, we shall pay to DisperSolar royalties on sales of covered products at a rate of 8% of gross margin. | |

| (ii) | Once we paid to DisperSolar an aggregate amount in royalties of $30 million, we shall pay to DisperSolar royalties on sales of covered products at a rate of 4.75% of gross margin until the earlier of (x) such time as covered products are not covered by any claims of any assigned patent, and (y) the date of the consummation of a strategic transaction. |

As of the date of this prospectus, we recorded no royalties payment obligations as no gross margin was realized.

We will pay to DisperSolar 7.6% of all license consideration received by us until the date of the consummation of a Strategic Transaction. “Strategic Transaction” means a transaction or a series of related transactions that results in an acquisition of the Company by a third party, including by way of merger, purchase of capital stock or purchase of assets or change of control or otherwise.

| 9 |

“Strategic Transaction Consideration” means any cash consideration and the fair market value of any non-cash consideration paid to us by any acquirer as consideration for the Strategic Transaction, less the costs and expenses incurred by a purchaser for the purpose of consummating a Strategic Transaction. We will pay to DisperSolar a percentage of all License Consideration received by a prospective purchaser as follows:

| (i) | 3.8% of the first $50 million of the Strategic Transaction Consideration; | |

| (ii) | 5.7% of the next $100 million of the Strategic Transaction Consideration (i.e., over $50 million and up to $150 million); and | |

| (iii) | 7.6% of Strategic Transaction Consideration over $150 million. |

Our Chief Science Officer, Yosepha Shahak Ravid, and our Chief Technology Officer, Nicholas Booth, are both control persons of DisperSolar and named inventors of the acquired patents we acquired from DisperSolar.

Corporate Information

Our executive offices are located at 190 N Canon Drive, Suite 304, Beverly Hills, California 90210, and our telephone number is (310) 788-0200. Our website address is www.opti-harvest.com. We do not incorporate information on or accessible through our website into this prospectus, and you should not consider any information on, or that can be accessed through our website as a part of this prospectus and the inclusion of our website address in this prospectus is an inactive textual reference only. We were incorporated under the laws of the State of Delaware on June 20, 2016.

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We qualify as an “emerging growth company”, as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable, in general, to public companies that are not emerging growth companies. These provisions include:

| ● | the option to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus; | |

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002; | |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and | |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We will remain an emerging growth company until the earliest to occur of: (i) the last day of the first fiscal year in which our annual gross revenue exceeds $1.07 billion; (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter; (iii) the date on which we have issued, in any three-year period, more than $1.0 billion in non-convertible debt securities; and (iv) the last day of the fiscal year ending after the fifth anniversary of the completion of this offering.

As an emerging growth company, we can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to use this extended transition period for complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier of the date we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in the JOBS Act. As a result, our financial statements may not be comparable to companies that comply with new or revised accounting pronouncements as of public company effective dates. If we were to subsequently elect instead to comply with these public company effective dates, such election would be irrevocable pursuant to the JOBS Act.

We are also a “smaller reporting company” as defined in the Exchange Act. We may continue to be a smaller reporting company even after we are no longer an emerging growth company. We may take advantage of certain of the scaled disclosures available to smaller reporting companies and will be able to take advantage of these scaled disclosures for so long as the market value of our common stock held by non-affiliates is less than $250.0 million measured on the last business day of our second fiscal quarter, or our annual revenue is less than $100.0 million during the most recently completed fiscal year, and the market value of our common stock held by non-affiliates is less than $700.0 million measured on the last business day of our second fiscal quarter.

Reverse Stock Split

Effective on June 2, 2023, and February 22, 2023, the Board of Directors and stockholders have approved resolutions authorizing a reverse stock split of the outstanding shares of the Company’s common stock on the basis of one share of common stock for every two shares or common stock, and 0.6786 shares for every one share of common stock, respectively. All shares and per share amounts and information presented herein have been retroactively adjusted to reflect the reverse stock splits for all periods presented.

| 10 |

The Offering

| Units offered by us: | 1,930,000 Units (or 2,219,500 units if the underwriters exercise the over-allotment option to purchase additional units in full), at an initial public offering price of $4.15 per unit, with each unit consisting of one share of common stock and a warrant to purchase one share of common stock at an exercise price of $4.15, equal to 100% of the initial public offering price, which will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. The shares and warrants that are part of the units are immediately separable and will be issued separately in this offering. | |

|

Warrants offered by us: |

Warrants to purchase up to 1,930,000 shares of common stock. Each warrants will have an exercise price of $4.15 per share, will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. Warrants may be exercised only for a whole number of shares. The shares of common stock and warrants are immediately separable and will be issued separately, but must be purchased together in this offering as units. This prospectus also relates to the offering of the shares issuable upon exercise of the warrants. | |

| Common stock outstanding immediately before the conversion of senior convertible notes: | 12,106,609 shares of common stock (excludes 2,409,281 shares of common stock issued on the conversion of senior convertible notes). | |

Common stock outstanding immediately after the conversion of senior convertible notes and before the offering: |

14,515,890 shares of common stock (includes 2,409,281 shares of common stock issued on the conversion of senior convertible notes). | |

| Common stock to be outstanding immediately after the offering: | 16,445,890 shares of common stock (or 16,735,390 shares if the underwriters exercise the over-allotment option in full). | |

| Over-allotment option | The underwriters have an option for a period of 45 days to purchase up to additional shares of our common stock and/or warrants sold in the offering in any combination thereof, to cover over-allotments, if any. | |

| Use of proceeds | We estimate the that net proceeds from the sale of our units in this offering will be approximately $6,789,000 or approximately $7,882,000 if the underwriters exercise their option to purchase additional units in full), based on the initial public offering price of $4.15 per share, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

We currently intend to use the net proceeds we receive from this offering to repay the outstanding principal and interest accrued on Convertible and Promissory Notes, to fund the sales and marketing, as well as research and development and field trial activities supporting commercialization of our products, and to use the remainder of the net proceeds for general corporate purposes, including working capital and operating expenses. See the section entitled “Use of Proceeds” for additional information. | |

| Controlled company | Upon the closing of this offering, Jonathan Destler will beneficially own more than 50% of the voting power for the election of members of our board of directors and we will be a “controlled company” under the Nasdaq rules. As a controlled company, we qualify for, and intend to rely on, exemptions from certain Nasdaq corporate governance requirements. See “Management—Controlled company exception.” | |

| Voting rights | Each share of common stock will entitle the holder to one vote. We also have one share of Series A preferred stock outstanding, which entitles its holder to a number of votes that is equal to 110% of the issued and outstanding shares of our common stock. Holders of our common stock and Series A preferred stock will generally vote together as a single class, unless otherwise required by law or our certificate of incorporation. The outstanding share of our Series A preferred stock is owned by our Founder and Head of Corporate Development, Jonathan Destler and the subject of a voting trust under the Voting Trust Agreement pursuant to which our sole director, Jeffrey Klausner, is trustee and has to right to vote the shares. Immediately following the completion of this offering, Mr. Destler will own approximately 59.8% of the voting power of our outstanding capital stock (based on the initial public offering price of $4.15 per unit), assuming no exercise of the underwriters’ option to purchase additional shares. Upon termination of the Voting Trust Agreement, Mr. Destler will have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of our directors and the approval of any change of control transaction. See “Description of Capital Stock” for additional information. |

| 11 |

| Representative’s warrants | We have agreed to issue to Westpark Capital, acting as the representative of underwriters of the offering, referred to as the “Representative,” compensation warrants to purchase up to 3% of the number of shares of common stock issued in this offering, referred to as the “Representative’s Warrants.” The Representative’s Warrants will be exercisable commencing 180 days after, and will terminate five years from, the effective date of the offering. The Representative’s Warrants are exercisable at a per share price equal to 100% of the initial public offering price per share in the offering. The Representative’s Warrants will provide for cashless exercise, a one-time demand registration right and unlimited piggyback rights. | |

| Risk factors | Investing in our securities involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully read “Risk Factors” on page 14 in this prospectus for a discussion of factors that you should consider before deciding to invest in our common stock and warrants. | |

| Lock-up | We, all of our directors and officers and our shareholders who hold the number of shares of our common stock equal to 1% or more of our issued and outstanding shares of common stock have agreed with the underwriters, subject to certain exceptions, not to sell, transfer or dispose of, directly or indirectly, any of our common stock or securities convertible into or exercisable or exchangeable for our common stock for a period of six months after the closing of this offering. See “Underwriting” for more information. | |

| Nasdaq symbol | In connection with this offering, our common stock have been approved for listing on the Nasdaq Capital Market (“Nasdaq”) under the symbol “OPHV” and “OPHVW”, respectively. We will not apply for listing of our units on any other nationally recognized trading system. The closing of this offering is contingent upon the successful listing of our common stock on the Nasdaq Capital Market. |

The number of shares of our common stock that will be outstanding after this offering is based on (i) an initial public offering price of $4.15 per unit, (ii) shares of our common stock outstanding as of the date of this prospectus, and (iii) excludes the following:

| ● | 1,596,831 shares of common stock reserved for issuance upon the exercise of outstanding options at a weighted average exercise price of $6.24 per share, as well as any future increases in the number of shares of our common stock reserved for issuance under our equity incentive plan; | |

| ● | 2,061,285 shares of common stock reserved for issuance upon the exercise of outstanding warrants at a weighted average exercise price of $6.39 per share; | |

| ● | up to 292,512 shares of common stock issuable upon conversion of Convertible Promissory Notes (the “Promissory Notes”) and interest accrued; | |

| ● | 67,860 restricted stock units issued to our employees; | |

| ● | 1 share of common stock reserved for issuance upon the conversion of 1 share of Series A preferred stock; | |

| ● | up to 1,930,000 shares of common stock issuable upon exercise of warrants included in the units being offered in this offering; and | |

| ● | up to 115,800 shares of common stock issuable upon exercise of the representative’s warrants issued in connection with this offering. |

In this prospectus, unless otherwise indicated or the context otherwise requires, the number of shares of common stock outstanding and the other information based thereon reflects and assumes the following:

| ● | no exercise of warrants included in the units being offered in this offering; | |

| ● | no exercise by the underwriters of their option to purchase additional shares of common stock from us; and | |

| ● | no exercise of Representative’s Warrants. |

| 12 |

SUMMARY FINANCIAL DATA

The following tables summarize our historical financial data as of and for the periods indicated. We derived the summary statement of operations data for the years ended December 31, 2022 and 2021 and our summary balance sheet data as of December 31, 2022 set forth below from our audited financial statements contained elsewhere in this prospectus. We derived the summary statement of operations data for the three months ended March 31, 2023 and 2022 and our summary balance sheet data as of March 31, 2023 from our unaudited condensed financial statements contained elsewhere in this prospectus, and such summary information is not necessarily indicative of results to be expected for the full year. The unaudited condensed financial statements have been prepared on the same basis as the audited financial statements and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary to present fairly our financial position as of March 31, 2023 and the results of operations for the three months ended March 31, 2023 and 2022. You should read this data together with our financial statements and related notes included elsewhere in this prospectus and the information under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The summary financial data included in this section are not intended to replace the financial statements and related notes included elsewhere in this prospectus and are qualified in their entirety by those financial statements and related notes. Our historical results are not necessarily indicative of our future results.

Effective on June 2, 2023, and February 22, 2023, the Board of Directors and stockholders have approved resolutions authorizing a reverse stock split of the outstanding shares of the Company’s common stock on the basis of one share of common stock for every two shares or common stock, and 0.6786 shares for every one share of common stock, respectively. All shares and per share amounts and information presented herein have been retroactively adjusted to reflect the reverse stock splits for all periods presented.

In the table below, amounts are rounded to nearest thousands, except share and per share amounts.

Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||

| 2023 | 2022 | 2022 | 2021 | |||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

| Statement of Operations Data: | ||||||||||||||||

| Total revenues | $ | 24,000 | $ | 1,000 | $ | 53,000 | $ | 40,000 | ||||||||

| Total cost of revenues | 23,000 | 1,000 | 515,000 | 102,000 | ||||||||||||

| Operating expenses | 2,693,000 | 2,851,000 | 10,230,000 | 9,212,000 | ||||||||||||

| Financing costs | - | (2,497,000 | ) | |||||||||||||

| Interest expense | (189,000 | ) | (856,000 | ) | (2,761,000 | ) | (817,000 | ) | ||||||||

| Gain on forgiveness of debt | - | - | - | 38,000 | ||||||||||||

| Net loss | $ | (2,881,000 | ) | $ | (3,707,000 | ) | $ | (15,950,000 | ) | $ | (10,053,000 | ) | ||||

| Net loss per share, basic and diluted | $ | (0.24 | ) | $ | (0.34 | ) | $ | (1.40 | ) | $ | (0.96 | ) | ||||

| Weighted-average shares used in computing net loss per share, basic and diluted | 11,926,066 | 11,006,904 | 11,401,562 | 10,508,343 | ||||||||||||

In the table below, amounts are rounded to nearest thousands.

| March 31, 2023 | December 31, 2022 | |||||||

| (unaudited) | ||||||||

| Balance Sheet Data: | ||||||||

| Cash | $ | 12,000 | $ | 172,000 | ||||

| Total current assets | $ | 93,000 | $ | 274,000 | ||||

| Total assets | $ | 1,141,000 | $ | 1,463,000 | ||||

| Total current liabilities | $ | 6,661,000 | $ | 5,835,000 | ||||

| Long-term debt, net of current portion | $ | 53,000 | $ | 56,000 | ||||

| Total liabilities | $ | 6,750,000 | $ | 5,927,000 | ||||

| Total shareholders’ deficit | $ | (5,609,000 | ) | $ | (4,464,000 | ) | ||

| 13 |

RISK FACTORS

An investment in our securities is speculative and involves a high degree of risk including the risk of a loss of your entire investment. You should carefully consider the following risk factors. These risk factors contain, in addition to historical information, forward looking statements that involve risks and uncertainties. Our actual results could differ significantly from the results discussed in the forward-looking statements. The occurrence of any of the adverse developments described in the following risk factors could materially and adversely harm our business, financial condition, results of operations or prospects. In such event, the value of our securities could decline, and you could lose all or a substantial portion of your investment. In addition, the risks and uncertainties discussed below are not the only ones we face. Our business, financial condition, results of operations or prospects could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are material, and these risks and uncertainties could result in a complete loss of your investment. In assessing the risks and uncertainties described below, you should also refer to the other information contained in this prospectus.

Risks Related to Our Business and Industry

There is uncertainty regarding our ability to continue as a going concern, indicating the possibility that we may be required to curtail or discontinue our operations in the future. If we discontinue our operations, you may lose all of your investment.

We have incurred net losses of $38.0 million from our inception on June 20, 2016 to March 31, 2023 and have completed only the preliminary stages of our business plan. We anticipate incurring additional losses before generating any revenues and will depend on additional financing in order to meet our continuing obligations and ultimately, to attain profitability. The report of our independent registered public accounting firm on our financial statements for the year ended December 31, 2022 included an explanatory paragraph describing conditions that raise substantial doubt about our ability to continue as a going concern. The conditions giving rise to this uncertainty are also disclosed in Note 1 to our financial statements for the year ended December 31, 2022 and three months ended March 31, 2023, respectively, appearing at the end of this prospectus, citing our recurring losses and cash used in operations among other factors. Our ability to continue as a going concern will be determined by our ability to generate sufficient cash flow to sustain our operations and/or raise additional capital in the form of debt or equity financing. We believe that the inclusion of a going concern explanatory paragraph in the report of our registered public accounting firm will make it more difficult for us to secure additional financing or enter into strategic relationships with distributors on terms acceptable to us, if at all, and likely will materially and adversely affect the terms of any financing that we might obtain. Our financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts and classification of liabilities that might be necessary should we be unable to continue as a going concern.

Pandemics and epidemics, including the ongoing COVID-19 pandemic, natural disasters, terrorist activities, political unrest, and other outbreaks could have a material adverse impact on our business, results of operations, financial condition and cash flows or liquidity.

During the ongoing global COVID-19 pandemic, the capital markets are experiencing pronounced volatility, which may adversely affect investor’s confidence and, in turn may affect our initial public offering.

In addition, the COVID-19 pandemic has caused us to modify our business practices (such as employee travel plan and cancellation of physical participation in meetings, events, and conference), and we may take further actions as required by governmental authorities or that we determine are in the best interests of our employees, customers, and business partners. In addition, the business and operations of our manufacturers, suppliers, and other business partners have also been adversely impacted by the COVID-19 pandemic and may be further adversely impacted in the future, which could result in delays in our ability to commercialize our agricultural products and services.

As a result of social distancing, travel bans, and quarantine measures, access to our facilities, users, management, and support staff has been limited, which in turn has impacted, and will continue to impact, our operations, and financial condition.

| 14 |

The extent to which COVID-19 impacts our, and those of our suppliers’ and potential users’, business, results of operations, and financial condition will depend on future developments, which are uncertain and cannot be predicted, including, but not limited to, the occurrence of an additional “wave,” duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. Even if the COVID-19 outbreak subsides, we may continue to experience materially adverse impacts to our business as a result of its global economic impact, including any recession that has occurred or may occur in the future.

We are also vulnerable to natural disasters and other calamities. Although we have servers that are hosted in an offsite location, our backup system does not capture data on a real-time basis, and we may be unable to recover certain data in the event of a server failure. We cannot assure you that any backup systems will be adequate to protect us from the effects of fire, floods, typhoons, earthquakes, power loss, telecommunications failures, break-ins, war, riots, terrorist attacks or similar events. Any of the foregoing events may give rise to interruptions, breakdowns, system failures, technology platform failures or internet failures, which could cause the loss or corruption of data or malfunctions of software or hardware.

We had negative cash flow for the year ended December 31, 2022 and the three months ended March 31, 2023.

We had negative operating cash flow for the year ended December 31, 2022 and the three months ended March 31, 2023. To the extent that we have negative operating cash flow in future periods, we may need to allocate a portion of our cash reserves to fund such negative cash flow. We may also be required to raise additional funds through the issuance of equity or debt securities. There can be no assurance that we will be able to generate a positive cash flow from our operations, that additional capital or other types of financing will be available when needed or that these financings will be on terms favorable to us.

We are an early-stage agricultural technology business, with no experience in the market, and failure to successfully compensate for this inexperience may adversely impact our operations and financial position.

We were incorporated on June 20, 2016, and we are an early-stage agricultural technology business, with few substantial tangible assets in a highly competitive industry. We have limited operating history, a small customer base and low revenue to date. This makes it difficult to evaluate our future performance and prospects. Our prospectus must be considered in light of the risks, expenses, delays and difficulties frequently encountered in establishing a new business in an evolving agricultural technology industry characterized by intense competition, including:

● our business model and strategy are still evolving and are continually being reviewed and revised;

● we may not be able to raise the capital required to develop our initial customer base and reputation;

● we may not be able to successfully implement our business model and strategy; and

● our management consists of few persons and is heavily reliant on Geoff Andersen, our Chief Executive Officer, and Jonathan Destler, our Founder and Head of Corporate Development.

We cannot be sure that we will be successful in meeting these challenges and addressing these risks and uncertainties. If we are unable to do so, our business will not be successful and you could lose all or a substantial portion of your investment.

We expect to suffer losses in the immediate future that may cause us to curtail or discontinue our operations.

We expect to incur operating losses in future periods. These losses will occur because we do not yet have any revenues to offset the expenses associated with the development of our agricultural technology business, garnering revenues, and our business operations, generally. We cannot guarantee that we will ever be successful in generating revenues in the future. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will almost certainly fail.

We may not be able to execute our business plan or stay in business without additional funding.

Our ability to generate future operating revenues depends in part on whether we can obtain the financing necessary to implement our business plan. We will likely require additional financing through the issuance of debt and/or equity in order to establish profitable operations, and such financing may not be forthcoming. As widely reported, the global and domestic financial markets have been extremely volatile in recent months. If such conditions and constraints continue or if there is no investor appetite to finance our specific business, we may not be able to acquire additional financing through credit markets or equity markets. Even if additional financing is available, it may not be available on terms favorable to us. At this time, we have not identified or secured sources of additional financing. Our failure to secure additional financing when it becomes required will have an adverse effect on our ability to remain in business.

| 15 |

The agriculture technology business is extremely competitive, and if we are not able to compete successfully against other agricultural technology businesses, both large and small, we will not be able operate our business and investors will lose their entire investment.

The agricultural technology business is extremely competitive and rapidly changing. We currently and in the future face competitive pressures from numerous actual and potential competitors. Many of our current and potential competitors in the agricultural growth business have substantial competitive advantages than we have, including:

| ● | longer operating histories; | |

| ● | significantly greater financial, technical and marketing resources; | |

| ● | greater brand name recognition; | |

| ● | better advertising and marketing; | |

| ● | existing customer bases; and | |

| ● | commercially accepted technology and products. |

Our competitors may be able to respond more quickly to new or emerging methods and changes in the agricultural technology business and devote greater resources to identify, develop and market new agricultural products and services, and better market and sell their agricultural products and services than we can.

We rely on a limited number of suppliers, manufacturers, and logistics partners for our products. A loss of any of these partners could negatively affect our business.

We rely on a limited number of suppliers to manufacture and transport our products, including in some cases only a single supplier for some of our products and components. One single supplier currently manufactures three of our four products available for sale, and houses our sole set of tooling required to manufacture these products. One additional supplier manufactures one of our products which became available for sale in the second half of fiscal year 2022. We have no material agreements with our manufacturing suppliers. Our reliance on a limited number of manufacturers for each of our products increases our risks, since we do not currently have alternative or replacement manufacturers beyond these key parties. In the event of interruption from any of our manufacturers, we may not be able to increase capacity from other sources or develop alternate or secondary sources without incurring material additional costs and substantial delays. Thus, our business could be adversely affected if one or more of our suppliers is impacted by a natural disaster or other interruption at a particular location.

If we experience a significant increase in demand for our products, or if we need to replace an existing supplier or partner, we may be unable to supplement or replace them on terms that are acceptable to us, which may undermine our ability to deliver our products to customers in a timely manner. For example, it may take a significant amount of time to identify a manufacturer that has the capability and resources to build our products to our specifications in sufficient volume. Identifying suitable suppliers, manufacturers, and logistics partners is an extensive process that requires us to become satisfied with their quality control, technical capabilities, responsiveness and service, financial stability, regulatory compliance, and labor and other ethical practices. Accordingly, a loss of any of our significant suppliers, manufactures, or logistics partners could have an adverse effect on our business, financial condition and operating results.

The loss of the services of Geoff Andersen, our Chief Executive Officer, and Jonathan Destler, our Founder and Head of Corporate Development, or our failure to timely identify and retain competent personnel could negatively impact our ability to develop our website and sell our services.

The development of our agricultural technology business and the marketing of our prospective business will continue to place a significant strain on our limited personnel, management, and other resources. Our future success depends upon the continued services of our executive officers who are developing our business, and on our ability to identify and retain competent consultants and employees with the skills required to execute our business objectives. The loss of the services of Geoff Andersen, our Chief Executive Officer, or Jonathan Destler, our Founder and Head of Corporate Development, or our failure to timely identify and retain competent personnel could negatively impact our ability to develop our website and sell our services, which could adversely affect our financial results and impair our growth.

| 16 |

Our business could suffer if our former Chief Executive Officer and director, Jonathan Destler, loses his civil ligation with the SEC and/or criminal litigation with the US.

On September 30, 2022, a Complaint (the “Complaint”), captioned Securities and Exchange Commission vs. David Stephens, Donald Linn Danks, Jonathan Destler and Robert Lazarus, and Daniel Solomita and 8198381 Canada, Inc., as relief defendants, Case No. ‘22CV1483AJB DEB, was filed in the United States District Court, Southern District of California. In general, the Complaint alleges that Jonathan Destler, a co-founder and our former Chairman and Chief Executive Officer, and Donald Danks, a co-founder and a former director, and a current employee, were part of a control group that committed securities fraud in connection with the purchase and sale of securities of Loop Industries, Inc., a Nasdaq-listed company.

On November 22, 2022, an Indictment (the “Indictment”), captioned United States of America v. David Stephens, Donald Danks, Jonathan Destler and Robert Lazarus, Case No. ‘22CR2701 BAS, was filed in the United States District Court, Southern District of California. In general, the Indictment alleges that Mr. Destler and Mr. Danks conspired to and committed securities fraud, based on the same allegations in the Complaint. The indictment also alleges that Donald Danks engaged in money laundering.

Furthermore, the Complaint and the Indictment allege that Mr. Destler and Mr. Danks were part of a control group consisting of four other persons (David Stephens, Jonathan Destler, Don Danks and Robert Lazarus) who used a third person to make an unregistered offering of securities. The third person is a deceased former-stockholder of Opti-Harvest, whose Opti-Harvest shares are now held by his estate.

Mr. Destler is currently our key employee with respect to our business development because of his material role marketing selling our products. Additionally, the Voting Trust Agreement with Mr. Destler terminates on the first to occur of (i) final disposition of the proceedings related to the Complaint and the Indictment, or (ii) mutual agreement of Opti-Harvest and Mr. Destler. If Mr. Destler loses his criminal litigation, it is possible that Mr. Destler could be incarcerated, in which case our marketing and sales could suffer because of his inability to communicate with potential new and existing customers. Furthermore, final disposition of the proceedings related to the Complaint and the Indictment could possibly also mean that Mr. Destler would have voting control over us while being incarcerated. In such event, Mr. Destler’s separation from daily business activities could cause him to make voting decisions with out the knowledge of our daily operations that he has today.

We have limited human resources; we need to attract and retain highly skilled personnel; and we may be unable to manage our growth with our limited resources effectively.

The expansion of our business has placed a significant strain on our limited managerial, operational, and financial resources. We have been and will continue to be required to expand our operational and financial systems significantly and to expand, train and manage our work force in order to manage the expansion of our operations. Our future success will depend in large part on our ability to attract, train, and retain additional highly skilled executive level management with experience in our industry. Competition is intense for these types of personnel from more established organizations, many of which have significantly larger operations and greater financial, marketing, human, and other resources than we have. We may not be successful in attracting and retaining qualified personnel on a timely basis, on competitive terms or at all. To date we have had to limit the engagement of critical management and other key personnel due in part to limited financial resources. If we are not successful in attracting and retaining these personnel, our business, prospects, financial condition and operating results would be materially adversely affected. Further, our ability to manage our growth effectively will require us to continue to improve our operational, financial and management controls, reporting systems and procedures, to install new management information and control systems and to train, motivate and manage employees. If we are unable to manage growth effectively and new employees are unable to achieve adequate performance levels, our business, prospects, financial condition and operating results will be materially adversely affected.

Our lack of insurance may expose us to liabilities which could cause us to cease operations.

While we intend to maintain insurance in the future for certain risks, the amount of our insurance coverage may not be adequate to cover all claims or liabilities, and we may be forced to bear substantial costs resulting from risks and uncertainties of our business. It is also not possible to obtain insurance to protect against all operational risks and liabilities. The failure to obtain adequate insurance coverage on terms favorable to us, or at all, could have a material adverse effect on our business, financial condition and results of operations. We do not have any business interruption insurance. Any business disruption or natural disaster could result in substantial costs and diversion of resources.

Our technology and agricultural growth products have only been developed in the last several years and we have had only limited opportunities to deploy and assess their performance in the field at full scale.

The current generation of our agricultural growth products have only been developed in the last several years and are continuing to evolve. Deploying and operating our technology is a complex endeavor and, until recently, had been done primarily by a small number of customers in the agricultural crop industry, mostly as part of our field trials. As we deploy our products, we may encounter unforeseen operational, technical and other challenges, some of which could cause significant delays, trigger contractual penalties, result in unanticipated expenses, and/or damage to our reputation, each of which could materially and adversely affect our business, financial condition and results of operations.

Our agricultural growth products might not operate properly or contain defects, which could damage our reputation, give rise to claims against us, or divert application of our resources from other purposes, any of which could harm our business and operating results.

Our products are complex and may contain defects or experience failures due to any number of issues in design, materials, manufacture, deployment and/or use. Despite extensive testing, from time to time we have discovered defects or errors in our products. Material performance problems or defects in our products might arise in the future, which could have an adverse impact on our business and customer relationship and subject us to claims.

Defects and errors related to our agricultural growth products and any failure by us to identify and address them could result in delays in product introductions and updates, loss of revenue or market share, liability to customers or others, failure to achieve market acceptance or expansion, diversion of development and other resources, injury to our reputation, and increased service and maintenance costs. Defects or errors in our products might discourage existing or potential customers from purchasing from us. Correction of defects or errors could prove to be impossible or impracticable. The costs incurred in correcting any defects or errors or in responding to resulting claims or liability might be substantial and could adversely affect our operating results.

| 17 |