May 2, 2023 US May 3, 2023 Australia Ron Delia CEO Michael Casamento CFO Fiscal 2023 year to date results (nine months ended March 31, 2023) NYSE: AMCR | ASX: AMC

Disclaimers 2 Cautionary Statement Regarding Forward-Looking Statements This document contains certain statements that are “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identified with words like “believe,” “expect,” “target,” “project,” “may,” “could,” “would,” “approximately,” “possible,” “will,” “should,” “intend,” “plan,” “anticipate,” "commit," “estimate,” “potential,” "ambitions," “outlook,” or “continue,” the negative of these words, other terms of similar meaning, or the use of future dates. Such statements are based on the current expectations of the management of Amcor and are qualified by the inherent risks and uncertainties surrounding future expectations generally. Actual results could differ materially from those currently anticipated due to a number of risks and uncertainties. None of Amcor or any of its respective directors, executive officers, or advisors provide any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur. Risks and uncertainties that could cause actual results to differ from expectations include, but are not limited to: changes in consumer demand patterns and customer requirements; the loss of key customers, a reduction in production requirements of key customers; significant competition in the industries and regions in which Amcor operates; failure by Amcor to expand its business; challenging current and future global economic conditions, including inflation and supply chain disruptions; impact of operating internationally, including negative impacts from the Russia-Ukraine conflict; price fluctuations or shortages in the availability of raw materials, energy, and other inputs; disruptions to production, supply, and commercial risks, which may be exacerbated in times of economic volatility; global health outbreaks, including COVID-19; an inability to attract and retain key personnel; costs and liabilities related to current and future environment, health, and safety laws and regulations; labor disputes; risks related to climate change; failures or disruptions in information technology systems; cybersecurity risks; a significant increase in indebtedness or a downgrade in the credit rating; foreign exchange rate risk; rising interest rates; a significant write-down of goodwill and/or other intangible assets; failure to maintain an effective system of internal control over financial reporting; inability of the Company’s insurance policies to provide adequate protections; challenges to or the loss of intellectual property rights; litigation, including product liability claims; increasing scrutiny and changing expectations with respect to Amcor Environmental, Social and Governance policies resulting in increased costs; changing government regulations in environmental, health, and safety matters; changes in tax laws or changes in our geographic mix of earnings; and other risks and uncertainties identified from time to time in Amcor’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including without limitation, those described under Item 1A. “Risk Factors” of Amcor’s annual report on Form 10-K for the fiscal year ended June 30, 2022 and any subsequent quarterly reports on Form 10-Q. You can obtain copies of Amcor’s filings with the SEC for free at the SEC’s website (www.sec.gov). Forward-looking statements included herein are made only as of the date hereof and Amcor does not undertake any obligation to update any forward-looking statements, or any other information in this communication, as a result of new information, future developments or otherwise, or to correct any inaccuracies or omissions in them which become apparent, except as expressly required by law. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement. Presentation of non-GAAP information Included in this release are measures of financial performance that are not calculated in accordance with U.S. GAAP. These measures include adjusted EBITDA and EBITDA (calculated as earnings before interest and tax and depreciation and amortization), adjusted EBIT and EBIT (calculated as earnings before interest and tax), adjusted net income, adjusted earnings per share, adjusted free cash flow and net debt. In arriving at these non-GAAP measures, we exclude items that either have a non-recurring impact on the income statement or which, in the judgment of our management, are items that, either as a result of their nature or size, could, were they not singled out, potentially cause investors to extrapolate future performance from an improper base. Note although amortization of acquired intangible assets is excluded from non-GAAP adjusted financial measures, the revenue of the acquired entities and all other expenses unless otherwise stated, are reflected in our non-GAAP financial performance earnings measures. While not all inclusive, examples of these items include: • material restructuring programs, including associated costs such as employee severance, pension and related benefits, impairment of property and equipment and other assets, accelerated depreciation, termination payments for contracts and leases, contractual obligations, and any other qualifying costs related to the restructuring plan; • material sales and earnings from disposed or ceased operations and any associated profit or loss on sale of businesses or subsidiaries; • impairments in goodwill and equity method investments; • material acquisition compensation and transaction costs such as due diligence expenses, professional and legal fees, and integration costs; • material purchase accounting adjustments for inventory; • amortization of acquired intangible assets from business combination; • significant property impairments, net of insurance recovery; • payments or settlements related to legal claims; • impacts from hyperinflation accounting; and • impacts related to the Russia-Ukraine conflict. Amcor also evaluates performance on a comparable constant currency basis, which measures financial results assuming constant foreign currency exchange rates used for translation based on the average rates in effect for the comparable prior year period. In order to compute comparable constant currency results, we multiply or divide, as appropriate, current-year U.S. dollar results by the current year average foreign exchange rates and then multiply or divide, as appropriate, those amounts by the prior-year average foreign exchange rates. We then adjust for other items affecting comparability. While not all inclusive, examples of items affecting comparability include the difference between sales or earnings in the current period and the prior period related to acquired, disposed, or ceased operations. Comparable constant currency net sales performance also excludes the impact from passing through movements in raw material costs. Management has used and uses these measures internally for planning, forecasting and evaluating the performance of the Company’s reporting segments and certain of the measures are used as a component of Amcor’s Board of Directors’ measurement of Amcor’s performance for incentive compensation purposes. Amcor believes that these non-GAAP measures are useful to enable investors to perform comparisons of current and historical performance of the Company. For each of these non-GAAP financial measures, a reconciliation to the most directly comparable U.S. GAAP financial measure has been provided herein. These non-GAAP financial measures should not be construed as an alternative to results determined in accordance with U.S. GAAP. The Company provides guidance on a non-GAAP basis as we are unable to predict with reasonable certainty the ultimate outcome and timing of certain significant forward-looking items without unreasonable effort. These items include but are not limited to the impact of foreign exchange translation, restructuring program costs, asset impairments, possible gains and losses on the sale of assets, and certain tax related events. These items are uncertain, depend on various factors, and could have a material impact on U.S. GAAP earnings and cash flow measures for the guidance period.

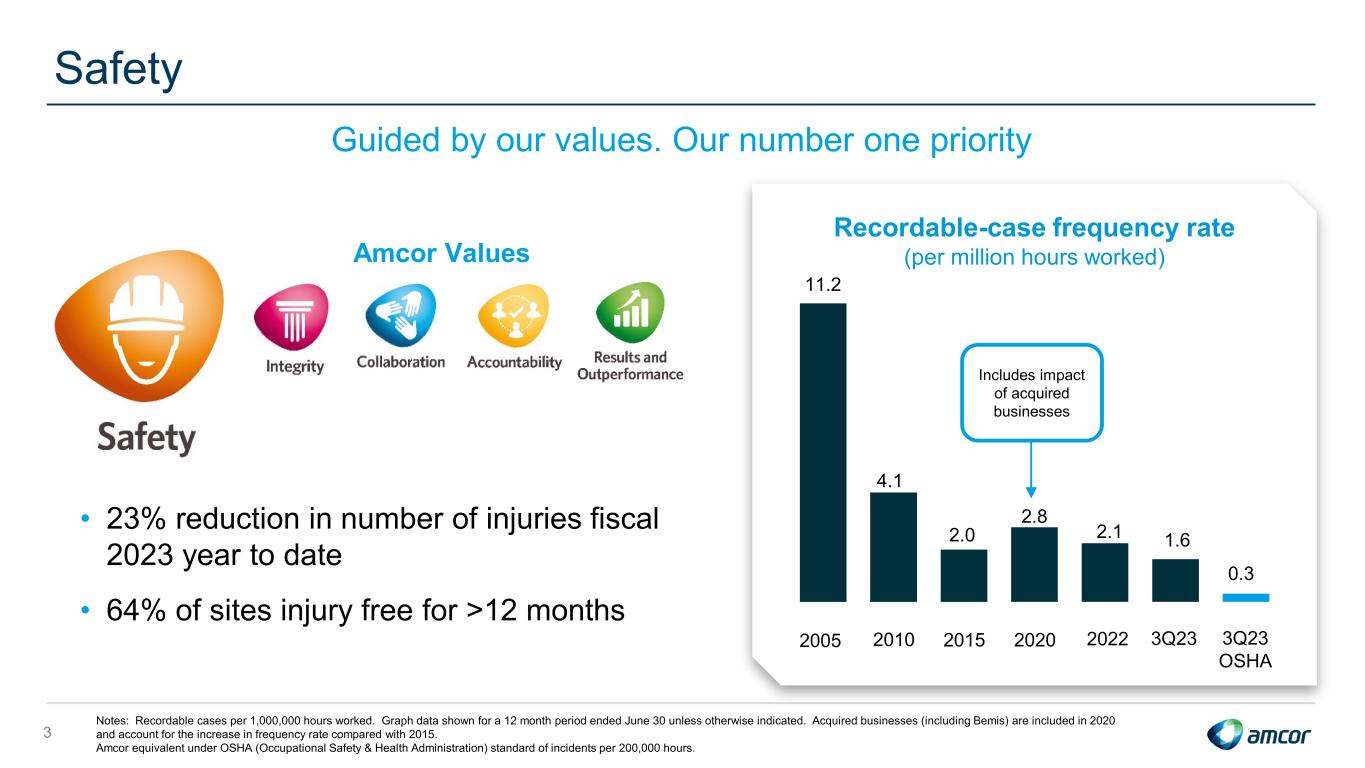

Safety 3 Guided by our values. Our number one priority 11.2 4.1 2.0 2.8 2.1 1.6 0.3 Recordable-case frequency rate (per million hours worked) 3Q23 OSHA Includes impact of acquired businesses 201520102005 2020 Notes: Recordable cases per 1,000,000 hours worked. Graph data shown for a 12 month period ended June 30 unless otherwise indicated. Acquired businesses (including Bemis) are included in 2020 and account for the increase in frequency rate compared with 2015. Amcor equivalent under OSHA (Occupational Safety & Health Administration) standard of incidents per 200,000 hours. Amcor Values 2022 • 23% reduction in number of injuries fiscal 2023 year to date • 64% of sites injury free for >12 months 3Q23

Key messages 4 1. Well positioned with consumer staples and healthcare exposure 2. Not immune from challenging operating environment 3. Decisive actions on price and cost 4. FY23 guidance updated on general market softness 5. Continuing to invest to drive growth and value creation

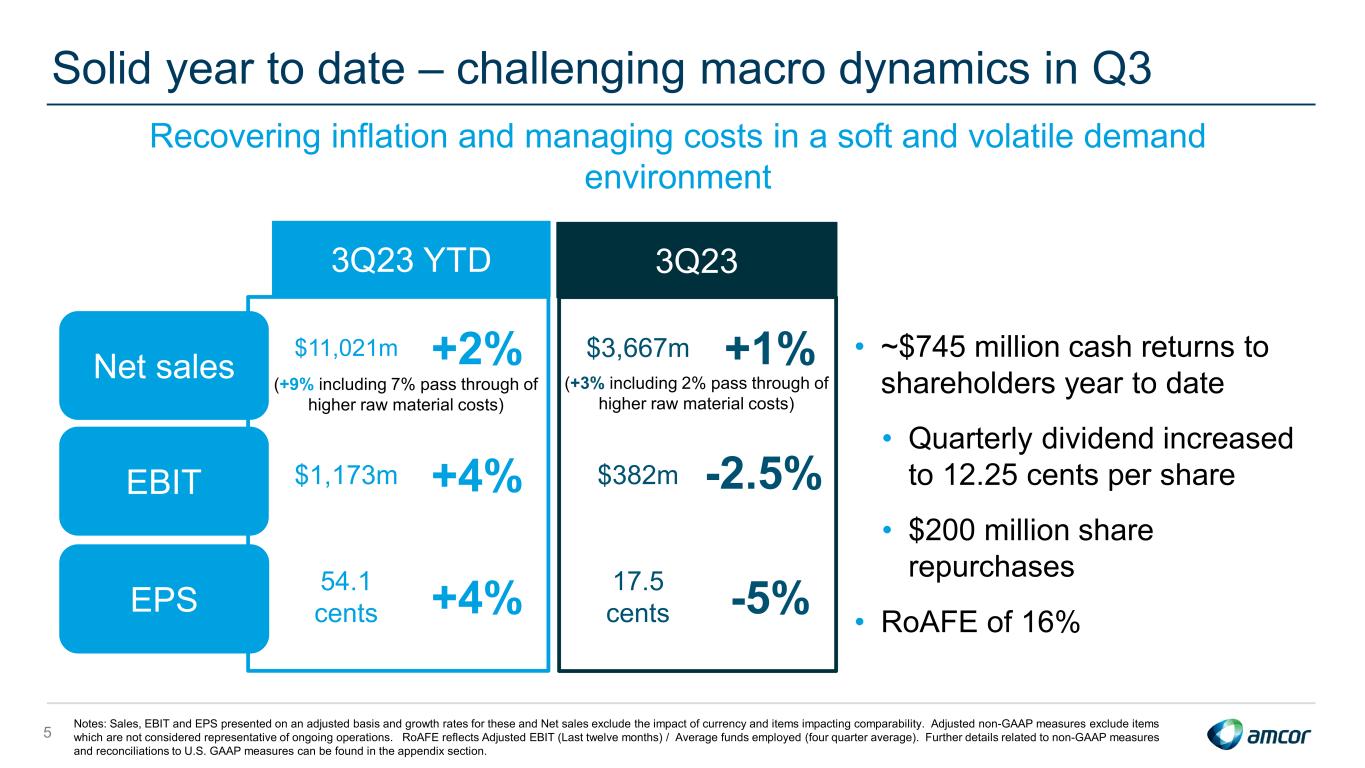

5 Notes: Sales, EBIT and EPS presented on an adjusted basis and growth rates for these and Net sales exclude the impact of currency and items impacting comparability. Adjusted non-GAAP measures exclude items which are not considered representative of ongoing operations. RoAFE reflects Adjusted EBIT (Last twelve months) / Average funds employed (four quarter average). Further details related to non-GAAP measures and reconciliations to U.S. GAAP measures can be found in the appendix section. Net sales $11,021m +2% $3,667m +1% EBIT $1,173m +4% $382m EPS 54.1 cents +4% 17.5 cents -5% Net sales (+9% including 7% pass through of higher raw material costs) 3Q23 YTD 3Q23 EBIT EPS (+3% including 2% pass through of higher raw material costs) Solid year to date – challenging macro dynamics in Q3 Recovering inflation and managing costs in a soft and volatile demand environment • ~$745 million cash returns to shareholders year to date • Quarterly dividend increased to 12.25 cents per share • $200 million share repurchases • RoAFE of 16% -2.5%

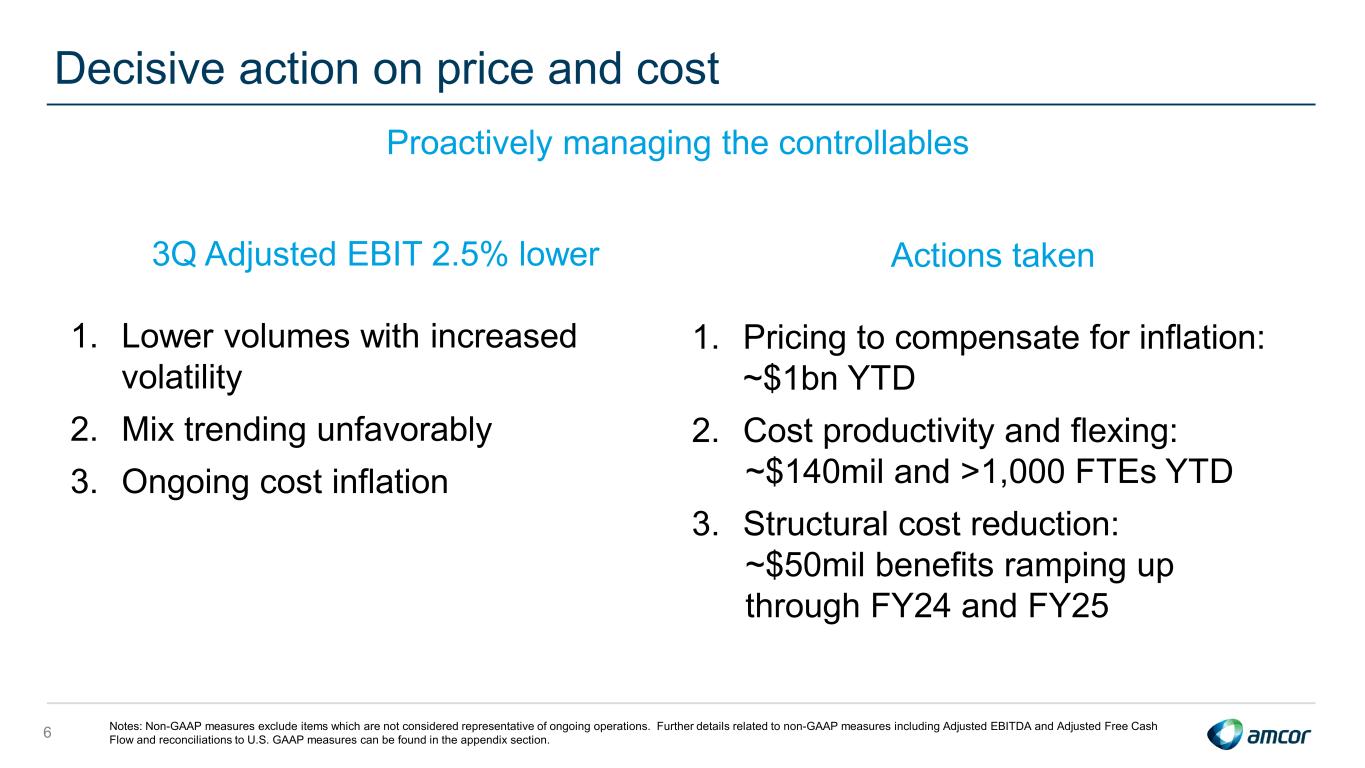

Decisive action on price and cost 6 3Q Adjusted EBIT 2.5% lower 1. Lower volumes with increased volatility 2. Mix trending unfavorably 3. Ongoing cost inflation Proactively managing the controllables Actions taken 1. Pricing to compensate for inflation: ~$1bn YTD 2. Cost productivity and flexing: ~$140mil and >1,000 FTEs YTD 3. Structural cost reduction: ~$50mil benefits ramping up through FY24 and FY25 Notes: Non-GAAP measures exclude items which are not considered representative of ongoing operations. Further details related to non-GAAP measures including Adjusted EBITDA and Adjusted Free Cash Flow and reconciliations to U.S. GAAP measures can be found in the appendix section.

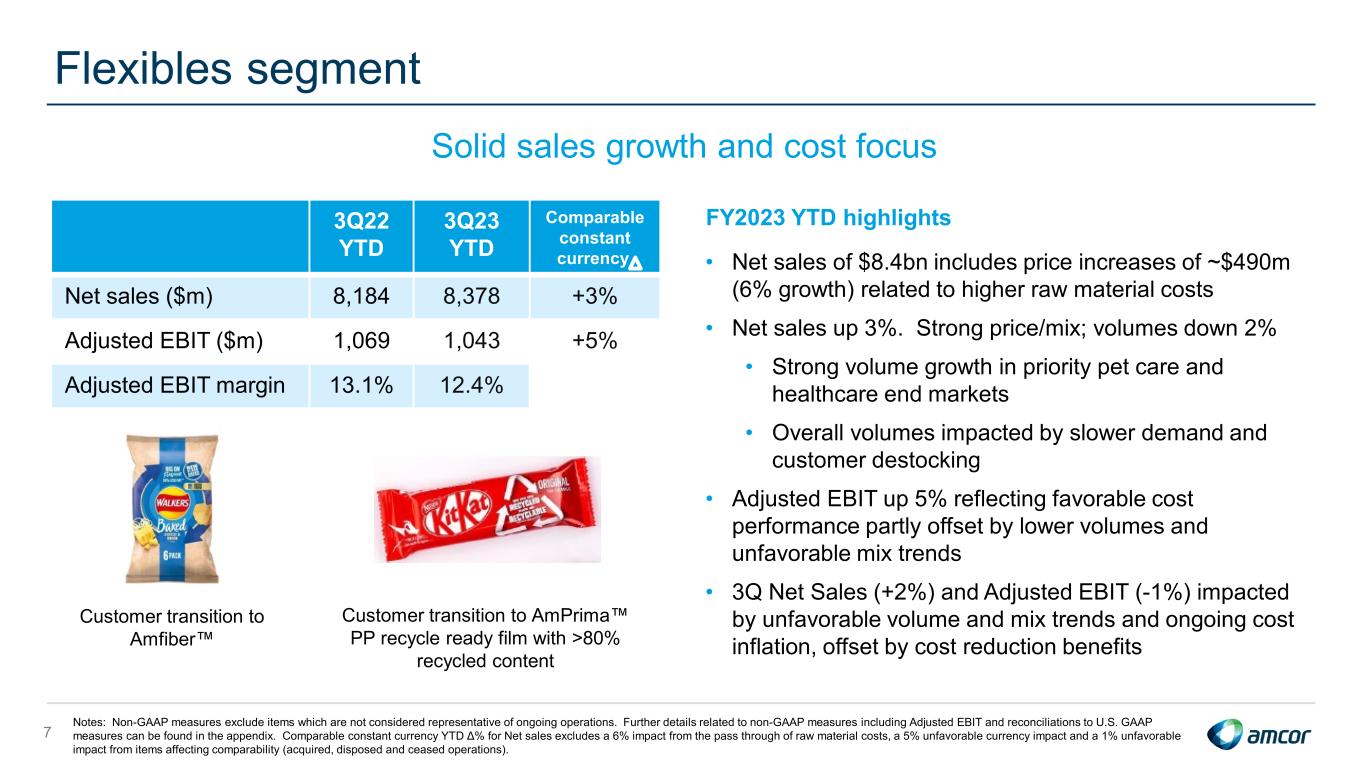

FY2023 YTD highlights • Net sales of $8.4bn includes price increases of ~$490m (6% growth) related to higher raw material costs • Net sales up 3%. Strong price/mix; volumes down 2% • Strong volume growth in priority pet care and healthcare end markets • Overall volumes impacted by slower demand and customer destocking • Adjusted EBIT up 5% reflecting favorable cost performance partly offset by lower volumes and unfavorable mix trends • 3Q Net Sales (+2%) and Adjusted EBIT (-1%) impacted by unfavorable volume and mix trends and ongoing cost inflation, offset by cost reduction benefits Flexibles segment 7 Notes: Non-GAAP measures exclude items which are not considered representative of ongoing operations. Further details related to non-GAAP measures including Adjusted EBIT and reconciliations to U.S. GAAP measures can be found in the appendix. Comparable constant currency YTD Δ% for Net sales excludes a 6% impact from the pass through of raw material costs, a 5% unfavorable currency impact and a 1% unfavorable impact from items affecting comparability (acquired, disposed and ceased operations). Solid sales growth and cost focus 3Q22 YTD 3Q23 YTD Comparable constant currency Net sales ($m) 8,184 8,378 +3% Adjusted EBIT ($m) 1,069 1,043 +5% Adjusted EBIT margin 13.1% 12.4% Customer transition to Amfiber™ Customer transition to AmPrima™ PP recycle ready film with >80% recycled content

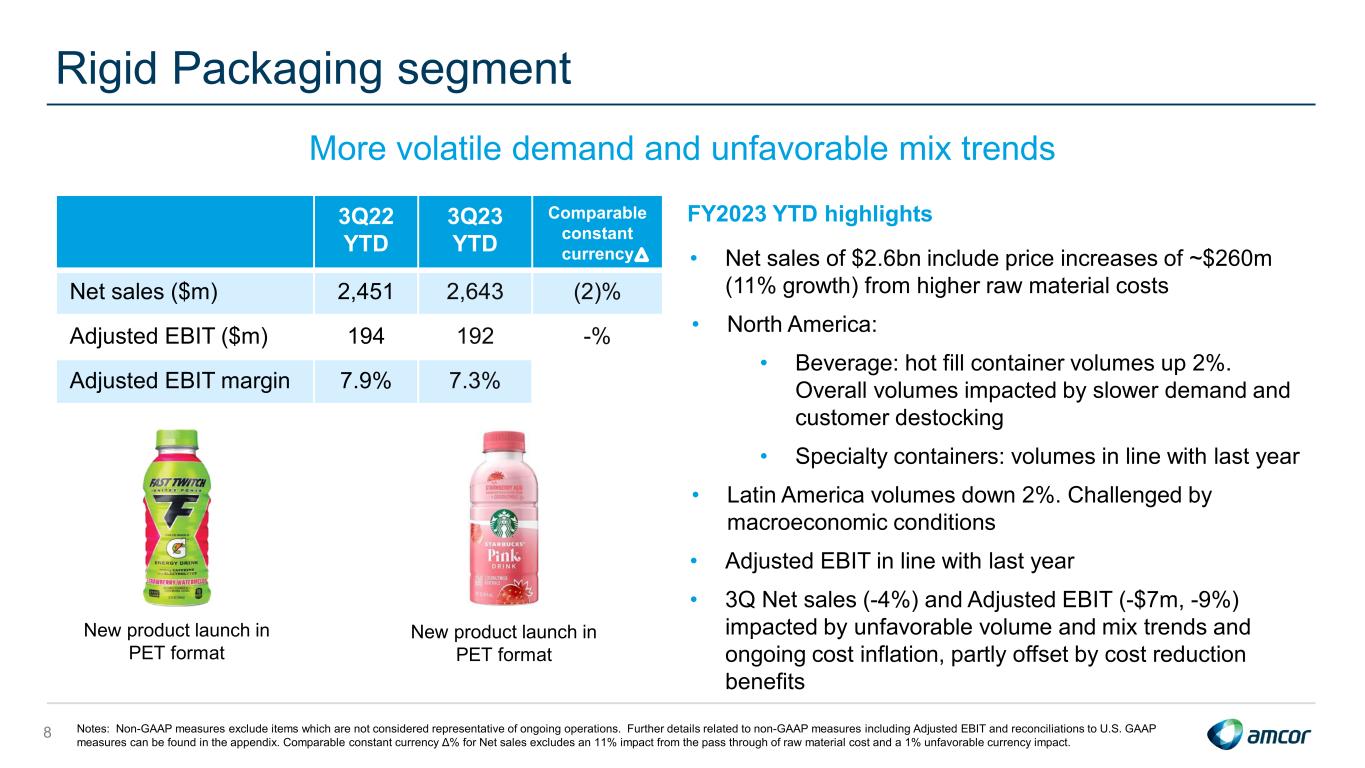

Rigid Packaging segment 8 Notes: Non-GAAP measures exclude items which are not considered representative of ongoing operations. Further details related to non-GAAP measures including Adjusted EBIT and reconciliations to U.S. GAAP measures can be found in the appendix. Comparable constant currency Δ% for Net sales excludes an 11% impact from the pass through of raw material cost and a 1% unfavorable currency impact. More volatile demand and unfavorable mix trends FY2023 YTD highlights • Net sales of $2.6bn include price increases of ~$260m (11% growth) from higher raw material costs • North America: • Beverage: hot fill container volumes up 2%. Overall volumes impacted by slower demand and customer destocking • Specialty containers: volumes in line with last year • Latin America volumes down 2%. Challenged by macroeconomic conditions • Adjusted EBIT in line with last year • 3Q Net sales (-4%) and Adjusted EBIT (-$7m, -9%) impacted by unfavorable volume and mix trends and ongoing cost inflation, partly offset by cost reduction benefits 3Q22 YTD 3Q23 YTD Comparable constant currency Net sales ($m) 2,451 2,643 (2)% Adjusted EBIT ($m) 194 192 -% Adjusted EBIT margin 7.9% 7.3% New product launch in PET format New product launch in PET format

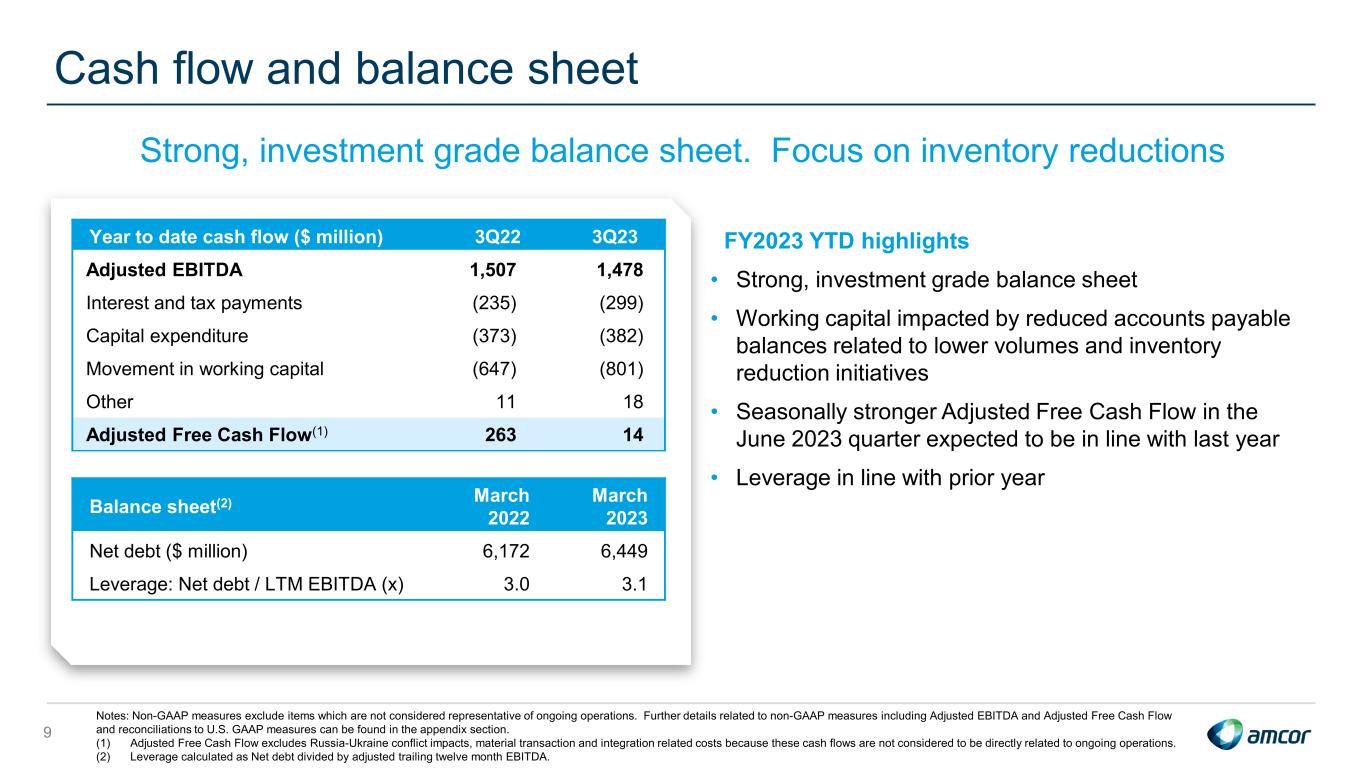

Cash flow and balance sheet 9 Notes: Non-GAAP measures exclude items which are not considered representative of ongoing operations. Further details related to non-GAAP measures including Adjusted EBITDA and Adjusted Free Cash Flow and reconciliations to U.S. GAAP measures can be found in the appendix section. (1) Adjusted Free Cash Flow excludes Russia-Ukraine conflict impacts, material transaction and integration related costs because these cash flows are not considered to be directly related to ongoing operations. (2) Leverage calculated as Net debt divided by adjusted trailing twelve month EBITDA. Year to date cash flow ($ million) 3Q22 3Q23 Adjusted EBITDA 1,507 1,478 Interest and tax payments (235) (299) Capital expenditure (373) (382) Movement in working capital (647) (801) Other 11 18 Adjusted Free Cash Flow(1) 263 14 Balance sheet(2) March 2022 March 2023 Net debt ($ million) 6,172 6,449 Leverage: Net debt / LTM EBITDA (x) 3.0 3.1 FY2023 YTD highlights • Strong, investment grade balance sheet • Working capital impacted by reduced accounts payable balances related to lower volumes and inventory reduction initiatives • Seasonally stronger Adjusted Free Cash Flow in the June 2023 quarter expected to be in line with last year • Leverage in line with prior year Strong, investment grade balance sheet. Focus on inventory reductions

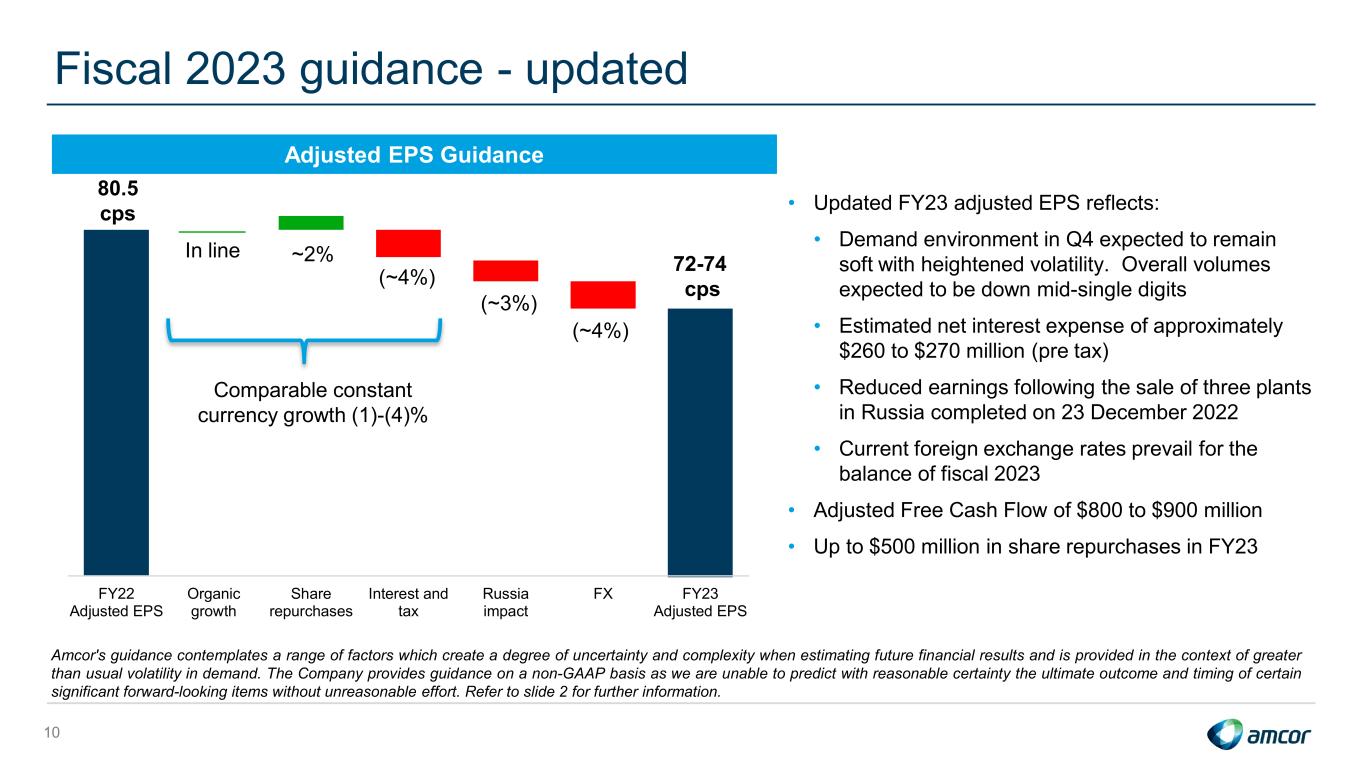

10 Fiscal 2023 guidance - updated Amcor's guidance contemplates a range of factors which create a degree of uncertainty and complexity when estimating future financial results and is provided in the context of greater than usual volatility in demand. The Company provides guidance on a non-GAAP basis as we are unable to predict with reasonable certainty the ultimate outcome and timing of certain significant forward-looking items without unreasonable effort. Refer to slide 2 for further information. FY22 Adjusted EPS Organic growth Share repurchases Interest and tax Russia impact FX FY23 Adjusted EPS (~4%) ~2%In line • Updated FY23 adjusted EPS reflects: • Demand environment in Q4 expected to remain soft with heightened volatility. Overall volumes expected to be down mid-single digits • Estimated net interest expense of approximately $260 to $270 million (pre tax) • Reduced earnings following the sale of three plants in Russia completed on 23 December 2022 • Current foreign exchange rates prevail for the balance of fiscal 2023 • Adjusted Free Cash Flow of $800 to $900 million • Up to $500 million in share repurchases in FY23 Adjusted EPS Guidance (~4%) (~3%) 80.5 cps 72-74 cps Comparable constant currency growth (1)-(4)%

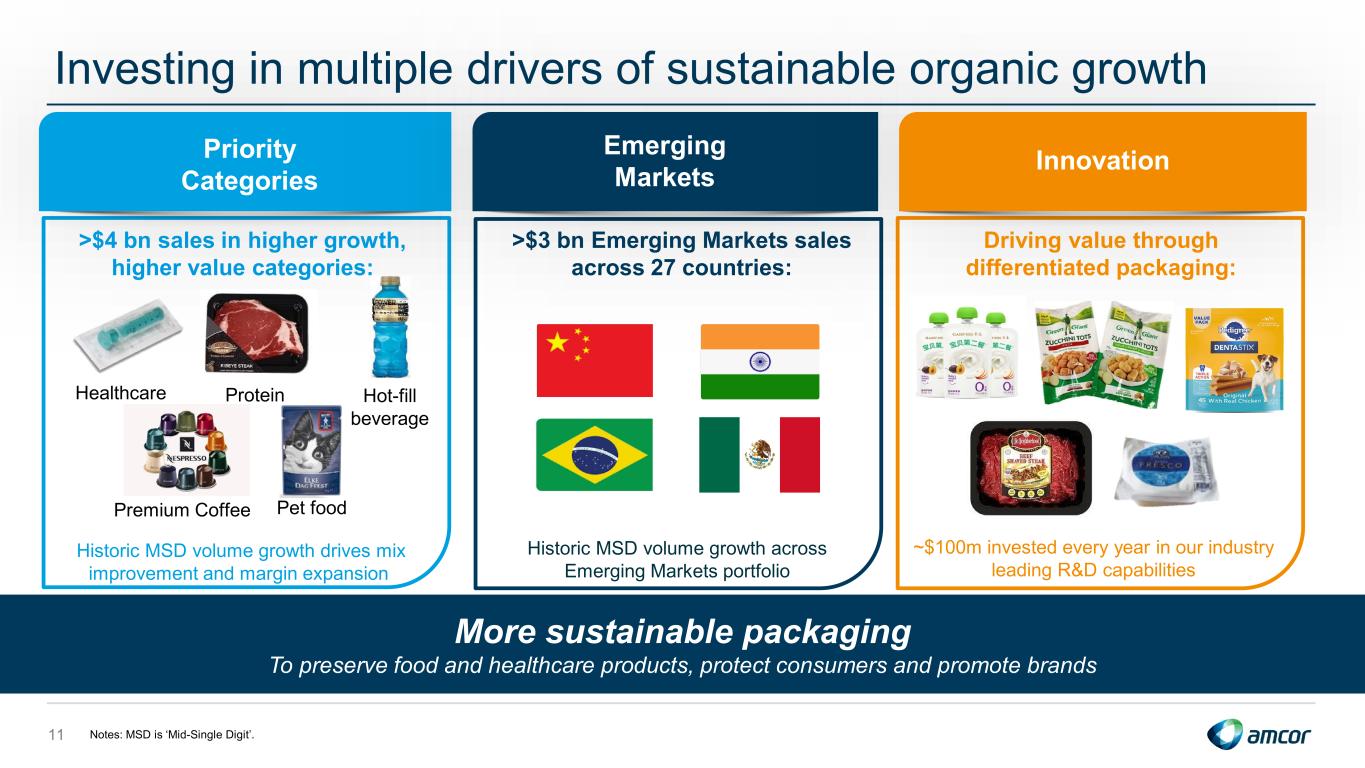

Investing in multiple drivers of sustainable organic growth Priority Categories Emerging Markets >$3 bn Emerging Markets sales across 27 countries: Driving value through differentiated packaging: Innovation ProteinHealthcare Hot-fill beverage 11 Historic MSD volume growth across Emerging Markets portfolio >$4 bn sales in higher growth, higher value categories: Notes: MSD is ‘Mid-Single Digit’. Premium Coffee Pet food Historic MSD volume growth drives mix improvement and margin expansion ~$100m invested every year in our industry leading R&D capabilities More sustainable packaging To preserve food and healthcare products, protect consumers and promote brands

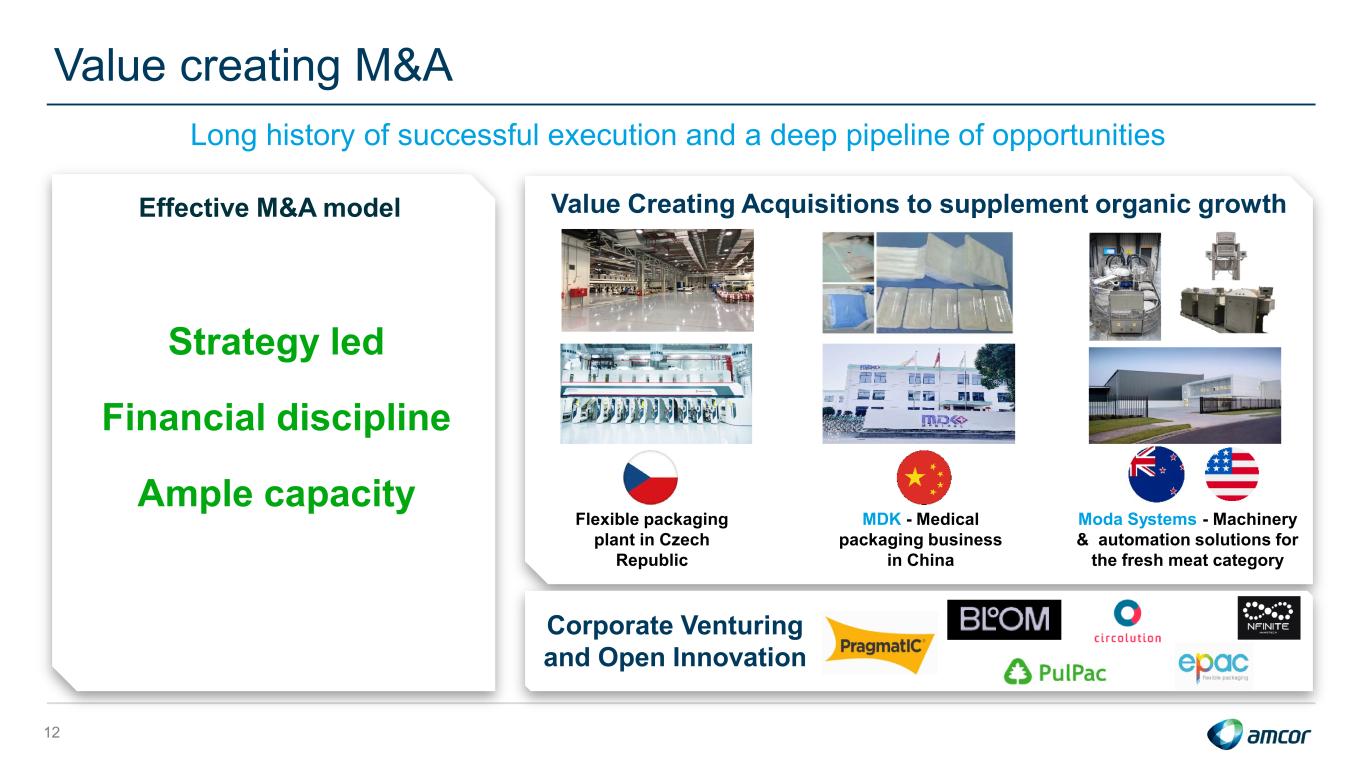

12 Value Creating Acquisitions to supplement organic growth Flexible packaging plant in Czech Republic MDK - Medical packaging business in China Moda Systems - Machinery & automation solutions for the fresh meat category Strategy led Financial discipline Ample capacity Effective M&A model Corporate Venturing and Open Innovation Value creating M&A Long history of successful execution and a deep pipeline of opportunities

13 Recognition for progress against our sustainability agenda Recognizing Amcor’s ongoing sustainability commitment and achievements A- 5 Consecutive Years identified as a leader in responsible packaging and ESG topics AA 2023 winner in Food, Health & Personal Care and Medical and Pharmaceutical categories

Key messages 14 1. Well positioned with consumer staples and healthcare exposure 2. Not immune from challenging operating environment 3. Decisive actions on price and cost 4. FY23 guidance updated on general market softness 5. Continuing to invest to drive growth and value creation

Appendix slides Supplementary schedules and reconciliations

Strong foundation for growth & value creation Global leader in primary packaging for consumer staples and healthcare with a strong track record Consistent growth from priority categories, emerging markets and innovation Strong cash flow and balance sheet provide ongoing capacity to invest Increasing investment for growth and building momentum Compelling and growing dividend with current yield ~4% EPS growth + Dividend yield = 10-15% per year 16 Notes: EPS growth refers to comparable constant currency growth. A range of factors are contemplated when estimating future financial results. Refer to slide 2 for further information.

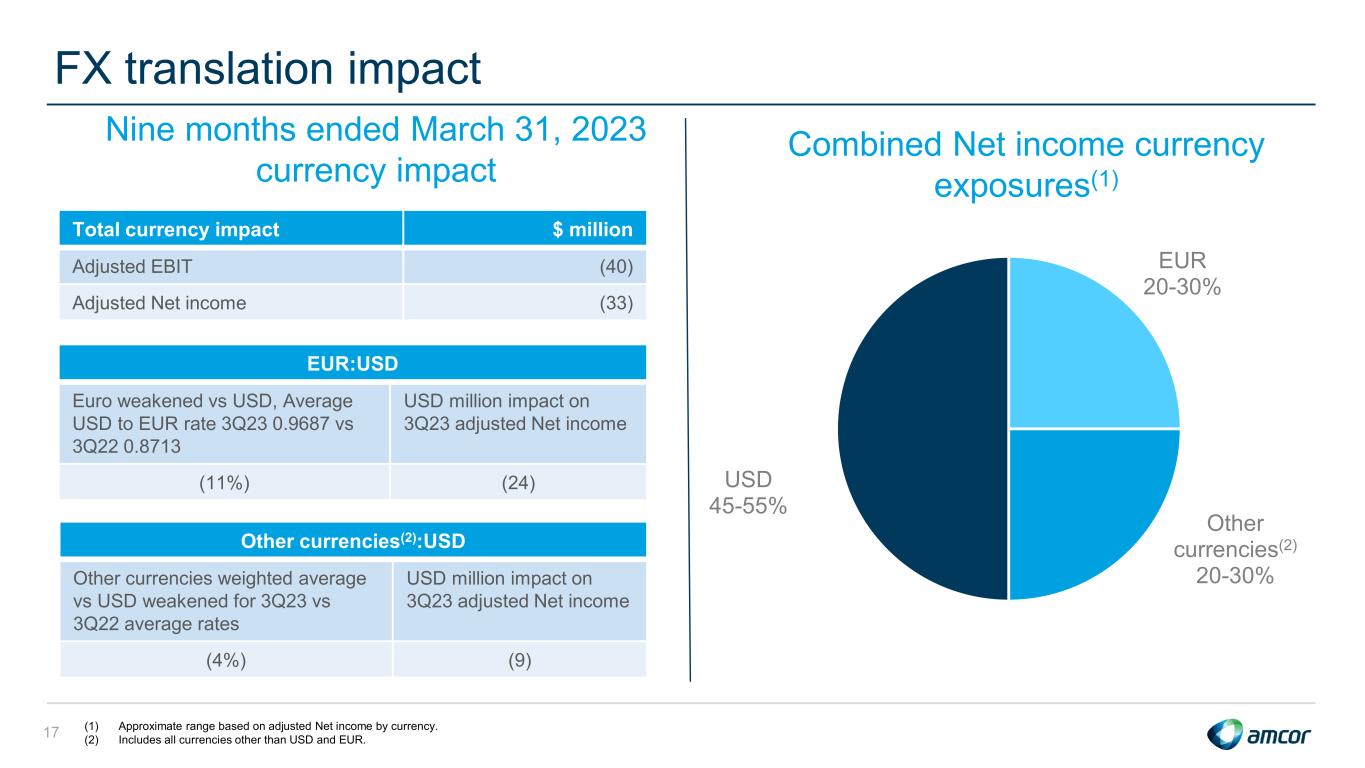

FX translation impact 17 EUR 20-30% Other currencies(2) 20-30% USD 45-55% EUR:USD Euro weakened vs USD, Average USD to EUR rate 3Q23 0.9687 vs 3Q22 0.8713 USD million impact on 3Q23 adjusted Net income (11%) (24) Other currencies(2):USD Other currencies weighted average vs USD weakened for 3Q23 vs 3Q22 average rates USD million impact on 3Q23 adjusted Net income (4%) (9) (1) Approximate range based on adjusted Net income by currency. (2) Includes all currencies other than USD and EUR. Total currency impact $ million Adjusted EBIT (40) Adjusted Net income (33) Combined Net income currency exposures(1) Nine months ended March 31, 2023 currency impact

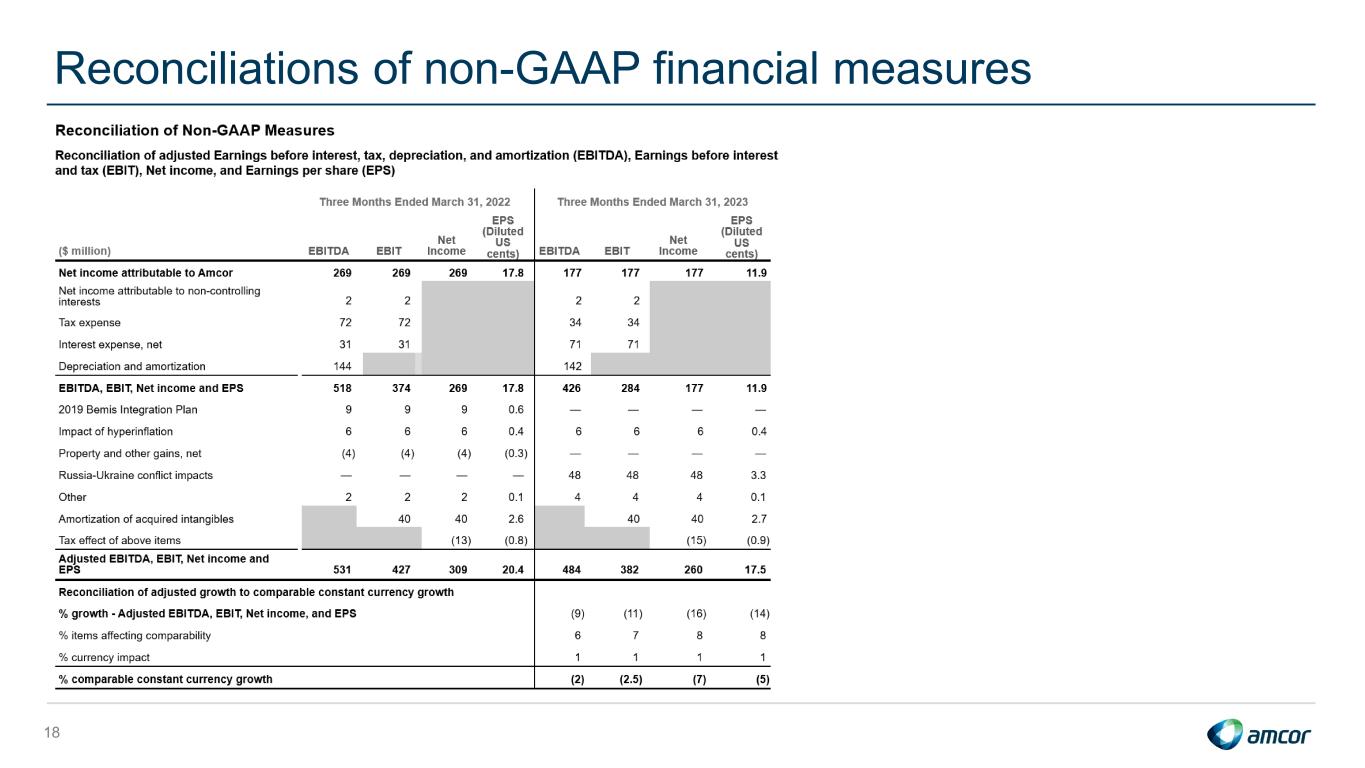

Reconciliations of non-GAAP financial measures 18

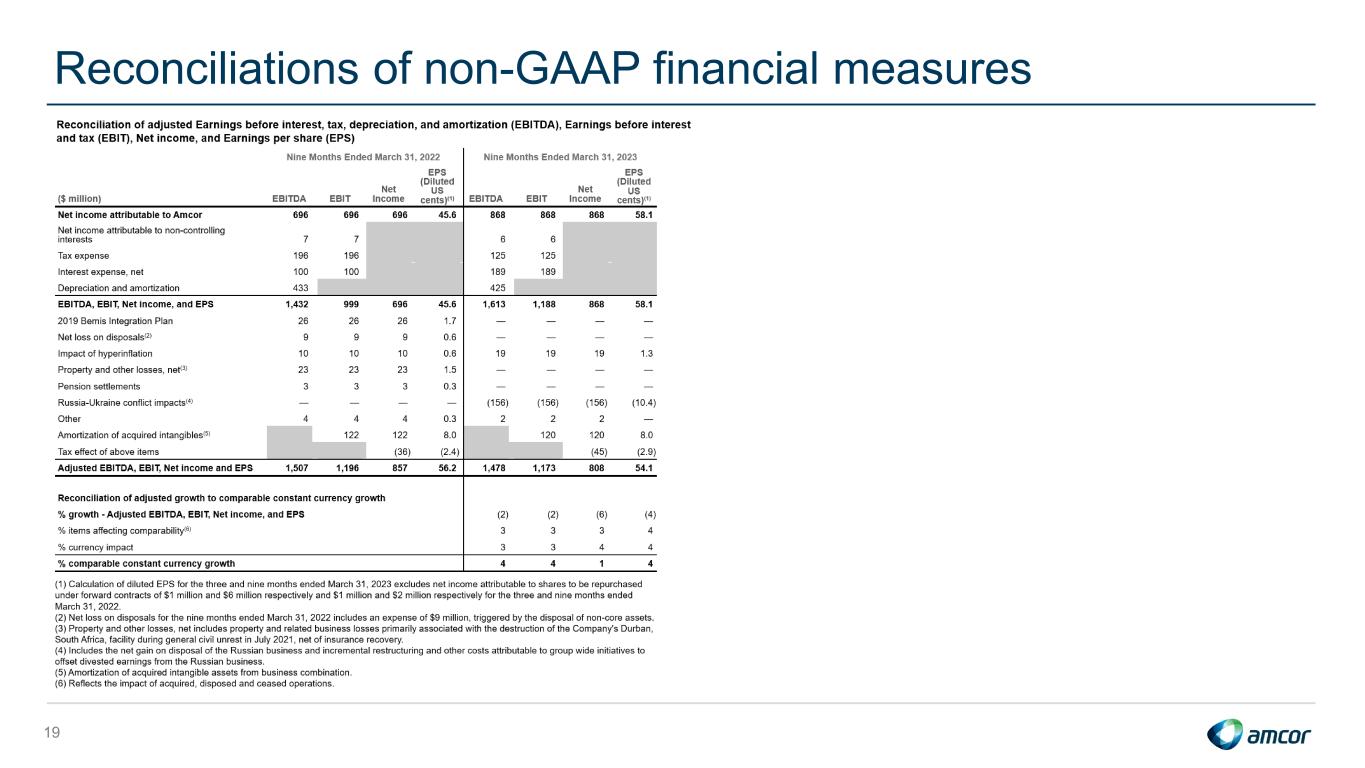

Reconciliations of non-GAAP financial measures 19

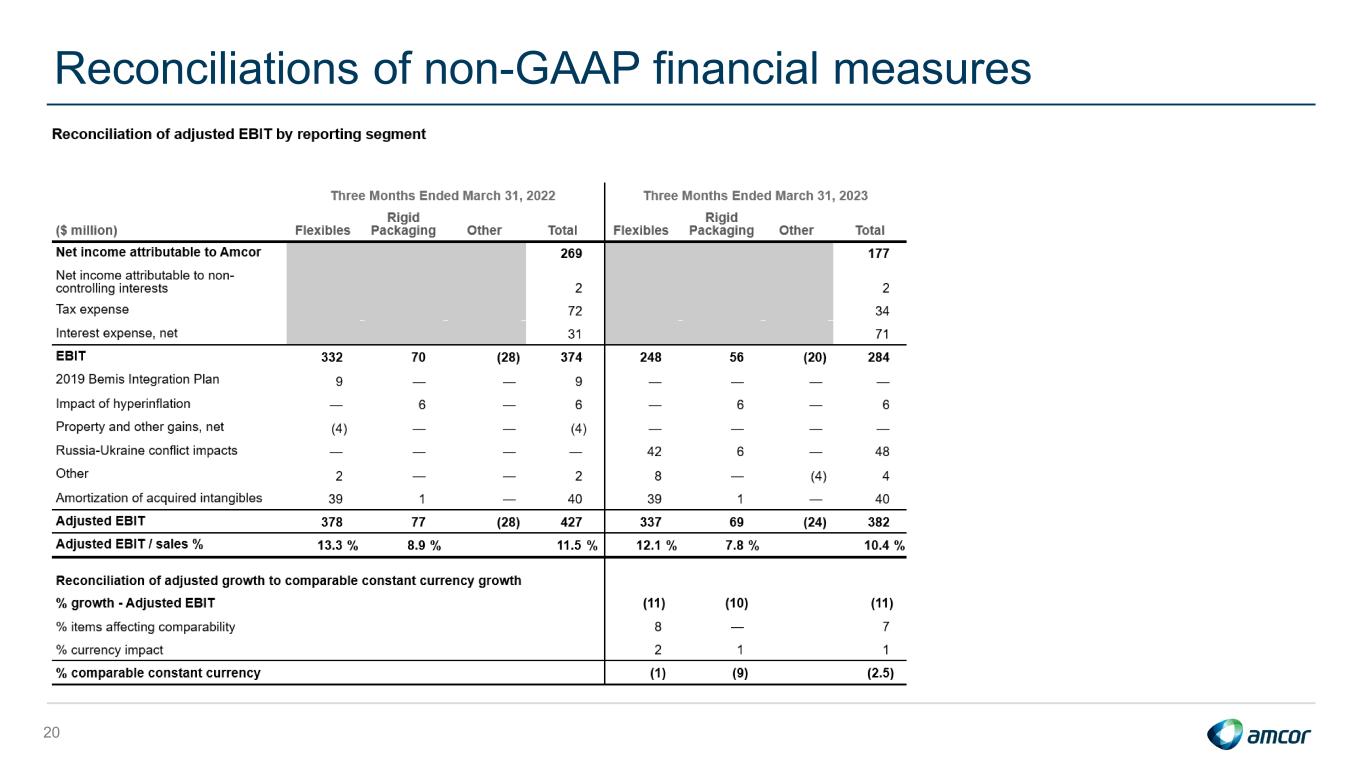

Reconciliations of non-GAAP financial measures 20

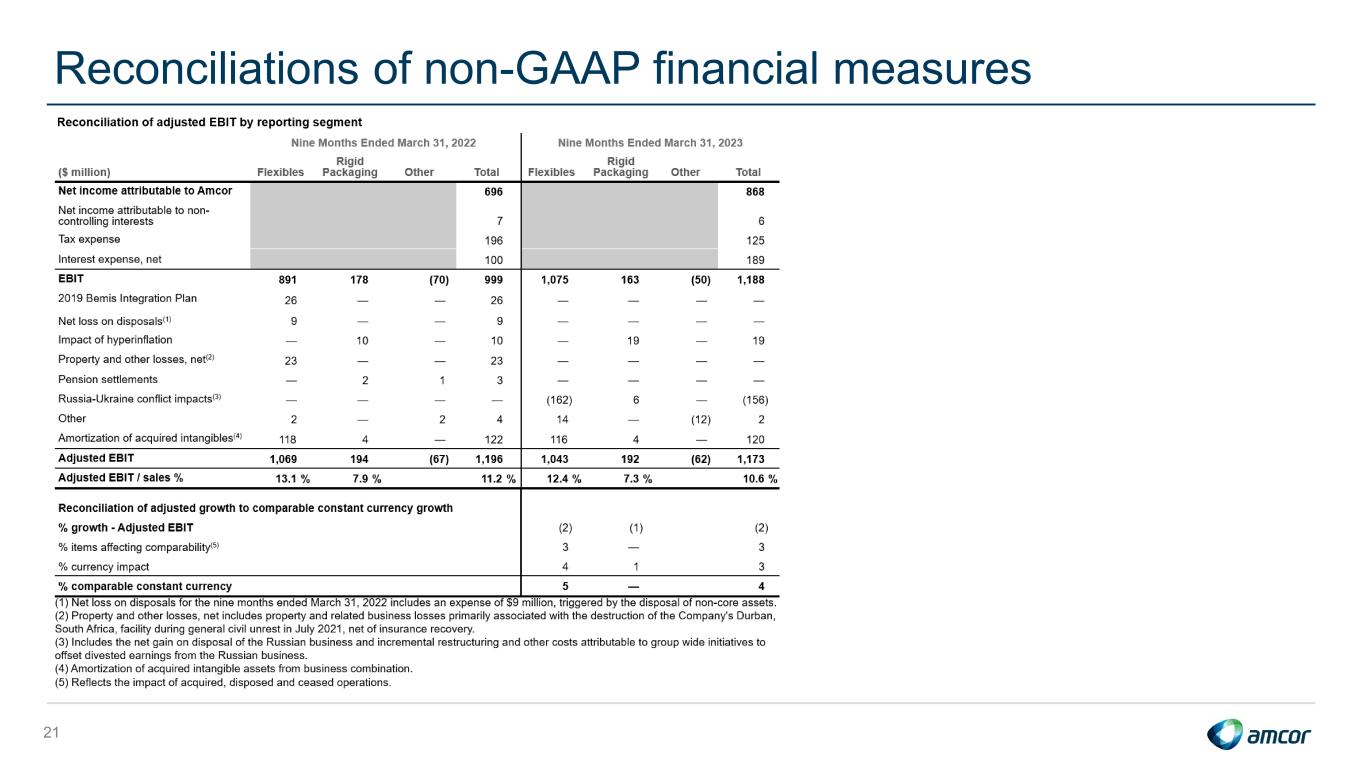

Reconciliations of non-GAAP financial measures 21

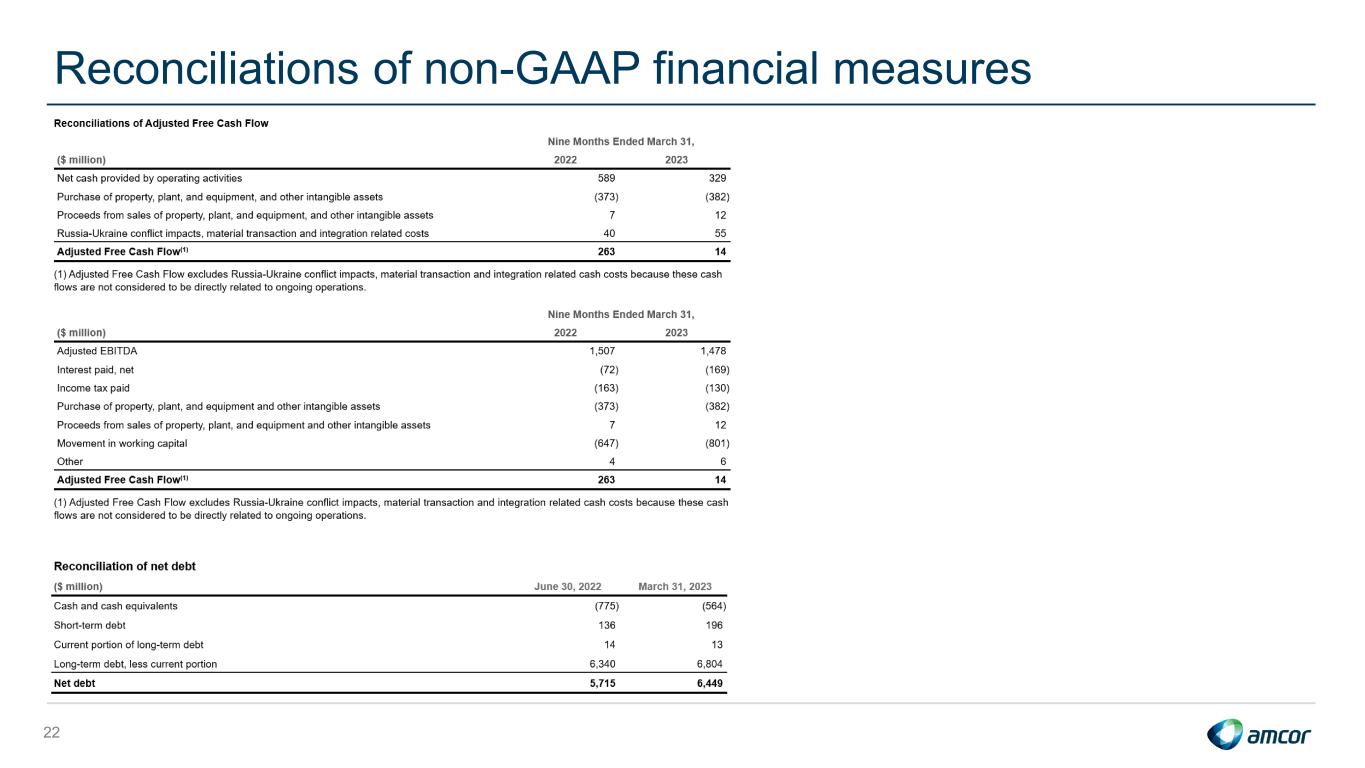

Reconciliations of non-GAAP financial measures 22