UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

| Doing It Right® |

|

|

Our Vision:

Be the most respected global independent provider of aviation parts and repair services Create value for customers through differentiated capabilities and offerings, resulting in a sustainable, unique competitive advantage |

ESG commitments statement

In July 2023, our Board of Directors (“Board”) adopted commitments in each of our environmental, social and governance (“ESG”) focus areas. See “Environmental, social and governance focus – ESG commitments statement” at the end of “Proxy statement summary” for details. Along with our guiding principle of Doing It Right®, our ESG commitments help inform AAR’s decision-making as we navigate an ever-changing world. We are committed to analyzing and better understanding how AAR impacts our local and global communities, the environment, and our industry so that we may reduce potential risk, promote resiliency, and drive value for all stakeholders. Our ESG commitments are embedded in our strategy, which is overseen by our Board, and our assessment of risk through our enterprise risk management program, which is overseen by our Audit Committee. At the management level, a cross-functional team oversees the implementation of our ESG commitments.

ESG focus areas

Environment Protecting the planet |

Social Empowering people |

Governance Governing with integrity | |

|

●Energy

●Materials

●Waste

●Greenhouse

gas emissions |

●Aviation

safety

●Employee

engagement

●Diversity

and inclusion

●Employee

health, safety, and well-being |

●Nondiscrimination

●Training

and education

●Local

communities

●Occupational

health and safety |

●Information

security

●Ethics

and compliance

●Anti-corruption

●Risk

identification / mitigation |

Fiscal 2023 highlights in ESG

| ● | Named to Newsweek’s America’s Greatest Workplaces 2023 |

| ● | Named to Newsweek’s America’s Greatest Workplaces for Diversity 2023 |

| ● | Received recognition from FAA for Corporate Safety Management System program |

| ● | Awarded first Captains of Industry contract by U.S. DoD’s Defense Logistics Agency focused on distribution of sustainment services |

| ● | Named to Bloomberg Government’s BGOV 200 list of top federal contractors |

| ● | Received additional Military Friendly® awards, including as employer, spouse employer, top 10 brand and top 10 supplier diversity program |

| ● | Announced additional AAR Fellowship Programs to build aviation maintenance talent pipeline |

| ● | Published second ESG report |

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our ESG goals, commitments, and strategies, and our executive compensation program. These statements involve risks and uncertainties. Actual results could differ materially from any future results expressed or implied by the forward-looking statements for various reasons, including due to the risks, uncertainties, and other important factors that are discussed in our Annual Report on Form 10-K for the fiscal year ended May 31, 2023 and subsequent filings. We assume no obligation to update any forward-looking statements or information, which speak as of the date of this proxy statement.

AAR CORP. 1100 North Wood Dale Road Wood Dale, Illinois 60191 August 8, 2023 |

|

Dear fellow stockholders:

AAR began Fiscal 2023 strongly positioned to reach new heights, and I am pleased to share that we have delivered on our goals. We established new partnerships, expanded our service offerings, and continued to invest in our world-class quality and safety processes to best serve our customers across 100+ countries.

The global recovery in air travel drove increased demand for our services, enabling us to achieve strong results across our portfolio, particularly in used serviceable material, new parts distribution, and airframe maintenance. Our actions to reduce costs and improve operating efficiency were reflected in our adjusted operating margin improvement over nine consecutive quarters and led to record adjusted diluted earnings per share from continuing operations for the fiscal year.

We broadened many areas of our business, including significantly growing our parts business as customers turned to used serviceable material given ongoing supply chain challenges. We also further expanded our aftermarket product distribution services through several contract wins and the growth of our relationship with Unison Industries, becoming their exclusive global distributor for multiple product offerings.

AAR’s leaders, officers, and directors share a strong commitment to Doing It Right® and are supported by what we believe is the best team in aviation. When I became the Chairman of the Board earlier this year, the Company’s third, I was humbled and honored to succeed my longtime mentor David Storch. I am grateful for the opportunity to lead this Company on its next phase of growth and build on the foundation that David established.

With that, I am pleased to invite you to AAR’s 2023 annual meeting of stockholders, which will be a virtual meeting of the stockholders. The annual meeting will be held on Tuesday, September 19, 2023, at 9:00 a.m., Central Time and you will be able to attend the annual meeting online, vote your shares electronically, and submit your questions during the annual meeting by visiting www.virtualshareholdermeeting.com/AIR2023 and entering your control number. You will not be able to attend the annual meeting in person.

I encourage you to read our 2023 proxy statement, our annual report, and our other proxy materials. Please see Appendix B for reconciliations of non-GAAP financial measures. Whether or not you plan to attend the annual meeting of stockholders, your vote is important. Please follow the voting instructions to ensure that your shares are represented and voted at the meeting.

We are grateful to our employees for their hard work and commitment, and to you, our stockholders, for choosing to invest in AAR.

Sincerely,

John M. Holmes

Chairman, President and Chief Executive Officer

| 2023 Proxy Statement | 1 |

| Notice of 2023 annual meeting of stockholders |

|

To our stockholders:

| We are pleased to invite you to attend our 2023 annual meeting of stockholders. Please read the information in this notice and proxy statement to learn more about AAR and the matters to be voted on at the annual meeting. | Date and time Tuesday, September 19, 2023 9:00 a.m. Central Time |

Place www.virtualshareholder meeting.com/AIR2023 |

Record date You may vote your shares at the annual meeting if you were a stockholder on Thursday, July 27, 2023. |

Items of business

You will be asked at our annual meeting to:

| Items of business | Board recommendation | Page | |||||

| 1 | Elect four directors included in our annual proxy statement |

|

FOR each director nominee | 13 | |||

| 2 | Vote on an advisory proposal to approve our Fiscal 2023 executive compensation |

|

FOR | 36 | |||

| 3 | Vote on an advisory proposal to approve the frequency for future advisory proposals to approve our executive compensation |

|

“1 year“ | 78 | |||

| 4 | Approve an amendment to our stock plan |

|

FOR | 79 | |||

| 5 | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for Fiscal 2024 |

|

FOR | 85 | |||

Stockholders will transact any other business that may properly come before the annual meeting or any adjournment or postponement of the annual meeting.

Voting

Your vote is important. We encourage you to vote your shares as soon as possible. You may vote by proxy over the Internet, by telephone, or by completing and returning the enclosed proxy card in the postage-paid envelope provided. If you are a “street name” stockholder (meaning that your shares are registered in the name of your bank or broker), you will receive instructions from your bank, broker or other nominee describing how to vote your shares. We also welcome you to attend the virtual meeting and vote online.

|

|

|

| |||

| www.proxyvote.com | www.virtualshareholdermeeting.com/AIR2023 | 1-800-690-6903 | Complete and return the proxy card or voting information card |

Please see Appendix A for important information about voting your shares at our 2023 annual meeting.

By Order of the Board,

Jessica A. Garascia

Senior

Vice President, General Counsel, Chief Administrative Officer and Secretary

August 8, 2023

| 2 |

|

| Table of contents |  |

Important notice regarding the availability of the proxy materials for our annual meeting of stockholders to be held on Tuesday, September 19, 2023:

The notice and proxy statement, our proxy card, our 2023 Annual Report to Stockholders and our Annual Report on Form 10-K for the fiscal year ended May 31, 2023, are available free of charge at www.proxyvote.com. Proxy materials or a Notice of Internet Availability of Proxy Materials are first being made available, released, or mailed to shareholders on August 8, 2023. |

| 2023 Proxy Statement | 3 |

| Proxy statement summary |  |

This summary highlights selected information contained in this proxy statement. Please read the entire proxy statement carefully before voting your shares. We are providing the enclosed proxy materials to you in connection with the solicitation by the Board of proxies to be voted at the annual meeting of stockholders to be held on September 19, 2023. We began providing these proxy materials to our stockholders on August 8, 2023.

Proposals to be voted on at the annual meeting

| Proposal 1 | Election of four directors named in this proxy statement |

|

FOR each director nominee | ► See (pages 13-35) |

|

John W. Dietrich Independent Director |  |

Robert F. Leduc Independent Director |  |

Duncan J. McNabb Independent Director |  |

Peter Pace Independent Director | |||

| Executive Vice President and Chief Financial Officer, FedEx Corp., a global provider of transportation, e-commerce and business services, since August 2023. Previously he served as President and Chief Executive Officer of Atlas Air Worldwide Holdings, Inc. from January 2020 until June 2023. He also served on the Atlas Air board during that time. Prior to 2020, he served in a number of other leadership positions since joining Atlas Air in 1999. | Retired President of Pratt & Whitney, an aerospace manufacturer and a subsidiary of United Technologies Corporation, where he served from 2016 until his retirement in early 2020. President of Sikorsky Aircraft, a helicopter manufacturer, from 2015 to 2016. Previously, he served in leadership positions at Hamilton Sundstrand and UTC Aerospace Systems. He also serves as an advisor to Advent International. | Co-Founder and Managing Partner of Ares Mobility Solutions Inc., a privately-held logistics business, since 2011; General, U.S. Air Force (Retired) after 37 years of active commissioned service. Former Commander, U.S. Air Mobility Command, 33rd Vice Chief of Staff of the U.S. Air Force and Former Commander of US TRANSCOM. | General, U.S. Marine Corps (Retired). From 2005 to 2007, Chairman of the Joint Chiefs of Staff, the most senior position in the United States Armed Forces. | |||||||

| Proposal 2 | Advisory proposal to approve our Fiscal 2023 executive compensation |

|

FOR | ► See (pages 36-77) |

| Proposal 3 | Advisory proposal to approve the frequency for future advisory proposals to approve our executive compensation |

|

“1 year” | ► See (page 78) |

| Proposal 4 | Approval of an amendment to our stock plan |

|

FOR | ► See (pages 79-84) |

| Proposal 5 | Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for Fiscal 2024 |

|

FOR | ► See (pages 85-86) |

| 4 |

|

Proxy statement summary

AAR – Who we are and what we do

AAR is a global aerospace and defense aftermarket solutions company that operates in over 60 sites around the world. Headquartered in the Chicago area, AAR supports commercial and government customers across 100+ countries.

Business overview

|

|

|

|

| Parts Supply | Repair & Engineering | Integrated Solutions | Expeditionary Services |

|

●Used serviceable material (USM)

●New parts distribution

●Online PAARTSSM Store

●24/7 global aircraft on-ground (AOG) service |

●Airframe MRO

●Component Repair & Landing Gear Overhaul

●Engineering

●Development of proprietary Parts Manufacturer Approval (PMA) parts |

●Government aircraft maintenance, logistics, and operations support programs

●Commercial flight-hour-based aircraft component support

●Consumable and expendable parts programs

●Trax ERP software for aircraft MRO |

Mobility Systems: Rapid deployment sustainment solutions for government applications

●Pallets for use in military transport aircraft

●Containers for customized air-mobile shipping and storage of equipment

●Shelter systems for military operations |

Connected businesses model

|

Integrated Solutions

●Programmatic parts and repair solutions

●Fuels Parts Supply activities

●Funds component repair capability development

●Government USM customer relationships |

|

Parts Supply:

USM & Distribution ●Sourcing to supply Repair & Engineering and Integrated Solutions

●Data for use in repair capability development

●Sales channels supported by maintenance relationships

Repair & Engineering

●Strategic relationships with blue chip airlines that support parts volumes

●Repair knowledge and data collection

●PMA parts development for internal and external consumption |

Customers (percentage of Fiscal 2023 sales)

| 2023 Proxy Statement | 5 |

Proxy statement summary

Key business achievements in Fiscal 2023

|

Continued execution and expansion in commercial and government markets | ||

| ● | Our sales to commercial customers in Fiscal 2023 increased by $245.0 million, or 22.6%, over the prior year reflecting continued recovery in commercial passenger air traffic from the impact of the pandemic as well as growth from recently awarded new parts distribution contracts. | ||

| ● | We were successful in winning new long-term agreements in both our commercial and government markets. | ||

| ● | We were awarded a significant expansion of our exclusive agreement with Unison Industries which broadens our distribution of select Unison ignitor plugs, ignition leads, harnesses, and related spare parts. | ||

| ● | We also extended our distribution relationship with Leach International Corp. to supply electromechanical and solid-state switch gears to the electronics end-market. | ||

| ● | In our commercial programs activities, we were awarded a multi-year, flight-hour component support contract with flydubai for their growing Boeing 737 MAX fleet. | ||

| ● | In our government market, we were awarded a firm-fixed price contract from the U.S. Air Force to produce Next Generation All Aluminum Cargo Pallets with a total contract value, including option periods, of $173.5 million. We were also awarded a contract from the Norwegian Defence Logistics Organisation to provide commercial common parts for the Royal Norwegian Air Force P-8A fleet. | ||

|

Acquired leading provider of airframe MRO and fleet management software to drive growth | ||

| ● | In March 2023, we acquired Trax USA Corp. (“Trax”), a leading independent provider of aircraft MRO and fleet management software incorporated in 1999. Trax offers critical software applications to a diverse global customer base of airlines and MROs supporting approximately 5,000 aircraft. | ||

| ● | Trax’s comprehensive solutions support the entire spectrum of maintenance activities and create the system of record required by airlines and MROs. | ||

| ● | The Trax acquisition adds established, higher-margin aviation aftermarket software offerings with recurring revenue to our portfolio and provides opportunities to cross-sell products and services. | ||

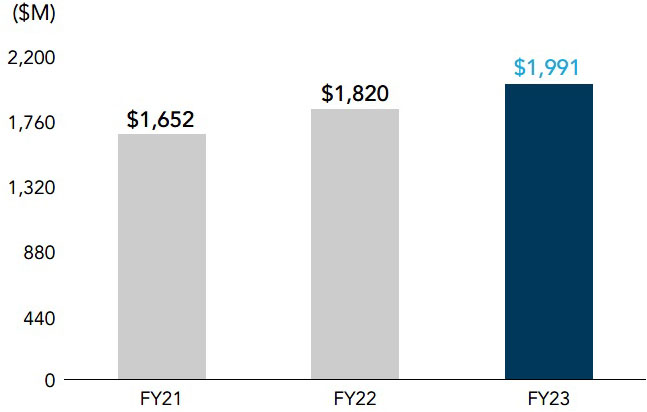

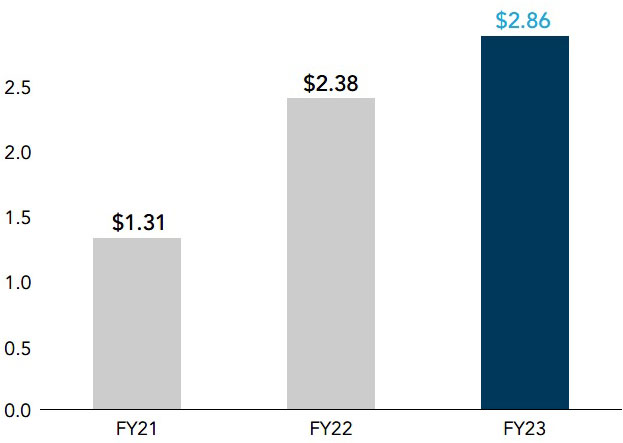

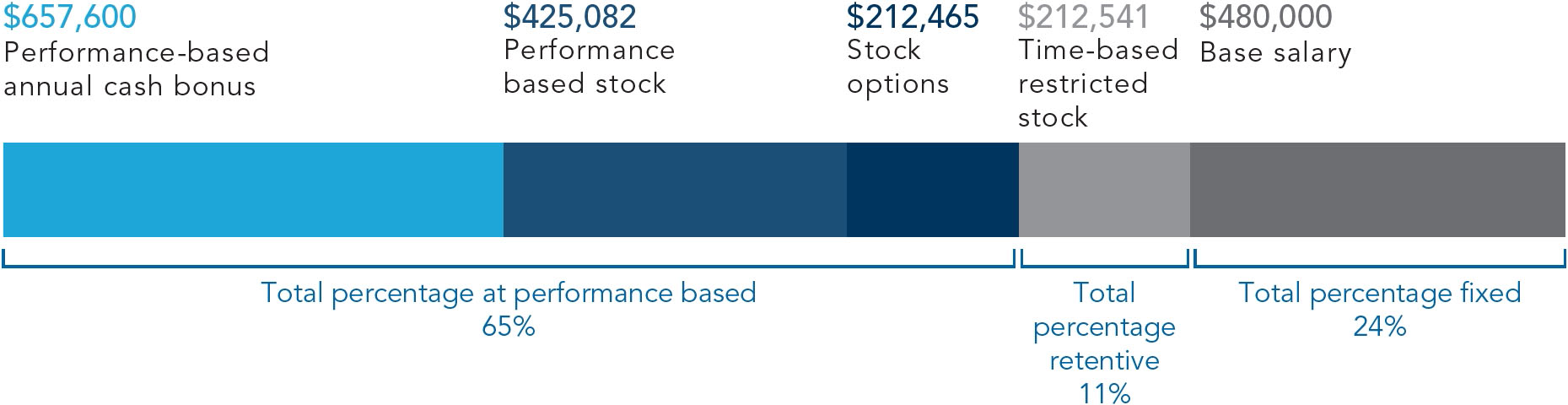

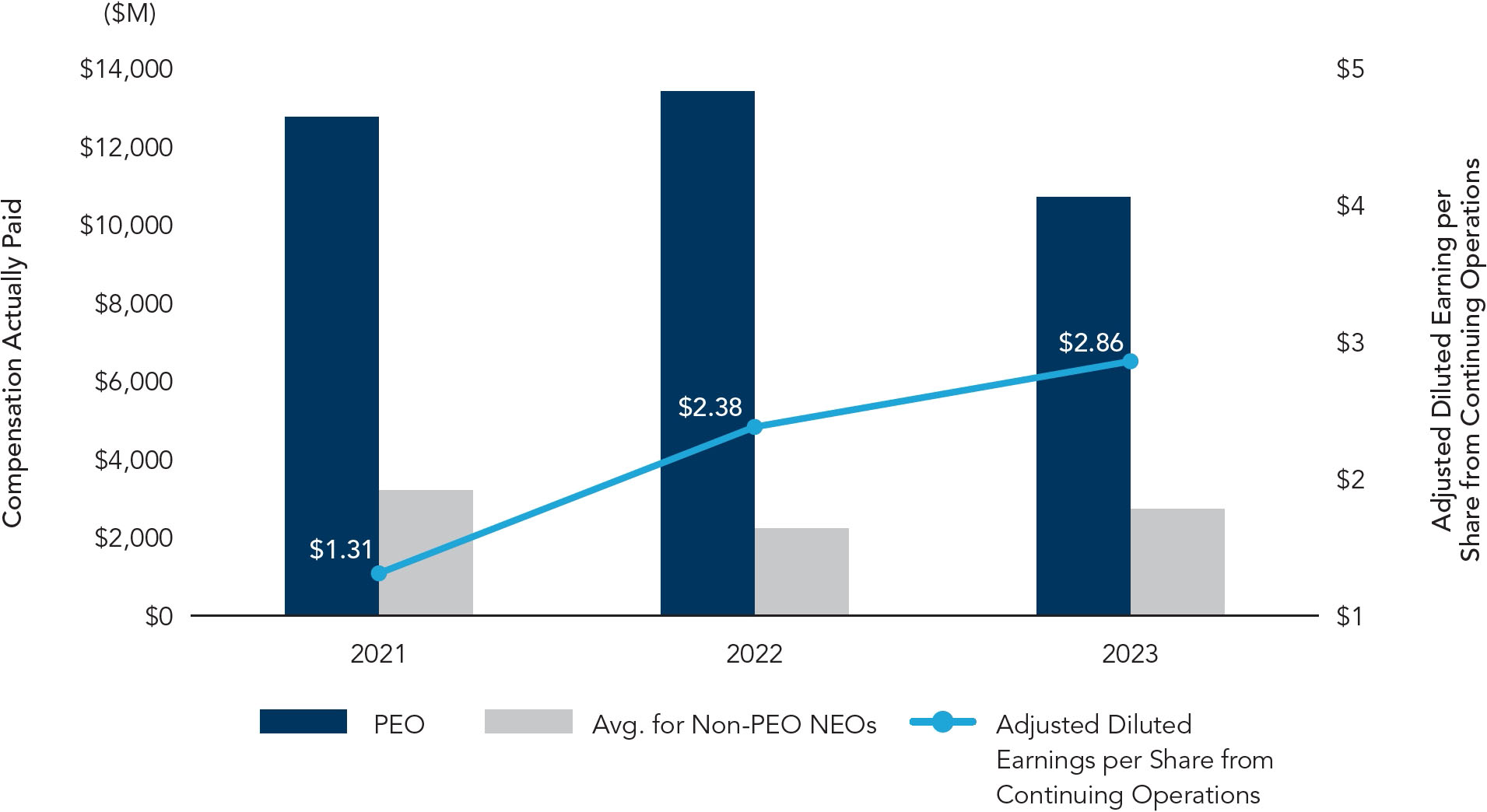

Financial highlights

AAR had strong financial performance for Fiscal 2023 as the commercial aviation industry continued its recovery from the COVID-19 pandemic. Consolidated sales were $2.0 billion, diluted earnings per share from continuing operations were $2.52 (an increase of 17% over Fiscal 2022) and adjusted diluted earnings per share from continuing operations, a non-GAAP financial measure, were $2.86 (an increase of 20% from Fiscal 2022). Further, AAR drove significant cash generation in Fiscal 2023, which enabled it to make investments to drive growth, return capital to stockholders, and maintain an exceptionally strong balance sheet.

For a definition of adjusted diluted earnings per share from continuing operations and a reconciliation of this measure to the closest comparable GAAP financial measure, see Appendix B.

Selected financial information

| (dollars in millions except per share data) For the fiscal year ended May 31 |

2023 ($) |

2022 ($) |

2021 ($) | |||

| Sales | 1,990.5 | 1,820.0 | 1,652.3 | |||

| Operating income | 133.9 | 106.9 | 85.2 | |||

| Diluted earnings per share from continuing operations | 2.52 | 2.16 | 1.30 | |||

| Cash provided from operations – continuing operations | 23.8 | 89.8 | 108.5 | |||

| As of May 31 | ||||||

| Working capital | 746.4 | 659.0 | 600.2 | |||

| Total assets | 1,833.1 | 1,573.9 | 1,539.7 | |||

| Total debt | 272.0 | 100.0 | 135.2 | |||

| Equity | 1,099.1 | 1,034.5 | 974.4 | |||

| 6 |

|

Proxy statement summary

Key financial achievements

| Sales | Adjusted diluted EPS from continuing operations* |

|

|

| * | See prior page for diluted EPS from continuing operations (GAAP) and Appendix B for a reconciliation of adjusted diluted EPS from continuing operations (non-GAAP) to the GAAP measure. |

Stockholder engagement

We recognize and value the importance of engaging with our stockholders and other key constituents in an open and constructive manner.

Why we engage

The purposes of our stockholder engagement program are to promote communication, increase transparency and most importantly, better understand and address the perspectives of our stockholders. We believe that opportunities to receive and consider stockholder feedback enhance our corporate governance, strategic vision, and executive compensation practices, which in turn contributes to the long-term value of the Company.

Stockholder outreach

In Fiscal 2023, we continued our longstanding practice to regularly engage with stockholders on a host of topics including company strategy and performance, corporate governance, sustainability, and other topics. Members of our senior management team participated from time to time in numerous stockholder meetings and virtual or in-person investor conferences. These interactions allow investors the opportunity to meet, ask questions of, and provide advice to, our key executives. Our independent Lead Director attends these meetings when requested by stockholders.

In connection with the say-on-pay proposal for Fiscal 2022, the Human Capital and Compensation Committee led extensive stockholder outreach and engagement efforts, together with a thorough evaluation of our executive compensation program. In 2022, the principal focus of our outreach was to discuss the grant of one-time awards to our CEO, which received negative attention from proxy advisors in advance of our 2022 say-on-pay vote. In 2023, the principal focus of the outreach was to understand the factors that impacted our 2022 say-on-pay vote, which ultimately did not receive majority support from our stockholders. These discussions were led by the Chair of our Human Capital and Compensation Committee and included our CFO, General Counsel and Chief Human Resources Officer.

| 2023 Proxy Statement | 7 |

Proxy statement summary

|

EXECUTIVE SUMMARY:

Through 2022-2023, we contacted stockholders representing over 85% of our outstanding shares of common stock, and held 17 meetings about our executive compensation program with stockholders representing over 55% of our outstanding shares of common stock.

Our Human Capital and Compensation Committee:

●listened to stockholder concerns;

●considered changes to address the identified concerns;

●reached out once more to stockholders to discuss potential changes; and

●adopted the changes to our executive compensation program for Fiscal 2024 as described in this proxy statement. |

See “Stockholder engagement” and “Response to stockholder feedback” in the “Compensation discussion and analysis” (“CD&A”) section for details on how we engaged with stockholders, what we heard from them and how we responded to their feedback related to executive compensation. The feedback received from our stockholder outreach efforts was shared with and considered by our Board. Our engagement has generated valuable input that helps inform our decisions and strategy regarding executive compensation.

We also engaged directly with and carefully considered the viewpoints of the proxy advisory firms that represent the interests of various stockholders. In calendar year 2023, we engaged with Institutional Shareholder Services Inc. (“ISS”) and Glass, Lewis & Co. (“Glass Lewis”) regarding our executive compensation practices. These engagements further informed the actions that our Board and Human Capital and Compensation Committee are taking to enhance our executive compensation program as further described in the “Response to stockholder feedback” section of the CD&A.

Executive compensation highlights

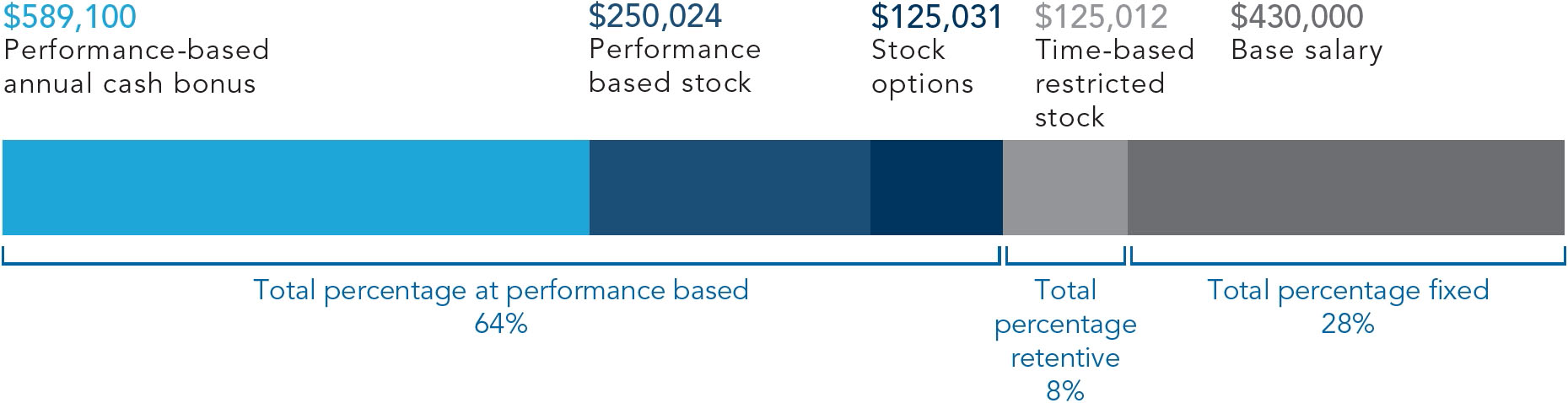

Pay-for-performance and stockholder alignment

| ● | Annual cash bonuses are linked to two key performance metrics critical to the success of our business strategy: adjusted diluted earnings per share from continuing operations (60%) and adjusted net working capital turns (20%). In addition, certain strategic objectives (20%) are included in the annual cash bonus program for Fiscal 2023 to align management interests with priorities that are important to the Company. |

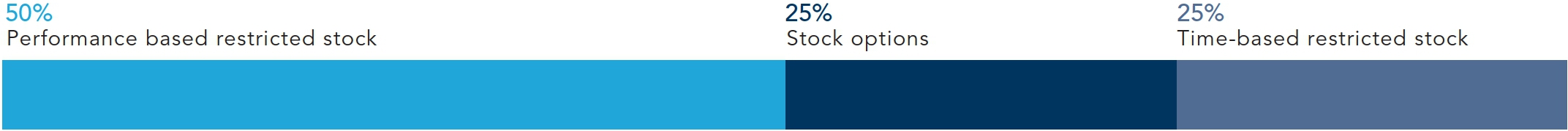

| ● | The Fiscal 2023 long-term incentive program is 100% equity based, consisting of performance-based restricted stock (50%), stock options (25%) and time-based restricted stock (25%). |

| ● | Performance-based restricted stock for Fiscal 2023 is linked to three key performance metrics: adjusted income from continuing operations (70%), return on invested capital (20%) and relative total stockholder return (10%). |

| ● | AAR targets total pay opportunities for its executive officers, individually and as a group, within a competitive range around the median of the market. |

| ● | AAR’s compensation mix – cash versus equity, fixed versus variable, and annual versus longer-term – is consistent with competitive best practices. |

Cash bonuses under the Fiscal 2023 short-term incentive plan

| Strategic goal | Compensation measure | ||

| Drive profitability and deliver value to stockholders | 60 | % | Adjusted diluted earnings per share from continuing operations |

| Make efficient use of stockholder capital in support of Company sales | 20 | % | Adjusted net working capital turns |

| Align management’s interests with priorities that are important to the Company | 20 | % | Strategic objectives |

| 8 |

|

Proxy statement summary

Performance shares under the Fiscal 2023 long-term incentive plan

| Strategic goal | Compensation measure | ||

| Increase profitability and deliver value to stockholders | 70 | % | Adjusted income from continuing operations |

| Enhance efficiency in allocating capital to generate higher returns | 20 | % | Average return on invested capital |

| Outperform peer group* companies in generating stockholder value | 10 | % | Relative total stockholder return |

| * | Companies include a custom peer group of companies in commercial aviation-linked lines of business. |

Fiscal 2023 compensation of our Chief Executive Officer, John M. Holmes

Fiscal 2023 compensation of other named executive officers as a group

Executive compensation program enhancements

We continue to be committed to pay-for-performance. We believe the outcomes of our 2019 through 2021 say-on-pay votes (at least 97% support each year) demonstrated strong stockholder support for our executive compensation program. In response to feedback from stockholders following our 2022 say-on-pay vote, our Human Capital and Compensation Committee made enhancements to our executive compensation program for the fiscal year ending May 31, 2024 (“Fiscal 2024”). See the “Letter from our human capital and compensation committee” and “Compensation discussion and analysis” for further information.

We will continue to consider investor feedback relating to our executive compensation program.

Executive compensation practices

| What We Do | What We Do Not Do | |||

Annual say-on-pay stockholder vote Annual say-on-pay stockholder vote Emphasis on performance-based or at-risk compensation Emphasis on performance-based or at-risk compensation Multi-year vesting periods for stock awards Multi-year vesting periods for stock awards Limited perquisites Limited perquisites “Double trigger” change-in-control provisions in executive agreements “Double trigger” change-in-control provisions in executive agreements Meaningful stock ownership and retention guidelines for directors and executive officers Meaningful stock ownership and retention guidelines for directors and executive officers Prohibition on short sales, pledging and hedging transactions Prohibition on short sales, pledging and hedging transactions Claw-backs of incentive compensation in the event of certain financial restatements Claw-backs of incentive compensation in the event of certain financial restatements Annual assessment of incentive compensation plans Annual assessment of incentive compensation plans |

No tax gross-ups No tax gross-ups No repricing of stock options No repricing of stock options No dividends or dividend equivalents paid on stock or stock unit awards unless vesting conditions are met No dividends or dividend equivalents paid on stock or stock unit awards unless vesting conditions are met | |||

|

Note about links to websites

Links to websites included in this proxy statement are provided solely for convenience purposes. Content on the websites, including content on our website, is not, and shall not be deemed to be, part of this proxy statement or incorporated herein or into any of our other filings with the Securities and Exchange Commission. |

| 2023 Proxy Statement | 9 |

Proxy statement summary

Corporate governance highlights

Our goal is to ensure that our corporate governance practices reflect best practices tailored, as necessary, to our culture, strategy and performance.

Corporate governance practices

| 10 | 9 | 65.6 | 8.7 years |

| directors | independent directors | Average age of directors | Average tenure of directors |

Independent Lead Director Independent Lead Director Majority voting in uncontested director elections Majority voting in uncontested director elections Stock ownership and retention guidelines Stock ownership and retention guidelines Annual stock grant to non-employee directors Annual stock grant to non-employee directors Executive sessions of independent directors Executive sessions of independent directors Independent compensation consultant Independent compensation consultant Annual Board and Board Committee self-evaluations Annual Board and Board Committee self-evaluations Director orientation and continuing education programs Director orientation and continuing education programs All directors on the Audit Committee are “audit committee financial experts” All directors on the Audit Committee are “audit committee financial experts” Three of our ten directors are female or racially/ethnically diverse Three of our ten directors are female or racially/ethnically diverse |

Code of business ethics and conduct Code of business ethics and conduct Ethics hotline policy Ethics hotline policy Related person transaction policy Related person transaction policy Disclosure committee for financial reporting Disclosure committee for financial reporting Annual stockholder approval of executive compensation Annual stockholder approval of executive compensation Stockholder engagement program Stockholder engagement program Independent Board Committees Independent Board Committees Enterprise risk management program Enterprise risk management program Active board refreshment processes Active board refreshment processes |

| 10 |

|

Proxy statement summary

Environmental, social and governance focus

Our ESG commitments statement

In July 2023, our Board adopted a commitments statement reflecting AAR’s objectives in each of our ESG focus areas. Along with our guiding principle of Doing It Right®, our ESG commitments help inform AAR’s decision-making as we navigate an ever-changing world. We are committed to analyzing and better understanding how AAR impacts our local and global communities, the environment, and our industry so that we may reduce potential risk, promote resiliency, and drive value for all stakeholders. Our commitments include:

| ● | Environmental: We are committed to carefully monitoring environmental impacts and instituting safeguards for preserving the natural environment, reducing climate-related risks, and creating opportunities for the prevention, reduction, and recycling of waste and other materials used in our business processes, wherever possible. Key impact areas include energy, materials, waste, and greenhouse gas emissions. |

| ● | Social: We are committed to managing our relationships with all stakeholders, including our employees, customers, supply chain partners, and communities, in an inclusive, fair, and respectful manner. Key impact areas include aviation safety, employment, employee health, safety, and well-being, diversity and inclusion, nondiscrimination, training & education, occupational health & safety, and local communities. |

| ● | Governance: We are committed to establishing, implementing, and maintaining an effective governance structure that is agile and responsive to business needs and evolving best practices, and sets high ethical standards. Key impact areas include information security, risk identification / mitigation, anti-corruption, and ethics and compliance. |

Our ESG governance framework

Our focus on ESG matters is embedded in our strategy, which is overseen by the Board.

The Board’s standing committees oversee our ESG focus areas based on the delegated subject matter:

| ● | The Aviation Safety and Training Committee oversees all aspects of aviation safety, including our culture of safety compliance; |

| ● | The Nominating and Governance Committee oversees our governance policies and practices, reviews various components of our ESG framework, including our ESG oversight structure, overall ESG strategy and material disclosures regarding the oversight process and our ESG initiatives; |

| ● | The Human Capital and Compensation Committee oversees our activities with respect to our human capital function, including succession planning and talent development as well as the oversight of ESG goals, if any, in our compensation plans; and |

| ● | The Audit Committee receives reports related to our ethics hotline, oversees AAR’s cybersecurity planning and protection efforts, oversees the internal and external review of quantitative environmental data and related disclosures included in our ESG report or any interim reports, and oversees our enterprise risk management process, including environmental (such as climate) risks. |

At the management level, a cross-functional team of senior leaders represents legal, communications, human resources, and environmental, health and safety and receives input and guidance from senior business leaders. Together, this group assesses risks and opportunities related to our ESG focus areas, monitors and implements our ESG strategies, tracks our progress and guides our reporting to stakeholders.

| 2023 Proxy Statement | 11 |

Proxy statement summary

Our ESG focus areas

Our ESG focus areas are long-standing AAR priorities that align with our business and our values and are also areas where we believe that we have the greatest opportunity to make a meaningful impact.

|

|

| ||

| Environment Protecting the planet |

Social Empowering people |

Governance Governing with integrity | ||

|

●Energy

●Materials

●Waste

●Greenhouse gas emissions |

●Aviation safety

●Employee engagement

●Diversity and inclusion

●Employee health, safety,

and well-being ●Nondiscrimination

●Training and education

●Local communities

●Occupational health and safety |

●Information security

●Ethics and compliance

●Anti-corruption

●Risk identification / mitigation | ||

Public diversity statement

As reflected in our values, we have a long-standing commitment to embracing diversity and fostering a culture of inclusion. Below is our public diversity statement:

| Just as unique parts are essential to an aircraft’s ability to fly, unique talent is essential to AAR’s ability to succeed. Our strength is rooted in our commitment to diversity, equity and inclusion. We create opportunity through new thoughts and ideas to embrace an ever-changing world. These values empower our people to be a team of producers, innovators and world class leaders, who are “Doing It Right” to better connect the world. |

This statement was developed by a group of employees selected from throughout the business, reflecting the varied perspectives, experiences and priorities of our workforce.

| 12 |  |

|

Proposal

1 Election of directors |

|

| Proposal 1 | Election of four directors named in this proxy statement |

| Board recommendation | |

|

Our Board unanimously recommends that you vote FOR each director nominee. |

Proposal summary

We are asking you to elect four directors named in this proxy statement at this annual meeting. The director nominees are: John W. Dietrich, Robert F. Leduc, Duncan J. McNabb and Peter Pace.

Each director nominee is currently serving as a director of the Company. All of the director nominees have been determined by the Board to be “independent” within the meaning of the rules of the New York Stock Exchange (“NYSE”) and the SEC.

Director skills & qualifications

The Nominating and Governance Committee believes that the Board is currently well-balanced and able to address our Company’s needs. As evidenced by the biographical information provided below, our directors have significant experience in chief executive or other senior level operating, financial and international management positions.

Four of our existing directors currently serve as a director of other public companies, which provides them with diverse experiences that can enhance their contribution to our Board.

| 2023 Proxy Statement | 13 |

Proposal 1 Election of directors

Set forth below is information regarding the nominees for election as directors and information regarding the directors in each class continuing in office after the annual meeting. Also discussed below are specific experience, qualifications, attributes and skills of our directors considered by the Nominating and Governance Committee as part of its review of our Board’s membership and in connection with its nomination of the candidates for election to the Board at the annual meeting.

| Anthony K. Anderson |

Michael R. Boyce |

John

W. Dietrich |

John M. Holmes |

Robert F. Leduc |

Ellen M. Lord |

Duncan J. McNabb |

Peter Pace |

Jennifer L. Vogel |

Marc J. Walfish | ||||||||||

|

CEO experience |  |

|

|

|

|

|

||||||||||||

|

Finance |  |

|

|

|

|

|

| |||||||||||

|

Accounting |  |

|

| |||||||||||||||

|

Commercial aerospace |  |

|

|

|

|

|

|

|||||||||||

|

Military aerospace |  |

|

|

|

|

|||||||||||||

|

Services |  |

|

|

|

|

|

|

|

||||||||||

|

International business |  |

|

|

|

|

|

||||||||||||

|

Sales & marketing |  |

|

|

|

|

|

| |||||||||||

|

Supply chain & logistics |  |

|

|

|

|

|

|

|||||||||||

|

Operating |  |

|

|

|

|

|

|

|

||||||||||

|

M&A |  |

|

|

|

|

|

|

| ||||||||||

|

Manufacturing |  |

|

|

|||||||||||||||

|

Government contracting |  |

|

|

|

|

|

||||||||||||

|

Information

technology / cyber / innovation |

|

|

||||||||||||||||

|

Human resources |  |

|

|

|

|

|||||||||||||

|

Risk management |  |

|

|

|

|

|

|

|

|

| ||||||||

|

Corporate governance |  |

|

|

|

|

|

|

|

||||||||||

|

Safety |  |

|

|

|

|

|

|

|

||||||||||

|

Racial diversity |  |

|||||||||||||||||

|

Gender diversity |  |

|

| 14 |  |

Proposal 1 Election of directors

Information about our director nominees

and our

continuing directors

Information about our director nominees and our continuing directors whose terms expire in future years is set forth below.

Our director nominees

Class III Directors whose terms expire at the 2023 annual meeting:

Age: 58

Director since: 2023

Other public company directorships:

●None

Other public company directorships held in the past five years:

●Atlas Air Worldwide Holdings, Inc.

|

John

W. Dietrich Independent

Director

Skills and qualifications

CEO experience, Finance, Accounting, Commercial aerospace, Military aerospace, Services, International business, Sales & marketing, Supply chain & logistics, Operating, M&A, Human resources, Risk management, Corporate governance, Government contracting, Safety

Career highlights

Executive Vice President and Chief Financial Officer, FedEx Corp., a global provider of transportation, e-commerce and business services, since August 2023. He previously served as President and Chief Executive Officer, Atlas Air Worldwide Holdings, Inc., a leading global provider of outsourced aircraft and aviation operating services, where he served from January 2020 until June 2023. He also served on the board of Atlas Air during that time. Prior to January 2020, he served in a number of executive leadership positions at Atlas Air, including President and Chief Operating Officer from July 2019 and Executive Vice President and Chief Operating Officer from September 2006. He previously held several senior leadership roles in legal, human resources and communications since joining Atlas Air in 1999. He also served as a litigation attorney at United Airlines prior to joining Atlas Air.

Director qualifications

The

Board concluded that Mr. Dietrich should serve as a director of the Company based on his experience in the aviation industry,

including as President and CEO of a public company, his knowledge of commercial and government aircraft services, and his expertise

in operations, supply chain, human resources and risk management.

|

Age: 67

Director since: July 2020

Other public company directorships held in the past five years:

●JetBlue Airways Corporation

●Howmet Aerospace, Inc.

|

Robert

F. Leduc Independent

Director

Skills and qualifications

CEO experience, Finance, Commercial aerospace, Military aerospace, Services, International business, Sales & marketing, Supply chain & logistics, Operating, M&A, Manufacturing, Human resources, Risk management, Corporate governance, Government contracting, Safety

Career highlights

President of Pratt & Whitney, an aerospace manufacturer and a subsidiary of United Technologies Corporation, from 2016 until his retirement early 2020. President of Sikorsky Aircraft, a helicopter manufacturer, from 2015 to 2016. Previously, served in leadership positions at Hamilton Sundstrand and UTC Aerospace Systems. He also serves as an advisor to Advent International.

Director qualifications

The

Board concluded that Mr. Leduc should serve as a director of the Company based on his extensive experience in the aviation sector,

his operational expertise managing through various down cycles, and his significant experience in enhancing brands and managing

talent, in addition to his experience serving on other public company boards.

|

| 2023 Proxy Statement | 15 |

Proposal 1 Election of directors

Age: 71

Director since: 2017

Other public company directorship:

●None

Other public company directorships held in the past five years:

●Atlas Air Worldwide Holdings, Inc.

|

Duncan

J. McNabb Independent

Director

Skills and qualifications

Commercial aerospace, Military aerospace, Services, Supply chain & logistics, Operating, Government contracting, Risk management, Corporate governance, Safety

Career highlights

Since 2011, Co-Founder and Managing Partner of Ares Mobility Solutions Inc., a privately-held logistics business; General, U.S. Air Force (Retired) after 37 years of active commissioned service. Former Commander, U.S. Air Mobility Command, 33rd Vice Chief of Staff of the U.S. Air Force and Former Commander of US TRANSCOM.

Director qualifications

The

Board concluded that General McNabb should serve as a director of the Company based on his government resourcing and government

affairs expertise, his strategic planning, operations and leadership skills and his 37-year record of service with the United

States Air Force, including his service as Commander of the United States Transportation Command (the single manager for global

air, land and sea transportation for the Department of Defense).

|

Age: 77

Director since: 2011

Other public company directorship:

●None

Other public company directorships held in the past five years:

●Qualys, Inc.

●Rigetti Computing, Inc.

|

Peter

Pace Independent

Director

Skills and qualifications

Commercial aerospace, Military aerospace, Services, Supply chain & logistics, Operating, Government contracting, Information technology / cyber / innovation, Human resources, Risk management, Corporate governance, Safety

Career highlights

General, U.S. Marine Corps (Retired). From 2005 to 2007, Chairman of the Joint Chiefs of Staff, the most senior position in the United States Armed Forces.

Director qualifications

The

Board concluded that General Pace should serve as a director of the Company based on his leadership and management skills and

experience from over 40 years of service with the United States Marine Corps, culminating in his appointment as the 16th Chairman

of the Joint Chiefs of Staff (where he served from 2005 to 2007 as the principal military advisor to the President, the Secretary

of Defense, the National Security Council and the Homeland Security Council), his understanding of the government and defense

markets, his cybersecurity expertise and his current and prior service as a director of other public companies.

|

| 16 |  |

Proposal 1 Election of directors

Class I Directors whose terms expire at the 2024 annual meeting:

Age: 67

Director since: 2012

Other public company directorships:

●Avery Dennison Corp.

●Exelon Corp.

●Marsh & McLennan Companies

Other public company directorships held in the past five years:

●First American Financial Corporation |

Anthony K.

Anderson Independent

Director

Skills and qualifications

CEO experience, Finance, Accounting, Services, Sales & marketing, Operating, M&A, Risk management, Corporate governance

Career highlights

Since April 2012, an independent business consultant. From 2006 to April 2012, Vice Chair and Managing Partner of Midwest Area at Ernst & Young LLP, a global accounting and consulting firm. Prior thereto, Mr. Anderson served in various management positions during a 35-year career with Ernst & Young LLP.

Director qualifications

The Board concluded that Mr. Anderson

should serve as a director of the Company based on his 35 years working with a global accounting and consulting firm, his accounting

and financial knowledge, his leadership in developing talent management programs, his service as a director of other public companies,

and his professional, civic and charitable service, including as a director of private companies and numerous not-for-profit organizations.

The Board also values his risk management experience and his knowledge and experience with corporate governance matters.

|

Age: 75

Director since: 2005

Other public company directorships:

●None

Other public company directorships held in the past five years:

●Stepan Company |

Michael R.

Boyce Independent Director

Skills and qualifications

CEO experience, Finance, International business, Sales & marketing, Supply chain & logistics, Operating, M&A, Manufacturing, Risk management, Corporate governance, Safety

Career highlights

Since 2018, Chairman, Chief Executive Officer and Managing Director of Peak Investments, LLC (an operating and acquisition company). Retired Chairman of the Board of PQ Corporation (a specialty chemicals and catalyst company) where he served from 2017 to 2019. From 2005 to 2017, Chairman and Chief Executive Officer of PQ Corporation.

Director qualifications

The Board concluded that Mr. Boyce

should serve as a director of the Company based on his experience in leading two global organizations, his insight into global manufacturing,

supply and distribution practices and his international business development skills.

|

| 2023 Proxy Statement | 17 |

Proposal 1 Election of directors

Age: 61

Director since: 2016

Other public company directorships:

●Sun Country Airlines Holdings, Inc.

Other public company directorships held in the past five years:

●American Science and Engineering, Inc.

●Clearwire Corporation

●Virgin America, Inc. |

Jennifer L.

Vogel Independent Director

Skills and qualifications

Commercial aerospace, Services, International business, M&A, Government contracting, Human resources, Risk management, Corporate governance, Safety

Career highlights

2012 to 2020, co-founder and owner of InVista Advisors, an advisory firm focused on legal department effectiveness, leadership, compliance, crisis readiness and risk management. From 2003 to 2010, Senior Vice President, General Counsel, Secretary and Chief Compliance Officer of Continental Airlines, Inc.

Director qualifications

The Board concluded that Ms. Vogel

should serve as a director of the Company based on her experience as a highly successful corporate executive with over 25 years of

leadership experience in the airline and energy industries, including her leadership positions with Continental Airlines, her legal

and corporate governance expertise, her experience in regulatory issues, mergers and acquisitions, ethics and compliance matters and

her experience as a director of other public companies, including Sun Country Airlines Holdings, Inc. and Virgin America, Inc. |

Class II Directors whose terms expire at the 2025 annual meeting:

President and Chief Executive Officer of AAR CORP.

Age: 46

Director since: 2017

Other public company directorships:

●None |

John M. Holmes Chairman

of the Board

Skills and qualifications

CEO experience, Finance, Commercial aerospace, Services, International business, Sales & marketing, Supply chain & logistics, Operating, M&A, Human resources, Risk management, Corporate governance, Safety

Career highlights

Chairman of the Board since January 2023. President and Chief Executive Officer of AAR CORP. since June 1, 2018. President and Chief Operating Officer from June 1, 2017 to June 1, 2018. From 2015 to June 1, 2017, Chief Operating Officer of the Aviation Services business group of AAR CORP. From 2012 to 2015, Group Vice President, Aviation Services – Inventory Management and Distribution; and prior thereto, General Manager and Division President of AAR Allen Asset Management.

Director qualifications

The Board concluded that Mr. Holmes

should serve as a director of the Company based on his position as President and Chief Executive Officer, his demonstrated leadership

and management abilities, and his knowledge of the Company’s businesses, its portfolio of services and the markets in which

it competes, and the customer and supplier relationships that Mr. Holmes has developed during his 20-year tenure with the Company. |

| 18 |

|

Proposal 1 Election of directors

Age: 63

Director since: 2021

Other public company directorships:

●Comtech Telecommunications Corp.

●Parsons Corporation |

Ellen M. Lord Independent

Director

Skills and qualifications

CEO experience, Finance, Commercial aerospace, Military aerospace, Services, International business, Sales & marketing, Supply chain & logistics, Operating, M&A, Manufacturing, Government contracting, Information technology / cyber / innovation, Risk management, Safety

Career highlights

Served as the Under Secretary of Defense for Acquisition and Sustainment for the United States Department of Defense from August 2017 until January 2021. President and Chief Executive Officer of Textron Systems from October 2012 to August 2017. Prior to that, served in other leadership positions at Textron Systems and related companies.

Director qualifications

The Board concluded that Ms. Lord

should serve as a director of the Company based on her leadership, management and strategic planning expertise she acquired while

serving as the Under Secretary of Defense for Acquisition and Sustainment for the United States Department of Defense, as well as

her experience in the private sector working as the Chief Executive Officer of Textron Systems, where she led a multi-billion dollar

company with products and services supporting defense, homeland security, aerospace and infrastructure protection.

|

Age: 71

Director since: 2003

Other public company directorships:

●None |

Marc J. Walfish Lead

Independent Director

Skills and qualifications

Finance, Accounting, Sales & marketing, M&A, Risk management

Career highlights

Founding Partner of Merit Capital Partners, a mezzanine investor company formerly known as William Blair Mezzanine Capital Partners, since 1991. From 1978 to 1991, various positions at Prudential Capital Corporation.

Director qualifications

The Board concluded that Mr. Walfish

should serve as a director of the Company based on his experience in the finance industry, including as a founding partner of Merit

Capital Partners, his knowledge of the capital markets and his expertise in corporate finance, strategic planning and risk management. |

| 2023 Proxy Statement | 19 |

Proposal 1 Election of directors

Our culture

Our purpose—doing it right to better connect the world

At AAR, we constantly search for the right thing to do for our customers, for our employees, for partners and for society. We wake up in the morning knowing we have to deliver and we leave at the end of the day having done our best and determined to return the next day to do even better. We do not rest on our earlier accomplishments.

In 1955, American aviation was the new tech industry. AAR—a startup—was already supplying parts to the aviation industry—efficiently moving inventory, setting in motion our participation in America’s great boom.

Today, from Chicago to London to Singapore to Dubai, our customers, employees and partners are helping us do what is right worldwide—and that includes being a vital link in commercial airline safety and supporting the U.S. military and its allies. Our commitment to our government customers also continued in Fiscal 2023 as demonstrated, in particular, by the logistics and supply chain programs we provide in support of the U.S. Navy, U.S. Air Force, U.S. Marshals Service, and U.S. Department of State.

Through our AAR Aviation Services and Expeditionary Services businesses, we design technical, operational, logistic and financial solutions—doing it right and quickly delivering our customers safety, efficiencies and competitiveness. This lets them do what they do best—fly and connect the world.

Our vision

Our vision is to be the most respected global independent provider of aviation parts and repair services, and to create value for customers through differentiated capabilities and offerings, resulting in a sustainable, unique competitive advantage.

Our values

Our strategy

Our strategy is to become the leading independent provider of innovative solutions to the aviation aftermarket. We will achieve this strategy through our ability to:

| ● | Execute through focus on customer satisfaction

and cost leadership; |

| ● |

Pursue connected businesses that reinforce

collective growth prospects; |

| ● |

Leverage data and digital to deliver better

customer-focused offerings; |

| ● |

Expand margins through intellectual property; |

| ● |

Increase our global footprint into emerging

markets; |

| ● |

Leverage our independence to provide unbiased

solutions; and |

| ● |

Attract, empower and deploy exceptional, entrepreneurial

talent. |

| 20 |

|

Proposal 1 Election of directors

Connected businesses model

|

Parts Supply: USM & Distribution

●Sourcing to supply Repair & Engineering and Integrated Solutions

●Data for use in repair capability development

●Sales channels supported by maintenance relationships |

|

Repair & Engineering

●Strategic relationships with blue chip airlines that support parts volumes

●Repair knowledge and data collection

●PMA parts development for internal and external consumption | |

|

Integrated Solutions

●Programmatic parts and repair solutions

●Fuels Parts Supply activities

●Funds component repair capability development

●Government USM customer relationships |

Together, our “Connected Businesses” – Parts Supply (Used Serviceable Material and Distribution), Repair & Engineering and Integrated Solutions – aim to drive growth through best–in–class services within each discipline and leverage each to reinforce and grow the whole.

We also remain focused on enhancing our Expeditionary Services at our Mobility Systems business.

Corporate governance

Good corporate governance is an essential part of our corporate culture. We review our corporate governance policies and procedures on an annual basis. We strive to emulate “best practices,” tailoring them, as appropriate, to fit our culture, strategy and performance. We believe that we comply with all applicable SEC and NYSE corporate governance rules and regulations. We also have adopted additional corporate governance practices that we believe are in the best interests of the Company and its stockholders.

Copies of the following corporate governance documents are available on the Company’s website at www.aarcorp.com under “Investors / Corporate Governance”:

| ● |

Audit Committee Charter |

| ● |

Human Capital and Compensation Committee Charter |

| ● |

Nominating and Governance Committee Charter |

| ● |

Aviation Safety and Training Committee Charter |

| ● |

Executive Committee Charter |

| ● |

Corporate Governance Guidelines |

| ● |

Categorical Standards for Determining Director Independence |

| ● |

Code of Conduct |

These corporate governance documents are also available in print to any stockholder upon written request to the Secretary of the Company at the Company’s address listed on the first page of this proxy statement.

| 2023 Proxy Statement | 21 |

Proposal 1 Election of directors

Director nominations and qualifications

The Board, acting through its Nominating and Governance Committee, is responsible for identifying, evaluating and recommending candidates for director.

Solicitation of director candidate recommendations

The Nominating and Governance Committee solicits director candidate recommendations from management, other directors, business and community leaders and stockholders. The Nominating and Governance Committee also may retain the services of a search firm to assist in identifying director candidates.

|

||

Candidate considerations

The Nominating and Governance Committee considers all director candidates in the same manner, regardless of whether recommendations come from the Board, stockholders or other sources. In its evaluation of director candidates, the Nominating and Governance Committee considers the factors specified in the Company’s Corporate Governance Guidelines, including:

| ● | A high level of integrity and professional and personal ethics and values consistent with those of the Company; |

| ● | Professional background and relevant business and industry experience; |

| ● | Current employment, leadership experience and other board service; |

| ● | Demonstrated business acumen or special technical skills or expertise (e.g., auditing, financial, law and aviation/aerospace); |

| ● | A commitment to enhancing stockholder value and serving the interests of all stockholders; |

| ● | Independence (including within the meaning of the applicable SEC rules and applied to all NYSE rules) and freedom from any conflicts of interest that may interfere with a director’s ability to discharge his/her fiduciary duties; |

| ● | Willingness and ability to make the commitment of time and attention necessary for effective Board service; |

| ● | A balance of business, financial and other experience, expertise, capabilities and perspectives among sitting directors in the context of the current composition of the Board, operating requirements of the Company and long-term interests of stockholders; and |

| ● | Other factors the Nominating and Governance Committee deems appropriate. |

|

||

Consideration of inclusive diversity and expertise

The Nominating and Governance Committee considers the racial, ethnic and gender diversity of the Board and director candidates, as well as the diversity of their knowledge, skills, experience, background and perspective, to ensure that the Company maintains the benefit of a diverse, balanced and effective Board. In order to help facilitate the evaluation of diverse candidates, our Corporate Governance Guidelines mandate that a diverse candidate must be included in any director search. The Nominating and Governance Committee and the full Board maintain a current matrix of skills, competencies and experiences of each director. This matrix enables the Committee and the Board to ensure that the Board as a whole has the diversity of expertise and experience necessary for the effective oversight of the Company.

|

||

|

Recommendation

Following its evaluation of director candidates, the Nominating and Governance Committee recommends its director nominees to the full Board. Based on its review and consideration of the Committee’s recommendation, the Board makes the final determination of the director nominees to be presented for election by the Company’s stockholders. | ||

| 22 |

|

Proposal 1 Election of directors

A full list of the qualifications of director candidates considered by the Committee is set forth in the Corporate Governance Guidelines on the Company’s website at www.aarcorp.com under “Investors/Corporate Governance” and is available in print to any stockholder upon written request to the Secretary of the Company at the address listed on the first page of this proxy statement. The Nominating and Governance Committee regularly reviews these qualifications and the performance of individual directors and the Board as a whole.

Stockholders may submit a proposed director nomination to the Nominating and Governance Committee for consideration at the 2024 annual meeting of stockholders by writing to the Secretary, AAR CORP., 1100 North Wood Dale Road, Wood Dale, Illinois 60191. To be eligible for consideration under the Company’s By-Laws, a proposed nomination must be received by the Secretary of the Company no later than March 23, 2024, must state the reasons for the proposed nomination and must contain the information required under the Company’s By-Laws, including the full name and address of the proposed nominee, a brief biographical background setting forth the nominee’s past and present directorships, principal employment and occupation and information as to stock ownership and certain arrangements regarding the Company’s common stock. A proposed nomination must also include a statement indicating that the proposed nominee has consented to being named in the proxy statement and to serve if elected.

Universal Proxy Rules. In addition to satisfying the requirements under our By-Laws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Securities Exchange Act of 1934 (including a statement that such stockholder intends to solicit the holders of shares representing at least 67% of the voting power of the Company’s shares entitled to vote on the election of directors in support of director nominees other than the Company’s nominees), which notice must be postmarked or transmitted electronically to the Company at its principal executive offices no later than 60 calendar days prior to the anniversary date of the annual meeting (for the 2024 annual meeting of stockholders, no later than July 22, 2024). However, if the date of the 2024 annual meeting is changed by more than 30 calendar days from such anniversary date, then notice must be provided by the later of 60 calendar days prior to the date of the 2024 annual meeting of stockholders or the 10th calendar day following the day on which public announcement of the date of the 2024 annual meeting of stockholders is first made.

Director independence

|

A majority of the members of the Board must be independent directors under the Company’s Corporate Governance Guidelines and applicable SEC and NYSE rules. The Nominating and Governance Committee and the Board review each director annually and make a determination concerning independence after consideration of all known facts and circumstances. The Board has established categorical standards to assist it in determining director independence. The Company’s “Categorical Standards for Determining Director Independence” include all of the elements of the applicable SEC and NYSE rules with respect to director independence.

Based on these categorical standards, its review of all relevant facts and information available, and the recommendations of the Nominating and Governance Committee, the Board, at its meeting in July 2023, affirmatively determined that no director has a material relationship with the Company that would impair the director’s ability to exercise independent judgment and, accordingly, that each director is an independent director, except for Mr. Holmes. |

Director independence

9 of 10

directors are independent  |

The Board also determined that Mr. H. John Gilbertson, Jr., who served as a director during Fiscal 2023 prior to his resignation effective October 27, 2022, and Mr. James E. Goodwin, who served as a director during Fiscal 2023 prior to his retirement at the 2022 annual meeting of stockholders, were each independent within the meaning of applicable independence standards. The Board determined that Mr. Storch, who served as a director prior to his retirement effective January 10, 2023, was not independent within the meaning of applicable independence standards.

The Board’s independence determinations consider the impact of Board service tenure on a director’s independence, particularly with respect to directors with 10 or more years of Board service. The Board concluded that all longer-tenured directors, based on their communications and interactions with management, their decisions and their adherence to their fiduciary duties to stockholders, have demonstrated their independence from management.

| 2023 Proxy Statement | 23 |

Proposal 1 Election of directors

Board composition and refreshment

|

The Board currently consists of ten directors that are divided into three classes, designated as Class I, Class II and Class III. Three of the directors — Robert F. Leduc, Ellen M. Lord and John W. Dietrich — have joined in the last three years as a part of ongoing Board refreshment processes. David P. Storch, the Company’s former Chairman, retired effective January 2023, and John M. Holmes became Chairman of the Board. The Board will continue to adjust its composition as needed to lead the Company as it seeks to solidify and enhance its status in the aviation services markets.

We do not currently have a mandatory retirement age. The Board reviews director succession on an annual basis, and evaluates director skills, experience, diversity, qualifications and other attributes, including tenure and age, as well as fit with the Company's current business needs, before nominating such Board member for re-election. Recognizing the value of continuity of directors who have experience with the Company, there are no limits on the number of terms a director may hold office. As an alternative to term limits, the Board’s goal is to seek to maintain an average tenure of ten years or less for the independent directors as a group.

|

Average tenure: 8.7 years |

In considering new director candidates, the Board takes into account the skills, tenure and diversity of current directors to ensure that there is a proper balance between director stability and fresh perspectives in the boardroom.

As a part of this effort, the Board maintains a director matrix as shown on page 14, to ensure that the Board, as a whole, has the expertise, experience, diversity and skillset critical to the Company’s continued success.

| 24 |

|

Proposal 1 Election of directors

The Board’s role and responsibilities

Role and responsibilities of the Board

The Board is elected by our stockholders and represents their interests in overseeing our management, strategic direction and financial success. The Board exercises its oversight responsibilities directly and through its Committees.

The Board identified and gives particular attention to four “Critical Areas of Board Focus”.

| 1 | Risk management (including cybersecurity) |

|

Effective risk management is an important Board priority. The risk oversight function at the Board begins with a fundamental understanding of the Company’s culture, business and strategy. The Board delegates significant aspects of its risk management oversight responsibilities to its committees, as detailed below for each committee under “Key Risk Oversight Responsibilities.” The Board also works with management in managing risk through robust and comprehensive internal processes, an effective internal control environment and an enterprise risk management program. Our enterprise risk management program is designed to identify, assess and prioritize our risk exposures across various timeframes, from the short term to the long term. Further, the enterprise risk management program and our disclosure controls and procedures are designed to appropriately escalate key risks to the Audit Committee as well as analyze potential risks for disclosure.

In addition, the Board regularly reviews the identification and management of cybersecurity risks. The Board and Audit Committee receive regular reports from management on system vulnerabilities and security measures in effect to deter or mitigate breaches or hacking activities.

The Company’s Annual Report on Form 10-K for Fiscal 2023 includes in Part I, “Item 1A, Risk Factors” a listing of the significant risks facing the Company. | |

| 2 | Strategic planning |

|

The Board oversees the Company’s business and capital allocation strategies. It discusses strategic planning at each Board meeting and typically holds a special strategy session with management each year dedicated exclusively to strategic planning. This session focuses on the development and implementation of the Company’s short-term, intermediate-term and long-term strategic plans. The Board and management review and discuss the Company’s operations, and financial and non-financial performance. They analyze aviation industry developments and trends, the Company’s service and solution offerings and the competitive landscape in which the Company operates.

The Board monitors management’s performance in the execution of the Company’s strategy throughout the year. It receives regular updates from management at each meeting on strategic opportunities and risks that the Company is currently assessing or addressing, including through the oversight of management’s enterprise risk management program. | |

| 3 | Management development, succession planning and diversity |

|

AAR’s Board places a high priority on senior management development and succession planning. The Nominating and Governance Committee conducts an annual evaluation review focused on CEO succession planning, and the Human Capital and Compensation Committee evaluates succession planning and retention practices for senior management leaders.

The annual review addresses the development and evaluation of current and potential senior leaders, and the development of short-term and longer-term succession plans for key positions, including a succession plan for the CEO position. The Board also has a CEO emergency succession planning process to address unanticipated events and emergency situations.

The annual review also includes a diversity presentation that provides information on minority hiring and retention, as well as the status of our diversity and inclusiveness programs, including outreach programs focused on increasing the employee applicant pool, particularly for women, minorities and veterans. The Board is focused on improving diversity at all levels of the Company, but particularly at the middle and senior management levels. In order to help facilitate the evaluation of diverse candidates, the Corporate Governance Guidelines mandate that a diverse candidate must be included in any director search. In addition, management, with the Board’s oversight, published an ESG Report that further discusses AAR’s efforts in this regard. | |

| 4 | Company performance |

|

The Board receives regular updates relating to our financial performance against key measures, including sales growth, earnings per share growth, selling, general and administrative expense as a percentage of sales, return on invested capital and working capital turnover. The Board oversees operational performance at our business units through management presentations at each meeting.

The Board regularly reviews and compares its corporate governance profile against its peer group companies, competitors and market indices and is committed to engaging with and listening to its various stakeholders. See “Stockholder engagement” in the proxy summary and “Stockholder engagement” and “Response to stockholder feedback” in the CD&A for examples of how AAR listens and responds to its stockholders. | |

| 2023 Proxy Statement | 25 |

Proposal 1 Election of directors

Role and responsibilities of the Board committees

The Board has an Audit Committee, a Human Capital and Compensation Committee, a Nominating and Governance Committee, an Aviation Safety and Training Committee, and an Executive Committee. The following table outlines the risk oversight and general responsibilities of the Board committees as well the composition of such committees during Fiscal 2023:

Nominating and Governance Committee

Anthony K.

Anderson Chair Members Michael R. Boyce Ellen M. Lord Duncan J. McNabb Jennifer L. Vogel Marc J. Walfish |

Role and responsibilities

The Nominating and Governance Committee is comprised entirely of independent directors qualified to serve on the Committee under applicable SEC and NYSE rules and our Categorical Standards for Determining Director Independence. The Nominating and Governance

Committee acts under a written charter adopted by the Board. The charter was last reviewed and approved by the Committee and the Board

at their July 2023 meetings. The full text of the Committee charter appears on our website at www.aarcorp.com/investor-relations/corporate-governance

and is available in print to any stockholder upon written request to the Secretary of the Company at the Company’s address

listed on the first page of this proxy statement.

The Nominating and Governance Committee is responsible for both nominating and governance matters as described in its charter. The Committee performs the specific functions described in its charter, including:

●Oversees the composition, structure and evaluation of the Board and its committees;

●Conducts, together with the Human Capital and Compensation Committee and Lead Director, an annual performance evaluation of the Chief Executive Officer;

●Reviews, considers, and acts upon related person transactions;

●Reviews succession plans for the Chairman and committee chairs, as well as the Chief Executive Officer, and recommends individuals to fill these positions;

●Reviews various components of our ESG framework, including our ESG oversight structure, overall ESG strategy and material disclosures regarding the oversight process and our ESG initiatives, and, if appropriate, make recommendations to the Board concerning the same;

●Develops and recommends Corporate Governance Guidelines for Board approval; and

●Monitors and screens directors for independence and recommends to the Board qualified candidates for election as directors and to serve on Board committees.

The Nominating and Governance Committee held five meetings during Fiscal 2023.

Key risk oversight

responsibilities

●Corporate

governance

●Board

and committee membership

●Director

succession planning

●Corporate

responsibility strategy, practices and policies

●Board,

committee and CEO effectiveness

●Related

person transactions

The Nominating

and Governance Committee oversees and reports to the Board on corporate governance risks, including Board and committee membership,

director independence and related person transactions. |

| 26 |

|

Proposal 1 Election of directors

Human Capital and Compensation Committee

Jennifer L. Vogel

Chair Members

Anthony K. Anderson Michael R. Boyce* Robert F. Leduc Ellen M. Lord Peter Pace * Note that Mr. Dietrich has been appointed to serve as a member in place of Mr. Boyce effective on the date of the 2023 annual meeting. |

Role and responsibilities

The Human Capital and Compensation Committee is comprised entirely of independent directors qualified to serve on the Committee under applicable SEC and NYSE rules and our Categorical Standards for Determining Director Independence.