Exhibit 10.23

AMENDED AND RESTATED CONTRIBUTION AGREEMENT

by and between

HD Sunland Park Property LLC

a Delaware limited liability company

and

Lodging Fund REIT III OP, LP

a Delaware limited partnership

Dated as of May 12, 2021

TABLE OF CONTENTS

| | | Page |

| | | |

1. | Defined Terms | 1 | |

| | | |

2. | Contribution; Total Consideration; Inspection and Title | 7 | |

| 2.1 | Contribution of Property | 7 |

| 2.2 | Contribution of Assets | 7 |

| 2.3 | Inventory | 7 |

| 2.4 | Excluded Assets | 8 |

| 2.5 | Assumed Liabilities | 8 |

| 2.6 | Excluded Liabilities | 8 |

| 2.7 | Existing Loans and Creditors | 8 |

| 2.8 | Consideration and Exchange of Series T Limited Units | 10 |

| 2.9 | Treatment as Contribution | 10 |

| 2.10 | Allocation of Total Consideration | 10 |

| 2.11 | Terms of Series T Limited Units | 11 |

| 2.12 | Term of Agreement | 11 |

| 2.13 | Management Company | 11 |

| 2.14 | Risk of Loss | 11 |

| 2.15 | Escrow | 12 |

| 2.16 | Title | 12 |

| 2.17 | Due Diligence Period. | 12 |

| | | |

3. | Closing | 13 | |

| 3.1 | Conditions Precedent- Operating Partnership | 13 |

| 3.2 | Conditions Precedent - Contributor | 15 |

| 3.3 | Time and Place | 16 |

| 3.4 | Closing Deliveries | 16 |

| 3.5 | Closing Costs | 17 |

| | | |

4. | Representations and Warranties and Indemnities. | 18 | |

| 4.1 | Representations and Warranties of the Operating Partnership | 18 |

| 4.2 | Representations and Warranties of the Contributor | 20 |

| | | |

5. | Indemnification | 29 | |

| 5.1 | Survival of Representations and Warranties; Remedy for Breach | 29 |

| 5.2 | General Indemnification | 30 |

| 5.3 | Notice and Defense of Claims | 30 |

| 5.4 | Limitations on Indemnification Under Section 5.2.1 | 31 |

| 5.5 | Matters Excluded from Indemnification | 31 |

| 5.6 | Offset | 31 |

| | | |

6. | Covenants | 31 | |

| 6.1 | Covenants of the Contributor. | 31 |

| 6.2 | Prorations | 33 |

| 6.3 | Tax Covenants | 35 |

| 6.4 | Capital Contribution | 35 |

| | | |

7. | Termination | 36 | |

| 7.1 | Termination | 36 |

-i-

TABLE OF CONTENTS

(continued)

| | | Page |

| | | |

| 7.2 | Default by the Operating Partnership | 36 |

| 7.3 | Default by the Contributor | 36 |

| | | |

8. | Miscellaneous | 37 | |

| 8.1 | Further Assurances | 37 |

| 8.2 | Counterparts | 37 |

| 8.3 | Governing Law | 37 |

| 8.4 | Amendment; Waiver | 37 |

| 8.5 | Entire Agreement | 37 |

| 8.6 | Assignability | 37 |

| 8.7 | Titles | 38 |

| 8.8 | Third Party Beneficiary | 38 |

| 8.9 | Severability | 38 |

| 8.10 | Reliance | 38 |

| 8.11 | Survival | 38 |

| 8.12 | Days | 38 |

| 8.13 | Calculating Time Periods | 38 |

| 8.14 | Incorporation of Exhibits | 38 |

| 8.15 | Notice | 38 |

| 8.16 | Force Majeure | 39 |

| 8.17 | Impracticability | 40 |

| 8.18 | Equitable Remedies | 40 |

EXHIBITS

ALegal Description of the Properties

BContribution and Assumption Agreement

CAssignment of Warranties

DTotal Consideration

ENon-Competition Agreement and Non-Solicitation Agreement

FConfidentiality and Non-Disclosure Agreement

GTax Information

SCHEDULES

2.2List of Contributed Assets, Assumed Agreements and Leases

2.4List of Excluded Assets

2.5List of Assumed Liabilities; Permitted Liens

2.6List of Excluded Liabilities

2.10Allocation of Total Consideration

3.1.83-05 Audit

APPENDICES

ADisclosure Schedule

-ii-

AMENDED AND RESTATED CONTRIBUTION AGREEMENT

This Amended and Restated Contribution Agreement (this “Agreement”) is made and entered into as of May 12, 2021 (the “Effective Date”) by and between Lodging Fund REIT III OP, LP, a Delaware limited partnership (the “Operating Partnership”), and HD Sunland Park Property LLC, Delaware limited liability company (the “Contributor”).

RECITALS

A.The Contributor and Operating Partnership entered into a contribution agreement (the “Original Agreement”) on January 8, 2021 on terms similar to the terms found herein, the Original Agreement was amended by the First Amendment on April 27, 2021, which said Original Agreement is hereby Terminated. This Agreement hereby supersedes any and all other agreements.

B.The Contributor currently owns a certain 175-room hotel business known as the Holiday Inn El Paso West Sunland Park located at 900 Sunland Park Dr., El Paso, TX 79922 (the “Property”), as the Property is more fully described in Exhibit A.

C.The Operating Partnership desires to acquire the Property, along with the Contributed Assets whereby the Operating Partnership will acquire a direct fee simple interest and ownership in the Property.

NOW, THEREFORE, in consideration of the foregoing premises, and the mutual undertakings set forth below, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1.Defined Terms.

The following terms have the meanings set forth below:

“Act” shall have the meaning as set forth in Section 4.2.9.

“Actions” mean all actions, litigations, complaints, charges, accusations, investigations, petitions, suits, arbitrations, mediations or other proceedings, whether civil or criminal, at law or in equity, or before any arbitrator or Governmental Entity.

“Adverse Change” shall have the meaning as set forth in Section 2.16.1.

“Adverse Change Review Period” shall have the meaning as set forth in Section 2.16.1.

“Agreement” shall have the meaning as set forth in the Preamble.

“Amendment” shall have the meaning as set forth in Section 2.8.

“Assumed Agreements” shall have the meaning as set forth in Section 2.2.

“Assumed Liabilities” shall have the meaning as set forth in Section 2.5.

“Basket” shall have the meaning as set forth in Section 5.4.

“Closing” shall have the meaning as set forth in Section 3.2.

1

“Closing Agent” shall have the meaning as set forth in Section 2.14.

“Closing Date” shall have the meaning as set forth in Section 3.2.

“Closing Documents” shall have the meaning as set forth in Section 3.3.

“Code” shall mean the Internal Revenue Code of 1986, as amended.

“Common Limited Units” shall have the meaning set forth in the OP Agreement.

“Company” shall mean Lodging Fund REIT III, Inc., a Maryland corporation.

“Contributed Assets” shall have the meaning as set forth in Section 2.2.

“Contributor” shall have the meaning as set forth in the Preamble.

“Contributor Point of Contact” shall have the meaning as set forth in Section 2.16.3(d).

“Contributor’s Breakage Fee” shall have the meaning as set forth in Section 7.3.

“Contributor’s Cure Period” shall have the meaning as set forth in Section 2.15.

“Deed” shall have the meaning as set forth in Section 3.3.2.

“Disclosure Schedule” means that disclosure schedule attached as Appendix A.

“Due Diligence Documents” shall have the meaning as set forth in Section 2.16.1.

“Due Diligence Period” shall have the meaning as set forth in Section 2.16.1.

“Due Diligence Review” shall have the meaning as set forth in Section 2.16.3.

“Earnest Money” shall have the meaning as set forth in Section 2.14.

“Environmental Law” means all applicable statutes, regulations, rules, ordinances, codes, licenses, permits, orders, demands, approvals, authorizations and similar items of any Governmental Entity and all applicable judicial, administrative and regulatory decrees, judgments and orders relating to the protection of human health or the environment as in effect on the Closing Date, including but not limited to those pertaining to reporting, licensing, permitting, investigation, removal and remediation of Hazardous Materials, including without limitation (i) the Comprehensive Environmental Response, Compensation and Liability Act (42 U.S.C. Section 9601 et seq.), the Resource Conservation and Recovery Act (42 U.S.C. Section 6901 et seq.), the Clean Air Act (42 U.S.C. Section 7401 et seq.), the Federal Water Pollution Control Act (33 U.S.C. Section 1251), the Safe Drinking Water Act (42 U.S.C. 300f et seq.), the Toxic Substances Control Act (15 U.S.C. 2601 et seq.), the Endangered Species Act (16 U.S.C. 1531 et seq.), the Emergency Planning and Community Right-to-Know Act of 1986 (42 U.S.C. 11001 et seq.), and (ii) applicable state and local statutory and regulatory laws, statutes and regulations pertaining to Hazardous Materials.

2

“Environmental Permits” means any and all licenses, certificates, permits, directives, requirements, registrations, government approvals, agreements, authorizations, and consents that are required under or are issued pursuant to any Environmental Laws.

“Effective Date” shall have the meaning as set forth in the Preamble.

“Excluded Assets” shall have the meaning as set forth in Section 2.4.

“Excluded Liabilities” shall have the meaning as set forth in Section 2.6.

“Existing Loan” shall have the meaning as set forth in Section 2.7.1.

“Existing Loan Documents” shall have the meaning as set forth in Section 2.7.1.

“Fixtures and Personal Property” shall mean all fixtures, furniture, furnishings, apparatus and fittings, equipment, machinery, appliances, building supplies, business supplies, software, tools, linens (in no event less than 3 par), inventories of standard supplies, services and amenities including without limitation paper goods, brochures, office supplies, unopened food and beverage inventory, chinaware, glassware, flatware, soap, gasoline, fuel oil, inventory held for sale, engineering, pool, maintenance and housekeeping supplies, TV, phone, and internet services, software and hardware, and other operation and guest supplies (each of which shall be maintained and transferred in accordance with brand standards), merchandise, goods, electronics, customer lists and records (including but not limited to customer, supplier, advertising, promotional material, sales, services, delivery and/or operations lists and records), goodwill, intellectual and/or proprietary information and property and applications therefor or licenses thereof and other items of personal property used in connection with the ownership, operation or maintenance of the Property, including all assets located off site from the Property but owned and used by the Contributor in connection with operation of the Property; excluding, however, all fixtures, furniture, furnishings, apparatus and fittings, equipment, machinery, appliances, building supplies, business supplies, software, tools, linens, merchandise, goods, electronics and other items of personal property owned by tenants, subtenants, guests, invitees, employees, easement holders, service contractors and other Persons who own any such property located on the Property.

“Franchise Agreement” shall have the meaning as set forth in Section 3.1.12.

“Governmental Entity” means any governmental agency or quasi-governmental agency, bureau, board, commission, court, department, official, political subdivision, tribunal or other instrumentality of any government, whether federal, state or local, domestic or foreign.

“Hazardous Material” means any substance:

(a)the presence of which requires investigation or remediation under any Environmental Law action or policy, administrative request or civil complaint under the foregoing or under common law; or

(b)which is controlled, regulated or prohibited under any Environmental Law as in effect as of the Closing Date, including the Comprehensive Environmental Response, Compensation and Liability Act (42 U.S.C. Section 9601 et seq.) and the Resource Conservation and Recovery Act (42 U.S.C. Section 6901 et seq.); or

3

(c)which is toxic, explosive, corrosive, flammable, infectious, radioactive, carcinogenic, mutagenic or otherwise hazardous and as of the Closing Date is regulated by any Governmental Entity; or

(d)the presence of which on, under or about, the Property poses a hazard to the health or safety of persons on or about the Property; or

(e)which contains gasoline, diesel fuel or other petroleum hydrocarbons, polychlorinated biphenyls (PCBs) or asbestos or asbestos-containing materials or urea formaldehyde foam insulation; or

(f)radon gas.

“Indemnified Contributor Party” shall have the meaning as set forth in Section 5.5.

“Indemnified OP Party” shall have the meaning as set forth in Section 5.5.

“Indemnified Party” shall have the meaning as set forth in Section 5.2.1.

“Independent Consideration” shall have the meaning as set forth in Section 2.14.

“Intangible Personal Property” shall mean all, right, title and interest relating to the Property in and to all intangible personal property now or hereafter used in connection with the operation, ownership, maintenance, management, or occupancy of the Property, including without limitation: all trade names and trademarks associated with the ownership of the Property; the plans and specifications for the Improvements; warranties; guaranties; indemnities; claims against third parties; claims against tenants for tenant improvement reimbursements; all contract rights related to the construction, operation, ownership or management of the Property; certificates of occupancy; applications, permits, approvals and licenses; insurance proceeds and condemnation awards or claims thereto to be assigned to the Operating Partnership hereunder; all books and records relating to the Property; any existing computer software or programs; any franchise agreements which shall not be terminated at the Closing and are to be assigned to the Operating Partnership, if any; any records, files, lists, and other tangible assets that pertain to the Property, including lists and records pertaining to any one or more of the following: the Contributor’s customers, suppliers, advertising, promotional material, sales, services, delivery, and/or operations, except those items, if any, required to be retained by law, including accounting records and returns.

“Inventory Period” shall have the meaning as set forth in Section 2.3.1.

“Key Personnel” shall have the meaning as set forth in Section 2.16.3(d).

“Knowledge” means with respect to any representation or warranty so indicated, the actual awareness of facts of other information, of Sean Hawkins and Ken Okamoto, collectively, in the case of the Contributor, or David Durell in the case of the Operating Partnership. The term “Knowledge” expressly includes the knowledge of the foregoing individuals would be reasonably expected to have if, as a result of the position such individual holds, such person made a reasonable inquiry in light of the circumstances.

“Leases” shall have the meaning as set forth in Section 4.2.21.

4

“Lender” shall have the meaning as set forth in Section 2.7.1.

“Liens” means with respect to any real and personal property, all mortgages, pledges, liens, options, charges, security interests, mortgage deed, restrictions, prior assignments, encumbrances, covenants, encroachments, assessments, purchase rights, rights of others, licenses, easements, voting agreements, liabilities or claims of any kind or nature whatsoever, direct or indirect, including, without limitation, interests in or claims to revenues generated by such property.

“Losses” shall have the meaning as set forth in Section 5.2.1.

“Material Adverse Effect” shall have the meaning as set forth in Section 4.2.3.

“Maximum Per Property Total Consideration Adjustment” shall have the meaning as set forth in Section 2.13.

“Merchandise” shall have the meaning as set forth in Section 2.3.1.

“Name” shall have the meaning as set forth in Section 4.2.19(c).

“NDA” shall have the meaning as set forth in Section 6.1.8.

“Non-Competition Agreement and Non-Solicitation Agreement” shall have the meaning as set forth in Section 6.1.7.

“Objections” shall have the meaning as set forth in Section 2.15.

“OFAC” shall have the meaning as set forth in Section 4.2.32.

“Offering Documents” shall have the meaning as set forth in Section 2.16.2.

“Offering Review Period” shall have the meaning as set forth in Section 2.16.2.

“OP Agreement” shall mean the Amended and Restated Limited Partnership Agreement of Lodging Fund REIT III OP, LP, a Delaware limited partnership, as may be amended.

“Operating Partnership” shall have the meaning as set forth in the Preamble.

“Original Agreement” shall mean a certain Contribution Agreement and First Amendment between Operating Partnership and Contributor.

“Other Taxes” means Taxes other than income Taxes.

“Permitted Liens” means:

(a)Liens securing taxes, the payment of which is not now due and payable or the payment of which is actively being contested in good faith by appropriate proceedings diligently pursued;

(b)Zoning laws and ordinances applicable to the Property which are not violated by the existing structures or present uses thereof or the transfer of the Property;

5

(c)non-exclusive easements for public utilities and other operational purposes that do not materially interfere with the current use of the Property;

(d)all Liens listed in Schedule 2.5 of the Disclosure Schedule and any similar liens incurred in any refinancing of the related obligations; and

(e)all matters either not objected to or deemed accepted by the Operating Partnership under Section 2.16.

“Person” means any individual, corporation, limited liability company, partnership, joint venture, association, joint-stock company, trust, unincorporated organization or governmental entity.

“PIP” shall have the meaning as set forth in Section 4.2.31.

“Preliminary Title Report” means the preliminary commitment for title insurance committing to insure marketable fee simple title as of the date of the Closing, subject only to the Permitted Liens.

“Property” shall have the meaning as set forth in the Recitals.

“Property Deposits” shall have the meaning as set forth in Section 6.2.1(b)(i).

“Property Reports” means the property condition assessment reports, appraisals, zoning reports and other similar reports prepared for the Property.

“Proprietary Rights” shall have the meaning as set forth in Section 4.2.19(a).

“REIT Shares” shall have the meaning set forth in the OP Agreement.

“Release” shall have the same meaning as the definition of “release” in the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) at 42 U.S.C. Section 9601(22), but not including the exclusions identified in that definition, at subparts (A) through (D).

“Satisfaction Notice” shall have the meaning as set forth in Section 2.16.1.

“Series T Limited Units” shall have the meaning set forth in the OP Agreement.

“Service Contracts” shall have the meaning as set forth in Section 4.2.23.

“Subscription Agreement” shall mean the Subscription Agreement to be entered into by Contributor with respect to the acquisition of the Series T Units.

“Tax” or “Taxes” means any federal, state, provincial, local or foreign income, gross receipts, license, payroll, employment-related, excise, goods and services, harmonized sales, severance, stamp, occupation, premium, windfall profits, environmental, customs duties, capital stock, franchise, profits, withholding, social security, unemployment, disability, real property, personal property, sales, use, transfer, registration, value added, alternative or add-on minimum, estimated, or other tax of any kind whatsoever, including any interest, penalty, or addition thereto, whether disputed or not.

6

“Tax Return” means any return, declaration, report, claim for refund, or information return or statement related to Taxes, including any schedule or attachment thereto, and including any amendment thereof.

“Tenants” shall have the meaning as set forth in Section 4.2.21.

“Terminated” shall mean that as of the Effective Date the Original Agreement has no force or effect and is replaced herein by this Agreement.

“Title Company” shall have the meaning as set forth in Section 2.15.

“Title Policy” shall have the meaning as set forth in Section 3.1.6.

“Total Consideration” shall have the meaning as set forth in Section 2.8.

“Transfer” shall have the meaning as set forth in Section 4.2.9(a).

2.Contribution; Total Consideration; Inspection and Title.

2.1Contribution of Property. At the Closing and subject to the terms and conditions contained in this Agreement, the Contributor shall contribute, transfer, assign, convey and deliver to the Operating Partnership, absolutely and unconditionally, and free and clear of all Liens (other than Permitted Liens), all of its right, title and interest to the Property. The contribution of the Property shall be evidenced by a Deed. The parties shall take such additional actions and execute such additional documentation as may be required by the Contributor’s entity documents and the OP Agreement, or as reasonably requested by the Operating Partnership in order to effect the transactions contemplated hereby.

2.2Contribution of Assets. At the Closing and subject to the terms and conditions contained in this Agreement, the Contributor shall contribute, transfer, assign convey and deliver to the Operating Partnership, and the Operating Partnership shall acquire, assume and accept, all of the Contributor’s right, title and interest in and to (i) (a) those assets listed on Schedule 2.2, (b) all Fixtures and Personal Property related to the Property, and (c) all Intangible Personal Property now or hereafter used in connection with the operation, ownership, maintenance, management or occupancy of the Property (collectively, the “Contributed Assets”), and (ii) (a) those certain agreements listed on Schedule 2.2, which reflect all agreements and arrangements related to the Property to which Contributor (or its affiliates or predecessors) is a party and (b) Service Contracts (collectively, the “Assumed Agreements”), and in each case, free and clear of any and all Liens, subject only to the Permitted Liens. The contribution of the Contributed Assets and the Assumed Agreements and the assumption of all obligations thereunder shall be evidenced by a Contribution and Assumption Agreement in substantially the form of Exhibit B.

2.3Inventory. In addition to the purchase and sale of the Contributed Assets, Contributor shall sell and the Operating Partnership will buy the inventory of saleable merchandise of Contributor, subject to the following:

2.3.1Purchase and Sale of Merchandise Inventory. An inventory of all merchandise will be conducted not earlier than 15 days prior to Closing but not later than 1 day prior to Closing (the “Inventory Period”), and Contributor shall sell, transfer, and deliver to the

7

Operating Partnership all of the merchandise and other inventory used in connection with the Property. As used in this Agreement, the “Merchandise” will include only unopened merchandise and merchandise that (i) is not obsolete and (ii) has an expiration of 30 days or more after Closing Date.

2.3.2Method of Taking Inventory. The Contributor and the Operating Partnership mutually agree to a method of inventory during the Inventory Period, and only if the Parties do not agree, then the Operating Partnership, at the Contributor’s expense, will use an inventory auditing service to conduct the counting of inventory.

2.3.3Inventory Purchase Price. The Merchandise shall be purchased at the Contributor’s actual cost. The Contributor shall, upon written request therefor by the Operating Partnership, provide written evidence of the Contributor’s actual cost, which will include the cost of the delivery of the Merchandise, if any.

2.4Excluded Assets. Notwithstanding the foregoing, the parties expressly acknowledge and agree that all assets and properties of the Contributor set forth on Schedule 2.4, shall be deemed “Excluded Assets” and not contributed, transferred, assigned, conveyed or delivered to the Operating Partnership pursuant to this Agreement, and the Operating Partnership shall not have any rights or obligations with respect thereto. Unless otherwise agreed in writing, the Contributor, at the Contributor’s expense, shall remove the Excluded Assets from the Property as soon as possible after the Closing Date but in no event later than 30 days after the Closing Date. If the Contributor fails to comply with the foregoing provisions, the Operating Partnership may dispose of such items at the Contributor’s expense or make such other arrangements as the Operating Partnership may determine appropriate.

2.5Assumed Liabilities. On the terms and subject to the conditions set forth in this Agreement, at the Closing, the Operating Partnership shall assume from the Contributor and thereafter pay, perform or discharge in accordance with their terms all of the liabilities of the Contributor listed on Schedule 2.5 (the “Assumed Liabilities”).

2.6Excluded Liabilities. Notwithstanding the foregoing, the parties expressly acknowledge and agree that the Operating Partnership shall not assume or agree to pay, perform or otherwise discharge any liabilities, obligations or other expenses of either the Contributor (or acquire the Property subject thereto) other than those assumed pursuant to the Contribution and Assumption Agreement and the Assumed Liabilities (the “Excluded Liabilities”), and such Excluded Liabilities shall not be contributed, transferred, assigned, conveyed or delivered to the Operating Partnership pursuant to this Agreement or any other means, and the Operating Partnership shall not have any obligations with respect thereto.

2.7Existing Loans and Creditors.

2.7.1The Contributor has obtained certain financing encumbering the Property through EPH Development Fund LLC at an original loan balance of $8,400,000 (the “Existing Loan”). Such notes, deed of trusts and all other documents or instruments evidencing or securing such Existing Loan, including any financing statements, and any amendments, modifications and assignments of the foregoing, shall be referred to, collectively, as the “Existing Loan Documents.” The Existing Loan shall be considered a Permitted Lien for purposes of this Agreement. The

8

Operating Partnership at its election shall either (i) assume the applicable Existing Loan at the Closing pursuant to the terms and conditions set forth in the Letter of Intent, dated November 18, 2020, between Contributor and the Operating Partnership (the “LOI”) (subject to obtaining any necessary consents from EPH Development Company LLC, the holder of the mortgage or deed of trust related to the Existing Loan (the “Lender”) prior to the Closing), or (ii) cause the Existing Loan to be refinanced or repaid in connection with the Closing. The Operating Partnership shall have the right to discuss with the Lender any of the options described in this Section 2.7.1 immediately upon the Contributor discussing the transaction contemplated by this Agreement with such entities.

2.7.2The Contributor shall use commercially reasonable efforts along with the Operating Partnership in seeking to process approval of the assumption of the Existing Loan or in beginning the process for any refinancing or a payoff.

2.7.3In addition to the Existing Loan, Contributor applied for, and was awarded the loans described in (a) and (b) below (the “Loans”) under the Paycheck Protection Program (“PPP”). Such loans have been promulgated under the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”) and the Consolidated Appropriations Act, 2021 (the “CAA Act”), respectively, each of which is backed by the Small Business Association (“SBA”).

(a)The first PPP loan, Loan No. 70711018, was issued by WestStar Bank in El Paso, Texas (“WestStar”) for the original loan balance of $257,500 (“PPP Loan 1”). The Contributor sought partial forgiveness of PPP Loan 1 pursuant to the forgiveness qualification and application pursuant to the CARES Act on or about October 13, 2020, facilitated by WestStar Bank. Such forgiveness has not yet been granted by the SBA.

(b)The second PPP loan, Loan No. 68911985-02, was issued by WestStar on March 3, 2021, for the original loan amount of $360,538.50 (“PPP Loan 2”). PPP Loan 2 has not as of the date of this Agreement met the forgiveness criteria to due constraints under the CARES Act, the CAA Act and guidance by the SBA, which include the timing of the forgiveness and use of funds.

(c)Operating Partnership consents to the Loans as additional existing loans and hereby assumes all obligations and liabilities under such loans, subject to the terms of this subsection (c). Contributor has notified or within three days after the date hereof will notify WestStar in writing of this Agreement and of the nature of the present transaction and of the assumption of the Loans. Contributor will promptly open an interest-bearing escrow account as directed by WestStar with funds equal to the outstanding balance of the Loans, which escrow funds will be disbursed to Contributor in accordance with guidance expounded by the SBA. The escrowed funds and the benefits of the Loans being forgiven (in whole are in part) are not being transferred by Contributor, and shall continue to be owned by Contributor. Notwithstanding the foregoing, if as a condition to the right to receive forgiveness of the Loans, the escrow described above must be opened and funded before the Loans are assigned by Contributor, then the parties intend that the assignment in this paragraph will not be a present assignment, but rather will be effective immediately following the opening and funding of such escrow.

9

(d)Operating Partnership shall cooperate with Contributor in (i) amending the application for the first PPP Loan to maximize forgiveness and (ii) making the application to the SBA for forgiveness on the second PPP loan, and each agrees to use best efforts to obtain the maximum legal forgiveness as soon as practicable.

2.7.4Before the Closing, the Contributor shall furnish to the Operating Partnership a true and complete list of all existing creditors. This list shall set forth the names and addresses of all of the Contributor’s creditors and shall contain information regarding the nature and extent of the claim or claims of each creditor. The Contributor shall afford to the Operating Partnership access to the Contributor’s books and records related to each claim and shall furnish the Operating Partnership with such financial and operating data and other information regarding each such claim as the Operating Partnership may from time to time reasonably request.

2.7.5On or before Closing, with the exception of Permitted Liens, the Contributor will pay all amounts owed to any creditors or persons and entities that otherwise possess any type of right or interest in the Contributed Assets arising from the ownership or operation of the Property by the Contributor prior to the Closing. If the creditor holds or obtains a lien on the Contributed Assets, then the following shall apply:

(a)The Contributor, on written notice given by the Operating Partnership to the Contributor, shall pay such monies arising from the ownership or operation of the Property by the Contributor prior to the Closing required to obtain the release of any lien on the property.

(b)In the event of default by the Contributor as to the foregoing, the Operating Partnership, on written notice given by the Operating Partnership to the Contributor, shall have the right to pay for the same and/or obtain the release of lien, if any, and receive a credit toward the Total Consideration at Closing.

2.8Consideration and Exchange of Series T Limited Units. Subject to this Section, the Operating Partnership shall, in exchange for the Property, the Contributed Assets, the Assumed Liabilities and the Assumed Agreements, transfer to the Contributor consideration equal to the Contributor’s “Total Consideration” as indicated on Exhibit D. The transfer of the Series T Limited Units to the Contributor shall be evidenced by an amendment (the “Amendment”) to the OP Agreement as determined by the Operating Partnership. The parties shall take such additional actions and execute such additional documentation as may be required by such party’s operating agreement and the OP Agreement in order to effect the transactions contemplated hereby.

2.9Treatment as Contribution. The transfer, assignment and exchange effectuated pursuant to this Agreement shall constitute a “capital contribution” to the Operating Partnership and is intended to be governed by Section 721(a) of the Code, and the Contributor hereby consents to such treatment.

2.10Allocation of Total Consideration. The Total Consideration shall be allocated as set forth in Schedule 2.10. The Operating Partnership and the Contributor agree to (i) be bound by the allocation, (ii) act in accordance with the allocation in the preparation of financial statements and filing of all tax returns and in the course of any tax audit, tax review or tax litigation relating

10

thereto and (iii) take no position and cause their affiliates that they control to take no position inconsistent with the allocation for income tax purposes.

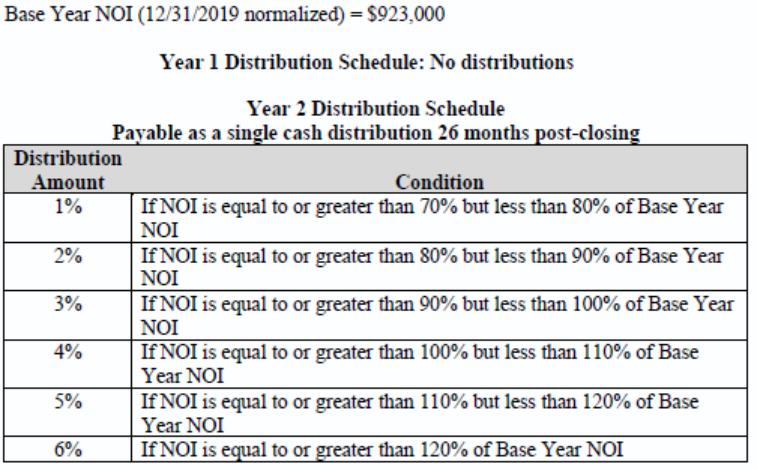

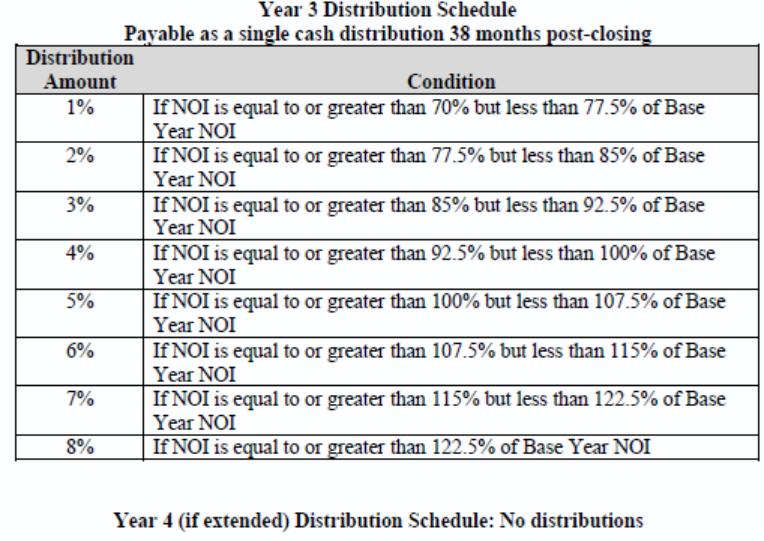

2.11Terms of Series T Limited Units. The Series T Limited Units shall be entitled to cash distributions according to Exhibit D and may be converted to Common Limited Units pursuant to the OP Agreement and on terms set forth therein and in Exhibit D. The Contributor acknowledges that the Series T Limited Units will be converted into Common Limited Units pursuant to the terms in the OP Agreement beginning 36 months, or in the event the Operating Partnership is then in the process of transacting a sale of the Operating Partnership’s assets or another significant capital event necessitating a conversion is then in process, up to 48 months, after issuance to the Contributor and will be valued as set forth on Exhibit D. The Contributor acknowledges that the assigned value upon conversion may be higher or lower than the initial valuation depending on the information imputed into the formula set forth on Exhibit D.

2.12Term of Agreement. If the Closing does not occur by the Closing Date, this Agreement shall, except as specifically set forth herein, be deemed terminated and shall be of no further force and effect and neither the Operating Partnership nor the Contributor shall have any further obligations hereunder.

2.13Management Company. The Operating Partnership and the Contributor shall jointly select a management company to manage the Property. Neither the Operating Partnership nor the selected management company shall be liable to the Contributor for, and the Contributor hereby waives, any claims, damages or losses incurred under any theory of liability as a result of, arising out of, in connection with, or related to the management company’s management and operation of the Property or the Property’s performance after the Closing Date.

2.14Risk of Loss. The risk of loss relating to the Contributor’s Property prior to Closing shall be borne by the Contributor. If, prior to the Closing, the Property is partially or totally destroyed or damaged by fire or other casualty, or is taken by eminent domain or through condemnation proceedings, then the Operating Partnership may, at its option (so long as the cost of repairing such destruction or damage is in the reasonable judgment of the Operating Partnership in excess of $15,000 (the “Maximum Per Property Total Consideration Adjustment”), determine not to acquire the Property if it has been partially or totally destroyed, damaged or taken (with an adjustment to the Contributor’s Total Consideration as indicated on Exhibit D). After the occurrence of any such casualty or condemnation affecting the Property, the Operating Partnership may also, at its option within 30 days after the Operating Partnership is notified of any such casualty or condemnation, elect to (a) acquire the Property and (b) direct the Contributor to pay or cause to be paid to the Operating Partnership upon or following the Closing any sums collected by the Contributor, if any, under any policies of insurance, if any, or award proceeds relating to such casualty or condemnation (to the extent that the Contributor has not applied such sums or proceeds to the restoration of the Property or otherwise to address the impacts of such casualty or condemnation) and otherwise assign to the Operating Partnership upon or following the Closing all rights of the Contributor to collect such sums as may then be uncollected, and/or to the extent available to the Contributor, adjust or settle any insurance claim or condemnation proceeding, which the Contributor has not adjusted or settled prior to the Closing. Under such circumstances, the Contributor’s Total Consideration shall be reduced by the amount of (i) any deductibles under the applicable insurance policies or award with respect to the Property contributed at Closing and (ii) any uninsured casualty or loss with respect to the Property contributed at Closing. Insurance

11

on the transferred Property shall be cancelled as of 12:01 a.m. local El Paso, Texas time after the Closing Date, and thereafter the Operating Partnership shall be solely responsible for all risk of loss relating to the Property. In the event that this Agreement is terminated by the Operating Partnership as provided above, the Earnest Money shall be returned in full to the Operating Partnership and neither party shall have any further duties or obligations to the other, except for any obligations expressly surviving the termination of this Agreement.

2.15Escrow. Escrow shall remain open with First American Title Company (the “Closing Agent”) and upon execution of this Agreement by both parties the escrow account shall inure to the benefit of this Agreement. The Escrow Agent shall ratify the terms of this Section 2.15 contemporaneous with execution of this Agreement. The current escrow account consists of $100,000 as an earnest money deposit (the “Earnest Money”) which shall be applied to the cash payable by the Operating Partnership at the Closing. A copy of this fully-executed Agreement will be delivered to the Closing Agent by the Operating Partnership and will serve as escrow instructions together with any additional instructions required by the Contributor and/or the Operating Partnership or their respective counsels. The Contributor and the Operating Partnership agree to cooperate with the Closing Agent and sign any additional instructions reasonably required by the Closing Agent to close escrow. If there is any conflict between any other instructions and this Agreement, this Agreement shall control. Notwithstanding anything else herein, in all events, the sum of $1,000.00 (the “Independent Consideration”), which sum has been bargained for and agreed to as consideration for Contributor’s execution and delivery of this Agreement, will be payable to the Contributor out of the Earnest Money, even if this Agreement is terminated under its express provisions. The Independent Consideration is independent of all other consideration provided in this Agreement, and is nonrefundable in all events. The Operating Partnership and Contributor stipulate that the Independent Consideration is sufficient consideration to support this Agreement notwithstanding the Operating Partnership’s rights to terminate this Agreement as set forth herein.

2.16Title. Operating Partnership received the title commitment issued by First American Title Insurance Company (the “Title Company”) effective as of the date of recording with a policy number of NCS-1046641-CO, which reflects the status of title acceptable to the Operating Partnership.

2.17Due Diligence Period.

2.17.1The Operating Partnership. As of May 7, 2021 the Operating Partnership satisfactorily completed its Due Diligence Review concluding the Due Diligence Review Period.

2.17.2The Contributor. As of the Effective Date, the Contributor has reviewed and approved of the Confidential Private Placement Memorandum and all related documents (collectively, the “Offering Documents”) of the Operating Partnership.

2.17.3Representation and Warranties of Due Diligence. The Operating Partnership’s conclusion regarding the Due Diligence Review is based on a full business, financial, accounting, (the “Due Diligence Review”), which shall remain true and accurate until Closing, including:

12

(a)Continuous right to monitor the sales and operations of the Property from and after the Effective Date.

(b)The Contributor will take all reasonable steps necessary to cooperate with the Operating Partnership in undertaking the Due Diligence Review.

(c)Except as set forth in this Agreement or as agreed by the Contributor and Operating Partnership, the Due Diligence Review by the Operating Partnership or its representatives will not affect the representations and warranties of the Contributor or the Operating Partnership’s reliance on them.

(d)Until Closing, the primary Contributor point of contact will be Michelle Kaip (the “Contributor Point of Contact”), with copies of any written correspondence being sent via email to Ken Okamoto and Sean Hawkins. Furthermore, during the Due Diligence Period, the Operating Partnership will be given direct access, and ability to communicate to the General Manager, Assistant General Manager, Head Housekeeper, Chief Engineer, and Director of Sales (collectively, “Key Personnel”).

(e)The Contributor’s obligation to provide information to the Operating Partnership will continue through the Closing even if the Due Diligence Period has ended.

3.Closing.

3.1Conditions Precedent- Operating Partnership. The obligations of the Operating Partnership to effect the transactions contemplated hereby shall be subject to the following conditions precedent:

3.1.1The representations and warranties of the Contributor contained in this Agreement shall have been true and correct in all respects on the date such representations and warranties were made and on the Closing Date as if made at and as of such date;

3.1.2The obligations of the Contributor contained in this Agreement to be performed by Contributor shall have been duly performed on or before the Closing Date, including without limitation, the Contributor’s obligations to deliver the Closing deliveries set forth in Section 3.4, and the Contributor shall not have breached any of its covenants contained herein in any material respect;

3.1.3Concurrently with the Closing, the Contributor shall have executed and delivered to the Operating Partnership the documents required to be delivered pursuant to Section 3.4;

3.1.4The Contributor shall have obtained and delivered to the Operating Partnership any consents or approvals of any Governmental Entity or third parties (including, without limitation, any lenders and lessors) required to consummate the transactions contemplated hereby;

3.1.5No order, statute, rule, regulation, executive order, injunction, stay, decree or restraining order shall have been enacted, entered, promulgated or enforced by any court of

13

competent jurisdiction or Governmental Entity that prohibits the consummation of the transactions contemplated hereby, and no litigation or governmental proceeding seeking such an order shall be pending, threatened or reasonably foreseeable;

3.1.6The Title Company shall be irrevocably committed to issue an Owner’s Title Insurance Policy (on standard T-1 form), with such endorsements thereto as the Operating Partnership may reasonably request (including, without limitation, non-imputation endorsements and deletion of creditors’ rights to the extent permitted under Texas law), all at the sole cost and expense of the Operating Partnership, with coverage for the Property acceptable to the Operating Partnership in its sole and absolute discretion, and levels of reinsurance for the Property as reasonably acceptable to the Operating Partnership, insuring fee simple to all real property and improvements comprising the Property in the name of the Operating Partnership (or a subsidiary thereof, as the Operating Partnership may designate), subject only to the Permitted Liens (the “Title Policy”).

3.1.7There shall not have occurred between the Effective Date and the Closing Date any material adverse change in any of the assets, business, financial condition, results or prospects of operation of the Property, taken as a whole.

3.1.8If necessary, the Contributor shall make all reasonable and good faith efforts to cooperate with and provide assistance to the Operating Partnership and its third party auditor in complying with the Company’s reporting requirements to the Securities and Exchange Commission, including without limitation, any Rule 3-05 or Rule 3-14 of Regulation S-X Audit as described on Schedule 3.1.8.

3.1.9The Operating Partnership shall have received environmental reports or assessments on the Property and operations requested by the Operating Partnership which show the Property in an environmental condition reasonably satisfactory to the Operating Partnership, in its sole discretion. If the Operating Partnership does not request the foregoing, this condition will be waived without further action by the Parties.

3.1.10If any of the Property or Contributed Assets are materially damaged at any time before the Closing, and the damages cannot reasonably be repaired on payment of the sums available by insurance settlement or from any sums to be paid by the Operating Partnership to the Contributor at the Closing, the Operating Partnership, at its option and notwithstanding anything herein to the contrary, shall have the right to terminate this Agreement and, on giving notice of such election to the Contributor, the Operating Partnership will immediately receive a refund of the Earnest Money in full termination of this Agreement. This paragraph will not apply if the damages are caused by the Operating Partnership’s negligence.

3.1.11This Agreement is conditioned on the Operating Partnership assuming or replacing the Contributor’s current mortgage loan. If the Operating Partnership is unable to assume or replace such loan under terms acceptable to the Operating Partnership, in the Operating Partnership’s sole discretion, at any point prior to the Closing Date, the Operating Partnership will give notice of such inability to the Contributor and notwithstanding anything herein to the contrary, the Operating Partnership shall have the right to terminate this Agreement and, on giving notice of such election to the Contributor, the Operating Partnership will immediately receive a refund of the Earnest Money in full termination of the Agreement. Notwithstanding anything to the contrary

14

set forth herein, loan terms substantially in compliance with the terms thereof set forth in the LOI shall be deemed “terms acceptable to the Operating Partnership” as utilized in this paragraph.

3.1.12The Operating Partnership shall have assumed the existing franchise agreement from the Contributor or have entered into a new franchise agreement under term of years acceptable to the Operating Partnership, in the Operating Partnership’s sole and absolute discretion (the “Franchise Agreement”).

Any or all of the foregoing conditions may be waived by the Operating Partnership in its sole and absolute discretion.

3.2Conditions Precedent - Contributor. The obligations of the Operating Partnership to effect the transactions contemplated hereby shall be subject to the following conditions precedent:

3.2.1The Operating Partnership shall have agreed to assume the Existing Loan by Lender pursuant to the terms set forth in the LOI.

3.2.2The Operating Partnership shall have furnished to Contributor such documentation to show adequate capitalization and intent to remain adequately capitalized for the party designated by the Operating Partnership to be the guarantor for the Existing Loan. There shall not have occurred between the Effective Date and the Closing Date any material adverse change in any of the assets, business, financial condition, results or prospects of operation of the Operating Partnership.

3.2.3The representations and warranties of the Operating Partnership contained in this Agreement shall have been true and correct in all respects on the date such representations and warranties were made and on the Closing Date as if made at and as of such date;

3.2.4The obligations of the Operating Partnership contained in this Agreement to be performed by Operating Partnership shall have been duly performed on or before the Closing Date, including without limitation, the Operating Partnership’s obligations to deliver the Closing deliveries set forth in Section 3.4, and the Operating Partnership shall not have breached any of its covenants contained herein in any material respect;

3.2.5Concurrently with the Closing, the Operating Partnership shall have executed and delivered to the Contributor the documents and other deliveries required to be delivered pursuant to Section 3.4;

3.2.6The Operating Partnership shall have obtained and delivered to the Contributor any consents or approvals of any Governmental Entity or third parties (including, without limitation, any lenders and lessors) required to consummate the transactions contemplated hereby;

3.2.7No order, statute, rule, regulation, executive order, injunction, stay, decree or restraining order shall have been enacted, entered, promulgated or enforced by any court of competent jurisdiction or Governmental Entity that prohibits the consummation of the transactions contemplated hereby, and no litigation or governmental proceeding seeking such an order shall be pending, threatened or reasonably foreseeable;

15

3.3Time and Place. The closing date on the Operating Partnership’s acquisition of the Property shall be upon the 30th day following the expiration of the Due Diligence Period (the “Closing” or the “Closing Date” as the context may require). However, the Closing Date may be earlier upon the mutual agreement of the parties.

3.4Closing Deliveries. At the Closing, the parties shall make, execute, acknowledge and deliver, or cause to be made, executed, acknowledged and delivered, the legal documents and other items (collectively the “Closing Documents”) necessary to carry out the intention of this Agreement and the other transactions contemplated to take place in connection therewith, which Closing Documents and other items shall include, without limitation, the following:

3.4.1The Contribution and Assumption Agreement in the form attached hereto as Exhibit B;

3.4.2A duly executed and notarized special warranty deed (the “Deed”), in the form provided for under the law of the State of Texas and otherwise in conformity with the custom in the jurisdiction where the Property is located and in form and substance satisfactory to the Operating Partnership, conveying good, indefeasible and marketable fee simple title to the Property, subject only to the Permitted Liens;

3.4.3The OP Agreement;

3.4.4The Amendment evidencing the transfer of Series T Limited Units to the Contributor;

3.4.5The Contributor shall deliver all books and records, title insurance policies, leases, lease files, contracts, stock certificates, original promissory notes, and other indicia of ownership or interest with respect to the Property which are in the Contributor’s possession or which can be obtained through the Contributor’s reasonable efforts along with appropriate evidence of the Contributor’s assignment thereof;

3.4.6An affidavit from the Contributor, stating under penalty of perjury, the Contributor’s United States Taxpayer Identification Number and that the Contributor is not a foreign person pursuant to Section 1445(b)(2) of the Code and a comparable affidavit satisfying any applicable federal and state law and Section 4.2.7 and any other withholding requirements;

3.4.7The Contributor shall deliver a beneficiary’s statement or other evidence satisfactory to the Operating Partnership in its sole discretion confirming the outstanding principal balance and term of the Existing Loan to be assumed by the Operating Partnership;

3.4.8The Contributor shall deliver any other documents reasonably requested by the Operating Partnership or reasonably necessary or desirable to assign, transfer, convey, contribute and deliver the Contributor’s Property (subject to the Permitted Liens) and effectuate the transactions contemplated hereby, including, without limitation, and only to the extent applicable, quitclaim deeds and/or grant deeds, assignments of ground leases, air space leases and space leases, bills of sale, assignments, and all state and local transfer tax returns and any filings with any applicable governmental jurisdiction in which the Operating Partnership is required to file its partnership documentation or the recording of the Contribution and Assumption Agreement or Deed or other Property transfer documents as required;

16

3.4.9If requested by the Operating Partnership, a certified copy of all appropriate corporate resolutions or partnership actions authorizing the execution, delivery and performance by the Contributor of this Agreement, any related documents and the documents listed in this Section 3.3;

3.4.10The Contributor shall deliver to the Operating Partnership possession of the Property;

3.4.11The Operating Partnership, on the one hand, and the Contributor, on the other hand, shall provide to the other a certification regarding the accuracy of each of their respective representations and warranties herein and in this Agreement as of such date. The Contributor shall provide a certification that it has performed the respective covenants required to be performed by them prior to Closing;

3.4.12The Contributor shall deliver an affidavit as may be required by the Title Company to delete from the Title Policy the standard exceptions and to issue any title endorsements as may be required by the Operating Partnership;

3.4.13Closing Statements detailing all prorations and adjustments;

3.4.14A duly executed Non-Competition and Non-Solicitation Agreement;

3.4.15The Contributor shall deliver UCC searches in form and content satisfactory to the Operating Partnership;

3.4.16The Contributor shall deliver evidence that any existing Leases shall be terminated as of the Closing Date;

3.4.17The Contributor shall deliver an Assignment of Warranties, in the form as attached hereto and incorporated herein as Exhibit C;

3.4.18The Operating Partnership shall deliver duly executed loan documents, a comfort letter from IHG , Lender’s Policy of Title Insurance and endorsements thereto and a legal opinion, in each case in form and substance acceptable to Contributor’s legal counsel;

3.4.19The Operating Partnership shall have delivered to Contributor the funds and any other documentation required under the terms of this Agreement;

3.5Closing Costs. Subject to Section 2.14, the Operating Partnership shall be responsible for (i) reassessments, (ii) escrow charges, (iii) the cost of the Owner’s and Lender’s Title Policy and any endorsements to such Title Policies which the Operating Partnership shall require, respectively, (iv) all costs associated with any new Property Reports obtained by the Operating Partnership, (v) all costs relating to the issuance of the Franchise Agreement, and (vi) the legal fees, costs and expenses and any charges attributable to new loan documents, recording the warranty deed and other closing documents and (vii) any documentary or other transfer taxes. The Contributor shall be responsible for (i) the cost of scheduling, ordering and providing the Operating Partnership an approved change of ownership PIP (which shall not include the funding thereof) and (ii) any withholding taxes required to be paid and/or withheld in respect of the

17

Contributor at Closing as a result of the Contributor’s tax status. Except as set forth above, each party will pay its own attorneys’ fees for this transaction.

4.Representations and Warranties and Indemnities.

4.1Representations and Warranties of the Operating Partnership. The Operating Partnership hereby represents and warrants to the Contributor that:

4.1.1Organization; Authority. The Operating Partnership has been duly formed and is validly existing under the laws of the jurisdiction of its formation and is and at the Closing shall be treated as a “partnership” for federal income tax purposes, and has all requisite power and authority to enter this Agreement, each agreement contemplated hereby and to carry out the transactions contemplated hereby and thereby, and own, lease or operate its property and to carry on its business as described in the Memorandum and, to the extent required under applicable law, is qualified to do business and is in good standing in each jurisdiction in which the nature of its business or the character of its property make such qualification necessary.

4.1.2Due Authorization. The execution, delivery and performance of this Agreement by the Operating Partnership has been duly and validly authorized by all necessary action of the Operating Partnership. This Agreement and each agreement, document and instrument executed and delivered by or on behalf of the Operating Partnership pursuant to this Agreement constitutes, or when executed and delivered will constitute, the legal, valid and binding obligation of the Operating Partnership, each enforceable against the Operating Partnership in accordance with its terms, as such enforceability may be limited by bankruptcy or the application of equitable principles.

4.1.3Consents and Approvals. Assuming the accuracy of the representations and warranties of the Contributor and the accuracy of the representations and warranties contained in the Subscription Agreement and this Agreement, no consent, waiver, approval or authorization of any third party or governmental authority or agency is required to be obtained by the Operating Partnership in connection with the execution, delivery and performance of this Agreement and the transactions contemplated hereby, except any of the foregoing that shall have been satisfied prior to the Closing Date and except for those consents, waivers and approvals or authorizations, the failure of which to obtain would not have a Material Adverse Effect on the Operating Partnership.

4.1.4Partnership Matters. The Series T Limited Units which will be part of the Total Consideration, when issued and delivered in accordance with the terms of this Agreement for the consideration described herein, will be duly and validly issued, and free of any Liens other than any Liens arising through the Contributor.

4.1.5Non-Contravention. Assuming the accuracy of the representations and warranties of the Contributor made hereunder, none of the execution, delivery or performance of this Agreement, any agreement contemplated hereby and the consummation of the contribution transactions contemplated hereby and thereby will (a) result in a default (or an event that, with notice or lapse of time or both would become a default) or give to any third party any right of termination, cancellation, amendment or acceleration under, or result in any loss of any material benefit, pursuant to any material agreement, document or instrument to which the Operating Partnership or any of its properties or assets may be bound, or (b) violate or conflict with any

18

judgment, order, decree or law applicable to the Operating Partnership or any of its properties or assets; provided in the case of (a) and (b), unless any such default, violation or conflict would not have a Material Adverse Effect on the Operating Partnership.

4.1.6Offering Documents. The information and financials in the Operating Partnership’s Offering Documents referred to in Section 2.17.2 (1) are true, correct and complete as of the applicable dates specified therein, (2) do not omit any material information necessary to make them not misleading in any material respect, (3) fully and accurately present the financial condition of the Operating Partnership as of such dates and (4) no event has occurred or circumstance has changed that would make the Offering Documents misleading in any material respect or have a material, adverse effect on the Operating Partnership’s financial condition, results of operations or assets.

4.1.7Full Disclosure. This Agreement and any other information furnished to the Contributor in connection with the transactions contemplated by this Agreement, including, without limitation, the information contained in all filings with the SEC or other governmental agencies, neither contains any untrue statement of material fact nor omits to state any material fact necessary to make the statements contained therein, in light of the circumstances under which they were made, not misleading.

4.1.8No Brokers. Neither the Operating Partnership nor any of its or its affiliates’ respective officers, directors or employees, to the extent applicable, has employed or made any agreement with any broker, finder or similar agent or any person or firm which will result in the obligation of the Contributor, Operating Partnership or any of their affiliates to pay any finder’s fee, brokerage fees or commissions or similar payment in connection with the transactions contemplated by the Agreement. The Operating Partnership shall indemnify, defend and hold the Contributor harmless from and against any broker’s commission or finder’s fee and other claims asserted by any person claiming a broker’s commission or finder’s fee concerning this Agreement or the purchase and sale of the Property. The terms and conditions of this Section 4.1.8 shall survive Closing.

4.1.9Litigation or Insolvency Proceedings. There is no Action, litigation, claim or other proceeding, either judicial or administrative (including, without limitation, any governmental action or proceeding), pending or, to the Operating Partnership’s Knowledge, threatened or reasonably anticipated in the last 12 months, against the Operating Partnership, or its assets or that would reasonably be expected to adversely affect the Operating Partnership’s ability to consummate the transactions contemplated hereby. The Operating Partnership is not bound by any outstanding order, writ, injunction or decree of any court, Governmental Entity or arbitration against or affecting all or any portion of its assets, which in any such case would impair the Operating Partnership’s ability to enter into and perform all of its obligations under the Agreement or would have a Material Adverse Effect on the Operating Partnership. The Operating Partnership is not involved in any proceeding by or against the Operating Partnership in any court under the Bankruptcy Code or any other insolvency or debtor’s relief act, whether state or federal, or for the appointment of a trustee, receiver, liquidator, assignee, or other similar official of the Operating Partnership or the Operating Partnership’s assets.

4.1.10Compliance With Laws. To the Operating Partnership’s Knowledge, the Operating Partnership has been operated and on the Effective Date are, and as of the Closing Date

19

will be, in compliance in all material respects with all applicable laws, ordinances, rules, regulations, codes, orders and statutes, whether federal, state or local, foreign. The Operating Partnership presently possesses and will continue to possess at the Closing Date all governmental licenses, permits, certificates of inspection, other authorizations, filings, and registrations which are necessary for a privately held real estate investment trust and or umbrella partnership real estate investment trust. The Operating Partnership has not received written notice of any violation of any laws, ordinances or regulations from any governmental or regulatory authority with respect to itself or any of its assets that has not been corrected.

4.1.10AS-IS CONDITION OF THE CONTRIBUTED ASSETS. THE OPERATING PARTNERSHP ACKNOWLEDGES TO CONTRIBUTOR AND THE OPERATING PARTNERSHP UNDERSTANDS THAT EXCEPT TO THE EXTENT OTHERWISE EXPRESSLY STATED IN THIS AGREEMENT, THE CONTRIBUTED ASSETS ARE TO BE CONVEYED AS IS, AND WITH ALL FAULTS, AND WITHOUT ANY REPRESENTATIONS OR WARRANTIES WHATSOEVER, EXPRESS OR IMPLIED, OR WRITTEN OR ORAL, EXCEPT THE WARRANTIES AND REPRESNTATIONS MADE BY CONTRIBUTOR IN THIS AGREEMENT AND THE WARRANTY OF TITLE THAT WILL BE SET FORTH IN THE CONVEYANCE INSTRUMENTS.

4.2Representations and Warranties of the Contributor. The Contributor represents and warrants to the Operating Partnership, which representations and warranties are true and correct as of the Effective Date and will be true and correct as of the date of Closing:

4.2.1Organization; Authority; Qualification. The Contributor is duly formed, validly existing and in good standing under the laws of the jurisdiction of its formation. The Contributor has all requisite power and authority to enter into this Agreement, each agreement contemplated hereby and to carry out the transactions contemplated hereby and thereby, and to own, lease or operate its property and to carry on its business as presently conducted and, to the extent required under applicable law, is qualified to do business and is in good standing in each jurisdiction in which the nature of its business or the character of its property make such qualification necessary.

4.2.2Due Authorization. The execution, delivery and performance of the Agreement by the Contributor has been duly and validly authorized by all necessary action of the Contributor. The Agreement and each agreement, document and instrument executed and delivered by or on behalf of the Contributor pursuant to the Agreement constitutes, or when executed and delivered will constitute, the legal, valid and binding obligation of the Contributor, each enforceable against the Contributor in accordance with its terms, as such enforceability may be limited by bankruptcy or the application of equitable principles.

4.2.3Consents and Approvals. Except as shall have been satisfied prior to the Closing Date, no consent, waiver, approval or authorization of any third party or governmental authority or agency is required to be obtained by the Contributor in connection with the execution, delivery and performance of the Agreement and the transactions contemplated hereby, except for those consents, waivers, approvals or authorizations, the failure of which to obtain would not have a material adverse effect on the assets, business, financial condition and results of operation of the Property, taken as a whole (a “Material Adverse Effect”).

20

4.2.4Full Disclosure. This Agreement and any other information furnished to the Operating Partnership in connection with the transactions contemplated by this Agreement neither contains any untrue statement of material fact nor omits to state any material fact necessary to make the statements contained therein, in light of the circumstances under which they were made, not misleading.

4.2.5Ownership of the Property; Contributed Assets.

(a)The Contributor is the sole owner of the Property, beneficially and of record, free and clear of any Liens of any nature (other than the Permitted Liens) and has full power and authority to convey the Property, free and clear of any Liens (other than the Permitted Liens), and, upon delivery of consideration for the Property as herein provided, the Operating Partnership will acquire good and marketable title thereto, free and clear of any Liens (other than the Permitted Liens and any liens arising through the Operating Partnership).

(b)The Contributor is the sole owner of the Contributed Assets, beneficially and of record, free and clear of any Liens of any nature (other than Permitted Liens) and has full power and authority to convey the Contributed Assets, free and clear of any Liens (other than the Permitted Liens), and, upon delivery of consideration for such Contributed Assets as provided herein, the Operating Partnership will acquire good and marketable title thereto, free and clear of any Liens (other than Permitted Liens and any liens arising through the Operating Partnership). The Property, Contributed Assets and Assumed Agreements constitute all assets, rights, interests, and property interests owned or held by the Contributor related to the Property.

(c)The Contributor has not been served with any notice of intent to claim a mechanic’s Lien on the Property and states that all parties who have furnished labor or materials on or at the Property within the last 90 days whether for repair, improvement, or otherwise have been fully compensated. Further, the Contributor has not contracted for nor is liable for obligations related to repairs, services, and other items that will not be paid in full at Closing, however, the Contributor will provide the Title Company with such documents requested by Title Company for the issuance of without the standard exception for liens.

4.2.6No Violation. None of the execution, delivery or performance of the Agreement, any agreement contemplated thereby and the transactions contemplated hereby and thereby does or will, with or without the giving of notice, lapse of time, or both, violate, conflict with, result in a breach of, or constitute a default under or give to others any right of termination, acceleration, cancellation or other right adverse to the Contributor or the Operating Partnership of (a) the organizational documents, including the operating agreement, if any, of the Contributor, (b) any agreement, document or instrument to which the Contributor is a party or by which the Contributor, Property, or the Contributed Assets are bound or (c) any term or provision of any judgment, order, writ, injunction, or decree, or require any approval, consent or waiver of, or make any filing with, any person or governmental or regulatory authority or foreign, federal, state, local or other law binding on the Contributor or by which the Contributor, or any of its assets or properties (including the Contributed Assets) are bound or subject; provided in the case of (b) and (c) above, unless any such violation, conflict, breach or default would not have a Material Adverse Effect.

21

4.2.7Non-Foreign Status. The Contributor is a United States person (as defined in Section 7701(a)(30) of the Code) and is not a “foreign person” (within the meaning of Section 1445 of the Code), and is, therefore, not subject to the provisions of the Code relating to the withholding of sales proceeds to foreign persons, and is not subject to any state withholding requirements. The Contributor will provide affidavits at the Closing to this effect as provided for in this Section 4.2.7.

4.2.8Withholding. The Contributor shall execute at Closing such certificates or affidavits reasonably necessary to document the inapplicability of any United States federal or state withholding provisions, including without limitation those referred to in Section 4.2.7. If the Contributor fails to provide such certificates or affidavits, the Operating Partnership may withhold a portion of any payments otherwise to be made to the Contributor as required by the Code or applicable state law.

4.2.9Investment Purposes. The Contributor acknowledges its understanding that the offering and issuance of the Series T Limited Units to be acquired pursuant to the Agreement are intended to be exempt from registration under the Securities Act of 1933, as amended and the rules and regulations in effect thereunder (the “Act”) and that the Operating Partnership’s reliance on such exemption is predicated in part on the accuracy and completeness of the representations and warranties of the Contributor contained herein. In furtherance thereof, the Contributor represents and warrants to the Operating Partnership as follows:

(a)Investment. The Contributor is acquiring the Series T Limited Units solely for its own account for the purpose of investment and not as a nominee or agent for any other person and not with a view to, or for offer or sale in connection with, any distribution of any thereof. The Contributor agrees and acknowledges that it will not, directly or indirectly, offer, transfer, sell, assign, pledge, hypothecate or otherwise dispose of (hereinafter, “Transfer”) any of the Series T Limited Units, except as set forth in the OP Agreement, unless (i) the Transfer is pursuant to an effective registration statement under the Act and qualification or other compliance under applicable blue sky or state securities laws, or (ii) counsel for the Contributor (which counsel shall be reasonably acceptable to the Operating Partnership) shall have furnished the Operating Partnership with an opinion, reasonably satisfactory in form and substance to the Operating Partnership, to the effect that no such registration is required because of the availability of an exemption from registration under the Act and qualification or other compliance under applicable blue sky or state securities laws, and (iii) the Transfer is permitted pursuant to the OP Agreement. The term “Transfer” shall not include any redemption of the Series T Limited Units or exchange of the Series T Limited Units for REIT Shares pursuant to Section 9.4 of the OP Agreement. Notwithstanding the foregoing, no Transfer shall be made unless it is permitted under the OP Agreement.

(b)Knowledge. The Contributor is knowledgeable, sophisticated and experienced in business and financial matters and fully understands the limitations on transfer imposed by the Federal securities laws and as described in the Agreement. The Contributor is able to bear the economic risk of holding the Series T Limited Units for an indefinite period and is able to afford the complete loss of its investment in the Series T Limited Units; the Contributor has received and reviewed all information and documents about or pertaining to the Company, the Operating Partnership, the business and prospects of the Operating Partnership and the issuance of the Series T Limited Units as the Contributor deems necessary or desirable, has had cash flow and

22

operations data for the Property made available by the Operating Partnership upon request and has been given the opportunity to obtain any additional information or documents and to ask questions and receive answers about such information and documents, the Operating Partnership, the Property, the business and prospects of the Operating Partnership and the Series T Limited Units which the Contributor deems necessary or desirable to evaluate the merits and risks related to its investment in the Series T Limited Units and to conduct its own independent valuation of the Property.

(c)Holding Period. The Contributor acknowledges that it has been advised that (i) the Series T Limited Units must be held for 12 months and may have to be held indefinitely thereafter, and the Contributor must continue to bear the economic risk of the investment in the Series T Limited Units (and any Common Stock that might be exchanged therefor), unless they are subsequently registered under the Act or an exemption from such registration is available (it being understood that the Operating Partnership has no intention of so registering the Series T Limited Units) and (ii) a notation shall be made in the appropriate records of the Operating Partnership indicating that the Series T Limited Units are subject to restrictions on transfer.

(d)Accredited Investor. The Contributor is an “accredited investor” (as such term is defined in Rule 501(a) of Regulation D under the Act). The Contributor has previously provided the Operating Partnership with a duly executed Accredited Investor Questionnaire. No event or circumstance has occurred since delivery of such questionnaire to make the statements contained therein false or misleading.

4.2.10No Brokers. Neither the Contributor nor any of the Contributor’s respective officers, directors or employees, to the extent applicable, has employed or made any agreement with any broker, finder or similar agent or any person or firm which will result in the obligation of the Operating Partnership or any of its affiliates to pay any finder’s fee, brokerage fees or commissions or similar payment in connection with the transactions contemplated by the Agreement. The Contributor shall indemnify, defend and hold the Operating Partnership harmless from and against any other broker’s commission or finder’s fee and other claims asserted by any person claiming a broker’s commission or finder’s fee concerning this Agreement or the purchase and sale of the Property. The terms and conditions of this Section 4.2.10 shall survive Closing.

4.2.11Solvency. The Contributor will be solvent immediately following the transfer of the Property and the Contributed Assets to the Operating Partnership.

4.2.12Taxes. No tax lien or other charge exists or will exist upon consummation of the transactions contemplated hereby with respect to the Property, except such tax liens for which the tax is not delinquent and has been properly reserved for payment by the Contributor. Contributor has instructed the Title Company to send to the Operating Partnership true and correct copies of the real property tax bills for the Property for the current tax year. For federal income tax purposes, the Contributor is, and at all times during its existence has been either (i) a partnership or limited liability company taxable as a partnership (rather than an association or a publicly traded partnership taxable as a corporation) or (ii) a disregarded entity. The Contributor has timely and properly filed all tax returns required to be filed by it and has timely paid all Other Taxes required to be paid by it. The Contributor has not requested any extension of time or agreed to any extension of the applicable statute of limitations within which to file any pending Tax Return

23

relating to Other Taxes. None of the tax returns relating to Other Taxes filed by the Contributor is the subject of a pending or ongoing audit, and no federal, state, local or foreign taxing authority has asserted any tax deficiency or other assessment against the Property.