UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

AAR Corp.

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

|

Doing It Right® |

|

With long-standing values that prioritize quality and safety, inclusion, creative thinking and integrity, our commitment to sustainability principles is embedded in our culture. Learn more by reading our 2021 Environmental, Social and Governance (ESG) report, which is available at: www.aarcorp.com/about/environmental-social-governance-esg. |

ESG focus areas

|

|

| |||||

| Environment | Social | Governance | |||||

| Protecting the planet | Empowering people | Governing with Integrity | |||||

|

Waste prevention and reduction |

|

Diversity and inclusion |

|

Ethics and compliance | ||

|

Military and veteran programs |

|

Safety | ||||

|

STEM and aviation-focused education |

||||||

Fiscal 2021 Highlights

| • |

Published inaugural ESG annual report. |

| • |

Developed baseline inventory of key environmental data. |

| • |

Reduced natural gas and electricity use by nearly 5.5% from FY2020 to FY2021. |

| • |

Reduced Scope 1 and Scope 2 greenhouse gas emissions by nearly 12.5% from FY2020 to FY2021. |

| • |

Launched AAR Public Diversity Statement. |

| • |

Hired first all-female cohort. 49% of U.S. workforce is minority, 18% female, and 22% veteran. |

| • |

Formed Board’s new Aviation Safety and Training Committee. |

| • |

Set standard for safety with APRISe™ safety management system. |

| • |

Recognized by Smithsonian for $500,000 donation. |

AAR CORP. August 18, 2021 |

|

|

Dear fellow stockholders: |

||

|

The COVID-19 pandemic impacted the commercial aviation industry and workforce in ways never seen before. At AAR, one of our core values is “Find a Way. Every Day” and that was never more important than in Fiscal Year (FY) 2021. Our team of dedicated employees worked tirelessly to deliver outstanding service to our customers and strong performance for our shareholders. AAR entered the pandemic from a position of strength and we are emerging even stronger. During the year we focused on cash generation, margin improvement and business optimization. We exited non-core and underperforming activities and invested in processes that we believe will drive increased efficiency going forward. These actions resulted in sequential quarterly progress throughout the year and we expect continued improvements as the market recovers. I would like to thank our customers for their partnership, our stockholders for their confidence in AAR and our Board of Directors for their guidance. I specifically wish to extend my gratitude to our employees for all their sacrifices during this time of uncertainty and their continued dedication to maintaining the highest level of service to our customers around the world. With that, I am pleased to invite you to AAR’s 2021 annual meeting of stockholders, which will be a virtual meeting of the stockholders. The annual meeting will |

be held on Tuesday, September 28, 2021 at 9:00 a.m., Central Time and you will be able to attend the annual meeting online, vote your shares electronically, and submit your questions during the annual meeting by visiting www.virtualshareholdermeeting.com/AIR2021 and entering your control number. You will not be able to attend the annual meeting in person. I encourage you to read our 2021 proxy statement, our annual report and our other proxy materials. Whether or not you plan to attend the annual meeting of stockholders, your vote is important. Please follow the voting instructions to ensure that your shares are represented and voted at the meeting. We are grateful to our employees for their hard work and commitment, and to you, our stockholders, for choosing to invest in AAR. Sincerely,  John M. Holmes |

|

2021 Proxy Statement |

1 |

|

To our stockholders:

|

We are pleased to invite you to attend our 2021 annual meeting of stockholders. Please read the information in this notice and proxy statement to learn more about AAR and the matters to be voted on at the annual meeting. |

Date and time |

Place |

Record date |

Items of business

You will be asked at our annual meeting to:

| Items of business | Board recommendation | Page | ||||

| 1 | Elect four directors included in our annual proxy statement |

|

FOR each director nominee | 11 | ||

| 2 | Vote on an advisory proposal to approve our Fiscal 2021 executive compensation |

|

FOR | 36 | ||

| 3 | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for Fiscal 2022 |

|

FOR | 70 | ||

Stockholders will transact any other business that may properly come before the annual meeting or any adjournment or postponement of the annual meeting.

Voting

Your vote is important. We encourage you to vote your shares as soon as possible. You may vote by proxy over the Internet, by telephone, or by completing and returning the enclosed proxy card in the postage-paid envelope provided. If you are a “street name” stockholder (meaning that your shares are registered in the name of your bank or broker), you will receive instructions from your bank, broker or other nominee describing how to vote your shares. We also welcome you to attend the virtual meeting and vote online.

|

|

|

| |||

| www.proxyvote.com | www.virtualshareholdermeeting.com/AIR2021 | 1-800-690-6903 | Complete and return the proxy card or voting information card |

Please see Appendix A for important information about voting your shares at our 2021 annual meeting.

By Order of the Board of Directors,

Jessica A. Garascia

Vice President, General Counsel, Chief Compliance Officer and Secretary

August 18, 2021

| 2 |

|

|

|

Important notice regarding the availability of the proxy materials for our annual meeting of stockholders This notice and proxy statement, our proxy card, our 2021 Annual Report to Stockholders and our Annual Report on Form 10-K for the fiscal year ended May 31, 2021 are available free of charge at www.proxyvote.com |

|

2021 Proxy Statement |

3 |

|

This summary highlights selected information contained in this proxy statement. Please read the entire proxy statement carefully before voting your shares.

We are providing the enclosed proxy materials to you in connection with the solicitation by the Board of Directors of proxies to be voted at the annual meeting of stockholders to be held on September 28, 2021. We began giving these proxy materials to our stockholders on August 18, 2021.

Proposals to be voted on at the annual meeting

| Proposal 1 | Election of four directors named in this proxy statement |

FOR each director nominee FOR each director nominee |

► See (pages 11-35) |

|

Anthony K. Anderson Independent Director Incumbent |

|

Michael R. Boyce Independent Director Incumbent | |

| Since 2012, an independent business consultant. From 2006 to 2012, Vice Chair and Managing Partner of Midwest Area at Ernst & Young LLP (a global accounting and consulting firm). Prior thereto, Mr. Anderson served in various management positions during a 35-year career with Ernst & Young LLP. | Since 2018, Chairman, Chief Executive Officer and Managing Director of Peak Investments, LLC. Retired Chairman of the Board of PQ Corporation (a specialty chemicals and catalyst company) where he served from 2017 to 2019. From 2005 to 2017, Chairman and Chief Executive Officer of PQ Corporation. | |||

|

David P. Storch Chairman of the Board Incumbent |

|

Jennifer L. Vogel Independent Director Incumbent | |

| Chairman of the Board of AAR CORP. since 2005. Chief Executive Officer from 1996 to May 31, 2018 and President from 1989 to 2007 and 2015 to June 2017. | 2012 to 2020, co-founder and owner of InVista Advisors, an advisory firm focused on legal department effectiveness, leadership, compliance, crisis readiness and risk management. From 2003 to 2010, Senior Vice President, General Counsel, Secretary and Chief Compliance Officer of Continental Airlines, Inc. | |||

| Proposal 2 | Advisory proposal to approve our Fiscal 2021 executive compensation | ||

FOR FOR |

► See (pages 36-69) | ||

| Proposal 3 | Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for Fiscal 2022 | ||

FOR FOR |

► See (pages 70-71) | ||

| 4 |

|

2021 Proxy statement summary

AAR – Who we are and what we do

AAR is a global aerospace and defense aftermarket solutions company that operates in over 20 countries. Headquartered in the Chicago area, AAR supports commercial and government customers in over 100 countries through two operating segments: Aviation Services and Expeditionary Services.

| Aviation Services | Expeditionary Services | |||||

|

|

|

| |||

| Parts Supply | MRO Services | Integrated Solutions | Mobility Systems | |||

|

●Used serviceable and original equipment manufacturer (“OEM”) factory-new parts

●Airframe and engine parts sales, exchange, loan and lease

●Engine solutions, management, sales, leasing and exchange

●Aircraft sales and leasing

●OEM Solutions

●Online PAARTSSM Store

● 24/7 worldwide AOG service |

●Airframe Maintenance, Repair and Overhaul (“MRO”)

●Component Repair

●Landing Gear

●Wheels and Brakes

●Engineering Services |

●Total fleet services

●Flight hour support

●Contractor Logistics Support

●Performance-Based Logistics |

●Air cargo containers (ISU®) and pallets

●Rapidly deployable mobile tactical shelters

●SPACEMAX® shelters

●Integrated Command Control (C4) centers | |||

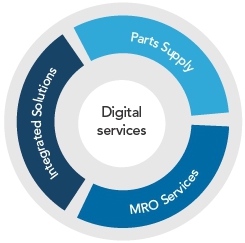

Aviation Services – connected businesses model

Integrated businesses leveraged to reinforce and grow the whole

|

Integrated Solutions ●Strategic relationships with airlines, MROs, OEMs and repair vendors

●Fuel Parts Supply business

●Fund Component Repair capability development

●Long-term contracts / predictable revenue |

|

Parts Supply ●Transactional data collection

●Exclusive relationships with OEMs and customers

●Inventory pooling with programs

MRO Services ●Strategic relationships with airlines

●Technical repair knowledge and data collection

●Develop parts for internal and external consumption | ||

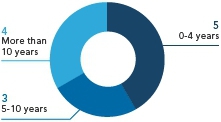

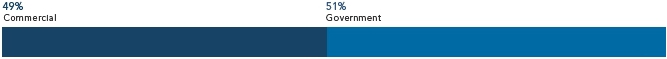

Customers (percentage of Fiscal 2021 sales)

|

2021 Proxy Statement |

5 |

2021 Proxy statement summary

Key business achievements in Fiscal 2021

|

Continued execution of Aviation Services “connected businesses” strategy | ||

|

●Parts Supply, MRO Services, and Integrated Solutions – Leveraged best-in-class services within Parts Supply, MRO Services and Integrated Solutions to continue to serve customers, despite the impact of COVID-19.

●Parts Supply – entered into partnership with Fortress Transportation and Infrastructure Investors to provide CFM56 engine material to the global aviation aftermarket.

●Parts Supply – extended and expanded longstanding partnership with Unison Industries for AAR to be the exclusive worldwide aftermarket distributor for Unison parts.

●MRO Services – announced a multi-year agreement with United Airlines for heavy maintenance services at Rockford, IL hangar.

●Integrated Solutions – awarded $148 million contract to continue C-40 contractor logistics support with Naval Air Systems Command.

●MRO Services – named sole authorized service center for Honeywell’s B737 MAX Bleed Air System components. | |||

|

Implemented portfolio actions and cost reductions | ||

|

●Divested non-core Composites manufacturing business.

●Exited and/or restructured multiple underperforming contracts.

●Reduced headcount and compensation and benefits, as well as eliminating non-essential spending.

●Reduced total selling, general and administrative expenses by $39 million, or 18%, to $182 million in FY21 from $221 million in FY20. | |||

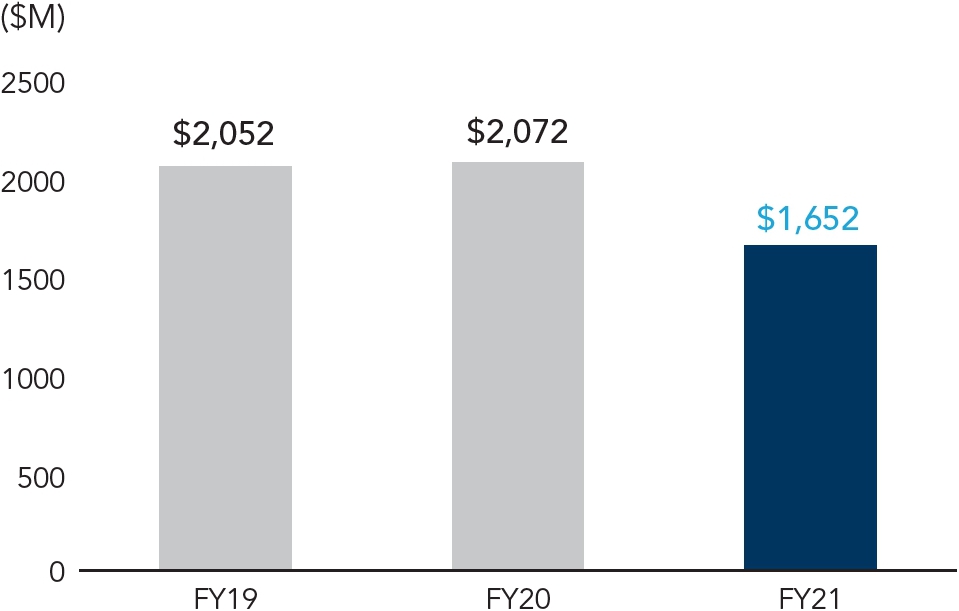

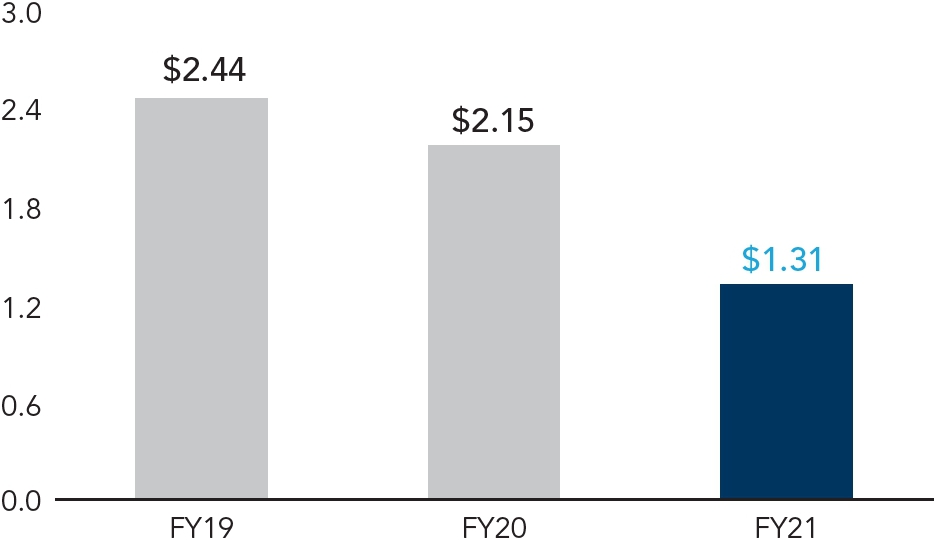

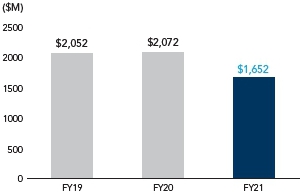

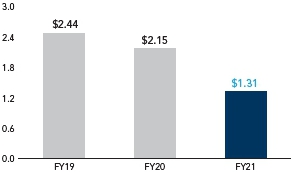

AAR had strong financial performance for Fiscal 2021 relative to the significant negative impact of the COVID-19 pandemic. Consolidated sales were $1.7 billion, diluted earnings per share from continuing operations was $1.30 (an increase of 83% over Fiscal 2020) and adjusted diluted earnings per share from continuing operations, a non-GAAP financial measure, was $1.31 (a decrease of 39% from Fiscal 2020). AAR further strengthened its balance sheet in Fiscal 2021 by driving significant cash generation and implemented several cost cutting initiatives to help it navigate uncertain market conditions presented by COVID-19.

For a definition of adjusted diluted earnings per share from continuing operations and a reconciliation of this measure to the closest comparable GAAP financial measure, see Appendix B.

Selected financial information

| (dollars in millions except per share data) For the year ended May 31 |

2021 ($) |

2020 ($) |

2019 ($) | ||||

| Sales | 1,652.3 | 2,072.0 | 2,051.8 | ||||

| Operating income | 85.2 | 41.3 | 98.3 | ||||

| Diluted earnings per share from continuing operations | 1.30 | 0.71 | 2.40 | ||||

| Cash provided from (used in) operations – continuing operations | 108.5 | (19.1 | ) | 60.5 | |||

| As of May 31 | |||||||

| Working capital | 600.2 | 1,055.6 | 595.0 | ||||

| Total assets | 1,539.7 | 2,079.0 | 1,517.2 | ||||

| Total debt | 135.2 | 602.0 | 142.9 | ||||

| Equity | 974.4 | 902.6 | 905.9 |

| 6 |

|

2021 Proxy statement summary

Key financial achievements

| Sales | Adjusted diluted EPS from continuing operations* | |

|

|

| * | Please see Appendix B for reconciliations of non-GAAP financial measures. |

Coronavirus aid, relief, and economic security act (CARES Act) and compensation

As previously disclosed, on July 30, 2020, the Company entered into a Payroll Support Program Agreement (the “PSP Agreement”) with the U.S. Treasury Department providing the Company with total funding of approximately $57.2 million pursuant to the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). Under the PSP Agreement, the Company and its business are subject to certain restrictions, including, but not limited to, certain limitations on executive compensation through March 24, 2022. These compensation restrictions impacted numerous executive compensation decisions made in Fiscal 2021.

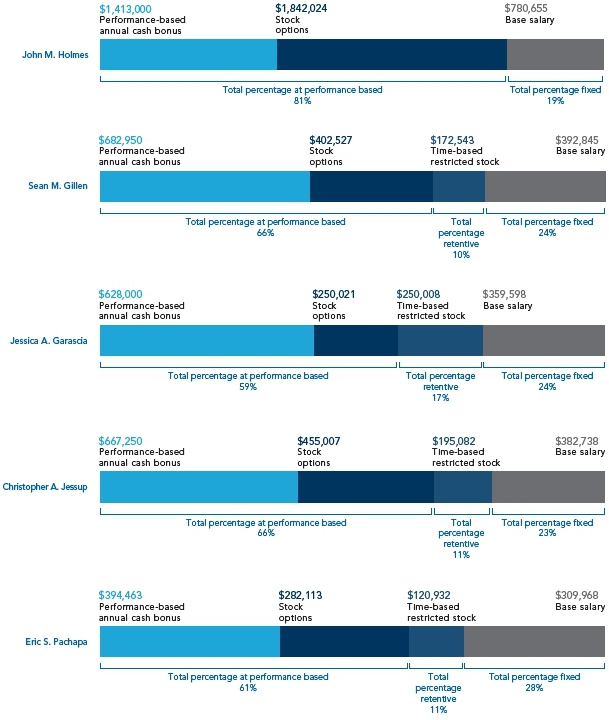

Executive compensation highlights

Pay-for-Performance and Stockholder Alignment

| ● | Annual cash bonuses are linked to two key performance metrics critical to the success of our business strategy: adjusted earnings per share from continuing operations (40%) and adjusted net working capital turns (20%). In addition, for Fiscal 2021, the Compensation Committee added certain strategic objectives (40%) to the annual cash bonus program in order to align management interests with priorities that are important to the Company, including navigating the impact of COVID-19 on the business. |

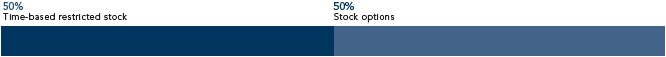

| ● | Given the economic uncertainty resulting from COVID-19, the subsequent difficulty in setting meaningful long-term performance targets, and the compensation restrictions imposed by the CARES Act, the Fiscal 2021 long-term incentive program consists of stock options and restricted stock. The Compensation Committee determined that a one-year, temporary, reprieve from the use of performance shares was appropriate in Fiscal 2021 given the impact of COVID-19 on the business and restrictions related to the Company’s use of CARES Act funding, as further discussed herein. The Compensation Committee awarded only stock options to Mr. Holmes and a mix of stock options and time-based restricted stock to the other named executive officers because stock options align management’s interests with those of its stockholders and time-based restricted stock has a retentive value. |

| ● | Our Fiscal 2021 long-term incentives are 100% equity-based: restricted stock and stock options. |

| ● | AAR targets total pay opportunities for its executive officers, individually and as a group, within a competitive range around the median of the market. |

| ● | AAR’s compensation mix – cash versus equity, fixed versus variable, and annual versus longer-term – is consistent with competitive best practices, subject to reductions made to comply with CARES Act restrictions. |

|

2021 Proxy Statement |

7 |

2021 Proxy statement summary

Cash bonuses under the Fiscal 2021 short-term incentive plan

| Strategic goal | Compensation measure | |||

|

Drive profitability and deliver value to stockholders |

40% |

Adjusted earnings per share from continuing operations | ||

|

Align management’s interests with priorities that are important to the Company, including navigating the effects of COVID-19 |

40% |

Strategic objectives | ||

|

Make efficient use of stockholder capital in support of Company sales |

20% |

Adjusted net working capital turns | ||

Fiscal 2021 Compensation of our Chief Executive Officer John M. Holmes

Fiscal 2021 compensation of our other named executive officers

Fiscal 2021 executive compensation program

Through the first half of Fiscal 2021, we had measures in place to help us manage our business in light of the challenges presented by the impact of COVID-19:

| ● | Reductions in base salary of 20% for our CEO and 15% for the other executive officers, and reductions in base salary ranging from 5% to 10% for other salaried employees through December 1, 2020 |

| ● | Reduction in cash retainer of 20% for our non-employee directors through December 1, 2020 |

| ● | Suspension of the Company’s contributions under its 401(k) and Supplemental Key Employee Retirement Plan (“SKERP”) through December 1, 2020 |

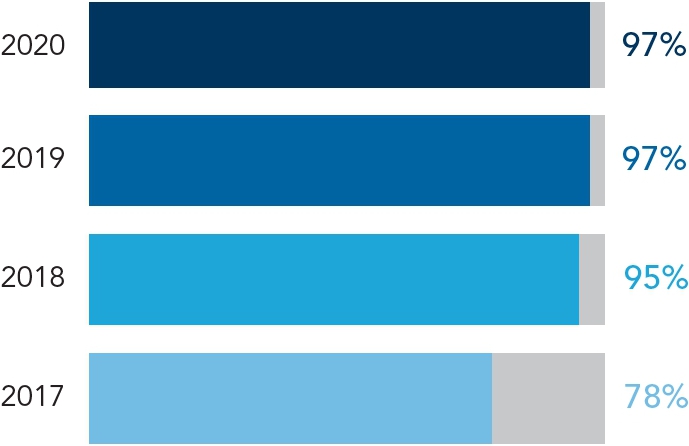

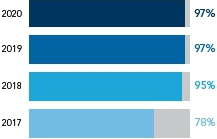

In addition, we continue to be committed to ensuring pay-for-performance in response to stockholder feedback from our 2017 say-on-pay votes and investor feedback. We believe the outcome of our 2018 through 2020 say-on-pay votes (over 95% support each year) demonstrated strong stockholder support for our executive compensation program. We will continue to consider investor feedback relating to our executive compensation program.

Say-on-pay vote

Links to websites included in this Proxy Statement are provided solely for convenience purposes. Content on the websites, including content on our Company website, is not, and shall not be deemed to be, part of this Proxy Statement or incorporated herein or into any of our other filings with the Securities and Exchange Commission.

| 8 |

|

2021 Proxy statement summary

Executive compensation practices

| What We Do | What We Do Not Do | |||

Annual say-on-pay stockholder vote Annual say-on-pay stockholder vote Emphasis on performance-based or at-risk compensation Emphasis on performance-based or at-risk compensation Multi-year vesting periods for stock awards Multi-year vesting periods for stock awards Limited perquisites Limited perquisites “Double trigger” change-in-control provisions in executive agreements “Double trigger” change-in-control provisions in executive agreements Meaningful stock ownership and retention guidelines for directors and executive officers Meaningful stock ownership and retention guidelines for directors and executive officers Prohibition on short sales, pledging and hedging transactions Prohibition on short sales, pledging and hedging transactions Claw-backs of incentive compensation in the event of certain financial restatements Claw-backs of incentive compensation in the event of certain financial restatements Annual assessment of incentive compensation plans Annual assessment of incentive compensation plans |

No tax gross-ups No tax gross-ups No repricing of stock options No repricing of stock options No dividends on performance-based restricted stock unless performance goals are met No dividends on performance-based restricted stock unless performance goals are met | |||

Corporate governance highlights

Our goal is to ensure that our corporate governance practices reflect best practices tailored, as necessary, to the Company’s culture, strategy and performance.

Corporate governance practices

| 12 | 10 | 65.75 | 10.16 years |

75 |

| directors | independent directors | Average age of directors | Average tenure of directors | Director retirement age |

Independent Lead Director Independent Lead Director Majority voting in uncontested director elections Majority voting in uncontested director elections Stock ownership and retention guidelines Stock ownership and retention guidelines Annual stock grant to non-employee directors Annual stock grant to non-employee directors Executive sessions of Independent directors Executive sessions of Independent directors Independent compensation consultant Independent compensation consultant Annual Board and Board Committee self-evaluations Annual Board and Board Committee self-evaluations Director orientation and continuing education programs Director orientation and continuing education programs All directors on the Audit Committee are “audit committee financial experts” All directors on the Audit Committee are “audit committee financial experts” Three of our twelve directors are female or racially/ ethnically diverse Three of our twelve directors are female or racially/ ethnically diverse |

Code of business ethics and conduct Code of business ethics and conduct Ethics hotline policy Ethics hotline policy Related person transaction policy Related person transaction policy Disclosure committee for financial reporting Disclosure committee for financial reporting Annual stockholder approval of executive compensation Annual stockholder approval of executive compensation Stockholder engagement program Stockholder engagement program Separation of Chairman and CEO roles Separation of Chairman and CEO roles Independent Board Committees Independent Board Committees Enterprise Risk Management Program Enterprise Risk Management Program |

| 2 of our 12 directors are female |

1 of our 12 directors is racially/ethnically diverse | |

|

|

|

2021 Proxy Statement |

9 |

2021 Proxy statement summary

Environmental, social and governance focus

Our focus on environmental, social and governance (ESG) matters is embedded in our strategy, which is overseen by the Board of Directors. The Board’s standing committees oversee our ESG focus areas based on the delegated subject matter:

| ● | The Aviation Safety and Training Committee oversees all aspects of aviation safety, including our culture of safety compliance; |

| ● | The Nominating and Governance Committee oversees our governance policies and practices, and reviewed our 2021 ESG report on behalf of the Board; and |

| ● | The Audit Committee receives reports related to our ethics hotline and oversees AAR’s cybersecurity planning and protection efforts. |

At the management level, we have assembled a multidisciplinary team of senior leaders representing legal, communications, human resources, and environmental, health and safety. This group, with input and guidance from senior business leaders, assesses risks and opportunities related to our ESG focus areas, monitors and implements our ESG strategies, tracks our progress and guides our reporting to stakeholders.

Our ESG focus areas

Our ESG focus areas are long-standing AAR priorities that align with our business and our values and are also areas where we believe that we have the greatest opportunity to make a meaningful impact. For more information, please see our 2021 ESG report, which is available at www.aarcorp.com/about/environmental-social-governance-esg.

|

|

|

|||

|

Environment |

Social Empowering people |

Governance | |||

|

Waste reduction and prevention |

|

Diversity and inclusion |

|

Ethics and compliance |

|

Military and veteran programs |

|

Safety | ||

|

STEM and aviation-focused education | ||||

Public Diversity Statement

As reflected in our values, we have a long-standing commitment to embracing diversity and fostering a culture of inclusion. In July 2021, we adopted and published the following Public Diversity Statement:

| Just as unique parts are essential to an aircraft’s ability to fly, unique talent is essential to AAR’s ability to succeed. Our strength is rooted in our commitment to diversity, equity and inclusion. We create opportunity through new thoughts and ideas to embrace an ever-changing world. These values empower our people to be a team of producers, innovators and world class leaders, who are “Doing it right” to better connect the world. |

This statement was developed by a group of employees selected from throughout the business, reflecting the varied perspectives, experiences and priorities of our workforce.

| 10 |

|

|

| Proposal 1 Election of four directors named in this proxy statement | |

| Board recommendation | |

|

Our Board of Directors unanimously recommends that you vote FOR each director nominee. |

We are asking you to elect four directors named in this proxy statement at this annual meeting. The director nominees are: Anthony K. Anderson, Michael R. Boyce, David P. Storch and Jennifer L. Vogel.

Each director nominee is currently serving as a director of the Company. Three of the four director nominees have been determined by the Board to be “independent” within the meaning of the rules of the New York Stock Exchange (“NYSE”) and the SEC.

Director skills & qualifications

The Nominating and Governance Committee believes that the Board is currently well-balanced and able to address our Company’s needs, and the recent addition of Ms. Ellen M. Lord increases the Board’s diversity of thought and prepares us for future growth and innovation. As evidenced by the biographical information provided below, our directors have significant experience in chief executive or other senior level operating, financial and international management positions.

More than half of our existing directors currently serve as a director of other public companies, which provides them with diverse experiences that can enhance their contribution to our Board.

|

2021 Proxy Statement |

11 |

Proposal 1 Election of directors

Set forth below is information regarding the nominees for election as directors and information regarding the directors in each class continuing in office after the annual meeting. Also discussed below are specific experience, qualifications, attributes and skills of our directors considered by the Nominating and Governance Committee as part of its review of our Board’s membership and in connection with its nomination of the candidates for election to the Board at the annual meeting.

| Anthony

K. Anderson |

Michael

R. Boyce |

H.

John Gilbertson |

James

E. Goodwin |

John

M. Holmes |

Robert

F. Leduc |

Ellen

M. Lord |

Duncan

J. McNabb |

Peter Pace |

David

P. Storch |

Jennifer

L. Vogel |

Marc

J. Walfish | ||

|

CEO experience |

|

|

|

|

|

|

|

|||||

|

Finance |

|

|

|

|

|

|

|

| ||||

|

Accounting |

|

|

|

| ||||||||

|

Commercial aerospace |

|

|

|

|

|

|

|

|

||||

|

Military aerospace |

|

|

|

|

|

|||||||

|

Services |

|

|

|

|

|

|

|

|

|

|

||

|

International business |

|

|

|

|

|

|

|

|

||||

|

Sales & marketing |

|

|

|

|

|

|

|

|

| |||

|

Supply chain & logistics |

|

|

|

|

|

|

|

|||||

|

Operating |

|

|

|

|

|

|

|

|

|

|||

|

M&A |

|

|

|

|

|

|

|

|

| |||

|

Manufacturing |

|

|

|

|

||||||||

|

Government contracting |

|

|

|

|

|

|

||||||

|

Information technology |

|

|

||||||||||

|

Human resources |

|

|

|

|

|

|||||||

|

Risk management |

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate governance |

|

|

|

|

|

|

|

|

|

|

||

|

Racial diversity |

|

|||||||||||

|

Gender diversity |

|

|

| 12 |

|

Proposal 1 Election of directors

Information about our director nominees and our continuing directors

Information about our director nominees and our continuing directors whose terms expire in future years is set forth below.

Our director nominees

Class I Directors whose terms expire at the 2021 annual meeting:

|

Anthony K. Anderson Independent Director Skills and qualifications CEO experience, Finance, Accounting, Services, Sales & marketing, Operating, M&A, Risk management, Corporate governance Career highlights Since April 2012, an independent business consultant. From 2006 to April 2012, Vice Chair and Managing Partner of Midwest Area at Ernst & Young LLP, a global accounting and consulting firm. Prior thereto, Mr. Anderson served in various management positions during a 35-year career with Ernst & Young LLP. Director qualifications The Board of Directors concluded that Mr. Anderson should serve as a director of the Company based on his 35 years working with a global accounting and consulting firm, his accounting and financial knowledge, his leadership in developing talent management programs, his service as a director of other public companies, and his professional, civic and charitable service, including as a director of private companies and numerous not-for-profit organizations. |

|

Age: 65 Director since: 2012 Other public company directorships: ●Avery Dennison Corp.

●Exelon Corp.

●Marsh & McLennan Companies

Other public company directorships held in the past five years: ●First American Financial Corporation |

|

Michael R. Boyce Independent Director Skills and qualifications CEO experience, Finance, International business, Sales & marketing, Supply chain & logistics, Operating, M&A, Manufacturing, Risk management, Corporate governance Career highlights Since 2018, Chairman, Chief Executive Officer and Managing Director of Peak Investments, LLC (an operating and acquisition company). Retired Chairman of the Board of PQ Corporation (a specialty chemicals and catalyst company) where he served from 2017 to 2019. From 2005 to 2017, Chairman and Chief Executive Officer of PQ Corporation. Director qualifications The Board of Directors concluded that Mr. Boyce should serve as a director of the Company based on his experience in leading two global organizations, his insight into global manufacturing, supply and distribution practices and his international business development skills. |

|

Age: 73 Director since: Other public company directorships: ●Stepan Company |

|

2021 Proxy Statement |

13 |

Proposal 1 Election of directors

|

David P. Storch Chairman of the Board Skills and qualifications CEO experience, Commercial aerospace, Military aerospace, Services, International business, Sales & marketing, Supply chain & logistics, Operating, M&A, Manufacturing, Government contracting, Human resources, Risk management, Corporate governance Career highlights Chairman of the Board of AAR CORP. since 2005. Chief Executive Officer from 1996 to May 31, 2018 and President from 1989 to 2007 and 2015 to 2017. Director qualifications The Board of Directors concluded that Mr. Storch should serve as a director of the Company based on his previous position as Chief Executive Officer of the Company, his leadership and management skills, his understanding of the Company’s businesses gained during his 40-year career with the Company and his knowledge of the commercial aviation and government/defense markets. |

|

Age: 68 Director since: 1989 Other public company directorships: ●Kemper Corporation

Other public company directorships held in the past five years: ●KapStone Paper and

Packaging Corp. |

|

Jennifer L. Vogel Independent Director Skills and qualifications Commercial aerospace, Services, International business, M&A, Government contracting, Human resources, Risk management, Corporate governance Career highlights 2012 to 2020, co-founder and owner of InVista Advisors, an advisory firm focused on legal department effectiveness, leadership, compliance, crisis readiness and risk management. From 2003 to 2010, Senior Vice President, General Counsel, Secretary and Chief Compliance Officer of Continental Airlines, Inc. Director qualifications The Board of Directors concluded that Ms. Vogel should serve as a director of the Company based on her experience as a highly successful corporate executive with over 25 years of leadership experience in the airline and energy industries, including her leadership positions with Continental Airlines, her legal and corporate governance expertise, her experience in regulatory issues, mergers and acquisitions, ethics and compliance matters and her past experience as a director of other public companies, including Virgin America, Inc. |

|

Age: 59 Director since: 2016 Other public company directorships: ●None

Other public company directorships held in the past five years: ●American Science and

Engineering, Inc.

●Clearwire Corporation

●Virgin America,

Inc. |

| 14 |

|

Proposal 1 Election of directors

Our continuing directors

Class II Directors whose terms expire at the 2022 annual meeting:

|

James E. Goodwin Lead Independent Director Skills and qualifications CEO experience, Finance, Accounting, Commercial aerospace, Services, International business, Sales & marketing, Operating, Risk management, Corporate governance Career highlights From 2016 to April 2019, Lead Director of Federal Signal Corporation, a safety and security products manufacturer. From 2009 to 2016, Chairman of Federal Signal Corporation. From 2007 to 2008, Interim President and Chief Executive Officer of Federal Signal Corporation. From 2001 to 2007, an independent business consultant. From 1999 to 2001, Chairman and Chief Executive Officer of UAL, Inc. and United Airlines, Inc., from which he retired after 34 years. Director qualifications The Board of Directors concluded that Mr. Goodwin should serve as a director of the Company based on his significant airline industry experience and expertise, including his leadership positions at UAL, Inc. and United Airlines, Inc., his management experience and his financial expertise, as well as his global consulting experience, and his service as a director of other public companies. |

|

Age: 77 Director since: 2002 Other public company directorships: ●John Bean Technologies

Corporation

Other public company directorships held in the past five years: ●Federal Signal

Corporation |

|

John M. Holmes Director Skills and qualifications CEO experience, Finance, Commercial aerospace, Services, International business, Sales & marketing, Supply chain & logistics, Operating, M&A, Human resources, Risk management, Corporate governance Career highlights President and Chief Executive Officer of AAR CORP. since June 1, 2018. President and Chief Operating Officer from June 1, 2017 to June 1, 2018. From 2015 to June 1, 2017, Chief Operating Officer of the Aviation Services business group of AAR CORP. From 2012 to 2015, Group Vice President, Aviation Services – Inventory Management and Distribution; and prior thereto, General Manager and Division President of AAR Allen Asset Management. Director qualifications The Board of Directors concluded that Mr. Holmes should serve as a director of the Company based on his position as President and Chief Executive Officer, his demonstrated leadership and management abilities, and his knowledge of the Company’s businesses, its portfolio of services and the markets in which it competes, and the customer and supplier relationships that Mr. Holmes has developed during his 19-year tenure with the Company. |

|

President and Chief Executive Officer of AAR CORP. Age: 44 Director since: 2017 Other public company directorships: ●None |

|

2021 Proxy Statement |

15 |

Proposal 1 Election of directors

Age: 61 Director since: 2021 Other public company directorships: ●None |

Ellen M. Lord Independent Director Skills and qualifications CEO experience, Finance, Commercial aerospace, Military aerospace, Services, International business, Sales & marketing, Supply chain & logistics, Operating, M&A, Government contracting, Information technology, Risk management Career highlights Served as the Under Secretary of Defense for Acquisition and Sustainment for the United States Department of Defense from August 2017 until January 2021. President and Chief Executive Officer of Textron Systems from October 2012 to August 2017. Prior to that, served in other leadership positions at Textron Systems and related companies. Director qualifications The Board of Directors concluded that Ms. Lord should serve as a director of the Company based on her leadership, management and strategic planning expertise she acquired while serving as the Under Secretary of Defense for Acquisition and Sustainment for the United States Department of Defense, as well as her experience in the private sector working as the Chief Executive Officer of Textron Systems, where she led a multi-billion dollar company with products and services supporting defense, homeland security, aerospace and infrastructure protection. |

Age: 69 Director since: 2003 Other public company directorships: ●None |

Marc J. Walfish Independent Director Skills and qualifications Finance, Accounting, Sales & marketing, M&A, Risk management Career highlights Founding Partner of Merit Capital Partners, a mezzanine investor company formerly known as William Blair Mezzanine Capital Partners, since 1991. From 1978 to 1991, various positions at Prudential Capital Corporation. Director qualifications The Board of Directors concluded that Mr. Walfish should serve as a director of the Company based on his experience in the finance industry, including as a founding partner of Merit Capital Partners, his knowledge of the capital markets and his expertise in corporate finance, strategic planning and risk management. |

| 16 |

|

Proposal 1 Election of directors

Class III Directors whose terms expire at the 2023 annual meeting:

Age: 64 Director since: Other public company directorships: ●Dover Corporation |

H. John Gilbertson, Jr. Independent Director Skills and qualifications Finance, Accounting, Services, International business, Sales & marketing, M&A, Manufacturing, Risk management, Corporate governance Career highlights Retired Managing Director (1997 to 2012) at Goldman Sachs, a global investment banking, securities and investment management firm; also served as Advisory Director (2013 to 2015), and Partner-in-Charge, Midwest Region Investment Banking Services (2001 to 2010); prior thereto, various positions within Goldman Sachs. Director qualifications The Board of Directors concluded that Mr. Gilbertson should serve as a director of the Company based on his almost four decades of experience in the professional and financial services industry, his service as a director of other public companies, and his knowledge and experience in corporate finance, capital markets, mergers and acquisitions, financial risk oversight and capital allocation, senior leadership development, succession planning, and organizational culture development. |

Age: 65 Director since: Other public company directorships: ●JetBlue Airways

Corporation

●Howmet Aerospace,

Inc. |

Robert F. Leduc Independent Director Skills and qualifications CEO experience, Finance, Commercial aerospace, Military aerospace, Services, International business, Sales & marketing, Supply chain & logistics, Operating, M&A, Manufacturing, Human resources, Risk management, Corporate governance, Government contracting Career highlights President of Pratt & Whitney, an aerospace manufacturer and a subsidiary of United Technologies Corporation, from 2016 until his retirement early 2020. President of Sikorsky Aircraft, a helicopter manufacturer, from 2015 to 2016. Previously, served in leadership positions at Hamilton Sundstrand and UTC Aerospace Systems. Director qualifications The Board of Directors concluded that Mr. Leduc should serve as a director of the Company based on his extensive experience in the aviation sector, his operational expertise managing through various down cycles, and his significant experience in enhancing brands and managing talent, in addition to his experience serving on other public company boards. |

|

2021 Proxy Statement |

17 |

Proposal 1 Election of directors

|

Duncan J. McNabb Independent Director Skills and qualifications Commercial aerospace, Military aerospace, Services, Supply chain & logistics, Operating, Government contracting, Risk management, Corporate governance Career highlights Since 2011, Co-Founder and Managing Partner of Ares Mobility Solutions Inc., a privately-held logistics business; General, U.S. Air Force (Retired) after 37 years of active commissioned service. Former Commander, U.S. Air Mobility Command, 33rd Vice Chief of Staff of the U.S. Air Force and Former Commander of US TRANSCOM. Director qualifications The Board of Directors concluded that General McNabb should serve as a director of the Company based on his government resourcing and government affairs expertise, his strategic planning, operations and leadership skills and his 37-year record of service with the United States Air Force, including his service as Commander of the United States Transportation Command (the single manager for global air, land and sea transportation for the Department of Defense). |

|

Age: 69 Director since: 2017 Other public company directorship: ●Atlas Air Worldwide, Inc. |

|

Peter Pace Independent Director Skills and qualifications Commercial aerospace, Military aerospace, Services, Supply chain & logistics, Operating, Government contracting, Information technology, Human resources, Risk management, Corporate governance Career highlights General, U.S. Marine Corps (Retired). From 2005 to 2007, Chairman of the Joint Chiefs of Staff, the most senior position in the United States Armed Forces. Director qualifications The Board of Directors concluded that General Pace should serve as a director of the Company based on his leadership and management skills and experience from over 40 years of service with the United States Marine Corps, culminating in his appointment as the 16th Chairman of the Joint Chiefs of Staff (where he served from 2005 to 2007 as the principal military adviser to the President, the Secretary of Defense, the National Security Council and the Homeland Security Council), his understanding of the government and defense markets, his cybersecurity expertise and his current and prior service as a director of other public companies. |

|

Age: 75 Director since: 2011 Other public company directorship: ●Qualys, Inc.

Other public company directorships held in the past five years: ●None |

| 18 |

|

Proposal 1 Election of directors

|

Our purpose—doing it right to better connect the world At AAR, we constantly search for the right thing to do for our customers, for our employees, for partners and for society. We wake up in the morning knowing we have to deliver and we leave at the end of the day having done our best and determined to return the next day to do even better. We do not rest on our earlier accomplishments. In 1955, American aviation was the new tech industry. AAR—a startup—was already supplying parts to the aviation industry—efficiently moving inventory, setting in motion our participation in America’s great boom. Today, from Chicago to London to Singapore to Dubai, our customers, employees and partners are helping us do what is right worldwide—and that includes being a vital link in commercial airline safety and supporting the U.S. military and its allies. Our commitment to our government customers also reached new heights in Fiscal 2021 as demonstrated, in particular, by the logistics and supply chain programs we provide in support of the U.S. Navy, U.S. Air Force, U.S. Marshals Service, and U.S. Department of State. Through our AAR Aviation Services and Expeditionary Services businesses, we design technical, operational, logistic and financial solutions—doing it right and quickly delivering our customers safety, efficiencies and competitiveness. This lets them do what they do best—fly and connect the world. Our mission To be the best at designing and delivering technical, operational and financial solutions to enhance the efficiency and competitiveness of our commercial aviation and government customers. Our strategy is to become the leading independent provider of innovative solutions to the aviation aftermarket. We will achieve this strategy through our ability to: ●Execute through focus on customer satisfaction and cost leadership;

●Pursue connected businesses that reinforce collective growth prospects;

●Leverage data and digital to deliver better customer-focused solutions;

●Expand margins through intellectual property;

●Increase our global footprint into emerging markets;

●Leverage our independence to provide feasible solutions; and

●Attract, empower and deploy exceptional, entrepreneurial talent. |

Our values |

||

|

| ||

|

| ||

|

| ||

|

| ||

|

2021 Proxy Statement |

19 |

Proposal 1 Election of directors

Aviation Services – connected businesses model

Integrated businesses leveraged to reinforce and grow the whole

Together, our Aviation Services “Connected Businesses” – Parts Supply (Trading and OEM aftermarket solutions), MRO Services and Integrated Solutions (Government and Commercial Programs) – aim to drive growth through best–in–class services within each discipline and leverage each to reinforce and grow the whole.

We also remain focused on enhancing our manufacturing capabilities at our Mobility Systems business.

Corporate governance

Good corporate governance is an essential part of our corporate culture. We review our corporate governance policies and procedures on an annual basis. We strive to emulate “best practices,” tailoring them, as appropriate, to fit our culture, strategy and performance. We believe that we comply with all applicable SEC and NYSE corporate governance rules and regulations. We also have adopted additional corporate governance practices that we believe are in the best interests of the Company and its stockholders.

Copies of the following corporate governance documents are available on the Company’s website at www.aarcorp.com under “Investors / Corporate Governance”:

| ● | Audit Committee Charter |

| ● | Compensation Committee Charter |

| ● | Nominating and Governance Committee Charter |

| ● | Aviation Safety and Training Committee Charter |

| ● | Executive Committee Charter |

| ● | Corporate Governance Guidelines |

| ● | Categorical Standards for Determining Director Independence |

| ● | Code of Conduct |

These corporate governance documents are also available in print to any stockholder upon written request to the Secretary of the Company at the Company’s address listed on the first page of this proxy statement.

| 20 |

|

Proposal 1 Election of directors

Stockholder engagement

We recognize and value the importance of engaging with our stockholders and other key constituents in an open and constructive manner.

| Why we engage | |

The purposes of our stockholder engagement program are to promote communication, increase transparency and, most importantly, better understand and address the perspectives of our stockholders. We believe that opportunities to receive and consider stockholder feedback enhance, in particular, our corporate governance and executive compensation practices, which in turn will contribute to the long-term value of the Company.

| Fiscal 2021 outreach | |

In Fiscal 2021, we estimate that we communicated with stockholders owning over a majority of our actively managed outstanding shares.

| Fiscal 2021 engagement covered | |

Through our stockholder engagement program, we participated in numerous investor meetings which included telephone calls with stockholders and presentations at various investor conferences. These interactions allow investors the opportunity to meet, ask questions of, and provide advice to, our key executives.

| BUSINESS | FINANCIAL RESULTS |

DIGITAL INITIATIVES |

| STRATEGY | ||

| EXECUTIVE COMPENSATION PRACTICES | ||

| OPERATING PERFORMANCE | ||

| We listened to our stockholders | |

| What we heard | What we did | Implementation date |

| Concerns about our Rights Agreement | Board terminated Rights Agreement | October 2020 |

| Concerns about performance shares | Introduced relative total stockholder return as a new metric | July 2018 |

| Concerns about plurality voting | Adopted majority voting | June 2018 |

|

2021 Proxy Statement |

21 |

Proposal 1 Election of directors

Director nominations and qualifications

The Board of Directors, acting through its Nominating and Governance Committee, is responsible for identifying, evaluating and recommending candidates for director.

|

Solicitation of director candidate recommendations The Nominating and Governance Committee solicits director candidate recommendations from management, other directors, business and community leaders and stockholders. The Nominating and Governance Committee also may retain the services of a search firm to assist in identifying director candidates. | ||

|

||

|

Candidate considerations The Nominating and Governance Committee considers all director candidates in the same manner, regardless of whether recommendations come from the Board, stockholders or other sources. In its evaluation of director candidates, the Nominating and Governance Committee considers the factors specified in the Company’s Corporate Governance Guidelines, including: ●A high level of integrity and professional and personal ethics and values consistent with those of the Company;

●Professional background and relevant business and industry experience;

●Current employment, leadership experience and other board service;

●Demonstrated business acumen or special technical skills or expertise (e.g., auditing, financial, law and aviation/aerospace);

●A commitment to enhancing stockholder value and serving the interests of all stockholders;

●Independence (including within the meaning of the applicable SEC rules and applied to all NYSE rules) and freedom from any conflicts of interest that may interfere with a director’s ability to discharge his/her fiduciary duties;

●Willingness and ability to make the commitment of time and attention necessary for effective Board service;

●A balance of business, financial and other experience, expertise, capabilities and perspectives among sitting directors in the context of the current composition of the Board, operating requirements of the Company and long-term interests of stockholders; and

●Other factors the Nominating and Governance Committee deems appropriate. | ||

|

||

|

Consideration of inclusive diversity and expertise The Nominating and Governance Committee considers the racial, ethnic and gender diversity of the Board and director candidates, as well as the diversity of their knowledge, skills, experience, background and perspective, to assure that the Company maintains the benefit of a diverse, balanced and effective Board. In order to help facilitate the evaluation of diverse candidates, the Board adopted amended Corporate Governance Guidelines in December 2019 that mandate that a diverse candidate must be included in any director search. The Nominating and Governance Committee and the full Board maintain a current matrix of skills, competencies and experiences of each director. This matrix enables the Committee and the Board to ensure that the Board as a whole has the diversity of expertise and experience necessary for the effective oversight of the Company. | ||

|

||

| Recommendation | ||

|

Following its evaluation of director candidates, the Nominating and Governance Committee recommends its director nominees to the full Board of Directors. Based on its review and consideration of the Committee’s recommendation, the Board makes the final determination of the director nominees to be presented for election by the Company’s stockholders. | ||

| 22 |

|

Proposal 1 Election of directors

A full list of the qualifications of director candidates considered by the Committee is set forth in the Corporate Governance Guidelines on the Company’s website at www.aarcorp.com under “Investors/Corporate Governance” and is available in print to any stockholder upon written request to the Secretary of the Company at the address listed on the first page of this proxy statement. The Nominating and Governance Committee regularly reviews these qualifications and the performance of individual directors and the Board as a whole.

Stockholders may submit a proposed director nomination to the Nominating and Governance Committee for consideration at the 2022 annual meeting of stockholders by writing to the Secretary, AAR CORP., One AAR Place, 1100 North Wood Dale Road, Wood Dale, Illinois 60191. To be eligible for consideration under the Company’s By-Laws, a proposed nomination must be received by the Secretary of the Company no later than April 1, 2022, must state the reasons for the proposed nomination and must contain the information required under the Company’s By-Laws, including the full name and address of the proposed nominee, a brief biographical background setting forth the nominee’s past and present directorships, principal employment and occupation and information as to stock ownership and certain arrangements regarding the Company’s common stock. A proposed nomination must also include a statement indicating that the proposed nominee has consented to being named in the proxy statement and to serve if elected.

Director independence

A majority of the members of the Board of Directors must be independent directors under the Company’s Corporate Governance Guidelines and applicable SEC and NYSE rules. The Nominating and Governance Committee and the Board of Directors review each director annually and make a determination concerning independence after consideration of all known facts and circumstances. The Board has established categorical standards to assist it in determining director independence. The Company’s “Categorical Standards for Determining Director Independence” include all of the elements of the applicable SEC and NYSE rules with respect to director independence.

Based on these categorical standards, its review of all relevant facts and information available, and the recommendations of the Nominating and Governance Committee, the Board, at its meeting in July 2021, affirmatively determined that no director has a material relationship with the Company that would impair the director’s ability to exercise independent judgment and, accordingly, that each director is an independent director, except for Mr. Storch and Mr. Holmes. The Board has also determined that Patrick J. Kelly and Ronald B. Woodard, who served as directors during Fiscal 2021 prior to their retirement following the 2020 annual meeting, were independent within the meaning of applicable independence standards.

The Board’s independence determinations consider the impact of Board service tenure on a director’s independence, particularly with respect to directors with 10 or more years of Board service. The Board concluded that all longer-tenured directors, based on their communications and interactions with management, their decisions and their adherence to their fiduciary duties to stockholders, have demonstrated their independence from management, except for Mr. Storch.

| Director independence |

| 10 of 12 |

| directors are independent |

|

Board composition and refreshment

The Company has added five new directors — H. John Gilbertson, Jr., John M. Holmes, Robert F. Leduc, Ellen M. Lord and Duncan J. McNabb — in the last five years as a part of its ongoing Board refreshment process. There are three director retirements upcoming in the next four years. The Board, therefore, will have the opportunity to continue to adjust its composition by seating a new generation of directors to lead the Company as it seeks to solidify and enhance its status in the aviation services markets.

In considering director candidates, the Board takes into account the skills, tenure and diversity of current directors to ensure that there is a proper balance between director stability and fresh perspectives in the boardroom.

As a part of this effort, the Board maintains a director matrix to ensure that the Board, as a whole, has the expertise, experience, diversity and skillset critical to the Company’s continued success.

Average tenure: 10.2 years |

|

2021 Proxy Statement |

23 |

Proposal 1 Election of directors

The Board’s role and responsibilities

Role and responsibilities of the Board

The Board of Directors is elected by the Company’s stockholders and represents their interests in overseeing the Company’s management, strategic direction and financial success. The Board exercises its oversight responsibilities directly and through its Committees.

The Board identified and gives particular attention to four “Critical Areas of Board Focus”.

|

1 Risk management (including COVID-19 response and cybersecurity) In light of COVID-19, and the impact it has had on the Company’s financial performance, the Board spent a significant amount of time in the first half of Fiscal 2021 considering and overseeing the Company’s COVID-19 response, and related risk mitigation plan. This included monitoring the Company’s response to COVID-19 in the workplace, as well as the Company’s financial response plan, including cash management and operational initiatives. In addition, the Board places significant emphasis on the identification and management of cybersecurity risks. The Board and Audit Committee receive regular reports from management on system vulnerabilities and security measures in effect to deter or mitigate breaches or hacking activities. The Company’s Annual Report on Form 10-K for Fiscal 2021 includes in Part I, “Item 1A, Risk Factors” a listing of the significant risks facing the Company. |

|

2 Strategic planning The Board monitors management’s performance in the execution of the Company’s strategy throughout the year. It receives regular updates from management at each meeting on strategic opportunities and risks that the Company is currently assessing or addressing, including through the oversight of management’s enterprise risk management program. |

|

3 Management

development, succession planning and diversity The annual review addresses the development and evaluation of current and potential senior leaders, and the development of short-term and longer-term succession plans for key positions, including a succession plan for the CEO position. The Board also has a CEO emergency succession planning process to address unanticipated events and emergency situations. The annual review also includes a diversity presentation that provides information on minority hiring and retention, the status of the Company’s diversity and inclusiveness programs, including outreach programs focused on increasing the employee applicant pool, particularly for women, minorities and veterans. The Board is focused on improving diversity at all levels of the Company, but particularly at the middle and senior management levels. In order to help facilitate the evaluation of diverse candidates, the Board adopted amended Corporate Governance Guidelines that mandate that a diverse candidate must be included in any director search. Similarly, management has adopted internal goals with respect to diverse hiring and supplier spend. In addition, management, with the Board’s oversight, recently published AAR’s inaugural ESG Report that further discusses AAR’s efforts in this regard. |

|

4 Company performance The Board regularly reviews and compares its corporate governance profile against its peer group companies, competitors and market indices and is committed to engaging with and listening to its various stakeholders. As an example, in response to investor feedback, the Company terminated its Rights Agreement in October 2020, prior to its expiration date. |

| 24 |

|

Proposal 1 Election of directors

Role and responsibilities of the Board committees

The Board has an Audit Committee, a Compensation Committee, a Nominating and Governance Committee, an Aviation and Safety Committee, and an Executive Committee. The following table outlines the risk oversight and general responsibilities of the Board committees as well the composition of such committees during Fiscal 2021:

Nominating and governance committee

James E. Goodwin Members |

Role and responsibilities The Nominating and Governance Committee acts under a written charter adopted by the Board of Directors. The charter was last reviewed and approved by the Nominating and Governance Committee and the Board of Directors at their July 2021 meetings. The full text of the Nominating and Governance Committee charter appears on the Company’s website at www.aarcorp.com/investor-relations/corporate-governance and is available in print to any stockholder upon written request to the Secretary of the Company at the Company’s address listed on the first page of this proxy statement. The Nominating and Governance Committee is responsible for both nominating and governance matters as described in its charter. The Nominating and Governance Committee performs the specific functions described in its charter, including: ●Oversees the composition, structure and evaluation of the Board and its committees;

●Conducts, together with the Compensation Committee, an annual performance evaluation of the Chief Executive Officer;

●Reviews, considers, and acts upon related person transactions;

●Reviews succession plans for the Chief Executive Officer and Chief Financial Officer and recommends individuals to fill these positions;

●Assesses the Company’s corporate responsibility strategy, practices and policies, including public issues of significance which affect investors and other key stakeholders and, if appropriate, make recommendations to the Board concerning the same;

●Develops and recommends Corporate Governance Guidelines for Board approval; and

●Monitors and screens directors for independence and recommends to the Board qualified candidates for election as directors and to serve on Board committees.

The Nominating and Governance Committee held five meetings during Fiscal 2021. Key risk oversight responsibilities

●Corporate governance

●Board and committee membership

●Succession planning

●Diversity

●Board, committee and CEO effectiveness

●Related person transactions

The Nominating and Governance Committee oversees and reports to the Board on corporate governance risks, including Board and committee membership, director independence and related person transactions. It makes recommendations to the full Board on succession planning at the Chief Executive Officer and senior executive level and the annual evaluation of the performance of the Board of Directors. |

|

2021 Proxy Statement |

25 |

Proposal 1 Election of directors

Compensation committee

H.

John Gilbertson, Jr. Members |

Role and

responsibilities The Compensation Committee acts under a written charter adopted by the Board of Directors. The charter was last reviewed and approved by the Compensation Committee and the Board of Directors at their July 2021 meetings. The full text of the Compensation Committee charter appears on the Company’s website at www.aarcorp.com/investor-relations/corporate-governance and is available in print to any stockholder upon written request to the Secretary of the Company at the Company’s address listed on the first page of this proxy statement. The Compensation Committee is primarily concerned with establishing, reviewing and approving Chief Executive Officer compensation, reviewing and approving other senior executive compensation and overseeing the Company’s stock plans and other executive compensation and employee benefit plans. The Compensation Committee performs the specific functions described in its charter, including: ●Sets the compensation of the Chief Executive Officer and,

together with the Nominating and Governance Committee, conducts an annual performance review of the

Chief Executive Officer;

●Reviews and approves compensation policies and practices for

all elected corporate officers, including named executive officers;

●Administers the Company’s annual cash bonus plan and the

long-term incentive stock plan, and reviews and monitors awards under such plans, including, if

desired, by delegating to the Chief Executive Officer in his capacity as a director of the Company

the authority to grant to persons other than himself stock-based awards under incentive

compensation and stock plans of up to an aggregate of 50,000 shares in any one fiscal year and in

accordance with the terms of such plans;

●Recommends director compensation and benefits to the Board for

approval; and

●Oversees administration of certain other employee benefit,

director deferred compensation, savings and retirement plans.

The Compensation Committee held six meetings during Fiscal 2021. Information about the roles of the Committee’s independent compensation consultant and management in the executive compensation process is set forth under “Executive Compensation — Compensation Discussion and Analysis.” Key risk oversight responsibilities ●Target-setting under annual cash bonus programs

●Target-setting under performance share programs

●Compensation policies and

practices

●Impact of performance-based compensation on

risk-taking by management

●Compensation consultant independence

●Executive employment

agreements

The Compensation Committee oversees and reports to the Board on the Company’s cash bonus programs and stock-based compensation to be sure that they are appropriately structured to incentivize officers and key employees while avoiding unnecessary or excessive risk-taking. |

| 26 |

|

Proposal 1 Election of directors

Audit committee

Marc

J. Walfish Members |

Role and

responsibilities The Audit Committee acts under a written charter adopted by the Board of Directors. The charter was last reviewed and approved by the Audit Committee and the Board of Directors at their July 2021 meetings. The full text of the Audit Committee charter appears on the Company’s website at www.aarcorp.com/ investor-relations/corporate-governance and is available in print to any stockholder upon written request to the Secretary of the Company at the Company’s address listed on the first page of this proxy statement. The Audit Committee’s primary responsibility is to assist the Board of Directors in fulfilling its duty to stockholders to oversee and review: the quality and integrity of the Company’s financial statements and internal controls over financial reporting; the qualifications, independence and performance of the Company’s independent registered public accounting firm; and the performance of the Company’s Internal Audit function. The Audit Committee performs the specific functions described in its charter, including: ●Approves and engages the independent registered public

accounting firm that audits the Company’s consolidated financial

statements;

●Pre-approves all non-audit and audit-related services

furnished by the independent registered public accounting firm;

●Maintains communication between the Board and the independent

registered public accounting firm;

●Monitors the qualifications, independence and performance of

the independent registered public accounting firm;

●Oversees and reviews the Company’s financial reporting

processes and practices;

●Oversees and reviews the quality and adequacy of internal

controls over financial reporting, disclosure controls and the organization and performance of the

Company’s internal audit department;

●Reviews the scope and results of audits;

●Oversees the Company’s enterprise risk management

program; and

●Meets with the independent registered public accounting firm

representatives and internal audit department representatives without members of management

present.

The Audit Committee held six meetings during Fiscal 2021. Key risk oversight responsibilities ●Risk assessment and risk management practices

●Financial reporting and investor disclosure

●Accounting and auditing

●Quality and adequacy of processes and internal

controls

●Cybersecurity risk

●Ethics Hotline

●Oversight of enterprise risk management

program

The Audit Committee reviews and assesses management’s processes for managing risks relating to accounting, financial reporting, investment, tax and legal compliance, risks identified by the Company’s internal and external auditors, and matters raised through the Company’s Ethics Hotline. The Audit Committee oversees the enterprise risk management process, which is led by the Company’s internal audit department and includes developing and implementing risk mitigation strategies, overseeing the effectiveness of the risk mitigation strategies and reporting to the Audit Committee. The results of the Company’s enterprise risk management process are reported to the Audit Committee to review and discuss the Company’s principal risks and outline its risk mitigation approach for addressing these risks. |

|

2021 Proxy Statement |

27 |

Proposal 1 Election of directors

Aviation safety and training committee

Duncan J. McNabb Members |

Role and

responsibilities The Aviation Safety and Training Committee was formed in December 2020 and acts under a written charter adopted by the Board of Directors. The charter was last reviewed and approved by the Aviation Safety and Training Committee and the Board of Directors at their July 2021 meetings. The full text of the Aviation Safety and Training Committee charter appears on the Company’s website at www.aarcorp.com/investor-relations/corporate-governance and is available in print to any stockholder upon written request to the Secretary of the Company at the Company’s address listed on the first page of this proxy statement. The Aviation Safety and Training Committee assists the Board in the oversight of aviation safety matters relating to the Company’s operations as described in its charter. The Aviation Safety and Training Committee performs the specific functions described in its charter, including: ●Monitors policies and processes relating to the delivery of

services and products in a manner to promote safety;

●Monitors efforts to ensure the safety of employees and create

a culture of safety compliance; and

●Periodically reviews all aspects of aviation safety as it may

affect business operations including, without limitation:

○The Federal Aviation Administration’s Voluntary

Disclosure Reporting Program;

○Regulatory findings and corrective

actions;

○Safety training and programs; and

○The Company’s safety management system and reporting of

injury/lost time and aircraft damage/accidents, and any response thereto.

The Aviation and Safety Training Committee held three meetings during Fiscal 2021. Key risk oversight responsibilities ●Safety compliance

●Reporting practices

●Training programs

The Aviation Safety and Training Committee oversees and reports to the Board on aviation safety-related risks. |

| 28 |

|

Proposal 1 Election of directors

Executive committee

David

P. Storch Members |

Role and

responsibilities The Executive Committee is authorized to meet between meetings of the Board of Directors and exercise certain powers of the Board with respect to urgent matters or other matters referred to it by the Board for deliberation or action, subject to limitations imposed by the Committee’s charter, the Board, applicable law and the Company’s By-Laws. The Executive Committee met once during Fiscal 2021. |

Board, management and employee interaction

The Board and its committees receive information from, and have regular access to, individual members of management responsible for managing risk, including the Company’s President and Chief Executive Officer, the Chief Financial Officer, the Controller and Chief Accounting Officer, the General Counsel, the Internal Auditor, the Chief Compliance Officer and the business group leaders.

The directors, when possible, also meet each quarter with a broader group of the Company’s employees at regularly scheduled Board dinners and in other informal settings to learn more about the Company’s businesses, employees and culture. The Board also periodically holds meetings at a Company facility other than the corporate headquarters to promote interaction with local management and employees and allow directors a first-hand opportunity to inspect and better understand the Company’s business operations. Due to the COVID-19 pandemic, all meetings during Fiscal 2021 were held virtually.

Executive sessions

The independent directors of the Board meet in executive session without management as part of each regular Board meeting and otherwise when circumstances make it advisable or necessary. The independent directors also hold meetings with and without the Chairman of the Board. The Lead Director presides at all executive sessions of the independent directors. The independent directors met separately as a group on four occasions in Fiscal 2021.

Board leadership

The Board of Directors determines the appropriate leadership structure for the Board and the Company consistent with the best interests of stockholders. The leadership structure is intended to promote strong oversight, encourage open and independent viewpoints and contribute to the long-term success of the Company and the effective performance of the Board. The Board regularly reviews the Company’s leadership structure.

Effective June 1, 2018, the Board approved the separation of the Chairman of the Board and Chief Executive Officer roles, appointing David P. Storch as Chairman of the Board and electing John M. Holmes as Chief Executive Officer of the Company. The Board believes that this is the most effective leadership structure for the Company at this time, but reserves the right to make future changes in the best interests of stockholders.

|

2021 Proxy Statement |

29 |