UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2018

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report:

Commission File Number: 001-38204

REEBONZ HOLDING LIMITED

(Exact name of Registrant as specified in its charter)

| Not applicable | Cayman Islands | |

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

c/o Reebonz Limited

5 Tampines North Drive 5

#07-00

Singapore 528548

+65 6499 9469

(Address of Principal Executive Offices)

Samuel Lim

5 Tampines North Drive 5

#07-00

Singapore 528548

+65 6499 9469

samuel.lim@reebonz.com

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Ordinary Shares, $0.0001 par value per share | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Warrants to purchase Ordinary Shares

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of as of the close of the period covered by the Annual Report: 2,686,720 ordinary shares, as adjusted to give effect to the 1-for-8 reverse split effective on March 15, 2019.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☒ |

| Emerging Growth Company | ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| US GAAP ☐ | International

Financial Reporting Standards as issued by the International Accounting Standards Board ☒ |

Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

TABLE OF CONTENTS

| Page | ||

| Cautionary Note Regarding Forward-Looking Statements | iii | |

| Explanatory Note | iv | |

| PART I | 1 | |

| Item 1. | Identity of Directors, Senior Management and Advisors | 1 |

| Item 2. | Offer Statistics and Expected Timetable | 1 |

| Item 3. | Key Information | 1 |

| Item 4. | Information on the Company | 33 |

| Item 4A. | Unresolved Staff Comments | 65 |

| Item 5. | Operating and Financial Review and Prospects | 65 |

| Item 6. | Directors, Senior Management and Employees | 81 |

| Item 7. | Major Shareholders and Related Party Transactions | 89 |

| Item 8. | Financial Information | 91 |

| Item 9. | The Offer and Listing | 91 |

| Item 10. | Additional Information | 91 |

| Item 11. | Quantitative and Qualitative Disclosures About Market Risk | 97 |

| Item 12. | Description of Securities Other than Equity Securities | 97 |

| PART II | 98 | |

| PART III | 102 | |

| Item 17. | Financial Statements | 102 |

| Item 18. | Financial Statements | 102 |

| Item 19. | Exhibits | 102 |

i

CONVENTIONS USED IN THIS ANNUAL REPORT

In this Annual Report, references to “U.S.,” the “United States” or “USA” are to the United States of America, its territories and its possessions. References to “Singapore” are to the Republic of Singapore. References to “$”, “US$” and “U.S. Dollars” are to the lawful currency of the United States of America.

Unless otherwise indicated, our consolidated financial statements and related notes as of and for the fiscal years ended December 31, 2018 and 2017 included elsewhere in this Annual Report have been prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. References to a particular “fiscal year” are to our fiscal year ended December 31 of that year. Our fiscal quarters end on March 31, June 30, September 30, and December 31. We refer in various places within this Annual Report to Adjusted EBITDA, which are non-IFRS measures. The presentation of non-IFRS measures is not meant to be considered in isolation or as a substitute for our consolidated financial results prepared in accordance with IFRS. See “Operating and Financial Review and Prospects.”

In this Annual Report, we rely on and refers to industry data, information and statistics regarding the markets in which it competes from research as well as from publicly available information, industry and general publications and research and studies conducted by third parties such as data by International Monetary Fund, World Economic Outlook database and Bain & Company (“Bain”). We have supplemented this information where necessary with its own internal estimates and information obtained from discussions with our customers, taking into account publicly available information about other industry participants and our management’s best view as to information that is not publicly available. This information appears in “ITEM 4. INFORMATION ON THE COMPANY” and other sections of this Annual Report. We have taken such care as we consider reasonable in the extraction and reproduction of information from such data from third-party sources.

Industry publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the forecasts or estimates from independent third parties and us.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F for the fiscal year ended December 31, 2018 (including information incorporated by reference herein, the “Annual Report”) contains or may contain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”) that involve significant risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements include information about our possible or assumed future results of operations or our performance. Words such as “expects,” “intends,” “plans,” “believes,” “anticipates,” “estimates,” and variations of such words and similar expressions are intended to identify the forward-looking statements. The risk factors and cautionary language referred to or incorporated by reference in this Report provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described in our forward-looking statements, including among other things, the items identified in the Risk Factors section of this Report. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are the following:

| ● | our ability to maintain the listing of our securities on Nasdaq; |

| ● | our ability to adapt to technology and other changes in our highly competitive industry; |

| ● | management of growth; |

| ● | general economic conditions, especially changes in disposal income in our markets; |

| ● | our business strategy and plans; and |

| ● | the result of future financing efforts. |

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. Although we believe that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements contained in this Report, or the documents to which we refer readers in this Report, to reflect any change in our expectations with respect to such statements or any change in events, conditions or circumstances upon which any statement is based.

iii

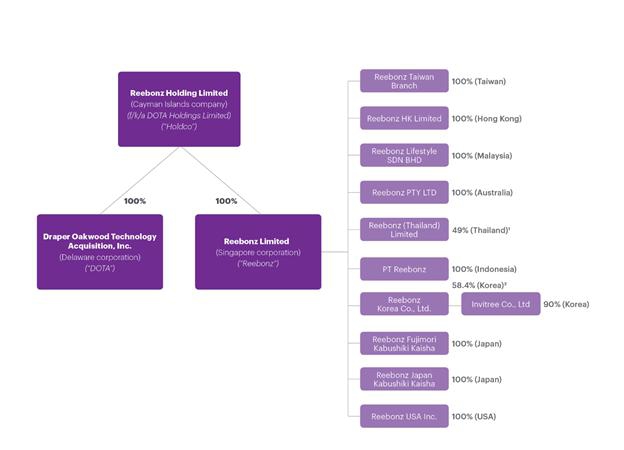

On September 4, 2018, a Business Combination Agreement (“Business Combination Agreement”) was made and entered into by and among Draper Oakwood Technology Acquisition, Inc., a Delaware corporation ( “DOTA” or “Purchaser”), Reebonz Holdings Limited, a Cayman Islands exempted company (f/k/a DOTA Holdings Limited, “Holdco” or the “Company”), DOTA Merger Subsidiary Inc., a Delaware corporation and a wholly owned subsidiary of Holdco (“Merger Sub”), Draper Oakwood Investments, LLC (solely in the capacity as the Purchaser Representative), Reebonz Limited, a Singapore corporation (“Reebonz”) and the shareholders of Reebonz named therein (the “Sellers”), which provided for (a) the merger of Merger Sub with and into Purchaser, with Purchaser surviving the merger and the security holders of Purchaser becoming security holders of Holdco, which will become a new public company, and (b) upon the effectiveness of such merger, the exchange of 100% of the outstanding share capital of Reebonz by the shareholders of Reebonz for ordinary shares of Holdco and the assumption by Holdco of outstanding Reebonz options and warrants (with equitable adjustments and additional amendments to the options) and (c) adoption of the amended and restated memorandum and articles of association, and to approve the business combination contemplated by such agreement (collectively, the “Business Combination”).

On December 19, 2018, DOTA Holdings Limited consummated the Business Combination pursuant to the terms of the Business Combination Agreement and changed its corporate name to Reebonz Holdings Limited.

Unless otherwise indicated, “we,” “us,” “our,” “Holdco,” “the Company,” and similar terminology refers to Reebonz Holdings Limited, a company organized under the laws of the Cayman Islands, and its subsidiaries subsequent to the Business Combination. References to “DOTA Holdings Limited” refers to Reebonz Holdings Limited prior to the consummation of the Business Combination.

On March 15, 2019, the Company effected a 1-for-8 reverse stock split of its ordinary shares. All share and per share information herein that relates to our ordinary shares prior to the effective date has been retroactively restated to reflect the reverse stock split.

iv

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

A. Selected Financial Data

The following selected consolidated statement of profit or loss and other comprehensive loss data for fiscal years 2018, 2017 and 2016 and the selected consolidated statement of financial position data as of December 31, 2018 and 2017 have been derived from our audited consolidated financial statements included elsewhere in this Annual Report. The selected consolidated balance sheets data as of December 31, 2016 have been derived from our audited consolidated financial statements that were part of the final prospectus included in the Registration Statement on Form F-4 filed on September 17, 2018 but are not included in this Annual Report. The financial data set forth below should be read in conjunction with, and is qualified by reference to, “Item 5. Operating and Financial Review and Prospects” and the consolidated financial statements and notes thereto included elsewhere in this Annual Report. Our consolidated financial statements are prepared and presented in accordance with IFRS as issued by the IASB. Our historical results do not necessarily indicate results expected for any future period.

The financial statements of the Company have been presented in United States Dollars (“USD”).

Selected Financial Information — Reebonz (in thousands)

| 2016 | 2017 | 2018 | ||||||||||

| USD ’000 | USD ’000 | USD ’000 | ||||||||||

| Revenue | 128,003 | 107,739 | 88,379 | |||||||||

| Cost of revenue | (95,230 | ) | (77,628 | ) | (66,222 | ) | ||||||

| Gross profit | 32,773 | 30,111 | 22,157 | |||||||||

| Fulfillment expenses | (18,882 | ) | (18,175 | ) | (14,917 | ) | ||||||

| Marketing expenses | (9,739 | ) | (7,573 | ) | (5,400 | ) | ||||||

| Technology and content expenses | (5,252 | ) | (4,811 | ) | (3,809 | ) | ||||||

| General and administrative expenses | (15,974 | ) | (11,055 | ) | (11,394 | ) | ||||||

| Government grant | 290 | 167 | 203 | |||||||||

| Operating loss | (16,784 | ) | (11,336 | ) | (13,160 | ) | ||||||

| Other income | 550 | 415 | 676 | |||||||||

| Other expenses | (1,157 | ) | (923 | ) | (731 | ) | ||||||

| Finance costs | (1,797 | ) | (3,250 | ) | (3,533 | ) | ||||||

| Finance income | 35 | 14 | 7 | |||||||||

| (19,153 | ) | (15,080 | ) | (16,741 | ) | |||||||

| Change in fair value of: | ||||||||||||

| - convertible preference shares | 59,233 | 70,063 | (2,068 | ) | ||||||||

| Recapitalization expenses | – | – | (16,530 | ) | ||||||||

| Profit/(Loss) before tax | 40,080 | 54,983 | (35,339 | ) | ||||||||

| Income tax expense | (10 | ) | (75 | ) | (116 | ) | ||||||

| Profit/(Loss) for the year | 40,070 | 54,908 | (35,455 | ) | ||||||||

| Attributable to: | ||||||||||||

| Owners of the Company | 40,654 | 55,365 | (35,239 | ) | ||||||||

| Non-controlling interests | (584 | ) | (457 | ) | (216 | ) | ||||||

| Profit/(Loss) for the year | 40,070 | 54,908 | (35,455 | ) | ||||||||

| Selected Non-IFRS Financial Data | ||||||||||||

| Adjusted EBITDA | (10,264 | ) | (7,668 | ) | (8,345 | ) | ||||||

| Adjusted EBITDA margin | -8.0 | % | -7.1 | % | -9.4 | % | ||||||

| Profit/(Loss) per share ($) | ||||||||||||

| Basic, profit/(loss) for the year/period attributable to ordinary equity holders of the parent | 51.99 | * | 69.73 | * | (42.92 | ) | ||||||

| Diluted, profit/(loss) for the year/period attributable to ordinary equity holders of the parent | (7.89 | )* | (6.44 | )* | (42.92 | ) | ||||||

| Weighted average number of ordinary shares outstanding used in computing Basic earnings per share | 782,000 | 794,000 | 821,000 | |||||||||

| Diluted earnings per share | 2,356,000 | 2,274,000 | 2,237,000 | |||||||||

*Restated due to reverse stock split.

1

Consolidated statements of financial position as of December 31 2018, 2017 and January 1 2017:

| 1/1/2017 | 31/12/2017 | 31/12/2018 | ||||||||||

| USD ’000 | USD ’000 | USD ’000 | ||||||||||

| Non-current assets | 27,619 | 37,304 | 34,718 | |||||||||

| Current assets | 45,303 | 37,704 | 44,421 | |||||||||

| Cash and cash equivalents | 11,926 | 7,312 | 2,604 | |||||||||

| Total assets | 72,922 | 75,008 | 79,139 | |||||||||

| Current liabilities | 38,893 | 44,810 | 81,506 | |||||||||

| Non-current liabilities | 151,270 | 87,918 | 19,178 | |||||||||

| Convertible preference shares | 123,468 | 56,854 | – | |||||||||

| Total liabilities | 190,163 | 132,728 | 100,684 | |||||||||

Other Data:

The following table sets forth for the periods indicated; certain selected consolidated financial and other data:

| 2016 | 2017 | 2018 | ||||||||||

| Accumulated buyers | 349,880 | 441,612 | 523,057 | |||||||||

| New buyers | 92,640 | 91,732 | 81,445 | |||||||||

| Repeat buyers | 63,054 | 54,329 | 49,932 | |||||||||

| Total buyers | 136,828 | 131,677 | 119,659 | |||||||||

| Total orders | 248,800 | 215,510 | 198,489 | |||||||||

| Percentage of total orders placed by repeat buyers | 70.3 | % | 64.1 | % | 64.9 | % | ||||||

| GMV (USD$, in millions) | 247.0 | 250.1 | 234.5 | |||||||||

| Revenue (USD$, in millions) | 128.0 | 107.7 | 88.4 | |||||||||

| AOV (USD$) | 568 | 672 | 675 | |||||||||

| Average GMV per user (USD$) | 1,033 | 1,099 | 1,119 | |||||||||

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

This Annual Report contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those described in the following risk factors and elsewhere in this Annual Report. If any of the following risks actually occur, our business, financial condition and results of operations could suffer.

2

Risks Related to Our Business and Industry

Our independent registered public accounting firm has included an explanatory paragraph relating to our ability to continue as a going concern in its report on our audited consolidated financial statements included in this Annual Report.

Our audited consolidated financial statements were prepared assuming that we will continue as a going concern. However, the report of our independent registered public accounting firm included elsewhere in this Annual Report contains an explanatory paragraph on our consolidated financial statements stating there is substantial doubt about our ability to continue as a going concern, meaning that we may not be able to continue in operation for the foreseeable future or be able to realize assets and discharge liabilities in the ordinary course of operations. Such an opinion could materially limit our ability to raise additional funds through the issuance of new debt or equity securities or otherwise. There is no assurance that sufficient financing will be available when needed to allow us to continue as a going concern. The perception that we may not be able to continue as a going concern may also make it more difficult to raise additional funds or operate our business due to concerns about our ability to meet our contractual obligations.

Based on current operating plans, assuming successful completion of a public offering pursuant to the registration statement originally filed with the SEC of February 25, 2019, as amended, and the continuation by the Group’s bankers to provide access to the Group to drawdown and roll forward existing short term financing facilities, we believe that we have resources to fund our operations for at least the next twelve months, but will require further funds to finance our activities thereafter. Reebonz may also consider potential financing options with banks or other third parties. In the event this public offering is not completed as expected we will need to consider alternative arrangements and such arrangements could have a potentially significant negative impact on our ability to continue our operations.

Any harm to our brand or reputation may materially and adversely affect our business and results of operations.

Brand recognition and reputation are invaluable assets in the luxury goods market. We believe that the recognition and reputation of our Reebonz brand among buyers of luxury goods, our suppliers, marketplace merchants and individual sellers have contributed significantly to the growth and success of our business. Maintaining and enhancing such brand recognition and reputation are critical to our business and competitiveness. Many factors, including those beyond our control, are important to maintaining and enhancing our brand. These factors include our ability to:

| ● | provide a compelling online buying and selling experience to customers; |

| ● | maintain the authenticity, quality and diversity of the products we offer in sufficient quantities; |

| ● | maintain the efficiency, reliability and security of our fulfillment services and payment systems; |

| ● | maintain or improve buyer satisfaction with our after-sale services; |

| ● | enhance brand awareness through marketing and brand promotion activities; |

| ● | preserve our reputation and goodwill in the event of any negative publicity involving our product authenticity and quality, customer service, cybersecurity, data protection, authorization to sell products or other issues affecting it; and |

| ● | maintain positive relationships with our suppliers, marketplace merchants, individual sellers and other service providers. |

Any public perception (i) that counterfeit goods, pre-owned goods that are in a worse-than-described condition or unauthorized or stolen goods are sold on our website, (ii) that we, or our third-party service providers, do not provide satisfactory customer service or (iii) that we infringe upon any brand owners’ intellectual property rights could damage our reputation, diminish our brand value, undermine our credibility and adversely impact our business. If we are unable to maintain our reputation, enhance our brand recognition or increase positive awareness of our website, products and services, we may be difficult to maintain and grow our customer base, and our business and growth prospects may be materially and adversely affected.

3

We operate in a competitive environment and may lose market share and customers if we fail to compete effectively.

The online luxury goods industry in the Asia Pacific region is competitive. We compete for customers, third-party merchants and individual sellers. Our current and potential competitors include other specialist online luxury retailers, general online retailers, fashion online retailers, luxury brand owners’ online stores, luxury department retailers’ online stores, as well as physical stores that sell luxury goods, including retail stores owned and operated by the brands that we carry. See “Business Overview— Competition.” In addition, new technologies may increase or even transform the competitive landscape in the online luxury goods industry. New competitive business models may appear, such as business models based on new forms of social media, and we may not adapt quickly enough, or at all, to changing industry trends.

Increased competition may reduce our margins, market share and brand recognition, or result in significant losses. For example, when we set prices, we consider how competitors have set prices for the same or similar products. When they cut prices or offer additional incentives to compete with it, we may have to lower our own prices or offer comparable incentives or risk losing market share. When we have products that do not sell, we often reduce prices to clear inventory. Competitive price reduction on certain luxury items lowers prices and benefits buyers, but in the longer term may hurt the perceived prestige of those luxury goods and dampen consumer interest. In addition, third-party merchants are crucial in broadening our product listings, and we compete with other companies for these sellers.

We also compete on the basis of non-price terms. For example, in our B2C Merchandise Business, we offer free international shipping for orders above a certain minimum value and aim to make deliveries within three to seven business days depending on the country of delivery. We plan to employ a variety of strategies to shorten delivery times, such as increased monitoring of third-party courier performance and implementation of a “local sourcing and local sale” model. If these strategies do not succeed, and one or more of our significant competitors manage to shorten delivery times, we may lose any competitive advantage.

Some of our current or future competitors may have longer operating histories, greater brand recognition, better supplier relationships and sourcing expertise, including direct relationships with brand owners, larger customer bases or greater financial, technical or marketing resources than we do. Those smaller companies or new entrants may be acquired by, receive investment from or enter into strategic relationships with well-established and well-financed companies or investors which would help enhance their competitive positions. We cannot assure you that we will be able to compete successfully against current or future competitors, and competitive pressures may have a material and adverse effect on our business, financial condition and results of operations.

If we are unable to manage our growth or execute our strategies effectively, our business and prospects may be materially and adversely affected.

Our business has grown substantially since its inception in 2009. We continue to introduce new lines of business and plan to continue to grow our business. Specifically, we launched our Reebonz Closets, a C2C marketplace, in February 2015, our Merchant’s Marketplace, a B2C marketplace, in May 2015, and introduced the “Sell Back” feature in May 2017. In addition, in the past few years, we have expanded into new markets and increased our product offerings. Expanding our business has entailed and will continue to entail significant risks as we work with new suppliers, expands into new markets and offers new products. As the business grows and our product offerings increase, we will need to continue to work with a large number of merchants and an even larger number of individual sellers efficiently and establish and maintain mutually beneficial relationships with them. We will also need to perform sufficient due diligence and other checks to prevent the sale of counterfeit or unauthorized goods on our platform. To support our growth, we also plan to implement a variety of new and upgraded managerial, operating, financial and human resource systems, procedures and controls. All of these efforts will require significant financial, managerial and human resources. In addition, our number of employees has increased since our inception, and may continue to increase in the future. We cannot assure you that we will be able to effectively manage our growth or to implement desired systems, procedures and controls successfully, particularly as the size of our organization grows, or that our system will perform as expected or that our new business initiatives will be successful. If we are not able to manage our growth or execute our strategies effectively, our growth may be interrupted and our business and prospects may be materially and adversely affected.

4

Our limited operating history makes it difficult to evaluate our business and prospects, and we may not be able to sustain our historical growth rates.

We commenced our Reebonz business in May 2009 and have a limited operating history. Since our inception, we have experienced rapid growth in our business. Our revenue was US$88.4 million in 2018. We have incurred operating losses every year since inception. Our business has undergone significant changes each year since its inception, including through acquisitions and the introduction of new products and services, and therefore our historical growth rate may not be indicative of future performance. We cannot assure you that we will be able to achieve similar results or grow at a similar rate as we have in the past. Growth may slow, revenue may decline and losses may increase for a number of possible reasons, some of which are beyond Reebonz’s control, including decreased consumer spending, greater competition, slower growth of the luxury goods market in the Asia Pacific region, negative perceptions about product quality or authenticity, fulfillment bottlenecks, sourcing difficulties, emergence of alternative business models, changes in government policies, tax policies or general economic conditions. It is difficult to evaluate our prospects, as we may not have sufficient experience in addressing the risks to which companies operating in rapidly evolving markets may be exposed. If our growth rate declines, investors’ perceptions of our business and business prospects may be adversely affected and the market price of our securities could decline. You should consider our prospects in light of the risks and uncertainties that fast-growing companies with a limited operating history may encounter.

We have limited control over sellers in our Reebonz Closets and B2C Merchant’s Marketplace platform.

In 2015, we started Reebonz Closets, a C2C marketplace, and B2C Merchant’s Marketplace in Singapore. In our Marketplace Business, we do not source goods ourselves and instead provide a platform for sellers and buyers to directly buy and sell goods using our platform. We have limited control over the actions of sellers in our marketplaces and their interactions with buyers. Many of the buyers in our Marketplace Business are our existing customers and any negative experience buying through our marketplaces could adversely impact their trust in our Reebonz brand. For example, sometimes sellers advertising a product on our platform may no longer have the product available for sale. A significant percentage of sellers using our Reebonz marketplace platform may identify buyers and then transact with them outside our platform, thereby avoiding the payment of commissions, which would result in lower revenue and GMV.

Furthermore, if any seller on our platform does not control the quality of the goods that we sell, does not deliver the goods on time or at all, delivers goods that are materially different from our description of them, sells counterfeit, unlicensed or stolen goods on our platforms, or sells certain goods in violation of relevant laws and regulations or in violation of brand owners’ distribution restrictions, the reputation of our Marketplace Business and our brand may be materially and adversely affected, and we could face claims that we should be held liable for any losses. Any perception that counterfeit goods are sold on our platform could severely harm our brand and reputation. Third-party sellers may offer certain goods that are the same as, or similar to, the products that we directly offer for sale, thereby competing with our B2C Merchandise Business. In addition, expanding into these new businesses has required, and will continue to require, significant management attention and other resources. In order for our online marketplace to be successful, we must also continue to identify and attract third-party sellers, and we may not be successful in this regard. While every item sold through our C2C Individual Seller’s Marketplace is authenticated by our ateliers, we may still fail to detect some counterfeit goods and we are generally unable to detect stolen goods as there is typically no way to ascertain this.

We have a history of losses, operating losses and negative cash flow from operating activities, and we may continue to incur losses and operating losses, and experience negative cash flow from operating activities, in the future.

We have incurred significant losses and negative cash flow from operating activities since our inception. In 2017 and 2018, we had negative cash flow from operating activities of US$8.1 million and US$6.5 million, respectively. Our loss for the year in 2018 was US$35.5 million. We cannot assure you that we will be able to generate profits, operating profits or positive cash flow from operating activities in the future or that we will be able to continue to obtain financing (and in particular trust receipt financing, which is our primary source of financing for inventory purchases) on acceptable terms or at all. Our ability to achieve profitability and positive cash flow from operating activities will depend on a mix of factors, some of which are beyond our control, including our ability to grow and retain our buyer and seller base, our ability to secure favorable commercial terms from suppliers, our ability to spot trends in the luxury goods market and manage our product mix accordingly and our ability to expand our new lines of business and offer value-added services with higher profit margins. In addition, we intend to continue to invest heavily in the foreseeable future in order to grow our business in the Asia Pacific online luxury goods market. As a result, we believe that we may continue to incur losses for some time in the future.

5

We do not have direct contractual or business relationships with luxury brand owners except in limited circumstances, and as a result we may face legal risks from potential liability for goods sold by us, or individuals or merchants in our marketplaces, outside brand owners’ authorized distribution channels and potential claims related to “parallel import” activities, and we may also face commercial risks from actions by luxury brand owners.

We do not have direct contractual or business relationships with luxury brand owners except in limited circumstances. Instead, we source new luxury goods in our B2C Merchandise Business primarily from authorized distributors and luxury wholesalers in various countries. The contractual arrangements between some luxury brand owners and certain of our suppliers could contain restrictions on the price, geographic region and manner in which goods may be resold. We also source luxury goods through distribution channels outside the control of brand owners, which are often referred to as “parallel imports.” We believe that the import and sale of parallel import goods is generally permitted under the laws and regulations of the primary jurisdictions in which we operate, subject to certain exceptions. If our sourcing from any supplier is in violation of contractual arrangements with brand owners or legal restrictions on parallel import activities, we could be subject to claims of intellectual property rights infringement, tortious interference or inducement of contract breach, among others, and face significant liabilities. Any such perception that we are a parallel importer may undermine our reputation among buyers and sellers of luxury goods.

We are also subject to the commercial risks that brand owners may instruct our suppliers not to sell goods to us or may cease selling goods to our suppliers completely or in sufficient quantities to meet our sourcing needs. In particular, brand owners may object to our pricing practices, especially the discounts to the retail prices fixed or suggested by brand owners. If we are successful in increasing the scale of our business and becomes more prominent in the luxury goods industry, the risk that brand owners may take legal or commercial action against us or our suppliers may increase. Any such actions could harm our reputation and adversely impact our product offerings, which could have a material and adverse effect on our results of operations and growth prospects.

Authorized distributors and luxury wholesalers have entered into framework supply agreements with us, which contain representations that they are not restricted from selling such goods us and indemnities for losses we suffer or costs we incur in connection with the agreement. We are actively seeking to enter into such agreements with all of our suppliers from which we source new luxury items, but there can be no assurance that such suppliers will agree to the proposed terms. In addition, there can be no assurance that the representations made by our suppliers are accurate, and we may not be able to successfully enforce our contractual rights, including any indemnities, and may need to initiate costly and lengthy legal proceedings to protect our rights. Enforcing our contractual rights under those agreements may require us to incur significant costs and effort, and may divert our management’s attention from day-to-day operations. With our other suppliers that have not entered into any framework supply agreements, we place spot purchase orders, and any contractual rights or other recourse we may have against them in the event their sales to it are in violation of the rights of brand owners are highly limited and unlikely to provide sufficient compensation for any losses we suffer or costs we incur.

With respect to our online Marketplace Business, although we plan to implement standard terms and conditions requiring individual sellers and merchants to confirm to us that, among other things, their sale of luxury goods on our platforms is not in violation of any distribution agreements and does not infringe the intellectual property rights of brand owners, there can be no assurance that these confirmations will be accurate, and we may not be able to successfully enforce any contractual rights or other recourse we may have against them in the event such confirmations are not accurate.

We have in the past received and may continue to receive claims alleging that sales of luxury goods by us, or individuals or merchants in our marketplaces, are not through brand owners’ authorized distribution channels. In March 2013, November 2015 and in March 2016, we received letters from a brand owner demanding that we cease selling our products and claiming we are not part of its authorized distribution network. Although such allegations and claims have not had a material adverse impact on our business, we might be required to allocate significant resources and incur material expenses to address such claims in the future. Irrespective of the validity of such claims, we could incur significant costs and effort in either defending or settling such claims, which could divert our management’s attention from day-to-day operations. If a successful claim is made against us, we might be required to pay substantial damages or refrain from further sale of the relevant products. Regardless of whether we successfully defend against such claims, we could suffer negative publicity, our reputation could be severely damaged and our product offerings could be significantly reduced. Any of these events could have a material and adverse effect on our business, results of operations or financial condition.

6

If we fail to manage and expand our relationships with suppliers of luxury goods, or otherwise fail to procure products on favorable terms, our business and growth prospects may be materially and adversely affected.

For our B2C Merchandise Business, we source substantially all new luxury items from authorized distributors and luxury wholesalers, and we source pre-owned items from individuals, pre-owned luxury goods dealers and auction houses. Maintaining strong relationships with these suppliers is important to the growth of our business. In particular, we depend on our ability to procure products from authorized distributors and luxury wholesalers and, to a lesser extent, brand owners, on favorable pricing terms. In the past, we typically entered into spot purchase orders and did not have long-term arrangements for the supply of products. We are actively seeking to enter into framework supply agreements with all of the authorized distributors and wholesalers that we source new luxury items from. In addition, there is no assurance that all of our relevant suppliers will enter into our standard supply agreements with us or that our efforts to enter into such agreements will not adversely affect our relationships with our suppliers. We may also choose to discontinue our relationship with a supplier that declines to enter into such agreements, which would reduce the pool of suppliers that we source luxury goods from and could materially and adversely affect our business and growth prospects. We cannot assure you that our current suppliers will continue to sell products to us on commercially acceptable terms, if at all. Even if we maintain good relations with our suppliers, their ability to supply products to us in sufficient quantity and at competitive prices may be adversely affected by changes in their relationship with brand owners, economic conditions, labor unrest, regulatory or legal decisions, natural disasters or other contingencies. In addition, it is possible that our Marketplace Business will not be able to retain existing sellers or to attract sufficient new sellers in the future. In the event that we are not able to source luxury goods at favorable prices, our revenue and cost of revenue may be materially and adversely affected. If we are unable to develop and maintain good relationships with suppliers that would allow us to obtain a sufficient amount and variety of luxury merchandise on commercially acceptable terms, it may inhibit our ability to offer sufficient products sought by luxury goods buyers, or to offer these products at competitive prices. Any adverse developments in our relationships with our suppliers, as well as with merchants and individual sellers on our marketplaces, could materially and adversely affect our business and growth prospects.

If counterfeit products are inadvertently sold by us or through our platform, we may be subject to legal claims from brand owners, and our reputation and results of operations could be materially and adversely affected.

We are subject to the risk that counterfeit goods could be sold through our platform. Although we conduct due diligence on most of our suppliers and have quality control procedures in place to ensure that new luxury goods sold through our B2C Merchandise Business are authentic, we do not authenticate each item that we take in our inventory and sell and therefore rely on suppliers to sell us authentic luxury goods. Although we authenticate pre-owned luxury goods sold by us or through our C2C Individual Seller’s Marketplace (consisting of Reebonz Closets and our White Glove Service), our authentication procedures may not be effective in all circumstances. In addition, we do not authenticate products sold through our B2C Merchant’s Marketplace. Any sale of counterfeit goods through our platform could significantly harm our reputation and could result in brand owners making legal claims against us for infringement of trademark, copyright or other intellectual property rights. From time to time in the ordinary course of our business, buyers, brand owners or other third parties have alleged and may allege that counterfeit products have been sold by us or through our platform. Any perception that our platform may contain counterfeit goods, even without merit, could have a material and adverse impact on our reputation.

When we receive complaints or allegations regarding infringement or counterfeit goods, we typically verify the nature of the complaint and the relevant facts. Our procedures could result in delays in de-listing products. In the event that alleged counterfeit or infringing products are listed or sold through our platform, we could face claims relating thereto for alleged failure to act in a timely or effective manner or to otherwise restrict or limit such sales or infringement. We may implement further measures in an effort to strengthen our protection against these potential liabilities, which could require us to spend substantial resources or discontinue certain service offerings. In addition, these changes may reduce the attractiveness of our marketplaces and other services to buyers, sellers or other users. A seller whose content is removed or whose services are suspended or terminated by us, regardless of its compliance with the applicable laws, rules and regulations, may dispute our actions and commence action against us for damages based on breach of contract or other causes of action or make public complaints or allegations. Any costs incurred as a result of liability or asserted liability relating to the sale of unlawful goods or other infringement could harm our business.

7

Companies that operate merchandise sales and online marketplace businesses, particularly those in the Asia Pacific region, have been subject to claims regarding counterfeit goods, and we could be subject to such claims in the future. For example, in January 2015, China’s State Administration for Industry and Commerce accused a major e-commerce company of failing to implement adequate procedures to prevent the sale of counterfeit goods on its platforms, and in May 2015, Kering, owner of Gucci and other luxury brands, filed a claim in U.S. federal court against this major e-commerce company alleging that it profited from the sale of counterfeit goods on its online marketplaces. Manufacturers and distributors of counterfeit goods are also increasingly sophisticated, making their products increasingly difficult to detect as counterfeits. If we were to be held to have sold or facilitated the sale of counterfeit goods, potential legal sanctions may include injunctions to cease infringing activities, rectification, compensation, administrative penalties and even criminal liability, depending on the governing law and the seriousness of the misconduct.

We may be subject to intellectual property infringement claims, especially claims alleging unauthorized use of brand names or trademarks, which may be expensive to defend and may disrupt our business and operations.

We cannot be certain that our operations or any aspects of our business do not, or will not, infringe upon or otherwise violate trademarks, patents, copyrights or other intellectual property rights held by third parties. We may be subject to legal proceedings and claims relating to the intellectual property rights of others, especially those relating to luxury brand owners’ brand names, logos and trademarks. Although our practice is not to display those brand names, logos and trademarks on our website (except in product photos), we have received complaints in the past that we have displayed certain brand names and trademarks without authorization or in a misleading manner, including from brand owners whose goods have accounted for a significant percentage of our revenues.

For example, we received a letter of complaint in June 2012 from the legal counsel of a luxury brand, alleging that we had displayed certain trademarks on our website without authorization and demanding that we cease the sale of its products. We also received a letter of complaint in February 2013 from the legal counsel of a luxury brand alleging that one of our promotional events used certain trademarks without authorization and conveyed a false impression that such event had its endorsement. Based on advice from our intellectual property law counsel, we generally believe that our actions referred to in those letters have not infringed on the brand owners’ rights, and we have responded as such to those letters through our legal counsel. We also have intellectual property rights policies and take-down procedures in place to deal with claims that we believe have merit. However, we cannot assure you that our policies and practices will be successful in averting similar complaints in the future, or that our legal interpretation or other defenses against claims that we believe are without merit will be upheld in a court of law or otherwise successful. Even if none of the claims are successful, defending our rights against such claims could involve significant costs and effort and divert our management’s attention from day-to-day operations. Actively defending against such claims could also lead brand owners to take commercial or other actions against us, such as instructing our suppliers not to sell goods to us or ceasing to sell goods to our suppliers completely or in sufficient quantities to meet our sourcing needs.

In addition, other third-party intellectual property may be infringed by our products, services or other aspects of our business. Holders of patents purportedly relating to some aspect of our technology platform or business, if any such holders exist, may seek to enforce such patents against us in the United States or any other jurisdictions. Further, the application and interpretation of patent laws and the procedures and standards for granting patents in certain jurisdictions in which we operate are still evolving and are uncertain, and we cannot assure you that the courts or regulatory authorities would agree with our analysis.

8

If we are found to have violated the intellectual property rights of others, we may be subject to liability for our infringement activities or may be prohibited from using such intellectual property, and we may incur licensing fees or be forced to develop alternatives of our own. For instance, we were alerted in September 2012 by Getty Images, the copyright licensee of certain images we had used on our website, that those images were used without proper licensing and we subsequently paid licensing fees to Getty Images. In addition, we may incur significant expenses, and may be forced to divert management’s time and other resources from our business and operations to defend against these third-party infringement claims. Any ensuing negative publicity may severely damage our brand and reputation, regardless of the merits of the claims. Successful infringement or licensing claims made against us may result in significant monetary liabilities and may materially disrupt our business and operations by restricting or prohibiting our use of the intellectual property in question.

Finally, we use open source software in connection with our products and services. Some open source software licenses require users who distribute open source software as part of their software to publicly disclose all or part of the source code to such software and make available any derivative works of the open source code on unfavorable terms or at no cost. Any requirement to disclose our source code or pay damages for breach of contract could be harmful to our business, results of operations and financial condition.

We may not be able to secure trademark registrations, which could adversely affect our ability to operate our business.

We file trademark applications with the proper authorities in each country in which we operate and will continue to do so if and when we expand into other jurisdictions. Trademark applications where we may file may not be allowed registration, and we may not be able to maintain or enforce our registered trademarks. If there are trademark registration proceedings, we may receive rejections. Although trademark applicants are given an opportunity to respond to those rejections, we may be unable to overcome such rejections. In addition, third parties are given an opportunity to oppose pending trademark applications and to seek to cancel registered trademarks. Opposition or cancellation proceedings may be filed against our applications and/or registrations, and our applications and/or registrations may not survive such proceedings. For example, we received a notice of opposition to our U.S. trademark application number 79189277 relating to the registration of “Reebonz” for, inter alia, business organization and business management of sales of products and services via a global computer network in the field of luxury fashion. The opponent alleges that our registration would result in likelihood of confusion and dilution of the “Reebok” mark. Based on advice from our intellectual property law counsel, we generally believe that such allegations are unfounded and are working with the opponent, through our legal counsel, to address the opponent’s concerns so that our mark can be registered in the U.S. for the aforementioned goods and services. Failure to secure such trademark registrations could adversely affect our ability to operate our business in a specific jurisdiction.

Failure to safeguard private and confidential information of our buyers and sellers and protect our network against security breaches could damage our reputation and brand and substantially harm our business and results of operations.

An important challenge to the online retail industry in general, and the online luxury retail market in particular, is the safekeeping and secure transmission of private and confidential information. Through third-party cloud computing service providers, we maintain a large database of confidential and private information as a result of buyers of luxury goods placing orders and inputting payment and contact information online, and sellers listing products and accepting payments, all through our website and our mobile application. In addition, we accept a variety of payment methods such as major credit cards networks, bank transfers and third party payment service providers, and online payments are settled through third-party online payment services. We also share certain personal information about our customers with contracted third-party couriers, such as their names, addresses, phone numbers and transaction records in order to facilitate pickups and deliveries. Maintaining complete security for the storage and transmission of confidential information in our system presents us with significant challenges.

Given the high monetary value of the luxury goods we carry and the relatively high average net worth of our buyers, safeguarding consumer privacy is essential to maintaining customer confidence. Advances in technology and the sophistication of cyber-attackers, new discoveries in cryptography or other developments could result in a compromise or breach of the technology that we use to protect confidential information, which could lead to third parties illegally obtaining private and confidential information we hold as a result of our customers’ visits to our website and use of our mobile application, which could significantly affect consumer confidence in our platform and harm our business. In a Facebook post in November 2014, a satirical group, SMRT Ltd (Feedback), claimed that the personal data of 400,000 customers from Zalora, 440,000 customers from us and 650,000 records from deal.com.sg, were being peddled. Although we and other retailers have refuted this claim, such report or any similar reports in the future, whether factual or not, could negatively impact consumer perceptions of the safety and security of our platform or online shopping generally as well as our relationships with third parties, such as payment platforms. In addition to external threats, leaks of private and confidential information may result from operational errors. For instance, there have been instances where our staff have inadvertently sent e-mails with information regarding particular customers to the wrong customer. There can be no assurance that similar instances will not occur in the future.

9

In addition, we have limited control or influence over the security policies or measures adopted by third-party providers of online payment services through which our customers may elect to make or accept payments. Any negative publicity on our website’s or mobile application’s safety or privacy protection mechanisms and policies, and any claims asserted against us or fines imposed upon it as a result of actual or perceived failures, could have a material and adverse effect on our public image, reputation, financial condition and results of operations. Any compromise of our information security, or the information security measures of our contracted third-party couriers or third-party online payment service providers, could have a material and adverse effect on our reputation, business, prospects, financial condition and results of operations.

Practices regarding the collection, use, storage and transmission of personal information by companies operating over the internet and mobile platforms have recently come under increased public scrutiny in the various jurisdictions in which we and our subsidiaries operate. In addition to already existing stringent laws and regulations in such jurisdictions applicable to the solicitation, collection, processing, sharing or use of personal or consumer information, we may become subject to newly enacted laws and regulations that could affect how we store, process and share data with our customers, suppliers and third-party sellers. Compliance with any additional laws could be expensive, and may place restrictions on the conduct of our business and the manner in which we interact with our customers. Any failure to comply with applicable regulations could also result in regulatory enforcement actions against us.

Significant capital, managerial resources and other resources may be required to protect against information security breaches or to alleviate problems caused by such breaches or to comply with our privacy policies or privacy-related legal obligations. The resources required may increase over time as the methods used by cyber-attackers and others engaged in online criminal activities are increasingly sophisticated and constantly evolving. Any failure or perceived failure by us to prevent information security breaches or to comply with privacy policies or privacy-related legal obligations, or any compromise of security that results in the unauthorized release or transfer of personally identifiable information or other customer data, could cause our customers to lose trust in us and could expose us to legal claims. Any perception by the public that e-commerce or the privacy of customer information is becoming increasingly unsafe or vulnerable to attacks could inhibit the growth of online luxury retail and other online services generally, which could have a material and adverse effect on our financial condition and results of operations.

If we fail to manage our inventory effectively, our results of operations, financial condition and liquidity may be materially and adversely affected.

We take inventory risk in our B2C Merchandise Business, which requires us to effectively manage a large volume of high-value inventory. We depend on our demand forecasts for various kinds of luxury items and the subjective judgments of our merchandising team regarding fashion and style trends to make sourcing decisions and to manage our inventory. Demand, however, can change unexpectedly between the time inventory is ordered and the time by which we intend to sell it. Demand may be affected by changes in consumer tastes, new product launches, changes in product cycles and pricing, product defects and many other factors, and luxury goods buyers may not order products in the quantities that we expect. In such circumstances, given that we do not typically have the right to return unsold items to our suppliers, we may decide to clear our inventory by reducing prices and making sales at a loss. In addition, when we begin selling a new product, it may be difficult to establish supplier relationships, determine appropriate product selection and accurately forecast demand. The acquisition of certain types of inventory may require significant lead time and prepayment that is typically nonrefundable. We are also subject to the risk that our inventory may be lost or damaged in storage or in transit, to the extent that such loss or damage is outside the coverage of our insurance.

If we fail to manage our inventory effectively, we may face inventory obsolescence, a decline in inventory value and significant inventory write-downs or write-offs. Such decline in inventory value may be substantial, especially given the high monetary value of the luxury goods we sell. We may be required to lower sale prices or conduct additional marketing activities in order to reduce inventory levels, which may lead to lower margins. High inventory levels may also tie up substantial capital resources, preventing us from using that capital for other purposes. On the other hand, if we underestimate demand for our products, or if our suppliers fail to supply quality products in a timely manner, we may experience inventory shortages and as a result, lost sales and damage to our reputation. Any of the above may materially and adversely affect our results of operations and financial condition.

10

If we are unable to provide a high level of customer service, our business and reputation may be materially and adversely affected.

Our ability to ensure an enjoyable, efficient and user-friendly buying and selling experience for customers is crucial to our success. The quality of our customer service depends on a variety of factors, including our ability to continue to offer a wide range of authentic luxury goods at affordable prices, source products to respond to ever-changing buyer demands and preferences, maintain the quality of our products and services, provide a secure and user-friendly website interface and mobile application for our buyers and sellers, and provide timely delivery and pick up and satisfactory after-sales service. If our customers are not satisfied with any aspect of our goods or services, or the prices we offer, or if our internet platform is interrupted or otherwise fails to meet our customers’ requests, our reputation and customer loyalty could be materially and adversely affected.

We depend on our customer service center and online customer service representatives to provide live assistance to our buyers and sellers. Each member of our loyalty programs with Reebonz Black or Reebonz Solitaire status, which are the two statuses achievable by members of our loyalty program being earned either by spending beyond certain thresholds, has access to our team of relationship managers and customer service representatives whom he or she can contact for any of his or her customer service needs. If our customer service representatives, including relationship managers, fail to provide satisfactory service, our brand and customer loyalty may be adversely affected. In addition, any negative publicity or poor feedback regarding our customer service may harm our brand and reputation and in turn cause us to lose customers and market share.

We also rely on contracted third-party delivery service providers, including global logistics providers and smaller local logistics providers, to pick up and deliver various high-value luxury goods. We also rely on these and other third parties to act as collection locations for our C2C Individual Seller’s Marketplace. If product pick up or delivery is not on time, or if the product is damaged in transit or while held at a collection location, customers’ confidence in our fulfillment capabilities could be diminished, particularly given the high monetary value of the goods sold on our platform. Furthermore, the personnel of contracted third-party delivery service providers act on our behalf and interact with our customers personally. Any failure to provide high-quality services to our customers may negatively impact the experience of our customers, damage our reputation and cause us to lose customers.

As a result, if we are unable to continue to maintain our customer experience and provide high-quality customer service, we may not be able to retain existing customers or attract new customers, which will have a material and adverse effect on our business, financial condition and results of operations.

We use third-party couriers to deliver orders, and rely heavily on them for our fulfillment services we provide to sellers and buyers in our online marketplace. Any failure on the part of these couriers to provide reliable services may materially and adversely affect our business and reputation.

We maintain arrangements with 16 third-party logistics providers, including multinational delivery companies and local couriers. We use our services to deliver our products to buyers and pick up goods from individual sellers. In addition, our Reebonz marketplaces, including both the B2C Merchant’s Marketplace and the C2C Individual Seller’s Marketplace, requires us to build and maintain a compelling platform, on which it provides fulfillment services to sellers and buyers. We rely heavily on the third-party couriers to provide pick-up and delivery services, which form an integral part of our fulfillment services.

Interruptions to, or failures of the delivery or collection services, could prevent the timely and successful pick-up and delivery of products. We may not be in a position to forestall or minimize the impact of these interruptions or failures, given that we are not in direct control of the third-party couriers. In addition, these interruptions or failures may be due to unforeseen events that are beyond our control or the control of the couriers, such as inclement weather, natural disasters or labor unrest.

11

We also encountered situations in the past where shipments were lost or stolen in transit and in certain cases we may choose not to utilize insurance coverage (such as where we believe paying the claim directly may be more beneficial than paying the deductible and electing to use insurance coverage) to cover losses or such losses may not be covered by insurance. Given the high monetary value of the luxury merchandise we handle, the reliability of third-party courier services and the quality of services they provide are crucial factors that merchants and individual sellers consider when determining whether to do business on our platform, and any mistake or interruption on the part of those couriers could severely dampen their confidence in our services and the Reebonz brand. Relatively small local couriers may be less reliable than long-established multinational delivery companies. For example, if our third-party couriers, especially those relatively small local couriers, fail to comply with applicable rules and regulations in their respective jurisdictions, our fulfillment services may be materially and adversely affected. We may not be able to find alternative delivery companies to provide pick-up and delivery services in a timely and reliable manner, if at all. Delivery of our products could also be affected or interrupted by merger, acquisition, insolvency or shut-down of the delivery companies it engages, especially those local companies with relatively small business scales. If our products are not delivered in proper condition or on a timely basis, or if our fulfillment services are disrupted by service failure of the third-party couriers, our business and reputation could be materially and adversely affected.

Our delivery, return and warranty policies and those of luxury brand owners may adversely affect our results of operations.

We generally provide free three- to seven-business day shipping for luxury items we directly sells to buyers. We also have adopted buyer-friendly return policies that make it convenient for buyers to return the purchase and obtain a refund. We may also be required by law to adopt new or amend existing return and exchange policies from time to time. Our return policy is even more generous for members of our loyalty programs, Reebonz Black and Reebonz Solitaire. In addition, luxury watches purchased from us come with a one-year warranty. These return, exchange and warranty policies could subject us to additional costs and expenses which may not be offset by increased revenue. Our ability to handle a large volume of returns is unproven. If our return and exchange policy is abused by a significant number of buyers, our costs may increase significantly and our results of operations may be materially and adversely affected. If we revise these policies to reduce our costs and expenses, our customers may be dissatisfied, which may result in loss of existing customers or failure to acquire new customers at a desirable pace, which may materially and adversely affect our results of operations. Some of the new and pre-owned luxury goods we sell may not be covered by the relevant manufacturer’s or brand owner’s original warranty, and such manufacturers or brand owners may refuse to provide replacement, repair, cleaning or other services for goods purchased on our platform. Although we intend to improve our disclosure of this risk to our buyers, we may be subject to consumer claims under applicable consumer protection or other laws and regulations in connection with limitations on manufacturer’s or brand owner’s warranties.

If we fail to implement and maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, our security holders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our securities.

Until consummation of the Business Combination, we were not a publicly listed company and we had limited accounting personnel and other resources with which to address our internal controls and procedures. Effective internal control over financial reporting is necessary for it to provide reliable financial reports and, together with adequate disclosure controls and procedures, are designed to prevent fraud. Effective internal controls can be particularly important to preparing consolidated financial results for the company since we operate in multiple markets with varying financial reporting rules and standards, such that it may have to make adjustments to our subsidiaries’ financial results as part of the consolidation process. If in subsequent years we are unable to assert that our internal control over financial reporting is effective, we could lose investor confidence in the accuracy and completeness of our financial reports, which could have a material adverse effect on the price of our securities.

Our internal controls relating to financial reporting have not kept pace with the expansion of our business. Our financial reporting function and system of internal controls are less developed in certain respects than those of similar companies that operate in fewer or more developed markets and may not provide our management with as much or as accurate or timely information. The Public Company Accounting Oversight Board, or PCAOB, has defined a material weakness as “deficiency, or a combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis.”

12

In connection with the preparation and external audit of our consolidated financial statements as of and for the years ended December 31, 2017 and 2018, we and KPMG LLP, independent registered public accounting firm, noted a material weakness in our internal control over financial reporting. The material weakness identified relates to the control environment and risk assessment: due to insufficient accounting resources important to the Company’s compliance with financial reporting requirements of International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board, and the United States Securities and Exchange Commission (“SEC”), and inadequate oversight and assessment of risks by management that could significantly impact internal control over financial reporting, to ensure accountability for the design, implementation, and performance of controls, including general information technology controls. This material weakness could allow errors to go undetected and resulted in corrected and uncorrected audit misstatements. As a result of the identification of this material weakness, we plan to take measures to remedy this control deficiency. However, we can give no assurance that our planned remediation will be properly implemented or will be sufficient to eliminate such material weakness or that material weaknesses or significant deficiencies in our internal control over financial reporting will not be identified in the future. Our failure to implement and maintain effective internal controls over financial reporting could result in errors in our financial statements that could result in a restatement of our financial statements, cause us to fail to meet our reporting obligations and cause investors to lose confidence in our reported financial information, which may result in volatility in and a decline in the market price of our securities.

Our independent registered public accounting firm did not undertake an audit of the effectiveness of our internal controls over financial reporting. Our independent registered public accounting firm will not be required to report on the effectiveness of our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002 until our annual report on Form 20-F following the date on which we cease to qualify as an “emerging growth company,” which may be up to five full fiscal years following the first sale of common equity securities pursuant to an effective registration statement, which occurred on September 15, 2017. The process of assessing the effectiveness of our internal control over financial reporting may require the investment of substantial time and resources, including by members of our senior management. As a result, this process may divert internal resources and take a significant amount of time and effort to complete. In addition, we cannot predict the outcome of this determination and whether we will need to implement remedial actions in order to implement effective control over financial reporting. If in subsequent years we are unable to assert that our internal control over financial reporting is effective, or if our auditors express an opinion that our internal control over financial reporting is ineffective, we could lose investor confidence in the accuracy and completeness of our financial reports, which could have a material adverse effect on the price of our securities. We will be implementing a number of measures to address the material weakness including: (i) hiring a number of financial reporting and internal control with IFRS and SEC financial reporting expertise, and (ii) conducting training for our personnel with respect to IFRS and SEC financial reporting requirements. We intend to remediate material weaknesses in our internal control over financial reporting by the end of 2020.

We are an “emerging growth company” and as a result of the reduced disclosure and governance requirements applicable to emerging growth companies, our ordinary shares may be less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our ordinary shares less attractive because Reebonz will rely on these exemptions. If some investors find Reebonz’s ordinary shares less attractive as a result, there may be a less active trading market for our ordinary shares and our stock price may be more volatile. We may take advantage of these reporting exemptions until we are no longer an emerging growth company. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the first sale of common equity securities pursuant to an effective registration statement, which occurred on September 15, 2017, (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the prior June 30, and (2) the date on which it has issued more than $1.0 billion in non-convertible debt during the prior three-year period.

13

We rely on online sale of luxury handbags for a major portion of our revenue.