UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C., 20549

FORM

For the year ended

OR

Commission File Number:

(Exact name of registrant as specified in its charter)

|

(State or other jurisdiction of incorporation) |

(I.R.S. Employer Identification No.) |

|

|

||

|

(Address of principal executive offices) |

(zip code) |

Registrant’s telephone number, including

area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol (s) | Name of each exchange on which registered |

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter periods as the registrant was required to file such reports) and (2) has been subject to such filing

requirements for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (check one)

| Large accelerated filer | o | Accelerated filer | o | |

| x | Smaller reporting company | |||

| Emerging growth company |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404 (b) of the Sarbanes-Oxley Act (15 U.S.C. 7262 (b)) by the registered public accounting firm that prepared or issued its audit report. ¨

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨

The aggregate market value of the registrant’s

voting equity held by non-affiliates of the registrant, computed by reference to the price at which the common stock was last sold as

of the last business day of the registrant’s most recently completed second fiscal quarter, was $

The number of shares of the registrant’s common stock outstanding as of September 27, 2022 was .

DOCUMENTS INCORPORATED BY REFERENCE

Portions of this registrant’s definitive proxy statement for its 2022 Annual Meeting of Stockholders to be filed with the SEC no later than 120 days after the end of the registrant’s fiscal year are incorporated herein by reference in Part III of this Annual Report on Form 10-K.

Table of Contents

| i |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) contains certain statements that constitute “forward-looking statements”, including within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect” and the negative and plural forms of these words and similar expressions are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. Those statements appear in this Report, particularly in the sections titled “Business,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors,” and include statements regarding the intent, belief or current expectations of the Company and management that are subject to known and unknown risks, uncertainties and assumptions.

Forward-looking statements include, but are not limited to, statements about:

| · | our ability to obtain additional funding to develop and market our products; | |

| · | the need to obtain regulatory approval of our products in the states in which we operate or expect to operate in the future; | |

| · | our ability to market our products; | |

| · | market acceptance of our product; | |

| · | competition from existing products or new products that may emerge; | |

| · | potential product liability claims; | |

| · | our dependency on third-party manufacturers to supply or manufacture our products; | |

| · | our ability to establish or maintain collaborations, licensing or other arrangements; | |

| · | our ability and third parties’ abilities to protect intellectual property rights; | |

| · | our ability to adequately support future growth; and | |

| · | our ability to attract and retain key personnel to manage our business effectively. |

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Forward-looking statements speak only as of the date of this Report or the date of any document incorporated by reference in this Report, as applicable. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we do not plan to publicly update or revise any forward-looking statements contained herein after we distribute this Report, whether as a result of any new information, future events or otherwise.

You should not rely upon forward-looking statements as predictions of future events. We are under no duty to update any of these forward-looking statements after the date of this Report to conform our prior statements to actual results or revised expectations, and we do not intend to do so, except as otherwise provided by law.

You should read the matters described in “Risk Factors” and the other cautionary statements made in this Report, as being applicable to all related forward-looking statements wherever they appear in this Report.

This information should be read in conjunction with the audited financial statements and the notes thereto included in this Report.

Our logo and some of our trademarks and tradenames are used in this Report. This Report also includes trademarks, tradenames and service marks that are the property of others. Solely for convenience, trademarks, tradenames and service marks referred to in this Report may appear without the ®, ™ and SM symbols. References to our trademarks, tradenames and service marks are not intended to indicate in any way that we will not assert to the fullest extent under applicable law our rights or the rights of the applicable licensors if any, nor that respective owners to other intellectual property rights will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Unless the context requires otherwise, references to the “Company,” “we,” “us,” “our,” “NeoVolta”, refer specifically to NeoVolta, Inc.

| 1 |

PART I

ITEM 1. BUSINESS

Overview

We are a designer, manufacturer, and seller of high-end Energy Storage Systems (or ESS), primarily our NeoVolta NV14 and NV 24, which can store and use energy via batteries and an inverter at residential or commercial sites. We were founded to identify new ways to leverage emerging technologies with the dynamic changes that are taking place in the energy delivery space. We primarily market and sell our products directly to our certified solar installers and solar equipment distributors. In the future, we intend to pursue residential developers, commercial developers, and other commercial opportunities. Because we are purely dedicated to energy solar systems, virtually all of our current resources and efforts go into further developing our flagship NV14 and NV 24 products, while focusing on specific industry needs for our next generation of products. We believe we are unique in the marketplace due to our low cost, our innovative battery chemistry, our product versatility, and our commitment to installer service. Because of these factors, we believe NeoVolta is uniquely equipped to establish ourselves as a major player in the energy storage market.

Our NV14 ESS contains a 7,680 W hybrid 120V / 240V and 208V inverter and a 14.4 kWh battery system power. The NV14 is energy efficient, has a variety of operating options, and uses Lithium Iron Phosphate (LiFe (PO4)) batteries. The batteries we utilize are capable of 6,000 cycles at a Depth of Discharge (DoD) of 90% and have a high thermal range (heat and cold tolerances). Our NV14 ESS integrates all components and is NEMA Type 3R rated (indoor/outdoor). Our NV24 provides additional energy storage capacity raising the NV14 from 14.4 KW to 24.0 KW. Our newest update of the NV14 ESS allows for commercial 208V 3-phase installations adding significantly to our potential customer base.

| 2 |

History

We completed the initial design work and completed testing and certification of our first offering, the NeoVolta NV14, in August 2018. In September 2018, we completed our first production prototype. By March 2019, we completed all certifications and were granted approval by the California Energy Commission (CEC) for off-grid and on-grid installation. Since our headquarters are located in San Diego County, a county with more than 160,000 solar customers, we chose San Diego for our initial rollout. In May 2019, the NV14 was approved throughout San Diego County and City areas by San Diego Gas & Electric (SDG&E) for connection to its grid system and customer installations began. In June 2019, we moved our contracted manufacturing to a facility in Poway, California. In June 2019, we began marketing to San Diego based solar installers. In early 2020, we expanded our certified installer network to the greater Los Angeles, San Francisco, and Sacramento areas, and, importantly, out of California to Arizona, Nevada, and Georgia. In January 2021, we moved to a larger production facility in Poway, California to facilitate growth. In 2021, we increased our national distribution, which we conduct through certified wholesale dealers, and now have installs in Utah, Florida, Puerto Rico, Oklahoma, Texas, Colorado, Wyoming, Tennessee, and Missouri.

Our Products - NeoVolta NV14 and NV24

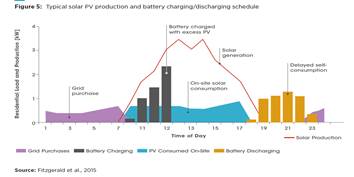

The NV14 is a complete ESS with 7,680-Watt 120V / 240V hybrid inverter (one of the largest in the industry) which is also capable of 208V 3-phase commercial power with a 14.4 kWh lithium iron phosphate (LiFe (PO4)) battery system. This is all incorporated in one National Electrical Manufacturer Association (NEMA) Type 3R rated indoor/outdoor cabinet system with all United Laboratories (UL) compliant electrical certifications, and fire code requirements. The NV14 is capable of storing and using inverted (AC) photovoltaic, non-inverted (DC) photovoltaic, or both AC and DC photovoltaic solar sources. It can also accept utility grid AC power as a charging source for the integrated 14.4 kWh battery system. The NV14 system will charge the batteries with excess solar photovoltaic (AC, DC or both AC and DC) power during daylight conditions - a unique functionality in the ESS industry. The inverter will invert DC battery power into AC power during periods of darkness or higher use periods. Once discharged, the batteries will be idle until excess solar photovoltaic is available and will subsequently begin to recharge. The NV14 is designed to primarily charge from solar but can be programmed to charge from other sources of power (solar, wind turbine, generator, and grid). It can be easily programmed by our certified installers to customer-specific use profiles, including for “rate arbitrage,” (graph below) which allows charging from the grid during the lowest rate periods (A) if the utility company allows this activity. Once recharged, the batteries will discharge once solar photovoltaic begins to wane or when the customer needs more power than available from solar photovoltaic (B). By doing this, customers will be consuming their own solar photovoltaic production instead of sending excess photovoltaic power to the grid and then buying this power back later in the evening from the utility at an often significantly higher retail rate, thereby potentially lowering their monthly electric bill depending on their local utility’s rate plan. Our NV14 is also capable of multi-tasking by recharging via solar photovoltaic power while also supplying power.

| 3 |

We believe our NV14 is unique among its competitors in that the cabinet is rated for indoor/outdoor installation (NEMA Type 3R) allowing for more installation configurations and the ability to fit more residential customer use cases. With measurements of 50.5” H x 38” W x 10” D it can be installed either inside the garage or outside (preferable near existing utility connections) of the residence or facility.

No solar system can provide power to a home without a system capable of “Islanding,” due to safety regulations put in place for utility workers during outages. “Islanding” is when a PV generator or other electrical source continues to power a location or residence even though electrical grid power is no longer present. According to Bloomenergy.com, power outages are on the rise in California. There were 25,281 blackout events in 2019, a 23% increase from 20,598 in 2018. The number of utility customers affected jumped to 28.4 million in 2019, up 50% from 19 million in 2018. Our NV14 is capable of “Islanding” when used with AC or DC photovoltaic (PV) systems. As islanding can be dangerous to utility workers, who may not realize that a circuit is still powered, an ESS capable of “islanding” must be capable of physically disconnecting from the grid power when it senses that grid supply is not present, has an over current, or an undercurrent condition. The NV14 includes “islanding” relays that are approved to perform this function. Islanding also allows solar production to function and power the residence or facility thereby decreasing the impact of a grid outage.

Our NV14 currently includes a commercially available encrypted WiFi logger and associated smart phone application that allows customers to visualize the state of the system in 8-minute intervals (battery, home, grid, photovoltaic, and/or generator). Settings adjustments for how the system works can be made remotely by the installer if/when utilities make changes to Time-of-Use billing rates/times. Our remote management system is included with the product and allows NeoVolta 24/7 system health monitoring, malfunction diagnosis, and the ability to push firmware and software updates. This allows NeoVolta, installers, and their customers, insight into system health 24/7. Remote monitoring and programming is accomplished using AWS Key Management encryption and cloud storage ensuring customer privacy and security.

Our NV24 has additional battery capability that raises NV14 energy storage from 14.4 KW to 24.0 KW. As the NV24 has add-on battery capacity, additional inverters are not required. This enables customers to achieve a 67% increase in storage for a fraction of the typical cost of adding more storage. Most competitive systems require an additional inverter for any additional storage.

New ESS fire code regulations have been significant and are ongoing, especially in California. ESSs can no longer be installed inside the living areas of a home. ESSs can be installed inside the garage but require smoke and heat detectors and may also require bollards or caging to protect the ESS from being accidentally struck by a vehicle. This is a particularly detrimental code to ESS that cannot be installed outside. Both requirements are directly related to fire risk from certain battery chemistries. Lithium Ion, a very popular chemistry in the ESS industry, has demonstrated fire and thermal runaway characteristics in certain circumstances. Our batteries were UL 9540 certified at the cell and modular level in July 2021 certifying that they will not catch on fire and exhibit no thermal runaway characteristics.

| 4 |

We are aware of additional regulatory requirements being planned in various jurisdictions for 2022 and 2023. We expect such changes in regulatory code to be a routine requirement as ESS is a new field that warrants scrutiny and is a major focus of our management team. We also see the complex regulatory environment as a significant barrier to new market entry.

Market Characteristics

Our market can be looked at two ways: the solar installer market and the ESS market.

Solar Installer Market. The bulk of NeoVolta’s revenue and recurring customer base is residential and commercial solar system installers. According to IBIS Worldwide, there are over 13,000 solar installers in the US employing almost 55,000 employees. With SunRun and Tesla Energy representing approximately 20% of the market combined, and the top 10 companies representing about 38%. Most solar installers in the US are very small, independently owned operators and are generally not serviced by the larger companies. These underserved installers have been NeoVolta’s target market. Based on IBIS’ figures, we estimate this to be at least 13,000 installers with less than 25 employees. Our average recurring installer customer purchases 1-2 systems a month. They generally sell their systems and install and pay for them within the same month, and typically do not stock inventory, so we believe NeoVolta’s “just in time” product availability makes us an ideal fit. Once these customers become certified NeoVolta installers, they become recurring customers. We built our company based on servicing small installers and will continue to do so by focusing on product availability, installer service, and, most importantly, the characteristics of our product while we capture market share. As we gain market acceptance, we expect larger installers to take notice. This is especially true when considering repeated product availability challenges within the industry.

Installer storage installation activity has grown over time, with 50% of all active residential installers in 2020 having completed at least one solar + storage system, up from less than 20% in 2016 according to Berkeley Labs. The rate of attachment, or number of PV systems installed with storage, is growing considerably. According to Wood Mackenzie, by 2025, nearly 29% of all behind-the-meter solar systems will be paired with storage, compared to under 11% in 2021. Most of the growth will be powered by the smaller installers, as larger installers have already incorporated storage into their standard new solar offerings. Although Tesla and LG Chem have dominated the market in the past few years, new market entries continue to gain ground and new opportunities in the space continue to present themselves to those who can adapt to fill the need. Additionally, our larger ESS competitors focus on energy storage as a component of their new solar installation, whereas NeoVolta focuses entirely on ESSs, revealing what we believe to be a compelling market in existing solar system retrofits. According to Berkeley Lab’s Tracking the Sun dataset, there are over 3 million solar systems installed in the US and only 6.8% of those have energy solar installed. This marketplace scenario presents small installer customers almost 3 million households to revisit for a storage retrofit especially when their 10-15 year old inverter experiences end of life.

We believe that our 100% commitment to ESS and our relatively small size allow us to navigate this nascent industry more nimbly, and we have been able to develop distinct competitive advantages despite our relative resources.

ESS Market. This is a relatively new market as solar attached storage systems have only become viable in the last decade. It is a subset of what the Solar Energy Industries Association (SEIA) refers to as the $17 billion U.S. residential solar PV market. Wood Mackenzie forecasts that there will be 3 million installations in 2021 growing to 4 million in 2023. According to Mordor Intelligence, the global residential energy storage systems market is expected to register a compound annual growth rate (CAGR) of more than 19% during the forecast period of 2021 - 2026, reaching a market value of more than $8.5 billion by 2026 from $2.2 billion in 2019. The growth of the ESS market comes from a combination of retrofits to existing solar installations and more widespread adoption of storage as part of new solar installations.

| 5 |

According to Wood Mackenzie’s U.S. Energy Storage Monitor, released in December 2020, the residential storage segment posted its best quarter ever in the third quarter of 2020, during the height of the coronavirus pandemic with 52 megawatts and 119 megawatt-hours of new storage installed. The U.S. market is expected to reach 7.5 gigawatts in 2025, which amounts to six-fold growth from 2020. The Q3 2021 US Energy Storage Monitor estimates that the U.S. residential market will surpass $1 billion in 2022; a 14% share of the estimated $7 billion total US Energy Storage market. The report added that Q2 surpassed Q1 2021 to become the second-largest quarter for storage deployment on record in MWh terms.

Market Drivers

Regulatory. The regulatory drivers regarding ESS come in the form of an increasing number of mandates and incentives. On the mandate side, in August of 2021, California became the first state in the country to require builders to install solar and battery storage on new commercial buildings and high-rise multifamily buildings. This state approved Energy Code also includes requirements for builders to design single-family homes so battery storage can be easily added to the already existing solar system in the future as well as incentives to eliminate natural gas from new buildings. On the incentive side, the federal Investment Tax Credit, or ITC, has been the most impactful providing a 26% credit for the cost of a unit if you pair the battery with an on-site renewable resource. For a typical ESS, the ITC can reduce the cost of the system by $4,500 to $6,000. This will become even more beneficial with the enactment of The Inflation Reduction Act, increasing the credit to 30% for all ESS. Many states are also putting incentive systems in place. Beyond states taking steps to encourage greater adoption of energy storage technologies, some utilities are now also offering incentives to home and business owners who install storage. To date, most of these utility-specific storage incentives are in the Northeast. We anticipate more of these programs being put in place in the future.

Utilities can also impact battery storage adoption on the cost side of the equation. In certain circumstances, when state utilities change their billing profiles, the market for ESS becomes more (or less) attractive. For example, Hawaii’s attachment rate rose to 80% after the state began transitioning away from net energy metering (NEM) and reduced compensation for grid exports.

Resiliency. Energy dependence has been a growing concern in the last few years as weather patterns have become more erratic. New findings from the U.S. Department of Energy’s National Renewable Energy Laboratory (NREL) and Clean Energy Group (CEG) found that when the value of resilience is considered - preventing power outages - several more integrated solar-plus-storage projects are economically viable.

Utilities are addressing this matter in some cases through Public Safety Power Shut Off (PSPS) events (when power is purposefully turned off in the case of high winds with very dry vegetation conditions that increase wildfire risks). The direct result of this was seen in California after the PSPS events of late 2019 (below)

Consumer Perception. Although both economics and resiliency have been impactful on ESS demand, researchers at Berkeley Labs concluded that a third category of consumer perception may be adding to the trend. The feedback they received included the concept that consumers saw ESS as a “green” investment and felt like it was a way to “stick it to the utilities”. These factors are obviously less measurable than the more objective drivers above but are an additive factor in the market.

Growth Strategy

Our growth strategy is focused on expanding our core business of distributing our products on a recurring basis to small and medium sized installers and to continue expanding the application of our product into various commercial applications through development partnerships. We plan to do this through an increase in targeted direct sales and marketing to installers in ripe regional markets, concentrating efforts on adding to our national distributor partners, and marketing in ESS industry circles to identify new potential applications of our systems. Our growth thus far has been through word of mouth and networking mainly in Southern California. We have been successful in consistently growing both our installer base and our number of installs through these means, but recognize that to succeed in the national marketplace, we will need to bring on a team of sales and marketing professionals to reach our goals. We have plans to start to build out this team utilizing the proceeds from our recent offering.

| 6 |

Non-Residential / Commercial Growth: Our all-in-one system was engineered with the intent to be easily configurable to the needs of the client and easily serviced and updated for our installers. Flexibility due to the close contact with the manufacturing process and the adaptability of the product, along with our ability to handle commercial 208V 3-phse power, have opened up a number of new opportunities for us. These customers sought us out to create an energy storage system for their unique needs specifically because others would not or could not accept the challenge. NeoVolta was and continues to be open to customizing our products for energy storage contracts should they meet our volume, profitability, and system requirements. This strategy of flexibility in R&D is affording NeoVolta access into markets that would normally be closed to companies of our size. We will continue to leverage this customer-driven approach in the future.

New opportunities in this sector are difficult to forecast, but are a core focus of our current sales and marketing plan. As these projects roll out and begin to be publicized, we believe NeoVolta can establish itself as an energy storage system engineering firm for large projects in applications globally. We intend to take advantage of our adaptability and the nascent industry to fill these diverse and complicated needs.

Competition

We compete with several large competitors already successfully selling in the ESS space. Notable competitors include Tesla, LG Chem, Sonnen, and SMA America, among others. Some of our competitors have significantly greater financial, product development, manufacturing, marketing resources, and name recognition. In addition to competitors in the ESS space, we compete with companies in power generation equipment and other engine powered products industries. We face competition from a variety of large diversified industrial companies as well as smaller generator manufacturers, along with mobile equipment, engine powered tools, solar inverter, battery storage and grid services providers, both domestic and internationally. In addition, as energy storage becomes a necessary component for residential customers to realize better value/savings from their solar PV installation, we believe new competitors will emerge in this field. There is no assurance that we will be able to successfully compete in this market.

NeoVolta Competitive Advantages:

Availability. We believe recent back-order times for competitive products have been as long as 9-months in 2021. Smaller installers rely on quick sales to install to payment to keep their business going, and the lack of availability of competitive products is often the reason they are introduced to NeoVolta. Since December 2021, NeoVolta has been delivering on orders in under two weeks, very often the same day. We achieve this by maintaining a high level of inventory relative to projected sales, component consolidation prior to shipment, and a small lot, recurring freight strategy, which we believe allows for more flexibility in getting through the supply chain. Our strategy of maintaining higher levels of inventory based on projected sales means that to the extent our sales expectations in any periods are incorrect we may suffer cash flow constraints for such periods. LG Chem recently experienced a large recall of their older systems due to fire risk and product defects associated with their lithium-ion chemistry. Inability to secure reliable product delivery, fire risk, and recalls have harmed reputations of our competitors.

| 7 |

Installer Service. NeoVolta considers its installer relationships to be the key to our growth. The relative newness of the industry requires a great deal of education and support to ensure quality and efficient installations. With all energy storage, there is significant necessary electrical work, which may be new to smaller solar installers. NeoVolta requires that every installer go through our Certified Installer Program and we often walk them through early installations one-on-one to get them comfortable with the product either in-person or via smart phone video. NeoVolta’s San Diego-based direct customer support is available throughout the install and for any ongoing service, as well as through our remote system monitoring. This one-on-one philosophy has generated great customer loyalty and install success and we intend to invest the resources necessary to keep this partnership culture a priority.

Superior Product. Some of our competitors have significantly greater financial, product development, manufacturing, marketing resources, and name recognition than we have. However, with the industry’s growth will come frequent and dramatic change. We believe that our 100% commitment to ESS and our size allow us to navigate this nascent industry more nimbly, and we have been able to develop distinct competitive advantages to appeal to smaller and regional independent installers. We designed the NeoVolta NV14 to be cost effective, easy to install and service, and adaptable to customer needs. We are one of very few in the ESS industry to focus virtually all our resources on energy storage systems.

Key Product Advantages:

| · | Residential / Commercial: System adapts to either application without the need for any additional equipment (transformers) | |

| · | Outdoor or Indoor installations: NEMA 3R rated | |

| · | Higher power than most competitive options (7,680 W inverter) | |

| · | Compatible with AC, DC or both AC and DC power | |

| · | UL certified to have no thermal runaway and no thermal risk (UL 9540A) | |

| · | Compatible with generators | |

| · | Capable of adding additional battery storage capacity without need for additional inverter |

Our NV14 inverter can also accept 208 Volt 3-phase commercial power by simply making a settings change. This feature allows small businesses to back up vital systems such as refrigeration, servers, alarm systems, entry and exit security features, vaults, emergency lighting, etc. Some States are beginning to require these capabilities as an emergency capability due to frequent grid outages.

IP & Product Development

We currently have one issued utility patent (US Patent No. 10,998,730) that is directed to NeoVolta’s solar power inverter system. This patent expires on November 25, 2039. A continuing utility application was also filed directed to the ‘730 patent, which is currently pending. Furthermore, another U.S. patent application was filed directed to supply circuitry that is implemented as part of NeoVolta’s solar power inverter system (the “supply circuitry patent application”), which is also currently pending. A Patent Cooperation Treaty (PCT) application has also been filed claiming priority to the supply circuitry patent application, which is also pending. The PCT application affords NeoVolta the opportunity to file a foreign application in any PCT-member country by the deadline of August 12, 2023. We also intend to further broaden our product portfolio to pursue new and diverse markets. We believe investment in our operations and engineering teams in the first quarter will accelerate these improvements.

We rely on a combination of patent, trademark, copyright, trade secret, including federal, state and common law rights in the United States and other countries, nondisclosure agreements, and other measures to protect our intellectual property. We require our employees, consultants, and advisors to execute confidentiality agreements and to agree to disclose and assign to us all inventions conceived under their respective employment, consultant, or advisor agreement, using our property, or which relate to our business. Despite any measures taken to protect our intellectual property, unauthorized parties may attempt to copy aspects of our products or to obtain and use information that we regard as proprietary. Our business is affected by our ability to protect against misappropriation and infringement of our intellectual property, including our trademarks, service marks, patents, domain names, copyrights and other proprietary rights.

| 8 |

Regulatory Environment

Regulators are quickly getting involved in the ESS space. In the past two years, California regulators have implemented major requirements, including CSIP and CPUC “rapid shutdown,” garage safety, non-ferrous cabinet, and more are being planned. We have a track record of understanding, adapting, and deploying our products in this ever-changing world.

California, via the California Public Utilities Commission (CPUC), and Hawaii appear to be leading the United States when it comes to new ESS regulations. In the past 16-months, CPUC adopted Common Smart Inverter Profile (CSIP), solar rapid shutdown, and several fire standards both inside garages and outside on residential dwellings. On June 22, 2020, with significant technical development and relationship building, NeoVolta received all certifications necessary for California CSIP compliance. On August 5, 2020, the California Energy Commission (CEC) approved NeoVolta’s CSIP application. CEC facilitates regulatory approvals for the CPUC.

In January 2021, CPUC adopted solar “rapid shutdown” requirements, which means emergency responders needed to be able to quickly terminate all with a switch or lever within a few feet of the Main Service Panel (MSP). NeoVolta already met this challenge with outside AC solar installations, and quickly met the requirements for indoor installations and DC solar.

NeoVolta’s other certifications include:

| · | Underwriters Laboratories (UL) 9540, 9540A, 1973, 1741SA, 1642, and 1699B Arc Fault Circuit Protection Type | |

| · | UL 9540A Battery Energy Storage System (ANSI/CAN/UL 9540:2020) | |

| · | Institute of Electrical and Electronics Engineers (IEEE) 1547 (2003 standard) | |

| · | International Electrotechnical Commission (IEC) 62897 | |

| · | Electrical Codes: National Fire Codes (NEC) 2017 | |

| · | California Public Utilities Commission (CPUC) Rule 21 Interconnection | |

| · | Hawaii Electric Companies Source Requirement Document Version 1.1 (SRD-UL-1741-SA-V1.1) | |

| · | CSA Group C22.2 No. 107.1:2001 Ed. 3 | |

| · | Federal Communications Commission (FCC) 15 Class B | |

| · | National Electrical Manufacturers Association (NEMA) Type 3R | |

| · | California Energy Commission (CEC) off-grid and on-grid R-F38 | |

| · | California Energy Commission (CEC) on-grid R-F58 |

NeoVolta has established a track record for quickly understanding and meeting regulatory hurdles. Although regulatory changes will cause an enduring need for increases in Research and Development (R&D) and product constraints, we believe this will also raise the barrier of entry to new market entrants. We believe NeoVolta is well positioned to face new regulatory requirements due to our battery chemistry and our product being developed in California - where regulatory standards in energy are generally set. In fact, most states default their own regulations to California’s standards for energy solar systems.

Employees

As of June 30, 2022, we have five full-time employees. Our CEO manages all Company strategy, sales and R&D, our CFO manages all finance and administration. The balance of the staff manages supply chain, technical support and marketing/sales support. We also contract for hire with four outside consultants and contractors on an ongoing basis. Also, specific contracts for non-recurring R&D. Our intent is to hire up to three executive level leaders early in the new fiscal year to head up sales & marketing, operations and product development and build out their teams.

| 9 |

ITEM 1A. RISK FACTORS

The following risks and uncertainties should be carefully considered in addition to the other information included in this Report. If any of the following conditions or other unknown conditions should occur, our business, financial condition or operating results could be materially harmed. An investment in our securities is speculative in nature, involves a high degree of risk and should not be made by an investor who cannot bear the economic risk of its investment for an indefinite period of time and who cannot afford the loss of its entire investment.

Risks Related to our Business and Industry

We are a relatively new company, with our sales having only commenced in July 2019, and we continue to have some of the risks associated with start-up ventures.

We formed our corporation in 2018. Since formation, we have focused on research, development and certification of our first energy storage system. We began marketing, sales, and installations via our certified installers in May 2019 (although no sales were completed in the year ended June 30, 2019). We may never achieve commercial success with our energy storage systems. We have limited historical financial data upon which we may base our projected revenue and operating expenses. Our relatively short operating history makes it difficult for potential investors to evaluate our technology or prospective operations and business prospects. Accordingly, we continue to be subject to many of the risks inherent in business development, financing, unexpected expenditures, and complications and delays that often occur in a new business. Investors should evaluate an investment in us in light of the uncertainties encountered by developing companies in a competitive environment. There can be no assurance that our efforts will be successful or that we will ultimately be able to attain profitability.

We have a history of net losses and we are uncertain about our future profitability.

We have incurred significant net losses since our inception. For the years ended June 30, 2022 and 2021, we have incurred net losses of $5.8 million and $7.6 million, respectively. As of June 30, 2022, we had an accumulated deficit of $15.8 million. If our revenue grows more slowly than currently anticipated, or if operating expenses are higher than expected, we may be unable to consistently achieve profitability, our financial condition will suffer, and the value of our common stock could decline. Even if we are successful increasing our sales, we may incur losses in the foreseeable future as we continue to develop and market our products. If sales revenue from any of our current products or any additional products that we develop in the future is insufficient, or if our product development is delayed, we may be unable to achieve profitability and, in the event we are unable to secure financing for prolonged periods of time, we may need to temporarily cease operations and, possibly, shut them down altogether. Furthermore, even if we are able to achieve profitability, we may be unable to sustain or increase such profitability on a quarterly or annual basis, which would adversely impact our financial condition and significantly reduce the value of our common stock.

We may experience in the future, delays or other complications in the design, manufacture, launch and production ramp of our energy storage products which could harm our brand, business, prospects, financial condition and operating results.

We may encounter unanticipated challenges, such as supply chain or logistics constraints, that lead to delays in producing and ramping our energy storage products. Any significant delay or other complication in the production of our products or the development, manufacture, and production ramp of our future products, including complications associated with expanding our production capacity and supply chain or obtaining or maintaining regulatory approvals, and/or coronavirus impacts, could materially damage our brand, business, prospects, financial condition and operating results.

| 10 |

We may be unable to meet our growing energy storage production plans and delivery plans, any of which could harm our business and prospects.

Our plans call for achieving and sustaining significant increases in energy storage systems production and deliveries. Our ability to achieve these plans will depend upon a number of factors, including our ability to utilize installed manufacturing capacity, achieve the planned production yield and further increase capacity as planned while maintaining our desired quality levels and optimize design and production changes, and our suppliers’ ability to support our needs. If we are unable to realize our plans, our brand, business, prospects, financial condition and operating results could be materially damaged.

We are dependent on our two main component vendors for our suppliers of batteries, inverters and other raw materials and the inability of these single-source suppliers to deliver necessary components of our products according to our schedule and at prices, quality levels and volumes acceptable to us, or our inability to efficiently manage these components, could have a material adverse effect on our financial condition and operating results.

Our products contain numerous purchased parts which we source globally from direct suppliers, the majority of whom are currently single-source suppliers. Any significant unanticipated demand would require us to procure additional components in a short amount of time. While we believe that we will be able to secure additional or alternate sources of supply for most of our components in a relatively short time frame, there is no assurance that we will be able to do so or develop our own replacements for certain highly customized components of our products. In addition, if we are required to use alternative suppliers for certain critical components, we may need to have our products go through a re-certification process with various regulatory bodies, which process may be lengthy. In such event, we would not be able to sell our products using these new components until we received all required certifications.

If we encounter unexpected difficulties with key suppliers such as our inverter or lithium-iron phosphate cell supplier, and if we are unable to fill these needs from other suppliers, we could experience production delays and potential loss of access to important technology and parts for producing, servicing and supporting our products. This limited, and in many cases single source, supply chain exposes us to multiple potential sources of delivery failure or component shortages for the production of our products. The loss of any single or limited source supplier or the disruption in the supply of components from these suppliers could lead to significant product design changes and delays in product deliveries to our customers, which could hurt our relationships with our customers and result in negative publicity, damage to our brand and a material and adverse effect on our business, prospects, financial condition and operating results.

Changes in our supply chain may result in increased cost. If we are unsuccessful in our efforts to control and reduce supplier costs, our operating results will suffer.

There is no assurance that our suppliers will ultimately be able to meet our cost, quality and volume needs, or do so at the times needed. Furthermore, as the scale of our energy storage systems increase, we will need to accurately forecast, purchase, warehouse and transport to our manufacturing facilities components at much higher volumes than we have experience with. If we are unable to accurately match the timing and quantities of component purchases to our actual needs, or successfully implement automation, inventory management and other systems to accommodate the increased complexity in our supply chain, we may incur unexpected production disruption, storage, transportation and write-off costs, which could have a material adverse effect on our financial condition and operating results.

The duration and scope of the impacts of the COVID-19 pandemic are uncertain and may continue to adversely affect our operations, supply chain, distribution, and demand for our products.

The impact of COVID-19 on the global economy and our customers has thus far not affected us materially. To date, we have not experienced any issues with our supply chain, but delays through international ports have been experienced in the industry. If we were to encounter a significant disruption due to COVID-19 at one or more of our locations or suppliers, we may not be able to satisfy customer demand for a period of time.

| 11 |

Furthermore, the impact of COVID-19 on the economy, demand for our products and impacts to our operations, including the measures taken by governmental authorities to address it, may precipitate or exacerbate other risks and/or uncertainties, including specifically many of the risk factors set forth herein, which may have a significant impact on our operating results and financial condition, although we are unable to predict the extent or nature of these impacts at this time.

We are currently selling two products and if these products that we sell or install fail to perform as expected, our reputation could be harmed and our ability to develop, market and sell our products and services could be harmed.

If our energy products were to contain defects in design and manufacture that cause them not to perform as expected or that require repair or take longer than expected to become enabled or are legally restricted, our ability to develop, market and sell our products and services could be harmed. While we intend to perform internal testing on the products we manufacture, as a start-up company we currently have no frame of reference by which to evaluate detailed long-term quality, reliability, durability and performance characteristics of our battery packs, inverters, and energy storage products. There can be no assurance that we will be able to detect and fix any defects in our products prior to their sale to or installation for consumers. Any product defects, delays or legal restrictions on product features, or other failure of our products to perform as expected could harm our reputation and result in delivery delays, product recalls, product liability claims, significant warranty and other expenses, and could have a material adverse impact on our business, financial condition, operating results and prospects.

We depend on a small number of wholesale dealers for a significant portion of our revenues to date.

Due to our limited operating history, we depend on a relatively small number of wholesale dealers and installers, primarily in California, for our revenue. In the year ended June 30, 2022, two such dealers represented approximately 20% each of the Company’s revenues whereas in the year ended June 30, 2021, four such dealers represented approximately 18%, 15%, 13% and 10% of the Company’s revenues. As of June 30, 2022, one dealer represented 33% of the Company’s accounts receivable. As of June 30, 2021, three such dealers represented an aggregate of 54% of our accounts receivable. Our limited customer base and concentration could expose us to the risk of substantial losses if a single dominant customer stops purchasing, or significantly reduces orders for, our products. Our ability to maintain close relationships with these top customers is essential to the growth and profitability of our business. If we fail to sell our products to one or more of these top customers in any particular period, or if a large customer purchases fewer of our products, defers orders or fails to place additional orders with us, or if we fail to develop additional major customers, our revenue could decline, and our results of operations could be adversely affected.

If we fail to scale our business operations and otherwise manage future growth and adapt to new conditions effectively as we grow our company, we may not be able to produce, market, sell and service our products successfully.

Any failure to manage our growth effectively could materially and adversely affect our business, prospects, operating results and financial condition. Our future operating results depend to a large extent on our ability to manage our expansion and growth successfully. We may not be successful in undertaking this expansion if we are unable to control expenses and avoid cost overruns and other unexpected operating costs; adapt our products and conduct our operations to meet local requirements; implement the required infrastructure, systems and processes; and find and hire the right skills to make our growth successful.

If we are unable to achieve our targeted manufacturing costs for our energy storage products our financial condition and operating results will suffer.

As a relatively new company, we have limited historical data that ensures our targeted manufacturing costs will be achievable. While we expect in the future to better understand our manufacturing costs, there is no guarantee we will be able to achieve sufficient cost savings to reach our gross margin and profitability goals. We may also incur substantial costs or cost overruns in utilizing and increasing the production capability of our energy storage system facilities.

| 12 |

If we are unable to achieve production cost targets on our products pursuant to our plans, we may not be able to meet our gross margin and other financial targets. Many of the factors that impact our manufacturing costs are beyond our control, such as potential increases in the costs of our materials and components, such as lithium iron phosphate, nickel and other components of our battery cells. If we are unable to continue to control and reduce our manufacturing costs, our operating results, business and prospects will be harmed.

Increases in costs, disruption of supply or shortage of materials, in particular for inverters and lithium iron phosphate cells, could harm our business.

We may experience increases in the cost or a sustained interruption in the supply or shortage of materials. Any such increase, supply interruption or shortage could materially and negatively impact our business, prospects, financial condition and operating results. We use various materials in our business, including inverters and lithium iron phosphate cells, from suppliers.

The prices for these materials fluctuate, and their available supply may be unstable, depending on market conditions and global demand for these materials, including as a result of increased production of energy storage products by our competitors, and could adversely affect our business and operating results. For instance, we are exposed to multiple risks relating to inverters and lithium iron phosphate cells.

These risks include:

| · | an increase in the cost, or decrease in the available supply, of materials used; | |

| · | disruption in the supply of cells due to quality issues or recalls by manufacturers; | |

| · | tariffs on the materials we source in China, which make up a significant amount of the materials we require; | |

| · | fluctuations in the value of the Chinese Renminbi against the U.S. dollar as our purchases for energy storage products will be denominated in Chinese Renminbi. Already in 2021, we have experienced five percent inflation in our cost of goods sold because of currency valuations; and | |

| · | increases in global shipping costs have gone up 70 percent in 2021 due to shipping container shortages and delays at both shipping and receiving ports due to COVID and lack of appropriate workforce. |

Our business is dependent on the continued supply of inverters and battery cells for the battery packs used in our energy storage products. Any disruption in the supply of inverters or battery cells could disrupt production of our battery packs we require for our energy storage product. Substantial increases in the prices for our materials or prices charged to us would increase our operating costs, and could reduce our margins if we cannot recoup the increased costs through increased prices. Any attempts to increase prices in response to increased material costs could result in cancellations of energy storage orders and therefore materially and adversely affect our brand, image, business, prospects and operating results.

We are currently operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by geopolitical instability due to the ongoing military conflict between Russia and Ukraine. Our business, financial condition and results of operations may be materially and adversely affected by any negative impact on the global economy and capital markets resulting from the conflict in Ukraine or any other geopolitical tensions.

U.S. and global markets are experiencing volatility and disruption following the escalation of geopolitical tensions and the start of the military conflict between Russia and Ukraine. On February 24, 2022, a full-scale military invasion of Ukraine by Russian troops was reported. Although the length and impact of the ongoing military conflict is highly unpredictable, the conflict in Ukraine could lead to market disruptions, including significant volatility in commodity prices, credit and capital markets, as well as supply chain interruptions. We are continuing to monitor the situation in Ukraine and globally and assessing its potential impact on our business. In addition, Russian military actions and the resulting sanctions could adversely affect the global economy and financial markets and lead to instability and lack of liquidity in capital markets, potentially making it more difficult for us to obtain additional funds.

Any of the above mentioned factors could affect our business, prospects, financial condition, and operating results. The extent and duration of the military action, sanctions and resulting market disruptions are impossible to predict, but could be substantial. Any such disruptions may also magnify the impact of other risks described in this registration statement.

| 13 |

We may become subject to product liability claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims.

Although we believe we have designed our products for safety, product liability claims, even those without merit, could harm our business, prospects, operating results and financial condition. Our risks in this area are particularly pronounced given that we have only recently begun to deliver energy storage products. Moreover, a product liability claim could generate substantial negative publicity about our products and business and could have material adverse effect on our brand, business, prospects and operating results.

The markets in which we operate are in their infancy and highly competitive, and we may not be successful in competing in these industries as the industry further develops. We currently face competition from new and established domestic and international competitors and expect to face competition from others in the future, including competition from companies with new technology.

The worldwide energy storage market is in its infancy, and we expect it will become more competitive in the future. We also expect more regulatory burden as customers adopt this new technology. There is no assurance that our energy storage systems will be successful in the respective markets in which they compete. A significant and growing number of established and new companies, as well as other companies, have entered or are reported to have plans to enter the energy storage market. Most of our current and potential competitors have significantly greater financial, technical, manufacturing, marketing, sales networks and other resources than we do and may be able to devote greater resources to the design, development, manufacturing, distribution, promotion, sale and support of their products. Increased competition could result in lower unit sales, price reductions, revenue shortfalls, loss of customers and loss of market share, which could harm our business, prospects, financial condition and operating results. The energy storage industry is highly competitive.

We face competition from other manufacturers, developers and installers of energy storage systems, as well as from large utilities. Decreases in the retail prices of electricity from utilities or other renewable energy sources could make our products less attractive to customers. Reduction in various federal and state rebate and incentive programs could also adversely affect product adoption.

Our products and services are subject to substantial regulations, which are evolving, and unfavorable changes or failure by us to comply with these regulations could substantially harm our business and operating results.

As a manufacturer of energy storage systems, we are impacted by federal, state and local regulations and policies concerning electricity pricing, the interconnection of electricity generation and storage equipment with the electric grid, and the sale of electricity generated by third-party owned systems. For example, existing or proposed regulations and policies would permit utilities to limit the amount of electricity generated by our customers with their solar energy systems, adjust electricity rate designs such that the price of our products may not be competitive with that of electricity from the grid, restrict us and our customers qualifying for government incentives and benefits that apply to renewable energy, and limit or eliminate net energy metering. If such regulations and policies remain in effect or are adopted in other jurisdictions, or if other regulations and policies that adversely impact the interconnection or use of our energy storage systems are introduced, they could deter potential customers from purchasing our energy storage products, which could harm our business, prospects, financial condition and results of operations.

We may need to assert intellectual property-related claims or defend ourselves against intellectual property infringement claims, which may be time-consuming and could cause us to incur substantial costs.

Others, including our competitors, may hold or obtain patents, copyrights, trademarks or other proprietary rights that could prevent, limit or interfere with our ability to make, use, develop, sell or market our products and services, which could make it more difficult for us to operate our business. From time to time, the holders of such intellectual property rights may assert their rights and urge us to take licenses, and/or may bring suits alleging infringement or misappropriation of such rights. We may consider the entering into licensing agreements with respect to such rights, although no assurance can be given that such licenses can be obtained on acceptable terms or that litigation will not occur, and such licenses could significantly increase our operating expenses. In addition, if we are determined to have infringed upon a third party’s intellectual property rights, we may be required to cease making, selling or incorporating certain components or intellectual property into the goods and services we offer, to pay substantial damages and/or license royalties, to redesign our products and services, and/or to establish and maintain alternative branding for our products and services. In the event that we were required to take one or more such actions, our business, prospects, operating results and financial condition could be materially adversely affected. In addition, any litigation or claims, whether or not valid, could result in substantial costs, negative publicity and diversion of resources and management attention.

| 14 |

In August 2021, we entered into an exclusive supply agreement with our Asian supplier pertaining to our NV7600 product. This agreement contains provisions that address the ownership and use of intellectual property rights. While we are unaware of any present dispute concerning this agreement or our other agreements that concern ownership of or use of intellectual property rights , future disputes may arise concerning this or other agreements we have entered into that concern ownership of or use of intellectual property rights.

Our business could be negatively impacted if we fail to adequately protect our intellectual property rights.

We consider our intellectual property rights to be important assets, and seek to protect them through a combination of patent, trademark, copyright and trade secret laws, as well as licensing and confidentiality agreements. These protections may not be adequate to prevent third parties from using our intellectual property without our authorization, breaching any confidentiality agreements with us, copying or reverse engineering our products, or developing and marketing products that are substantially equivalent to or superior to our own. The unauthorized use of our intellectual property by others could reduce our competitive advantage and harm our business. Not only are intellectual property-related proceedings burdensome and costly, but they could span years to resolve and we might not ultimately prevail. We cannot guarantee that any patents, issued or pending, will provide us with any competitive advantage or will not be challenged by third parties. Moreover, the expiration of our patents may lead to increased competition with respect to certain products.

Potential tariffs or a global trade war have increased our costs and could further increase the cost of our products, which could adversely impact the competitiveness of our products and our financial results.

In 2019, the Trump Administration announced tariffs on goods imported from China in connection with China’s intellectual property practices. Our products depend on materials from China, namely inverters and batteries, which are the main components of our products. Traditionally, the tariff rate for our imports has been 3.4%. Presently, our tariff rate is 10.9% on these imports. To date, the Biden Administration has made no significant changes to these Chinese tariffs.

We cannot predict what actions may ultimately be taken with respect to tariffs or trade relations between the United States and China, what products may be subject to such actions, or what actions may be taken by the China in retaliation. The tariffs described above, the adoption and expansion of trade restrictions, the occurrence of a trade war, or other governmental action related to tariffs, trade agreements or related policies have the potential to adversely impact our supply chain and access to equipment, our costs and our product margins. Any such cost increases or decreases in availability could slow our growth and cause our financial results and operational metrics to suffer.

Our industry is subject to technological change, and our failure to continue developing new and improved products and to bring these products rapidly to market could have an adverse impact on our business.

New products, or refinements and improvements to our existing products, may have technical failures, delayed introductions, higher than expected production costs or may not be well accepted by our customers. If we are not able to anticipate, identify, develop and market high quality products in line with technological advancements that respond to changes in customer preferences, demand for our products could decline and our operating results could be adversely affected.

Public company compliance may make it more difficult to attract and retain officers and directors.

The Sarbanes-Oxley Act and rules subsequently implemented by the SEC have required changes in corporate governance practices of public companies. As a public company, we expect these rules and regulations to increase our compliance costs in 2022 and beyond and to make certain activities more time consuming and costly. As a public company, we also expect that these rules and regulations may make it more difficult and expensive for us to obtain director and officer liability insurance in the future and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our Board of Directors or as executive officers.

| 15 |

Confidentiality agreements with employees and third parties may not prevent unauthorized disclosure of trade secrets and other proprietary information, and our inability to maintain the confidentiality of that information, due to unauthorized disclosure or use, or other event, could have a material adverse effect on our business.

In addition to the protection afforded by patents, we seek to rely on trade secret protection and confidentiality agreements to protect proprietary know-how that is not patentable or that we elect not to patent, processes for which patents are difficult to enforce, and any other elements of our product discovery and development processes that involve proprietary know-how, information, or technology that is not covered by patents. Trade secrets, however, may be difficult to protect. We seek to protect our proprietary processes, in part, by entering into confidentiality agreements with our employees, consultants, advisors, contractors and collaborators. Although we use reasonable efforts to protect our trade secrets, our employees, consultants, advisors, contractors, and collaborators might intentionally or inadvertently disclose our trade secret information to competitors. In addition, competitors may otherwise gain access to our trade secrets or independently develop substantially equivalent information and techniques. Furthermore, the laws of some foreign countries do not protect proprietary rights to the same extent or in the same manner as the laws of the United States. As a result, we may encounter significant problems in protecting and defending our intellectual property both in the United States and abroad. If we are unable to prevent unauthorized material disclosure of our intellectual property to third parties, or misappropriation of our intellectual property by third parties, we will not be able to establish or maintain a competitive advantage in our market, which could materially adversely affect our business, operating results and financial condition.

We are heavily reliant on Brent Willson, our Chief Executive Officer and President, and the departure or loss of Brent Willson could disrupt our business.

We depend heavily on the continued efforts of Brent Willson, our Chief Executive Officer and President and a director. Mr. Willson, who is also a director, is the founder of NeoVolta and is essential to our strategic vision and day-to-day operations and would be difficult to replace. The departure or loss of Mr. Willson, or the inability to timely hire and retain a qualified replacement, could negatively impact our ability to manage our business.

If we are unable to recruit and retain key management, technical and sales personnel, our business would be negatively affected.

For our business to be successful, we need to attract and retain highly qualified technical, management and sales personnel. The failure to recruit additional key personnel when needed with specific qualifications and on acceptable terms or to retain good relationships with our partners might impede our ability to continue to develop, commercialize and sell our products. To the extent the demand for skilled personnel exceeds supply, we could experience higher labor, recruiting and training costs in order to attract and retain such employees. We face competition for qualified personnel from other companies with significantly more resources available to them and thus may not be able to attract the level of personnel needed for our business to succeed.

Risks Related to Our Securities

Our executive officers and directors will exercise significant control over us for the foreseeable future, which will limit our shareholders ability to influence corporate matters and could delay or prevent a change in corporate control.

As of the closing of our recent underwritten public offering, our executive officers and directors currently hold or have the right to acquire, in the aggregate, up to approximately 13.9% of our outstanding common stock. As a result, these stockholders will be able to influence our management and affairs and heavily influence the outcome of matters submitted to our stockholders for approval, including the election of directors and any sale, merger, consolidation, or sale of all or substantially all of our assets.

These stockholders may have interests, with respect to their common stock, that are different from our other stockholders and the concentration of voting power among one or more of these stockholders may have an adverse effect on the price of our common stock.

| 16 |

In addition, this concentration of ownership might adversely affect the market price of our common stock by: (1) delaying, deferring or preventing a change of control of our company; (2) impeding a merger, consolidation, takeover or other business combination involving our company; or (3) discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of our company.

Future sales of shares by existing stockholders could cause our stock price to decline.

If our existing stockholders, who acquired their shares of common stock at prices substantially below our current trading price, sell, or indicate an intention to sell, substantial amounts of our common stock in the public market after the contractual lock-up agreements such stockholders entered into in connection with our July 2022 offering expire and other restrictions on resale lapse, the trading price of our common stock could be adversely impacted.

Certain of our stockholders holding an aggregate of 13,907,867 shares and our officers and directors, have agreed not to offer, sell, dispose of or hedge such shares of our common stock, subject to specified limited exceptions, during the period continuing through the date that is 180 days after the date of our IPO, or January 23, 2023. Upon the expiration of the lock-up agreements, all such shares will be eligible for resale in the public market, subject to applicable securities laws, including the Securities Act. Upon expiration of each of these lock-up periods or upon the ability to sell shares pursuant to Rule 144, the trading price of our common stock could be adversely impacted if these stockholders sell, or indicate an intention to sell, substantial amounts of our common stock in the public market.

Nevada law and provisions in our articles of incorporation and bylaws could make a takeover proposal more difficult.

We are a Nevada corporation and the anti-takeover provisions of the Nevada Revised Statutes may discourage, delay or prevent a change in control by prohibiting us from engaging in a business combination with an interested stockholder for a period of three years after the person becomes an interested stockholder, even if a change in control would be beneficial to our existing stockholders. In addition, our articles of incorporation and bylaws may discourage, delay or prevent a change in our management or control over us that stockholders may consider favorable. Our articles of incorporation and bylaws:

| · | authorize the issuance of “blank check” preferred stock that could be issued by our board of directors to thwart a takeover attempt; | |

| · | place restrictive requirements (including advance notification of stockholder nominations and proposals) on how special meetings of stockholders may be called by our stockholders; do not provide stockholders with the ability to cumulate their votes; and | |

| · | provide that our board of directors may amend our bylaws. |

Additionally, our authorized capital includes preferred stock issuable in one or more series. Our board has the authority to issue preferred stock and determine the price, designation, rights, preferences, privileges, restrictions and conditions, including voting and dividend rights, of those shares without any further vote or action by stockholders. The rights of the holders of common stock will be subject to, and may be adversely affected by, the rights of holders of any preferred stock that may be issued in the future. The issuance of additional preferred stock, while providing desirable flexibility in connection with possible financings and acquisitions and other corporate purposes, could make it more difficult for a third party to acquire a majority of the voting power of our outstanding voting securities, which could deprive our holders of common stock of a premium that they might otherwise realize in connection with a proposed acquisition of our company.

| 17 |

As an “emerging growth company” under the Jumpstart Our Business Startups Act, or JOBS Act, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements.

As an “emerging growth company” under the JOBS Act, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. We are an emerging growth company until the earliest of:

| · | the last day of the fiscal year during which we have total annual gross revenues of $1 billion or more; | |

| · | the last day of the fiscal year following the fifth anniversary of our initial public offering; | |

| · | the date on which we have, during the previous 3-year period, issued more than $1 billion in non-convertible debt; or | |

| · | the date on which we are deemed a “large accelerated issuer” as defined under the federal securities laws. |

For so long as we remain an emerging growth company, we will not be required to:

| · | have an auditor report on our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; | |

| · | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (auditor discussion and analysis); | |

| · | submit certain executive compensation matters to shareholders advisory votes pursuant to the “say on frequency” and “say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the “say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010; and | |

| · | include detailed compensation discussion and analysis in our filings under the Securities Exchange Act of 1934, as amended, and instead may provide a reduced level of disclosure concerning executive compensation. |

For so long as we remain an emerging growth company, we:

| · | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A; and | |

| · | are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. |

We intend to take advantage of all of these reduced reporting requirements and exemptions.

Certain of these reduced reporting requirements and exemptions were already available to us due to the fact that we also qualify as a “smaller reporting company” under SEC rules. For instance, smaller reporting companies are not required to obtain an auditor attestation and report regarding management’s assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are not required to provide a pay-for-performance graph or CEO pay ratio disclosure; and may present only two years of audited financial statements and related MD&A disclosure.

We cannot predict if investors will find our securities less attractive due to our reliance on these exemptions. If investors were to find our common stock less attractive as a result of our election, we may have difficulty raising additional capital.