UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended: June 30, 2020

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-39412

FATHOM HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| North Carolina | 82-1518164 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

211 New Edition Court, Suite 211

Cary, North Carolina 27511

(Address of principal executive offices) (Zip Code)

(888) 455-6040

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading Symbol(s) | Name of each exchange on which registered: | ||

| Common Stock, no par value per share | FTHM | Nasdaq Capital Market |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes¨ No x

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer x | Smaller reporting company x

Emerging growth company x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of August 14, 2020, the registrant had 13,640,381 shares of common stock outstanding.

FATHOM HOLDINGS INC.

FORM 10-Q

For the Quarterly Period Ended June 30, 2020

TABLE OF CONTENTS

1

PART I - FINANCIAL INFORMATION

CONDENSED CONSOLIDATED BALANCE SHEETS

| June 30, 2020 | December 31, 2019 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 1,490,278 | $ | 579,416 | ||||

| Accounts receivable | 1,203,947 | 304,769 | ||||||

| Agent annual fees receivable, net of allowance for doubtful accounts of $449,076 and $349,420 | 769,899 | 356,131 | ||||||

| Due from affiliates | 1,476 | 2,561 | ||||||

| Prepaid and other current assets | 398,010 | 411,202 | ||||||

| Total current assets | 3,863,610 | 1,654,079 | ||||||

| Property and equipment, net | 99,391 | 105,972 | ||||||

| Capitalized software, net | 644,421 | 464,842 | ||||||

| Lease right of use assets | 213,501 | 265,140 | ||||||

| Total assets | $ | 4,820,923 | $ | 2,490,033 | ||||

| LIABILITIES AND STOCKHOLDERS DEFICIT | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued liabilities | $ | 4,346,927 | $ | 2,806,228 | ||||

| Due to affiliates | 23,087 | 23,658 | ||||||

| Loan payable - current portion | 17,244 | 17,095 | ||||||

| Notes payable - current portion | 135,349 | — | ||||||

| Lease liability - current portion | 63,767 | 89,566 | ||||||

| Total current liabilities | 4,586,374 | 2,936,547 | ||||||

| Loan payable, net of current portion | 26,433 | 35,093 | ||||||

| Notes payable, net of current portion | 818,232 | 500,000 | ||||||

| Lease liability, net of current portion | 152,814 | 177,578 | ||||||

| Total liabilities | 5,583,853 | 3,649,218 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders' Deficit | ||||||||

| Common stock, $0.00 par value, 100,000,000 authorized and 10,210,571 and 10,211,658 issued and outstanding as of June 30, 2020 and December 31, 2019 | — | — | ||||||

| Treasury Stock, at cost, 5,683 and 0 shares as of June 30, 2020 and December 31, 2019 | (30,000 | ) | — | |||||

| Additional paid-in capital | 5,296,610 | 4,988,382 | ||||||

| Accumulated deficit | (6,029,540 | ) | (6,147,567 | ) | ||||

| Total stockholders' deficit | (762,930 | ) | (1,159,185 | ) | ||||

| Total liabilities and stockholders' equity | $ | 4,820,923 | $ | 2,490,033 | ||||

The accompanying notes are an integral part of the Unaudited Condensed Consolidated Financial Statements.

2

FATHOM HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| Three months ended June 30, | Six months ended June 30, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Revenue | $ | 38,688,744 | $ | 27,792,313 | $ | 67,527,575 | $ | 45,927,039 | ||||||||

| Cost of revenue | 36,356,779 | 26,026,425 | 63,044,034 | 42,879,197 | ||||||||||||

| Gross profit | 2,331,965 | 1,765,888 | 4,483,541 | 3,047,842 | ||||||||||||

| General and administrative | 2,009,277 | 2,743,398 | 3,939,353 | 5,405,443 | ||||||||||||

| Marketing | 138,231 | 46,187 | 368,664 | 103,949 | ||||||||||||

| Total operating expenses | 2,147,508 | 2,789,585 | 4,308,017 | 5,509,392 | ||||||||||||

| Income (loss) from operations | 184,457 | (1,023,697 | ) | 175,524 | (2,461,550 | ) | ||||||||||

| Other expense (income), net | ||||||||||||||||

| Interest expense, net | 32,659 | 27,061 | 65,497 | 54,431 | ||||||||||||

| Other income, net | (10,000 | ) | — | (10,000 | ) | — | ||||||||||

| Other expense (income), net | 22,659 | 27,061 | 55,497 | 54,431 | ||||||||||||

| Income (loss) from operations before income taxes | 161,798 | (1,050,758 | ) | 120,027 | (2,515,981 | ) | ||||||||||

| Income tax (expense) benefit | (1,000 | ) | 12,000 | (2,000 | ) | 7,980 | ||||||||||

| Net income (loss) | $ | 160,798 | $ | (1,038,758 | ) | $ | 118,027 | $ | (2,508,001 | ) | ||||||

| Net income (loss) per share | ||||||||||||||||

| Basic | $ | 0.02 | $ | (0.11 | ) | $ | 0.01 | $ | (0.26 | ) | ||||||

| Diluted | $ | 0.02 | $ | (0.11 | ) | $ | 0.01 | $ | (0.26 | ) | ||||||

| Weighted average common shares outstanding | ||||||||||||||||

| Basic | 9,996,775 | 9,779,753 | 9,996,939 | 9,745,574 | ||||||||||||

| Diluted | 10,030,025 | 9,779,753 | 10,016,269 | 9,745,574 | ||||||||||||

The accompanying notes are an integral part of the Unaudited Condensed Consolidated Financial Statements.

3

FATHOM HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN

STOCKHOLDERS’ DEFICIT

(UNAUDITED)

| Six months ended June 30, 2020 | ||||||||||||||||||||||||||||

| Common Stock | Treasury Stock | |||||||||||||||||||||||||||

| Shares | Par Value | Shares | Amount | Additional Paid in Capital | Accumulated deficit | Total | ||||||||||||||||||||||

| Balance at December 31, 2019 | 10,211,658 | $ | — | — | $ | — | $ | 4,988,382 | $ | (6,147,567 | ) | $ | (1,159,185 | ) | ||||||||||||||

| Issuance of common stock | 15,726 | — | — | — | 83,014 | — | 83,014 | |||||||||||||||||||||

| Share-based compensation | (4,216 | ) | — | — | — | 124,721 | — | 124,721 | ||||||||||||||||||||

| Net loss | — | — | — | — | — | (42,771 | ) | (42,771 | ) | |||||||||||||||||||

| Balance at March 31, 2020 | 10,223,168 | $ | — | — | $ | — | $ | 5,196,117 | $ | (6,190,338 | ) | $ | (994,221 | ) | ||||||||||||||

| Purchase of treasury stock | (5,683 | ) | — | 5,683 | (30,000 | ) | — | — | (30,000 | ) | ||||||||||||||||||

| Share-based compensation | (6,914 | ) | — | — | — | 100,493 | — | 100,493 | ||||||||||||||||||||

| Net income | — | — | — | — | — | 160,798 | 160,798 | |||||||||||||||||||||

| Balance at June 30, 2020 | 10,210,571 | $ | — | 5,683 | $ | (30,000 | ) | $ | 5,296,610 | $ | (6,029,540 | ) | $ | (762,930 | ) | |||||||||||||

| Six months ended June 30, 2019 | ||||||||||||||||||||||||||||

| Common Stock | Treasury Stock | |||||||||||||||||||||||||||

| Shares | Par Value | Shares | Amount | Additional Paid in Capital | Accumulated deficit | Total | ||||||||||||||||||||||

| Balance at December 31, 2018 | 9,440,061 | $ | — | — | $ | — | $ | 2,287,312 | $ | (2,055,270 | ) | $ | 232,042 | |||||||||||||||

| Issuance of common stock | 122,255 | — | — | — | 576,000 | — | 576,000 | |||||||||||||||||||||

| Share-based compensation | 193,081 | — | — | — | 910,092 | — | 910,092 | |||||||||||||||||||||

| Net loss | — | — | — | — | — | (1,469,243 | ) | (1,469,243 | ) | |||||||||||||||||||

| Balance at March 31, 2019 | 9,755,397 | $ | — | — | $ | — | $ | 3,773,404 | $ | (3,524,513 | ) | $ | 248,891 | |||||||||||||||

| Share-based compensation | 133,065 | — | — | — | 645,032 | — | 645,032 | |||||||||||||||||||||

| Net loss | — | — | — | — | — | (1,038,758 | ) | (1,038,758 | ) | |||||||||||||||||||

| Balance at June 30, 2019 | 9,888,462 | $ | — | — | $ | — | $ | 4,418,436 | $ | (4,563,271 | ) | $ | (144,835 | ) | ||||||||||||||

The accompanying notes are an integral part of the Unaudited Condensed Consolidated Financial Statements.

4

FATHOM HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| Six months ended June 30, | ||||||||

| 2020 | 2019 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net income (loss) | $ | 118,027 | $ | (2,508,001 | ) | |||

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | ||||||||

| Depreciation and amortization | 63,771 | 23,633 | ||||||

| Bad debt expense | 99,656 | 81,694 | ||||||

| Share based compensation | 225,214 | 1,555,124 | ||||||

| Change in operating assets and liabilities: | ||||||||

| Accounts receivable | (899,178 | ) | 784,693 | |||||

| Agent annual fees receivable | (513,424 | ) | (388,122 | ) | ||||

| Due from affiliates | 1,085 | 188,621 | ||||||

| Prepaid and other assets | 13,192 | 10,641 | ||||||

| Accounts payable and accrued liabilities | 1,540,699 | (198,592 | ) | |||||

| Operating lease right of use assets | 51,639 | 42,674 | ||||||

| Operating lease liabilities | (50,563 | ) | (41,735 | ) | ||||

| Due to affiliates | (571 | ) | 1 | |||||

| Net cash provided by (used in) operating activities | 649,547 | (449,369 | ) | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchase of property and equipment | (9,369 | ) | (11,137 | ) | ||||

| Purchase of capitalized software | (227,400 | ) | (136,600 | ) | ||||

| Net cash used in investing activities | (236,769 | ) | (147,737 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Principal payments on loan payable | (8,511 | ) | (8,364 | ) | ||||

| Proceeds from issuance of common stock | 83,014 | 576,000 | ||||||

| Purchase of treasury stock | (30,000 | ) | — | |||||

| Proceeds from note payable | 453,581 | — | ||||||

| Net cash provided by financing activities | 498,084 | 567,636 | ||||||

| Net increase (decrease) in cash and cash equivalents | 910,862 | (29,470 | ) | |||||

| Cash and cash equivalents at beginning of period | 579,416 | 1,008,538 | ||||||

| Cash and cash equivalents at end of period | $ | 1,490,278 | $ | 979,068 | ||||

| Supplemental disclosure of cash and non-cash transactions: | ||||||||

| Cash paid for interest | $ | 65,560 | $ | 54,500 | ||||

| Income taxes paid | $ | 2,261 | $ | 12,505 | ||||

| Right of use assets obtained in exchange for lease liabilities | $ | — | $ | 261,814 | ||||

The accompanying notes are an integral part of the Unaudited Condensed Consolidated Financial Statements.

5

FATHOM HOLDINGS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1. Description of Business and Nature of Operations

Fathom Holdings Inc. (“Fathom Holdings,” and collectively with its consolidated subsidiaries and affiliates, the “Company”) is a cloud-based, technology-driven platform-as-a-service company, working with agents, to help individuals purchase and sell residential properties primarily in the South, Atlantic, Southwest and Western parts of the United States. The Company has operations located in multiple states nationwide. The Company is engaged by its customers to assist with buying, selling, or leasing property. In exchange for its services, the Company is compensated by commission income earned upon closing of the sale of a property or execution of a lease. Typically, within the brokerage industry, all brokers involved in a sale are compensated based on commission rates negotiated in a listing agreement. Agents on the “buy” and “sell” sides of each transaction share the total commission identified in the listing agreement. The Company may provide services to the buyer, seller, or both parties to a transaction. When the Company provides services to the seller in a transaction, it recognizes revenue for its portion of the commission, which is calculated as the sales price multiplied by the commission rate less the commission separately distributed to the buyer’s agent, or the “sell” side portion of the commission. When the Company provides services to the buyer in a transaction, the Company recognizes revenue in an amount equal to the sales price for the property multiplied by the commission rate for the “buy” side of the transaction. In instances in which the Company represents both the buyer and the seller in a transaction, it recognizes the full commission on the transaction. The Company operates as one operating and reporting segment.

On July 10, 2020, the Company approved a 4.71352-for-one reverse stock split of the Company’s common stock. No fractional shares were issued in connection with the reverse stock split. All fractional shares as a result of the reverse stock split were rounded up to a full share. The par value and other terms of the common stock were not affected by the reverse stock split.

All share and per share amounts, including stock options, have been retroactively adjusted in these financial statements for all periods presented to reflect the 4.71352-for-one reverse stock split. Further, exercise prices of stock options have been retroactively adjusted in these financial statements for all periods presented to reflect the 4.71352-for-one reverse stock split.

Note 2. Summary of Significant Accounting Policies

Basis of Presentation and Principles of Consolidation — The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”) as determined by the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) for interim financial information. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, the unaudited interim condensed consolidated financial statements reflect all adjustments, which include only normal recurring adjustments necessary for the fair statement of the balances and results of operations for the periods presented. They may not include all of the information and footnotes required by GAAP for complete financial statements. Therefore, these financial statements should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto for the year ended December 31, 2019 included in the Company’s final prospectus filed pursuant to Rule 424(b) under the Securities Act of 1933 with the SEC on July 31, 2020. The results of operations for any interim periods are not necessarily indicative of the results that may be expected for the entire fiscal year or any other interim period.

The unaudited interim condensed consolidated financial statements include the accounts of Fathom Holdings’ wholly owned subsidiaries. All transactions and accounts between and among its subsidiaries have been eliminated. All adjustments and disclosures necessary for a fair presentation of these unaudited interim condensed consolidated financial statements have been included.

Certain Significant Risks and Business Uncertainties — The Company is subject to the risks and challenges associated with companies at a similar stage of development. These include dependence on key individuals, successful development and marketing of its offerings, and competition with larger companies with greater financial, technical, and marketing resources. Further, during the period required to achieve substantially higher revenue in order to become consistently profitable, the Company may require additional funds that might not be readily available or might not be on terms that are acceptable to the Company.

6

Consideration of Going Concern — The Company has a history of negative cash flows from operations and operating losses and experienced net income of $0.1 million for the six months ended June 30, 2020 and a net loss of approximately $4.1 million for the year ended December 31, 2019. Additionally, the Company anticipates further expenditures associated with the process of expanding the business. Combined with the Company’s negative working capital and stockholders’ deficit, management determined these conditions raised substantial doubt as to the Company’s ability to continue as a going concern. Management believes that its planned budget, which includes continued increases in the number of our agents and transactions at rates consistent with historical growth, and the expected ability to achieve sales volumes necessary to cover forecasted expenses along with the $31.3 million in proceeds from the IPO completed on August 4, 2020 (See Note 13) alleviates the substantial doubt about our ability to continue as a going concern for a period of at least one year from the date of the issuance of the unaudited interim condensed consolidated financial statements.

COVID-19 Risks, Impacts and Uncertainties — On January 30, 2020, the World Health Organization (“WHO”) announced a global health emergency because of a new strain of coronavirus originating in Wuhan, China (the “COVID-19 Outbreak”) and the risks to the international community as the virus spreads globally beyond its point of origin. In March 2020, the WHO classified the COVID-19 Outbreak as a pandemic, based on the rapid increase in exposure globally.

We are subject to the risks arising from the COVID-19 Outbreak’s social and economic impacts on the residential real estate industry. Our management believes that the social and economic impacts, which include but are not limited to the following, could have a significant impact on future financial condition, liquidity, and results of operations: (i) restrictions on in-person activities associated with residential real estate transactions arising from shelter-in-place, or similar isolation orders; (ii) decline in consumer demand for in-person interactions and physical home tours; and (iii) deteriorating economic conditions, such as increased unemployment rates, recessionary conditions, lower yields on individual investment portfolios, and more stringent mortgage financing conditions.

In response to the COVID-19 Outbreak, the Company has implemented cost saving measures including elimination of non-essential travel and in-person training activities, and deferral of certain planned expenditures. Additionally, our Chief Executive Officer, Joshua Harley, and our President and Chief Financial Officer, Marco Fregenal, voluntarily took no base salary for March and April 2020. In addition, our Chief Broker Operations Officer, Samantha Giuggio, and one other senior employee voluntarily took 50% reductions in their base salary for those months. Based in part on business operations and results through the end of April, the Company resumed paying all of these salaries in full in May. Given the daily evolution of the COVID-19 Outbreak and the global responses to curb its spread, the Company is not able to estimate the effects of the COVID-19 Outbreak on its results of operations, financial condition, or liquidity for the year ending December 31, 2020 and beyond. If the COVID-19 Outbreak continues, it may have a material adverse effect on the Company’s financial condition, liquidity, and future results of operations.

Use of Estimates — The preparation of consolidated financial statements, in conformity with GAAP, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to provisions for doubtful accounts, legal contingencies, income taxes, deferred income tax, asset valuation allowances, and share-based compensation. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company might differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

7

Cash and Cash Equivalents — The Company considers all highly liquid investments with original maturities of three months or less at the date of purchase to be cash equivalents. Cash equivalents consist primarily of money market instruments. From time to time, the Company’s cash deposits exceed federally insured limits. The Company has not experienced any losses resulting from these excess deposits.

Fair Value Measurements — FASB ASC 820, Fair Value Measurement, (“ASC 820”) defines fair value as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants at the reporting date. The methodology establishes consistency and comparability by providing a fair value hierarchy that prioritizes the inputs to valuation techniques into three broad levels, which are described below:

• Level 1 inputs are quoted market prices in active markets for identical assets or liabilities (these are observable market inputs).

• Level 2 inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or liability (includes quoted market prices for similar assets or identical or similar assets in markets in which there are few transactions, prices that are not current or prices that vary substantially).

• Level 3 inputs are unobservable inputs that reflect the entity’s own assumptions in pricing the asset or liability (used when little or no market data is available).

The fair value of cash and cash equivalents, accounts receivable, agent annual fees receivable, prepaids and other current assets, due from affiliates, accounts payable and accrued liabilities, and due to affiliates approximate their carrying value due to their short-term maturities. The loan and note payable, and lease liability are presented at their carrying value, which based on borrowing rates currently available to the Company for loans and leases with similar terms, approximates their fair values.

Accounts Receivable — Accounts receivable consist of balances due from customers, net of estimated allowances for uncollectible accounts. In determining collectability, historical trends are evaluated, and specific customer issues are reviewed on a periodic basis to arrive at appropriate allowances.

Agent Annual Fees Receivable — Agent annual fees receivable consist of the $500 fee every agent pays on their first sale or their one year anniversary date, which is recognized as a reduction to Cost of Revenue ratably over the year in which the fee pertains.

Property and Equipment — Property and equipment is stated at cost, less accumulated depreciation. Maintenance and repairs are charged to expense when incurred. Additions and improvements that extend the economic useful life of the asset are capitalized and depreciated over the remaining useful lives of the assets. The cost and accumulated depreciation of assets sold or retired are removed from the respective accounts, and any resulting gain or loss is reflected in current earnings. Depreciation is provided using the straight-line method in amounts considered to be sufficient to amortize the cost of the assets to operations over their estimated useful lives, as follows:

8

| Asset category | Depreciable life | |

| Vehicles | 7 years | |

| Computers and equipment | 5 years | |

| Furniture and fixtures | 7 years |

Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of such assets might not be recoverable. Recoverability of assets to be held and used is measured first by a comparison of the carrying amount of an asset to future undiscounted net cash flows expected to be generated by the asset. If such assets were considered to be impaired, an impairment loss would be recognized as the difference between the fair value and carrying value when the carrying amount of the asset exceeds the fair value of the asset. To date, no such impairment has occurred.

Capitalized internal use software — Costs incurred in the preliminary stages of website and software development are expensed as incurred. Once an application has reached the development stage, direct internal and external costs relating to upgrades or enhancements that meet the capitalization criteria are capitalized in property and equipment and amortized on a straight-line basis over their estimated useful lives. Maintenance and enhancement costs (including those costs in the post-implementation stages) are typically expensed as incurred, unless such costs relate to substantial upgrades and enhancements to the websites (or software) that result in added functionality, in which case the costs are capitalized as well.

Capitalized software costs are amortized over the expected useful lives of those releases. Currently, capitalized software costs for internal use has a useful life estimated at three years.

Estimated useful lives of website and software development activities are reviewed annually or whenever events or changes in circumstances indicate that intangible assets may be impaired and adjusted as appropriate to reflect upcoming development activities that may include significant upgrades or enhancements to the existing functionality.

Revenue Recognition — We apply the provisions of FASB ASC Topic 606, Revenue from Contracts with Customers (“ASC 606”), and all related appropriate guidance. The Company recognizes revenue under the core principle to depict the transfer of control to the Company’s customers in an amount reflecting the consideration to which the Company expects to be entitled. In order to achieve that core principle, the Company applies the following five-step approach: (1) identify the contract with a customer; (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to the performance obligations in the contract; and (5) recognize revenue when a performance obligation is satisfied.

The Company’s revenue substantially consists of commissions generated from real estate brokerage services. The Company is contractually obligated to provide for the fulfillment of transfers of real estate between buyers and sellers. The Company provides these services itself and controls the services of its agents necessary to legally transfer the real estate. Correspondingly, the Company is defined as the principal. The Company, as principal, satisfies its obligation upon the closing of a real estate transaction. The Company has concluded that agents are not employees of the Company, rather deemed to be independent contractors. Upon satisfaction of its obligation, the Company recognizes revenue in the gross amount of consideration it is entitled to receive. The transaction price is calculated by applying the Company’s portion of the agreed-upon commission rate to the property’s selling price. The Company may provide services to the buyer, seller, or both parties to a transaction. When the Company provides services to the seller in a transaction, it recognizes revenue for its portion of the commission, which is calculated as the sales price multiplied by the commission rate less the commission separately distributed to the buyer’s agent, or the “sell” side portion of the commission. When the Company provides services to the buyer in a transaction, the Company recognizes revenue in an amount equal to the sales price for the property multiplied by the commission rate for the “buy” side of the transaction. In instances in which the Company represents both the buyer and the seller in a transaction, it recognizes the full commission on the transaction. Commissions revenue contains a single performance obligation that is satisfied upon the closing of a real estate transaction, at which point the entire transaction price is earned. The Company’s customers remit payment for the Company’s services to the title company or attorney closing the sale of property at the time of closing. The Company receives payment upon close of property or within days of the closing of a transaction. The Company is not entitled to any commission until the performance obligation is satisfied and is not owed any commission for unsuccessful transactions, even if services have been provided.

9

The Company has utilized the practical expedient in ASC 606 and elected not to capitalize contract costs for contracts with customers with durations less than one year. The Company does not have significant remaining unfulfilled performance obligations or contract balances.

Cost of Revenue — Cost of revenue consists primarily of agent commissions less transaction and annual fees paid by our agents.

Marketing Expenses — Marketing expenses consist primarily of marketing and promotional materials. Marketing costs are expensed as they are incurred.

Leases — The Company adopted FASB ASC Topic 842, Leases, (“ASC 842”) on January 1, 2019. The Company categorizes leases at their inception as either operating or finance leases. On certain lease agreements, the Company may receive rent holidays and other incentives. The Company recognizes lease costs on a straight-line basis without regard to deferred payment terms, such as rent holidays, that defer the commencement date of required payments.

Share-based Compensation — Share-based compensation for employees and non-employees (principally independent contractor agents) is measured at the grant date based on the fair value of the award and is recognized as expense over the requisite service period, which is generally the vesting period of the respective award. Forfeitures are recognized when they occur. Fully vested restricted stock awards are measured on grant date at fair value.

Income Taxes — Income taxes are accounted for using an asset and liability approach that requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the combined financial statement and tax bases of assets and liabilities at the applicable enacted tax rates. The Company will establish a valuation allowance for deferred tax assets if it is more likely than not that these items will expire before either the Company is able to realize their benefit or that future deductibility is uncertain.

The Company believes that it is currently more likely than not that its deferred tax assets will not be realized and as such, it has recorded a full valuation allowance for these assets. The Company evaluates the likelihood of the ability to realize deferred tax assets in future periods on a quarterly basis, and when appropriate evidence indicates it would release its valuation allowance accordingly. The determination to provide a valuation allowance is dependent upon the assessment of whether it is more likely than not that sufficient taxable income will be generated to utilize the deferred tax assets. Based on the weight of the available evidence, which includes the Company’s historical operating losses, lack of taxable income, and accumulated deficit, the Company provided a full valuation allowance against the U.S. tax assets resulting from the tax losses as of June 30, 2020 and December 31, 2019.

10

Deferred Offering Costs — Deferred offering costs are included in prepaid and other current assets and consists of legal, accounting, underwriting fees and other costs incurred through the balance sheet date that are directly related to the Company’s initial public offering (“IPO”) and that will be charged to stockholders’ equity upon the completion of the IPO. The Company’s IPO closed on August 4, 2020.

For the six months ended June 30, 2020 and the year ended December 31, 2019, the Company capitalized approximately $213,000 and $37,000, respectively, of deferred offering costs related to the IPO. For the six months ended June 30, 2019, the Company did not capitalize any deferred offering costs related to the IPO.

Earnings (Loss) Per Share — Basic earnings (loss) per share is computed by dividing net income (loss) attributable to the Company by the weighted-average number of shares of common stock outstanding for the period. Our diluted earnings per share of common stock is computed similarly to basic earnings per share, except that it reflects the effect of shares of common stock issuable for presently unvested restricted stock and upon exercise of stock options, using the treasury stock method in periods in which they have a dilutive effect.

The following table shows the computation of weighted-average diluted shares for the three and six months ended June 30, 2020 and June 30, 2019:

| Three months ended June 30, | Six months ended June 30, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Weighted-average basic shares outstanding | 9,996,775 | 9,779,753 | 9,996,939 | 9,745,574 | ||||||||||||

| Effect of dilutive securities: | ||||||||||||||||

| Stock options | 3,483 | — | 1,441 | — | ||||||||||||

| Unvested restricted stock awards | 29,767 | — | 17,889 | — | ||||||||||||

| Weighted-average diluted shares | 10,030,025 | 9,779,753 | 10,016,269 | 9,745,574 | ||||||||||||

Recently Issued Accounting Pronouncements Not Yet Adopted

In June 2016, the FASB issued ASU 2016-13, Financial Instruments — Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, that changes the impairment model for most financial assets and certain other instruments. For receivables, loans and other instruments, entities will be required to use a new forward-looking “expected loss” model that generally will result in the earlier recognition of allowance for losses. In addition, an entity will have to disclose significantly more information about allowances and credit quality indicators. The new standard is effective for the Company for fiscal years beginning after December 15, 2022. The Company is currently evaluating the impact of the pending adoption of the new standard on its consolidated financial statements and intends to adopt the standard on January 1, 2023.

In December 2019, the FASB issued ASU 2019-12, Simplifying the Accounting for Income Taxes ("ASU 2019-12"), which modifies ASC 740 to reduce complexity while maintaining or improving the usefulness of the information provided to users of financial statements. ASU 2019-12 is effective for the Company for interim and annual reporting periods beginning after December 15, 2021. The Company is currently assessing the impact of ASU 2019-12, but it is not expected to have a material impact on the Company’s consolidated financial statement.

11

Note 3. Property and Equipment, Net

Property and equipment, net consisted of the following at the dates indicated:

| June 30, 2020 | December 31, 2019 | |||||||

| (Unaudited) | ||||||||

| Vehicles | $ | 119,324 | $ | 119,324 | ||||

| Computers and equipment | 82,484 | 73,115 | ||||||

| Furniture and fixtures | 30,058 | 30,058 | ||||||

| Total property and equipment | 231,866 | 222,497 | ||||||

| Accumulated depreciation | (132,475 | ) | (116,525 | ) | ||||

| Total property and equipment, net | $ | 99,391 | $ | 105,972 | ||||

Depreciation expense for property and equipment was approximately $8,000 and $6,000 for the three months ended June 30, 2020 and 2019, respectively, and $16,000 and $12,000 for the six months ended June 30, 2020 and 2019, respectively.

Note 4. Capitalized Software, Net

Capitalized software, net consisted of the following at the dates indicated:

| June 30, 2020 | December 31, 2019 | |||||||

| (Unaudited) | ||||||||

| Software development | $ | 726,700 | $ | 499,300 | ||||

| Total capitalized software | 726,700 | 499,300 | ||||||

| Accumulated amortization | (82,279 | ) | (34,458 | ) | ||||

| Total capitalized software, net | $ | 644,421 | $ | 464,842 | ||||

Amortization expense for capitalized software was approximately $37,000 and $11,000 for the three months ended June 30, 2020 and 2019, respectively, and $48,000 and $11,000 for the six months ended June 30, 2020 and 2019, respectively.

Note 5. Accounts Payable and Accrued Liabilities

Accounts payable and accrued liabilities consisted of the following at the dates indicated:

| June 30, 2020 | December 31, 2019 | |||||||

| (Unaudited) | ||||||||

| Accounts payable | $ | 1,802,129 | $ | 922,373 | ||||

| Deferred annual fee | 958,700 | 463,667 | ||||||

| Accrued commissions | 370,405 | 261,161 | ||||||

| Accrued compensation | 363,690 | 196,948 | ||||||

| Accrued professional fees | 356,139 | 601,797 | ||||||

| Accrued legal fees | 173,542 | 71,724 | ||||||

| Other accrued liabilities | 142,888 | 72,836 | ||||||

| Credit card liability | 141,065 | 70,431 | ||||||

| Insurance premium liabilities | 36,269 | 139,891 | ||||||

| Accrued bonuses | 2,100 | 5,400 | ||||||

| Total accounts payable and accrued liabilities | $ | 4,346,927 | $ | 2,806,228 | ||||

12

Note 6. Debt

Loan Payable

The Company obtained a loan for an automobile used by the Chief Executive Officer. The term of the loan is from July 2016 through December 2022 with an annual interest rate of 1.74%. The components of the loan payable were as follows:

| June 30, 2020 | December 31, 2019 | |||||||

| (Unaudited) | ||||||||

| Loan payable - Automobile loan | $ | 43,677 | $ | 52,188 | ||||

| Less current portion | (17,244 | ) | (17,095 | ) | ||||

| Loan payable, net of current portion | $ | 26,433 | $ | 35,093 | ||||

Notes Payable

| June 30, 2020 | December 31, 2019 | |||||||

| (Unaudited) | ||||||||

| Quail Point Corp. | $ | 500,000 | $ | 500,000 | ||||

| Paycheck Protection Program Loan | 303,681 | — | ||||||

| Small Business Administration Loan | 149,900 | — | ||||||

| Long term debt | 953,581 | 500,000 | ||||||

| Less current portion the Paycheck Protection Program Loan | (135,093 | ) | — | |||||

| Less current portion of the Small Business Administration Loan | (256 | ) | — | |||||

| Note payable, net of current portion | $ | 818,232 | $ | 500,000 | ||||

Note Payable – Quail Point Corp.

On April 14, 2017, Fathom Realty entered into a Loan Agreement with Quail Point Corp. (the “Lender”) whereby Fathom Realty borrowed $400,000 from the Lender. Interest is payable each month at 1.6675% (20% annually) and the note was due to mature on March 1, 2037 with the principal due at that time. The Loan Agreement allowed for principal payments at any time without pre-payment penalty.

On February 6, 2018, Fathom Realty entered into a new Loan Agreement (‘New Loan Agreement”) for $500,000 with the Lender. The New Loan Agreement extinguished the original loan and established a new loan. The fair value of the New Loan Agreement equaled the carrying value. Interest is payable each month at 1.6675% (20% annually) and the note matures on March 1, 2023 with the principal due at that time. The New Loan Agreement allows for principal payments at any time without pre-payment penalty.

Note Payable – Paycheck Protection Program Loan

On May 5, 2020, the Company received $303,681 in loan funding from the Paycheck Protection Program (the “PPP”), established pursuant to the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) and administered by the U.S. Small Business Administration (“SBA”). The application for these funds requires the Company to, in good faith, certify that the current economic uncertainty made the loan request necessary to support the ongoing operations of the Company. This certification further requires the Company to take into account current business activity and ability to access other sources of liquidity sufficient to support ongoing operations in a manner that is not significantly detrimental to the business. The unsecured loan (the “PPP Loan”) is evidenced by a promissory note of the Company dated May 5, 2020 (the “ PPP Note”) in the principal amount of $303,681, to Bank of America (the “Bank”), the lender. Under the terms of the PPP Note and the PPP Loan, interest accrues on the outstanding principal at the rate of 1% per annum, and there is a deferment period of six months until equal installment payments of $17,090 of principal and interest are due. The term of the PPP Note is two years, though payments greater than the monthly payment or additional payments may be made at any time without prepayment penalty but shall not relieve the Company of its obligations to pay the next succeeding monthly payment.

13

The CARES Act and the PPP provide a mechanism for forgiveness of up to the full amount borrowed. Under the PPP, the Company may apply for and be granted forgiveness for all or part of the PPP Loan. The amount of loan proceeds eligible for forgiveness is based on a formula that takes into account a number of factors, including the amount of loan proceeds used by the Company during the twenty-four week period after the loan origination for certain purposes including payroll costs, rent payments on certain leases, and certain qualified utility payments, provided that at least 60% of the loan amount is used for eligible payroll costs; the employer maintaining or rehiring employees and maintaining salaries at certain levels; and other factors. Subject to the other requirements and limitations on loan forgiveness, only loan proceeds spent on payroll and other eligible costs during the covered twenty-four-week period will qualify for forgiveness. Forgiveness of the loan is dependent on the Company having initially qualified for the loan and qualifying for the forgiveness of such loan based on future adherence to the forgiveness criteria. The Company intends to use the entire Loan amount for qualifying expense, though no assurance is provided that the Company will obtain forgiveness of the PPP Loan in whole or in part.

Note Payable – Small Business Administration Loan

On June 5, 2020, the Company received $150,000 in loan funding from the SBA (the “SBA Note”) under the Economic Injury Disaster Loan program (“EIDL”). The Company will use all the proceeds of this secured SBA Note solely as working capital to alleviate economic injury caused by COVID-19. The SBA Note is evidenced by a promissory note of the Company dated June 5, 2020 in the principal amount of $150,000, to the SBA, the lender. Debt issuance costs incurred in connection with the SBA Note of $100 were expensed. Under the terms of the SBA Note, interest accrues on the outstanding principal at the rate of 3.75% per annum, and installment payments, including principal and interest, of $731 monthly, will begin twelve months from the date of the SBA Note. All remaining principal and accrued interest is due and payable thirty years from the date of the Note. In connection with the SBA Note, the Company received a $10,000 grant, which does not need to be repaid, and is recorded in other income.

Note 7. Stockholders’ Equity

On July 10, 2020, the Company approved a 4.71352-for-one reverse stock split of the Company’s common stock. No fractional shares were issued in connection with the reverse stock split. All fractional shares as a result of the reverse stock split were rounded up to a full share. The par value and other terms of the common stock were not affected by the reverse stock split.

All share and per share amounts, including stock options, have been retroactively adjusted in these financial statements for all periods presented to reflect the 4.71352-for-one reverse stock split. Further, exercise prices of stock options have been retroactively adjusted in these financial statements for all periods presented to reflect the 4.71352-for-one reverse stock split.

Common Stock

During the six months ended June 30, 2020, the Company sold, in aggregate, 15,726 shares of common stock for gross proceeds of $83,014.

Treasury Stock

During the six months ended June 30, 2020, the Company repurchased, in aggregate, 5,683 shares of common stock for a total of $30,000.

14

Note 8. Share-based Compensation

The Company’s 2017 Stock Plan (the “Plan”) provides for granting stock options and restricted stock awards to employees, directors, contractors and consultants of the Company. A total of 3,182,335 shares of common stock are authorized to be issued pursuant to the Plan. Determining the appropriate fair value of share-based awards requires the input of subjective assumptions, including the fair value of the Company’s common stock, and, for stock options, the expected life of the option, and expected stock price volatility. The assumptions used in calculating the fair value of share-based awards represent management’s best estimates and involve inherent uncertainties and the application of management’s judgment. As a result, if factors change and management uses different assumptions, share-based compensation expense could be materially different for future awards.

Restricted Stock Awards

| Shares | Weighted Average Grant Date Fair Value | |||||||

| Nonvested at December 31, 2019 | 227,981 | $ | 5.28 | |||||

| Granted | — | — | ||||||

| Vested | — | — | ||||||

| Forfeited | (4,216 | ) | $ | (5.28 | ) | |||

| Nonvested at March 31, 2020 | 223,765 | $ | 5.28 | |||||

| Granted | — | — | ||||||

| Vested | — | — | ||||||

| Forfeited | (6,914 | ) | $ | (5.28 | ) | |||

| Nonvested at June 30, 2020 | 216,851 | $ | 5.28 | |||||

The Company recognized stock compensation expense for restricted stock awards of $97,862, net of forfeitures of $8,984, and $633,217 for the three months ended June 30, 2020 and June 30, 2019, respectively, and $201,020, net of forfeitures of $11,355, and $1,543,309, for the six months ended June 30, 2020 and June 30, 2019, respectively, which is included in general and administrative expense. At June 30, 2020, the total unrecognized compensation expense related to unvested restricted stock awards granted was $923,992, which the Company expects to recognize over a period of approximately 2.32 years. No shares were granted during the six months ended June 30, 2020.

Stock Option Awards

For the three months ended June 30, 2020 and June 30, 2019, the Company recognized $2,631 and $11,815, respectively, and for the six months ended June 30, 2020 and June 30, 2019, the Company recognized $24,194 and $11,815, respectively, of share-based compensation expense in general and administrative expense. At June 30, 2020, the total unrecognized compensation related to unvested stock option awards granted was $0. No stock option awards were granted during the six months ended June 30, 2020.

15

Note 9. Leases

Operating Leases

The Company has operating leases primarily consisting of office space with remaining lease terms of 1 to 7 years, subject to certain renewal options as applicable.

Leases with an initial term of twelve months or less are not recorded on the balance sheet, and the Company does not separate lease and non-lease components of contracts. There are no material residual guarantees associated with any of the Company’s leases, and there are no significant restrictions or covenants included in the Company’s lease agreements. Certain leases include variable payments related to common area maintenance and property taxes, which are billed by the landlord, as is customary with these types of charges for office space.

Our lease agreements generally do not provide an implicit borrowing rate. Therefore, the Company used a benchmark approach to derive an appropriate imputed discount rate. The Company benchmarked itself against other companies of similar credit ratings and comparable quality and derived an imputed rate, which was used in a portfolio approach to discount its real estate lease liabilities. We used an estimated incremental borrowing rate of 8% on December 31, 2018 for all leases that commenced prior to that date.

There was no sublease rental income for the six months ended June 30, 2020, the Company is not the lessor in any lease arrangement, and no related party transactions for lease arrangements have occurred.

Lease Costs

The table below presents certain information related to the lease costs for the Company’s operating leases for the six months ended June 30, 2020 and June 30, 2019:

| Six months ended June 30, | ||||||||

| Components of total lease cost: | 2020 | 2019 | ||||||

| (Unaudited) | ||||||||

| Operating lease expense | $ | 70,151 | $ | 54,456 | ||||

| Short-term lease expense | 35,047 | 29,994 | ||||||

| Total lease cost | $ | 105,198 | $ | 84,450 | ||||

Lease Position as of June 30, 2020

Right of use lease assets and lease liabilities for our operating leases were recorded in the condensed consolidated balance sheet as follows:

| As of June 30, 2020 | ||||

| (Unaudited) | ||||

| Assets | ||||

| Lease right of use assets | $ | 213,501 | ||

| Total lease assets | $ | 213,501 | ||

| Liabilities | ||||

| Current liabilities: | ||||

| Lease liability - current portion | $ | 63,767 | ||

| Noncurrent liabilities: | ||||

| Lease liability, net of current portion | 152,814 | |||

| Total lease liability | $ | 216,581 | ||

16

Lease Terms and Discount Rate

The table below presents certain information related to the weighted average remaining lease term and the weighted average discount rate for the Company’s operating leases as of June 30, 2020:

| Weighted average remaining lease term (in years) - operating leases | 4.48 | |||

| Weighted average discount rate - operating leases | 8 | % |

Undiscounted Cash Flows

Future lease payments included in the measurement of lease liabilities on the condensed consolidated balance sheet as of June 30, 2020, for the following five fiscal years and thereafter were as follows:

| Year ending December 31, | Operating Leases | |||

| 2020 (remaining) | $ | 58,314 | ||

| 2021 | 39,350 | |||

| 2022 | 40,175 | |||

| 2023 | 41,686 | |||

| 2024 | 43,243 | |||

| 2025 | 37,353 | |||

| Total Minimum Lease Payments | $ | 260,121 | ||

| Less effects of discounting | (43,540 | ) | ||

| Present value of future minimum lease payments | $ | 216,581 | ||

Note 10. Related Party Transactions

Due from affiliates

Fathom Realty has loaned monies to other entities controlled by shareholders of the Company.

Due from affiliates consists of the following:

| June 30, 2020 | December 31, 2019 | |||||||

| (Unaudited) | ||||||||

| On Target Transactions LLC | $ | 1,476 | $ | 2,561 | ||||

| Total due from affiliates | $ | 1,476 | $ | 2,561 | ||||

17

On Target Transactions LLC (“On Target Transactions”) is a transaction management company for real estate agents. Messrs. Harley and Fregenal own a total of 60% of On Target Transactions.

Due to affiliates

Fathom Realty has outstanding monies due to related parties and other entities controlled by shareholders of the Company.

Due to affiliates consists of the following:

| June 30, 2020 | December 31, 2019 | |||||||

| (Unaudited) | ||||||||

| Hometown Heroes Holdings, LLC | $ | 23,087 | $ | 23,658 | ||||

| Total due to affiliates | $ | 23,087 | $ | 23,658 | ||||

Hometown Heroes Holdings, LLC (“Hometown Heroes Holdings”) is a real estate portal that generates real estate leads. Hometown Heroes Holdings is fully owned by Joshua Harley, Marco Fregenal and Glenn Sampson, who are officers (Harley and Fregenal), directors and shareholders of the Company.

Note 11. Income Taxes

As of June 30, 2020, and December 31, 2019, the Company had federal net operating loss carryforwards of $6.4 million and $6.5 million and state net operating loss carryforwards of $3.1 million and $3.2 million, respectively. Losses will begin to expire, if not utilized, in 2032. Utilization of the net operating loss carryforwards may be subject to an annual limitation according to Section 382 of the Internal Revenue Code of 1986 as amended, and similar provisions.

The Company applies the standards on uncertainty in income taxes contained in ASC Topic 740, Accounting for Income Taxes. The adoption of this interpretation did not have any impact on the Company’s consolidated financial statements, as the Company did not have any significant unrecognized tax benefits during the six months ended June 30, 2020 or the year ended December 31, 2019. Currently, the statute of limitations remains open subsequent to and including the year ended December 31, 2016.

Note 12. Legal Proceedings

From time to time the Company is involved in litigation, claims, and other proceedings arising in the ordinary course of business. Such litigation and other proceedings may include, but are not limited to, actions relating to employment law and misclassification, intellectual property, commercial or contractual claims, brokerage or real estate disputes, or other consumer protection statutes, ordinary-course brokerage disputes like the failure to disclose property defects, commission disputes, and vicarious liability based upon conduct of individuals or entities outside of the Company’s control, including agents and third-party contractor agents. Litigation and other disputes are inherently unpredictable and subject to substantial uncertainties and unfavorable resolutions could occur. As of June 30, 2020, there was no material litigation against the Company.

Note 13. Subsequent Events

On August 4, 2020 the Company completed an IPO of its common stock, which resulted in the issuance and sale of 3,430,000 shares of its common stock at a public offering price of $10.00 per share, generating net proceeds of $31.3 million after deducting underwriting discounts and other offering costs. The shares commenced trading on the Nasdaq Capital Market on July 31, 2020 under the ticker symbol “FTHM.”

On July 30, 2020, the effective date of the registration statement used in the IPO, the Company agreed to issue warrants to the underwriter (the “Underwriter Warrant”) to purchase 240,100 shares of common stock. The Underwriter Warrant is exercisable at a per share exercise price of $11.00, which is equal to 110% of the public offering price per share of common stock sold in the IPO. The Underwriter Warrant is exercisable at any time and from time to time from and after January 26, 2021, which is 180 days following the effective date of the registration statement used in the IPO.

18

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Company’s consolidated operating results are affected by a wide variety of factors that could materially and adversely affect revenues and profitability, including the risk factors described in our Registration Statement on Form S-1 (File No. 333-235972), as amended (our “Initial Public Offering Registration Statement”) and the risk factors described in this quarterly report. As a result of these and other factors, the Company may experience material fluctuations in future operating results on a quarterly or annual basis, which could materially and adversely affect its business, consolidated financial condition, liquidity, operating results, and common stock prices. Furthermore, this document and other documents filed by the Company with the Securities and Exchange Commission (“SEC”) contain certain forward-looking statements under the Private Securities Litigation Reform Act of 1995 (“Forward-Looking Statements”) with respect to the business of the Company. Forward-Looking Statements are necessarily subject to risks and uncertainties, many of which are outside our control, that could cause actual results to differ materially from these statements. Forward-Looking Statements can be identified by such words as “anticipates,” “believes,” “plan,” “assumes,” “could,” “should,” “estimates,” “expects,” “intends,” “potential,” “seek,” “predict,” “may,” “will” and similar references to future periods. All statements other than statements of historical facts included in this report regarding our strategies, prospects, financial condition, operations, costs, plans and objectives and regarding the anticipated impact of COVID-19 are Forward-Looking Statements. These Forward-Looking Statements are subject to certain risks and uncertainties, including those detailed in our Initial Public Offering Registration Statement and in the risk factors described in this quarterly report, which could cause actual results to differ materially from these Forward-Looking Statements. The Company undertakes no obligation to publicly release the results of any revisions to these Forward-Looking Statements which may be necessary to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Any Forward-Looking Statement made by the Company is based only on information currently available to us and speaks only as of the date on which it is made.

The terms the “Company,” “Fathom,” “we,” “us,” and “our” as used in this report refer to Fathom Holdings Inc. and its consolidated subsidiaries unless otherwise specified.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

The information in this Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) should be read in conjunction with the Company’s condensed consolidated financial statements and the related notes set forth in Item 1 of Part I of this quarterly report on Form 10-Q, our MD&A set forth in our Initial Public Offering Registration Statement, and our consolidated financial statements and related notes set forth in our Initial Public Offering Registration Statement. See Part II, Item 1A, “Risk Factors,” below, and “Cautionary Notice Regarding Forward-Looking Information,” above, and the information referenced therein, for a description of risks that we face and important factors that we believe could cause actual results to differ materially from those in our forward-looking statements. All statements herein regarding the likely impact of COVID-19 constitute forward-looking statements. All amounts and percentages are approximate due to rounding and all dollars in the text are in millions, except per share amounts or where otherwise noted. When we cross-reference to a “Note,” we are referring to our “Notes to Unaudited Condensed Consolidated Financial Statements,” unless the context indicates otherwise. All amounts noted within the tables are in thousands and amounts and percentages are approximate due to rounding.

Overview

Fathom is a cloud-based, technology-driven platform-as-a-service company operating in the real estate industry. Our primary operation, Fathom Realty (as defined below), operates as a real estate brokerage company, working with real estate agents to help individuals purchase and sell residential and commercial properties, primarily in the South, Atlantic, Southwest, and Western parts of the United States, with the intention of expanding into all states. We operate as one operating and reporting segment.

19

Fathom Realty Holdings, LLC, a Texas limited liability company (“Fathom Realty”), is a wholly owned subsidiary of Fathom Holdings that was formed on April 11, 2011 and is headquartered in Cary, North Carolina. Fathom Realty owns 100% of 24 subsidiaries, each an LLC representing the state in which the entity operates in (e.g. Fathom Realty NJ, LLC).

Fathom Realty Group Inc. (“Fathom Group”), is an S-Corporation formed in Texas on April 14, 2011. Fathom Group functions in a manner similar to the subsidiaries of Fathom Realty (i.e. representing our business interests in California).

Fathom Holdings Inc. (together with its consolidated subsidiaries, “Fathom”, “we”, “our”, “us”, or “the Company”) was incorporated in North Carolina on May 5, 2017 as “Fathom Ventures, Inc.” (“Fathom Ventures”). On September 4, 2018 we filed Articles of Amendment to our Articles of Incorporation changing our name and amending the number of authorized shares to 185,000,000 shares, no par value per share, all of one class designated common stock (85,000,000 of which were designated as Series A common stock and 100,000,000 of which were designated as Series B common stock).

Beginning in August 2018, we effected a corporate reorganization (the "Reorganization”), whereby the former members of our direct, wholly-owned subsidiary, Fathom Realty contributed all of their ownership interests in Fathom Realty to us in exchange for shares of our stock at a ratio of 1 to 3.169907. Prior to such contribution and exchange, the shareholders of Fathom Group contributed all of their shares of stock in Fathom Group to Fathom Realty in exchange for additional ownership interests in Fathom Realty.

As part of the Reorganization, we restated our Articles of Incorporation on September 11, 2018 such that (i) each share of Series A common stock outstanding as of immediately prior to the filing of the Restated Articles of Incorporation was canceled and (ii) each two shares of Series B common stock outstanding as of immediately prior to the filing of the Restated Articles of Incorporation was converted and reclassified into one share of common stock. Pursuant to the Restated Articles of Incorporation, we also amended the number of authorized shares of the corporation to 100,000,000 shares, no par value, all of one class designated common stock. We refer to these steps as the “Exchange Transactions.” The Exchange Transactions did not affect our operations, which we continue to conduct through our operating subsidiaries.

Prior to and through the date of the Exchange Transactions, our Chief Executive Officer was the majority shareholder/member in each of Fathom Realty, Fathom Group and Fathom Ventures. Therefore, the Exchange Transactions have been accounted for as acquisitions under common control. The financial statements for the three and six months ended June 30, 2020 and 2019 and for the year ended December 31, 2019 have been presented on a consolidated basis.

On August 4, 2020 the Company completed an IPO of its common stock, which resulted in the issuance and sale of 3,430,000 shares of its common stock at a public offering price of $10.00 per share, generating net proceeds of $31.3 million after deducting underwriting discounts and other offering costs.

COVID-19

Our business is dependent on the economic conditions within the markets in which we operate. Changes in these conditions can have a positive or negative impact on our business. The economic conditions influencing the housing markets primarily include economic growth, interest rates, unemployment, consumer confidence, mortgage availability, and supply and demand.

In periods of economic growth, demand typically increases resulting in increasing home sales transactions and home sales prices. Similarly, a decline in economic growth, increasing interest rates and declining consumer confidence generally decreases demand. Additionally, regulations imposed by local, state, and federal government agencies, and geopolitical instability, can also negatively impact the housing markets in which we operate.

20

In December 2019, a novel strain of coronavirus, COVID-19, was identified in Wuhan, China. This new coronavirus has caused a global health emergency and was declared a pandemic by the World Health Organization in March 2020 (“COVID-19 Outbreak”). We are continually monitoring the impacts the COVID-19 Outbreak could have on our business. Risks relating to the spread of coronavirus pushed the United States Federal Reserve to cut interest rates as part of an emergency action to protect the economy from the COVID-19 Outbreak’s impact. In an effort to contain and slow the spread of COVID-19, governments have implemented various measures, such as, ordering non-essential businesses to close, issuing travel advisories, cancelling large scale public events, ordering residents to shelter in place, and requiring the public to practice social distancing. In most states, real estate has been considered an essential business.

The COVID-19 Outbreak has materially and adversely affected businesses worldwide. The magnitude and duration of the impact from COVID-19 are unknown and cannot be reasonably estimated.

According to the National Association of Realtors (“NAR”), the coronavirus is leading to fewer homebuyers, as well as listings being delayed. The decline in consumer confidence and the measures taken to prevent the spread of COVID-19 are bringing caution to buyers and sellers. The NAR is predicting that the COVID-19 Outbreak could accelerate economic corrections and contribute to sharper but temporary drags on housing activity. While the effect of lower interest rates could offset some of the negative impacts on housing demand, it is too early to determine whether the lower interest rates can overcome the current economic concerns and rising uncertainty. We are constantly monitoring the spread of COVID-19, especially in states and regions in which we currently operate, primarily in the South, Atlantic, Southwest and Western parts of the United States. Certain states in which we primarily operate, including Texas and North Carolina, have reported a recent spike in diagnosed cases of COVID-19.

We believe that the social and economic impacts in the states and regions in which we operate, which include but are not limited to the following, could have a significant impact on future financial condition, liquidity, and results of operations: (i) restrictions on in-person activities associated with residential real estate transactions arising from shelter-in-place, or similar isolation orders; (ii) decline in consumer demand for in-person interactions and physical home tours; and (iii) deteriorating economic conditions, such as increased unemployment rates, recessionary conditions, lower yields on individual investment portfolios, and more stringent mortgage financing conditions. In response to the COVID-19 Outbreak, the Company has implemented cost-saving measures including elimination of non-essential travel and in-person training activities, and deferral of certain planned expenditures. Additionally, our Chief Executive Officer, Joshua Harley, and our President and Chief Financial Officer, Marco Fregenal, voluntarily took no base salary for March and April 2020. In addition, our Chief Broker Operations Officer, Samantha Giuggio, and one other senior employee voluntarily took 50% reductions in their base salary for those months. Based in part on business operations and results through the end of April, the Company resumed paying all of these salaries in full in May.

While the Company believes it is well positioned in times of economic uncertainty, the Company is not able to estimate the effects of the COVID-19 Outbreak on its results of operations, financial condition, or liquidity for the year ending December 31, 2020 and beyond. If the COVID-19 Outbreak continues, it may have a material adverse effect on the Company’s financial condition, liquidity, and future results of operations.

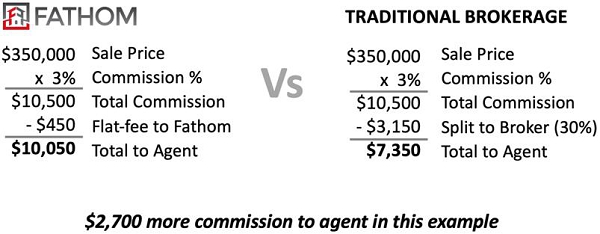

Agents

Due to our low-overhead business model, which leverages our proprietary technology, we can offer our agents the ability to keep significantly more of their commissions compared to traditional real estate brokerage firms. We believe we offer our agents some of the best technology, training, and support available in the industry. We believe our business model and our focus on treating our agents well attract more agents and higher-producing agents.

21

We had the following number of agents as of:

| June 30, 2020 | June 30, 2019 | Change | ||||||||||

| Agents | 4,554 | 3,275 | 39 | % | ||||||||

Components of Our Results of Operations

Revenue

The Company’s revenue substantially consists of commissions generated from real estate brokerage services.

We recognize commission-based revenue on the closing of a transaction, less the amount of any closing-cost reductions. Commission revenue is affected by the number of real estate transactions we close, the mix of transactions, home sale prices, and commission rates.

Agent Equity Ownership

Through our stock plans, we intend to offer an equity incentive program where all of our agents can receive, in lieu of cash commissions at the closing of sales transactions, common stock grants that vest in three years based on continued affiliation with the Company.

Effective January 1, 2019, agents can receive stock grants in two ways: 1) When they refer an agent to join the Company and the referred agent closes their first sale after joining the Company; and 2) When an agent closes a residential and commercial sale.

Cost of Revenue

Cost of revenue consists primarily of agent commissions less fees paid to us by our agents. We expect cost of revenue to continue to rise in proportion to the expected increase in revenue.

Operating Expenses

General and Administrative

General and administrative expenses consist primarily of personnel costs, share-based compensation, and fees for professional services. Professional services principally consist of external legal, audit, and tax services. In the short term, we expect general and administrative expenses to increase in absolute dollars due to the anticipated growth of our business and to meet the increased compliance requirements associated with our transition to, and operation as, a public company. However, in the long term, we anticipate general and administrative expenses as a percentage of revenue to decrease over time.

Marketing

Marketing expenses consist primarily of expenses for online and traditional advertising, as well as costs for marketing and promotional materials. Advertising costs are expensed as they are incurred. We expect marketing expenses to increase in absolute dollars as we expand advertising programs and we anticipate marketing expenses as a percentage of revenue to decrease over time.

22

Income Taxes

From inception until the completion of the Exchange Transactions, we did not record any U.S. federal or state income tax benefits for the net losses we had incurred because our legal entities were pass-through tax entities. Subsequent to the Exchange Transactions, we have not recorded any U.S. federal or state income tax benefits for the net losses we have incurred due to our uncertainty of realizing a benefit from those items. As of June 30, 2020, and December 31, 2019, we had federal net operating loss carryforwards of $6.4 million and $6.5 million and state net operating loss carryforwards of $3.1 million and $3.2 million, respectively. Losses will begin to expire, if not utilized, in 2032. Utilization of the net operating loss carryforwards may be subject to an annual limitation according to Section 382 of the Internal Revenue Code of 1986 as amended, and similar state law provisions.

Results of Operations

Comparison of the Three Months Ended June 30, 2020 and 2019

Revenue

| Three months ended June 30, | Change | |||||||||||||||

| 2020 | 2019 | Dollars | Percentage | |||||||||||||

| (Unaudited) | ||||||||||||||||

| Revenue | $ | 38,688,744 | $ | 27,792,313 | $ | 10,896,431 | 39 | % | ||||||||

For the three months ended June 30, 2020, revenue increased by approximately $10.9 million or 39%, as compared with the three months ended June 30, 2019. This was primarily due to an increase in transaction volume, from approximately 4,500 transactions for the quarter ended June 30, 2019 to approximately 5,800 transactions for the quarter ended June 30, 2020, and an increase in revenue per transaction primarily due to rising home prices. Our transaction volume increased primarily due to the growth in the number of agents contracted with us.

Cost of Revenue

| Three months ended June 30, | Change | |||||||||||||||

| 2020 | 2019 | Dollars | Percentage | |||||||||||||

| (Unaudited) | ||||||||||||||||

| Cost of revenue | $ | 36,356,779 | $ | 26,026,425 | $ | 10,330,354 | 40 | % | ||||||||

For the three months ended June 30, 2020, cost of revenue increased by approximately $10.3 million, or 40%, as compared with the three months ended June 30, 2019. Cost of revenue primarily includes costs related to agent commissions net of fees paid to us by our agents. These costs are generally correlated with recognized revenues. As such, the increase in cost of revenue, compared to the same period in 2019 was primarily attributable to a higher amount of revenues and an increase in agent commissions paid.

Operating Expenses

| Three months ended June 30, | Change | |||||||||||||||

| 2020 | 2019 | Dollars | Percentage | |||||||||||||

| (Unaudited) | ||||||||||||||||

| General and administrative | $ | 2,009,277 | $ | 2,743,398 | $ | (734,121 | ) | (27 | )% | |||||||

| Marketing | $ | 138,231 | $ | 46,187 | $ | 92,044 | 199 | % | ||||||||

| Total operating expenses | $ | 2,147,508 | $ | 2,789,585 | $ | (642,077 | ) | (23 | )% | |||||||

23

For the three months ended June 30, 2020, general and administrative expenses decreased by approximately $0.7 million, or 27%, as compared with the three months ended June 30, 2019. The decrease was primarily attributable to a $0.6 million decrease in share-based compensation expense and a $0.1 million decrease in professional fees incurred.

For the three months ended June 30, 2020, marketing expenses increased by approximately $0.1 million, or 199%, as compared with the three months ended June 30, 2019. The increase was primarily attributable to an increase in direct advertising costs.

Comparison of the Six Months Ended June 30, 2020 and 2019

Revenue

| Six months ended June 30, | Change | |||||||||||||||

| 2020 | 2019 | Dollars | Percentage | |||||||||||||

| (Unaudited) | ||||||||||||||||

| Revenue | $ | 67,527,575 | $ | 45,927,039 | $ | 21,600,536 | 47 | % | ||||||||

For the six months ended June 30, 2020, revenue increased by approximately $21.6 million or 47%, as compared with the six months ended June 30, 2019. This was primarily due to an increase in transaction volume, from approximately 7,600 transactions for the six months ended June 30, 2019 to approximately 10,100 transactions for the six months ended June 30, 2020, and an increase in revenue per transaction primarily due to rising home prices. Our transaction volume increased primarily due to the growth in the number of agents contracted with us.

Cost of Revenue

| Six months ended June 30, | Change | |||||||||||||||

| 2020 | 2019 | Dollars | Percentage | |||||||||||||

| (Unaudited) | ||||||||||||||||

| Cost of revenue | $ | 63,044,034 | $ | 42,879,197 | $ | 20,164,837 | 47 | % | ||||||||

For the six months ended June 30, 2020, cost of revenue increased by approximately $20.2 million, or 47%, as compared with the six months ended June 30, 2019. Cost of revenue primarily includes costs related to agent commissions net of fees paid to us by our agents. These costs are generally correlated with recognized revenues. As such, the increase in cost of revenue compared to the same period in 2019 was primarily attributable to a higher amount of revenues and an increase in agent commissions paid.

Operating Expenses

| Six months ended June 30, | Change | |||||||||||||||

| 2020 | 2019 | Dollars | Percentage | |||||||||||||

| (Unaudited) | ||||||||||||||||

| General and administrative | $ | 3,939,353 | $ | 5,405,443 | $ | (1,466,090 | ) | (27 | )% | |||||||

| Marketing | $ | 368,664 | $ | 103,949 | $ | 264,715 | 255 | % | ||||||||

| Total operating expenses | $ | 4,308,017 | $ | 5,509,392 | $ | (1,201,375 | ) | (22 | )% | |||||||