UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C.

20549

____________________

FORM 10

____________________

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant

to Section 12(b) or (g) of the Securities Exchange Act of

1934

____________________

VIVI HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

____________________

|

Delaware

(State

or other jurisdiction of incorporation)

|

81-3401645

(IRS

Employer Identification No.)

|

|

951 Yamato Road, Suite 101, Boca Raton, Florida

(Address

of principal executive offices)

|

33431

(Zip

Code)

|

Registrant’s

telephone number, including area code: (561) 717-4138

Securities to be

registered pursuant to Section 12(b) of the Act:

Securities to be

registered pursuant to Section 12(g) of the Act:

Common Stock, $.001 par value

(Title of Class)

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See definitions of

“large accelerated filer,” “accelerated

filer,” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the

Exchange Act.

|

Large

accelerated filer ☐

|

Accelerated

filer ☐

|

Non-accelerated

filer ☐

|

Smaller

reporting company ☒

|

Emerging

growth company ☒

|

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

TABLE OF CONTENTS

|

EXPLANATORY

NOTE

|

i

|

||

|

FORWARD-LOOKING

STATEMENTS

|

i

|

||

|

|

Item

1.

|

Business.

|

1

|

|

|

Item

1A.

|

Risk

Factors.

|

17

|

|

|

Item

2.

|

Financial

Information.

|

48

|

|

|

Item

3.

|

Properties.

|

55

|

|

|

Item

4.

|

Security

Ownership of Certain Beneficial Owners and Management.

|

55

|

|

|

Item

5.

|

Directors

and Executive Officers.

|

57

|

|

|

Item

6.

|

Executive

Compensation.

|

60

|

|

|

Item

7.

|

Certain

Relationships and Related Transactions, and Director

Independence.

|

61

|

|

|

Item

8.

|

Legal

Proceedings.

|

64

|

|

|

Item

9.

|

Market

Price of and Dividends on the Registrant’s Common Equity and

Related Stockholder Matters.

|

64

|

|

|

Item

10.

|

Recent

Sales of Unregistered Securities.

|

66

|

|

|

Item

11.

|

Description

of Registrant’s Securities to be Registered.

|

71

|

|

|

Item

12.

|

Indemnification

of Directors and Officers.

|

75

|

|

|

Item

13.

|

Financial

Statements and Supplementary Data.

|

78

|

|

|

Item

14.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure.

|

78

|

|

|

Item

15.

|

Financial

Statements and Exhibits.

|

78

|

|

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

94

|

||

|

SIGNATURES

|

112

|

||

EXPLANATORY NOTE

Vivi

Holdings, Inc. is filing this General Form for Registration of

Securities on Form 10, which we refer to as the Registration

Statement, to register its common stock, par value $0.001 per

share, pursuant to Section 12(g) of the Securities Exchange

Act of 1934, as amended, or the Exchange Act. Unless otherwise

mentioned or unless the context requires otherwise, when used in

this Registration Statement, the terms “ViVi,”

“Company,” “we,” “us,” and

“our” refer to Vivi Holdings, Inc.

ViVi is

an “emerging growth company” as defined under the

federal securities laws and, as such, may elect to comply with

certain reduced public company reporting requirements in future

reports that we file with the United States Securities and Exchange

Commission, or SEC.

ViVi is

also a “smaller reporting company” as defined in

Exchange Act Rule 12b-2.

FORWARD-LOOKING STATEMENTS

This

Registration Statement contains forward-looking statements that

involve substantial risks and uncertainties. Any such statements

that do not relate to historical or current facts or matters are

forward-looking statements. All statements, other than statements

of historical fact, contained in this Registration Statement,

including statements regarding our strategy, future operations,

future financial position, future revenues, projected costs,

prospects, plans and objectives of management, are forward-looking

statements. The words “anticipate,”

“believe,” “estimate,”

“expect,” “intend,” “may,”

“plan,” “predict,” “project,”

“target,” “potential,” “will,”

“would,” “could,” “should,”

“continue,” and similar expressions are intended to

identify forward-looking statements, although not all

forward-looking statements contain these identifying words. These

statements are based on ViVi’s current plans and are subject

to risks and uncertainties, and as such ViVi’s actual future

activities and results of operations may be materially different

from those set forth in the forward-looking statements. Any or all

of the forward-looking statements in this Registration Statement

may turn out to be inaccurate and as such, you should not place

undue reliance on these forward-looking statements. ViVi has based

these forward-looking statements largely on its current

expectations and projections about future events and financial

trends that it believes may affect its financial condition, results

of operations, business strategy and financial needs. The

forward-looking statements can be affected by inaccurate

assumptions or by known or unknown risks, uncertainties and

assumptions due to a number of factors, including, dependence on

key personnel, competitive factors, the operation of ViVi’s

intended business, and general economic conditions in the United

States, Brazil, Mexico, or globally. These forward-looking

statements speak only as of the date on which they are made. ViVi

assumes no obligation to update or to publicly announce the results

of any change to any of the forward-looking statements contained or

included herein to reflect actual results, future events or

developments, changes in assumptions or changes in other factors

affecting the forward-looking statements, other than where a duty

to update such information or provide further disclosure is imposed

by applicable law, including applicable United States federal

securities laws, and any applicable Brazilian laws or regulations.

In addition, ViVi cannot assess the impact of each factor on its

intended business or the extent to which any factor, or combination

of factors, may cause actual results to differ materially from

those contained in any forward-looking statements.

i

The

forward-looking statements in this Registration Statement include,

among other things, statements about:

●

projections and

related assumptions;

●

business and

corporate strategy;

●

plans, objectives,

expectations, and intentions;

●

the anticipated

development of our technologies, products, and

operations;

●

anticipated revenue

and growth in revenue from various product offerings, including

consulting, virtual finance and payment platforms;

●

future operating

results;

●

intellectual

property portfolio;

●

projected liquidity

and capital expenditures;

●

development and

expansion of strategic relationships, collaborations, and

alliances; and

●

market opportunity,

including without limitation the potential market and regulatory

acceptance of our technologies and products and the size of the

market for information technology and virtual finance and payment

platform products.

These

forward-looking statements reflect our current views about future

events and are subject to risks, uncertainties and assumptions. We

may not actually achieve the plans, intentions or expectations

disclosed in our forward-looking statements, and you should not

place undue reliance on our forward-looking statements. Actual

results or events could differ significantly from the plans,

intentions and expectations disclosed in the forward-looking

statements we make. These forward-looking statements do not reflect

the potential impact of any future acquisitions, mergers,

dispositions, joint ventures or investments we may make. When

considering forward-looking statements, you should keep in mind the

risk factors and other cautionary statements described under the

heading “Risk Factors”, as well as those set forth

below. Accordingly, readers should not place undue reliance on

forward-looking statements. All subsequent written and oral

forward-looking statements attributable to ViVi or persons acting

on its behalf are expressly qualified in their entirety by the

cautionary statements contained in this Registration Statement.

Important factors that you should also consider, include, but are

not limited to, the factors discussed under “Risk

Factors” in this Registration Statement.

You

should read this Registration Statement and the documents that we

have filed as exhibits to this Registration Statement with the

understanding that our actual future results may be materially

different from what we expect. The forward-looking statements

contained in this Registration Statement are made as of the date of

this Registration Statement, and we do not assume any obligation to

update any forward-looking statements except as required by

applicable law.

Industry Data

Market

data and certain industry forecasts used throughout this

Registration Statement were obtained from our internal analyses,

market research, publicly available information, and industry

publications. Industry publications generally provide that the

information contained in such publications has been obtained from

sources believed to be reliable, but that the accuracy and

completeness of such information is not guaranteed. The information

in internal analyses, market research, and industry publications

has not been independently verified by us, and we make no

representation as to the accuracy of this information. All

references in this Registration Statement to internal analyses,

market research, industry publications, and other documents are

qualified in their entirety by reference to the full text of those

documents.

ii

Item

1. Business.

Overview

ViVi

Holdings, Inc. is a technology company, incorporated in the State

of Delaware in June 2016, to provide information technology

(“IT”) consulting services and a virtual and electronic

payment processing platform in Brazil. In 2016 and 2017, we focused

on developing our ViViPay platform described below and did not have

any operations. We began generating revenues in 2018 by providing

outside IT consulting services to businesses and organizations

through our ViViTECH business (“ViviTech”). However, we

believe that our principal business and growth opportunities in the

future will arise from our virtual and electronic payment

processing platform that was developed to serve underserved

communities in Brazil, known as ViViPay (“ViviPay”).

During the past 24 months, we have invested significant capital and

internal resources in the development of ViviPay. The ViviPay

platform is centered around our proprietary ViViWALLET application

(“ViviWallet”) and helps consumers and businesses

process payment transactions and manage their payments efficiently.

We also offer prepaid cards which our users can fund using money

transfers from the ViviWallet. We launched the ViviWallet and the

associated prepaid cards in the fourth quarter 2018. Our current

ViviPay and ViviTech customers are located primarily in

Brazil.

From

our inception through September 30, 2018, we generated all of

our revenue from IT service agreements with our ViviTech customers.

However, with the launch of our initial ViviPay products in the

fourth quarter of 2018, we have slowly started earning revenues by

charging our ViviPay customers recurring monthly fees and

transaction fees associated with the use of our ViviWallet or

prepaid cards. Depending on the nature of the transaction,

transaction fees can be either fixed or based on a percentage of

the transaction. We expect that revenues from our ViviPay products

will grow and constitute a higher percentage of our consolidated

revenues moving forward.

Key Growth Strategies and Industry Trends

We

believe ViviPay provides our greatest growth opportunity. Our

ability to grow revenue associated with ViviPay is affected by,

among other things, consumer spending patterns, merchant and

consumer adoption of virtual and electronic payment methods, the

expansion of commerce channels, the growth of mobile devices and

merchant and consumer applications on those devices, the growth of

consumers globally with Internet and mobile access, the pace of

transition from cash and checks to virtual and electronic forms of

payment, our share of the virtual and electronic payments market,

and our ability to innovate new methods of payment that merchants

and consumers value. Our strategy to drive growth in ViviPay

includes the following:

●

Extending through strategic

partnerships: by building strategic

partnerships to acquire new customers and establish our role in the

virtual and electronic payment processing community;

●

Growing our userbase: through expanding

our customer base and scale, increasing our customers’ use of

our products and services by better addressing their everyday needs

related to accessing, managing and moving money and expanding the

adoption of our solutions by new merchants and

consumers;

●

Seeking new areas of growth: through

new international markets, including the U.S. and Mexico, and

focusing on innovation both in the virtual and the physical

world.

1

In

pursuing the above strategies, we intend to capitalize on certain

industry trends currently impacting our business operations,

including:

Growth of FinTech Industry

The

financial technology industry (“Fintech”), which is

built on the merging of financial services with communications

technology, is a growing industry for a variety of reasons.

Developments in technology, including big data analytics,

artificial intelligence, and mobile development, are combining to

give Fintech companies and the services they offer, also referred

to as Fintech platforms, an increasing advantage over traditional

financial platforms. Faster payment networks typically reduce the

time required to move money between accounts. Management believes

that as we accumulate customer data, we will be able to increase

product sales by combining analytics and marketing to bring new

products to market, improve service offerings, and make Fintech

processes more efficient and transparent.

Brazil

has continued to define itself as a leader in Fintech throughout

Latin America. Overall Fintech investment in Brazil has grown

dramatically through the second quarter of 2018, with investment

through the second quarter of 2018 nearly doubling the cumulative

investment in all of 2017. The Brazilian Fintech industry is also

relatively immature compared to other countries, which helps

explain this high level of investor interest. In addition, the

Fintech industry in Brazil has benefited from changes in the

competitive and regulatory landscape in the aftermath of the 2008

financial crisis. Larger, more-established financial service

providers, particularly banks, must now comply with additional

regulatory and capital requirements that are, at present, not

required for Fintech companies that earn less than 500 million

Brazilian Reais. A lack of such requirements may make it cheaper or

easier for Fintech companies to provide particular services or

reach certain market niches. In addition, millennials are more

willing to use mobile devices to effect transactions, including

financial transactions, and have become a driving force in Fintech

innovation.

For

information on risks relating to our business and industry, see

“Risk Factors- RISKS RELATED TO OUR BUSINESS AND

INDUSTRY.”

Shift to Electronic Payments in Brazil

The

ongoing migration from cash, check, and other paper methods of

payment to electronic (e.g. prepaid card) and virtual payments

continues to benefit the transaction processing industry globally.

We believe that the penetration of electronic and virtual payments

in Brazil is significantly lower relative to more mature markets.

Thus, as the Brazilian market continues to grow and financial

inclusion increases, the emergence of a larger and more

sophisticated consumer base may influence and drive an increase in

electronic and virtual payments usage.

For

information on risks relating to our business and industry, see

“Risk Factors- RISKS RELATED TO OUR BUSINESS AND

INDUSTRY.”

2

Overview of Business Lines

ViviTech

We

currently generate significantly all of our revenue from our IT

consulting services. Our ViviTech business helps our clients manage

their IT environments so that they can improve business outcomes

and transform operations. Our goal is to build high-performance

solutions for our clients, offering a diverse array of services

that include core business consulting, enterprise project

management, information technology services and outsourcing,

development and operations services, blockchain and cloud services,

advance integration services, web development and automation

services, and strategic development services, among others. Working

closely with our clients, we develop products and solutions that

are designed to help clients increase productivity, efficiency,

revenue, and profit margin.

Our

revenues from ViviTech operations are derived from our IT service

contracts with clients across the financial services and commercial

industries. We enter into contracts with clients and deploy

software engineers to carry out the ViviTech services. In 2017, we

began soliciting ViviTech customers for contracts that became

effective in 2018, and thus we did not record any revenue from

ViviTech services last year. We incurred costs from administrative

overhead, employee wages and benefits and expenses relating to the

development of ViviPay products.

ViviPay

ViviPay

is our electronic and virtual payment system. Our ViviPay platform

is centered around our proprietary ViviWallet application and helps

consumers and businesses process payment transactions and manage

their payments efficiently. We also offer prepaid cards which our

users can fund using money transfers from the ViviWallet. With its

first initial products launched in the fourth quarter of 2018,

ViviPay is our developing business line and has generated

negligible revenue to date. Our current key customer target groups

for ViviPay products are underserved consumers and small and

medium-sized enterprises located in Brazil. We have agreements with

multiple member-based organizations in order to grow our small

ViviPay consumer base and are negotiating similar agreements. These

organizations operate primarily in the business, social and

religious communities. We are also negotiating agreements with

various merchants pursuant to which merchants would recognize

payment using the ViviPay platform. However, no such merchant

agreements are currently in place.

Our

recently launched ViviPay products are the ViviWallet and the

prepaid card. We plan to launch numerous other products in the

future, including point-of-sale terminals.

3

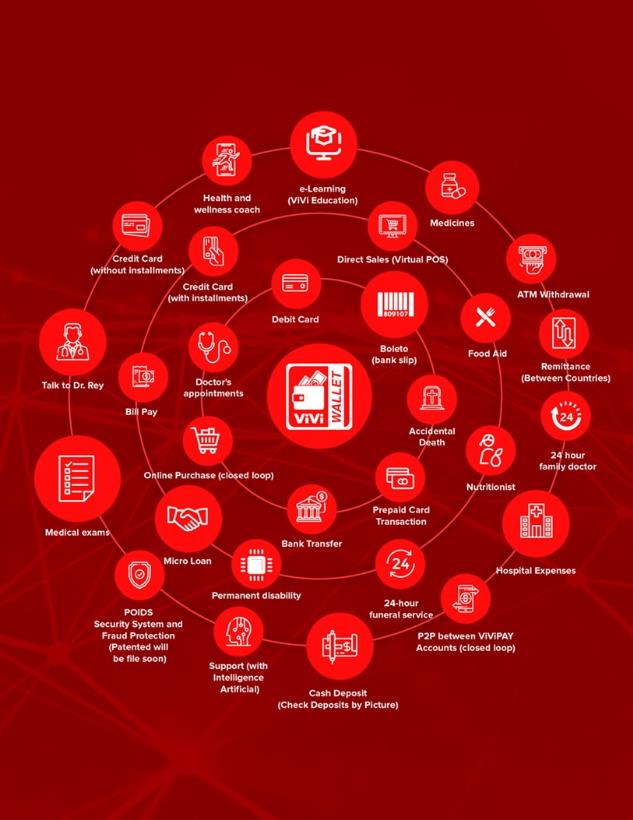

Recently Launched ViviPay Products-

Our

recently released ViviPay products include:

●

ViviWallet

ViviWallet is a

mobile application that holds users’ cash and can be used to

process a variety of consumer transactions. Users can deposit cash

into their ViviWallet by using the application to generate a

virtual boleto bancário slip, which includes a barcode that

serves as a unique routing number. Users can bring these virtual

boletos with their cash to any location that processes boletos and

make deposits into their ViviWallet. Boletos are processed in many

locations throughout Brazil, including supermarket chains,

convenience stores, and lottery ticket vendors.

With a

funded ViviWallet, users can engage in a variety of transactions

with merchants that accept ViviPay directly through their mobile

phone. For example, users can pay their monthly rent by scanning

the barcode of boletos that relate to the rent bill directly into

the ViviWallet. Without having to go to a physical location, the

ViviWallet then transfers the funds to the appropriate account in

order to complete payment. Merchants can accept and process these

transfers from the ViviWallet. We currently have no merchant

agreements in place.

We

expect to generate revenue from the ViviWallet from fixed recurring

fees and transaction fees, which are paid by our ViviWallet

customers. We expect these revenues will be offset by

administrative overhead and the costs of our

partnerships.

4

5

●

Prepaid

Cards

Our

ViviWallet users may request prepaid cards that are accepted as

payment by any merchant that accepts MasterCard. Using the

ViviWallet, users can transfer funds to their prepaid card in order

to participate in transactions that require either a debit or

credit card. However, unlike traditional debit and credit cards,

our prepaid cardholders can qualify without a credit score and do

not need to open a formal bank account. The funds transferred from

the ViviWallet are held in an account managed by our Mastercard

licensed issuer, a regulated financial entity.

Our

prepaid cards can be used both at physical locations and online. In

addition, the cards provide consumers with additional benefits,

such as access to doctors and nutritionists via telephone, health

and wellness coaching, discount networks for doctors’

appointments, examinations, medicines, and accidental death and

permanent disability coverage. Our prepaid cards provide an

alternative way for consumers to manage their finances, avoid high

banking fees, and gain access to a wider range of

transactions.

We

expect to generate revenue from our prepaid cards by charging our

cardholders acquisition fees, fixed recurring fees, and transaction

fees, which vary depending on the type of transaction. We expect

our revenue, if any, will be offset by administrative overhead, the

costs of cardholder benefits provided by third-parties, and the

costs of our partnerships.

We are

also developing other ViviPay products, including:

●

“Point of

Sale” Solutions

We are

currently developing both physical and virtual “point of

sale” (“POS”) merchant solutions. We plan to

offer our handheld POS terminals to merchants for use in their

physical locations. We also plan to offer virtual POS capabilities

through our “Pay1” technology, which operates within

the ViviWallet. Using the “Pay1” function of the

ViviWallet, merchants will be able to process customer

transactions. The handheld POS terminal will be able to process any

card licensed by Mastercard, including the ViviPay prepaid card;

the virtual POS solution will be able to process transactions

originated by a customer using their ViviWallet. We expect to generate revenue

from our POS solutions by charging merchants transaction fees,

which will vary depending on the type of transaction.

6

Marketing and Sales Strategy

Customer Acquisition-

●

Partnerships

We are

currently developing channel partner sales strategies to acquire

end-users for our ViviPay products. We have multiple partnership

agreements that allow us to market and distribute our ViviPay

products to our partners’ membership bases. These partners

are in the commercial, health, entertainment, and religious

sectors. Pursuant to the agreements, our partners market our

ViviPay products to their existing member bases in return for a

commission or share in the revenues generated. Certain of the

agreements require that we make fixed payments in order to access

our partners’ members.

●

Direct Sales and Marketing

We have

developed a new commercial sales team to actively pursue new

customers and partners for our businesses and increase our services

with existing customers and partners. We have locations in São

Paulo, Aracaju, Blumenau, and Maceió, and each location has

its own regional sales team. Our sales teams pursue opportunities

for both ViviTech and ViviPay.

Geographic Markets

Our

ViviPay and ViviTech consumer and business customers are located

primarily in Brazil. However, we provide ViviTech services to a

small number of companies located in the United States. We plan to

expand our ViviTech presence in the United States and begin

providing our ViviPay products throughout Mexico and the United

States.

Material Customers

As of

September 30, 2018, our four largest customers have generated

98% of our total revenues in 2018, or approximately $855,700. Loss

of any of these customers could have a material adverse effect on

the results of operations of the Company. Our four largest

customers and their respective service agreements are listed below.

The agreements below are non-exclusive and we are not entitled to

any fixed payments thereunder.

●

Redecard S.A.: On

July 13, 2018, the Company entered into a service agreement

with Redecard, S.A. in which it undertakes to provide software

development and/or customization services until July 12, 2019,

when it can be renewed.

●

Itau Unibanco: On

August 1, 2018, the Company entered into a one-year service

agreement with Itau Unibanco in which it undertakes to provide

software development and/or customization services.

●

Gerdau Acos Longos

S.A.: On May 25, 2018, the Company entered into an 18-month service

agreement with Gerdau Acos Longos S.A. in which it undertakes to

provide software development and/or customization

services.

●

Advus Corporation:

Since its inception, the Company has entered into numerous service

arrangements with Advus Corporation on an as-needed basis. Please

see “Certain Relationships and Related Transactions, and

Director Independence— Certain Relationships and Related

Transactions—Other Related Party

Transactions.”

7

Competition

Our

business lines are affected by rapid change in technology in the

information services and technology industries and aggressive

competition from many domestic and foreign companies.

With

respect to our ViviTech business line, our principal competitors

are systems integrators, consulting and other professional services

firms, outsourcing providers, infrastructure services providers,

computer hardware manufacturers, and software providers. With

respect to our ViviPay business line, we expect to compete against

a wide range of businesses, including banks, credit card providers,

technology and e-commerce companies, and traditional retailers,

many of which are larger than we are, have a dominant and secure

position, or offer other products and services to consumers and

merchants which we do not offer. We compete against all forms of

payment processing companies, including companies that offer credit

and debit cards, automated clearing house and bank transfers, other

online payment services, mobile payments, and offline payment

methods, including cash and check.

We

compete primarily on the basis of service, product performance,

technological innovation, and price. We believe that our continued

focused investment in software engineering and research and

development, coupled with our partnerships and sales and marketing

capabilities, will have a favorable impact on our competitive

position.

For

information on risks relating to increased competition in our

industry, see “Risk Factors— RISKS RELATED TO OUR

BUSINESS AND INDUSTRY— Substantial and increasingly intense

competition within our industry may harm our

business.”

Intellectual Property

We have

assembled and continue to assemble a portfolio of trademarks,

service marks, and domain names covering our products and services.

We have registered and applied for the registration of Brazilian

and U.S. trademarks, service marks, and domain names and have in

place an active program to continue to secure trademarks, service

marks and domain names that correspond to our brands in markets of

interest.

We rely

on a combination of intellectual property laws, confidentiality

procedures and contractual provisions to protect our proprietary

technology and our brand. We believe our intellectual property has

value in providing our services and marketing our products. It is

our policy to protect and defend our IP rights.

We have

a Brazilian federal registration for the ViviPay trademark and

pending applications for ViViMobile and ViViCyberbank. We also have

a pending U.S. patent application for POIDS, our proprietary Prove

Online Identity System.

Research and Development

We

estimate that our total research and development expenses during

2016 and 2017 were $6 million U.S. dollars,

cumulatively.

8

Regulation

Our

business is subject to a number of laws and regulations, many of

which are still evolving and could be interpreted in ways that

could harm our business. While it is difficult to fully ascertain

the extent to which new developments in the field of law will

affect our business, there has been a trend towards increased

consumer and data privacy protection. It is possible that general

business regulations and laws, or those specifically governing

payment processing, may be interpreted and applied in a manner that

may place restrictions on the conduct of our business.

Although

we currently are not required to be licensed with the Central Bank

per applicable regulations, we have applied for licenses of

operation with the Central Bank, which licenses are currently

pending.

There

are currently no regulations for creating software or providing

software consulting services.

Below

is a summary of the most relevant laws that apply to the operations

of the Company.

Regulation of the Company in Brazil

Our

activities in Brazil are subject to Brazilian laws and regulations

relating to payment schemes and payment institutions. Law

No. 12,865/13, which was enacted on October 9, 2013,

establishes the first set of rules regulating the electronic

payments industry within the overall Brazilian Payment System (the

Sistema de Pagamentos

Brasileiro, or SPB) and creates the concepts of payment

schemes, payment scheme settlors, and payment

institutions.

In

addition, Law No. 12,865/13 gave the Central Bank, in

accordance with the guidelines set out by the National Monetary

Counsel (the Conselho

Monetário Nacional, or CMN), and the CMN authority to

regulate entities involved in the payments industry. Such authority

covers matters such as the operation of these entities, risk

management, the opening of payment accounts, and the transfer of

funds to and from payment accounts. After the enactment of Law

No. 12,865/13, the CMN and the Central Bank created a

regulatory framework regulating the operation of payment schemes

and payment institutions. The framework consists of Resolutions

4,282, Circulars 3,680, 3,681 and 3,682, as amended, all of which

were published on November 4, 2013, and Circular 3,885

published on March 26, 2018, among others.

9

Payment Schemes

A

payment scheme, for Brazilian regulatory purposes, is the

collection of rules and procedures that governs payment services

provided to the public, with direct access by its end users (i.e.

payors and receivers). In addition, such payment service must be

accepted by more than one receiver in order to qualify as a payment

scheme. The regulations applicable to payment schemes depend on

certain features, such as the number of users and the annual cash

value of transactions handled by the payment scheme:

●

Payment schemes

that exceed certain thresholds are considered to form part of the

SPB and are subject to the legal and regulatory framework

applicable to the payment industry in Brazil, including the

requirement to obtain an authorization by the Central

Bank.

●

Payment schemes

that operate below these thresholds are not considered to form part

of the SPB and are therefore not subject to the legal and

regulatory framework applicable to the payment industry in Brazil,

including the requirement to obtain an authorization from the

Central Bank, although they are required to report certain

operational information to the Central Bank on an annual

basis.

●

Limited-purpose

payment schemes are not considered to form part of the SPB and,

therefore, are not subject to the legal and regulatory framework

applicable to the payment industry in Brazil, including the

requirement to obtain authorization from the Central Bank. Limited

purpose payment schemes are those whose payment orders are: (a)

accepted only at the network of merchants that clearly display the

same visual identity that of the issuer, such as franchisees and

other merchants licensed to use the issuer’s brand; or (b)

intended for payment of specific public utility services, such as

public transport and public telecommunications.

●

Certain types of

payment schemes have specific exemptions from the requirement to

obtain authorization from the Central Bank. This applies, for

example, to payment schemes set up by governmental authorities,

payment schemes set up by certain financial institutions, payment

schemes aimed at granting benefits to natural persons due to

employment relationships, and payment schemes set up by an

authorized payment institution in which financial settlement of

payment transactions are carried out exclusively using the

book-transfer method.

Payment Scheme Settlor

A

payment scheme is set up and operated by a payment scheme settlor,

which is the entity responsible for the payment scheme’s

authorization and function. Payment scheme settlors, for Brazilian

regulatory purposes, are the legal entities responsible for

managing the rules, procedures, and the use of the brand associated with a

payment scheme. Central Bank regulations require that payment

scheme settlors must be (i) incorporated in Brazil;

(ii) have a corporate purpose compatible with

its payments activities; and (iii) have the technical,

operational, organizational, administrative, and financial capacity

to meet their

obligations. They must also have clear and effective corporate

governance mechanisms that are appropriate for the needs of payment

institutions and the users of payment schemes.

10

Payment Institutions

A

payment institution is defined as the legal entity that

participates in one or more payment schemes and is dedicated to the

execution of the remittance of funds to the receivers in payment

schemes, among other activities. Specifically, based on the

Brazilian payment regulations, payment institutions are entities

that can be classified into one of the following three

categories:

●

Issuers of

electronic currency (prepaid payment instruments): these payment

institutions manage prepaid payment accounts for cardholders or

end-users. They carry out payment transactions using electronic

currency deposited into such prepaid accounts, and convert the

deposits into physical or book-entry currency or vice

versa.

●

Issuers of

post-paid payment instruments (e.g. credit cards): these payment

institutions manage payment accounts where the end-user intends to

make payment on a post-paid basis. They carry out payment

transactions using these post-paid accounts.

●

Acquirers: these

payment institutions do not manage payment accounts, but enable

merchants to accept payment instruments issued by a payment

institution or by a financial institution that participates in a

payment scheme. They participate in the settlement process for

payment transactions by receiving the payment from the card issuer

and settling with the merchant.

Payment

institutions must operate in Brazil and must have a corporate

purpose that is compatible with payments activities. As for payment

schemes, the regulations applicable to payment institutions depend

on certain features, such as the annual cash value of transactions

handled by the payment institution or the value of resources

maintained in prepaid payment accounts.

Certain

financial institutions have specific exemptions from the

requirement to obtain authorization from the Central Bank to act as

a payment institution and provide payment services. Furthermore,

certain payment institutions are not subject to the legal and

regulatory framework applicable to the payment industry in Brazil.

This applies, for example, to payment institutions that only

participate in limited-purpose payment schemes and payment

institutions that provide services in the scope of programs set up

by governmental authorities aimed at granting benefits to natural

persons due to employment relationships.

The CMN

and Central Bank regulations applicable to payment institutions

cover a wide variety of issues, including (i) penalties for

noncompliance; (ii) the promotion of financial inclusion;

(iii) the reduction of systemic, operational and credit risks;

(iv) reporting obligations; and

(v) governance.

11

The

regulations applicable to payment institutions also cover

“payment accounts” (contas

de pagamento), which are the end-user accounts, in

registered (i.e., book-entry) form, which are opened with payment

institutions that are card issuers of prepaid or post-paid

instruments and used for carrying out each payment transaction.

Circular No. 3,860/13 classifies payment accounts into two

types:

●

Prepaid payment

accounts: where the funds have been deposited into the payment

account in advance of the intended payment transaction;

and

●

Post-paid payment

accounts: where the payment transaction is intended to be performed

regardless of whether or not funds have been deposited into the

payment account in advance.

In

order to provide protection from bankruptcy, Law No. 12,865/13

requires payment institutions that issue electronic currency to

segregate the funds deposited in prepaid payment accounts from

their own assets. In addition, with respect to prepaid electronic

currency, the payment institutions must hold a portion of the funds

deposited in the prepaid payment account in certain specified

instruments: either (i) in a specific account with the Central

Bank that does not pay interest; or (ii) in federal government

bonds registered with the SELIC. The portion of the prepaid

electronic currency that must be held in this form is currently 80%

and will increase to 100% on January 1, 2019.

Our Regulatory Position in Brazil

We

perform activities that are in particular subject to Law

No. 12,865/13 and regulations from the Central Bank and the

CMN. Although we currently are not required to be licensed per

applicable regulations, we have applied for licenses of operation

with the Central Bank, which licenses are currently

pending.

In

addition, Law No. 12,865/2013 prohibits payment institutions

from performing activities that are restricted to financial

institutions, which are regulated by Law No. 4,595/1964. There

is some debate under Brazilian law as to whether providing early

payment of receivables to merchants could be characterized as

“lending,” which is an activity that is restricted to

financial institutions.

Similarly,

there is some debate as to whether the discount rates applicable to

this early payment feature should be considered as

“interest,” in which case the limits set by the

Brazilian Usury Law would apply to these rates. For transactions

that form part of the Brazilian financial system, financial

institutions may set interest rates freely, provided that they are

not excessively burdensome to consumers. For transactions that do

not form part of the Brazilian financial system, the Brazilian

Usury Law (Decree-Law No. 22,623/1933) capped interest rates

at 12% per year. Subsequently, the Brazilian Civil Code, which

replaced the Usury Law, capped interest rates at two times the

interest rates applicable to National Treasury (Fazenda Nacional), which is currently

the SELIC rate (although there is some legal debate as to whether

the Brazilian Civil Code has effectively replaced the original

Usury Law). As a result, if the discount rate that we charge

merchants for early payment of their receivables is considered to

be “interest,” it would be capped at two times the

SELIC rate.

12

If we

fail to comply with the requirements of the Brazilian legal and

regulatory frameworks, we could be prevented from carrying out our

regulated activities, we could be (i) required to pay

substantial fines (including per transaction fines) and

disgorgement of our profits, (ii) required to change our

business practices, or (iii) subjected to insolvency

procedures, such as an intervention by the Central Bank. We could

also be subject to private lawsuits. For additional information,

see “Risk Factors—RISKS RELATED TO REGULATORY

APPROVALS.”

The

Central Bank’s regulations also allow payment schemes to set

additional rules for entities that use their brands. Since we

participate in these third-party payment schemes, we must comply

with their rules in order to continue accepting payments from

payment instruments bearing their brands.

Anti-Money Laundering Rules in Brazil

Our

activities in Brazil are subject to Brazilian laws and regulations

relating to anti-money laundering, or AML, terrorism financing and

other potentially illegal activities. These rules require us to

implement policies and internal procedures to monitor and identify

suspicious transactions, which must be duly reported to the

relevant authorities. We comply with the applicable AML laws and

regulations and we have implemented required policies and internal

procedures to ensure compliance with such rules and regulations,

including procedures to report suspicious activities, suspected

terrorism financing and other potentially illegal activities to the

authorities. Our employees are aware of our policies and internal

procedures, which shall be mandatorily complied with and

supervised.

We have

employees and third-party consultants that focus on risk and fraud

prevention. The Brazilian AML law specifies the acts that may

constitute a crime and the required measures to prevent such

crimes. It also prohibits the concealment or dissimulation of the

origin, location, availability, handling or ownership of assets,

rights or financial resources directly or indirectly originated

from crimes, and subjects the agents of these illegal practices to

imprisonment, temporary disqualification from managing enterprises

up to 10 years and monetary fines.

The

Brazilian AML law also created the Financial Activities Control

Council, or COAF, which is the Brazilian financial intelligence

unit that operates under the jurisdiction of the Ministry of

Finance. COAF has a key role in the Brazilian AML and

counter-terrorism financing system, and it is legally liable for

the coordination of the mechanisms for international cooperation

and information exchange.

We have

adopted the internal controls and procedures required by the

Brazilian AML rules, which are focused on:

●

identifying and

knowing our clients;

●

checking the

compatibility between the volume of funds of a client and such

client’s economic and financial capacity;

●

checking the origin

of funds;

●

carrying out a

prior analysis of new products and services, under the perspective

of money laundering prevention;

13

●

keeping records of

all transactions;

●

reporting to COAF,

within one business day and without informing the involved person

or any third party, (i) any transaction exceeding the limit

set by the competent authority and as required under applicable

regulations; (ii) any transaction deemed to be suspicious, as

required under applicable regulations; and (iii) at least once

a year, whether or not suspicious transactions are verified, in

order to certify the non-occurrence of transactions subject to

reporting to COAF (negative report);

●

applying special

attention to (i) unusual transactions or proposed transactions

with no apparent economic or legal bases; (ii) clients and

transactions for which the ultimate beneficial owner cannot be

identified; and (iii) situations in which it is not possible

to keep the clients’ identification records duly

updated;

●

offering anti-money

laundering training for employees;

●

monitoring

transactions and situations which could be considered suspicious

for anti-money laundering purposes; and

●

ensuring that

policies, procedures and internal controls are commensurate with

the size and volume of transactions.

E-Commerce, Data Protection, Consumer Protection and

Taxes

In

addition to regulations affecting digital payment schemes, we are

also subject to laws relating to internet activities and

e-commerce, as well as banking secrecy laws, consumer protection

laws, tax laws, and other regulations applicable to Brazilian

companies generally. Internet activities in Brazil are regulated by

Law No. 12,965/14, known as the Brazilian Civil Rights

Framework for the internet, which embodies a substantial set of

rights and obligations relating to internet service providers. This

law exempts intermediary platforms such as ViviPay from liability

for activities carried out by their users. Since the Brazilian

Civil Rights Framework for the internet is a new legislation and,

therefore, there are few court decisions in this area, it is still

possible that we may be subject to joint civil liability for

activities carried out by our users.

Law

No. 8,078/90, known as the Consumer Protection Code, regulates

consumer relations in Brazil, including matters such as: commercial

practices; product and service liability; areas where suppliers of

products or services are subject to strict liability; the reversal

of the burden of proof so as to benefit consumers; the joint and

several liability of all companies within a supply chain; unfair

contract terms; advertising; and information on products and

services that are offered to the public. Consumers have the right

to receive clear and accurate information regarding retail products

and services, with correct specification of characteristics,

structure, quality, price, risks, and consumers’ rights to

access and amend personal information collected about them and

stored in private databases.

Customer

accounts on our digital platform are subject to data protection

under the Brazilian Civil Rights Framework for the internet and

bank secrecy laws (Complementary Law 105/01 c/c/ Article 17 of the

CMN’s Resolution No. 4,282/13). We are also subject to

trademark protection rules, and to tax laws and related

obligations, such as the rules governing the sharing of customer

information with tax and financial authorities. It is unclear

whether the tax and regulatory authorities would seek to obtain

information regarding our customers. Any such request could come

into conflict with the data protection rules, which could create

risks for our business.

14

The

laws and regulations applicable to the Brazilian digital payments

industry are subject to ongoing interpretation and change, and our

digital payments business may become subject to regulation by other

authorities. For further information on the risks relating to

regulation of business, please see “Risk Factors—RISKS

RELATED TO REGULATORY APPROVALS.”

Consumer Protection Laws

Brazil’s

Consumer Protection Code (Código de Defesa do Consumidor)

sets forth the legal principles and requirements applicable to

consumer relations in Brazil. This law regulates, among other

things, commercial practices, product and service liability, strict

liability of the supplier of products or services, reversal of the

burden of proof to the benefit of consumers, the joint and several

liability of all companies within the supply chain, abuse of rights

in contractual clauses, advertising, and information on products

and services offered to the public. Specifically, we are subject to

several laws and regulations designed to protect consumer

rights—most importantly, Law No. 8,078 of

September 11, 1990—known as the Consumer Protection

Code. The Consumer Protection Code establishes the legal framework

for the protection of consumers, setting out certain basic rights,

and the consumers’ rights to access and modify personal

information collected about them and stored in private databases.

These consumer protection laws could result in substantial

compliance costs.

Data Privacy and Protection

The

Brazilian Civil Rights Framework for the internet establishes

principles, guarantees, rights, and duties for the use of the

internet in Brazil, including regulation about data privacy for

internet users. Under Brazilian law, personal data may only be

treated (i.e., collected, used, transferred, etc.) upon

users’ prior and express consent. Privacy policies of any

company must be clear and detailed and include information

regarding all contemplated uses for such users’ data and

excessively ample or vague consent for data treatment may be deemed

invalid in Brazil. Furthermore, consent from users must be obtained

separately and contractual clauses relating to consent must be

specifically highlighted. Brazilian courts have applied joint and

several liability among all entities that shared and/or used

personal data subject to a breach. See “Risk Factors—

RISKS RELATED TO REGULATORY APPROVALS.”

On

August 14, 2018, the Brazilian President signed Law

No. 13,709 (Lei Geral de

Proteção de Dados), or the LGPD, a comprehensive

data protection law establishing general principles and obligations

that apply across multiple economic sectors and contractual

relationships. The LGPD establishes detailed rules for the

collection, use, processing and storage of personal data and is

expected to affect all economic sectors, including the relationship

between customers and suppliers of goods and services, employees

and employers and other relationships in which personal data is

collected, whether in a digital or physical environment. The

obligations established by the LGPD will become effective within 18

months from the date of publication of the law, by which date all

legal entities will be required to conform their data processing

activities to these new rules. A comprehensive understanding of

personal data flows and, as a consequence, the review of internal

documents and procedures, as well as the negotiation of contractual

amendments are examples of adaptations required for compliance with

the LGPD.

The

foregoing list of laws and regulations to which we are subject is

not exhaustive and the regulatory framework governing our

operations changes continuously. Although we do not believe that

compliance with future laws and regulations related to the payment

processing industry and our business will have a material adverse

effect on our business, financial condition or results of

operations, the enactment of new laws and regulations may

increasingly affect the operation of our business, directly and

indirectly, which could result in substantial regulatory compliance

costs, litigation expense, adverse publicity, the loss of revenue

and decreased profitability.

15

Employees

As of

November 30, 2018, we had approximately 200 full-time employees

located throughout Brazil, the United States, and Mexico.

Approximately 150 of our employees are software

engineers.

Emerging Growth Company

We are

and we will remain an “emerging growth company” as

defined under The Jumpstart Our Business Startups Act, or the JOBS

Act, until the earliest to occur of (i) the last day of the

fiscal year during which our total annual revenues equal or exceed

$1.07 billion, (ii) the last day of the fiscal year following

the fifth anniversary of our initial public offering,

(iii) the date on which we have, during the previous

three-year period, issued more than $1 billion in non-convertible

debt securities, or (iv) the date on which we are deemed a

“large accelerated filer” (with at least $700 million

in public float) under the Securities and Exchange Act of 1934, as

amended (the “Exchange Act”).

As an

“emerging growth company”, we may take advantage of

specified reduced disclosure and other requirements that are

otherwise applicable generally to public companies. These

provisions include:

●

only two years of

audited financial statements in addition to any required unaudited

interim financial statements with correspondingly reduced

“Management’s Discussion and Analysis”

disclosure;

●

reduced disclosure

about our executive compensation arrangements;

●

no requirement that

we hold non-binding advisory votes on executive compensation or

golden parachute arrangements; and

●

exemption from the

auditor attestation requirement in the assessment of our internal

control over financial reporting.

We have

taken advantage of some of these reduced burdens, and thus the

information we provide stockholders may be different from what you

might receive from other public companies in which you hold

shares.

In

addition, Section 107 of the JOBS Act also provides that an

emerging growth company can take advantage of the extended

transition period provided in Section 7(a)(2)(B) of the

Securities Act for complying with new or revised accounting

standards. In other words, an emerging growth company can delay the

adoption of certain accounting standards until those standards

would otherwise apply to private companies.

Notwithstanding the

above, we are also currently a “smaller reporting

company,” meaning that we are not an investment company, an

asset-backed issuer, or a majority-owned subsidiary of a parent

company that is not a smaller reporting company and that had a

public float of less than $250 million or annual revenues of less

than $100 million during the most recently completed fiscal year.

In the event that we are still considered a smaller reporting

company, at such time as we cease being an emerging growth company,

the disclosure we will be required to provide in our SEC filings

will increase, but will still be less than it would be if we were

not considered either an emerging growth company or a smaller

reporting company. Specifically, similar to emerging growth

companies, smaller reporting companies are able to provide

simplified executive compensation disclosures in their filings; are

exempt from the provisions of Section 404(b) of the

Sarbanes-Oxley Act requiring that independent registered public

accounting firms provide an attestation report on the effectiveness

of internal control over financial reporting; and have certain

other decreased disclosure obligations in their SEC filings,

including, among other things, only being required to provide two

years of audited financial statements in annual

reports.

16

Item

1A. Risk

Factors.

An investment in our common stock involves a high degree of risk.

The risks described below are those that we currently believe may

harm our business or the trading price of our Common Stock. In

general, investing in the securities of issuers whose main

operations are located in emerging market countries such as Brazil

involves a higher degree of risk than investing in the securities

of U.S. companies and companies located in other countries with

more developed capital markets.

We routinely encounter and address risks in conducting our

business. Some of these risks may cause our future results to be

different – sometimes materially different – than we

presently anticipate. Below are material risks we have identified

that could adversely affect our business. How we react to material

future developments, as well as how our competitors and customers

react to those developments, could also affect our future

results.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

Our business has generated losses, and we intend to continue to

make significant investments in our business. Our results of

operations and operating metrics may fluctuate and we may continue

to generate losses in the future.

We

generated losses of $76,925,165 and $50,680,774 in the years ended

December 31, 2017 and 2016, respectively. We intend to

continue to make significant investments in our business, including

with respect to our employee base, sales, and marketing, including

expenses relating to the development of new products, services, and

features; expansion of office space, data centers and other

infrastructure; development of international operations; and

general administration, including legal, finance, and other

compliance expenses related to being a public company. If the costs

associated with acquiring and supporting new or larger customers

and merchants materially rise in the future, including the fees we

pay to strategic partners and third parties, our expenses may rise

significantly. In addition, increases in our client base could

cause us to incur increased losses, because costs associated with

new clients are generally incurred up front, while revenue is

recognized thereafter as merchants utilize our services. If we are

unable to generate adequate revenue growth and manage our expenses,

our results of operations and operating metrics may fluctuate and

we may continue to incur significant losses.

We

intend to invest in developing products or services that we believe

will improve the experiences of our clients and therefore improve

our long-term results of operations. However, these improvements

often cause us to incur significant up-front costs and

may not result in the long-term benefits that we expect, which may

materially and adversely affect our business. For example, our

growth strategy contemplates an expansion in the number of

customers we service and an expansion to countries outside of

Brazil such as the United States and Mexico. Successful

implementation of our growth strategy will require significant

expenditures before any substantial associated revenue is

generated. Since our business operations, partnerships and

customers are still relatively new, we cannot assure you that we

will generate revenue and cash flow.

17

Because we have a limited operating history, you may not be able to

accurately evaluate our operations.

We are

a start-up company and have limited operations to date. Potential

investors should be aware of the difficulties normally encountered

by new companies and the high rate of failure of such enterprises.

Our likelihood of success must be considered in light of the

problems, expenses, difficulties, complications and delays

encountered in connection with the operations that we plan to

undertake. These potential problems include, but are not limited

to, unanticipated problems relating to the ability to generate

sufficient cash flow to operate our business, and additional costs

and expenses that may exceed current estimates. We expect to incur

significant losses into the foreseeable future. If our business

plan is not effective, we will not be able to continue business

operations. Our assumptions are not based on our operating history

and we may not generate any operating revenues or ever achieve

profitable operations. If we are unsuccessful in addressing these

risks, our business may fail.

We are dependent on management, certain stockholders, and investors

for future development.

We are

dependent upon our management, certain stockholders and investors

for fundraising. We expect additional operating losses will occur

until revenues are sufficient to offset our costs for marketing,

sales, general and administrative, and product and services

development.

We are a start-up company operating under a new business model and

have no assurance of market acceptance.

We have

a relatively new business model in an emerging and rapidly evolving

market. Accordingly, this makes it difficult to evaluate our future

prospects and may increase the risk that we will not continue or be

successful. We will encounter risks and difficulties by operating

in a new and rapidly evolving market. We may not be able to

successfully address these risks and difficulties, which could

materially harm our business and operating results.

Even if

we are successful in our ViviPay business, there can be no

assurance that the market reception will be positive for us or our

ventures.

As with

any new technology, there is a substantial risk that potential

customers may not accept the potential benefits of our products.

Market acceptance of our products will depend, in large part, upon

our ability to demonstrate the performance advantages and

cost-effectiveness of our products over competing products. There

can be no assurance that we will be able to market our technology

successfully on a widespread basis or that any of our current or

future products or services will be accepted in the marketplace.

Furthermore, we intend to develop products and systems and sell

them at a price assumed by us as sufficient to generate a profit.

Even if our products and services are accepted in the industry, the

market for our products may not be able to support our

operations.

18

Reliance on third-party agreements and relationships is necessary

for development of our business.

We will

need to pursue and maintain strong third-party relationships and

partnerships in order to develop and grow our business. We will be

substantially dependent on these strategic partners and third-party

relationships to commercialize our business.

If we cannot keep pace with rapid technological developments to

provide new and innovative products and services, and address the

rapidly evolving market for transactions on mobile devices, the use

of our product and services and, consequently, our revenues could

decline.

Rapid,

significant, and disruptive technological changes continue to

impact the industries in which we operate, including developments

in the IT consulting industry and with respect to payment

processors, innovations in payment card tokenization, mobile

payments, e-commerce through social networks, authentication,

virtual currencies, distributed ledger or blockchain technologies,

near field communication, and other proximity or contactless

payment methods, virtual reality, machine learning, and artificial

intelligence.

For

instance, our customers will be using mobile devices for their

transactions and payments. We may lose customers if we are not able

to continue to meet our customers’ mobile and multi-screen

experience expectations.

We

cannot predict the effects of technological changes on our

business. We expect that new services and technologies applicable

to the industries in which we operate will continue to emerge and

may be superior to, or render obsolete, the technologies we

currently use in our products and services. Developing and

incorporating new technologies into our products and services may

require substantial expenditures, take considerable time, and

ultimately may not be successful. In addition, our ability to adopt

new products and services and develop new technologies may be

inhibited by industry-wide standards, payment networks, changes to

laws and regulations, resistance to change from consumers or

merchants, third-party intellectual property rights, or other

factors. Our success will depend on our ability to develop and

incorporate new technologies, address the challenges posed by the

rapidly evolving market for mobile transactions through our

platforms and adapt to technological changes and evolving industry

standards. If we are unable to do so in a timely or cost-effective

manner, our business could be harmed.

The development and operation of our payment processing systems

depends on our ability to raise capital. Our operations may require

more capital than we are able to raise, and in the future, we may

not be able to obtain additional capital on favorable or even

acceptable terms. We may also have to incur additional debt, which

may adversely affect our liquidity and operating

performance.

Our

ability to successfully grow our business and implement our growth

and expansion strategy depends in large part on the availability of

adequate capital to finance operations. We can give no assurance

that the funds we have previously will provide sufficient capital

to support the continued operations of our company. Changes in our

growth and expansion strategy, lower than anticipated revenue for

our IT consulting business and payment processing business,

unanticipated and/or uncontrollable events in the credit or equity

markets, changes to our liquidity, increased expenses, and other

events may cause us to seek additional debt or equity financing.

Financing may not be available on favorable or acceptable terms, or

at all, and our failure to raise capital could adversely

affect our operations and financial condition.

19

Additional equity

financing may result in a dilution of the pro rata ownership stake

of the holders of our common stock. Further, we may be required to

offer subsequent investors investment terms, such as preferred

distributions and voting rights, that are superior to the rights of

the holders of our common stock, which could have an adverse effect

on the value of your investment.

Additional debt

financing, if available, may involve significant cash payment

obligations, covenants and financial ratios that restrict our

ability to operate and grow our business, and would cause us to

incur additional interest expense and financing costs. As a

consequence, our operating performance may be materially adversely

affected.

Substantial and increasingly intense competition within our

industry may harm our business.

We

compete against a wide range of businesses, most of which are

larger than we are, have a dominant and secure position in the

market, or offer other products and services to customers that we

do not offer.

In the

IT consulting industry, we compete against business with comparable

software, platforms and services which may have longer operating

histories, greater revenue and resources and a larger customer

base, which could negatively affect our business and results of

operations.

The

payments industry is rapidly changing, highly innovative and

subject to substantial regulatory oversight. Our competitors offer

a wide range of payment services, some of which are the same or

similar to our business, including businesses that provide

customers with other means of payments, including:

●

Paper-based

transactions;

●

Providers of

traditional electronic payment methods, including credit and debit

cards;

●

Payment networks

which facilitate payments for credit card users;

●

Providers of

“digital wallets” which offer customers the ability to

pay online and/or in store through a variety of payment methods,

including with mobile applications, through contactless payments,

and with a variety of payment cards;

●

Providers of mobile

payments solutions that use tokenized card data approaches and

contactless payments (e.g. near field communication

“NFC”) or host card emulation functionality to

eliminate the need to swipe or insert a card or enter a personal

identification number or password;

●

Providers of

“person-to-person” payments that facilitate individuals

sending money with an email address or mobile phone

number;

●

Money

remitters;

●

Providers of card

readers for mobile devices and of other point of sale and

multi-channel technologies; and

●

Providers of

virtual currencies and distributed ledger

technologies.

20

We

expect competition to intensify in the future as existing and new

competitors introduce new services or enhance existing services. We

compete against many companies to attract customers, and most of

these companies have greater financial resources and substantially

larger bases of customers than we do, which may provide them with

significant competitive advantages. These companies may devote

greater resources than we do to the development, promotion and sale

of products and services, and they may be more effective in

introducing innovative, less expensive products and services that

hinder our growth. Competing services that have partnered with, or

are tied to established banks and other financial institutions, may

offer greater liquidity and create greater consumer confidence in

the safety and efficiency of their services than we do. We expect

that there will be continued mergers and acquisitions by or among

these companies, which will lead to even larger competitors with

more resources. We also expect to continue to see new entrants to

our field, which offer competitive products and services. For

example, traditional banks and other financial institutions

currently offer online payments for their customers. These factors

may make it difficult or cost prohibitive for us to do business. If

we are unable to gain market acceptance, differentiate ourselves

from, and successfully compete with our competitors, our business

will be adversely affected.

Our ability to further develop our business depends on our ability

to build a strong and trusted brand.

Although we have

built a brand through our IT consulting business, we cannot be

assured that our reputation and brand will be recognized or

extended to our payments business. Building, maintaining,

protecting and enhancing our brand are critical to expanding our

customer base, as well as increasing strategic partnerships and

developing new products. Harm to our brand can arise from many

sources, including failure by us or our partners to satisfy

expectations of service and quality; inadequate protection of

sensitive information; compliance failures and claims; litigation

and other claims; employee misconduct; and misconduct by our

partners, service providers or other counterparties. If we do not

successfully maintain a strong and trusted brand, our business

could be harmed.

Customer complaints or negative publicity about our customer

service could reduce usage of our products and, as a result, our

business could suffer.

Our

ability to successfully address customer complaints or negative

publicity about our IT consulting business or customer service in

the payments industry could severely diminish consumer confidence

in and use of our product. Breaches of our customers’ privacy

and our security measures could have the same effect. We expect to