|

|

|

|

Page

|

|

PART I

|

|

|

|

|

Item 1.

|

|

6

|

|

|

Item 1A.

|

|

15

|

|

|

Item 1B.

|

|

30

|

|

|

Item 2.

|

|

30

|

|

|

Item 3.

|

|

31

|

|

|

Item 4.

|

|

31

|

| |

|

|

|

|

PART II

|

|

|

|

|

Item 5.

|

|

32

|

|

|

Item 6.

|

|

32

|

|

|

Item 7.

|

|

32

|

|

|

Item 7A.

|

|

48

|

|

|

Item 8.

|

|

48

|

|

|

Item 9.

|

|

48

|

|

|

Item 9A.

|

|

48

|

|

|

Item 9B.

|

|

49

|

|

|

|

|

|

|

PART III

|

|

|

|

|

Item 10.

|

|

50

|

|

|

Item 11.

|

|

55

|

|

|

Item 12.

|

|

62

|

|

|

Item 13.

|

|

63

|

|

|

Item 14.

|

|

66

|

|

|

|

|

|

|

PART IV

|

|

|

|

|

Item 15.

|

|

67

|

|

|

Item 16

|

|

69

|

| |

|

70

|

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the information incorporated herein by reference may constitute “forward-looking

statements”, which reflect our current views with respect to, among other things, our operations and financial performance. All statements other than statements of historical facts contained in this Annual Report on Form 10-K, including statements

regarding our future results of operations and financial position, business strategy and plans and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “should,” “could,” “target,” “predict,” “seek” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about

future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short- and long-term business operations and objectives, and financial needs. These forward-looking statements are

subject to a number of risks, uncertainties and assumptions, including those described in “Item 1.A Risk Factors” in this Annual Report on Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment and new risks emerge

from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially

from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Annual Report on Form 10-K may not occur and actual results

could differ materially and adversely from those anticipated or implied in the forward-looking statements.

Some of the key factors that could cause actual results to differ from our expectations include:

|

• |

our ability to maintain the listing of our shares of common stock and warrants on Nasdaq;

|

|

• |

our ability to raise financing in the future;

|

|

• |

our success in retaining or recruiting officers, key employees or directors;

|

|

• |

factors relating to our business, operations and financial performance, including:

|

|

o |

our ability to control the costs associated with our operations;

|

|

o |

our ability to grow and manage growth profitably;

|

|

o |

our reliance on complex machinery for our operations and production;

|

|

o |

the market’s willingness to adopt our technology;

|

|

o |

our ability to maintain relationships with customers;

|

|

o |

the potential impact of product recalls;

|

|

o |

our ability to compete within our industry;

|

|

o |

increases in costs, disruption of supply or shortage of raw materials;

|

|

o |

risks associated with strategic alliances or acquisitions, including the acquisition of SerEnergy A/S, a Danish stock corporation (“SerEnergy”) and fischer eco solutions GmbH, a German

limited liability company (“FES”), former wholly-owned subsidiaries of F.E.R. fischer Edelstahlrohre GmbH, completed on August 31, 2021;

|

|

o |

the impact of unfavorable changes in U.S. and international regulations;

|

|

o |

the availability of and our ability to meet the terms and conditions for government grants and economic incentives; and

|

|

o |

our ability to protect our intellectual property rights;

|

|

• |

market conditions and global and economic factors beyond our control, including the potential adverse effects of the ongoing global coronavirus (COVID-19) pandemic on capital markets,

general economic conditions, unemployment and our liquidity, operations and personnel;

|

|

• |

volatility of our stock price and potential share dilution;

|

|

• |

future exchange and interest rates; and

|

|

• |

other factors detailed herein under the section entitled “Risk Factors.”

|

The forward-looking statements included in this Annual Report on Form 10-K are made only as of the date of this Annual Report.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of

activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking

statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report on Form 10-K to conform these statements to actual results or to changes in our expectations.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially

different from those expressed or implied by these forward-looking statements. For a discussion of the risks involved in our business and investing in our common stock, see the section entitled “Risk Factors.”

Should one or more of these risks or uncertainties materialize, or should any of the underlying

assumptions prove incorrect, actual results may vary in material respects from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements.

PART I

References in this annual report to “we,” “us,” “Advent,” “company,” or “our company” are to Advent Technologies Holdings,

Inc., a Delaware corporation, and its consolidated subsidiaries. References to “management” or our “management team” are to our officers and directors.

Overview

We are an advanced materials and technology development company operating in the fuel cell and hydrogen

technology space. We develop, manufacture, and assemble complete fuel cell systems and the critical components that determine the performance of hydrogen fuel cells and other energy systems.

We develop and manufacture high-temperature proton exchange membranes (“HT-PEM” or “HT-PEMs”) and fuel

cell systems for the off-grid and portable power markets and plan to expand into the mobility market. Select applications are telecom towers (5G and older), energy infrastructure (methane emissions mitigation for the oil and gas industry), and

portable power for defense or emergency response units. Our mission is to become a leading provider of fuel cell systems, HT-PEMs, fuel cells, and HT-PEM based membrane electrode assemblies (“MEA” or “MEAs”), which are critical components used

in fuel cells, and other electrochemical applications such as electrolyzers and flow batteries. We develop the core chemistry components, the MEAs, that enable fuel cells to operate at high temperatures and also provide these MEAs to third-party

fuel cell manufacturers. HT-PEM fuel cells have the advantage of operating with multiple low-carbon fuels (in addition to hydrogen) and under extreme conditions.

Our current revenue is derived from the sale of fuel cell systems and from the sale of MEAs, membranes,

and electrodes for specific applications in the fuel cell and energy storage (flow battery) markets. While fuel cell systems sales and associated revenue is expected to provide the majority of our income in the near future, the MEA innovation is

expected to facilitate strategic partnerships between us and Tier 1 suppliers and original equipment manufacturers (“OEMs”) as these downstream manufacturers develop their own white-labelled HT-PEM products.

We have our headquarters in Boston, Massachusetts, and are building out a product development and

research and development facility in Charlestown, Massachusetts expected to open in 2022, and have MEA fabrication and system production facilities in Livermore, California; Achern, Germany; Aalborg, Denmark; and Patras, Greece. We plan to

scale-up U.S. and European production and its global sales operations to handle future demand. Our investment priorities are increasing MEA production volumes, executing on new product development initiatives (next-generation fuel cell systems

and MEAs), and optimizing production operations to improve unit costs.

Our principal focus is on the total fuel cell market, from components to complete systems, and we plan

to use our products and technology to address pressing global climate needs. Fuel cell and hydrogen technology is expected to play a critical role in global decarbonization. In order to meet the targets established in the Paris Climate Accords,

which seek to mitigate climate change and maintain global temperature less than 1.5°C-2.0°C above pre-industrial levels, the global community will need to accelerate the adoption of technologies like our fuel cells, that reduce or eliminate

emissions of carbon dioxide and other greenhouse gases. We believe that fuel cells will be a key component of the future energy generation platform given that:

|

• |

Fuel cells generate electricity and heat from hydrogen-based fuels, thereby substantially reducing emissions of carbon dioxide and other pollutants generated by the combustion process in

internal combustion engines (“ICE” or “ICEs”) and diesel generators. Fuel cells can be powered autonomously for hours or days where the fuel comes from a discrete source, or for longer where there is a pipeline or other large available

source of fuel such as a tank.

|

|

• |

Fuel cells utilize fuels with a high energy density relative to lithium-ion batteries and other battery technology (according to ARPA-E power densities, hydrogen contains 40,000 Wh/kg

while lithium-ion batteries carry only about 260Wh/kg). This makes fuel cell technology well-suited for use in mobility and off-grid energy generation applications where battery technology faces limitations such as lifespan,

self-discharge, weight (fuel cells are between 3 to 25 times lighter than batteries providing equivalent power), operation under almost any weather conditions, and recharge times.

|

|

• |

We expect that hydrogen will also be used to create liquid, synthetic fuels (eFuels like eMethanol, made by combining hydrogen with carbon dioxide for a net-zero liquid fuel) that have

the advantage of lower transportation costs and network infrastructure investment relative to hydrogen gas. Fuels like methanol have become subject to an increasing interest in Asia because they are currently available. We believe

methanol has the potential to become a leading zero-emissions liquid fuel that can leverage the current global infrastructure from gas stations to fuel tankers and trucks. Given the urgency to decarbonize power generation, and the

challenges the investment requirement poses for developing countries, we expect methanol to have an increasingly significant role as a liquid hydrogen carrier and a low/no carbon dioxide emission alternative to oil.

|

Fuel cell and hydrogen technology is expected to play a critical role in global decarbonization given the clean nature of

emissions from hydrogen and hydrogen-carrier fuels relative to fossil fuels. In addition, the challenges associated with existing battery technology limit it from mass adoption across industries. Globally, an average of $38 billion per annum is

expected to be invested in the hydrogen and fuel cell sector between 2020 and 2040 with the goal of significantly increasing production capacity while lowering the cost of production. While the availability of hydrogen limited the fuel cell

industry in the past, it is now expected to become an opportunity for growth, particularly in sectors such as industrials, power generation and automotive.

Within the fuel cell market, our products have significant advantages relative to its competitors that are focused on

low-temperature proton exchange membrane technology (“LT-PEM” or “LT-PEMs”). We believe these advantages will help us secure commercial opportunities in the fuel cell market and help drive wide-spread adoption of fuel cell technology. The

benefits of our HT-PEMs relative to LT-PEMs include:

|

• |

We have developed our products under the principle of “Any Fuel. Anywhere.” which can be distilled into the two components:

|

|

o |

Any Fuel: While LT-PEMs

require high-purity hydrogen to operate, our HT-PEMs can utilize low cost and abundant hydrogen-carrier fuels, including methanol, natural gas, e-fuels, liquid organic hydrogen carriers, dimethyl ether, and renewable biofuels. The

infrastructure required for clean energy powered solely by high-purity hydrogen would cost trillions of dollars. In contrast, many of the hydrogen-carrier fuels can use existing or in-development infrastructure and have a much lower

transport cost than hydrogen. This key technology differentiator bypasses the need to commit to a specific energy distribution network and leverages existing infrastructure. Most importantly, it provides an immediately serviceable

market today, while we believe many LT-PEM competitors may have to wait another decade for the availability of green, high-purity, inexpensive hydrogen, and potentially longer for the maturity of hydrogen transportation and storage

networks. Given the urgency to decarbonize power generation, and the investment challenges faced by developing countries, we expect methanol to have an increasingly significant role as a liquid hydrogen carrier and a low or no carbon

dioxide emission alternative to oil.

|

| |

o |

Anywhere: Our HT-PEM

fuel cells have the ability to operate in a variety of practical conditions, including a wide range of geographies, weather, ambient temperatures (as low as -20oC

and up to +55oC), and in humid or polluted environments. LT-PEM fuel cells, on the other hand, tend to struggle in the heat, can be damaged by dry

climates, or polluted air, and cannot handle impurities of the hydrogen supply. LT-PEM technology is intolerant to CO damage (with performance degradation at levels as low as 10 ppm), while HT-PEM can withstand 1-4% CO concentrations,

depending on temperature and operation. For example, readily available low-cost hydrogen can be made with 1-2% carbon monoxide (20,000ppm), which works well with HT- PEMs. LT-PEM loses performance with only 10ppm of carbon monoxide.

The relative durability of our products in a range of environments also provides a longer life of operation relative to LT-PEM fuel cells.

|

|

• |

Our HT-PEM technology significantly reduces the balance of plant requirements of a fuel cell system relative to LT-PEM fuel cells. This means that fuel cells using our HT-PEMs have

simplified requirements for supporting components and auxiliary systems, which enables reduced cost and increases application range for the end-user. It does this through two methods:

|

|

o |

Superior Heat Management: HT-PEM fuel cells operate at high temperatures (between 160°C and 220°C, with next-generation MEA-based fuel cells operating between 80°C and 240°C). Therefore,

the temperature differential between a HT-PEM fuel cell and the outside environment is large. As a result, only a small radiator, similar or smaller than the radiator in an ICE vehicle, is needed to transfer heat away from the fuel cell

stack. Conversely, because LT-PEM fuel cells run relatively cooler (under 85°C), a significantly larger radiator is required to effectively maintain suitable operating temperatures and conditions for an LT-PEM fuel cell.

|

|

o |

Water Management Issues: HT-PEM fuel cells use phosphoric acid as an electrolyte rather than water-assisted membranes. Therefore, they reduce the need for water balance and other

compensating engineering systems.

|

Our Solution

Our core product offering include:

|

1. |

Systems: Fuel cells for portable and stationary applications of power generation, in the range of 20W to 20kW. These fuel cells have applications in the telecom tower (e.g. 5G, 4G)

power, surveillance, defense (and other portable power applications), energy (and other critical) infrastructure, and auxiliary power (marine, leisure) markets. Our fuel cells are manufactured in the U.S., Denmark, and Germany. Fuel cell

systems provide the majority of our current revenue.

|

|

2. |

The next generation of our fuel cells, in the 15kW to 1MW range, is expected to target the mobility sector (e.g., heavy-duty automotive, mining

equipment, marine, aerospace, and unmanned aerial vehicles (“UAV”)). We are planning to enter into joint development agreements with Tier 1 suppliers and OEMs to bring HT-PEM fuel cells to the mobility market. We intend to be a provider

of MEAs and core technology via licensing, rather than producing end-products for the mobility industry. Revenue from joint development agreements may include engineering fees during the 1-3 year initial development cycle, MEA sales, and

on-going licensing fees.

|

|

3. |

We are a developer of the key component of the fuel cell, the MEA. The operation of the MEA is key to the functionality and characteristics of a fuel cell system. Our MEA enables a

robust, long-lasting, and ultimately low-cost fuel cell product, relative to LT-PEM technologies. In addition to our fuel cell system offerings, our MEA is also a discrete product offering to third-party fuel cell manufacturers. MEA sales

are expected to be a rapidly growing market in the future as more and more fuel cells are deployed globally by third parties, especially in the mobility space.

|

Our Business Outlook

In 2021, we became publicly listed on NASDAQ. We acquired UltraCell LLC (“UltraCell”), which spearheaded our product

offering in the portable and defense markets. In the defense sector, we deliver human portable systems. In addition, the UltraCell portable system is being repurposed to provide remote power to oil and gas wellheads (Advent M-ZERØ family of

products) and to address the critical problem of methane emissions in Canada and the U.S. Furthermore, the Company has continued with delivery of MEAs to fuel cell manufacturers in Asia and with delivery of electrodes to the high-growth redox

flow-battery market. We are also part of a consortium that has applied to develop “White Dragon,” the seminal large-scale decarbonization project in Southern Europe. We were selected by the Greek Ministry of Development and Investment to be

part of the first wave of Important Projects of Common European Interest (“IPCEI”) on Hydrogen, which is currently pending European Union approval.

In September 2021, we completed the acquisition of SerEnergy A/S (“SerEnergy”) and fischer eco solutions GmbH (“FES”), a

leading manufacturer of fuel cell systems, with thousands of systems shipped in recent years. SerEnergy is located in Denmark and FES is located in Germany. The acquisition effectively doubled our team to over 170 people, and we believe the

acquired business will be a strong pillar of its potential growth strategy. SerEnergy and FES have significant production capabilities, are expected to benefit significantly from our next-generation MEAs and are expected to provide a very strong

foothold in the off-grid market. SerEnergy systems, primarily in the 5kW range, target the telecoms industry (especially the growing 5G tower demand) and other diesel generator replacement off-grid markets.

Our growth strategy is focused on targeting the following four sectors:

|

• |

The stationary off-grid market, expected to be a growing market.

|

|

• |

The human-portable defense, surveillance, energy infrastructure, and leisure market based on UltraCell’s innovative products.

|

|

• |

The development of next-generation MEA and fuel cell solutions for the mobility market.

|

|

• |

The large-scale fuel cell systems market (power generation and power to gas), especially following developments in the multi-billion euro “White Dragon” project (in which Advent is the

fuel cell development partner), if approved by the European Union.

|

Business Strengths

Simplified balance of plant technology: Our HT-PEM technology significantly reduces the balance of plant requirements of a fuel cell system relative to LT-PEM fuel cells. Fuel cells utilizing our technology have simplified requirements for

supporting components and auxiliary systems because they reduce the complexity of water management systems. Our technology enables advanced, low-cost and simplified cooling technology, and increases the application range for the end-user. This

is especially important for air, heavy-duty transportation, and marine applications.

Leveraging existing fuel infrastructure: Given the fuel-flexible nature of our technology, we are able to leverage the existing fuel delivery infrastructure – e.g. around 3 million miles of natural gas

pipelines connecting production, storage and distribution systems in the U.S. – to deliver power to a wide range of customers and markets today. Our plug-and-play dynamic enables swift “time-to-market” capabilities. By contrast, the

infrastructure investment required for a high-purity hydrogen economy is expected to be significant – approximately $15 trillion between now and 2050 globally.

Experienced management team with proven track

record: The team that we have recruited to bring innovation to the fuel cell industry is highly experienced with a long pedigree in R&D and world-class manufacturing. Our team has been

developing MEA components since 2006 and is led by Dr. Emory De Castro (CTO) who has significant industrial experience. In addition, we initiated in 2021 a joint development effort under the U.S. Department of Energy (“DoE”) umbrella to

commercialize next-generation MEAs and ultra-low platinum catalyst solutions developed by Los Alamos, NREL Laboratories, and Brookhaven Laboratories in the U.S. We were selected as the scale-up and commercialization partner of the DoE and is

working closely with the highly-skilled R&D teams of top U.S. labs.

Following the acquisitions of UltraCell, SerEnergy and FES, and its ongoing recruiting and development in the U.S. (including

the new product development facility, close to Harvard and MIT, under construction in Charlestown, Massachusetts that is expected to open in 2022), we have significantly increased our product, system integration, manufacturing, and testing

capabilities. UltraCell brings Silicon Valley-type innovation, while SerEnergy’s expertise and world-class reputation in the stationary fuel cell industry is well established. Our team now numbers over 200 people, many with more than a decade

of hands-on expertise in the HT-PEM market. Our investment plan reflects its strategic goal to assemble significant global know-how of the HT-PEM industry. We expect that HT-PEM, with technology initially developed decades after LT-PEM, is in

early stages of growth as compared to LT-PEM, a technology initially developed during the 1960s.

Technology

Our fuel cells can use “Any Fuel. Anywhere.” because of the HT-PEM technology that we have pioneered since 2006.

High-temperature fuel cells currently operate at high temperatures (between 160°C and 220°C) and have the potential to operate between 80°C and 240°C, unlike typical LT-PEM fuel cells that are limited to below 100°C. This temperature advantage

allows the fuel cell to work with other fuels and to have reliable operation at extreme conditions, which we believe is a significant competitive advantage for the stationary power generation market.

Enhanced market opportunity: The multi-fuel capability enables us to have a very strong position in the off-grid and portable power market in select applications like telecom towers and critical infrastructure power needs. In

these applications, diesel generators are primed for replacement for environmental and cost reasons, batteries are unable to provide a long-term year-round solution, and hydrogen presents difficult logistical concerns. We believe fuels like

methanol are a more compelling choice and that our HT-PEM fuel cells are highly suitable for these applications. We believe decreasing fuel cell costs, due to technology innovation and manufacturing scale-up, can provide us with an opportunity

to grow in the power generation market and potentially displace diesel generators in applications with a clear total cost of ownership value proposition, in addition to the environmental mandate.

The next-generation of our fuel cells is being developed in collaboration with the U.S. DoE after we were awarded the

L’Innovator commercialization program. Under this program, we are working closely with the Los Alamos National Laboratory (LANL), Brookhaven National Laboratory (BNL), and National Renewable Energy Laboratory (NREL), to commercialize the

decade-long materials advancements in the field of MEA development. We expect that these next-generation MEAs (“Advanced MEA”) will bring the HT-PEM technology into the mobility area by enabling fuel cells to be lightweight with high-power

density. The Advanced MEA is also anticipated to deliver as much as three times the power output of its current MEA product. While we are already projecting being able to pass through substantial cost benefits to its customers through economies of

scale as it increases MEA production, the successful development of the Advanced MEA will be an important factor in delivering the required improvement in cost effective performance to our customers.

Based on the several critical advantages offered by our HT-PEM

technology over batteries and LT-PEM technology, we expect to be highly competitive in numerous applications. In particular, our HT-PEM fuel cells and MEAs are well-suited to off-grid power, portable power applications, combined heat and

power, and mobility (e.g., heavy-duty automotive, aviation, mining equipment, marine, and UAV). Our goal is to

partner with Tier 1 suppliers and OEMs in these new markets, focusing on the fuel cell technology development, licensing, and the mass production of the next-generation MEAs.

|

1. |

Off-Grid Power: We have a growing presence in the off-grid power market, with its recently acquired SerEnergy subsidiary having shipped thousands of systems worldwide to

telecommunications providers for back-up power systems and stationary power sectors. Methanol is easier and cheaper to deliver to remote locations compared to pure hydrogen, providing our HT-PEM technology with an advantage in the off-grid

market. Off-grid fuel cell solutions can use methanol already available at some remote industrial sites, like wellheads. Additionally, methanol can be found in products already present at some remote sites, such as certain windshield

washer fluids. These products could be repurposed as a fuel source for the fuel cell. Fuel cells in these applications produce significantly less of the greenhouse gases compared to ICE generators and produce power without ICEs’ attendant

high levels of nitrogen oxides, sulfur oxides or particulate emissions. Off-grid power solutions have the potential to run full-time, 365 days a year, 24 hours per day. Our launch of the M-ZERØ methanol-fueled low-power system targets the

power generation needs of remote oil and gas locations. The current method of powering such equipment results in significant methane emissions that are equivalent to millions of cars’ emissions per year.

|

|

2. |

Portable Power: Our acquisition of Silicon Valley-based UltraCell provided us with complete system technology for the portable power and defense markets. Electrification is one of the

key initiatives in the defense industry as the needs for mobility and power on demand are increasing dramatically. Our fuel cells have already been deployed by the US Department of Defense (“DoD”), in the XX-55 portable power system, while

the next-generation “Honey Badger” product, a wearable fuel cell designed to provide soldiers with on the go power, is currently in the DoD’s demonstration/validation program.

|

The above markets define our current products, while the markets below constitute its largest opportunities for growth in the

future:

|

3. |

Combined Heat and Power (“CHP”): By virtue of their high temperature operation, HT-PEM fuel cells are well suited for delivering heat in addition to power to large commercial buildings

and single or multi-family homes. The CHP efficiency is at the 85%-90% range, making HT-PEM fuel cells extremely efficient for such uses. HT-PEM fuel cells can be supplied by existing natural gas infrastructure and eventually by a future

hydrogen-blend or pure-hydrogen pipeline network.

|

|

4. |

Automotive: By charging electric vehicles’ batteries on-board through the conversion of high-purity hydrogen or hydrogen-carrier fuels into electricity, our fuel cells solve the range and

recharging issues that battery-only electric vehicles currently face. This issue is a particular challenge in heavy-duty and commercial vehicles. Since our fuel cells can use hydrogen-carrier fuels such as natural gas, methanol and

biofuels, fuels that are of growing in importance in China, India, and Western Europe, we believe that our technology will be critical in accelerating the mass adoption of electric vehicles and the shift away from ICEs. Existing battery

and LT-PEM technology are unable to meet the needs of heavy-duty transportation which require long-range, heavy payloads, fast refill times, and the ability to operate in diverse environments. For example, LT-PEM fuel cells are unable to

operate in hot environments because the radiator required to cool the MEA to the appropriate temperature range would be too large and therefore impractical. The use of battery-only technology has the added disadvantage of insufficient

power capacity without a substantial volume and weight of batteries, which results in a significant reduction in cargo capacity.

|

|

5. |

Aviation: Our fuel cells can deliver much longer range (autonomy) and better utilization (through faster time to refill and greater payload) for commercial drones, eVTOLs, and auxiliary

power for traditional aircraft than battery power alone can deliver. Existing commercial drones based on battery-only technology have a limited flight time given the power limitations of the lightweight requirements of flight. Compared to

battery powered flights, aircrafts powered by fuel cells using next generation HT-PEMs and ultra-lightweight non-metal plates could increase range, payload/passenger capacity, and the number of trips made on one charge or fill-up. HT-PEM

aircraft have the potential to refuel significantly faster than an equivalent battery could recharge. The high-purity hydrogen currently required by LT-PEM is considered unsafe for widespread commercial use, while our HT-PEM provides

sufficient range using safer liquid fuels and the Company believes it is key to efficient real-world flight usage. Hydrogen gas and dimethyl ether are suitable for use as fuel for aviation fuel cells, and both work well with HT-PEM

technology. Additionally, high-temperature operation in aviation is essential, given heat exchange issues. Fuel cells have shown that drones can stay airborne for longer periods of time, which enhances their value proposition and business

applications. We expect drone prototypes based on our technology to be available as soon as 2022.

|

|

6. |

Marine: In the marine industry, neither compressed hydrogen nor batteries are a viable option for commercial shipping. The industry is evaluating alternative fuels to replace bunker

fuel, and methanol appears to be among the most likely hydrogen carriers positioned to meet the European Union’s 2050 decarbonization objectives. Our fuel cells are well-suited for methanol use, as the high-temperature operation can use

low-grade hydrogen (converted from methanol via reformation) that does not work with current LT-PEM fuel cells. Applications in the marine industry are likely to develop initially in auxiliary power and smaller ships, and eventually scale

to the multi-MW range main propulsion market. Our fuel cells promise fuel flexibility with hydrogen gas, liquid organic hydrogen carriers, methanol, and natural gas, and operate at high temperatures through proprietary chemistry. Marine

applications could be scalable for divergent load requirements and applications such as powering the entire propulsion system or, alternatively, providing auxiliary power to a differently powered primary propulsion system. Marine fuel cell

usage could offer long range and a fast refill; unlike battery power, and longer routes and larger vessels can be powered by fuel cells as compared to batteries. In addition, fuel cells can be used in a hybrid structure in conjunction with

battery power. We are planning our initial focus on applications for auxiliary marine power, and then plans to focus on vessels’ main power.

|

We have been issued, acquired, licensed, or applied for approximately 190 international and United States patents, with a

concentration in membranes, electrodes, and MEAs, which support its product offerings. In the MEA sector, our products include two existing membrane technologies: “TPS®”, which we have exclusive rights to use and was obtained through patents filed

by its founders and technical staff, and “PBI” technology, of which we are a selective licensee, and provides exclusive rights to us for commercial sale of MEAs using PBI technology. Leveraging our membrane technologies, we also have intellectual

property for lightweight stacks made through advances in bipolar plate materials, which supports water-cooled systems. This results in a simpler and more compact balance-of-plant design. Our own investments in developing leading next-generation

fuel cell technology are supported by being able to leverage the research and development efforts of its strategic partners. We are planning next generation prototypes for fuel stacks as soon as 2022, with pilot production as soon as 2023 and mass

production as soon as 2024.

Our rights to commercialize the next-generation HT-PEM materials technology from the DoE L’Innovator Program also includes

rights to a portfolio of patents supporting this advanced technology. We were selected through a highly competitive bidding process by virtue of our management team’s track record in taking laboratory inventions and processes through to a

fully-scaled and manufactured product. We expect that this technology will reduce production costs of its MEAs significantly through a 3-fold increase in power output per unit area of membrane, and will provide longer operating lifetime and a

wider temperature operating range as well as substantially lower platinum content. We expect these advantages will enable us to reduce the cost to end-users of fuel cells and encourage a wider market adoption. We anticipate commercialization

and mass manufacture of this product by 2022. This and other partnerships, joint ventures, and joint development agreements, including with DoE, NASA (through Advent’s affiliation with Northeastern University) and the European Space Agency, are

expected to assist Advent in the mobility and off-grid power markets.

Our products and technology are currently being used in the marketplace to generate electricity for commercial applications,

and we are developing partnerships with Tier 1 suppliers, OEMs, and system integrators to further drive commercial adoption and use in an increasing number of applications and end markets. To date, more than 300,000 TPS® and PBI MEAs have been

sold (by us and others) for use in defense, micro-combined heat and power (µCHP) systems, battery range extenders for fuel cell battery hybrid vehicles, remote power for telecom and auxiliary power in remote locations, demonstrating strong

early-stage adoption of our existing product line. To date, we have shipped thousands of systems for defense, off-grid and remote/portable power markets.

As our business ramps up to mass-production, we plan to pursue a revenue model that includes engineering fees, MEA sales and

hardware-technology licensing fees through the life of product development. Our customer relationship is split into two phases: 1) partner with OEMs to co-develop customized fuel cell systems based on our MEAs, for which we earn engineering and

licensing fees, and 2) produce and sell proprietary MEAs directly to OEMs while earning licensing fees on fuel cells produced by customers using our technology. We expect high-margin licensing fees to become a larger component of our revenue mix

over time as our customers scale to mass manufacturing of fuel cells and other products.

We were founded and are managed by a team of world-class electrochemists, material scientists, and fuel cell specialists with

significant industry and manufacturing expertise. We have received numerous R&D funds from the DoE and the European Union and are considered a pioneer with years of experience in clean energy

technology innovation. We have our headquarters in Boston, Massachusetts and our operations in other Massachusetts locations, as well as in California, Greece, Germany, Denmark, and the Philippines. In 2022, We will open a facility in

Charlestown, Massachusetts offering research and development facilities and additional production capacity. For additional capacity, we intend to utilize existing U.S.-based toll-manufacturing for the membrane and electrode production to

scale-up its production levels without significant capital expenditure. Our Patras, Greece based production of membranes, electrodes, and MEAs benefits from labor cost and skill availability advantages.

We intend to direct the majority of our near-term funding requirements to operating expenses and capital expenses for product

development and plan to make substantial investments over the next several years, among others, in new production equipment and warehousing, systems assembly line, MEA assembly automation, aeronautical stacks and U.S. facility expansion.

Recent Acquisitions

Business Combination of AMCI Acquisition Corp. and Advent Technologies

In February 2021, we closed our business combination with AMCI Acquisition Corp. The business combination has provided us

with a sustainable funding base for the next phase of our expansion efforts to respond to significant and immediate market opportunities. Our shareholders opted to roll 100% of their equity and, as of the completion of the business combination,

owned 54% of the pro-forma equity base.

On February 18, 2021, we acquired UltraCell, formerly a fuel cell division of Bren-Tronics, Inc. Prior to the acquisition,

we had a mutually beneficial partnership, having worked together for several years. UltraCell is a leader in lightweight fuel cells for the portable power market, including small-scale fuel cell technology for the defense industry, and has sold

thousands of battery pack charger systems built around Advent MEAs to four NATO militaries, including those of the U.S. and the U.K. UltraCell systems have been deployed with excellent performance in stringent and challenging conditions and

climates. UltraCell’s technology uses hydrogen or liquid fuels to deliver reliable power at a fraction of the weight of batteries. Traditional LT-PEM fuel cell technology cannot be used in this type of remote environment fuel cell product due to

the issues with compressed high-purity hydrogen. Our fuel flexibility allows for the use of methanol in its fuel cell application, which is stable in liquid form, cheaper, and more accessible than hydrogen. With our technology powering

UltraCell products like the “Honey Badger”, a portable fuel cell which is in advanced testing with the U.S. military, multi-day military missions that generally required over 100 pounds of batteries can substitute a fuel cell and methanol

canister with a total weight of 25 pounds. UltraCell’s fuel cell innovations are expected to complement the development of our next-generation lightweight systems for the mobility market, with an emphasis on the commercial drone, aviation, and

heavy-duty automotive industries. UltraCell produces the only made in the U.S. NATO approved fuel cell products and is one of only two manufacturers of NATO approved fuel cell products manufacturing in a NATO country. Since the acquisition, we

have retained current UltraCell operations in the Livermore, California area, in parallel to its Boston operations, and plan to continue to do so, with the possibility of expansion in the future.

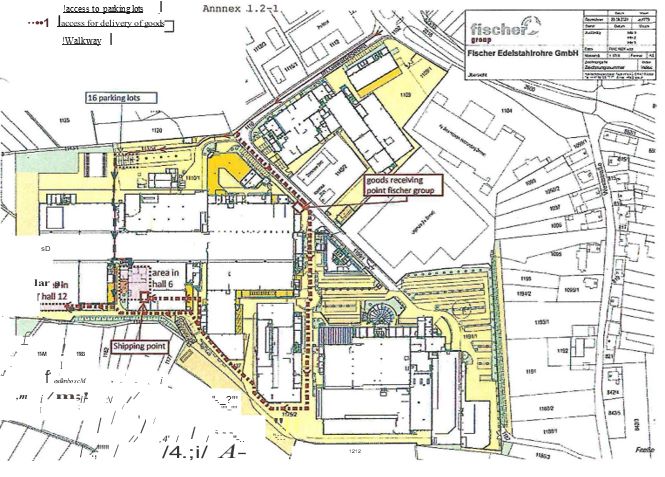

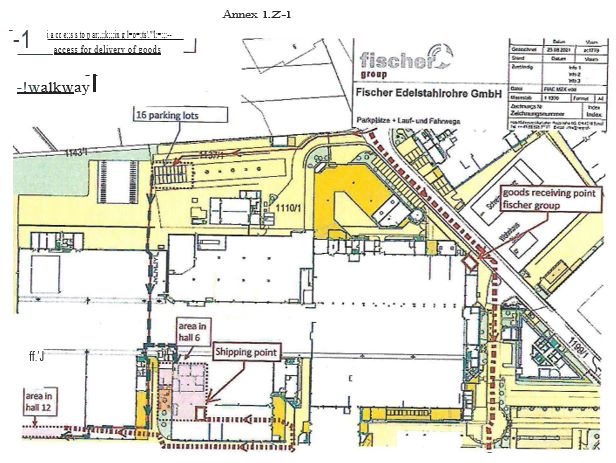

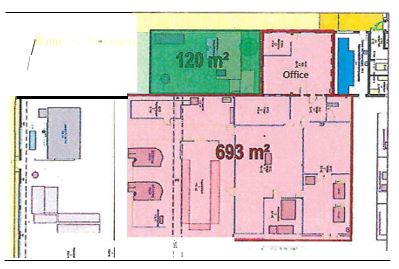

On September 1, 2021 (CEST), we completed our acquisition (the “Fischer Acquisition”) of SerEnergy and FES from F.E.R.

fischer Edelstahlrohre GmbH (“Fischer”). SerEnergy and FES currently market and build standalone systems and critical fuel cell components. These products are complementary to the mobile systems produced by Advent. The Fischer Acquisition is

well aligned to the “Any Fuel. Anywhere.” strategy, and is expected to accelerate our growing revenue base in fuel cell stacks and systems. The Fischer Acquisition also increases our patent and trademark portfolio with new intellectual property

and increases our labor force by approximately 90 employees, many of whom are highly-skilled manufacturing and sales professionals experienced in the fuel cell industry. SerEnergy has deployed hundreds of standalone telecom remote

self-maintaining power systems, including sales to Smart Communications, a leading telecommunications provider in the Philippines. These systems can operate in both high humidity and high temperature environments and offer remote monitoring. We

believe that the combined HT-PEM fuel cell production capacity and operations in international markets, currently consisting of Germany, Denmark and the Philippines, will support our expansion into international customer segments, in particular

the Asian and European markets.

Specific Product Offerings

Honey Badger: The Reformed Methanol Wearable Fuel Cell Power System, or “Honey Badger” is an offering marketed by our subsidiary UltraCell. On June 7, 2021, the U.S. DoD, through the U.S. Army DEVCOM Command, Control, Communications,

Computers, Cyber, Intelligence, Surveillance and Reconnaissance (C5ISR) Center, with funding through the Project Manager Integrated Visual Augmentation System (PM IVAS), has entered into a contract with us to complete the MIL-STD certification

of the cutting edge “Honey Badger”. “Honey Badger” is placed on a soldier worn plate carrier and provides on the move battery charging in the field. It has been selected by the DoD’s National Defense Center for Energy and Environment (NDCEE)

to take part in its 2021 demonstration/validation program and is the only fuel cell to take part in this program. The NDCEE is a DoD program that addresses high-priority environmental, safety, occupational health, and energy technological

challenges that are demonstrated and validated at active installations for military application. The product is offered at 20W and 50W power versions, and both are in testing and certification stages. Its core technology has completed

successful field trials in Army Expeditionary Warrior Experiments and high-altitude tests in California’s Sierra Nevada. UltraCell’s “Honey Badger 50” (the 50W power version) fuel cell is the only fuel cell that is part of this program that

supports the U.S. Army’s goal of having a technology-enabled force by 2028.

M-ZERØ: Our M-ZERØ line of products are designed to generate power in remote environments. Their use significantly reduces methane emissions where they replace older, less efficient technology. The current M-ZERØ products are 50W and 150W

systems, with systems featuring up to 400W of power expected to be released by the end of 2022. We have entered into agreements to trial ten 50W systems in Canada starting in the third quarter of 2021. If the trials are successful, this could

result in mass deployment of M-ZERØ systems during 2023. The products, which are not expected to require extensive servicing or refueling schedules, can work throughout the year, including in extreme cold. Traditional green remote power options

of solar plus battery storage do not function well in either extreme cold or in hard-to-reach areas. Widespread adoption of M-ZERØ technology at all of the wellheads in the U.S. and Canada will result in a substantial reduction of carbon dioxide

emissions.

Important Projects of Common European Interest (“IPCEI”)

White Dragon: White Dragon is an IPCEI proposal submitted by a consortium of Advent, Damco Energy S.A. (Copelouzos Group Company), PPC Greece, The Hellenic Gas Transmission System Operator (“DESFA”)

S.A., Hellenic Petroleum, Motor Oil, Corinth Pipeworks, TAP and Terna Energy (together the “consortium”) to develop a more than €8 billion green hydrogen project in Greece to gradually replace Western Macedonia’s lignite coal power plants of and

transition to clean energy production and transmission, with the ultimate goal of fully decarbonizing Greece’s energy system. The project plans to use large-scale renewable electricity to produce green hydrogen by electrolysis in Western

Macedonia. This hydrogen would then be stored and, through our HT-PEM fuel cells, would be expected to supply all of Greece with clean electricity, green energy, and heat. Our HT-PEM fuel cells provide a combination of both heat and electrical

power, and the heat generated by the project can initially be used in conjunction with the district heating networks of Western Macedonia, and in the future in other applications that require a heating and/or cooling system, such as industrial

workings, data centers and greenhouses. The White Dragon proposal also includes plans covering the transportation sector. We are the sole fuel cell development partner for the proposed project. Estimates are that the project, if approved,

would continue from 2022 through 2029, produce over 200,000 tons of hydrogen per year, reduce annual carbon dioxide emissions by 11.5 million tons and create 18,000 direct jobs and almost 30,000 indirect jobs. We were informed in September 2021

that the Greek government had approved of the White Dragon proposal and it is currently pending European Union approval.

Green HiPo: Green HiPo is an IPCEI proposal submitted by us which will, if approved, allow us to develop,

design, and manufacture fully scalable HT-PEM fuel cells for the production of power and heat. Green HiPo is linked to, but independent of, the White Dragon project. It proposes to establish a production facility in Western Macedonia with a

staggered production plan, starting with 15kW stacks, integration into 120kW modules, 1MW scale single units, and ultimately multi-MW fully integrated systems. Estimates are that the project, if approved, would continue from 2022 through 2029,

create approximately 1,400 jobs in the Western Macedonia region and the total cost of the project could exceed €4 billion. We were informed in September 2021 that the Greek government had approved of the Green HiPo proposal and it is currently

pending European Union approval.

Our intellectual property portfolio covers among other things: membranes, electrodes, MEAs, and systems exploiting the unique

operating characteristics of its materials. In general, our employees are party to agreements providing that all inventions, whether patented or not, made or conceived while being an Advent employee, which are related to or result from work or

research that the Company performs, will remain our sole and exclusive property.

We have been issued, acquired, licensed, or applied for approximately 190 international patents (including the intellectual

property from the Fischer Acquisition), the vast majority in membranes, electrodes, and MEAs, which support our product offerings. Additionally, we have approximately eighteen trademarks registered with the USPTO and various international

trademark offices, with additional trademark applications pending.

The market for alternative fuel and energy storage systems is still in the early stages of growth and is characterized by

well-established battery and LT-PEM products. We believe the principal competitive factors in the markets in which it operates include, but are not limited to, the size, weight, lifetime, durability, and total cost of ownership of these systems

to the end-user. We believe that our HT-PEM technology competes with these other technologies across a number of new and existing applications in the alternative energy fuel market, especially in the realm of fuel flexibility and heat

management. We believe the total addressable market opportunity could be over $72 billion by the year 2030.

Employees and Human Capital Resources

Our employees are critical to our success. As of December 31, 2021, we had approximately 200 employees, including part-time,

contractors and employees who joined us from the recent Fischer Acquisition. We also occasionally rely on additional independent contractors to support our operations. To date, we have not experienced any work stoppages and consider our

relationship with our employees to be in good standing. None of our employees are represented by a labor organization or are a party to any collective bargaining arrangement.

We believe that developing a diverse, equitable and inclusive culture is critical to continuing to attract and retain the top

talent necessary for our long-term success and strategy. We value diversity at all levels.

We strive to create a collaborative environment where our colleagues feel respected and valued. We provide our employees

with competitive compensation, opportunities for equity ownership and a robust employment package, including health care, retirement benefits and paid time off. In addition, we regularly interact with our employees to gauge employee satisfaction

and identify areas of focus.

Available Information

Our Internet address is https://www.advent.energy. Our website and the information contained on, or that can be accessed

through, the website will not be deemed to be incorporated by reference in, and are not considered part of, this Annual Report on Form 10-K. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, including

exhibits, proxy and information statements and amendments to those reports filed or furnished pursuant to Sections 13(a), 14, and 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, are available through the “Investors”

portion of our website free of charge as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. In addition, our filings with the SEC may be accessed through the SEC’s Interactive Data Electronic

Applications system at http://www.sec.gov. All statements made in any of our securities filings, including all forward-looking statements or information, are made as of the date of the document in which the

statement is included, and we do not assume or undertake any obligation to update any of those statements or documents unless we are required to do so by law.

An investment in our common stock involves a high degree of risks. You should consider carefully the risks

described below as well as the other information contained in this Annual Report on Form 10-K before investing in our common stock. The risks described below are those that we believe are the material risks that we face. If any of the following

risks actually occurs, our business, prospects, operating results and financial condition could suffer materially, the trading price of our common stock could decline and you could lose all or part of your investment. The risks and uncertainties

described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business. See “Forward-Looking Statements” in this Annual Report

on Form 10-K.

Risk Factors Relating to Our Operations and Business

We may be unable to adequately control the costs associated with our operations.

We will require significant capital to develop and grow our business, including developing and manufacturing our fuel cells and

building Advent’s brand. We expect to incur significant expenses which will impact our profitability, including research and development expenses, raw material procurement costs, sales and distribution expenses as we build Advent’s brand and market

our fuel cells, and general and administrative expenses as we scale our operations. Our ability to become profitable in the future will not only depend on our ability to successfully market our fuel cells and other products and services, but also

to control our costs. If we are unable to cost efficiently design, manufacture, market, sell, distribute and service our fuel cells, our margins, profitability and prospects would be materially and adversely affected.

We may need to raise additional funds and these funds may not be available to us when we need them. If we

cannot raise additional funds when we need them, our operations and prospects could be negatively affected.

The scale-up of production of our fuel cells, membranes and electrodes, together with the associated investment in our assembly

line and product development activities, will consume capital. While we expect that we will have sufficient capital to fund our planned operations through to breakeven, we may need to raise additional funds through the issuance of equity, equity

related or debt securities, or through obtaining credit from government or financial institutions. This capital will be necessary to fund our ongoing operations, continue research, development and design efforts, improve infrastructure, and

introduce new technologies. We cannot be certain that additional funds will be available to us on favorable terms when required, or at all. If we cannot raise additional funds when we need them, our financial condition, results of operations,

business and prospects could be materially adversely affected.

If we fail to manage our future growth effectively, we may not be able to market and sell our fuel cells

successfully.

Any failure to manage our growth effectively could materially and adversely affect our business, prospects, operating results

and financial condition. We intend to expand our operations significantly. Our future expansion will include:

|

• |

training new personnel;

|

|

• |

forecasting production and revenue;

|

|

• |

controlling expenses and investments in anticipation of expanded operations;

|

|

• |

entry into new material contracts;

|

|

• |

establishing or expanding design, production, licensing and sales; and

|

|

• |

implementing and enhancing administrative infrastructure, systems and processes.

|

We intend to hire additional personnel, including design and production personnel. Because our technologies are different from

traditional electric vehicle battery technology, individuals with sufficient training in alternative fuel and electric vehicles may not be available to hire, and as a result, we will need to expend significant time and expense training the

employees we do hire. Competition for individuals with experience designing and manufacturing hydrogen fuel cells is high, and we may not be able to attract, integrate, train, motivate or retain additional highly qualified personnel in the future.

The failure to attract, integrate, train, motivate and retain these additional employees could seriously harm our business and prospects.

We will rely on complex machinery for our operations and production involves a significant degree of risk

and uncertainty in terms of operational performance and costs.

We will rely heavily on complex machinery for our operations and our production will involve a significant degree of

uncertainty and risk in terms of operational performance and costs. Our membrane and fuel cell production plant will consist of large-scale machinery combining many components. The production plant components are likely to suffer unexpected

malfunctions from time to time and will depend on repairs and spare parts to resume operations, which may not be available when needed. Unexpected malfunctions of the production plant components may significantly affect the intended operational

efficiency. Operational performance and costs can be difficult to predict and are often influenced by factors outside of our control, such as, but not limited to, scarcity of natural resources, environmental hazards and remediation, costs

associated with decommissioning of machines, labor disputes and strikes, difficulty or delays in obtaining governmental permits, damages or defects in electronic systems, industrial accidents, fire, and seismic activity and natural disasters.

Should operational risks materialize, it may result in the personal injury to or death of workers, the loss of production equipment, damage to manufacturing facilities, monetary losses, delays and unanticipated fluctuations in production,

environmental damage, administrative fines, increased insurance costs and potential legal liabilities, all which could have a material adverse effect on our business, results of operations, cash flows, financial condition or prospects.

Our future growth is dependent upon the market’s willingness to adopt our hydrogen-powered fuel cell and

membrane technology.

Our growth is highly dependent upon the adoption by the automotive, aerospace, power and energy

industries. If the market for our fuel cells and membranes does not develop at the rate or to the extent that we expect, our business, prospects, financial condition and operating results will be harmed. The market for alternative fuel and energy

storage systems is still new and is characterized by rapidly changing technologies, price competition, numerous competitors, evolving government regulation and industry standards and uncertain customer demands and behaviors.

Factors that may influence the adoption of our fuel cell and membrane technology include:

|

• |

perceptions about safety, design, performance and cost, especially if adverse events or accidents occur that are linked to the quality or safety of alternative fuel or electric vehicles;

|

|

• |

improvements in the fuel economy of internal combustion engines and battery powered vehicles;

|

|

• |

the availability of service for alternative fuel vehicles;

|

|

• |

volatility in the cost of energy, oil, gasoline and hydrogen;

|

|

• |

government regulations and economic incentives promoting fuel efficiency, alternate forms of energy, and regulations banning internal combustion engines;

|

|

• |

the availability of tax and other governmental incentives to sell hydrogen;

|

|

• |

volatility in the cost of energy, oil, gasoline and hydrogen;

|

|

• |

government regulations and economic incentives promoting fuel efficiency, alternate forms of energy, and regulations banning internal combustion engines;

|

|

• |

the availability of tax and other governmental incentives to sell hydrogen;

|

|

• |

perceptions about and the actual cost of alternative fuel; and

|

We Continue to Generate a Low Level of Revenue from our core product MEA and Developing Commercial Sales to

Major Organizations.

Based on conversations with existing customers and incoming inquiries from new customers, we anticipate substantial increased

demand for our MEAs from a wide range of customers as we scale up our production facilities and testing capabilities, and as the awareness our MEA capabilities become widely known in the industry. We expect both its existing customers to increase

order volume, and to generate substantial new orders from major organizations, with some of whom it is already in discussions regarding prospective commercial partnerships and joint development agreements. As of December 31, 2021, we were still

generating a low level of revenues compared to our future projections and have not made any commercial sales to major organizations.

Future product recalls could materially adversely affect our business, prospects, operating results and

financial condition.

Any product recall in the future may result in adverse publicity, damage our brand and materially adversely affect our

business, prospects, operating results and financial condition. In the future, we may voluntarily or involuntarily, initiate a recall if any of our fuel cells or membranes prove to be defective. Such recalls involve significant expense and

diversion of management attention and other resources, which could adversely affect our brand image in our target markets, as well as our business, prospects, financial condition and results of operations.

If we are unable to attract and retain key employees and hire qualified management, technical and fuel cell

and system engineering personnel, our ability to compete could be harmed.

Our success depends, in part, on our ability to retain our key personnel. The unexpected loss of or failure to retain one or

more of our key employees could adversely affect our business. Our success also depends, in part, on our continuing ability to identify, hire, attract, train and develop other highly qualified personnel.

Competition for these employees can be intense, and our ability to hire, attract and retain them depends on our ability to

provide competitive compensation. We may not be able to attract, assimilate, develop or retain qualified personnel in the future, and our failure to do so could adversely affect our business, including the execution of our global business strategy.

Any failure by our management team to perform as expected may have a material adverse effect on our business, prospects, financial condition and results of operations.

We have been, and may in the future be, adversely affected by the global COVID-19 pandemic.

We face various risks related to epidemics, pandemics, and other outbreaks, including the recent COVID-19 pandemic. The impact

of COVID-19, including changes in consumer and business behavior, pandemic fears and market downturns, and restrictions on business and individual activities, has created significant volatility in the global economy and led to reduced economic

activity. The spread of COVID-19 has also impacted our potential customers and suppliers by disrupting the manufacturing, delivery and overall supply chain of fuel cell manufacturers and suppliers.

Actions taken around the world to help mitigate the spread of COVID-19 include restrictions on travel, quarantines in certain

areas and forced closures for certain types of public places and businesses. COVID-19 and actions taken to mitigate its spread have had and are expected to continue to have an adverse impact on the economies and financial markets of many countries,

including the geographical area in which Advent operates. For example, In May 2021, Advent’s research and development activities in Boston were limited by the restrictions imposed on laboratory work in the U.S., with laboratories being run at

approximately 25% occupancy, with the result that certain business development activities have moved more slowly. Additionally, in Patras, Greece, approximately half of the Company’s workforce have worked from home during the temporary lockdowns

imposed by the Greek authorities, although these have largely been in support functions. These measures limit operations in our U.S. and Greece locations and have and may continue to adversely impact our employees, research and development

activities and operations and the operations of our suppliers, vendors and business partners, and may negatively impact our sales and marketing activities. We may take further actions as may be required by government authorities or that we

determine are in the best interests of our employees, suppliers, vendors and business partners.

The extent to which the COVID-19 pandemic continues to impact our business, prospects and results of operations will depend on

future developments, which are highly uncertain and cannot be predicted, including the duration and spread of the pandemic, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and

operating activities can resume. Even after the COVID-19 pandemic has subsided, we may continue to experience an adverse impact to our business as a result of the global economic impact, including any recession that has occurred or may occur in the

future.

There are no comparable recent events that may provide guidance as to the effect of the spread of COVID-19 and a pandemic, and,

as a result, the ultimate impact of the COVID-19 pandemic or a similar health epidemic is highly uncertain.

Increases in costs, disruption of supply or shortage of raw materials could harm our business.

Once we increase production, we may experience increases in the cost or a sustained interruption in the supply or shortage of

raw materials. Any such increase or supply interruption could materially negatively impact our business, prospects, financial condition and operating results. We use various raw materials including precious group metals such as platinum; carbon

black; polymer precursors, reactants, and solvents; as well as carbon cloth and carbon fiber paper. The prices for these raw materials fluctuate depending on market conditions and global demand and could adversely affect our business and operating

results.

We are or may be subject to risks associated with strategic alliances or acquisitions.

We have entered into, and may in the future enter into additional, strategic alliances, including joint ventures or minority

equity investments with various third parties to further our business purpose. These alliances could subject us to a number of risks, including risks associated with sharing proprietary information, non-performance by the third party and increased

expenses in establishing new strategic alliances, any of which may materially and adversely affect our business. We may have limited ability to monitor or control the actions of these third parties and, to the extent any of these strategic third

parties suffers negative publicity or harm to their reputation from events relating to their business, we may also suffer negative publicity or harm to our reputation by virtue of our association with any such third party.

When appropriate opportunities arise, we may acquire additional assets, products, technologies or businesses that are

complementary to our existing business. In addition to possible stockholder approval, we may need approvals and licenses from relevant government authorities for the acquisitions and to comply with any applicable laws and regulations, which could

result in increased delay and costs, and may disrupt our business strategy if we fail to do so. Furthermore, acquisitions and the subsequent integration of new assets and businesses into our own require significant attention from our management and

could result in a diversion of resources from our existing business, which in turn could have an adverse effect on our operations. Acquired assets or businesses may not generate the financial results we expect. Acquisitions could result in the use

of substantial amounts of cash, potentially dilutive issuances of equity securities and exposure to potential unknown liabilities of the acquired business. Moreover, the costs of identifying and consummating acquisitions may be significant.

We may experience difficulties integrating the operations of acquired companies into our business and in

realizing the expected benefits of these acquisitions.

We completed the acquisition of SerEnergy and FES on August 31, 2021. Acquisitions involve numerous

risks, any of which could harm our business and negatively affect our financial condition and results of operations. The success of our acquisition of FES and SerEnergy will depend in part on our ability to realize the anticipated business

opportunities from combining their and our operations in an efficient and effective manner. These integration processes could take longer than anticipated and could result in the loss of key employees, the disruption of each company’s ongoing

businesses, tax costs or inefficiencies, or inconsistencies in standards, controls, information technology systems, procedures and policies, any of which could adversely affect our ability to maintain relationships with customers, employees or

other third parties, or our ability to achieve the anticipated benefits of the acquisitions, and could harm our financial performance. If we are unable to successfully or timely integrate the operations of FES and SerEnergy with our business, we

may incur unanticipated liabilities and be unable to realize the revenue growth, synergies and other anticipated benefits resulting from the acquisitions, or fully offset the costs of the acquisition, and our business, results of operations and

financial condition could be materially and adversely affected.

We are subject to substantial regulation and unfavorable changes to, or failure by us to comply with, these

regulations could substantially harm our business and operating results.

Our fuel cells and membranes are subject to substantial regulation under international, federal, state, and local laws. We

expect to incur significant costs in complying with these regulations. Regulations related to alternative energy are currently evolving and we face risks associated with changes to these regulations, including but not limited to:

|

• |

increased subsidies for corn and ethanol production, which could reduce the operating cost of vehicles that use ethanol or a combination of ethanol and gasoline; and

|

|

• |

increased sensitivity by regulators to the needs of established automobile manufacturers with large employment bases, high fixed costs and business models based on the internal combustion

engine, which could lead them to pass regulations that could reduce the compliance costs of such established manufacturers or mitigate the effects of government efforts to promote alternative fuel vehicles. Compliance with changing

regulations could be burdensome, time consuming, and expensive. To the extent compliance with new regulations is cost prohibitive, our business, prospects, financial condition and operating results would be adversely affected.

|

We face risks associated with our international operations, including unfavorable regulatory, political,

tax and labor conditions, which could harm our business.

We face risks associated with our international operations, including possible unfavorable regulatory, political, tax and labor

conditions, which could harm our business. We have international operations in Greece that are subject to the legal, political, regulatory and social requirements and economic conditions in these jurisdictions. We are subject to a number of risks

associated with international business activities that may increase our costs, impact our ability to sell our fuel cells and membranes and require significant management attention. These risks include:

|

• |

difficulty in staffing and managing foreign operations;

|

|

• |

foreign government taxes, regulations and permit requirements, including foreign taxes that we may not be able to offset against taxes imposed upon us in the U.S., and foreign tax and

other laws limiting our ability to repatriate funds to the U.S.;

|

|

• |

fluctuations in foreign currency exchange rates and interest rates;

|

|

• |

U.S. and foreign government trade restrictions, tariffs and price or exchange controls;

|

|

• |

foreign labor laws, regulations and restrictions;

|

|

• |

changes in diplomatic and trade relationships;

|

|

• |

political instability, natural disasters, war or events of terrorism; and

|

|

• |

the strength of international economies.

|

If we fail to successfully address these risks, our business, prospects, operating results and financial condition could be

materially harmed.

The unavailability, reduction or elimination of government and economic incentives could have a material

adverse effect on our business, prospects, financial condition and operating results.

Any reduction, elimination or discriminatory application of government subsidies and economic incentives because of policy

changes, the reduced need for such subsidies and incentives due to the perceived success of alternative energies or other reasons may result in the diminished competitiveness of the alternative fuel industry generally. This could materially and

adversely affect the growth of the alternative fuel automotive markets and our business, prospects, financial condition and operating results.

While certain tax credits and other incentives for alternative energy production and alternative fuel vehicles have been

available in the past, there is no guarantee these programs will be available in the future. If current tax incentives are not available in the future, our financial position could be harmed.

We may not be able to obtain or agree on acceptable terms and conditions for all or a significant portion

of the government grants, loans and other incentives for which we may apply in the future. As a result, our business and prospects may be adversely affected.

We anticipate continuing to apply for federal and state grants, loans and tax

incentives under government programs designed to stimulate the economy and support the production of alternative fuel vehicles and related technologies. We anticipate that in the future there will be new opportunities for us to apply for grants,

loans and other incentives from the U.S., state and foreign governments. Our ability to obtain funds or incentives from government sources is subject to the availability of funds under applicable government programs and approval of our applications

to participate in such programs. The application process for these funds and other incentives will likely be highly competitive. We cannot assure you that we will be successful in obtaining any of these additional grants, loans and other

incentives. If we are not successful in obtaining any of these additional incentives and we are unable to find alternative sources of funding to meet our planned capital needs, our business and prospects could be materially adversely affected.

We may need to defend ourselves against patent or trademark infringement claims, which may be

time-consuming and cause us to incur substantial costs.