00017429242020FYFALSE1P5DP5D0.114488500017429242020-01-012020-12-31iso4217:USD00017429242020-06-30xbrli:shares00017429242020-12-3100017429242019-01-012019-12-3100017429242018-01-012018-12-31iso4217:USDxbrli:shares0001742924srt:ProFormaMember2018-10-150001742924lthm:PublicStockOfferingMember2018-10-152018-10-1500017429242019-12-3100017429242018-12-3100017429242017-12-310001742924lthm:A2019FederalIncomeTaxReturnMember2020-01-012020-12-310001742924lthm:A2018FederalIncomeTaxReturnMember2020-01-012020-12-310001742924lthm:SeparationStepsMember2019-01-012019-12-310001742924lthm:NetParentInvestmentMember2017-12-310001742924us-gaap:CommonStockMember2017-12-310001742924us-gaap:AdditionalPaidInCapitalMember2017-12-310001742924us-gaap:RetainedEarningsMember2017-12-310001742924us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310001742924us-gaap:TreasuryStockMember2018-12-310001742924lthm:NetParentInvestmentMember2018-01-012018-12-310001742924us-gaap:RetainedEarningsMember2018-01-012018-12-310001742924us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310001742924us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001742924us-gaap:CommonStockMember2018-01-012018-12-310001742924lthm:NetParentInvestmentMember2018-12-310001742924us-gaap:CommonStockMember2018-12-310001742924us-gaap:AdditionalPaidInCapitalMember2018-12-310001742924us-gaap:RetainedEarningsMember2018-12-310001742924us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001742924us-gaap:RetainedEarningsMember2019-01-012019-12-310001742924us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001742924us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001742924us-gaap:TreasuryStockMember2019-01-012019-12-310001742924lthm:NetParentInvestmentMember2019-12-310001742924us-gaap:CommonStockMember2019-12-310001742924us-gaap:AdditionalPaidInCapitalMember2019-12-310001742924us-gaap:RetainedEarningsMember2019-12-310001742924us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001742924us-gaap:TreasuryStockMember2019-12-310001742924us-gaap:RetainedEarningsMember2020-01-012020-12-310001742924us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001742924us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001742924us-gaap:TreasuryStockMember2020-01-012020-12-310001742924lthm:NetParentInvestmentMember2020-12-310001742924us-gaap:CommonStockMember2020-12-310001742924us-gaap:AdditionalPaidInCapitalMember2020-12-310001742924us-gaap:RetainedEarningsMember2020-12-310001742924us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001742924us-gaap:TreasuryStockMember2020-12-310001742924us-gaap:IPOMember2018-10-012018-10-010001742924us-gaap:IPOMember2018-10-152018-10-150001742924us-gaap:IPOMember2018-10-150001742924us-gaap:OverAllotmentOptionMember2018-11-132018-11-130001742924us-gaap:IPOMember2018-10-152018-11-13xbrli:pure0001742924lthm:LiventMemberlthm:FMCMember2018-10-150001742924us-gaap:IPOMember2019-03-012019-03-010001742924us-gaap:IPOMemberlthm:LiventMember2019-03-012019-03-010001742924lthm:LiventMemberlthm:FMCMember2019-03-010001742924us-gaap:MajorityShareholderMemberlthm:SharedServiceCostsMember2018-01-012018-12-310001742924us-gaap:MajorityShareholderMemberlthm:AllocatedSharedServiceCostsMember2018-01-012018-12-310001742924us-gaap:MajorityShareholderMemberlthm:AllocatedStockCompensationExpenseMember2018-01-012018-12-310001742924us-gaap:MajorityShareholderMemberlthm:CorporateExpenseAllocationMember2018-01-012018-12-310001742924us-gaap:MajorityShareholderMember2018-01-012018-12-310001742924us-gaap:MajorityShareholderMemberlthm:SharedServiceCostsMemberus-gaap:CostOfSalesMember2018-01-012018-12-310001742924us-gaap:MajorityShareholderMemberlthm:ShareBasedCompensationExpenseIncludedInSharedServiceCostsMember2018-01-012018-12-310001742924srt:ProFormaMember2020-12-310001742924us-gaap:LandImprovementsMember2020-01-012020-12-310001742924us-gaap:BuildingMembersrt:MinimumMember2020-01-012020-12-310001742924us-gaap:BuildingMembersrt:MaximumMember2020-01-012020-12-310001742924srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2020-01-012020-12-310001742924us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2020-01-012020-12-310001742924srt:MinimumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2020-01-012020-12-310001742924srt:MaximumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2020-01-012020-12-310001742924us-gaap:ConvertibleDebtMemberlthm:ConvertibleSeniorNotesDue2025Member2020-12-310001742924us-gaap:PatentsMember2020-01-012020-12-310001742924srt:MinimumMember2020-01-012020-12-310001742924srt:MaximumMember2020-01-012020-12-31lthm:segment0001742924lthm:LiventCorporationIncentiveCompensationAndStockPlanMember2020-12-310001742924lthm:LiventCorporationIncentiveCompensationAndStockPlanMemberus-gaap:SubsequentEventMember2021-01-08lthm:remediationSite0001742924lthm:AccountingStandardsUpdate202006Memberus-gaap:SubsequentEventMember2021-01-012021-01-010001742924us-gaap:AccountingStandardsUpdate201602Member2019-01-010001742924srt:NorthAmericaMember2020-01-012020-12-310001742924srt:NorthAmericaMember2019-01-012019-12-310001742924srt:NorthAmericaMember2018-01-012018-12-310001742924srt:LatinAmericaMember2020-01-012020-12-310001742924srt:LatinAmericaMember2019-01-012019-12-310001742924srt:LatinAmericaMember2018-01-012018-12-310001742924us-gaap:EMEAMember2020-01-012020-12-310001742924us-gaap:EMEAMember2019-01-012019-12-310001742924us-gaap:EMEAMember2018-01-012018-12-310001742924srt:AsiaPacificMember2020-01-012020-12-310001742924srt:AsiaPacificMember2019-01-012019-12-310001742924srt:AsiaPacificMember2018-01-012018-12-310001742924country:JP2020-01-012020-12-310001742924country:US2020-01-012020-12-310001742924country:CN2020-01-012020-12-310001742924country:JP2019-01-012019-12-310001742924country:US2019-01-012019-12-310001742924country:CN2019-01-012019-12-310001742924country:JP2018-01-012018-12-310001742924country:US2018-01-012018-12-310001742924country:CN2018-01-012018-12-310001742924lthm:CustomerOneMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001742924lthm:CustomerOneMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001742924lthm:CustomerOneMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2018-01-012018-12-310001742924lthm:TenLargestCustomersMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001742924lthm:TenLargestCustomersMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001742924lthm:TenLargestCustomersMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2018-01-012018-12-310001742924lthm:LithiumHydroxideMember2020-01-012020-12-310001742924lthm:LithiumHydroxideMember2019-01-012019-12-310001742924lthm:LithiumHydroxideMember2018-01-012018-12-310001742924lthm:ButyllithiumMember2020-01-012020-12-310001742924lthm:ButyllithiumMember2019-01-012019-12-310001742924lthm:ButyllithiumMember2018-01-012018-12-310001742924lthm:HighPurityLithiumMetalandOtherSpecialtyCompoundsMember2020-01-012020-12-310001742924lthm:HighPurityLithiumMetalandOtherSpecialtyCompoundsMember2019-01-012019-12-310001742924lthm:HighPurityLithiumMetalandOtherSpecialtyCompoundsMember2018-01-012018-12-310001742924lthm:LithiumCarbonateLithiumChlorideMember2020-01-012020-12-310001742924lthm:LithiumCarbonateLithiumChlorideMember2019-01-012019-12-310001742924lthm:LithiumCarbonateLithiumChlorideMember2018-01-012018-12-3100017429242021-01-012020-12-310001742924us-gaap:LandAndLandImprovementsMember2020-12-310001742924us-gaap:LandAndLandImprovementsMember2019-12-310001742924us-gaap:BuildingMember2020-12-310001742924us-gaap:BuildingMember2019-12-310001742924us-gaap:MachineryAndEquipmentMember2020-12-310001742924us-gaap:MachineryAndEquipmentMember2019-12-310001742924us-gaap:ConstructionInProgressMember2020-12-310001742924us-gaap:ConstructionInProgressMember2019-12-310001742924lthm:DemolitionAndExitChargesMember2020-01-012020-12-310001742924lthm:DemolitionAndExitChargesMember2019-01-012019-12-310001742924lthm:DemolitionAndExitChargesMember2018-01-012018-12-310001742924us-gaap:FacilityClosingMember2020-01-012020-12-310001742924us-gaap:FacilityClosingMember2019-01-012019-12-310001742924us-gaap:FacilityClosingMember2018-01-012018-12-310001742924lthm:AssetDisposalChargesMember2020-01-012020-12-310001742924lthm:AssetDisposalChargesMember2019-01-012019-12-310001742924lthm:AssetDisposalChargesMember2018-01-012018-12-31lthm:site0001742924lthm:NikolovVLiventCorpMemberus-gaap:PendingLitigationMember2020-12-310001742924us-gaap:DomesticCountryMember2020-12-310001742924us-gaap:ForeignCountryMember2020-12-310001742924lthm:SwitzerlandAndNetherlandsMemberus-gaap:ForeignCountryMember2020-12-310001742924lthm:TMAAgreementIndemnificationAssetMember2019-12-31lthm:jurisdiction0001742924srt:MinimumMember2020-12-310001742924srt:MaximumMember2020-12-310001742924lthm:TMAAgreementIndemnificationLiabilityMember2020-12-310001742924us-gaap:RevolvingCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-12-310001742924us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMember2020-12-310001742924us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-12-310001742924us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2019-12-310001742924us-gaap:ConvertibleDebtMember2020-12-310001742924us-gaap:ConvertibleDebtMember2019-12-310001742924us-gaap:RevolvingCreditFacilityMember2020-12-310001742924us-gaap:RevolvingCreditFacilityMember2019-12-310001742924us-gaap:ConvertibleDebtMemberlthm:ConvertibleSeniorNotesDue2025Member2020-06-2500017429242020-06-252020-06-250001742924us-gaap:ConvertibleDebtMemberlthm:ConvertibleSeniorNotesOverAllotmentOptionMember2020-06-250001742924us-gaap:ConvertibleDebtMemberlthm:ConvertibleSeniorNotesOverAllotmentOptionMember2020-07-070001742924us-gaap:ConvertibleDebtMemberlthm:ConvertibleSeniorNotesOverAllotmentOptionMember2020-07-072020-07-070001742924us-gaap:ConvertibleDebtMemberlthm:ConvertibleSeniorNotesDue2025Member2020-06-252020-06-250001742924us-gaap:ConvertibleDebtMemberlthm:ConvertibleSeniorNotesDue2025Memberus-gaap:SubsequentEventMember2021-01-012021-03-310001742924us-gaap:ConvertibleDebtMemberlthm:ConvertibleSeniorNotesOverAllotmentOptionMember2020-08-060001742924us-gaap:ConvertibleDebtMemberlthm:ConvertibleSeniorNotesDue2025Member2020-01-012020-12-310001742924us-gaap:ConvertibleDebtMemberlthm:ConvertibleSeniorNotesOverAllotmentOptionMember2020-12-310001742924lthm:ConvertibleSeniorNotesDue2025Member2020-01-012020-12-310001742924lthm:ConvertibleSeniorNotesOverAllotmentOptionMember2020-12-310001742924lthm:A2025NotesMemberus-gaap:ConvertibleDebtMember2020-12-310001742924lthm:ConvertibleSeniorNotesDue2025Member2020-12-310001742924us-gaap:ConvertibleDebtMemberlthm:ConvertibleSeniorNotesOverAllotmentOptionMember2020-01-012020-12-310001742924us-gaap:RevolvingCreditFacilityMemberlthm:CitibankN.A.Member2018-09-280001742924lthm:CitibankN.A.Memberus-gaap:LetterOfCreditMember2018-09-280001742924us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMemberlthm:CitibankN.A.Member2018-09-282018-09-280001742924us-gaap:RevolvingCreditFacilityMemberus-gaap:EurodollarMemberlthm:CitibankN.A.Member2018-09-282018-09-280001742924us-gaap:RevolvingCreditFacilityMemberlthm:CitibankN.A.Memberlthm:FirstAmendmentMember2020-08-032020-08-030001742924us-gaap:RevolvingCreditFacilityMemberlthm:CitibankN.A.Memberlthm:FirstAmendmentMember2020-05-062020-05-060001742924us-gaap:RevolvingCreditFacilityMemberlthm:CitibankN.A.Memberlthm:FirstAmendmentMember2020-05-060001742924lthm:FirstAmendmentMember2020-05-060001742924lthm:FirstAmendmentMember2020-05-062020-05-060001742924lthm:FirstAmendmentMember2020-12-310001742924lthm:FiscalQuarterEndingSeptember302020Memberus-gaap:RevolvingCreditFacilityMemberlthm:CitibankN.A.Memberlthm:SecondAmendmentMember2020-05-062020-05-060001742924us-gaap:RevolvingCreditFacilityMemberlthm:FiscalQuarterEndingDecember312020Memberlthm:CitibankN.A.Memberlthm:SecondAmendmentMember2020-05-062020-05-060001742924us-gaap:RevolvingCreditFacilityMemberlthm:CitibankN.A.Memberlthm:FirstAmendmentMember2020-01-012020-12-310001742924us-gaap:EmployeeStockOptionMemberlthm:LiventCorporationIncentiveCompensationAndStockPlanMember2020-01-012020-12-310001742924us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001742924us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001742924us-gaap:EmployeeStockOptionMember2018-01-012018-12-310001742924us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001742924us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001742924us-gaap:RestrictedStockUnitsRSUMember2018-01-012018-12-310001742924us-gaap:SellingGeneralAndAdministrativeExpensesMember2020-01-012020-12-310001742924us-gaap:RestructuringChargesMember2020-01-012020-12-310001742924lthm:BusinessSeparationCostsMember2020-01-012020-12-310001742924us-gaap:SellingGeneralAndAdministrativeExpensesMember2019-01-012019-12-310001742924us-gaap:RestructuringChargesMember2019-01-012019-12-310001742924lthm:BusinessSeparationCostsMember2019-01-012019-12-310001742924lthm:LiventCorporationIncentiveCompensationAndStockPlanMember2019-10-012019-12-310001742924srt:MinimumMemberus-gaap:EmployeeStockOptionMember2020-01-012020-12-310001742924us-gaap:EmployeeStockOptionMembersrt:MaximumMember2020-01-012020-12-310001742924srt:MinimumMemberus-gaap:EmployeeStockOptionMember2019-01-012019-12-310001742924us-gaap:EmployeeStockOptionMembersrt:MaximumMember2019-01-012019-12-310001742924us-gaap:RestrictedStockUnitsRSUMember2019-12-310001742924us-gaap:RestrictedStockUnitsRSUMember2020-12-310001742924lthm:FMCPlanMember2019-01-012019-12-310001742924lthm:FMCPlanMember2018-01-012018-12-310001742924lthm:PurchaseOfBusinessAssetsMember2018-01-012018-12-310001742924us-gaap:IPOMember2018-01-012018-12-310001742924us-gaap:OverAllotmentOptionMember2018-01-012018-12-310001742924lthm:FMCPlanMemberus-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001742924lthm:LiventPlanMemberus-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001742924lthm:FMCPlanMemberus-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001742924lthm:LiventPlanMemberus-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001742924lthm:LiventPlanMember2020-01-012020-12-310001742924us-gaap:AccumulatedTranslationAdjustmentMember2017-12-310001742924us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2017-12-310001742924us-gaap:AccumulatedTranslationAdjustmentMember2018-01-012018-12-310001742924us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2018-01-012018-12-310001742924us-gaap:AccumulatedTranslationAdjustmentMember2018-12-310001742924us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2018-12-310001742924us-gaap:AccumulatedTranslationAdjustmentMember2019-01-012019-12-310001742924us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-01-012019-12-310001742924us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001742924us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-310001742924us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-12-310001742924us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-12-310001742924us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001742924us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001742924us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001742924us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001742924us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001742924us-gaap:ConvertibleDebtSecuritiesMember2020-01-012020-12-310001742924us-gaap:RestrictedStockUnitsRSUMember2018-01-012018-12-310001742924us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001742924us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001742924us-gaap:EmployeeStockOptionMember2018-01-012018-12-310001742924lthm:FMCPlanMember2020-01-012020-12-310001742924us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001742924us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001742924us-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310001742924us-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001742924us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2020-12-310001742924us-gaap:ForeignExchangeContractMemberlthm:CostOfSalesAndServicesMember2020-01-012020-12-310001742924us-gaap:ForeignExchangeContractMemberlthm:CostOfSalesAndServicesMember2019-01-012019-12-310001742924us-gaap:ForeignExchangeContractMemberlthm:CostOfSalesAndServicesMember2018-01-012018-12-310001742924lthm:RestructuringSettlementAndImpairmentProvisionsMemberlthm:IntercompanyLoanHedgesMember2020-01-012020-12-310001742924lthm:RestructuringSettlementAndImpairmentProvisionsMemberlthm:IntercompanyLoanHedgesMember2019-01-012019-12-310001742924lthm:RestructuringSettlementAndImpairmentProvisionsMemberlthm:IntercompanyLoanHedgesMember2018-01-012018-12-310001742924us-gaap:FairValueInputsLevel1Member2020-12-310001742924us-gaap:FairValueInputsLevel2Member2020-12-310001742924us-gaap:FairValueInputsLevel3Member2020-12-310001742924us-gaap:FairValueInputsLevel1Member2019-12-310001742924us-gaap:FairValueInputsLevel2Member2019-12-310001742924us-gaap:FairValueInputsLevel3Member2019-12-310001742924lthm:NikolovVLiventCorpMemberus-gaap:PendingLitigationMember2020-10-2700017429242020-05-290001742924lthm:PositiveOutcomeOfLitigationReimbursementOfPaymentMember2020-05-290001742924lthm:PositiveOutcomeOfLitigationTerminationPenaltyRepaymentMember2020-05-290001742924lthm:ArgentinaGovernmentMember2020-12-310001742924lthm:ArgentinaGovernmentMember2019-12-310001742924lthm:TMAAgreementUncertainTaxPositionsMember2020-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________

FORM 10-K

_______________________________________________________________________

| | | | | |

| ☒ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2020

or

| | | | | |

| ☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from _______ to _______

Commission File Number 001-38694

__________________________________________________________________________

LIVENT CORPORATION

(Exact name of registrant as specified in its charter)

__________________________________________________________________________

| | | | | | | | |

| Delaware | | 82-4699376 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

2929 Walnut Street Philadelphia, Pennsylvania | | 19104 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 215-299-5900

__________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol (s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | LTHM | New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒

| | Accelerated filer | | ☐ |

| | | | | | |

| Non-accelerated filer | | ¨

| | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☐ |

| | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ☐ |

| |

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☒ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2020, the last day of the registrant’s second fiscal quarter was $899,347,224. The market value of voting stock held by non-affiliates excludes the value of those shares held by executive officers and directors of the registrant.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date

| | | | | | | | |

| Class | | December 31, 2020 |

| Common Stock, par value $0.001 per share | | 146,361,981 |

DOCUMENTS INCORPORATED BY REFERENCE

| | | | | | | | |

| DOCUMENT | | FORM 10-K REFERENCE |

| Portions of Proxy Statement for 2021 Annual Meeting of Stockholders | | Part III |

Livent Corporation

2020 Form 10-K

Table of Contents

Glossary of Terms

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below:

| | | | | |

| 2025 Notes | $245.75 million principal amount 4.125% Convertible Senior Notes due 2025, including $20.75 million issued upon exercise of the Over-Allotment Option on July 7, 2020 |

| AOCI | Accumulated other comprehensive income |

| Application | The application filed by Livent with the CCAA Court to obtain remittance of the Escrow Funds |

| ARO | Asset retirement obligation |

| ASC | Accounting Standards Codification, under U.S. GAAP |

| ASC 842 | Accounting Standards Codification Topic 842 - Leases |

| ASU | Accounting Standards Update, under U.S. GAAP |

| Brexit | The withdrawal of the United Kingdom from the European Union |

| CARES Act | Coronavirus Aid, Relief, and Economic Security Act |

| CCAA | The Companies’ Creditors Arrangement Act |

| CCAA Court | The Superior Court of Quebec where Nemaska, Nemaska Lithium Inc. and certain affiliates filed for creditor protection in Canada under the CCAA |

| CERCLA | Comprehensive Environmental Response, Compensation and Liability Act |

| Credit Agreement | The Original Credit Agreement, as amended on May 6, 2020, by the First Amendment and August 3, 2020, by the Second Amendment |

| Distribution | On March 1, 2019, FMC made a tax-free distribution to its stockholders of all its remaining interest in Livent Corporation |

| ESG | Environmental, social and governance |

| Exchange Act | Securities and Exchange Act of 1934 |

| EV | Electric vehicle |

| FASB | Financial Accounting Standards Board |

| First Amendment | On May 6, 2020, Livent Corporation entered into the First Amendment to the Credit Agreement to amend and restate the Original Credit Agreement |

| FMC | FMC Corporation |

| FMC Plan | FMC Corporation Incentive Compensation and Stock Plan |

| GDP | Gross domestic product |

| HCM | Human Capital Management |

| IPO | Initial public offering |

| kMT | Thousand metric tons |

| LCE | Lithium carbonate equivalent |

| Livent NQSP | Livent Non-qualified Savings Plan |

| Livent Plan | Livent Corporation Incentive Compensation and Stock Plan |

| MdA | Minera del Altiplano SA, our local operating subsidiary in Argentina |

| MT | Metric ton |

| Nemaska | Nemaska Lithium Shawinigan Transformation Inc., a subsidiary of Nemaska Lithium Inc. |

| Nemaska Transaction | The transaction through which a consortium has purchased and will operate the business previously conducted by Nemaska Lithium Inc., a Canadian lithium producer |

| NQO | Non-qualified stock option |

| NYSE | New York Stock Exchange |

| OCI | Other comprehensive income |

| OM&M | Operation, maintenance and monitoring of site environmental remediation |

| Original Credit Agreement | On September 18, 2018 Livent Corporation entered into the credit agreement, which provides for a $400 million senior secured revolving credit facility |

| OSHA | Occupational Safety and Health Administration |

| Over-Allotment Option | Option to purchase an additional $20.75 million principal amount of 2025 Notes exercised on July 7, 2020 |

| Prospectus | The final Prospectus included in our Registration on Form S-1 originally filed with the SEC on October 12, 2018 |

| | | | | |

| RCRA | Resource Conservation and Recovery Act |

| REACH | Registration, Evaluation, Authorization and Restriction of Chemicals |

| REMSA | Recursos Energeticos y Mineros Salta, S.A., local natural-gas sub-distributor in Argentina |

| Revolving Credit Facility | Livent's $400 million senior secured revolving credit facility |

| ROU Asset | Right-of-use asset |

| RSU | Restricted stock unit |

| SEC | Securities and Exchange Commission |

| Second Amendment | On August 3, 2020, Livent Corporation entered into the Second Amendment to the Credit Agreement to amend the Credit Agreement |

| Securities Act | Securities Act of 1933 |

| Separation Date | On October 15, 2018, Livent Corporation completed the IPO and sold 20 million shares of Livent common stock to the public at a price of $17.00 per share |

| Tax Act | Tax Cuts and Jobs Act |

| TCA | UK-EU Trade and Cooperation Agreement |

| TMA | Tax Matters Agreement |

| TSA | Transaction Services Agreement |

| U.S. GAAP | United States Generally Accepted Accounting Principles |

PART I

ITEM 1. BUSINESS

Livent Corporation was formed and incorporated by FMC Corporation as FMC Lithium USA Holding Corp. in the State of Delaware on February 27, 2018, and was subsequently renamed Livent Corporation ("Livent"). Livent's principal executive offices are located at 2929 Walnut Street, Philadelphia, Pennsylvania, 19104. Throughout this Annual Report on Form 10-K, except where otherwise stated or indicated by the context, “Livent”, the "Company", “we,” “us,” or “our” means Livent Corporation and its consolidated subsidiaries and their predecessors after giving effect to the transactions described under “The Separation" and "The Distribution" below, and references to “FMC” refer to FMC Corporation and its consolidated subsidiaries. Unless the context requires otherwise, statements relating to our history throughout this Annual Report on Form 10-K describe the history of FMC’s lithium segment. Copies of the annual, quarterly and current reports we file with the Securities and Exchange Commission (“SEC”), and any amendments to those reports, are available on our website at www.livent.com as soon as practicable after we furnish such materials to the SEC.

The Separation and Distribution

Prior to the completion of the initial public offering ("IPO" or the "Separation") on October 15, 2018 (the "Separation Date"), we were a wholly owned subsidiary of FMC, and all of our outstanding shares of common stock were owned by FMC. Following a series of restructuring steps, on October 1, 2018, prior to the IPO of Livent common stock, FMC transferred to us substantially all of the assets and liabilities of its lithium business (the “Lithium Business”). In exchange, we issued to FMC 123 million shares of our common stock.

In connection with the Separation and completion of the IPO, we entered into certain agreements with FMC that govern various relationships between the parties. These agreements include a separation and distribution agreement, a transition services agreement, a shareholders’ agreement, a tax matters agreement, a registration rights agreement, an employee matters agreement and a trademark license agreement.

On March 1, 2019, FMC completed the spin-off distribution of 123 million shares of common stock of Livent as a pro rata dividend on shares of FMC common stock outstanding at the close of business on the record date of February 25, 2019 (the “Distribution”). Effective upon completion of the Distribution, we became an independent company and FMC no longer owns any shares of Livent common stock.

General

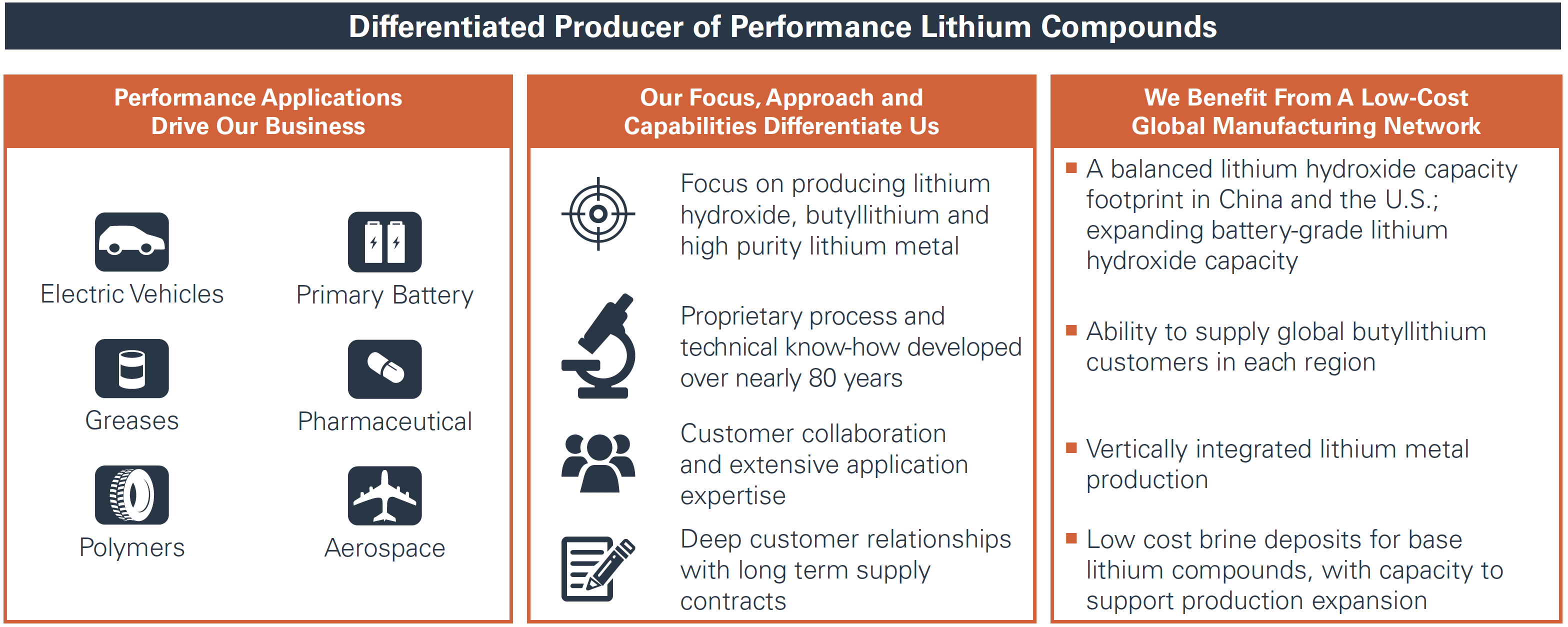

We are a pure-play, fully integrated lithium company, with a long, proven history of producing performance lithium compounds. Our primary products, namely battery-grade lithium hydroxide, lithium carbonate, butyllithium and high purity lithium metal are critical inputs used in various performance applications. Our strategy is to focus on supplying high performance lithium compounds to the fast-growing electric vehicles ("EV") and broader battery markets, while continuing to maintain our position as a leading global producer of butyllithium and high purity lithium metal. With extensive global capabilities, nearly 80 years of continuous production experience, applications and technical expertise, long standing customer relationships and a favorable sustainability profile, we believe we are well positioned to capitalize on the accelerating trends of vehicle electrification and renewable energy adoption.

We produce lithium compounds for use in applications that have specific and constantly changing performance requirements, including battery-grade lithium hydroxide for use in high performance lithium-ion batteries. We believe the demand for our compounds will continue to grow as the electrification of transportation accelerates, and as the use of high nickel content cathode materials increases in the next generation of battery technology products. We also supply butyllithium, which is used in the production of polymers and pharmaceutical products, as well as a range of specialty lithium compounds including high purity lithium metal, which is used in non-rechargeable batteries and in the production of lightweight materials for aerospace applications. It is in these applications that we have established a differentiated position in the market through our ability to consistently produce and deliver performance lithium compounds.

Livent Strategy

We believe that growth in EV sales will drive significant growth in demand for performance lithium compounds. We believe that we are well positioned to benefit from this trend thanks to our leading position, long-standing customer relationships and favorable sustainability profile and we view sustainability as central to our mission and a key consideration in all of our investment and operational decisions.

To fully capitalize on our growth opportunities, our strategy will involve investing in our assets, our technology capabilities and our people to ensure we can continue to meet our customers’ demands as well as our broader commitments to other key stakeholders, including investors, employees, regulators and our local communities.

Expand our Production Capacities

We intend to expand our lithium hydroxide capacity at multiple locations in order to meet customer demands globally, as our customers expand their own production networks around the globe. To support our lithium hydroxide expansion and reduce our need to procure lithium carbonate from third party suppliers, we started a project in 2018 to expand annual lithium carbonate production at our existing operations in Argentina in addition to seeking alternative lithium resources. We paused our expansion project in Argentina in March 2020, resulting in the delay of phase 1 completion of 9,500 MT of additional lithium carbonate capacity. We also paused a lithium hydroxide expansion project for 5,000 MT of additional capacity in Bessemer City, North Carolina, to align its completion with that of phase 1 in Argentina. The restart, timing and scope of our capacity expansion plans will be driven by improved pricing dynamics or firm long-term commitments from customers coupled with the absence of COVID-19 related restrictions, among other factors. We plan to increase our lithium carbonate capacity in Argentina to roughly 60,000 MT in multiple phases over time. We also plan to increase our lithium hydroxide capacity in phases at multiple locations to a total of roughly 55,000 MT over time.

We will continue to evaluate our butyllithium capacity regionally and add capacity as our demand continues to increase. For high purity lithium metal, we are evaluating expansion opportunities to align with the potential increase in demand for lithium metal as our customers develop next generation battery technologies.

Diversify our Sources of Supply

We continue to pursue additional sources of lithium products, which may include further expansion in Argentina, increasing our ownership stake in the Nemaska Lithium Inc. development project and assets, acquisition and development of new resources, entering into long-term supply agreements with other producers or some combination thereof. We will continually assess new resources that offer the potential to provide alternative sources of lithium products and will look to invest in developing such resources where it makes sense to do so.

Expand our Applications and Process Technology Capabilities

Our market position today depends on our ability to consistently provide our customers with the products they need, in a sustainable and responsible manner. To maintain this position, we are continuously investing to improve our application, process and extraction technologies, on both existing and new potential resources, and to reduce our environmental footprint. As we work with our customers to understand their evolving lithium needs, we will focus on expanding our extraction and processing capabilities and our ability to adapt the properties of our products, whether chemical or physical, to meet those needs. This may require us to invest in and potentially acquire new capabilities, hire people or acquire new technical resources.

Develop Next Generation Lithium Compounds

We believe that the evolution of battery technologies will lead to the adoption of lithium-based applications in the anode and electrolyte within the battery. This evolution will require new forms of lithium to be produced, such as new lithium metal powders or printable lithium products. We will continue to invest in our research and development efforts to help us create new products, and we will also invest with and partner with our customers to further their own research and development efforts.

Invest in Our People

Our business requires that we hire, retain and engage research scientists, engineers and a technical sales force. We will continue to invest in our people through training and developing our employees to retain talent. We will look to cultivate an inclusive

and positive work environment that (1) creates and supports diversity; (2) prioritizes equal opportunity and fairness in the company’s management systems and practices; and (3) fosters a sense of belonging for employees with diverse perspectives, backgrounds and expertise.

Focus on Sustainability

Environmental, Social and Governance ("ESG") issues and concerns are having an increasing impact on our industry, business and operations. We intend to continue to integrate ESG and sustainability considerations into our business, operations and investment decisions. We believe our ESG and sustainability efforts will help us differentiate ourselves from other competitors and help us develop and strengthen relationships with customers and other key stakeholders.

We encourage you to review our 2019 Sustainability Report (located on our website at www.livent.com) for more detailed information regarding our ESG programs and initiatives. Nothing on our website, including our Sustainability Report or sections thereof, shall be deemed incorporated by reference into this Form 10-K.

Financial Information About Our Business

We operate as one reportable segment based on the commonalities among our products and services, the types of customers we serve and the manner in which we review and evaluate operating performance. As we earn a substantial amount of our revenues through the sale of lithium products, we have concluded that we have one operating segment for reporting purposes.

Business Overview

As a result of our focus on supplying performance lithium compounds for use in the rapidly growing EV and broader energy storage battery markets, we expect our revenue generated from lithium hydroxide, energy storage and our Asia operations, respectively, to increase. We intend to maintain our leadership positions in other high performance markets such as non-rechargeable batteries, greases, pharmaceuticals and polymers.

We believe that we have earned a reputation as a leading supplier in the markets we serve, based on the performance of our products in our customers’ production processes and our ability to provide application know-how and technical support. In the EV market, we are one of a small number of lithium suppliers whose battery-grade lithium hydroxide has been qualified by global customers for use in their cathode material production that is ultimately used in numerous global EV programs. Throughout our history, as end market application technologies have evolved, we have worked closely with our customers to understand their changing performance requirements and have developed products to address their needs.

As a vertically integrated producer, we benefit from operating one of the lowest cost lithium mineral deposits in the world that also has a favorable, industry leading sustainability footprint. We have been extracting lithium brine at our operations at the Salar del Hombre Muerto in Argentina for more than 20 years, and have been producing lithium compounds for approximately 80 years. Our operational history provides us with a deep understanding of the process of extracting lithium compounds from brine safely and sustainably. We have developed proprietary process knowledge that enables us to produce high quality, low impurity lithium carbonate and lithium chloride. We source the majority of our base lithium compounds for use in the production of performance lithium compounds from these low cost operations in Argentina. Our operations in Argentina are expandable, giving us the ability to increase our lithium carbonate and lithium chloride production to meet increasing demand. We also have the operational flexibility to procure lithium carbonate from third party suppliers. This strategy allows us to manage our production requirements and produce more end-products for customers, as needed, than we would have the ability to do with lithium carbonate derived solely from our internal sources of supply.

We are one of a few lithium compound producers with global manufacturing capabilities. We use the majority of the lithium carbonate we produce in the production of battery-grade lithium hydroxide in the United States and China. We use the lithium chloride we produce in the production of butyllithium products in the United States, the United Kingdom, China and India, as well as in the production of high purity lithium metal in the United States. We have significant know-how and experience in the lithium hydroxide, butyllithium and high purity lithium metal production processes and product applications, which we believe provide us with a competitive advantage in these markets.

Capacity and Production

The chart below presents a breakdown of our capacity and production by product type and category presented in product basis metric tons ("MT") for the years ended December 31, 2020, 2019 and 2018:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Product Category | | Product | | 2020 | | 2019 | | 2018 |

| | | | Capacity | | Production | | Capacity | | Production | | Capacity | | Production |

| Performance Lithium | | Lithium Hydroxide | | 25,000 | | | 14,686 | | | 25,000 | | | 21,348 | | | 18,500 | | | 15,936 | |

| | Butyllithium | | 3,265 | | | 2,180 | | | 3,265 | | | 2,437 | | | 3,265 | | | 2,389 | |

| | High Purity Lithium Metal (1) | | 250 | | | 160 | | | 250 | | | 167 | | | 250 | | | 140 | |

| Base Lithium | | Lithium Carbonate (2) | | 18,000 | | | 15,589 | | | 18,000 | | | 16,785 | | | 18,000 | | | 17,238 | |

| | Lithium Chloride (2) | | 9,000 | | | 4,836 | | | 9,000 | | | 4,284 | | | 9,000 | | | 5,005 | |

____________________

(1) Excludes other specialty product capacities and production.

(2) Represents theoretical capacity for lithium carbonate and lithium chloride. Actual combined production of both products is lower and limited by the total capacity of lithium brine production. Lithium brine production was approximately 19,500 MT on a lithium carbonate equivalent ("LCE") basis for 2020, approximately 20,000 MT for 2019 and approximately 21,000 MT for 2018, resulting in the total production shown in the chart.

The charts below detail our 2020 revenues by product, application and geography.

____________________

(1) Company internal estimates

Products and Markets

Our performance lithium compounds are frequently produced to meet specific customer application and performance requirements. We have developed our capabilities in producing performance lithium compounds through decades of interaction with our customers, and our products are key inputs into their production processes. Our customer relationships provide us with first-hand insight into our customers’ production objectives and future needs in terms of product volume, mix and specifications, which we in turn use to further develop our products.

Other specialties include lithium phosphate, pharmaceutical-grade lithium carbonate, high purity lithium chloride and specialty organics. In addition to performance lithium compounds, we also produce lithium carbonate and lithium chloride, both of which we largely consume as feedstock in the process of producing our performance lithium compounds.

Competition and Industry Overview

We sell our performance lithium compounds worldwide. Most markets for lithium compounds are global, with significant growth occurring in Asia and Europe, driven primarily by the development and manufacturing of lithium-ion batteries. The market for lithium compounds also faces some barriers to entry, including access to an adequate and stable supply of lithium, technical expertise and development lead time. According to Roskill's 2019 estimates, we are one of the five largest producers of lithium compounds, including Albemarle, Jiangxi Ganfeng Lithium, Sichuan Tianqi, and SQM, which accounted for 64% of the global refined lithium production as measured by lithium carbonate equivalent ("LCE"). Roskill estimates the share of these five largest refined lithium producers to increase to 67% in 2020. We expect capacity to be added by new and existing producers over time. We believe our lithium brines in Salar del Hombre Muerto, Argentina, which have a favorable sustainability profile and are considered by the industry to be one of the lowest-cost sources of lithium, provide us with a distinct competitive advantage against current and future entrants.

We compete by providing advanced technology, high product quality, reliability, quality customer and technical service, and by operating in a cost-efficient manner and prioritizing safety and sustainability. We believe that we are a leading provider of battery-grade lithium hydroxide in EV battery applications and in performance grease applications. We are the only fully integrated producer of high purity lithium metal in the Western Hemisphere and enjoy competitive advantages from our vertically integrated manufacturing approach, low production costs and history of efficient capital deployment. We currently have lithium hydroxide capacity in the United States and China. We believe that we are one of only two global suppliers of butyllithium and, according to Roskill, we are one of the two largest producers of downstream lithium chemicals outside of China. Our primary competitors for performance lithium compounds are Albemarle Corporation and Jiangxi Ganfeng Lithium.

Growth

According to BloombergNEF's May 2020 Long-Term Electric Vehicle Outlook, EV (battery electric and plug-in hybrid electric passenger vehicles) sales are expected to be approximately 25.8 million units in 2030, rising to 54.9 million units in 2040, representing a penetration rate of 28% and 58%, respectively, of all passenger vehicles sold. According to EV Volumes’ November 2020 report on global plug-in (battery electric and plug-in hybrid electric) passenger cars and light commercial vehicles forecast, sales are expected to be 29.1 million units in 2030, rising to 52.8 million units in 2035, representing a penetration rate of 31% and 53%, respectively, of all passenger cars and light commercial vehicles sold. Both BloombergNEF, and EV Volumes expect battery electric vehicles to comprise a clear majority of the EV sales mix, while the share of plug-in hybrid electric vehicles in the sales mix remains steady.

Throughout 2020, national and regional governments across the world announced incentives, subsidies and more stringent fuel economy/carbon dioxide emissions regulations to stimulate the automotive industry’s recovery from the pandemic’s impact. Most automakers responded by announcing large investments towards drivetrain electrification and by laying out roadmaps for launching a growing number of competitive models across various segments. Besides electrification of transportation, electricity generation continued its decarbonization trend with solar and wind installations crossing new milestones; many of these installations are coupled with lithium-ion battery-based energy storage systems. According to BloombergNEF’s December 2020 Long-Term Energy Storage Outlook, global lithium-ion battery demand for stationary storage applications, in gigawatt-hour terms, is expected to grow at a compounded annual rate of 36% between 2020 and 2030.

In line with varying consumer preferences across regions, automakers are launching an increasing number of EVs across segments and for shorter-ranges and longer-ranges. In Europe, North America and certain segments of the China market, automakers have been introducing longer-range EV models using higher energy density batteries and are increasingly doing so by using high (>60%) nickel content cathode materials. According to BloombergNEF's May 2020 Long-Term Electric Vehicle Outlook, approximately 84% of all passenger EVs in 2025 will have high (>60%) nickel content cathodes compared to 75% of all passenger EVs in 2019. In the December 2020 Long-Term Energy Storage Outlook, BloombergNEF estimated that approximately 28% of all lithium-ion battery-based stationary storage applications will have high nickel content cathodes compared to less than 1% in 2019. This shift towards high nickel content cathode materials for automotive and stationary storage applications will increasingly require battery-grade lithium hydroxide in the production of cathode materials.

As an existing, proven global producer of battery-grade lithium hydroxide, we are well positioned to benefit from this expected increase in lithium demand from EV growth. As one of the pioneers in the lithium industry, we have relationships throughout the lithium-ion battery value chain. Across the battery value chain, product performance requirements have continued to evolve since the first lithium-ion batteries and cathode materials were introduced in the early 1990s. We have developed our application and materials knowledge by working with our customers over time to produce performance lithium compounds which meet evolving customer needs.

Our growth efforts focus on developing environmentally compatible and sustainable lithium products. We are committed to providing unique, differentiated products to our customers by acquiring and further developing technologies as well as investing in innovation to extend product life cycles.

______________________

(1) Includes capital expenditures and other investing activities, inclusive of capitalized interest. See our consolidated and combined statements of cash flows in Part II, Item 8 of this Form 10-K for further details.

Raw Materials

Lithium

Our primary raw material is lithium, and we obtain the substantial majority of our lithium from our operations in Argentina. We extract lithium from naturally occurring lithium-rich brines located in the Andes Mountains of Argentina, which are believed to be one of the world’s most significant and lowest cost sources of lithium, through a proprietary selective adsorption and solar evaporation process. We process the brine into lithium carbonate at our co-located manufacturing facility in Fénix, Argentina and into lithium chloride at our nearby manufacturing facility in Güemes, Argentina. In 2019 and 2018, we expanded capacity of lithium carbonate at these facilities through debottlenecking projects.

For the years ended December 31, 2020, 2019 and 2018, our Argentine operations extracted and processed approximately 16 kMT, 17 kMT and 17 kMT of lithium carbonate, respectively, and approximately 5 kMT, 4 kMT and 5 kMT of lithium chloride, respectively. For the years ended December 31, 2020, 2019 and 2018, lithium brine production from both lithium carbonate and lithium chloride, on a lithium carbonate equivalent ("LCE") basis, was approximately 19.5 kMT, 20 kMT and 21 kMT, respectively.

We have also historically purchased a portion of our lithium carbonate raw materials from other suppliers as needed.

Salar del Hombre Muerto

We conduct our Argentine operations through Minera del Altiplano SA ("MdA"), our local operating subsidiary. We extract lithium from naturally occurring lithium-rich brines in Salar del Hombre Muerto, an area covering approximately 600 square kilometers in a region of the Andes Mountains of northwest Argentina known as the “lithium triangle.” This area of the Central Andes is within an arid plateau with numerous volcanic peaks and salt flats known as “salars” and is the principal lithium-bearing region of South America.

Salar del Hombre Muerto consists of evaporite deposits formed within an isolated basin depression. Fault-bounded bedrock hills occur within and along the margins of the salar basin, subdividing the Salar del Hombre Muerto into two separate sub-basins (eastern and western), each with different evaporite sediment compositions. The eastern sub-basin is dominated by

borate evaporites, whereas the western sub-basin is relatively free of clastic sediment (such as sand, silts and clays) and is dominated by halite (sodium chloride) evaporite deposits.

We performed initial geological investigations of the Salar del Hombre Muerto in the early 1990s, prior to development of our lithium production facilities. We commenced commercial extraction operations in Salar del Hombre Muerto in 1998. Lithium extract is processed into lithium carbonate at our co-located manufacturing facility in Fénix, Argentina and into lithium chloride at our nearby manufacturing facility in Güemes, Argentina. These facilities were opened in conjunction with the commencement of our extraction operations and are in good working condition. MdA owns these facilities. We use natural gas and diesel to generate electricity, which is the principal source of power at our facilities. From time to time, we experience interruptions in the supply of electricity, but we do not believe these interruptions materially impact our operations.

Brine containing approximately 600 parts per million ("ppm") lithium is pumped from saltwater aquifers using extraction wells. The brine is then diverted to an evaporation pond system. We have also developed a proprietary lithium concentration and purification process for brine operations that significantly reduces the time from pumping brine from the Salar to processing it into lithium carbonate or lithium chloride. This reduction in processing time compares favorably to a conventional solar evaporation process, while effectively removing impurities and providing increased process control. During evaporation, other minerals, such as sodium, potassium and magnesium, which are typically contained in brine, are concentrated and removed through processing. The resulting lithium chloride brine from the terminal pond of the system is then routed to our processing plants.

We access our extraction sites and nearby manufacturing facilities by local roadway, which is a suitable transportation alternative. We transport the brine extract from our Fénix facility by truck to our Güemes facility for processing. We then transport the processed lithium carbonate and lithium chloride by truck to ports in Argentina and Chile, where it is shipped by vessel to our manufacturing facilities and customers.

Mineral concession rights

MdA holds title to mineral concession rights for its extraction activities in Salar del Hombre Muerto. These mineral concession rights cover an area of approximately 327 square kilometers and are granted to MdA pursuant to the Argentine Mining Code. See subsection “Argentine Law and Regulation” to this Item 1 for more information. Pursuant to the Argentine Mining Code, MdA’s mineral concession rights are valid until the deposit is depleted of all minerals. The concession rights may be rescinded if we fail to pay fees or do not actively extract minerals for a period lasting more than four years.

In 1991, MdA entered into an ongoing agreement, for so long a time as our mineral concession is valid, with the Argentine federal government and the Catamarca province in connection with the development of the Salar del Hombre Muerto exploration site. Following legislative and constitutional reforms in 1993 and 1994, the Argentine federal government assigned all of its rights and obligations under the agreement to the Catamarca province. The agreement governs limited matters relating to our production activities and grants to the Catamarca province an immaterial minority ownership stake in MdA, which enables the province to receive certain dividends and to appoint two of MdA’s ten member Board of Directors and one of MdA’s three member audit committee. The term of the agreement expires when MdA ceases to extract and produce lithium compounds from Salar del Hombre Muerto.

MdA is required to pay the Catamarca province an immaterial semi-annual “canon” fee pursuant to the Argentine Mining Code and royalties equal to 3% of the pithead value of the minerals extracted by MdA pursuant to the Argentine Mining Investment Law and Catamarca provincial law. Under an amendment to its long-term agreement with Catamarca entered into on January 25, 2018, and contingent upon the receipt of certain required permits, MdA is currently paying the Catamarca province a monthly contribution and royalty payment. Together, the contribution and royalty amount will equal 2% of sales of products in a given month measured at the higher of MdA’s average invoice price or an average international price for similar products, net of tax. The monthly contribution and the royalty payment to the province are netted against the royalties paid under the Mining Investment Law. Total payments to the Catamarca province, including "canon" fee, royalties, water trust and CSR payments, would have been approximately $5.9 million, $7.6 million and $9.2 million for the years ended December 31, 2020, 2019 and 2018 had the amendment described above been in effect for all twelve months for such years.

A portion of the territory governed by our concession rights is subject to a longstanding border dispute between Catamarca and the adjacent Salta province. The border dispute has not impacted our operations for the over twenty years we have been operating in Argentina and we do not expect that it will impact our operations going forward. We estimate the total area in dispute represents approximately 7.6% of our concession (approximately 25 square kilometers). We do not view this as material, especially considering that the area in question is largely at the fringe of the salar, where the deposits are not as thick and the grade of lithium concentration is much lower.

Salta province claims that it is entitled to royalties from us for the minerals extracted within the small portion of our concession that falls within the disputed territory, although under Argentine law we cannot be charged duplicate royalties for the same minerals. In addition, the Salta province has granted and may grant mineral concessions in the disputed territory to other parties, although to date Catamarca authorities have not permitted any others to extract lithium from within the boundaries of our

concession. We are engaged in judicial proceedings in Argentina with the Salta province. The outcome of these proceedings is not expected to have a material impact on our financial position or results of operations.

In December 2019, the provinces of Catamarca and Salta entered into an agreement to create an interprovincial commission to: evaluate projects and programs for mining activity in the area subject to the border dispute; prepare a technical report to set the border between both provinces; and submit a bill to the Congress on the matter.

Water

Our Argentine operations require fresh water. We have water rights for the supply of fresh water from the Trapiche aquifer, from which water is pumped through a battery of wells to our facilities. We and the Catamarca province regularly monitor the water and salinity levels of the aquifer.

We have only once had to temporarily suspend water extraction, which was due to a dispute with the Catamarca province, and our access to our water source was quickly restored. We also regularly evaluate supplemental supplies of fresh water. The grant of water concessions and other water rights is subject to local governmental approvals, the timing and availability of which are uncertain and may be subject to delay or denial.

In October 2015, MdA entered into a trust agreement with the Catamarca province that was amended in 2018. Under the amended trust agreement, MdA is obligated to pay an amount equal to 1.2% of its annual sales determined in a manner consistent with the contribution and royalty payments described above in the "Mineral Concession Rights" subsection to this Item 1, which payment obligations are fully reflected in our financial statements, in lieu of any water use fees.

Energy

Our Argentine operations rely on a steady source of energy. In 2015, we completed construction of a 135 kilometer natural gas pipeline from Pocitos, within the Salta province, to our Fénix facilities at Salar del Hombre Muerto, which eliminated our reliance on natural gas shipments by truck. This pipeline is governed by various agreements between MdA and Recursos Energeticos y Mineros Salta, S.A., or REMSA, a local natural gas sub-distributor, including a subdistribution agreement providing for contracted capacity through 2027. We are in discussions to increase our contracted capacity in advance of our needs for all phases of our expansion plans and may need to invest in additional infrastructure to support this expansion. REMSA or Gasnor S.A., another local natural gas distributor that operates in the northeast of Argentina, have no obligation to provide us the additional capacity on a timely basis or at all. If we cannot obtain such additional capacity, we would need to secure alternative arrangements to meet the increased energy needs of the planned expansion and such alternative arrangements may be less cost effective.

MdA also has a natural gas supply contract with Rafael G. Albanesi S.A. providing for the supply of natural gas for our Fénix manufacturing facility. This supply agreement expires in April 2021 and is typically renewed on an annual basis. We also have a purchase agreement with YPF SA for the supply of diesel fuel and gasoline to our Fénix and Güemes manufacturing facilities, pursuant to which we submit monthly purchase orders.

Other raw materials

We purchase raw materials and chemical intermediates for use in our production processes, including materials for use in our production of the proprietary adsorbent used to selectively extract lithium from our brine in Argentina, soda ash, or sodium carbonate, for use in our production of lithium carbonate, and lithium metal for our production of butyllithium. In 2020, 2019 and 2018, costs of major raw materials represented 13%, 11% and 9% of our total revenues, respectively. Major raw materials include soda ash, solvents, butyl chloride, hydrochloric acid, quicklime and caustic soda. We generally satisfy our requirements through spot purchases and medium- or long-term contractual relationships. In general, where we have limited sources of raw materials, we have developed contingency plans to minimize the effect of any interruption or reduction in supply, such as sourcing from other suppliers or maintaining safety stocks.

Temporary shortages of raw materials may occasionally occur and cause temporary price increases. For example, we have had past regional interruptions in raw material supply, notably in China. In recent years, these shortages have not resulted in any material unavailability of raw materials. However, the continuing availability and price of raw materials are affected by many factors, including domestic and world market and political conditions, as well as the direct or indirect effect of governmental regulations. During periods of high demand, our raw materials are subject to significant price fluctuations, and such fluctuations may have an adverse impact on our results of operations. The impact of any future raw material shortages on our business as a whole or in specific geographic regions, including China, or in specific business lines cannot be accurately predicted.

Seasonality

Our operations in Argentina are seasonally impacted by weather, including varying evaporation rates and amounts of rainfall during different seasons. These changes impact the concentration in large evaporation ponds and can have an impact on the downstream processes to produce lithium carbonate and lithium chloride. Our operations team continuously measures pond concentrations and models how they will change based on operating decisions. Our processes use proprietary and traditional

technologies to minimize the variation of concentrations at the inlet to our plants. There was an abnormally large rain event in the first quarter of 2019, resulting in an approximate 1,000 MT reduction in lithium carbonate production in 2019.

Argentine Law and Regulation

We are subject to various regulatory requirements in Argentina under the Argentine Mining Code, the Argentine Mining Investment Law and certain federal and provincial regulations, including with respect to environmental compliance. In addition, the relationship between us, MdA and the Catamarca provincial government is regulated through a contractual framework.

The Argentine Mining Code, which sets forth the rights and obligations of both mining companies and their workers, is the principal regulatory framework under which we conduct our operations in Argentina. The Argentine Mining Code provides for the terms under which the provinces regulate and administer the granting of mining rights to third parties.

The Argentine Mining Code establishes two basic means of granting title to mining property: the exploration permit and the mining concession, both of which convey valid mining title in Argentina.

Exploration permits grant their holders the right to freely explore for minerals within the boundaries of the territory covered by that permit as well as to request the mining concession for any discoveries within the covered territory.

Once a mining concession is granted, the recipient owns all in-place mineral deposits within the boundaries of the territory covered by the concession. Mining concessions are freely tradable by the title holder and can be sold, leased or otherwise transferred to third parties. Two requirements must be met to keep a mining concession in good standing: (i) the concession holder must make regular payments of a semi-annual fee known as a canon; and (ii) the concession holder must file and perform an initial five year expenditure plan. In addition, prior to commencing mining activities, the concession holder must submit environmental impact studies, which must be renewed at least every two years, for approval by the relevant environmental authorities.

In addition to the Argentine Mining Code, we are also subject to the Argentine Mining Investment Law. The Argentine Mining Investment Law offers specific financial incentives to mining investors, including a 30 year term fiscal stability of national, provincial and municipal tax rates; a deduction from income tax for prospecting, exploration and feasibility study expenditures; a refund of Value Added Tax fiscal credits resulting from exploration works; accelerated depreciation of fixed assets; and a 3% cap on royalties payable out of production to the province where the deposit is located. Our 30 year term fiscal stability certificate expires in 2026.

Our fiscal stability rights under the Argentine Mining Investment Law have been challenged by the imposition of certain export taxes on our lithium chloride and carbonate exports that did not exist at the time we obtained our 30 year term fiscal stability certificate. For instance, in 2018, the Federal Government imposed another export duty on lithium carbonate and chloride through Decree No. 793/2018, which was in effect until December 31, 2020. Furthermore, in December 2019, after the change of Presidential administration, the Congress passed Law No. 27,541 creating a new legal framework for export duties and establishing a new rate for mining and hydrocarbon exports not to exceed 8% on the taxable amounts or the FOB value. In December 2020, the Executive Power issued Decree No. 1060/2020 establishing a new export duty applicable to all kinds of goods effective from January 1, 2021. In the case of lithium chloride and lithium carbonate, the applicable tax rate amounts to 4.5% and no cap has been set.

Under our 30 year term fiscal stability certificate, we are entitled to reimbursement or set-off (against other federal taxes) of any amount paid in excess of the total federal taxable burden applicable to us under such certificate. Although we are litigating to exercise our fiscal stability rights and are requesting an administrative reimbursement with respect to the imposition of certain of such export taxes, there can be no assurance that we will seek, or be able to obtain, reimbursement or set-off.

Environmental Laws and Regulations

We are subject to and incur capital and operating costs to comply with, numerous foreign, U.S. federal, state and local environmental, health and safety laws and regulations, including those governing employee health and safety, the composition of our products, the discharge of pollutants into the air and water, the management and disposal of hazardous substances and wastes, the usage and availability of water, the cleanup of contaminated properties and the reclamation of our mines, brine extraction operations and certain other assets at the end of their useful life.

Our business and our customers are subject to significant requirements under the European Community Regulation for the Registration, Evaluation, Authorization and Restriction of Chemicals (“REACH”). REACH imposes obligations on European Union manufacturers and importers of chemicals and other products into the European Union to compile and file comprehensive reports, including testing data, on each chemical substance, and perform chemical safety assessments. Additionally, substances of very high concern, as defined under REACH, are subject to an authorization process. Authorization may result in restrictions in the use of products by application or even in banning of the product. REACH regulations impose significant additional responsibilities and costs on chemical producers, importers, downstream users of chemical substances and preparations, and the entire supply chain. Our manufacturing presence in the United Kingdom and sales activities in the European Union may result in increases in the costs of raw materials we purchase and the products we sell. Increases in the

costs of our products could result in a decrease in their overall demand; additionally, customers may seek products that are not regulated by REACH, which could also result in a decrease in the demand of certain products subject to the REACH regulations.

In June 2016, modifications to the Toxic Substances Control Act in the U.S. were signed into law, requiring chemicals to be assessed against a risk-based safety standard and for the elimination of unreasonable risks identified during risk evaluation. Other initiatives in Asia and potentially in other regions will require toxicological testing and risk assessments of a wide variety of chemicals, including chemicals used or produced by us. These assessments may result in heightened concerns about the chemicals involved and additional requirements being placed on the production, handling, labeling or use of the subject chemicals. Such concerns and additional requirements could also increase the cost incurred by our customers to use our chemical products and otherwise limit the use of these products, which could lead to a decrease in demand for these products.

Liabilities associated with the investigation and cleanup of hazardous substances and wastes, as well as personal injury, property damages or natural resource damages arising from the release of, or exposure to, such hazardous substances and wastes, may be imposed in many situations without regard to violations of laws or regulations or other fault, and may also be imposed jointly and severally. Such liabilities may be imposed on entities that formerly owned or operated the property affected by the hazardous substances and wastes, entities that arranged for the disposal of the hazardous substances and wastes at the affected property, and entities that currently own or operate such property. Our Bessemer City, North Carolina facility is currently undergoing monitoring and remediation of contamination pursuant to a Resource Conservation and Recovery Act Part B corrective action permit. In addition, we currently have, and may in the future incur, liability as a potentially responsible party with respect to third party locations under CERCLA or state and foreign equivalents, including potential joint and several liability requiring us to pay in excess of our pro rata share of remediation costs.

We use and generate hazardous substances and wastes in our operations and may become subject to claims and substantial liability for personal injury, property damage, wrongful death, loss of production, pollution and other environmental damages relating to the release of such substances into the environment. In addition, some of our current properties are, or have been, used for industrial purposes, which could contain currently unknown contamination that could expose us to governmental requirements or claims relating to environmental remediation, personal injury and/or property damage. Depending on the frequency and severity of such incidents, it is possible that the Company’s revenues, operating costs, insurability and relationships with customers, employees and regulators could be impaired.

We record accruals for environmental matters when it is probable that a liability has been incurred and the amount of the liability can be reasonably estimated. It is possible that new information or future developments could require us to reassess our potential exposure related to environmental matters. We may incur significant costs and liabilities in order to comply with existing environmental laws and regulations. It is also possible that other developments, such as increasingly strict environmental laws, regulations and orders of regulatory agencies, as well as claims for damages to property and the environment or injuries to employees and other persons resulting from our current or past operations, could result in substantial costs and liabilities in the future.

A discussion of environmental related factors and related reserves can be found in Note 8 “Environmental Obligations” in the notes to our consolidated financial statements included in this Form 10-K.

Human Capital Management

Human Capital Management ("HCM") General Statement

Livent is striving to be an industry leader in harnessing lithium’s potential to change the energy landscape. Our success depends in part on our ability to similarly harness the energy and potential of our employees, the people who drive our business forward. Both the Executive Leadership Team ("ELT") and Board of Directors ("Board") believe in recruiting and promoting the professional development of talented people who can meet the needs of our rapidly advancing industry and reflect the diverse cultures represented in our markets. This has been a focus of our business since its formation in late 2018. At Livent, we work to cultivate a culture of inclusiveness and representation that mirrors today’s global emphasis on these themes. This philosophy is further supported by our core values which honor our commitment to our customers, our employees and the communities in which we operate:

•Safety First. We put safety at the forefront of everything we do. Simply put: the safety of everyone is everyone's responsibility.

•Be Responsible. We act ethically and honestly and advance responsible and sustainable practices in all aspects of our business.

•Constantly Innovate. We move the world forward and strive to constantly innovate through agile thinking, our industry-leading material science expertise and an intimate understanding of our core element: lithium.

•Celebrate Differences. We celebrate our differences in perspective, background and expertise, empowering our employees to be authentic and transparent. By encouraging employees to bring their own selves to work, we make Livent more dynamic.

•Thrive with Customers. Customers are at the heart of everything we do. By listening to and learning from them, we work together to build better lithium technologies.

Employee Safety, Health & Wellbeing

At Livent, safety is a core value of our business and drives our focus in everything we do for our customers and our employees. We reinforce this commitment in many ways including through the publication of a weekly, company-wide “safety, quality and reliability” message relative to top organizational priorities. In 2020, we did not have an OSHA reportable employee injury. As a global chemical manufacturing company producing specialty lithium chemicals for critical industries, it was important to keep our plant operations functioning safely during the COVID-19 pandemic. Accordingly, we considered the needs of all employees worldwide and provided support for them and their families1. The COVID-19 pandemic presented both physical and mental health challenges for our employees. While our in-country teams worked to ensure employees had access to leave policies consistent with local COVID-19 requirements, we expanded our access to mental health resources globally by making sure every employee has access to an employee assistance program.

Board of Directors’ Oversight of the HCM Process

The Board receives updates on relevant aspects of the HCM process through Livent’s ELT. The Compensation Committee also reports to the Board on organizational and compensation recommendations impacting current and future pay structures and succession planning. Our Sustainability Committee receives updates on those aspects of HCM relevant to ESG topics through our employee-based Diversity Equity & Inclusion Committee (“DE&I Committee”). The Board’s ability to make informed HCM decisions requires visibility and access to current, accurate data and we continue to review our systems and communication methods to ensure transparency.

Employee Demographics

Livent has operations throughout the United States, Asia, Europe, and Argentina. As of December 31, 2020, we had a combined workforce of approximately 906 full-time, part-time, temporary, and contract employees. Argentina represents our only location with a union employee population of approximately 185 employees. Our representative employee breakdowns by region are: North America (39%); South America (40%); Europe (8%); and Asia (13%). Our global gender makeup is 78% male, 21% female, 1% unspecified. Approximately 30% of our employees support our Commercial, Research and Development and Corporate functions, while 70% support our global plant operations.

Workforce Diversity and Governance for Diversity, Equity & Inclusion ("DE&I")