Exhibit (g)(i)

CUSTODY AGREEMENT

THIS AGREEMENT is made and entered into as of the last date on the signature page, by and between Cushing ETF Trust, a Delaware trust (the “Trust”), and U.S. BANK NATIONAL ASSOCIATION, a national banking association organized and existing under the laws of the United States of America (the “Custodian”).

WHEREAS, the Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, and is authorized to issue shares of beneficial interest in separate series, with each such series representing interests in a separate portfolio of securities and other assets;

WHEREAS, the Custodian is a bank having the qualifications prescribed in Section 26(a)(1) of the 1940 Act; and

WHEREAS, the Trust desires to retain the Custodian to act as custodian of the cash and securities of each series of the Trust listed on Exhibit B hereto (as amended from time to time) (each a “Fund” and collectively, the “Funds”); and

WHEREAS, the Board of Trustees of the Trust has delegated to the Custodian the responsibilities set forth in Rule 17f-5(c) under the 1940 Act and the Custodian is willing to undertake the responsibilities and serve as the foreign custody manager for the Trust.

NOW, THEREFORE, in consideration of the promises and mutual covenants herein contained, and other good and valuable consideration, the receipt of which is hereby acknowledged, the parties hereto, intending to be legally bound, do hereby agree as follows:

ARTICLE I

CERTAIN DEFINITIONS

Whenever used in this Agreement, the following words and phrases shall have the meanings set forth below unless the context otherwise requires:

1.01 “Authorized Person” means any Officer or person who has been designated as such by written notice and named in Exhibit A and delivered to the Custodian by the Trust, or if the Trust has notified the Custodian in writing that it has an authorized investment manager or other agent, delivered to the Custodian by the Trust’s investment advisor or other agent. Such Officer or person shall continue to be an Authorized Person until such time as the Custodian receives Written Instructions from the Trust or the Trust’s investment advisor or other agent that any such person is no longer an Authorized Person.

1.02 “Board of Trustees” shall mean the trustees from time to time serving under the Trust’s declaration of trust, as amended from time to time.

1.03 “Book-Entry System” shall mean a federal book-entry system as provided in Subpart O of Treasury Circular No. 300, 31 CFR 306, in Subpart B of 31 CFR Part 350, or in such book-entry regulations of federal agencies as are substantially in the form of such Subpart O.

1

1.04 “Business Day” shall mean any day recognized as a settlement day by The New York Stock Exchange, Inc. and any other day for which the Trust computes the net asset value of Shares of the Fund.

1.05 “Eligible Foreign Custodian” has the meaning set forth in Rule 17f-5(a)(1), including a majority-owned or indirect subsidiary of a U.S. Bank (as defined in Rule 17f-5), a bank holding company meeting the requirements of an Eligible Foreign Custodian (as set forth in Rule 17f-5 or by other appropriate action of the SEC), or a foreign branch of a Bank (as defined in Section 2(a)(5) of the 1940 Act) meeting the requirements of a custodian under Section 17(f) of the 1940 Act; the term does not include any Eligible Securities Depository.

1.06 “Eligible Securities Depository” shall mean a system for the central handling of securities as that term is defined in Rule 17f-4 and 17f-7 under the 1940 Act.

1.07 “Foreign Securities” means any investments of a Fund (including foreign currencies) for which the primary market is outside the United States and such cash and cash equivalents as are reasonably necessary to effect such Fund’s transactions in such investments.

1.08 “Fund Custody Account” shall mean any of the accounts in the name of the Trust, which is provided for in Section 3.2 below.

1.09 “IRS” shall mean the Internal Revenue Service.

1.10 “FINRA” shall mean the Financial Industry Regulatory Authority, Inc.

1.11 “Officer” shall mean the Chairman, President, any Vice President, any Assistant Vice President, the Secretary, any Assistant Secretary, the Treasurer, or any Assistant Treasurer of the Trust.

1.12 “SEC” shall mean the U.S. Securities and Exchange Commission.

1.13 “Securities” shall include, without limitation, common and preferred stocks, bonds, call options, put options, debentures, notes, bank certificates of deposit, bankers’ acceptances, mortgage-backed securities or other obligations, and any certificates, receipts, warrants or other instruments or documents representing rights to receive, purchase or subscribe for the same, or evidencing or representing any other rights or interests therein, or any similar property or assets that the Custodian or its agents have the facilities to clear and service.

1.14 “Securities Depository” shall mean The Depository Trust Company and any other clearing agency registered with the SEC under Section 17A of the Securities Exchange Act of 1934, as amended (the “1934 Act”), which acts as a system for the central handling of Securities where all Securities of any particular class or series of an issuer deposited within the system are treated as fungible and may be transferred or pledged by bookkeeping entry without physical delivery of the Securities, and any successor or nominee of such clearing agency.

2

1.15 “Shares” shall mean, with respect to a Fund, the units of beneficial interest issued by the Trust on account of the Fund.

1.16 “Sub-Custodian” shall mean and include (i) any branch of a “U.S. bank,” as that term is defined in Rule 17f-5 under the 1940 Act, and (ii) any “Eligible Foreign Custodian” having a contract with the Custodian which the Custodian has determined will provide reasonable care of assets of the Fund based on the standards specified in Section 3.3 below. Such contract shall be in writing and shall include provisions that provide: (i) for indemnification or insurance arrangements (or any combination of the foregoing) such that the Fund will be adequately protected against the risk of loss of assets held in accordance with such contract; (ii) that the Foreign Securities will not be subject to any right, charge, security interest, lien or claim of any kind in favor of the Sub-Custodian or its creditors except a claim of payment for their safe custody or administration, in the case of cash deposits, liens or rights in favor of creditors of the Sub-Custodian arising under bankruptcy, insolvency, or similar laws; (iii) that beneficial ownership for the Foreign Securities will be freely transferable without the payment of money or value other than for safe custody or administration; (iv) that adequate records will be maintained identifying the assets as belonging to the Fund or as being held by a third party for the benefit of the Fund; (v) that the Fund’s independent public accountants will be given access to those records or confirmation of the contents of those records; and (vi) that the Fund will receive periodic reports with respect to the safekeeping of the Fund’s assets, including, but not limited to, notification of any transfer to or from a Fund’s account or a third party account containing assets held for the benefit of the Fund. Such contract may contain, in lieu of any or all of the provisions specified in (i)‑(vi) above, such other provisions that the Custodian determines will provide, in their entirety, the same or a greater level of care and protection for Fund assets as the specified provisions.

1.17 “Written Instructions” shall mean (i) written communications received by the Custodian and signed by an Authorized Person, (ii) communications by facsimile or Internet electronic e-mail or any other such system from one or more persons reasonably believed by the Custodian to be an Authorized Person.

ARTICLE II.

APPOINTMENT OF CUSTODIAN

2.01 Appointment. The Trust hereby appoints the Custodian as custodian of all Securities and cash owned by or in the possession of the Fund at any time during the period of this Agreement, on the terms and conditions set forth in this Agreement, and the Custodian hereby accepts such appointment and agrees to perform the services and duties set forth in this Agreement. The Trust hereby delegates to the Custodian, subject to Rule 17f-5(b), the responsibilities with respect to the Fund’s Foreign Securities, and the Custodian hereby accepts such delegation as foreign custody manager with respect to the Fund. The services and duties of the Custodian shall be confined to those matters expressly set forth herein, and no implied duties are assumed by or may be asserted against the Custodian hereunder.

3

2.02 Documents to be Furnished. The following documents, including any amendments thereto, will be provided contemporaneously with the execution of the Agreement to the Custodian by the Trust:

| (a) |

A copy of the Trust’s declaration of trust, certified by the Secretary;

|

| (b) |

A copy of the Trust’s bylaws, certified by the Secretary;

|

| (c) |

A copy of the resolution of the Board of Trustees of the Trust appointing the Custodian, certified by the Secretary;

|

| (d) |

A copy of the current prospectuses of the Fund (the “Prospectus”);

|

| (e) |

A certification of the Chairman or the President and the Secretary of the Trust setting forth the names and signatures of the current Officers of the Trust and other Authorized Persons; and

|

| (f) |

An executed authorization required by the Shareholder Communications Act of 1985, attached hereto as Exhibit D.

|

2.03 Notice of Appointment of Transfer Agent. The Trust agrees to notify the Custodian in writing of the appointment, termination or change in appointment of any transfer agent of the Fund.

ARTICLE III.

CUSTODY OF CASH AND SECURITIES

3.01 Segregation. All Securities and non-cash property held by the Custodian for the account of the Fund (other than Securities maintained in a Securities Depository, Eligible Securities Depository or Book-Entry System) shall be physically segregated from other Securities and non-cash property in the possession of the Custodian (including the Securities and non-cash property of the other series of the Trust, if applicable) and shall be identified as subject to this Agreement.

3.02 Fund Custody Accounts. As to each Fund, the Custodian shall open and maintain in its trust department a custody account in the name of the Trust coupled with the name of the Fund, subject only to draft or order of the Custodian, in which the Custodian shall enter and carry all Securities, cash and other assets of such Fund which are delivered to it.

3.03 Appointment of Agents.

| (a) |

In its discretion, the Custodian may appoint one or more Sub-Custodians to establish and maintain arrangements with (i) Eligible Securities Depositories or (ii) Eligible Foreign Custodians who are members of the Sub-Custodian’s network to hold Securities and cash of the Fund and to carry out such other provisions of this Agreement as it may determine; provided, however, that the appointment of any such agents and maintenance of any Securities and cash of the Fund shall be at the Custodian’s expense and shall not relieve the Custodian of any of its obligations or liabilities under this Agreement. The Custodian shall be liable for the actions of any Sub-Custodians (regardless of whether assets are maintained in the custody of a Sub-Custodian, a member of its network or an Eligible Securities Depository) appointed by it as if such actions had been done by the Custodian.

|

4

| (b) |

If, after the initial appointment of Sub-Custodians by the Board of Trustees in connection with this Agreement, the Custodian wishes to appoint other Sub-Custodians to hold property of the Fund, it will so notify the Trust and make the necessary determinations as to any such new Sub-Custodian’s eligibility under Rule 17f-5 under the 1940 Act.

|

| (c) |

In performing its delegated responsibilities as foreign custody manager to place or maintain the Fund’s assets with a Sub-Custodian, the Custodian will determine that the Fund’s assets will be subject to reasonable care, based on the standards applicable to custodians in the country in which the Fund’s assets will be held by that Sub-Custodian, after considering all factors relevant to safekeeping of such assets, including, without limitation the factors specified in Rule 17f-5(c)(1).

|

| (d) |

The agreement between the Custodian and each Sub-Custodian acting hereunder shall contain the required provisions set forth in Rule 17f-5(c)(2) under the 1940 Act.

|

| (e) |

At the end of each calendar quarter, the Custodian shall provide written reports notifying the Board of Trustees of the withdrawal or placement of the Securities and cash of the Fund with a Sub-Custodian and of any material changes in the Fund’s arrangements. Such reports shall include an analysis of the custody risks associated with maintaining assets with any Eligible Securities Depositories. The Custodian shall promptly take such steps as may be required to withdraw assets of the Fund from any Sub-Custodian arrangement that has ceased to meet the requirements of Rule 17f-5 or Rule 17f-7 under the 1940 Act, as applicable.

|

| (f) |

With respect to its responsibilities under this Section 3.3, the Custodian hereby warrants to the Trust that it agrees to exercise reasonable care, prudence and diligence such as a person having responsibility for the safekeeping of property of the Fund. The Custodian further warrants that the Fund’s assets will be subject to reasonable care if maintained with a Sub-Custodian, after considering all factors relevant to the safekeeping of such assets, including, without limitation: (i) the Sub-Custodian’s practices, procedures, and internal controls for certificated securities (if applicable), its method of keeping custodial records, and its security and data protection practices; (ii) whether the Sub-Custodian has the requisite financial strength to provide reasonable care for Fund assets; (iii) the Sub-Custodian’s general reputation and standing and, in the case of a Securities Depository, the Securities Depository’s operating history and number of participants; and (iv) whether the Fund will have jurisdiction over and be able to enforce judgments against the Sub-Custodian, such as by virtue of the existence of any offices of the Sub-Custodian in the United States or the Sub-Custodian’s consent to service of process in the United States.

|

5

| (g) |

The Custodian shall establish a system or ensure that its Sub-Custodian has established a system to monitor on a continuing basis (i) the appropriateness of maintaining the Fund’s assets with a Sub-Custodian or Eligible Foreign Custodians who are members of a Sub-Custodian’s network; (ii) the performance of the contract governing the Fund’s arrangements with such Sub-Custodian or Eligible Foreign Custodian’s members of a Sub-Custodian’s network; and (iii) the custody risks of maintaining assets with an Eligible Securities Depository. The Custodian must promptly notify the Fund or its investment adviser of any material change in these risks.

|

| (h) |

The Custodian shall use commercially reasonable efforts to collect all income and other payments with respect to Foreign Securities to which the Fund shall be entitled and shall credit such income, as collected, to the Trust. In the event that extraordinary measures are required to collect such income, the Trust and Custodian shall consult as to the measures and as to the compensation and expenses of the Custodian relating to such measures.

|

3.04 Delivery of Assets to Custodian. The Trust shall deliver, or cause to be delivered, to the Custodian all of the Fund’s Securities, cash and other investment assets, including (i) all payments of income, payments of principal and capital distributions received by the Fund with respect to such Securities, cash or other assets owned by the Fund at any time during the period of this Agreement, and (ii) all cash received by the Fund for the issuance of Shares. The Custodian shall not be responsible for such Securities, cash or other assets until actually received by it.

3.05 Securities Depositories and Book-Entry Systems. The Custodian may deposit and/or maintain Securities of the Fund in a Securities Depository or in a Book-Entry System, subject to the following provisions:

| (a) |

The Custodian, on an on-going basis, shall deposit in a Securities Depository or Book-Entry System all Securities eligible for deposit therein and shall make use of such Securities Depository or Book-Entry System to the extent possible and practical in connection with its performance hereunder, including, without limitation, in connection with settlements of purchases and sales of Securities, loans of Securities, and deliveries and returns of collateral consisting of Securities.

|

| (b) |

Securities of the Fund kept in a Book-Entry System or Securities Depository shall be kept in an account (“Depository Account”) of the Custodian in such Book-Entry System or Securities Depository which includes only assets held by the Custodian as a fiduciary, custodian or otherwise for customers.

|

| (c) |

The records of the Custodian with respect to Securities of the Fund maintained in a Book-Entry System or Securities Depository shall, by book-entry, identify such Securities as belonging to the Fund.

|

| (d) |

If Securities purchased by the Fund are to be held in a Book-Entry System or Securities Depository, the Custodian shall pay for such Securities upon (i) receipt of advice from the Book-Entry System or Securities Depository that such Securities have been transferred to the Depository Account, and (ii) the making of an entry on the records of the Custodian to reflect such payment and transfer for the account of the Fund. If Securities sold by the Fund are held in a Book-Entry System or Securities Depository, the Custodian shall transfer such Securities upon (i) receipt of advice from the Book-Entry System or Securities Depository that payment for such Securities has been transferred to the Depository Account, and (ii) the making of an entry on the records of the Custodian to reflect such transfer and payment for the account of the Fund.

|

6

| (e) |

The Custodian shall provide the Trust with copies of any report (obtained by the Custodian from a Book-Entry System or Securities Depository in which Securities of the Fund are kept) on the internal accounting controls and procedures for safeguarding Securities deposited in such Book-Entry System or Securities Depository.

|

| (f) |

Notwithstanding anything to the contrary in this Agreement, the Custodian shall be liable to the Trust for any loss or damage to the Fund resulting from (i) the use of a Book-Entry System or Securities Depository by reason of any negligence or willful misconduct on the part of the Custodian or any Sub-Custodian, or (ii) failure of the Custodian or any Sub-Custodian to enforce effectively such rights as it may have against a Book-Entry System or Securities Depository. At its election, the Trust shall be subrogated to the rights of the Custodian with respect to any claim against a Book-Entry System or Securities Depository or any other person from any loss or damage to the Fund arising from the use of such Book-Entry System or Securities Depository, if and to the extent that the Fund has not been made whole for any such loss or damage.

|

| (g) |

With respect to its responsibilities under this Section 3.05 and pursuant to Rule 17f‑4 under the 1940 Act, the Custodian hereby warrants to the Trust that it agrees to (i) exercise due care in accordance with reasonable commercial standards in discharging its duty as a securities intermediary to obtain and thereafter maintain such assets, (ii) provide, promptly upon request by the Trust, such reports as are available concerning the Custodian’s internal accounting controls and financial strength, and (iii) require any Sub-Custodian to exercise due care in accordance with reasonable commercial standards in discharging its duty as a securities intermediary to obtain and thereafter maintain assets corresponding to the security entitlements of its entitlement holders.

|

3.06 Disbursement of Moneys from Fund Custody Account. Upon receipt of Written Instructions, the Custodian shall disburse moneys from the Fund Custody Account but only in the following cases:

| (a) |

For the purchase of Securities for the Fund but only in accordance with Section 4.01 of this Agreement and only (i) in the case of Securities (other than options on Securities, futures contracts and options on futures contracts), against the delivery to the Custodian (or any Sub-Custodian) of such Securities registered as provided in Section 3.09 below or in proper form for transfer, or if the purchase of such Securities is effected through a Book-Entry System or Securities Depository, in accordance with the conditions set forth in Section 3.05 above; (ii) in the case of options on Securities, against delivery to the Custodian (or any Sub-Custodian) of such receipts as are required by the customs prevailing among dealers in such options; (iii) in the case of futures contracts and options on futures contracts, against delivery to the Custodian (or any Sub-Custodian) of evidence of title thereto in favor of the Fund or any nominee referred to in Section 3.09 below; and (iv) in the case of repurchase or reverse repurchase agreements entered into between the Trust and a bank which is a member of the Federal Reserve System or between the Trust and a primary dealer in U.S. Government securities, against delivery of the purchased Securities either in certificate form or through an entry crediting the Custodian’s account at a Book-Entry System or Securities Depository with such Securities;

|

7

| (b) |

In connection with the conversion, exchange or surrender, as set forth in Section 3.07(f) below, of Securities owned by the Fund;

|

| (c) |

For the payment of any dividends or capital gain distributions declared by the Fund;

|

| (d) |

In payment of the redemption price of Shares as provided in Section 5.01 below;

|

| (e) |

For the payment of any expense or liability incurred by the Fund, including, but not limited to, the following payments for the account of the Fund: interest; taxes; administration, investment advisory, accounting, auditing, transfer agent, custodian, trustee and legal fees; and other operating expenses of the Fund; in all cases, whether or not such expenses are to be in whole or in part capitalized or treated as deferred expenses;

|

| (f) |

For transfer in accordance with the provisions of any agreement among the Trust, the Custodian and a broker-dealer registered under the 1934 Act and a member of FINRA, relating to compliance with rules of the Options Clearing Corporation and of any registered national securities exchange (or of any similar organization or organizations) regarding escrow or other arrangements in connection with transactions by the Fund;

|

| (g) |

For transfer in accordance with the provisions of any agreement among the Trust, the Custodian and a futures commission merchant registered under the Commodity Exchange Act, relating to compliance with the rules of the Commodity Futures Trading Commission and/or any contract market (or any similar organization or organizations) regarding account deposits in connection with transactions by the Fund;

|

| (h) |

For the funding of any uncertificated time deposit or other interest-bearing account with any banking institution (including the Custodian), which deposit or account has a term of one year or less; and

|

| (i) |

For any other proper purpose, but only upon receipt of Written Instructions, specifying the amount and purpose of such payment, declaring such purpose to be a proper corporate purpose, and naming the person or persons to whom such payment is to be made.

|

3.07 Delivery of Securities from Fund Custody Account. Upon receipt of Written Instructions, the Custodian shall release and deliver, or cause the Sub-Custodian to release and deliver, Securities from the Fund Custody Account but only in the following cases:

| (a) |

Upon the sale of Securities for the account of the Fund but only against receipt of payment therefor in cash, by certified or cashier’s check or bank credit;

|

8

| (b) |

In the case of a sale effected through a Book-Entry System or Securities Depository, in accordance with the provisions of Section 3.05 above;

|

| (c) |

To an offeror’s depository agent in connection with tender or other similar offers for Securities of the Fund; provided that, in any such case, the cash or other consideration is to be delivered to the Custodian;

|

| (d) |

To the issuer thereof or its agent (i) for transfer into the name of the Fund, the Custodian or any Sub-Custodian, or any nominee or nominees of any of the foregoing, or (ii) for exchange for a different number of certificates or other evidence representing the same aggregate face amount or number of units; provided that, in any such case, the new Securities are to be delivered to the Custodian;

|

| (e) |

To the broker selling the Securities, for examination in accordance with the “street delivery” custom;

|

| (f) |

For exchange or conversion pursuant to any plan of merger, consolidation, recapitalization, reorganization or readjustment of the issuer of such Securities, or pursuant to provisions for conversion contained in such Securities, or pursuant to any deposit agreement, including surrender or receipt of underlying Securities in connection with the issuance or cancellation of depository receipts; provided that, in any such case, the new Securities and cash, if any, are to be delivered to the Custodian;

|

| (g) |

Upon receipt of payment therefor pursuant to any repurchase or reverse repurchase agreement entered into by the Fund;

|

| (h) |

In the case of warrants, rights or similar Securities, upon the exercise thereof, provided that, in any such case, the new Securities and cash, if any, are to be delivered to the Custodian;

|

| (i) |

For delivery in connection with any loans of Securities of the Fund, but only against receipt of such collateral as the Trust shall have specified to the Custodian in Written Instructions;

|

| (j) |

For delivery as security in connection with any borrowings by the Fund requiring a pledge of assets by the Trust, but only against receipt by the Custodian of the amounts borrowed;

|

| (k) |

Pursuant to any authorized plan of liquidation, reorganization, merger, consolidation or recapitalization of the Trust;

|

| (l) |

For delivery in accordance with the provisions of any agreement among the Trust, the Custodian and a broker-dealer registered under the 1934 Act and a member of FINRA, relating to compliance with the rules of the Options Clearing Corporation and of any registered national securities exchange (or of any similar organization or organizations) regarding escrow or other arrangements in connection with transactions by the Fund;

|

| (m) |

For delivery in accordance with the provisions of any agreement among the Trust, the Custodian and a futures commission merchant registered under the Commodity Exchange Act, relating to compliance with the rules of the Commodity Futures Trading Commission and/or any contract market (or any similar organization or organizations) regarding account deposits in connection with transactions by the Fund;

|

9

| (n) |

For any other proper trust purpose, but only upon receipt of Written Instructions, specifying the Securities to be delivered, setting forth the purpose for which such delivery is to be made, declaring such purpose to be a proper trust purpose, and naming the person or persons to whom delivery of such Securities shall be made; or

|

| (o) |

To brokers, clearing banks or other clearing agents for examination or trade execution in accordance with market custom; provided that in any such case the Custodian shall have no responsibility or liability for any loss arising from the delivery of such securities prior to receiving payment for such securities except as may arise from the Custodian’s own negligence or willful misconduct.

|

3.08 Actions Not Requiring Written Instructions. Unless otherwise instructed by the Trust, the Custodian shall with respect to all Securities held for the Fund:

| (a) |

Subject to Section 9.04 below, collect on a timely basis all income and other payments to which the Fund is entitled either by law or pursuant to custom in the securities business;

|

| (b) |

Present for payment and, subject to Section 9.04 below, collect on a timely basis the amount payable upon all Securities which may mature or be called, redeemed, or retired, or otherwise become payable;

|

| (c) |

Endorse for collection, in the name of the Fund, checks, drafts and other negotiable instruments;

|

| (d) |

Surrender interim receipts or Securities in temporary form for Securities in definitive form;

|

| (e) |

Execute, as custodian, any necessary declarations or certificates of ownership under the federal income tax laws or the laws or regulations of any other taxing authority now or hereafter in effect, and prepare and submit reports to the IRS and the Trust at such time, in such manner and containing such information as is prescribed by the IRS;

|

| (f) |

Hold for the Fund, either directly or, with respect to Securities held therein, through a Book-Entry System or Securities Depository, all rights and similar Securities issued with respect to Securities of the Fund; and

|

| (g) |

In general, and except as otherwise directed in Written Instructions, attend to all non-discretionary details in connection with the sale, exchange, substitution, purchase, transfer and other dealings with Securities and other assets of the Fund.

|

3.09 Registration and Transfer of Securities. All Securities held for the Fund that are issued or issuable only in bearer form shall be held by the Custodian in that form, provided that any such Securities shall be held in a Book-Entry System if eligible therefor. All other Securities held for the Fund may be registered in the name of the Fund, the Custodian, a Sub-Custodian or any nominee thereof, or in the name of a Book-Entry System, Securities Depository or any nominee of either thereof. The records of the Custodian with respect to foreign securities of the Fund that are maintained with a Sub-Custodian in an account that is identified as belonging to the Custodian for the benefit of its customers shall identify those securities as belonging to the Fund. The Trust shall furnish to the Custodian appropriate instruments to enable the Custodian to hold or deliver in proper form for transfer, or to register in the name of any of the nominees referred to above or in the name of a Book-Entry System or Securities Depository, any Securities registered in the name of the Fund.

10

3.10 Records.

| (a) |

The Custodian shall maintain complete and accurate records with respect to Securities, cash or other property held for the Fund, including (i) journals or other records of original entry containing an itemized daily record in detail of all receipts and deliveries of Securities and all receipts and disbursements of cash; (ii) ledgers (or other records) reflecting (A) Securities in transfer, (B) Securities in physical possession, (C) monies and Securities borrowed and monies and Securities loaned (together with a record of the collateral therefor and substitutions of such collateral), (D) dividends and interest received, and (E) dividends receivable and interest receivable; (iii) canceled checks and bank records related thereto; and (iv) all records relating to its activities and obligations under this Agreement. The Custodian shall keep such other books and records of the Fund as the Trust shall reasonably request, or as may be required by the 1940 Act, including, but not limited to, Section 31 of the 1940 Act and Rule 31a-2 promulgated thereunder.

|

| (b) |

All such books and records maintained by the Custodian shall (i) be maintained in a form acceptable to the Trust and in compliance with the rules and regulations of the SEC, (ii) be the property of the Trust and at all times during the regular business hours of the Custodian be made available upon request for inspection by duly authorized officers, employees or agents of the Trust and employees or agents of the SEC, and (iii) if required to be maintained by Rule 31a-1 under the 1940 Act, be preserved for the periods prescribed in Rules 31a‑1 and 31a-2 under the 1940 Act.

|

3.11 Fund Reports by Custodian. The Custodian shall furnish the Trust with a daily activity statement and a summary of all transfers to or from each Fund Custody Account on the day following such transfers. At least monthly, the Custodian shall furnish the Trust with a detailed statement of the Securities and moneys held by the Custodian and the Sub-Custodians for the Fund under this Agreement.

3.12 Other Reports by Custodian. As the Trust may reasonably request from time to time, the Custodian shall provide the Trust with reports on the internal accounting controls and procedures for safeguarding Securities which are employed by the Custodian or any Sub-Custodian.

3.13 Proxies and Other Materials. The Custodian shall cause all proxies relating to Securities which are not registered in the name of the Fund to be promptly executed by the registered holder of such Securities, without indication of the manner in which such proxies are to be voted, and shall promptly deliver to the Trust such proxies, all proxy soliciting materials and all notices relating to such Securities. With respect to the foreign Securities, the Custodian will use reasonable commercial efforts to facilitate the exercise of voting and other shareholder rights, subject to the laws, regulations and practical constraints that may exist in the country where such securities are issued. The Trust acknowledges that local conditions, including lack of regulation, onerous procedural obligations, lack of notice and other factors may have the effect of severely limiting the ability of the Trust to exercise shareholder rights.

11

3.14 Information on Corporate Actions. The Custodian shall promptly deliver to the Trust all information received by the Custodian and pertaining to Securities being held by the Fund with respect to optional tender or exchange offers, calls for redemption or purchase, or expiration of rights. If the Trust desires to take action with respect to any tender offer, exchange offer or other similar transaction, the Trust shall notify the Custodian at least three Business Days prior to the date on which the Custodian is to take such action. The Trust will provide or cause to be provided to the Custodian all relevant information for any Security which has unique put/option provisions at least three Business Days prior to the beginning date of the tender period.

3.15 Pledge or Encumbrance of Securities or Cash. Except as expressly provided in this Agreement, the Custodian may not pledge, assign, hypothecate or otherwise encumber securities or cash of the Fund held in the Fund’s account without the prior written consent of the Trust on behalf of the Fund.

3.16 Insurance. The Custodian need not maintain any special insurance for the benefit of the Trust, although the Custodian shall at all times maintain insurance coverage adequate for the nature of its operations, including directors and officers, errors and omissions and fidelity bond insurance coverage. The Custodian shall notify the Trust if there are any material adverse changes to its insurance policies or coverage. The Custodian shall notify the Trust of any material errors or omissions, interruptions in, or delay or unavailability of the Custodian’s abilities to safeguard and hold the securities and cash of the Fund in accordance with this Agreement as promptly as practicable, and proceed to correct the same as soon as is reasonably possible.

ARTICLE IV.

PURCHASE AND SALE OF INVESTMENTS OF THE FUND

4.01 Purchase of Securities. Promptly upon each purchase of Securities for the Fund, Written Instructions shall be delivered to the Custodian, specifying (i) the name of the issuer or writer of such Securities, and the title or other description thereof, (ii) the number of shares, principal amount (and accrued interest, if any) or other units purchased, (iii) the date of purchase and settlement, (iv) the purchase price per unit, (v) the total amount payable upon such purchase, and (vi) the name of the person to whom such amount is payable. The Custodian shall upon receipt of such Securities purchased by the Fund pay out of the moneys held for the account of the Fund the total amount specified in such Written Instructions to the person named therein. The Custodian shall not be under any obligation to pay out moneys to cover the cost of a purchase of Securities for the Fund, if in the Fund Custody Account there is insufficient cash available to the Fund for which such purchase was made.

12

4.02 Liability for Payment in Advance of Receipt of Securities Purchased. In any and every case where payment for the purchase of Securities for the Fund is made by the Custodian in advance of receipt of the Securities purchased and in the absence of specified Written Instructions to so pay in advance, the Custodian shall be liable to the Fund for such payment.

4.03 Sale of Securities. Promptly upon each sale of Securities by the Fund, Written Instructions shall be delivered to the Custodian, specifying (i) the name of the issuer or writer of such Securities, and the title or other description thereof, (ii) the number of shares, principal amount (and accrued interest, if any), or other units sold, (iii) the date of sale and settlement, (iv) the sale price per unit, (v) the total amount payable upon such sale, and (vi) the person to whom such Securities are to be delivered. Upon receipt of the total amount payable to the Fund as specified in such Written Instructions, the Custodian shall deliver such Securities to the person specified in such Written Instructions. Subject to the foregoing, the Custodian may accept payment in such form as shall be satisfactory to it, and may deliver Securities and arrange for payment in accordance with the customs prevailing among dealers in Securities.

4.04 Delivery of Securities Sold. Notwithstanding Section 4.03 above or any other provision of this Agreement, the Custodian, when instructed to deliver Securities against payment, shall be entitled, if in accordance with generally accepted market practice, to deliver such Securities prior to actual receipt of final payment therefor. In any such case, the Fund shall bear the risk that final payment for such Securities may not be made or that such Securities may be returned or otherwise held or disposed of by or through the person to whom they were delivered, and the Custodian shall have no liability for any for the foregoing.

4.05 Payment for Securities Sold. In its sole discretion and from time to time, the Custodian may credit the Fund Custody Account, prior to actual receipt of final payment thereof, with (i) proceeds from the sale of Securities which it has been instructed to deliver against payment, (ii) proceeds from the redemption of Securities or other assets of the Fund, and (iii) income from cash, Securities or other assets of the Fund. Any such credit shall be conditional upon actual receipt by Custodian of final payment and may be reversed if final payment is not actually received in full. The Custodian may, in its sole discretion and from time to time, permit the Fund to use funds so credited to the Fund Custody Account in anticipation of actual receipt of final payment. Any such funds shall be repayable immediately upon demand made by the Custodian at any time prior to the actual receipt of all final payments in anticipation of which funds were credited to the Fund Custody Account.

4.06 Advances by Custodian for Settlement. The Custodian may, in its sole discretion and from time to time, advance funds to the Trust to facilitate the settlement of a Fund’s transactions in the Fund Custody Account. Any such advance shall be repayable immediately upon demand made by Custodian.

13

ARTICLE V.

REDEMPTION OF FUND SHARES

5.01 Transfer of Funds. From such funds as may be available for the purpose in the relevant Fund Custody Account, and upon receipt of Written Instructions specifying that the funds are required to redeem Shares of the Fund, the Custodian shall wire each amount specified in such Written Instructions to or through such bank or broker-dealer as the Trust may designate.

5.02 No Duty Regarding Paying Banks. Once the Custodian has wired amounts to a bank or broker-dealer pursuant to Section 5.01 above, the Custodian shall not be under any obligation to effect any further payment or distribution by such bank or broker-dealer.

ARTICLE VI.

SEGREGATED ACCOUNTS

Upon receipt of Written Instructions, the Custodian shall establish and maintain a segregated account or accounts for and on behalf of the Fund, into which account or accounts may be transferred cash and/or Securities, including Securities maintained in a Depository Account:

| (a) |

in accordance with the provisions of any agreement among the Trust, the Custodian and a broker-dealer registered under the 1934 Act and a member of FINRA (or any futures commission merchant registered under the Commodity Exchange Act), relating to compliance with the rules of the Options Clearing Corporation and of any registered national securities exchange (or the Commodity Futures Trading Commission or any registered contract market), or of any similar organization or organizations, regarding escrow or other arrangements in connection with transactions by the Fund;

|

| (b) |

for purposes of segregating cash or Securities in connection with securities options purchased or written by the Fund or in connection with financial futures contracts (or options thereon) purchased or sold by the Fund;

|

| (c) |

which constitute collateral for loans of Securities made by the Fund;

|

| (d) |

for purposes of compliance by the Fund with requirements under the 1940 Act for the maintenance of segregated accounts by registered investment companies in connection with reverse repurchase agreements and when-issued, delayed delivery and firm commitment transactions; and

|

| (e) |

for other proper trust purposes, but only upon receipt of Written Instructions, setting forth the purpose or purposes of such segregated account and declaring such purposes to be proper trust purposes.

|

Each segregated account established under this Article VI shall be established and maintained for the Fund only. All Written Instructions relating to a segregated account shall specify the Fund.

14

ARTICLE VII.

COMPENSATION OF CUSTODIAN

7.01 Compensation. The Custodian shall be compensated for providing the services set forth in this Agreement in accordance with the fee schedule set forth on Exhibit C hereto (as amended from time to time). The Custodian shall also be reimbursed for such miscellaneous expenses (e.g., telecommunication charges, postage and delivery charges, and reproduction charges) as are reasonably incurred by the Custodian in performing its duties hereunder. The Trust shall pay all such fees and reimbursable expenses within 30 calendar days following receipt of the billing notice, except for any fee or expense subject to a good faith dispute. The Trust shall notify the Custodian in writing within 30 calendar days following receipt of each invoice if the Trust is disputing any amounts in good faith. The Trust shall pay such disputed amounts within 10 calendar days of the day on which the parties agree to the amount to be paid. With the exception of any fee or expense the Trust is disputing in good faith as set forth above, unpaid invoices shall accrue a finance charge of 1½% per month after the due date. Notwithstanding anything to the contrary, amounts owed by the Trust to the Custodian shall only be paid out of the assets and property of the particular Fund involved.

7.02 Overdrafts. The Trust is responsible for maintaining an appropriate level of short term cash investments to accommodate cash outflows. The Trust may obtain a formal line of credit for potential overdrafts of its custody account. In the event of an overdraft or in the event the line of credit is insufficient to cover an overdraft, the overdraft amount or the overdraft amount that exceeds the line of credit will be charged in accordance with the fee schedule set forth on Exhibit C hereto (as amended from time to time).

ARTICLE VIII.

REPRESENTATIONS AND WARRANTIES

8.01 Representations and Warranties of the Trust. The Trust hereby represents and warrants to the Custodian, which representations and warranties shall be deemed to be continuing throughout the term of this Agreement, that:

| (a) |

It is duly organized and existing under the laws of the jurisdiction of its organization, with full power to carry on its business as now conducted, to enter into this Agreement and to perform its obligations hereunder;

|

| (b) |

This Agreement has been duly authorized, executed and delivered by the Trust in accordance with all requisite action and constitutes a valid and legally binding obligation of the Trust, enforceable in accordance with its terms, subject to bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting the rights and remedies of creditors and secured parties; and

|

| (c) |

It is conducting its business in compliance in all material respects with all applicable laws and regulations, both state and federal, and has obtained all regulatory approvals necessary to carry on its business as now conducted; there is no statute, rule, regulation, order or judgment binding on it and no provision of its charter, bylaws or any contract binding it or affecting its property which would prohibit its execution or performance of this Agreement.

|

15

8.02 Representations and Warranties of the Custodian. The Custodian hereby represents and warrants to the Trust, which representations and warranties shall be deemed to be continuing throughout the term of this Agreement, that:

| (a) |

It is duly organized and existing under the laws of the jurisdiction of its organization, with full power to carry on its business as now conducted, to enter into this Agreement and to perform its obligations hereunder;

|

| (b) |

It is a U.S. Bank as defined in section (a)(7) of Rule 17f-5.

|

| (c) |

This Agreement has been duly authorized, executed and delivered by the Custodian in accordance with all requisite action and constitutes a valid and legally binding obligation of the Custodian, enforceable in accordance with its terms, subject to bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting the rights and remedies of creditors and secured parties; and

|

| (d) |

It is conducting its business in compliance in all material respects with all applicable laws and regulations, both state and federal, and has obtained all regulatory approvals necessary to carry on its business as now conducted; there is no statute, rule, regulation, order or judgment binding on it and no provision of its charter, bylaws or any contract binding it or affecting its property which would prohibit its execution or performance of this Agreement.

|

| (e) |

It has and will continue to have in place a commercially reasonable business recovery program.

|

ARTICLE IX.

CONCERNING THE CUSTODIAN

9.01 Standard of Care. The Custodian shall exercise reasonable care in the performance of its duties under this Agreement. The Custodian shall not be liable for any error of judgment or mistake of law or for any loss suffered by the Trust in connection with its duties under this Agreement, except a loss arising out of or relating to the Custodian’s (or a Sub-Custodian’s) refusal or failure to comply with the terms of this Agreement (or any sub-custody agreement) or from its (or a Sub-Custodian’s) bad faith, negligence or willful misconduct in the performance of its duties under this Agreement (or any sub-custody agreement). The Custodian shall be entitled to rely on and may act upon advice of counsel on all matters, and shall be without liability for any action reasonably taken or omitted pursuant to such advice. The Custodian shall promptly notify the Trust of any action taken or omitted by the Custodian pursuant to advice of counsel.

9.02 Actual Collection Required. The Custodian shall not be liable for, or considered to be the custodian of, any cash belonging to the Fund or any money represented by a check, draft or other instrument for the payment of money, until the Custodian or its agents actually receive such cash or collect on such instrument.

16

9.03 No Responsibility for Title, etc. So long as and to the extent that it is in the exercise of reasonable care, the Custodian shall not be responsible for the title, validity or genuineness of any property or evidence of title thereto received or delivered by it pursuant to this Agreement.

9.04 Limitation on Duty to Collect. The Custodian will use reasonable efforts to collect any funds which may to its knowledge become collectible arising from Securities, including dividends, interest and other income, and to transmit to the Trust notice actually received by it if any call or redemption, offer of exchange, right of subscription, reorganization or other proceedings affecting such Securities. If Securities upon which such income is payable are in default or payment is refused after due demand or presentation, and Custodian becomes aware, the Custodian will notify the Trust within a reasonable period of time. Custodian shall not be required to enforce collection, by legal means or otherwise, of any money or property due and payable with respect to Securities held for the Fund if such Securities are in default or payment is not made after due demand or presentation.

9.05 Reliance Upon Documents and Instructions. The Custodian shall be entitled to rely upon any certificate, notice or other instrument in writing received by it and reasonably believed by it to be genuine. The Custodian shall be entitled to rely upon any Written Instructions actually received by it pursuant to this Agreement.

9.06 Cooperation. The Custodian shall cooperate with and supply necessary information to the entity or entities appointed by the Trust to keep the books of account of the Fund and/or compute the value of the assets of the Fund. The Custodian shall take all such reasonable actions as the Trust may from time to time request to enable the Trust to obtain, from year to year, favorable opinions from the Trust’s independent accountants with respect to the Custodian’s activities hereunder in connection with (i) the preparation of the Trust’s reports on Form N‑1A and Form N‑SAR and any other reports required by the SEC, and (ii) the fulfillment by the Trust of any other requirements of the SEC.

ARTICLE X.

INDEMNIFICATION

10.01 Indemnification by Trust. The Trust shall indemnify and hold harmless the Custodian, any Sub-Custodian and any nominee thereof (each, an “Indemnified Party” and collectively, the “Indemnified Parties”) from and against any and all claims, demands, losses, expenses and liabilities of any and every nature (including reasonable attorneys’ fees) that an Indemnified Party may sustain or incur or that may be asserted against an Indemnified Party by any person arising directly or indirectly (i) from the fact that Securities are registered in the name of any such nominee, (ii) from any action taken or omitted to be taken by the Custodian or such Sub-Custodian (a) at the request or direction of or in reliance on the advice of the Trust, or (b) upon Written Instructions, or (iii) from the performance of its obligations under this Agreement or any sub-custody agreement, provided that neither the Custodian nor any such Sub-Custodian shall be indemnified and held harmless from and against any such claim, demand, loss, expense or liability arising out of or relating to its refusal or failure to comply with the terms of this Agreement (or any sub-custody agreement), or from its bad faith, negligence or willful misconduct in the performance of its duties under this Agreement (or any sub-custody agreement). This indemnity shall be a continuing obligation of the Trust, its successors and assigns, notwithstanding the termination of this Agreement. As used in this paragraph, the terms “Custodian” and “Sub-Custodian” shall include their respective directors, officers and employees.

17

10.02 Indemnification by Custodian. The Custodian shall indemnify and hold harmless the Trust from and against any and all claims, demands, losses, expenses, and liabilities of any and every nature (including reasonable attorneys’ fees) that the Trust may sustain or incur or that may be asserted against the Trust by any person arising directly or indirectly out of any action taken or omitted to be taken by an Indemnified Party as a result of the Indemnified Party’s refusal or failure to comply with the terms of this Agreement (or any sub-custody agreement), or from its bad faith, negligence or willful misconduct in the performance of its duties under this Agreement (or any sub-custody agreement). This indemnity shall be a continuing obligation of the Custodian, its successors and assigns, notwithstanding the termination of this Agreement. As used in this paragraph, the term “Trust” shall include the Trust’s trustees, officers and employees.

10.03 Security. If the Custodian advances cash or Securities to the Fund for any purpose, either at the Trust’s request or as otherwise contemplated in this Agreement, or in the event that the Custodian or its nominee incurs, in connection with its performance under this Agreement, any claim, demand, loss, expense or liability (including reasonable attorneys’ fees) (except such as may arise from its or its nominee’s bad faith, negligence or willful misconduct), then, in any such event, any property at any time held for the account of the Fund shall be security therefor, and should the Fund fail promptly to repay or indemnify the Custodian, the Custodian shall be entitled to utilize available cash of such Fund and to dispose of other assets of such Fund to the extent necessary to obtain reimbursement or indemnification.

10.04 Miscellaneous.

| (a) |

Neither party to this Agreement shall be liable to the other party for consequential, special or punitive damages under any provision of this Agreement.

|

| (b) |

The indemnity provisions of this Article shall indefinitely survive the termination and/or assignment of this Agreement.

|

| (c) |

In order that the indemnification provisions contained in this Article X shall apply, it is understood that if in any case the indemnitor may be asked to indemnify or hold the indemnitee harmless, the indemnitor shall be fully and promptly advised of all pertinent facts concerning the situation in question, and it is further understood that the indemnitee will use all reasonable care to notify the indemnitor promptly concerning any situation that presents or appears likely to present the probability of a claim for indemnification. The indemnitor shall have the option to defend the indemnitee against any claim that may be the subject of this indemnification. In the event that the indemnitor so elects, it will so notify the indemnitee and thereupon the indemnitor shall take over complete defense of the claim, and the indemnitee shall in such situation initiate no further legal or other expenses for which it shall seek indemnification under this Article X. The indemnitee shall in no case confess any claim or make any compromise in any case in which the indemnitor will be asked to indemnify the indemnitee except with the indemnitor’s prior written consent.

|

18

ARTICLE XI.

FORCE MAJEURE

Neither the Custodian nor the Trust shall be liable for any failure or delay in performance of its obligations under this Agreement arising out of or caused, directly or indirectly, by circumstances beyond its reasonable control, including, without limitation, acts of God; earthquakes; fires; floods; wars; civil or military disturbances; acts of terrorism; sabotage; strikes; epidemics; riots; power failures; computer failure and any such circumstances beyond its reasonable control as may cause interruption, loss or malfunction of utility, transportation, computer (hardware or software) or telephone communication service; accidents; labor disputes; acts of civil or military authority; governmental actions; or inability to obtain labor, material, equipment or transportation; provided, however, that in the event of a failure or delay, the Custodian (i) shall not discriminate against the Fund in favor of any other customer of the Custodian in making computer time and personnel available to input or process the transactions contemplated by this Agreement, and (ii) shall use its best efforts to ameliorate the effects of any such failure or delay.

ARTICLE XII.

PROPRIETARY AND CONFIDENTIAL INFORMATION

12.01 The Custodian agrees on behalf of itself and its directors, officers, and employees to treat confidentially and as proprietary information of the Trust, all records and other information relative to the Trust and prior, present, or potential shareholders of the Trust (and clients of said shareholders), and not to use such records and information for any purpose other than the performance of its responsibilities and duties hereunder, except (i) after prior notification to and approval in writing by the Trust, which approval shall not be unreasonably withheld and may not be withheld where the Custodian may be exposed to civil or criminal contempt proceedings for failure to comply, (ii) when requested to divulge such information by duly constituted authorities although the Custodian will promptly report such disclosure to the Trust if disclosure is permitted by applicable law and regulation, or (iii) when so requested by the Trust. Records and other information which have become known to the public through no wrongful act of the Custodian or any of its employees, agents or representatives, and information that was already in the possession of the Custodian prior to receipt thereof from the Trust or its agent, shall not be subject to this paragraph.

12.02 Further, the Custodian will adhere to the privacy policies adopted by the Trust pursuant to Title V of the Gramm-Leach-Bliley Act, as may be modified from time to time. In this regard, the Custodian shall have in place and maintain physical, electronic and procedural safeguards reasonably designed to protect the security, confidentiality and integrity of, and to prevent unauthorized access to or use of, records and information relating to the Trust and its shareholders.

19

ARTICLE XIII.

EFFECTIVE PERIOD; TERMINATION

13.01 Effective Period. This Agreement shall become effective as of the date first written above and will continue in effect for a period of three (3) years.

13.02 Termination. This Agreement may be terminated by either party upon giving 90 days prior written notice to the other party or such shorter notice period as is mutually agreed upon by the parties. Subsequent to the end of the one (1) year period, this Agreement continues until one party gives 90 days prior written notice to the other party or such shorter notice period as is mutually agreed upon by the parties. Notwithstanding the foregoing, this Agreement may be terminated by any party upon the breach of the other party of any material term of this Agreement if such breach is not cured within 15 days of notice of such breach to the breaching party. In addition, the Trust may, at any time, immediately terminate this Agreement in the event of the appointment of a conservator or receiver for the Custodian by regulatory authorities or upon the happening of a like event at the direction of an appropriate regulatory agency or court of competent jurisdiction.

| (a) |

In the event of the termination of this Agreement, the Custodian will immediately upon receipt or transmittal, as the case may be, of notice of termination, commence and prosecute diligently to completion the transfer of all cash and delivery of all Securities duly endorsed and all records maintained under this Agreement to the successor custodian when appointed by the Trust. The obligation for the Custodian to deliver and transfer over the assets of the Trust held by it directly to such successor custodian will commence as soon as such successor is appointed and will continue until completed as aforesaid.

|

| (b) |

At any time after the termination of this Agreement, the Trust may, upon written request, have reasonable access to the records of the Custodian relating to its performance of its duties as custodian.

|

13.03 Early Termination. In the absence of any material breach of this Agreement, should the Trust elect to terminate this Agreement prior to the end of the three year term, the trust agrees to pay the following fees:

a) All monthly fees through the life of the Agreement, including the repayment of any negotiated discounts;

b) All fees associated with converting services to a successor service provider;

c) All fees associated with any record retention and/or tax reporting obligations that may not be eliminated due to the conversion to a successor service provider;

20

d) All miscellaneous costs associated with a) through c) above

13.04 Appointment of Successor Custodian. If a successor custodian shall have been appointed by the Board of Trustees, the Custodian shall, upon receipt of a notice of acceptance by the successor custodian, on such specified date of termination (i) deliver directly to the successor custodian all Securities (other than Securities held in a Book-Entry System or Securities Depository) and cash then owned by the Fund and held by the Custodian as custodian, and (ii) transfer any Securities held in a Book-Entry System or Securities Depository to an account of or for the benefit of the Fund at the successor custodian, provided that the Trust shall have paid to the Custodian all fees, expenses and other amounts to the payment or reimbursement of which it shall then be entitled. In addition, the Custodian shall, at the expense of the Trust, transfer to such successor all relevant books, records, correspondence, and other data established or maintained by the Custodian under this Agreement in a form reasonably acceptable to the Trust (if such form differs from the form in which the Custodian has maintained the same, the Trust shall pay any expenses associated with transferring the data to such form), and will cooperate in the transfer of such duties and responsibilities, including provision for assistance from the Custodian’s personnel in the establishment of books, records, and other data by such successor. Upon such delivery and transfer, the Custodian shall be relieved of all obligations under this Agreement.

13.05 Failure to Appoint Successor Custodian. If a successor custodian is not designated by the Trust on or before the date of termination of this Agreement, then the Custodian shall have the right to deliver to a bank or trust company of its own selection, which bank or trust company (i) is a “bank” as defined in the 1940 Act, and (ii) has aggregate capital, surplus and undivided profits as shown on its most recent published report of not less than $25 million, all Securities, cash and other property held by Custodian under this Agreement and to transfer to an account of or for the Fund at such bank or trust company all Securities of the Fund held in a Book-Entry System or Securities Depository. Upon such delivery and transfer, such bank or trust company shall be the successor custodian under this Agreement and the Custodian shall be relieved of all obligations under this Agreement. In addition, under these circumstances, all books, records and other data of the Trust shall be returned to the Trust.

ARTICLE XIV.

CLASS ACTIONS

The Custodian shall use its best efforts to identify and file claims for the Fund(s) involving any class action litigation that impacts any security the Fund(s) may have held during the class period. The Trust agrees that the Custodian may file such claims on its behalf and understands that it may be waiving and/or releasing certain rights to make claims or otherwise pursue class action defendants who settle their claims. Further, the Trust acknowledges that there is no guarantee these claims will result in any payment or partial payment of potential class action proceeds and that the timing of such payment, if any, is uncertain.

21

However, the Trust may instruct the Custodian to distribute class action notices and other relevant documentation to the Fund(s) or its designee and, if it so elects, will relieve the Custodian from any and all liability and responsibility for filing class action claims on behalf of the Fund(s).

ARTICLE XV.

MISCELLANEOUS

15.01 Compliance with Laws. The Trust has and retains primary responsibility for all compliance matters relating to the Fund, including but not limited to compliance with the 1940 Act, the Internal Revenue Code of 1986, the Sarbanes-Oxley Act of 2002, the USA Patriot Act of 2001 and the policies and limitations of the Fund relating to its portfolio investments as set forth in its Prospectus and statement of additional information. The Custodian’s services hereunder shall not relieve the Trust of its responsibilities for assuring such compliance or the Board of Trustee’s oversight responsibility with respect thereto.

15.02 Amendment. This Agreement may not be amended or modified in any manner except by written agreement executed by the Custodian and the Trust, and authorized or approved by the Board of Trustees.

(a) Notwithstanding the preceding paragraph (a), upon the occurrence of any change in the information set forth in the most recent Exhibit A on file (including without limitation any person named in the most recent Exhibit A who is no longer an Officer or Authorized Person named in the most recent Exhibit A received by the Custodian will sign a new or amended Exhibit A setting forth the change and the new, additional or omitted names or signatures

15.03 Assignment. This Agreement shall extend to and be binding upon the parties hereto and their respective successors and assigns; provided, however, that this Agreement shall not be assignable by the Trust without the written consent of the Custodian, or by the Custodian without the written consent of the Trust accompanied by the authorization or approval of the Board of Trustees.

15.04 Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware, without regard to conflicts of law principles. To the extent that the applicable laws of the State of Delaware, or any of the provisions herein, conflict with the applicable provisions of the 1940 Act, the latter shall control, and nothing herein shall be construed in a manner inconsistent with the 1940 Act or any rule or order of the SEC thereunder.

15.05 No Agency Relationship. Nothing herein contained shall be deemed to authorize or empower either party to act as agent for the other party to this Agreement, or to conduct business in the name, or for the account, of the other party to this Agreement.

15.06 Services Not Exclusive. Nothing in this Agreement shall limit or restrict the Custodian from providing services to other parties that are similar or identical to some or all of the services provided hereunder.

22

15.07 Invalidity. Any provision of this Agreement which may be determined by competent authority to be prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction. In such case, the parties shall in good faith modify or substitute such provision consistent with the original intent of the parties.

15.08 Notices. Any notice required or permitted to be given by either party to the other shall be in writing and shall be deemed to have been given on the date delivered personally or by courier service, or three days after sent by registered or certified mail, postage prepaid, return receipt requested, or on the date sent and confirmed received by facsimile transmission to the other party’s address set forth below:

Notice to the Custodian shall be sent to:

U.S Bank, N.A.

1555 N. Rivercenter Dr., MK-WI-S302

Milwaukee, WI 53212

Attn: Tom Fuller

Phone: 414-905-6118

Fax: 866-350-5066

and notice to the Trust shall be sent to:

Cushing ETF Trust

8117 Preston Road, Suite 440

Dallas, TX 75225

Attn: Jerry V. Swank

Phone: 214-692-6334

Fax: 214-219-2353

15.09 Multiple Originals. This Agreement may be executed on two or more counterparts, each of which when so executed shall be deemed an original, but such counterparts shall together constitute but one and the same instrument.

15.10 No Waiver. No failure by either party hereto to exercise, and no delay by such party in exercising, any right hereunder shall operate as a waiver thereof. The exercise by either party hereto of any right hereunder shall not preclude the exercise of any other right, and the remedies provided herein are cumulative and not exclusive of any remedies provided at law or in equity.

15.11 References to Custodian. The Trust shall not circulate any printed matter which contains any reference to Custodian without the prior written approval of Custodian, excepting printed matter contained in the Prospectus or statement of additional information for the Fund and such other printed matter as merely identifies Custodian as custodian for the Fund. The Trust shall submit printed matter requiring approval to Custodian in draft form, allowing sufficient time for review by Custodian and its counsel prior to any deadline for printing.

23

15.12 Trust Disclaimer. It is expressly agreed that the obligations of the Trust hereunder shall not be binding upon any of its Trustees, shareholders, nominees, officers, agents or employees personally, but shall bind only the property or assets of the Trust, as the case may be. The execution and delivery of this Agreement has been authorized by the Trustees, and this Agreement has been signed and delivered by an authorized officer of the Trust, acting as such, and neither such authorization by the Trustees nor such execution and delivery by such officer shall be deemed to have been made by any of them individually or to impose any liability on any of them personally, but shall bind only the property or assets of the Trust as provided in the Trust’s organizational documents.

15.13 Entire Agreement. This Agreement, together with its Exhibits, constitutes the sole and entire agreement between the parties relating to the subject matter herein and does not operate as an acceptance of any conflicting terms or provisions of any other instrument and terminates and supersedes any and all prior agreements and undertakings between the parties relating to the subject matter herein.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed by a duly authorized officer on one or more counterparts as of the date last written below.

|

CUSHING ETF TRUST

|

U.S. BANK NATIONAL ASSOCIATION

|

|

By:

|

/s/ Jerry V. Swank |

By:

|

/s/ Anita M. Zagrodnik |

|

Name:

|

Jerry V. Swank |

Name:

|

Anita M. Zagrodnik |

|

Title:

|

President |

Title:

|

Senior Vice President |

|

Date:

|

8-30-18 |

Date:

|

9/21/18 |

24

EXHIBIT A

AUTHORIZED PERSONS

Set forth below are the names and specimen signatures of the persons authorized by the Trust to administer the Fund Custody Accounts.

|

Name

|

|

Telephone/Fax Number

|

|

Signature

|

|

Jerry V. Swank

|

|

P: 214-692-6334

F: 214-219-2353

|

|

/s/ Jerry V. Swank

|

|

John Alban

|

|

P: 214-692-6334

F: 214-219-2353

|

|

/s/ John Alban |

|

Matt Wenk

|

|

P: 214-692-6334

F: 214-219-2353

|

|

/s/ Matt Wenk

|

|

Blake Nelson

|

|

P: 214-692-6334

F: 214-219-2353

|

|

/s/ Blake Nelson

|

|

Guillermo Femat

|

|

P: 214-692-6334

F: 214-219-2353

|

|

/s/ Guillermo Femat |

25

EXHIBIT B

to the Custody Agreement

Separate Series of Cushing ETF Trust

|

Name of Series

|

|

Cushing Energy & MLP ETF

Cushing Utility & MLP ETF

Cushing Transportation & MLP ETF

Cushing Energy Supply Chain & MLP ETF

|

26

EXHIBIT C to the Custody Agreement -Cushing ETF Trust

Base Fee for Domestic Custody Services

The following reflects the greater of the basis point fee or annual minimum1 where Cushing Asset Management, LP acts as Adviser to the fund in the Cushing ETF Trust

|

Annual Minimum per Fund2

|

Basis Points on Trust AUM2

|

|||

|

Funds 1-10

|

$4,000

|

First $500m

|

1 bp

|

|

|

Funds 11-20

|

$3,000

|

Next $500m

|

.75 bp

|

|

|

Funds 21+

|

$1,000

|

Balance

|

.50 bp

|

|

1Each fund, regardless of asset size, will have fees allocated to it equal to the per fund minimum. Should the complex level basis point fee calculation exceed the complex level minimum fee level calculation, the fees in excess of the minimum will be allocated to each fund based on the percent on AUM.

Once a Fund is operational, should “The Adviser” terminate this service agreement with USBFS prior to the end of the initial three year period, “The Adviser” will be responsible for the balance of the minimum fees for the remainder of the service agreement’s 12-month period beginning with the Fund’s launch or any anniversary of launch. To avoid doubt, if “The Adviser” launched a Fund on March 1, 2017 and terminated the relationship on June 30, 2018, “The Adviser” would owe would owe USBFS up to 50% of $69,000 ($55,000 admin/acct/ta + $4,000 Custody + $10,000 Distributor)

In addition to the fees described above, additional fees may be charged to the extent that changes to applicable laws, rules or regulations require additional work or expenses related to services provided (e.g., compliance with new liquidity risk management and reporting requirements).

2 Subject to annual CPI increase – All Urban Consumers – U.S. City Average.

Fees are calculated pro rata and billed monthly

27

EXHIBIT C (continued) to the Custody Agreement -Cushing ETF Trust

Domestic Custody Services in addition to the Base Fee

Portfolio Transaction Fees2

| § |

$ 4.00 – Book entry DTC transaction, Federal Reserve transaction, principal paydown

|

| § |

$ 7.00 – Repurchase agreement, reverse repurchase agreement, time deposit/CD or other non-depository transaction

|

| § |

$ 8.00 – Option/SWAPS/future contract written, exercised or expired

|

| § |

$15.00 – Mutual fund trade, Margin Variation Wire and outbound Fed wire

|

| § |

$50.00 – Physical security transaction

|

| § |

$ 5.00 – Check disbursement (waived if U.S. Bancorp is Administrator)

|

A transaction is a purchase/sale of a security, free receipt/free delivery, maturity, tender or exchange.

Securities Lending and Money Market Deposit Account (MMDA)

| § |

Coordinated by USBFS per Board of Trustee approval – Negotiable

|

Miscellaneous Expenses

All other miscellaneous fees and expenses, including but not limited to the following, will be separately billed as incurred: expenses incurred in the safekeeping, delivery and receipt of securities, shipping, transfer fees, deposit withdrawals at custodian (DWAC) fees, SWIFT charges, negative interest charges and extraordinary expenses based upon complexity.

Additional Services

| § |

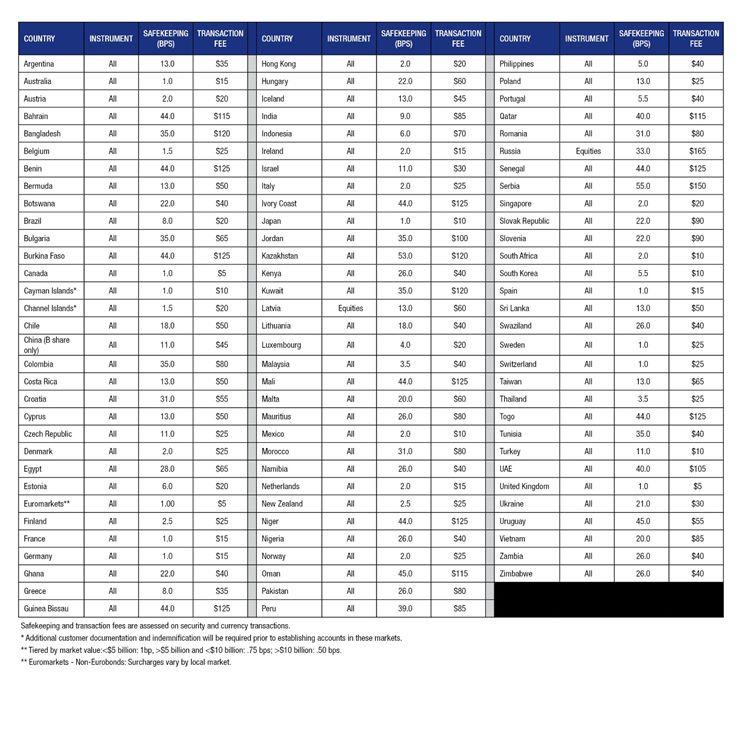

Additional fees apply for global servicing. Fund of Fund expenses quoted separately.

|

| § |

$600 per custody sub – account per year (e.g., per sub –adviser, segregated account, etc.)

|

| § |

Class Action Services – $25 filing fee per class action per account, plus 2% of gross proceeds, up to a maximum per recovery not to exceed $2,000.

|

| § |

No charge for the initial conversion free receipt.

|

| § |

Overdrafts – charged to the account at prime interest rate plus 2%, unless a line of credit is in place

|

Fees are calculated pro rata and billed monthly