As confidentially submitted to the Securities and Exchange Commission on November 12, 2019

This draft registration statement has not been filed publicly with the Securities and Exchange Commission,

and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| FATHOM HOLDINGS INC. |

| (Exact name of registrant as specified in its charter) |

| North Carolina | 6531 | 82-1518164 | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification Number) |

211 New Edition Court, Suite 211

Cary, North Carolina, 27511

888-455-6040

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Joshua Harley

Chief Executive Officer

211 New Edition Court, Suite 211

Cary, North Carolina, 27511

888-455-6040

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

Donald R. Reynolds

Wyrick Robbins Yates & Ponton LLP

4101 Lake Boone Trail, Suite 300

Raleigh, North Carolina 27607

(919) 781-4000

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

|

Non-accelerated filer ¨

|

Smaller reporting company x Emerging growth company x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities To Be Registered |

Amount to

be |

Proposed Maximum Offering Price Per Share |

Proposed Maximum Aggregate Offering Price (1) |

Amount of |

| Common Stock, no par value per share | Not applicable | $ | $ | |

| (1) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(a) of the Securities Act. Given that there is no proposed maximum offering price per share of common stock, the registrant calculates the proposed maximum aggregate offering price, by analogy to Rule 457(f)(2), based on the book value of its common stock, which will be calculated from its unaudited pro forma balance sheet as of June 30, 2019. Given that the registrant’s shares of common stock are not traded on an exchange or over-the-counter, the registrant did not use the market prices of its shares of common stock in accordance with Rule 457(c). |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated , 2019

PRELIMINARY PROSPECTUS

FATHOM HOLDINGS INC.

SHARES OF COMMON STOCK

This prospectus relates to the registration of the resale of up to of our shares of common stock, no par value (the “Shares”) by the selling shareholders identified in this prospectus (“Selling Shareholders”). Unlike an initial public offering, the resale of Shares by the Selling Shareholders is not being underwritten by any investment bank. The Selling Shareholders might, or might not, elect to sell the Shares covered by this prospectus, as and to the extent they may determine. Such sales, if any, will be made through brokerage transactions on the OTC Markets at prevailing market prices. If the Selling Shareholders choose to sell their Shares, we will not receive any proceeds from the sale of Shares.

No public market for our common stock currently exists. However, we sold shares of our common stock in unregistered private placements in 2018 and 2019. The sales prices per share for such private placements were $1.00. For more information, see “Market for Common Stock.” Our recent sales prices in private placements may have little or no relation to the public price of our common stock. Further, the public sale of our shares without listing on a national securities exchange and without underwriters is a novel method for commencing public trading in our common stock, and consequently, the trading volume and price of our common stock may be more volatile than if our common stock were initially listed on a national securities exchange in connection with an underwritten initial public offering.

The opening public price of our common stock on the OTC Markets will be determined by buy and sell orders collected from broker-dealers. Based on such orders, the designated market maker will determine an opening price for our common stock in consultation with a financial advisor. For more information, see “Plan of Distribution.”

Our common stock is presently not traded on any national securities exchange, and we do not intend to apply to have our common stock listed on any national securities exchange. Instead, we plan to apply to have our common stock quoted on the OTC Markets under the symbol “[FTHM]”. The OTC Markets is a regulated quotation service that displays real-time quotes, last-sale prices and volume information for over-the-counter equity securities. Over-the-counter securities are traded by a community of market makers that enter quotes and trade through a sophisticated computer network.

There is no guarantee that a trading market for our common stock will develop and the purchasers in this offering may be receiving an illiquid security.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings, see “Prospectus Summary – Implications of Being an Emerging Growth Company.”

Investing in the Shares involves risks, see “Risk Factors” beginning on page 13 of this prospectus.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is _______, 2019

TABLE OF CONTENTS

We are responsible for the information contained in this prospectus and in any free writing prospectus we prepare or authorize. Neither we nor the Selling Shareholders have authorized anyone to provide you with different information, and neither we nor the Selling Shareholders take responsibility for any other information others may give you. We are not, and the Selling Shareholders are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information in this prospectus is only accurate as of the date of this prospectus. Our business, financial condition, results of operations, and prospects may have changed since that date.

For investors outside the United States: We have not, and the Selling Shareholders have not, done anything that would permit the use of or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Shares and the distribution of this prospectus outside the United States.

Copies of some of the documents referred to herein have been filed as exhibits to the registration statement of which this prospectus forms a part, and you may obtain copies of those documents as described in this prospectus under the heading “Where You Can Find More Information.”

Unless the context indicates otherwise, as used in this prospectus, the terms “Fathom,” “we,” “us,” “our,” “the Company,” “our Company” and “our business” refer to Fathom Holdings Inc. and its direct and indirect subsidiaries, after giving effect to our corporate reorganization. For more information, please refer to the corporate reorganization described under “Business—Our Structure.” Unless the context otherwise requires, references to “common stock” refer to our common stock, no par value.

i

This summary highlights certain information about us and this offering contained elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in our securities and should be read in conjunction with the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our securities, you should read the entire prospectus carefully, including “Risk Factors” beginning on page 13, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” beginning on page 30 and the consolidated financial statements and related notes thereto included in this prospectus.

Overview

Fathom Holdings Inc. was founded in 2010 as a cloud-based, technology-driven real estate brokerage company. Our low-overhead business model leverages our proprietary software platform for management of real estate brokerage back-office functions, without the cost of physical brick and mortar offices or of redundant personnel. As a result, we are able to offer our agents the ability to keep significantly more of their commissions compared to traditional real estate brokerage firms. We believe we offer our agents some of the best technology, training, and support available in the industry. We also offer our agents valuable benefits, including equity in our Company if they achieve revenue and growth goals, as well as what we believe is relatively broad and affordable healthcare coverage. We believe our commission structure, business model and our focus on treating our agents well attract more agents and higher-producing agents to join and stay with our Company.

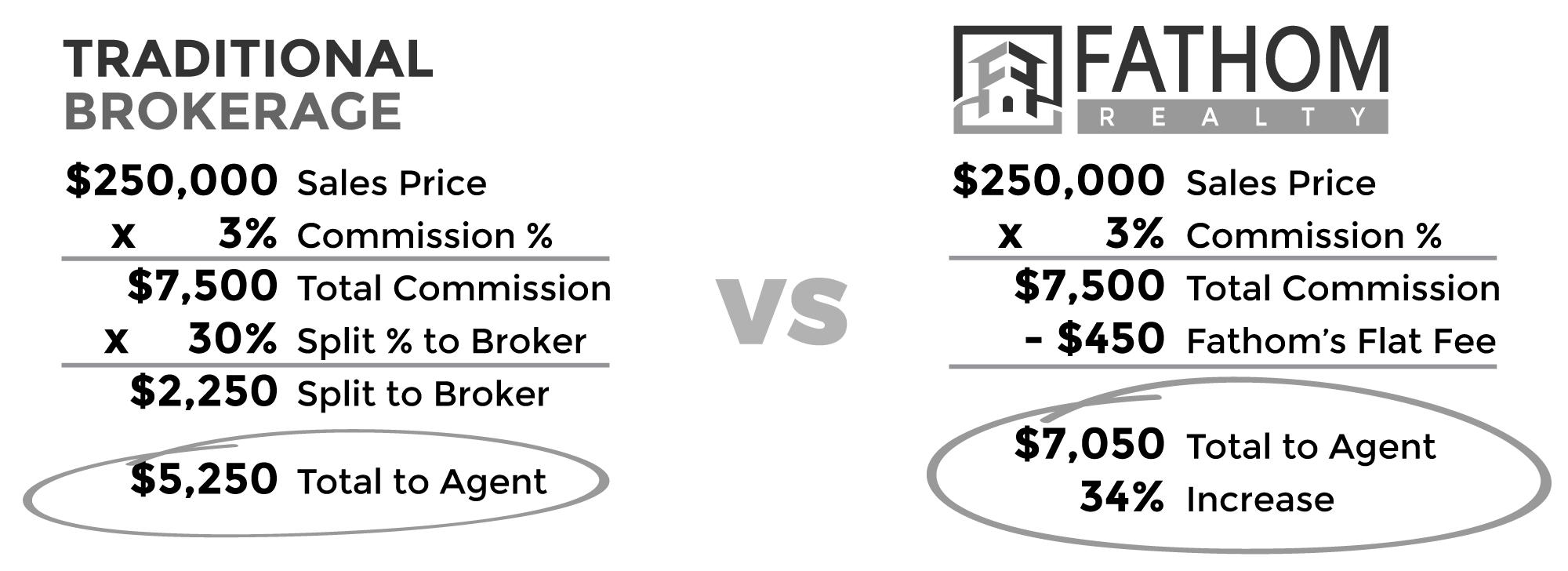

Fathom’s commission model is designed to empower real estate agents to build a more profitable business by allowing them to keep a high percentage of their commission without sacrificing support, technology, or training. We believe that by simply joining Fathom, agents from traditional model brokerages can increase their income by 25% on average. More importantly, agents are able to take that increase and reinvest it into their marketing thereby increasing their number of transactions and revenue.

We believe Fathom’s commission model also allows agents to directly compete against discount brokerages and other disruptive new competitors. The flat transaction fee that we charge to our agents allows our agents to charge whatever commission they need to be highly competitive.

We recognize revenue primarily through the commissions that our agents charge their clients. From the gross commission revenue, we keep a flat transaction fee of $450 and the remainder is paid to the agent. This $450 transaction fee is charged for the agent’s first 12 sales per agent’s anniversary year and then $99 per sale for the rest of their anniversary year. For leases, we recognize revenue through lease commissions negotiated between our agents and landlords, and we retain $85 per transaction and the remainder is paid to the agent. Each year, every agent also pays a fee of $500 on their first sale (recognized in Cost of Revenue over the year), which helps cover our operating costs such as technology, errors and omissions insurance, training, and oversight.

In 2019, Fathom was ranked the #16 largest independent real estate brokerage firm and the #37 overall largest brokerage firm in the United States. These rankings were published by The Real Trends Five Hundred based on several criteria including transaction sides, sales volume, affiliation, top movers, core services, and others.

Our Strategy

Fathom’s goal is to be one of the leading 100% commission real estate brokerages in the United States while offering superior customer service, state of the art technology, and a great company culture. We have grown rapidly since inception, and plan to accelerate our growth through the following aspects of our vision:

| · | offer full brokerage services via our technology-enabled, low-overhead business model; |

| · | attract and retain high-producing agents by offering high compensation per transaction and industry-leading benefits; |

| · | use our publicly traded stock to further incentivize agents; |

1

| · | continue to enhance and develop our proprietary software platform to facilitate our own business and potentially increase our revenue by licensing it to others; and |

| · | pursue further growth through potential acquisitions, including using our publicly traded stock as consideration. |

Technology

We operate as a cloud-based real estate brokerage by utilizing our consumer-facing website, https://www.FathomRealty.com, and our internal proprietary technology, IntelliAgent®, to manage our brokerage operations. Through our website, we provide buyers, sellers, landlords, and tenants with access to all of the available properties for sale or lease on the multiple listing service, or MLS, in each of the markets in which we operate. We provide each of our agents their own personal website that they can modify to match their personal branding. Our website also gives consumers access to our network of professional real estate agents and vendors. Through a combination of our proprietary technology platform and third-party systems, we provide our agents with marketing, training, and other support services, as well as client and transaction management. Our technology, services, data, lead generation, and marketing tools are designed to allow our agents to leverage them to represent their real estate clients with best-in-class service.

Internally, we use our technology to provide agents with opportunities to increase their profitability, reduce risk, and develop professionally, while fostering a culture that values collaboration, strength of community, and commitment to serving the consumer’s best interests. We provide our agents with the systems, support, professional development and infrastructure designed to help them succeed in unpredictable, and often challenging, economic conditions. This includes delivering 24/7 access to collaborative tools and training for real estate agents.

Specifically, using advanced Internet-based software, we can improve compliance and oversight while providing, at no cost to our agents, technology tools and services to our agents and their customers, including:

| · | A robust, mobile-friendly, customer-facing corporate website providing access to view all homes for sale and lease in the markets that we serve, with the ability to search and save favorite properties and receive alerts for new properties that fit their criteria; |

| · | A customizable, mobile-friendly, agent website with home search, lead capture, and blogging capabilities; |

| · | An advanced customer relationship management system, with visitor tracking, property alerts, and customer communication, all designed to help convert leads into customers; |

| · | Social media tools to enhance agent marketing and visibility; |

| · | Streamlined solicitation, collection, verification and posting of customer testimonials; |

| · | Single property websites for our agents’ listings; |

| · | A wide array of on-demand training modules for the professional development of agents at all levels of experience; and |

| · | Agent access to IntelliAgent®, which is described in more detail below. |

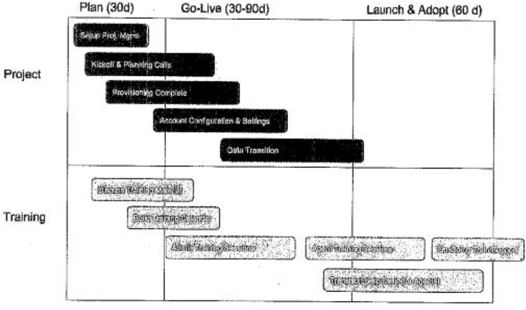

Our proprietary IntelliAgent® real estate technology platform is designed to provide a suite of brokerage and agent level tools, technology, business processes, business intelligence and reporting, training, and marketing, along with a marketplace for add-on services and third-party technology. Our IntelliAgent rollout strategy began with the core technology needed by every real estate brokerage to manage their agents, their agents’ transactions, commission structures, payments, and compliance, as well as the ability to gain a better understanding as to what is happening in the business through business intelligence and robust reporting. Our technology roadmap for IntelliAgent includes brokerage and agent level websites, content creation and management, customer relationship management, email and social media marketing, agent reviews, goal setting, accountability, expense tracking, training platform, marketing repository, and APIs for integration with third-party tools. We intend for IntelliAgent to be more than just a technology platform for Fathom; we might someday use a simplified version of IntelliAgent as a platform to unify independent brokerages through a smarter broker network allowing them to effectively compete against larger regional and national brands. This should allow us to monetize a portion to our technology and generate revenue from small brokerages and agents who would not otherwise join Fathom. We believe that IntelliAgent also provides us with the platform needed to more fully integrate services companies that are, or become, part of the Fathom Holdings network. This deeper integration is designed to encourage a higher level of agent adoption of our various services companies and therefore create a better agent experience, customer experience, and generate higher revenues for Fathom Holdings.

2

Our Focus on Agents

We believe that agents deliver unique value to the specific customers they serve in different ways depending upon the knowledge, skills or niche of the agent and the needs and desires of the customers. We also believe that customers work with agents because of the agent’s skills and service individually and generally place greater weight on those individual skill sets, service levels and style than they do on the brokerage brand with which the agent is affiliated. Therefore, we focus to a great degree on serving our agents, so that we attract and retain the best in the industry.

Fee Structure

The lower overall cost of operating our business via the cloud has enabled us to offer our agents a 100% commission model. Consequently, this higher commission paid to our agents combined with our unique delivery of support services and the flexibility it provides for agents has facilitated our growth over the past several years. We also differentiate ourselves by not charging our agents royalties or franchise fees. A commission calculator on our website allows agents to determine how much money they could make if they join Fathom.

We believe we offer agents further opportunity to increase their overall revenue and income, because they can invest the additional income earned under our fee structure in incremental marketing.

Our Markets

Currently, our primary market is the United States. We currently operate in more than 75 cities or regions, which are located in the following 22 states or districts:

| Arizona | Indiana | Oregon |

| Arkansas | Kentucky | South Carolina |

| California | Maryland | Tennessee |

| Colorado | Nevada | Texas |

| District of Columbia | New Jersey | Virginia |

| Florida | North Carolina | Washington |

| Georgia | Ohio | |

| Illinois | Oklahoma |

We target urban or suburban cities or regions with populations of at least 50,000, of which there are approximately 775 in the United States. We believe this provides us opportunity for continued growth. We have expanded rapidly since our inception nine years ago to over 75 cities or regions. As we continue to expand, we might also target smaller rural markets.

Risks Associated with Our Business

Investing in the Shares involves a number of risks, including the following:

| · | If we do not remain an innovative leader in the real estate industry, we might not be able to grow our business and leverage our costs to achieve profitability. |

| · | We might not be able to effectively manage rapid growth in our business. |

| · | If we fail to grow in the various local markets that we serve or are unsuccessful in identifying and pursuing new business opportunities, our long-term prospects and profitability will be harmed. |

3

| · | Our value proposition for agents includes allowing them to keep more of their commissions than traditional companies do, and receive equity in our Company, which is not typical in the real estate industry. If agents do not understand our value proposition we might not be able to attract, retain, and incentivize agents. |

| · | We might not be able to attract and retain additional qualified agents and other personnel. |

| · | Our operating results are subject to seasonality and vary significantly among quarters during each calendar year, making meaningful comparisons of consecutive quarters difficult. |

| · | If we fail to protect the privacy of the employees, independent contractors, or consumers personal information that our employees share with us, our reputation and business could be significantly harmed. |

| · | Our business could be adversely affected if we are unable to expand, maintain, and improve the systems and technologies that we rely on to operate. |

| · | Our business, financial condition and reputation may be substantially harmed by security breaches, interruptions, delays and failures in our systems and operations. |

| · | We face significant risk to our brand and revenue if we fail to maintain compliance with the law and regulations of federal, state, foreign, county governmental authorities, or private associations and governing boards. |

| · | Loss of our current executive officers or other key management could significantly harm our business. |

| · | Employee or agent litigation and unfavorable publicity could negatively affect our future business. |

| · | Failure to protect intellectual property rights could adversely affect our business. |

| · | Cybersecurity incidents could disrupt our business operations, result in the loss of critical and confidential information, adversely impact our reputation and harm our business. |

| · | We may evaluate potential vendors, suppliers and other business partners for acquisition in order to accelerate growth but might not succeed in identifying suitable candidates or may acquire businesses that negatively impact us. |

| · | Our future revenues and growth prospects could be adversely affected by our dependence on other contractors. |

| · | We are subject to certain risks related to litigation filed by or against us, and adverse results may harm our business and financial condition. |

| · | Part of our technology is currently developed in foreign countries, including Brazil, which makes us subject to certain risks associated with foreign laws and regulations. |

These and other risks are more fully described in the section entitled “Risk Factors” on page 13, which you should carefully read and consider before deciding to invest in the Shares. If any of these risks actually occur, our business, financial condition, results of operations, cash flows or reputation would likely be materially adversely affected. In such case, the trading price of the Shares would likely decline, and you could lose all or part of your investment.

4

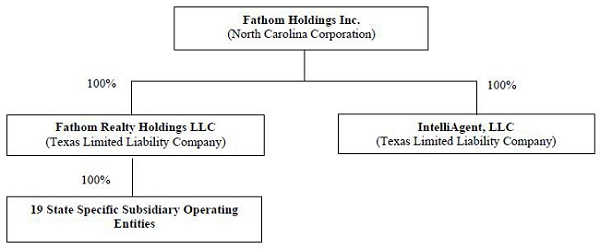

Our Structure

Fathom Holdings Inc., which is a North Carolina corporation, was known as Fathom Ventures, Inc. prior to our filing of Articles of Amendment to our Articles of Incorporation on September 4, 2018 changing the name of the corporation and amending the number of authorized shares to 185,000,000 shares, no par value per share, all of one class designated common stock (85,000,000 of which were designated as Series A common stock and 100,000,000 of which were designated as Series B common stock).

Prior to the filing of this registration statement, we effected a corporate reorganization, whereby the former members of our direct, wholly-owned subsidiary, Fathom Realty Holdings LLC, a Texas limited liability company, contributed all of their ownership interests in Fathom Realty Holdings LLC to Fathom Holdings Inc. in exchange for shares of our stock. Prior to such contribution and exchange, the shareholders of Fathom Realty Group Inc., a Texas corporation, contributed all of their shares of stock in Fathom Realty Group Inc. to Fathom Realty Holdings LLC in exchange for additional ownership interests in Fathom Realty Holdings LLC. Fathom Realty Group Inc. is a wholly-owned subsidiary of Fathom Realty Holdings LLC. Additionally, the former members of our direct, wholly-owned subsidiary, IntelliAgent, LLC, a Texas limited liability company, contributed all of their ownership interests in IntelliAgent, LLC to Fathom Holdings Inc. in exchange for shares of our stock.

As part of the reorganization, we restated our Articles of Incorporation on September 11, 2018 such that (i) each share of Series A common stock outstanding as of immediately prior to the filing of the Restated Articles of Incorporation was cancelled and (ii) each two shares of Series B common stock outstanding as of immediately prior to the filing of the Restated Articles of Incorporation was converted and reclassified into one share of common stock. Pursuant to the Restated Articles of Incorporation, we also amended the number of authorized shares of the corporation to 100,000,000 shares, no par value, all of one class designated common stock. We refer to these steps as the “Exchange Transactions.” The Exchange Transactions have not affected our operations, which we have continued to conduct through our operating subsidiaries.

Corporate Information

We are a North Carolina corporation and were incorporated on May 5, 2017 as Fathom Ventures, Inc. On September 4, 2018, we changed our name to Fathom Holdings Inc. Our principal executive office is located at 211 New Edition Court, Suite 211, Cary, North Carolina, 27511. Our telephone number at our principal executive office is 888-455-6040. Our corporate website is https://www.fathomrealty.com. The information on our corporate website is not part of, and is not incorporated by reference into, this prospectus.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of relief from certain reporting requirements and other burdens that are otherwise applicable generally to public companies. These provisions include:

| • | reduced obligations with respect to financial data, including presenting only two years of audited financial statements and only two years of selected financial data in this prospectus; |

5

| • | an exception from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”); |

| • | reduced disclosure about our executive compensation arrangements in our periodic reports, proxy statements and registration statements; and |

| • | exemptions from the requirements of holding non-binding advisory votes on executive compensation or golden parachute arrangements. |

We may take advantage of these provisions for up to five years or such earlier time that we no longer qualify as an emerging growth company. We would cease to be an emerging growth company if we have more than $1.07 billion in annual revenue, have more than $700 million in market value of our capital stock held by non-affiliates or issue more than $1.0 billion of non-convertible debt over a three-year period. We intend to take advantage of the reduced reporting requirements with respect to disclosure regarding our executive compensation arrangements, have presented only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure in our filings with the Securities and Exchange Commission, or the SEC, and have taken advantage of the exemption from auditor attestation on the effectiveness of our internal control over financial reporting. To the extent that we take advantage of these reduced reporting burdens, the information that we provide shareholders may be different than you might obtain from other public companies in which you hold equity interests.

In addition, under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies.

6

| THE OFFERING | ||

| Securities offered by us in this offering | We are not selling any Shares pursuant to this prospectus. | |

| Securities being registered | shares of common stock held by the Selling Shareholders, including 41,895,987 shares owned by our management, including Chief Executive Officer Joshua Harley, President and Chief Financial Officer Marco Fregenal, and director Glenn Sampson. Messrs. Fregenal and Sampson intend to enter into Rule 10b5-1 trading plans for the sale of up to , and shares hereunder, respectively. | |

| Public offering price | The opening public price of our common stock on the OTC Markets will be determined by buy and sell orders collected from broker-dealers. Based on such orders, the designated market maker will determine an opening price for our common stock in consultation with a financial advisor. See “Plan of Distribution” beginning on page 71 of this prospectus. | |

| Use of proceeds | We will not receive any proceeds from the sale of our common stock by the Selling Shareholders. | |

| Risk Factors | An investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page 13 of this prospectus. | |

| Dividend policy | We do not anticipate paying any dividends on the Shares in the foreseeable future; however, we may change this policy in the future. See “Dividend Policy” beginning on page 29 of this prospectus. | |

| Proposed quotation symbol for our shares of common stock | “[FTHM]” on the OTC Markets. We currently do not intend to apply to list our securities on any national securities exchange. | |

7

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

You should read the following selected financial data together with our financial statements and the related notes thereto included elsewhere in this prospectus and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this prospectus. We have derived the statement of operations data for the years ended December 31, 2017 and 2018 and the balance sheet data as of December 31, 2017 and 2018 from our audited financial statements included elsewhere in this prospectus. The statement of operations data for the three and six months ended June 30, 2018 and 2019 and the balance sheet data as of June 30, 2019 have been derived from our unaudited interim financial statements included elsewhere in this prospectus and have been prepared on the same basis as the audited financial statements. In the opinion of management, the unaudited data reflects all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the financial information in those statements. Our historical results are not necessarily indicative of the results that should be expected in the future and the results for the three and six months ended June 30, 2019 are not necessarily indicative of the results to be expected for the full year ending December 31, 2019 or any other future period.

8

| Years ended December 31, | Six months ended June 30, | |||||||||||||||

| 2017 | 2018 | 2018 (Unaudited) | 2019 (Unaudited) | |||||||||||||

| Statement of Operations Data: | ||||||||||||||||

| Revenue | $ | 55,378,037 | $ | 77,305,562 | $ | 36,244,979 | $ | 45,927,039 | ||||||||

| Cost of revenue | 51,902,836 | 73,436,660 | 33,723,461 | 42,879,197 | ||||||||||||

| Gross profit | 3,475,201 | 3,868,902 | 2,521,518 | 3,047,842 | ||||||||||||

| General and administrative | 3,502,850 | 5,130,920 | 2,138,937 | 5,371,326 | ||||||||||||

| Marketing | 315,942 | 255,090 | 197,004 | 103,949 | ||||||||||||

| Total operating expenses | 3,818,792 | 5,386,010 | 2,335,941 | 5,475,275 | ||||||||||||

| Loss (income) from operations | (343,591 | ) | (1,517,108 | ) | 185,577 | (2,427,433 | ) | |||||||||

| Other (expense), net | ||||||||||||||||

| Interest (expense), net | (76,971 | ) | (102,123 | ) | (54,753 | ) | (54,431 | ) | ||||||||

| Other expense | - | (16,819 | ) | (187,000 | ) | (34,117 | ) | |||||||||

| Other (expense), net | (76,971 | ) | (118,942 | ) | (241,753 | ) | (88,548 | ) | ||||||||

| Loss from operations before income taxes | (420,562 | ) | (1,636,050 | ) | (56,176 | ) | (2,515,981 | ) | ||||||||

| Income tax expense (benefit) | - | 27,155 | - | (7,980 | ) | |||||||||||

| Net loss | (420,562 | ) | (1,663,205 | ) | (56,176 | ) | (2,508,001 | ) | ||||||||

| Net loss per share | ||||||||||||||||

| Basic and Diluted | $ | (0.04 | ) | $ | (0.05 | ) | ||||||||||

| Weighted average common shares outstanding | ||||||||||||||||

| Basic and Diluted | 38,955,107 | 45,805,669 | ||||||||||||||

| Pro forma Net loss per share | ||||||||||||||||

| Basic and Diluted | $ | (0.01 | ) | $ | (0.00 | ) | ||||||||||

| Pro forma Weighted average common shares outstanding | ||||||||||||||||

| Basic and Diluted | 32,455,711 | 36,267,887 | ||||||||||||||

9

| As of December 31, | As of June 30, | |||||||||||

| 2017 | 2018 | 2019 (Unaudited) | ||||||||||

| Balance Sheet Data: | ||||||||||||

| Cash and cash equivalents | $ | 154,438 | $ | 1,008,538 | $ | 979,068 | ||||||

| Working capital1 | 369,086 | 525, 791 | (62,867 | ) | ||||||||

| Total assets | 2,635,320 | 3,834,139 | 3,470,386 | |||||||||

| Loan payable, net of current portion | 68,988 | 52,188 | 43,677 | |||||||||

| Note payable | 400,000 | 500,000 | 500,000 | |||||||||

| Lease liability, net of current portion | - | - | 139,974 | |||||||||

| Total stockholders' equity | 180,933 | 232,042 | 144,835 | |||||||||

1 We define working capital as current assets less current liabilities. See our financial statements included elsewhere in this prospectus for further details regarding our current assets and current liabilities.

10

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, included in this prospectus regarding our strategy, future operations, future product research or development, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “goals,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements in this prospectus include, but are not limited to, statements about:

| · | Our ability to remain an innovative leader in the real estate industry; |

| · | Whether or not we are able to effectively manage rapid growth in our business; |

| · | Our ability to grow in the various local markets that we serve; |

| · | Whether or not we are successful in identifying and pursuing new business opportunities; |

| · | Our value proposition for agents, including allowing them to keep more of their commissions than traditional companies do, and receive equity in our Company; |

| · | Our failure to make sure agents understand our value proposition so that we are able to attract, retain and incentivize agents; |

| · | Our ability to attract and retain additional qualified agents and other personnel; |

| · | The risks associated with making meaningful comparisons of successive quarters; |

| · | Our ability to protect the privacy of employees, independent contractors, or consumers or personal information that they share with us so that we do not harm our reputation and business; |

| · | Our failure to be able to expand, maintain and improve the systems and technologies upon which we rely on to operate; |

| · | Our failure to prevent security breaches, interruptions, delays and failures in our systems and operations; |

| · | If we fail to maintain compliance with the law and regulations of federal, state, foreign, county governmental authorities, or private associations and governing boards; |

| · | Our ability to remediate the material weaknesses identified in our internal controls over financial reporting; |

| · | The risks associated with the loss of our current executive officers or other key management; |

| · | The risks associated with employee or agent litigation and unfavorable publicity; |

| · | Our failure to protect intellectual property rights; |

| · | Our ability to prevent cybersecurity incidents that could disrupt our business operations, resulting in the loss of critical and confidential information; |

| · | Our ability to be able to evaluate potential vendors, suppliers and other business partners for acquisition in order to accelerate growth; |

| · | Our future revenues and growth prospects and our dependence on other contractors; |

11

| · | The risks associated with litigation filed by or against us, and adverse results therefrom; |

| · | Our ability to manage technology that currently developed in foreign countries, including Brazil, which makes us subject to certain risks associated with foreign laws and regulations; and |

| · | Other factors discussed elsewhere in this prospectus. |

We might not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this prospectus, particularly under “Risk Factors” on page 13 of this prospectus and the documents incorporated herein that we believe could cause actual results or events to differ materially from the forward-looking statements that we make.

You should read this prospectus and the documents that we have filed as exhibits to this prospectus completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. You should therefore not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this prospectus. You also should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. Before deciding to purchase our securities, you should carefully consider the risk factors discussed in this prospectus.

12

An investment in our securities involves a high degree of risk. You should consider carefully the risks and uncertainties described below together with the other information included in this prospectus, including our consolidated financial statements and the related notes thereto included elsewhere in this prospectus, before deciding to purchase the Shares. The occurrence of any of the following risks may materially and adversely affect our business, financial condition, results of operations, cash flows, reputation and future prospects. In this event, the market price the Shares could decline, and you could lose part or all of your investment.

Risks Related to Our Business

If we do not remain an innovative leader in the real estate industry, we might not be able to grow our business and leverage our costs to achieve profitability.

Innovation has been critical to our ability to compete for clients and real estate agents. If competitors follow our practices or develop more innovative practices, our ability to achieve profitability may diminish or erode. For example, certain other brokerages could develop or license cloud-based office platforms that are equal to or superior to ours. If we do not remain on the forefront of innovation, we might not be able to achieve or sustain profitability.

The market for Internet products and services is characterized by rapid technological developments, evolving industry standards and customer demands, and frequent new product introductions and enhancements. The Company’s future success will depend in significant part on its ability to continually improve the performance, features and reliability of its technological developments in response to both evolving demands of the marketplace and competitive product offerings, and there can be no assurance that the Company will be successful in doing so.

We might not be able to effectively manage rapid growth in our business.

We might not be able to scale our business services and support quickly enough to meet the growing needs of our real estate agents. If we are not able to grow efficiently, our operating results could be harmed. As the Company adds new agents, we will need to devote additional financial and human resources to improving our internal systems, integrating with third-party systems, and maintaining infrastructure performance. In addition, we will need to appropriately scale our internal business systems and our services organization, including support of our affiliated agents as our demographics expand over time. Any failure of, or delay in, these efforts could cause impaired system performance and reduced satisfaction from our agents. These issues could result in difficulty in both attracting and retaining agents. Even if we are able to upgrade our systems and expand our staff, such expansion may be expensive, complex, and place increasing demands on our management. We could also face inefficiencies or operational failures as a result of our efforts to scale our infrastructure and we might not be successful in maintaining adequate financial and operating systems and controls as we expand. Moreover, there are inherent risks associated with upgrading, improving and expanding our information technology systems. We cannot be sure that the expansion and improvements to our infrastructure and systems will be fully or effectively implemented on a timely basis, if at all. These efforts may reduce revenue and our margins and adversely impact our financial results.

If we fail to grow in the various local markets that we serve or are unsuccessful in identifying and pursuing new business opportunities our long-term prospects and profitability will be harmed.

To capture and retain market share in the various local markets that we serve, we must compete successfully against other brokerages for agents and for the consumer relationships that they bring. Our competitors could lower the fees that they charge to agents or could raise the compensation structure for those agents. Our competitors may have access to greater financial resources than us, allowing them to undertake expensive local advertising or marketing efforts. In addition, our competitors may be able to leverage local relationships, referral sources, and strong local brand and name recognition that we have not established. Our competitors could, as a result, have greater leverage in attracting both new and established agents in the market and in generating business among local consumers. Our ability to grow in the local markets that we serve will depend on our ability to compete with these local brokerages.

We may implement changes to our business model and operations to improve revenues that cause a disproportionate increase in our expenses or reduce profit margins. For example, we may allocate resources to acquire lower margin brokerage models or develop a mortgage servicing division, a commercial real estate division, a title and escrow company or a continuing education division. These decisions could involve significant up-front costs that may only be recovered after lengthy periods of time. Any of these attempts to pursue new business opportunities could result in a disproportionate increase in our expenses and in reduced profit margins. In addition, any of these additional activities could expose us to additional compliance obligations and regulatory risks.

13

If we fail to continue to grow in the local markets we serve or if we fail to successfully identify and pursue new business opportunities, our long-term prospects, financial condition and results of operations may be harmed, and our stock price may decline.

Our value proposition for agents includes allowing them to keep more of their commissions than traditional companies do, and receive equity in our Company, which is not typical in the real estate industry. If agents do not understand our value proposition, we might not be able to attract, retain and incentivize agents.

Participation in our commission plan represents a key component of our agent and broker value proposition. Agents might not understand or appreciate its value. In addition, agents might not appreciate other components of our value proposition including the systems and tools that we provide to agents, and the professional development opportunities we create and deliver. If agents do not understand the elements of our agent value proposition, or do not perceive it to be more valuable than the models used by most competitors, we might not be able to attract, retain and incentivize new and existing agents to grow our revenues.

We might not be able to attract and retain additional qualified agents and other personnel.

To execute our business strategy, we must attract and retain highly qualified agents and other personnel. In particular, we compete with many other real estate brokerages for qualified agents who manage our operations in each state. We must also compete with technology companies for developers with high levels of experience in designing, developing and managing cloud-based software, as well as for skilled service and operations professionals, and we might not be successful in attracting and retaining the professionals we need. We might have difficulty in hiring and difficulty in retaining highly skilled personnel with appropriate qualifications. Many of the companies that we compete with for experienced personnel have greater resources than we do. In addition, in making decisions about where to work, in addition to cash compensation, people often consider the value of the stock options or other equity incentives they receive. If the price of our stock declines or experiences significant volatility, our ability to attract or retain personnel may be adversely affected. If we fail to attract new personnel or fail to retain and motivate our current personnel, our growth prospects could be severely harmed.

We have had a history of losses, and we might not be able to achieve or sustain profitability.

We experienced net losses of approximately $1.6 million for the year ended December 31, 2018. We cannot predict if we will achieve sustained profitability in the near future or at all. We expect to make significant future expenditures to develop and expand our business. In addition, once we are a public company, we will incur significant legal, accounting, and other expenses that we do not currently have as a private company. These expenditures make it harder for us to achieve and maintain future profitability. Our recent growth in revenue might not be sustainable, and we might not achieve sufficient revenue to achieve or maintain profitability. We could incur significant losses in the future for a number of reasons, including the other risks described in this prospectus, and we may encounter unforeseen expenses, difficulties, complications and delays and other unknown events. Accordingly, we might not be able to achieve or maintain profitability and we may incur significant losses for the foreseeable future.

Our operating results are subject to seasonality and vary significantly among quarters during each calendar year, making meaningful comparisons of successive quarters difficult.

Seasons and weather traditionally impact the real estate industry. Spring and summer seasons historically reflect greater sales activity in comparison to fall and winter seasons. We have historically experienced lower revenues during the fall and winter seasons, as well as during periods of unseasonable weather, which reduces our operating income, net income, operating margins and cash flow. Real estate listings precede sales and a period of poor listings activity will negatively impact revenue. Past performance in similar seasons or during similar weather events can provide no assurance of future or current performance, and macroeconomic shifts in the markets we serve can conceal the impact of seasonality.

14

Home sales in successive quarters can fluctuate widely due to a wide variety of seasonal factors, including holidays, and the school year calendar’s impact on timing of family relocations. Our revenue and operating margins each quarter will remain subject to seasonal fluctuations, that may make it difficult to compare or analyze our financial performance effectively across successive quarters.

If we fail to protect the privacy of employees, independent contractors, or consumers or personal information that they share with us, our reputation and business could be significantly harmed.

Tens of thousands of consumers, independent contractors, and employees have shared personal information with us during the normal course of our business processing residential real estate transactions. This includes, but is not limited to, social security numbers, annual income amounts and sources, consumer names, addresses, telephone and cell phone numbers, and email addresses.

The application, disclosure and safeguarding of this information is regulated by federal and state privacy laws. To comply with privacy laws, we invested resources and adopted a privacy policy outlining policies and procedures for the use of safeguarding personal information. This policy includes informing consumers, independent contractors and employees that we will not share their personal information with third parties without their consent unless required by law.

Privacy policies and compliance with federal and state privacy laws presents risk and we could incur legal liability for failing to maintain compliance. We might not become aware of all privacy laws, changes to privacy laws, or third- party privacy regulations governing the real estate business or be unable to comply with all of these regulations, given the rate of regulatory changes, ambiguities in regulations, contradictions in regulations between jurisdictions, and the difficulties in achieving both company-wide and region-specific knowledge and compliance.

Our policy and safeguards could be deemed insufficient if third parties with whom we have shared personal information fail to protect the privacy of that information. Our legal liability could include significant defense costs, settlement costs, damages and penalties, plus, damage our reputation with consumers, which could significantly damage our ability to attract and maintain customers. Any or all of these consequences would result in meaningful unfavorable impact on our brand, business model, revenue, expenses, income and margins.

Our business could be adversely affected if we are unable to expand, maintain and improve the systems and technologies upon which we rely on to operate.

As the number of agents in our Company grows, our success will depend on our ability to expand, maintain and improve the technology that supports our business operations, including, but not limited to, our cloud office platform. Loss of key personnel or the lack of adequate staffing with the requisite expertise and training could impede our efforts in this regard. If our systems and technologies lack capacity or quality sufficient to service agents and their clients, then the number of agents who wish to use our products could decrease, the level of client service and transaction volume afforded by our systems could suffer, and our costs could increase. In addition, if our systems, procedures or controls are not adequate to provide reliable, accurate and timely financial and other reporting, we might not be able to satisfy regulatory scrutiny or contractual obligations with third parties and may suffer a loss of reputation. Any of these events could negatively affect our financial position.

Cybersecurity incidents could disrupt our business operations, result in the loss of critical and confidential information, adversely impact our reputation and harm our business.

Cybersecurity threats and incidents directed at us could range from uncoordinated individual attempts to gain unauthorized access to information technology systems to sophisticated and targeted measures aimed at disrupting business or gathering personal data of customers. In the ordinary course of our business, we collect and store sensitive data, including proprietary business information and personal information about our customers. Our business, and particularly our cloud-based platform, is reliant on the uninterrupted functioning of our information technology systems. The secure processing, maintenance, and transmission of information are critical to our operations, especially the processing and closing of real estate transactions. Although we employ measures designed to prevent, detect, address, and mitigate these threats (including access controls, data encryption, vulnerability assessments, and maintenance of backup and protective systems), cybersecurity incidents, depending on their nature and scope, could potentially result in the misappropriation, destruction, corruption, or unavailability of critical data and confidential or proprietary information (our own or that of third parties, including potentially sensitive personal information of our customers) and the disruption of business operations. Any such compromises to our security could cause harm to our reputation, which could cause customers to lose trust and confidence in us or could cause agents to stop working for us. In addition, we may incur significant costs for remediation that may include liability for stolen assets or information, repair of system damage, and compensation to customers and business partners. We may also be subject to legal claims, government investigation, and additional state and federal statutory requirements.

15

The potential consequences of a material cybersecurity incident include regulatory violations of applicable U.S. and international privacy and other laws, reputational damage, loss of market value, litigation with third parties (which could result in our exposure to material civil or criminal liability), diminution in the value of the services we provide to our customers, and increased cybersecurity protection and remediation costs (that may include liability for stolen assets or information), which in turn could have a material adverse effect on our competitiveness and results of operations.

Our business, financial condition and reputation may be substantially harmed by security breaches, interruptions, delays and failures in our systems and operations.

The performance and reliability of our systems and operations are critical to our reputation and ability to attract agents and teams of agents into our Company as well as our ability to service home buyers and sellers. Our systems and operations are vulnerable to security breaches, interruption or malfunction due to certain events beyond our control, including natural disasters, such as earthquakes, fire and flood, power loss, telecommunication failures, break-ins, sabotage, computer viruses, intentional acts of vandalism and similar events. In addition, we rely on third-party vendors to provide the cloud office platform and to provide additional systems and related support. If we cannot continue to retain these services on acceptable terms, our access to these systems and services could be interrupted. Any security breach, interruption, delay or failure in our systems and operations could substantially reduce the transaction volume that can be processed with our systems, impair quality of service, increase costs, prompt litigation and other consumer claims, and damage our reputation, any of which could substantially harm our financial condition.

We face significant risk to our brand and revenue if we fail to maintain compliance with the law and regulations of federal, state, foreign, or county governmental authorities, or private associations and governing boards.

We operate in a heavily regulated industry with regulated labor classifications which present significant risk in general for each potential instance where we fail to maintain compliance.

Our agents can be classified as either employees or independent contractors, and we could potentially misclassify or fail to consistently achieve compliance. Classifications and compliance are subject to the Internal Revenue Service regulations and applicable state law guidelines and penalties.

Classifications, regulations and guidelines for agents are subject to judicial and agency interpretation as well as periodic changes. Changes, or any indication of changes, may adversely impact our workforce classifications, expenses, compensation, commission structure, roles and responsibilities and broker organization.

Beyond workforce regulations and classifications, there exist complex, heavily regulated federal, state and local authority laws, regulations and policies governing our real estate business.

In general, the laws, rules and regulations that apply to our business practices include, without limitation, the federal Real Estate Settlement Procedures Act, or RESPA, the federal Fair Housing Act, the Dodd-Frank Act, and federal advertising and other laws, as well as comparable state statutes; rules of trade organization such as NAR, local MLSs, and state and local AORs; licensing requirements and related obligations that could arise from our business practices relating to the provision of services other than real estate brokerage services; privacy regulations relating to our use of personal information collected from the registered users of our websites; laws relating to the use and publication of information through the Internet; and state real estate brokerage licensing requirements, as well as statutory due diligence, disclosure, record keeping and standard-of-care obligations relating to these licenses. The U.S. Department of Justice has opened an anti-trust investigation of some of our biggest competitors, and they are defendants in related lawsuits that could negatively impact our industry.

16

Additionally, the Dodd-Frank Wall Street Reform and Consumer Protection Act contains the Mortgage Reform and Anti-Predatory Lending Act, or the Mortgage Act, which imposes a number of additional requirements on lenders and servicers of residential mortgage loans, by amending certain existing provisions and adding new sections to RESPA and other federal laws. It also broadly prohibits unfair, deceptive or abusive acts and practices, and knowingly or recklessly providing substantial assistance to a covered person in violation of that prohibition. The penalties for noncompliance with these laws are also significantly increased by the Mortgage Act, which could lead to an increase in lawsuits against mortgage lenders and servicers.

Maintaining legal compliance is challenging and increases our costs due to resources required to continually monitor business practices for compliance with applicable laws, rules and regulations, and to monitor changes in the applicable laws themselves.

We might not be aware of all the laws, rules and regulations that govern our business, or be able to comply with all of them, given the rate of regulatory changes, ambiguities in regulations, contradictions in laws and regulations between jurisdictions, and the difficulties in achieving both company-wide and region-specific knowledge and compliance.

If we fail, or we have been alleged to have failed, to comply with any existing or future applicable laws, rules and regulations, we could be subject to lawsuits and administrative complaints and proceedings, as well as criminal proceedings. Our noncompliance could result in significant defense costs, settlement costs, damages and penalties.

Additionally, our business licenses could be suspended or revoked, our business practices enjoined, or we could be required to modify our business practices, which could materially impair, or even prevent, our ability to conduct all or any portion of our business. Any such events could also damage our reputation and impair our ability to attract and service home buyers, home sellers and agents, as well our ability to attract brokerages, teams of agents and individual agents to our Company, without increasing our costs.

Further, if we lose our ability to obtain and maintain all of the regulatory approvals and licenses necessary to conduct business as we currently operate, our ability to conduct business may be harmed. Lastly, any lobbying or related activities we undertake in response to mitigate liability of current or new regulations could substantially increase our operating expenses.

We identified material weaknesses in our internal control over financial reporting, and we may identify additional material weaknesses in the future that may cause us to fail to meet our reporting obligations or result in material misstatements of our financial statements. If we fail to remediate any material weaknesses or if we otherwise fail to establish and maintain effective control over financial reporting, our ability to accurately and timely report our financial results could be adversely affected.

Upon becoming a public company, we will be required to comply with the SEC’s rules implementing Sections 302 and 404 of the Sarbanes-Oxley Act, which will require management to certify financial and other information in our quarterly and annual reports and provide an annual management report on the effectiveness of our controls over financial reporting. Although we will be required to disclose changes made in our internal controls and procedures on a quarterly basis, we will not be required to make our first annual assessment of our internal controls over financial reporting pursuant to Section 404 until our annual report on Form 10-K for the fiscal year ending December 31, 2020. This assessment will need to include disclosure of any material weaknesses identified by our management in our internal control over financial reporting, as well as a statement that our independent registered public accounting firm has issued an opinion on the effectiveness of our internal control over financial reporting, provided that our independent registered public accounting firm will not be required to attest to the effectiveness of our internal control over financial reporting until our first annual report required to be filed with the Securities and Exchange Commission, or SEC, following the later of the date we are deemed to be an “accelerated filer” or a “large accelerated filer,” each as defined in the Exchange Act, or the date we are no longer an emerging growth company, as defined in the JOBS Act. We could be an emerging growth company for up to five years.

17

In connection with the audit of our financial statements for the year ended December 31, 2018, we identified material weaknesses in our internal control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our consolidated financial statements will not be prevented or detected on a timely basis.

For the years ended December 31, 2017 and 2018, we did not effectively apply the Internal Control- Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission, or the COSO framework, due primarily to an insufficient complement of personnel possessing the appropriate accounting and financial reporting knowledge and experience to determine the appropriate accounting for non-recurring transactions and transactions requiring more complex accounting judgment.

In addition, we utilize a general ledger system that is not integrated with BackAgent, the system utilized to track our revenue transactions. Ineffective control activities related to the reconciliation of BackAgent to the general ledger system resulted in material adjustments to revenue for the years ended December 31, 2017 and 2018. Finally, the Company did not maintain effective logical access and program change controls over the third-party systems, including BackAgent and the general ledger system.

Although, management is working to remediate the material weakness by hiring additional qualified accounting and financial reporting personnel, and further evolving our accounting processes and systems, we cannot assure you that these measures will be sufficient to remediate the material weaknesses that has been identified or prevent future material weaknesses or significant deficiencies from occurring. Beginning in 2019, we implemented a new revenue tracking system and have enhanced the logical access and program change controls. We also continue to utilize an accounting and financial reporting advisory firm with significant experience with publicly held companies to assist our management in evaluating significant transactions and conclusions reached regarding technical accounting matters and financial reporting disclosures.

We may identify future material weaknesses in our internal controls over financial reporting or fail to meet the demands that will be placed upon us as a public company, including the requirements of the Sarbanes-Oxley, and we may be unable to accurately report our financial results, or report them within the timeframes required by law or stock exchange regulations. We cannot assure that our existing material weakness will be remediated or that additional material weaknesses will not exist or otherwise be discovered, any of which could adversely affect our reputation, financial condition and results of operations.

Loss of our current executive officers or other key management could significantly harm our business.

We depend on the industry experience and talent of our current executives, including our Founder and Chief Executive Officer Joshua Harley, and President and Chief Financial Officer Marco Fregenal. We also rely on individuals in key management positions within our operations, finance, and technology teams. We believe that our future results will depend, in part, upon our ability to retain and attract highly skilled and qualified management. The loss of our executive officers or any key personnel could have a material adverse effect on our operations because other officers might not have the experience and expertise to readily replace these individuals. To the extent that one or more of our top executives or other key management personnel depart from the Company, our operations and business prospects may be adversely affected. In addition, changes in executives and key personnel could be disruptive to our business. The Company does not have any key person insurance.

Employee or agent litigation and unfavorable publicity could negatively affect our future business.

Our employees or agents may, from time to time, bring lawsuits against us alleging injury, creating a hostile work place, discrimination, wage and hour disputes, sexual harassment, or other employment issues. In recent years there has been an increase in the number of discrimination and harassment claims against companies generally. Coupled with the expansion of social media platforms and similar devices that allow individuals access to a broad audience, these claims have had a significant negative impact on some businesses. Certain companies that have faced such lawsuits have had to terminate management or other key personnel, and have suffered reputational harm that has negatively impacted their business. If we were to face any claims, our business could be negatively affected.

Failure to protect intellectual property rights could adversely affect our business.

Our intellectual property rights, including existing and future trademarks, trade secrets and copyrights, are important assets of the business. We have taken measures to protect our intellectual property, but these measures might not be sufficient or effective. We may bring lawsuits to protect against the potential infringement of our intellectual property rights and other companies, including our competitors, could make claims against us alleging our infringement of their intellectual property rights. There can be no assurance that we would prevail in such lawsuits. Any significant impairment of our intellectual property rights could harm our business.

18

We may evaluate potential vendors, suppliers and other business partners for acquisition in order to accelerate growth but might not succeed in identifying suitable candidates or may acquire businesses that negatively impact us.

As part of our growth strategy, we may evaluate the potential acquisition of businesses offering products or services that complement our services offerings. If we identify a business that we deem to be suitable for acquisition and complete an acquisition, our evaluation may prove faulty and the acquisition may prove unsuccessful. In addition, an acquisition may prove unsuccessful if we fail to effectively execute a post-acquisition integration strategy. We may be unable to successfully integrate the systems and personnel of the acquired businesses. An acquisition could negatively impact our culture or undermine its core values. Acquisitions could disrupt our existing operations or cause management to divert its focus from our core business. An acquisition could cause potentially dilutive issuances of equity securities, incurrence of debt, contingent liabilities or could cause us to assume or incur unknown or unforeseen liabilities. From time to time, we intend to evaluate other brokerages for acquisition in order to accelerate growth and might not succeed in identifying suitable candidates or we may acquire brokerages that negatively impact us.

Our future revenues and growth prospects could be adversely affected by our dependence on other contractors.

Our business is highly dependent on a few significant technology vendors. In the event we were to lose one of our significant vendor partners, our business could be adversely affected because we could be forced to move this technology to another vendor, which would take significant time away from our management running our core business. Our business, results of operations and financial condition could be materially adversely affected by the loss of one key relationship, as it would take a significant amount of time to replace this relationship with uncertain results.

We are subject to certain risks related to litigation filed by or against us, and adverse results may harm our business and financial condition.

The real estate industry often involves litigation, ranging from individual lawsuits by unhappy buyers or sellers to large class actions and government investigations, like those some of our biggest competitors are currently facing for alleged anti-trust law violations. We often are involved in various lawsuits and legal proceedings that arise in the ordinary course of business.

We cannot predict with certainty the cost of our defense, the cost of prosecution, insurance coverage, or the ultimate outcome of litigation and other proceedings filed by or against us, including remedies or damage awards. Adverse results in such litigation and other proceedings may harm our business and financial condition. Such litigation and other proceedings may include, but are not limited to, actions relating to intellectual property, commercial arrangements, negligence and fiduciary duty claims arising from our Company-owned brokerage operations, actions against our title company alleging it knew or should have known others were committing mortgage fraud, standard brokerage disputes like the failure to disclose hidden defects in a property such as mold, vicarious liability based upon conduct of individuals or entities outside of our control, including our agents, third-party service or product providers, antitrust claims, general fraud claims, employment law claims, including claims challenging the classification of our agents as independent contractors and compliance with wage and hour regulations, and claims alleging violations of RESPA or state consumer fraud statutes. In addition, class action lawsuits can often be particularly burdensome given the breadth of claims, large potential damages and significant costs of defense. In the case of intellectual property litigation and proceedings, adverse outcomes could include the cancellation, invalidation or other loss of material intellectual property rights used in our business and injunctions prohibiting our use of business processes or technology that is subject to third party patents or other third-party intellectual property rights. In addition, we may be required to enter into licensing agreements (if available on acceptable terms) and be required to pay royalties.

The real estate industry generates a lot of litigation, which could harm our business, reputation, operating results, and liquidity. The Company has general liability and an errors and omissions insurance policy to help protect the Company against claims of inadequate work or negligent action. However, this insurance might not continue to be available to us on commercially reasonable terms or at all, or a claim otherwise covered by our insurance may exceed our coverage limits, or a claim might not be covered at all. We may be subject to errors or omissions claims that could have an adverse effect on us. Moreover, defending a suit, regardless of its merits, could entail substantial expense and require the time and attention of key management personnel.

19

Part of our technology is currently developed in foreign countries, including Brazil, which makes us subject to certain risks associated with foreign laws and regulations.

We currently develop portions of our technology in Brazil and could in the future conduct operations in foreign jurisdictions. Conducting business in foreign countries involves inherent risks, including, but not limited to: difficulties in staffing, funding and managing foreign operations; unexpected changes in regulatory requirements; export restrictions; tariffs and other trade barriers; difficulties in protecting, acquiring, enforcing and litigating intellectual property rights; fluctuations in currency exchange rates; and potentially adverse tax consequences.

If we were to experience any of the difficulties listed above, or any other difficulties, any international development activities and our overall financial condition may suffer.

Risks Related to Our Industry

Our results are tied to the residential real estate market and we may be negatively impacted by downturns in this market and general global economic conditions.