0001747079DEF 14AFALSE00017470792023-01-012023-12-310001747079baly:RobesonReevesMember2023-04-012023-12-31iso4217:USD0001747079baly:LeeFentonMember2023-01-012023-03-310001747079baly:LeeFentonMember2022-01-012022-12-3100017470792022-01-012022-12-310001747079baly:LeeFentonMember2021-10-012021-12-310001747079baly:GeorgePapanierMember2021-01-012021-09-3000017470792021-01-012021-12-310001747079baly:LeeFentonMember2020-01-012020-12-310001747079baly:GeorgePapanierMember2020-01-012020-12-3100017470792020-01-012020-12-3100017470792023-04-012023-12-3100017470792021-10-012021-12-3100017470792021-01-012021-09-300001747079ecd:PeoMemberbaly:ChangeInStockAwardsValueMemberbaly:RobesonReevesMember2023-01-012023-12-310001747079ecd:PeoMemberbaly:EquityAwardsReportedValueMemberbaly:RobesonReevesMember2023-01-012023-12-310001747079ecd:PeoMemberbaly:EquityAwardsGrantedInPriorYearsUnvestedMemberbaly:RobesonReevesMember2023-01-012023-12-310001747079ecd:PeoMemberbaly:EquityAwardsVestingDateReportedValueGrantedInPriorYearsVestedMemberbaly:RobesonReevesMember2023-01-012023-12-310001747079ecd:PeoMemberbaly:EquityAwardsGrantedInPriorYearsVestedMemberbaly:RobesonReevesMember2023-01-012023-12-310001747079ecd:PeoMemberbaly:EquityAwardsGrantedInPriorYearsForfeitedMemberbaly:RobesonReevesMember2023-01-012023-12-310001747079baly:LeeFentonMemberecd:PeoMemberbaly:ChangeInStockAwardsValueMember2023-01-012023-12-310001747079baly:LeeFentonMemberecd:PeoMemberbaly:EquityAwardsReportedValueMember2023-01-012023-12-310001747079baly:LeeFentonMemberecd:PeoMemberbaly:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310001747079baly:LeeFentonMemberecd:PeoMemberbaly:EquityAwardsVestingDateReportedValueGrantedInPriorYearsVestedMember2023-01-012023-12-310001747079baly:LeeFentonMemberecd:PeoMemberbaly:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001747079baly:LeeFentonMemberecd:PeoMemberbaly:EquityAwardsGrantedInPriorYearsForfeitedMember2023-01-012023-12-310001747079ecd:NonPeoNeoMemberbaly:ChangeInStockAwardsValueMember2023-01-012023-12-310001747079ecd:NonPeoNeoMemberbaly:EquityAwardsReportedValueMember2023-01-012023-12-310001747079baly:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001747079ecd:NonPeoNeoMemberbaly:EquityAwardsVestingDateReportedValueGrantedInPriorYearsVestedMember2023-01-012023-12-310001747079ecd:NonPeoNeoMemberbaly:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001747079ecd:NonPeoNeoMemberbaly:EquityAwardsGrantedInPriorYearsForfeitedMember2023-01-012023-12-31000174707912023-01-012023-12-31000174707922023-01-012023-12-31

| | |

UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of |

| the Securities Exchange Act of 1934 |

| (Amendment No.) |

|

| | | | | |

| Filed by the Registrant ☒ | Filed by a party other than the Registrant |

Check the appropriate box: | | | | | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

| BALLY’S CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply): | | | | | | | | |

| ☒ | No fee required. |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Fee paid previously with preliminary materials. |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

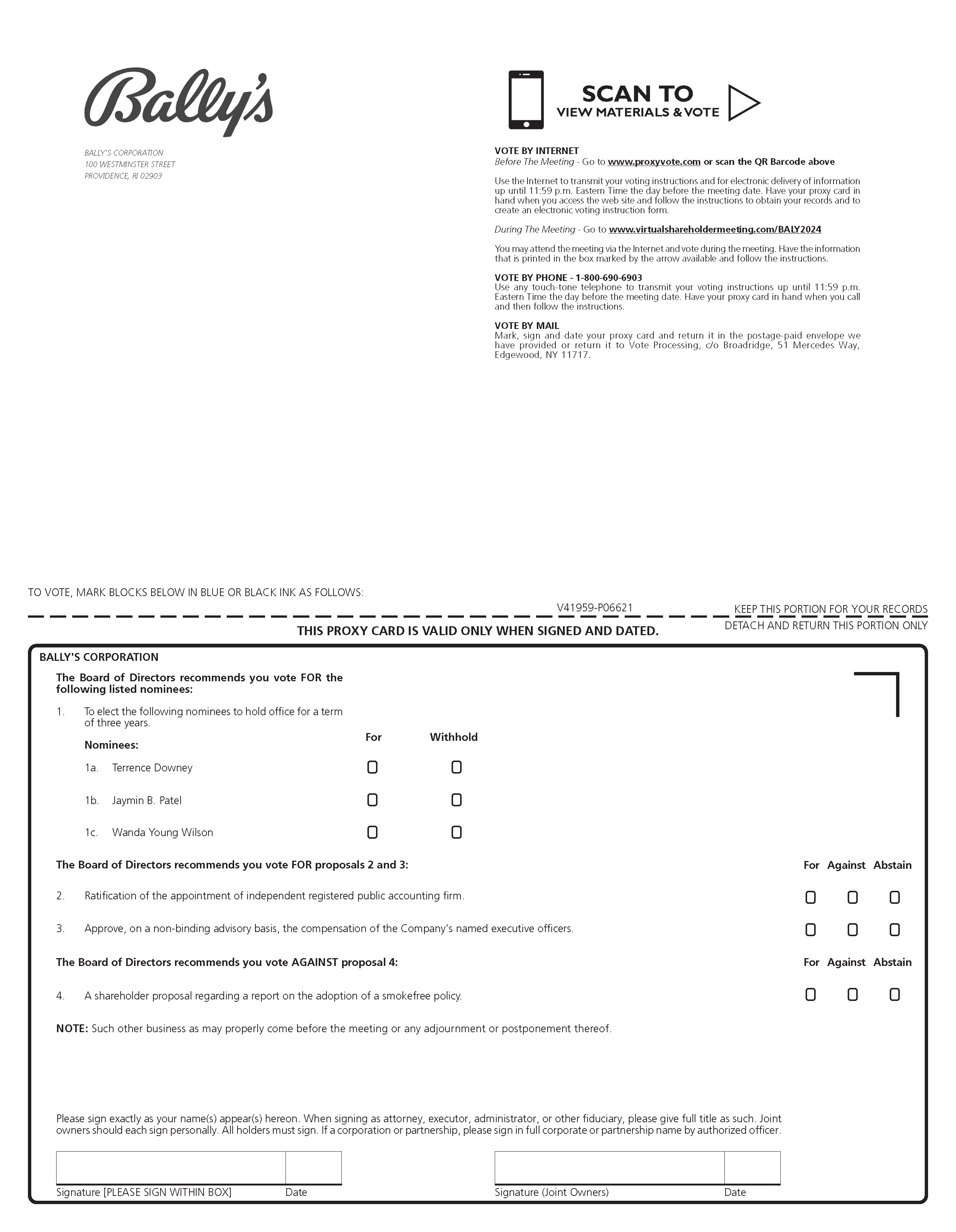

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders of Bally’s Corporation:

You are cordially invited to attend the 2024 Annual Meeting of Shareholders (the “Annual Meeting”) of Bally’s Corporation to be held virtually on May 16, 2024 at 2:00 p.m., Eastern Time. You may access the Annual Meeting via the internet through a virtual web conference at www.virtualshareholdermeeting.com/BALY2024. Shareholders entitled to notice of, and to vote at, the Annual Meeting are shareholders as of the close of business on March 20, 2024. You will be able to attend the meeting online, vote your shares electronically and submit questions during the meeting.

The following items are to be voted on at the Annual Meeting:

| | | | | |

| 1. | To elect the following nominees to hold office for a term of three years: |

| Terrence Downey, Jaymin B. Patel, and Wanda Young Wilson; |

| 2. | To ratify the appointment of Deloitte & Touche, LLP as our independent registered public accounting firm for the year ending December 31, 2024; |

| 3. | To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers; |

| 4. | To consider and vote on a shareholder proposal regarding a report on the adoption of a smokefree policy; and |

| 5. | To transact other business, if any, that may properly come before the Annual Meeting or any adjournments or postponements. |

You may vote your shares in advance of the meeting via the internet, by telephone or by mail or by attending and voting online at the Annual Meeting via www.virtualshareholdermeeting.com/BALY2024. Please refer to the section “How do I vote?” in the proxy statement for detailed voting instructions. Whether or not you expect to attend the meeting, please sign, date and return the enclosed proxy card or vote over the internet at www.proxyvote.com or by telephone at 1-800-690-6903 (toll free) as soon as possible to ensure that your shares are represented at the meeting. To participate in the virtual meeting, you will need the 16-digit control number included on your notice, proxy card or voting instruction form. The meeting webcast will begin promptly at 2:00 p.m., Eastern Time. Online check-in will begin at 1:45 p.m., Eastern Time, and you should allow ample time for the check-in procedures.

We look forward to speaking with you at the meeting.

| | | | | |

| By Order of the Board of Directors |

| |

| Soohyung Kim |

| April 5, 2024 | Chairman of the Board of Directors |

TABLE OF CONTENTS | | | | | |

| | Page |

| |

| |

| |

| |

| |

EXECUTIVE OFFICERS | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PROPOSAL 4: SHAREHOLDER PROPOSAL REGARDING A REPORT ON THE ADOPTION OF A SMOKEFREE POLICY | |

| |

| |

PROPOSALS OF SHAREHOLDERS | |

| |

BALLY’S CORPORATION

100 Westminster Street

Providence, Rhode Island 02903

PROXY STATEMENT

Annual Meeting of Shareholders

to be held virtually on May 16, 2024

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Bally’s Corporation for the Annual Meeting of shareholders to be held virtually on May 16, 2024 at 2:00 p.m., Eastern Time. Shareholders of record as of the close of business on March 20, 2024 can attend the Annual Meeting online, including to vote and/or to submit questions at www.virtualshareholdermeeting.com/BALY2024. As used in this proxy statement, references to the “Company,” “Bally’s,” “we,” “our” or “us” mean Bally’s Corporation and all entities included in our consolidated financial statements.

On or about April 5, 2024, the proxy materials for the Annual Meeting, including this proxy statement and our 2023 annual report to shareholders, were first sent to shareholders of record as of the close of business on March 20, 2024, and are available over the internet at www.proxyvote.com.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

You are being sent this proxy statement and the enclosed proxy card because our Board is soliciting your proxy to vote at the Annual Meeting. This proxy statement summarizes the information you need to know to vote at the meeting. To vote your shares, please simply sign, date and return the enclosed proxy card or vote over the internet at www.proxyvote.com or by telephone at 1-800-690-6903 (toll free) so that it is received by 11:59 p.m. Eastern Time the day before the meeting date.

Record Date. Only shareholders of record as of the close of business on March 20, 2024 will be entitled to notice of and to vote at the Annual Meeting and any postponement or adjournments thereof. As of March 20, 2024, 40,426,353 common shares were issued and outstanding. Each share outstanding as of the record date will be entitled to one vote, and shareholders may vote in advance of the meeting via the internet, by telephone or by mail, or by attending and voting online at the Annual Meeting.

Quorum. One-third of the common shares entitled to vote at the Annual Meeting, represented online or by proxy, or as instructed herein virtually will constitute a quorum for the transaction of business at the meeting. Common shares represented online, by proxy (including shares which abstain, broker non-votes and shares that are not voted with respect to one or more of the matters presented for shareholder approval) will be counted for purposes of determining whether a quorum is present at the meeting.

Notice and Access. In accordance with rules approved by the Securities and Exchange Commission (“SEC”), we furnish proxy materials to our shareholders over the internet. On or about April 5, 2024, we mailed to all shareholders of record as of the close of business on March 20, 2024, a notice containing instructions on how to access our Annual Report to Shareholders, which contains our audited consolidated financial statements for the fiscal year ended December 31, 2023, our proxy statement, proxy card, and other items of interest to shareholders on the internet website indicated in our notice, at www.proxyvote.com, as well as instructions on how to vote your common shares in connection with the Annual Meeting. That notice also provided instructions on how you can request a paper copy of our proxy materials and Annual Report to Shareholders if you desire.

Required Vote. Proposal 1 is based on plurality voting, which means the director nominees who receive the most votes will be elected even if less than a majority. Only Messrs. Downey, Patel and Ms. Wilson have been duly nominated for election. As such, a shareholder may vote to “withhold” but doing so will not affect the results of the election.

Proposals 2, 3, and 4 require the affirmative vote of a majority of the votes cast at the meeting online or by proxy. A vote “against” or “abstain” will have the effect of a negative vote.

| | | | | | | | | | | | | | |

| | | Board Recommendation | Page |

| PROPOSAL 1 | | Election of Directors | FOR | |

| PROPOSAL 2 | | Ratification of the appointment of independent registered public accounting firm | FOR | |

| PROPOSAL 3 | | Approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers | FOR | |

| PROPOSAL 4 | | Consider and vote on a shareholder proposal regarding a report on the adoption of a smokefree policy | AGAINST | |

| | | | |

We know of no other matter to be presented at the Annual Meeting. If any other matter should be presented at the meeting for a vote, then the persons named as proxies would have discretion to vote on those matters according to their best judgment to the same extent as the person signing the proxy would be entitled to vote. At the date of this proxy statement, we do not anticipate that any other matters will be raised at the meeting.

Broker Non-Votes. A broker non-vote occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have discretion to direct the voting of the shares.

Brokers do not have discretionary authority to vote on election of directors, on matters related to executive compensation, including the approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers or on the shareholder proposal. Therefore, there may be broker non-votes with respect to those votes. Broker non-votes will not affect the outcome of these votes and will not be counted in determining the number of shares necessary for approval of those proposals. Brokers have discretionary authority to vote on ratification of Deloitte & Touche, LLP as our independent registered public accounting firm and, therefore, no broker non-votes are expected in connection with that vote.

Method and Expenses of Solicitation. Proxies may also be solicited personally and by telephone or facsimile or other electronic means by our regular employees, without any additional remuneration. We will also make arrangements with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation material to beneficial owners of shares held of record by such persons, and we will reimburse such persons for their reasonable out-of-pocket expenses in forwarding solicitation material.

Shareholders of Record. If your shares are registered in your own name, you may request paper copies of the proxy materials by following the instructions contained in the notice. Shareholders who have already made a permanent election to receive paper copies of the proxy materials will receive a full set of the proxy documents in the mail.

Beneficial Shareholders. As the beneficial owner, you have the right to direct your broker, bank or other nominee regarding how to vote your shares. If a broker or other nominee holds your shares in “street name,” your broker has enclosed a voting instruction form, which you should use to vote those shares. The voting instruction form indicates whether you have the option to vote those shares by telephone or by using the internet.

Attendance at the Annual Meeting. To participate in the virtual meeting, you will need the 16-digit control number included on your notice, proxy card or voting instruction form. The meeting webcast will begin promptly at 2:00 p.m., Eastern Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 1:45 p.m., Eastern Time, and you should allow ample time for the check-in procedures.

Revocation of Proxies. Any shareholder giving a proxy has the right to revoke it at any time before it is exercised by written notice to our Secretary at our principal executive offices at Bally’s Corporation, 100 Westminster Street, Providence, Rhode Island 02903, Attn: Secretary or by submission of another proxy bearing a later date. In addition, shareholders of record attending the meeting online may revoke their proxies at any time before they are exercised.

Your vote is important. Whether or not you plan to attend the virtual Annual Meeting, we urge you to sign, date and return the enclosed proxy card or vote over the internet at www.proxyvote.com or by telephone at 1-800-690-6903 (toll free) as soon as possible to ensure that your vote is recorded promptly. Returning the proxy card will not affect your right to attend the meeting or vote your shares online. If you complete, sign and submit your proxy card, the persons named as proxies will vote your shares in accordance with your instructions. If you sign and submit a proxy card but do not fill out the voting instructions on the proxy card, your shares will be voted as recommended by our Board. If any other matters are properly presented for voting at the meeting, or any adjournments or postponements of the meeting, the proxy card will confer discretionary authority on the individuals named as proxies to vote your shares in accordance with their best judgment. As of the date of this proxy statement, we have not received notice of other matters that may properly be presented for voting at the meeting.

PROPOSAL 1

ELECTION OF DIRECTORS

At the Annual Meeting, shareholders will vote to elect the three persons identified below to serve in the class of directors for a term of three years expiring at the 2027 annual meeting of shareholders and thereafter until their respective successors are duly elected and qualified or until the earlier of their resignation, death or removal.

Directors will be elected by the affirmative vote of the holders of a plurality of the shares represented online or by proxy at the meeting. Shareholders may not vote their shares cumulatively in the election of directors. Proxies cannot be voted for a greater number of persons than the number of nominees named. Any shareholder submitting a proxy has the right to withhold authority to vote for an individual nominee by writing that nominee’s name in the space provided on the proxy. Shares represented by all proxies received by us and not marked to withhold authority to vote for any individual director or for all directors will be voted “for” the election of all of the nominees named below. If for any reason any nominee is unable to accept the nomination or to serve as a director, an event not currently anticipated, the persons named as proxies reserve the right to exercise their discretionary authority to nominate someone else or to reduce the number of management nominees to such extent as the persons named as proxies may deem advisable.

Nominees for Directors

Terrence Downey, Jaymin B. Patel, and Wanda Young Wilson have been nominated to serve as directors by our Board, based upon the recommendation of our Nominating and Governance Committee. The following table sets forth certain information regarding the nominees:

| | | | | | | | |

| Name and Age of Nominee | | Biographical Information |

Terrence Downey Age 69 | | Mr. Downey has served as an independent director at Bally’s Corporation since January 2019. Mr. Downey served as the President and Chief Operating Officer of SLS Las Vegas from January 2017 to July 2017. Earlier in his career, Mr. Downey served as the President and General Manager of Aliante Gaming LLC from November 2012 through October 2016. Prior to joining Aliante Gaming LLC, Mr. Downey worked over 15 years as Vice President and General Manager at multiple Station Casinos locations. Mr. Downey brings valuable experience with his demonstrated history of working in the hospitality industry and strong business development skills. |

Jaymin B. Patel Age 56

| | Mr. Patel has served as Vice-Chairman of the Bally's Corporation Board since May of 2023 and as an independent director since January 2021. He currently serves as Executive Chairman of Perennial Climate, Inc., a company building the world’s leading verification platform for soil-based carbon removal and climate smart agriculture. From 2015 to 2018, Mr. Patel served as the CEO and Director of Brightstar Corporation, a $10+ billion SoftBank global wireless device services company. Prior to that, Mr. Patel served as President and CEO of GTECH Corporation (now IGT) from 2008 to 2015, President and COO in 2007 and CFO of GTECH Holdings Corporation from 2000 to 2006 (NYSE:GTK), and as CFO of Lottomatica SPA from 2006 to 2007 (Milan:LTO.MI). Additionally, Mr. Patel has served on the Board of Directors of SpartanNash (NASDAQ:SPTN) since February 2022 and Brown & Brown, Inc. (NYSE:BRO) since January 2023. Mr. Patel is also on the Foundation Board of the Community College of Rhode Island.

Mr. Patel brings valuable experience with his demonstrated history of executive leadership roles, global operations experience, finance and board service. |

| | | | | | | | |

| Name and Age of Nominee | | Biographical Information |

Wanda Young Wilson Age 74

| | Ms. Wilson has served as an independent director at Bally’s Corporation since May 2019. Ms. Wilson retired as the Chief Operating Officer, General Counsel and Secretary of the Tennessee Education Lottery Corporation (“TEL”) in 2019. Ms. Wilson joined the TEL in 2003 as Executive Vice President and General Counsel and was promoted to Chief Operating Officer in 2013. Prior to joining the TEL, Ms. Wilson was employed at the Georgia Lottery Corporation, where she served as the Senior Vice President and General Counsel for 10 years. Earlier in her career, she was an investment banker with EF Hutton and the Northern Trust Bank.

Ms. Wilson brings valuable experience with her demonstrated history of legal, regulatory and compliance roles. |

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF ALL NOMINEES FOR THE BOARD OF DIRECTORS NAMED ABOVE.

Continuing Directors

The following table sets forth information relating to our directors who will continue to serve as directors until the expiration of their respective terms of office:

| | | | | | | | |

| Name and Age of Director | | Biographical Information |

Soohyung Kim Age 49 Term expires: 2025 | | Mr. Kim has served as the Chairman of the Bally's Corporation Board since December 2019 and as an independent director since 2016. Mr. Kim is the Managing Partner and Chief Investment Officer of Standard General L.P., an investment firm. Mr. Kim has been investing in special situations strategies since 1997 including stints at Bankers Trust Company, Och-Ziff Capital Management and Cyrus Capital Partners. Mr. Kim is a Director of Intralot SA, a Director of Coalition for Queens, a Director of the Cary Institute of Ecosystem Studies and a Director of the Stuyvesant High School Alumni Association. Mr. Kim is a former member of the board of directors of Greektown Superholdings and Media General, Inc. and the board of managers of ALST Casino Holdco, LLC. |

Tracy S. Harris Age 60 Term expires: 2025 | | Ms. Harris has served as an independent director of Bally’s Corporation since February 2023. Ms. Harris has extensive financial and operational experience, having served as Chief Financial Officer for MIB Group Holdings, Inc., UMUC\Ventures, Bullis School LLC, The BondFactor Company, American Institute of Architects, Deion Hampton & Associates, and the Washington Convention Center Authority. She currently serves on the Board of 1847 Holdings LLC (NYSE:EFSH), CareFirst Blue Cross Blue Shield, District of Columbia Retirement Board, and the Council of Institutional Investors. Ms. Harris was recently appointed to the PCAOB Investor Advisory Group. Ms. Harris holds a BS in Marketing from Fontbonne University, an MBA from St. Louis University and a Master of Public Administration from the University of Pennsylvania. |

George T. Papanier Age 66 Term expires: 2026 | | George Papanier became President of Bally’s Corporation on March 31, 2023. His association with Bally’s began in 2004 when he served as the Chief Operating Officer, an appointment he held until February 2011 when he was then appointed to the role of President and CEO of Bally’s. Prior to joining Bally’s, Mr. Papanier served in the same capacity for Peninsula Gaming with properties in Iowa and Louisiana, from 2000 to 2004 and as COO for Resorts Casino Hotel in Atlantic City, NJ from 1997 to 2000. Both positions involved strategic and tactical planning for the resorts and supervision of major renovation and construction projects. He was also active in evaluating potential acquisitions and development of projects for the two organizations. From 1995 to 1997, he served as CFO for both Sun International Hotels Limited in the Bahamas and Mohegan Sun Casino in Uncasville, CT. Earlier in his career he served in executive operations capacities of Hemmeter Enterprises in Denver, CO and in an executive financial capacity for Trump Plaza Hotel and Casino in Atlantic City. Mr. Papanier is a graduate of Rowan University where he received a B.A. in Business Administration and Accounting. He is a Certified Public Accountant and served as Treasurer of the Casino Association in New Jersey from 1999 to 2000. |

| | | | | | | | |

| Name and Age of Director | | Biographical Information |

Robeson M. Reeves Age 40 Term expires: 2025 | | Robeson Reeves became Chief Executive Officer of Bally’s Corporation on March 31, 2023. Formerly, he served as President of Bally’s Interactive Division since October 1, 2021 and the Chief Operating Officer of Gamesys since July 2015. Mr. Reeves joined Gamesys in September 2005 and held a number of positions, most recently Director of Gaming Operations since May 2010 and served as a member of the Gamesys Board of Directors since August 2010. Since joining Gamesys, Mr. Reeves has built a strong record in cohesively connecting player and product experiences to marketing and business KPIs, ensuring sustainable growth. He graduated in 2005 with a BSc in Statistics, Operations Research and Management Studies from University College, London. |

Jeffrey W. Rollins Age 59 Term expires: 2026 | | Mr. Rollins has served as an independent director at Bally’s Corporation since May 2019. Mr. Rollins has extensive experience in gaming, having previously served as an independent director at Dover Downs, a position he held from 2002 to 2019. He joined Ashford Capital Management in August 2013 as Managing Director and Managing Member, Osprey Advisors. Prior to joining Ashford, Mr. Rollins founded J.W. Rollins & Associates, which focused on investing in and building established and early stage growth companies. He was also a Partner and Managing Director of a private equity fund focused on growth companies. Mr. Rollins currently serves on the Board of Dover Motorsports (NYSE:DVD) and the Duke University Fuqua School of Business, Board of Visitors. |

CORPORATE GOVERNANCE

Board of Directors

Our Board is currently comprised of eight members and has the following five standing committees: the Audit Committee, the Compensation Committee, the Nominating and Governance Committee, the Compliance Committee and the Environmental, Social and Governance (“ESG”) Committee. The membership and functions of each standing committee are described below. Each standing committee operates under a written charter which, along with our Code of Business Conduct and Corporate Governance Guidelines, can be found on the About—Governance Documents section of our website at www.ballys.com. The information on our website is not part of this proxy statement or any other report or registration statement that we furnish to or file with the SEC.

Board Meetings

During the year ended December 31, 2023, our Board held 10 meetings, including telephonic meetings. During this period, all of the existing directors attended or participated in at least 67% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which each such director served. The independent directors met without management present at each of the regular quarterly meetings of the Board in 2023.

Director Attendance at Annual Meetings of Shareholders

Although we do not have a formal policy regarding attendance by members of our Board at our annual meetings of shareholders, we encourage the members of our Board to attend such meetings. All of our directors attended last year’s annual meeting of shareholders, which was held on May 17, 2023.

Director Independence

Under the rules of the New York Stock Exchange (the “NYSE”), independent directors must comprise a majority of our Board. Our Board has undertaken a review of the independence of each director based upon definitions promulgated by the SEC and the rules of the NYSE and, applying these standards, our Board has affirmatively determined that each of Messrs. Downey, Kim, Patel, Rollins and Mses. Harris and Wilson qualify as an independent director under applicable rules. In making these determinations, our Board considered the current and prior relationships that each director has with us and all other facts and circumstances our Board deemed relevant.

Board Leadership Structure

Since December 2019, Soohyung Kim has served as Chairman of our Board. Our Board has considered this leadership structure and believes it currently provides the most efficient and effective leadership model for Bally’s by enhancing both the Chairman’s and Chief Executive Officer’s ability to provide clear insight and direction of business strategies and plans to both our Board and management. Separating the role of Chairman of the Board and our Chief Executive Officer ensures that each individual is able to more exclusively focus on their role. Our Board has not appointed a lead independent director at this time.

Ability of Shareholders to Communicate with our Board

We have established several means for shareholders, interested parties and others to communicate with our Board. If a shareholder or interested party has a concern regarding our financial statements, accounting practices or internal controls, the concern should be submitted in writing to the Chair of the Audit Committee in care of our Secretary at our corporate office address. If the concern relates to our governance practices, business ethics or corporate conduct, the concern should be submitted in writing to a member of the Nominating and Governance Committee in care of our Secretary at our corporate office address. If a shareholder or interested party is unsure as to which category the concern relates, the shareholder may communicate it to any one or more of the independent directors in care of our Secretary at our corporate office address. All such shareholder communications will be forwarded to the applicable director(s), unless such communications are considered, in the reasonable judgment of our Secretary, to be improper for submission to the intended recipient(s). Examples of shareholder communications that would be considered improper for submission include customer complaints, solicitations, communications that do not relate directly or indirectly to Bally’s or its business or communications that relate to improper or irrelevant topics. Any such improper communication will be made available to any non-employee director upon request.

Audit Committee

Our Audit Committee currently consists of Ms. Harris (Chair), Mr. Rollins and Ms. Wilson. Our Board has determined that each of the members is independent under the NYSE and SEC standards, and that each are financially literate within the requirements of the NYSE listing standards. Our Board has also determined that Ms. Harris qualifies as an “audit committee financial expert” as that term is defined by the applicable SEC and NYSE requirements.

The Audit Committee operates under a written charter adopted by the Board. The primary duties and responsibilities of the Audit Committee are to (1) assist the Board in fulfilling its oversight responsibilities with respect to (a) the Company’s financial statements, (b) the Company’s compliance with legal and regulatory requirements, (c) the independent auditors’ qualifications, independence and performance, and (d) the performance of the Company’s internal audit function; (2) prepare the Committee’s report to be included in the Company’s annual proxy statement; (3) advise and consult with management and the Board regarding the financial affairs of the Company; and (4) appoint, compensate, retain, terminate and oversee the work of the Company’s independent auditors. The responsibilities and activities of the Audit Committee are described in greater detail in the report included in this proxy statement under the caption “Report of the Audit Committee.”

The Audit Committee held 11 meetings during the year ended December 31, 2023. The Audit Committee also held executive sessions on several occasions during the year with Company management not present.

Compensation Committee

Membership, Responsibilities, Authority and Process

Our Compensation Committee currently consists of Mr. Rollins (Chair), Mr. Patel and Ms. Wilson. Our Board has determined that each member is independent under the NYSE and SEC standards. All members of our Compensation Committee are also “non-employee directors” under SEC standards.

The Compensation Committee operates under a written charter adopted by the Board. The Compensation Committee is responsible for decisions relating to all compensation plans, policies and perquisites as they affect the CEO and other executive officers and may form and delegate authority to subcommittees when it deems appropriate. Among other things, the role of the Compensation Committee is to: (1) establish and review executive compensation policies and programs; (2) review and approve executive officer compensation; (3) recommend incentive compensation plans; (4) recommend equity-based plans; (5) administer compensation plans; (6) review annually and determine the peer group(s) used for benchmarking executive compensation levels; (7) oversee regulatory compliance; (8) review employment agreements and severance agreements; (9) oversee management continuity; (10) review director compensation; (11) determine and review stock ownership guidelines; and (12) review compensation discussion and analysis.

The Compensation Committee has the authority, to the extent it deems necessary or appropriate, to retain a compensation consultant to assist in the evaluation of director or executive officer compensation. The Compensation Committee also has the sole authority to approve the consultant’s fees and other retention terms. In addition, the Compensation Committee has the authority, to the extent it deems necessary or appropriate, to retain other advisors. Bally’s will provide appropriate funding, as determined by the Compensation Committee, for payment of compensation to any consulting firm, independent counsel or other independent advisors hired by the Compensation Committee. The Compensation Committee may delegate all or a portion of its duties and responsibilities to a subcommittee or as otherwise permitted by the terms of any compensation plan, program, policy, agreement or arrangement approved by the Compensation Committee or the Board.

The Compensation Committee held eight meetings during the year ended December 31, 2023. Our Chief Executive Officer does not participate in deliberations concerning, and was not present for the vote on, his compensation arrangements. Additional information regarding the Compensation Committee’s processes and procedures for establishing and overseeing executive compensation is disclosed under the heading “Executive Compensation — Compensation Discussion and Analysis.”

Compensation Committee Interlocks and Insider Participation

Our Compensation Committee currently consists of Mr. Rollins (Chair), Mr. Patel and Ms. Wilson. None of these Compensation Committee members are a current or former Bally’s officer or employee. During 2023, none of Bally’s executive officers served on the board of directors or compensation committee of any entity that had one or more of its executive officers serving on Bally’s Board or the Compensation Committee.

Nominating and Governance Committee

Our Nominating and Governance Committee currently consists of Mr. Downey (Chair), Ms. Harris and Mr. Kim. Our Board has determined that each member is independent under the NYSE and SEC standards.

The Nominating and Governance Committee operates under a written charter adopted by the Board. The primary purpose of the Nominating and Governance Committee is to identify individuals it determines to be qualified to become members of the Board, recommend candidates to fill vacancies on the Board and newly created director positions, recommend whether incumbent directors should be nominated for re-election to the Board upon the expiration of their terms, recommend corporate governance guidelines applicable to the Board and the Company’s employees, oversees the evaluation of the Board and its committees and assess and recommend members of the Board to the Board for committee membership. The Nominating and Governance Committee evaluates prospective nominees suggested by any stockholder in substantially the same manner and against substantially the same criteria as any other prospective nominee identified from any other source. No person may serve as a member of the Board or be elected or nominated for election to the Board, unless such person has been licensed to serve as a member of the Board by the applicable gaming authorities at the time of such service, election or nomination.

The Nominating and Governance Committee held six meetings during the year ended December 31, 2023.

Compliance Committee

Our Compliance Committee currently consists of: Ms. Wilson (Chair) and Messrs. Downey and Papanier. The Compliance Committee was formed by the Board and operates under a written charter adopted by the Board. The primary purpose of the Compliance Committee is to establish and administer the Company’s compliance program (the “Compliance Program”) and develop, initiate, maintain and revise compliance policies and procedures to prevent illegal, unethical, or improper conduct. Among other things, the role of the Compliance Committee is to: (1) periodically review the Code of Business Conduct to ensure continuing relevance in providing guidance to management and employees and, if applicable, recommend updates to the Code to the Board; (2) maintain reasonable current knowledge of laws and regulations; (3) respond to alleged material violations of rules, regulations, policies, procedures and the Code of Business Conduct as identified by the compliance officer by evaluating or recommending the initiation of investigative procedures; (4) act as an independent review and evaluation body with the objective of ensuring that identified compliance issues within the Company are evaluated, investigated and resolved; (5) identify potential areas of compliance vulnerability and risk, develop and implement corrective action plans determined to be appropriate for resolution of compliance issues and provide general guidance on how to avoid and address similar situations in the future; (6) monitor anti-money laundering requirements and compliance; (7) monitor the compliance communication program for the Company; (8) monitor the performance of the Compliance Program and related activities on a continuing basis, taking appropriate steps to improve its effectiveness; and (9) provide updates to the Audit Committee, as necessary, regarding the operation and progress of compliance efforts.

The Compliance Committee held nine meetings during the year ended December 31, 2023.

ESG Committee

The Board’s ESG Committee consists of Mr. Kim (Chair), Ms. Harris and Mr. Reeves. The purpose of the ESG Committee is to (1) review significant policies and performance on matters relating to ESG issues and opportunities, employee health and safety, approach to corporate social responsibility, and activities related to stakeholder engagement and philanthropy; (2) oversee and monitor the Company’s vision and values; (3) advise the Board and management on significant public issues that are pertinent to the Company and its stakeholders and; (4) assist management in setting strategy, establishing goals and integration, and sustainability into strategic and tactical business activities across the Company to create long-term shareholder value. The ESG Committee also evaluates policies related to responsible gaming, including the prevention of underage and problem gambling; diversity in the workforce; community engagement and investment; impact on the environment; and certain health and safety programs in respect of the Company’s employees, guests, and premises.

The ESG Committee held three meetings during the year ended December 31, 2023.

Board’s Role in Risk Oversight

Our Board has an active role, as a whole and at the committee level, in overseeing the management of our exposure to risk. The Board is regularly updated regarding risks that we face, including those that may impact our financial and operational performance, our credit and liquidity profile and other elements of our strategic plans. The Audit Committee assists our Board in this function and is charged with oversight of our policies regarding risk assessment and management, including our policies regarding management of financial risk exposure and review of related party transactions. Our other standing committees also have responsibilities with respect to risk oversight. The Compensation Committee is responsible for overseeing the management of risks relating to executive compensation plans and arrangements. The Nominating and Governance Committee was formed to manage risks associated with the independence of the Board, including considering whether any director nominees have relationships or potential conflicts of interest that could affect their independence. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is informed of risks we face through reports from our committees and management.

Bally’s ESG Commitment

Bally’s is committed to engaging and investing in the communities in which we operate, promoting a diverse and inclusive workplace for our valued team members, and a positive and safe experience for our players and guests. We strive to make a positive impact and embrace our commitment to ESG, including a focus on responsible gaming and business practices across our global company.

In 2023, the Company formed an executive Sustainability Committee, comprised of senior leaders across our global footprint from diverse areas within the company including operations, public affairs, human resources and corporate governance. A key achievement in 2023 was the launch of the Company’s first ESG materiality assessment to inform a global ESG strategy and areas of focus, supported by more robust reporting capabilities.

Diversity, Equity, and Inclusion. The Company’s executive Diversity, Equity, and Inclusion (“DEI”) committee sets the strategy for ensuring Bally’s people and business priorities reflect the diversity of our customers and guests and that inclusion is fully embraced as core to our DNA and how we operate. Bally’s Executive Director of DEI leads this enterprise-wide DEI initiatives in collaboration with all aspects of our business, including human resources, procurement, and operations.

Across all jurisdictions where we are located, we are dedicated to building stronger communities by becoming an integral part of the local community as reflected in our workforce and community engagement. As an example, Bally’s actively considers local applicants, military personnel and first responders. The Company donates to local veteran homes and has hosted veteran career fairs to actively recruit military personnel and connect them with prospective employers. The Company also donates concert tickets to veterans and active-duty military personnel. We are also committed to providing employment opportunities to individuals with developmental disabilities. For example, we work with Access Point RI, a non-profit human services organization that provides children and adults with developmental disabilities the means to lead full and productive lives, to make available such opportunities at our Rhode Island properties.

Bally’s is committed to a diverse, inclusive workforce. Globally, 47% of Bally’s employees are women and in the United States, 46% of its employees self-identify as members of minority groups. Bally’s leadership (management and above) is comprised of 33% women and 13.9% self-identify as members of minority groups.

We have expanded the reach of our DEI activities across all our operations and report our progress to Bally’s ESG Committee. Bally’s engaged the entire company in education designed to enhance awareness of DEI and promote a more inclusive workplace. As part of our DEI strategy for 2023, education specific to inclusion was rolled out throughout the organization, including mandatory education for people managers and leaders, as well as our executive leadership team. At present, this education has a completion rate of over 90% by our North American employees, with plans to continue expand to an even wider audience across the Company.

Offering our employees the opportunity and resources to connect, support one another, and contribute to building a more inclusive environment is one of the key objectives in our DEI strategy. In previous years, our Bally’s Interactive division has been able to support the activities of 4 networks with a total of 665 members and programming attended or supported by thousands. Bally’s employee networks serve as a platform and community for employees from diverse backgrounds. Participation in our employee networks is open to all employees. The current Bally’s employee networks are PRIDE – promoting an inclusive environment for our LGBTQIA+ community; EMBRACE – giving a voice to employees from ethnically diverse backgrounds; The Parents Network – supporting working parents, carers, and parents-to-be; and The Global League of Women (GLoW) – highlighting and discussing gender-driven issues.

Our DEI strategy in action, illustrates we have built a robust cultural calendar aimed at celebrating and honoring diversity throughout the year. Our internal actions within this space provide our employees key opportunities to expand their understanding of diverse experiences, build supportive communities, and engage with one another. Several key events in our cultural calendar for the past year have included:

•International Women’s Day Roundtable – held in our property in Atlantic City and streamed across our channels, this event brought together four members of our Bally’s senior leadership to discuss their career paths, achievements, and observations as women in our fast-paced and competitive industry.

•Pride Celebrations – scheduled throughout the summer, in line with the local Pride events in many of our offices. We hosted internal events and attend celebrations supporting the LGBTQ+ communities in Providence, Toronto, Isle of Man, Malta, Manila, and Spain.

•Global Diversity Month – we had the privilege of hosting an exclusive talk delivered by Dr. Yusef Salaam, noted activist and author of Better Not Bitter, who delivered an impactful talk on growth and resilience.

•Veteran’s Day – we were proud to honor the sacrifices and bravery of the veterans amongst our teams. We highlighted the stories and experiences of these individuals through a video which was shared across the enterprise and on our social media platforms.

Last year, our work in supplier diversity advanced in Chicago with the opening of our flagship temporary casino. Bally’s, in partnership with the City of Chicago have curated the most aggressive goals in the country in support of small, women and minority owned business enterprises. In 2024, we will support our first supplier diversity fair. Bally’s have national and international memberships to support our business diversity efforts in half dozen organizations including the National Minority Supplier Development Council (NMSDC); Women’s Business Enterprise National Council (WBENC); Stonewall; Business in the Community; Global Gaming Women; and African Americans in Gaming; Bally’s is committed to business diversity by engaging veteran, minority and women owned businesses across our Company.

Responsible Gaming. We are committed to ensuring responsible play and guest safety. All our employees participate in training to better equip them to identify and mitigate problem play. In 2023, Bally’s spent approximately 6,000 hours training staff members on responsible gaming measures. The Company is a member of the US Responsible Gaming Coalition and the corporate Leadership Circle for the National Council on Problem Gambling, adopted American Gaming Association’s Responsible Marketing Code of Conduct and Have a Game Plan Campaign, and commenced the process to obtain Responsible Gaming Accreditation for North America through RG Check in Ontario. We are also committed to supporting responsible gaming research and in 2023 made a $1.05 million to the International Center of Responsible Gaming for expanded research for underage play prevention and the usage of responsible gaming tools. Our properties participate in Responsible Gaming programs, including self-exclusion programs.

Community Investment and Engagement. The Bally’s UK based Foundation, focused on programs aimed at addressing mental health and wellness, donated more than $300,000 in 2023. In 2023, the Bally’s Foundation expanded its focus to North America.

In 2023, the Company made a $5 million donation over 5 years to the Community College of Rhode Island Foundation. Bally’s landmark support will increase pathways to higher education and provide economic opportunities for students interested in pursuing a career in the casino and gaming industries, as well as Bally’s employees looking to advance their skill sets. In addition, each of our sixteen properties makes significant contributions to their local communities and has donated to many non-profit and charitable organizations, including various local hospitals, senior care facilities, food banks, schools, and community programs. In 2023, Bally’s employees donated thousands of hours to various community service efforts, which reflects the company’s continued commitment to creating opportunities for economic growth and development in the communities we serve.

Our People; Employee Health and Well-Being. Bally’s engages in a number of employee wellness initiatives, including annual blood drives, wellness fairs, flu shot clinics, weight management support programs, employee dining programs and property sanitation programs, in addition to a weekly wellness communication distribution to employees providing helpful information on health initiatives and best practices. The Company also offers a wellness fund through our medical benefits provider which provides our employees with the opportunity to earn health-conscious rewards through the completion of certain wellness initiatives. We also maintain positive relationships with various unions and currently have thirty-two collective bargaining agreements covering approximately 3,040 employees.

During the Covid-19 pandemic Bally’s adopted robust, enhanced safety measures across all properties. While requirements have subsided, Bally’s remains vigilant with its various health and safety policies in a continued effort to protect our employees and create safe environments for our valued guests.

As we move forward, Bally’s plans to implement new employee-focused programs. One such program is a formal Management Development Program across our retail properties. This two-year management training program will be rotational in nature providing exposure to both front and back-of-the-house operations, enabling management the opportunity to identify and recruit high performing talent.

Environment. Respect for the environment is part of our culture and we have implemented several energy and emission efficiency initiatives at our properties. Examples from individual properties include switching lights to LEDs, switching from oil and other fuel sources to cleaner, more efficient natural gas sources, installation of electric vehicle charging points, waste segregation to maximize recycling and converting our waste vegetable oil into biofuel. Bally’s also participates in demand response and energy curtailment programs run by local utilities and regional power distribution organizations to remove part or all of the electric load from the utility grid on peak days (when requested) to save energy, reduce the need for fossil fuel power plants and help integrate renewable energy onto the electric grid by providing increased sustainability.

During the last year we have taken a number of steps to formalize and advance our approach to environmental sustainability. We now have an Environment and Climate Change Policy, have established processes to measure our direct (‘scope 1 and 2’) greenhouse gas emissions and have measured our scope 3 emissions at all of our properties in 2023. Bally’s continues to support Earth Day annually and uses this platform to raise awareness of global environmental issues. Bally’s Earth Day theme in 2024 will be “Planet V’s Plastics”. We run several events globally to celebrate Earth Day and encourage and support our employees to participate in local events such as beach and community clean-ups.

Governance; Board Diversity. Bally’s has developed and maintained robust corporate governance, including our Code of Business Conduct and Ethics, Corporate Governance Guidelines, and Board Committee Charters, which are available on our corporate website. Beyond our policies, we support a culture that prioritizes ethical business conduct and integrity. On an annual basis all employees receive and review the Code of Business Conduct and Ethics which is subject to the oversight of Bally’s Chief Compliance Officer. Within the Code of Business Conduct and Ethics, an independent third-party whistleblower hotline number is provided to employees. Violations of the Code of Business Conduct and Ethics, Company policies, and other business misconduct may be reported 24 hours a day, 7 days a week, and remain anonymous.

At Bally’s, data privacy and security are essential to the trust of our guests and employees. We work hard to ensure that our team members are aware of and supported by technology to protect everyone, and we continually evaluate and update our procedures and training in this area. In this regard, Bally’s has established a Data Protection Committee, chaired by its Data Privacy Officer, to oversee all data protection and privacy matters across all its operations.

Bally’s requires all property leaders, all new hires and rehires, and all employees handling or verifying large current transactions to undertake a series of annual training courses on anti-money laundering practices to ensure proper compliance. The Board Compliance Committee, chaired by Wanda Y. Wilson, an independent director of Bally’s, is responsible for reviewing and monitoring compliance with the Gaming Compliance Review and Reporting Plan. The Company’s commitment to compliance includes a separate department dedicated to the regulatory compliance of its interactive operations, which is facilitated through a detailed compliance monitoring program covering licensing, technology, and regulatory requirements.

In addition, Bally’s is committed to maintaining a diverse make-up of our Board, including diversity of race, gender, ethnicity, and experience. Bally’s commitment to diversity is reflected in the composition of our Board of Directors and Executive Management Team. 62.5% of our Board members and 60% of the executive management team self-identify as members of minority groups. Women comprise 25% and 20% of the Board and executive management team, respectively, women, inclusive of women of color.

DIRECTOR COMPENSATION

Pursuant to the Company’s non-employee director compensation policy that was in place for 2023, the Vice-Chairman received an annual retainer of $400,000, consisting of $200,000 in cash paid in equal installments quarterly and $200,000 in the form of an annual grant of a Bally’s restricted stock award. Other non-employee directors (other than Mr. Kim who declined compensation for his service as a Bally’s director in 2023) were paid an annual retainer of $200,000, consisting of $100,000 in cash paid in equal installments quarterly and $100,000 in the form of an annual grant of a Bally’s restricted stock award. Director restricted stock awards vest in full in one installment on the earlier of the first anniversary of the grant date and the date of the Company’s annual meeting of shareholders that occurs in the year immediately following the grant date year. The Chair of each of the committees of the Board receives an additional $50,000 cash retainer annually, paid in equal installments quarterly. In addition, new members of the Board receive a one-time equity grant with a grant date value of $100,000 on the grant date.

The Board designed the director compensation program to attract and retain talented directors with the relevant skills and capabilities, to fairly compensate directors for the work required, to recognize the individual roles and responsibilities of the directors and to align directors’ interests with the long-term interests of Bally’s shareholders.

Non-employee directors are subject to share ownership guidelines that Bally’s adopted in 2019. See the section “Bally’s Share Ownership Guidelines and Policies for Directors and Officers” in this proxy statement for further information about these guidelines as they pertain to Bally’s non-employee directors.

2023 Director Compensation Table

The following table provides compensation information for the year ended December 31, 2023. Messrs. Papanier and Reeves do not receive compensation for their service as directors because they are employees of Bally’s. Mr. Kim has declined compensation for his service as a Bally’s director in 2023. Ms. Harris joined the Board during the first quarter of 2023. Mr. Ryan resigned as a director during the first quarter of 2023. During 2023, Ms. Wilson and Messrs. Patel and Rollins served on a newly created Operational Integration Committee that oversees the Company’s global process for streamlining company operations, among other things, and received and received additional cash compensation for such services equal to $80,000, $320,000 and $80,000, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash(1) ($) | | Stock Awards(2) ($) | | Option Awards ($) | | Non-Equity Incentive Plan Compensation ($) | | | All Other Compensation ($) | | Total ($) |

| Terrence Downey | | 150,000 | | | 99,995 | | | — | | | — | | | | — | | | 249,995 | |

Tracy S. Harris | | 130,000 | | | 199,991 | | | — | | | — | | | | — | | | 329,991 | |

| Soohyung Kim | | — | | | — | | | — | | | — | | | | — | | | — | |

| Jaymin B. Patel | | 495,000 | | | 199,991 | | | — | | | — | | | | — | | | 694,991 | |

| Jeffrey W. Rollins | | 240,000 | | | 99,995 | | | — | | | — | | | | — | | | 339,995 | |

| James Ryan | | 4,214 | | | — | | | — | | | — | | | | — | | | 4,214 | |

| Wanda Y. Wilson | | 255,000 | | | 99,995 | | | — | | | — | | | | — | | | 354,995 | |

__________________________________

| | | | | |

| (1) | This column shows the amount of cash compensation earned for service on the Board and its committees. Mr. Ryan’s cash compensation was pro-rated for his time served on the Board prior to his resignation. |

| (2) | The amounts contained in this column represent the aggregate grant date fair value for the restricted stock awards, including unvested restricted stock awards, granted in 2023 calculated in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 718, Stock Compensation (“ASC 718”). The grant date fair value for restricted stock awards is calculated using the intrinsic value method based on the closing price of our common shares on the NYSE on the date of grant. On May 17, 2023, Ms. Wilson and Messrs. Downey and Rollins received an award of restricted stock (“RSAs”) with a grant date fair value of approximately $100,000. Ms. Harris received an award of RSAs with a grant date fair value of approximately $200,000 which includes an additional one-time award with a grant date fair value of $100,000 as a new member of the board. Mr. Patel received an award of RSAs with a grant date fair value of approximately $200,000 which includes an additional award with a grant date fair value of $100,000 for his position as Vice Chairman. Ms. Wilson and Messrs. Downey and Rollins each have 6,468 unvested RSAs outstanding as of December 31, 2023. Ms. Harris and Mr. Patel each have 12,936 unvested RSAs outstanding as of December 31, 2023. Mr. Ryan forfeited his RSA award granted in 2022 when he resigned in early 2023 and did not receive a new grant in 2023. |

EXECUTIVE OFFICERS

Biographical information for the executive officers of Bally’s as of the date of this proxy statement (other than our Chief Executive Officer, Robeson M. Reeves and our President, George T. Papanier, whose biographical information is provided above under “Continuing Directors”) is set forth below. Executive officers serve at the discretion of our Board and until their successors have been duly appointed and qualified, unless sooner removed by the Board. There are no family relationships between our directors and executive officers.

Executive Officers: | | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Robeson M. Reeves | | 40 | | Chief Executive Officer |

| Marcus Glover | | 48 | | Executive Vice President and Chief Financial Officer |

| Craig L. Eaton | | 59 | | President, Rhode Island Operations and Corporate Secretary |

| Kim Barker Lee | | 56 | | Executive Vice President and Chief Legal Officer |

| George T. Papanier | | 66 | | President |

__________________________________

Marcus Glover

Mr. Glover has served as the Chief Financial Officer at Bally’s Corporation since May 2023. He is a senior executive in the hospitality and gaming industry with more than 20 years of experience. Most recently, Mr. Glover served as Chief Strategy Officer for QPSI LLC, a supply chain solutions and contract packaging company, where he was responsible for developing and executing the business’s growth strategy. Prior to that, Mr. Glover served in Senior Executive leadership roles for MGM Resorts, most notably as President and Chief Operating Officer of the Borgata Hotel, Casino & Spa, and President and Chief Operating Officer of the Beau Rivage Resort & Casino. Mr. Glover was also a senior executive with Caesars Entertainment in various positions, including Senior Vice President & General Manager for the Horseshoe Casino and Thistledown Racino, Assistant General Manager at Harrah’s/Caesars Entertainment in St. Louis, Missouri, and Vice President of Operations at Harrah’s/Caesars Entertainment in Biloxi, Mississippi. Marcus holds an M.B.A. from The Duke University Fuqua School of Business and received a B.A. in Business Administration, Finance from Morehouse College.

Craig L. Eaton

Craig Eaton is the President, Rhode Island Operations and Corporate Secretary for Bally’s Corporation. He has been associated with the Company since 2005 and has over 30 years of legal, regulatory, government relations and business experience. Mr. Eaton was a partner at the law firm of Adler, Pollock and Sheehan, chairing its regulatory and compliance practice group from 1998 through 2004. From 1995 to 1998, Mr. Eaton was General Counsel to the Narragansett Electric Company. A 1987 cum laude graduate of Union College and 1990 graduate of Boston College Law School, he is an active participant on various charitable and civic boards, and is a volunteer coach for various youth sports organizations.

Kim Barker Lee

Kim Barker Lee is the Executive Vice President and Chief Legal Officer at Bally’s Corporation. Ms. Lee oversees Bally’s global legal, compliance and data privacy teams, supporting the Company's global strategic initiatives.

Ms. Lee served as General Counsel and Vice President, Legal and Regulatory Affairs for Chicago-based Northstar Lottery Group, LLC, a majority-owned IGT affiliate. Ms. Lee also served as General Counsel to the Illinois Student Assistance Commission (ISAC), an Illinois state agency. She was also a partner in the public law practice while in private practice in the City of Chicago. Ms. Lee also served as the Vice President and Deputy General Counsel for IGT’s Digital and Sports Betting team from 2020 to 2021. In 2018, Ms. Lee was appointed IGT’s inaugural Vice President, Diversity and Inclusion.

Ms. Lee is a graduate of Yale College and New York University School of Law. Her board service includes Community College of Rhode Island Foundation, Family Service of Rhode Island and Providence Mutual Fire Insurance Company. She also serves as the Chair of the Board Governance Committee of the Providence Mutual Fire Insurance Company and on the board of American Gaming Association.

Ms. Lee was named one of iGB’s Most Influential Women in 2022 and one of Global Gaming Business’s 25 People to Watch for 2020 and 2024.

OWNERSHIP OF SECURITIES AND RELATED SHAREHOLDER MATTERS

Security Ownership of Certain Beneficial Owners and Management

The following table contains information about the beneficial ownership of our common shares as of March 20, 2024 for (1) each shareholder known by us to beneficially own more than 5% of our common shares, (2) each of our current directors, (3) each of our named executive officers, and (4) all of our directors and executive officers as a group. The percentage of ownership indicated in the following table is based on 40,426,353 common shares issued and outstanding on March 20, 2024.

Information with respect to beneficial ownership has been furnished by each director and executive officer and with respect to beneficial owners of more than 5% of our common shares, by filings made with the SEC by them. Beneficial ownership is determined in accordance with the rules of the SEC. Except as indicated by footnote, to our knowledge, the persons named in the table below have sole voting and investment power with respect to all shares of common shares shown as beneficially owned by them. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, common shares subject to options or warrants held by that person that are currently exercisable or will become exercisable within 60 days after March 20, 2024 are deemed outstanding, as well as any common shares that such person has the right to acquire upon the vesting of restricted stock units within 60 days after March 20, 2024, while such shares are not deemed outstanding for purposes of computing the percentage ownership of any other person. Except as otherwise indicated, the mailing address of each shareholder is c/o Bally’s Corporation, 100 Westminster Street, Providence, Rhode Island 02903.

| | | | | | | | | | | | | | | | | |

| Beneficial Owners | | Number of Shares Beneficially Owned |

| Percentage Ownership |

| | | | | |

| Directors and Named Executive Officers | |

|

|

|

Soohyung Kim(1) | | 10,589,849 |

| 26.1% |

| Terrence Downey | | 37,773 |

| * |

| Tracy S. Harris | | 13,136 | | | * |

| Jaymin B. Patel | | 33,624 | | * |

Jeffrey W. Rollins(2) | | 85,584 | | * |

| Wanda Y. Wilson | | 26,721 |

| * |

Robeson M. Reeves(3) | | 325,823 |

| * |

| Marcus Glover | | 12,014 | | * |

| Robert M. Lavan | | 24,320 | | * |

| Craig L. Eaton | | 151,503 | | * |

| Kim Barker Lee | | 12,039 | | | * |

George T. Papanier(4) | | 467,658 | | 1.2% |

| All directors and executive officers, as a group (11 persons) | | 11,755,724 | | 28.9% |

Standard RI Ltd(1) | | 10,589,849 |

| 26.1% |

Noel Hayden(5) | | 4,953,272 |

| 12.2% |

| BlackRock Institutional Trust Company, N.A. | | 3,659,857 | | 9.0% |

* Less than 1% | | | | |

__________________________________ | | | | |

| (1) | Consists of 10,589,849 common shares of Bally’s held by Standard RI Ltd. Standard General L.P. serves as investment manager to Standard RI Ltd and, in that capacity, exercises voting and investment control over the shares held by Standard RI Ltd. Soohyung Kim is the managing partner and chief investment officer of Standard General L.P. Each of Mr. Kim and Standard General L.P. disclaims beneficial ownership of the shares reported except to the extent of its or his pecuniary interest in such shares. |

| (2) | Consists of 82,175 common shares of Bally’s held by Mr. Rollins in a brokerage margin account and as such have been pledged as security for the account and 3,409 common shares of Bally’s held by a Limited Liability Corporation over which Mr. Rollins has sole voting and investment power. |

| (3) | Consists of 325,376 common shares of Bally’s held by Mr. Reeves and 447 common shares of Bally’s held by Mr. Reeves’ wife. Mr. Reeves disclaims beneficial ownership of these 447 common shares. |

| (4) | Consists of 449,658 common shares of Bally’s held by Mr. Papanier and 18,000 common shares of Bally’s held in trust. |

| (5) | Amounts beneficially owned by Mr. Hayden are based solely on an amended and restated Schedule 13G filed with the SEC on August 15, 2022. Mr. Hayden may be deemed the beneficial owner of all shares indicated. |

| (6) | Amounts beneficially owned by BlackRock Institutional Trust Company, N.A. are based solely on a Schedule 13G/A filed with the SEC on February 2, 2024. BlackRock Institutional Trust Company, N.A. may be deemed the beneficial owner of all shares indicated. |

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires our directors, executive officers and holders of more than 10% of our common shares to file reports of ownership and changes in ownership with the SEC. These persons are required to furnish us with copies of all Section 16(a) forms they file.

SEC regulations require us to identify in this proxy statement anyone who filed a required report late during the most recent fiscal year. Based solely on the reports received by us and on the representations of the reporting persons, to the Company’s knowledge, these persons have complied with all applicable filing requirements during the year ended December 31, 2023, except that a Form 4 for Ms. Wilson reporting a purchase transaction was filed late.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (“CD&A”) describes the principles and practices underlying our named executive officer compensation program and the decisions made by the Compensation Committee of our Board related to 2023 compensation for our named executive officers.

Bally’s compensation philosophy has historically focused on the following principal objectives and has continued to use these objectives when setting executive compensation:

•pay for performance based on achievement of corporate and any applicable individual objectives;

•pay competitively to attract, retain and motivate exceptional management performance; and

•align management compensation with the achievement of business objectives and the creation of value for stakeholders.

These objectives are designed to reward results linked to both short-term and long-term performance (pay-for-performance) and to provide compensation that will attract, incentivize and retain high-caliber individuals for the most impactful management positions at Bally’s. This philosophy generally takes into account the market practices of similarly situated peer companies and reflects the Compensation Committee’s priority of attracting and retaining the highest quality talent for achievement of Bally’s strategic business plan and annual operating goals.

2023 Named Executive Officers

This CD&A focuses on the compensation of Bally’s named executive officers (the “NEOs”) for the year ended December 31, 2023:

•Robeson M. Reeves, Chief Executive Officer

•Lee D. Fenton, Former Chief Executive Officer

•Marcus Glover, Executive Vice President and Chief Financial Officer

•Robert M. Lavan, Former Executive Vice President and Chief Financial Officer

•Craig L. Eaton, President, Rhode Island Operations and Corporate Secretary

•Kim Barker Lee, Executive Vice President and Chief Legal Officer

•George T. Papanier, President

Recent Executive Transitions

Effective March 31, 2023, Bally’s appointed Robeson Reeves as Bally’s Chief Executive Officer, replacing Lee Fenton who stepped down from his role as Chief Executive Officer as a result of a mutual decision between Mr. Fenton and the Company. In connection with this leadership change, the Company appointed George Papanier as Bally’s President, effective as of March 31, 2023. Effective May 5, 2023, Bally's appointed Marcus Glover as Bally's Executive Vice President and Chief Financial Officer, replacing Robert Lavan who resigned effective as of the same date, not as the result of any disagreement with Bally's. Effective January 1, 2024, Craig Eaton’s title changed from Senior Vice President, Head of Rhode Island Operations and Corporate Secretary to President, Rhode Island Operations and Corporate Secretary due to a modification of his duties.

Development of Bally’s Executive Compensation Program

Role of the Compensation Committee

The Compensation Committee reviews, considers and makes determinations with respect to the compensation of Bally’s executive officers (including decisions with respect to base salary, annual bonus and long-term equity compensation). The Compensation Committee’s responsibilities include development and oversight of Bally’s incentive plans, including the approval of performance criteria to be used in connection with Bally’s performance-based compensation programs.

Role of Bally’s Executive Officers in Determining Compensation

From time to time, the Chief Executive Officer and Chief Financial Officer may provide input to the Compensation Committee with respect to the performance criteria established in connection with Bally’s performance-based compensation programs, and the Chief Executive Officer may provide input and recommendations to the Compensation Committee with respect to any individual performance goals that may be established (for example, management objectives, etc.) in connection with those programs. However, no executive officer provides input to the Compensation Committee regarding the amount or form of compensation he receives.

Consideration of 2023 Shareholder Advisory Vote to Approve Named Executive Officer Compensation (“Say-on-Pay”)

We provide our shareholders with an annual “Say-on-Pay” advisory vote on our named executive compensation program as required under applicable U.S. securities laws. In 2023, approximately 95.5% of the votes cast approved the compensation for our NEOs described in our Proxy Statement for the 2023 Annual Meeting of Shareholders. We expect that our next required “Say-on-Pay” vote to determine the frequency of future Say-on-Pay votes will occur at the annual meeting of shareholders in 2028.

In evaluating the design of our executive compensation programs and the specific compensation decisions for each of our NEOs, the Compensation Committee considers, in addition to other factors, shareholder input, including the advisory Say-on-Pay vote at our annual meeting. The Compensation Committee did not make any changes to our compensation programs or policies that were specifically driven by the results of the Say-on-Pay vote or shareholder feedback.

Establishment of Peer Group

In both 2023 and 2022, Bally’s management engaged a compensation consultant, Lockton Companies (“Lockton”), to provide information regarding compensation and pay practices and to prepare a peer group for the Company. The project in 2022 focused on the Company’s U.S. operations, and the project was extended into 2023 to focus on our global operations. Constituent companies in the peer group were selected based on an analysis of entities in the same general industry as Bally’s (or similar industries), with revenues in the range of 0.40 to 2.50 times Bally’s revenue, market capitalization in the range of 0.25 to 4.00 times Bally’s market capitalization, and similar employee populations, international footprints and non-U.S. revenue streams compared to Bally’s.

The peer group proposed by Lockton for 2023, which remained unchanged from 2022, consisted of the following companies:

•Boyd Gaming Corporation

•Churchill Downs Incorporated

•DraftKings Inc.

•Golden Entertainment, Inc.

•International Game Technology PLC

•Las Vegas Sands Corporation

•Penn National Gaming, Inc.

•Playtika Holding Corp.

•Red Rocks Resorts, Inc.

•Roblox Corporation

•Scientific Games Corporation

•Take-Two Interactive Software, Inc.

•Wynn Resorts, Limited

•Zynga Inc.

Although Bally’s did not engage in benchmarking for any of its fiscal year 2023 compensation decisions, comparative compensation information from Lockton was provided to the Compensation Committee to generally inform it of market practices with respect to compensation and pay practices. The Compensation Committee’s review of the peer group prepared by Lockton had no material impact on fiscal year 2023 compensation decisions for any of our NEOs.

Elements of Bally’s 2023 Executive Compensation Program

In 2023, compensation for the NEOs had three principal components: (1) annual base salary, (2) eligibility to receive an annual cash incentive bonus, and (3) participation in Bally’s long-term, equity-based incentive program. For purposes of this CD&A, unless otherwise noted, the amounts disclosed in U.S. dollars in this CD&A for Messrs. Fenton and Reeves are opportunities denominated in U.S. dollars in their employment agreements, but such amounts are converted from U.S. dollars into sterling pounds (GBP) when such amounts are actually paid to Messrs. Fenton and Reeves based on the applicable exchange rate.

2023 Base Salary