| - |

Pre-tax, pre-provision earnings of $8.4 million, an increase of 31.60%

|

| - |

Interest income on loans, including loan fee income, totaled $13.2 million, an increase of 7.18%

|

| - |

Cost of funds of 0.51%, a decrease of 59.53%

|

| - |

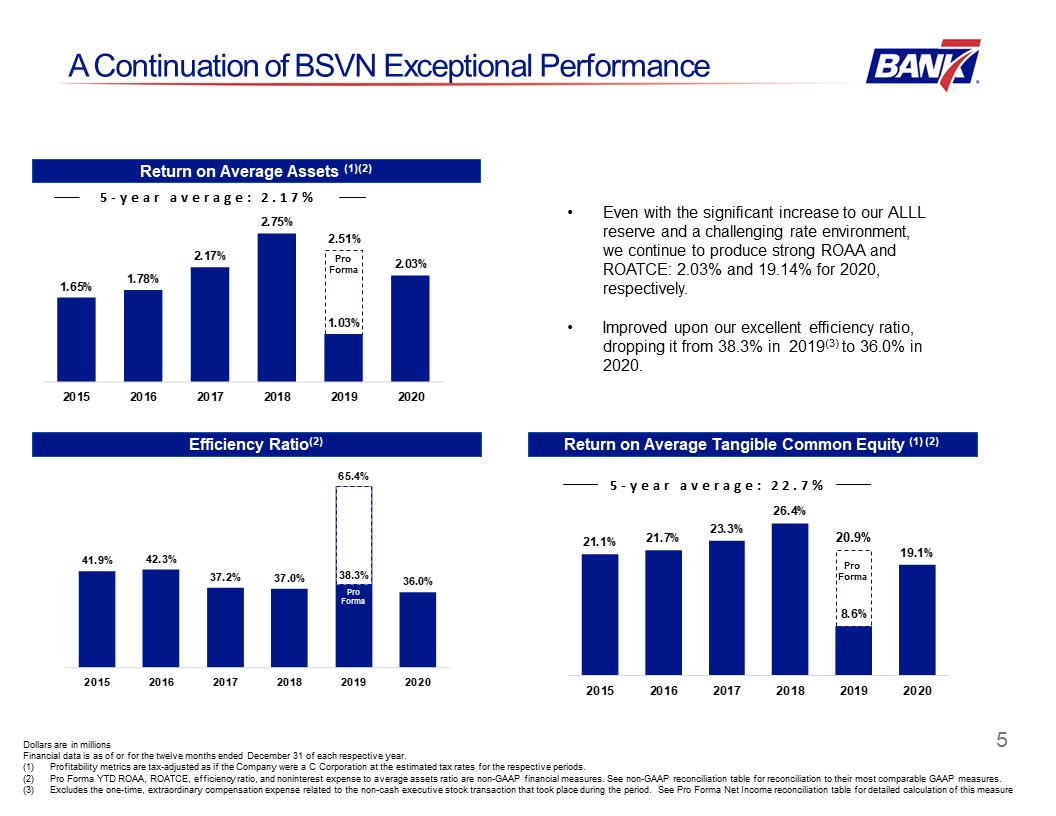

Efficiency ratio of 35.13%, compared to 41.74%

|

| - |

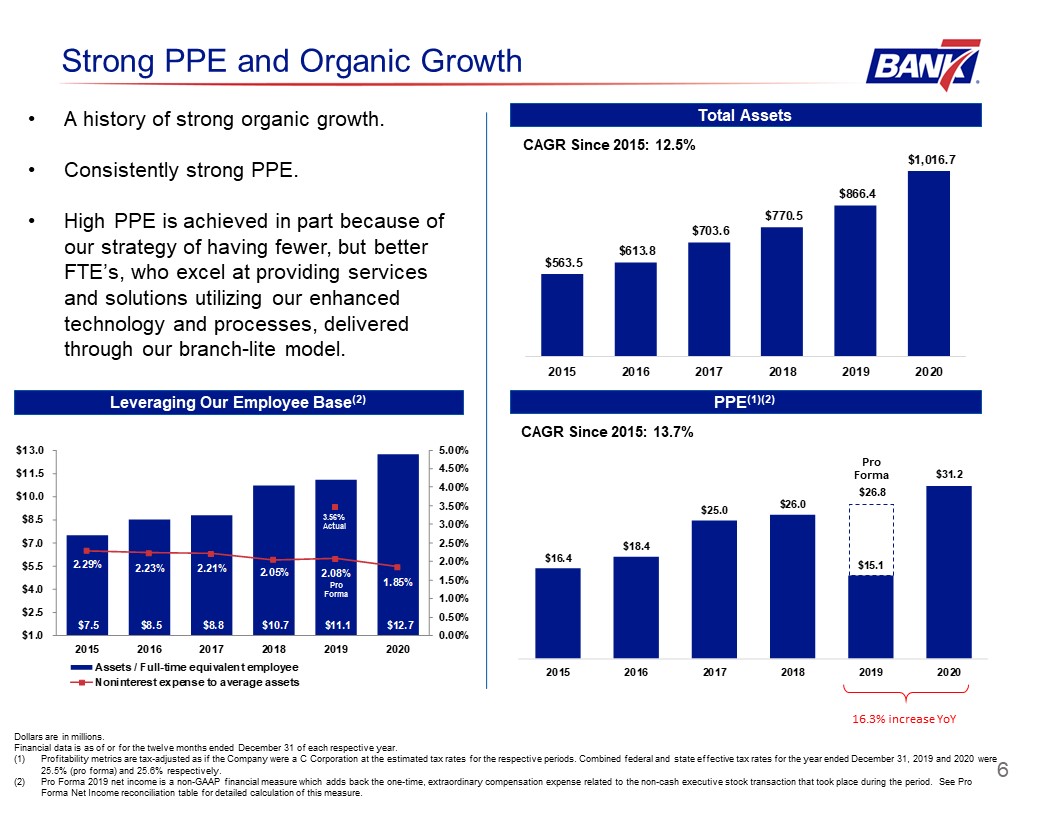

Pre-tax, pre-provision earnings of $31.2 million, an increase of 16.25%, excluding the one-time, non-cash executive stock transaction expense in Q3 2019.

|

| - |

Interest income on loans, including loan fee income, totaled $52.4 million, an increase of 8.82%

|

| - |

Cost of funds of 0.73%, a decrease of 46.71%

|

| - |

Total assets of $1.0 billion, an increase of 17.35%

|

| - |

Total loans of $824.1 million, an increase of 18.23%

|

| - |

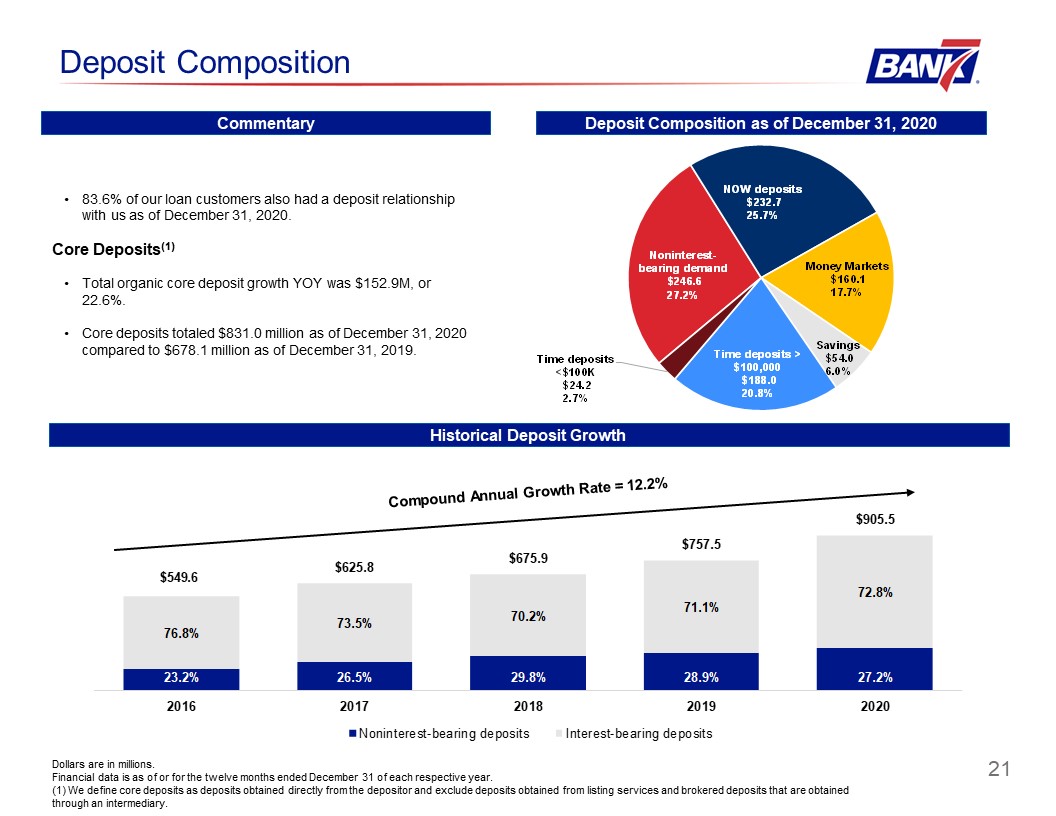

Total deposits of $905.5 million, an increase of 19.54%

|

|

Three months ended

December 31,

|

For the Year ended

December 31,

|

|||||||||||||||

|

(Dollars in thousands, except per share data)

|

2020

|

2019

|

2020

|

2019

|

||||||||||||

|

Loan interest income (excluding loan fees)

|

||||||||||||||||

|

Total loan interest income, including loan fee income

|

$

|

13,182

|

$

|

12,299

|

$

|

52,450

|

$

|

48,200

|

||||||||

|

Loan fee income

|

(1,066

|

)

|

(944

|

)

|

(5,035

|

)

|

(4,443

|

)

|

||||||||

|

Loan interest income excluding loan fee income

|

$

|

12,116

|

$

|

11,355

|

$

|

47,415

|

$

|

43,757

|

||||||||

|

Average total loans

|

$

|

871,163

|

$

|

692,286

|

$

|

823,228

|

$

|

636,274

|

||||||||

|

Yield on loans (including loan fee income)

|

6.02

|

%

|

7.05

|

%

|

6.37

|

%

|

7.58

|

%

|

||||||||

|

Yield on loans (excluding loan fee income)

|

5.53

|

%

|

6.51

|

%

|

5.76

|

%

|

6.88

|

%

|

||||||||

|

Pre-tax, pre-provision net earnings

|

||||||||||||||||

|

Net income before income taxes

|

$

|

6,317

|

$

|

6,358

|

$

|

25,884

|

$

|

15,069

|

||||||||

|

Plus: Provision for loan losses

|

2,050

|

|

-

|

5,350

|

|

-

|

||||||||||

|

Pre-tax, pre-provision net earnings

|

$

|

8,367

|

$

|

6,358

|

$

|

31,234

|

$

|

15,069

|

||||||||

|

Adjusted provision for income tax

|

||||||||||||||||

|

Net income before income taxes

|

$

|

6,317

|

$

|

6,358

|

$

|

25,884

|

$

|

15,069

|

||||||||

|

Total effective adjusted tax rate

|

25.0

|

%

|

29.6

|

%

|

25.6

|

%

|

45.4

|

%

|

||||||||

|

Adjusted provision for income taxes

|

$

|

1,578

|

$

|

1,879

|

$

|

6,618

|

$

|

6,844

|

||||||||

|

Tax-adjusted net income

|

||||||||||||||||

|

Net income before income taxes

|

$

|

6,317

|

$

|

6,358

|

$

|

25,884

|

$

|

15,069

|

||||||||

|

Adjusted provision for income taxes

|

1,578

|

1,879

|

6,618

|

6,844

|

||||||||||||

|

Tax-adjusted net income

|

$

|

4,739

|

$

|

4,479

|

$

|

19,266

|

$

|

8,225

|

||||||||

|

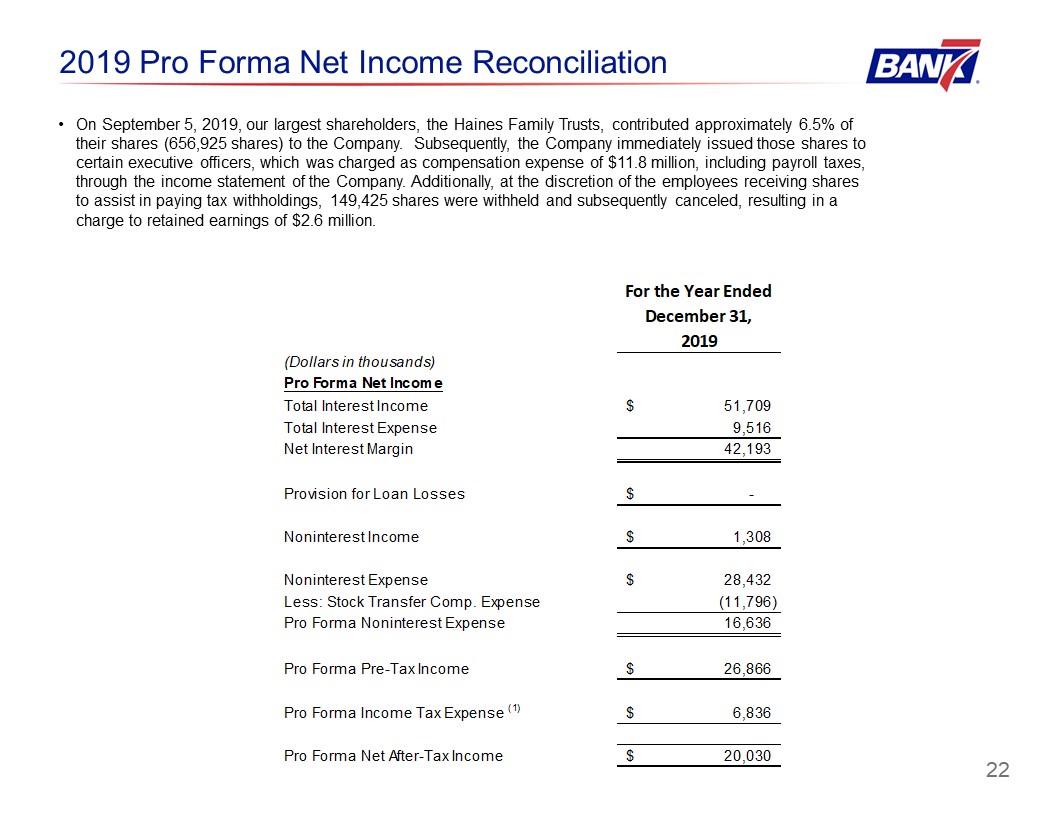

Pro Forma Pre-tax, pre-provision net earnings

|

||||||||||||||||

|

Net income before income taxes

|

$

|

6,317

|

$

|

6,358

|

$

|

25,884

|

$

|

15,069

|

||||||||

|

Plus: Provision loan losses

|

2,050

|

|

-

|

5,350

|

|

-

|

||||||||||

|

Plus: Stock Transfer Compensation Expense

|

-

|

-

|

-

|

11,797

|

||||||||||||

|

Pro Forma Pre-tax, pre-provision net earnings

|

$

|

8,367

|

$

|

6,358

|

$

|

31,234

|

$

|

26,866

|

||||||||

|

Tax-adjusted ratios and per share data

|

||||||||||||||||

|

Tax-adjusted net income (numerator)

|

$

|

4,739

|

$

|

4,479

|

$

|

19,266

|

$

|

8,225

|

||||||||

|

Average assets (denominator)

|

$

|

982,024

|

$

|

845,510

|

$

|

948,957

|

$

|

798,528

|

||||||||

|

Tax-adjusted return on average assets

|

1.92

|

%

|

2.10

|

%

|

2.03

|

%

|

1.03

|

%

|

||||||||

|

Average shareholders' equity (denominator)

|

$

|

105,283

|

$

|

102,691

|

$

|

102,359

|

$

|

97,430

|

||||||||

|

Tax-adjusted return on average shareholders' equity

|

17.91

|

%

|

17.31

|

%

|

18.82

|

%

|

8.44

|

%

|

||||||||

|

Average tangible common equity (denominator)

|

$

|

103,675

|

$

|

100,872

|

$

|

100,675

|

$

|

95,537

|

||||||||

|

Tax-adjusted return on average tangible common equity

|

18.18

|

%

|

17.62

|

%

|

19.14

|

%

|

8.61

|

%

|

||||||||

|

Weighted average common shares outstanding basic (denominator)

|

9,066,737

|

10,057,506

|

9,378,769

|

10,145,032

|

||||||||||||

|

Tax-adjusted net income per common share--basic

|

$

|

0.52

|

$

|

0.45

|

$

|

2.05

|

$

|

0.81

|

||||||||

|

Weighted average common shares outstanding diluted (denominator)

|

9,068,161

|

10,059,208

|

9,379,154

|

10,147,311

|

||||||||||||

|

Tax-adjusted net income per common share--diluted

|

$

|

0.52

|

$

|

0.45

|

$

|

2.05

|

$

|

0.81

|

||||||||

|

Tangible assets

|

||||||||||||||||

|

Total assets

|

$

|

1,016,669

|

$

|

866,392

|

||||||||||||

|

Less: Goodwill and intangibles

|

(1,583

|

)

|

(1,789

|

)

|

||||||||||||

|

Tangible assets

|

$

|

1,015,086

|

$

|

864,603

|

||||||||||||

|

Tangible shareholders' equity

|

||||||||||||||||

|

Total shareholders' equity

|

$

|

107,319

|

$

|

100,126

|

||||||||||||

|

Less: Goodwill and intangibles

|

(1,583

|

)

|

(1,789

|

)

|

||||||||||||

|

Tangible shareholders' equity

|

$

|

105,736

|

$

|

98,337

|

||||||||||||

|

Tangible shareholders' equity

|

||||||||||||||||

|

Tangible shareholders' equity (numerator)

|

$

|

105,736

|

$

|

98,337

|

||||||||||||

|

Tangible assets (denominator)

|

$

|

1,015,086

|

$

|

864,603

|

||||||||||||

|

Tangible common equity to tangible assets

|

10.42

|

%

|

11.37

|

%

|

||||||||||||

|

End of period common shares outstanding

|

9,044,765

|

10,057,506

|

||||||||||||||

|

Book value per share

|

$

|

11.87

|

$

|

9.96

|

||||||||||||

|

Tangible book value per share

|

$

|

11.69

|

$

|

9.78

|

||||||||||||

|

Total shareholders' equity to total assets

|

10.56

|

%

|

11.56

|

%

|

||||||||||||

|

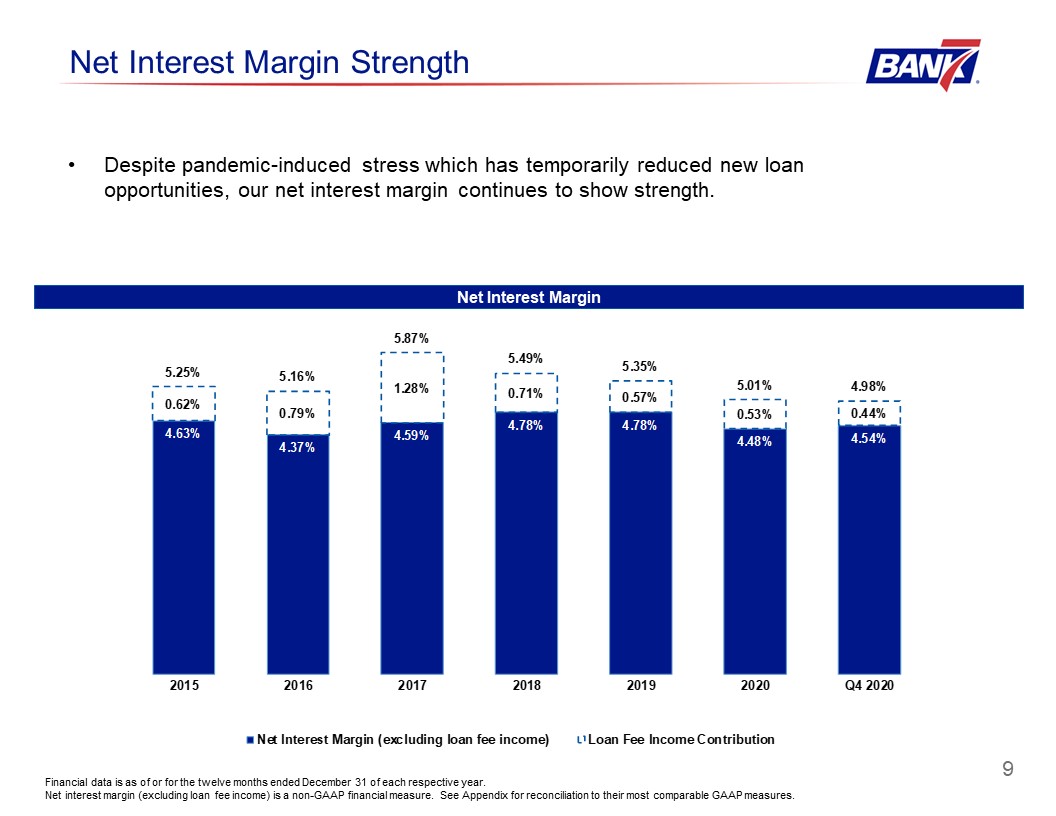

Net Interest Margin Excluding Loan Fee Income

|

||||||||||||||||||||||||

|

For the Three Months Ended December 31,

|

||||||||||||||||||||||||

|

2020

|

2019

|

|||||||||||||||||||||||

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||

|

Short-term investments(1)

|

$

|

102,544

|

$

|

127

|

0.49

|

%

|

$

|

143,604

|

$

|

674

|

1.86

|

%

|

||||||||||||

|

Investment securities(2)

|

1,165

|

15

|

5.12

|

1,073

|

23

|

8.50

|

||||||||||||||||||

|

Loans held for sale

|

198

|

—

|

0.00

|

289

|

—

|

0.00

|

||||||||||||||||||

|

Total loans(3)

|

871,163

|

12,116

|

5.53

|

692,286

|

11,355

|

6.51

|

||||||||||||||||||

|

Total interest-earning assets

|

975,070

|

12,258

|

5.00

|

837,252

|

12,052

|

5.71

|

||||||||||||||||||

|

Noninterest-earning assets

|

6,954

|

8,258

|

||||||||||||||||||||||

|

Total assets

|

$

|

982,024

|

$

|

845,510

|

||||||||||||||||||||

|

Funding sources:

|

||||||||||||||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||

|

Deposits:

|

||||||||||||||||||||||||

|

Transaction accounts

|

$

|

409,174

|

470

|

0.46

|

%

|

$

|

314,106

|

1,133

|

1.43

|

%

|

||||||||||||||

|

Time deposits

|

203,842

|

655

|

1.28

|

213,716

|

1,205

|

2.24

|

||||||||||||||||||

|

Total interest-bearing deposits

|

613,016

|

1,125

|

0.73

|

527,822

|

2,338

|

1.76

|

||||||||||||||||||

|

Other borrowings

|

—

|

—

|

0.00

|

—

|

—

|

0.00

|

||||||||||||||||||

|

Total interest-bearing liabilities

|

613,016

|

1,125

|

0.73

|

527,822

|

2,338

|

1.76

|

||||||||||||||||||

|

Noninterest-bearing liabilities:

|

||||||||||||||||||||||||

|

Noninterest-bearing deposits

|

258,599

|

210,986

|

||||||||||||||||||||||

|

Other noninterest-bearing liabilities

|

5,126

|

4,011

|

||||||||||||||||||||||

|

Total noninterest-bearing liabilities

|

263,725

|

214,997

|

||||||||||||||||||||||

|

Shareholders’ equity

|

105,283

|

102,691

|

||||||||||||||||||||||

|

Total liabilities and shareholders’ equity

|

$

|

982,024

|

$

|

845,510

|

||||||||||||||||||||

|

Net interest income excluding loan fee income

|

$

|

11,133

|

$

|

9,714

|

||||||||||||||||||||

|

Net interest spread excluding loan fee income(4)

|

4.27

|

%

|

3.95

|

%

|

||||||||||||||||||||

|

Net interest margin excluding loan fee income

|

4.54

|

%

|

4.60

|

%

|

||||||||||||||||||||

|

Net Interest Margin With Loan Fee Income

|

||||||||||||||||||||||||

|

For the Three Months Ended December 31,

|

||||||||||||||||||||||||

|

2020

|

2019

|

|||||||||||||||||||||||

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||

|

Short-term investments(1)

|

$

|

102,544

|

|

$

|

127

|

0.49

|

%

|

$

|

143,604

|

$

|

674

|

1.80

|

%

|

|||||||||||

|

Investment securities(2)

|

1,165

|

15

|

5.12

|

1,073

|

23

|

8.50

|

||||||||||||||||||

|

Loans held for sale

|

198

|

—

|

0.00

|

289

|

—

|

0.00

|

||||||||||||||||||

|

Total loans(3)

|

871,163

|

13,182

|

6.02

|

692,286

|

12,299

|

7.05

|

||||||||||||||||||

|

Total interest-earning assets

|

975,070

|

13,324

|

5.44

|

837,252

|

12,996

|

6.16

|

||||||||||||||||||

|

Noninterest-earning assets

|

6,954

|

8,258

|

||||||||||||||||||||||

|

Total assets

|

$

|

982,024

|

$

|

845,510

|

||||||||||||||||||||

|

Funding sources:

|

||||||||||||||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||

|

Deposits:

|

||||||||||||||||||||||||

|

Transaction accounts

|

$

|

409,174

|

470

|

0.46

|

%

|

$

|

314,106

|

1,133

|

1.43

|

%

|

||||||||||||||

|

Time deposits

|

203,842

|

655

|

1.28

|

213,716

|

1,205

|

2.24

|

||||||||||||||||||

|

Total interest-bearing deposits

|

613,016

|

1,125

|

0.73

|

527,822

|

2,338

|

1.76

|

||||||||||||||||||

|

Other borrowings

|

—

|

—

|

0.00

|

—

|

—

|

0.00

|

||||||||||||||||||

|

Total interest-bearing liabilities

|

613,016

|

1,125

|

0.73

|

527,822

|

2,338

|

1.76

|

||||||||||||||||||

|

Noninterest-bearing liabilities:

|

||||||||||||||||||||||||

|

Noninterest-bearing deposits

|

258,599

|

210,986

|

||||||||||||||||||||||

|

Other noninterest-bearing liabilities

|

5,126

|

4,011

|

||||||||||||||||||||||

|

Total noninterest-bearing liabilities

|

263,725

|

214,997

|

||||||||||||||||||||||

|

Shareholders’ equity

|

105,283

|

102,691

|

||||||||||||||||||||||

|

Total liabilities and shareholders’ equity

|

$

|

982,024

|

$

|

845,510

|

||||||||||||||||||||

|

Net interest income including loan fee income

|

|

$

|

12,199

|

$

|

10,658

|

|||||||||||||||||||

|

Net interest spread including loan fee income(4)

|

4.71

|

%

|

4.40

|

%

|

||||||||||||||||||||

|

Net interest margin including loan fee income

|

4.98

|

%

|

5.05

|

%

|

||||||||||||||||||||

| (1) |

Includes income and average balances for fed funds sold, interest-earning deposits in banks and other miscellaneous interest-earning assets.

|

| (2) |

Includes income and average balances for FHLB and FRB stock.

|

| (3) |

Non-accrual loans are included in loans.

|

| (4) |

Net interest spread is the average yield on interest-earning assets minus the average rate on interest-bearing liabilities.

|

|

Net Interest Margin Excluding Loan Fee Income

|

||||||||||||||||||||||||

|

For the Year Ended December 31,

|

||||||||||||||||||||||||

|

2020

|

2019

|

|||||||||||||||||||||||

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||

|

Short-term investments(1)

|

$

|

116,295

|

$

|

828

|

0.71

|

% |

$

|

151,434

|

$

|

3,459

|

2.28

|

%

|

||||||||||||

|

Investment securities(2)

|

1,123

|

36

|

3.21

|

1,065

|

50

|

4.69

|

||||||||||||||||||

|

Loans held for sale

|

244

|

—

|

0.00

|

236

|

—

|

0.00

|

||||||||||||||||||

|

Total loans(3)

|

823,228

|

47,415

|

5.76

|

636,274

|

43,757

|

6.88

|

||||||||||||||||||

|

Total interest-earning assets

|

940,890

|

48,279

|

5.13

|

789,009

|

47,266

|

5.99

|

||||||||||||||||||

|

Noninterest-earning assets

|

8,067

|

9,519

|

||||||||||||||||||||||

|

Total assets

|

$

|

948,957

|

$

|

798,528

|

||||||||||||||||||||

|

Funding sources:

|

||||||||||||||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||

|

Deposits:

|

||||||||||||||||||||||||

|

Transaction accounts

|

$

|

377,519

|

2,729

|

0.72

|

% |

$

|

295,576

|

5,057

|

1.71

|

%

|

||||||||||||||

|

Time deposits

|

207,442

|

3,424

|

1.65

|

208,375

|

4,459

|

2.14

|

||||||||||||||||||

|

Total interest-bearing deposits

|

584,961

|

6,153

|

1.05

|

503,951

|

9,516

|

1.89

|

||||||||||||||||||

|

Other borrowings

|

—

|

—

|

0.00

|

—

|

—

|

0.00

|

||||||||||||||||||

|

Total interest-bearing liabilities

|

584,961

|

6,153

|

1.05

|

503,951

|

9,516

|

1.89

|

||||||||||||||||||

|

Noninterest-bearing liabilities:

|

||||||||||||||||||||||||

|

Noninterest-bearing deposits

|

256,431

|

192,562

|

||||||||||||||||||||||

|

Other noninterest-bearing liabilities

|

5,206

|

4,585

|

||||||||||||||||||||||

|

Total noninterest-bearing liabilities

|

261,637

|

197,147

|

||||||||||||||||||||||

|

Shareholders’ equity

|

102,359

|

97,430

|

||||||||||||||||||||||

|

Total liabilities and shareholders’ equity

|

$

|

948,957

|

$

|

798,528

|

||||||||||||||||||||

|

Net interest income excluding loan fee income

|

$

|

42,126

|

$

|

37,750

|

||||||||||||||||||||

|

Net interest spread excluding loan fee income(4)

|

4.08

|

% |

4.10

|

%

|

||||||||||||||||||||

|

Net interest margin excluding loan fee income

|

4.48

|

% |

4.78

|

%

|

||||||||||||||||||||

|

Net Interest Margin With Loan Fee Income

|

||||||||||||||||||||||||

|

For the Year Ended December 31,

|

||||||||||||||||||||||||

|

2020

|

2019

|

|||||||||||||||||||||||

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Rate

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||

|

Short-term investments(1)

|

$

|

116,295

|

$

|

828

|

0.71

|

%

|

$

|

151,434

|

$

|

3,459

|

2.28

|

%

|

||||||||||||

|

Investment securities(2)

|

1,123

|

36

|

3.21

|

1,065

|

50

|

4.69

|

||||||||||||||||||

|

Loans held for sale

|

244

|

—

|

0.00

|

236

|

—

|

0.00

|

||||||||||||||||||

|

Total loans(3)

|

823,228

|

52,450

|

6.37

|

636,274

|

48,200

|

7.58

|

||||||||||||||||||

|

Total interest-earning assets

|

940,890

|

53,314

|

5.67

|

789,009

|

51,709

|

6.55

|

||||||||||||||||||

|

Noninterest-earning assets

|

8,067

|

9,519

|

||||||||||||||||||||||

|

Total assets

|

$

|

948,957

|

$

|

798,528

|

||||||||||||||||||||

|

Funding sources:

|

||||||||||||||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||

|

Deposits:

|

||||||||||||||||||||||||

|

Transaction accounts

|

$

|

377,519

|

2,729

|

0.72

|

%

|

$

|

295,576

|

5,057

|

1.71

|

%

|

||||||||||||||

|

Time deposits

|

207,442

|

3,424

|

1.65

|

208,375

|

4,459

|

2.14

|

||||||||||||||||||

|

Total interest-bearing deposits

|

584,961

|

6,153

|

1.05

|

503,951

|

9,516

|

1.89

|

||||||||||||||||||

|

Other borrowings

|

—

|

—

|

0.00

|

—

|

—

|

0.00

|

||||||||||||||||||

|

Total interest-bearing liabilities

|

584,961

|

6,153

|

1.05

|

503,951

|

9,516

|

1.89

|

||||||||||||||||||

|

Noninterest-bearing liabilities:

|

||||||||||||||||||||||||

|

Noninterest-bearing deposits

|

256,431

|

192,562

|

||||||||||||||||||||||

|

Other noninterest-bearing liabilities

|

5,206

|

4,585

|

||||||||||||||||||||||

|

Total noninterest-bearing liabilities

|

261,637

|

197,147

|

||||||||||||||||||||||

|

Shareholders’ equity

|

102,359

|

97,430

|

||||||||||||||||||||||

|

Total liabilities and shareholders’ equity

|

$

|

948,957

|

$

|

798,528

|

||||||||||||||||||||

|

Net interest income including loan fee income

|

$

|

47,161

|

$

|

42,193

|

||||||||||||||||||||

|

Net interest spread including loan fee income(4)

|

4.61

|

%

|

4.67

|

%

|

||||||||||||||||||||

|

Net interest margin including loan fee income

|

5.01

|

%

|

5.35

|

%

|

||||||||||||||||||||

|

Dollars in thousands, except per share data

|

Unaudited as of

|

|||||||||||

|

Assets

|

2020

|

December 31,

|

||||||||||

|

December 31

|

September 30

|

2019

|

||||||||||

|

Cash and due from banks

|

$

|

153,901

|

$

|

60,718

|

$

|

117,128

|

||||||

|

Interest-bearing time deposits in other banks

|

16,412

|

23,384

|

30,147

|

|||||||||

|

Loans, net

|

826,974

|

869,448

|

699,458

|

|||||||||

|

Loans held for sale

|

324

|

315

|

1,031

|

|||||||||

|

Premises and equipment, net

|

9,151

|

9,387

|

9,624

|

|||||||||

|

Nonmarketable equity securities

|

1,172

|

1,165

|

1,100

|

|||||||||

|

Goodwill and intangibles

|

1,583

|

1,634

|

1,789

|

|||||||||

|

Interest receivable and other assets

|

7,152

|

7,303

|

6,115

|

|||||||||

|

Total assets

|

$

|

1,016,669

|

$

|

973,354

|

$

|

866,392

|

||||||

|

Liabilities and Shareholders’ Equity

|

||||||||||||

|

Deposits

|

||||||||||||

|

Noninterest-bearing

|

$

|

246,569

|

$

|

272,008

|

$

|

219,221

|

||||||

|

Interest-bearing

|

658,945

|

591,661

|

538,262

|

|||||||||

|

Total deposits

|

905,514

|

863,669

|

757,483

|

|||||||||

|

Income taxes payable

|

9

|

565

|

357

|

|||||||||

|

Interest payable and other liabilities

|

3,827

|

3,890

|

8,426

|

|||||||||

|

Total liabilities

|

909,350

|

868,124

|

766,266

|

|||||||||

|

Common stock

|

90

|

92

|

101

|

|||||||||

|

Additional paid-in capital

|

93,162

|

92,960

|

92,391

|

|||||||||

|

Retained earnings

|

14,067

|

12,178

|

7,634

|

|||||||||

|

Total shareholders’ equity

|

107,319

|

105,230

|

100,126

|

|||||||||

|

Total liabilities and shareholders’ equity

|

$

|

1,016,669

|

$

|

973,354

|

$

|

866,392

|

||||||

|

Unaudited as of

|

||||||||||||||||||||

|

Quarter Ended

|

Year Ended

|

|||||||||||||||||||

|

2020

|

2019

|

2020

|

2019

|

|||||||||||||||||

|

Dollars in thousands, except per share data

|

December 31

|

September 30

|

December 31

|

December 31

|

December 31

|

|||||||||||||||

|

Interest Income

|

||||||||||||||||||||

|

Loans, including fees

|

$

|

13,182

|

$

|

12,777

|

$

|

12,299

|

$

|

52,450

|

$

|

48,200

|

||||||||||

|

Interest-bearing time deposits in other banks

|

107

|

123

|

295

|

526

|

1,709

|

|||||||||||||||

|

Interest-bearing deposits in other banks

|

35

|

26

|

402

|

338

|

1,800

|

|||||||||||||||

|

Total interest income

|

13,324

|

12,926

|

12,996

|

53,314

|

51,709

|

|||||||||||||||

|

Interest Expense

|

||||||||||||||||||||

|

Deposits

|

1,125

|

1,325

|

2,338

|

6,153

|

9,516

|

|||||||||||||||

|

Total interest expense

|

1,125

|

1,325

|

2,338

|

6,153

|

9,516

|

|||||||||||||||

|

Net Interest Income

|

12,199

|

11,601

|

10,658

|

47,161

|

42,193

|

|||||||||||||||

|

Provision for Loan Losses

|

2,050

|

1,250

|

-

|

5,350

|

-

|

|||||||||||||||

|

Net Interest Income After Provision for Loan Losses

|

10,149

|

10,351

|

10,658

|

41,811

|

42,193

|

|||||||||||||||

|

Noninterest Income

|

||||||||||||||||||||

|

Secondary market income

|

41

|

57

|

18

|

175

|

164

|

|||||||||||||||

|

Service charges on deposit accounts

|

124

|

104

|

113

|

442

|

392

|

|||||||||||||||

|

Other

|

535

|

173

|

126

|

1,048

|

752

|

|||||||||||||||

|

Total noninterest income

|

700

|

334

|

257

|

1,665

|

1,308

|

|||||||||||||||

|

Noninterest Expense

|

||||||||||||||||||||

|

Salaries and employee benefits

|

2,554

|

2,505

|

2,473

|

10,130

|

21,265

|

|||||||||||||||

|

Furniture and equipment

|

210

|

224

|

223

|

868

|

829

|

|||||||||||||||

|

Occupancy

|

540

|

543

|

520

|

1,957

|

1,677

|

|||||||||||||||

|

Data and item processing

|

270

|

276

|

264

|

1,091

|

1,078

|

|||||||||||||||

|

Accounting, marketing and legal fees

|

198

|

135

|

250

|

536

|

757

|

|||||||||||||||

|

Regulatory assessments

|

225

|

164

|

32

|

506

|

126

|

|||||||||||||||

|

Advertising and public relations

|

40

|

62

|

239

|

400

|

588

|

|||||||||||||||

|

Travel, lodging and entertainment

|

95

|

50

|

81

|

241

|

368

|

|||||||||||||||

|

Other

|

400

|

625

|

475

|

1,863

|

1,744

|

|||||||||||||||

|

Total noninterest expense

|

4,532

|

4,584

|

4,557

|

17,592

|

28,432

|

|||||||||||||||

|

Income Before Taxes

|

6,317

|

6,101

|

6,358

|

25,884

|

15,069

|

|||||||||||||||

|

Income tax expense

|

1,578

|

1,661

|

1,879

|

6,618

|

6,844

|

|||||||||||||||

|

Net Income

|

$

|

4,739

|

$

|

4,440

|

$

|

4,479

|

$

|

19,266

|

$

|

8,225

|

||||||||||

|

Earnings per common share - basic

|

$

|

0.52

|

$

|

0.48

|

$

|

0.45

|

$

|

2.05

|

$

|

0.81

|

||||||||||

|

Diluted earnings per common share

|

0.52

|

0.48

|

0.45

|

2.05

|

0.81

|

|||||||||||||||

|

Weighted average common shares outstanding - basic

|

9,066,737

|

9,228,128

|

10,057,506

|

9,378,769

|

10,145,032

|

|||||||||||||||

|

Weighted average common shares outstanding - diluted

|

9,068,161

|

9,228,128

|

10,059,208

|

9,379,154

|

10,147,311

|

|||||||||||||||