Use these links to rapidly review the document

TABLE OF CONTENTS

PART IV

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| ý | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

For the fiscal year ended May 31, 2015 or |

||

o |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

For the transition period from to

Commission file number 1-6263

AAR CORP.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

36-2334820 (I.R.S. Employer Identification No.) |

One AAR Place, 1100 N. Wood Dale Road, Wood Dale, Illinois 60191

(Address of principal executive offices, including zip code)

Registrant's telephone number, including area code: (630) 227-2000

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

| Common Stock, $1.00 par value | New York Stock Exchange Chicago Stock Exchange |

|

| Common Stock Purchase Rights | New York Stock Exchange Chicago Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.(Check one):

| Large accelerated filer ý | Accelerated filer o | Non-Accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No ý

The aggregate market value of the registrant's voting stock held by nonaffiliates was approximately $962 million (based upon the closing price of the Common Stock at November 28, 2014 as reported on the New York Stock Exchange).

On June 30, 2015, there were 35,366,407 shares of Common Stock outstanding.

Documents Incorporated by Reference

Portions of the Company's proxy statement for the Company's 2015 Annual Meeting of Stockholders, to be held October 13, 2015, are incorporated by reference in Part III of this report.

1

ITEM 1. BUSINESS

(Dollars in millions)

General

AAR CORP. and its subsidiaries are referred to herein collectively as "AAR," "Company," "we," "us," and "our" unless the context indicates otherwise. AAR was founded in 1951, organized in 1955 and reincorporated in Delaware in 1966. We are a diversified provider of products and services to the worldwide aviation and government and defense markets.

Upon completing our annual strategic review process and assessing our markets, we entered fiscal 2015 with a mission to narrow our focus, excel as an independent services provider to the global commercial aviation and government and defense markets, strengthen our balance sheet, and improve shareholder return. The comprehensive plan included exploring selling certain manufacturing businesses and as the year progressed included a review of our underperforming product lines and inventories in our services businesses to determine which product areas to focus on going forward. The first phase of this transformation included the sale of the Telair Cargo Group for $725 million in the fourth quarter of fiscal 2015 which resulted in a pre-tax gain (net of transaction expenses and fees) of $198.6 million. The gain excludes $35 million of contingent consideration which could be realized prior to December 31, 2015. Our plans further called for us to sell our Precision Systems Manufacturing ("PSM") business, comprised of our metal and composite machined and fabricated parts manufacturing operations. During fiscal 2015, we recognized total impairment charges of $57.5 million to reduce the carrying value of PSM's net assets to their expected value at time of sale.

The product lines and inventories identified as underperforming or not part of our strategy going forward in our services businesses included certain aircraft in our aircraft lease portfolio, inventory and rotable assets in our supply chain and maintenance, repair and overhaul ("MRO") operations, and certain aircraft and inventory in our expeditionary airlift business. We recognized $71.4 million in impairment charges and other losses in fiscal 2015 from these actions while at the same time generating approximately $57.1 million of cash.

By executing this plan, we strengthened our balance sheet and returned capital to shareholders. Using the proceeds from the sale of the Telair Cargo Group and other assets, we reduced our total debt from $634.0 million at May 31, 2014 to $154.0 million at May 31, 2015. Taking into consideration cash on hand, our net debt position at May 31, 2015 is $99.3 million. In addition, we acquired 4,682,620 of our common shares during fiscal 2015 for an aggregate cost of $151.5 million, and paid $12.5 million in dividends.

As we enter fiscal 2016, we find ourselves in a strong financial position to build out our strategy as a best in class aviation and expeditionary services company. Our cash on hand plus unused capacity on our Credit Agreement is $490 million at May 31, 2015. We expect to invest opportunistically in expanding our comprehensive suite of services to the global commercial aviation and government and defense markets.

Prior to the third quarter of fiscal 2015, we reported our activities in the following two business segments: Aviation Services comprised of our supply chain, MRO, and airlift activities and Technology Products comprised of our Telair Cargo Group, Precision Systems Manufacturing, and mobility businesses.

With the decisions to sell Telair Cargo Group and PSM in the third quarter of fiscal 2015, we reported those businesses as discontinued operations for all periods presented. We also revised our reportable segments to align to our new organizational structure. We now report our results in two new segments: Aviation Services, comprised of supply chain and MRO activities and Expeditionary Services, comprised of airlift and mobility activities. This new presentation reflects the way our chief operating decision making officer (Chief Executive Officer) now evaluates performance and our internal organizational and management structure.

2

Business Segments

Aviation Services

The Aviation Services segment provides aftermarket support and services for the commercial aviation and government and defense markets and accounted for 83%, 72%, and 69% of our sales in fiscal 2015, 2014, and 2013, respectively. In this segment, we also provide inventory management and distribution services, MRO, and engineering services. Business activities in this segment are primarily conducted through AAR Parts Trading, Inc.; AAR Aircraft & Engine Sales & Leasing, Inc.; AAR Aircraft Services, Inc.; AAR Allen Services, Inc. (a wholly-owned subsidiary of AAR Parts Trading, Inc.); AAR Landing Gear LLC; and AAR International, Inc.

We sell and lease a wide variety of new, overhauled and repaired engine and airframe parts and components to our commercial aviation and government/defense customers.

We provide customized inventory supply and management, warranty claim management, and outsourcing programs for engine and airframe parts and components in support of our airline and government customers' maintenance activities. The types of services provided under these programs include material planning, sourcing, logistics, information and program management, and parts and component repair and overhaul. We are also an authorized distributor for more than 60 leading aviation product manufacturers.

We also provide customized performance-based logistics programs in support of the U.S. Department of Defense ("DoD") and foreign governments. The types of services provided under these programs include material planning, sourcing, logistics, information and program management, airframe maintenance and maintenance planning, and component repair and overhaul.

We provide major airframe maintenance inspection and overhaul, painting services, line maintenance, airframe modifications, structural repairs, avionic service and installation, exterior and interior refurbishment, and engineering services and support for many types of commercial and military aircraft. We also repair and overhaul landing gears, wheels, and brakes for commercial and military aircraft.

We operate six airframe maintenance facilities and one landing gear overhaul facility. Our landing gear overhaul facility is in Miami, Florida, where we repair and overhaul landing gear, wheels, brakes, and actuators for different types of commercial and military aircraft. Our airframe maintenance facilities are in Indianapolis, Indiana; Oklahoma City, Oklahoma; Duluth, Minnesota; Miami, Florida; and Lake Charles, Louisiana. During fiscal 2015, we also operated a regional aircraft maintenance facility in Hot Springs, Arkansas. On June 24, 2015, we announced our plan to close this facility and transfer its operations to our Oklahoma City facility. We expect to incur approximately $1.5 million of exit-related costs in fiscal 2016 comprised of severance, relocation, lease termination fees and other exit costs.

Activities in our Aviation Services segment also include the sale and lease of used commercial aircraft. Each sale or lease is negotiated as a separate agreement which includes term, price, representations, warranties, and lease return provisions. During fiscal 2015, we sold our last two remaining wholly-owned aircraft and one aircraft owned with joint venture partners. At May 31, 2015, our remaining portfolio consisted of three aircraft owned through joint ventures.

The majority of our sales are made pursuant to standard commercial purchase orders. U.S. government sales are generally made under standard types of government contracts, including definite contracts which call for the performance of specified services or the delivery of specified products and ID/IQ (i.e., indefinite delivery/indefinite quantity) contracts. Certain inventory supply and management and performance-based logistics program agreements reflect negotiated terms and conditions.

To support activities within the Aviation Services segment, we acquire aviation parts and components from domestic and foreign airlines, independent aviation service companies, aircraft leasing companies,

3

and original equipment manufacturers ("OEM"s). We have ongoing arrangements with OEMs that provide us access to parts, repair manuals, and service bulletins in support of parts manufactured by them. Although the terms of each arrangement vary, they typically are made on standard OEM terms as to duration, price, and delivery. From time to time, we purchase engines for disassembly into individual parts and components. These engines may be leased to airlines on a short-term basis prior to disassembly.

Expeditionary Services

The Expeditionary Services segment consists of businesses that provide products and services supporting the movement of equipment and personnel by the DoD, foreign governments and non-governmental organizations. The Expeditionary Services segment accounted for 17%, 28%, and 31% of our sales in fiscal 2015, 2014, and 2013, respectively. Business activities in this segment are primarily conducted through AAR Airlift Group, Inc.; AAR Manufacturing, Inc. and Brown International Corporation (a wholly-owned subsidiary of AAR Manufacturing, Inc.).

We provide expeditionary airlift services to the United States and other government customers. Our expeditionary airlift services provide fixed- and rotary-wing flight operations, transporting personnel and cargo principally in support of the DoD. We operate and maintain a fleet of special mission customized fixed- and rotary-wing aircraft, principally in Afghanistan, Iraq, Northern Africa, and Western Pacific regions. We hold FAR Part 133 and 135 certificates to operate aircraft and a FAR Part 145 certificate to operate a repair station. We are also Commercial Airlift Review Board certified with the DoD.

We design, manufacture, and repair transportation pallets, and a wide variety of containers and shelters used in support of military and humanitarian tactical deployment activities. The containers and shelters are used in numerous mission requirements, including armories, supply and parts storage, refrigeration systems, tactical operation centers, briefing rooms, laundry and kitchen facilities, water treatment, and sleeping quarters. Shelters include both stationary and vehicle-mounted applications.

We also provide engineering, design, and system integration services for specialized command and control systems.

Sales in this segment are made to customers pursuant to standard commercial purchase orders and contracts. U.S. government sales are generally made under standard types of government contracts, including definite contracts which call for the performance of specified services or the delivery of specified products and ID/IQ (i.e., indefinite delivery/indefinite quantity) contracts. The majority of our products and services are procured via definite contracts. We purchase raw materials for this segment, including steel, aluminum, extrusions, and other necessary supplies from several vendors.

Raw Materials

Although we generated 56% of our fiscal 2015 sales from products, our businesses are generally engaged in only limited manufacturing activities and have minimal exposure to fluctuations in both the availability and pricing for raw materials. Where necessary, we have been able to obtain raw materials and other inventory items from numerous sources for each segment at competitive prices, terms, and conditions; we expect to be able to continue to do so.

Terms of Sale

We generally sell our products under standard 30-day payment terms. On occasion, certain customers, principally foreign customers, will negotiate extended payment terms of 60-90 days. Except for customary warranty provisions, customers neither have the right to return products nor do they have the right to extended financing. Our contracts with the DoD and its contractors and other governmental agencies are typically firm agreements to provide products and services at a fixed price or on a time and material basis,

4

and have a term of one year or less, frequently subject to extension for one or more additional periods of one year at the option of the government customer.

Customers

We primarily market and sell products and services through our own employees. In certain markets outside of the United States, we rely on foreign sales agents to assist in the sale of our products and services.

The principal customers for our products and services in the Aviation Services segment are domestic and foreign commercial airlines, domestic and foreign freight airlines, regional and commuter airlines, business and general aviation operators, OEMs, aircraft leasing companies, aftermarket aviation support companies, the DoD and its contractors, and foreign military organizations or governments. In the Expeditionary Services segment, our principal customers include the DoD and its contractors and foreign governmental and defense organizations.

Sales of aviation products and services to our commercial airline customers are generally affected by such factors as the number, type and average age of aircraft in service, the levels of aircraft utilization (e.g., frequency of schedules), the number of airline operators, the general economy, and the level of sales of new and used aircraft. Sales to the DoD and other government agencies are subject to a number of factors, including the level of troop deployment worldwide, government funding, competitive bidding, and requirements generated by worldwide geopolitical events.

Sales to Government and Defense Customers

Sales to global government and defense customers (including sales to branches, agencies, and departments of the U.S. government) were $589.8 million (37.0% of consolidated sales), $777.5 million (45.4% of consolidated sales) and $808.0 million (44.7% of consolidated sales) in fiscal 2015, 2014 and 2013, respectively. Sales to branches, agencies, and departments of the U.S. government and their contractors were $493.1 million (30.9% of consolidated sales), $661.7 million (38.7% of consolidated sales), and $733.7 million (40.6% of consolidated sales) in fiscal 2015, 2014, and 2013, respectively. Sales to government and defense customers are reported in each of our reportable segments (See Note 13 of Notes to Consolidated Financial Statements). Since such sales are subject to competitive bidding and government funding, no assurance can be given that such sales will continue at levels previously experienced. The majority of our U.S. government contracts are for products and services supporting the DoD logistics and mobility strategy, as well as for expeditionary airlift services. Thus, our government contracts have changed, and may continue to change, with fluctuations in defense and other governmental agency spending. Our government contracts are also subject to termination by the customer; in the event of such a termination we would be entitled to recover all allowable costs incurred by us through the date of termination.

Government Regulation and Certificates

The Federal Aviation Administration ("FAA") regulates the manufacture, repair, distribution, and operation of all aircraft and aircraft parts operated in the United States. Similar rules and regulatory authorities exist in other countries. The inspection, maintenance and repair procedures for the various types of aircraft and equipment are prescribed by these regulatory authorities and can be performed only by certified repair facilities utilizing certified technicians. The FAA requires that various maintenance routines be performed on aircraft engines, certain engine parts, and airframes at regular intervals based on cycles or flight time. Our businesses which sell defense products and services directly to the U.S. government or through its contractors can be subject to various laws and regulations governing pricing and other factors.

5

We have 13 FAA certificated repair stations in the United States and Europe. Of the 13 certificated FAA repair stations, seven are also European Aviation Safety Agency ("EASA") certificated repair stations. Such certificates, which are ongoing in duration, are required for us to perform authorized maintenance, repair and overhaul services for our customers and are subject to revocation by the government for non-compliance with applicable regulations. Of the 13 FAA certificated repair stations, 12 are in the Aviation Services segment and one is in the Expeditionary Services segment. The seven EASA certificated repair stations are in the Aviation Services segment. We also hold FAR Part 133 and 135 certificates to operate aircraft in our Expeditionary Services segment. We are also Commercial Airlift Review Board certified with the DoD. We believe that we possess all licenses and certifications that are material to the conduct of our business. During fiscal 2015, we operated a regional aircraft maintenance facility in Hot Springs, Arkansas. On June 24, 2015, we announced our plan to close this facility and transfer its operations to our Oklahoma City facility. Once this facility is closed, we will have 12 FAA certificated repair stations.

Competition

Competition in each of our markets is based on quality, ability to provide a broad range of products and services, speed of delivery, and price. Competitors in our Aviation Services segment include OEMs, the service divisions of large commercial airlines, and other independent suppliers of parts, repair, and overhaul services to the commercial and defense markets. Our Expeditionary Services segment competes with domestic and foreign contracting companies and a number of divisions of large corporations and other large and small companies. Although certain of our competitors have substantially greater financial and other resources than we do, we believe that we have maintained a satisfactory competitive position through our responsiveness to customer needs, our attention to quality, and our unique combination of market expertise and technical and financial capabilities.

Backlog

Backlog represents the amount of revenue that we expect to derive from unshipped orders or signed contracts. At May 31, 2015, backlog was approximately $950.6 million compared to $811.7 million at May 31, 2014. Approximately $450.7 million of our May 31, 2015 backlog is expected to be filled within the next 12 months.

Employees

At May 31, 2015, we employed approximately 4,850 employees worldwide, of which approximately 150 employees are subject to a collective bargaining agreement. We also retain approximately 900 contract workers, the majority of whom are located at our airframe maintenance facilities.

Available Information

For additional information concerning our business segments, see Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business Segment Information" in Note 13 of Notes to Consolidated Financial Statements under Item 8, "Financial Statements and Supplementary Data."

Our internet address is www.aarcorp.com. We make available free of charge through our web site our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission. Information contained on our web site is not a part of this report.

6

The following is a description of the principal risks inherent in our business.

We are affected by factors that adversely impact the commercial aviation industry.

As a provider of products and services to the commercial aviation industry, we are greatly affected by overall economic conditions of that industry. The commercial aviation industry is historically cyclical and has been negatively affected in the past by geopolitical events, high fuel and oil prices, lack of capital, and weak economic conditions. In addition, as a result of these and other events, from time to time certain of our customers have filed for bankruptcy protection or ceased operation. The impact of instability in the global financial markets may lead airlines to reduce domestic or international capacity. In addition, certain of our airline customers have in the past been impacted by tight credit markets, which limited their ability to buy parts, services, engines, and aircraft.

A reduction in the operating fleet of aircraft both in the U.S. and abroad will result in reduced demand for parts support and maintenance activities for the type of aircraft affected. Further, tight credit conditions negatively impact the amount of liquidity available to buy parts, services, engines, and aircraft. A deteriorating airline environment may also result in additional airline bankruptcies, and in such circumstances we may not be able to fully collect outstanding accounts receivable. Reduced demand from customers caused by weak economic conditions, including tight credit conditions and customer bankruptcies, may adversely impact our financial condition or results of operations.

Our business, financial condition, results of operations, and growth rates may be adversely affected by these and other events that impact the aviation industry, including the following:

- •

- deterioration in the financial condition of our existing and potential customers;

- •

- reductions in the need for, or the deferral of, aircraft maintenance and repair services and spare parts support;

- •

- retirement of older generation aircraft, resulting in lower prices for spare parts and services for those aircraft;

- •

- reductions in demand for used aircraft and engines;

- •

- increased in-house maintenance by airlines;

- •

- lack of parts in the marketplace;

- •

- future terrorist attacks and the ongoing war on terrorism;

- •

- future outbreaks of infectious diseases; and

- •

- acts of God.

Our U.S. government contracts may not continue at present sales levels, which may have a material adverse effect on our financial condition and results of operations.

Our sales to branches, agencies and departments of the U.S. government and their contractors were $493.1 million (30.9% of consolidated sales) in fiscal 2015 (See Note 13 of Notes to Consolidated Financial Statements). The majority of our U.S. government contracts is for products and services supporting DoD logistics and mobility strategy, as well as for expeditionary airlift services and is, therefore, subject to changes in defense and other governmental agency funding and spending. Our contracts with the U.S. government, including the DoD and its contractors, are typically agreements to provide products and services at a fixed price and have a term of one year or less, frequently subject to extension for one or more additional periods of one year at the option of the government customer. Sales to agencies of the U.S. government and their contractors are subject to a number of factors, including the level of troop

7

deployment worldwide, competitive bidding, U.S. government funding, requirements generated by world events, and budgetary constraints.

Defense funding continues to face pressure due to U.S. budget deficit challenges. Congress enacted the Budget Control Act of 2011 ("Budget Act"), which reduced defense spending by a minimum of $487 billion over a ten-year period that began in the government's fiscal year 2012. The Budget Act also provided that the defense budget would face "sequestration" cuts of up to an additional $500 billion during that same period to the extent that discretionary spending limits are exceeded. The impact of sequestration cuts was reduced with respect to the government's fiscal years 2014 and 2015 following the enactment of The Bipartisan Budget Act in December 2013. However, significant uncertainty remains with respect to overall levels of defense spending and it is likely that U.S. government discretionary spending levels will continue to be constrained, including risk of future sequestration cuts.

Future congressional appropriation and authorization of defense spending and the application of sequestration remain marked by significant debate and an uncertain schedule. The federal debt limit continues to be actively debated as plans for long-term national fiscal policy are discussed. The outcome of these debates could have a significant impact on defense spending broadly and programs we support in particular.

If the existing federal debt limit is not raised, we may be required to continue to perform for some period of time on certain of our U.S. government contracts even if the U.S. government is unable to make timely payments. Future budget cuts, including cuts mandated by sequestration, or future procurement decisions could result in reductions, cancellations, and/or delays of existing contracts or programs which could adversely affect our results of operations and financial condition.

We face risks of cost overruns and losses on fixed-price contracts.

We sell certain of our products and services to our commercial, government, and defense customers under firm contracts providing for fixed unit prices, regardless of costs incurred by us. The cost of producing products or providing services may be adversely affected by increases in the cost of labor, materials, fuel, overhead, and other unknown variants, including manufacturing and other operational inefficiencies and differences between assumptions used by us to price a contract and actual results. Increased costs may result in cost overruns and losses on such contracts, which could adversely affect our results of operations and financial condition.

Success at our airframe maintenance facilities is dependent upon continued outsourcing by the airlines.

We currently perform airframe maintenance, repair and overhaul activities at six leased facilities one of which is in the process of being closed. Revenues at these facilities fluctuate based on demand for maintenance which, in turn, is driven by the number of aircraft operating and the extent of outsourcing of maintenance activities by airlines. In addition, certain airlines operate certain new fleet types and/or newer generation aircraft and we may not have contractual arrangements to service these aircraft nor technicians trained and certified to perform the required airframe maintenance, repair and overhaul activities. If either the number of aircraft operating or the level of outsourcing of maintenance activities declines, we may not be able to execute our operational and financial plans at our maintenance, repair and overhaul facilities, which could adversely affect our results of operations and financial condition.

We operate in highly competitive markets, and competitive pressures may adversely affect us.

The markets for our products and services to our commercial, government, and defense customers are highly competitive, and we face competition from a number of sources, both domestic and international. Our competitors include aircraft manufacturers, aircraft component and parts manufacturers, airline and aircraft service companies, other companies providing maintenance, repair and overhaul services, other aircraft spare parts distributors and redistributors, and other expeditionary airlift service providers. Some

8

of our competitors have substantially greater financial and other resources than we have and others may price their products and services below our selling prices. We believe that our ability to compete depends on superior customer service and support, on-time delivery, sufficient inventory availability, competitive pricing and effective quality assurance programs.

Our government customers, including the DoD, may turn to commercial contractors, rather than traditional defense contractors, for certain work, or may utilize small business contractors or determine to source work internally rather than use us. We are also impacted by bid protests from unsuccessful bidders on new program awards. Bid protests could result in significant expense for us, contract modifications, or the award decision being overturned and loss of the contract award. Even where a bid protest does not result in the loss of an award, the resolution can extend the time until the contract activity can begin, and delay earnings. These competitive pressures, with potential impacts on both our commercial and government business, could adversely affect our results of operations and financial condition.

We are subject to significant government regulation and may need to incur significant expenses to comply with new or more stringent governmental regulation.

The aviation industry is highly regulated by the FAA in the United States and equivalent regulatory agencies in other countries. Before we sell any of our products that are to be installed in an aircraft, such as engines, engine parts and components, and airframe and accessory parts and components, they must meet certain standards of airworthiness established by the FAA or the equivalent regulatory agencies in certain other countries. We operate repair stations that are licensed by the FAA and the equivalent regulatory agencies in certain other countries, and hold certificates to operate aircraft. Specific regulations vary from country to country, although regulatory requirements in other countries are generally satisfied by compliance with FAA requirements. New and more stringent governmental regulations may be adopted in the future that, if enacted, may have an adverse impact on us.

If any of our material licenses, certificates, authorizations, or approvals were revoked or suspended by the FAA or equivalent regulatory agencies in other countries, our results of operations and financial condition may be adversely affected.

If we fail to comply with government procurement laws and regulations, we could lose business and be liable for various penalties or sanctions.

We must comply with laws and regulations relating to the formation, administration, and performance of U.S. government contracts. These laws and regulations include the Federal Acquisition Regulations, Defense Federal Acquisition Regulations, the Truth in Negotiations Act, Cost Accounting Standards, and laws, regulations, and orders restricting the use and dissemination of classified information under the U.S. export control laws and the export of certain products and technical information. Certain government contracts provide audit rights by government agencies, including with respect to performance, costs, internal controls and compliance with applicable laws and regulations. In complying with these laws and regulations, we may incur significant costs, and non-compliance may result in the imposition of fines and penalties, including contractual damages. If we fail to comply with these laws and regulations or if a government audit, review, or investigation uncovers improper or illegal activities, we may be subject to civil penalties, criminal penalties, or administrative sanctions, including debarment from contracting with the U.S. government. Our reputation could suffer harm if allegations of impropriety were made against us, which could adversely affect our operating performance and may result in additional expenses and possible loss of revenue.

9

A significant portion of our expeditionary airlift revenue is derived from providing expeditionary airlift services in Afghanistan.

Our expeditionary airlift business derives a significant portion of its revenue from providing expeditionary airlift services in Afghanistan for the DoD. The U.S. has been reducing military activities in Afghanistan and began calendar year 2015 with approximately 10,000 military personnel in Afghanistan. The U.S. government previously announced plans to reduce the number of troops in Afghanistan by approximately half before the end of calendar year 2016. Recent indications are that the reduction in troops may be slower than previously communicated. Our expeditionary airlift services revenue will likely experience further declines as troop reductions occur in Afghanistan.

We are bidding on expeditionary airlift contracts in other regions supporting both DoD and non-DoD customers, although there can be no assurance we will be awarded any of these contracts. Although we expect ongoing demand for expeditionary airlift services in Afghanistan and other regions from the DoD and other governmental departments, we are exposed to the risk that our expeditionary airlift revenues may further decline if contracts are not renewed, renewed only in part, or are terminated, which could adversely affect our results of operations and financial condition. If we are unable to successfully redeploy aircraft not actively supporting current customers at favorable rates or sell them on favorable terms, it could have a material adverse effect on our business, results of operations and financial condition.

U.S. government contractors that provide support services in theaters of conflict such as Afghanistan have come under increasing scrutiny by agency inspectors general, government auditors and congressional committees. Investigations pursued by any or all of these groups may result in adverse publicity for us and reputational harm, regardless of the underlying merit of the allegations being investigated.

We are exposed to risks associated with operating internationally.

We conduct our business in certain foreign countries, some of which are politically unstable or subject to military or civil conflicts. Consequently, we are subject to a variety of risks that are specific to international operations, including the following:

- •

- military conflicts, civil strife, and political risks;

- •

- export regulations that could erode profit margins or restrict exports;

- •

- compliance with the U.S. Foreign Corrupt Practices Act, UK Anti-bribery Act, and other anti-bribery laws;

- •

- the burden and cost of compliance with foreign laws, treaties, and technical standards and changes in those regulations;

- •

- contract award and funding delays;

- •

- potential restrictions on transfers of funds;

- •

- import and export duties and value added taxes;

- •

- foreign exchange risk;

- •

- transportation delays and interruptions; and

- •

- uncertainties arising from foreign local business practices and cultural considerations.

While we have adopted and will continue to adopt measures to reduce the potential impact of losses resulting from the risks of doing business internationally, we cannot ensure that such measures will be adequate or that the regions in which we operate will continue to be stable enough to allow us to operate profitably or at all.

10

Acquisitions expose us to risks, including the risk that we may be unable to effectively integrate acquired businesses.

We explore and have discussions with third parties regarding acquisitions on a regular basis. Acquisitions involve risks, including difficulties in integrating the operations and personnel, the effects of amortization of any acquired intangible assets and the potential impairment of goodwill, and the potential loss of key employees of the acquired business. In addition, acquisitions often require substantial management resources and have the potential to divert our attention from our existing business. For any businesses we may acquire in the future, we may not be able to execute our operational, financial, or integration plans for the acquired businesses, which could adversely affect our results of operations and financial condition.

Market values for our aviation products fluctuate, and we may be unable to re-lease or sell aircraft and engines when their current lease expires.

We use a number of assumptions when determining the recoverability of inventories, aircraft, and engines, which are on lease or available for lease. These assumptions include historical sales trends, current and expected usage trends, replacement values, current and expected lease rates, residual values, future demand, and future cash flows. Reductions in demand for our inventories or declining market values, as well as differences between actual results and the assumptions utilized by us when determining the recoverability of our inventories, aircraft, and engines, could result in impairment charges in future periods, which would adversely affect our results of operations and financial condition.

We lease aircraft and engines to our customers on an operating lease basis. Our ability to re-lease or sell these assets on acceptable terms when the lease expires is subject to a number of factors which drive industry capacity, including new aircraft deliveries, availability of used aircraft and engines in the marketplace, competition, financial condition of our customers, overall health of the airline industry, and general economic conditions. Our inability to re-lease or sell aircraft and engines could adversely affect our results of operations and financial condition.

We may need to reduce the carrying value of our assets.

We own and distribute a significant amount of aircraft, aircraft parts and components, and manufacturing facilities and related equipment. The removal of aircraft from service or recurring losses in certain operations could require us to evaluate the recoverability of the carrying value of those assets and record an impairment charge through earnings to reduce the carrying value. We recognized impairment charges and other losses of $71.4 million in fiscal 2015 related to our actions to address underperforming product lines and inventories. In addition, if aircraft or engines for which we offer replacement parts or supply repair and overhaul services are retired and there are fewer aircraft that require these parts or services, our revenues may decline.

We have recorded goodwill and other intangible assets related to acquisitions. If we are unable to achieve the projected levels of operating results, it may be necessary to record an impairment charge to reduce the carrying value of goodwill and related intangible assets. Similarly, if we were to lose a key customer or one of our airframe maintenance or landing gear facilities were to lose its authority to operate, we might be required to record an impairment charge.

We are dependent upon continued availability of financing to manage our business and to execute our business strategy, and additional financing may not be available on terms acceptable to us.

Our ability to manage our business and to execute our business strategy is dependent, in part, on the continued availability of debt and equity capital. Access to the debt and equity capital markets may be limited by various factors, including the condition of overall credit markets, general economic factors, state of the aviation industry, our financial performance, and credit ratings. Debt and equity capital may not

11

continue to be available to us on favorable terms, or at all. Our inability to obtain financing on favorable terms could adversely affect our results of operations and financial condition.

Our existing debt includes restrictive and financial covenants.

Certain loan and debt agreements require us to comply with various restrictive covenants and some contain financial covenants that require us to comply with specified financial ratios and tests. Our failure to meet these covenants could result in default under these loan and debt agreements and may result in a cross-default under other debt agreements. In the event of a default and our inability to obtain a waiver of the default, all amounts outstanding under our debt agreements could be declared immediately due and payable. Our failure to comply with these covenants could adversely affect our results of operations and financial condition.

Our industry is susceptible to product and other liability claims, and claims not adequately covered by insurance may adversely affect our financial condition.

Our business exposes us to possible claims for property damage and bodily injury or death which may result if an engine, engine part or component, airframe part or accessory, or any other aviation product which we have sold, manufactured, or repaired fails, or if an aircraft we operated, serviced, or in which our products are installed, crashes we carry substantial liability insurance in amounts that we believe are adequate for our risk exposure and commensurate with industry norms. However, claims may arise in the future, and our insurance coverage may not be adequate to protect us in all circumstances. Additionally, we might not be able to maintain adequate insurance coverage in the future at an acceptable cost. Any liability claim not covered by adequate insurance could adversely affect our results of operations and financial condition.

Our business could be negatively affected by cyber or other security threats or other disruptions.

Our businesses depend heavily on information technology and computerized systems to communicate and operate effectively. The Company's systems and technologies, or those of third parties on which we rely, could fail or become unreliable due to equipment failures, software viruses, cyber threats, terrorist acts, natural disasters, power failures or other causes. These threats arise in some cases as a result of our role as a defense contractor.

Cyber security threats are evolving and include, but are not limited to, malicious software, attempts to gain unauthorized access to our sensitive information, including our customers, suppliers, subcontractors, and joint venture partners, and other electronic security breaches that could lead to disruptions in mission critical systems, unauthorized release of confidential or otherwise protected information, and corruption of data.

Although we utilize various procedures and controls to monitor and mitigate these threats, there can be no assurance that these procedures and controls will be sufficient to prevent security threats from materializing. If any of these events were to materialize, the costs related to cyber or other security threats or disruptions may not be fully insured or indemnified and could have a material adverse effect on our reputation, operating results, and financial condition.

We must comply with extensive environmental requirements, and any exposure to environmental liabilities may adversely affect us.

Federal, state, and local requirements relating to the discharge and emission of substances into the environment, the disposal of hazardous wastes, the remediation and abatement of contaminants, and other activities affecting the environment have had and may continue to have an impact on our operations. Management cannot assess the possible effect of compliance with future environmental requirements or of future environmental claims for which we may not have adequate indemnification or insurance coverage. If

12

we were required to pay the expenses related to any future environmental claims for which neither indemnification nor insurance coverage were available, these expenses could have an adverse impact on our results of operations and financial condition.

Future environmental regulatory developments in the United States and abroad concerning environmental issues, such as climate change, could adversely affect our operations and increase operating costs and, through their impact on our customers, reduce demand for our products and services. Actions may be taken in the future by the U.S. government, state governments within the United States, foreign governments, the International Civil Aviation Organization, or by signatory countries through a new global climate change treaty to regulate the emission of greenhouse gases by the aviation industry. The precise nature of any such requirements and their applicability to us and our customers are difficult to predict, but the impact to us and the aviation industry would likely be adverse and could be significant, including the potential for increased fuel costs, carbon taxes or fees, or a requirement to purchase carbon credits.

We may need to make significant capital expenditures to keep pace with technological developments in our industry.

The industries in which we participate are constantly undergoing development and change, and it is likely that new products, equipment, and methods of repair and overhaul services will be introduced in the future. We may need to make significant expenditures to purchase new equipment and to train our employees to keep pace with any new technological developments. These expenditures could adversely affect our results of operations and financial condition.

Our operations would be adversely affected by a shortage of skilled personnel or work stoppages.

We are dependent on an educated and highly skilled workforce, because of the complex nature of many of our products and services. Furthermore, we have a collective bargaining agreement covering approximately 150 employees. Our ability to operate successfully and meet our customers' demands could be jeopardized if we are unable to attract and retain a sufficient number of skilled personnel, including qualified licensed mechanics, to conduct our business, or if we experience a significant or prolonged work stoppage. These and similar events may adversely affect our results of operations and financial condition.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not Applicable.

In the Aviation Services segment, we conduct inventory management and distribution activities from our headquarters in Wood Dale, Illinois, which we own subject to a mortgage. In addition to warehouse space, this facility includes executive, sales and administrative offices. Our principal maintenance, repair, overhaul, and engineering activities for this segment are conducted at facilities leased by us in Indianapolis, Indiana; Oklahoma City, Oklahoma; Miami, Florida; Duluth, Minnesota; and Lake Charles, Louisiana. During fiscal 2015, we also operated a leased regional aircraft maintenance facility in Hot Springs, Arkansas. On June 24, 2015, we announced our plan to close this facility and transfer its operations to our Oklahoma City facility.

We also lease facilities in Garden City, New York; Jacksonville, Florida; and London, England, and own a building near Schiphol International Airport in the Netherlands to support activities in the Aviation Services segment.

Our principal activities in the Expeditionary Services segment are conducted at facilities we lease in Melbourne, Florida and own in Cadillac, Michigan and Goldsboro, North Carolina.

13

We also operate sales offices which support all our activities and are leased in London, England; Paris, France; Rio de Janeiro, Brazil; Shanghai, China; Singapore, Republic of Singapore; and Abu Dhabi, UAE.

We believe that our owned and leased facilities are suitable and adequate for our operational requirements.

We are not a party to any material, pending legal proceeding (including any governmental or environmental proceedings) other than routine litigation incidental to our business.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

EXECUTIVE OFFICERS OF THE REGISTRANT

Information concerning each of our executive officers is set forth below:

Name

|

Age | Present Position with the Company

|

||

|---|---|---|---|---|

| David P. Storch | 62 | Chairman and Chief Executive Officer, Director | ||

| Timothy J. Romenesko | 58 | President and Chief Operating Officer—Expeditionary Services, Director | ||

| John C. Fortson | 48 | Vice President, Chief Financial Officer and Treasurer | ||

| Robert J. Regan | 57 | Vice President, General Counsel and Secretary | ||

| Michael J. Sharp | 53 | Vice President, Controller and Chief Accounting Officer | ||

| John Holmes | 38 | Chief Operating Officer—Aviation Services |

Mr. Storch is Chairman of the Board and Chief Executive Officer of AAR, having served in that capacity since October 2005. From 1996 to 2005, Mr. Storch served as President and Chief Executive Officer and from 1989 to 1996 he served as Chief Operating Officer. Prior to that, Mr. Storch served as a Vice President of the Company from 1988 to 1989. Mr. Storch joined the Company in 1979 and also served as president of a major subsidiary from 1984 to 1988. Mr. Storch has been a director of the Company since 1989.

Mr. Romenesko is President and Chief Operating Officer—Expeditionary Services, having served in that capacity since June 2015. Previously, he served as President and Chief Operating Officer of the Company from 2007, and Vice President and Chief Financial Officer from 1994 to 2007. Mr. Romenesko also served as Controller from 1991 to 1995, and in various other positions since joining AAR in 1981. Mr. Romenesko has been a director of the Company since 2007.

Mr. Fortson joined the Company as Vice President, Finance in May 2013, and became Vice President, Chief Financial Officer and Treasurer on July 26, 2013. Prior to joining the Company, he was a Managing Director of Investment Banking at Bank of America Merrill Lynch since 2007.

Mr. Regan is Vice President, General Counsel and Secretary, having served in that capacity since June 2009. From 2008 to June 2009, Mr. Regan served as Vice President and General Counsel and, prior to that, Associate General Counsel since joining AAR in February 2008. Prior to joining AAR, he was a partner at the law firm of Schiff Hardin LLP since 1989.

Mr. Sharp is Vice President, Controller and Chief Accounting Officer, having served in those capacities since July 1996 and April 1999, respectively. Mr. Sharp was Vice President, Chief Financial Officer and Treasurer from October 2012 to July 26, 2013. Prior to joining the Company, he was with Kraft Foods from 1994 to 1996, and with KPMG LLP from 1984 to 1994.

14

Mr. Holmes is Chief Operating Officer—Aviation Services, having served in that capacity since February 2015. Mr. Holmes previously served as Group Vice President, Aviation Services—Inventory Management and Distribution since 2012, General Manager and Division President of our Allen Asset Management business since 2003, and in various other positions since joining the Company in September 2001.

Each executive officer is elected annually by the Board of Directors at the first meeting of the Board held after the annual meeting of stockholders. Executive officers continue to hold office until their successors are duly elected or until their death, resignation, termination or reassignment.

15

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is traded on the New York Stock Exchange and the Chicago Stock Exchange under the symbol "AIR." On July 1, 2015, there were approximately 1,061 holders of common stock, including participants in security position listings.

The following table shows the range of prices for our common stock and the amount of dividends declared per share during each quarter of our last two fiscal years:

| |

Fiscal 2015 | |

|

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

Full Year | |||||||||||

Market price |

||||||||||||||||

High |

$ | 28.33 | $ | 29.05 | $ | 31.93 | $ | 34.24 | $ | 34.24 | ||||||

Low |

23.74 | 22.37 | 25.04 | 29.18 | 22.37 | |||||||||||

Dividends declared |

0.075 | 0.075 | 0.075 | 0.075 | 0.30 | |||||||||||

| |

Fiscal 2014 | |

|

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

Full Year | |||||||||||

Market price |

||||||||||||||||

High |

$ | 25.84 | $ | 31.30 | $ | 30.56 | $ | 31.05 | $ | 31.30 | ||||||

Low |

20.06 | 25.51 | 25.91 | 24.22 | 20.06 | |||||||||||

Dividends declared |

0.075 | 0.075 | 0.075 | 0.075 | 0.30 | |||||||||||

Stockholder Return Performance Graph

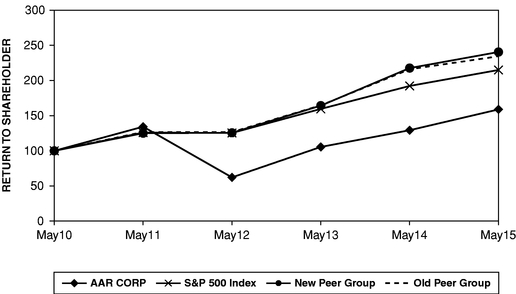

The following graph compares the total return on a cumulative basis of $100 invested, and reinvestment of dividends in our common stock on May 31, 2010 to the Standard and Poor's ("S&P") 500 Index and the Proxy Peer Groups.

Comparison of Cumulative Five Year Total Return

16

The S&P 500 Index is comprised of domestic industry leaders in four major sectors: Industrial, Financial, Utility, and Transportation, and serves as a broad indicator of the performance of the U.S. equity market. The Proxy Peer Group companies are listed as follows:

| Aerojet Rocketdyne Holdings, Inc.1 | Moog Inc. | |

| Applied Industrial Technologies, Inc. | Orbital ATK, Inc.2 | |

| B/E Aerospace, Inc. | Rockwell Collins, Inc. | |

| Crane Co. | Spirit AeroSystems Holdings | |

| Cubic Corporation | Teledyne Technologies Incorporated | |

| Curtiss-Wright Corporation | TransDigm Group Inc. | |

| Esterline Technologies Corporation | Triumph Group, Inc. | |

| Hexcel Corporation | Woodward, Inc.1 | |

| Kaman Corporation | Wesco International, Inc.1 | |

| Kratos Defense & Security |

- 1

- These

companies are new peer group companies added during fiscal 2015.

- 2

- Orbital ATK, Inc. is the successor entity to the merger of Alliant Techsystems, Inc. (included in our Proxy Peer Group in fiscal 2014) and Orbital Sciences Corporation.

Kennametal, Inc. and MSC Industrial Direct Co., Inc. are no longer included in our Proxy Peer Group. The Company annually revisits the composition of the peer group to ensure that the Company's performance is measured against those of comparably-sized and situated companies. The mix of the Company's commercial and defense businesses presents a challenge in constructing a peer group, given that many defense contractors have substantially greater resources than the Company.

Issuer Purchases of Equity Securities

The following table provides information about purchases we made during the quarter ended May 31, 2015 of equity securities that are registered by us pursuant to Section 12 of the Exchange Act:

Period

|

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs1 |

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

3/1/2015 - 3/31/2015 |

— | $ | — | — | |||||||||

4/1/2015 - 4/30/2015 |

496,660 | 30.40 | 496,660 | ||||||||||

5/1/2015 - 5/31/2015 |

4,185,960 | 31.90 | 4,185,960 | ||||||||||

| | | | | | | | | | | | | | |

Total |

4,682,620 | $ | 31.74 | 4,682,620 | $ | 101,336,732 | |||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

- 1

- On March 16, 2015, we announced a new Board of Directors authorization to purchase up to $250 million of our common stock with no expiration date. The shares in May were purchased pursuant to a tender offer completed on May 29, 2015.

17

ITEM 6. SELECTED FINANCIAL DATA

(In millions, except per share amounts)

| |

For the Year Ended May 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||

RESULTS OF OPERATIONS1 |

||||||||||||||||

Sales |

$ | 1,594.3 | $ | 1,709.1 | $ | 1,807.9 | $ | 1,865.7 | $ | 1,723.9 | ||||||

Gross profit2 |

159.3 | 288.9 | 259.5 | 287.7 | 295.5 | |||||||||||

Operating income (loss)2 |

(11.9 | ) | 125.6 | 102.2 | 118.4 | 129.4 | ||||||||||

(Loss) gain on extinguishment of debt3 |

(44.9 | ) | — | (0.3 | ) | (0.7 | ) | 0.1 | ||||||||

Interest expense |

26.5 | 28.3 | 29.1 | 30.2 | 27.6 | |||||||||||

Income (Loss) from continuing operations |

(54.5 | ) | 67.2 | 48.8 | 64.9 | 69.1 | ||||||||||

Income from discontinued operations4 |

64.7 | 5.7 | 6.2 | 2.8 | 0.7 | |||||||||||

Net income attributable to AAR |

10.2 | 72.9 | 55.0 | 67.7 | 69.8 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Share data: |

||||||||||||||||

Earnings per share—basic: |

||||||||||||||||

Earnings (Loss) from continuing operations |

$ | (1.40 | ) | $ | 1.70 | $ | 1.23 | $ | 1.61 | $ | 1.74 | |||||

Earnings from discontinued operations |

1.66 | 0.15 | 0.15 | 0.07 | 0.02 | |||||||||||

| | | | | | | | | | | | | | | | | |

Earnings per share—basic |

$ | 0.26 | $ | 1.85 | $ | 1.38 | $ | 1.68 | $ | 1.76 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Earnings per share—diluted: |

||||||||||||||||

Earnings (Loss) from continuing operations |

$ | (1.40 | ) | $ | 1.68 | $ | 1.23 | $ | 1.58 | $ | 1.71 | |||||

Earnings from discontinued operations |

1.64 | 0.15 | 0.15 | 0.07 | 0.02 | |||||||||||

| | | | | | | | | | | | | | | | | |

Earnings per share—diluted |

$ | 0.24 | $ | 1.83 | $ | 1.38 | $ | 1.65 | $ | 1.73 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Cash dividends declared per share |

$ | 0.30 | $ | 0.30 | $ | 0.30 | $ | 0.30 | $ | 0.08 | ||||||

Weighted average common shares outstanding—basic |

39.1 | 38.6 | 38.3 | 38.8 | 38.4 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Weighted average common shares outstanding—diluted |

39.4 | 39.1 | 40.6 | 43.1 | 43.6 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| |

May 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||

FINANCIAL POSITION |

||||||||||||||||

Total cash and cash equivalents |

$ | 54.7 | $ | 89.2 | $ | 75.3 | $ | 67.7 | $ | 57.4 | ||||||

Working capital |

542.1 | 709.3 | 644.7 | 590.1 | 498.0 | |||||||||||

Total assets |

1,515.0 | 2,194.0 | 2,136.9 | 2,195.7 | 1,703.7 | |||||||||||

Total debt3 |

154.0 | 634.0 | 708.6 | 792.2 | 425.3 | |||||||||||

Equity5 |

845.1 | 1,000.7 | 919.5 | 866.0 | 835.3 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Number of shares outstanding at end of year4 |

35.4 | 39.6 | 39.4 | 40.3 | 39.8 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Book value per share of common stock |

$ | 23.87 | $ | 25.27 | $ | 23.34 | $ | 21.50 | $ | 21.00 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Notes:

- 1

- Telair Cargo Group and Precision Systems Manufacturing have been reported as discontinued operations in the results of operations for all periods presented.

18

- 2

- In fiscal 2015, we recognized $71.4 million in impairment charges and other losses related to product lines and inventories identified as underperforming or not part of our strategy going forward. These actions included aircraft in our aircraft lease portfolio, inventory in our supply chain and MRO operations, and certain aircraft and inventory in our expeditionary airlift business.

In fiscal 2013, we recorded a $29.8 million charge due to lower revenue and profit expectations on a contract supporting the KC10 aircraft as a result of lower than expected flight hours of the KC10 aircraft and changes to our anticipated recovery of costs in excess of amounts billed within this contract.

- 3

- In

fiscal 2015, we redeemed our $325 million 7.25% Senior Notes due 2022 for $370.6 million. We recognized a loss on

extinguishment of debt of $44.9 million comprised of a make-whole premium of $45.6 million and unamortized deferred financing costs of $6.2 million, partially offset by an

unamortized net premium of $6.9 million.

- 4

- In

fiscal 2015, we sold our Telair Cargo Group for $725 million resulting in a $198.6 million pre-tax gain. In addition, we

announced our intention to sell our PSM business and recognized impairment charges of $57.5 million to reduce the carrying value of PSM business's net assets to their expected value at the time

of sale.

- 5

- On May 29, 2015, we repurchased 4,185,960 shares of our common stock at a price of $31.90 per share pursuant to a tender offer utilizing $133.5 million cash on hand. Fees and expenses of $1.2 million were incurred related to the tender offer and were recorded in treasury stock.

19

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(Dollars in millions)

Forward-Looking Statements

Management's Discussion and Analysis of Financial Condition and Results of Operations contain certain statements relating to future results, which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on the beliefs of management, as well as assumptions and estimates based on information available to us as of the dates such assumptions and estimates are made, and are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or those anticipated, depending on a variety of factors, including those factors discussed under Item 1A, "Risk Factors." Should one or more of those risks or uncertainties materialize adversely, or should underlying assumptions or estimates prove incorrect, actual results may vary materially from those described. Those events and uncertainties are difficult or impossible to predict accurately and many are beyond our control. We assume no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

General Overview

Upon completing our annual strategic review process and assessing our markets, we entered fiscal 2015 with a mission to narrow our focus, excel as an independent services provider to the global commercial aviation and government and defense markets, strengthen our balance sheet, and improve shareholder return. The comprehensive plan included exploring selling certain manufacturing businesses and as the year progressed included a review of our underperforming product lines and inventories in our services businesses to determine which product areas to focus on going forward. The first phase of this transformation included the sale of the Telair Cargo Group for $725 million in the fourth quarter of fiscal 2015 which resulted in a pre-tax gain (net of transaction expenses and fees) of $198.6 million. The gain excludes $35 million of contingent consideration which could be realized prior to December 31, 2015. Our plans further called for us to sell our Precision Systems Manufacturing ("PSM") business, comprised of our metal and composite machined and fabricated parts manufacturing operations. During fiscal 2015, we recognized total impairment charges of $57.5 million to reduce the carrying value of PSM's net assets to their expected value at time of sale.

The product lines and inventories identified as underperforming or not part of our strategy going forward in our services businesses included certain aircraft in our aircraft lease portfolio, inventory and rotable assets in our supply chain and maintenance, repair and overhaul ("MRO") operations, and certain aircraft and inventory in our expeditionary airlift business. We recognized $71.4 million in impairment charges and other losses in fiscal 2015 from these actions while at the same time generating approximately $57.1 million of cash.

By executing this plan, we strengthened our balance sheet and returned capital to shareholders. Using the proceeds from the sale of the Telair Cargo Group and other assets, we reduced our total debt from $634.0 million at May 31, 2014 to $154.0 million at May 31, 2015. Taking into consideration cash on hand, our net debt position at May 31, 2015 is $99.3 million. In addition, we acquired 4,682,620 of our common shares during fiscal 2015 for an aggregate cost of $151.5 million, and paid $12.5 million in dividends.

As we enter fiscal 2016, we find ourselves in a strong financial position to build out our strategy as a best in class aviation and expeditionary services company. Our cash on hand plus unused capacity on our Credit Agreement is $490 million at May 31, 2015. We expect to invest opportunistically in expanding our comprehensive suite of services to the global commercial aviation and government and defense markets.

20

Changes in Segment Presentation

We began reporting our Telair Cargo Group and PSM businesses as discontinued operations in the third quarter of fiscal 2015. The decision to sell these two businesses was an important strategic step to position us as a pure-play, industry-leading global aviation and expeditionary services company and will allow us to focus our resources where we see the best opportunities.

Prior to the decision to sell these two businesses, we reported our activities in the following two business segments: Aviation Services comprised of our supply chain, maintenance, repair and overhaul ("MRO") and airlift activities and Technology Products comprised of our Telair Cargo Group, Precision Systems Manufacturing, and mobility businesses.

As a result of the decision to divest the Telair Cargo Group and PSM, we have revised our reportable segments to align to our new organizational structure. We now report our results in two new segments: Aviation Services comprised of supply chain and MRO activities and Expeditionary Services comprised of airlift and mobility activities. This new presentation reflects the way our chief operating decision making officer (Chief Executive Officer) now evaluates performance and our internal organizational and management structure.

The Aviation Services segment consists of businesses that provide spares and maintenance support for aircraft operated by our commercial and government/defense customers. Sales in the Aviation Services segment are derived from the sale and lease of a wide variety of new, overhauled and repaired engine and airframe parts and components to the commercial aviation and government and defense markets. We provide customized inventory supply chain management, performance based logistics programs, aircraft component repair management services, and aircraft modifications. The segment also includes repair, maintenance and overhaul of aircraft, landing gear and components. We also sell and lease used commercial aircraft (exclusively through joint ventures following the sale of our last two wholly-owned aircraft in the fourth quarter of fiscal 2015). Cost of sales consists principally of the cost of product, direct labor, and overhead.

The Expeditionary Services segment consists of businesses that provide products and services supporting the movement of equipment and personnel by the U.S. DoD, foreign governments and non-governmental organizations. Sales in the Expeditionary Services segment are derived from the delivery of airlift services to mostly government and defense customers and the design and manufacture of pallets, shelters, and containers used to support the U.S. military's requirements for a mobile and agile force. We also provide system integration services for specialized command and control systems. Cost of sales consists principally of aircraft maintenance costs, depreciation, the cost of material to manufacture products, direct labor and overhead.

Segment results have been reclassified to reflect our new segment presentation for all periods presented. The Telair Cargo Group and PSM businesses have been reported as discontinued operations for all periods presented.

Our chief operating decision making officer (Chief Executive Officer) evaluates performance based on the reportable segments and utilizes gross profit as a primary profitability measure. Gross profit is calculated by subtracting cost of sales from sales. The assets and certain expenses related to corporate activities are not allocated to the segments. Our reportable segments are aligned principally around differences in products and services.

Business Trends and Outlook for Fiscal 2016

Consolidated sales for fiscal 2015 decreased $114.8 million or 6.7% compared to the prior year primarily due to a decrease of $187.7 million or 24.1% in sales to government and defense customers. The reduction in sales to government and defense customers was primarily due to a $206.6 million decline in sales within our Expeditionary Services segment to government and defense customers. The DoD's

21

reduced role in Afghanistan as a result of the troop drawdown has had a significant impact on our expeditionary airlift services operations in Afghanistan. At the beginning of fiscal 2014, we had 40 aircraft contract positions which reduced to 20 positions by the end of fiscal 2014. We were largely able to offset additional contract terminations in Afghanistan during fiscal 2015 with new contract positions in Africa and ended fiscal 2015 at 19 aircraft positions.

We believe that the pipeline of opportunities in the airlift services market will enable us to return our idled aircraft to revenue service. In March 2015, we were awarded a contract from the United Nations for passenger and cargo air charter services in support of the MONUSCO operation, the United Nations Organization Stabilization Mission in the Democratic Republic of Congo. We also expect to have aircraft in revenue service in Iraq in early fiscal 2016 which represents a new geography for our expeditionary airlift services business.

During fiscal 2015, sales to commercial customers increased $72.9 million or 7.8% compared to the prior year driven primarily by higher supply chain volumes principally from new contract wins announced in the second half of fiscal 2014. This increase was partially offset by a significant engineering services program that ended in the second quarter of fiscal 2014 which represented $14.6 million of sales in the prior period. We also experienced a decrease in sales of $13.7 million related to lower volumes in our maintenance, repair and overhaul services businesses.

For fiscal 2016, we expect to see continued growth in our aviation services platform given their strong positions in the growing global aviation market which should benefit commercial sales in our Aviation Services segment. We believe there continues to be a favorable trend by both commercial and government and defense customers for comprehensive supply chain and maintenance programs, as these customers continue to seek ways to reduce their operating cost structure. As part of our three phased transformation in fiscal 2015, we have reorganized the sales and business development areas and other functions within our Aviation Services segment to capitalize on our comprehensive supply chain and maintenance solutions. While defense budgets are expected to remain under pressure due to budgetary constraints and the current geopolitical environment, we see ongoing demand for our low cost solutions, products and services.

Results of Operations—Fiscal 2015 Compared with Fiscal 2014

Sales and gross profit for our two business segments for the two years ended May 31, 2015 and 2014 were as follows:

| |

For the Year Ended May 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2014 | % Change | |||||||

Sales: |

||||||||||

Aviation Services |

||||||||||

Commercial |

$ | 985.7 | $ | 919.9 | 7.2 | % | ||||

Defense |

330.4 | 311.3 | 6.1 | % | ||||||

| | | | | | | | | | | |

|

$ | 1,316.1 | $ | 1,231.2 | 6.9 | % | ||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Expeditionary Services |

||||||||||

Commercial |

$ | 18.8 | $ | 11.7 | 60.7 | % | ||||

Defense |

259.4 | 466.2 | (44.4 | )% | ||||||

| | | | | | | | | | | |

|

$ | 278.2 | $ | 477.9 | (41.8 | )% | ||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

22

| |

For the Year Ended May 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2014 | % Change | |||||||

Gross Profit: |

||||||||||

Aviation Services |

||||||||||

Commercial |

$ | 93.5 | $ | 137.6 | (32.0 | )% | ||||

Defense |

50.3 | 34.9 | 44.1 | % | ||||||

| | | | | | | | | | | |

|

$ | 143.8 | $ | 172.5 | (16.6 | )% | ||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Expeditionary Services |

||||||||||

Commercial |

$ | 1.5 | $ | 1.0 | 50.0 | % | ||||

Defense |

14.0 | 115.4 | (87.9 | )% | ||||||

| | | | | | | | | | | |

|

$ | 15.5 | $ | 116.4 | (86.7 | )% | ||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Aviation Services Segment