As filed with the Securities and Exchange Commission on August 28, 2020

Registration No. 333-238510

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1 TO

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Color Star Technology Co., Ltd.

(Exact name of registrant as specified in its charter)

| Cayman Islands | N/A | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

800 3rd Ave, Suite 2800

New York, NY 10022

Tel: +1 (212) 220-3967

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Biao Lu

Chief Executive Officer

800 3rd Ave, Suite 2800

New York, NY 10022

Tel: +1 (212) 220-3967

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

William S. Rosenstadt, Esq.

Mengyi “Jason” Ye, Esq.

Yarona L. Yieh, Esq.

Ortoli Rosenstadt LLP

366 Madison Avenue, 3rd Floor

New York, NY 10017

(212) 588 0022

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of the registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Aggregate Price Per Share(2) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee(3) | ||||||||||||

| Ordinary Shares, $0.001 par value, issuable upon exercise of warrants(4)(5) | 1,013,637 | $ | 0.04 | $ | 40,545.48 | $ | 5.26 | |||||||||

| Ordinary Shares, $0.001 par value, issuable upon exercise of warrants(4)(5) | 2,300,000 | $ | 0.185 | $ | 425,500 | $ | 55.23 | |||||||||

| Total | 3,313,637 | $ | - | $ | 466,045.48 | $ | 60.49 | (6) | ||||||||

| (1) | All shares registered pursuant to this registration statement are to be offered for resale by the Selling Shareholders (defined below). Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also covers such indeterminate number of additional ordinary shares of the registrant, $0.001 par value per share, issued to prevent dilution resulting from stock splits, stock dividends or similar events. No additional consideration will be received for such additional number of Ordinary Shares, and therefore no registration fee is required pursuant to Rule 457(i) under the Securities Act. |

| (2) | Calculated pursuant to Rule 457(g) under the Securities Act. |

| (3) | Calculated pursuant to Rule 457(o) under the Securities Act. |

| (4) | As described in greater detail in the prospectus contained in this registration statement, the ordinary shares to be offered for resale by selling shareholders include an aggregate of 3,313,637 ordinary shares underlying warrants to purchase ordinary shares issued to the selling shareholders in connection with private placement transactions. |

| (5) | Relates to the ordinary shares underlying the ordinary shares purchase warrants, if such warrants are exercised for cash. If such warrants are exercised on a cashless basis, then the underlying ordinary shares shall be covered by the registration fee in respect of the ordinary shares. |

| (6) | Previously paid a total of $790 registration fee. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

The purpose of this Post-Effective Amendment No. 1 to the Form F-3 is to remove the registration of 2,096,252 Ordinary Shares issuable upon exercise of certain warrants issued on July 22, 2020.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 28, 2020

PROSPECTUS

Color Star Technology Co., Ltd.

3,313,637 Ordinary Shares underlying Warrants

This prospectus relates to the offer and resale of up to an aggregate of 3,313,637 ordinary shares of Color Star Technology Co., Ltd. (the “Company,” “we,” “us” or “our”), par value $0.001 per share (“Ordinary Shares”) issuable upon exercise of certain warrants currently held by such Selling Shareholders as follows: (a) 1,013,637 Ordinary Shares issuable upon exercise of certain Ordinary Shares purchase warrants issued on April 2, 2020 (the “April Warrants”) and (b) 2,300,000 Ordinary Shares issuable upon exercise of certain ordinary shares purchase warrants issued on May 13, 2020 (the “May Warrants” and together with the “April Warrants”, the “Warrants”). The holders of the Warrants are each referred to herein as a “Selling Shareholder” and collectively as the “Selling Shareholders.” Each of the Warrants is exercisable for one Ordinary Share and had an initial exercise price of $0.55 per share. Pursuant to the adjustment clause stated in the Warrants, as a result of the our sale of an aggregate of 3,225,000 Ordinary Shares in a registered direct offering and warrants to purchase up to 2,096,252 ordinary shares in a concurrent private placement on July 22, 2020, the exercise prices of the April Warrants and the May Warrants have been adjusted to $0.04 and $0.185 per share, respectively.

This prospectus also covers any additional Ordinary Shares that may become issuable upon any anti-dilution adjustment pursuant to the terms of the Warrants by reason of stock splits, stock dividends, subsequent equity sale and other events described therein.

The Selling Shareholders identified in this prospectus, or their respective transferees, pledgees, donees or other successors-in-interest, may offer the Warrants issuable from time to time upon exercise of the Warrants, through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. For additional information on the methods of sale for the Warrants that may be used by the Selling Shareholders, see the section entitled “Plan of Distribution” on page 18. For a list of the Selling Shareholders, see the section entitled “Selling Shareholders” on page 16.

The Selling Shareholders may sell any, all or none of the securities offered by this prospectus, and we do not know when or in what amount the Selling Shareholders may sell their Ordinary Shares hereunder following the effective date of this registration statement.

We are registering the Warrants on behalf of the Selling Shareholders, to be offered and sold by them from time to time. While we will not receive any proceeds from the sale of the Ordinary Shares underlying the Warrants, we may receive up to $0.04 per share upon the cash exercise of each of the April Warrants and $0.185 per share upon the cash exercise of each of the May Warrants. However, we cannot predict when and in what amounts or if the Warrants will be exercised, and it is possible that the Warrants may expire and never be exercised, in which case we would not receive any cash proceeds. We have agreed to bear all of the expenses incurred in connection with the registration of the Warrants. The Selling Shareholders will pay or assume discounts, commissions, fees of underwriters, selling brokers or dealer managers and similar expenses, if any, incurred for the sale the Warrants.

Our Ordinary Shares are listed on the Nasdaq Capital Market under the symbol “HHT.” On August 26, 2020, the last reported sale price of our Ordinary Shares on the Nasdaq Capital Market was $0.81 per share. The applicable prospectus supplement will contain information, where applicable, as to other listings, if any, on the Nasdaq Capital Market or other securities exchange of the securities covered by the prospectus supplement.

Investing in our securities involves a high degree of risk. See “Risk Factors” on page 7 of this prospectus and in the documents incorporated by reference in this prospectus, as updated in the applicable prospectus supplement, any related free writing prospectus and other future filings we make with the Securities and Exchange Commission that are incorporated by reference into this prospectus, for a discussion of the factors you should consider carefully before deciding to purchase our securities.

This prospectus describes the general manner in which the Warrants may be offered and sold. If necessary, the specific manner in which the Warrants may be offered and sold will be described in a supplement to this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 28, 2020.

TABLE OF CONTENTS

i

This prospectus describes the general manner in which the Selling Shareholders may offer from time to time up to an aggregate of 3,313,637 Ordinary Shares issuable upon the exercise of the Warrants. You should rely only on the information contained in this prospectus and the related exhibits, any prospectus supplement or amendment thereto and the documents incorporated by reference, or to which we have referred you, before making your investment decision. Neither we nor the Selling Shareholders have authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus, any prospectus supplement or amendments thereto do not constitute an offer to sell, or a solicitation of an offer to purchase, the Ordinary Shares offered by this prospectus, any prospectus supplement or amendments thereto in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. You should not assume that the information contained in this prospectus, any prospectus supplement or amendments thereto, as well as information we have previously filed with the U.S. Securities and Exchange Commission (the “SEC”), is accurate as of any date other than the date on the front cover of the applicable document.

If necessary, the specific manner in which the Ordinary Shares may be offered and sold will be described in a supplement to this prospectus, which supplement may also add, update or change any of the information contained in this prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date-for example, a document incorporated by reference in this prospectus or any prospectus supplement-the statement in the document having the later date modifies or supersedes the earlier statement.

Neither the delivery of this prospectus nor any distribution of Ordinary Shares pursuant to this prospectus shall, under any circumstances, create any implication that there has been no change in the information set forth or incorporated by reference into this prospectus or in our affairs since the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since such date.

As permitted by SEC rules and regulations, the registration statement of which this prospectus forms a part includes additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at its website or at its offices described below under “Where You Can Find More Information.”

Unless the context otherwise requires, all references in this prospectus to “Color Star,” “Color Star Technology,” “we,” “us,” “our,” “the Company” or similar words refer to Color Star Technology Co., Ltd., together with our subsidiaries.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and our SEC filings that are incorporated by reference into this prospectus contain or incorporate by reference forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical fact are “forward-looking statements,” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. The words “believe,” “anticipate,” “estimate,” “plan,” “expect,” “intend,” “may,” “could,” “should,” “potential,” “likely,” “projects,” “continue,” “will,” and “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements reflect our current views with respect to future events, are based on assumptions and are subject to risks and uncertainties. We cannot guarantee that we actually will achieve the plans, intentions or expectations expressed in our forward-looking statements and you should not place undue reliance on these statements. There are a number of important factors that could cause our actual results to differ materially from those indicated or implied by forward-looking statements. These important factors include those discussed under the heading “Risk Factors” contained or incorporated by reference in this prospectus and in the applicable prospectus supplement and any free writing prospectus we may authorize for use in connection with a specific offering. These factors and the other cautionary statements made in this prospectus should be read as being applicable to all related forward-looking statements whenever they appear in this prospectus. Except as required by law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

1

History and Development of the Company

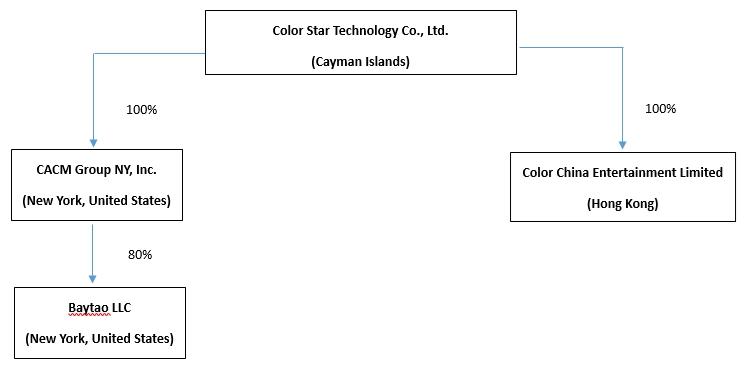

We are an innovative education provider which provides performance support and music education services via our wholly-owned subsidiary, Color China Entertainment Limited (“Color China”), after-school education service carried out via our wholly-owned subsidiary CACM Group NY, Inc. (“CACM”) and our joint venture entity, Baytao LLC.

Color Star Technology Co., Ltd. (formerly known as Huitao Technology Co., Ltd.) was founded as an unincorporated business on September 1, 2005, under the name TJS Wood Flooring, Inc., and became a C-corporation in the State of Delaware on February 15, 2007. On April 29, 2008, we changed our name to China Advanced Construction Materials Group, Inc.

On August 20, 2018, CACM Group NY, Inc. (“CACM”) was incorporated in the State of New York and is wholly owned by us. The establishment of CACM was to expand the Company’s business in the U.S. CACM has not commenced operations.

On December 31, 2018, we consummated a re-domicile merger pursuant to which we merged with and into our wholly-owned subsidiary, China Advanced Construction Materials Group, Inc., a newly formed Cayman Islands company and the surviving entity in the merger, pursuant to the terms and conditions of an Agreement and Plan of Merger adopted in July 2018. As a result of the reincorporation, the Company is now governed by the laws of the Cayman Islands.

On June 27, 2019, upon effectiveness of the Company’s amendment and restatement of the Company’s memorandum and articles of association which was approved by the Company’s shareholders, the Company’s name was changed from China Advanced Construction Materials Group, Inc. to Huitao Technology Co., Ltd.

On December 31, 2019, we entered into a share exchange agreement with Sunway Kids International Education Group Ltd. (“Sunway Kids”) and its shareholders. On February 14, 2020, the Company consummated the acquisition of Sunway Kids whereby we issued 1,989,262 ordinary shares and $2 million of cash to be paid in exchange for all of the issued and outstanding capital stock of Sunway Kids. The $2 million cash consideration is payable in five installments over five years according to an earn-out schedule. Sunway Kids thereby became our wholly-owned subsidiary. Sunway Kids was established on February 29, 2012, under the laws of the British Virgin Islands as an offshore holding company. On August 23, 2018, Sunway Kids established its wholly-owned subsidiary, Brave Millenium Limited (“Brave Millenium”) under the laws of Hong Kong. On December 4, 2019, Brave Millenium established Chengdu Hengshanghui Intelligent Technology Co., Ltd. (“Chengdu Hengshanghui”) in China as a wholly foreign owned limited liability company (the “WFOE”). On December 9, 2019, Chengdu Hengshanghui entered into a series of variable interest entity agreements with Chengdu Hengshanghui Education Consulting Co., Ltd. (“Hengshanghui Education”). Through Sunway Kids and its variable interest entity Hengshanghui Education, we are engaged in providing education and health services to day-care and preschools in China.

On March 10, 2020, CACM entered into a certain joint venture agreement (the “JV Agreement”) with Baydolphin, Inc., a company organized under the laws of New York (“Baydolphin”). Pursuant to the JV Agreement, CACM and Baydolphin have established a limited liability company under the laws of New York, Baytao LLC (“Baytao”), which will be the 100% owner of one or more operating entities in the U.S. to engage in the business of online and offline after-school education.

2

Prior to acquisition of Sunway Kids in February 2020, our core business has been the concrete business in China. Our concrete business is highly affected by the economic cycle and government policies. The concrete industry was influenced by the decline in the macro economy in recent years. The entire concrete industry in the Beijing area experienced a slowdown in industry production and economic growth in the last few years as the Beijing government continues to enforce concrete production reformation and tightened environmental laws from late 2017 to date. The reformation causes great uncertainties for local enterprises in the construction market. Since 2017, the pressure on small concrete companies has further increased and many have been shut down. Also, the Beijing government ordered the suspension of construction jobsites during winters to reduce air pollution since 2017. The operations of Beijing Xin Ao were also severely affected. As a result of the Company’s deteriorating cash position, we defaulted on bank loans and experienced a substantial increase in contingent liabilities. As of December 31, 2019, there was a default on a bank loan of $24,345,129. As of December 31, 2019, Beijing Xin Ao is subject to several civil lawsuits for which the Company estimated that it is more than likely to pay judgments in the amount of approximately $6.8 million (including interest and penalties of $1.6 million). During the six months ended December 31, 2019 and 2018, there were additional estimated claims of approximately $0.3 million and $1.1 million, respectively. The Company believes it would be very difficult, if not impossible, to turn around the concrete business. As such, the Company has been actively seeking to dispose of the concrete business after the acquisition of Sunway Kids.

On May 6, 2020, the Company completed the disposition (the “Disposition”) of its former subsidiary, Xin Ao Construction Materials, Inc. (“BVI-ACM”), after obtaining its shareholders’ approval on April 27, 2020 and satisfaction or waiver of all other closing conditions. Upon the closing of the Disposition, Mr. Xianfu Han and Mr. Weili He became the sole shareholders of BVI-ACM and as a result, assumed all assets and liabilities of all the subsidiaries and variable interest entities owned or controlled by BVI-ACM. The proceeds of $600,000 from the Disposition will be used for the Company’s working capital and general corporate purposes.

On May 1, 2020, upon effectiveness of the Company’s amendment and restatement of its memorandum and articles of association (which was approved by the Company’s shareholders), the Company’s name was changed to Color Star Technology Co., Ltd.

On May 7, 2020, we entered into a Share Exchange Agreement (“Exchange Agreement”) with Color China Entertainment Limited (“Color China”), a Hong Kong limited company, and shareholders of Color China (the “Sellers”), pursuant to which, among other things and subject to the terms and conditions contained therein, the Company will acquire all of the outstanding issued shares and other equity interests in Color China from the sellers (the “Acquisition”). Pursuant to the Exchange Agreement, in exchange for all of the outstanding shares of Color China, the Company will issue 4,633,333 ordinary shares of the Company and pay an aggregate of $2,000,000 to the sellers. Headquartered in Hong Kong, China, Color China is an emerging performance equipment and music education provider with a significant collection of performance specific assets and unique experience in working with many renowned artists. Immediately after the Acquisition, Color Star will own 100% of Color China. On June 3, 2020, the transaction contemplated by the Exchange Agreement consummated when the Company issued 4,633,333 ordinary shares of the Company to the Sellers and the Sellers transferred all of Color China’s issued and outstanding shares to the Company.

On June 25, 2020, the Company, Sunway Kids, the Company’s wholly owned subsidiary, and the former shareholders of Sunway Kids entered into an Amendment No. 2 (“Amendment”) to the Share Exchange Agreement dated December 31, 2019, as amended. Pursuant to the Amendment, the Company shall not make any the Earn-out Payment to the former shareholders of Sunway Kids since Sunway Kids has been unable to conduct its normal operations due to the COVID-19 pandemic and management of Sunway Kids believes it will be very difficult to achieve its projected financial results. On the same day, Sunway Kids and Yanliang Han (the “Purchaser”), entered into certain share purchase agreement (the “Disposition SPA”). Pursuant to the Disposition SPA, the Purchaser agreed to purchase Sunway Kids in exchange for cash consideration of $2.4 million consisting of $400,000 which shall be paid within a month of closing, and $2,000,000 to be paid in monthly installments of $200,000 over 10 months. Upon the closing of the transaction (the “Disposition”) contemplated by the Disposition SPA on June 25, 2020, the Purchaser became the sole shareholder of Sunway Kids and as a result, assumed all assets and liabilities of all the subsidiaries and variable interest entities owned or controlled by Sunway Kids.

On August 21, 2020, the Company entered into an Asset Purchase Agreement with a non-affiliated third party pursuant to which the Company agreed to purchase certain machinery and equipment for stage performance for a total purchase price of $6,818,000, of which $3,000,000 shall be paid in cash and $3,818,000 shall be paid in the form of 6,060,318 ordinary shares (the “Shares”), valued at $0.63 per share, the closing price of the shares on August 20, 2020. $2,000,000 of the cash consideration were paid upon execution of the agreement and the remaining $1,000,000 shall be paid within sixty days of the date of the agreement. The purchased assets will be in furtherance of the Company’s performance support and music education business. The Company issued the above-mentioned shares on August 27, 2020 upon satisfaction of closing conditions. These shares are exempt from the registration requirements of the Securities Act, pursuant to Regulation S promulgated thereunder.

3

Below is the Company’s corporate structure chart as of the date of this prospectus.

Business Overview

Performance Support and Music Education Business

Color China is in the performance support and music education business with a significant collection of music performance specific equipment. Color China’s management team has extensive experience in large-scale entertainment performance, equipment leasing and IP licensing. Color China’s founders have unique experience in working with many renowned artists in Asia and North American and have also established good relationships with many record companies and entertainment agencies in Asia and North America. Leveraging its unique resources, Color China is in the process of building an online entertainment and music education platform, “Color World,” featuring artists as its lead instructors.

Management believes that the Color World platform being built by Color China and CACM will bring innovative changes to the current state of music education and entertainment industry. Entertainment and music education will no longer be divided by nationality, region, and cultural differences. Through the Internet, Color World can provide professional entertainment and music education globally.

The ongoing COVID-19 pandemic has claimed hundreds of thousands of lives and caused massive global health and economic crisis, while also causing large-scale social and behavioral changes in societies. Online entertainment and online education are experiencing enormous growth which management believes will last long after the pandemic. The Company’s management believes that these market conditions have created tremendous opportunity for Color China’s business plan, and therefore expects to focus on the expansion of Color China’s business in light of its great potential for revenue generation and profitability.

4

Color China has entered into various educational licensing and performance agreements with renowned and successful artists and professionals in the entertainment industry for their services as instructors on the Color World platform (“Star Teachers”) and has secured the rights to the exclusive streaming of online lessons taught by the Star Teachers on the platform. Color China is also in the process of seeking out and contracting more Star Teachers in a variety of fields such as music, film, sports, animation, television, presentations, dance, and art to provide its prospective student subscribers with a large repertoire of first-hand exposure to and lessons from successful professionals in their desired fields.

The “Color World” platform will generate revenue primarily through paid membership subscriptions to our online courses. The Company also plans to generate revenue through the sales of relevant products, including but not limited to peripheral products of entertainment stars and trendy brands. Over time, we may develop more sources of revenues. Our freemium model allows us to attract users with free services and convert them into paying users. On our “Color World” platform, individual users can access a number of our courses and services for free. We convert non-paying users to paying users through a variety of means. For example, we will provide free trial periods to our users to allow them try premium contents that can usually be accessed exclusively by paid subscribers, free credits to users for trying premium courses, prompts with personalized suggestions on how users can improve their skills with links to our paid courses, and discounts on peripheral products for paid subscribers.

Joint Venture with Baydolphin, Inc.

On March 10, 2020, CACM, a New York corporation and wholly owned subsidiary of the Company, entered into a certain joint venture agreement (the “JV Agreement”) with Baydolphin, Inc., a company organized under the laws of New York, (“Baydolphin”). Pursuant to the JV Agreement, among other things and subject to the terms and conditions contained therein, CACM and Baydolphin agreed to establish a limited company under the laws of New York, Baytao LLC (the “JV”), which will be the 100% owner of one or more operating entities in the U.S. to engage in the business of after-school education (the “Operating Entities”).

Pursuant to the JV Agreement, CACM shall contribute necessary capital for the Operating Entities to fund their operations and obtain the right to use of certain software platform and other technologies related to it from the Company, which will be provided to the JV and Operating Entities with no charge to facilitate the operation of the Operating Entities and provide online classes to the registered students of Operating Entities, and Baydolphin shall be responsible for managing the Operating Entities with its expertise in after-school education, including but not limited to recruiting and training personnel for the Operating Entities and implementing all promotional and marketing activities incidental to the Operating Entities. Eighty percent (80%) of the net profits or net loss of the joint venture will be distributed to or assigned to CACM and the remaining twenty percent (20%) being distributed to or assigned to Baydolphin.

U.S. After-School Education Business

Pursuant to the JV Agreement, once Baytao sets up one or more Operating Entities, CACM shall contribute the necessary capital for the Operating Entities to fund their operations, and the Company will provide Baytao and Operating Entities with the use of its technologies at no extra costs to facilitate the operations of the Operating Entities and provide online classes to the registered students of the Operating Entities. Furthermore, Baydolphin is responsible for managing the Operating Entities with its expertise in after-school education, including but not limited to recruiting and training personnel for the Operating Entities and implementing all promotional and marketing activities incidental to the Operating Entities.

Corporate Information

Our principal executive office is located on 800 3rd Ave, Suite 2800, New York, NY 10022. Our telephone number is (212) 220-3967. We maintain a website at www.china-acm.com that contains information about our Company, though no information contained on our website is part of this prospectus.

5

This prospectus relates to the offer and resale by the Selling Shareholders of an aggregate of 3,313,637 Ordinary Shares issuable upon the exercise of the Warrants. All of the Ordinary Shares underlying the Warrants, when sold, will be sold by the Selling Shareholders. The Selling Shareholders may sell the Ordinary Shares underlying the Warrants from time to time at prevailing market prices or at privately negotiated prices.

| Ordinary Shares underlying Warrants Offered by the Selling Shareholders: | 3,313,637 Ordinary Shares. | |

| Ordinary Shares Outstanding at August 27, 2020: | 36,922,777(1) | |

| Use of Proceeds: | While we will not receive any proceeds from the sale of the Ordinary Shares underlying the Warrants offered by this prospectus by the Selling Shareholders, we may receive cash proceeds of up to $466,045.48 from the cash exercise of the April Warrants and May Warrants, as holders of the April Warrants can purchase up to 1,013,637 Ordinary Shares at an exercise price of $0.04 per share and holders of the May Warrants can purchase up to 2,300,000 Ordinary Shares at an exercise price of $0.185 per share as of the date this prospectus. | |

| Risk Factors: | An investment in the Ordinary Shares offered under this prospectus is highly speculative and involves substantial risk. Please carefully consider the “Risk Factors” section on page 7 and other information in this prospectus for a discussion of risks. Additional risks and uncertainties not presently known to us or that we currently deem to be immaterial may also impair our business and operations. | |

| Nasdaq Symbol: | HHT |

| (1) | The number of Ordinary Shares outstanding prior to and that will be outstanding after this offering excludes all Warrants outstanding or issuable in connection with this offering. |

6

Before you make a decision to invest in our securities, you should consider carefully the risks described below. If any of the following events actually occur, our business, operating results, prospects or financial condition could be materially and adversely affected. This could cause the trading price of our ordinary shares to decline and you may lose all or part of your investment. The risks described below are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also significantly impair our business operations and could result in a complete loss of your investment.

You should also carefully consider the risk factors set forth under “Risk Factors” described in our most recent annual report on Form 20-F, filed on November 15, 2019, and our most recent prospectus supplement, filed on July 21, 2020 as supplemented and updated by any subsequent prospectus and prospectus supplement that we have filed with the SEC, together with all other information contained or incorporated by reference in this prospectus and any applicable prospectus supplement and in any related free writing prospectus in connection with a specific offering, before making an investment decision. Each of the risk factors could materially and adversely affect our business, operating results, financial condition and prospects, as well as the value of an investment in our securities, and the occurrence of any of these risks might cause you to lose all or part of your investment.

Risks Related to the Current Pandemic

Our business, results of operations and financial condition may be adversely affected by global public health epidemics, including the strain of coronavirus known as COVID-19.

In December 2019, a novel strain of coronavirus causing respiratory illness, or COVID-19, has surfaced in Wuhan, China, spreading at a fast rate in January and February of 2020, and confirmed cases were also reported in other parts of the world. In reaction to this outbreak, an increasing number of countries imposed travel suspensions to and from China following the World Health Organization’s “public health emergency of international concern” (PHEIC) announcement on January 30, 2020. Since this outbreak, business activities in China and many other countries including U.S. have been disrupted by a series of emergency quarantine measures taken by the government.

As a result, our operations in China and U.S. have been materially affected. Our offices in Chengdu were temporarily closed until early March. Although our offices re-opened in early March, since no children have been allowed to attend daycare centers or preschools as of the date of this Prospectus, Sunway Kids has not been able to generate any meaningful revenue since the start of the pandemic. Additionally, New York, where our U.S. operations are based, is currently significantly affected by COVID-19, which led to measures taken by the New York government trying to contain the spread of COVID-19, such as shelter in place, closure of schools and travel restrictions. Additional travel and other restrictions may be put in place to further control the outbreak in U.S. As a result of these, management has to temporarily postpone the rolling out of our afterschool centers in New York. The launching of the online education platform we are jointly developing with Color China has also been delayed. Accordingly, our operation and business have been and will continue to be adversely affected as the results of the wide-spread pandemic. Management may have to adjust or change our business plan in response to the prolonged pandemic and change of social behavior.

The extent to which COVID-19 negatively impacts our business is highly uncertain and cannot be accurately predicted. We believe that the coronavirus outbreak and the measures taken to control it may have a significant negative impact on not only our business, but economic activities globally. The magnitude of this negative effect on the continuity of our business operation in China and U.S. remains uncertain. These uncertainties impede our ability to conduct our daily operations and could materially and adversely affect our business, financial condition and results of operations, and as a result affect our stock price and create more volatility.

7

Risks Related to our Joint Venture with Baydolphin, Inc.

We may not be able to oversee the new joint venture efficiently.

We may not be able to oversee Baytao, our new joint venture, efficiently, realize anticipated profits or effectively implement our growth and operating strategies. As we begin our operations in the United States through our joint venture, we may encounter unforeseen expenses, difficulties, complications, delays and other known and unknown factors. We will need to transition from a company with our primary operations in China to a company capable of supporting operations in both China and the United States. We might not be successful in such a transition. There can be no guarantee that the addition of the new joint venture will not cause us to incur additional debt and increase our exposure to market and other risks. Our failure to successfully pursue our strategies or effectively operate the joint venture entity could also have a material adverse effect on our rate of growth and operating performance.

There may be integration issues between Baytao and Color China’s technologies.

The services provided by Baytao will need to be integrated with Color China’s existing software and technologies so as to achieve our operating strategies. If we are unable to achieve a successful integration with Color China’s software and technologies, we may not be successful in developing and marketing our new services and courses and our operating results will materially suffer. In addition, if the integrated services and courses we offer do not achieve acceptance by the marketplace, our operating results will materially suffer. Also, if new industry standards emerge that we do not anticipate or adapt to, our software products could be rendered obsolete and, as a result, our business and operating results, as well as our ability to compete in the marketplace, would be materially harmed.

Risks Related to our Acquisition of Color China Entertainment Limited

We may not be able to oversee the combined entity efficiently.

We may not be able to oversee the combined entity efficiently, realize anticipated profits or effectively implement our growth and operating strategies. We are now managing two related businesses in the education industry, the music education business conducted through Color China and the online learning platform conducted via Baytao, which have different customers, suppliers, and competition landscapes. This involves risks that could adversely affect our operating results due to uncertainties involved with the new business, diversion of management’s attention in operating and managing the new business. There can be no guarantee that the addition of the new business will not cause us to incur additional debt and increase our exposure to market and other risks. In addition, Color China’s management team has very little experience with the necessary disclosure practices of a public company and may not be able to timely provide sufficient information to our accounting staff. Our failure to successfully pursue our strategies or effectively operate and manage the combined entity could also have a material adverse effect on our rate of growth and operating performance.

Risks Related to our Education Service Business

If we are unable to launch and operate the “Color World” platform as planned, our results of operation will be significantly impacted.

The launch of the “Color World” platform will depend on many factors, including realistic scheduling of the development time, the effectiveness of quality control, maintaining high productivity when facing unexpected technical difficulties, the time to obtain and integrate third-party services, the changes in availabilities of software and hardware infrastructures provided by third parties, and sudden changes in government policies. Once Color World has launched, the attractiveness of our platform to our prospective “Star Teachers” and student subscribers also depends on our ability to innovate. To remain competitive, we must continue to develop and expand our platform and education services. We must also continue to enhance and improve our technology infrastructure. These efforts may require us to develop or license increasingly complex technologies. In addition, new education services and technologies developed and introduced by competitors could render our education services and technologies obsolete if we are unable to update or modify our own technology. Developing and integrating new education services and technologies into our existing platform and infrastructure could be expensive and time-consuming. Furthermore, any new features and functions may not achieve market acceptance. We may not succeed in implementing new technologies, or may incur substantial costs in doing so. Our platform and education services must achieve high levels of market acceptance in order for us to recoup our investments. Our platform and education services could fail to attain sufficient market acceptance for many reasons, including:

| ● | we may fail to predict market demand accurately and to provide education services that meet this demand in a timely fashion; |

8

| ● | our marketing efforts may be inefficient and fail to attract the potential users; |

| ● | Star Teachers that we recruit on our platforms may not like, find useful or agree with any changes; |

| ● | there may be defects, errors or failures on our platform; |

| ● | there may be negative publicity about our platforms’ performance or effectiveness; and |

| ● | there may be competing services or technologies introduced or anticipated to be introduced by our competitors. |

If our platform and education services or technologies do not achieve adequate acceptance in the market, our competitive position, results of operations and financial condition could be materially and adversely affected.

Our success relies on the continuing efforts of our senior management team and qualified key personnel, and our business may be harmed if we are unable to retain or motivate them.

Our business operations depend on the continued services of our senior management team and qualified key personnel, particularly our executive officers and the senior management of Color China, our wholly owned subsidiary.

Although we have provided different incentives to our senior management team, we cannot assure you that we can continue to retain their services. One or more of our key executives may be unable or unwilling to continue in their present positions. Meanwhile, we have also provided attractive compensation packages to our qualified key personnel. However, we may not be able to hire and retain these personnel at compensation levels consistent with our existing compensation and salary structure. Some of the companies with which we compete for qualified and skilled personnel have greater resources than we have and may be able to offer more attractive terms of employment. In addition, we invest significant time and resources in training our employees, which increases their value to competitors who may seek to recruit them.

If we are unable to retain the services of our senior management team or qualified key personnel, we may not be able to find suitable replacements or may incur significant expenses in finding such replacements, thus our future growth may be constrained, our business may be severely disrupted and our results of operations and financial condition may be materially and adversely affected. In addition, although we have entered into confidentiality and non-competition agreements with our senior management team and qualified key personnel, there is no assurance that any member of our senior management team or any of our qualified key personnel will not join a competitor. In the event that any dispute arises between us, on one hand, and any of our senior management and qualified key personnel, on the other hand, we may have to incur substantial costs and expenses in order to enforce such agreements, or we may be unable to enforce them at all.

9

If we are unable to recruit “Star Teachers” as planned or if these instructors do not perform according to the agreements we have with them, the operation of our performance support and music education business will be negatively impacted.

Professional artists and producers that we have begun recruiting as our Star Teachers help us build and maintain the quality of our education and services, as well as our brand and reputation. Our ability to continue to attract recruit the instructors with the necessary experience and qualifications is a key factor in the success of our operations. We seek to continue hiring experienced and successful professionals in music, film, sports, animation, television, presentations, dance, art and other entertainment industries whom are able to follow our education service protocols and deliver effective instructions based on the agreements we have with them. The market for the recruitment of these professionals is competitive, and we must also provide continued training to ensure that our instructors stay abreast of changes in student demands, teaching methodologies and other necessary changes.

In order to recruit these industry professionals as instructors on our platform, we must provide candidates with competitive compensation packages. Although we have not experienced major difficulties in recruiting or training qualified instructors thus far, we cannot guarantee we will be able to continue to recruit, train and retain a sufficient number of qualified instructors in the future, which may have a material adverse effect on our business, financial condition and results of operations.

If we are unable to reach a critical mass of subscribers, our revenues may not be sufficient to cover the costs of our recruitment of Star Teachers.

We are obligated to pay each of our Star Teachers on a case-by-case basis depending on the results of our negotiations. Some Star Teachers will accept fixed payments following a predefined schedule, whereas others may instead request a revenue sharing payment model whereby we will need to distribute to the Star Teachers a percentage of the net income earned from generated sales, licensing or other revenue from their courses on our platform, including a pro rata share of our subscription fees, or a hybrid of the two. If we are unable to generate enough revenue from our subscription fees from our users to cover our Star Teachers’ recruitment costs, our results of operations and financial condition could be materially and adversely affected.

Our education service revenue model depends on developing a subscriber base of users. If we fail to reach a critical mass of subscribers, our net revenues may decline, and we may not be able to implement our business plan.

We expect to generate revenue primarily from the fees we collect from our users. It is critical for us to enroll subscribers in a cost-effective manner. Some of the factors, many of which are largely beyond our control, could prevent us from successfully increasing subscriptions in a cost-effective manner, or at all. These factors include, among other things, (i) reduced interest in the products and services we offer; (ii) negative publicity or perceptions regarding us, or electronic education services in general; (iii) the emergence of alternative technologies not offered by us; (iv) the inability of subscribers to pay the fees; (v) increasing market competition, particularly price reductions by competitors that we are unable or unwilling to match; and (vi) adverse changes in relevant government policies or general economic conditions. If one or more of these factors reduce market demand for our services, our subscriber base may not materialize as anticipated or our costs associated with subscriber acquisition and retention could increase, or both, any of which could materially affect our ability to grow our gross billings and net revenues. These developments could also harm our brand and reputation, which would negatively impact our ability to establish or expand our business.

10

We expect to invest in our growth for the foreseeable future. If we fail to manage this growth effectively, the success of our business model will be compromised.

We anticipate rapid growth in gross billings and net revenues upon the acquisition of our childhood education business segment, which growth is expected to be driven primarily by the growth of our subscriber base. Rapid growth may place a significant strain on our sales and marketing capacities, administrative and operating infrastructure, facilities and other resources. To manage our anticipated our growth, we may need to continue to acquire more subscribers, scale up our product and service offerings, as well as strengthen our platforms and systems. We will also be required to refine our operational, financial and management controls and reporting systems and procedures. If we fail to efficiently manage the establishment and future expansion of our business, our costs and expenses may increase more than we plan and we may not successfully attract a sufficient number of subscribers and strategic partners in a cost-effective manner, respond to competitive challenges, or otherwise execute our business plans. In addition, we may, as part of carrying out our growth strategies, adopt new initiatives to offer additional educational content and to implement new pricing models and strategies. We cannot assure you that these initiatives may achieve the anticipated results. These proposed changes may not be well received by our existing and prospective users, in which case their experience with our education services may suffer, which could damage our reputation and business prospects.

Our ability to effectively implement our strategies and manage any significant growth of our business will depend on a number of factors, including our ability to: (i) identify and effectively market our products and services in new markets with sufficient growth potential; (ii) develop and improve service and product offerings to make them appealing to our users; (iii) maintain and increase our subscriber base; (iv) effectively recruit, train and motivate a large number of new employees, including sales and marketing personnel; (v) successfully implement enhancements and improvements to the systems and platforms; (vi) continue to improve our operational, financial and management controls and efficiencies; (vii) protect and further develop our intellectual property rights; and (viii) make sound business decisions in light of the scrutiny associated with operating as a public company. These activities require significant capital expenditures and investment of valuable management and financial resources, and our growth will continue to place significant demands on our management. There are no guarantees that we will be able to effectively manage any future growth in an efficient, cost-effective and timely manner, or at all. If we do not effectively manage the growth of our business and operations, our reputation, results of operations and overall business and prospects could be negatively impacted.

11

We expect to rely heavily on information and technology to operate our existing and future education products and services, and any cybersecurity incident or other disruption to our technology infrastructure could result in the loss of critical confidential information or adversely impact our reputation, business or results of operations.

Our ability to attract and retain customers and to compete effectively depends in part upon the satisfactory performance and reliability of our technology network, including the ability to provide features of services that are important to our customers and to protect our confidential business information and the information provided by our customers. We also rely on our technology to maintain and process various operating and financial data that are essential to the day-to-day operation of our business and formulation of our development strategies. Our business operations and growth prospects depend on our ability to maintain and make timely and cost-effective enhancements and upgrades to our technology system and to introduce innovative additions that can meet changing operational needs in future. Therefore, we expect to continue to invest in advanced information technology and any equipment to enhance operational efficiency and reliability as we grow. Accordingly, any errors, defects, disruptions or other performance problems with our IT infrastructure could damage our reputation, decrease user satisfaction and retention, adversely impact our ability to attract new users and expand our service and product offerings, and materially disrupt our operations. If any of these occur, our business operations, reputation and prospects could be harmed.

If our security measures are breached or fail and result in unauthorized disclosure of data by our employees or our third-party agents, we could lose existing subscribers, fail to attract new subscribers and be exposed to protracted and costly litigation.

Maintaining platform security is of critical importance to our subscribers because the platform stores and transmits proprietary and confidential information, which may include sensitive personally identifiable information that may be subject to stringent legal and regulatory obligations. As an electronic education service provider, we face an increasing number of threats to our IT infrastructure, including unauthorized activity and access by our employees or third-party agents, system viruses, worms, malicious code and organized cyber-attacks, which could breach our security and disrupt our business. We hope to introduce data security and confidentiality protocols into the cooperation agreements we enter into with third-party sales agents with whom we share prospective subscribers’ contact information. As we expand, we hope to invest in improving our technology security initiatives, information technology risk management and disaster recovery plans to prevent unauthorized access of confidential or sensitive personal information by our employees and third-party sales agents in the process of engaging prospective subscribers.

These measures, however, may not be as effective as we anticipate. In addition, there is no assurance that our third-party sales agents will comply with contractual and legal requirements with respect to data privacy when they collect data from our prospective customers. If our security measures are breached or fail as a result of third-party action, employee error, malfeasance or otherwise, we could be subject to liability or our business could be interrupted, potentially over an extended period of time. Any or all of these issues could harm our reputation, adversely affect our ability to attract and enroll prospective subscribers, cause prospective subscribers not to enroll or stay enrolled, or subject us to third-party lawsuits, regulatory fines or other action or liability. Further, any reputational damage resulting from breach of our security measures could create distrust of our company by prospective subscribers or investors. We may be required to expend significant management time and additional resources to protect against the threat of these disruptions and security breaches or to alleviate problems caused by such disruptions or breaches.

Privacy concerns could limit our ability to collect and leverage our user data and disclosure of user data could adversely impact our business and reputation.

In the ordinary course of our business and in particular in connection with conducting sales and marketing activities with our existing and prospective subscribers as well as the utilization of our AI-powered platform programs, we collect and utilize data supplied by our users. We currently face certain legal obligations regarding the manner in which we treat such information. Increased regulation of data utilization practices, including self-regulation or findings under existing laws that limit our ability to collect, transfer and use data, could have an adverse effect on our business. In addition, if we were to disclose data about our users in a manner that was objectionable to them, our business reputation could be adversely affected, and we could face potential legal claims that could impact our operating results.

Internationally, we may become subject to additional and/or more stringent legal obligations concerning our treatment of customer and other personal information, such as laws regarding data localization and/or restrictions on data export. Failure to comply with these obligations could subject us to liability, and to the extent that we need to alter our business model or practices to adapt to these obligations, we could incur additional expenses.

12

We face regulatory risks and uncertainties with respect to the licensing requirement for the online transmission of internet audio-visual programs in China.

On December 20, 2007, the National Radio and Television Administration fka known as the State Administration of Press Publication Radio Film and Television, or SAPPRFT, and the Ministry of Industry and Information Technology, or the MIIT, jointly promulgated the Administrative Provisions on Internet Audio Visual Program Services, or the Audio Visual Program Provisions, which became effective on January 31, 2008 and were amended on August 28, 2015. Among other things, the Audio Visual Program Provisions stipulate that no entities or individuals may provide Internet audio-visual program services without a License for Online Transmission of Audio-Visual Programs issued by SAPPRFT or completing the relevant filing with SAPPRFT or its local bureaus, and only state-owned or state-controlled entities are eligible to apply for a License for Online Transmission of Audio Visual Programs. On April 1, 2010, SAPPRFT promulgated the Provisional Implementations of Tentative Categories of Internet Audio Visual Program Services, or the Categories, which clarified the scope of Internet audio-visual programs services, which was amended on March 10, 2017. According to the Categories, there are four categories of Internet audio-visual program services which are further divided into seventeen sub-categories. Sub-category No. 3 to the second category covers the making and editing of certain specialized audio-visual programs concerning, among other things, educational content, and broadcasting such content to the general public online. Sub-category No. 5 of the first category and sub-category No. 7 of the second category cover the live broadcasting of important political, martial, economic, social, cultural, sports activities or events or general social or community cultural activities, sports games and other organized activities. However, there are still significant uncertainties relating to the interpretation and implementation of the Audio Visual Program Provisions, in particular, the scope of “internet audio-visual programs.” See “Regulations Relating to Online Transmission of Audio-Visual Programs.”

We plan to deliver our courses in live streaming format worldwide. Our teachers and students communicate and interact live with each other via our virtual learning community. The audio and video data will likely be transmitted through the platforms between specific recipients instantly without any further redaction. We believe the nature of the raw data we transmit will distinguish us from general providers of internet audio-visual program services, such as the operator of online video websites, and the provision of the Audio-Visual Program Provisions are not applicable with regard to our offering of the courses. However, we cannot assure you that the competent PRC government authorities will not ultimately take a view contrary to our opinion. In addition, we also plan to offer video recordings of live streaming courses and certain other audio-video contents on our electronic platforms to our students as supplementary course materials on our platforms. If the government authorities determine that our offering of the courses fall within the relevant category of Internet audio-visual program services under the Categories, we may be required to obtain the License for Online Transmission of Audio Visual Programs.

The Categories describe “Internet audio-visual program services” in a very broad, vague manner and are unclear as to whether electronic courses, whether delivered in a live streaming format or through video recordings, fall into the definition of audio-visual programs. We have made inquiries to the relevant bureaus of SAPPRFT and were informed that online educational content provided through live streaming or recorded courses does not fall within the scope of internet audio-visual programs, the transmission of which does not require a License for Online Transmission of Audio-Visual Programs. We cannot assure you that the PRC government will not ultimately take a view that live streaming or recorded courses or any other content offered on our platforms are subject to the Audio Visual Program Provisions. We currently do not hold a License for Online Transmission of Audio Visual Programs, and since we are not a state-owned or state-controlled entity, we are not eligible to apply for such license. If the PRC government determines that our content should be considered as “internet audio- visual programs” for the purpose of the Audio-Visual Program Provisions, we may be required to obtain a License for Online Transmission of Audio Visual Programs. We are, however, not eligible apply for such license since we are not a state-owned or state-controlled entity. If this were to occur, we may be subject to penalties, fines, legal sanctions or an order to suspend the provision of our live streaming courses. As of the date of this annual report, we have not received any notice of warning or been subject to penalties or other disciplinary action from the relevant governmental authorities regarding the lack of a License for Online Transmission of Audio Visual Programs in conducting of our business.

Our failure to obtain and maintain approvals, licenses or permits in China applicable to our business could have a material adverse impact on our business, financial conditions and results of operations.

A number of PRC regulatory authorities, such as the SAIC, the Cyberspace Administration of China, the MITT, the National Radio and Television Administration, and the State Council Information Office, the Ministry of Civil Affairs, and the Ministry of Human Resources and Social Welfare, oversee different aspects of our business operations. We may be required in the future to obtain additional government approvals, licenses and permits in connection with our operations.

13

By way of example, depending upon regulatory interpretation, under the current PRC laws and regulations, the provision of our educational content through our electronic platform may be considered “online publishing” and may require us to obtain an Internet Publishing License, which we currently do not have.

As of the date of this prospectus, we have not received any notice of warning or been subject to penalties or other disciplinary action from the relevant governmental authorities regarding the lack of any the above-mentioned approvals, licenses or permits. However, we cannot guarantee that the government authorities will not impose any penalties or sanctions on us in the future, which may include warnings, fines, mandates to remedy any violations, confiscation of the gains derived from the services for which approvals, licenses or permits are required, and/or an order to cease to provide such services. In addition, we cannot guarantee that the government will not promulgate new laws and regulations that require additional licenses, permits and/or approvals for the operation of any of our existing or future business. If we are unable to obtain such licenses, permits, or approvals in a timely fashion, we could be subject to penalties and operational disruption and our financial condition and results of operations could be adversely affected.

We face intense competition which could adversely affect our results of operations and market share.

We operate in a highly competitive and fragmented industry that is sensitive to price, content (i.e. curriculum) and quality of service. Some of our competitors may have more financial resources, longer operating histories, larger customer bases and greater brand recognition than we do, or they are controlled or subsidized by foreign governments, which enables them to obtain or raise capital and enter into strategic relationships more easily. We also compete with leading domestic supplier companies based on a number of factors including business model, operational capabilities, cost control and service quality, as well as in-house delivery capabilities to serve their logistics needs and compete with us.

We are also subject to other risks and uncertainties that affect many other businesses, including but not limited to:

| (1) | Increasing costs, the volatility of costs and funding requirements and other legal mandates for employee benefits, especially pension and healthcare benefits; |

| (2) | The increasing costs of compliance with federal, state and foreign governmental agency mandates; |

| (3) | Any impacts on our business resulting from new domestic and international government laws and regulation; |

| (4) | Market conditions in the childhood education industry or the economy as a whole; |

| (5) | Market acceptance of our new service and growth initiatives; |

| (6) | Announcements of the introduction of new products and services by our competitors; |

| (7) | The impact of technology developments on our operations and on demand for our products and services; |

| (8) | Developments concerning current or future strategic collaborations; |

| (9) | Widespread outbreak of an illness or any other communicable disease, or any other public health crisis such as we are currently experiencing with the COVID 19 pandemic. |

If we are unable to respond to these changing market conditions, our business and financial results may be materially affected.

14

Risks Related to Our Ordinary Shares

If we fail to comply with the continued listing requirements of NASDAQ, we would face possible delisting, which would result in a limited public market for our shares and make obtaining future debt or equity financing more difficult for us.

On November 18, 2019, we received a notification letter from the Nasdaq Listing Qualifications Staff of The NASDAQ Stock Market LLC (“Nasdaq”) notifying us that we are no longer in compliance with the minimum stockholders’ equity requirement for continued listing on the Nasdaq Capital Market set forth in Nasdaq Listing Rule 5550(b)(1) (the “Stockholder Equity Requirement”).The notification received had no immediate effect on the listing of the Company’s ordinary shares on Nasdaq. Nasdaq has provided us with 45 calendar days, or until January 2, 2020, to submit a plan to regain compliance with the minimum stockholders’ equity standard. If our plan to regain compliance is accepted, Nasdaq may grant an extension of up to 180 calendar days from the date of the notification letter, or until May 16, 2019, to evidence compliance. On January 2, 2020, we submitted our plan of compliance to Nasdaq.

On January 24, 2020, we received a notice (the “Notice”) from Nasdaq stating that we were not able to regain compliance with the Stockholder Equity Requirement or the alternative criteria set forth in Nasdaq Listing Rule 5550(b) and that the Staff had determined to seek to delist the Company’s securities from Nasdaq unless the Company requests a hearing before the Nasdaq Hearings Panel (the “Panel”). On January 28, 2020 we requested a hearing before the Panel. Such request will stay any suspension or delisting action by Nasdaq pending the completion of the hearing process. On January 30, 2020, we received a hearing instruction letter from Nasdaq stating that the delisting action referenced in the Notice has been stayed, pending a final written decision by the Panel.

On March 12, 2020, the Company appeared before the Panel to demonstrate its ability to regain compliance with the Stockholder Equity Requirement and subsequently submitted supplemental information to the Panel on March 23, 2020 pursuant to the Panel’s request. By a letter dated April 16, 2020, the Company was notified by Nasdaq that the Panel had determined to continue the listing of the Company’s ordinary shares based upon the Company’s compliance with the Stockholder Equity Requirement. Additionally, the Panel advised in such letter that is has placed the Company under a Panel Monitor (the “Monitor”) that shall last through April 15, 2021. Pursuant to that Monitor and as provided in the Nasdaq Rules, if at any time during the monitor period the Company fails to maintain compliance with any listing standard, Nasdaq will issue a Staff Delisting Determination and the Hearings Department will promptly schedule a new hearing.

15

The table below lists the Selling Shareholders and other information regarding the “beneficial ownership” of the Ordinary Shares by the Selling Shareholders. In accordance with Rule 13d-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), “beneficial ownership” includes any Ordinary Shares as to which the Selling Shareholders have sole or shared voting power or investment power and any Ordinary Shares that the Selling Shareholders have the right to acquire within sixty (60) days (including Ordinary Shares issuable upon exercise of warrants to purchase Ordinary Shares that are currently exercisable or exercisable within sixty (60) days).

The second column indicates the number of Ordinary Shares beneficially owned by the Selling Shareholders, based on their respective ownership as of August 28, 2020. The second column also assumes the exercise of all of the Warrants held by the Selling Shareholders as of August 28, 2020, without regard to any limitations on exercise described in this prospectus or in the Warrants.

The third column lists the Ordinary Shares being offered by this prospectus by the Selling Shareholders.

This prospectus covers the resale of all of the Ordinary Shares issuable upon exercise of the Warrants that are held by the Selling Shareholders. The Selling Shareholders can offer all, some or none of their Ordinary Shares, thus we have no way of determining the number of the Ordinary Shares underlying Warrants that will be held after this offering. Therefore, the fourth and fifth columns assume that the Selling Shareholders will sell all of the Ordinary Shares issuable upon exercise of the Warrants which are covered by this prospectus. See “Plan of Distribution.”

| Number

of Ordinary Shares Owned Prior to Offering(1) | Maximum Number of Ordinary Shares to be Sold Pursuant to this Prospectus | Number

of Ordinary Shares Owned After Offering(1) | Percentage Beneficially Owned After Offering(1) | |||||||||||||

| Hudson Bay Master Fund Ltd.(2) | 650,000 | 650,000 | 0 | * | % | |||||||||||

| Anson Investments Master Fund LP(3) | 650,000 | 650,000 | 0 | * | ||||||||||||

| Intracoastal Capital LLC(4) | 1,081,819 | 1,081,819 | 0 | * | ||||||||||||

| L1 Capital Global Opportunities Master Fund(5) | 931,818 | 931,818 | 0 | * | ||||||||||||

| TOTAL | 3,313,637 | 3,313,637 | 0 | * | % | |||||||||||

| * | Less than 1% |

| (1) | Includes Ordinary Shares owned by the Selling Shareholders upon full exercise of all Warrants to purchase Ordinary Shares that are held by the Selling Shareholders. The April Warrants and May Warrants are exercisable for one Ordinary Share at exercise prices of $0.04 and $0.185 per share (as adjusted), respectively. |

| (2) | Hudson Bay Capital Management LP, the investment manager of Hudson Bay Master Fund Ltd., has voting and investment power over these securities. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management LP. Each of Hudson Bay Master Fund Ltd. and Sander Gerber disclaims beneficial ownership over these securities. |

| (3) | Anson Advisors Inc and Anson Funds Management LP, the Co-Investment Advisers of Anson Investments Master Fund LP (“Anson”), hold voting and dispositive power over the Ordinary Shares held by Anson. Bruce Winson is the managing member of Anson Management GP LLC, which is the general partner of Anson Funds Management LP. Moez Kassam and Amin Nathoo are directors of Anson Advisors Inc. Mr. Winson, Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of these Common Shares except to the extent of their pecuniary interest therein. The principal business address of Anson is Walkers Corporate Limited, Cayman Corporate Centre, 27 Hospital Road, George Town, Grand Cayman KY1-9008, Cayman Islands. |

| (4) | Mitchell P. Kopin (“Mr. Kopin”) and Daniel B. Asher (“Mr. Asher”), each of whom are managers of Intracoastal Capital LLC (“Intracoastal”), have shared voting control and investment discretion over the securities reported herein that are held by Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be deemed to have beneficial ownership (as determined under Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) of the securities reported herein that are held by Intracoastal. |

| (5) | David Feldman has voting and dispositive power over the securities owned by L1 Capital Global Opportunities Master Fund. The address of L1 Capital Global Opportunities Master Fund is 161A Shedden Road, 1 Artillery Court, PO Box 10085, Grand Cayman KY1-1001, Cayman Islands. |

16

Material Relationships with Selling Shareholders

We have had the following material relationships with the Selling Shareholders in the last three (3) years:

Registered Direct Offering

On March 31, 2020, the Company and the Selling Shareholders entered into certain securities purchase agreement, pursuant to which the Company agreed to sell to the Selling Shareholders an aggregate of 2,727,274 Ordinary Shares in a registered direct offering and the April Warrants to purchase up to 2,727,274 Ordinary Shares in a concurrent private placement, for gross proceeds of approximately $1.5 million (the “April Offering”). The April Offering closed on April 2, 2020, upon the satisfaction of all closing conditions. As of the date of this prospectus, the Selling Shareholders have partially exercised the April Warrants to purchase 1,713,637 Ordinary Shares at the exercise price of $0.04 per share.

On May 11, 2020, the Company and the Selling Shareholders entered into certain securities purchase agreement, pursuant to which the Company agreed to sell to the Selling Shareholders an aggregate of 2,600,000 Ordinary Shares in a registered direct offering and the May Warrants to purchase up to 2,600,000 Ordinary Shares in a concurrent private placement, for gross proceeds of approximately $1.43 million (the “May Offering”). The May Offering closed on May 13, 2020, upon the satisfaction of all closing conditions. As of the date of this prospectus, the Selling Shareholders have partially exercised the May Warrants to purchase 300,000 Ordinary Shares at the exercise price of $0.185 per share.