As filed with the Securities and Exchange Commission on July 2, 2018.

Registration No. 333-[_______]

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GraniteShares

Gold MiniBAR Trust

(Exact name of registrant as specified in its charter)

| New York | ||

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

c/o

GraniteShares LLC

205 Hudson Street, 7th Floor

New York, New York 10013

646-876-5096

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

GraniteShares

LLC

205 Hudson Street, 7th Floor

New York, New York 10013

646-876-5096

(Name, address, including zip code and telephone number, including

area code, of agent for service)

Copies

to:

W. Thomas Conner, Esq.

Vedder Price P.C.

1633 Broadway, 31st Floor

New York, NY 10019

(212) 407-7715

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [X] |

| Emerging growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [X]

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Unit(1) | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(1) | ||||||||||||

| GraniteShares Gold MiniBAR Shares | 1,000 | $ | 12.546 | $ | 12,546.00 | $ | 1.56 | |||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(d) under the Securities Act of 1933, as amended. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated July 2, 2018

PROSPECTUS

[ ] Shares

GraniteShares Gold MiniBAR Trust*

| * | Principal U.S. Listing Exchange: NYSE Arca |

GraniteShares Gold MiniBAR Trust (the “Trust”) will issue GraniteShares Gold MiniBAR Shares (“Shares”) which represent units of fractional undivided beneficial interest in the net assets of the Trust. The Trust will seek to reflect generally the performance of the price of gold. The Trust will seek to reflect such performance before payment of the Trust’s expenses and liabilities. GraniteShares LLC (the “Sponsor”) is the sponsor of the Trust; The Bank of New York Mellon (the “Trustee”) is the trustee of the Trust; and ICBC Standard Bank Plc (the “Custodian”) is the custodian of the Trust. The Trust intends to issue additional Shares on a continuous basis.

The Shares may be purchased from the Trust only in one or more blocks of 50,000 Shares (a block of 50,000 Shares is called a “Basket”). The Trust will issue Shares in Baskets to certain authorized participants (“Authorized Participants”) on an ongoing basis, as described in “Plan of Distribution.” Baskets will be offered continuously at the net asset value for 50,000 Shares on the day that an order to create a Basket is accepted by the Trustee. The net asset value per Share (“NAV”) is calculated by taking the current price of the Trust’s total assets (determined with respect to gold on the LBMA Gold Price PM), subtracting any liabilities, and dividing by the total number of Shares outstanding. The offering of the Trust’s Shares is a “best efforts” offering, which means that the Authorized Participants are not required to purchase a specific number or dollar amount of Shares. Authorized Participants will not receive from the Sponsor, the Trust or any affiliates any fee or other compensation in connection with the offering of the Shares.

Prior to this offering, there has been no public market for the Shares. The Shares will trade on the NYSE Arca (the “Exchange”) under the symbol “MBAR” after they are initially purchased by Authorized Participants. It is expected that the Shares will be sold to the public at varying prices to be determined by reference to, among other considerations, the price of gold and the trading price of the Shares on the Exchange at the time of each sale. The market price of the Shares may be different from the NAV and may trade at a discount or premium. Investors who decide to buy or sell Shares of the Trust will place their trade orders through their brokers and may incur customary brokerage commissions and charges.

Except when aggregated in Baskets, the Shares are not redeemable securities. Baskets are only redeemable by Authorized Participants.

Investing in the Shares involves significant risks. See “Risk Factors” beginning on page 10.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of the securities offered in this prospectus, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Trust is an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act (the “JOBS Act”) and, as such, may elect to comply with certain reduced reporting requirements.

The Shares are neither interests in nor obligations of the Sponsor or the Trustee. The Trust is not an investment company registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”). The Trust is not a commodity pool for purposes of the Commodity Exchange Act of 1936, as amended (the “Commodity Exchange Act”). [See p. 59]

The initial Basket of Shares were purchased by an Authorized Purchaser, [ ], as described in the Plan of Distribution.

| Per Share(1) | Per Basket | ||

| Public offering price for the initial Baskets(2) | [$ ] | [$ ] |

| (1) | The initial Baskets were created at a per share price equal to the value of 1/100th of a Fine Ounce of gold on the date of formation of the Trust. |

| (2) | The initial Authorized Purchaser may receive commissions/fees from investors who purchase shares from the initial Baskets through their commission/fee-based brokerage accounts. The price per Basket that will be paid in the future by the Authorized Participants may be different than the initial Basket price. |

The date of this prospectus is [ ].

Table of Contents

| -i- |

Statement Regarding Forward-Looking Statements

This prospectus includes statements which relate to future events or future performance. In some cases, you can identify such forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this prospectus that address activities, events or developments that may occur in the future, including such matters as changes in commodity prices and market conditions (for gold and the Shares), the Trust’s operations, the Sponsor’s plans and references to the Trust’s future success and other similar matters are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses made by the Sponsor on the basis of its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate in the circumstances. Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions, however, is subject to a number of risks and uncertainties, including the special considerations discussed in this prospectus, general economic, market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or regulatory bodies, and other world economic and political developments. See “Risk Factors.” Consequently, all the forward-looking statements made in this prospectus are qualified by these cautionary statements, and there can be no assurance that the actual results or developments the Sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, the Trust’s operations or the value of the Shares. Moreover, neither the Sponsor, nor any other person assumes responsibility for the accuracy or completeness of the forward-looking statements. Neither the Trust nor the Sponsor undertakes an obligation to publicly update or conform to actual results any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

| 1 |

The following is a summary of this prospectus, and while it contains material information about the Trust and the Shares, it does not contain or summarize all of the information about the Trust and the Shares contained in this prospectus that is material and that may be important to you. You should read this entire prospectus, including “Risk Factors” beginning on page 10 before making an investment decision about the Shares. Capitalized terms not defined in this section have the meaning set forth in the Glossary.

Trust Structure, the Sponsor, the Trustee and the Custodian

The Trust was formed in 2018 when an initial deposit of gold was made in exchange for the issuance of [ ] Baskets. The purpose of the Trust is to own gold transferred to the Trust in exchange for Shares issued by the Trust. Each Share represents a fractional undivided beneficial interest in the net assets of the Trust. The assets of the Trust consist primarily of gold held by the Custodian on behalf of the Trust. However, there may be situations where the Trust will unexpectedly hold cash. For example, a claim may arise against a third party, which is settled in cash. In situations where the Trust unexpectedly receives cash or other assets, no new Shares will be issued until after the record date for the distribution of such cash or other property has passed.

The Sponsor of the Trust is GraniteShares LLC, a Delaware limited liability company. The Shares are not obligations of, and are not guaranteed by the Sponsor, or any of its subsidiaries or affiliates.

The Trust is governed by the provisions of the Depositary Trust Agreement (as amended from time to time, the “Trust Agreement”) executed on [XXX, XX, 2018] by the Sponsor and the Trustee.

The Trust issues Shares only in blocks of [50,000] or integral multiples thereof. Baskets of Shares may be redeemed by the Trust in exchange for the amount of gold corresponding to their redemption value. Individual Shares are not redeemed by the Trust, but are listed and trade on the Exchange under the symbol “MBAR.” The Trust seeks to reflect generally the performance of the price of gold. The Trust seeks to reflect such performance before payment of the Trust’s expenses and liabilities. The material terms of the Trust are discussed in greater detail under the section “Description of the Shares and the Trust Agreement.” The Trust is not a registered investment company under the Investment Company Act and is not required to register under such act. The Trust is not a commodity pool for purposes of the Commodity Exchange Act.

The Sponsor will arrange for the creation of the Trust, the ongoing registration of the Shares for their public offering in the United States and the listing of the Shares on the Exchange. The Sponsor will not exercise day-to-day oversight over the Trustee or the Custodian. The Sponsor will (1) develop a marketing plan for the Trust on an ongoing basis, (2) prepare marketing materials regarding the Shares of the Trust, and (3) execute the marketing plan of the Trust. The Sponsor has agreed to assume the following expenses incurred by the Trust: the Trustee’s fee (the “Trustee’s Fee”) and its ordinary out-of-pocket expenses, the Custodian’s fee (the “Custodian’s Fee”) and its reimbursable expenses, the Exchange listing fees, SEC registration fees, marketing expenses, printing and mailing costs, audit fees and expenses and up to $100,000 per annum in legal fees and expenses.

The Trustee is The Bank of New York Mellon and the Custodian is ICBC Standard Bank Plc. The agreements between the Trustee and the Custodian for the custody of the Trust’s gold are governed by English law.

| 2 |

The Trustee is responsible for the day-to-day administration of the Trust. The responsibilities of the Trustee include (1) processing orders for the creation and redemption of Baskets; (2) coordinating with the Custodian the receipt and delivery of gold transferred to, or by, the Trust in connection with each issuance and redemption of Baskets; (3) calculating the net asset value of the Trust on each business day; and (4) selling the Trust’s gold as needed to cover the Trust’s expenses. For a more detailed description of the role and responsibilities of the Trustee see “Description of the Shares and the Trust Agreement” and “The Trustee.”

The Custodian is responsible for safekeeping the gold owned by the Trust. The Custodian was selected by the Sponsor and, at the direction of the Sponsor, appointed by the Trustee, and is responsible to the Trustee under the Trust’s gold custody agreements. The general role and responsibilities of the Custodian are further described in “The Custodian.”

Trust Objective

The objective of the Trust is for the value of the Shares to reflect, at any given time, the value of the assets owned by the Trust at that time less the Trust’s accrued expenses and liabilities as of that time. The Shares are intended to constitute a simple and cost-effective means of making an investment similar to an investment in gold. An investment in allocated physical gold bullion requires expensive and sometimes complicated arrangements in connection with the assay, transportation and warehousing of the metal. Traditionally, such expense and complications have resulted in investments in physical gold bullion being efficient only in amounts beyond the reach of many investors. The Shares have been designed to remove the obstacles represented by the expense and complications involved in an investment in physical gold bullion, while at the same time having an intrinsic value that reflects, at any given time, the price of the assets owned by the Trust at such time less the Trust expenses and liabilities. Although the Shares are not the exact equivalent of an investment in gold, they provide investors with an alternative that allows a level of participation in the gold market through the securities market.

Advantages of investing in the Shares include:

| ● | Minimal credit risk. |

The Shares represent an interest in physical gold owned by the Trust (other than up to a maximum of 430 ounces of gold held in unallocated form) and held in physical custody at the Custodian. Physical gold of the Trust in the Custodian’s possession is not subject to borrowing arrangements with third parties. Other than the gold temporarily being held in an unallocated gold account of the Trust in connection with deposits and an amount of gold comprising less than 430 ounces which may be held in the unallocated gold account of the Trust on an ongoing basis, the physical gold of the Trust is not subject to counterparty or credit risks. This contrasts with most other financial products that gain exposure to precious metals through the use of derivatives that are subject to counterparty and credit risks.

| ● | Backed by gold held by the Custodian on behalf of the Trust. |

The Shares are backed primarily by allocated physical gold bullion identified as the Trust’s property in the Custodian’s books. The Trust arrangements contemplate that no Shares can be issued unless the corresponding amount of gold has been deposited into the Trust. Once deposited into the Trust, gold is only removed from the Trust if (i) sold to pay Trust expenses (such as the Sponsor’s Fee and any other expenses not assumed by the Sponsor) or liabilities to which the Trust may be subject, or (ii) transferred from the Trust’s account to an Authorized Participant’s account in exchange for one or more Baskets of Shares surrendered for redemption.

| 3 |

| ● | Ease and flexibility of investment. |

Retail investors may purchase and sell Shares through traditional brokerage accounts. Because the amount of gold corresponding to a Share is significantly less than the minimum amounts of physical gold bullion that are commercially available for investment purposes, the cash outlay necessary for an investment in Shares should be less than the amount required for currently existing means of investing in physical gold bullion. Shares are eligible for margin accounts.

| ● | Relatively cost efficient. |

Although the return, if any, of an investment in the Shares is subject to the additional expenses of the Trust, including the Sponsor’s Fee and other costs and expenses not assumed by the Sponsor which would not be incurred in the case of a direct investment in gold, the Shares may represent a cost-efficient alternative for investors not otherwise in a position to participate directly in the market for allocated physical gold bullion, because the expenses involved in an investment in allocated physical gold bullion through the Shares are dispersed among all holders of Shares.

Emerging Growth Company Status

The Trust is an “emerging growth company,” as defined in the JOBS Act. For as long as the Trust is an “emerging growth company,” the Trust may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes–Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in the Trust’s periodic reports, and exemptions from the requirements of holding advisory “say-on-pay” votes on executive compensation and shareholder advisory votes on golden parachute compensation.

Under the JOBS Act, the Trust will remain an “emerging growth company” until the earliest of:

| ● | The last day of the fiscal year during which the Trust has total annual gross revenues of $1 billion; | |

| ● | The last day of the fiscal year following the fifth anniversary of the completion of this offering; | |

| ● | The date on which the Trust has, during the previous three-year period, issued more than $1 billion in non-convertible debt; and | |

| ● | The date on which the Trust is deemed to be a “large accelerated filer” (i.e., an issuer that (1) has more than $700 million in outstanding equity held by non-affiliates and (2) has been subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) for at least 12 calendar months and has filed at least one annual report on Form 10-K. |

The JOBS Act also provides that an “emerging growth company” can utilize the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards. The Trust is choosing to opt out of this extended transition period and, as a result, the Trust will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for companies that are not “emerging growth companies.” Section 107 of the JOBS Act provides that the Trust’s decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Principal Offices

The Sponsor’s office is located at 205 Hudson Street, 7th Floor, New York, New York 10013. The Trustee has a Trust office at 2 Hanson Place, 9th Floor, Brooklyn, New York 11217. The Custodian’s office is located at 20 Gresham Street, London, EC2V 7JE, United Kingdom.

| 4 |

| Offering | The Shares represent units of fractional undivided beneficial interest in the net assets of the Trust. |

| Use of proceeds | Proceeds received by the Trust from the issuance and sale of Baskets, including the [..] Baskets issued to the initial Authorized Participant, which is [ ], in connection with the formation of the Trust, and the Shares (as described on the front page of this prospectus) will consist of gold deposits and, possibly from time to time, cash. Pursuant to the Trust Agreement, during the life of the Trust such proceeds will only be (1) held by the Trust, (2) distributed to Authorized Participants in connection with the redemption of Baskets, or (3) disbursed or sold as needed to pay the Trust’s ongoing expenses. |

| Exchange symbol | MBAR |

| CUSIP | [ ] |

| Creation and redemption | The Trust expects to issue and redeem Baskets of Shares on a continuous basis. Baskets of Shares will only be issued or redeemed in exchange for an amount of gold determined by the Trustee on each day that the Exchange is open for regular trading. No Shares will be issued unless the Custodian has allocated to the Trust’s account the corresponding amount of gold. Initially, a Basket will require delivery of [500] Fine Ounces of gold. The amount of gold necessary for the creation of a Basket, or to be received upon redemption of a Basket, will decrease over the life of the Trust, due to the payment or accrual of fees and other expenses or liabilities payable by the Trust. Baskets may be created or redeemed only by Authorized Participants, who will pay the Trustee a transaction fee for each order to create or redeem Baskets. See “Description of the Shares and the Trust Agreement” for more details. |

| Net Asset Value | The net asset value of the Trust will be obtained by subtracting the Trust’s expenses and liabilities on any day from the value of the gold owned by the Trust on that day; the NAV per Share will be obtained by dividing the net asset value of the Trust on a given day by the number of Shares outstanding on that day. On each day on which the Exchange is open for regular trading, the Trustee will determine the net asset value of the Trust and the NAV per Share as promptly as practicable after 4:00 p.m. (New York time). The Trustee will value the Trust’s gold on the basis of LBMA Gold Price PM. If there is no LBMA Gold Price PM on any day, the Trustee is authorized to use the LBMA Gold Price AM announced on that day. If neither price is available for that day, the Trustee will value the Trust’s gold based on the most recently announced LBMA Gold Price PM or LBMA Gold Price AM. If the Sponsor determines that such price is inappropriate to use, the Sponsor will identify an alternate basis for evaluation to be employed by the Trustee. Further, the Sponsor may instruct the Trustee to use on an on-going basis a different publicly available price which the Sponsor determines to fairly represent the commercial value of the Trust’s gold. See “The Trust—Valuation of Gold; Computation of Net Asset Value.” |

| 5 |

| Trust Expenses | The Trust’s only ordinary recurring expense is expected to be the remuneration due to the Sponsor (the “Sponsor’s Fee”). In exchange for the Sponsor’s Fee, the Sponsor has agreed to assume the following expenses of the Trust: the Trustee’s Fee and its ordinary out-of-pocket expenses, the Custodian’s Fee and its reimbursable expenses, the Exchange listing fees, SEC registration fees, marketing expenses, printing and mailing costs, audit fees and expenses and up to $100,000 per annum in legal fees and expenses. The Sponsor’s Fee is accrued daily at an annualized rate equal to [ ]% of the net asset value of the Trust and is payable monthly in arrears. The Sponsor may, at its discretion and from time to time, waive all or a portion of the Sponsor’s Fee for stated periods of time. The Sponsor is under no obligation to waive any portion of its fees and any such waiver shall create no obligation to waive any such fees during any period not covered by the waiver. Presently, the Sponsor does not intend to waive any part of its fee. The Trustee from time to time may sell gold in such quantities as may be necessary to permit the payment of the Sponsor’s Fee and other Trust expenses and liabilities not assumed by the Sponsor. The Trustee will endeavor to sell gold at such times and in the smallest amounts required to permit such payments as they become due, it being the intention to avoid or minimize the Trust’s holdings of assets other than gold. Accordingly, the amount of gold to be sold may vary from time to time depending on the level of the Trust’s expenses and liabilities and the market price of gold. See “The Trust—Trust Expenses” and “Description of the Shares and the Trust Agreement—Trust Expenses and Gold Sales.” |

| Federal Income Tax Considerations | Owners of Shares are treated, for U.S. federal income tax purposes, as if they owned a corresponding share of the assets of the Trust. They are also viewed as if they directly received a corresponding share of any income of the Trust, or as if they had incurred a corresponding share of the expenses of the Trust. Consequently, each sale of gold by the Trust constitutes a taxable event to owners of beneficial interests in the Shares (“Shareholders”). See “United States Federal Income Tax Consequences—Taxation of U.S. Shareholders” and “ERISA and Related Considerations.” |

| 6 |

| Voting Rights | Owners of Shares have the right to vote in limited circumstances, i.e., causing the Trustee to cure a material breach by the Trustee under the Trust Agreement, or requiring the Trustee to terminate the Trust Agreement. See “Description of the Shares and the Trust Agreement—Voting Rights.” |

| Suspension of Issuance, | |

| Transfers and Redemptions | The Trustee may, and upon direction of the Sponsor will, generally suspend the delivery of Shares against deposits of gold or the registration of transfer of Shares or refuse a particular delivery or transfer (i) during any period when the Trustee’s transfer books are closed, (ii) if the Custodian has informed the Trustee and the Sponsor that it is unable to allocate gold to the Trust Allocated Account or (iii) if any such action is otherwise deemed necessary or advisable by the Sponsor for any reason in its sole discretion. Redemptions may be suspended only (i) during any period in which regular trading on the Exchange is suspended or restricted, or the Exchange is closed, or (ii) during an emergency as a result of which delivery, disposal or evaluation of gold is not reasonably practicable. See “Description of the Shares and the Trust Agreement—Redemption of Baskets.” |

| Limitation on Liability | The Sponsor and the Trustee: |

| ● | are only obligated to take the actions specifically set forth in the Trust Agreement without gross negligence, willful misconduct or bad faith; | |

| ● | are not liable for the exercise of discretion permitted under the Trust Agreement; and | |

| ● | have no obligation to prosecute any lawsuit or other proceeding on behalf of the Shareholders or any other person. |

| See “Description of the Shares and the Trust Agreement—The Sponsor (Liability of the Sponsor and indemnification)” and “The Trustee (Limitation on Trustee’s liability).” |

| 7 |

| Termination events | The Trustee will terminate the Trust Agreement if: |

| ● | the Trustee is notified that the Shares are delisted from the Exchange and are not approved for listing on another national securities exchange within five business days of their delisting; | |

| ● | Shareholders acting in respect of at least 75% of the outstanding Shares notify the Trustee that they elect to terminate the Trust; | |

| ● | 60 days have elapsed since the Trustee notified the Sponsor of the Trustee’s election to resign or since the Sponsor removed the Trustee, and a successor trustee has not been appointed and accepted its appointment; | |

| ● | any sole Custodian then acting resigns or is removed and no successor custodian has been employed within 60 days of such resignation or removal; | |

| ● | the SEC determines that the Trust is an investment company under the Investment Company Act, and the Trustee has actual knowledge of that determination; | |

| ● | the U.S. Commodity Futures Trading Commission (the “CFTC”) determines that (i) the Trust is a commodity pool under the Commodity Exchange Act; and/or (ii) the Shares constitute “commodity interests”, as defined by the CFTC in CFTC Regulation 1.3(yy) and the Trustee has actual knowledge of that determination; | |

| ● | the aggregate market capitalization of the Trust, based on the closing price for the Shares, is less than $50 million (as adjusted for inflation by reference to the U.S. Consumer Price Index) at any time more than 18 months after the Trust’s formation, and the Trust receives, within 6 months after the last trading date on which such capitalization was less than $50 million, notice from the Sponsor of its decision to terminate the Trust; | |

| ● | the Trust fails to qualify for treatment, or ceases to be treated, as a grantor trust under the United States Internal Revenue Code of 1986, as amended (the “Code”), or under any comparable provision of any other jurisdiction where such treatment is sought, and the Trustee receives notice that the Sponsor has determined that the termination of the Trust is advisable; or | |

| ● | 60 days have elapsed since DTC ceases to act as depository with respect to the Shares and the Sponsor has not identified another depository which is willing to act in such capacity. |

| 8 |

| If the Sponsor resigns without appointing a successor sponsor, or is dissolved or has ceased to exist as a legal entity for any reason or is deemed to have resigned because (1) it fails to undertake or perform, or becomes incapable of undertaking or performing, any of the duties required by the Trust Agreement, and such failure or incapacity is not cured, or (2) the Sponsor is adjudged bankrupt or insolvent, or a receiver of the Sponsor or of its property is appointed, or a trustee or liquidator or any public officer takes charge or control of the Sponsor or of its property or affairs for the purpose of rehabilitation, conservation or liquidation, then the Trustee may, among other actions, terminate and liquidate the Trust. | |

| See “Description of the Shares and the Trust Agreement—Amendment and Termination.” After termination of the Trust, the Trustee will deliver Trust property to Authorized Participants upon surrender and cancellation of Shares and, at least 60 days after termination, may sell any remaining Trust property in a private or public sale, and hold the proceeds, uninvested and in a non-interest bearing account, for the benefit of the holders who have not surrendered their Shares for cancellation. See “Description of the Shares and the Trust Agreement—Amendment and Termination.” | |

| Authorized Participants | Baskets may be created or redeemed only by Authorized Participants. Each Authorized Participant must be a registered broker-dealer or other securities market participant, a participant in DTC, have entered into an agreement with the Trustee and the Sponsor (the “Authorized Participant Agreement”) and have established a gold unallocated account with the Custodian or another LBMA-approved gold-clearing bank. The Authorized Participant Agreement provides the procedures for the creation and redemption of Baskets and for the delivery of gold in connection with such creations or redemptions. A list of the current Authorized Participants can be obtained from the Trustee or the Sponsor. |

| Clearance and settlement | The Shares are issued in book-entry form only. Transactions in Shares clear through the facilities of DTC. Investors may hold their Shares through DTC, if they are participants in DTC, or indirectly through entities that are participants in DTC. |

As of the date of the formation of the Trust and the date the initial Authorized Participant deposited [ ] Fine Ounces of gold into the Trust, the net asset value of the Trust, which represents the value of the gold deposited into the Trust in exchange for the initial Baskets, was [$ ] and the NAV per Share was [$ ].

| 9 |

Before making an investment decision, you should consider carefully the risks described below, as well as the other information included in this prospectus.

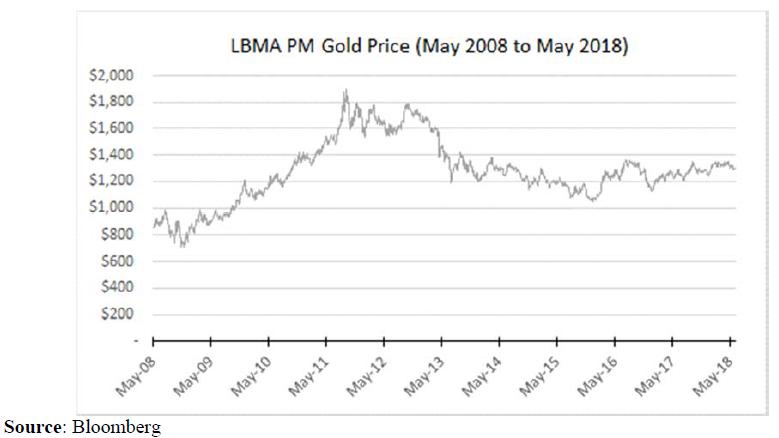

Because the Shares are created to reflect the price of the gold held by the Trust, the market price of the Shares will be as unpredictable as the price of gold has historically been. This creates the potential for losses, regardless of whether you hold Shares for the short-, mid- or long-term.

Shares are created to reflect, at any given time, the market price of gold owned by the Trust at that time less the Trust’s expenses and liabilities. Because the value of Shares depends on the price of gold, it is subject to fluctuations similar to those affecting gold prices. The price of gold has fluctuated widely over the past several years. If gold markets continue to be characterized by the wide fluctuations that they have shown in the past several years, the price of the Shares will change widely and in an unpredictable manner. This exposes your investment in Shares to potential losses if you need to sell your Shares at a time when the price of gold is lower than it was when you made your investment in Shares. Even if you are able to hold Shares for the mid- or long-term you may never realize a profit, because gold markets have historically experienced extended periods of flat or declining prices.

Following an investment in Shares, several factors may have the effect of causing a decline in the prices of gold and a corresponding decline in the price of Shares. Among them:

| ● | Large sales, including those by the official sector (government, central banks and related institutions), which own a significant portion of the aggregate world holdings. If one or more of these institutions decides to sell in amounts large enough to cause a decline in world gold prices, the price of the Shares will be adversely affected. | |

| ● | A significant increase in gold hedging activity by gold producers. Should there be an increase in the level of hedge activity of gold producing companies, it could cause a decline in world gold prices, adversely affecting the price of the Shares. | |

| ● | A significant change in the attitude of speculators and investors towards gold. Should the speculative community take a negative view towards gold, it could cause a decline in world gold prices, negatively impacting the price of the Shares. Attitudes towards gold could be influenced by: |

| ● | Investors’ expectations regarding future inflation rates; | |

| ● | Currency exchange rate volatility; | |

| ● | Interest rate volatility; and | |

| ● | Unexpected political, economic, global or regional incidents. |

Conversely, several factors may trigger a temporary increase in the price of gold prior to your investment in the Shares. If that is the case, you will be buying Shares at prices affected by the temporarily high prices of gold, and you may incur losses when the causes for the temporary increase disappear.

As the Sponsor has a limited history of operating an investment vehicle like the Trust, its experience may be inadequate or unsuitable to manage the Trust.

The Sponsor has a limited history of past performance in operating an investment vehicle like the Trust. The past performances of the Sponsor’s management in other positions are no indication of their ability to manage an investment vehicle such as the Trust. If the experience of the Sponsor and its management is not adequate or suitable to manage an investment vehicle such as the Trust, the operations of the Trust may be adversely affected.

| 10 |

Actual or perceived disruptions in the processes used to determine the new LBMA Gold Price PM, or lack of confidence in that benchmark, may adversely affect the return on your investment in the Shares (if any).

The London PM Fix was the benchmark price for valuation of gold prior to March 20, 2015, at which time the London PM Fix was discontinued and replaced by the LBMA Gold Price PM. The LBMA Gold Price AM and LBMA Gold Price PM are gold price benchmark mechanisms administered by ICE Benchmark Administration (“IBA”), an independent specialist benchmark administrator appointed by the LBMA. Twice daily during London business hours IBA hosts an electronic, physically settled, and tradable auction, during which buyers and sellers trade physical spot gold at a pre-determined price and the price of the final auction is published to the market as the LBMA Gold Price AM and LBMA Gold Price PM for that day. IBA hosts each auction in rounds of 45 seconds (which may be adjusted by IBA by notice). The prices for each round of any auction are set by an independent chairperson appointed by IBA, who sets the prices in their sole discretion in line with the market conditions and the activity in the auction. An auction will conclude following a round in which the difference between the entered buying and selling interest (referred to as imbalance) does not exceed a certain volume of gold identified by IBA (initially set at 20,000 troy ounces), and the price for that round will be published as the LBMA Gold Price AM (for the auction taking place at 10:00 a.m. (London time)) or the LBMA Gold Price PM (for the auction taking place at 3:00 p.m. (London time)) for that day. IBA has indicated that the chairperson responsible for setting the prices for the auctions will have the requisite credentials and experience and will be independent from any direct participant or sponsored client. However, because the identity of the chairperson will not be disclosed to the market, it will not be possible to independently assess the adequacy of the chairperson’s qualifications or to assure the chairperson’s independence from any third party or market participant. In addition, because the chairperson has unlimited discretion in setting the auction prices and does not rely on any automated algorithm for the price setting, there can be no assurance that the LBMA Gold Price AM or LBMA Gold Price PM will accurately reflect the fundamentals of the gold market. See “The Trust – Valuation of Gold; Computation of Net Asset Value” for a description of how the LBMA Gold Price PM is determined.

Furthermore, while the features of the mechanism to determine the LBMA Gold Price AM and LBMA Gold Price PM may be improvements over the London AM Fix and London PM Fix, investors should keep in mind that electronic markets are not exempt from failures.

As with any innovation, it is possible that electronic failures or other unanticipated events may occur that could result in delays in the announcement of, or the inability of the system to produce, a LBMA Gold Price AM or LBMA Gold Price PM on any given day. In addition, if a perception were to develop that the LBMA Gold Price AM or LBMA Gold Price PM is vulnerable to manipulation attempts, or if the new administration proceedings surrounding the determination of the LBMA Gold Price AM or LBMA Gold Price PM are not received with confidence by the markets, the behavior of investors and traders in gold may change, and those changes may have an effect on the price of gold (and, consequently, the value of the Shares). In any of these circumstances, the intervention of extraneous events disruptive of the normal interaction of supply and demand of gold at any given time may result in distorted prices and losses on an investment in the Shares that, but for such extraneous events, might not have occurred.

| 11 |

Other effects of disruptions in the determination of the LBMA Gold Price AM or LBMA Gold Price PM or any inaccuracies in setting of the auction prices on the operations of the Trust include the potential for an incorrect valuation of the Trust’s gold, an inaccurate computation of the Sponsor’s Fee, and the sales of gold to cover Trust expenses at prices that do not accurately reflect the fundamentals of the gold market. Each of these events could have an adverse effect on the value of the Shares.

Effective April 1, 2015, the LBMA Gold Price AM and LBMA Gold Price PM became regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”).

As of the date of this prospectus, the Sponsor has no reason to believe that the LBMA Gold Price (AM or PM) will not fairly represent the price of the gold held by the Trust. Should this situation change, the Sponsor expects to use the powers granted by the Trust’s governing documents to seek to replace the LBMA Gold Price PM with a more reliable indicator of the value of the Trust’s gold. There is no assurance that such alternative value indicator will be identified, or that the process of changing from the LBMA Gold Price PM to a new benchmark price will not adversely affect the price of the Shares.

The amount of gold represented by each Share will decrease over the life of the Trust due to the sales of gold necessary to pay the Sponsor’s Fee and Trust expenses. Without increases in the price of gold sufficient to compensate for that decrease, the price of the Shares will also decline and you will lose money on your investment in Shares.

Although the Sponsor has agreed to assume all organizational and certain ordinary expenses incurred by the Trust, not all Trust expenses have been assumed by the Sponsor. For example, any taxes and other governmental charges that may be imposed on the Trust’s property will not be paid by the Sponsor. As part of its agreement to assume some of the Trust’s ordinary administrative expenses, the Sponsor has agreed to pay legal fees and expenses of the Trust not in excess of $100,000 per annum. Any legal fees and expenses in excess of that amount will be the responsibility of the Trust.

Because the Trust does not have any income, it needs to sell gold to cover expenses not assumed by the Sponsor. The Trust may also be subject to other liabilities (for example, as a result of litigation) which have also not been assumed by the Sponsor. The only source of funds to cover those liabilities will be sales of gold held by the Trust. Even if there are no expenses other than those assumed by the Sponsor, and there are no other liabilities of the Trust, the Trustee will still need to sell gold to pay the Sponsor’s Fee. The result of these sales is a decrease in the amount of gold represented by each Share. New deposits of gold, received in exchange for new Shares issued by the Trust, do not reverse this trend.

A decrease in the amount of gold represented by each Share results in a decrease in its price assuming the price of gold does not change. To retain the Share’s original price, the price of gold has to increase. Without that increase, the lesser amount of gold represented by the Share will have a correspondingly lower price. If these increases do not occur, or are not sufficient to counter the lesser amount of gold represented by each Share, you will sustain losses on your investment in Shares.

An increase in the Trust expenses not assumed by the Sponsor, or the existence of unexpected liabilities affecting the Trust, will force the Trustee to sell larger amounts of gold, and will result in a more rapid decrease of the amount of gold represented by each Share and a corresponding decrease in its value.

Future governmental decisions may have significant impact on the price of gold, which may result in a significant decrease or increase in the value of the net assets and the net asset value of the Trust.

Generally, gold prices reflect the supply and demand of available gold. Governmental decisions, such as the executive order issued by the President of the United States in 1933 requiring all persons in the United States to deliver gold to the Federal Reserve or the abandonment of the gold standard by the United States in 1971, have been viewed as having significant impact on the supply and demand of gold and the price of gold. Future governmental decisions may have an impact on the price of gold, and may result in a significant decrease or increase in the value of the net assets and the net asset value of the Trust. Further regulations applicable to U.S. banks and non-U.S. bank entities operating in the U.S. with respect to their trading in physical commodities, such as precious metals, may further impact the price of gold in the U.S.

| 12 |

The Trust is a passive investment vehicle. This means that the value of your Shares may be adversely affected by Trust losses that, if the Trust had been actively managed, it might have been possible to avoid.

The Trustee does not actively manage the gold held by the Trust. This means that the Trustee does not sell gold at times when its price is high, or acquire gold at low prices in the expectation of future price increases. It also means that the Trustee does not make use of any of the hedging techniques available to professional gold investors to attempt to reduce the risks of losses resulting from price decreases. Any losses sustained by the Trust will adversely affect the value of your Shares.

The price received upon the sale of Shares may be less than the value of the gold represented by them.

The result obtained by subtracting the Trust’s expenses and liabilities on any day from the price of the gold owned by the Trust on that day is the net asset value of the Trust which, when divided by the number of Shares outstanding on that day, results in the NAV per Share.

Shares may trade at, above or below their NAV. The NAV will fluctuate with changes in the market value of the Trust’s assets. The trading prices of Shares will fluctuate in accordance with changes in their NAVs as well as market supply and demand. The amount of the discount or premium in the trading price relative to the NAV may be influenced by non-concurrent trading hours between the major gold markets and the Exchange. While the Shares will trade on the Exchange until 4:00 p.m. (New York time), liquidity in the market for gold will be reduced after the close of the major world gold markets, including London, Zurich and COMEX. As a result, during this time, trading spreads, and the resulting premium or discount on Shares, may widen.

An investment in the Trust may be adversely affected by competition from other methods of investing in gold.

The Trust competes with other financial vehicles, including traditional debt and equity securities issued by companies in the gold industry and other securities backed by or linked to gold, direct investments in gold and investment vehicles similar to the Trust. Market and financial conditions, and other conditions beyond the Sponsor’s control, may make it more attractive to invest in other financial vehicles or to invest in gold directly, which could affect the market capitalization of the Trust and reduce the NAV. To the extent existing exchange traded funds, or ETFs, or other exchange traded vehicles tracking gold markets represent a significant proportion of demand for physical gold bullion, large redemptions of the securities of these ETFs or other exchange traded vehicles could negatively affect physical gold bullion prices and the price and NAV.

The Trust may be forced to sell gold earlier than anticipated if expenses are higher than expected.

The Trust may be forced to sell physical gold earlier than anticipated if the Trust’s expenses are higher than estimated. Such accelerated sales may result in a reduction of the NAV and the value of the Shares.

| 13 |

Because the Trust is not a diversified investment, it may be more volatile than other investments.

An investment in the Trust is not intended as a complete investment plan. Because the Trust principally only holds physical gold, an investment in the Trust may be more volatile than an investment in a more broadly diversified portfolio. Accordingly, the NAV may be more volatile than another investment vehicle with a more broadly diversified portfolio and may fluctuate substantially over time. An investment in the Trust may be deemed speculative and is not intended as a complete investment program; therefore investors should review closely the objective and strategy, the investment and operating restrictions and the redemption provisions of the Trust as outlined herein and familiarize themselves with the risks associated with an investment in the Trust.

The liquidation of the Trust may occur at a time when the disposition of the Trust’s gold will result in losses to investors in Shares.

The Trust may have a limited duration. If certain events occur, at any time, the Trustee will have to terminate the Trust. See “Description of the Shares and the Trust Agreement—Amendment and Termination” for more information about the termination of the Trust, including when events outside the control of the Sponsor, the Trustee or the Shareholders may prompt the Trust’s termination.

Upon termination of the Trust, the Trustee will sell gold in the amount necessary to cover all expenses of liquidation, and to pay any outstanding liabilities of the Trust. The remaining gold will be distributed among Authorized Participants surrendering Shares. Any gold remaining in the possession of the Trustee after 60 days may be sold by the Trustee and the proceeds of the sale will be held by the Trustee until claimed by any remaining holders of Shares. Sales of gold in connection with the liquidation of the Trust at a time of low prices will likely result in losses, or adversely affect your gains, on your investment in Shares.

There may be situations where an Authorized Participant is unable to redeem a Basket of Shares. To the extent the value of gold decreases, these delays may result in a decrease in the value of the gold the Authorized Participant will receive when the redemption occurs, as well as a reduction in liquidity for all Shareholders in the secondary market.

Although Shares surrendered by Authorized Participants in Basket-size aggregations are redeemable in exchange for the underlying amount of gold, redemptions may be suspended during any period while regular trading on the Exchange is suspended or restricted, or in which an emergency exists that makes it reasonably impracticable to deliver, dispose of, or evaluate gold. If any of these events occurs at a time when an Authorized Participant intends to redeem Shares, and the price of gold decreases before such Authorized Participant is able again to surrender Shares for redemption, such Authorized Participant will sustain a loss with respect to the amount that it would have been able to obtain in exchange for the gold received from the Trust upon the redemption of its Shares, had the redemption taken place when such Authorized Participant originally intended it to occur. As a consequence, Authorized Participants may reduce their trading in Shares during periods of suspension, decreasing the number of potential buyers of Shares in the secondary market and, therefore, decreasing the price a Shareholder may receive upon sale.

The liquidity of the Shares may also be affected by the withdrawal from participation of Authorized Participants.

In the event that one or more Authorized Participants that have substantial interests in Shares withdraw from participation, the liquidity of the Shares will likely decrease which could adversely affect the market price of the Shares and result in your incurring a loss on your investment.

| 14 |

The Trust is an “emerging growth company” and it cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make the Shares less attractive to investors.

The Trust is an “emerging growth company” as defined in the JOBS Act. For as long as the Trust continues to be an emerging growth company it may choose to take advantage of certain exemptions from various reporting requirements applicable to other public companies but not to emerging public companies, which include, among other things:

| ● | Exemption from the auditor attestation requirements under Section 404 of the Sarbanes-Oxley Act; | |

| ● | Reduced disclosure obligations regarding executive compensation in the Trust’s periodic reports; | |

| ● | Exemption from the requirements of holding non-binding shareholder votes on executive compensation arrangements; and | |

| ● | Exemption from any rules requiring mandatory audit firm rotation and auditor discussion and analysis and, unless otherwise determined by the SEC, any new audit rules adopted by the Public Company Accounting Oversight Board. |

The Trust could be an emerging growth company until the last day of the fiscal year following the fifth anniversary after its initial public offering, or until the earliest of (1) the last day of the fiscal year in which it has annual gross revenue of $1 billion or more, (2) the date on which it has, during the previous three year period, issued more than $1 billion in non-convertible debt or (3) the date on which it is deemed to be a large accelerated filer under the federal securities laws. The Trust will qualify as a large accelerated filer as of the first day of the first fiscal year after it has (A) more than $700 million in outstanding equity held by nonaffiliates and (B) been public for at least 12 months. The value of the Trust’s outstanding equity will be measured each year on the last day of its second fiscal quarter.

Under the JOBS Act, emerging growth companies are also permitted to elect to delay adoption of new or revised accounting standards until companies that are not subject to periodic reporting obligations are required to comply, if such accounting standards apply to non-reporting companies. However, the Trust has chosen to opt out of this extended transition period for complying with new or revised accounting standards. Section 107 of the JOBS Act provides that the decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

The Trust cannot predict if investors will find an investment in the Trust less attractive if it relies on these exemptions.

Authorized Participants with large holdings may choose to terminate the Trust.

Holders of 75% of the Shares have the power to terminate the Trust. This power may be exercised by a relatively small number of holders. If it is so exercised, investors who wished to continue to invest in gold through the vehicle of the Trust will have to find another vehicle, and may not be able to find another vehicle that offers the same features as the Trust.

| 15 |

The lack of an active trading market for the Shares may result in losses on your investment at the time of disposition of your Shares.

Although Shares are listed for trading on the Exchange, you should not assume that an active trading market for the Shares will develop or be maintained. If you need to sell your Shares at a time when no active market for them exists, such lack of an active market will most likely adversely affect the price you receive for your Shares (assuming you are able to sell them).

If the process of creation and redemption of Baskets encounters any unanticipated difficulties, the possibility for arbitrage transactions intended to keep the price of the Shares closely linked to the price of gold may not exist and, as a result, the price of the Shares may fall or otherwise diverge from NAV.

If the processes of creation and redemption of Shares (which depend on timely transfers of gold to and by the Custodian) encounter any unanticipated difficulties, potential market participants, such as the Authorized Participants and their customers, who would otherwise be willing to purchase or redeem Baskets to take advantage of any arbitrage opportunity arising from discrepancies between the price of the Shares and the price of the underlying gold may not take the risk that, as a result of those difficulties, they may not be able to realize the profit they expect. If this is the case, the liquidity of the Shares may decline and the price of the Shares may fluctuate independently of the price of gold and may fall or otherwise diverge from NAV.

As an owner of Shares, you will not have the rights normally associated with ownership of other types of shares.

Shares are not entitled to the same rights as shares issued by a corporation. By acquiring Shares, you are not acquiring the right to elect directors, to receive dividends, to vote on certain matters regarding the issuer of your Shares or to take other actions normally associated with the ownership of shares of a corporation. You will only have the limited rights described under “Description of the Shares and the Trust Agreement.”

As an owner of Shares, you will not have the protections normally associated with ownership of shares in an investment company registered under the Investment Company Act, or the protections afforded by the Commodity Exchange Act.

The Trust is not registered as an investment company for purposes of United States federal securities laws, and is not subject to regulation by the SEC as an investment company. Consequently, the owners of Shares do not have the regulatory protections provided to investors in registered investment companies. For example, the provisions of the Investment Company Act that limit transactions with affiliates, prohibit the suspension of redemptions (except under certain limited circumstances) or limit sales loads, among others, do not apply to the Trust.

The Trust does not hold or trade in commodity futures contracts, “commodity interests”, or any other instruments regulated by the CEA, as administered by the CFTC and the National Futures Association (the “NFA”). Furthermore, the Trust is not a commodity pool for purposes of the CEA and the Shares are not “commodity interests”. Consequently, the Trustee and Sponsor are not subject to registration as commodity pool operators or commodity trading advisors with respect to the Trust or the Shares. The owners of Shares do not receive the CEA disclosure document and certified annual report required to be delivered by a registered commodity pool operator or a commodity trading advisor with respect to the Trust, and the owners of Shares do not have the regulatory protections provided to investors in commodity pools operated by registered commodity pool operators or advised by commodity trading advisors.

| 16 |

The value of the Shares will be adversely affected if gold owned by the Trust is lost or damaged in circumstances in which the Trust is not in a position to recover the corresponding loss.

The Custodian is responsible to the Trust for loss or damage to the Trust’s gold only under limited circumstances. The agreements with the Custodian contemplate that the Custodian will be responsible to the Trust only if it acts with negligence, fraud or in willful default of its obligations under those agreements. The Custodian’s liability will not exceed the market value of the gold credited to the Trust Unallocated Account and the Trust Allocated Account at the time such negligence, fraud or willful default is either discovered by or notified to the Custodian (such market value calculated using the nearest available LBMA Gold Price PM following the occurrence of such negligence, fraud or willful default), provided that, in the case of such discovery by or notification to the Custodian, the Custodian notifies the Sponsor and the Trustee promptly after any discovery of such negligence, fraud or willful default. Furthermore, the Custodian is not liable for any delay in performance, or for the non-performance, of any of its obligations under the Custody Agreements by reason of any cause beyond the Custodian’s reasonable control, including any act of God or war or terrorism, any breakdown, malfunction or failure of, or connected with, any communication, computer, transmission, clearing or settlement facilities, industrial action, or acts, rules and regulations of any governmental or supra national bodies or authorities or any relevant regulatory or self-regulatory organization.

In addition, because the Custody Agreements are governed by English law, the holders of the Shares may have no rights against the Custodian and any rights they may have against the Custodian will be different from, and may be more limited than, those that could have been available to them under the laws of a different jurisdiction. The choice of English law to govern the Custody Agreements, however, is not expected to affect any rights that the holders of the Shares may have against the Trust or the Trustee.

Moreover, the Trust may not be in a position to recover insurance proceeds in the event of any loss with respect to its gold. The Trust does not insure its gold. The Custodian maintains insurance with regard to its business on such terms and conditions as it considers appropriate, which does not cover the full amount of gold held in custody. The Trust is not a beneficiary of any such insurance and does not have the ability to dictate the existence, nature or amount of coverage. Therefore, Shareholders cannot be assured that the Custodian will maintain adequate insurance or any insurance with respect to the gold held by the Custodian on behalf of the Trust. The Custodian and the Trustee do not require any direct or indirect subcustodians to be insured or bonded with respect to their custodial activities or in respect of the gold held by them on behalf of the Trust. Consequently, a loss may be suffered with respect to the Trust’s gold which is not covered by insurance and for which no person is liable in damages.

Any loss of gold owned by the Trust will result in a corresponding loss in the net asset value of the Trust and it is reasonable to expect that such loss will also result in a decrease in the value at which the Shares are traded on the Exchange.

Although the relationship between the Custodian and the Trustee concerning the Trust’s allocated gold is expressly governed by English law, a court hearing any legal dispute concerning that arrangement may disregard that choice of law and apply U.S. law, in which case the ability of the Trust to seek legal redress against the Custodian may be frustrated.

The obligations of the Custodian under the Custody Agreements are governed by English law. The Trust is a New York common law trust. Any United States, New York or other court situated in the United States may have difficulty interpreting English law (which, insofar as it relates to custody arrangements, is largely derived from court rulings rather than statute), London Bullion Market Association (LBMA) rules or the customs and practices in the London custody market. It may be difficult or impossible for the Trust to sue the Custodian in a United States, New York or other court situated in the United States. In addition, it may be difficult, time consuming and/or expensive for the Trust to enforce in a foreign court a judgment rendered by a United States, New York or other court situated in the United States.

| 17 |

Shareholders and Authorized Participants lack the right under the Custody Agreements to assert claims directly against the Custodian, which significantly limits their options for recourse.

Neither the Shareholders nor any Authorized Participant will have a right under the Custody Agreements to assert a claim of the Trustee against the Custodian. Claims under the Custody Agreements may only be asserted by the Trustee on behalf of the Trust.

Gold held in the Trust Unallocated Account and any Authorized Participant’s unallocated gold account will not be segregated from the Custodian’s assets. If the Custodian becomes insolvent, its assets may not be adequate to satisfy a claim by the Trust or any Authorized Participant. In addition, in the event of the Custodian’s insolvency, there may be a delay and costs incurred in identifying the gold bars held in the Trust Allocated Account.

Gold which is part of a deposit for a purchase order or part of a redemption distribution will be held for a time in the Trust Unallocated Account and, previously or subsequently in, the unallocated gold account of the purchasing or redeeming Authorized Participant. During those times, the Trust and the Authorized Participant, as the case may be, will have no proprietary rights to any specific bars of gold held by the Custodian and will each be an unsecured creditor of the Custodian with respect to the amount of gold held in such unallocated accounts. In addition, if the Custodian fails to allocate the Trust’s gold in a timely manner, in the proper amounts or otherwise in accordance with the terms of the Trust Unallocated Account Agreement, or if a subcustodian fails to so segregate gold held by it on behalf of the Trust, unallocated gold will not be segregated from the Custodian’s assets, and the Trust will be an unsecured creditor of the Custodian with respect to the amount so held in the event of the insolvency of the Custodian. In the event the Custodian becomes insolvent, the Custodian’s assets might not be adequate to satisfy a claim by the Trust or the Authorized Participant for the amount of gold held in their respective unallocated gold accounts.

In the event of the insolvency of the Custodian, a liquidator may seek to freeze access to the gold held in all of the accounts held by the Custodian, including the Trust Allocated Account. Although the Trust would retain legal title to the allocated gold bars, the Trust could incur expenses in connection with obtaining control of the allocated gold bars, and the assertion of a claim by such liquidator for unpaid fees could delay creations and redemptions of Baskets.

From time to time subcustodians may be employed by the Custodian to provide temporary custody and safekeeping of the Trust’s gold. The obligations of any subcustodian of the Trust’s gold are not determined by contractual arrangements but by LBMA rules and London bullion market customs and practices, which may prevent the Trust’s recovery of damages for losses on its gold custodied with subcustodians.

Gold bars may be held by one or more subcustodians appointed by the Custodian, or employed by the subcustodians appointed by the Custodian, until it is transported to the Custodian’s London vault premises. Under the Trust Allocated Account Agreement, except for an obligation on the part of the Custodian to use commercially reasonable efforts to obtain delivery of the Trust’s gold bars from any subcustodians appointed by the Custodian, the Custodian is not liable for the acts or omissions of its subcustodians unless the selection of such subcustodians was made negligently or in bad faith. There are expected to be no written contractual arrangements between subcustodians that hold the Trust’s gold bars and the Trustee or the Custodian, because traditionally such arrangements are based on the LBMA’s rules and on the customs and practices of the London bullion market. In the event of a legal dispute with respect to or arising from such arrangements, it may be difficult to define such customs and practices. The LBMA’s rules may be subject to change outside the control of the Trust. Under English law, neither the Trustee nor the Custodian would have a supportable breach of contract claim against a subcustodian for losses relating to the safekeeping of gold. If the Trust’s gold bars are lost or damaged while in the custody of a subcustodian, the Trust may not be able to recover damages from the Custodian or the subcustodian.

| 18 |

Because neither the Trustee nor the Custodian oversees or monitors the activities of subcustodians who may temporarily hold the Trust’s gold bars until transported to the Custodian’s London vault, failure by the subcustodians to exercise due care in the safekeeping of the Trust’s gold bars could result in a loss to the Trust.

Under the Trust Allocated Account Agreement, the Custodian agreed that it will hold all of the Trust’s gold bars in its own vault premises except when the gold bars have been allocated in a vault other than the Custodian’s vault premises, and in such cases the Custodian agreed that it will use commercially reasonable efforts promptly to transport the gold bars to the Custodian’s vault, at the Custodian’s cost and risk. Nevertheless, there may be periods of time when some portion of the Trust’s gold bars will be held by one or more subcustodians appointed by the Custodian or by a subcustodian of such subcustodian.

The Custodian is required under the Trust Allocated Account Agreement to use reasonable care in appointing its subcustodians but otherwise has no other responsibility in relation to the subcustodians appointed by it. These subcustodians may in turn appoint further subcustodians, but the Custodian is not responsible for the appointment of these further subcustodians. The Custodian does not undertake to monitor the performance by subcustodians of their custody functions or their selection of further subcustodians. The Trustee does not undertake to monitor the performance of any subcustodian. Furthermore, the Trustee may have no right to visit the premises of any subcustodian for the purposes of examining the Trust’s gold bars or any records maintained by the subcustodian, and no subcustodian will be obligated to cooperate in any review the Trustee may wish to conduct of the facilities, procedures, records or creditworthiness of such subcustodian.

In addition, the ability of the Trustee to monitor the performance of the Custodian may be limited because under the Custody Agreements the Trustee has only limited rights to visit the premises of the Custodian for the purpose of examining the Trust’s gold bars and certain related records maintained by the Custodian.

The value of the Shares will be adversely affected if any services provided to the Trust by the Sponsor, the Custodian or the Trustee are suddenly or unexpectedly terminated.

Upon the sudden or unexpected termination, resignation or removal of any service provider to the Trust, it is possible that a comparable replacement service provider will be available or able to be appointed without material delay. Any such unavailability or delay could cause the Trustee to expend assets of the Trust and consequently, the NAV of the Shares, in finding a replacement service provider.

The value of the Shares will be adversely affected if the Trust is required to indemnify the Sponsor, the Trustee, or the Custodian as contemplated in the Trust Agreement and the Custody Agreements.

Under the Trust Agreement, the Sponsor and the Trustee each have the right to be indemnified from the Trust for any liability or expense it incurs without gross negligence, bad faith, willful misconduct or willful malfeasance on its part. Similarly, the Custody Agreements provide for indemnification of the Custodian by the Trust under certain circumstances. The Trust will not carry any insurance to cover such potential obligations. This means that it may be necessary to sell assets of the Trust in order to cover losses or liability suffered by the Sponsor, the Trustee or the Custodian. Any sale of that kind would reduce the net asset value of the Trust and the value of the Shares.

| 19 |

The service providers engaged by the Trust may not carry adequate insurance to cover claims against them by the Trust, which could adversely affect the value of net assets of the Trust.

The Trustee, the Custodian and other service providers engaged by the Trust maintain such insurance as they deem adequate with respect to their respective businesses. Investors cannot be assured that any of the aforementioned parties will maintain any insurance with respect to the Trust’s assets held or the services that such parties provide to the Trust and, if they maintain insurance, that such insurance is sufficient to satisfy any losses incurred by them in respect of their relationship with the Trust. Accordingly, the Trust will have to rely on the efforts of the service provider to recover from their insurer compensation for any losses incurred by the Trust in connection with such arrangements.

The Sponsor and its affiliates manage other funds, including those that invest in physical gold bullion or other precious metals, and conflicts of interest may occur, which may reduce the value of the net assets of the Trust, the NAV and the trading price of the Shares.

The Sponsor or its affiliates and associates currently engage in, and may in the future engage, in the promotion, management or investment management of other accounts, funds or trusts that invest primarily in physical gold bullion or other precious metals. Although officers and professional staff of the Sponsor’s management intend to devote as much time to the Trust as is deemed appropriate to perform their duties, the Sponsor’s management may allocate their time and services among the Trust and the other accounts, funds or trusts. The Sponsor will provide any such services to the Trust on terms not less favorable to the Trust than would be available from a non-affiliated party.

The Sponsor and the Trustee may agree to amend the Trust Agreement without the consent of the Shareholders.

The Sponsor and the Trustee may agree to amend the Trust Agreement, including to increase the Sponsor’s Fee, without Shareholder consent. If an amendment imposes new fees and charges or increases existing fees or charges, including the Sponsor’s Fee (except for taxes and other governmental charges, registration fees or other such expenses, or prejudices a substantial right of Shareholders), it will become effective for outstanding Shares 30 days after notice of such amendment is given to registered owners. Shareholders that are not registered owners (which most shareholders will not be) may not receive specific notice of a fee increase other than through an amendment to the prospectus. Moreover, at the time an amendment becomes effective, by continuing to hold Shares, Shareholders are deemed to agree to the amendment and to be bound by the Trust Agreement as amended without specific agreement to such increase (other than through the “negative consent” procedure described above).

Shareholders could incur a tax liability without an associated distribution of the Trust.

In the normal course of business it is possible that the Trust could incur a taxable gain in connection with the sale of gold that is otherwise not associated with a distribution. In the event that this occurs, Shareholders may be subject to tax due to the grantor trust status of the Trust even though there is not a corresponding distribution from the Trust.

Proceeds received by the Trust from the issuance and sale of Baskets consist of gold deposits. Such deposits are held by the Custodian on behalf of the Trust until (i) delivered to Authorized Participants in connection with redemptions of Baskets or (ii) sold to pay fees due to the Sponsor and Trust expenses and liabilities not assumed by the Sponsor. See “The Trust—Trust Expenses.”

| 20 |

Description of the Gold Industry

Introduction

This section provides a brief introduction to the gold industry by looking at some of the key participants, detailing the primary sources of demand and supply and outlining the role of the “official” sector (i.e., central banks) in the market.

Market Participants

The participants in the world gold industry may be classified in the following sectors: the mining and producer sector, the banking sector, the official sector, the investment sector, and the manufacturing sector. A brief description of each follows.

The Mining and Producer Sector

This group includes mining companies that specialize in gold and silver production; mining companies that produce gold as a by-product of other production (such as a copper or silver producer); scrap merchants and recyclers.

The Banking Sector