UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23352

FlowStone Opportunity Fund

(Exact name of registrant as specified in charter)

55 Nod Road, Ste 120

Avon, CT 06001

(Address of principal executive offices) (Zip code)

Scott Conners

FlowStone Partners, LLC

55 Nod Road, Ste 120

Avon, CT 06001

(Name and address of agent for service)

registrant's telephone number, including area code: (312) 429-2419

Date of fiscal year end: March 31

Date of reporting period: March 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The Report to Shareholders is attached herewith.

(a)

FlowStone Opportunity Fund

Annual Report

For the Year Ended March 31, 2022

FlowStone Opportunity Fund

Table of Contents

Investor Letter (Unaudited) |

2-3 |

Management Discussion of Fund Performance (Unaudited) |

4 |

Schedule of Investments |

5-8 |

Statement of Assets, Liabilities and Shareholders’ Capital |

9 |

Statement of Operations |

10 |

Statements of Changes in Shareholders’ Capital |

11 |

Statement of Cash Flows |

12 |

Financial Highlights |

13 |

Notes to the Financial Statements |

14-21 |

Report of Independent Registered Public Accounting Firm |

22 |

Other Information (Unaudited) |

23-24 |

Fund Management (Unaudited) |

25-28 |

Privacy Notice (Unaudited) |

29-30 |

1

FlowStone Opportunity Fund

Investor Letter

March 31, 2022 (Unaudited)

To All FlowStone Opportunity Fund investors:

We are very pleased to present you with the annual report for FlowStone Opportunity Fund, dated March 31, 2022. For the year ended March 31, 2022, the Fund accepted $205.2 million in new subscriptions. The Fund’s Net Asset Value is $377.9 million, as of March 31, 2022.

During the year ended March 31, 2022, the Fund’s total return was 20.53%; a result with which the Adviser is very pleased. In any investment strategy, the market environment is a significant contributor to absolute returns. We are quite satisfied with our outperformance relative to our primary benchmark, the Russell 2000 stock index, which returned -6.77%. We outperformed our secondary benchmarks of the S&P 500 Index and the MSCI World Index, as well.

We believe the key components of our performance are 1) the strong returns of risk assets over the last twelve months; 2) the continuance of the long-term historical outperformance of private equity as an asset class relative to public indices; 3) the excess risk adjusted returns possible through properly executed private equity secondary transactions, including the purchase of assets at a discount to Net Asset Value; 4) the level of investment portfolio diversification across all of the relevant metrics (fund, manager, investment strategy, industry sector, and vintage year); and 5) the quality of the Fund’s portfolio (in the manager’ assessment).Equally as important, the Adviser has increased the profile of the Fund’s portfolio through the enhancement of its diversification as measured by all the relevant exposures: funds, managers, asset type, industry sector, and vintage year.

Through Q1 2022, the Fund has completed 30 private equity transactions, the details of which can be found in the Quarterly Snapshot section of the Adviser’s website (www.flowstonepartners.com). The 2021 calendar year saw record secondary transaction volume, with most estimates around $135 billion. The Adviser is pleased with quality, pricing, and pace of the Fund’s deal flow pipeline and investment activity. We expect the private equity secondary markets will continue to enjoy increased transaction volume as pent-up supply finds its way to the market. As of March 31, 2022, the Fund has approximately $71.4 million of uninvested capital available to make secondary purchases and primary commitments in the private equity market. The Adviser’s investment team’s experience investing through multiple macro environments over the past 25 years leads us to believe that the increase in deal volume, combined with a relatively favorable pricing environment at the smaller end of the secondary market where the Fund focuses, may create an attractive buying opportunity.

Please don’t hesitate to contact us with any questions or concerns.

Sincerely,

Scott P. Conners, CFA

President

FlowStone Opportunity Fund

Past performance is not indicative of future results. Investment in this Fund may result in the loss of all principal amounts invested. Shares are not listed on any securities exchange and it is not anticipated that a secondary market for Shares will develop. Shares are subject to substantial restrictions on transferability and resale and may not be transferred or resold except as permitted under the Agreement and Declaration of Trust. Although the Fund may offer to repurchase Shares from time to time, Shares will not be redeemable at a Shareholder’s option nor will they be exchangeable for Shares or shares of any other fund. As a result, an investor may not be able to sell or otherwise liquidate his or her Shares. Shares are appropriate only for those investors who can tolerate a high degree of risk and do not require a liquid investment and for whom an investment in the Fund does not constitute a complete investment program. The amount of distributions that the Fund may pay, if any, is uncertain. The Fund may pay distributions in significant part from sources that may not be available in the future and that are unrelated to the Fund’s performance, such as offering proceeds, borrowings, and amounts from the Fund’s affiliates that are subject to repayment by investors.

The Russell 2000 is a stock market index that tracks the performance of 2,000 small-cap U.S. public companies.

The S&P 500 Index is a market capitalization weighted price index composed of 500 widely held U.S. common stocks and is frequently used as a measure of U.S. stock market performance.

2

FlowStone Opportunity Fund

Investor Letter

March 31, 2022 (Unaudited) (Continued)

The MSCI World Index is a market capitalization weighted price index that measures the market performance of large and mid-cap companies that have a global presence.

This is not an offer to sell Shares and is not soliciting an offer to buy Shares in any state or jurisdiction where such offer or sale is not permitted. You are advised to read the Prospectus carefully prior to investment.

Investments in the Fund may be made only by “Eligible Investors” defined as a “qualified client” within the meaning of Rule 205-3 under the Investment Advisers Act of 1940 and an “accredited investor” within the meaning of Rule 501 under the Securities Act of 1933, as amended (the “Securities Act”).

This material represents the manager’s assessment of the Fund and market environment as of March 31, 2022 and should not be relied upon by the reader as research, tax or investment advice, is subject to change at any time based upon economic, market, or other conditions and the Advisor undertakes no obligation to update the views expressed herein. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent.

This report contains certain forward-looking statements about factors that may affect the performance of the Fund in the future. These statements are based on the Fund’s management’s predictions and expectations concerning certain future events such as the performance of the economy as a whole and of specific industry sectors. Management believes these forward-looking statements are reasonable, although they are inherently uncertain and difficult to predict.

The Fund’s principal underwriter is Foreside Financial Services, LLC.

3

FlowStone Opportunity Fund

Management Discussion of Fund Performance

March 31, 2022 (Unaudited)

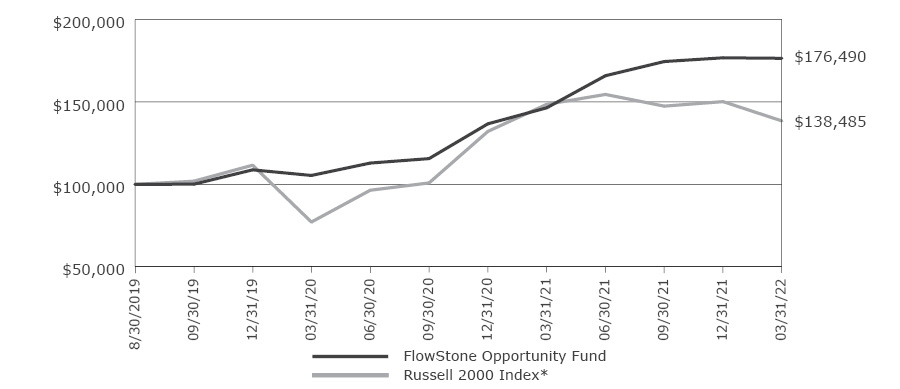

This chart represents historical performance of a hypothetical investment of $100,000 of the Fund and Russell 2000 Index* from August 31, 2019 to March 31, 2022 and includes the reinvestment of dividends and capital gains.

|

One |

Annualized |

Cumulative |

Expense Ratio |

||||||||||||

FlowStone Opportunity Fund |

20.53% | 24.56% | 76.49% | 7.33% / 6.49% | ||||||||||||

Russell 2000 Index* |

-6.77% | 14.88% | 38.49% | |||||||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The total returns shown reflect any expenses that were contractually or voluntarily reduced, reimbursed or paid by any party during the periods presented. In such instances, and without activity, the total returns would have been lower.

|

* |

The Russell 2000 is a stock market index that tracks the performance of 2,000 small-cap U.S. public companies. |

|

** |

Reflects the expense ratios as reported in the Registration Statement dated March 31,2022. The net expense ratio reflects a contractual fee waiver through August 29, 2023. |

The above index is for illustrative purposes only and does not reflect the deduction of expenses associated with a Fund, such as investment management, incentive and fund accounting fees. The Fund’s performance reflects the deduction of these expenses. An investor cannot invest directly in an index, although an investor can invest in its underlying securities.

4

FlowStone Opportunity Fund

Schedule of Investments

March 31, 2022

Investment Funds* |

Geographic |

Investment |

Cost |

Fair Value |

% of |

Original |

|||||||||||||||

Primary Investments |

|||||||||||||||||||||

Apax X USD, L.P.(a)(b) |

Guernsey | Leveraged Buyout | $ | 1,223,473 | $ | 1,491,795 | 0.39 | % | 3/3/2020 |

||||||||||||

Clearlake Capital Partners VII (USTE), L.P.(a)(b)(c) |

North America | Leveraged Buyout | — | (101,373 | ) | -0.03 | % | 10/29/2021 |

|||||||||||||

Fin VC Flagship II, LP(a)(b) |

North America | Venture | 845,868 | 865,687 | 0.23 | % | 5/6/2021 |

||||||||||||||

Liquid Stock I, L.P.(a)(b) |

North America | Private Equity Fund | 3,700,126 | 5,174,298 | 1.37 | % | 8/30/2019 |

||||||||||||||

Madison Dearborn Capital Partners VIII-A, L.P.(b) |

North America | Leveraged Buyout | 1,530,909 | 1,812,700 | 0.48 | % | 6/21/2021 |

||||||||||||||

New Mountain Partners VI, L.P.(a)(b) |

North America | Leveraged Buyout | 871,068 | 856,500 | 0.23 | % | 4/8/2020 |

||||||||||||||

Trident Capital IX, L.P.(a)(b)(c) |

North America | Leveraged Buyout | 21,376 | (55,000 | ) | -0.01 | % | 9/17/2021 |

|||||||||||||

Total Primary Investments (Cost $8,192,820) (2.66%)*** |

10,044,607 | ||||||||||||||||||||

Secondary Investments |

|||||||||||||||||||||

AEA Investors Fund V LP (a)(b) |

North America | Leveraged Buyout | 688,694 | 988,751 | 0.25 | % | 1/1/2022 |

||||||||||||||

AEA-SEI Holding II (Delta Rigging) (a)(b) |

North America | Leveraged Buyout | 970,716 | 1,348,218 | 0.36 | % | 3/31/2022 |

||||||||||||||

AIC Credit Opportunities Partners Fund II, L.P.(b) |

North America | Private Credit | 6,084,866 | 6,225,603 | 1.65 | % | 10/31/2019 |

||||||||||||||

American Securities Partners VI, L.P.(b) |

North America | Leveraged Buyout | 2,921,655 | 3,008,810 | 0.80 | % | 12/31/2021 |

||||||||||||||

Ampersand CF Limited Partnership - Class A(b) |

North America | Leveraged Buyout | 168,143 | 1,336,122 | 0.35 | % | 10/29/2020 |

||||||||||||||

Ampersand CF Limited Partnership - Class B(b) |

North America | Leveraged Buyout | 300,565 | 2,382,232 | 0.63 | % | 10/29/2020 |

||||||||||||||

Ampersand 2006, L.P.(a)(b)(d) |

North America | Venture | — | 59,757 | 0.02 | % | 12/31/2019 |

||||||||||||||

Arsenal Capital Partners III-B LP.(a)(b) |

North America | Leveraged Buyout | 2,034,163 | 1,744,182 | 0.46 | % | 1/1/2022 |

||||||||||||||

Audax Mezzanine Fund III, L.P.(b) |

North America | Private Credit | 351,978 | 502,529 | 0.13 | % | 6/30/2021 |

||||||||||||||

Bain Capital Europe III, L.P.(a)(b) |

North America | Leveraged Buyout | 118,055 | 68,925 | 0.02 | % | 12/31/2021 |

||||||||||||||

BC European Capital IX, L.P.(a)(b) |

Guernsey | Leveraged Buyout | 8,699,298 | 9,893,898 | 2.62 | % | 12/31/2020 |

||||||||||||||

BC Partners Galileo (2) L.P.(a)(b) |

Guernsey | Leveraged Buyout | 2,177,902 | 2,689,281 | 0.71 | % | 6/10/2021 |

||||||||||||||

Caltius Partners IV, L.P.(a)(b) |

North America | Private Credit | 4,748,031 | 5,609,550 | 1.48 | % | 6/30/2021 |

||||||||||||||

Canaan VII, L.P.(a)(b) |

North America | Venture | 432,808 | 886,875 | 0.23 | % | 12/31/2019 |

||||||||||||||

Carlyle Europe Partners IV, L.P.(b)(e) |

United Kingdom | Leveraged Buyout | 1,926,379 | 2,179,426 | 0.58 | % | 12/31/2021 |

||||||||||||||

Carlyle Partners VI, L.P.(b) |

North America | Leveraged Buyout | 2,902,899 | 2,830,023 | 0.75 | % | 12/31/2021 |

||||||||||||||

Castle Harlan Partners V & AIV(a)(b)(d)(e) |

North America | Leveraged Buyout | 737,572 | 1,163,710 | 0.31 | % | 9/30/2021 |

||||||||||||||

Catterton Partners VI, L.P.(a)(b) |

North America | Leveraged Buyout | 546,441 | 1,023,227 | 0.27 | % | 12/31/2019 |

||||||||||||||

Centerbridge Special Credit Partners, L.P.(a)(b) |

North America | Private Credit | 71,891 | 61,098 | 0.02 | % | 12/31/2021 |

||||||||||||||

Cerberus Institutional Partners VI, L.P.(a)(b) |

North America | Leveraged Buyout | 1,413,229 | 1,864,242 | 0.49 | % | 7/30/2021 |

||||||||||||||

Clayton, Dubilier & Rice Fund IX, L.P.(b) |

North America | Leveraged Buyout | 7,018,240 | 7,090,375 | 1.88 | % | 12/31/2021 |

||||||||||||||

Court Square Capital Partners (Offshore) III, L.P.(b) |

North America | Leveraged Buyout | 5,442,524 | 4,684,673 | 1.24 | % | 12/31/2021 |

||||||||||||||

CRG Partners III (Holdings I) L.P.(b)(e) |

North America | Private Credit | 568,759 | 703,301 | 0.19 | % | 6/30/2021 |

||||||||||||||

Crosslink Ventures V, L.P.(a)(b)(d)(e) |

North America | Venture | 468,540 | 478,388 | 0.13 | % | 1/1/2020 |

||||||||||||||

CVC Capital Partners VI (A) L.P. (b) |

Jersey | Leveraged Buyout | 5,638,141 | 6,652,692 | 1.76 | % | 1/1/2022 |

||||||||||||||

Dace Ventures I, L.P.(a)(b) |

North America | Venture | 291,049 | 353,500 | 0.09 | % | 12/31/2019 |

||||||||||||||

DBAG Fund VI (Guernsey) L.P.(b) |

Guernsey | Leveraged Buyout | 1,462,296 | 1,414,929 | 0.37 | % | 12/31/2021 |

||||||||||||||

DFJ Growth 2006 Continuation, L.P.(a)(b)(e) |

North America | Leveraged Buyout | 1,497,477 | 4,825,551 | 1.28 | % | 12/31/2019 |

||||||||||||||

EagleTree Partners IV, LP(b) |

North America | Leveraged Buyout | 1,261,274 | 1,819,004 | 0.48 | % | 6/30/2021 |

||||||||||||||

Emerald Partners V, L.P.(a)(b)(d)(e) |

North America | Leveraged Buyout | 733 | 3,072 | 0.00 | % | 12/31/2019 |

||||||||||||||

EnerTech Capital Partners III, L.P.(a)(b) |

North America | Venture | 287,373 | 283,698 | 0.08 | % | 12/31/2019 |

||||||||||||||

See accompanying Notes to the Financial Statements.

5

FlowStone Opportunity Fund

Schedule of Investments

March 31, 2022 (Continued)

Investment Funds* |

Geographic |

Investment |

Cost |

Fair Value |

% of |

Original |

|||||||||||||||

Secondary Investments (continued) |

|||||||||||||||||||||

Falcon Strategic Partners III, L.P.(b) |

North America | Private Credit | $ | 1,875,506 | $ | 2,712,822 | 0.72 | % | 6/30/2021 |

||||||||||||

Fin Venture Capital I, L.P.(a)(b) |

North America | Venture | 3,573,341 | 11,745,355 | 3.11 | % | 6/30/2020 |

||||||||||||||

Francisco Partners III (Cayman), L.P.(b) |

Cayman | Leveraged Buyout | — | 664,750 | 0.18 | % | 12/31/2020 |

||||||||||||||

Francisco Partners III (Domestic AIV), L.P.(b) |

North America | Leveraged Buyout | — | 242,910 | 0.06 | % | 12/31/2020 |

||||||||||||||

Francisco Partners III, L.P.(b) |

North America | Leveraged Buyout | — | 933,727 | 0.25 | % | 12/31/2020 |

||||||||||||||

GF Capital Private Equity Fund II-B, L.P.(a)(b) |

North America | Leveraged Buyout | 5,350,086 | 4,767,500 | 1.26 | % | 12/31/2021 |

||||||||||||||

Great Hill Equity Partners VIII, L.P.(a)(b)(c) |

North America | Leveraged Buyout | — | (15,864 | ) | 0.00 | % | 12/31/2021 |

|||||||||||||

Hony Capital Fund V, L.P.(a)(b) |

North America | Leveraged Buyout | 1,976,425 | 1,641,936 | 0.43 | % | 1/31/2022 |

||||||||||||||

ICG Ludgate Hill IB SCSp(b)(e) |

Luxembourg | Leveraged Buyout | 11,966,736 | 25,292,642 | 6.69 | % | 6/22/2021 |

||||||||||||||

Icon Partners IV, L.P.(a)(b) |

North America | Leveraged Buyout | 8,349,670 | 8,542,691 | 2.26 | % | 5/21/2021 |

||||||||||||||

Icon Partners V, L.P.(a)(b) |

North America | Leveraged Buyout | 7,417,800 | 7,593,930 | 2.01 | % | 8/27/2021 |

||||||||||||||

IK VII Fund(b) |

Jersey | Leveraged Buyout | 531,885 | 649,983 | 0.17 | % | 12/31/2021 |

||||||||||||||

Institutional Venture Partners XII, L.P.(a)(b)(d)(e) |

North America | Venture | 342,941 | 96,975 | 0.03 | % | 12/31/2019 |

||||||||||||||

Institutional Venture Partners XIV, L.P.(a)(b) |

North America | Venture | 2,759,794 | 2,645,915 | 0.70 | % | 12/31/2021 |

||||||||||||||

Intermediate Capital Asia Pacific Fund 2008, L.P.(b) |

Jersey | Private Credit | 245,618 | 756,185 | 0.20 | % | 6/30/2021 |

||||||||||||||

JFL-NG Continuation Fund, L.P.(a)(b) |

North America | Leveraged Buyout | 2,753,434 | 3,953,789 | 1.05 | % | 10/27/2021 |

||||||||||||||

JK&B Capital V, L.P.(a)(b)(d)(e) |

North America | Venture | 148,521 | 196,399 | 0.05 | % | 12/31/2019 |

||||||||||||||

Lincolnshire Equity Fund IV-A, L.P.(a)(b) |

North America | Leveraged Buyout | 1,606,812 | 3,304,525 | 0.87 | % | 12/31/2020 |

||||||||||||||

Littlejohn Fund IV, LP(b)(e) |

North America | Leveraged Buyout | 268,332 | 513,266 | 0.14 | % | 9/30/2021 |

||||||||||||||

Lord Investment S.a r.l. (Valextra SpA)(a)(b)(e) |

Western Europe | Leveraged Buyout | 1,839,017 | 1,779,574 | 0.47 | % | 3/31/2022 |

||||||||||||||

MDV IX, L.P.(a)(b) |

North America | Venture | 799,539 | 2,132,212 | 0.56 | % | 12/31/2020 |

||||||||||||||

Milestone Partners FS LP(a)(b) |

North America | Leveraged Buyout | 1,530,920 | 1,416,946 | 0.37 | % | 12/31/2021 |

||||||||||||||

Milestone Partners IV, L.P.(a)(b) |

North America | Leveraged Buyout | 1,267,111 | 1,371,424 | 0.36 | % | 12/31/2021 |

||||||||||||||

Morgenthaler Venture Partners IX, LP(b) |

North America | Venture | 572,678 | 1,340,531 | 0.35 | % | 12/31/2020 |

||||||||||||||

NEO Capital Private Equity Fund II L.P.(b) |

Western Europe | Fund of Funds | 1,558,572 | 1,655,267 | 0.44 | % | 1/18/2022 |

||||||||||||||

Northstar Mezzanine Partners V, L.P.(b) |

North America | Private Credit | 3,907,895 | 2,068,293 | 0.55 | % | 6/30/2021 |

||||||||||||||

NYLCAP Mezzanine Offshore Partners III, L.P.(b) |

North America | Private Credit | 618,346 | 680,072 | 0.18 | % | 6/30/2021 |

||||||||||||||

Oaktree European Principal Fund III (U.S.), L.P.(a)(b) |

North America | Private Credit | 1,481,205 | 1,856,849 | 0.49 | % | 11/1/2021 |

||||||||||||||

Onex Partners III LP(b) |

North America | Leveraged Buyout | 516,086 | 681,896 | 0.18 | % | 10/1/2021 |

||||||||||||||

Park Square Capital Partners II, L.P.(b) |

Guernsey | Private Credit | 1,680,967 | 2,008,704 | 0.53 | % | 6/30/2021 |

||||||||||||||

Parthenon Investors III, L.P.(b) |

North America | Leveraged Buyout | 431,547 | 1,814,181 | 0.48 | % | 12/31/2019 |

||||||||||||||

Pegasus WSJLL Fund, L.P.(a)(b) |

North America | Leveraged Buyout | 8,477,772 | 8,411,841 | 2.23 | % | 12/14/2021 |

||||||||||||||

Permira V(a)(b) |

Guernsey | Leveraged Buyout | 6,581,838 | 5,647,667 | 1.49 | % | 2/1/2022 |

||||||||||||||

Platinum Equity Capital Partners III, L.P.(a)(b)(e) |

North America | Leveraged Buyout | 1,617,070 | 1,854,203 | 0.49 | % | 3/31/2022 |

||||||||||||||

Point 406 Ventures I, L.P.(a)(b) |

North America | Venture | 1,865,426 | 751,786 | 0.20 | % | 12/31/2019 |

||||||||||||||

Pro SPV, LP(a)(b) |

North America | Leveraged Buyout | 8,345,445 | 10,612,934 | 2.81 | % | 8/27/2021 |

||||||||||||||

PT2-A, L.P.(a)(b) |

North America | Leveraged Buyout | 6,339,350 | 6,273,507 | 1.66 | % | 12/15/2021 |

||||||||||||||

Quad-C Partners VIII, LP(a)(b) |

North America | Leveraged Buyout | 678,626 | 22,392 | 0.01 | % | 9/30/2021 |

||||||||||||||

Redpoint Ventures IV, L.P.(a)(b) |

North America | Venture | 3,020,976 | 2,036,199 | 0.54 | % | 12/31/2020 |

||||||||||||||

Rembrandt Venture Partners Fund Two, L.P.(a)(b) |

North America | Venture | 922,119 | 1,052,017 | 0.28 | % | 12/31/2019 |

||||||||||||||

Reverence Capital Partners Opportunities Fund I, L.P.(b)(e) |

North America | Leveraged Buyout | 1,487,996 | 2,028,032 | 0.54 | % | 12/31/2020 |

||||||||||||||

Riverstone Global Energy and Power Fund VI, LP(b) |

North America | Leveraged Buyout | 398,541 | 853,688 | 0.23 | % | 6/30/2021 |

||||||||||||||

See accompanying Notes to the Financial Statements.

6

FlowStone Opportunity Fund

Schedule of Investments

March 31, 2022 (Continued)

Investment Funds* |

Geographic |

Investment |

Cost |

Fair Value |

% of |

Original |

|||||||||||||||

Secondary Investments (continued) |

|||||||||||||||||||||

Savant Growth Fund I, LP(a)(b) |

North America | Leveraged Buyout | $ | 1,857,148 | $ | 1,710,664 | 0.45 | % | 12/8/2020 |

||||||||||||

StepStone Real Estate Partners III, L.P.(b)(e) |

North America | Fund of Funds | 133,888 | 204,696 | 0.05 | % | 6/30/2021 |

||||||||||||||

Summit Partners Growth Equity Fund IX-A, L.P.(a)(b) |

North America | Leveraged Buyout | 2,844,040 | 3,197,657 | 0.85 | % | 6/30/2021 |

||||||||||||||

Summit Partners Subordinated Debt IV-B, L.P.(a)(b) |

North America | Private Credit | 828,415 | 657,545 | 0.17 | % | 6/30/2021 |

||||||||||||||

TA Subordinated Debt Fund III, L.P.(b) |

North America | Private Credit | 890,213 | 927,993 | 0.25 | % | 7/30/2021 |

||||||||||||||

TCW/Crescent Mezzanine Partners VB, L.P.(a)(b) |

North America | Private Credit | 26,042 | 280,859 | 0.07 | % | 6/30/2021 |

||||||||||||||

The Peninsula Fund V, L.P.(b) |

North America | Private Credit | 10,623,668 | 13,638,736 | 3.61 | % | 7/1/2021 |

||||||||||||||

The Resolute Fund III, L.P.(a)(b) |

North America | Leveraged Buyout | 1,630,206 | 2,252,312 | 0.60 | % | 12/31/2021 |

||||||||||||||

The Veritas Capital Partners IV, LP(a)(b) |

North America | Leveraged Buyout | 28,583 | 101,660 | 0.03 | % | 1/1/2022 |

||||||||||||||

TowerBrook Investors IV (OS), L.P.(b) |

North America | Leveraged Buyout | 4,584,343 | 4,752,046 | 1.26 | % | 12/31/2021 |

||||||||||||||

Tudor Ventures III, L.P.(a)(b) |

North America | Venture | — | 20,333 | 0.01 | % | 12/31/2019 |

||||||||||||||

TZP Capital Partners I (PIV), LP(a)(b) |

North America | Leveraged Buyout | 74,639 | 67,275 | 0.02 | % | 4/7/2021 |

||||||||||||||

TZP Capital Partners II-A (Blocker), LP(b) |

North America | Leveraged Buyout | 588,172 | 969,859 | 0.26 | % | 4/7/2021 |

||||||||||||||

TZP Small Cap Partners I-A (Blocker), LP(b) |

North America | Leveraged Buyout | 283,033 | 380,094 | 0.10 | % | 4/7/2021 |

||||||||||||||

Versant Venture Capital IV, L.P.(b) |

North America | Venture | 6,545,505 | 1,258,336 | 0.33 | % | 12/31/2020 |

||||||||||||||

Warburg Pincus Global Growth 14, L.P.(a)(b) |

North America | Leveraged Buyout | 500,000 | 525,788 | 0.14 | % | 1/31/2022 |

||||||||||||||

Total Secondary Investments (Cost $197,775,529) (63.45%)*** |

239,711,146 | ||||||||||||||||||||

Total Investment Funds (Cost $205,968,349) (66.11%)*** |

$ | 249,755,753 | |||||||||||||||||||

| Short-Term Investment (34.70%)*** | Shares | Fair Value | ||||||

| Money Market Fund | ||||||||

Morgan Stanley Institutional Liquidity Fund - Treasury Portfolio, 0.19% (f) | 131,126,797 | $ | 131,126,797 | |||||

| Total Money Market Fund (Cost $131,126,797) (34.70%)*** | $ | 131,126,797 | ||||||

| Total Investments (Cost $337,095,146) (100.81%)*** | $ | 380,882,550 | ||||||

| Liabilities less other assets (-0.81%)*** | (2,967,423 | ) | ||||||

| Shareholders’ Capital - 100.00%*** | $ | 377,915,127 | ||||||

Primary Investments are investments in newly established private equity partnerships where underlying portfolio companies are not known as of the time of investment.

Secondary Investments are Private Equity Fund Investments generally acquired in the secondary market.

|

* |

Restricted investments as to resale. Certain Investment Funds will distribute proceeds upon realization events and such proceeds are distributed at the discretion of the Investment Manager, as they become available. |

|

** |

The geographic region disclosed is based on where each Investment Fund is domiciled. |

|

*** |

As a percentage of total shareholders’ capital. |

|

(a) |

Non-income producing. |

|

(b) |

Investment Funds are issued in private placement transactions and as such are restricted as to resale per Rule 12-12-8 of Regulation S-X. |

|

(c) |

As of March 31, 2022, no capital has been contributed to this Investment Fund and the fair value represents a liability of a commitment to the Investment Fund. |

|

(d) |

The Investment Fund is liquidating its assets and is in the process of returning capital to its limited partners in a reasonable manner. |

|

(e) |

Fair valued by the Fair Value Committee based on policies and procedures established by the Board of Trustees and considered a Level 3 investment. |

|

(f) |

The rate quoted is the annualized seven-day yield of the fund at the period end. |

See accompanying Notes to the Financial Statements.

7

FlowStone Opportunity Fund

Schedule of Investments

March 31, 2022 (Continued)

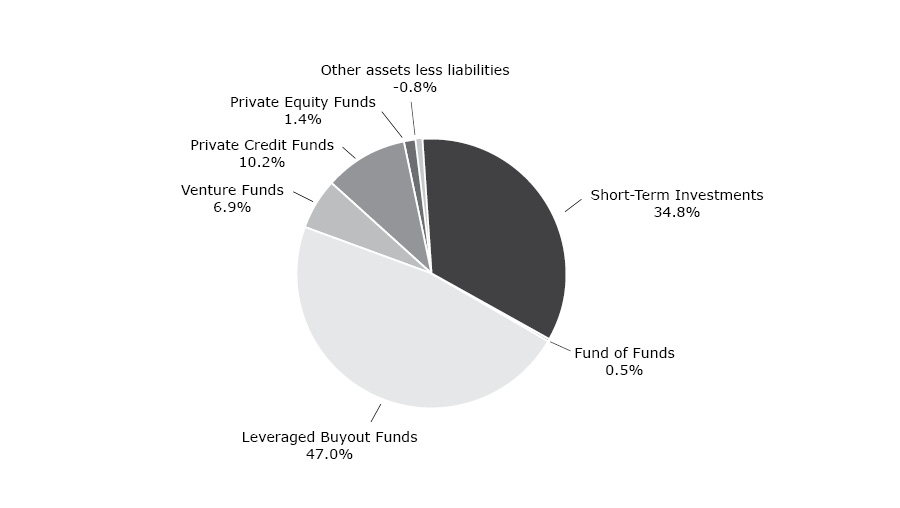

Investment Strategy as a Percentage of Total Shareholders’ Capital (Unaudited)

See accompanying Notes to the Financial Statements.

8

FlowStone Opportunity Fund

Statement of Assets, Liabilities and Shareholders’ Capital

March 31, 2022

Assets |

||||

Investments in Investment Funds, at fair value (cost $205,968,349) |

$ | 249,755,753 | ||

Investments in Short-Term Investments, at fair value (cost $131,126,797) |

131,126,797 | |||

Cash |

71,435,000 | |||

Dividends receivable |

10,826 | |||

Total Assets |

452,328,376 | |||

Liabilities |

||||

Investments purchased payable |

239,838 | |||

Shareholders’ Capital received in advance |

71,435,000 | |||

Investment Advisory fee payable |

1,214,374 | |||

Payable for shares repurchased |

700,000 | |||

Professional fees payable |

160,367 | |||

Administration & Accounting fees payable |

107,162 | |||

Transfer Agent fees payable |

30,697 | |||

Chief Compliance Officer & Chief Financial Officer fees payable |

26,938 | |||

Trustees fees payable |

74,720 | |||

Other accrued expenses |

424,153 | |||

Total Liabilities |

74,413,249 | |||

Shareholders’ Capital |

||||

Paid-in Capital |

$ | 338,723,211 | ||

Total distributable earnings |

39,191,916 | |||

Total Shareholders’ Capital |

$ | 377,915,127 | ||

Shares Outstanding |

22,160,179 | |||

Net asset value per Share: |

$ | 17.05 |

See accompanying Notes to the Financial Statements.

9

FlowStone Opportunity Fund

Statement of Operations

For the Year Ended March 31, 2022

Income |

||||

Dividend income |

$ | 553,500 | ||

Interest income |

178,754 | |||

Income from underlying Investment Funds |

2,402,933 | |||

Total Income |

3,135,187 | |||

Expenses |

||||

Incentive Fee (See Note 8) |

4,382,456 | |||

Investment Advisory fee (See Note 8) |

3,662,536 | |||

Professional fees |

510,500 | |||

Administration & Accounting fees |

344,923 | |||

Expense waiver recoupment |

527,657 | |||

Chief Compliance Officer & Chief Financial Officer fees |

140,000 | |||

Trustees’ fees |

100,000 | |||

Transfer Agent fees |

54,145 | |||

Other expenses |

262,396 | |||

Total Expenses |

9,984,613 | |||

Net Investment Income (Loss) |

(6,849,426 | ) | ||

Net Realized Gain and Change in Unrealized Appreciation/Depreciation on Investments in Investment Funds, Investments in Securities and Foreign Currency Translation |

||||

Net realized gain on Investments in Investment Funds, investments in securities and foreign currency transactions |

32,500,636 | |||

Net change in unrealized appreciation/depreciation on Investments in Investment Funds and foreign currency translation |

13,119,056 | |||

Total Net Realized Gain and Change in Unrealized Appreciation/Depreciation on Investments in Investment Funds, Investments in Securities and Foreign Currency Translation |

45,619,692 | |||

Net increase in Shareholders’ Capital from operations |

$ | 38,770,266 |

See accompanying Notes to the Financial Statements.

10

FlowStone Opportunity Fund

Statements of Changes in Shareholders’ Capital

For the |

For the |

|||||||

Operations |

||||||||

Net investment income (loss) |

$ | (6,849,426 | ) | $ | (3,331,018 | ) | ||

Net realized gain from investments in Investment Funds, investments in securities and foreign currency transactions |

32,500,636 | 4,423,031 | ||||||

Net change in unrealized appreciation/depreciation on investments in Investment Funds and foreign currency translation |

13,119,056 | 29,270,691 | ||||||

Net increase in Shareholders’ Capital from operations |

38,770,266 | 30,362,704 | ||||||

Distributions to shareholders |

||||||||

Distributions |

(8,368,152 | ) | (9,591 | ) | ||||

Net decrease in Shareholders’ Capital from distributions |

(8,368,152 | ) | (9,591 | ) | ||||

Shareholders’ Capital Transactions |

||||||||

Proceeds from sale of Shares |

205,160,001 | 59,792,500 | ||||||

Reinvestment of distributions |

8,060,830 | 8,919 | ||||||

Repurchase of Shares |

(1,228,748 | ) | — | |||||

Net Increase in Shareholders’ Capital from capital transactions |

211,992,083 | 59,801,419 | ||||||

Shareholders’ Capital |

||||||||

Beginning of year |

135,520,930 | 45,366,398 | ||||||

End of year |

$ | 377,915,127 | $ | 135,520,930 | ||||

Shares outstanding at beginning of year |

9,256,913 | 4,304,938 | ||||||

Shares sold |

12,497,176 | 4,951,185 | ||||||

Shares reinvested |

478,103 | 790 | ||||||

Shares redeemed |

(72,013 | ) | — | |||||

Shares outstanding at end of year |

22,160,179 | 9,256,913 | ||||||

See accompanying Notes to the Financial Statements.

11

FlowStone Opportunity Fund

Statement of Cash Flows

For the Year Ended March 31, 2022

Cash flows from operating activities |

||||

Net increase in Shareholders’ Capital from operations |

$ | 38,770,266 | ||

Adjustments to reconcile net increase in Shareholders’ Capital from operations to net cash used in operating activities: |

||||

Purchases of investments in Investment Funds |

(177,899,557 | ) | ||

Capital distributions received from Investment Funds |

58,952,671 | |||

Net realized gain from investments in Investment Funds, investments in securities and foreign currency transactions |

(32,500,636 | ) | ||

Net change in unrealized appreciation/depreciation on investments in Investment Funds and foreign currency translation |

(13,119,056 | ) | ||

Net cash paid for purchases, sales, and maturities of short-term investments |

(79,076,820 | ) | ||

Changes in operating assets and liabilities: |

||||

(Increase) Decrease in investments in Investment Funds paid in advance |

79,110 | |||

(Increase) Decrease in dividends receivable |

(10,367 | ) | ||

(Increase) Decrease in due from adviser |

76,608 | |||

Increase (Decrease) in investments purchased payable |

239,838 | |||

Increase (Decrease) in investment advisory fees payable |

775,257 | |||

Increase (Decrease) in administration & accounting fees payable |

66,513 | |||

Increase (Decrease) in transfer agent fees payable |

(8,288 | ) | ||

Increase (Decrease) in chief compliance officer & chief financial officer fees payable |

11,667 | |||

Increase (Decrease) in professional fees payable |

1,039 | |||

Increase (Decrease) in trustees fees payable |

22,500 | |||

Increase (Decrease) in incentive fee payable |

(994,857 | ) | ||

Increase (Decrease) in other accrued expenses |

242,910 | |||

Net cash used in operating activities |

(204,371,202 | ) | ||

Cash flows from financing activities |

||||

Proceeds from sale of shares |

261,450,001 | |||

Distributions |

(307,322 | ) | ||

Repurchase of shares |

(528,748 | ) | ||

Net cash provided by financing activities |

260,613,931 | |||

Net change in cash |

56,242,729 | |||

Cash at beginning of year |

15,192,271 | |||

Cash at End of Year |

$ | 71,435,000 | ||

Supplemental disclosure of financing activity |

||||

Supplemental disclosure of non-cash stock distributions |

$ | 16,597,891 | ||

Supplemental disclosure of reinvested distributions |

8,060,830 |

See accompanying Notes to the Financial Statements.

12

FlowStone Opportunity Fund

Financial Highlights

Year Ended |

Year Ended |

For the Period |

||||||||||

Net asset value per Share, beginning of period |

$ | 14.64 | $ | 10.54 | $ | 10.00 | ||||||

Net increase in Shareholders’ Capital from operations: |

||||||||||||

Net investment loss* |

(0.41 | ) | (0.48 | ) | (0.02 | ) | ||||||

Net realized gain and change in unrealized appreciation |

3.41 | 4.58 | 0.56 | |||||||||

Net increase in Shareholders’ Capital from operations: |

3.00 | 4.10 | 0.54 | |||||||||

Distributions from net investment income |

— | — | ** | — | ||||||||

Distributions from capital gains |

(0.59 | ) | — | — | ||||||||

Total distributions |

(0.59 | ) | — | ** | — | |||||||

Net asset value per Share, end of period |

$ | 17.05 | $ | 14.64 | $ | 10.54 | ||||||

Total Return(1)(2) |

20.53 | % | 38.90 | % | 5.40 | % | ||||||

Ratios/Supplemental Data: |

||||||||||||

Shareholders’ Capital, end of period (in thousands) |

$ | 377,915 | $ | 135,521 | $ | 45,366 | ||||||

Ratio of net investment income/(loss) to average Shareholders’ Capital(7) |

(2.40 | )% | (3.65 | )% | 0.35 | %(2)(3) | ||||||

Ratio of gross expenses to average Shareholders’ Capital(4)(7) |

3.49 | % | 6.32 | % | 5.65 | %(2)(3) | ||||||

Ratio of net expenses to average Shareholders’ Capital(5)(6)(7) |

3.49 | % | 5.48 | % | 2.82 | %(2)(3) | ||||||

Portfolio Turnover(2) |

0.00 | % | 0.00 | % | 0.00 | % | ||||||

|

* |

Per share data is computed using the average shares method. |

|

** |

Amount represents less than $0.005 per share. |

|

(1) |

Total Return based on net asset value per Share is the combination of changes in net asset value per Share and reinvested distributions at net asset value per Share, if any. |

|

(2) |

Not annualized for periods less than 12 months. |

|

(3) |

Annualized, except for incentive fees. |

|

(4) |

Represents the ratio of expenses to average Shareholders’ Capital absent fee waivers and/or expense reimbursement by the Adviser. |

|

(5) |

The Adviser has entered into an Expense Limitation and Reimbursement Agreement with the Fund for a one-year term ending at the end of the Limitation Period to limit the amount of the Fund’s total annual ordinary operating expenses, excluding certain “Specified Expenses” as outlined in the Notes to the Financial Statements. |

|

(6) |

The incentive fee of $4,382,456; 3,209,563; and 329,102, respectively, is exclusive of the 1.95% expense cap. |

|

(7) |

The income and expense ratios do not reflect the Fund’s proportionate share of the net income (loss) and expenses, including incentive fees or allocations, of the Investment Funds. The Investment Funds’ expense ratios, excluding incentive fees or allocations range from 0.00% to 23.50% (unaudited). The Investment Funds’ incentive fees or allocations can be up to 30% of profits earned (unaudited). |

See accompanying Notes to the Financial Statements.

13

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2022

1. Organization

FlowStone Opportunity Fund (the “Fund”) was organized as a Delaware statutory trust on May 23, 2018 and commenced operations on August 30, 2019. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. FlowStone Partners, LLC, an investment adviser registered under the Investment Advisers Act of 1940, as amended, (the “Advisers Act”) serves as the Fund’s investment adviser (the “Adviser”).

The Fund’s primary investment objective is to generate appropriate risk-adjusted long-term returns by investing in a diversified portfolio of private equity investments. The Fund’s investments are expected to consist primarily of: (i) secondary investments in private equity funds managed by third-party managers; (ii) primary investments in private equity funds managed by third-party managers; and (iii) direct co-investments in the equity and/or debt of operating companies.

The Board of Trustees (the “Board”) of the Fund has overall responsibility for the management and supervision of the business operations of the Fund. As permitted by applicable law, the Board may delegate any of its rights, powers and authority to, among others, the officers of the Fund, any committee of the Board, or the Adviser.

2. Summary of Significant Accounting Policies

The Fund is an investment company and as a result, maintains its accounting records and has presented these financial statements in accordance with the reporting requirements under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies (“ASC 946”).

A) Investment Transactions - Purchases of investments in the Investment Funds are recorded as of the first day of legal ownership of an Investment Fund and redemptions from the Investment Funds are recorded as of the last day of legal ownership. Non-cash stock distributions received from Investment Funds are recorded on the date that the distributions are known. Realized gains or losses on investments in the Investment Funds and investments in securities are recorded at the time of the disposition of the respective investment based on specific identification. Investment in security transactions are recorded on trade date.

B) Valuation of Investments - Pursuant to Fund’s valuation policies, the Board has delegated to the Adviser, the general responsibility for valuation of the investments subject to oversight by the Board. The Board has approved procedures pursuant to which the Fund values its investments in Investment Funds at fair value, generally at an amount equal to the Net Asset Value (“NAV”) of the Fund’s investment in the Investment Funds as determined by the Investment Fund’s general partner or Investment Manager. This is commonly referred to as using NAV as the practical expedient which allows for estimation of the fair value of an investment in an investment entity based on NAV or its equivalent if the NAV of the investment entity is calculated in a manner consistent with ASC 946. Because of the inherent uncertainty of valuations of the investments in the Investment Funds, their estimated values may differ significantly from the values that would have been used had a ready market for the Investment Funds existed, and the differences could be material. In accordance with its valuation policies, if no such information is available, or if such information is deemed to not be reflective of fair value by the Adviser, an estimated fair value is determined in good faith by the Adviser pursuant to the Fund’s valuation procedures. All adjustments to fair value made by the Adviser are reviewed and approved by the Fund’s Valuation Committee, subject to Board approval.

Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the primary exchange on the business day the value is being determined. Investments in open-end investment companies are valued at their reported NAV per share.

C) Use of Estimates - The preparation of the financial statements in accordance with accounting principles generally accepted in the United States (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

D) Dividend, Interest and Investment Income Recognition and Expenses - Dividend, interest and investment income is recognized on an accrual basis as earned. The Fund accounts for income from underlying Investment Fund distributions based on the nature of such distributions as determined by the underlying investment managers. Expenses are recognized on an accrual basis as incurred. The Fund bears all expenses incurred in the course of its operations, including, but not limited to,

14

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2022 (Continued)

the following: all costs and expenses related to portfolio transactions and positions for the Fund’s account; professional fees; costs of insurance; registration expenses; and expenses of meetings of the Board. Expenses are subject to the Fund’s Expense Limitation Agreement (see Note 8).

E) Foreign Currency Translation - The functional currency of the Fund is the U.S. dollar. Assets and liabilities denominated in currencies other than the U.S. dollar are translated into U.S. dollars at the composite rate of exchange as reported at the end of each reporting period by third-party pricing sources. Purchases and sales of investments and income and expenses denominated in currencies other than U.S. dollars are translated at the rates of exchange on the respective dates of such transactions. The resulting foreign exchange realized and or unrealized gain (loss) from such transactions is included in net change in unrealized appreciation/depreciation on investments in Investment Funds and foreign currency translation on the statement of operations.

3. Risk Associated with Investments in Investment Funds

A) Dependence on the Investment Fund Managers - Because the Fund invests in private equity funds (“Investment Funds”), a Shareholder’s investment in the Fund will be affected by the investment policies and decisions of the Investment Fund Manager of each Investment Fund in direct proportion to the amount of Fund assets that are invested in each Investment Fund. The Fund’s NAV may fluctuate in response to, among other things, various market and economic factors related to the markets in which the Investment Funds invest and the financial condition and prospects of issuers in which the Investment Funds invest. The success of the Fund depends upon the ability of the Investment Fund Managers to develop and implement strategies that achieve their investment objectives. Shareholders will not have an opportunity to evaluate the specific investments made by the Investment Funds or the Investment Fund Managers, or the terms of any such investments. In addition, the Investment Fund Managers could materially alter their investment strategies from time to time without notice to the Fund. There can be no assurance that the Investment Fund Managers will be able to select or implement successful strategies or achieve their respective investment objectives.

B) Investment Funds Not Registered - The Fund is registered as an investment company under the Investment Company Act. The Investment Company Act is designed to afford various protections to investors in pooled investment vehicles. For example, the Investment Company Act imposes limits on the amount of leverage that a registered investment company can assume, restricts layering of costs and fees, restricts transactions with affiliated persons and requires that the investment company’s operations be supervised by a board of directors, a majority of whose members are independent of management. However, most of the Investment Funds in which the Fund invests are not subject to the provisions of the Investment Company Act. Many Investment Fund Managers may not be registered as investment advisers under the Advisers Act. As an indirect investor in the Investment Funds managed by Investment Fund Managers that are not registered as investment advisers, the Fund will not have the benefit of certain of the protections of the Advisers Act. The Investment Funds generally are exempted from regulation under the Investment Company Act because they permit investment only by investors who meet very high thresholds of investment experience and sophistication, as measured by net worth. The Fund’s investment qualification thresholds are generally lower. As a result, the Fund provides an avenue for investing in Investment Funds that would not otherwise be available to certain investors. This means that investors who would not otherwise qualify to meet the initial subscription threshold would qualify to invest in largely unregulated vehicles will have the opportunity to make such an investment through the Fund.

C) Maintenance of Security and Other Assets in The Custody of a Bank - The Investment Funds typically do not maintain their securities and other assets in the custody of a bank or a member of a securities exchange, as generally required of registered investment companies, in accordance with certain SEC rules. A registered investment company which places its securities in the custody of a member of a securities exchange is required to have a written custodian agreement, which provides that securities held in custody will be at all times individually segregated from the securities of any other person and marked to clearly identify such securities as the property of such investment company and which contains other provisions designed to protect the assets of such investment company. The Investment Funds in which the Fund invests may maintain custody of their assets with brokerage firms which do not separately segregate such customer assets as would be required in the case of registered investment companies, or may not use a custodian to hold their assets. Under the provisions of the Securities Investor Protection Act of 1970, as amended, the bankruptcy of any brokerage firm used to hold Investment Fund assets could have a greater adverse effect on the Fund than would be the case if custody of assets were maintained in accordance with the requirements applicable to registered investment companies. There is also a risk that an Investment Fund Manager could convert assets committed to it by the Fund to its own use or that a custodian could convert assets committed to it by an Investment Fund Manager to its own use. There can be no assurance that the Investment Fund Managers or the entities they manage will comply with all applicable laws and that assets entrusted to the Investment Fund Managers will be protected.

15

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2022 (Continued)

D) Investment Funds are Generally Non-diversified - While there are no regulatory requirements that the investments of the Investment Funds be diversified, some Investment Funds may undertake to comply with certain investment concentration limits. Investment Funds may at certain times hold large positions in a relatively limited number of investments. Investment Funds may target or concentrate their investments in particular markets, sectors or industries. Those Investment Funds that concentrate in a specific industry or target a specific sector will also be subject to the risks of that industry or sector, which may include, but are not limited to, rapid obsolescence of technology, sensitivity to regulatory changes, minimal barriers to entry and sensitivity to overall market swings. As a result, the net asset values of such Investment Funds may be subject to greater volatility than those of investment companies that are subject to diversification requirements and this may negatively impact the NAV of the Fund.

E) Investment Funds’ Securities are Generally Illiquid - The securities of the Investment Funds in which the Fund invests or plans to invest will generally be illiquid. Subscriptions to purchase the securities of Investment Funds are generally subject to restrictions or delays. Similarly, the Fund may not be able to dispose of Investment Fund interests that it has purchased in a timely manner and, if adverse market conditions were to develop during any period in which the Fund is unable to sell Investment Fund interests, the Fund might obtain a less favorable price than that which prevailed when it acquired or subscribed for such interests, and this may negatively impact the net asset values of the Fund.

F) Investment Fund Operations Not Transparent - The Adviser does not control the investments or operations of the Investment Funds. An Investment Fund Manager may employ investment strategies that differ from its past practices and are not fully disclosed to the Adviser and that involve risks that are not anticipated by the Adviser. Some Investment Fund Managers may have a limited operating history, and some may have limited experience in executing one or more investment strategies to be employed for an Investment Fund. Furthermore, there is no guarantee that the information given to the Administrator and reports given to the Adviser with respect to the Fund Investments will not be fraudulent, inaccurate or incomplete.

G) Investments in Investment Funds of Foreign Investment Fund Managers - These investments may carry certain risks not ordinarily associated with investments in Investment Funds of domestic Investment Fund Managers. Such risks include adverse future political and economic developments and the possible imposition of exchange controls or other foreign governmental laws and restrictions. In addition, with respect to certain countries, there is the possibility of expropriation of assets, confiscatory taxation, political or social instability or diplomatic developments which could adversely affect investments in those countries. Certain countries may also impose substantial restrictions on investments on their capital markets by foreign entities, including restriction on investment in issuers or industries deemed sensitive to the relevant nation’s interests. These factors may limit the investment opportunities available or result in lack of liquidity and high valuation volatility.

4. Market Risk

The Fund is subject to market risk, which means the value of the Fund’s shares will fluctuate based on market conditions and shareholders could lose money. The value of the Fund’s shares could decline significantly and unexpectedly, based on many factors, including national and international political, economic, regulatory, interest rate levels, market, or other conditions, as well as global events such as war or other conflict, natural or environmental disasters and infectious disease outbreaks. Events in the financial markets and in the broader economy may cause uncertainty and volatility and may adversely affect Fund performance. Events in one market may impact other markets. Future events may impact the Fund in unforeseen ways.

5. Foreign Currency Risk

Although the Fund intends to invest predominantly in the United States, the Fund’s portfolio includes investments in different currencies. Any returns on, and the value of such investments may, therefore, be materially affected by exchange rate fluctuations, local exchange control, limited liquidity of the relevant foreign exchange markets, the convertibility of the currencies in question and/or other factors. A decline in the value of the currencies in which the Fund Investments that are denominated against the U.S. Dollar may result in a decrease of the Fund’s net asset value. The Adviser may or may not elect to hedge the value of investments made by the Fund against currency fluctuations, and even if the Adviser deems hedging appropriate, it may not be possible or practicable to hedge currency risk exposure. Accordingly, the performance of the Fund could be adversely affected by such currency fluctuations.

16

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2022 (Continued)

6. Capital Share Transactions

The offering of shares of beneficial interest in the Fund (the “Shares”) is registered under the Securities Act of 1933, as amended. The initial offering of Shares was made at the initial NAV per Share of $10.00 on August 30, 2019, and thereafter Shares have been and are expected to be offered quarterly at the NAV per Share as of the date such Shares are purchased.

The Board may, from time to time and in its sole discretion, cause the Fund to repurchase Shares from Shareholders pursuant to written tenders by Shareholders at such times and on such terms and conditions as established by the Board. In determining whether the Fund should offer to repurchase Shares, the Board considers the recommendation of the Adviser, as well as a variety of other operational, business and economic factors. The Adviser anticipates recommending to the Board that, under normal market circumstances, the Fund conduct tender offers of no more than 5% of the Fund’s net assets quarterly on or about each January 1, April 1, July 1 and October 1. A 2.00% early repurchase fee will be charged by the Fund with respect to any repurchase of Shares from a Shareholder at any time prior to the day immediately preceding the first anniversary of the Shareholder’s purchase of such Shares.

During the year ended March 31, 2022, the Fund completed two tender offers. the results were as follows:

2022 Tender Offer Activity |

|

|

|

|

Commencement Date |

April 1, 2021 |

July 2, 2021 |

October 1, 2021 |

January 4, 2022 |

Tender Offer Expiration Date |

April 29, 2021 |

August 2, 2021 |

November 1, 2021 |

February 2, 2022 |

Valuation Date |

June 30, 2021 |

September 30, 2021 |

December 31, 2021 |

March 31, 2022 |

Tender Offer Date Net Asset Value |

$16.59 |

$16.86 |

$17.08 |

$17.05 |

Shares Tendered |

N/A |

N/A |

30,957 |

41,056 |

Value of Shares Tendered |

N/A |

N/A |

$528,748 |

$700,000 |

Percentage of Shares Tendered |

NA |

NA |

0.16% |

0.19% |

7. Fair Value Disclosures

In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The hierarchy gives the highest priority to valuations based on unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurement) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (Level 3 measurement). The guidance establishes three levels of fair value as listed below.

|

● |

Level 1 - Inputs that reflect unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access at the measurement date |

|

● |

Level 2 - Inputs other than quoted prices that are observable for the asset or liability, either directly or indirectly, including inputs in markets that are not considered to be active |

|

● |

Level 3 - Inputs that are unobservable |

The notion of unobservable inputs is intended to allow for situations in which there is little, if any, market activity for the asset or liability at the measurement date. Under Level 3, the owner of an asset must determine fair value based on its own assumptions about what market participants would take into account in determining the fair value of the asset, using the best information available.

The inputs or methodology for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

A financial instrument’s level within the fair value hierarchy is based upon the lowest level of any input that is significant to the fair value measurement; however, the determination of what constitutes “observable” requires significant judgment by the Valuation Committee. The Valuation Committee considers observable data to be market data that is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively

17

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2022 (Continued)

involved in the relevant market. Private equity funds are generally restricted securities that are subject to substantial holding periods and restrictions on resale and are not traded in public markets. Accordingly, the Fund may not be able to resell such investments for extended periods, if at all.

As the Fund uses the NAV as a practical expedient to determine the fair value of certain Investment Funds, these investments have not been classified in the GAAP fair value hierarchy.

The following table is a summary of information about the levels within the fair value hierarchy at which the Fund’s investments are measured as of March 31, 2022:

Investments |

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||

Investment Funds |

$ | — | $ | — | $ | 41,319,235 | $ | 41,319,235 | ||||||||

Short-Term Investments |

131,126,797 | — | — | 131,126,797 | ||||||||||||

NAV as a practical expedient |

— | — | — | 208,436,518 | ||||||||||||

Total |

$ | 131,126,797 | $ | — | $ | 41,319,235 | $ | 380,882,550 | ||||||||

The following is a reconciliation of Investment Funds in which significant unobservable inputs (Level 3) were used in determining value:

Beginning |

Transfers into |

Transfers out |

Total realized |

Total |

Purchases |

Capital |

Balance as |

||||||||||||||||||||||||

| $ | 4,610,390 | $ | 1,994,708 | $ | — | $ | 332,711 | $ | 15,590,321 | $ | 27,630,953 | $ | (8,839,848 | ) | $ | 41,319,235 | |||||||||||||||

The following table presents additional information about valuation methodologies and inputs used for investments that are measured at fair value and categorized within Level 3 as of March 31, 2022:

Investment Type |

Fair Value |

Valuation |

Unobservable Input |

Input Range |

||||||||||||

Investment Funds |

$ | 41,319,235 | Adjusted reported net asset value | Reported net asset value with fair value adjustments | Not applicable | |||||||||||

8. Investment Management Fee and Other Expenses

A) Investment Advisory Fee - The Fund has entered into an investment management fee agreement (the “Investment Management Fee”) with the Adviser. In consideration of services provided, the Fund pays the Adviser a quarterly Investment Management Fee equal to 1.25% on an annualized basis of the greater of (i) the Fund’s NAV and (ii) the Fund’s NAV less cash and cash equivalents plus the total of all commitments made by the Fund that have not yet been drawn for investment. In no event will the Investment Management Fee payable by the Fund exceed 1.75% as a percentage of the Fund’s NAV. For purposes of determining the Investment Management Fee payable to the Adviser for any quarter, NAV is calculated prior to any reduction for any fees and expenses of the Fund for that quarter, including, without limitation, the Investment Management Fee payable to the Adviser for that quarter.

In addition, at the end of each calendar quarter of the Fund, the Adviser will be entitled to receive an Incentive Fee equal to 10% of the excess, if any, of (i) the net profits of the Fund for the relevant period over (ii) the then balance, if any, of the Loss Recovery Account (as defined below). For the purposes of the Incentive Fee, the term “net profits” shall mean the amount by which the NAV of the Fund on the last day of the relevant period exceeds the NAV of the Fund as of the commencement of the same period, including any net change in unrealized appreciation or depreciation of investments and realized income and gains or losses and expenses (including offering and organizational expenses). The Fund will maintain a memorandum account (the “Loss Recovery Account”), which will have an initial balance of zero and will be (i) increased upon the close of

18

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2022 (Continued)

each calendar quarter of the Fund by the amount of the net losses of the Fund for the quarter, and (ii) decreased (but not below zero) upon the close of each calendar quarter by the amount of the net profits of the Fund for the quarter. Shareholders will benefit from the Loss Recovery Account in proportion to their holdings of Shares.

The Adviser has entered into an expense limitation agreement (the “Expense Limitation Agreement”) with the Fund, whereby the Adviser has agreed to waive fees that it would otherwise be paid, and/or to assume expenses of the Fund (a “Waiver”), if required to ensure the Total Annual Expenses (excluding taxes, interest, brokerage commissions, certain transaction-related expenses, extraordinary expenses, and the Incentive Fee) do not exceed 1.95% on an annualized basis (the “Expense Limit”). For a period not to exceed three years from the date on which a Waiver is made, the Adviser may recoup amounts waived or assumed, provided it is able to effect such recoupment without causing the Fund’s expense ratio (after recoupment) to exceed the lesser of (a) the expense limit in effect at the time of the Waiver, and (b) the expense limit in effect at the time of recoupment. The Expense Limitation Agreement will continue until at least August 29, 2023, and will automatically renew thereafter for consecutive twelve-month terms, provided that such continuance is specifically approved at least annually by a majority of the Trustees. The Expense Limitation Agreement may be terminated by the Fund’s Board of Trustees upon thirty days’ written notice to the Adviser.

At March 31, 2022 $657,818 is eligible for recoupment, broken out quarterly in the table below:

| Quarter of Expiration | ||||||

March 31, 2023 | $ | 107,467 | ||||

June 30, 2023 | $ | 155,621 | ||||

September 30, 2023 | $ | 266,790 | ||||

December 31, 2023 | $ | 51,332 | ||||

March 31, 2024 | $ | 76,608 | ||||

B) Administration, Accounting, and Transfer Agent Fees - Pursuant to an agreement between the Fund and UMB Fund Services (the “Administrator”), the Administrator provides administration, fund accounting, and assists with compliance services to the Fund. The Fund pays the Administrator a basis point fee, subject to fee minimums, for various administration, fund accounting, and investor accounting and taxation services to the Fund, as well as certain out of pocket expenses.

C) Distribution - Foreside Fund Services, LLC (the “Distributor”) serves as the distributor of the Fund’s Shares on a best effort basis, subject to various conditions. The Distributor may retain additional unaffiliated broker-dealers to assist in the distribution of Fund shares.

D) Chief Compliance Officer and Chief Financial Officer Fees - Foreside Fund Officer Services, LLC provides chief compliance officer and chief financial officer services to the Fund under a Fund CCO Agreement and a Fund CFO Agreement.

E) Custodian Fees - UMB Bank N.A. serves as the custodian for the Fund’s assets and is responsible for maintaining custody of the Fund’s cash.

9. Federal Income Taxes

It is the Fund’s intention to meet the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), that are applicable to a regulated investment company (“RIC”). The Fund intends to continue to operate so as to qualify to be taxed as a RIC under the Code and, as such, to not be subject to federal income tax on the portion of its taxable income and gains distributed to stockholders. To qualify for RIC tax treatment, among other requirements, the Fund is required to distribute at least 90% of its investment company taxable income, as defined by the Code. Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. While the Fund intends to distribute substantially all of its taxable net investment income and capital gains, if any, in a manner necessary to minimize the imposition of a 4% excise tax, there can be no assurance that it will avoid any or all of the excise tax. In such event, the Fund will be liable only for the amount by which it does not meet the foregoing distribution requirements. The Fund has adopted September 30 as its tax year end.

19

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2022 (Continued)

If the Fund were to fail to meet the requirements of Subchapter M to qualify as a RIC, and if the Fund were ineligible to or otherwise were not to cure such failure, the Fund would be subject to tax on its taxable income at corporate rates, whether or not distributed to Shareholders, and all distributions out of earnings and profits would be taxable to Shareholders as ordinary income. In addition, the Fund could be required to recognize unrealized gains, pay substantial taxes and interest and make substantial distributions before requalifying as a RIC that is accorded special tax treatment under Subchapter M.

In accounting for income taxes, the Fund follows the guidance in FASB ASC Codification 740, as amended by ASU 2009-06, “Accounting for Uncertainty in Income Taxes” (“ASC 740”). ASC 740 prescribes the minimum recognition threshold a tax position must meet in connection with accounting for uncertainties in income tax positions taken or expected to be taken by an entity before being measured and recognized in the financial statements. Management has concluded, there were no uncertain tax positions as of March 31, 2022 for federal income tax purposes or in, the Fund’s major state and local tax jurisdiction of Delaware.

Because U.S. federal income tax regulations differ from GAAP, distributions in accordance with tax regulations may differ from net investment income and realized gains recognized for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect the applicable tax characterization. Temporary differences arise when certain items of income, expense, gain or loss are recognized at some time in the future. The tax basis components of distributable earnings may differ from the amounts reflected in the Statement of Assets, Liabilities and Shareholders’ Capital due to temporary book/tax differences arising primarily from partnership investments.

At September 30, 2021, gross unrealized appreciation and depreciation of investments owned by the Fund, based on cost for federal income tax purposes were as follows:

Cost of Investments |

$ | 116,446,881 | ||

Gross Unrealized Appreciation |

$ | 78,819,878 | ||

Gross Unrealized Depreciation |

(7,181,623 | ) | ||

Net Unrealized Appreciation/(Depreciation) |

$ | 71,638,255 |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in security transactions.

GAAP requires that certain components of net assets be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. Permanent differences due to differing book and tax treatments for the timing of the recognition of income, gain and losses and return of capital on certain partnership transactions resulted in reclassifications to increase total distributable earnings and decrease in paid-in capital as of September 30,2021.

Undistributed long-term gains |

$ | 6,682,672 | ||

Tax accumulated earnings |

6,682,672 | |||

Accumulated capital and other losses |

(6,122,946 | ) | ||

Unrealized appreciation on investments |

71,638,255 | |||

Total accumulated earnings/(deficit) |

$ | 72,197,981 |

The tax character of the distributions paid during the fiscal year ended September 30, 2021 and Septemebr 30, 2020 were as follows:

| Distributions paid from: | 2021 | 2020 | ||||||

| Ordinary income | $ | — | $ | 9,591 | ||||

| Net long term capital gains | — | — | ||||||

| Total distributions paid | $ | — | $ | 9,591 | ||||

As of September 30, 2021, the Fund had qualified late-year ordinary losses of $6,122,946, which are deferred until fiscal year 2022 for tax purposes. Net late year losses incurred after December 31, and within the taxable year are deemed to arise on the first day of the funds next taxable year.

20

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2022 (Continued)

10. Investment Transactions

Purchases and sales of investments, excluding short-term investments, for the year ended March 31, 2022 were $177,899,557 and $0, respectively.

11. Indemnification

Under the Fund’s organizational documents, its officers and Board are indemnified against certain liabilities arising out of the performance of their services to the Fund. In addition, in the normal course of business, the Fund may enter into contracts and agreements that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

12. Commitments

As of March 31, 2022, the Fund had outstanding investment commitments to Investment Funds totaling approximately $104,421,611.

13. Recent Rulemaking

On October 28, 2020, the Securities and Exchange Commission (the “SEC”) adopted regulations governing the use of derivatives by registered investment companies (“Rule 18f-4”). The Fund will be required to implement and comply with Rule 18f-4 by August 19, 2022. Once implemented, Rule 18f-4 will impose limits on the amount of derivatives a fund can enter into, eliminate the asset segregation framework currently used by funds to comply with Section 18 of the 1940 Act, treat derivatives as senior securities and require funds whose use of derivatives is more than a limited specified exposure amount to establish and maintain a comprehensive derivatives risk management program and appoint a derivatives risk manager.

In December 2020, the SEC adopted a new rule providing a framework for fund valuation practices (“Rule 2a-5”). Rule 2a-5 establishes requirements for determining fair value in good faith for purposes of the 1940 Act. Rule 2a-5 will permit fund boards to designate certain parties to perform fair value determinations, subject to board oversight and certain other conditions. Rule 2a-5 also defines when market quotations are “readily available” for purposes of the 1940 Act and the threshold for determining whether a fund must fair value a security. In connection with Rule 2a-5, the SEC also adopted related recordkeeping requirements and is rescinding previously issued guidance, including with respect to the role of a board in determining fair value and the accounting and auditing of fund investments. The Fund will be required to comply with the rules by September 8, 2022.

Management is currently assessing the potential impact of the new rules on the Fund’s financial statements.

In April 2020, the SEC issued a final rule entitled “Securities Offering Reform for Closed-End Investment Companies” (the “Release”) containing amended rules and forms intended to streamline the registration, communications and offering practices for business development companies and registered closed-end investment companies (“registered CEFs”), including interval funds and tender offer funds. Among its provisions, the Release amends Form N-2 to extend a Management Discussion of Fund Performance disclosure requirement to the annual reports of all registered CEFs and also mandates, for certain CEFs, the inclusion of a Fee and Expense Table, Share Price Data information and a Senior Securities Table, all of which are currently contained in a registered CEF’s prospectus, in its annual report. The Release’s rule and form amendments became effective August 1, 2020, with the new annual report requirements effective in August 2021. Management has assessed these new rules and has adopted them for inclusion in this annual report, as applicable.

14. Subsequent Events

Management has evaluated subsequent events through the date the financial statements were issued, and has determined that there were no other subsequent events that require disclosure in or adjustment to the financial statements.

21

FlowStone Opportunity Fund

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of FlowStone Opportunity Fund

Opinion on the Financial Statements