UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

FOR THE FISCAL YEAR ENDED DECEMBER 31 , 2021

| or | |||||

| FOR THE TRANSITION PERIOD FROM ___________ TO __________ | |||||

| COMMISSION FILE NUMBER | |||||

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | ||||

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code: (724 ) 271-7600

Securities registered pursuant to Section 12(b) of the Act

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated Filer | ☐ | Emerging Growth Company | ||||||||||||||||||||||||||

| Non-Accelerated Filer | ☐ | Smaller Reporting Company | |||||||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of common stock held by non-affiliates of the registrant as of June 30, 2021: $3.4 billion

The number of shares of common stock outstanding (in thousands), as of January 31, 2022: 432,676

DOCUMENTS INCORPORATED BY REFERENCE

EQUITRANS MIDSTREAM CORPORATION

Table of Contents

| Page No. | ||||||||

| PART I | ||||||||

| PART II | ||||||||

| PART III | ||||||||

| PART IV | ||||||||

2

EQUITRANS MIDSTREAM CORPORATION

Glossary of Commonly Used Terms, Abbreviations and Measurements

2021 Water Services Agreement – that certain mixed-use water services agreement entered into on October 22, 2021 by the Company and EQT (as defined below), as subsequently amended, which, upon its effectiveness, will replace the Water Services Letter Agreement (as defined below) and certain other existing Pennsylvania water services agreements.

Allowance for Funds Used During Construction (AFUDC) – carrying costs for the construction of certain long-lived regulated assets are capitalized and amortized over the related assets' estimated useful lives. The capitalized amount for construction of regulated assets includes interest cost and a designated cost of equity for financing the construction of these regulated assets.

Appalachian Basin – the area of the United States composed of those portions of West Virginia, Pennsylvania, Ohio, Maryland, Kentucky and Virginia that lie in the Appalachian Mountains.

associated gas – natural gas that is produced as a byproduct of principally oil production activities.

British thermal unit – a measure of the amount of energy required to raise the temperature of one pound of water one-degree Fahrenheit.

Code – the U.S. Internal Revenue Code of 1986, as amended, and the regulations and interpretations promulgated thereunder.

delivery point – the point where gas is delivered into a downstream gathering system or transmission pipeline.

Distribution – the distribution of 80.1% of the then-outstanding shares of common stock, no par value, of Equitrans Midstream Corporation (Equitrans Midstream common stock) to EQT shareholders of record as of the close of business on November 1, 2018.

EQGP – EQGP Holdings, LP and its subsidiaries.

EQM – EQM Midstream Partners, LP and its subsidiaries.

EQT – EQT Corporation (NYSE: EQT) and its subsidiaries.

EQT Global GGA – that certain Gas Gathering and Compression Agreement entered into on February 26, 2020 (the EQT Global GGA Effective Date) by the Company with EQT and certain affiliates of EQT for the provision of certain gas gathering services to EQT in the Marcellus and Utica Shales of Pennsylvania and West Virginia, as subsequently amended.

firm contracts – contracts for gathering, transmission, storage and water services that reserve an agreed upon amount of pipeline or storage capacity regardless of the capacity used by the customer during each month, and generally obligate the customer to pay a fixed, monthly charge.

firm reservation fee revenues – contractually obligated revenues that include fixed monthly charges under firm contracts and fixed volumetric charges under MVC (as defined below) contracts.

gas – natural gas.

liquefied natural gas (LNG) – natural gas that has been cooled to minus 161 degrees Celsius for transportation, typically by ship. The cooling process reduces the volume of natural gas by 600 times.

local distribution company (LDC) – LDCs are companies involved in the delivery of natural gas to consumers within a specific geographic area.

Minimum volume commitments (MVC or MVCs) – contracts for gathering or water services that obligate the customer to pay for a fixed amount of volumes daily, monthly, annually or over the life of the contract.

Mountain Valley Pipeline (MVP) – an estimated 300-mile, 42-inch diameter natural gas interstate pipeline with a targeted capacity of 2.0 Bcf per day that is designed to span from the Company's existing transmission and storage system in Wetzel County, West Virginia to Pittsylvania County, Virginia, providing access to the growing Southeast demand markets.

Mountain Valley Pipeline, LLC (MVP Joint Venture) – a joint venture among the Company and, as applicable, affiliates of each of NextEra Energy, Inc., Consolidated Edison, Inc. (Con Edison), AltaGas Ltd. and RGC Resources, Inc. that is constructing the MVP and the MVP Southgate (as defined below) projects.

3

MVP Southgate – a proposed 75-mile interstate pipeline that is contemplated to extend from the MVP at Pittsylvania County, Virginia to new delivery points in Rockingham and Alamance Counties, North Carolina. The project is subject to ongoing discussions between the MVP Joint Venture and the project shipper, Dominion Energy North Carolina, as discussed in "MVP Southgate Project" under "Developments, Market Trends and Competitive Conditions" in "Item 1. Business" of this Annual Report on Form 10-K.

natural gas liquids (NGLs) – those hydrocarbons in natural gas that are separated from the gas as liquids through the process of absorption, condensation, adsorption or other methods in gas processing plants. Natural gas liquids include ethane, propane, butane and iso-butane.

play – a proven geological formation that contains commercial amounts of hydrocarbons.

Predecessor period – the periods prior to the Separation Date (as defined below).

Preferred Interest – the preferred interest that the Company has in EQT Energy Supply, LLC (EES), a subsidiary of EQT.

Proxy Statement – the Company's definitive proxy statement relating to the 2022 annual meeting of shareholders to be filed with the Securities and Exchange Commission.

receipt point – the point where gas is received by or into a gathering system or transmission pipeline.

reservoir – a porous and permeable underground formation containing an individual and separate natural accumulation of producible hydrocarbons (crude oil and/or natural gas) which is confined by impermeable rock or water barriers and is characterized by a single natural pressure system.

Scope 1 emissions – direct greenhouse gas emissions from owned or controlled sources.

Scope 2 emissions – indirect greenhouse gas emissions from the generation of purchased energy.

Separation – the separation of EQT's midstream business, which was composed of the assets and liabilities of EQT's separately-operated natural gas gathering, transmission and storage and water services operations of EQT, from EQT's upstream business, which was composed of the natural gas, oil and natural gas liquids development, production and sales and commercial operations of EQT, which occurred on the Separation Date.

Separation Date – November 12, 2018.

throughput – the volume of natural gas transported or passing through a pipeline, plant, terminal or other facility during a particular period.

Water Services Letter Agreement – that certain letter agreement entered into on February 26, 2020 by the Company and EQT, pursuant to which EQT agreed to utilize the Company for the provision of water services in Pennsylvania under existing water services agreements and new water services agreements if negotiated between the parties, which letter agreement will be replaced by the 2021 Water Services Agreement.

wellhead – the equipment at the surface of a well used to control the well's pressure and the point at which the hydrocarbons and water exit the ground.

working gas – the volume of natural gas in the storage reservoir that can be extracted during the normal operation of the storage facility.

Unless context otherwise requires, a reference to a "Note" herein refers to the accompanying Notes to Consolidated Financial Statements contained in "Item 8. Financial Statements and Supplementary Data."

4

| Abbreviations | Measurements | ||||

ARO – asset retirement obligations | Btu = one British thermal unit | ||||

ASC – Accounting Standards Codification | BBtu = billion British thermal units | ||||

ASU – Accounting Standards Update | Bcf = billion cubic feet | ||||

CERCLA – Comprehensive Environmental Response, Compensation and Liability Act | Mcf = thousand cubic feet | ||||

DOT – United States Department of Transportation | MMBtu = million British thermal units | ||||

EPA – United States Environmental Protection Agency | MMcf = million cubic feet | ||||

FASB – Financial Accounting Standards Board | MMgal = million gallons | ||||

FERC – United States Federal Energy Regulatory Commission | |||||

GAAP – United States Generally Accepted Accounting Principles | |||||

GHG – greenhouse gas | |||||

HCA – high consequence area | |||||

IRS – United States Internal Revenue Service | |||||

NAAQS – National Ambient Air Quality Standards | |||||

NGA – Natural Gas Act of 1938 | |||||

NGPA – Natural Gas Policy Act of 1978 | |||||

NYMEX – New York Mercantile Exchange | |||||

NYSE – New York Stock Exchange | |||||

PHMSA – Pipeline and Hazardous Materials Safety Administration of the DOT | |||||

RCRA – Resource Conservation and Recovery Act | |||||

SEC – United States Securities and Exchange Commission | |||||

5

EQUITRANS MIDSTREAM CORPORATION

Cautionary Statements

Disclosures in this Annual Report on Form 10-K contain certain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act), and Section 27A of the Securities Act of 1933, as amended (the Securities Act). Statements that do not relate strictly to historical or current facts are forward-looking and usually identified by the use of words such as "anticipate," "estimate," "could," "would," "will," "may," "forecast," "approximate," "expect," "project," "intend," "plan," "believe," "target" and other words of similar meaning in connection with any discussion of future operating or financial matters. Without limiting the generality of the foregoing, forward-looking statements contained in this Annual Report on Form 10-K include the matters discussed in the sections captioned "Strategy" under "Developments, Market Trends and Competitive Conditions" in "Item 1. Business" and "Outlook" in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations," and the expectations of plans, strategies, objectives, and growth and anticipated financial and operational performance of Equitrans Midstream Corporation (together with its subsidiaries, Equitrans Midstream or the Company), including:

•guidance and any changes in such guidance regarding the Company’s gathering, transmission and storage and water services revenue and volume, including the anticipated effects associated with the EQT Global GGA and related documents entered into with EQT;

•projected revenue (including from firm reservation fees) and volumes, deferred revenues, expenses and contract liabilities, and the effects on liquidity, leverage, projected revenue, deferred revenue and contract liabilities associated with the EQT Global GGA and the MVP project (including changes in the targeted full in-service date for such project);

•the ultimate gathering fee relief, and timing thereof, provided to EQT under the EQT Global GGA and related agreements, including the exercise by EQT of any cash-out option as an alternative to receiving a portion of such relief;

•the Company's ability to de-lever;

•the weighted average contract life of gathering, transmission and storage contracts;

•infrastructure programs (including the timing, cost, capacity and sources of funding with respect to gathering, transmission and storage and water projects);

•the cost to construct or restore right-of-way for, capacity, shippers for, timing of regulatory approvals and concluding litigation, final design (including expansions, extensions or refinements and capital related thereto), ability to contract additional capacity on, mitigate emissions from and complete, and targeted in-service dates of current or in-service projects or assets, in each case as applicable;

•the ultimate terms, partner relationships and structure of the MVP Joint Venture and ownership interests therein;

•the impact of changes in the targeted full in-service date of the MVP project on, among other things, the fair value of the Henry Hub cash bonus payment provision of the EQT Global GGA and the estimated transaction price allocated to the Company's remaining performance obligations under certain contracts with firm reservation fees and MVCs;

•expansion projects in the Company's operating areas and in areas that would provide access to new markets;

•the Company's ability to provide produced and mixed water handling services and realize expansion opportunities;

•the Company's ability to identify and complete acquisitions and other strategic transactions, including joint ventures, effectively integrate transactions into the Company's operations, and achieve synergies, system optionality, accretion and other benefits associated with transactions, including through increased scale;

•any credit rating impacts associated with the MVP project, customer credit ratings changes, defaults, acquisitions, dispositions and financings and any changes in EQM's credit ratings;

•the effect and outcome of future litigation and other proceedings, including regulatory proceedings;

•the effects of any consolidation of or effected by upstream gas producers, whether in or outside of the Appalachian Basin;

6

•the timing and amount of future issuances or repurchases of the Company's securities;

•the effects of conversion, if at all, of the Equitrans Midstream Preferred Shares (as defined herein);

•the effects of seasonality;

•expected cash flows and MVCs, including those associated with the EQT Global GGA, and the potential impacts thereon of the commission timing and cost of the MVP project;

•the ability to achieve, and time for achieving, Hammerhead pipeline full commercial in-service;

•projected capital contributions and capital and operating expenditures, including the amount and timing of reimbursable capital expenditures, capital budget and sources of funds for capital expenditures;

•dividend amounts, timing and rates;

•changes in commodity prices and the effect of commodity prices on the Company's business;

•future decisions of customers in respect of curtailing natural gas production, timing of turning wells in line, rig and completion activity and related impacts on the Company's business;

•liquidity and financing requirements, including sources and availability;

•interest rates;

•the ability of the Company's subsidiaries (some of which are not wholly owned) to service debt under, and comply with the covenants contained in, their respective credit agreements and to timely extend and obtain modifications in terms under such agreements;

•expectations regarding natural gas and water volumes in the Company's areas of operations;

•the Company's ability to achieve anticipated benefits associated with the execution of the EQT Global GGA and other commercial agreements;

•the impact on the Company and its subsidiaries of the coronavirus disease 2019 (COVID-19) pandemic, including, among other things, effects on demand for natural gas and the Company’s services, commodity prices, access to capital and costs which may be incurred as a result of, and potential need for compliance with, governmental (including state or local) regulations or orders which may be enacted and upheld with respect to testing and/or vaccination for COVID-19;

•the Company's ability to achieve, and create value from, its environmental, social and governance (ESG) and sustainability targets (including targets set forth in its climate policy) and the Company's ability to respond to increasing stakeholder scrutiny in these areas;

•the effectiveness of the Company's information technology systems and practices to defend against evolving cyberattacks on United States critical infrastructure;

•the effects of government regulation including any quantification of potential impacts of regulatory matters related to climate change on the Company; and

•tax status and position.

The forward-looking statements included in this Annual Report on Form 10-K involve risks and uncertainties that could cause actual results to differ materially from projected results. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. The Company has based these forward-looking statements on management's current expectations and assumptions about future events. While the Company considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory, judicial and other risks and uncertainties, many of which are difficult to predict and are beyond the Company's control. The risks and uncertainties that may affect the operations, performance and results of the Company's business and forward-looking statements include, but are not limited to, those set forth under "Item 1A. Risk Factors," and elsewhere in this Annual Report on Form 10-K.

Any forward-looking statement speaks only as of the date on which such statement is made and the Company does not intend to correct or update any forward-looking statement, unless required by securities law, whether as a result of new information, future events or otherwise.

7

PART I

Item 1. Business

Overview of the Company

Equitrans Midstream is one of the largest natural gas gatherers in the U.S. and holds a significant transmission footprint in the Appalachian Basin. Equitrans Midstream, a Pennsylvania corporation, became an independent, publicly traded company on November 12, 2018, as a result of the Separation (as defined below).

The Separation. On November 12, 2018, Equitrans Midstream, EQT and, for certain limited purposes, EQT Production Company, a wholly owned subsidiary of EQT, entered into a separation and distribution agreement (the Separation and Distribution Agreement), pursuant to which, among other things, EQT effected the separation of its midstream business, which was composed of the assets and liabilities of the separately-operated natural gas gathering, transmission and storage and water services operations of EQT (the Midstream Business), from EQT's upstream business, which was composed of the natural gas, oil and natural gas liquids development, production and sales and commercial operations of EQT (the Separation), to Equitrans Midstream, and distributed 80.1% of the then-outstanding shares of common stock, no par value, of Equitrans Midstream (Equitrans Midstream common stock) to EQT shareholders of record as of the close of business on November 1, 2018 (the Distribution).

In connection with the Separation, the Company acquired control of the entities conducting the Midstream Business. See Note 1 to the consolidated financial statements for further information on the entities conducting the Midstream Business.

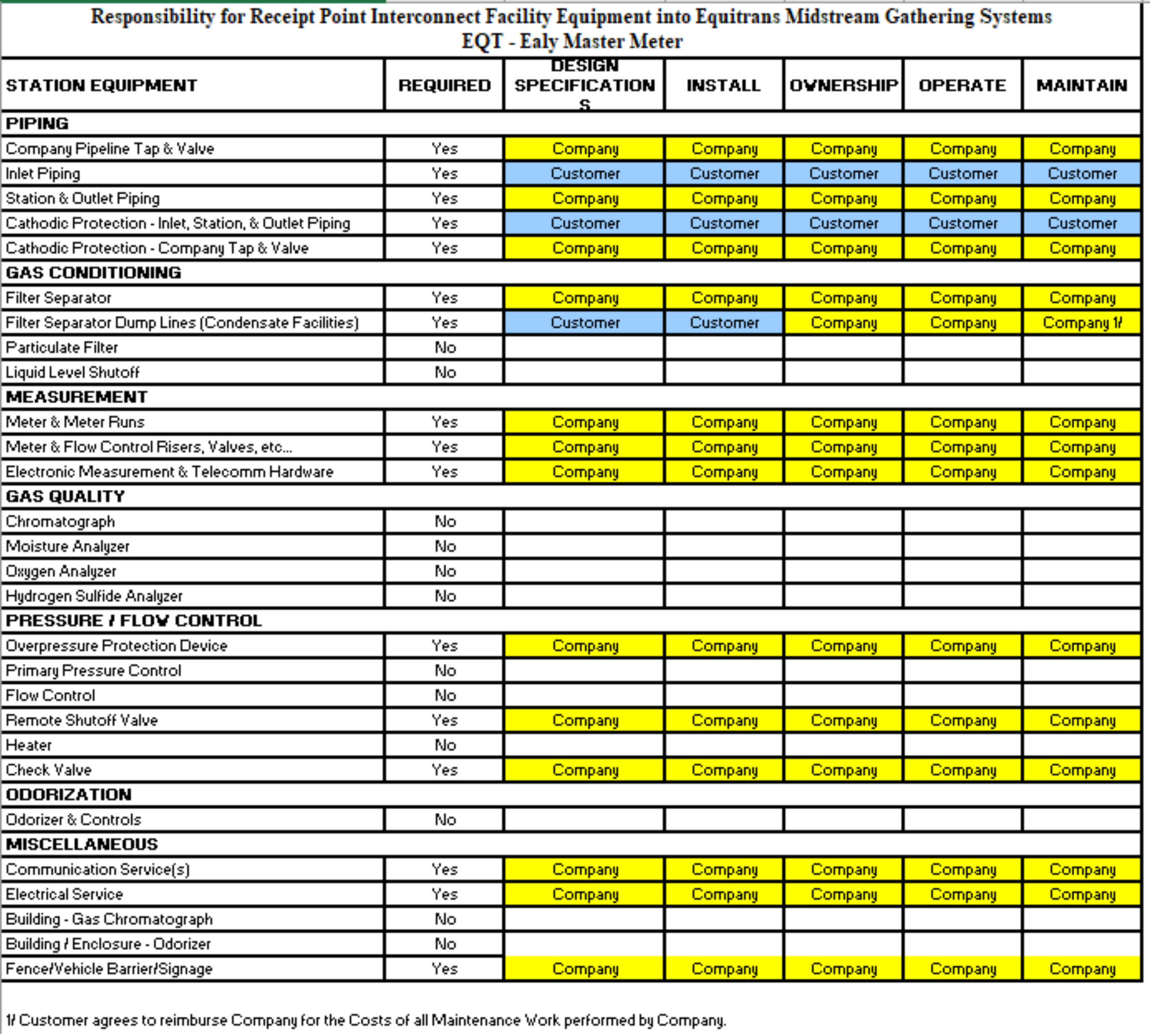

The Company's Post-Separation Relationship with EQT. The Company and EQT are separate companies with separate management teams and separate boards of directors. Although they operate separately, due to the approximately 5.3% of Equitrans Midstream's outstanding shares of common stock held by EQT as of December 31, 2021, the Company and EQT are characterized for certain purposes as related parties. In connection with the Separation and Distribution, the Company and EQT executed the Separation and Distribution Agreement and various other agreements to effect the Separation. See Notes 1 and 8 to the consolidated financial statements for further information on the relationship between the Company and EQT subsequent to the Separation.

EQGP Unit Purchases and Limited Call Right. On November 29, 2018, the Company entered into written agreements (the Unit Purchase Agreements) with certain investors owning an aggregate of 15,364,421 common units representing limited partner interests in EQGP (EQGP common units) for $20.00 per EQGP common unit that closed through a series of transactions ending on January 3, 2019 for an aggregate purchase price of $307.3 million (collectively, the EQGP Unit Purchases).

On December 31, 2018, the Company exercised a limited call right (the Limited Call Right) under EQGP's partnership agreement, pursuant to which, on January 10, 2019, the Company closed on the acquisition of the remaining 11,097,287 outstanding EQGP common units not owned by the Company or its affiliates for an aggregate purchase price of $221.9 million (such acquisition, together with the EQGP Unit Purchases, the EQGP Buyout), and EQGP became an indirect, wholly owned subsidiary of the Company. See Note 1 to the consolidated financial statements for further information on the EQGP Buyout.

EQM IDR Transaction. On February 22, 2019, Equitrans Midstream completed a simplification transaction pursuant to that certain Agreement and Plan of Merger, dated as of February 13, 2019 (the IDR Merger Agreement), by and among Equitrans Midstream and certain related parties, pursuant to which, among other things, (i) Equitrans Merger Sub, LP merged with and into EQGP (the Merger) with EQGP continuing as the surviving limited partnership and a wholly owned subsidiary of EQM, and (ii) each of (a) the IDRs in EQM, (b) the economic portion of the general partner interest in EQM and (c) the issued and outstanding EQGP common units were canceled, and, as consideration for such cancellation, certain affiliates of the Company received on a pro rata basis 80,000,000 newly-issued common units representing limited partner interests in EQM (EQM common units) and 7,000,000 newly-issued Class B units representing limited partner interests in EQM (Class B units), and EQGP Services, LLC (the EQM General Partner) retained the non-economic general partner interest in EQM (such transactions, collectively, the EQM IDR Transaction). Additionally, as part of the EQM IDR Transaction, the 21,811,643 EQM common units held by EQGP were canceled and 21,811,643 EQM common units were issued pro rata to certain subsidiaries of the Company. As a result of the EQM IDR Transaction, the EQM General Partner replaced EQM Midstream Services, LLC as the general partner of EQM. See Note 2 to the consolidated financial statements for further information on the EQM IDR Transaction.

EQM Series A Preferred Units. On March 13, 2019, EQM entered into a Convertible Preferred Unit Purchase Agreement, together with Joinder Agreements entered into on March 18, 2019, with certain investors (such investors, collectively, the Investors) to issue and sell in a private placement (the Private Placement) an aggregate of 24,605,291 Series A Perpetual Convertible Preferred Units (EQM Series A Preferred Units) representing limited partner interests in EQM for a cash purchase

8

price of $48.77 per EQM Series A Preferred Unit, resulting in total gross proceeds of approximately $1.2 billion. The net proceeds from the Private Placement were used in part to fund the purchase price in the Bolt-on Acquisition (as defined in Note 3) and to pay certain fees and expenses related to the Bolt-on Acquisition, and the remainder was used for general partnership purposes. The Private Placement closed concurrently with the closing of the Bolt-on Acquisition on April 10, 2019. See Note 2 to the consolidated financial statements for further information on the EQM Series A Preferred Units, none of which remain outstanding, and Note 3 to the consolidated financial statement for further information on the Bolt-on Acquisition.

EQM Merger. On June 17, 2020, pursuant to that certain Agreement and Plan of Merger, dated as of February 26, 2020 (the EQM Merger Agreement), by and among the Company, EQM LP Corporation, a wholly owned subsidiary of the Company (EQM LP), LS Merger Sub, LLC, a wholly owned subsidiary of EQM LP (Merger Sub), EQM and the EQM General Partner, Merger Sub merged with and into EQM (the EQM Merger), with EQM continuing and surviving as an indirect, wholly owned subsidiary of the Company. Upon consummation of the EQM Merger, the Company acquired all of the outstanding EQM common units that the Company and its subsidiaries did not already own. Following the closing of the EQM Merger, EQM was no longer a publicly traded entity. See Note 2 to the consolidated financial statements for further information on the EQM Merger.

Preferred Restructuring Agreement. On February 26, 2020, the Company and EQM entered into a Preferred Restructuring Agreement (the Restructuring Agreement) with all of the Investors pursuant to which, at the effective time of the EQM Merger (the Effective Time): (i) EQM redeemed $600 million aggregate principal amount of the Investors' EQM Series A Preferred Units issued and outstanding immediately prior to the Restructuring Closing (as defined below), which occurred substantially concurrent with the closing of the EQM Merger, for cash at 101% of the EQM Series A Preferred Unit purchase price of $48.77 per such unit (the EQM Series A Preferred Unit Purchase Price) plus any accrued and unpaid distribution amounts and partial period distribution amounts, and (ii) immediately following such redemption, each remaining issued and outstanding EQM Series A Preferred Unit was exchanged for 2.44 shares of a newly authorized and created series of preferred stock, without par value, of Equitrans Midstream, convertible into Equitrans Midstream common stock (the Equitrans Midstream Preferred Shares) on a one for one basis, in each case, in connection with the occurrence of the “Series A Change of Control” (as defined in the Fourth Amended and Restated Agreement of Limited Partnership of EQM (as amended, the Former EQM Partnership Agreement)) that occurred upon the closing of the EQM Merger (collectively, the Restructuring and, the closing of the Restructuring, the Restructuring Closing). See Note 2 to the consolidated financial statements for further information on the Restructuring Agreement and the Restructuring.

The EQT Global GGA. On February 26, 2020 (the EQT Global GGA Effective Date), the Company entered into a Gas Gathering and Compression Agreement (the EQT Global GGA) with EQT for the provision by the Company of certain gas gathering services to EQT in the Marcellus and Utica Shales of Pennsylvania and West Virginia. Pursuant to the EQT Global GGA, EQT is subject to an initial annual MVC of 3.0 Bcf per day that gradually steps up to 4.0 Bcf per day through December 2031 following the full in-service date of the MVP. The EQT Global GGA runs from the EQT Global GGA Effective Date through December 31, 2035, and will renew annually thereafter unless terminated by EQT or the Company pursuant to its terms. Pursuant to the EQT Global GGA, the Company has certain obligations to build connections to connect EQT wells to its gathering system, which are subject to geographical limitations in relation to the dedicated area in Pennsylvania and West Virginia, as well as the distance of such connections to the Company's then-existing gathering system. In addition to the fees related to gathering services, the EQT Global GGA provides for potential cash bonus payments payable by EQT to the Company during the period beginning on the first day of the calendar quarter in which the MVP full in-service date occurs through the calendar quarter ending December 31, 2024 (the Henry Hub cash bonus payment provision). The potential cash bonus payments are conditioned upon the quarterly average of certain Henry Hub natural gas prices exceeding certain price thresholds.

The gathering MVC fees payable by EQT to the Company set forth in the EQT Global GGA are subject to potential reductions for certain contract years as set forth in the EQT Global GGA, conditioned to begin the first day of the quarter in which the full in-service date of the MVP occurs, which provide for estimated aggregate fee relief of approximately $270 million in the first twelve-month period, approximately $230 million in the second twelve-month period and approximately $35 million in the third twelve-month period. Further, the EQT Global GGA provides for a fee credit to the gathering rate for certain gathered volumes that also receive separate transmission services under certain transmission contracts. In addition, given that the MVP full in-service date did not occur by January 1, 2022, EQT has an option, exercisable through December 31, 2022, to forgo approximately $145 million of the gathering fee relief in such first twelve-month period and approximately $90 million of the gathering fee relief in such second twelve-month period in exchange for a cash payment from the Company to EQT in the amount of approximately $196 million (the EQT Cash Option). See Note 6 to the consolidated financial statements for further information on the EQT Global GGA.

Credit Letter Agreement. On February 26, 2020, in connection with the execution of the EQT Global GGA, the Company and EQT entered into a letter agreement (the Credit Letter Agreement) pursuant to which, among other things, (a) the Company

9

agreed to relieve certain credit posting requirements for EQT, in an amount up to approximately $250 million, under its commercial agreements with the Company, subject to EQT maintaining a minimum credit rating from two of three rating agencies of (i) Ba3 with Moody’s Investors Service (Moody's), (ii) BB- with S&P Global Ratings (S&P) and (iii) BB- with Fitch Investor Services (Fitch) and (b) the Company agreed to use commercially reasonable good faith efforts to negotiate similar credit support arrangements for EQT in respect of its commitments to the MVP Joint Venture.

Water Services Letter Agreement and 2021 Water Services Agreement. On February 26, 2020, the Company entered into a letter agreement with EQT relating to the provision of water services in Pennsylvania (such letter agreement, the Water Services Letter Agreement). Subject to the effect of the 2021 Water Services Agreement (as defined below), the Water Services Letter Agreement would have been effective as of the first day of the first month following the MVP full in-service date and would have expired on the fifth anniversary of such date. During each year of the Water Services Letter Agreement, EQT had agreed to pay the Company a minimum $60 million per year annual revenue commitment (ARC) for volumetric water services provided in Pennsylvania, all in accordance with existing water service agreements and new water service agreements entered into between the parties pursuant to the Water Services Letter Agreement (or the related agreements).

On October 22, 2021, the Company and EQT entered into a new 10-year, mixed-use water services agreement covering operations within a dedicated area in southwestern Pennsylvania (as subsequently amended, the 2021 Water Services Agreement). The 2021 Water Services Agreement, which, upon its effectiveness, replaces the Water Services Letter Agreement and certain other existing Pennsylvania water services agreements, will become effective with the commencement of water delivery service to a certain EQT well pad (anticipated in the first quarter of 2022). Pursuant to the 2021 Water Services Agreement, EQT has agreed to pay the Company a minimum ARC for water services equal to $40 million in each of the first five years of the 10-year contract term and equal to $35 million per year for the remaining five years of the contract term.

Share Purchase Agreements. On February 26, 2020, the Company entered into two share purchase agreements (the Share Purchase Agreements) with EQT, pursuant to which the Company agreed to (i) purchase 4,769,496 shares of Equitrans Midstream common stock (the Cash Shares) from EQT in exchange for approximately $46 million in cash, (ii) purchase 20,530,256 shares of Equitrans Midstream common stock (the Rate Relief Shares and, together with the Cash Shares, the Share Purchases) from EQT in exchange for a promissory note in the aggregate principal amount of approximately $196 million (which EQT subsequently assigned to EQM as consideration for certain commercial terms under the EQT Global GGA), and (iii) pay EQT cash in the amount of approximately $7 million (the Cash Amount). On March 5, 2020, the Company completed the Share Purchases and paid the Cash Amount. The Company used proceeds from the EQM Credit Facility (as defined in Note 11) to fund the purchase of the Cash Shares and to pay the Cash Amount in addition to other uses of proceeds. After the closing of the Share Purchases, the Company retired the Cash Shares and the Rate Relief Shares. On September 29, 2020, the Company made a prepayment to EQM of all principal, interest, fees and other obligations outstanding under the promissory note EQT assigned to EQM and the promissory note was terminated.

10

The following diagram depicts the Company's organizational and ownership structure as of December 31, 2021:

11

Overview of Operations

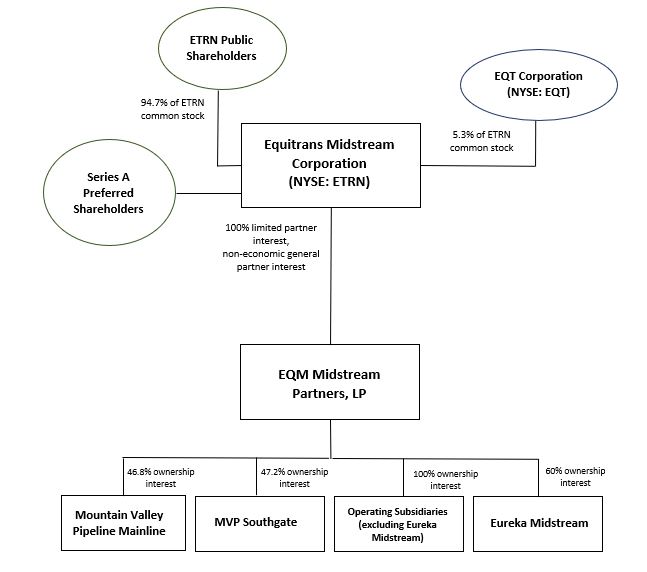

The Company provides midstream services to its customers in Pennsylvania, West Virginia and Ohio through its three primary assets: the gathering system, which includes predominantly dry gas gathering systems of high-pressure gathering lines; the transmission system, which includes FERC-regulated interstate pipelines and storage systems; and the water network, which primarily consists of water pipelines and other facilities that support well completion and produced water handling activities.

As of December 31, 2021, the Company provided a majority of its natural gas gathering, transmission and storage services under long-term contracts that generally include firm reservation fees. The Company maintains a stable cash flow profile, with approximately 64% of the Company's operating revenues for the year ended December 31, 2021 generated from firm reservation fees. The percentage of the Company's revenues that are generated by firm reservation fees is expected to increase in future years as a result of the 15-year term EQT Global GGA, which includes an MVC of 3.0 Bcf per day that became effective on April 1, 2020 and gradually steps up to 4.0 Bcf per day through December 2031 following the full in-service date of the MVP. These contract structures enhance the stability of the Company's cash flows and limit its exposure to customer volume variability.

The Company's operations are focused primarily in southwestern Pennsylvania, northern West Virginia and southeastern Ohio, which are prolific resource development areas in the natural gas shale plays known as the Marcellus and Utica Shales. These regions are also the primary operating areas of EQT, which was the largest natural gas producer in the United States based on average daily sales volumes as of December 31, 2021 and the Company's largest customer as of December 31, 2021. EQT accounted for approximately 59% of the Company's revenues for the year ended December 31, 2021.

12

The following is a map of the Company's gathering, transmission and storage and water services operations as of December 31, 2021. Also included are MVP and MVP Southgate routes, which projects are discussed in "Strategy" under "Developments, Market Trends and Competitive Conditions" in "Item 1. Business."

13

Business Segments

The Company reports its operations in three segments that reflect its three lines of business: Gathering, Transmission and Water. These segments include all of the Company's operations. For discussion of the composition of the three segments, see Notes 1 and 5 to the consolidated financial statements.

The Company's three business segments correspond to the Company's three primary assets: the gathering system, transmission and storage system and water service system. The following table summarizes the composition of the Company's operating revenues by business segment.

| Years Ended December 31, | |||||||||||||||||

| 2021 | 2020 | 2019 | |||||||||||||||

| Gathering operating revenues | 66 | % | 67 | % | 71 | % | |||||||||||

| Transmission operating revenues | 30 | % | 26 | % | 24 | % | |||||||||||

| Water operating revenues | 4 | % | 7 | % | 7 | % | |||||||||||

The Company's largest customer, EQT, accounted for approximately 59%, 64% and 69% of the Company's total revenues for the years ended December 31, 2021, 2020 and 2019, respectively.

Gathering Customers. For the year ended December 31, 2021, EQT accounted for approximately 59% of Gathering's revenues. Subject to certain exceptions and limitations, as of December 31, 2021, Gathering (inclusive of acreage dedications to Eureka Midstream Holdings, LLC (Eureka Midstream), a joint venture in which the Company has a 60% interest and that owns a 265-mile gathering header pipeline system in Ohio and West Virginia that services both dry Utica and wet Marcellus Shale production) had significant acreage dedications through which the Company has the right to elect to gather all natural gas produced from wells under dedicated areas in (i) Pennsylvania pursuant to agreements with EQT, including the EQT Global GGA, and agreements with certain other third parties, (ii) Ohio pursuant to agreements with EQT and other third parties, and (iii) West Virginia pursuant to the EQT Global GGA and agreements with certain other third parties.

The Company provides gathering services in two manners: firm service and interruptible service. Firm service contracts are typically long-term and often include firm reservation fees, which are fixed, monthly charges for the guaranteed reservation of pipeline access. Revenues under firm reservation fees also include fixed volumetric charges under MVCs. As of December 31, 2021, the gathering system had total contracted firm reservation capacity (including contracted MVCs) of approximately 7.0 Bcf per day (inclusive of Eureka Midstream contracted capacity), which included contracted firm reservation capacity of approximately 1.8 Bcf per day associated with the Company's high-pressure header pipelines. Including future capacity expected from expansion projects that are not yet fully constructed for which the Company has executed firm contracts, the gathering system had total contracted firm reservation capacity (including contracted MVCs) of approximately 8.1 Bcf per day (inclusive of Eureka Midstream contracted capacity) as of December 31, 2021, which included contracted firm reservation capacity of approximately 1.8 Bcf per day associated with the Company's high-pressure header pipelines. Volumetric-based fees can also be charged under firm contracts for each firm volume gathered, as well as for volumes gathered in excess of the firm contracted volume. Based on total projected contractual revenues, including projected contractual revenues from future capacity expected from expansion projects that are not yet fully constructed for which the Company has executed firm contracts, the Company's firm gathering contracts had a weighted average remaining term of approximately 14 years as of December 31, 2021.

Interruptible service contracts include volumetric-based fees, which are charges for the volume of natural gas gathered and generally do not guarantee access to the pipeline. These contracts can be short- or long-term. To the extent that capacity reserved by customers with firm service contracts is not fully used or excess capacity exists, the gathering system can allocate capacity to interruptible services.

The Company generally does not take title to the natural gas gathered for its customers but retains a percentage of wellhead gas receipts to recover natural gas used to power certain of its compressor stations and meet other requirements on the Company's gathering systems.

Transmission Customers. For the year ended December 31, 2021, EQT accounted for approximately 62% of Transmission's throughput and approximately 53% of Transmission's revenues. As of December 31, 2021, Transmission had an acreage dedication from EQT through which the Company had the right to elect to transport all gas produced from wells drilled by EQT under dedicated areas in Allegheny, Washington and Greene Counties in Pennsylvania and Wetzel, Marion, Taylor, Tyler, Doddridge, Harrison and Lewis Counties in West Virginia. The Company's other customers include LDCs, marketers, producers and commercial and industrial users. The Company's transmission and storage system provides customers with

14

access to markets in Pennsylvania, West Virginia and Ohio and to the Mid-Atlantic, Northeastern, Midwestern and Gulf Coast markets through interconnect points with major interstate pipelines.

The Company provides transmission and storage services in two manners: firm service and interruptible service. Firm service contracts are typically long-term and often include firm reservation fees, which are fixed, monthly charges for the guaranteed reservation of pipeline and storage capacity. Volumetric-based fees can also be charged under firm contracts for firm volume transported or stored, as well as for volumes transported or stored in excess of the firm contracted volume. As of December 31, 2021, the Company had firm capacity subscribed under firm transmission contracts of approximately 5.6 Bcf per day, which includes future capacity expected from expansion projects that are not yet fully constructed for which the Company has executed firm transmission contracts and excludes 2.3 Bcf per day of firm capacity commitments associated with the MVP and MVP Southgate projects. As of December 31, 2021, the Company had firm storage capacity of approximately 29.8 Bcf subscribed under firm storage contracts. Based on total projected contractual revenues, including projected contractual revenues from future capacity expected from expansion projects that are not yet fully constructed for which the Company has executed firm contracts, the Company's firm transmission and storage contracts had a weighted average remaining term of approximately 13 years as of December 31, 2021.

Interruptible service contracts include volumetric-based fees, which are charges for the volume of natural gas transported and generally do not guarantee access to the pipeline or storage facility. These contracts can be short- or long-term. To the extent that capacity reserved by customers with firm service contracts is not fully used or excess capacity exists, the transmission and storage systems can allocate capacity to interruptible services.

The Company generally does not take title to the natural gas transported or stored for its customers but retains a percentage of gas receipts to recover natural gas used to power its compressor stations and meet other requirements of the Company's transmission and storage systems.

As of December 31, 2021, approximately 97% of Transmission's contracted firm transmission capacity was subscribed by customers under negotiated rate agreements under its tariff, while the remainder was subscribed at discounted rates under its tariff, which are rates below the recourse rates and above a minimum level. As of December 31, 2021, Transmission did not have any contracted firm transmission capacity subscribed at recourse rates under its tariff, which are the maximum rates an interstate pipeline may charge for its services under its tariff. See also "FERC Regulation" under "Regulatory Environment" below and "Our natural gas gathering, transmission and storage services are subject to extensive regulation by federal, state and local regulatory authorities. Changes in or additional regulatory measures adopted by such authorities, and related litigation, could have a material adverse effect on our business, financial condition, results of operations, liquidity and ability to pay dividends.” included in "Item 1A. Risk Factors" for additional information.

Water Customers. For the year ended December 31, 2021, EQT accounted for approximately 96% of Water's revenues. The Company has the exclusive right to provide fluid handling services to certain EQT-operated wells through 2029 (and thereafter such right continues on a month-to-month basis) within areas of dedication in Belmont County, Ohio, including the delivery of fresh water for well completion operations and the collection and recycling or disposal of flowback and produced water. The Company also provides water services to other customers operating in the Marcellus and Utica Shales. Upon commencement of the 2021 Water Services Agreement, the majority of the Company's water service revenues will be subject to an ARC with EQT.

See also "Water Services Letter Agreement" and "2021 Water Services Agreement" above for additional information on the Company's Water customers.

The Company's Assets

Gathering Assets. As of December 31, 2021, the gathering system, inclusive of Eureka Midstream's gathering system, included approximately 1,170 miles of high-pressure gathering lines and 133 compressor units with compression of approximately 491,000 horsepower and multiple interconnect points with the Company's transmission and storage system and to other interstate pipelines.

Transmission and Storage Assets. As of December 31, 2021, the transmission and storage system included approximately 950 miles of FERC-regulated, interstate pipelines that have interconnect points to seven interstate pipelines and multiple LDCs. As of December 31, 2021, the transmission and storage system was supported by 43 compressor units, with total throughput capacity of approximately 4.4 Bcf per day and compression of approximately 136,000 horsepower, and 18 associated natural gas storage reservoirs, which had a peak withdrawal capacity of approximately 850 MMcf per day and a working gas capacity of approximately 43 Bcf.

15

Water Assets. As of December 31, 2021, the fresh water systems included approximately 200 miles of pipeline that deliver fresh water from local municipal water authorities, the Monongahela River, the Ohio River, local reservoirs and several regional waterways. In addition, as of December 31, 2021, the water system assets included 23 fresh water impoundment facilities.

During 2021, the Company began construction of a mixed water system in Greene County, Pennsylvania. The system has a targeted full in-service date of summer 2022 and is primarily supported by the 2021 Water Services Agreement. The mixed water system is designed to include 71 miles of buried water pipeline, two water storage facilities with 350,000 barrels of capacity and two interconnects with the Company’s existing Pennsylvania fresh water systems and will provide services to producers in southwestern Pennsylvania. As of December 31, 2021, the Company’s mixed water system included approximately eight miles of buried pipeline.

Developments, Market Trends and Competitive Conditions

The Company's strategically-located assets overlay core acreage in the Appalachian Basin. The location of the Company's assets allows its producer customers to access major demand markets in the U.S. The Company is one of the largest natural gas gatherers in the U.S., and its largest customer, EQT, was the largest natural gas producer in the U.S. based on average daily sales volumes as of December 31, 2021. The Company maintains a stable cash flow profile, with approximately 64% of its operating revenues for the year ended December 31, 2021 generated from firm reservation fees. Further, as discussed above, the percentage of the Company's revenues that are generated by firm reservation fees is expected to increase in future years as a result of the 15-year term EQT Global GGA, which includes an MVC of 3.0 Bcf per day that became effective on April 1, 2020 and gradually steps up to 4.0 Bcf per day through December 2031 following the full in-service date of the MVP. This contract structure enhances the stability of the Company's cash flows and limits its exposure to customer volume variability.

Strategy. The Company's principal strategy is to achieve greater scale and scope, enhance the durability of its financial strength and to continue to work to position itself for a lower carbon economy, which strategy the Company expects will drive future growth and investment. The Company is implementing its strategy by continuing to leverage its existing assets, execute on its growth projects (including through potential expansion and extension opportunities), periodically evaluate strategically-aligned inorganic growth opportunities (whether within its existing footprint or to extend the Company's reach into the southeast United States to become closer to key demand markets, such as the Gulf of Mexico LNG export market), and focus on ESG and sustainability-oriented initiatives. Additionally, the Company is also continuing to focus on strengthening its balance sheet through:

•highly predictable cash flows backed by firm reservation fees;

•actions to de-lever its balance sheet;

•disciplined capital spending;

•operating cost control; and

•an appropriate dividend policy.

As part of its approach to organic growth, the Company is focused on its projects and assets outlined below, many of which are supported by contracts with firm capacity or MVC commitments.

The Company expects that the MVP project (should it be placed in-service), together with the Hammerhead pipeline and Equitrans, L.P. Expansion Project (EEP), will primarily drive the Company's organic growth, as discussed in further detail below.

•Mountain Valley Pipeline. The MVP is being constructed by a joint venture among the Company and affiliates of each of NextEra Energy, Inc., Consolidated Edison, Inc. (Con Edison), AltaGas Ltd. and RGC Resources, Inc. As of December 31, 2021, the Company owned an approximate 46.8% interest in the MVP project and will operate the MVP. The MVP is an estimated 300-mile, 42-inch diameter natural gas interstate pipeline with a targeted capacity of 2.0 Bcf per day that is designed to span from the Company's existing transmission and storage system in Wetzel County, West Virginia to Pittsylvania County, Virginia, providing access to the growing southeast demand markets. The MVP Joint Venture has secured a total of 2.0 Bcf per day of firm capacity commitments at 20-year terms. Additional shippers have expressed interest in the MVP project and the MVP Joint Venture is evaluating an expansion opportunity that could add approximately 0.5 Bcf per day of capacity through the installation of incremental compression.

In October 2017, the FERC issued the Certificate of Public Convenience and Necessity (the Certificate) for the MVP. In the first quarter of 2018, the MVP Joint Venture received limited notice to proceed with certain construction

16

activities from the FERC and commenced construction. Following a comprehensive review of all outstanding stream and wetland crossings across the approximately 300-mile MVP project route, on February 19, 2021, the MVP Joint Venture submitted (i) a joint application package to each of the Huntington, Pittsburgh and Norfolk Districts of the U.S. Army Corps of Engineers (Army Corps) that requested an Individual Permit from the Army Corps to effect approximately 300 water crossings utilizing open cut techniques (the Army Corps Individual Permit) and (ii) an application to amend the Certificate that seeks FERC authority to utilize alternative trenchless construction methods to effect approximately 120 water crossings. Related to seeking the Army Corps Individual Permit, on March 4, 2021, the MVP Joint Venture submitted applications to each of the West Virginia Department of Environmental Protection (WVDEP) and the Virginia Department of Environmental Quality (VADEQ) seeking Section 401 water quality certification approvals or waivers (such approvals or waivers, the State 401 Approvals), which State 401 Approvals were each received in December 2021. In early June 2021, the FERC issued a notice of schedule for the MVP Joint Venture's Certificate amendment application and the FERC issued an Environmental Assessment in mid-August 2021. As discussed in Part I, "Item 3. Legal Proceedings" of this Annual Report on Form 10-K, on January 25, 2022, the MVP Joint Venture's authorizations related to the Jefferson National Forest (JNF) received from the Bureau of Land Management (BLM) and the U.S. Forest Service (USFS) were vacated and remanded on specific issues by the U.S. Court of Appeals for the Fourth Circuit (Fourth Circuit). As also discussed in Part I, "Item 3. Legal Proceedings" of this Annual Report on Form 10-K, on February 2, 2022, the Fourth Circuit vacated and remanded on specific issues the Biological Opinion and Incidental Take Statement issued by the United States Department of the Interior's Fish and Wildlife Service (FWS) for the MVP project. The MVP Joint Venture continues to review these recent decisions and evaluate the possible paths forward, which include working with the relevant federal agencies and consideration of potential legal appeals. As a result, the Company is not able to provide an update as to the in-service timing and overall cost for the project, except that the Company is no longer targeting a summer 2022 in-service date.

In addition to timely receiving, and subsequently maintaining, new authorizations in respect of the JNF, and a Biological Opinion and Incidental Take Statement, the MVP Joint Venture must, in order to complete the project, among other things, timely receive (i) the Army Corps Individual Permit (as well as timely receive, if necessary, certain other state-level approvals), and (ii) authorization from the FERC to amend the Certificate to utilize alternative trenchless construction methods for certain stream and wetland crossings, as well as any necessary extensions from FERC to complete the MVP project. The MVP Joint Venture also must (i) continue to have available the orders previously issued by the FERC, which are the subject of ongoing litigation, modifying its prior stop work orders and extending the MVP Joint Venture’s prescribed time to complete the MVP project; and (ii) timely receive authorization from the FERC to complete construction work in the portion of the project route currently remaining subject to the FERC’s previous stop work order and in the JNF. In each case, any such foregoing or other authorizations must remain in effect notwithstanding any pending or future challenge thereto. For further information regarding litigation and regulatory related delays affecting the completion of the MVP project, see Part I, "Item 3. Legal Proceedings" of this Annual Report on Form 10-K. See also "The regulatory approval process for the construction of new midstream assets is very challenging, has significantly increased costs and delayed targeted in-service dates, and decisions by regulatory and judicial authorities in pending or potential proceedings are likely to impact our or the MVP Joint Venture's ability to obtain or maintain in effect all approvals and authorizations necessary to complete certain projects on the targeted time frame or at all or our ability to achieve the expected investment returns on the projects." included in "Item 1A. Risk Factors" for additional discussion.

On November 4, 2019, Con Edison exercised an option to cap its investment in the construction of the MVP project at approximately $530 million (excluding AFUDC). The Company and NextEra Energy, Inc. are obligated, and RGC Resources, Inc., another member of the MVP Joint Venture owning an interest in the MVP project, has opted, to fund the shortfall in Con Edison's capital contributions on a pro rata basis. Such funding by the Company and funding by other members has and will correspondingly increase the Company's and such other members' respective interests in the MVP project and decrease Con Edison's interest in the MVP project. As a result, depending on the project's total cost, the Company's equity ownership in the MVP project will progressively increase to a percentage in excess of approximately 46.8%.

Through December 31, 2021, the Company had funded approximately $2.5 billion of its then-estimated total capital contributions. During the year ended December 31, 2021, the Company made approximately $284 million of capital contributions to the MVP Joint Venture for the MVP project. For 2022, the Company expects to make total capital contributions of approximately $175 million to $225 million related to work completed in late 2021 and ongoing right-of-way maintenance.

•Wellhead Gathering Expansion Projects and Hammerhead Pipeline. During the year ended December 31, 2021, the Company invested approximately $224 million in gathering projects (inclusive of capital expenditures related to the noncontrolling interest in Eureka Midstream). For 2022, the Company expects to invest approximately $270 million to

17

$320 million in gathering projects (inclusive of expected capital expenditures of approximately $20 million related to the noncontrolling interest in Eureka Midstream). The primary projects include infrastructure expansion of core development areas in the Marcellus and Utica Shales in southwestern Pennsylvania, southeastern Ohio and northern West Virginia for EQT, Range Resources Corporation (Range Resources) and other producers.

The Hammerhead pipeline is a 1.6 Bcf per day gathering header pipeline that is primarily designed to connect natural gas produced in Pennsylvania and West Virginia to the MVP, Texas Eastern Transmission and Dominion Transmission, is supported by a 20-year term, 1.2 Bcf per day, firm capacity commitment from EQT, and cost approximately $540 million. For more information, including regarding full commercial in-service status for the Hammerhead pipeline, see "Outlook" in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations."

•Transmission Projects and Equitrans Expansion Project. During the year ended December 31, 2021, the Company invested approximately $26 million in transmission projects, including the EEP. The EEP is designed to provide north-to-south capacity on the mainline Equitrans, L.P. system, including primarily for deliveries to the MVP. A portion of the EEP commenced operations with interruptible service in the third quarter of 2019. The EEP provides capacity of approximately 600 MMcf per day and offers access to several markets through interconnects with Texas Eastern Transmission, Dominion Transmission and Columbia Gas Transmission. Once the MVP is fully placed in service, firm transportation agreements for 550 MMcf per day of capacity will commence under 20-year terms.

For 2022, the Company expects to invest approximately $45 million in transmission projects, inclusive of capital expenditures expected for 2022 associated with the Company's Ohio Valley Connector expansion project (OVCX). OVCX will increase deliverability on the Company's existing Ohio Valley Connector pipeline (OVC) by approximately 350 MMcf per day, create new receipt and delivery transportation paths, and enhance long-term reliability. The project is supported by new long-term firm capacity commitments of 330 MMcf per day, as well as an extension of approximately 1.0 Bcf per day of existing contracted mainline capacity for EQT. OVCX is designed to meet growing demand in key markets in the mid-continent and gulf coast through existing interconnects with long-haul pipelines in Clarington, Ohio. The targeted in-service date for the incremental OVC capacity is the third quarter of 2023. The Company expects to invest approximately $160 million, which includes approximately $130 million for new compression. The project is consistent with the Company's ongoing efforts to optimize existing assets and achieve capital efficiency.

•MVP Southgate Project. In April 2018, the MVP Joint Venture announced the MVP Southgate project, which is a proposed 75-mile interstate pipeline that is contemplated to extend from the MVP at Pittsylvania County, Virginia to new delivery points in Rockingham and Alamance Counties, North Carolina. The MVP Southgate project is backed by a 300 MMcf per day firm capacity commitment from Dominion Energy North Carolina, and, as currently designed, reflects potential expansion capabilities that could provide up to 900 MMcf per day of total capacity. The Company is expected to operate the MVP Southgate project and owned a 47.2% interest in the MVP Southgate project as of December 31, 2021.

The MVP Joint Venture submitted the MVP Southgate certificate application to the FERC in November 2018. The Final Environmental Impact Statement for the MVP Southgate project was issued on February 14, 2020. In June 2020, the FERC issued the Certificate of Public Convenience and Necessity for the MVP Southgate; however, the FERC, while authorizing the project, directed the Office of Energy Projects not to issue a notice to proceed with construction until necessary federal permits are received for the MVP project and the Director of the Office of Energy Projects lifts the stop work order and authorizes the MVP Joint Venture to continue constructing the MVP project. On August 11, 2020, the North Carolina Department of Environmental Quality (NCDEQ) denied the MVP Southgate project's application for a Clean Water Act Section 401 Individual Water Quality Certification and Jordan Lake Riparian Buffer Authorization due to uncertainty surrounding the completion of the MVP project. On March 11, 2021, the Fourth Circuit, pursuant to an appeal filed by the MVP Joint Venture, vacated the NCDEQ's denial and remanded the matter to the NCDEQ for additional review. On April 29, 2021, the NCDEQ reissued its denial of the MVP Southgate project's application for a Clean Water Act Section 401 Individual Water Quality Certification and Jordan Lake Riparian Buffer Authorization. On December 3, 2021, the Virginia State Air Pollution Control Board denied the permit for the MVP Southgate project’s Lambert compressor station, which decision the MVP Joint Venture has appealed (and such appeal is pending). See the discussion of litigation and regulatory related delays affecting the completion of the MVP Southgate project set forth in Part I, "Item 3. Legal Proceedings" of this Annual Report on Form 10-K.

Given the continually evolving regulatory and legal environment for greenfield pipeline construction projects, as well as factors specific to the MVP and MVP Southgate projects, including the December 2021 compressor station state air permit denial, the MVP Joint Venture is evaluating the MVP Southgate project, including engaging in discussions with Dominion Energy North Carolina regarding options with respect to the MVP Southgate project, including potentially

18

refining the project’s design and timing in lieu of pursuing the project as originally contemplated. Dominion Energy North Carolina’s obligations under the precedent agreement in support of the original project are subject to certain conditions, including that the MVP Joint Venture complete construction of the project facilities by June 1, 2022, which deadline is subject to extension by virtue of previously declared events of force majeure. The Company is unable to predict the results of the discussions between the MVP Joint Venture and Dominion Energy North Carolina, including any potential modifications to the project, or ultimate undertaking or completion of the project.

The MVP Southgate project, as originally designed, was estimated to cost a total of approximately $450 million to $500 million, a portion of which the Company expected to fund. During the year ended December 31, 2021, the Company made approximately $4 million of capital contributions to the MVP Joint Venture for the MVP Southgate project. For 2022, the Company expects to make capital contributions of approximately $5 million to the MVP Joint Venture for the MVP Southgate project.

•Water Operations. During the year ended December 31, 2021, the Company invested approximately $35 million in its water infrastructure. For 2022, the Company expects to invest approximately $50 million in the operations of its water infrastructure in Pennsylvania, primarily for the construction of the mixed water system.

See "Sustainability and Corporate Responsibility" in "Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations" for a discussion of the Company's continued focus on ESG and sustainability matters which the Company believes will distinctively position the Company and create value.

Competitive Condition. Key competitors for new natural gas gathering systems include companies that own major natural gas pipelines, independent gas gatherers and integrated energy companies. When compared to the Company or its customers, some of the Company's competitors have operations in multiple natural gas producing basins, have greater capital resources and access to, or control of, larger natural gas supplies.

Competition for natural gas transmission and storage is primarily based on rates, customer commitment levels, timing, performance, commercial terms, reliability, service levels, location, reputation and fuel efficiencies. The Company's principal competitors in its transmission and storage market include companies that own major natural gas pipelines in the Marcellus and Utica Shales. In addition, the Company competes with companies that are building high-pressure gathering facilities that are able to transport natural gas to interstate pipelines without being subject to FERC jurisdiction. Major natural gas transmission companies that compete with the Company also have storage facilities connected to their transmission systems that compete with certain of the Company's storage facilities.

Key competition for water services includes natural gas producers that develop their own water distribution systems in lieu of employing the Company's water services assets and other natural gas midstream companies that offer water services. The Company's ability to attract customers to its water service business depends on its ability to evaluate and select suitable projects and to consummate transactions in a highly competitive environment.

Further, natural gas as a fuel competes with other forms of energy available to end-users, including coal, liquid fuels and, increasingly, renewable and alternative energy. Demand for renewable and alternative energy is increasing generally with changes in consumer preferences, governmental clean energy policies, and as renewable and alternative energy becomes more cost competitive with traditional fuels and more widely available. Continued increases in the demand for renewable and alternative energy at the expense of natural gas (or increases in the demand for other sources of energy, particularly if prices for natural gas are elevated relative to other forms of energy as fuel) could lead to a reduction in demand for natural gas gathering, transmission and storage, and water services.

Regulatory Environment

FERC Regulation. The Company's interstate natural gas transmission and storage operations are regulated by the FERC under the Natural Gas Act of 1938 (NGA), the Natural Gas Policy Act of 1978 (NGPA), and the regulations, rules and policies promulgated under those and other statutes. Certain portions of the Company's gathering operations are also currently rate-regulated by the FERC in connection with its interstate transmission operations. The Company's FERC-regulated operations are pursuant to tariffs approved by the FERC that establish rates (other than market-based rate authority), cost recovery mechanisms and terms and conditions of service to its customers. Generally, the FERC's authority extends to:

•rates and charges for the Company's natural gas transmission and storage services and FERC-regulated gathering services;

•certification and construction of new interstate transmission and storage facilities;

•abandonment of interstate transmission and storage services and facilities and certificated gathering facilities;

19

•maintenance of accounts and records;

•relationships between pipelines and certain affiliates;

•terms and conditions of services and service contracts with customers;

•depreciation and amortization policies;

•acquisitions and dispositions of interstate transmission and storage facilities; and

•initiation and discontinuation of interstate transmission and storage services.

The FERC regulates the rates and charges for transmission and storage in interstate commerce. Unless market-based rates have been approved by the FERC, the maximum applicable recourse rates and terms and conditions for service are set forth in the pipeline's FERC-approved tariff. Generally, the maximum filed recourse rates for interstate pipelines are based on the cost of providing service, including the recovery of a return on the pipeline's actual and prudent historical investment costs. Key determinants in the ratemaking process include the depreciated capital costs of the facilities, the costs of providing service, the allowed rate of return and income tax allowance, as well as volume throughput and contractual capacity commitment assumptions.

Interstate pipelines may not charge rates or impose terms and conditions of service that, upon review by the FERC, are found to be unjust or unreasonable, unduly discriminatory or preferential. Rate design and the allocation of costs also can affect a pipeline's profitability. While the ratemaking process establishes the maximum rate that can be charged, interstate pipelines such as the Company's transmission and storage system are permitted to discount their firm and interruptible rates without further FERC authorization down to a specified minimum level, provided they do not unduly discriminate. In addition, pipelines are allowed to negotiate different rates with their customers, under certain circumstances. Changes to rates or terms and conditions of service, and contracts can be proposed by a pipeline company under Section 4 of the NGA, or the existing interstate transmission and storage rates or terms and conditions of service, and contracts may be challenged by a complaint filed by interested persons including customers, state agencies or the FERC under Section 5 of the NGA. Rate increases proposed by a pipeline may be allowed to become effective subject to refund and/or a period of suspension, while rates or terms and conditions of service that are the subject of a complaint under Section 5 of the NGA are subject to prospective change by the FERC. Rate increases proposed by a regulated interstate pipeline may be challenged and such increases may ultimately be rejected by the FERC.

The Company's interstate pipeline may also use negotiated rates that could involve rates above or below the recourse rate or rates that are subject to a different rate structure than the rates specified in the Company's interstate pipeline tariffs, provided that the affected customers are willing to agree to such rates and that the FERC has approved the negotiated rate agreement. A prerequisite for allowing the negotiated rates is that negotiated rate customers must have had the option to take service under the pipeline's recourse rates. As of December 31, 2021, approximately 97% of the system's contracted firm transmission capacity was subscribed by customers under negotiated rate agreements under its tariff. Some negotiated rate transactions are designed to fix the negotiated rate for the term of the firm transportation agreement and the fixed rate is generally not subject to adjustment for increased or decreased costs occurring during the contract term.

The FERC’s regulations also extend to the terms and conditions set forth in agreements for transmission and storage services executed between interstate pipelines and their customers. These service agreements are required to conform, in all material respects, with the form of service agreements set forth in the pipeline's FERC-approved tariff. Non-conforming agreements must be filed with and accepted by the FERC. In the event that the FERC finds that an agreement is materially non-conforming, in whole or in part, it could reject, or require the Company to seek modification of, the agreement, or alternatively require the Company to modify its tariff so that the non-conforming provisions are generally available to all customers or class of customers.

The FERC’s jurisdiction also extends to the certification and construction of new interstate transmission and storage facilities, including, but not limited to, acquisitions, facility replacements and upgrades, expansions, and abandonment of facilities and services. While the FERC currently exercises jurisdiction over the rates and terms of service for the Company’s FERC-regulated gathering services, these gathering facilities may not be subject to the FERC’s certification and construction authority. Prior to commencing construction of new or existing interstate transmission and storage facilities, an interstate pipeline must obtain (except in certain circumstances, such as where the activity is permitted under the FERC’s regulations or is authorized under the operator’s existing blanket certificate issued by the FERC) a certificate authorizing the construction, or file to amend its existing certificate, from the FERC.

20

On April 19, 2018, the FERC issued a Notice of Inquiry (2018 Notice of Inquiry) seeking information regarding whether, and if so how, it should revise its approach under its currently effective policy statement on the certification of new natural gas transportation facilities (Certificate Policy Statement). The formal comment period in this proceeding closed on June 25, 2018. On February 18, 2021, the FERC issued another Notice of Inquiry in the same proceeding that modified and expanded the inquiry and renewed its request for public comment (together with the 2018 Notice of Inquiry, the Certificate Policy Statement NOI). The formal comment period closed May 26, 2021. On February 18, 2022, the FERC issued an Updated Certificate Policy Statement. The Company is evaluating the Updated Certificate Policy Statement, but at this time, it is not possible to predict the impact that the Updated Certificate Policy will have on the Company, if any.

In 2021, Congress did not pass legislation revising the NGA or other statutes that may impact the Company's existing facilities and operations or the ability to construct new facilities, though that remains a possibility in 2022. Potential areas of revision include, but are not limited to, (i) amending Section 5 of the NGA to allow the FERC to require a pipeline to make refunds from the date that a NGA Section 5 complaint was filed with the FERC if rates are later found to be unjust and unreasonable; (ii) amending Section 7 of the NGA affecting the ability of companies to exercise eminent domain; and (iii) amending Section 19(b) of the NGA to provide the FERC additional time to act on requests for rehearing.