UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

The Fiscal Year Ended

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission

File Number

(Exact name of registrant issuer as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices, including zip code)

Registrant’s

phone number, including area code

Securities registered pursuant to Section 12(b) of the Securities Exchange Act: None

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes

☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES ☐ ☒

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large

Accelerated Filer ☐ Accelerated Filer ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The OTC Market – Pink Sheets |

The aggregate market value of the Company’s common stock held by non-affiliates computed by reference to the closing bid price of the Company’s common stock, as of the last business day of the registrant’s most recently completed second fiscal quarter:

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Not Applicable

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class | Outstanding at July 31, 2022 | |

| Common Stock, $.0001 par value |

MU Global Holding Limited

FORM 10-K

For the Fiscal Year Ended July 31, 2022

Index

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| ● | The availability and adequacy of our cash flow to meet our requirements; | |

| ● | Economic, competitive, demographic, business and other conditions in our local and regional markets; | |

| ● | Changes or developments in laws, regulations or taxes in our industry; | |

| ● | Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities; | |

| ● | Competition in our industry; | |

| ● | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; | |

| ● | Changes in our business strategy, capital improvements or development plans; | |

| ● | The availability of additional capital to support capital improvements and development; and | |

| ● | Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Defined Terms

Except as otherwise indicated by the context, references in this Report to:

| ● | The “Company,” “we,” “us,” or “our,” “MU Global” are references to MU Global Holding Limited, a Nevada corporation. | |

| ● | “Common Stock” refers to the common stock, par value $.0001, of the Company; | |

| ● | “U.S. dollar,” “$” and “US$” refer to the legal currency of the United States; | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; and | |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

| 1 |

PART I

ITEM 1. BUSINESS

Corporate History

MU Global Holding Limited, a Nevada corporation (“the company”) was incorporated under the laws of the State of Nevada on June 4, 2018.

MU Global Holding Limited, the US Company, operates through its wholly owned subsidiary, MU Worldwide Group Limited, a Seychelles Company; which operates through its wholly owned subsidiary, MU Global Holding Limited, a Hong Kong Company; which operates through its wholly owned subsidiary, MU Global Health Management (Shanghai) Limited, a Shanghai Company.

MU Global Holding Limited is an early-stage wellness and beauty supply services company, which intends to offer customers a wide range of trusted non-surgical spa services and quality spa care products. All of the previous entities share the same exact business plan with the goal of developing and providing wellness and beauty services to our future clients. We aim to promote improved overall health and beauty in our clients through a holistic detoxification method.

The Company, through its subsidiaries, mainly supplies high quality spa services and spa care products. Details of the Company’s subsidiaries:

| Company name | Place and date of incorporation | Particulars of issued capital | Principal activities | Proportional of ownership interest and voting power held | ||||||||

| 1. | MU Worldwide Group Limited | Seychelles, June 7, 2018 | 100 shares of ordinary share of US$1 each | Investment holding | 100 | % | ||||||

| 2. | MU Global Holding Limited | Hong Kong, January 30, 2018 | 1 share of ordinary share of HK$1 each | Providing SPA and Wellness service in Hong Kong | 100 | % | ||||||

| 3. | MU Global Health Management | Shanghai, August 16, 2018 | RMB 7,400,300 | Providing SPA and Wellness service in China | 100 | % | ||||||

Business Overview

MU Global is a beauty and wellness company, providing SPA and wellness service and also SPA related products to the customers. The services provided are designed to improve the overall health system and body function.

Since our establishment, the Company has been focusing to expand in the Chinese market, with other country also under consideration as target destinations. As an emerging industry in China, the beauty and wellness industry is still in the early stage there is a huge potential for the industry to growth significantly.

In year 2020, COVID-19 crisis has resulted the sales of the global beauty and wellness industry weak due to consumers have had limited access to retail outlets and supply chain bottlenecks have reduced product availability. In China, the industry’s sales fell up to 80 percent compared with 2019. Nevertheless, based on Mckinsey and Company research report on April 8, 2021, shows that consumers care deeply about wellness—and that their interest is growing and the global wellness market is estimated at more than US$1.5 trillion, with annual growth of 5 to 10 percent. A rise in both consumer interest and purchasing power presents tremendous opportunities for companies, particularly as spending on personal wellness rebounds after stagnating or even declining during the COVID-19 crisis

China has large territory, population, diverse ethnicity and cultural background. As such, it has resulted in different consumer orientations in different cities and townships across the country, therefore, it is particularly challenging to tackle the consumer market with a single business model.

The advance in technological development and rise in use of technology in marketing has also intensified the competition, probing the Company to develop the business models that allow quick penetration and huge coverage of different markets, and also being able to cope with the swift changes in the consumer market. Thus, the Company is focusing on three key areas as part of the Company’s early development in the Chinese market.

The first and most key focus is to enter the regional market through the adoption of franchisee and agent model, which the other parties are familiar and have deep understanding in the local market, hence its operating strategy is effective and best suited the targeted region.

| 2 |

Second, the key strategy is to ensure rapid development of the Omni channel marketing plan which targets to lease out at least ten thousand Stone Spa Bed (Hot Stone Bath equipment), reducing the time cost for the development of project, and most importantly, working on to spur sales and revenue growth.

Lastly, the essential requirement for business success in the Chinese market is to ensure and maintain a clear and transparent business model, which would result in effective collaboration between the company and its agent/franchisee, and consequently leads to efficient market operation and a win-win situation between the two parties.

Currently, the Company operates in the Chinese market with three business models:

| 1. | Tripartite co-operation and profit sharing model (deployment of stone spa bed & franchise) |

| 2. | Large-scale chain agent model (deployment of stone spa bed) |

| 3. | Direct- service store model |

Our Service

DAY MORE STONE THERAPHY

1. Bedrock Bathing/ Hot Stone Bath

| 3 |

Bedrock Bathing is a method of keeping the body in shape that involves bathers lying down on a heated slab of rocks embedded on a spa treatment bed without using hot water wearing indoor clothing. The original name for this hot stone bathing is ‘Ganban’yoku’, and it is originated from Japan as the term for a popular form of hot stone or bedrock spa. It is also referred to as “stone-bathing”, but there is no actual bathing or water involved.

It is our belief that the effects of bedrock bathing are numerous and both aesthetic and metabolic. Furthermore, the rocks selected for this treatment are believed to provide many health benefits when they are heated. The five stones we intend to use are: Black Silica Stone, Radium Stone, Far Infrared Stone, Negative Ion Stone and Beitou Stone. The average time taken for each therapy is approximately 30 minutes.

The Company believes that bedrock bathing treatments will assist in the elimination of suboptimal health conditions caused by polluted environments, unhealthy dietary intake, and unhealthy lifestyles. The detoxification process will improve general bodily function and immune system, promote blood circulation, and yield visible skin improvement. The treatment is also believed to improve basal metabolism, resulting in more efficient energy utilization within the body, hence sustainable weight loss to a desirable level. Prolonged proper treatments have also been linked to miscellaneous anti-aging benefits.

Our pricing strategy offers great flexibility to our customers to opt for the service they desire which is also within their budget. In order to ensure flexibility, the Company has divided the service into three different tiers, each with different pricing strategy: Flagship, Luxury and Refined. Under the three tiers model, Flagship branch and will be the top tier and will target high-end segment with premium pricing packages. Luxury branch is designed to attract middle class individuals. Refined branch on the other side, will aim to attract customer with lower budget, but would still like to enjoy the service.

The Company started offering bedrock bathing services in the Shanghai outlet in January 2019. Different service packages are designed for each tier of service, which include option for subscription-based treatments, and pay per services. The packages offer customers either the option of purchasing our treatments at a discounted price if they purchase in bundle, or they can pay for the service every time they use at normal price. The bundle comprises of 3 different number of visits per bundle i.e., 10 times visit package, 20 times visit package, and 30 times visit package. We have also implemented a member database for our bedrock bathing centre. Customers can join our membership at an attracting fee to enjoy the services provided at member price. In addition to that, the Company also allows customers to purchase the services package via online and WeChat.

| 4 |

2. Quartz Therapy

Chakras is within and parts of the human body that connects with the environment. If chakra is blocked or overactive, we lose balance of our physical and mental balance and in turn, it affects the physical and mental well-being.

Quarts have the therapeutic effect of enabling Chakras to regain its balance. Thus, the therapy has the benefit of body cleansing, restoring good health and also spirit.

Our Product

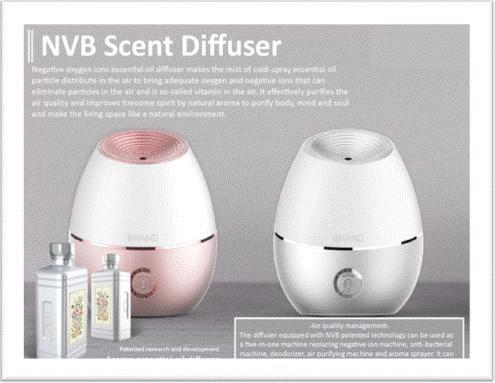

NVB Scent Diffuser

| 5 |

The negative oxygen ions essential oil diffuser distributes cold-sprayed essential oil particle to balance oxygen and negative ions in the air. The negative ions eliminate particles, and it’s called the vitamin in the air. The essential oil diffuser can purify air quality, and provide a natural aroma that relax the body. The essential oil diffuser has integrated the technology of “Never BAC anti-bacterial” that provides the effect of purification, anti-bacterial, second-hand smoke elimination, and deodorization.

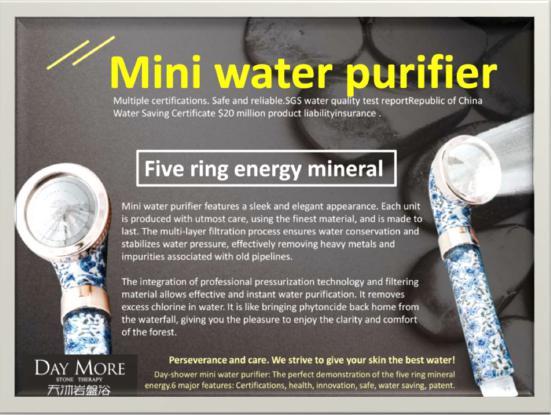

Mini Water Purifier

The mini water purifier integrates advanced pressurization technology and filtering materials, which allow instant purification of water and the removal of excess chlorine in water. The multi-layer filtration process of the purifier ensures water conservation and also stabilizes water pressure at the same time. Most importantly, the purifier can effectively remove heavy metals and impurity associated with old pipelines.

| 6 |

Trademarks

The Company owned several trademarks registered under its subsidiaries in respective jurisdictions of which the subsidiaries operate in. Currently, the Company is also applying for trademarks in other jurisdictions it intends to expand its operation into.

| Category | Registration Number | Trade Marks Logo | Ownership | Country | Effective Date and Duration | |||||

| Trademark | 304770982 |

[Class 35] |

MU Global Holding Limited | Hong Kong | July 12, 2019 For 10 Years | |||||

| Trademark | 304770991 |

[Class 11,44] |

MU Global Holding Limited | Hong Kong | June 20, 2019 For 10 Years | |||||

| Trademark | 14311788 |  |

MU Global Health Management | China | May 14, 2015 For 10 Years | |||||

| [Class 3] | ||||||||||

| Trademark | 14311839 |  |

MU Global Health Management | China | May 14, 2015 For 10 Years | |||||

| [Class 3] |

| 7 |

| Trademark | 34828880 |  |

MU Global Health Management | China | July 14, 2019

For 10 Years | |||||

| [Class 32] | ||||||||||

| Trademark | 35094440 |  |

MU Global Health Management | China | July 28, 2019 For 10 Years | |||||

| [Class 35] | ||||||||||

| Trademark | 34814157 |  |

MU Global Health Management | China | July 21, 2019 For 10 Years | |||||

| [Class 35] | ||||||||||

| Trademark | 34821472 |  |

MU Global Health Management | China | July 14, 2019 For 10 Years | |||||

| [Class 44] | ||||||||||

| Trademark | 34810654 |  |

MU Global Health Management | China | July 21, 2019 For 10 Years | |||||

| [Class 10] |

| 8 |

| Trademark | 38223024 |  |

MU Global Health Management | China | February 7, 2020 For 10 Years | |||||

| [Class 10] | ||||||||||

| Trademark | 38234836 |  |

MU Global Health Management | China | January 14, 2020 For 10 years | |||||

| [Class 20] | ||||||||||

| Trademark | 38229731 |  |

MU Global Health Management | China | January 14, 2020 For 10 years | |||||

| [Class 20] | ||||||||||

| Trademark | 38246309 |  |

MU Global Health Management | China | February 21, 2020 For 10 years | |||||

| [Class 35] | ||||||||||

| Trademark | 38238457 |  |

MU Global Health Management | China | January 14, 2020 For 10 years | |||||

| [Class 44] | ||||||||||

| Trademark | 38244932 |  |

MU Global Health Management | China | January 14, 2020 For 10 years | |||||

| [Class 03] |

| 9 |

| Trademark | 40201907290T |  |

MU Global Holding Limited | Singapore | April 4, 2019 For 10 years | |||||

| [Class 03] | ||||||||||

| Trademark | 1440029207 |  |

MU Global Holding Limited | Saudi Arabia | July 31, 2019 to April 11, 2029 | |||||

| [Class 44] | ||||||||||

| Trademark | 1440029205 |  |

MU Global Holding Limited | Saudi Arabia | July 30, 2019 to April 10, 2029 | |||||

| [Class 11] | ||||||||||

| Trademark | 1440029204 |  |

MU Global Holding Limited | Saudi Arabia | July 30, 2019 to April 10, 2029 | |||||

| [Class 03] | ||||||||||

| Trademark | 314481 |  |

MU Global Holding Limited | United Arab Emirates | July 25, 2019 For 10 years | |||||

| [Class 44] | ||||||||||

| Trademark | 314479 |  |

MU Global Holding Limited | United Arab Emirates | July 25, 2019 For 10 years | |||||

| [Class 11] | ||||||||||

| Trademark | 314480 |  |

MU Global Holding Limited | United Arab Emirates | July 25, 2019 For 10 years | |||||

| [Class 35] | ||||||||||

| Trademark | 304770982 |  |

MU Global Holding Limited | Hong Kong | December 14, 2018 For 10 years |

| 10 |

Patent

On September 4, 2019, our subsidiary, MU Global Health Management (Shanghai) Limited made 5 patent applications to China National Intellectual Property Administration (CNIPA) in regards to stone spa bed thermostatic control setting. On May 5, 2020, CNIPA officially granted one patent to MU Global Health Management (Shanghai) Limited for a duration period of 10 years, with an effective date from September 4, 2019. In the year ended July 31, 2021, CNIPA officially granted another four patents to MU Global Health Management (Shanghai) Limited for a duration period of 10 years, with an effective date from September 4, 2019. On June 22 2021, Intellectual Property Office of Singapore officially granted one invention patent to MU Global Holding Limited (HK) for a duration period of 20 years, with an effective date from September 11, 2019.

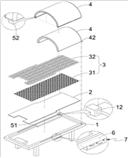

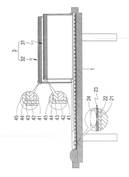

| Category | Registration Number | Thermostatic Control Setting Plan | Ownership | Country | Effective Date and Duration | |||||

| Patent | ZL 2019 2 1458259.5 |  |

MU Global Health Management | China | May 5, 2020 For 10 Years | |||||

| Patent | ZL 2019 2 1474367.1 |  |

MU Global Health Management | China | August 21, 2020 For 10 Years | |||||

| Patent | ZL 2019 2 1462066. 7 |  |

MU Global Health Management | China | August 28, 2020 For 10 Years | |||||

| Patent | ZL 2019 2 1458272.0 |  |

MU Global Health Management | China | September 29, 2020 For 10 Years | |||||

| Patent | ZL 2019 2 1458071.0 |  |

MU Global Health Management | China | December 15, 2020 For 10 Years | |||||

| Patent | 10201908402Q |  |

MU Global Holding Limited (HK) | Singapore | June 22, 2021 For 20 Years (from September 11, 2019) |

The setting displays a concept of thermostatic control for a stone spa bed, which includes a bed, a bed heating element, an energy part, a cover cabin, cover cabin’s opening/closing assembly, a thermostatic control device, and a thermostatic temperature adjustment device. Once the thermostatic temperature adjustment device sets the default temperature, the user can activate the bed heating element after lying down on the stone spa bed. Following the closure of the cover cabin, the bed heating element will start heating from the default temperature to the user’s ideal degree of temperature. Once the session completes, the thermostatic control device will reduce the heating efficiency to the default temperature in order to maintain the heat for the next session, which can largely reduce the heating time and electricity cost-saving.

| 11 |

Future Plan

Marketing Campaign and Publicity Enhancement

Under the group’s marketing development plan, the Company will implement actively the major projects launched by the group, including Omni channel marketing project and nationwide franchised program, which the Company aims to attract at least 1,000 franchised stores.

Since the opening of outlet shop in Shanghai, the shop has initiated the Omni-channel marketing projects, aiming to penetrate the market, and it has built a stronghold with the franchised stores and agents in multiple provinces across the country, including Shanghai, Zhejiang, Jiangsu, Sichuan, Shandong, Shanxi, Henan and Guangdong province. The initial expansion of operation is based on the business model of profit sharing, and through this model, the Company has managed to expand the Hot Stone Bath therapy service into different health and wellness service provider outlets in different cities. The outlets span across different sub-segment of the health and wellness industry, which include beauty centre, post-maternity care centre, as well as high-end beauty salon. The Company targets to achieve the Omni-channel marketing projects by 2021, and the nationwide franchised program is expected to be achieved by 2023.

Intelligent Marketing

The IT team in China has recently completed the development of “Intelligent Health Evaluation Application System” to provide support for the operation of Hot Stone Bath Therapy. Customers are now able to compare their health indicator through the mobile application and body fat measure device. The Company aims to build its own health indicator, recommend a personalized Hot Stone Bath therapy to the customers through the use of big data computation and analysis. By providing personalized service package, the Company believes it can effectively lead the consumers in making consuming decision, and consequently, the system will be upgraded to be a community marketing tool aiming to increase new customers flow and also retain existing customers.

| 12 |

Product Research and Development

While the Company is seeking to expand the access to the China market, it is also actively promoting the research and development of products and technology. In addition to the introduction of new products, under the ongoing smart technology trend led by China, the business model of beauty and health industry has also experienced rapid changes in the emerging environment. Responding to changes in the business model in this industry, the information and intelligent technology has thus become the core competency in successfully managing large-scale change industries

In MU Global, the Company has numerous experts in information technology, thus equipping the company with the capability to support the business technology required in this fast-changing business environment, providing the essential tool to manage a large-scale chain remotely, and also lay the foundation for the success of the Omni-channel marketing project. As such, the Company will continuously strengthen the capability of information and intelligent technology as it will be the top priority of the Company’s future development plan.

International Expansion

Currently, we are actively engaging and negotiating with different parties in the Gulf countries (UAE, Bahrain, Saudi Arabia, Oman, Qatar, and Kuwait). The Company plans to enter the Middle-East market through the model of national agency and establish a long-term partnership with the local counterpart to develop and promote the Omni channel marketing project. At the same time, the Company has already established the national agency network in Malaysia and Singapore, and we are aiming to further expand to other countries in the Association of Southeast Asian Nations (ASEAN).

Human Resources and Talent Development

Taking into consideration of aforementioned development, the Company is well aware that with existing man power is far from sufficient to materialization of future plan, thus investment in human resources and talent development is inevitable, including but it will not be limited to internal administrative and operation personnel, but also sales and marketing, accounting and finance, as well as top management personnel.

| 13 |

Competition

The beauty and wellness industry are highly competitive and fragmented, we might be in disadvantage competing with competitor who has greater reserve or has higher access to capital than the Company do to deploy in operations, capital expenditure, and marketing activities. We hope to maintain a competitive advantage by utilizing the knowledge and expertise of the Company in the industry and our beyond satisfactory customer service.

Customers

For the year ended July 31, 2022, the Company has generated revenue amounted to $46,702 from customers under the ordinary course of business. The revenue mainly represented direct sales to outlet shop customers, sales of products, and profit sharing amongst agents and franchised stores.

Employees

As of July 31, 2022, the Company has a total 4 employees. At the moment, the Company has adopted accountability system, hence management personnel have flexible working hours.

Our sole director and Chief Executive Officer, Niu Yen-Yen and Chief Financial Officer currently work full-time and fully committed to the operation of the company.

We do not presently have pension, health, annuity, insurance, stock options, profit sharing, or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our Officers, Directors or employees.

Government Regulation

At present, we are subject to the laws and regulations of the jurisdictions in which we operate, which may include business licensing requirements, income taxes and payroll taxes. In general, the development and operation of our business is not subject to special regulatory and supervisory requirements.

| 14 |

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 2. PROPERTIES

We had a physical office in Shanghai with address of Room 1510, Building 5, Ark Times Square, 3148 Chengliu Middle Road, Jiading District, Shanghai. This location has been rented by MU Global Health Management (Shanghai) Limited for a 12-month period from November 6, 2021 to November 5, 2022, for an initial deposit of RMB 7,000 and additional tri-monthly payments in the amount of RMB 3,500 per month over the course of the lease. The Company has an option to renew after the end of the agreement. On October 18, 2022, the Company has renewed the tenancy agreement for 12 months with tri-monthly payments in the amount of RMB 3,500 per month over the course of the lease from November 6, 2022 to November 5, 2023.

ITEM 3. LEGAL PROCEEDINGS

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. There are currently no pending legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results. None of our directors, officers or affiliates is involved in a proceeding adverse to our business or has a material interest adverse to our business.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 15 |

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Holders

As of July 31, 2022, we had 59,434,838 shares of our Common Stock par value, $.0001 issued and outstanding. There were 159 beneficial owners of our Common Stock.

Transfer Agent and Registrar

The transfer agent for our capital stock is VStock Transfer, LLC, with an address at 18, Lafayette Place, Woodmere, New York 11598 and telephone number is +1 (212) 828-8436.

Penny Stock Regulations

The Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our Common Stock, when and if a trading market develops, may fall within the definition of penny stock and be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 individually, or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Securities and Exchange Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our Common Stock and may affect the ability of investors to sell their Common Stock in the secondary market.

In addition to the “penny stock” rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit the investors’ ability to buy and sell our stock.

Dividend Policy

Any future determination as to the declaration and payment of dividends on shares of our Common Stock will be made at the discretion of our board of directors out of funds legally available for such purpose. We are under no obligations or restrictions to declare or pay dividends on our shares of Common Stock. In addition, we currently have no plans to pay such dividends. Our board of directors currently intends to retain all earnings for use in the business for the foreseeable future.

Equity Compensation Plan Information

Currently, there is no equity compensation plan in place.

Unregistered Sales of Equity Securities

Currently, there is no unregistered sales of equity securities.

| 16 |

Purchases of Equity Securities by the Registrant and Affiliated Purchasers

We have not repurchased any shares of our common stock during the fiscal year ended July 31, 2022.

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read in conjunction with our audited consolidated financial statements and the notes to those financial statements appearing elsewhere in this Report.

Certain statements in this Report constitute forward-looking statements. These forward-looking statements include statements, which involve risks and uncertainties, regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategy, (c) anticipated trends in our industry, (d) our future financing plans, and (e) our anticipated needs for, and use of, working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,” “potential,” “project,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Overview

MU Global Holding Limited, the US Company, operates through its wholly owned subsidiary, MU Worldwide Group Limited, a Seychelles Company; which operates through its wholly owned subsidiary, MU Global Holding Limited, a Hong Kong Company; which operates through its wholly owned subsidiary, MU Global Health Management (Shanghai) Limited, a Shanghai Company. The US, Seychelles and Hong Kong Companies act solely for holding purposes whereas all current and future operations in China are planned to be carried out via MU Global Health Management (Shanghai) Limited, the Shanghai Company. The purpose of the Hong Kong Company is to function as the current regional hub of the Company.

At present, we have a physical office in Shanghai with address of Room 1510, Building 5, Ark Times Square, 3148 Chengliu Middle Road, Jiading District, Shanghai. In the future, we do not have definitive plans for which markets intend to expand to, but we base our operations in Shanghai, as we prepare for future unidentified expansion efforts.

All of the previous entities share the same exact business plan with the goal of developing and providing wellness and beauty services to our future clients. We aim to promote improved overall health and beauty in our clients through a holistic detoxification method. We will, at least initially, primarily focus our efforts on attracting customers in China. We have intentions, but no definitive plans or timelines, to expand to Singapore, Malaysia, Hong Kong, and Middle Eastern countries in the coming years, and subsequently we intend to make efforts to expand throughout Asia. We anticipate spending a substantial amount in marketing and advertising in the coming year.

Results of Operations

Revenue

The Company generated revenue of $46,702 and $64,951 for the year ended July 31, 2022 and 2021. The revenue represented income from wellness and beauty services provided to customers and sales of products via Shanghai outlets.

Cost of Revenue and Gross Margin

For the year ended July 31, 2022 and 2021, cost incurred in providing wellness and beauty services amounted to $21,891 and $17,218 respectively. The Company generated gross profit of $24,811 and $47,733 for the year ended July 31, 2022 and 2021.

Selling and Marketing Expenses

Selling and distribution expenses for the year ended July 31, 2022 and 2021 amounted to $3,470 and $7,180 respectively, comprising advertisement expenses on WeChat, mobile apps and market public research.

| 17 |

General and Administrative Expenses

General and administrative expenses for the year ended July 31, 2022 and 2021 amounted to $428,710 and $463,641 respectively, comprising salary, allowances, professional fees, consultancy fee for IT and system management, office and outlet operation expenses and depreciation.

Other Income

The Company recorded an amount of $50,036 and $36,144 as other income for the year ended July 31, 2022 and 2021 respectively, being interest income, foreign exchange gain, gain on disposal and gain on remeasurement of long term liabilities.

Net Loss

Net loss for the year ended July 31, 2022 and 2021 amounted to $357,333 and $386,944 respectively. The decrease in net loss of $29,611 due to management have carried out strict control in expenses to reduce the general and administrative expenses incurred during the year ended July 31, 2022.

Liquidity and Capital Resources

As of July 31, 2022 and 2021, we had working capital of shortage of $339,398 and $170,303, consisting of cash and cash equivalents of $2,909 and $20,231 respectively. During the year ended July 31, 2022 and 2021, we had negative operating cash flows due to revenue is insufficient to cover the general and administrative expenses as the Company still in the development stage of commercialize its services and products and also the impact of impact of COVID-19 outbreak in China, which further slowdown the business development of the company.

We depend substantially on financing activities to provide us with the liquidity and capital resources we need to meet our working capital requirements and to make capital investments in connection with ongoing operations. During the year ended July 31, 2022, the Company had met these requirements primarily from the financial support from director and related company.

Cash Used in Operating Activities

For the year ended July 31, 2022 and 2021, net cash used in operating activities was $4,169 and $156,580 respectively. The cash used in operating activities was mainly for payment of general and administrative expenses.

Cash (Used) in /Provided by Financing Activities

For the year ended July 31, 2022 and 2021, net cash used in and provided by financing activities was $14,961 and $157,363 respectively. The financing cash flow performance primarily reflects loan from director, related company and third party.

Cash (Used) in /Provided by Investing Activities

For the year ended July 31, 2022 and 2021, net cash used in and provided by investing activities was $ 312 and $6,795 respectively. The investing cash flow performance primarily reflects the purchase of plant, equipment and trademarks and the disposal of plant and equipment.

Credit Facilities

We do not have any credit facilities or other access to bank credit.

Critical Accounting Policies and Estimates

Use of estimates

Management uses estimates and assumptions in preparing these financial statements in accordance with US GAAP. Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities in the balance sheets, and the reported revenue and expenses during the periods reported. Actual results may differ from these estimates.

Cash and cash equivalents

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

| 18 |

Revenue recognition

Financial Accounting Standards Board, or FASB, issued ASC 606. The standard is a comprehensive new revenue recognition model that requires revenue to be recognized in a manner to depict the transfer of goods or services to a customer at an amount that reflects the consideration expected to be received in exchange for those goods or services.

Revenue is measured at the fair value of the consideration received or receivable, net of discounts and taxes applicable to the revenue. The Company derives its revenue from provision of wellness and beauty services to customers via Company owned outlets, franchised outlets or distribution of our product to third party wellness and beauty salon.

Cost of revenues

Cost of revenue includes the cost of services and product incurred to provide wellness and beauty services and purchase of products.

Cash and cash equivalents

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

Inventories

Inventories consisting of products available for sell, are stated at the lower of cost or market value. Cost of inventory is determined using the first-in, first-out (FIFO) method. Inventory reserve is recorded to write down the cost of inventory to the estimated market value due to slow-moving merchandise and damaged goods, which is dependent upon factors such as historical and forecasted consumer demand, and promotional environment. The Company takes ownership, risks and rewards of the products purchased. Write downs are recorded in cost of revenues in the Consolidated Statements of Operations and Comprehensive Loss.

Property, plant and equipment

Property, plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated on the straight-line basis over the following expected useful lives from the date on which they become fully operational:

| Classification | Estimated useful life | |

| Leasable equipment | 5 years | |

| Computer hardware and software | 3 years | |

| Office equipment | 3 years | |

| Outlet design fee and equipment | 3 years | |

| Application development fee | 3 years |

Expenditures for maintenance and repairs are expensed as incurred. The gain or loss on the disposal of property, plant and equipment is the difference between the net sale proceeds and the carrying amount of the relevant assets and is recognized in the Consolidated Statements of Operations and Comprehensive Loss.

Impairment of long-live assets

Long-lived assets primarily include trademark of the Company. In accordance with the provision of ASC Topic 360, Impairment or Disposal of Long-Lived Assets, the Company generally conducts its annual impairment evaluation to its long-lived assets, usually in the fourth quarter of each fiscal year, or more frequently if indicators of impairment exist, such as significant sustained change in the business climate. The recoverability of long-lived assets is measured at the lowest level group. If the total of the expected undiscounted future net cash flows is less than the carrying amount of the asset, a loss is recognized for the difference between the fair value and carrying amount of the asset.

| 19 |

Leases

The Company recognizes lease payments for its short-term lease on a straight-line basis over the lease term in accordance with ASC 842.

The right-of-use asset is initially measured at cost, which comprises the initial amount of the lease liability adjusted for lease payments made at or before the lease commencement date, plus any initial direct costs incurred less any lease incentives received. Costs associated with operating lease assets are recognized on a straight-line basis within operating expenses over the term of the lease.

In determining the present value of the unpaid lease payments, ASC 842 requires a lessee to discount its unpaid lease payments using the interest rate implicit in the lease or, if that rate cannot be readily determined, its incremental borrowing rate. As most of the Company leases do not provide an implicit rate, the Company uses its incremental borrowing rate as the discount rate for the lease. The Company incremental borrowing rate is estimated to approximate the interest rate on a collateralized basis with similar terms and payments.

Income taxes

Income taxes are determined in accordance with the provisions of ASC Topic 740, “Income Taxes” (“ASC Topic 740”). Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted income tax rates expected to apply to taxable income in the periods in which those temporary differences are expected to be recovered or settled. Any effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

ASC 740 prescribes a comprehensive model for how companies should recognize, measure, present, and disclose in their financial statements uncertain tax positions taken or expected to be taken on a tax return. Under ASC 740, tax positions must initially be recognized in the financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. Such tax positions must initially and subsequently be measured as the largest amount of tax benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the tax authority assuming full knowledge of the position and relevant facts.

The Company conducts major businesses in China and is subject to tax in this jurisdiction. As a result of its business activities, the Company will file tax returns that are subject to examination by the foreign tax authority.

Going concern

The accompanying financial statements have been prepared using the going concern basis of accounting, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

For the year ended July 31, 2022, the Company has generated revenue of $46,702 and continuously incurred a net loss of $357,333. As of July 31, 2022, the Company suffered an accumulated deficit of $2,389,181, capital deficiency of $533,364 and negative operating cash flow of $4,169. The Company’s ability to continue as a going concern is dependent upon improving the profitability and the continuing financial support from its shareholders and director. Management believes the existing shareholders, director or external financing will provide the additional cash to meet the Company’s obligations as they become due.

These and other factors raise substantial doubt about the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result in the Company not being able to continue as a going concern

| 20 |

Net loss per share

The Company calculates net loss per share in accordance with ASC Topic 260 “Earnings Per Share”. Basic loss per share is computed by dividing the net loss by the weighted average number of common shares outstanding during the period. Diluted loss per share is computed similar to basic loss per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common stock equivalents had been issued and if the additional common shares were dilutive.

Foreign currencies translation

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the Consolidated Statements of Operations and Comprehensive Loss.

The reporting currency of the Company and its subsidiary is United States Dollars (“US$”) and the accompanying financial statements have been expressed in US$.

In general, for consolidation purposes, assets and liabilities of its subsidiary whose functional currency is not US$ are translated into US$, in accordance with ASC Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of foreign subsidiary are recorded as a separate component of accumulated other comprehensive loss within the statements of shareholders’ equity.

Translation of amounts from RMB, TWD and HK$ into US$1 has been made at the following exchange rates for the respective periods:

| As of and for the year ended July 31, | ||||||||

| 2022 | 2021 | |||||||

| Year-end RMB : US$1 exchange rate | 6.744 | 6.461 | ||||||

| Year-average RMB : US$1 exchange rate | 6.476 | 6.578 | ||||||

| Year-end HK$ : US$1 exchange rate | 7.850 | 7.772 | ||||||

| Year-average HK$ : US$1 exchange rate | 7.811 | 7.758 | ||||||

| Year-end TWD : US$1 exchange rate | 30.044 | 27.972 | ||||||

| Year-average TWD : US$1 exchange rate | 28.500 | 28.340 | ||||||

Related parties

Parties, which can be a corporation or individual, are considered to be related if the Company has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operating decisions. Companies are also considered to be related if they are subject to common control or common significant influence.

Fair value of financial instruments:

The carrying value of the Company’s financial instruments: cash and cash equivalents, accounts payable and accrued liabilities, and amount due to a director approximate at their fair values because of the short-term nature of these financial instruments.

The Company also follows the guidance of the ASC Topic 820-10, “Fair Value Measurements and Disclosures” (“ASC 820-10”), with respect to financial assets and liabilities that are measured at fair value. ASC 820-10 establishes a three-tier fair value hierarchy that prioritizes the inputs used in measuring fair value as follows:

| Level 1: Observable inputs such as quoted prices in active markets; | |

| Level 2: Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and |

| Level 3: Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions. |

Recent accounting pronouncements

The Company has reviewed all recently issued, but not yet effective, accounting pronouncements and do not believe the future adoption of any such pronouncements may be expected to cause a material impact on its financial condition or the results of its operations.

In February 2016, the FASB issued ASU 2016-02, “Leases (Topic 842),” to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements. Most prominent among the amendments is the recognition of assets and liabilities by lessees for those leases classified as operating leases under current U.S. GAAP. ASU 2016-02 is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. As required by the standard, the Company will adopt the provisions of the new standard effective November 1, 2019, using the required modified retrospective approach. We believe the adoption will not have a material impact on our financial statements.

Off-Balance Sheet Arrangements

The Company has no off-balance sheet arrangements

| 21 |

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The financial statements required by this item are located in PART IV of this Annual Report.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Disclosures Control and Procedures

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) or 15d-15(f) promulgated under the Exchange Act as a process designed by, or under the supervision of, the company’s principal executive and principal financial officers and effected by the company’s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America and includes those policies and procedures that:

| ● | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the company; | |

| ● | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and | |

| ● | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company’s assets that could have a material effect on the financial statements. |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Because of the inherent limitations of internal control, there is a risk that material misstatements may not be prevented or detected on a timely basis by internal control over financial reporting. However, these inherent limitations are known features of the financial reporting process. Therefore, it is possible to design into the process safeguards to reduce, though not eliminate, this risk.

As of July 31, 2022, the management assessed the effectiveness of our internal control over financial reporting based on the criteria for effective internal control over financial reporting established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) and SEC guidance on conducting such assessments. Based on such evaluation, the management concluded that during the year covered by this Report, internal controls and procedures overall were not effective. This was due to the deficiencies existed in the design or operation of our internal controls over financial reporting that adversely affected our internal controls and that may be considered to be material weaknesses.

| 22 |

Identified Material Weakness

A material weakness in internal control over financial reporting is a control deficiency, or combination of control deficiencies, that results in more than a remote likelihood that a material misstatement of the financial statements will not be prevented or detected.

Management identified the following material weakness during its assessment of internal controls over financial reporting as of July 31, 2022.

We do not have adequate segregation of duties and effective risk assessment – Lack of segregation of duties and effective risk assessment may cause the Company to face the likelihood of fraud or theft, due to poor oversight, governance and review to detect errors.

Accordingly, the Company concluded that these control deficiencies resulted in a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis by the company’s internal controls.

As a result of the material weaknesses described above, the management has concluded that the Company did not maintain effective internal control over financial reporting as of July 31, 2022 based on the criteria established in Internal Control—Integrated Framework issued by COSO.

Management’s Remediation Initiatives

In an effort to remediate the identified material weaknesses and other deficiencies and enhance our internal controls, we have initiated, or plan to initiate, the following series of measures:

| 1. | We plan to create a position to segregate duties consistent with control objectives and will increase our personnel resources and technical accounting expertise within the accounting function. The accounting personnel is responsible for reviewing the financing activities, facilitating the approval of the financing, recording the information regarding the financing, and submitting SEC filing related documents to our legal counsel in order to comply with the filing requirements of SEC. |

| 2. | We intend to add staff members to our management team to make sure that information required to be disclosed in our reports filed and submitted under the Exchange Act is recorded, processed, summarized and reported as and when required and will the staff members will have segregated responsibilities with regard to these responsibilities. |

We anticipate that these initiatives will be at least partially, if not fully, implemented by the end of fiscal year 2022.

Changes in internal controls over financial reporting

There was no change in our internal controls over financial reporting that occurred during the year covered by this Report, which has materially affected, or is reasonably likely to materially affect, our internal controls over financial reporting:

This annual report does not include an attestation report of the Company’s registered independent public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered independent public accounting firm pursuant to rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this Annual Report on Form 10-K.

ITEM 9B. OTHER INFORMATION

None.

| 23 |

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Our executive officer’s and director’s and their respective ages as of the date hereof are as follows:

| NAME | AGE | POSITION | ||

| Niu Yen-Yen | 49 | Chief Executive Officer, President, Secretary, Treasurer, Director | ||

| Hsieh Chang-Chung | 62 | Chief Financial Officer |

Set forth below is a brief description of the background and business experience of our executive officer and director for the past five years.

Niu Yen-Yen - President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer, Director

In 2014, Ms. Niu Yen-Yen received Master of Business Administration program from Aalto University Executive Education, Taiwan. From 1997 to 2006, Ms. Niu Yen-Yen served as the Business Development Director at Serax International Limited in Hong Kong, a multilevel marketing business.

Ms. Niu serves as Chief Executive Officer of Yu Qing International Co., Ltd. in Taiwan since 2006 and continues to hold this position at present. In 2006, when she first started this company, she became an agent to perfume brands such as, Calvin Klein, Clive Christian, Dior, Versace, Chanel, Hermes, Kenzo, Bvlgari, Jimmy Choo etc. In 2010, Ms. Niu has held over 500 sales events all over famous shopping malls and hotels. In 2012, she developed a retail brand called “Idol Beauty”. It provides various beauty care, organic skin care and cosmetic products. In 2013, she set up “Day More” as the first stone spa brand in Taiwan. In the same year, she worked with Horien Biochemical Technology Co., Ltd. to develop and apply patent beauty care products such as Antirincle and Biofresh.

In 2016, Ms. Niu opened a new business called Mu Chuan International Company Limited, a multilevel marketing business. In 2017, Ms. Niu established a cross-border e-commerce business, https://www.magicgo99.com, in order to reach consumers globally.

Ms. Niu Yen-Yen’s experience in corporate management and business development has led the Board of Directors to reach the conclusion that she should serve as President, Chief Executive Officer and Director of the Company.

Hsieh Chang-Chung- Chief Financial Officer

In 1985, Mr. Hsieh Chang-Chung received Master of Business Administration from Chung Yuan Christian University, Taiwan. From 1989 to 1992, Mr. Hsieh worked as the Special Assistant to the Chairman of Fu-I Industrial Group, a listed company in Taipei Stock Exchange. He served as the Co-Founder and Executive Vice President of Quanton Optronics Inc. from November 1992 to December 1993. Mr. Hsieh had also served as the Controller of UTC Co., Ltd from 1994 to 1995. From 1995 to 1998, Mr. Hsieh served as the Chief Staff of the CEO Office in EMI. Ltd., which is a listed company in Taipei Stock Exchange. He also served as the Vice President of Far Eastern VC Investment Co., Ltd from 1997 to 2006.

From 1999 to 2008, Mr. Hsieh served as the Chief Financial Officer and Senior Vice President of Eastern Multimedia Co., Ltd. (which was renamed to Kbro Co., Ltd. in 2006) in Taiwan. He then served as the Vice President and Chief Investment Officer of Head Office in Eastern Media International Group (EMI) from 2008 to 2016. From 2016 to 2019, Mr. Hsieh has served as the Senior Consultant of Eastern Media International Group (EMI) in Taiwan.

Mr. Hsieh Chang-Chung’s corporate and financial experience has led the Board of Directors to reach the conclusion that he should serve as the Chief Financial Officer of the Company.

| 24 |

Corporate Governance

The Company promotes accountability for adherence to honest and ethical conduct; endeavors to provide full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission (the “SEC”) and in other public communications made by the Company; and strives to be compliant with applicable governmental laws, rules and regulations. The Company has not formally adopted a written code of business conduct and ethics that governs the Company’s employees, officers and Directors as the Company is not required to do so.

In lieu of an Audit Committee, the Company’s Board of Directors is responsible for reviewing and making recommendations concerning the selection of external auditors, reviewing the scope, results and effectiveness of the annual audit of the Company’s financial statements and other services provided by the Company’s independent public accountants. The Board of Directors, Chief Executive Officer and Chief Financial Officer of the Company review the Company’s internal accounting controls, practices and policies.

Committees of the Board

Our Company currently does not have nominating, compensation, or audit committees or committees performing similar functions nor does our Company have a written nominating, compensation or audit committee charter. Our Director(s) believes that it is not necessary to have such committees, at this time, because the Director(s) can adequately perform the functions of such committees.

Audit Committee Financial Expert

Our Board of Directors has determined that we do not have a board member that qualifies as an “audit committee financial expert” as defined in Item 407(D)(5) of Regulation S-K, nor do we have a Board member that qualifies as “independent” as the term is used in Item 7(d)(3)(iv)(B) of Schedule 14A under the Securities Exchange Act of 1934, as amended, and as defined by Rule 4200(a)(14) of the FINRA Rules.

We believe that our Director(s) are capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. The Director(s) of our Company does not believe that it is necessary to have an audit committee because management believes that the Board of Directors can adequately perform the functions of an audit committee. In addition, we believe that retaining an independent Director who would qualify as an “audit committee financial expert” would be overly costly and burdensome and is not warranted in our circumstances given the stage of our development and the fact that we have not generated any positive cash flows from operations to date.

Involvement in Certain Legal Proceedings

Our Directors and our Executive officers have not been involved in any of the following events during the past ten years:

| 1. | bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| 25 |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his/her involvement in any type of business, securities or banking activities; or |

| 4. | being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

| 5. | Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated; |

| 6. | Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated; |

| 7. | Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:(i) Any Federal or State securities or commodities law or regulation; or(ii) Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or(iii) Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| 8. | Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Independence of Directors

We are not required to have independent members of our Board of Directors, and do not anticipate having independent Directors until such time as we are required to do so.

Code of Ethics

We have not adopted a formal Code of Ethics. The Board of Directors has evaluated the business of the Company and the number of employees and determined that since the business is operated by a small number of persons, general rules of fiduciary duty and federal and state criminal, business conduct and securities laws are adequate ethical guidelines. In the event our operations, employees and/or Directors expand in the future, we may take actions to adopt a formal Code of Ethics.

Shareholder Proposals

Our Company does not have any defined policy or procedural requirements for shareholders to submit recommendations or nominations for Directors. The Board of Directors believes that, given the stage of our development, a specific nominating policy would be premature and of little assistance until our business operations develop to a more advanced level. Our Company does not currently have any specific or minimum criteria for the election of nominees to the Board of Directors and we do not have any specific process or procedure for evaluating such nominees. The Board of Directors will assess all candidates, whether submitted by management or shareholders, and make recommendations for election or appointment.

A shareholder who wishes to communicate with our Board of Directors may do so by directing a written request addressed to our President, at the address appearing on the first page of this Information Statement.

| 26 |

ITEM 11. EXECUTIVE COMPENSATION

The following table sets forth information concerning the compensation of our Chief Executive Officer, and the executive officers who served at the end of the year July 31, 2022, for services rendered in all capacities to us.

Summary Compensation Table:

| Name and Principal Position | Year | Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||||||||||||

| Niu Yen Yen, Chief Executive Officer, | For the year ended July 31, 2022 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||

| President, Secretary, Treasurer, Director | For the year ended July 31, 2021 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||

| Hsieh Chang- Chung, | For the year ended July 31, 2022 | 32,400 | - | - | - | - | - | - | 32,400 | |||||||||||||||||||||||||

| Chief Financial Officer | For the year ended July 31, 2021 | 32,600 | - | - | - | - | - | - | 32,600 | |||||||||||||||||||||||||

Narrative Disclosure to Summary Compensation Table

There are no arrangements or plans in which we provide pension, retirement or similar benefits for directors or executive officers. Our directors and executive officers may receive stock options at the discretion of our board of directors in the future. We do not have any material bonus or profit sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options may be granted at the discretion of our board of directors from time to time. We have no plans or arrangements in respect of remuneration received or that may be received by our executive officers to compensate such officers in the event of termination of employment (as a result of resignation, retirement, change of control) or a change of responsibilities following a change of control.

Stock Option Grants

We have not granted any stock options to our executive officers since our incorporation.

Employment Agreements

We have entered into an employment agreement with the Mr. Hsieh Chang-Chung, our Chief Financial Officer on June 5, 2018. The agreement will be effective for 5 years and will expire in 2023. Based on the employment contract, Mr. Hsieh will be in charge of the financial control, capital financing, and merger and acquisition of the Company.

| 27 |

Compensation Discussion and Analysis

Director Compensation

Our Board of Directors does not currently receive any consideration for their services as members of the Board of Directors. The Board of Directors reserves the right in the future to award the members of the Board of Directors cash or stock-based consideration for their services to the Company, which awards, if granted shall be in the sole determination of the Board of Directors.

Executive Compensation Philosophy

Our Board of Directors determines the compensation given to our executive officers in their sole determination. Our Board of Directors reserves the right to pay our executives or any future executives a salary, and/or issue them shares of common stock in consideration for services rendered and/or to award incentive bonuses which are linked to our performance, as well as to the individual executive officer’s performance. This package may also include long-term stock-based compensation to certain executives, which is intended to align the performance of our executives with our long-term business strategies. Additionally, while our Board of Directors has not granted any performance base stock options to date, the Board of Directors reserves the right to grant such options in the future, if the Board in its sole determination believes such grants would be in the best interests of the Company.

Incentive Bonus

The Board of Directors may grant incentive bonuses to our executive officer and/or future executive officers in its sole discretion, if the Board of Directors believes such bonuses are in the Company’s best interest, after analyzing our current business objectives and growth, if any, and the amount of revenue we are able to generate each month, which revenue is a direct result of the actions and ability of such executives.

Long-term, Stock Based Compensation

In order to attract, retain and motivate executive talent necessary to support the Company’s long-term business strategy we may award our executive and any future executives with long-term, stock-based compensation in the future, at the sole discretion of our Board of Directors, which we do not currently have any immediate plans to award.

| 28 |

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

As of July 31, 2022, the Company has 59,434,838 shares of common stock issued and outstanding, which number of issued and outstanding shares of common stock have been used throughout this report.