As filed with the Securities and Exchange Commission on April 1, 2024

Securities Act Registration No. 333-

United States

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

Form

REGISTRATION STATEMENT

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

| ☐ | PRE-EFFECTIVE AMENDMENT NO. |

| ☐ | POST-EFFECTIVE AMENDMENT NO. |

and/or

| ☐ | REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 |

| ☐ | AMENDMENT NO. |

Registrant Exact Name as Specified in Charter

Address of Principal Executive Offices (Number, Street, City, State, Zip Code)

Registrant’s Telephone Number, including Area Code

Name and Address (Number, Street, City, State, Zip Code) of Agent for Service

Copies of Communications to:

| David A. Hearth Paul Hastings LLP 101 California Street, 48th Floor San Francisco, California 94111 (415) 856-7000 |

R.

William Burns Paul Hastings LLP 600 Travis Street, 58th Floor Houston, Texas 77002 (713) 860-7300 |

Paul D. Tropp, Esq. Ropes & Gray LLP 1211 Avenue of the Americas New York, NY 10036 (212) 596-9000 |

Approximate Date of Commencement of Proposed Public Offering:

| Check box if the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans. |

| Check box if any securities being registered on this form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend reinvestment plan. |

| Check box if this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto. |

| Check box if this Form is a registration statement pursuant to General Instruction B or a post-effective amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act. |

| Check box if this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction B to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act. |

It is proposed that this filing will become effective (check appropriate box)

| When declared effective pursuant to section 8(c) of the Securities Act. |

If appropriate, check the following box:

| This [post-effective] amendment designates a new effective date for a previously filed [post-effective amendment] [registration statement]. |

| This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is ___________. |

| This Form is a post-effective amendment filed pursuant to Rule 462(c)under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is ___________. |

| This Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is ___________. |

Check each box that appropriately characterizes the Registrant:

| Registered Closed-End Fund (closed-end company that is registered under the Investment Company Act of 1940 (“Investment Company Act”)). |

| Business Development Company (closed-end company that intends or has elected to be regulated as a business development company under the Investment Company Act). |

| Interval Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act). |

| A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form). |

| Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act). |

| Emerging Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934). |

| If an Emerging Growth Company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. |

| New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months preceding this filing). |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED APRIL 1, 2024

PRELIMINARY PROSPECTUS

Kayne

Anderson BDC, Inc.

Common Stock

We are a business development company (“BDC”) that invests primarily in first lien senior secured loans with a secondary focus on unitranche and split-lien loans to private middle market companies. We are managed by our investment adviser, KA Credit Advisors, LLC (the “Advisor”), an indirect controlled subsidiary of Kayne Anderson Capital Advisors, L.P. (“Kayne Anderson”), a prominent alternative investment management firm. Our investment objective is to generate current income and, to a lesser extent, capital appreciation. See “Prospectus Summary—Kayne Anderson, Kayne Anderson Private Credit and The Advisor” for a discussion of the Advisor’s and Kayne Anderson’s roles in achieving our investment objective.

Under normal market conditions, we expect at least 90% of our portfolio (including investments purchased with proceeds from borrowings under credit facilities and issuances of senior unsecured notes) to be invested in first lien senior secured, unitranche and split-lien loans. Our investment decisions are made on a case-by-case basis. We expect that a majority of these debt investments will be made in “core middle market companies” (as defined in “Prospectus Summary—Investment Objective, Principal Strategy and Investment Structures”) and will have stated maturities of three to six years. We expect that the loans in which we principally invest will be to companies that are located in the United States. We determine the location of a company as being in the United States by (i) such company being organized under the laws of one of the states in the United States; or (ii) during its most recent fiscal year, such company derived at least 50% of its revenues or profits from goods produced or sold, investments made, or services performed in the United States or has at least 50% of its assets in the United States.

We are an externally managed, non-diversified, closed-end management investment company that has elected to be regulated as a BDC under the Investment Company Act of 1940, as amended (“1940 Act”).

We have elected to be treated, and intend to qualify annually, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”) for U.S. federal income tax purposes. As a BDC and a RIC, we are required to comply with certain regulatory requirements.

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and will be subject to reduced public company reporting requirements.

This is our initial public offering of shares of our common stock and all of the shares of common stock offered by this prospectus are being sold by us.

Our Board of Directors has approved an open market share repurchase plan, (the “Company 10b5-1 Plan”), to acquire up to $ million in the aggregate of our Common Stock within one year of the closing of this offering. See “The Company—Share Repurchase Plan.” The purchase of shares of Common Stock pursuant to the Company 10b5-1 Plan is intended to satisfy the conditions of Rule 10b5-1 and Rule 10b-18 under the Securities Exchange Act of 1934.

Our common stock has no history of public trading. We currently expect that the initial public offering price per share will be $ per share. We intend to apply to list our common stock on The New York Stock Exchange under the symbol “KBDC” on or promptly after the date of this prospectus.

If you invest in shares of our common stock, your interest will be diluted to the extent of the difference between the initial public offering price per share of common stock and the pro forma net asset value per share of common stock immediately after the completion of this offering. Assuming an initial public offering price of $ per share, purchasers in this offering will experience dilution of approximately $ per share. See “Dilution” for more information.

Investing in shares of our common stock involves a high degree of risk, including credit risk and the risk of the use of leverage in the form of borrowings under credit facilities and issuances of senior unsecured notes, and is highly speculative. We also intend to further borrow under credit facilities and/or issue senior unsecured notes in the future in order to finance our investments. See “Risk Factors—Risks Relating to Our Business and Structure—We finance our investments with borrowings under credit facilities and issuances of senior unsecured notes, which will magnify the potential for gain or loss on amounts invested and may increase the risk of investing in us.” In addition, shares of closed-end investment companies, including BDCs, frequently trade at a discount to their net asset values. If shares of our common stock trade at a discount to our net asset value, purchasers in this offering will face increased risk of loss. Before buying any shares of our common stock, you should read the discussion of the material risks of investing in shares of our common stock, including the risk of leverage, in “Risk Factors” beginning on page 23 of this prospectus.

-i-

We invest in debt that is typically not rated by any rating agency, but we believe that if such investments were rated, they would be below investment grade, which are sometimes referred to as “high yield bonds” or “junk bonds.” See “Risk Factors—Risks Relating to Our Investments—We invest in highly leveraged companies, which could cause us to lose all or a part of our investment in those companies.” In addition, we have a maturity policy between three to six years for our debt investments. See “Risk Factors—Risks Relating to Our Investments—Our prospective portfolio companies may be unable to repay or refinance outstanding principal on their loans at or prior to maturity.”

This prospectus contains important information about the Company that you should know before investing in shares of our common stock. Please read this prospectus before deciding whether to invest in our securities and retain it for future reference. We also file annual, quarterly, and current reports, proxy statements and other information about us with the United States Securities and Exchange Commission (the “SEC”), and such filings will be available upon written or oral request and without charge. You may request a free copy of this information about us or make stockholder inquiries, by calling us at (713) 493-2020 or by contacting us at 717 Texas Avenue, Suite 2200, Houston Texas, 77002. Such information about the Company also will be available for free on our website at www.kaynebdc.com. Information on our website is not incorporated into or a part of this prospectus, and you should not consider that information to be part of this prospectus. The SEC maintains a website (http://www.sec.gov) that contains material incorporated by reference and other information regarding the Company.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Price to Public | Sales

load (underwriting discounts and commissions)(1) | Proceeds to us (2) | ||||||||||

| Per Share | $ | $ | $ | |||||||||

| Total | $ | $ | $ | |||||||||

| (1) | Because the sales load is an expense of the Company, our common stockholders will bear indirectly the sales load of this offering, which as a result will immediately reduce the net asset value of each common share purchased in this offering. See “Underwriters” for a more completed description of underwriting compensation. |

| (2) | We estimate that we will incur offering expenses of approximately $ million, or approximately $ per share for the number of shares in this offering, in connection with this offering. Our common stockholders will bear indirectly the offering expenses of this offering, which as a result will immediately reduce the net asset value of each common share purchased in this offering. For more information about such offering expenses, please see “Item 27. Other Expenses of Issuance and Distribution.” |

We have granted the underwriters an option to purchase up to an additional shares of our common stock from us, at the public offering price, less the sales load payable by us, within 30 days from the date of this prospectus. If the underwriters exercise their option in full, the total sales load will be $ million and total proceeds to us, before expenses, will be $ million.

The underwriters expect to deliver the common stock to purchasers on or about , 2024.

Joint Lead Book Running Managers

| Morgan Stanley | BofA Securities | Wells Fargo Securities | RBC Capital Markets |

Joint Book Running Managers

| UBS Investment Bank | Keefe, Bruyette & Woods |

| A Stifel Company |

Co-Managers

| SMBC Nikko | Regions Securities LLC | Academy Securities | Ramirez & Co., Inc. |

The date of this prospectus is , 2024.

-ii-

TABLE OF CONTENTS

Statistical and market data used in this prospectus has been obtained from governmental and independent industry sources and publications. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements contained in this prospectus, for which the safe harbor provided in Section 27A of the Securities Act and Section 21E of the Exchange Act is not available. See “Cautionary Notice Regarding Forward-Looking Statements.”

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this prospectus is accurate only as of the date on the front of this prospectus. Our business, financial condition and prospects may have changed since that date. To the extent required by applicable law, we will update this prospectus during the offering period to reflect material changes to the disclosure herein.

-iii-

Prospectus Summary

This summary highlights some of the information in this prospectus. It is not complete and may not contain all of the information that you may want to consider before investing in our common stock. You should read our entire prospectus before investing in our common stock. Throughout this prospectus we refer to Kayne Anderson BDC, Inc. as “we,” “us,” “our” or the “Company,” and to “KA Credit Advisors, LLC,” our investment advisor, as the “Advisor.”

Kayne Anderson BDC, Inc.

We are a business development company (“BDC”) that invests primarily in first lien senior secured loans, with a secondary focus on unitranche and split-lien loans to private middle market companies. We are managed by our investment advisor, KA Credit Advisors, LLC (the “Advisor”), an indirect controlled subsidiary of Kayne Anderson Capital Advisors, L.P. (“Kayne Anderson”), and the Advisor operates within Kayne Anderson’s private credit line of business (“KAPC”). Kayne Anderson is a prominent alternative investment management firm, focused on real estate, credit, infrastructure/energy and growth capital. Our Advisor is registered with the United States Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”).

We are a Delaware corporation that commenced operations on February 5, 2021. We are an externally managed, closed-end, non-diversified management investment company that has elected to be regulated as a BDC under the Investment Company Act of 1940, as amended (the “1940 Act”). In addition, for U.S. federal income tax purposes, we intend to qualify, annually, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”).

We generally intend to distribute, out of assets legally available for distribution, 90 to 100% of our available earnings, on a quarterly or annual basis, as determined by our Board of Directors (the “Board”) in its sole discretion. The distributions we pay to our stockholders in a year may exceed our taxable income for that year and, accordingly, a portion of such distributions equal to such excess of distributions over taxable income may constitute a return of invested capital for federal income tax purposes. Such a return of capital (i.e., a distribution that represents a return of an investor’s original investment) would be nontaxable to the stockholder and would reduce its basis in its shares. As a result, income tax related to the portion of such distributions treated as return of capital would be deferred until any subsequent sale of shares of common stock. The specific tax characteristics of our distributions will be reported to stockholders after the end of the calendar year. See “Distributions” and “Certain U.S. Federal Income Tax Considerations.”

Investment Portfolio

Our portfolio is currently comprised of a broad mix of loans with diversity among investment size and industry focus. Our Advisor’s team of professionals conducts due diligence on prospective investments during the underwriting process and is involved in structuring the credit terms of substantially all of our investments. Once an investment has been made, our Advisor closely monitors portfolio investments and takes a proactive approach identifying and addressing sector or company specific risks. Our Advisor maintains a regular dialogue with portfolio company management teams (as well as their owners, the majority of whom are private equity firms, where applicable), reviews detailed operating and financial results on a regular basis (typically monthly or quarterly) and monitors current and projected liquidity needs, in addition to other portfolio management activities.

As of December 31, 2023, we had investments in 76 portfolio companies with an aggregate fair value of approximately $1,363 million, and unfunded commitments to these portfolio companies of $148 million, and our portfolio consisted of 97.1% first lien senior secured loans, 1.6% junior debt and 1.3% equity investments.

As of December 31, 2023, our weighted average yield of debt and income producing securities at fair value, and amortized cost was 12.5% and 12.7%, respectively, and 100% of our debt investments were at floating rates.

As of December 31, 2023, our portfolio was invested across 26 different industries (Global Industry Classification “GICS”, Level 3 – Industry). The largest industries in our portfolio as of December 31, 2023 were Trading Companies & Distributors, Food Products and Commercial Services & Supplies, which represented, as a percentage of our portfolio of long-term investments, 15.3%, 11.5% and 9.4%, respectively, based on fair value. The industries in which our portfolio companies operate may change over time.

As of December 31, 2023, our average position size based on commitment (at the portfolio company level) was $20.1 million, and the weighted average and median last twelve months (“LTM”) earnings before interest expense, income tax expense, depreciation and amortization (“EBITDA”) of our portfolio companies was $51.3 million and $39.5 million, respectively, based on fair value.

As of December 31, 2023, the weighted average loan-to-enterprise value (“LTEV”) of our debt investments at the time of our initial investment was 44.0%. LTEV represents the total par value of our debt investment relative to our estimate of the enterprise value of the underlying borrower.

As of December 31, 2023, we had one debt investment on non-accrual status, which represented 0.4% and 0.4% of total debt investments at cost and fair value, respectively.

As of December 31, 2023, our portfolio companies had an average leverage of 4.3x and average interest coverage of 2.7x, the calculations for which are based on the most recent quarter end or latest available information from the portfolio companies.

As of December 31, 2023, 100% of our debt investments included at least one financial maintenance covenant.

As a BDC, at least 70% of our assets must be the type of “qualifying” assets listed in Section 55(a) of the 1940 Act, as described herein, which are generally privately-offered securities issued by U.S. private or thinly-traded companies. We may also invest up to 30% of our portfolio opportunistically in “non-qualifying” portfolio investments. As of December 31, 2023, 4.8% of the Company’s total assets were in non-qualifying investments.

1

Investment Objective, Principal Strategy and Investment Structures

Our investment objective is to generate current income and, to a lesser extent, capital appreciation. Nearly all of our debt investments are in private middle market companies. We use “private” to refer to companies that are not traded on a securities exchange and define “middle market companies” as companies that, in general, generate between $10 million and $150 million of annual EBITDA. Further, we refer to companies that generate between $10 million and $50 million of annual EBITDA as “core middle market companies” and companies that generate between $50 million and $150 million of annual EBITDA as “upper middle market companies.” We typically adjust EBITDA for non-recurring and/or normalizing items to assess the financial performance of our borrowers over time.

We intend to achieve our investment objective by investing primarily in first lien senior secured loans, with a secondary focus on unitranche and split-lien loans to private middle market companies. Under normal market conditions, we expect at least 90% of our portfolio (including investments purchased with proceeds from borrowings under credit facilities and issuances of senior unsecured notes) to be invested in first lien senior secured, unitranche and split-lien loans. Our investment decisions are made on a case-by-case basis. We expect that a majority of these debt investments will be made in core middle market companies and will have stated maturities of three to six years. We expect that the loans in which we principally invest will be to companies that are located in the United States. We determine the location of a company as being in the United States by (i) such company being organized under the laws of one of the states in the United States; or (ii) during its most recent fiscal year, such company derived at least 50% of its revenues or profits from goods produced or sold, investments made, or services performed in the United States or has at least 50% of its assets in the United States.

See “The Company—Investment Process Overview—Loan Origination” for a detailed description of our investment process and loan origination. See also “Risk Factors—Risks Relating to Our Business and Structure—We depend upon our Advisor and Administrator for our success and upon their access to the investment professionals and partners of Kayne Anderson and its affiliates. Any inability of the Advisor or the Administrator to maintain or develop these relationships, or the failure of these relationships to generate investment opportunities, could adversely affect our business, and “—Risks Relating to Our Investments—Limitations of investment due diligence in the private middle market companies in which we invest expose us to increased investment risk.”

We intend to principally invest in the following types of debt securities:

● | First lien debt: Typically senior on a lien basis to the other liabilities in the issuer’s capital structure with a first priority lien against substantially all assets of the borrower and often including a pledge of the capital stock of the business. The security interest ranks above the security interest of second lien lenders on those assets. These securities are typically floating rate investments priced with a spread to the reference rate (typically the Secured Overnight Financing Rate (“SOFR”)); | |

| ● | Split-lien debt: Typically includes (i) a first lien on fixed and intangible assets of the borrower and often including a pledge of the capital stock of the business and (ii) a second lien on working capital assets. Used in conjunction with an asset based lender who has a first lien on the borrower's working capital assets. These securities are typically floating rate investments priced with a spread to the reference rate (typically SOFR). | |

| ● | Unitranche debt: Combines features of first lien, second lien and subordinated debt, generally in a first lien position. These securities can generally be thought of as first lien investments beyond what may otherwise be considered “typical” first lien leverage levels, effectively representing a greater portion of the overall capitalization of the underlying business. These securities are typically structured as floating rate investments priced with a spread to the reference rate (typically SOFR). |

Senior secured debt often has restrictive covenants for the purpose of pursuing principal protection and repayment before junior creditors as covenants provide opportunities for lenders to take action following a covenant breach. The loans in which we principally invest will have financial maintenance covenants, which require borrowers to maintain certain financial performance criteria and financial ratios on a monthly or quarterly basis.

Currently, we partially finance our investments with leverage in the form of borrowings under credit facilities and issuances of senior unsecured notes. We also intend to further borrow under credit facilities and/or issue senior unsecured notes in the future in order to finance our investments. As of December 31, 2023, we had $695.8 million of indebtedness outstanding under our credit facilities and senior unsecured notes. See “Risk Factors—Risks Relating to Our Business and Structure—Provisions in our credit facilities and our senior unsecured notes contain various covenants, which, if not complied with, could accelerate our repayment obligations under such facilities, thereby materially and adversely affecting our liquidity, financial condition, results of operations and ability to pay distributions.” In accordance with the 1940 Act, we are required to meet a coverage ratio of total assets (less total liabilities other than indebtedness) to total borrowings and other senior securities of at least 150%. If this ratio declines below 150%, we cannot incur additional leverage and could be required to sell a portion of our investments to repay some leverage when it is disadvantageous to do so. See “Regulation” for a discussion of BDC regulation and other regulatory considerations. See also “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Contractual Obligations.”

We invest in debt that is typically not rated by any rating agency, but we believe that if such investments were rated, they would be below investment grade, which are sometimes referred to as “high yield bonds” or “junk bonds.” See “Risk Factors—Risks Relating to Our Investments—We invest in highly leveraged companies, which could cause us to lose all or a part of our investment in those companies.” In addition, we have a maturity policy between three to six years for our debt investments. See “Risk Factors—Risks Relating to Our Investments—Our prospective portfolio companies may be unable to repay or refinance outstanding principal on their loans at or prior to maturity.”

2

Private Offerings

Between February 2021 and December 2023, we executed subscription agreements with investors on sixteen occasions as part of one continuous private placement offering obligating those investors to purchase shares of common stock representing total aggregate capital commitments of $1.047 billion. The execution of the subscription agreements were effected as part of one continuous private placement offering exempt from the registration requirements of the Securities Act pursuant to Section 4(a)(2) thereunder. Pursuant to the private placement offering that began on February 5, 2021, we called capital under the terms of those subscription agreements and we issued shares of common stock to investors on twelve funding occasions between February 2021 and February 2024 in an aggregate amount of $777.0 million.

On March 22, 2024, we delivered the final capital call notice, which will result in the issuance of $269.9 million of additional shares of common stock in the private placement offering at a price per share of our expected NAV per share as of , 2024, which was $ . Following this final capital call and issuance of shares of our common stock, the investors’ obligations to purchase additional shares of common stock will be exhausted in the final closing expected to occur on or around April 2, 2024, and we will not have any remaining undrawn capital commitments. This final capital drawdown notice will complete our pre-initial public offering capital raise private placement offering exempt from the registration requirements of the Securities Act pursuant to Section 4(a)(2) thereunder. Such capital raise is separate from and not conditioned on this offering. See also “The Company—Private Offerings.”

Kayne Anderson, Kayne Anderson Private Credit and The Advisor

Kayne Anderson

Founded in 1984, Kayne Anderson is a prominent alternative investment management firm which is registered with the SEC under the Advisers Act, focused on real estate, credit, infrastructure/energy and growth capital. Kayne Anderson provides corporate and management services (such as information technology, human resources, compliance and legal services) to the Advisor.

As of December 31, 2023, investment vehicles managed or advised by Kayne Anderson had over $34 billion in assets under management (“AUM”) for institutional investors, family offices, high net worth and retail clients. Kayne Anderson has over 330 professionals located across five offices across the U.S. The firm has approximately 140 investment professionals, approximately 35 of which are dedicated to credit investing.

Kayne Anderson Private Credit

KAPC is Kayne Anderson’s line of business focused on private credit that operates various fund vehicles targeting middle market first lien senior secured, unitranche, and split-lien loans. KAPC was established in 2011 and manages (indirectly through affiliates) AUM of approximately $6.5 billion related to middle market private credit as of December 31, 2023.

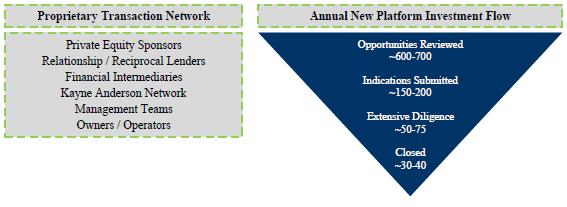

KAPC’s integrated and scaled platform combines direct loan origination, strong fundamental credit analysis and relative-value perspective.

The Advisor – KA Credit Advisors, LLC

Our investment activities are managed by our Advisor, an indirect controlled subsidiary of Kayne Anderson, and the Advisor operates within KAPC’s line of business. The Advisor is an investment advisor registered with the SEC under the Advisers Act pursuant to an investment advisory agreement between us and the Advisor (the “Investment Advisory Agreement”). In accordance with the Advisers Act, our Advisor is responsible for originating prospective investments, conducting research and due diligence investigations on potential investments, analyzing investment opportunities, negotiating and structuring investments and monitoring our investments and portfolio companies on an ongoing basis. The Advisor benefits from the scale and resources of Kayne Anderson and specifically KAPC.

The Advisor executes on our investment objective by (1) accessing the established loan sourcing channels developed by KAPC, which includes an extensive network of private equity firms, other middle market lenders, financial advisors, intermediaries and management teams, (2) selecting investments within our middle market company focus, (3) implementing KAPC’s underwriting process and (4) drawing upon its experience and resources and the broader Kayne Anderson network.

The principal executive offices of our Advisor are located at 717 Texas Avenue, Suite 2200, Houston, Texas 77002.

3

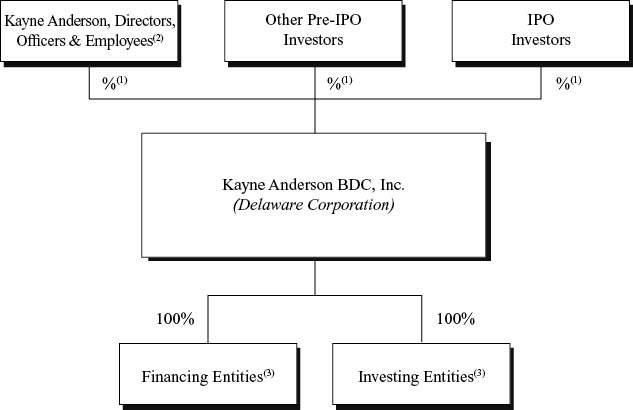

Corporate Structure

We are a Delaware corporation and commenced operations on February 5, 2021. The following chart depicts our ownership structure assuming closing of this offering:

| (1) | Assuming the underwriters do not exercise their option to purchase additional shares of common stock. |

| (2) | Includes Kayne Anderson, certain partners and employees of Kayne Anderson and certain directors and officers of the Company. |

| (3) | From time to time we may form wholly-owned subsidiaries to facilitate our normal course of business investing activities. |

4

Investment Advisory Agreement

On February 5, 2021, the Company entered into an investment advisory agreement (the “Investment Advisory Agreement”) with its Advisor. Pursuant to the Investment Advisory Agreement, the Company pays its Advisor a fee for investment advisory and management services consisting of two components—a base management fee and an incentive fee. The Advisor may, from time-to-time, grant waivers on the Company’s obligations, including waivers of the base management fee and/or incentive fee, pursuant to Section 3(c) of the Investment Advisory Agreement. Any base management fee or incentive fee so waived will not be subject to recoupment by the Advisor. The Investment Advisory Agreement automatically terminates in the event of its assignment, as defined in the 1940 Act, and may be terminated by either party without penalty upon 60 days’ prior written notice to the other. The Company may terminate the Investment Advisory Agreement upon 60 days' prior written notice to the Advisor: (i) upon the vote of the holders of a majority of the Company's outstanding voting securities, as defined in the 1940 Act, or (ii) by the vote of the independent directors of the Board. On March 7, 2023, the Board approved a one-year renewal of the Investment Advisory Agreement through March 15, 2024. The Investment Advisory Agreement will continue in effect from year to year after its current one-year term commencing on March 15, 2023 so long as its continuation is approved at least annually by our Board including a majority of Independent Directors or the vote of a majority of our outstanding voting securities.

On March 6, 2024, the Company entered into an amended and restated investment advisory agreement with the Advisor (the “Amended Investment Advisory Agreement”), which is effective upon the closing of this offering. The Amended Investment Advisory Agreement is materially the same as the Investment Advisory Agreement except, following this offering, the base management fee will be calculated at an annual rate of 1.00% and the incentive fee on income will be subject to a twelve-quarter lookback quarterly hurdle rate of 1.50% as opposed to a single quarter measurement and will become subject to an Incentive Fee Cap (as defined below) based on the Company’s Cumulative Pre-Incentive Fee Net Return (as defined below). The Amended Investment Advisory Agreement will not result in higher incentive fees (taking into account all fees payable during the calculation period) payable to the Advisor than the incentive fees that would have otherwise been payable to the Advisor under the Investment Advisory Agreement. See “Management and Other Agreements—Investment Advisory Agreement.”

The cost of both the management fee and the incentive fee under the Amended Investment Advisory Agreement will ultimately be borne by common stockholders. The Amended Investment Advisory Agreement was approved by the Board on March 6, 2024. Unless earlier terminated, the Amended Investment Advisory Agreement will renew automatically for successive annual periods, provided that such continuance is specifically approved at least annually by our Board including a majority of Independent Directors or the vote of a majority of our outstanding voting securities.

As discussed in more detail below, on March 6, 2024, the Advisor entered into the Amended Investment Advisory Agreement (effective upon the closing of this offering) to include a three-year total return lookback feature on the income incentive fee. This lookback feature provides that the Advisor’s income incentive fee may be reduced if the Company’s portfolio experiences aggregate write-downs or net capital losses during the applicable Trailing Twelve Quarters (as defined below). On March 6, 2024 the Advisor also entered into a fee waiver agreement (the “Fee Waiver Agreement”) for the waivers of (i) the income incentive fee for three calendar quarters commencing in the calendar quarter this offering is completed and (ii) a portion of the base management fee for one year following the completion of this offering. The Fee Waiver Agreement will become effective upon the closing of this offering. Amounts waived by the Advisor pursuant to the Fee Waiver Agreement are not subject to recoupment by the Advisor. The waivers of the base management fee and incentive income fee pursuant to the Fee Waiver Agreement may only be terminated by the Board and may not be terminated by the Advisor. The Fee Waiver Agreement is contractual in nature.

As described in more detail below, under the Amended and Restated Investment Advisory Agreement, upon the closing of this offering, (i) the base management fee will increase from 0.90% of the fair market value of the Company’s investments to 1.00% of the fair market value of the Company’s investments (prior to taking into account the effect of the Fee Waiver Agreement) and (ii) the income incentive fee will increase from 10.0% to 15.0% (prior to taking into account the effect of the Fee Waiver Agreement). As a result, the Advisor stands to benefit from the consummation of this offering resulting in an increase in the base management fee and income incentive fee (prior to taking into account the effect of the Fee Waiver Agreement), which would increase the expenses borne by our common stockholders. The Adviser, therefore, has an interest in facilitating the Company’s completion of this offering. See “Potential Conflicts of Interest.”

Base Management Fee

Effective upon the closing of this offering, the base management fee pursuant to the Amended Investment Advisory Agreement will be calculated at an annual rate of 1.00% of the fair market value of the Company’s investments. If this offering occurs on a date other than the first day of a calendar quarter, the base management fee will be calculated for such calendar quarter at a weighted rate based on the fee rates applicable before and after the closing of this offering based on the number of days in such calendar quarter before and after the closing of this offering. Pursuant to the Fee Waiver Agreement effective upon the closing of this offering, the Advisor has implemented a waiver of the base management fee at an annual rate of 0.25% for one year following the completion of this offering.

Prior to the closing of this offering, the base management fee is calculated at an annual rate of 0.90% of the fair market value of the Company’s investments.

The base management fee under the Amended Investment Advisory Agreement will be payable quarterly in arrears and calculated based on the average of the Company’s fair market value of investments, at the end of the two most recently completed calendar quarters, including, in each case, assets purchased with borrowings under credit facilities and issuances of senior unsecured notes, but excluding cash, U.S. government securities and commercial paper instruments maturing within one year of purchase. Base management fees for any partial quarter will be appropriately pro-rated.

5

Incentive Fee

The Company will also pay the Advisor an incentive fee. The incentive fee will consist of two parts—an incentive fee on income and an incentive fee on capital gains. Described in more detail below, these components of the incentive fee will be largely independent of each other with the result that one component may be payable even if the other is not.

Incentive Fee on Income

The incentive fee based on income (the “income incentive fee”) under the Amended Investment Advisory Agreement is determined and paid quarterly in arrears in cash (subject to the limitations described in “Payment of Incentive Fees” below).

Under the Amended Investment Advisory Agreement, the first part of the income incentive fee is calculated and payable quarterly in arrears based on the Company’s pre-incentive fee net investment income as defined in the Amended Investment Advisory Agreement. Pre-incentive fee net investment income means, as the context requires, either the dollar value of, or percentage rate of return on the value of, the Company’s net assets at the beginning of each applicable calendar quarter from interest income, dividend income and any other income (including any other fees (other than fees for providing managerial assistance), such as commitment, origination, structuring, diligence and consulting fees or other fees that the Company receives from portfolio companies) accrued during the calendar quarter, minus the Company’s operating expenses accrued for the quarter (including the management fee, expenses payable under the Administration Agreement (as defined below), and any interest expense or fees on any credit facilities or senior unsecured notes and dividends paid on any issued and outstanding preferred shares, but excluding the incentive fee). Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with pay in kind (“PIK”) interest and zero coupon securities), accrued income that the Company has not yet received in cash. Pre-incentive fee net investment income excludes any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation.

Pursuant to the Investment Advisory Agreement, the Company is required to pay an income incentive fee of 10.0% prior to the closing of this offering and 15.0% following the closing of this offering, with a 1.50% quarterly hurdle and 100% catch-up. Pursuant to the Fee Waiver Agreement, the Advisor has waived its right to receive an income incentive fee during the three calendar quarters commencing with the calendar quarter in which this offering is completed and amounts waived by the Advisor pursuant to the Fee Waiver Agreement are not subject to recoupment by the Advisor.

Following the closing of this offering, the Company will pay the Advisor an income incentive fee based on its aggregate pre-incentive fee net investment income (as described above), with respect to (i) the calendar quarter ending , 2024 (the “First Calendar Quarter”) and (ii) each subsequent calendar quarter, with the then, current calendar quarter and the eleven preceding calendar quarters beginning with the calendar quarter after the First Calendar Quarter (or the appropriate portion thereof in the case of any of the Company’s first eleven calendar quarters that commence after the First Calendar Quarter) (those calendar quarters after the First Calendar Quarter, the “Trailing Twelve Quarters”).

6

For the First Calendar Quarter, pre-incentive fee net investment income in respect of the First Calendar Quarter will be compared to a hurdle rate of 1.50% (6.00% annualized). The income incentive fee for the First Calendar Quarter will be determined as follows:

| ● | no income incentive fee is payable to the Advisor if the aggregate pre-incentive fee net investment income for the First Calendar Quarter does not exceed that hurdle rate; |

| ● | 100% of the aggregate pre-incentive fee net investment income with respect to that portion of such pre-incentive fee net investment income, if any, that exceeds that hurdle rate, but is less than a quarterly rate of 1.6667% for the portion of the First Calendar Quarter before the initial public offering and a quarterly rate of 1.7647% for the portion of the First Calendar Quarter after the initial public offering, referred to the “catch-up.” The “catch-up” is meant to provide the Advisor with approximately 10.0% of the Company’s pre-incentive fee net investment income for the portion of the First Calendar Quarter before the initial public offering and 15.0% for the balance of that First Calendar Quarter, as if the hurdle rate did not apply; and |

| ● | 10.0% of the aggregate pre-incentive fee net investment income, if any, that exceeds a quarterly rate of 1.6667% for the portion of the First Calendar Quarter before the initial public offering and 15.0% of the aggregate pre-incentive fee net investment income, if any, that exceeds a quarterly rate of 1.7647% for the balance of the First Calendar Quarter. |

Commencing with the calendar quarter beginning immediately after the First Calendar Quarter, subject to the Incentive Fee Cap (described below), the pre-incentive fee net investment income in respect of the relevant Trailing Twelve Quarters will be compared to a “Hurdle Rate” equal to the product of (i) the hurdle rate of 1.50% per quarter (6.00% annualized) and (ii) the sum of our net assets at the beginning of each applicable calendar quarter comprising the relevant Trailing Twelve Quarters. The income incentive fee for each calendar quarter will be determined as follows:

| ● | no income incentive fee is payable to the Advisor in any calendar quarter in which aggregate pre-incentive fee net investment income in respect of the relevant Trailing Twelve Quarters does not exceed the Hurdle Rate; |

| ● | 100% of the aggregate pre-incentive fee net investment income in respect of the Trailing Twelve Quarters with respect to that portion of such pre-incentive fee net investment income, if any, that exceeds the Hurdle Rate, but is less than or equal to an amount, which we refer to as the “Catch-up Amount,” determined on a quarterly basis by multiplying 1.7647% by the Company’s net asset value at the beginning of each applicable calendar quarter comprising the relevant Trailing Twelve Quarters (after making appropriate adjustments to the Company’s net asset value at the beginning of each applicable calendar quarter for all issuances by the Company of shares of its common stock, including issuances pursuant to its dividend reinvestment plan, and distributions during the applicable calendar quarter); and |

| ● | 15.0% of the aggregate pre-incentive fee net investment income in respect of the Trailing Twelve Quarters that exceeds the Catch-up Amount. |

Commencing with the quarter that begins immediately after the First Calendar Quarter, each income incentive fee will be subject to an “Incentive Fee Cap” that in respect of any calendar quarter is an amount equal to 15.0% of the Cumulative Pre-Incentive Fee Net Return (as defined herein) during the Trailing Twelve Quarters less the aggregate income incentive fees that were paid to the Advisor in the preceding eleven calendar quarters (or portion thereof) comprising the relevant Trailing Twelve Quarters. In the event the Incentive Fee Cap is zero or a negative value then no income incentive fee shall be payable and if the Incentive Fee Cap is less than the amount of income incentive fee that would otherwise be payable, the amount of income incentive fee shall be reduced to an amount equal to the Incentive Fee Cap.

“Cumulative Pre-Incentive Fee Net Return” means (x) with respect to the First Calendar Quarter, the sum of pre-incentive fee net investment income in respect of the First Calendar Quarter, (y) with respect to the relevant Trailing Twelve Quarters, the pre-incentive fee net investment income in respect of the relevant Trailing Twelve Quarters minus any Net Capital Loss (as defined below), if any, in respect of the relevant Trailing Twelve Quarters. If, in any quarter, the Incentive Fee Cap is zero or a negative value, the Company will pay no income incentive fee to the Advisor for such quarter. If, in any quarter, the Incentive Fee Cap for such quarter is a positive value but is less than the income incentive fee that is payable to the Advisor for such quarter (before giving effect to the Incentive Fee Cap) calculated as described above, the Company will pay an income incentive fee to the Advisor equal to the Incentive Fee Cap for such quarter. If, in any quarter, the Incentive Fee Cap for such quarter is equal to or greater than the income incentive fee that is payable to the Advisor for such quarter (before giving effect to the Incentive Fee Cap) calculated as described above, the Company will pay an income incentive fee to the Advisor equal to the incentive fee calculated as described above for such quarter without regard to the Incentive Fee Cap.

“Net Capital Loss” in respect of a particular period means the difference, if positive, between (i) aggregate capital losses, whether realized or unrealized, in such period and (ii) aggregate capital gains, whether realized or unrealized, in such period.

These calculations are prorated for any period of less than three months and adjusted for any share issuances or repurchases during the relevant quarter. In no event will the amendments to the income incentive fee to include the three year income and total return lookback features allow the Advisor to receive greater cumulative income incentive fees under the Amended Investment Advisory Agreement than it would have under the Investment Advisory Agreement. Amounts waived by the Advisor pursuant to the Fee Waiver Agreement are not subject to recoupment by the Advisor.

7

Incentive Fee on Capital Gains

The incentive fee on capital gains (the “capital gains incentive fee”) will be calculated and payable in arrears in cash as follows:

| ● | After this offering: 15.0% of the Company’s realized capital gains, if any, on a cumulative basis from formation through the end of a given calendar year or upon termination of the Investment Advisory Agreement, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gain incentive fees. |

| ● | Prior to this offering: 10.0% of the Company’s realized capital gains, if any, on a cumulative basis from formation through (a) the day before this offering, (b) upon consummation of a Liquidity Event or (c) upon the termination of the Investment Advisory Agreement, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gain incentive fees. For the purpose of computing the capital gain incentive fee, the calculation methodology will look through derivative financial instruments or swaps as if we owned the reference assets directly. |

Payment of Incentive Fees

Prior to this offering, any incentive fees earned by the Advisor shall accrue as earned but only become payable in cash to the Advisor upon closing of this offering. As of December 31, 2023, the Company had incurred incentive fees of $14.2 million that will become payable upon closing of this offering. To the extent the Company does not complete this offering, the incentive fees will be payable to the Advisor (a) upon consummation of a sale of the Company or (b) once substantially all the proceeds from a Company liquidation payable to the Company’s stockholders have been distributed to such stockholders.

The Administrator

On February 5, 2021, the Company entered into an administration agreement the (“Administration Agreement”) with its Advisor, which serves as its administrator (the “Administrator”) and will provide or oversee the performance of its required administrative services and professional services rendered by others, which will include (but are not limited to), accounting, payment of our expenses, legal, compliance, operations, technology and investor relations, preparation and filing of its tax returns, and preparation of financial reports provided to its stockholders and filed with the SEC. On March 6, 2024, the Board approved a one-year renewal of the Administration Agreement through March 15, 2025.

The Company will reimburse the Administrator for its costs and expenses incurred in performing its obligations under the Administration Agreement, which may include, after completion of this offering, its allocable portion of office facilities, overhead, and compensation paid to or compensatory distributions received by its officers (including our Chief Compliance Officer and Chief Financial Officer) and its respective staff who provide services to the Company. As the Company reimburses the Administrator for its expenses, such costs (including the costs of the sub-administrator) will be ultimately borne by common stockholders. The Administrator does not receive compensation from the Company other than reimbursement of its expenses. The Administration Agreement may be terminated by either party with 60 days’ written notice.

Since the inception of the Company, the Administrator has engaged a sub-administrator to assist the Administrator in performing certain of its administrative duties. Since the inception of the Company, the Administrator has not sought reimbursement of its expenses other than expenses incurred by the sub-administrator. However, the Administrator has a contractual right to seek reimbursement for its costs and expenses incurred in performing its obligations under the Administration Agreement and may do so in the future. On March 28, 2023, the Administrator engaged Ultimus Fund Solutions, LLC under a sub-administration agreement. Under the terms of the sub-administration agreement, Ultimus Fund Solutions, LLC will provide fund administration and fund accounting services. Since March 28, 2023, the Company has paid fees to Ultimus Fund Solutions, LLC, which constitute reimbursable expenses under the Administration Agreement. The Administrator may enter into additional sub-administration agreements with third-parties to perform other administrative and professional services on behalf of the Administrator. See “Management and Other Agreements—Investment Advisory Agreement.”

8

Policies and Procedures for Managing Conflicts

The Advisor and the Administrator have a fiduciary duty to the Company under the 1940 Act, including with respect to the receipt of compensation. The Advisor and its affiliates have policies and procedures in place designed to manage the potential conflicts of interest between our Advisor’s fiduciary obligations to us and its similar fiduciary obligations to other clients. For example, such policies and procedures are designed to ensure that investment opportunities are generally allocated on a pro rata basis based on each account’s capital available for investment. An investment opportunity that is suitable for multiple clients of our Advisor and its affiliates may not be capable of being shared among some or all of such clients and affiliates due to the limited scale of the opportunity or other factors, including regulatory restrictions imposed by the 1940 Act. We can offer no assurance that the efforts of our Advisor and its affiliates to allocate any particular investment opportunity fairly among all clients for whom such opportunity is appropriate will result in an allocation of all or part of such opportunity to us. Our investors should not expect all conflicts of interest to be resolved in our favor.

Allocation of Investment Opportunities and Exemptive Relief

We make investments alongside certain entities and accounts advised by our Advisor and its affiliates. Under the 1940 Act, we are prohibited from knowingly participating in certain joint transactions with our affiliates without the prior approval of the independent directors and, in some cases, prior approval by the SEC. However, we generally make investments alongside affiliated entities and accounts pursuant to exemptive relief granted by the SEC to us, our Advisor, and certain affiliates of ours on February 4, 2020. Pursuant to such exemptive relief, and subject to certain conditions, we are permitted to co-invest in the same security with our affiliates in a manner that is consistent with our investment objective, investment strategy, regulatory consideration and other relevant factors. If opportunities arise that would otherwise be appropriate for us and an affiliate to purchase different securities in the same issuer, our Advisor will need to decide which account will proceed with such investment. Our Advisor’s investment allocation policy incorporates the conditions of exemptive relief to seek to ensure that investment opportunities are allocated in a manner that is fair and equitable.

Corporate Information

Our principal executive offices are located at 717 Texas Avenue, Suite 2200, Houston, Texas, 77002 and our telephone number is (713) 493-2020. Our corporate website is located at www.kaynebdc.com. Information on our website and the SEC’s website is not incorporated into or a part of this prospectus.

Implications of Being an Emerging Growth Company

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and we are eligible to take advantage of certain specified reduced disclosure and other requirements that are otherwise generally applicable to public companies that are not “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). We expect to remain an emerging growth company for up to five years following the completion of this offering or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues equal or exceed $1.235 billion, (ii) December 31 of the fiscal year that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act of 1934, as amended (the “Exchange Act”), which would occur if the market value of our common stock that is held by non-affiliates exceeds $700.0 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 months or (iii) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the preceding three-year period.

DGCL

The General Corporation Law of the State of Delaware, as amended (the “DGCL”), contains provisions that may discourage, delay or make more difficult a change in control of us or the removal of our directors. Our certificate of incorporation and bylaws contain provisions that limit liability and provide for indemnification of our directors and officers. These provisions and others which we may adopt also may have the effect of deterring hostile takeovers or delaying changes in control or management. We are subject to Section 203 of the DGCL, the application of which is subject to any applicable requirements of the 1940 Act. See “Description of Our Capital Stock—Provisions of the DGCL and Our Certificate of Incorporation and Bylaws.”

9

Recent Developments

Declared Dividends

On March 6, 2024, our Board declared a distribution of $0.40 per share, for stockholders of record on March 29, 2024 payable on April 17, 2024.

On , our Board declared a distribution of $ per share, for stockholders of record on payable on or before . This distribution is only payable if this offering has commenced on or before .

Private Offerings

On March 22, 2024, we delivered the final capital call notice, which will result in the issuance of $269.9 million of common stock in the private placement offering at a price per share of our expected NAV per share as of , 2024, which was $ . Following this final capital call and issuance of shares of our common stock, the investors’ obligations to purchase additional shares of common stock will be exhausted in a final closing expected to occur on or around April 2, 2024. See “The Company—Private Offerings.”

Preliminary Estimates of Results as of March 31, 2024

We estimate that our NAV per share as of March 31, 2024 will be between $ per share and $ per share.

We estimate our net investment income per share for the three months ended March 31, 2024 will be between $ per share and $ per share, calculated using weighted average shares for the three-months ended March 31, 2024.

The preliminary estimates at and for the three-months ended March 31, 2024 set forth above are based on our management’s preliminary determinations and current expectations as of the date hereof, and such information is inherently uncertain. The preliminary financial estimates provided herein have been prepared by, and are the responsibility of, management. Neither PricewaterhouseCoopers LLP, our independent registered public accounting firm, nor any other independent accountants has audited, reviewed, compiled, or performed any procedures with respect to the preliminary financial data set forth above. Accordingly, PricewaterhouseCoopers LLP does not express an opinion or any form of assurance with respect thereto and assumes no responsibility for, and disclaims any association with, this information.

The preliminary estimates may not align with our actual results of operations for the period, which will not be known until we complete our customary financial quarter-end closing and related internal controls over financial reporting, final determination of the fair value of our portfolio investments, final adjustments, execution of our disclosure controls and procedures and other developments arising between now and the time that our financial results for the three-months ended March 31, 2024 are finalized. As a result, actual results could differ materially from these preliminary estimates based on adjustments made during our quarter-end closing and audit procedures. In addition, the information set forth above does not include all of the information regarding our financial condition and results of operations for the three-months ended March 31, 2024 that may be important to investors. See “Risk Factors—Risks Relating to Our Common Stock—There are material limitations with making available preliminary estimates of our financial results at and for the three-months ended March 31, 2024 prior to the completion of our and our auditor’s financial review procedures for such period” for more information.

10

Summary of Principal Risk Factors

Investing in our shares of common stock involves a number of significant risks. You should carefully consider information found in the section entitled “Risk Factors” and elsewhere in this prospectus. Some of the risks involved in investing in our shares of common stock include:

Principal Risks Relating to Our Business and Structure

| ● | We have a limited operating history and may not replicate the historical results achieved by other entities managed by members of the Advisor’s investment committee, the Advisor or its affiliates. |

| ● | We use leverage pursuant to borrowings under credit facilities and issuances of senior unsecured notes to finance our investments and changes in interest rates will affect our cost of capital and net investment income. |

| ● | We depend upon our Advisor and Administrator for our success and upon their access to the investment professionals and partners of Kayne Anderson and its affiliates. Any inability of the Advisor or the Administrator to maintain or develop these relationships, or the failure of these relationships to generate investment opportunities, could adversely affect our business. |

| ● | Our financial condition, results of operations and cash flows depend on our ability to manage our business and future growth effectively. |

| ● | There are significant potential conflicts of interest that could affect our investment returns, including conflicts related to obligations the Advisor’s investment committee, the Advisor or its affiliates have to other clients and conflicts related to fees and expenses of such other clients. |

| ● | We generally may make investments that could give rise to a conflict of interest and our ability to enter into transactions with our affiliates will be restricted. |

| ● | We operate in a highly competitive market for investment opportunities, which could reduce returns and result in losses. |

| ● | We will be subject to corporate-level income tax if we are unable to qualify as a RIC. |

| ● | We finance our investments with borrowings under credit facilities and issuances of senior unsecured notes, which will magnify the potential for gain or loss on amounts invested and may increase the risk of investing in us. |

| ● | Adverse developments in the credit markets may impair our ability to enter into new credit facilities or our ability to issue senior unsecured notes. |

| ● | The majority of our portfolio investments are recorded at fair value as determined in good faith by our Advisor and, as a result, there may be uncertainty as to the value of our portfolio investments. |

| ● | Our Board may change our investment objective, operating policies and strategies without prior notice or stockholder approval, and we may temporarily deviate from our regular investment strategy. |

| ● | Efforts to comply with the Exchange Act and the Sarbanes-Oxley Act will involve significant expenditures, and non-compliance would adversely affect us and the value of our shares of common stock. |

| ● | We are highly dependent on information systems, and cybersecurity risks and cyber incidents may adversely affect our business or the business of our portfolio companies, which may, in turn, negatively affect the value of our shares of common stock and our ability to pay distributions. |

11

Principal Risks Relating to Our Investments

| ● | Rising interest rates could affect the value of our investments and make it more difficult for portfolio companies to make periodic payments on their loans. |

| ● | Our business is dependent on bank relationships and recent strain on the banking system may adversely impact us. |

| ● | Limitations of investment due diligence in the private middle market companies in which we invest expose us to increased investment risk. |

| ● | We invest in highly leveraged companies, which could cause us to lose all or a part of our investment in those companies. |

| ● | We are subject to risks associated with our investments in unitranche secured loans and securities, including the potential loss of all or part of such investments. |

| ● | Our investments in securities that are rated below investment grade (i.e. “junk bonds”) may be risky and we could lose all or part of our investments. |

| ● | Defaults by our portfolio companies, including defaults relating to collateral, will harm our operating results. |

| ● | The lack of liquidity in our investments may adversely affect our business. |

| ● | Our prospective portfolio companies may prepay loans, which may reduce our yields if capital returned cannot be invested in transactions with equal or greater expected yields. |

| ● | Our prospective portfolio companies may be unable to repay or refinance outstanding principal on their loans at or prior to maturity. |

| ● | Our portfolio may be concentrated in a limited number of portfolio companies and industries, which will subject us to a risk of significant loss if any of these companies defaults on its obligations under any of its debt instruments or if there is a downturn in a particular industry. |

| ● | There is no assurance that portfolio company management will be able to operate their companies in accordance with our expectations. |

| ● | Our investments in the Trading Companies & Distributors industry face considerable uncertainties including significant regulatory challenges. |

Risks Relating to Our Common Stock

| ● | Prior to this offering, there has been no public market for our shares of common stock, and we cannot assure you that a market for our shares of common stock will develop or that the market price of our shares of common stock will not decline following the offering. Our share of common stock price may be volatile and may fluctuate substantially. |

| ● | Sales of substantial amounts of our shares of common stock in the public market may have an adverse effect on the market price of our shares of common stock. |

| ● | Trading in our shares may be limited and our shares may trade below NAV. |

| ● | During extended periods of capital market disruption and instability, there is a risk that you may not receive distributions or that our distributions may not grow over time and a portion of our distributions may be a return of capital. |

| ● | Our stockholders may experience dilution in their ownership percentage. |

12

THE OFFERING SUMMARY

|

Common Stock Offered by Us |

shares (or shares if the underwriters exercise their option to purchase additional shares of our common stock). |

| Common Stock to be Outstanding after this Offering | shares (or shares if the underwriters exercise their option to purchase additional shares of our common stock). |

| Use of Proceeds | Our net proceeds from this offering will be approximately $ , or approximately $ if the underwriters exercise their option to purchase additional shares of our common stock, based on an offering price of $ per share.

We intend to use the net proceeds from this offering to pay down some of our borrowings under credit facilities and to make investments in accordance with our investment objectives.

See “Use of Proceeds.” |

| Indication of Interest | Certain officers, employees, business associates and related persons of Kayne Anderson, as well as certain institutional investors affiliated with Kayne Anderson, have expressed indications of interest to purchase up to an aggregate of $ million of shares of our common stock in this offering at the initial public offering price. However, because indications of interest are not binding agreements or commitments to purchase, one or all of these potential investors may determine to purchase more, fewer or no shares in this offering. Accordingly, investors should not rely on such indications of interest as evidence that this offering is more likely to be successful. |

| Proposed Symbol on the New York Stock Exchange | “KBDC” |

| Distributions | We generally intend to distribute, out of assets legally available for distribution, 90 to 100% of our available earnings, on a quarterly or annual basis, as determined by our Board in its sole discretion. The distributions we pay to our stockholders in a year may exceed our taxable income for that year and, accordingly, a portion of such distributions equal to such excess of distributions over taxable income may constitute a return of invested capital for federal income tax purposes. Such a return of capital (i.e., a distribution that represents a return of an investor’s original investment) would be nontaxable to the stockholder and would reduce its basis in its shares. As a result, income tax related to the portion of such distributions treated as return of capital would be deferred until any subsequent sale of shares of common stock. The specific tax characteristics of our distributions will be reported to stockholders after the end of the calendar year. See “Distributions” and “Certain U.S. Federal Income Tax Considerations.” |

| Taxation | We have elected to be treated as a RIC for U.S. federal income tax purposes, and we intend to operate in a manner so as to continue to qualify for the tax treatment applicable to RICs. Our tax treatment as a RIC will enable us to deduct qualifying distributions to our stockholders, so that we will be subject to corporate-level U.S. federal income taxation only in respect of earnings that we retain and do not distribute.

To maintain our status as a RIC and to avoid being subject to corporate-level U.S. federal income taxation on our earnings, we must, among other things:

● maintain our election under the 1940 Act to be treated as a BDC;

● derive in each taxable year at least 90% of our gross income from dividends, interest, gains from the sale or other disposition of stock or securities and other specified categories of investment income; and

● maintain diversified holdings.

|

13

In addition, to receive tax treatment as a RIC, we must distribute (or be treated as distributing) in each taxable year dividends for tax purposes equal to at least 90% of the sum of our investment company taxable income (which is generally our ordinary income plus the excess, if any, of our realized net short-term capital gains over our realized net long-term capital losses) and net tax-exempt income for that taxable year.

As a RIC, we generally will not be subject to corporate-level U.S. federal income tax on our investment company taxable income and net capital gains that we distribute to stockholders. If we fail to distribute our investment company taxable income or net capital gains on a timely basis, we will be subject to a non-deductible 4% U.S. federal excise tax. See “Distributions” and “Certain U.S. Federal Income Tax Considerations.”

| |

| Leverage | As a BDC, we are permitted under the 1940 Act to make borrowings under credit facilities and issue senior unsecured notes to finance a portion of our investments. As a result, we are exposed to the risks of leverage, which may be considered a speculative investment technique.

We finance our investments with leverage in the form of borrowings under credit facilities and issuances of senior unsecured notes. We also intend to further borrow under credit facilities and/or issue senior unsecured notes in the future in order to finance our investments. In accordance with the 1940 Act, we are required to meet a coverage ratio of total assets (less total liabilities other than indebtedness) to total borrowings and other senior securities of at least 150%. If this ratio declines below 150%, we cannot incur additional leverage and could be required to sell a portion of our investments to repay some leverage when it is disadvantageous to do so.

Our common stockholders bear the burden of any increase in our expenses as a result of our use of leverage, including interest expenses and any increase in the base management fee payable to the Advisor.

As of December 31, 2023, we have $75 million of senior unsecured notes outstanding, with $25 million of 8.65% Series A Notes due June 2027 (the “Series A Notes”) and $50 million of 8.74% Series B Notes due June 2028 (the “Series B Notes”, and collectively with the Series A Notes, the “Notes”).

As of December 31, 2023, the amount of total debt outstanding under the Credit Facilities (as defined herein) was $620.8 million. The Corporate Credit Facility (as defined herein) has a maturity date of February 18, 2027 and an interest rate equal to Term SOFR (a forward-looking rate based on SOFR futures) plus an applicable spread of 2.35% per annum or an “alternate base rate” (as defined in the agreements governing the Corporate Credit Facility) plus an applicable spread of 1.25%. The Revolving Funding Facility (as defined herein) has a stated maturity date of February 18, 2027 and an interest rate equal to daily SOFR plus 2.75% per annum. The Revolving Funding Facility II (as defined herein) has a stated maturity date of December 22, 2028 and an interest rate equal to 3-month term SOFR plus 2.70% per annum. The Subscription Credit Facility (as defined herein) has a maturity date of December 31, 2024 and an interest rate equal to SOFR plus 2.25% per annum (subject to a 0.275% SOFR floor).

As of December 31, 2023, our asset coverage ratio was 198%. Following the receipt of proceeds from the capital call drawdown notice we delivered on and from this offering and the repayment of borrowings under our credit facilities upon receipt of these proceeds, we expect our asset coverage ratio to be approximately % based on the value of our total assets as of , 2023.

|

14

| Share Repurchase Plan | Our Board has approved an open market share repurchase program (the “Company 10b5-1 Plan”), pursuant to which the Company may purchase up to $ million in the aggregate of our outstanding shares of common stock in the open market within one year of the closing of this offering. See “The Company—Share Repurchase Plan.” The purchase of shares under the Company 10b5-1 Plan will be conducted in accordance with the guidelines and conditions of Rule 10b5-1 and Rule 10b-18 under the Exchange Act. See “Risk Factors —Risks Relating to Our Business and Structure—Purchases of shares of our common stock by us under our open market repurchase program, including the Company Rule 10b5-1 Plan, may result in the price of shares of our common stock being higher than the price that otherwise might exist in the open market and are subject to our ability to finance such repurchases.” |