UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number:

(Exact name of registrant as specified in its charter)

|

|

|

|

(State or other jurisdiction of |

(I.R.S. Employer |

| incorporation or organization) |

Identification No.) |

|

|

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class: |

Trading Symbol(s) |

Name of each exchange on which registered |

||

|

|

|

The |

||

|

|

|

The |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

|

|

Smaller reporting company |

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price of a share of the registrant’s common stock on June 30, 2023 as reported by the Nasdaq Capital Market on such date, was approximately $

As of April 4, 2024 the number of outstanding shares of the registrant’s common stock, par value $0.0001 per share, was

DOCUMENTS INCORPORATED BY REFERENCE

None.

REVIVA PHARMCEUTICALS HOLDINGS, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023

|

Page |

||

|

Item 1. |

||

|

Item 1A. |

35 | |

|

Item 1B. |

72 | |

|

Item 1C. |

72 | |

|

Item 2. |

72 | |

|

Item 3. |

72 | |

|

Item 4. |

72 | |

| 73 | ||

|

Item 5. |

73 | |

|

Item 6. |

73 | |

|

Item 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

73 |

|

Item 7A. |

82 | |

|

Item 8. |

82 | |

|

Item 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

82 |

|

Item 9A. |

82 | |

|

Item 9B. |

83 | |

|

Item 9C. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

83 |

| 84 | ||

|

Item 10. |

84 | |

|

Item 11. |

88 | |

|

Item 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

93 |

|

Item 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

97 |

|

Item 14. |

99 | |

| 99 | ||

|

Item 15. |

99 | |

|

Item 16. |

104 |

EXPLANATORY NOTE

Reviva Pharmaceuticals Holdings, Inc. (the “Company”, “we” or “us”) is filing this comprehensive annual report on Form 10-K for the fiscal years ended December 31, 2023 and 2022 (the “Comprehensive Form 10-K”). This Comprehensive Form 10-K contains our audited financial statements for the fiscal year ended December 31, 2023, as well as restatement of the following previously filed periods: (i) our audited consolidated financial statements for the fiscal year ended December 31, 2022, (ii) our unaudited consolidated financial statements covering the quarterly reporting period of September 30, 2022 during fiscal year 2022; and (iii) our unaudited consolidated financial statements covering the quarterly reporting periods during fiscal year 2023, consisting of September 30, 2023, June 30, 2023, and March 31, 2023.

Restatement Background

On April 12, 2024, the audit committee (the “audit committee”) of the board of directors of the Company, after meeting with management, concluded that the Company’s previously issued financial statements for the fiscal year ended December 31, 2022 included in its Annual Report on Form 10-K, the interim financial statements for the quarterly period ended September 30, 2022 included in its Quarterly Report on Form 10-Q, and each of the interim financial statements for the quarterly periods in fiscal 2023 included in its Quarterly Reports on Form 10-Q (cumulatively, the “Restatement Periods”) should be restated to correct historical errors related principally to the timing of recognition of the Company’s estimated accrual of certain research and development expenses.

The need for the restatement arose out of the results of certain financial analysis the Company performed in the course of preparing its fiscal year-end 2023 financial statements. Principally, the Company completed a detailed lookback analysis to compare certain estimated accrued clinical trial expenses, specifically investigator fees, from one contract research organization to its actual clinical trial expenses that were incurred for the respective periods for that contract research organization during the Restatement Periods based on review of historical invoices. In the course of its analysis of the actual information gathered through the lookback process, the Company detected differences between the estimated accrued amounts of those clinical trial expenses and the actual expenses recorded due primarily to the Company’s failure to properly review and evaluate expenses incurred in those clinical trial contracts resulting in the Company not properly accruing for clinical trial expenses that were incurred but for which invoices were not yet received. In addition, the Company determined that an effective process for evaluating the completeness of the research and development expense accrual for investigator fees and related costs, for that contract research organization, was necessary. This included estimated patient site visits not yet reported, average site visit costs and average delay in site invoicing. This provides the Company with an accurate estimate of the costs incurred as there can be a significant delay in receiving an invoice for the services provided from that contract research organization. Management and the audit committee have concluded that, in the ordinary course of closing its financial books and records, the Company previously excluded certain clinical trial expenses and associated accruals from the appropriate periods as required under applicable accounting guidelines. This impacted the Company’s previously-issued financial statements for the year ended December 31, 2022, which had understated by approximately $3.9 million certain research and development expenses and associated accrued liabilities, representing the under accrual of clinical expenses which would have otherwise been accounted for in the year ended December 31, 2023. The Company received FDA authorization in early 2022 to begin clinical trials and therefore, no similar error as of December 31, 2021 would be expected or identified. Further, management determined that any misstatements to the quarterly periods ended March 31, 2022 and June 30, 2022 included in its Quarterly Reports on Form 10-Q, were not material.

The Company principally attributes the errors to material weaknesses in its internal control over financial reporting and clinical trial expenses, as disclosed in Part II, Item 9A of its Annual Report on Form 10-K, relating to (i) a material weakness in internal control activities due to a failure in the design and implementation of our controls to review clinical trial expenses, including the evaluation of the terms of clinical trial contracts, specifically, we failed to properly review and evaluate progress of expenses incurred in clinical trial contracts resulting in us not properly accruing for clinical trial expenses that were incurred but for which invoices were not yet received, and (ii) a material weakness in internal controls due to insufficient resources including in relation to the Company’s financial close and reporting process with appropriate knowledge and expertise to design, implement, document and operate effective internal controls over financial reporting. This material weakness has a pervasive impact and consequently, impacts control activities over all financial statement account balances, classes of transactions, and disclosure. The Company has commenced procedures to remediate the material weaknesses. However, these material weaknesses will not be considered remediated until the applicable remedial actions have been fully implemented and we have concluded that these controls are operating effectively for a sufficient period of time.

Items Restated in this Form 10-K

This Comprehensive Form 10-K for the fiscal years ended December 31, 2023 and 2022 reflects changes to the Consolidated Balance Sheet at December 31, 2022 and the Consolidated Statements of Operations, Stockholders’ Equity, and Cash Flows for the year ended December 31, 2022, and the related notes thereto. Restatement of consolidated financial statements for the fiscal year ended December 31, 2022 is disclosed in Note 2 to the consolidated financial statements. Restatement of consolidated financial statements for the quarterly and year-to-date period ended September 30, 2022, in fiscal year 2022, and all quarterly periods in fiscal year 2023 are disclosed in Note 10 to the consolidated financial statements. Other sections impacted by the restatement are: Part I, Item 1A. Risk Factors; Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations; and Part II, Item 9A. Controls and Procedures.

The Company has not filed, and does not intend to file, amendments to the previously filed Quarterly Reports on Form 10-Q for the quarterly period ended September 30, 2022 or any of the quarterly periods during the fiscal year ended December 31, 2023, nor the previously filed Annual Report on Form 10-K for the fiscal year ended December 31, 2022. Accordingly, investors should rely only on the financial information and other disclosures regarding the restated periods in this Form 10-K or in future filings with the SEC (as applicable), and not on any previously issued or filed reports, earnings releases or similar communications relating to these periods.

See Note 2 and Note 10 to the consolidated financial statements, included in Part II, Item 8 of this Form 10-K, for additional information on the restatement and the related consolidated financial statement effects.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report on Form 10-K contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this report on Form 10-K may include, for example, statements about:

|

● |

the success of our current or planned clinical trials through all phases of clinical development, including our ability to conduct and complete clinical trials in accordance with projected timelines, our ability to achieve the desired results, and our ability to successfully complete requisite regulatory review and approval processes; |

|

● |

our ability to obtain the necessary financing to continue to conduct our business operations as planned, and to conduct our ongoing and planned trials, and continue and complete the planned development and commercialization of our product candidates |

|

● |

our ability to grow and manage growth economically; |

|

● |

our ability to retain key executives and medical and science personnel; |

|

● |

the possibility that our products in development succeed in or fail clinical trials or are not approved by the FDA or other applicable authorities; |

|

● |

the possibility that we could be forced to delay, reduce or eliminate our planned clinical trials or development programs; |

|

● |

our ability to obtain approval from regulatory agents in different jurisdictions for our current or future product candidates; |

|

● |

changes in applicable laws or regulations; |

|

● |

changes to our relationships within the pharmaceutical ecosystem; |

|

● |

the performance of third-party suppliers and manufacturers and our ability to find additional suppliers and manufacturers and obtain alternative sources of raw materials; |

|

● |

our current and future capital requirements to support our development and commercialization efforts and our ability to satisfy our capital needs; |

|

● |

our ability to access capital on acceptable terms in a rising interest rate and tighter credit environment; |

|

● |

expectations regarding our ability to continue as a going concern; |

|

● |

the accuracy of our estimates regarding expenses and capital requirements, including estimated costs of our clinical studies; |

|

● |

our limited operating history; |

|

● |

our history of operating losses in each year since inception and expectation that we will continue to incur operating losses for the foreseeable future; |

|

● |

the valuation of our private common warrants could increase the volatility in our net income (loss); |

|

● |

changes in the markets that we target; |

|

● |

our ability to maintain or protect the validity of our patents and other intellectual property; |

|

● |

our exposure to any liability, protracted and costly litigation or reputational damage relating to data security; |

|

● |

the sufficiency of our existing capital resources to fund our future operating expenses and capital expenditure requirements; |

|

● |

the commercial, reputational and regulatory risks to our business that may arise as a consequence of our need to restate our financial statements; |

|

● |

any disruption to our business that may occur on a longer-term basis should we be unable to remediate the material weaknesses we have identified in our internal controls over financial reporting and clinical trial expenses; |

|

● |

our ability to maintain the listing of our common stock and listed warrants on Nasdaq; |

|

● |

the possibility that we may be adversely affected by other economic, business, and/or competitive factors. |

The foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced with that may cause our actual results to differ from those anticipated in such forward-looking statements. Please see “Part I—Item 1A—Risk Factors” for additional risks which could adversely impact our business and financial performance.

All forward-looking statements are expressly qualified in their entirety by this cautionary notice. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this report or the date of the document incorporated by reference into this report. We have no obligation, and expressly disclaims any obligation, to update, revise or correct any of the forward-looking statements, whether as a result of new information, future events or otherwise. We have expressed our expectations, beliefs and projections in good faith and believe they have a reasonable basis. However, we cannot assure you that our expectations, beliefs or projections will result or be achieved or accomplished.

|

Item 1. |

BUSINESS |

All references in this report to “Reviva,” the “Company,” “we,” “us,” or “our” mean Reviva Pharmaceuticals Holdings, Inc. and its subsidiaries unless we state otherwise, or the context otherwise indicates.

Company Overview

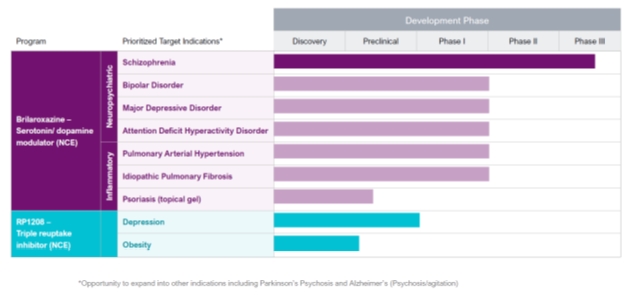

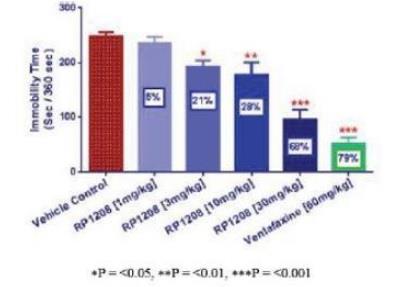

We are a late-stage pharmaceutical company that discovers, develops, and seeks to commercialize next-generation therapeutics for diseases representing significant unmet medical needs and burdens to society, patients, and their families. Our current pipeline focuses on the central nervous system, inflammatory, and cardiometabolic diseases. We use a chemical genomics driven technology platform and proprietary chemistry to develop new medicines. Our pipeline currently has two drug candidates, brilaroxazine (RP5063) and RP1208. Both are new chemical entities discovered in-house. We have been granted composition of matter patents for both brilaroxazine and RP1208 in the United States (U.S.), Europe, and several other countries.

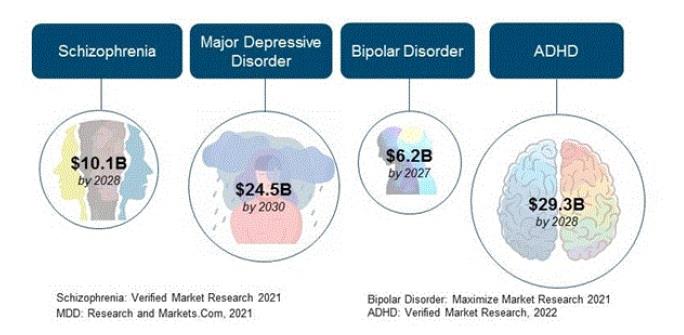

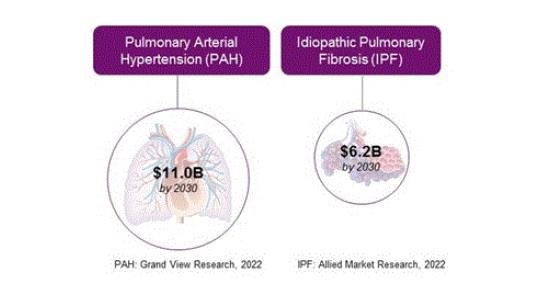

Our lead drug candidate, brilaroxazine, is in clinical development and is intended to treat multiple neuropsychiatric indications. These include schizophrenia, bipolar disorder (“BD”), major depressive disorder (“MDD”), attention–deficit/hyperactivity disorder (“ADHD”), behavioral and psychotic symptoms of dementia and Alzheimer’s disease (“BPSD”), and Parkinson’s disease psychosis (“PDP”). Furthermore, brilaroxazine is also ready for clinical development for two respiratory indications — pulmonary arterial hypertension (“PAH”) and idiopathic pulmonary fibrosis (“IPF”). The U.S. Food and Drug Administration (FDA) granted Orphan Drug Designation to brilaroxazine for the treatment of PAH in November 2016 and IPF in April 2018. Brilaroxazine also is in preclinical development for the treatment of psoriasis.

Our primary focus is to complete the clinical development of brilaroxazine for the treatment of acute and maintenance schizophrenia.

On October 30, 2023, we announced positive topline results from our Phase 3 RECOVER 1 trial (the “RECOVER-1 Trial”), which is a global Phase 3, randomized, double-blind, placebo-controlled, multicenter study designed to assess the safety and efficacy of brilaroxazine in approximately 400 patients with acute schizophrenia compared to placebo. See “Recent Developments” below for more details on brilaroxazine development.

Subject to the receipt of additional financing, we may also continue the clinical development of brilaroxazine for the treatment of BD, MDD, ADHD, BPSD, PDP, PAH and IPF. Moreover, subject to the receipt of additional financing, we may also advance the development of our second drug candidate, RP1208, for the treatment of depression and obesity.

Recent Developments

On October 30, 2023, we announced positive topline results and successful completion of our pivotal RECOVER-1 Trial evaluating the efficacy, safety and tolerability of once-daily brilaroxazine, a serotonin dopamine signaling modulator in adults with schizophrenia. The trial successfully met its primary endpoint at the 50 mg dose, with brilaroxazine at that dose achieving a statistically significant and clinically meaningful 10.1-point reduction in Positive and Negative Syndrome Scale (PANSS) total score compared to placebo (-23.9 brilaroxazine 50 mg vs. -13.8 placebo, p<0.001) at week 4. Brilaroxazine also achieved statistically significant and clinically meaningful reductions in all major symptom domains and secondary endpoints at week 4 with the 50 mg dose vs. placebo. The 15 mg dose of brilaroxazine was numerically superior to placebo on the primary endpoint and most secondary endpoints, and reached statistical significance on two key secondary endpoints.

Key statistically significant and clinically meaningful improvements with brilaroxazine vs. placebo in patients with schizophrenia and a mean PANSS total score of 97-99 at baseline include:

|

Primary and Secondary Endpoints |

Point Reduction/ Improvement for Brilaroxazine 50 mg vs. Placebo at Week 4 |

Cohen’s d Effect Size |

P Value |

|

PANSS Total Score |

10.1 |

0.6 |

< 0.001 |

|

Positive Symptoms |

2.8 |

0.5 |

< 0.001 |

|

Negative Symptoms (“NS”) |

2.0 |

0.4 |

0.003 |

|

NS Marder Factor |

2.1 |

0.4 |

0.002 |

|

PANSS Social Cognition |

1.6 |

0.5 |

< 0.001 |

|

PANSS Excitement/Agitation |

2.1 |

0.5 |

< 0.001 |

|

Personal and Social Performance |

6.3 |

0.5 |

< 0.001 |

|

CGI-S score |

≥1 |

0.5 |

< 0.001 |

Key clinical safety and tolerability findings of brilaroxazine support a well-tolerated safety profile

|

● |

No drug related serious adverse events (SAEs) or treatment-emergent SAEs (TESAEs) observed or major safety concerns reported for brilaroxazine after 4 weeks of treatment; |

|

|

● |

No incidence of suicidal ideation; |

|

|

● |

No significant change in bodyweight and blood glucose levels compared to placebo; |

|

|

● |

Significant decrease in cholesterol, LDL and increase in HDL compared to placebo; |

|

|

● |

Significant decrease in prolactin and no change in thyroid levels compared to placebo; |

|

|

● |

Akathisia and extrapyramidal symptoms <1% reported for brilaroxazine 50 mg and none for 15 mg; |

|

|

● |

Common brilaroxazine treatment-emergent adverse events (TEAEs) were headache (<6%) and somnolence (<7.5%) generally transient in nature; and |

|

|

● |

Low discontinuation rates with brilaroxazine that were less than placebo (16% in brilaroxazine 50mg and 19% in brilaroxazine 15mg vs. 22% placebo). |

The clinical development plan for brilaroxazine also includes the completed positive Phase 2 REFRESH trial, an ongoing 1-year open label extension (OLE) trial evaluating long-term safety and tolerability, and a soon to be initiated registrational global, randomized 4-week Phase 3 RECOVER 2 trial (the “RECOVER-2 Trial”). We expect to report topline data from the OLE trial in Q4-2024, and we expect to initiate the registrational RECOVER-2 Trial in the second quarter of 2024, with completion anticipated in the second quarter of 2025. RECOVER-2 was originally designed as a 6-week study, but after discussion between Reviva and FDA, the agency has agreed that it can be conducted as a 4-week study. Data from these brilaroxazine clinical trials will potentially support the planned NDA submission to the FDA in 2025.

The development status of the Reviva product pipeline is presented below:

Business Combination and Domestication

On December 14, 2020, our predecessor company, formerly known as Tenzing Acquisition Corp., a British Virgin Islands exempted company (“Tenzing”), and Reviva Pharmaceuticals, Inc., a Delaware corporation (together with its consolidated subsidiaries, “Old Reviva”), consummated the transactions (the “Business Combination”) contemplated by the Agreement and Plan of Merger, dated as of July 20, 2020 (as amended, the “Merger Agreement”), by and among Tenzing, Tenzing Merger Subsidiary Inc., a Delaware corporation and wholly-owned subsidiary of Tenzing (“Merger Sub”), Old Reviva, and the other parties thereto. Pursuant to the Merger Agreement, Merger Sub merged with and into Old Reviva, with Old Reviva surviving as our wholly owned subsidiary. We refer to this transaction as the Business Combination. In connection with and one day prior to the completion of the Business Combination, Tenzing re-domiciled out of the British Virgin Islands and continued as a company incorporated in the State of Delaware, and changed its name to Reviva Pharmaceuticals Holdings, Inc. Prior to the completion of the Business Combination, the Company was a shell company. Following the Business Combination, the business of Old Reviva is the business of the Company.

Old Reviva was incorporated in the state of Delaware on May 1, 2006 and its subsidiary, Reviva Pharmaceuticals India Pvt. Ltd., was incorporated on December 23, 2014. Tenzing was formed pursuant to the laws of the British Virgin Islands on March 20, 2018.

About Brilaroxazine (RP5063)

Our drug candidate brilaroxazine is a novel, multimodal serotonin (5HT), dopamine (DA), and nicotinic receptor modulator. Our compound displays a high affinity for 5HT2A/2B/7 and DA2/3/4 receptors and a moderate affinity for nicotinic (nACh- α4β2) receptors (Rajagopal et al., 2017). The binding affinity of brilaroxazine to dopamine and serotonin sub-receptors in radioligand binding assays is the following (Ki, nM): dopamine D2S (0.28), D2L (0.45), D3 (3.7), and D4.4 (6.0); Serotonin 5HT1A (1.5), 5-HT2A (2.5), 5-HT2B (0.19), 5-HT2C (39), 5-HT6 (51), and 5-HT7 (2.7). Brilaroxazine displayed moderate binding affinity to nicotine- nAChR, α4β2 (Ki = 36.3 nM).

Radioactive and non-radioactive studies in rat and dog show that the gastrointestinal tract completely absorbs orally administered brilaroxazine -related material, with acceptable bioavailability in rat (22%) and dog (85%) animal models. Exposure to brilaroxazine increased in a dose-dependent manner. Once absorbed, brilaroxazine rapidly and extensively distributes into various tissues. Noteworthy is the brain with a brain:plasma ratio of ~3.5, despite high plasma protein binding (>99%) characteristics. Rat and dog hepatocytes rapidly metabolize brilaroxazine; however, human hepatocytes metabolize this compound more slowly. This finding suggests that brilaroxazine will show a low clearance in humans. We believe the risk of brilaroxazine inducing or inhibiting cytochrome P450 (CYP) at anticipated pharmacologically relevant concentrations in humans is low. Hepatic metabolism via the cytochrome P450s is the primary route of elimination with CYP3A4/5 undertaking most of the metabolism (69%), a small contribution from CYP2D6 (17%) and minor contributions by other cytochromes including extra-hepatic CYP2J2. Two metabolites in human plasma and urine display no pharmacological activity. We believe there is a low risk of inhibition and induction of human cytochromes by brilaroxazine at expected plasma concentrations clinically.

A full battery of regulatory compliant toxicology and safety pharmacology studies is complete. We believe the results from these tests support the chronic administration of brilaroxazine in clinical trials. We believe the completed safety, pharmacology and toxicology studies support several significant safety findings. These include (1) brilaroxazine is neither genotoxic nor clastogenic, (2) it does not affect the function of cardiovascular (QT interval or blood pressure) or respiratory systems, and (3) it is not phototoxic in the 3T3 in vitro assay.

DEVELOPMENT OF BRILAROXAZINE (RP5063) FOR NEUROPSYCHIATRIC DISEASES

Brilaroxazine Development for Schizophrenia

Schizophrenia is a complex, chronic, and debilitating psychiatric syndrome. As presented in 2020, the Schizophrenia and Related Disorders Alliance of America (“SARDAA”) estimates schizophrenia can be found in approximately 1.1% of the world’s population, regardless of racial, ethnic, or economic background, with approximately 3.5 million people diagnosed in the U.S. It is a complex disease involving a mix of positive and negative symptoms, along with mood disorder and cognitive impairment. While the pathology of schizophrenia is not yet fully understood, scientists implicate the dysregulation or disruption of both dopaminergic and serotonergic functions in the development of this condition. The dysregulation of serotonergic function in the brain also contributes to schizoaffective disorders, such as bipolar, major depression, and mania. Thus, the optimal treatment for schizophrenia may not rely solely on dopamine blockade. Hypothetically, it may also include the stabilization of both the dopaminergic and serotonergic systems in the brain.

Current pharmacologic treatment involves antipsychotic therapy. There are two types of antipsychotics, typical and atypical agents. Tolerability issues (e.g., neuroleptic side effects with typical agents; metabolic and cardiovascular problems with atypical medications) limit compliance and the effectiveness of both classes of medications. Hence, compliance is poor. We estimate, pursuant to a review of multiple peer reviewed articles published between 1998 and 2015, discontinuation rates of 30 – 50% in the short-term management of acute patients and 42 – 74% in the long-term treatment. Also, both classes of antipsychotics fail to provide a broad spectrum of efficacy across the major symptoms or comorbidities of schizophrenia. Thus, we believe the optimal treatment of schizophrenia requires new compounds with broader efficacy, and better safety, tolerability and compliance profiles.

We believe the majority of the FDA approved antipsychotics in the last two decades block dopamine (D) and serotonin (5HT) receptors, particularly D2 and 5HT2A receptors. Brilaroxazine possesses a potent binding and functional activity for both D2 and 5HT2A receptors. We believe these targets are critical for treating schizophrenia. In addition, brilaroxazine has potent activities for D4, 5HT1A, 5HT2B and 5HT7 receptors implicated as targets for conditions associated with schizophrenia such as negative symptoms, mood symptoms (e.g., depression, anxiety) and cognitive impairment. Brilaroxazine also exerts a moderate activity on nicotinic (nAChR, α4β2) receptor, implicated as a target for comorbid conditions in schizophrenia, depression and cognitive impairment.

Preclinical studies define the activity, pharmacokinetic, and safety profiles of brilaroxazine in animals. Rodent models of pharmacologic-induced behaviors associated with schizophrenia have demonstrated that brilaroxazine attenuates both psychosis and cognitive symptoms.

We have completed a clinical Phase 1a study in healthy subjects, a Phase 1b study in stable schizophrenia patients, a Phase 2 study in acute schizophrenia and schizoaffective patients, and the Phase 3 RECOVER-1 Trial in acute schizophrenia patients.

Brilaroxazine (RP5063) Phase 1 Clinical Study in Stable Schizophrenia

Phase 1a and 1b studies have defined the initial clinical experience with brilaroxazine. The first-in-human study Phase 1a involved a single-dose ascending study of 24 individuals. Initially, it examined patient cohorts receiving individual doses of 10 and 15 mg fasting; this was followed by a food-effect investigation (food versus fasting, crossover), with a 15 mg dose (Figure 1a). The multiple-dose Phase 1b study examined doses of 10, 20, 50, and 100 mg given with food over ten days in 32 randomized patients (Figure 1b). Collectively, these studies characterized the initial safety and pharmacokinetic profiles in normal healthy volunteers (Caucasian or Japanese men, 20 – 45 years) and stable patients with schizophrenia (18 – 65 years, chronic, all types with Total Positive and Negative Syndrome Scale (PANSS) score < 90 points). Brilaroxazine displayed a dose-dependent Cmax at 4 to 6 h, linear dose proportionality for both Cmax and AUC, and a half-life between 40 and 71 h. In the single-dose study, food slightly increased the extent of drug absorption. In the multiple-dose study, drug concentrations approached steady-state after 120 h (5 days) of daily dosing. Pooled data in the single-dose study indicate that the pharmacokinetic profile appeared to be comparable between Caucasians and Japanese. Study data have suggested a straightforward pharmacokinetic profile for brilaroxazine that we believe supports once-daily dosing as an orally administered agent for Phase 2 and Phase 3 evaluation.

Figure 1. Brilaroxazine Phase 1 Clinical Studies, Pharmacokinetics in Healthy Subjects and Stable Schizophrenia Patients

|

1A. Single-dose pharmacokinetics profile of brilaroxazine (15 mg) in healthy subjects |

1B. Multiple-dose pharmacokinetics profile of brilaroxazine (10, 20, 50 or 100 mg/day) in stable schizophrenia patients for 10 days |

|

|

|

As the multiple-dose study included patients with stable schizophrenia, the data from this study provided an early assessment of the pharmacodynamics behavior and activity of brilaroxazine in this population. Notable were the results of secondary analyses to explore Positive and Negative Syndrome Scale (“PANSS”) observations relevant to the effect of brilaroxazine on positive symptoms, and Trails A and B tests to assess the effect on cognition, respectively. Pooled analysis of patients with PANSS scores ≥50 at baseline showed a statistically significant reduction in positive symptoms subscale scores (Figure 2a). Furthermore, study analysis identified favorable trends in reducing PANSS total scores from baseline and in the General Psychopathology Score from baseline vs. placebo. Similarly, a pooled analysis of Trails A and B scores from baseline to day 16 showed favorable trends in the improvement of cognition in the brilaroxazine treatment groups vs. placebo.

Figure 2. Brilaroxazine Efficacy in the Phase 1B Clinical Study in Stable Schizophrenia Patients

|

2A. A decrease in positive symptoms in stable |

2B. An improvement in cognition in stable |

|

●PANSS Baseline scores for sub-analysis: >50 ●Pooled data of brilaroxazine (10-100mg/day), N=19 |

●PANSS Baseline scores: 39-69 ●Pooled data of brilaroxazine (10-100mg/day), N=32 |

The Phase 1b study in stable schizophrenia patients found that brilaroxazine appears to be generally well-tolerated at doses ranging from 10 – 100 mg administered once daily over ten days. Most adverse events were mild and occurred at the higher doses 50mg and 100 mg. Notable was the lack of clinically significant changes in glucose or prolactin levels, lipid profiles, and weight or ECG findings. A pharmacodynamic analysis of the multiple-dose Phase 1b study data provided early insight regarding the clinical activity of brilaroxazine relevant to psychosis, along with mood and cognitive comorbidities, in patients with stable schizophrenia. Although we believe the Phase 1b study safety and efficacy findings are encouraging, it is important to recognize its power limitations due to the relatively small sample size.

Brilaroxazine (RP5063) Phase 2 Clinical Study in Acute Schizophrenia

The Phase 2 clinical study involved patients with acute exacerbations of schizophrenia or schizoaffective disorder and was designed to evaluate the efficacy, safety, tolerability, and pharmacokinetics of brilaroxazine versus placebo. The study was a double-blind, randomized, placebo-controlled 4-week trial. Aripiprazole was included in the study purely for assay sensitivity analysis and not as a comparator. A total of 234 eligible subjects were randomized into one of five treatment groups (15, 30, 50mg brilaroxazine, aripiprazole 15mg, or placebo; 3:3:3:1:2, respectively). Recruitment of male and female subjects occurred at 22 sites in the US, India, Philippines, Malaysia, and Moldova.

The sample size was calculated based on expected differences between the target dose of brilaroxazine and placebo of 8.3 points (standard deviation of 11.3 points, effect size = 0.735) in the primary efficacy analysis (mean change from baseline in PANSS Total Score). This plan projected a sample size of 180 completing subjects (i.e., 45 subjects in each brilaroxazine dose group; this cohort included 15 subjects in the aripiprazole group and 30 subjects in the placebo group) to achieve at least 85% power at an alpha level of 0.05% (two-sided). This level employed a t-test statistic for unequal group sizes, without controlling the alpha error in the pair-wise comparisons of the treatment groups with placebo. The statistical plan did not power the aripiprazole arm for statistical comparisons with other arms, as evaluation of this compound only assessed the study sensitivity; the study randomized 234 subjects to ensure that 180 would complete.

We conducted this study in compliance with the International Conference on Harmonization (ICH) Good Clinical Practice (GCP) Consolidated Guidelines. The FDA reviewed the protocol, as did investigational review boards/independent ethics committees, and all participating subjects provided informed consent.

The primary efficacy endpoint was the change from baseline to Day 28 or End of Treatment (EOT) on PANSS Total Score. The secondary efficacy endpoints were the change from baseline to Day 4, Day 8, Day 15, Day 22 and Day 28 on the following items: PANSS Total, PANSS Positive, and Negative subscales; 20% improvement in PANSS Total Score; Improvement by at least 1 point on the Clinical Global Impression (CGI-S); cognition by trail-making Tests A and B and the Digit Symbol Substitution Test (DSST). Safety variables included adverse events (AE), physical examinations, vital signs, body weight, laboratory measurements (hematology, serum chemistry including prolactin, urinalysis, and pregnancy tests), and electrocardiograms (ECGs). The measurement of extrapyramidal symptoms (EPS) utilized the Simpson Angus Scale (SAS), Abnormal Involuntary Movement Scale (AIMS), and the Barnes Akathisia Rating Scale (BARS). The Columbia-Suicide Severity Rating Scale (C-SSRS) assessed and classified reported suicidal behavior and depression by the Calgary Depression Scale for Schizophrenia (CDSS). Investigators collected blood samples throughout the dosing period and for 220 h beyond using a sparse sampling routine. Analysis of these samples defined the population pharmacokinetics (PK) and correlated pharmacokinetic and pharmacodynamic (PK/PD) effects.

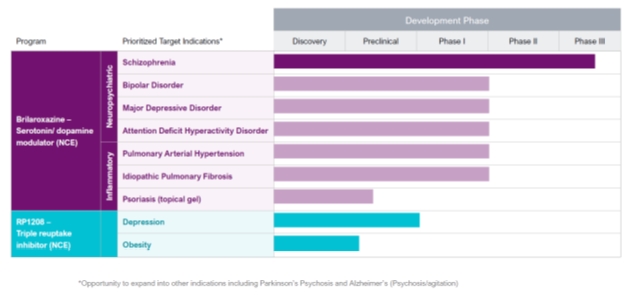

Brilaroxazine demonstrated a sustained decrease in the total PANSS scores from Day 1 to 28 with statistically significant improvement within the group for all doses of brilaroxazine (p=<0.001) and aripiprazole (p=0.013) (Figure 3).

Figure 3. Brilaroxazine Efficacy in the Phase 2 Clinical Study in Acute Schizophrenia patients, Total PANSS Scores, ITT Population (4 weeks, N = 234)

For the primary efficacy endpoint, the change in PANSS Total Score from baseline to Day 28/EOT there was a statistically significant treatment difference from placebo for the brilaroxazine 15-mg and 50-mg arms (p = 0.0212 and p = 0.0167), with a statistically significant difference versus placebo seen as early as the Day 15 assessment (mixed-effect model with repeated measures (MMRM) analyses). The 30-mg arm did not reach statistical significance (p=0.2733), although it was numerically superior. Investigators attributed the lack of significance of the brilaroxazine 30 mg dose to larger than normal early discontinuations (within 2-7 days) for reasons that were not related to the medication. Aripiprazole only showed efficacy in PANSS negative scores. PANSS subscales scores showed greater brilaroxazine improvement versus placebo in the PANSS Negative and Prosocial symptoms than the Positive symptoms (Figure 4). Both the brilaroxazine 15-mg and 50-mg treatment groups displayed statistical significance from placebo as early as Day 15 for the PANSS Negative and Prosocial scales. The 50-mg treatment group showed statistical significance at Day 28 for PANSS Positive. All brilaroxazine groups were numerically superior to placebo.

Figure 4. Brilaroxazine Phase 2 Clinical Efficacy for Acute Schizophrenia and Major Comorbid Symptoms

|

4A. Efficacy Data for Acute Schizophrenia

|

4B. Efficacy Data for Negative Symptoms

|

|

4C. Efficacy Data for Positive Symptoms

|

4D. Efficacy Data for Social Functioning

|

At Day 28/EOT, the frequency of a 30% improvement in total PANSS from baseline to EOT was 41%, 26%, and 39% for the respective brilaroxazine groups, versus 22% for the placebo cohort. Brilaroxazine subjects improved ≥2 points on the CGI-S by Day 28/EOT at twice the frequency of those on placebo. Brilaroxazine 15-mg, 30-mg, and 50-mg groups resulted in 46%, 37%, and 40% improvements, respectively, versus placebo showing a 19% change. Further, relative to >1 point changes, the 15-mg, 30-mg, and 50-mg brilaroxazine groups produced 73%, 58%, and 72% improvements, respectively, in the CGI-S, as compared to placebo showing 57% change. The CGI-S changes from baseline to Day 28/EOT were statistically superior to placebo for brilaroxazine 15 mg and 50 mg, while the change for 30 mg was numerically superior. Overall, brilaroxazine (15, 30, and 50mg) treated patients showed between 30-46% remission of acute schizophrenia symptoms, as compared with 22% in the placebo group (Figure 5a). As expected in a short study in patients with acute schizophrenia, there were no statistically significant differences in change from baseline for cognition scores. However, there were numerical improvements in brilaroxazine groups in the DSST, Trails A and Trails B scores for cognitive functions.

Figure 5. Brilaroxazine Phase 2 Study, Remission of Acute Schizophrenia and Discontinuation due to Side Effects

|

5A. Remission of Schizophrenia Symptoms |

5B. Discontinuation due to Side Effects |

|

|

|

Patients tolerated doses of brilaroxazine up to 50 mg with no side effect related discontinuations in the 15 mg and 30 mg dose groups. Only <2% of patients discontinued the treatment in the 50 mg dose group compared to 10% of patients in the aripiprazole 15 mg group (Figure 5b). Treatment discontinuations for any reason with 15 mg, 30 mg, and 50 mg doses of brilaroxazine; the 15 mg dose of aripiprazole; and placebo were 14%, 25%, 12%, 35%, and 26%, respectively. Investigators attribute the higher discontinuation rate in the 30 mg group of brilaroxazine to a larger than the normal number of early discontinued patients (~10%) due to non-treatment reasons. Such early discontinuation is not uncommon in a clinical study of acute schizophrenia. The discontinuation rates with aripiprazole (35% for any reason, and 10% due to side effects) are consistent with findings in published clinical studies. Common treatment-emergent adverse events (TEAEs) were EPS (3%, 5%, and 9%) and akathisia (2%, 5%, and 10%), and as expected there seemed to be a dose-dependent increase in TEAEs in the 15, 30, and 50 mg brilaroxazine treatment groups, respectively (Figure 6).

There were no clinically relevant changes from baseline in weight or body mass index (BMI); no subject had weight gain reported as a TEAE. This observation represented a clinically relevant finding because weight gain has been a common side effect of second-generation antipsychotics and identified as a key risk factor associated with increased morbidity and mortality in patients with schizophrenia with a major impact on compliance.

There were no clinically meaningful trends in laboratory parameters (including glucose, cholesterol, triglycerides or thyroid hormone T4), ECG, or vital signs. The study observed small mean decreases from baseline in prolactin levels in all treatment groups at Day 28. In addition, there were no reports of sexual side effects and no increase in suicidal ideation compared to placebo (Figure 6).

Figure 6. Brilaroxazine Side Effect Profile in the Phase 2 Clinical Study in Acute Schizophrenia (4 weeks, N=234)

|

6A. CNS or Neuroleptic Side effects |

|

|

Extrapyramidal Side effects (%) |

Akathisia (%) |

|

|

|

|

6B. Endocrine Side Effects |

|

|

Change in Prolactin (mIU/L)

|

Change in Thyroid T-4 (pmol/L)

|

|

6C. Metabolic Side Effects |

|

|

Body weight Increase (%)

|

Diabetes / Blood Sugar (mmol/L)

|

|

Cholesterol (mmol/L)

|

Lipids/Triglyceride (mmol/L)

|

The analysis of brilaroxazine pharmacokinetic-pharmacodynamics relationship (PK-PD) reflected a linear, dose-proportional increase in exposure with dose and with no evidence of time dependency. Noteworthy was that the finding of brilaroxazine dose dependent drug exposure, reflected by Cmax and AUC. These parameters increased in direct proportion to dose irrespective of the population studied (e.g., healthy volunteers, patients with stable schizophrenia, patients with acute exacerbations of schizophrenia or schizoaffective disorder). In Phase 1 multi-dose study, drug levels approached steady-state after 120 h (5 days) of daily dosing, with doses between 10 and 100 mg with maximum steady-state concentrations of 70.1 and 696 ng/mL and AUCs of 1361 and 12526 ng*h/mL at the 10 and 100 mg dose, respectively.

We believe these findings indicate a potential for important clinical benefits. We believe the lack of excessive drug accumulation should translate to a potential clinical benefit of not needing titration of therapy. Such might be the case with other atypical antipsychotics (e.g., aripiprazole). We believe that lack of accumulation and the long half-life (~40-50 h) of brilaroxazine should translate easily to a once-daily dosing schedule. We believe this schedule is of clinical importance for the schizophrenic patient population since medication adherence, and missing doses with shorter half-life drugs can be a clinical issue leading to destabilization of clinical control. Such can lead to poor long-term functional outcomes in the treatment of schizophrenia. With brilaroxazine, if a patient misses a single dose or two, we believe sufficient plasma concentrations remain for clinical control. Furthermore, the pharmacokinetic profile of brilaroxazine is independent of gender, age, ethnicity, glomerular filtration rate, smoking, concomitant medications, geographic location of the clinical site, and type of schizophrenia (acute or stable) patients treated. These observations mean that clinicians may not need dose adjustments based on the patient population (Figure 7b).

We performed the PK-PD modeling correlation with actual data using the observed and predicted PANSS demonstrating high predictability with relatively low variability. As shown in the graph below, both the regression line and line of identity are very close to each other. We believe this relationship indicates that the model is providing a very good fit (Figure 7a). The regression line is the line when one plots and regresses the observed data against the data predicted from the population model. The line of identity is when there is a perfect fit of the observed and predicted data (i.e., when each of the observed data is exactly equal to those of the corresponding predicted data, so the slope of the line is in exact unity). The dose-response curve showed that the total PANSS decrease was approaching its maximum response after a dose of approximately 15 mg. Thus, we believe brilaroxazine doses of 15 to 50 mg daily appear to be an effective clinical range of dosing (Figure 7b).

Figure 7. Brilaroxazine Phase 2 Clinical Study Pharmacokinetics and Pharmacodynamics Correlation

|

7A. Treatment PANSS vs. Predicted PANSS Scores |

7B. Predicted Dose-Response Relationship |

|

|

|

Brilaroxazine Phase 3 Studies in Schizophrenia

The Phase 1 and Phase 2 clinical experience in multiple populations (healthy volunteers, stable schizophrenia, and acute schizophrenia and schizoaffective disorder patients) reflect the promise of brilaroxazine as an addition to the treatment armamentarium of this disease. Both healthy volunteers and patients tolerated brilaroxazine well in both Phase 1 and 2 studies. The studies did not produce any cardiometabolic, cardiovascular, prolactin, or neurologic effects that would complicate current treatments. Investigators observed the early activity in Phase 1 after 10-days of dosing in stable patients and we believe that results from the Phase 2 trial may support the NDA for brilaroxazine, as brilaroxazine demonstrated significance versus placebo in Total PANSS Score at Day 28 as compared to baseline. The pharmacokinetics proved to be highly predictable and consistent between Phase 1 and 2 studies, participant type (healthy volunteer, patient), and racial characteristics (Caucasian, Black, Indian, and Japanese). Analyses showed substantive and relatively rapid oral absorption, linear, dose-proportional increases in Cmax and AUC, lack of undue accumulation, and a relatively long terminal half-life over 40 hours. We believe these findings translate to a straightforward once-daily dosing regimen with no need for titration or adjustments for the type of patient. These characteristics set the stage for further evaluation in Phase 3.

As part of the Phase 3 development plan in the end-of-Phase 2 (EOP2) meeting with the FDA in 2013, we presented the Phase 2 schizophrenia study results, discussed the Phase 3 development plans, and sought guidance from the FDA concerning the possibility of a superior safety label claim for brilaroxazine for the treatment of schizophrenia. We received a favorable response from the FDA, as the agency agreed to consider granting brilaroxazine a superior safety label claim for the treatment of schizophrenia if there is a positive outcome on a relevant endpoint in a pivotal Phase 3 study in schizophrenia. Further to support the superior safety label claim for brilaroxazine, the FDA agreed to waive the requirement to conduct a drug interaction clinical study with CYP2D6 inhibitors in Phase 3 development. We have accordingly planned Phase 3 development of brilaroxazine for acute and maintenance schizophrenia. We have completed the required regulatory compliant non-clinical studies. These include safety pharmacology studies, toxicology studies, and chemistry, manufacturing, and controls (CMC) development for initiating pivotal Phase 3 studies. Furthermore, the FDA has reviewed the results of these non-clinical studies and the Phase 3 protocols.

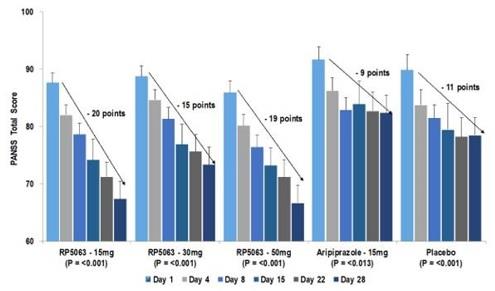

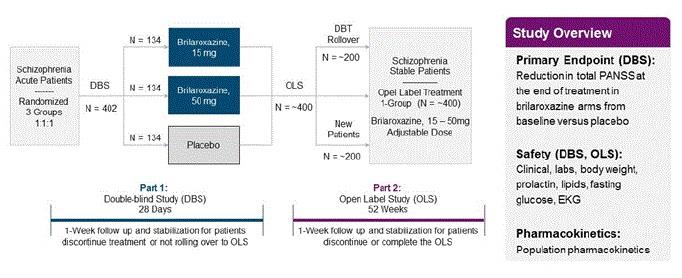

Figure 8. Brilaroxazine (RP503) Phase 3 RECOVER 1 Clinical Trial for Schizophrenia

On January 10, 2022, the FDA notified us that we may proceed with the RECOVER-1 Trial. On February 1, 2022, we announced that the first patients had been dosed in the RECOVER-1 Trial. On July 27, 2022, we announced that we had enrolled patients in 15 geographically diverse sites across the U.S. The RECOVER-1 Trial is a global Phase 3, randomized, double-blind, placebo-controlled, multicenter study designed to assess the safety and efficacy of brilaroxazine (RP5063) in 412 patients with acute schizophrenia compared to placebo. Brilaroxazine was administered at fixed doses of 15 mg or 50 mg once daily for 28 days. The primary endpoint was a decrease in Positive and Negative Symptoms Assessment total score compared to placebo from baseline to Day 28. Key secondary endpoints included clinical global impression (CGI) severity scale, positive and negative symptoms, social functioning and cognition. We enrolled approximately 60% of the patients in USA, 6% in Europe (Bulgaria) and 34% in Asia (India). On October 31, 2022, we announced over 30% enrollment in the RECOVER-1 Trial in the United States and the initiation of and ongoing enrollment in sites in Europe. The Company received regulatory approval for initiating the study in Asia (India) on October 11, 2022 and initiated multiple sites in India in November and December 2022. The RECOVER-1 Trial outline is described in Figure 8 above.

On October 30, 2023, we announced positive topline results and the successful completion of the RECOVER-1 Trial. The RECOVER-1 Trial successfully met its primary endpoint at the 50 mg dose, with brilaroxazine at that dose achieving a statistically significant and clinically meaningful 10.1-point reduction in Positive and Negative Syndrome Scale (PANSS) total score compared to placebo (-23.9 brilaroxazine 50 mg vs. -13.8 placebo, p<0.001) at week 4. Brilaroxazine also achieved statistically significant and clinically meaningful reductions in all major symptom domains and secondary endpoints at week 4 with the 50 mg dose vs. placebo. The 15 mg dose of brilaroxazine was numerically superior to placebo on the primary endpoint and most secondary endpoints, and reached statistical significance on two key secondary endpoints.

|

Key statistically significant and clinically meaningful improvements with brilaroxazine vs. placebo in patients with schizophrenia and a mean PANSS total score of 97-99 at baseline include: |

|

Primary and Secondary Endpoints |

Point Reduction/ Improvement for Brilaroxazine 50 mg vs. Placebo at Week 4 |

Cohen’s d Effect Size |

P Value |

|

|

PANSS Total Score |

10.1 |

0.6 |

< 0.001 |

|

|

Positive Symptoms |

2.8 |

0.5 |

< 0.001 |

|

|

Negative Symptoms (“NS”) |

2.0 |

0.4 |

0.003 |

|

|

NS Marder Factor |

2.1 |

0.4 |

0.002 |

|

|

PANSS Social Cognition |

1.6 |

0.5 |

< 0.001 |

|

|

PANSS Excitement/Agitation |

2.1 |

0.5 |

< 0.001 |

|

|

Personal and Social Performance |

6.3 |

0.5 |

< 0.001 |

|

|

CGI-S score |

≥1 |

0.5 |

< 0.001 |

Key clinical safety and tolerability findings of brilaroxazine support a safe and well-tolerated profile

|

● |

No drug related serious adverse events (SAEs) or treatment-emergent SAEs (TESAEs) observed or major safety concerns reported for brilaroxazine after 4 weeks of treatment; |

|

● |

No incidence of suicidal ideation; |

|

● |

No significant change in bodyweight and blood glucose levels compared to placebo; |

|

● |

Significant decrease in cholesterol, LDL and increase in HDL compared to placebo; |

|

● |

Significant decrease in prolactin and no change in thyroid levels compared to placebo; |

|

● |

Akathisia and extrapyramidal symptoms <1% reported for brilaroxazine 50 mg and none for 15 mg; and |

|

● |

Common brilaroxazine treatment-emergent adverse events (TEAEs) were headache (<6%) and somnolence (<7.5%) generally transient in nature; and |

|

● |

Low discontinuation rates with brilaroxazine that were less than placebo (16% in brilaroxazine 50mg and 19% in brilaroxazine 15mg vs. 22% placebo). |

The clinical development plan for brilaroxazine consists of the completed positive Phase 2 REFRESH and Phase 3 RECOVER 1 trials, as well as an ongoing 1-year open label extension (OLE) trial evaluating the long-term safety and tolerability, and soon to be initiated registrational global, randomized 4-week RECOVER-2 Trial. We expect to report topline data from the OLE trial in Q4-2024, and we expect to initiate the registrational RECOVER-2 Trial in the second quarter of 2024, with completion anticipated in the second quarter of 2025. RECOVER-2 was originally designed as a 6-week study, but after discussion between Reviva and FDA, the agency has agreed that it can be conducted as a 4-week study. These data from our brilaroxazine clinical development plan will potentially support the planned NDA submission to the FDA in 2025.

Brilaroxazine Clinical Development for Bipolar Disorder (BD), Major Depressive Disorder (MDD), and Attention-Deficit/Hyperactivity Disorder (ADHD)

Like schizophrenia, BD, MDD, and ADHD are major neuropsychiatric diseases. These neuropsychiatric diseases exhibit distinct symptoms yet share varying degrees of overlapping conditions that include psychosis, depression, and cognitive impairments. BD, a medical illness with substantial morbidity and mortality, involves episodic, recurrent mania or hypomania, and major depression. An article published in 2018 in the journal Therapeutic Advances in Psychopharmacology estimated that the global prevalence of bipolar spectrum disorders is approximately 2.4%, with approximately 0.6% for bipolar I and approximately 0.4% for bipolar II. The same journal article indicates prevalence of bipolar I in the U.S. is 1%, slightly higher than in other countries. Similarly, MDD is a common, chronic, recurrent, and debilitating psychiatric condition, leading to significant impairments in personal functional capacities. The National Institute of Mental Health (NIMH) estimated the prevalence of MDD among U.S. adults aged 18 or older at 17.3 million in 2017. NIMH also indicated the prevalence was higher among females (8.7%) compared to males (5.3%). ADHD is a common developmental disorder in children and often continues into adulthood. The prevalence of ADHD in children is 5-12% worldwide, according to an article published in 2016 in the Journal of Advanced Pharmaceutical Technology & Research. ADHD has a high rate of comorbid psychiatric disorders.

The clinical community also uses the antipsychotic drugs (e.g., olanzapine, risperidone, quetiapine, and aripiprazole) for the treatment of BD, MDD, and/or ADHD. All these antipsychotics display pharmacological activities for dopamine (D) and serotonin (5HT) receptors. The majority are selective for D2 and 5HT2A receptors, and may also be active for one or more of D4, 5HT1A, 5HT2B, and 5HT7 receptors. Brilaroxazine exhibits potent activity for D2 and 5HT2A receptors, and each of D4, 5HT1A, 5HT2B, and 5HT7 receptors are implicated as pharmacological targets for depression and cognitive impairment conditions.

Subject to the receipt of additional financing, we may proceed with Phase 2 studies for brilaroxazine in BD, MDD, and ADHD, potentially as early as the second half of 2024.

Brilaroxazine Clinical Development for Psychosis and Behavioral Symptoms in Alzheimer’s Disease (BPSD), and Parkinson’s Disease Psychosis (PDP)

Patients with Alzheimer’s disease (AD) manifest not only progressive memory impairment, cognitive deficits, and functional alterations but also a variety of neuropsychiatric symptoms (agitation, aggression, hallucinations, and delusions). An article published in 2002 in the journal Archives of General Psychiatry (now JAMA Psychiatry) states these symptoms ultimately affect up to 75% of individuals with dementia and, once present, sustain, or recur. Similarly, patients with Parkinson’s disease also suffer from neuropsychiatric symptoms. There are very limited pharmacological treatment options for managing psychotic and behavioral symptoms in Alzheimer’s and Parkinson’s diseases. Without an approved drug, clinicians often manage the psychosis and behavioral symptoms in Alzheimer’s disease with antipsychotics (e.g., quetiapine and olanzapine). Primavanserin (Nuplazid), a serotonin 5HT2A inverse agonist, is the only FDA approved treatment for the treatment of hallucinations and delusions associated with Parkinson’s disease psychosis. However, clinicians do use some antipsychotics (e.g., quetiapine, and olanzapine) as an off-label treatment.

Subject to the receipt of additional financing, we may also continue the clinical development of brilaroxazine for the treatment of BPSD and PDP.

DEVELOPMENT OF BRILAROXAZINE FOR RESPIRATORY DISEASES

Development of brilaroxazine for Pulmonary Arterial Hypertension (PAH)

PAH is a progressive, debilitating condition characterized by pulmonary vascular resistance leading to right ventricular failure and death. According to an article published in 2016 in the journal The Lancet Respiratory Medicine, the global prevalence of PAH is estimated at 6.6 – 26.0 cases per million with 1.1 – 7.6 incidences per million adults per year. The same article indicates PAH is frequently diagnosed in older patients, particularly those 65 years and older. As presented in 2020, the National Organization for Rare Disorders (“NORD”) estimates PAH occurs 3 – 5 times more frequently in females than in males, and it tends to affect females between the ages of 30 and 60. Pursuant to a study published in 2012, post-diagnosis of PAH, survival rates are approximately 1 year in 85%, 3 years in 68%, and 5 years in 57% of patients, respectively (Benza RL et al, CHEST 2012, 142(2):448-456).

PAH occurs when the pulmonary arteries have narrowed, thickened, or become blocked due to the constricting and remodeling of the pulmonary vasculature. Endothelial dysfunction occurs early in the disease pathogenesis. Such pathology leads to the proliferation of the endothelium and smooth muscle tissue, the remodeling of pulmonary arteriole walls, the impaired production of vasodilators, and the overexpression of vasoconstrictors. Remodeling can involve a variety of smooth muscle (e.g., hyperplasia, medial hypertrophy, perivascular fibrosis) and other extrinsic pathologic changes (e.g., microthrombosis, inflammatory cell infiltration, angioproliferative plexiform lesions).

Current treatment involves influencing smooth muscle tone: 1 — inhibition of phosphodiesterase 5 (PDE-5) (e.g., sildenafil) and nitric oxide; 2 — antagonizing endothelin (e.g., bosentan); and 3 — providing exogenous prostacyclins (e.g., epoprostenol, iloprost, treprostinil) to address the reduced production of prostaglandin I2. Such treatments can reduce symptoms, improve the performance of activities of daily living, delay disease progression, and improve survival somewhat (e.g., epoprostenol). However, they fail to stem the ongoing cytoproliferative processes that significantly modify the pulmonary vascular structure and lead to progressive disease and/or the need for lung transplantation.

Serotonin (5-hydroxytryptamine; 5HT) plays a role in both the proliferative and functional components of the pathogenesis of PAH, which involve a variety of contributing factors, including inflammatory cytokines and chemokines. Pulmonary arteries express several 5HT receptors, including the 5HT2A, 5HT2B, and 5HT7. The presence of 5HT in the pulmonary circulation activates vascular smooth muscle (VSM), 5HT2A and 5HT2B receptors, and SERT to cause constriction, the proliferation of pulmonary vascular smooth muscle cells, and fibroblast proliferation. Coupled with stimulating the transforming growth factor β pathway, the 5HT pathway facilitates cell proliferation and vascular remodeling. These changes lead to the thickening of the medial layer. These accompany the narrowing and the remodeling of the pulmonary artery. Together these define the characteristics of PAH.

Brilaroxazine is a novel candidate for the management of PAH. As a potent antagonist of the 5-HT receptor, it possesses a high binding affinity for several relevant targets associated with PAH. These include 5HT2A (2.5 nM), 5HT2B (0.19 nM), and 5HT7 (2.7 nM), as well as a moderate affinity for SERT (107 nM) in preclinical models.

Brilaroxazine Preclinical Development for PAH

The FDA designated brilaroxazine as an orphan drug for the treatment of PAH in 2016. The agency based its decision on encouraging preclinical results with brilaroxazine in PAH, including disease-modifying antiproliferative effects. Two studies using the monocrotaline (MCT) and Sugen hypoxia (Su-Hx) models evaluated the effectiveness of brilaroxazine as monotherapy. Further, an additional study with the MCT model assessed this compound’s effectiveness as an adjunct with several other standard treatments for PAH.

The monotherapy MCT-induced model involved a 28-day treatment on single-agent brilaroxazine. On Day 0, adult male Wistar–Kyoto rats, randomized into five groups of 10 animals, received a single intravenous 60-mg/kg MCT dose. Subsequently, on Days 0 to 27, the rats were gavaged twice daily (BID) with vehicle (MCT+Veh; 5% glucose solution), brilaroxazine (1, 3, or 10 mg/kg), or sildenafil (50 mg/kg). On Day 28, during terminal surgery, investigators obtained blood samples, hemodynamic readings, and harvested tissues.

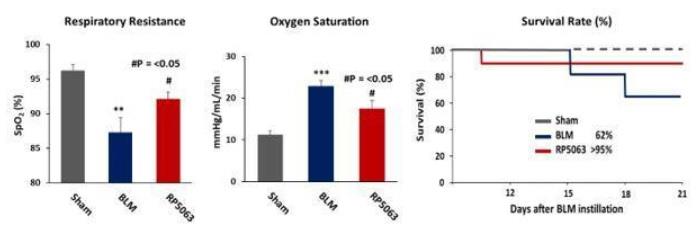

In this study, brilaroxazine produced significant functional and structural changes, as compared with those in the MCT+Veh group. Functionally, brilaroxazine displayed healthier pulmonary hemodynamic parameters, translating to reduced right ventricle (R.V.) hypertrophy and suggesting greater pulmonary vascular elasticity. This activity led to improved respiratory resistance and hemoglobin oxygen saturation, as compared with PAH animals without treatment. Structurally, brilaroxazine appeared to prevent the remodeling of the smooth muscle cells in the pulmonary vasculature. The 10 mg dose prevented vascular intimal thickening (endothelial and smooth muscle hyperplasia, and the multiplication of vascular smooth muscle cells) in the smaller vessels, mostly non-muscular in healthy animals. In exploring the cytokine response, the study found that all doses of brilaroxazine produced lower levels of tumor necrosis factor (TNF) α and interleukin (IL) β, and facilitated a significant reduction of IL-6 (p<0.05). These observations suggest an antiproliferative capacity.

In the SuHx-induced PAH study, investigators gave brilaroxazine treatment for 21 days. On Day 0, 4 groups of adult male Wistar–Kyoto rats received a subcutaneous injection of Sugen 5416 (20 mg/kg). Investigators kept them at FiO2 of 10% (Days 0 – 21) and 21% (Days 22 – 35). During the treatment period starting at Day 14, rats were gavaged twice daily (BID) with vehicle (SuHx+Veh; 5% glucose solution), brilaroxazine (10 or 20 mg/kg; RP-10 and RP-20, respectively), or sildenafil 50 mg) on Days 14 to 35. On Day 35, during terminal surgery, investigators obtained blood samples, hemodynamic readings, and harvested tissues.

Both doses of brilaroxazine and sildenafil produced a significant effect on functional and structural parameters, as compared with the induced group treated with vehicle (SuHx+Veh). Functionally, brilaroxazine improved pulmonary hemodynamics and respiratory function, resulting in higher oxygen saturation, as compared to non-treated, Sugen-induced animals. Structurally, brilaroxazine decreased small-vessel wall thickness and the percentage of muscular vessels. Most significantly, brilaroxazine limited arterial obliteration and prevented the formation of plexiform lesions. These observations suggest that the compound might exert antiproliferative effects and, potentially, a disease-modifying capacity. Concerning the cytokine effect, both brilaroxazine dose groups reflect lower levels of leukotriene-B4 at Days 21, 28, and 35.

Considering the initial observations with brilaroxazine as a single-agent treatment in both the MCT and SuHx models in rats, we undertook an additional MCT study with this compound to evaluate its role as adjunctive therapy to standard PAH treatments (Bhat et al., 2018). In the same MCT model as previously described, investigators examined brilaroxazine as monotherapy and as an adjunct to current standards of PAH care (bosentan, sildenafil, treprostinil).

As a single agent, brilaroxazine produced functional and structural effects seen in the MCT+Veh group and was consistent with those seen in the initial monotherapy MCT study. Furthermore, these effects were like (and in some cases, better than) the standard treatments. As an adjunct to all treatments, brilaroxazine significantly (p<0.05) lowered mean and systolic pulmonary artery pressures and R.V. systolic pressure, and improved oxygen saturation, as compared with the untreated, induced animals. The combination of brilaroxazine and sildenafil displayed the most consistent and robust effects. The most notable was on pulmonary hemodynamics, respiratory parameters, and histopathologic changes.

Figure 9. Effect of brilaroxazine Treatment in MCT (9A) and Sugen-Hypoxia (9B) Induced PAH in Rats

|

9A. Treatment Effects on PAH |

9B. Treatment Effects on Lung Vascular Structure |

|

|

|

Brilaroxazine Clinical Development for PAH

We had a pre-IND meeting with the FDA in August 2017, in which we presented brilaroxazine preclinical development data including efficacy results for PAH in rodent models, the data of regulatory compliant non-clinical studies (e.g., safety pharmacology studies, toxicology studies, and Chemistry, Manufacturing, and Controls (CMC) development), and the data of clinical Phase 1 studies. We discussed the Phase 2 clinical development plan with FDA and sought the agency’s guidance for our clinical development plan for a disease modifying label claim based on the positive specific clinical outcome. Pursuant to the agency’s guidance, we designed our clinical development plan to seek to obtain a disease modifying label claim.

Subject to the receipt of additional financing, we may proceed with a Phase 2 clinical trial for brilaroxazine in PAH.

Development of brilaroxazine for Idiopathic Pulmonary Fibrosis (IPF)

IPF is a chronic, progressive, and debilitating lung disease. In 2019, Medscape reported the worldwide prevalence of IPF is estimated at 20 cases per 100,000 persons for males and 13 cases per 100,000 persons for females. Medscape also reported that in the U.S., the prevalence among individuals aged 50 years or older ranges from 27.9 to 63 cases per 100,000. Medscape also reported, for patients suffering from IPF, the estimated mean survival is 2-5 years from the time of diagnosis and that mortality rates are estimated at 64.3 deaths per million in men and 58.4 deaths per million in women.

IPF involves chronic inflammation and progressive fibrosis of the alveoli. This pathology leads to destroyed lung architecture, reduced lung capacity, impaired oxygenation, and a decline in lung function.

Treatment involves early referral for lung transplantation, palliative care, and clinical trials. Limitations exist with various interventions, including commonly used agents (e.g., corticosteroids and immunosuppressants), and current guidelines do not support them. Clinical studies of two Food and Drug Administration approved treatments — Nintedanib (Ofev), and Pirfenidone (Esbriet) — have not demonstrated significant relief to functional decline and disease progression (Maher & Strek, Respiratory Research (2019)). Hence, we believe survival continues as an unmet need.

Various studies have implicated 5HT in the pathophysiology of IPF. It exerts a vasoactive effect on pulmonary arteries and stimulates lung myofibroblast actions. Pulmonary 5HT appears to mediate effects through 5-HT2A/2B/7 receptors.

Brilaroxazine may be a new candidate for the management of IPF. As a potent antagonist of the 5HT receptor, it possesses a high binding affinity for several relevant targets associated with IPF. These include 5HT2A (2.5 nM), 5HT2B (0.19 nM), and 5HT7 (2.7 nM), as well as a moderate affinity for SERT (107 nM) in preclinical models.

Brilaroxazine Preclinical Development for IPF

A bleomycin (BLM)-induced model involved a 21-day protocol using 34 Sprague Dawley rats divided into four groups- Group 1 (no induction, vehicle control), Group 2 (induction, vehicle control), Group 3 (induction, brilaroxazine, 15 mg/kg, intervention at Day 1), and Group 4 (induction, brilaroxazine, 15 mg/kg, intervention at Day 10). On Day 21, during terminal surgery, investigators obtained blood samples, hemodynamic readings, harvested tissues, and bronchoalveolar lavage fluid (BALF) samples. The histological analysis to evaluate effects on fibrosis involved several tests. Tissue stained with Masson’s Trichrome and visualized using a scanner to determine the percentage of the fibrotic tissue, reflective of excessive collagen disposition in the lung. A colorimetric assay assessed the content of hydroxyproline, an amino acid for fibrillar collagens, from the right lung tissue sample. Finally, cytokine analysis of the BALF samples evaluated the effects on Macrophage inflammatory protein 1 (MIP1), Monocyte chemoattractant protein 1 (MCP1), Interleukin (IL)-6, Interferon gamma-induced protein 10 (IP10) and RANTES levels.

Compared with the bleomycin-induced vehicle group, the use of brilaroxazine at Day 0 and Day 10 sustained animal survival at 90.5% and 89.5%, respectively (P<0.05). Furthermore, animals maintained their weight with both brilaroxazine interventions, as compared with the vehicle group (P<0.01). Animals in both brilaroxazine groups restored cardiac output, with the Day 0 group displaying a significant effect as compared to those treated with vehicle (P<0.01). The Day 0 brilaroxazine also normalized pulse pressure.

Brilaroxazine treatment influenced multiple functional, histological, and cytokine parameters reflective of pulmonary fibrosis. Animals in the brilaroxazine Day 0 group displayed a significant reduction in respiratory resistance (P<0.05). Those in Day 10 group showed improvement (P=0.10). Both brilaroxazine interventions produced a significant diminution in the concentration of hydroxyproline (P<0.05, Day 0; P<0.01, Day 10). Lung weights, which increased in the vehicle group suggesting the presence of edema, were significantly lower in the brilaroxazine Day 0 group (P<0.05). From the BALF samples, total cell count (inflammation) was lower in both brilaroxazine groups (P<0.05), as well as total protein content (edema) in the brilaroxazine Day 0 group (P<0.05). Ashcroft Score from stained lung tissue reflected a significant reduction in the lung parenchymal fibrotic changes in the Day 0 group (P<0.001). Concerning the percent of fibrosis areas measured with Masson’s trichrome staining, the Day 0 brilaroxazine group significantly reduced these changes (P<0.001), as compared with the vehicle group (Figure 9B). Furthermore, the Day 0 group showed significantly improved blood oxygen levels (P<0.05). Both groups induced a diminution of blood lactate levels (P<0.01, Day 0; P<0.05, Day 5). Finally, both brilaroxazine groups reduced proinflammatory and fibrotic cytokines, with significant effects on MCP-1 (P<0.05, Day 0), IP10 (P<0.01, both brilaroxazine interventions), and RANTES (P<0.01, both brilaroxazine interventions).

Figure 10. Effect of brilaroxazine (RP5063) as a Monotherapy and Co-administered with Standard of Care Nintedanib and Pirfenidone in Bleomycin (BLM) Induced IPF in Rats

|

10A. Treatment Effects on Lung Hydroxyproline |

10B. Treatment Effects on Lung Alveoli Fibrosis |

|

|

RP5063, PO: 15mg/kg, BID |

A follow-up preclinical study utilized the same BLM-induced model and methods. This study evaluated the effect of brilaroxazine (15 mg/kg twice daily) in combination with either nintedanib or pirfenidone (both dosed at 100 mg/kg once daily). Both nintedanib and pirfenidone are the current standard of care for patients with IPF. Single-agent treatment with nintedanib and pirfenidone (both dosed at 100 mg/kg once daily) served as controls. Treatment started on Day 7 following BLM-induction and continued until Day 20. Terminal surgery occurred on Day 21, in which harvesting of lung tissue and collecting of BALF occurred. Similar histological investigations evaluated the effects of treatment on mitigating the development of fibrosis via BLM-induction.

Figure 11. Effect of brilaroxazine Treatment in Bleomycin (BLM) Induced IPF in Rats