As filed with the U.S. Securities and Exchange Commission on June 22, 2023

Registration No. 333-[●]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Color Star Technology Co., Ltd.

(Exact name of registrant as specified in its charter)

| Cayman Islands | N/A | Not Applicable | ||

|

(State or other jurisdiction of incorporation or organization) |

(Translation of Registrant’s Name into English) | (I.R.S. Employer Identification No.) |

7 World Trade Center, Suite 4621

New York, NY 10022

Tel: +1-929-317-2699

(Address of principal executive offices, including zip code)

Mr. Louis Luo

7 World Trade Center, Suite 4621

New York, NY 10022

(Name, address including zip code, and telephone number, including area code, of agent for service)

Copies to:

Joan Wu, Esq.

Hunter Taubman Fisher & Li LLC

950 Third Avenue, 19th Floor

New York, NY 10022

Tel: (212) 530-2208

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the SEC pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities and it is not soliciting an offer to buy securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JUNE 22, 2023 |

4,200,000 Class A Ordinary Shares,

offered by the Selling Shareholders

of

Color Star Technology Co., Ltd.

This prospectus relates to the offer and sale of up to an aggregate of 4,200,000 Class A ordinary shares (the “Shares”), par value $0.04 each (“Ordinary Shares”) currently held by such Selling Shareholders as follows: (a) 2,400,000 Ordinary Shares issued pursuant to certain copyright acquisition agreement entered on March 27, 2023; and (b) 1,800,000 Ordinary Shares issued pursuant to certain advisory agreements entered on March 27, 2023. The holders of the Shares are each referred to herein as a “Selling Shareholder” and collectively as the “Selling Shareholders.”

The Selling Shareholders may sell any or all of the shares on any stock exchange, market or trading facility on which the Shares are traded or in privately negotiated transactions at fixed prices that may be changed, at market prices prevailing at the time of sale or at negotiated prices. Information on the Selling Shareholders and the times and manners in which they may offer and sell our shares is described under the sections entitled “Selling Shareholders” and “Plan of Distribution” in this prospectus. While we will bear all costs, expenses and fees in connection with the registration of the Shares, we will not receive any of the proceeds from the sale of our shares by the Selling Shareholders.

Our Ordinary Shares are currently traded on the Nasdaq Stock Market under the symbol “ADD”. On June 21, 2023, the closing price for our Ordinary Shares on Nasdaq was $1.27 per share.

As of June 22, 2023, the aggregate market value of the voting and non-voting common equity held by non-affiliates, computed by reference to the price at which the common equity was last sold on April 24, 2023 at $1.77, was approximately $23.3 million, based on 14,391,012 outstanding ordinary shares as of such date, of which 13,175,262 were held by non-affiliates. Pursuant to General Instruction I.B.5 of Form F-3, in no event will we sell securities in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75.0 million. During the 12 calendar months prior to and including the date of this prospectus, we have not sold any securities pursuant to General Instruction I.B.5 of Form F-3.

In the prospectus, “Color Star Technology Co., Ltd.”, “Color Star”, “we”, “us”, and “our” refer and relate to Color Star Technology Co., Ltd. and its consolidated subsidiaries.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required.

Investing in our securities involves risks. See “Risk Factors” beginning on page 3 of this prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated June 22, 2023

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission. Under this registration process, the selling shareholders may from time to time sell up to 4,200,000 Ordinary Shares in one or more offerings. This prospectus provides you with a general description of the securities that our selling shareholders may offer. Specific information about the offering may also be included in a prospectus supplement, which may update or change information included in this prospectus. You should read both this prospectus and any prospectus supplement together with additional information described under the heading “Where You Can Find More Information.”

You should rely only on the information contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by or on our behalf. Neither we, nor the selling shareholders, have authorized any other person to provide you with different or additional information. Neither we, nor the selling shareholders, take responsibility for, nor can we provide assurance as to the reliability of, any other information that others may provide. The selling shareholders are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus or such other date stated in this prospectus, and our business, financial condition, results of operations and/or prospects may have changed since those dates.

Except as otherwise set forth in this prospectus, neither we nor the selling shareholders have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

Certain Defined Terms and Conventions

Unless otherwise indicated, references in this prospectus to:

| ● | “shares” are to our Class A Ordinary Shares, par value US$0.04 per share. | |

| ● | “US$” and “U.S. dollars” are to the legal currency of the United States. |

ii

Our Business

We are an entertainment and education company which provides online entertainment performances and online music education services and education service carried out via our wholly-owned subsidiary CACM Group NY, Inc. (“CACM”).

On December 20, 2022, the Company entered into certain securities purchase agreement with a certain accredited investor, pursuant to which the Company agreed to sell 1,200,000 shares at a per share purchase price of $1.25 (the “Offering”). The issuance and sale of the shares is exempted from the registration requirements of the Securities Act pursuant to Regulation D promulgated thereunder and is issued as restricted securities. On January 22, 2023, the Offering closed and the Company received gross proceeds of US$1.5 million.

On January 11, 2023, the Company, Color Sky Entertainment Limited (“Color Sky”), a Hong Kong corporation and the Company’s wholly owned subsidiary, and Tian Jie (the “Purchaser”), entered into a certain share purchase agreement (the “Disposition SPA”). Pursuant to the Disposition SPA, the Purchaser agreed to purchase Color Sky in exchange for no consideration. Upon the closing of the transaction (the “Disposition”) contemplated by the Disposition SPA, the Purchaser will become the sole shareholder of Color Sky and as a result, assume all assets and liabilities of Color Sky. The Disposition closed on February 3, 2023 after the satisfaction of all closing conditions.

On March 24, 2023, the Company held its 2023 annual meeting of shareholders, pursuant to which the shareholders approved as a special resoliution the proposal to alter the share capital of the Company from (i) US$32,000,000 divided into 800,000,000 Ordinary Shares with a par value of US$0.04 each; to (ii) 700,000,000 Class A Ordinary Shares with a par value of $0.04 each and 100,000,000 Class B Ordinary Shares with a par value of US$0.04 each, in each case having the rights and subject to the restrictions set out in the Fifth Amended and Restated Memorandum of Association and Articles of Association of the Company.

1

On March 27, 2023, the Company entered into certain copyright acquisition agreement with Color Star DMCC, a United Arab Emirates corporation, a wholly owned subsidiary of the Company, and Nine Star Parties and Entertainment LLC (“Nine Star”), an Ohio limited liability company, pursuant to which the Company acquired all of Nine Star’s right, title, and interest in and to certain works, including all copyright and related rights in the works, in exchange for US$3,600,000 to be paid in restricted shares of the Company.

Business Overview

We are an entertainment and education company providing online entertainment performances and online innovative music education. We strive to offer students professional artist training platform featured by exclusive content and live interaction, with the mission of delivering world-class entertainment learning experiences and promoting entertainment exchange with our strong resources and deep connections in the industry. We launched our online cultural entertainment platform, Color World, globally on September 10, 2020. The curriculum development created by us includes music, sports, animation, painting and calligraphy, film and television, life skills, etc., covering plenty of aspects of entertainment, sports and culture. At present, we have signed contracts with well-known international artists and more than 50 celebrity teachers have been retained to launch online lectures. We believe that we, along with our alliance, have strong industry resources and influence to become a comprehensive online academy for global “future stars.”

The Color World platform not only has celebrity lectures, but also celebrity concert videos, celebrity peripheral products, such as celebrity branded merchandise, and artist interactive communication. We strive to build an all-star cultural and entertainment industry chain.

We are committed to the development of entertainment technology and intelligent technology. We strive to create a parallel world of entertainment, allowing more people to realize their dreams in the virtual entertainment world. We aim to unite artists from all over the world to create digital arts, or non-fungible token (NFT), products and offer fans their idols’ products exclusively available at the Color World platform. This will also allow copyrights owners and artists from across the globe to receive financial benefits from their NFT products.

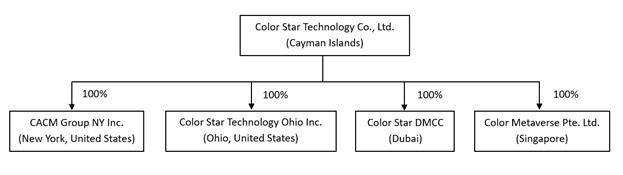

The following diagram illustrates our current corporate structure:

Corporate Information

Our principal executive office is located on 7 World Trade Center, Suite 4621, New York, NY 10007. Our telephone number is (929) 317-2699. We maintain a website at https://colorstarintemational.com/ that contains information about our Company, though no information contained on our website is part of this prospectus. We do not incorporate by reference into this prospectus the information on, or accessible through, our website, and you should not consider it as part of this prospectus. Our annual reports on Form 20-F and reports on Form 6-K filed with the SEC are available, as soon as practicable after filing, at the investors’ page on our corporate website, or by a direct link to its filings on the SEC’s free website.

2

Any investment in the shares is speculative and involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described under “Risk Factors” in our most recent Annual Report on Form 20-F, or any updates in our reports on Form 6-K, together with all of the other information appearing in, or incorporated by reference into, this prospectus and any applicable prospectus supplement. The risks so described are not the only risks facing our company. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition and results of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the information in this prospectus, any prospectus supplement, and the documents we incorporate by reference contains forward-looking statements within the meaning of the federal securities laws. You should not rely on forward-looking statements in this prospectus, any prospectus supplement, or the documents we incorporate by reference. Forward-looking statements typically are identified by use of terms such as “anticipate,” “believe,” “plan,” “expect,” “future,” “intend,” “may,” “will,” “should,” “estimate,” “predict,” “potential,” “continue,” and similar words, although some forward-looking statements are expressed differently. This prospectus, any prospectus supplement, and the documents we incorporate by reference may also contain forward-looking statements attributed to third parties relating to their estimates regarding the growth of our markets. All forward-looking statements address matters that involve risks and uncertainties, and there are many important risks, uncertainties and other factors that could cause our actual results, as well as those of the markets we serve, levels of activity, performance, achievements and prospects to differ materially from the forward-looking statements contained in this prospectus, any prospectus supplement, and the documents we incorporate by reference. You should also consider carefully the statements under “Risk Factors” and other sections of this prospectus, any prospectus supplement, and the documents we incorporate by reference, which address additional facts that could cause our actual results to differ from those set forth in the forward-looking statements. We caution investors not to place significant reliance on the forward-looking statements contained in this prospectus, any prospectus supplement, and the documents we incorporate by reference. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

3

| Ordinary Shares offered by the Selling Shareholders | 4,200,000 |

| Ordinary Shares to Be Outstanding After This Offering | 14,391,012 |

| Use of Proceeds | We will not receive any proceeds from the sale of the Shares offered in this prospectus by the Selling Shareholders. |

| Risk Factors | An investment in the Shares offered under this prospectus is highly speculative and involves substantial risk. Please carefully consider the “Risk Factors” section on page 3 and other information in this prospectus for a discussion of risks. Additional risks and uncertainties not presently known to us or that we currently deem to be immaterial may also impair our business and operations. |

| Nasdaq Market Symbol | ADD |

4

We will not receive any of the proceeds from the sale of any securities offered pursuant to this prospectus by any Selling Shareholders. The Selling Shareholderss will receive all of the proceeds from the sale of Ordinary Shares under the secondary offering of this prospectus. The Selling Shareholders will pay any agent’s commissions and expenses they incur for brokerage, accounting, tax or legal services or any other expenses that they incur in disposing of the Class A Ordinary Shares. We will bear all other costs, fees and expenses incurred in effecting the registration of the Class A Ordinary Shares covered by this prospectus and any prospectus supplement. These may include, without limitation, all registration and filing fees, SEC filing fees and expenses of compliance with state securities or “blue sky” laws.

We do not currently have any plans to pay any cash dividends in the foreseeable future on our shares being sold in this offering. We currently intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business. Our Board of Directors has discretion on whether to pay dividends. Even if our board of directors decides to pay dividends, the form, frequency and amount will depend upon our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions and other factors that our board of directors may deem relevant.

5

This prospectus covers the public resale of the Shares owned by the selling shareholders named below. Such selling shareholders may from time to time offer and sell pursuant to this prospectus any or all of the Shares owned by them. The selling shareholders, however, make no representations that the Shares will be offered for sale. The tables below present information regarding the selling shareholders and the Shares that each such selling shareholder may offer and sell from time to time under this prospectus.

Unless otherwise indicated, all information with respect to ownership of our Shares of the selling shareholders has been furnished by or on behalf of the selling shareholders and is as of June 22, 2023. We believe, based on information supplied by the selling shareholders, that except as may otherwise be indicated in the footnotes to the tables below, the selling shareholders have sole voting and dispositive power with respect to the Shares reported as beneficially owned by them. Because the selling shareholders identified in the tables may sell some or all of the Shares owned by them which are included in this prospectus, and because, except as set forth herein, there are currently no agreements, arrangements or understandings with respect to the sale of any of the Shares, no estimate can be given as to the number of Shares available for resale hereby that will be held by the selling shareholders upon termination of this offering. In addition, the selling shareholders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, the Shares they hold in transactions exempt from the registration requirements of the Securities Act after the date on which they provided the information set forth on the table below. We have, therefore, assumed for the purposes of the following table, that the selling shareholders will sell all of the Shares owned beneficially by them that are covered by this prospectus, but will not sell any other Ordinary Shares that they presently own. However, we are not aware of any agreements, arrangements or understandings with respect to the sale of any of the Shares by any of the selling shareholders. Beneficial ownership for the purposes of this table is determined in accordance with the rules and regulations of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire such powers within 60 days.

6

The selling shareholders and intermediaries through whom such securities are sold may be deemed “underwriters” within the meaning of the Securities Act with respect to the Shares offered by this prospectus, and any profits realized or commissions received may be deemed underwriting compensation. Additional selling shareholders not named in this prospectus will not be able to use this prospectus for resales until they are named in the tables above by prospectus supplement or post-effective amendment. Transferees, successors and donees of identified selling shareholders will not be able to use this prospectus for resales until they are named in the tables above by prospectus supplement or post-effective amendment. If required, we will add transferees, successors and donees by prospectus supplement in instances where the transferee, successor or donee has acquired its Shares from holders named in this prospectus after the effective date of this prospectus.

The following table sets forth:

| ● | the name of each selling shareholder holding Shares; | |

| ● | the number of Shares beneficially owned by each selling shareholder prior to the sale of the Shares covered by this prospectus; | |

| ● | the number of Shares that may be offered by each selling shareholder pursuant to this prospectus; | |

| ● | the number of Shares to be beneficially owned by each selling shareholder following the sale of the Shares covered by this prospectus; and | |

| ● | the percentage of our issued and outstanding Shares to be owned by each selling shareholder before and after the sale of the Shares covered by this prospectus. |

| Name of Selling Shareholder | Number of Shares Beneficially Owned Prior to this Offering | Maximum Number of Shares to be Sold Pursuant to this Prospectus | Number of Shares Beneficially Owned After Sale of Shares | % of Outstanding Shares Beneficially Owned After Sale of Shares | ||||||||||||

| Manman Yan (1) | 400,000 | 400,000 | 0 | * | ||||||||||||

| Sha Deng (2) | 400,000 | 400,000 | 0 | * | ||||||||||||

| Ting Yang (3) | 400,000 | 400,000 | 0 | * | ||||||||||||

| Jialun Zheng (4) | 400,000 | 400,000 | 0 | * | ||||||||||||

| Can Wang (5) | 400,000 | 400,000 | 0 | * | ||||||||||||

| Lyuzhang Jiang (6) | 400,000 | 400,000 | 0 | * | ||||||||||||

| Tianlong Zhu (7) | 450,000 | 450,000 | 0 | * | ||||||||||||

| Xi Chen Peng (8) | 450,000 | 450,000 | 0 | * | ||||||||||||

| Shuwen Wang (9) | 450,000 | 450,000 | 0 | * | ||||||||||||

| Monider Jazae Rajab (10) | 450,000 | 450,000 | 0 | * | ||||||||||||

| * | Less than 1% |

| (1) | Manman Yan received 400,000 Ordinary Shares pursuant to certain copyright acquisition agreement dated as of March 27, 2023, by and among the Company, Color Star DMCC and Nine Star Parties and Entertainment LLC. |

7

| (2) | Sha Deng received 400,000 Ordinary Shares pursuant to certain copyright acquisition agreement dated as of March 27, 2023, by and among the Company, Color Star DMCC and Nine Star Parties and Entertainment LLC. |

| (3) | Ting Yang received 400,000 Ordinary Shares pursuant to certain copyright acquisition agreement dated as of March 27, 2023, by and among the Company, Color Star DMCC and Nine Star Parties and Entertainment LLC. |

| (4) | Jialun Zheng received 400,000 Ordinary Shares pursuant to certain copyright acquisition agreement dated as of March 27, 2023, by and among the Company, Color Star DMCC and Nine Star Parties and Entertainment LLC. |

| (5) | Can Wang received 400,000 Ordinary Shares pursuant to certain copyright acquisition agreement dated as of March 27, 2023, by and among the Company, Color Star DMCC and Nine Star Parties and Entertainment LLC. |

| (6) | Lyuzhang Jiang received 400,000 Ordinary Shares pursuant to certain copyright acquisition agreement dated as of March 27, 2023, by and among the Company, Color Star DMCC and Nine Star Parties and Entertainment LLC. |

| (7) | Tianlong Zhu received 450,000 Ordinary Shares pursuant to certain advisory agreement dated as of March 27, 2023, by and among the Company, Color Star DMCC and Tianlong Zhu. |

| (8) | Xi Chen Peng received 450,000 Ordinary Shares pursuant to certain advisory agreement dated as of March 27, 2023, by and among the Company, Color Star DMCC and Xi Chen Peng. |

| (9) | Shuwen Wang received 450,000 Ordinary Shares pursuant to certain advisory agreement dated as of March 27, 2023, by and among the Company, Color Star DMCC and Shuwen Wang. |

| (10) | Monider Jazae Rajab received 450,000 Ordinary Shares pursuant to certain advisory agreement dated as of March 27, 2023, by and among the Company, Color Star DMCC and Monider Jazae Rajab. |

8

The selling shareholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling Shares or interests in Shares received after the date of this prospectus from a selling shareholder as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of the Shares on any stock exchange, market or trading facility on which the Shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The selling shareholders may use any one or more of the following methods when disposing of Shares:

| ● | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; | |

| ● | block trades in which the broker-dealer will attempt to sell the Shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction; | |

| ● | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; | |

| ● | an exchange distribution in accordance with the rules of the applicable exchange; | |

| ● | privately negotiated transactions; | |

| ● | short sales effected after the date the registration statement of which this prospectus is a part is declared effective by the SEC; |

| ● | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; | |

| ● | broker-dealers may agree with the selling shareholders to sell a specified number of such Shares at a stipulated price per share; | |

| ● | a combination of any such methods of sale; and | |

| ● | any other method permitted by applicable law. |

The selling shareholders may, from time to time, pledge or grant a security interest in some or all of the Shares owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the Shares, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling shareholders to include the pledgee, transferee or other successors in interest as selling shareholders under this prospectus. The selling shareholders also may transfer the Shares in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

9

In connection with the sale of their Shares or interests therein, the selling shareholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of such Shares in the course of hedging the positions they assume. The selling shareholders may also sell Shares short and deliver these securities to close out their short positions, or loan or pledge the Shares to broker-dealers that in turn may sell these securities. The selling shareholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of the Shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the selling shareholders from the sale of the Shares offered by them will be the purchase price of such Shares less discounts or commissions, if any. Each of the selling shareholders reserves the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of ordinary shares to be made directly or through agents. We will not receive any of the proceeds from the resale of the Shares.

The selling shareholders also may resell all or a portion of their Ordinary Shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule.

The selling shareholders and any underwriters, broker-dealers or agents that participate in the sale of the Shares therein may be “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the Ordinary Shares may be underwriting discounts and commissions under the Securities Act. Selling shareholders who are “underwriters” within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.

To the extent required, the Shares to be sold, the names of the selling shareholders, the respective purchase prices and public offering prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities laws of some states, if applicable, the Shares may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the Shares may not be sold unless it has been registered or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

10

We have advised the selling shareholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of Shares in the market and to the activities of the selling shareholders and their affiliates. In addition, to the extent applicable, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling shareholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling shareholders may indemnify any broker-dealer that participates in transactions involving the sale of the Shares against certain liabilities, including liabilities arising under the Securities Act. We have agreed to indemnify the selling shareholders against liabilities, including liabilities under the Securities Act and state securities laws, relating to the registration of the Ordinary Shares offered by this prospectus.

We estimate the fees and expenses to be incurred by us in connection with the resale of the ordinary shares in this offering, other than underwriting discounts and commissions, to be as follows:

| SEC registration fee | $ | 601.692 | ||

| Legal fees and expenses | $ | * | ||

| Accounting fees and expenses | $ | * | ||

| Miscellaneous expenses | $ | * | ||

| Total | $ | * |

| * | All amounts are estimated except the SEC registration fee. |

We are being represented by Hunter Taubman Fisher & Li LLC, New York, NY with respect to legal matters arising under the United States federal securities laws. The validity of the shares offered in this offering and legal matters as to Cayman Islands law will be passed upon for us by Conyers Dill & Pearman LLP.

The financial statements incorporated by reference in this prospectus as of and for the years ended June 30, 2022 and 2021 have been audited by Audit Alliance LLP, our independent registered public accounting firm, and are included in reliance upon such reports given upon the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

As permitted by SEC rules, this prospectus omits certain information and exhibits that are included in the registration statement of which this prospectus forms a part. Since this prospectus may not contain all of the information that you may find important, you should review the full text of these documents. If we have filed a contract, agreement or other document as an exhibit to the registration statement of which this prospectus forms a part, you should read the exhibit for a more complete understanding of the document or matter involved. Each statement in this prospectus, including statements incorporated by reference as discussed above, regarding a contract, agreement or other document is qualified in its entirety by reference to the actual document.

We are subject to the information reporting requirements of the Exchange Act that are applicable to foreign private issuers, and, in accordance with these requirements, we file annual and current reports and other information with the SEC. You may inspect, read (without charge) and copy the reports and other information we file with the SEC at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet website at www.sec.gov that contains our filed reports and other information that we file electronically with the SEC.

We maintain a corporate website at https://colorstarinternational.com/. Information contained on, or that can be accessed through, our website does not constitute a part of this prospectus.

11

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with them. This means that we can disclose important information to you by referring you to those documents. Each document incorporated by reference is current only as of the date of such document, and the incorporation by reference of such documents should not create any implication that there has been no change in our affairs since the date thereof or that the information contained therein is current as of any time subsequent to its date. The information incorporated by reference is considered to be a part of this prospectus and should be read with the same care. When we update the information contained in documents that have been incorporated by reference by making future filings with the SEC, the information incorporated by reference in this prospectus is considered to be automatically updated and superseded. In other words, in the case of a conflict or inconsistency between information contained in this prospectus and information incorporated by reference into this prospectus, you should rely on the information contained in the document that was filed later.

We hereby incorporate by reference into this prospectus the following documents that we have filed with the SEC under the Exchange Act:

| (1) | the Company’s Annual Report on Form 20-F for the fiscal year ended June 30, 2022, filed with the SEC on November 14, 2022; | |

| (2) | the Company’s Current Reports on Form 6-K, filed with the SEC on December 5, 2022, December 8, 2022, December 28, 2022, January 6, 2023, February 6, 2023, February 16, 2023, April 3, 2023, May 31, 2023 and June 6, 2023; | |

| (3) | our Registration Statement on Form F-4, as amended, filed with the Commission on September 20, 2018; | |

| (4) | the description of our Ordinary Shares incorporated by reference in our registration statement on Form 8-A, as amended (File No. 001-34515) filed with the Commission on October 30, 2009, including any amendment and report subsequently filed for the purpose of updating that description; and |

All documents that we file with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act (and in the case of a Current Report on Form 6-K, so long as they state that they are incorporated by reference into this prospectus, and other than Current Reports on Form 6-K, or portions thereof, furnished under Form 6-K) (i) after the initial filing date of the registration statement of which this prospectus forms a part and prior to the effectiveness of such registration statement and (ii) after the date of this prospectus and prior to the termination of the offering shall be deemed to be incorporated by reference in this prospectus from the date of filing of the documents, unless we specifically provide otherwise. Information that we file with the SEC will automatically update and may replace information previously filed with the SEC. To the extent that any information contained in any Current Report on Form 6-K or any exhibit thereto, was or is furnished to, rather than filed with the SEC, such information or exhibit is specifically not incorporated by reference.

Upon request, we will provide, without charge, to each person who receives this prospectus, a copy of any or all of the documents incorporated by reference (other than exhibits to the documents that are not specifically incorporated by reference in the documents). Please direct written or oral requests for copies to us at 7 World Trade Center, Suite 4621, New York, NY 10007, Attention: Basil Wilson, +1 (929) 317-2699

12

ENFORCEABILITY OF CIVIL LIABILITIES

We are incorporated under the laws of the Cayman Islands as an exempted company with limited liability. We incorporated in the Cayman Islands because of certain benefits associated with being a Cayman Islands exempted company, such as political and economic stability, an effective judicial system, a favorable tax system, the absence of foreign exchange control or currency restrictions and the availability of professional and support services. However, the Cayman Islands have a less developed body of securities laws that provide significantly less protection to investors as compared to the securities laws of the United States. In addition, Cayman Islands companies may not have standing to sue before the federal courts of the United States.

All of our assets are located outside of the United States. In addition, some of our directors and officers are residents of jurisdictions other than the United States and all or a substantial portion of their assets are located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon us or our directors and officers, or to enforce against us or them judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States.

According to our local Cayman Islands’ counsel, there is uncertainty with regard to Cayman Islands law relating to whether a judgment obtained from the United States under civil liability provisions of the securities laws will be determined by the courts of the Cayman Islands as penal or punitive in nature. If such a determination is made, the courts of the Cayman Islands will not recognize or enforce the judgment against a Cayman Islands’ company. The courts of the Cayman Islands in the past determined that disgorgement proceedings brought at the instance of the Securities and Exchange Commission are penal or punitive in nature and such judgments would not be enforceable in the Cayman Islands. Other civil liability provisions of the securities laws may be characterized as remedial, and therefore enforceable but the Cayman Islands’ Courts have not yet ruled in this regard. Our Cayman Islands’ counsel has further advised us that a final and conclusive judgment in the federal or state courts of the United States under which a sum of money is payable other than a sum payable in respect of taxes, fines, penalties or similar charges, may be subject to enforcement proceedings as a debt in the courts of the Cayman Islands.

As of the date hereof, no treaty or other form of reciprocity exists between the Cayman Islands and the United States governing the recognition and enforcement of judgments.

Cayman Islands’ counsel further advised that although there is no statutory enforcement in the Cayman Islands of judgments obtained in the United States, a judgment obtained in such jurisdictions will be recognized and enforced in the courts of the Cayman Islands at common law, without any re-examination of the merits of the underlying dispute, by an action commenced on the foreign judgment debt in the Grand Court of the Cayman Islands, provided such judgment (1) is given by a foreign court of competent jurisdiction, (2) imposes on the judgment debtor a liability to pay a liquidated sum for which the judgment has been given, (3) is final, (4) is not in respect of taxes, a fine or a penalty, and (5) was not obtained in a manner and is of a kind the enforcement of which is contrary to natural justice or the public policy of the Cayman Islands.

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

13

Prospectus

4,200,000 Class A Ordinary Shares,

offered by the Selling Shareholders

of

Color Star Technology Co., Ltd.

PROSPECTUS

June 22, 2023

You should rely only on the information contained in this prospectus. No dealer, salesperson or other person is authorized to give information that is not contained in this prospectus. This prospectus is not an offer to sell nor is it seeking an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is correct only as of the date of this prospectus, regardless of the time of the delivery of this prospectus or the sale of these securities.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

| Item 8. | Indemnification of Directors and Officers |

Cayman Islands law does not limit the extent to which a company’s memorandum and articles of association may provide for indemnification of officers and directors, except to the extent any such provision may be held by the Cayman Islands courts to be contrary to public policy, such as to provide indemnification against civil fraud or the consequences of committing a crime. Our M&A requires us to indemnify our officers and directors for actions, proceedings, claims, losses, damages, costs, liabilities and expenses (“Indemnified Losses”) incurred in their capacities as such unless such Indemnified Losses arise from dishonesty of such directors or officers. This standard of conduct is generally the same as permitted under the Delaware General Corporation Law for a Delaware corporation.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers or persons controlling us under the foregoing provisions, we have been informed that in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

| Item 9. | Exhibits |

| Item 10. | Undertakings |

| (a) | The undersigned registrant hereby undertakes: |

| (1) | to file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| (i) | To include any prospectus required by section 10(a)(3) of the Securities Act of 1933; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; |

II-1

Provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information otherwise required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

| (2) | That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

| (4) | To file a post-effective amendment to the registration statement to include any financial statements required by Item 8.A. of Form 20-F at the start of any delayed offering or throughout a continuous offering; provided, however, that a post-effective amendment need not be filed to include financial statements and information otherwise required by Section 10(a)(3) of the Act or §210.3-19 if such financial statements and information are contained in periodic reports filed with or furnished to the SEC by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this registration statement. |

| (5) | That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

| (i) | If the registrant is relying on Rule 430B: |

| (A) | Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and |

| (B) | Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or |

| (ii) | If the registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use. |

II-2

| (6) | That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities: |

The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

| (i) | Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424; (ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; (iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and (iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| (b) | The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (c) | Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue. |

| (d) | The undersigned registrant hereby further undertakes that: |

| (1) | For purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4), or 497(h) under the Securities Act of 1933 shall be deemed to be part of this registration statement as of the time it was declared effective. |

| (2) | For the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

II-3

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form F-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunder duly authorized, in the City of Dubai, United Arab Emirates on June 22, 2023.

| Color Star Technology Co., Ltd. | ||

| By: | /s/ Louis Luo | |

| Louis Luo | ||

| Chief Executive Officer | ||

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature | Position | Date | ||

| /s/ Louis Luo | Chief Executive Officer and Director | June 22, 2023 | ||

| Louis Luo | ||||

| /s/ Lili Jiang | Chief Financial Officer | June 22, 2023 | ||

| Lili Jiang | ||||

| /s/ Wei Zhang | Chairwoman of the Board and Director | June 22, 2023 | ||

| Wei Zhang | ||||

| /s/ Ahmad Khalfan Ahmad Saeed Almansoori | Director | June 22, 2023 | ||

| Ahmad Khalfan Ahmad Saeed Almansoori | ||||

| /s/ Hung-Jen Kuo | Director | June 22, 2023 | ||

| Hung-Jen Kuo | ||||

| /s/ Ahmad Essa Mohammed Saleh | Director | June 22, 2023 | ||

| Ahmad Essa Mohammed Saleh | ||||

| /s/ Honglei Jiang | Director | June 22, 2023 | ||

| Honglei Jiang | ||||

| /s/ Muhammed Irfan | Director | June 22, 2023 | ||

| Muhammed Irfan |

II-4