UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

For the fiscal year ended December 31 , 2023

OR

For the transition period from to

Commission File Number 001-38979

| ||||||||

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

(617 )-369-7300

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Ticker Symbol | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| ☒ | Accelerated filer | ☐ | Smaller reporting company | ||||||||||||||

Non-accelerated filer | ☐ | Emerging growth company | |||||||||||||||

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

At June 30, 2023, the aggregate market value of the shares of common stock held by non-affiliates of the registrant, based upon the closing price of $20.95 on that date on the New York Stock Exchange, was $675,607,793 . Calculation of holdings by non-affiliates is based upon the assumption, for this purpose only, that executive officers, directors and any persons holding 10% or more of the registrant’s shares of common stock are affiliates. There were 38,207,819 shares of the registrant’s shares of common stock outstanding on February 26, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement to be delivered to shareholders in connection with the Annual Meeting of Shareholders to be held on or about June 6, 2024 are incorporated by reference into Part III.

TABLE OF CONTENTS

| Page | ||||||||

| Part I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

Item 1C. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Part II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| Part III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Part IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

Forward-Looking Statements

This Annual Report on Form 10-K includes forward-looking statements, as that term is used in the Private Securities Litigation Reform Act of 1995, including information relating to anticipated revenues, earnings, anticipated performance of our business, expected future net cash flows and the sufficiency of capital resources, our anticipated expense levels, and expectations regarding market conditions. The words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “can be,” “may be,” “aim to,” “may affect,” “may depend,” “intends,” “expects,” “believes,” “estimate,” “plan,” “project,” and other similar expressions are intended to identify such forward-looking statements. Such statements are subject to various known and unknown risks and uncertainties and we caution readers that any forward-looking information provided by or on behalf of us is not a guarantee of future performance.

Actual results may differ materially from those in forward-looking information as a result of various factors including but not limited to our dependence on Acadian Asset Management LLC, or Acadian, reliance on key personnel, the potential for reputational harm, actual or potential conflicts of interest, potential losses on seed and co-investment capital, foreign currency exchange risk, litigation risk, competition, risks associated with governmental regulation, and other risks discussed under the heading “Risk Factors” in Item 1A of this Annual Report on Form 10-K. Due to such risks and uncertainties and other factors, we caution each person receiving such forward-looking information not to place undue reliance on such statements. Further, such forward-looking statements speak only as of the date of this Annual Report on Form 10-K and we undertake no obligations to update any forward looking statement to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect the occurrence of unanticipated events.

Unless we state otherwise or the context otherwise requires, references in this Annual Report on Form 10-K to “BrightSphere” or “BSIG” refer to BrightSphere Investment Group Inc., references to the “Company” and references to “we,” “our” and “us” refer to BSIG and its consolidated subsidiaries and, prior to their disposition, previously disposed equity-accounted Affiliates, excluding discontinued operations. References to the “Center” refer to the holding company excluding the Affiliates and/or BrightSphere Inc., or BSUS, a Delaware corporation and wholly owned subsidiary of BSIG. Unless we state otherwise or the context otherwise requires, references in this Annual Report on Form 10-K to “Affiliates” or an “Affiliate” refer to the asset management firms in which we have or previously had an ownership interest, and references to our Affiliates’ sponsored investment entities are “Funds.” References in this Annual Report on Form 10-K to “OM plc” refer to Old Mutual plc, our former parent. None of the information in this Annual Report on Form 10-K constitutes either an offer or a solicitation to buy or sell Acadian’s products or services, nor is any such information a recommendation for Acadian’s products or services.

Performance measures used in this report

We present economic net income, or ENI, to help us describe our operating and financial performance. ENI is the key measure our management uses to evaluate the financial performance of, and make operational decisions for, our business. ENI is not audited, and is not a substitute for net income or other performance measures that are derived in accordance with accounting principles generally accepted in the United States, or U.S. GAAP. Furthermore, our calculation of ENI may differ from similarly titled measures provided by other companies. Please refer to “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Supplemental Performance Measure—Economic Net Income and Segment Analysis” for a more thorough discussion of ENI and a reconciliation of ENI to U.S. GAAP net income.

3

Summary of Risk Factors

Our business is subject to numerous risks and uncertainties, discussed in more detail in Item 1A of this Annual Report on Form 10-K under the heading “Risk Factors.” These risks include, among others, the following key risks:

•Our overall financial results are dependent on the ability of Acadian to generate earnings

•Our ability to attract and retain assets under management and generate earnings is dependent on maintaining competitive investment performance, as well as market and other factors;

•We derive a substantial portion of our revenue from a limited number of investment strategies;

•We rely on certain key personnel, and our results are dependent upon our ability to retain and attract key personnel;

•Reputational harm could result in a loss of assets under management and revenues;

•Impairment of our relationships with clients and/or consultants may negatively impact our business and our results of operations;

•Pressure on fee levels and changes to our mix of assets could impact our results of operations;

•If our techniques for managing risk are ineffective, we may be exposed to material unanticipated losses;

•Our expenses are subject to fluctuations that could materially impact our results of operations;

•Investments in non-U.S. markets and in securities of non-U.S. companies may involve foreign currency exchange risk, and tax, political, social and economic uncertainties, and a reduction in assets under management associated with investments in non-U.S. equities could have a disproportionately adverse impact on our results of operations;

•Our outstanding indebtedness may impact our business and may restrict our growth and results of operations;

•Any significant limitation on the use of our facilities or the failure or security breach of our software applications or operating systems and networks, including the potential risk of cyber-attacks, could result in the accidental or unlawful destruction, loss, alteration, unauthorized disclosure of, or access to, confidential client information or personal data, damage to our reputation, additional costs, regulatory penalties and financial losses; and

•We operate in a highly regulated industry, and continually changing federal, state, local and foreign laws and regulations could materially adversely affect our business, financial condition and results of operations.

4

PART I

Item 1. Business.

Overview

We are a global, diversified asset management company with approximately $104 billion of assets under management as of December 31, 2023. We provide investment management services globally, predominantly to institutional investors. We operate our differentiated investment management business through our majority owned subsidiary, Acadian Asset Management LLC (“Acadian”), a leading systematic manager of active global, international equity and alternative strategies. The ownership structure of Acadian provides incentives for growth and prudent business management across multiple generations of Acadian partners, who retain meaningful levels of equity in their own business to preserve strong alignment of interests between us, Acadian, their clients and our shareholders. Acadian comprises our Quant & Solutions reportable segment.

We have generated strong, recurring free cash flow to our business that we can use for growth initiatives, return to shareholders through dividends and stock repurchases and to repay outstanding debt obligations. Our revenue consists largely of recurring management fees on assets under management and is not heavily dependent upon performance fees. Our profit-sharing model enables us to participate directly in margin expansion as Acadian grows.

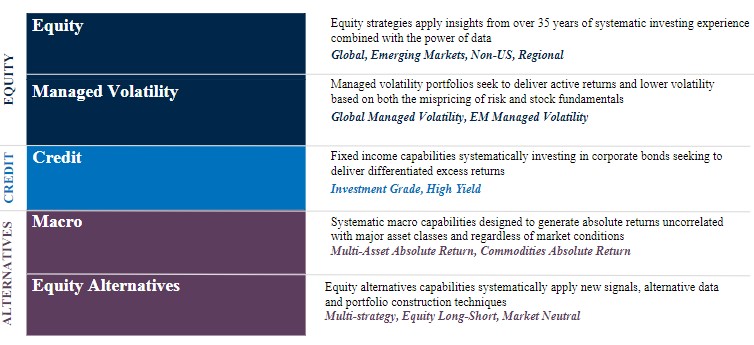

Acadian

Acadian, founded in 1986, is a leading systematic investment manager of active global, international equity, and alternative strategies with approximately $104 billion in AUM as of December 31, 2023. Acadian pursues a fundamentally grounded, data-rich and highly structured approach to investing that seeks to identify and exploit systematic and structural inefficiencies in the markets. Acadian applies a range of investment and risk considerations to a universe of 40,000-plus securities taken from over 150 global markets. Acadian manages strategies in developed and emerging markets, including global, non-U.S. and small-cap equities, as well as managed volatility, systematic macro, equity alternatives, and credit strategies.

Acadian invests on behalf of a wide range of institutional clients across the globe, including public and private funds, endowments and foundations, and retail clients through sub-advisory channels. The firm’s clients were domiciled in approximately 20 countries across Asia, Australia, Europe and North America as of December 31, 2023. The firm has over 100 investment and research professionals and manages approximately 70 distinct investment products and strategies.

Competitive Strengths

Experience. As a pioneer in systematic investing, Acadian has been managing systematic equity portfolios since the 1980s. This experience affords us a broad perspective and data history. Guided by the economic intuition and insights of a talented, experienced, and diverse investment team, Acadian has been at the forefront of systematic research, signal development, and portfolio construction for 37 years.

Objectivity. Acadian uses a disciplined and objective process, underpinned by rich data and powerful technological tools. An extensive data repository, continually supplemented by an active alternative scouting effort, provides an extensive source for exploring new investment ideas. Given the size, breadth, and complexity of global equity markets, we believe that such an empirical approach is essential to exploiting behaviorally based mispricings and deliver superior risk-adjusted returns for our clients.

Research. Acadian is a research-focused firm. Its scientific approach to innovation is driven by research across signal generation, portfolio construction, implementation, and risk management. Research is data-dependent, and Acadian’s process benefits from its objectivity, breadth, and computational power. We recognize that markets are dynamic and that a robust culture of investment research is essential to maintaining a competitive edge.

5

Capital Management

Our asset management business generates significant, recurring free cash flow that can be accessed to create value for our shareholders. In particular, we believe we can generate strong returns on allocated capital by, among other things, (i) providing seed capital to fund new products and strategies; (ii) providing investment capital to support strategic growth; and (iii) implementing opportunistic share repurchases. Management undertakes detailed business case analyses with respect to all growth opportunities, and only considers those that yield an acceptable return while operating within the parameters of our risk appetite. For the period January 1, 2019 to December 31, 2023, we repurchased approximately 63% of our shares.

Distribution Model and Client Base

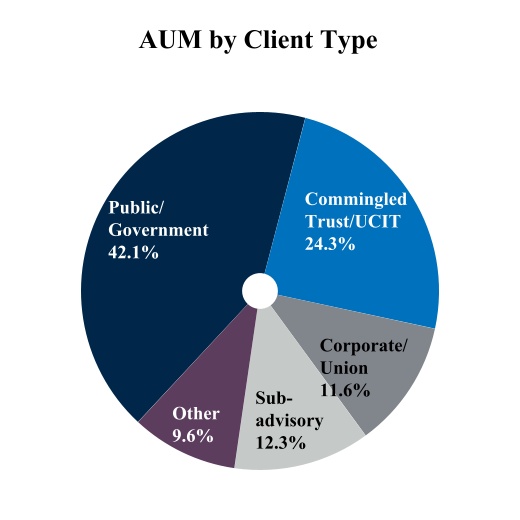

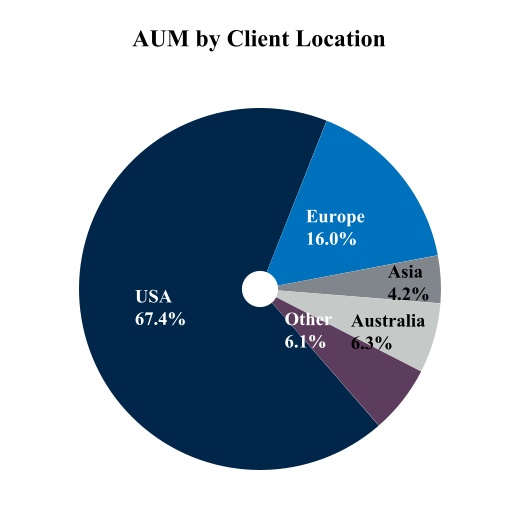

Our distribution is focused on the institutional and sub-advisory channels. The institutional channel accounts for approximately 79% of our AUM. Within this channel, we have strong relationships in the public/government pension market (42% of our AUM as of December 31, 2023) and the corporate plan market (12% of our AUM as of December 31, 2023), which comprise a substantial portion of the institutional investment market overall, particularly in the U.S. Our institutional marketplace clients are highly diverse across industry segments and geographies and have various growth characteristics. Our institutional distribution channel includes clients from across the globe, including, but not limited to, pension funds, state and local governments; employee benefit plans and foundations and endowments. We offer our investment products to institutional clients directly and by marketing our services to the investment consultants and advisors that advise them. We maintain relationships with a number of insurance companies, private banks, Outsourced Chief Investment Officers (“OCIOs”) and Fund of Funds (“FoFs”). While we market primarily to institutional investors, we participate in the individual investor market through the sub-advisory channel, which represented 12% of our AUM as of December 31, 2023. We also manage assets for mutual funds, and other commingled products including UCITs and Collective Investment Trusts, which gives us exposure to a retail investor base and the defined contribution market.

Our clients can access our investment strategies through a range of investment vehicles:

•Separate Account: We manage separate account assets within most of our investment strategies. Our separate account clients span the broad spectrum of institutional investors. The fees we charge on separate accounts vary by client, investment strategy and the size of the account.

•Commingled Vehicle: We also offer access to a number of our strategies through Acadian-branded commingled vehicles both within and outside the U.S. Investors that do not meet our minimum account size for a separate account, or who otherwise prefer to invest through a fund, can invest in our pooled funds.

The goal of our marketing, distribution and client service efforts is to grow and maintain a client base that is diversified by investment strategy, investment vehicle, distribution channel, and geographic region. We focus our distribution and marketing efforts on sophisticated investors and asset allocators. Our client service and distribution teams comprise knowledgeable, seasoned professionals, experienced in working across the investment spectrum of investors.

6

Our client base is diverse without significant concentration. As of December 31, 2023, our top five client relationships represented approximately 14% of total run rate gross management fee revenue, and our top 25 clients represented approximately 38% of run rate gross management fee revenue. The below graphic shows the breakdown of our assets under management as of December 31, 2023 by client type and location.

| Total AUM: | $103.7 bn | ||||

Data as of December 31, 2023 | |||||

Products and Investment Performance

Product Mix

We offer leading strategies in global, international, U.S. and emerging markets equities, in addition to credit, and alternative investments.

The chart below presents our wide range of offerings. These areas have the potential to provide a balanced earnings stream to our business. We believe our offerings are well-positioned in areas of investor demand and the diversity of investment style and asset class can enable us to participate in growing segments of the industry, through a range of investing environments.

7

Investment Performance

Our mission is to produce risk-adjusted performance, or alpha, for our clients. We have competitive near- and long-term alpha performance records and are well-positioned for continued growth.

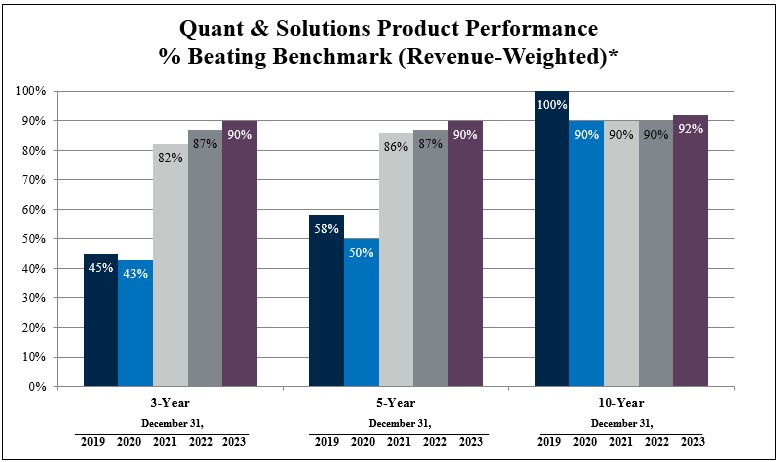

In addition to analyzing our performance on a revenue-weighted basis, which gives us a perspective on product performance with respect to our existing client base, we also consider the number of our at-scale product strategies (defined as strategies with greater than $100 million of AUM) beating benchmarks. This latter measure, labeled as “equal-weighted,” indicates the opportunity we have to generate sales in a variety of market environments. For instance, strong performance in a newer, smaller product such as small-cap emerging markets may not affect revenue-weighted performance, but it can have a meaningful effect on revenue growth given client demand for this higher fee product. The charts below indicate that performance on a revenue-weighted basis relative to benchmark over the last five years have performed ahead of their respective benchmarks on a three-, five- and ten-year basis.

8

Data as of December 31 for the years 2019 to 2023

*Acadian assets representing 11%, 47%, 89%, 88% and 80% of revenue were outperforming benchmarks on a 1- year basis as of December 31, 2019, 2020, 2021, 2022 and 2023, respectively.

9

The chart below indicates performance on a revenue-weighted and equal-weighted basis relative to benchmark, as at December 31, 2023. In addition, we have indicated the percentage of our assets beating their benchmarks over the same time periods. While we believe the first two methodologies provide better insight into our performance trends, we have also included AUM-weighted performance, as this is a more standard industry performance metric.

Quant & Solutions Investment Performance*

Data as of December 31, 2023*

* As of December 31, 2023, Acadian assets representing 80% of revenue were outperforming benchmarks on a 1- year basis.

Competition

We face competition from many segments in the asset management industry. We compete with other investment management firms, including investment management holding companies, insurance companies, and banks. We compete globally with international and domestic investment management firms, hedge funds, and other subsidiaries of financial institutions for institutional assets.

Many of the organizations we compete with offer investment strategies similar to those offered by Acadian, and these organizations may have greater financial resources and distribution capabilities than we offer. Some of these firms offer other products and services—in particular investment strategies such as passively managed products, including exchange traded funds, that typically carry lower fee rates. Additionally, there are limited barriers to entry for new investment managers. We compete with these organizations to attract and retain institutional clients and their assets based on the following primary factors:

•the investment performance records of Acadian’s strategies;

•the breadth of active investment strategies and vehicle options offered by Acadian;

•the alignment of Acadian’s investment strategies to the current market conditions and investment preferences and needs of potential clients;

•the quality, depth, and reputation of the investment teams that executes Acadian’s strategies;

•the continuity of our investment and distribution teams;

•the caliber of service we provide our clients; and

•Acadian brand recognition and reputation within the investment community

10

Our History and Organizational Structure

The predecessor of BSIG was formed in 1980. We were incorporated on May 29, 2014 as a private limited company under the laws of England and Wales. At the time of our initial public offering of our ordinary shares in 2014, we changed our name to OM Asset Management plc. On March 2, 2018, we announced the change of our name to BrightSphere Investment Group plc and on March 26, 2018, our ticker symbol changed to “BSIG.” On July 12, 2019, we completed a redomestication process to change from a company incorporated under the laws of England and Wales to a Delaware corporation. The common stock of BrightSphere Investment Group Inc. began trading on July 15, 2019, and our trading symbol on the NYSE remained unchanged as “BSIG.”

Regulation

We are subject to U.S. federal securities laws, state securities and corporate laws, and the rules and regulations of U.S. regulatory and self-regulatory organizations.

Acadian is also subject to regulation in the U.S. through its primary regulator, the SEC, under the Investment Advisers Act of 1940, as amended. To the extent Acadian acts as investment adviser or sub-adviser to registered investment companies, it must also comply with the terms of the Investment Company Act of 1940, as amended and the rules thereunder. The Advisers Act of 1940 imposes numerous obligations on registered investment advisers, including fiduciary, record keeping, advertising and operational requirements, disclosure obligations, and prohibitions on fraudulent activities. The Investment Company Act of 1940 regulates the structure and operations of registered investment companies and imposes additional obligations on advisers to registered investment companies, including detailed disclosure and regulatory requirements applicable to the registered investment companies and additional compliance responsibilities which must strictly be adhered to by the funds and their advisers. Acadian is also subject to the rules and regulations adopted by the Commodity Futures Trading Commission, under the Commodity Exchange Act; and may also be subject to the rules and regulations adopted by the Department of Labor, under ERISA; the Financial Industry Regulatory Authority, Inc., or FINRA; and state regulators. Acadian may also be registered from time to time in jurisdictions outside of the U.S. and will be subject to applicable regulation in those jurisdictions. Acadian is also subject to regulation relating to the offer and sale of financial products in each of the European Union countries in which Acadian operates. As Acadian expands distribution efforts into non-U.S. jurisdictions, including other member countries of the European Union, Latin America, the Middle East and Asian countries, Acadian may be required to register with additional foreign regulatory authorities or otherwise comply with non-U.S. rules and regulations that currently are not applicable to our business.

Through wholly owned affiliates, Acadian is also subject to the regulatory environments of the non-U.S. jurisdictions in which Acadian operates. Acadian’s U.K. affiliate is subject to regulation by the Financial Conduct Authority, or FCA. Acadian’s Singapore affiliate is subject to regulation by the Monetary Authority of Singapore, or MAS. Acadian Australia is subject to regulation by the Australian Securities and Investment Commission, or ASIC. Each regulatory body imposes a comprehensive system of regulation on investment advisers and the manner in which we conduct our business in that country.

11

Employees and Human Capital

We believe our ability to attract and retain employees is a key to our success. Accordingly, we strive to offer competitive compensation and employee benefits and monitor compensation and benefits to the competitive market. Our total rewards philosophy includes competitive compensation, talent development and a comprehensive benefits package that includes extensive health and welfare benefits. In addition, we provide a Profit Sharing and 401(k) Plan for all employees and contribute a percentage of compensation to this plan on a discretionary basis, subject to regulatory limits.

We recognize the value of a diverse and skilled workforce and are committed to creating and maintaining an inclusive and collaborative workplace culture that leverages the unique contributions of people with diverse backgrounds, experiences, and perspectives. We are committed to pay equity for employees doing similar work, regardless of gender, race or ethnicity and comply with applicable local regulations.

As of December 31, 2023, we had 387 full-time equivalent employees, of which 21 were employees of BrightSphere Investment Group Inc. and 366 were employees of Acadian. None of these employees are represented by any collective bargaining agreements.

Operations, Systems and Technology

Our advanced technological capabilities are one of our core strengths. Our investment process is systematically driven and is supported by a sophisticated systems environment. A key tenet of our investment philosophy is that it is crucial to examine as much relevant information about as many companies as possible. Our systems allow us to evaluate a broad array of investment opportunities on a daily basis. Important aspects of our systems environment include powerful servers that receive fundamental data on a continuous basis; proprietary software that transforms the data into stock-specific, macro, and peer forecasts; portfolio optimization software that assists in the creation of customized client portfolios; and a fully automated trading and compliance system. Beyond the investment process infrastructure, we use a number of sophisticated systems to help maximize back-office efficiencies across functions such as operations, accounting, and client reporting.

Available Information

Our web site is www.bsig.com. Our web site provides information about us, and from time to time we may use it as a distribution channel of material company information. We routinely post financial and other important information in the “Investor Relations” section of our web site and we encourage investors to consult that section regularly. That section of our web site includes “Public Filings” where one can download copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, including exhibits, and any other report filed or furnished with the U.S. Securities and Exchange Commission, or the SEC, pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. We make these reports available through our web site as soon as reasonably practicable after our electronic filing of such materials with, or the furnishing of them to, the SEC. The information contained or incorporated on our web site is not a part of this Annual Report on Form 10-K.

In addition, the SEC maintains a website that contains reports, proxy statement and other information about issuers, such as BSIG, who file electronically with the SEC. The address of the website is www.sec.gov.

12

Item 1A. Risk Factors

You should carefully consider the following risk factors in addition to the other information included or incorporated by reference in this Annual Report on Form 10-K before investing in our common stock. Any of the following risks could have a material adverse effect on our business, financial condition, results of operations or cash flow. If any of the following risks and uncertainties actually occurs, you may lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

Risks Related to Operations

Our overall financial results are dependent on the ability of Acadian to generate earnings.

Substantially all of our revenue generation is dependent on Acadian, who receives the majority of their fees based on the values of assets under management. Substantially all of our cash flows consist of distributions received from Acadian. As a result, our cash flows and ability to fund operations are largely dependent upon the profitability of Acadian.

Acadian is required to make certain cash distributions to us under its operating agreement. Distributions to us from Acadian may be subject to Acadian maintaining sufficient working capital, regulatory requirements, claims of creditors of Acadian and applicable bankruptcy and insolvency laws. Any material decrease in profits at, or material reduction in distributions from, Acadian could negatively impact our business and results of operations.

Acadian operates under ownership, governance and economic arrangements that we and Acadian negotiated either at inception or during the course of our relationship. Periodically, this arrangement is reviewed and, in some instances, may be renegotiated and revised. Any renegotiation that results in a reduction in our ownership interest in Acadian and/or a revision to the economic arrangements could reduce the economic benefits derived by us from Acadian.

Our ability to attract and retain assets under management and generate earnings is dependent on maintaining competitive investment performance, as well as market and other factors.

Our financial performance is dependent upon our ability to minimize outflows and increase inflows through sound relative investment performance over measured periods of time compared to relevant benchmarks and peer performance results. The performance of our systematic investment strategies, which can be impacted by factors within and/or outside our control, including general market and economic conditions, is critical to retaining existing client assets and investors, including in mutual funds and private funds we advise or sub-advise, and attracting new client and investor assets. Poor performance can be caused by our choices in investing in sectors, industries, companies or assets that do not perform as well as others. Additionally, companies in which we invest may incur negative changes in their financial conditions or suffer other adverse events that could reduce the values of investments in those companies.

Net flows related to our systematic investment strategies can be affected by investment performance relative to other competing investment strategies or to established benchmarks. Investment management strategies may be rated, ranked or assessed by independent third parties, distribution partners, and industry periodicals and services. These assessments often influence the investment decisions of our clients and investors in mutual funds and private funds we advise or sub-advise. If the performance or assessment of our systematic investment strategies is seen as underperforming relative to peers, it could, among other things, result in an increase in the withdrawal of assets by existing clients and investors in mutual funds and private funds we advise or sub-advise, the termination of us as a sub-adviser to a mutual fund and the inability to attract additional investments from existing and new clients or investors. If a significant portion of clients or investors decides to withdraw their investments or terminate their investment management agreements or sub-advisory agreements, our ability to generate earnings would decline and our results of operations and financial condition would be affected.

13

In addition, assets could be withdrawn for any number of reasons other than poor absolute or relative investment performance, including macro-economic factors unrelated to investment performance, a reduction in market demand for the systematic asset classes, products or strategies we offer, the loss of key personnel, price declines in the securities markets generally, price declines in those assets in which client assets are concentrated or changes in investment patterns of clients, a failure by us to comply with applicable client and regulatory investment guidelines, or factors wholly unrelated to us. Any of these factors could have a negative impact on our results of operations and financial condition.

We derive a substantial portion of our revenue from a limited number of investment strategies.

A significant portion of our assets are invested in a limited number of investment strategies. As of December 31, 2023, $44.7 billion, or 43%, of our assets under management were concentrated across three investment strategies: Acadian’s Emerging Markets Equity ($16.8 billion, or 16%), Acadian’s Global Equity ($14.1 billion, or 14%), and Acadian’s All-Country World ex-US Equity ($13.8 billion, or 13%). Consequently, our results of operations are dependent upon our ability to minimize the risk of outflows from these strategies through relatively strong performance over measured periods of time compared to relevant benchmarks and peer performance results. Also, certain investors may evaluate us on the basis of the asset-weighted performance of our assets under management. A relatively small change in the relative performance of one of our largest strategies, such as Acadian’s Emerging Markets Equity, could have a significant impact on the asset-weighted performance of our assets under management. Such volatility could adversely affect our results of operations and investors’ perception of us.

We rely on certain key personnel, and our results are dependent upon our ability to retain and attract key personnel.

We depend on the skills and expertise of our key investment and management personnel, and our success and growth depends on our ability to attract and retain key personnel. We rely heavily upon the services of certain key investment and management personnel. The loss of key investment and management personnel for any reason could have an adverse impact upon our business, results of operations and financial condition. Any of our key investment or management personnel could resign at any time, join a competitor or form a competing company. We have entered into non-competition agreements with some, but not all, of our investment and management personnel, but these agreements may not be enforceable or may not be enforceable to their full extent. In addition, we may agree to waive a non-competition agreement applicable to investment or management personnel in light of the circumstances of our relationship with that person. Additionally, key employees have the opportunity to participate in the appreciation in the value of our business. Award documents typically limit a recipient’s right to provide competitive services to our clients or solicit our employees for prescribed periods.

We rely upon the contributions of our senior management team to establish and implement our strategy and to manage the future growth of our business. The amount and structure of compensation and opportunities for equity ownership we offer are key components of our ability to attract and retain qualified management personnel. There is no assurance that we will be successful in designing and implementing an attractive compensation model to attract and retain qualified personnel.

14

Our business operations are complex, and a failure to properly perform operational tasks or maintain infrastructure could have an adverse effect on our revenues and income.

In addition to providing investment management services, we must have the necessary operational capabilities to manage our business effectively in accordance with client expectations and applicable law. The required non-investment management functions include sales, marketing, portfolio recordkeeping and accounting, security pricing, trading activity, investor reporting, corporate governance, compliance, net asset value computations, account reconciliations and calculations of required distributions to accounts. Some of these functions are performed either independently or with the support of or in conjunction with us or third-party service providers that we oversee. Also, we may be highly dependent on specially developed proprietary systems, including proprietary computer code. Any material failure to properly develop, update, review, test or maintain sufficient technological infrastructure, including applicable controls, or perform and monitor non-investment management functions and operations, or adequately oversee the entities that provide the services, could result in potential liability to clients, regulatory sanctions, investment losses, loss of clients and damage to our reputation.

Reputational harm could result in a loss of assets under management and revenues.

The integrity of our brand and reputation is critical to our ability to attract and retain clients, business partners and employees and maintain relationships with consultants. We operate within the highly regulated financial services industry and various potential scenarios could result in harm to our reputation. They include internal operational failures, failure to follow investment or legal guidelines in the management of accounts, instances of financial criminal activity by our employees, intentional or unintentional misrepresentation of our products and services in offering or advertising materials, public relations information, social media or other external communications, employee misconduct or investments in businesses or industries that are controversial to certain special interest groups. Such factors could potentially result in regulatory actions and litigation. The negative publicity associated with any of these factors could harm our reputation and adversely impact relationships with existing and potential clients, third-party distributors, consultants and other business partners and subject us to regulatory sanctions. Damage to our brand or reputation would negatively impact our standing in the industry and result in loss of business in both the short term and the long term.

We may not always successfully manage actual or potential conflicts of interests that may arise in our business.

As we continue to expand the scope of our business, we continue to confront actual, potential and perceived conflicts of interest relating to our activities. Conflicts may arise with respect to decisions regarding, among other things, the allocation of specific investment opportunities among accounts in which we may receive an allocation of profits and accounts in which we do not receive such an allocation or among client accounts that have overlapping investment objectives yet different fee structures, including certain accounts which may pay performance-based fees.

Certain client accounts have similar investment objectives and may engage in transactions in the same types of securities and instruments. These transactions could impact the prices and availability of the securities and instruments in which a client account invests and could have an adverse impact on an account’s performance.

The SEC and other regulators have increased their scrutiny of conflicts of interest. We have implemented procedures and controls to identify, manage, mitigate (where possible) and disclose actual, potential or perceived conflicts of interest, but it is possible that the procedures adopted may not be effective in identifying, managing or mitigating all conflicts which could give rise to the dissatisfaction of, or litigation by, investors or regulatory enforcement actions. Appropriately dealing with conflicts of interest is complex and difficult, and our reputation could be damaged if we fail, or appear to fail, to deal appropriately with one or more potential or actual conflicts of interest. Regulatory scrutiny, litigation or reputational risk incurred in connection with conflicts of interest would adversely impact our business in a number of ways, including by making counterparties reluctant to do business with us, impeding our ability to retain or increase our assets under management, subjecting us to potential litigation and adversely impacting our results of operations.

15

Equity ownership by employees of Acadian is at the level of Acadian and not at the holding company level, although employees of Acadian may acquire our common stock. There may be instances where the interests of Acadian’s key employee equity-holders may not align with ours in effecting a desired outcome.

There is no assurance that a resolution of any conflicts of interest may be possible or the interests of all parties can be taken into account.

Impairment of our relationships with clients and/or consultants may negatively impact our business and our results of operations.

We believe we have strong client and consultant relationships in our core institutional marketplaces, and we depend upon these relationships to successfully market our existing products and strategies and to introduce new products and strategies. As of December 31, 2023, our top five client relationships represented approximately 14% of total run rate gross management fee revenue, and our top 25 clients represented approximately 38% of run rate gross management fee revenue. Total run rate gross management fee revenue reflects the sum for each account at Acadian, of the product of (a) assets under management in each account at December 31, 2023, multiplied by (b) the relevant management fee rate on that account. Any negative changes in these relationships that reduce the number of client or consultant contacts, restrict access to existing or potential clients, or result in negative statements by a consultant, could have an adverse impact on our business and negatively impact our results of operations.

Our business is dependent upon investment advisory agreements that are subject to negotiation, non-renewal, or termination, including termination upon assignment.

We derive substantially all of our revenue from the fees charged to our clients under investment advisory agreements with those clients. The agreements generally provide for fees to be paid on the basis of the value of assets under management, although a portion also provide for performance-based fees to be paid on the basis of investment performance against stated benchmarks.

Acadian is a U.S. registered investment adviser. Acadian may provide investment advisory services to investment companies registered under the Investment Company Act pursuant to the terms of an investment advisory agreement between Acadian and the applicable U.S. registered investment company. Acadian may also be retained by U.S. registered investment advisers to certain U.S. registered investment companies to provide investment sub-advisory services to U.S. registered investment companies pursuant to the terms of an investment sub-advisory agreement between Acadian and the relevant U.S. registered investment adviser. An investment advisory agreement may be terminated by a client without penalty upon relatively short notice (typically no more than 30 days). In addition, the investment advisory agreements and sub-advisory agreements with respect to registered investment companies generally may be terminated by the registered investment company or, in those instances where Acadian serves as a sub-adviser, the registered investment company’s adviser, without penalty, upon 60 days’ notice and are subject to annual approval by the registered investment company’s board of directors or trustees. Clients may decide to terminate or not renew an agreement for poor investment performance or any variety of reasons which may be beyond our control. A decrease in revenues resulting from termination of an investment advisory agreement or sub-advisory agreement for any reason could have a material adverse effect on our revenue and profits and a negative effect on our results of operations.

16

Pursuant to the Advisers Act, investment advisory agreements between Acadian, who is a U.S. registered investment advisers and their clients are not assignable without the consent of the client. As required by the Investment Company Act of 1940, or the Investment Company Act, investment advisory agreements and sub-advisory agreements between Acadian and investment company clients and/or the investment advisers to those investment companies terminate upon their assignment. Assignment, as generally defined, includes direct assignments as well as assignments that may be deemed to occur, under certain circumstances, upon the direct or indirect transfer of a “controlling block” of the voting securities of Acadian. A transaction is not deemed an assignment under the Advisers Act or the Investment Company Act, however, if it does not result in a change of actual control or management of Acadian.

If anyone acquires, or is deemed to have acquired, a controlling block of our voting securities in the future, the contractual anti-assignment and termination provisions of the investment advisory and sub-advisory agreements between Acadian and its clients may be implicated. If an assignment of an investment advisory or sub-advisory agreement is deemed to occur, and clients do not consent to the assignment or, with respect to investment company clients, enter into a new agreement with Acadian, which may require the approval of the investment company’s stockholders in addition to its board of directors or trustees, our results of operations could be materially and adversely affected.

Pressure on fee levels and changes to mix of assets could impact our results of operations.

Our profit margins and net income are dependent on our ability to maintain current fee levels for the products and services we offer. The competitive nature of the asset management industry has led to a trend toward lower fees in certain segments of the asset management market, and there can be no assurance that we will be able to maintain our current pricing structures. We also may be required to restructure our fees due to regulatory changes. These factors also could inhibit the ability to increase fees for certain products. A reduction in the fees, or limited opportunities to increase fees, will reduce or limit our revenues and could reduce or limit our net income.

The fees charged on our assets under management vary by asset class and produce different revenues per dollar of assets under management based on factors such as the type of assets being managed, the applicable investment strategy, the type of client and the client fee schedule. Institutional clients may have significant negotiating leverage in establishing the terms of an advisory relationship, particularly with respect to the level of fees paid, and the competitive pressure to attract and retain institutional clients may impact the level of fee income we earn. In order for us to maintain our fee structure in a competitive environment, we may elect to decline to manage additional assets from potential clients who demand lower fees even though our revenues may be adversely affected in the short term.

Furthermore, a shift in the mix of assets under management from asset classes or products that generate higher fees to those that generate lower fees may result in a decrease in revenues while aggregate assets under management remain unchanged or increase. Such shifts can occur as various investment strategies go in and out of favor due to competition in the industry or as a result of movements between asset classes or certain products no longer being available to investors. In addition, in the event current or future Affiliates have or develop a focus on strategies that generate lower fees, a decrease in revenues may result. A decrease in revenues without a reduction in expenses will result in reduced net income.

Changes in how clients choose to access asset management services may also exert downward pressure on fees. Some investment consultants, for example, are implementing programs in which the consultant provides a range of services, including selection, in a fiduciary capacity, of asset managers to serve as sub-adviser at lower fee rates than the manager’s otherwise applicable rates, with the expectation of a larger amount of assets under management through that consultant. The expansion of those and similar programs could, over time, make it more difficult for us to maintain our fee rates.

17

Investments in non-U.S. markets, in securities of non-U.S. companies and utilization of currency forward contracts and options on currency may involve foreign currency exchange risk, and tax, political, social and economic uncertainties, and a reduction in assets under management associated with investments in non-U.S. equities could have a disproportionately adverse impact on our results of operations.

A significant amount of our assets under management is represented by strategies that invest in securities of non-U.S. companies. Fluctuations in foreign currency exchange rates could negatively impact the account values and the investment returns of clients who are invested in these strategies, with a corresponding reduction in management fee income. In addition, an increase in the value of the U.S. dollar relative to non-U.S. currencies could result in a decrease in the U.S. dollar value of assets under management that are denominated in non-U.S. currencies, which in turn would result in lower revenues.

Many non-U.S. financial markets are not as developed or as efficient as the U.S. financial markets and, as a result, have limited liquidity and greater price volatility and may lack established regulations. Liquidity in such markets also may be adversely impacted by political or economic events, government policies, expropriation, volume trading limits by foreign investors, and social or civil unrest. The ability to dispose of an investment and its market value may be adversely impacted by any of these factors. In addition, non-U.S. legal and regulatory financial accounting standards and practices may be different from those of the U.S., and there may be less publicly available information about non-U.S. companies and non-U.S. markets. Governments of foreign jurisdictions may assert their abilities to tax local gains and/or income of foreign investors, including our clients, which could adversely impact the economics associated with investing in foreign jurisdictions or non-U.S. based companies. These risks also could impact the performance of strategies that invest in such markets and, in particular, strategies that concentrate investments in emerging market companies and countries.

In general, management fees for accounts that invest in non-U.S. equity markets, particularly emerging markets, are higher than those for accounts that invest in the domestic markets. Since over 95% of our total assets under management as of December 31, 2023 were invested in global, international and emerging markets equities, a significant reduction in assets under management associated with such investments could have a disproportionately adverse impact on our results of operations.

If our techniques for managing risk are ineffective, we may be exposed to material unanticipated losses.

In order to manage the significant risks inherent in our business, we must maintain effective policies, procedures and systems that enable us to identify, monitor and control our exposure to operational, legal and reputational risks. Our risk management methods may prove to be ineffective due to their design or implementation, or as a result of the lack of adequate, accurate or timely information or otherwise. If our risk management efforts are ineffective, we could suffer losses that could have a material adverse effect on our financial condition or results of operations. The potential for some types of operational risks, including, for example, trading errors, may be increased or amplified in periods of increased volatility, which can magnify the cost of an error. We may experience operational errors, including trading errors, in the future. Additionally, we could be subject to litigation, particularly from our clients, and investigations and enforcement proceedings by and sanctions or fines from regulators. Our techniques for managing operational, legal and reputational risks in client portfolios may not fully mitigate the risk exposure in all economic or market environments, including exposure to risks that we might fail to identify or anticipate.

In addition, the development and use of various technologies based on machine learning and artificial intelligence is expanding rapidly in our industry. Our use, directly or indirectly, of these technologies could result in new or expanded risks to our business, including but not limited to legal and regulatory risk and the risk that information generated using such technologies is inaccurate, misleading, incomplete or otherwise flawed. To the extent that we do not anticipate or effectively mitigate these risks through policies, controls and procedures, and systems, there could be a material adverse effect on our financial condition and results of operations.

18

We may be exposed to potential liability as a general partner or a controlling person.

Acadian may serve as general partner, managing member or their equivalents for investment products that are organized as partnerships or other commingled vehicles. As such, we may be exposed to liability in the limited liability company, partnership or investment vehicle or required to undertake certain obligations under applicable law that we or they otherwise would not be required to undertake as a holding company or investment adviser. In addition we may be deemed to be a control person of Acadian as that term is defined in various U.S. federal and state statutes and, as such, potentially liable for the acts of Acadian or its employees. Consequently, if under such circumstances Acadian incurs liabilities or expenses that exceed its ability to pay, we may be directly or indirectly liable for its payment to the extent provided in the governing documents of the limited liability company, partnership or investment vehicle or under applicable law. While we maintain errors and omissions and general liability insurance in amounts believed to be adequate to cover certain potential liabilities, we cannot be certain that claims will not be made against us that exceed the limits of available insurance coverage, that the insurers will remain solvent and will meet their obligations to provide coverage or that an adequate amount of insurance coverage will continue to be available to us at a reasonable cost. A judgment against us in excess of available insurance coverage could have a material adverse impact on our business and financial condition.

Our expenses are subject to fluctuations that could materially impact our results of operations.

Our results of operations are dependent upon the level of our expenses, which can vary from period to period. We have certain fixed expenses that we incur as a going concern, and some of those expenses are not subject to adjustment. If our revenues decrease, without a corresponding decrease in expenses, our results of operations would be negatively impacted. While we attempt to project expense levels in advance, there is no guarantee that an unforeseen expense will not arise or that we will be able to adjust our variable expenses quickly enough to match a declining asset base. Consequently, either event could have either a temporary or permanent negative impact on our results of operations.

Losses on our seed capital could adversely impact our results of operations or financial condition.

As of December 31, 2023, we had approximately $41 million committed to seed capital, which is currently invested in five products. The amount we commit to, or invest in, seed capital could change materially from time to time in our discretion based on the needs of the business. The capital utilized in the seed portfolios may be subject to liquidity constraints over certain time periods and is subject to market conditions. A decline in the value of our seed capital would adversely impact our results of operations or financial condition.

The cost of insuring our business is meaningful and may increase.

Our insurance costs are meaningful and can fluctuate significantly from year to year. In addition, certain insurance coverage may not be available or may only be available at prohibitive costs. As we renew our insurance coverage, we may be subject to additional costs caused by premium increases, higher deductibles, co-insurance liability, changes in the size of our business or nature of our operations, litigation or acquisitions or dispositions. Higher insurance costs and incurred deductibles, as with any expense, would reduce our net income. In addition, we may obtain additional liability insurance for our directors and officers. There have been historical periods in which directors’ and officers’ liability insurance and errors and omissions insurance have been available only with limited coverage amounts, less favorable terms or at prohibitive cost, and these conditions could recur.

19

Our growth initiatives, including the development and introduction of new products and/or capabilities, may be unsuccessful, may expose us to risks and may not facilitate the growth of our business.

Our continued growth depends in part on our effectiveness in developing and introducing new products and/or capabilities. Such innovation may require significant time and resources, including upfront and ongoing expenses, as well as expose us to additional risks, including but not limited to legal and regulatory risks. There can be no assurances that we will correctly identify the strongest areas for growth, or that we will effectively develop and introduce products and/or capabilities in such areas and mitigate any additional risk related thereto. To the extent that our revenues associated with such products and/or capabilities do not increase as much as our related expenses, our profitability could be adversely affected.

Our outstanding indebtedness may impact our business and may restrict our growth and results of operations.

As of December 31, 2023, we had $275 million of long-term bonds outstanding. For additional information regarding our long-term bonds, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Capital Resources and Liquidity—Working Capital and Long-Term Debt.”

We may incur additional indebtedness in the future for a variety of business reasons, including in relation to our share repurchases, for seed or co-investment capital, or for other strategic reasons.

The level of our indebtedness has important consequences to investors in our securities. For example, our level of indebtedness may require us to use a substantial portion of our cash flow from operations to pay interest and principal on our debt, which would reduce the funds available to us for working capital, capital expenditures and other general corporate purposes and may limit our ability to pay future dividends. Too much debt may limit our ability to implement our business strategy; heighten our vulnerability to downturns in our business, the financial services industry or in the general economy and limit our flexibility in planning for, or reacting to, changes in our business and the financial services industry; limit our access to additional debt; or prevent us from taking advantage of business opportunities as they arise or successfully carrying out our plans to expand our business and our product offerings. Any of these consequences could have a material adverse effect on our financial condition or results of operations.

We may be unable to obtain sufficient capital and liquidity to meet the financing requirements of our business.

In July 2016 we issued an aggregate of $400 million of long-term bonds, $125 million of which we redeemed in January 2022. On August 20, 2019, we entered into a $450 million senior unsecured revolving credit facility with third party lenders. In February 2021, we assigned this credit facility to Acadian and the available borrowings were decreased to $125 million in connection with the assignment. Accordingly, this credit facility is no longer available to us at the holding company level for future borrowings. Our ability to finance our operations, strategic initiatives and maturing obligations under our long-terms bonds is therefore dependent on future issuances of long-term bonds and our future operating performance. Any future inability to obtain financing on reasonable terms and with reasonable restrictions on the operation of our business could impair our liquidity, have a negative impact on our growth and negatively impact our financial condition.

Our business involves risks of potential litigation that could harm our business.

We may be named as defendants or co-defendants in lawsuits, or may be involved in disputes that include the threat of lawsuits seeking substantial damages. Any such legal action, whether threatened or actual, could result in reputational damage, loss of clients and assets, increased costs and expenses in resolving a claim, diversion of employee resources and resulting financial losses.

20

We make investment decisions on behalf of our clients that could result in substantial losses to those clients. If our clients suffer significant losses or otherwise are dissatisfied with our service, we could be subject to the risk of legal liability or actions alleging, among other theories, negligent misconduct, breach of fiduciary duty, breach of contract, unjust enrichment and/or fraud. These risks often are difficult to assess or quantify and their existence and magnitude often remain unknown for substantial periods of time, even after an action has been commenced. We may incur substantial legal expenses in defending against litigation commenced by a client or regulatory authority. Substantial legal liability levied on us could have a material adverse effect on our business, financial condition, or results of operations and could cause significant reputational harm.

Any significant limitation on the use of our facilities or the failure or security breach of our software applications or operating systems and networks, including the potential risk of cyber-attacks, could result in the accidental or unlawful destruction, loss, alteration, unauthorized disclosure of, or access to, confidential client information or personal data, damage to our reputation, additional costs, regulatory penalties and financial losses.

We depend upon our various centers of operation, including our information technology systems and those of our vendors, contractors, and other third-party partners who process information on our behalf, for the continued operations of our business. A disruption in the infrastructure that supports our business or prevents our employees from performing their job functions, including communication failures, natural disasters, terrorist attacks, third party cyber-attacks including ransomware, and international hostilities, may have a material impact on our ability to continue business operations without interruption. Insurance and other safeguards might not be available or might only partially reimburse us for our losses.

Although we have back-up systems and disaster recovery programs in place and test their uses periodically, there can be no assurance that the recovery programs will be sufficient to mitigate any harm that may result from a disruption or disaster. Additionally, it is possible that any such disruption or disaster could have a significant impact on the general economy, domestic and local financial and capital markets or specific industries, including the financial services industry.

A significant portion of our operations relies heavily on the secure processing, storage and transmission of confidential and other information as well as the monitoring of a large number of complex transactions. Like many other financial institutions, we have been subject to cyber-attacks and will continue to be subject to an increasing risk of cyber incidents from these activities. Cyber-attacks are growing in sophistication and come from a variety of sources, including criminal hackers, hactivists, state-sponsored intrusions, industrial espionage, personnel or the personnel of third parties, and insider threats. We are required to expend significant resources in an effort to protect against security incidents and may be required or choose to spend additional resources or modify our business activities, particularly where required by applicable data privacy and security laws or regulations or industry standards. While we have implemented security measures, our technology systems, and those of our vendors, contractors, and other third-party partners who process information on our behalf, may still be vulnerable to security incidents, disruptions, cyber-attacks or similar events such as unauthorized access, computer malware, phishing attacks and other forms of social engineering, denial-of-service attacks, ransomware attacks, or other events that have a security impact, such as an authorized employee or vendor inadvertently causing the release of confidential information or third-party unauthorized access or account takeovers, which could materially damage our operations or cause the disclosure or modification of sensitive or confidential information. Breach of our technology systems through cyber-attacks, or failure to manage and secure our technology environment, could result in interruptions or malfunctions in the operations of our business, loss of valuable information, liability for stolen assets or information, remediation costs to repair damage caused by a breach, additional costs to mitigate against future incidents and litigation costs resulting from an incident. Moreover, accidental or unlawful destruction, loss, alteration, unauthorized disclosure of, or access to, personal data and confidential client information could harm our reputation and subject us to liability under the laws that protect personal data and confidential information, resulting in increased costs or loss of revenues. A successful attack could result in significant adverse consequences, including

regulatory inquiries or litigation, increased costs and expenses including costs related to insurance and remediation

of any security vulnerabilities, reputational damage, lost revenue, and fines or penalties.

21

We are subject to data protection laws including in the European Union (“EU”), United Kingdom (“U.K.”), United States (“U.S.”) and other jurisdictions, and any failure to comply with such legislation could adversely affect our business, reputation, results of operations and financial condition.

We are subject to privacy and security laws in the various jurisdictions in which we operate, obtain or store personally identifiable information. The legislative and regulatory landscape for privacy and data protection continues to evolve, and there has been an increasing focus on privacy and data protection issues with the potential to affect our business. For example, certain of our processing activities are subject to the General Data Protection Regulation (EU) 2016/679 (“GDPR”), and also as it forms part of the law of England and Wales, Scotland and Northern Ireland by virtue of section 3 of the European Union (Withdrawal) Act 2018 and as amended by the Data Protection, Privacy and Electronic Communications (Amendments etc.) (EU Exit) Regulations 2019 (SI 2019/419) (“U.K. GDPR”), along with the Data Protection Act 2018 in the U.K. (“Act”) (together “EU/U.K. Data Protection Laws”). The EU/U.K. Data Protection Laws have a wide territorial reach and apply to data controllers and data processors which have an establishment in the EU/U.K., or which offer goods or services to, or monitor the behavior of, data subjects in the EU and U.K. The EU/U.K. Data Protection Laws impose stringent operational requirements on data controllers and data processors. These include (i) accountability and transparency obligations which require organizations to demonstrate and record compliance with the EU/U.K. Data Protection Laws and to provide detailed information to data subjects regarding the processing of their personal data, (ii) obligations to consider data privacy as any new products or services are developed and to limit the amount of information they collect, process and store, (iii) ensuring and maintaining an appropriate level of security for personal data, and (iv) reporting breaches to data protection authorities and, in some cases, affected individuals. The EU/U.K. Data Protection Laws give strong enforcement powers to data protection authorities in the EU/U.K., and introduce significant penalties for non-compliance, with fines of up to 4% of total annual worldwide turnover or €20 million (whichever is higher), depending on the type and severity of the breach.

In the United States, we are subject to rules adopted pursuant to the Gramm Leach Bliley Act and an ever-increasing number of state laws and regulations, such as the California Consumer Privacy Act, as amended by the California Privacy Rights Act (together, the “CCPA”). The CCPA regulates companies’ use and disclosure of the personal information of California residents and grants California residents several rights with respect to their personal information. The CCPA also provides for civil penalties for violations, including statutory fines for noncompliance, as well as a limited private right of action in connection with certain data breaches, and establishes a new regulatory agency to implement and enforce the law. Moreover, comprehensive privacy laws similar to the CCPA are either in effect, have been enacted or are being considered in multiple other states. All of these new privacy laws and others that we expect to be developed and enacted going forward may impose additional data protection obligations and potential liability on companies such as ours doing business in those states. The evolving patchwork of differing state and federal privacy and data security laws increases the cost and complexity of operating our business and increases our exposure to liability, including from third-party litigation and regulatory investigations, enforcement, fines and penalties. In addition, the interpretation of EU/U.K. Data Protection Laws, the CCPA, and other privacy laws to which we are subject around the world can be uncertain, and as business practices are challenged by regulators, data subjects and consumer protection agencies, it is possible that these laws may be interpreted and applied in a manner that is inconsistent with our data protection practices. Compliance with data privacy and security regulations can require allocation of significant resources as well as changes in operations and non-compliance can result in substantial fines. Any failure or perceived failure by us or our employees, representatives, contractors, consultants, collaborators, or other third parties to comply with such requirements or adequately address privacy and security concerns, even if unfounded, could result in additional cost and liability to us, damage our reputation, and adversely affect our business and results of operations.

22

The failure of a counterparty to meet its obligations could affect our business adversely.

We routinely execute transactions with counterparties in the financial industry and for the provision of services that are important to the business, and we may engage in transactions with counterparties as part of our corporate finance management function and for the provision of services, including insurance protection. As a result, we and our clients have exposure to the credit, operational and other risks posed by such counterparties, including the risk of default by or bankruptcy of a counterparty. Additionally, we hold insurance policies which cover historical tax benefits relating to certain of our deferred tax assets. The insurers of the policies are considered a significant counterparty to us. The failure of a counterparty to meet its obligations or provide the services or insurance protection we depend on for these or other reasons could adversely affect our ability to conduct our business and result in loss of client assets and potential liability.

We are subject to the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act and other anti-corruption laws, as well as export control laws, customs laws, sanctions laws, anti-facilitation of tax evasion laws and other laws governing our operations. If we fail to comply with these laws, we could be subject to civil or criminal penalties, other remedial measures, and legal expenses, which could adversely affect our business, results of operations and financial condition.

Our operations are subject to anti-corruption laws, including the U.S. Foreign Corrupt Practices Act, or the FCPA, the U.K. Bribery Act 2010, or the Bribery Act, and other anti-corruption laws that apply in countries where we do business. The FCPA, the Bribery Act and other applicable anti-corruption laws generally prohibit us and our employees and intermediaries from paying bribes, receiving bribes or making other prohibited payments to government officials or other persons to obtain or retain business or gain some other business advantage. We and our commercial partners operate in a number of jurisdictions that may pose an elevated risk of corruption, and we participate in collaborations and relationships with third parties whose actions could potentially subject us to liability under FCPA, the Bribery Act or local anti-corruption laws.

We are also subject to other laws and regulations governing our international operations, including applicable export control regulations, economic sanctions on countries or persons, customs requirements currency exchange regulations, and anti-facilitation of tax evasion rules, or collectively Trade Control Laws. As with anti-corruption laws, misconduct by third parties could potentially subject us to liability under Trade Control Laws.