UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23352

FlowStone Opportunity Fund

(Exact name of registrant as specified in charter)

55 Nod Road, Ste 120

Avon, CT 06001

(Address of principal executive offices) (Zip code)

Scott Conners

FlowStone Partners, LLC

55 Nod Road, Ste 120

Avon, CT 06001

(Name and address of agent for service)

registrant's telephone number, including area code: (312) 429-2419

Date of fiscal year end: March 31

Date of reporting period: March 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The Report to Shareholders is attached herewith.

(a)

FlowStone Opportunity Fund

Annual Report

For the Year Ended March 31, 2021

FlowStone Opportunity Fund

Table of Contents

Investor Letter |

2 |

Schedule of Investments |

3-5 |

Statement of Assets, Liabilities and Shareholders’ Capital |

6 |

Statement of Operations |

7 |

Statements of Changes in Shareholders’ Capital |

8 |

Statement of Cash Flows |

9 |

Financial Highlights |

10 |

Notes to the Financial Statements |

11-18 |

Report of Independent Registered Public Accounting Firm |

19 |

Other Information |

20-21 |

Fund Management |

22-24 |

Privacy Notice |

25-26 |

1

FlowStone Opportunity Fund

Investor Letter

March 31, 2021 (Unaudited)

To All FlowStone Opportunity Fund Investors:

We are very pleased to present you with the annual report for FlowStone Opportunity Fund, dated March 31, 2021. For the year ended March 31, 2021, the Fund accepted $59.8 million in new subscriptions. The Fund’s net assets are $135.52 million, as of March 31, 2021. During the First Quarter, the Fund’s net assets increased 7.10%; a result with which the Adviser is very pleased. Equally as important, the Adviser has increased the profile of the Fund’s portfolio through the enhancement of its portfolio construction as measured by all the relevant exposures: funds, managers, asset type, industry sector, and vintage year.

Through Q1 2021, the Fund has completed eleven private equity transactions, the details of which can be found in the Quarterly Snapshot section of the Adviser’s website (www.flowstonepartners.com). Despite the reduction in industry-wide transaction volume during the fiscal year resulting from the COVID-19 pandemic, the Adviser is pleased with quality, pricing, and pace of the Fund’s investment activity. We expect the private equity secondary markets will enjoy increased transaction volume as pent-up supply finds its way to the market. As of March 31, 2021, the Fund has approximately $52.1 million of uninvested capital available to make secondary purchases and primary commitments in the private equity market. The Adviser’s experience investing through multiple macro environments over the past 25 years has it optimistic that the increase in deal volume, combined with a relatively favorable pricing environment at the smaller end of the secondary market where the Fund focuses, may create an attractive buying opportunity.

Please don’t hesitate to contact us with any questions or concerns.

Sincerely,

Scott P. Conners, CFA

President

FlowStone Opportunity Fund

Past performance is not indicative of future results. Investment in this Fund may result in the loss of all principal amounts invested. Shares are not listed on any securities exchange and it is not anticipated that a secondary market for Shares will develop. Shares are subject to substantial restrictions on transferability and resale and may not be transferred or resold except as permitted under the Agreement and Declaration of Trust. Although the Fund may offer to repurchase Shares from time to time, Shares will not be redeemable at a Shareholder’s option nor will they be exchangeable for Shares or shares of any other fund. As a result, an investor may not be able to sell or otherwise liquidate his or her Shares. Shares are appropriate only for those investors who can tolerate a high degree of risk and do not require a liquid investment and for whom an investment in the Fund does not constitute a complete investment program. The amount of distributions that the Fund may pay, if any, is uncertain. The Fund may pay distributions in significant part from sources that may not be available in the future and that are unrelated to the Fund’s performance, such as offering proceeds, borrowings, and amounts from the Fund’s affiliates that are subject to repayment by investors.

This is not an offer to sell Shares and is not soliciting an offer to buy Shares in any state or jurisdiction where such offer or sale is not permitted. You are advised to read the Prospectus carefully prior to investment.

Investments in the Fund may be made only by “Eligible Investors” defined as a “qualified client” within the meaning of Rule 205-3 under the Advisers Act and an “accredited investor” within the meaning of Rule 501 under the Securities Act of 1933, as amended (the “Securities Act”).

This material represents the manager’s assessment of the Fund and market environment as of March 31, 2021 and should not be relied upon by the reader as research, tax or investment advice, is subject to change at any time based upon economic, market, or other conditions and the Adviser undertakes no obligation to update the views expressed herein. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent.

The Fund’s principal underwriter is Foreside Financial Services, LLC.

2

FlowStone Opportunity Fund

Schedule of Investments

March 31, 2021

Investment Funds |

Geographic |

Redemptions |

Redemption |

Investment |

Cost |

Fair Value |

% of |

Original |

|||||||||||||||||||||

Primary Investments |

|||||||||||||||||||||||||||||

Apax X USD, L.P.(a)(b) |

Guernsey | NA | NA | Leveraged Buyout | $ | 277,154 | $ | 450,088 | 0.33 | % | 3/3/2020 |

||||||||||||||||||

Liquid Stock I, L.P.(a)(b) |

North America | NA | NA | Private Equity Fund | 2,890,004 | 3,861,044 | 2.85 | % | 8/30/2019 |

||||||||||||||||||||

New Mountain Partners VI, L.P.(a)(b) |

North America | NA | NA | Leveraged Buyout | 53,311 | 15,797 | 0.01 | % | 4/8/2020 |

||||||||||||||||||||

Total Primary Investments (Cost $3,220,469) (3.19%)*** |

4,326,929 | ||||||||||||||||||||||||||||

Secondary Investments |

|||||||||||||||||||||||||||||

AIC Credit Opportunities Partners Fund II, L.P.(b) |

North America | NA | NA | Private Credit | 6,772,626 | 6,936,423 | 5.13 | % | 10/31/2019 |

||||||||||||||||||||

Ampersand CF Limited Partnership - Class A (a)(b) |

North America | NA | NA | Leveraged Buyout | 2,243,479 | 2,295,374 | 1.70 | % | 10/29/2020 |

||||||||||||||||||||

Ampersand CF Limited Partnership - Class B (a)(b) |

North America | NA | NA | Leveraged Buyout | 4,018,450 | 4,092,527 | 3.02 | % | 10/29/2020 |

||||||||||||||||||||

Ampersand 2006, L.P.(a)(b)(c) |

North America | NA | NA | Venture | — | 59,047 | 0.04 | % | 12/31/2019 |

||||||||||||||||||||

BC European Capital IX, L.P.(a)(b) |

Guernsey | NA | NA | Leveraged Buyout | 11,507,979 | 18,476,256 | 13.63 | % | 12/31/2020 |

||||||||||||||||||||

Canaan VII, L.P.(a)(b) |

North America | NA | NA | Venture | 432,808 | 887,213 | 0.65 | % | 12/31/2019 |

||||||||||||||||||||

Catterton Partners VI, L.P.(a)(b) |

North America | NA | NA | Leveraged Buyout | 750,710 | 1,350,951 | 1.00 | % | 12/31/2019 |

||||||||||||||||||||

Crosslink Ventures V, L.P.(a)(b)(d) |

North America | NA | NA | Venture | 468,540 | 612,310 | 0.45 | % | 1/1/2020 |

||||||||||||||||||||

Dace Ventures I, L.P.(a)(b) |

North America | NA | NA | Venture | 286,224 | 330,250 | 0.24 | % | 12/31/2019 |

||||||||||||||||||||

DFJ Growth 2006 Continuation, L.P. (a)(b)(d) |

North America | NA | NA | Leveraged Buyout | 1,497,477 | 3,799,285 | 2.80 | % | 12/31/2019 |

||||||||||||||||||||

Emerald Partners V, L.P.(a)(b) |

North America | NA | NA | Leveraged Buyout | 6,272 | 17,000 | 0.01 | % | 12/31/2019 |

||||||||||||||||||||

EnerTech Capital Partners III, L.P.(a)(b) |

North America | NA | NA | Venture | 287,373 | 276,130 | 0.20 | % | 12/31/2019 |

||||||||||||||||||||

Fin Venture Capital I, L.P. (a)(b) |

North America | NA | NA | Venture | 2,836,232 | 5,019,339 | 3.70 | % | 6/30/2020 |

||||||||||||||||||||

Francisco Partners III (Cayman), L.P.(a)(b) |

North America | NA | NA | Leveraged Buyout | 116,043 | 1,333,051 | 0.98 | % | 12/31/2020 |

||||||||||||||||||||

Francisco Partners III (Domestic AIV), L.P.(a)(b) |

North America | NA | NA | Leveraged Buyout | 163,909 | 1,882,906 | 1.39 | % | 12/31/2020 |

||||||||||||||||||||

Francisco Partners III, L.P.(a)(b) |

North America | NA | NA | Leveraged Buyout | 118,668 | 1,363,197 | 1.01 | % | 12/31/2020 |

||||||||||||||||||||

Institutional Venture Partners XII, L.P.(a)(b) |

North America | NA | NA | Venture | 342,941 | 98,917 | 0.07 | % | 12/31/2019 |

||||||||||||||||||||

JK&B Capital V, L.P.(a)(b)(c)(d) |

North America | NA | NA | Venture | 148,521 | 198,795 | 0.15 | % | 12/31/2019 |

||||||||||||||||||||

See accompanying Notes to the Financial Statements.

3

FlowStone Opportunity Fund

Schedule of Investments

March 31, 2021 (Continued)

Investment Funds |

Geographic |

Redemptions |

Redemption |

Investment |

Cost |

Fair Value |

% of |

Original |

|||||||||||||||||||||

Secondary Investments (continued) |

|||||||||||||||||||||||||||||

Lincolnshire Equity Fund IV-A, L.P.(a)(b) |

North America | NA | NA | Leveraged Buyout | $ | 1,562,906 | $ | 3,287,858 | 2.43 | % | 12/31/2020 |

||||||||||||||||||

MDV IX, L.P.(a)(b) |

North America | NA | NA | Venture | 799,172 | 2,384,807 | 1.76 | % | 12/31/2020 |

||||||||||||||||||||

Morgenthaler Venture Partners IX, LP(a)(b) |

North America | NA | NA | Venture | 734,726 | 2,214,274 | 1.63 | % | 12/31/2020 |

||||||||||||||||||||

Parthenon Investors III, L.P.(b) |

North America | NA | NA | Leveraged Buyout | 842,150 | 9,083,294 | 6.70 | % | 12/31/2019 |

||||||||||||||||||||

Point 406 Ventures I, L.P.(a)(b) |

North America | NA | NA | Venture | 1,865,426 | 3,573,299 | 2.64 | % | 12/31/2019 |

||||||||||||||||||||

Redpoint Ventures IV, L.P.(a)(b) |

North America | NA | NA | Venture | 3,075,823 | 3,435,890 | 2.54 | % | 12/31/2020 |

||||||||||||||||||||

Rembrandt Venture Partners Fund Two, L.P.(a)(b) |

North America | NA | NA | Venture | 908,144 | 1,128,068 | 0.83 | % | 12/31/2019 |

||||||||||||||||||||

Reverence Capital Partners Opportunities Fund I, L.P.(b) |

North America | NA | NA | Leveraged Buyout | 1,416,395 | 1,878,791 | 1.39 | % | 12/31/2020 |

||||||||||||||||||||

Savant Growth Fund I, LP(a)(b) |

North America | NA | NA | Leveraged Buyout | 1,391,483 | 1,853,832 | 1.37 | % | 12/8/2020 |

||||||||||||||||||||

Tudor Ventures III, L.P.(a)(b) |

North America | NA | NA | Venture | 83,402 | 150,439 | 0.11 | % | 12/31/2019 |

||||||||||||||||||||

Versant Venture Capital IV, L.P.(a)(b) |

North America | NA | NA | Venture | 6,476,548 | 2,842,723 | 2.10 | % | 12/31/2020 |

||||||||||||||||||||

Total Secondary Investments (Cost $51,154,427) (59.67%)*** |

80,862,246 | ||||||||||||||||||||||||||||

Total Investment Funds (Cost $54,374,896) (62.86%)*** |

$ | 85,189,175 | |||||||||||||||||||||||||||

See accompanying Notes to the Financial Statements.

4

FlowStone Opportunity Fund

Schedule of Investments

March 31, 2021 (Continued)

Short-Term Investment (38.41%)*** |

Fair Value |

|||

Money Market Fund |

||||

Morgan Stanley Institutional Liquidity Fund - Treasury Portfolio (Shares 52,049,977), 0.01% (e) |

$ | 52,049,977 | ||

Total Money Market Fund (Cost $52,049,977) (38.41%)*** |

$ | 52,049,977 | ||

Total Investments (Cost $106,424,873) (101.27%)*** |

$ | 137,239,152 | ||

Liabilities less other assets (-1.27%)*** |

(1,718,222 | ) | ||

Shareholders’ Capital - 100.00%*** |

$ | 135,520,930 | ||

Primary Investments are investments in newly established private equity partnerships where underlying portfolio companies are not known as of the time of investment. Secondary Investments are Private Equity Fund Investments generally acquired in the secondary market.

|

* |

The geographic region disclosed is based on where each Investment Fund is domiciled. |

|

** |

Certain Investment Funds will distribute proceeds upon realization events and such proceeds are distributed at the discretion of the Investment Manager, as they become available. |

|

*** |

As a percentage of total shareholders’ capital. |

|

(a) |

Non-income producing. |

|

(b) |

Investment Funds are issued in private placement transactions and as such are restricted as to resale per Rule 12-12-8 of Regulation S-X. |

|

(c) |

The Investment Fund is liquidating its assets and is in the process of returning capital to its limited partners in a reasonable manner. |

|

(d) |

Fair valued by the Fair Value Committee based on policies and procedures established by the Board of Trustees and considered a Level 3 investment. |

|

(e) |

The rate quoted is the annualized seven-day yield of the fund at the period end. |

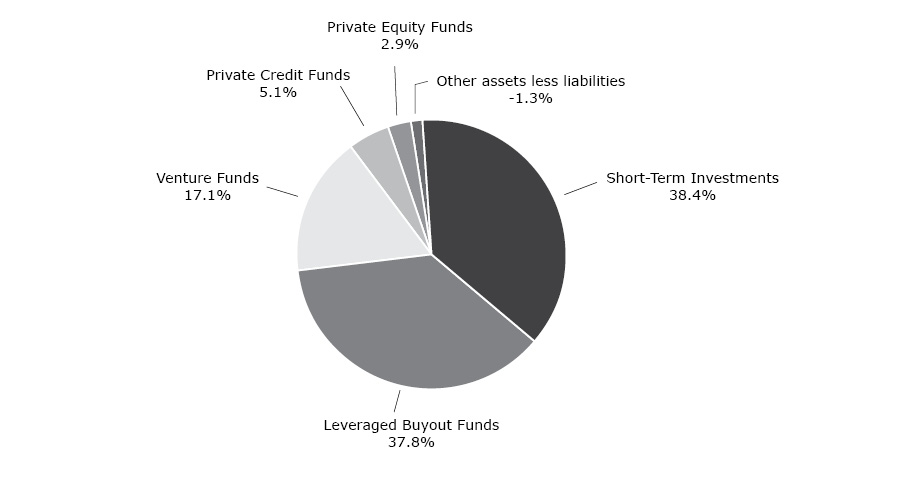

Investment Strategy as a Percentage of Total Shareholders’ Capital (Unaudited)

See accompanying Notes to the Financial Statements.

5

FlowStone Opportunity Fund

Statement of Assets, Liabilities and Shareholders’ Capital

March 31, 2021

Assets |

||||

Investments in Investment Funds, at fair value (cost $54,374,896) |

$ | 85,189,175 | ||

Investments in Short-Term Investments, at fair value (cost $52,049,977) |

52,049,977 | |||

Cash |

15,192,271 | |||

Investments in Investment Funds paid in advance |

79,110 | |||

Due from adviser |

76,608 | |||

Dividends receivable |

459 | |||

Total Assets |

152,587,600 | |||

Liabilities |

||||

Shareholders’ Capital received in advance |

15,145,000 | |||

Investment Advisory fee payable |

439,117 | |||

Professional fees payable |

159,328 | |||

Administration & Accounting fees payable |

40,649 | |||

Transfer Agent fees payable |

38,985 | |||

Chief Compliance Officer & Chief Financial Officer fees payable |

15,271 | |||

Trustees fees payable |

52,220 | |||

Incentive fee payable |

994,857 | |||

Other accrued expenses |

181,243 | |||

Total Liabilities |

17,066,670 | |||

Shareholders’ Capital |

||||

Paid-in Capital |

$ | 103,667,978 | ||

Total distributable earnings |

31,852,952 | |||

Total Shareholders’ Capital |

$ | 135,520,930 | ||

Shares Outstanding |

9,256,913 | |||

Net asset value per Share: |

$ | 14.64 |

See accompanying Notes to the Financial Statements.

6

FlowStone Opportunity Fund

Statement of Operations

For the Year Ended March 31, 2021

Income |

||||

Dividend income |

$ | 1,209,977 | ||

Income from underlying Investment Funds |

455,619 | |||

Total Income |

1,665,596 | |||

Expenses |

||||

Incentive Fee (See Note 7) |

3,209,563 | |||

Investment Advisory fee (See Note 7) |

1,168,201 | |||

Professional fees |

579,413 | |||

Chief Compliance Officer & Chief Financial Officer fees |

140,000 | |||

Administration & Accounting fees |

128,496 | |||

Offering costs (See Note 8) |

127,835 | |||

Trustees’ fees |

100,000 | |||

Transfer Agent fees |

48,170 | |||

Other expenses |

251,805 | |||

Total Expenses |

5,753,483 | |||

Less Waivers (See Note 7): |

||||

Expense waiver |

(550,351 | ) | ||

Investment Advisory fee waiver* |

(206,518 | ) | ||

Total Waivers |

(756,869 | ) | ||

Net Expenses |

4,996,614 | |||

Net Investment Income (Loss) |

(3,331,018 | ) | ||

Net Realized Gain and Change in Unrealized Appreciation/Depreciation on Investments in Investment Funds and Foreign Currency Translation |

||||

Realized gain from investments in Investment Funds |

4,423,031 | |||

Net change in unrealized appreciation/depreciation on investments in Investment Funds and foreign currency translation |

29,270,691 | |||

Total Net Realized Gain and Change in Unrealized Appreciation/Depreciation in Investment Funds and Foreign Currency Translation |

33,693,722 | |||

Net increase in Shareholders’ Capital from operations |

$ | 30,362,704 |

|

* |

Investment Advisory Fee Waiver not subject to recoupment (See Note 7). |

See accompanying Notes to the Financial Statements.

7

FlowStone Opportunity Fund

Statements of Changes in Shareholders’ Capital

For the |

For the |

|||||||

Operations |

||||||||

Net investment income (loss) |

$ | (3,331,018 | ) | $ | (76,842 | ) | ||

Realized gain from investments in Investment Funds |

4,423,031 | 21,807 | ||||||

Net change in unrealized appreciation/depreciation on investments in Investment Funds and foreign currency translation |

29,270,691 | 1,540,319 | ||||||

Net increase in Shareholders’ Capital from operations |

30,362,704 | 1,485,284 | ||||||

Distributions to shareholders |

||||||||

Distributions |

(9,591 | ) | — | |||||

Net decrease in Shareholders’ Capital from distributions |

(9,591 | ) | — | |||||

Shareholders’ Capital Transactions |

||||||||

Proceeds from sale of Shares |

59,792,500 | 43,781,114 | ||||||

Reinvestment of distributions |

8,919 | — | ||||||

Net Increase in Shareholders’ Capital from capital transactions |

59,801,419 | 43,781,114 | ||||||

Shareholders’ Capital |

||||||||

Beginning of period |

45,366,398 | 100,000 | ** | |||||

End of period |

$ | 135,520,930 | $ | 45,366,398 | ||||

Shares outstanding at beginning of period |

4,304,938 | 10,000 | ** | |||||

Shares sold |

4,951,185 | 4,294,938 | ||||||

Shares reinvested |

790 | — | ||||||

Shares outstanding at end of period |

9,256,913 | 4,304,938 | ||||||

|

* |

Reflects operations from August 30, 2019 (commencement of operations) to March 31, 2020. Prior to the commencement of operations date, the Fund was inactive except for matters related to the Fund’s establishment, designation and planned registration. |

|

** |

The initial Trustee purchased 10,000 shares at a Net Asset Value of $10.00 per share. |

See accompanying Notes to the Financial Statements.

8

FlowStone Opportunity Fund

Statement of Cash Flows

For the Year Ended March 31, 2021

Cash flows from operating activities |

||||

Net increase in Shareholders’ Capital from operations |

$ | 30,362,704 | ||

Adjustments to reconcile net increase in Shareholders’ Capital from operations to net cash used in operating activities: |

||||

Purchases of investments in Investment Funds |

(39,918,969 | ) | ||

Capital distributions received from Investment Funds |

7,370,408 | |||

Net realized gain from investments in Investment Funds |

(4,423,031 | ) | ||

Net change in unrealized appreciation/depreciation on investments in Investment Funds and foreign currency translation |

(29,270,691 | ) | ||

Net cash paid for purchases, sales, and maturities of short-term investments |

(25,117,936 | ) | ||

Changes in operating assets and liabilities: |

||||

(Increase) Decrease in investments in Investment Funds paid in advance |

(79,110 | ) | ||

(Increase) Decrease in deferred offering costs |

127,835 | |||

(Increase) Decrease in dividends receivable |

14,732 | |||

(Increase) Decrease in due from adviser |

558,515 | |||

Increase (Decrease) in due to adviser |

(425,514 | ) | ||

Increase (Decrease) in investment advisory fees payable |

259,201 | |||

Increase (Decrease) in administration & accounting fees payable |

(5,101 | ) | ||

Increase (Decrease) in transfer agent fees payable |

25,652 | |||

Increase (Decrease) in chief compliance officer & chief financial officer fees payable |

1,166 | |||

Increase (Decrease) in professional fees payable |

(20,502 | ) | ||

Increase (Decrease) in trustees fees payable |

15,000 | |||

Increase (Decrease) in incentive fee payable |

665,755 | |||

Increase (Decrease) in other accrued expenses |

115,329 | |||

Net cash used in operating activities |

(59,744,557 | ) | ||

Cash flows from financing activities |

||||

Proceeds from sale of shares |

74,657,500 | |||

Distributions |

(672 | ) | ||

Net cash provided by financing activities |

74,656,828 | |||

Net change in cash |

14,912,271 | |||

Cash at beginning of year |

280,000 | |||

Cash at End of Year |

$ | 15,192,271 | ||

Supplemental disclosure of financing activity |

||||

Supplemental disclosure of reinvested distributions |

$ | 8,919 |

See accompanying Notes to the Financial Statements.

9

FlowStone Opportunity Fund

Financial Highlights

For the |

For the Period |

|||||||

Net asset value per Share, beginning of period |

$ | 10.54 | $ | 10.00 | ||||

Net increase in Shareholders’ Capital from operations: |

||||||||

Net investment loss* |

(0.48 | ) | (0.02 | ) | ||||

Net realized gain and change in unrealized appreciation |

4.58 | 0.56 | ||||||

Net increase in Shareholders’ Capital from operations: |

4.10 | 0.54 | ||||||

Distributions from net investment income |

— | ** | — | |||||

Total distributions |

— | ** | — | |||||

Net asset value per Share, end of period |

$ | 14.64 | $ | 10.54 | ||||

Total Return (1) |

38.90 | % | 5.40 | %(2) | ||||

Ratios/Supplemental Data: |

||||||||

Shareholders’ Capital, end of period (in thousands) |

$ | 135,521 | $ | 45,366 | ||||

Ratio of net investment income/(loss) to average Shareholders’ Capital (7) |

(3.65 | )% | 0.35 | %(3) | ||||

Ratio of gross expenses to average Shareholders’ Capital (4)(7) |

6.32 | % | 5.65 | %(3) | ||||

Ratio of net expenses to average Shareholders’ Capital (5)(6)(7) |

5.48 | % | 2.82 | %(3) | ||||

Portfolio Turnover |

0.00 | % | 0.00 | %(2) | ||||

|

* |

Per share data is computed using the average shares method. |

|

** |

Amount represents less than $0.005 per share. |

|

(1) |

Total Return based on net asset value per Share is the combination of changes in net asset value per Share and reinvested distributions at net asset value per Share, if any. |

|

(2) |

Not annualized. |

|

(3) |

Annualized, except for incentive fees. |

|

(4) |

Represents the ratio of expenses to average Shareholders’ Capital absent fee waivers and/or expense reimbursement by the Adviser. |

|

(5) |

The Adviser has entered into an Expense Limitation and Reimbursement Agreement with the Fund for a one-year term ending at the end of the Limitation Period to limit the amount of the Fund’s total annual ordinary operating expenses, excluding certain “Specified Expenses” as outlined in the Notes to the Financial Statements. |

|

(6) |

The incentive fee of $3,209,563 and $329,102, respectively, is exclusive of the 1.95% expense cap. |

|

(7) |

The income and expense ratios do not reflect the Fund’s proportionate share of the net income (loss) and expenses, including incentive fees or allocations, of the Investment Funds. The Investment Funds’ expense ratios, excluding incentive fees or allocations range from 0.00% to 10.40% (unaudited). The Investment Funds’ incentive fees or allocations can be up to 30% of profits earned (unaudited). |

See accompanying Notes to the Financial Statements.

10

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2021

1. Organization

FlowStone Opportunity Fund (the “Fund”) was organized as a Delaware statutory trust on May 23, 2018 and commenced operations on August 30, 2019. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. FlowStone Partners, LLC, an investment adviser registered under the Investment Advisers Act of 1940, as amended, (the “Advisers Act”) serves as the Fund’s investment adviser (the “Adviser”).

The Fund’s primary investment objective is to generate appropriate risk-adjusted long-term returns by investing in a diversified portfolio of private equity investments. The Fund’s investments are expected to consist primarily of: (i) secondary investments in private equity funds managed by third-party managers; (ii) primary investments in private equity funds managed by third-party managers; and (iii) direct co-investments in the equity and/or debt of operating companies.

The Board of Trustees (the “Board”) of the Fund has overall responsibility for the management and supervision of the business operations of the Fund. As permitted by applicable law, the Board may delegate any of its rights, powers and authority to, among others, the officers of the Fund, any committee of the Board, or the Adviser.

2. Summary of Significant Accounting Policies

The Fund is an investment company and as a result, maintains its accounting records and has presented these financial statements in accordance with the reporting requirements under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies (“ASC 946”).

A) Investment Transactions - Purchases of investments in the Investment Funds are recorded as of the first day of legal ownership of an Investment Fund and redemptions from the Investment Funds are recorded as of the last day of legal ownership. Realized gains or losses on investments in the Investment Funds are recorded at the time of the disposition of the respective investment based on specific identification. Short-term investment transactions are recorded on trade date.

B) Valuation of Investments - Pursuant to Fund’s valuation policies, the Board has delegated to the Adviser, the general responsibility for valuation of the investments subject to oversight by the Board. The Board has approved procedures pursuant to which the Fund values its investments in Investment Funds at fair value, generally at an amount equal to the Net Asset Value (“NAV”) of the Fund’s investment in the Investment Funds as determined by the Investment Fund’s general partner or Investment Manager. This is commonly referred to as using NAV as the practical expedient which allows for estimation of the fair value of an investment in an investment entity based on NAV or its equivalent if the NAV of the investment entity is calculated in a manner consistent with ASC 946. Because of the inherent uncertainty of valuations of the investments in the Investment Funds, their estimated values may differ significantly from the values that would have been used had a ready market for the Investment Funds existed, and the differences could be material. In accordance with its valuation policies, if no such information is available, or if such information is deemed to not be reflective of fair value by the Adviser, an estimated fair value is determined in good faith by the Adviser pursuant to the Fund’s valuation procedures. All adjustments to fair value made by the Adviser are reviewed and approved by the Fund’s Valuation Committee, subject to Board approval.

Investments in open-end investment companies are valued at their reported NAV per share.

C) Use of Estimates - The preparation of the financial statements in accordance with accounting principles generally accepted in the United States (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

D) Income Recognition and Expenses — Income is recognized on an accrual basis as earned. The Fund accounts for income from underlying Investment Fund distributions based on the nature of such distributions as determined by the underlying investment managers. Expenses are recognized on an accrual basis as incurred. The Fund bears all expenses incurred in the course of its operations, including, but not limited to, the following: all costs and expenses related to portfolio transactions and positions for the Fund’s account; professional fees; costs of insurance; registration expenses; and expenses of meetings of the Board. Expenses are subject to the Fund’s Expense Limitation Agreement (see Note 7).

E) Foreign Currency Translation - The functional currency of the Fund is the U.S. dollar. Assets and liabilities denominated in currencies other than the U.S. dollar are translated into U.S. dollars at the composite rate of exchange as reported at the end of each reporting period by third-party pricing sources. Purchases and sales of investments and income and expenses

11

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2021 (Continued)

denominated in currencies other than U.S. dollars are translated at the rates of exchange on the respective dates of such transactions. The resulting foreign exchange unrealized gain from such transactions is included in net change in unrealized appreciation/depreciation on investments in Investment Funds and foreign currency translation on the statement of operations.

3. Risk Associated with Investments in Investment Funds

A) Dependence on the Investment Fund Managers - Because the Fund invests in private equity funds (“Investment Funds”), a Shareholder’s investment in the Fund will be affected by the investment policies and decisions of the Investment Fund Manager of each Investment Fund in direct proportion to the amount of Fund assets that are invested in each Investment Fund. The Fund’s NAV may fluctuate in response to, among other things, various market and economic factors related to the markets in which the Investment Funds invest and the financial condition and prospects of issuers in which the Investment Funds invest. The success of the Fund depends upon the ability of the Investment Fund Managers to develop and implement strategies that achieve their investment objectives. Shareholders will not have an opportunity to evaluate the specific investments made by the Investment Funds or the Investment Fund Managers, or the terms of any such investments. In addition, the Investment Fund Managers could materially alter their investment strategies from time to time without notice to the Fund. There can be no assurance that the Investment Fund Managers will be able to select or implement successful strategies or achieve their respective investment objectives.

B) Investment Funds Not Registered - The Fund is registered as an investment company under the Investment Company Act. The Investment Company Act is designed to afford various protections to investors in pooled investment vehicles. For example, the Investment Company Act imposes limits on the amount of leverage that a registered investment company can assume, restricts layering of costs and fees, restricts transactions with affiliated persons and requires that the investment company’s operations be supervised by a board of directors, a majority of whose members are independent of management. However, most of the Investment Funds in which the Fund invests are not subject to the provisions of the Investment Company Act. Many Investment Fund Managers may not be registered as investment advisers under the Advisers Act. As an indirect investor in the Investment Funds managed by Investment Fund Managers that are not registered as investment advisers, the Fund will not have the benefit of certain of the protections of the Advisers Act. The Investment Funds generally are exempted from regulation under the Investment Company Act because they permit investment only by investors who meet very high thresholds of investment experience and sophistication, as measured by net worth. The Fund’s investment qualification thresholds are generally lower. As a result, the Fund provides an avenue for investing in Investment Funds that would not otherwise be available to certain investors. This means that investors who would not otherwise qualify to invest in largely unregulated vehicles will have the opportunity to make such an investment through the Fund.

C) Maintenance of Security and Other Assets in The Custody of a Bank - The Investment Funds typically do not maintain their securities and other assets in the custody of a bank or a member of a securities exchange, as generally required of registered investment companies, in accordance with certain SEC rules. A registered investment company which places its securities in the custody of a member of a securities exchange is required to have a written custodian agreement, which provides that securities held in custody will be at all times individually segregated from the securities of any other person and marked to clearly identify such securities as the property of such investment company and which contains other provisions designed to protect the assets of such investment company. The Investment Funds in which the Fund invests may maintain custody of their assets with brokerage firms which do not separately segregate such customer assets as would be required in the case of registered investment companies, or may not use a custodian to hold their assets. Under the provisions of the Securities Investor Protection Act of 1970, as amended, the bankruptcy of any brokerage firm used to hold Investment Fund assets could have a greater adverse effect on the Fund than would be the case if custody of assets were maintained in accordance with the requirements applicable to registered investment companies. There is also a risk that an Investment Fund Manager could convert assets committed to it by the Fund to its own use or that a custodian could convert assets committed to it by an Investment Fund Manager to its own use. There can be no assurance that the Investment Fund Managers or the entities they manage will comply with all applicable laws and that assets entrusted to the Investment Fund Managers will be protected.

D) Investment Funds are Generally Non-diversified - While there are no regulatory requirements that the investments of the Investment Funds be diversified, some Investment Funds may undertake to comply with certain investment concentration limits. Investment Funds may at certain times hold large positions in a relatively limited number of investments. Investment Funds may target or concentrate their investments in particular markets, sectors or industries. Those Investment Funds that concentrate in a specific industry or target a specific sector will also be subject to the risks of that industry or sector, which may include, but are not limited to, rapid obsolescence of technology, sensitivity to regulatory changes, minimal barriers to entry and sensitivity to overall market swings. As a result, the net asset values of such Investment Funds may be subject to greater volatility than those of investment companies that are subject to diversification requirements and this may negatively impact the NAV of the Fund.

12

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2021 (Continued)

E) Investment Funds’ Securities are Generally Illiquid - The securities of the Investment Funds in which the Fund invests or plans to invest will generally be illiquid. Subscriptions to purchase the securities of Investment Funds are generally subject to restrictions or delays. Similarly, the Fund may not be able to dispose of Investment Fund interests that it has purchased in a timely manner and, if adverse market conditions were to develop during any period in which the Fund is unable to sell Investment Fund interests, the Fund might obtain a less favorable price than that which prevailed when it acquired or subscribed for such interests, and this may negatively impact the net asset values of the Fund.

F) Investment Fund Operations Not Transparent - The Adviser does not control the investments or operations of the Investment Funds. An Investment Fund Manager may employ investment strategies that differ from its past practices and are not fully disclosed to the Adviser and that involve risks that are not anticipated by the Adviser. Some Investment Fund Managers may have a limited operating history, and some may have limited experience in executing one or more investment strategies to be employed for an Investment Fund. Furthermore, there is no guarantee that the information given to the Administrator and reports given to the Adviser with respect to the Fund Investments will not be fraudulent, inaccurate or incomplete.

G) Investments in Investment Funds of Foreign Investment Fund Managers - These investments may carry certain risks not ordinarily associated with investments in Investment Funds of domestic Investment Fund Managers. Such risks include adverse future political and economic developments and the possible imposition of exchange controls or other foreign governmental laws and restrictions. In addition, with respect to certain countries, there is the possibility of expropriation of assets, confiscatory taxation, political or social instability or diplomatic developments which could adversely affect investments in those countries. Certain countries may also impose substantial restrictions on investments on their capital markets by foreign entities, including restriction on investment in issuers or industries deemed sensitive to the relevant nation’s interests. These factors may limit the investment opportunities available or result in lack of liquidity and high valuation volatility.

4. Foreign Currency Risk

Although the Fund intends to invest predominantly in the United States, the Fund’s portfolio is anticipated to include investments in a number of different currencies. Any returns on, and the value of such investments may, therefore, be materially affected by exchange rate fluctuations, local exchange control, limited liquidity of the relevant foreign exchange markets, the convertibility of the currencies in question and/or other factors. A decline in the value of the currencies in which the Fund Investments are denominated against the U.S. Dollar may result in a decrease the Fund’s net asset value. The Adviser may or may not elect to hedge the value of investments made by the Fund against currency fluctuations, and even if the Adviser deems hedging appropriate, it may not be possible or practicable to hedge currency risk exposure. Accordingly, the performance of the Fund could be adversely affected by such currency fluctuations.

5. Capital Share Transactions

The offering of shares of beneficial interest in the Fund (the “Shares”) is registered under the Securities Act of 1933, as amended. The initial offering of Shares was made at the initial NAV per Share of $10.00 on August 30, 2019, and thereafter Shares are expected to be offered quarterly at the NAV per Share as of the date such Shares are purchased.

The Board may, from time to time and in its sole discretion, cause the Fund to repurchase Shares from Shareholders pursuant to written tenders by Shareholders at such times and on such terms and conditions as established by the Board. In determining whether the Fund should offer to repurchase Shares, the Board considers the recommendation of the Adviser, as well as a variety of other operational, business and economic factors. The Adviser anticipates recommending to the Board that, under normal market circumstances, the Fund conduct tender offers of no more than 5% of the Fund’s net assets beginning on or about the first day of the calendar quarter immediately following the first anniversary of commencement of operations, and thereafter quarterly on or about each January 1, April 1, July 1 and October 1. A 2.00% early repurchase fee will be charged by the Fund with respect to any repurchase of Shares from a Shareholder at any time prior to the day immediately preceding the first anniversary of the Shareholder’s purchase of such Shares.

13

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2021 (Continued)

6. Fair Value Disclosures

In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The hierarchy gives the highest priority to valuations based on unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurement) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (Level 3 measurement). The guidance establishes three levels of fair value as listed below.

|

● |

Level 1 - Inputs that reflect unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access at the measurement date |

|

● |

Level 2 - Inputs other than quoted prices that are observable for the asset or liability, either directly or indirectly, including inputs in markets that are not considered to be active |

|

● |

Level 3 - Inputs that are unobservable |

The notion of unobservable inputs is intended to allow for situations in which there is little, if any, market activity for the asset or liability at the measurement date. Under Level 3, the owner of an asset must determine fair value based on its own assumptions about what market participants would take into account in determining the fair value of the asset, using the best information available.

The inputs or methodology for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

A financial instrument’s level within the fair value hierarchy is based upon the lowest level of any input that is significant to the fair value measurement; however, the determination of what constitutes “observable” requires significant judgment by the Valuation Committee. The Valuation Committee considers observable data to be market data that is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market. Private equity funds are generally restricted securities that are subject to substantial holding periods and restrictions on resale and are not traded in public markets. Accordingly, the Fund may not be able to resell such investments for extended periods, if at all.

As the Fund uses the NAV as a practical expedient to determine the fair value of certain Private Equity Investments, these investments have not been classified in the GAAP fair value hierarchy.

The following table is a summary of information about the levels within the fair value hierarchy at which the Fund’s investments are measured as of March 31, 2021:

Investments |

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||

Investment Funds |

$ | — | $ | — | $ | 4,610,390 | $ | 4,610,390 | ||||||||

Short-Term Investments |

52,049,977 | — | — | 52,049,977 | ||||||||||||

NAV as a practical expedient |

— | — | — | 80,578,785 | ||||||||||||

Total |

$ | 52,049,977 | $ | — | $ | 4,610,390 | $ | 137,239,152 | ||||||||

The following is a reconciliation of Investment Funds in which significant unobservable inputs (Level 3) were used in determining value:

Beginning |

Transfers into |

Transfers out |

Total realized |

Total |

Purchases |

Capital |

Balance as |

||||||||||||||||||||||||

| $ | 198,905 | $ | 3,270,145 | $ | — | $ | — | $ | 1,610,371 | $ | 42,698 | $ | (511,729 | ) | $ | 4,610,390 | |||||||||||||||

14

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2021 (Continued)

The following table presents additional information about valuation methodologies and inputs used for investments that are measured at fair value and categorized within Level 3 as of March 31, 2021:

Investment Type |

Fair Value |

Valuation |

Unobservable Input |

Input Range |

||||||||||||

Investment Funds |

$ | 4,610,390 | Adjusted reported net asset value | Reported net asset value with fair value adjustments | Not applicable | |||||||||||

7. Investment Management Fee and Other Expenses

A) Investment Advisory Fee - The Fund has entered into an investment management fee agreement (the “Investment Management Fee”) with the Adviser. In consideration of services provided, the Fund pays the Adviser a quarterly Investment Management Fee equal to 1.25% on an annualized basis of the greater of (i) the Fund’s NAV and (ii) the Fund’s NAV less cash and cash equivalents plus the total of all commitments made by the Fund that have not yet been drawn for investment. In no event will the Investment Management Fee payable by the Fund exceed 1.75% as a percentage of the Fund’s NAV. For purposes of determining the Investment Management Fee payable to the Adviser for any quarter, NAV is calculated prior to any reduction for any fees and expenses of the Fund for that quarter, including, without limitation, the Investment Management Fee payable to the Adviser for that quarter. For the year ended March 31, 2021, the Fund incurred $1,168,201 in investment management fees.

In addition, at the end of each calendar quarter of the Fund, the Adviser will be entitled to receive an Incentive Fee equal to 10% of the excess, if any, of (i) the net profits of the Fund for the relevant period over (ii) the then balance, if any, of the Loss Recovery Account (as defined below). For the purposes of the Incentive Fee, the term “net profits” shall mean the amount by which the NAV of the Fund on the last day of the relevant period exceeds the NAV of the Fund as of the commencement of the same period, including any net change in unrealized appreciation or depreciation of investments and realized income and gains or losses and expenses (including offering and organizational expenses). The Fund will maintain a memorandum account (the “Loss Recovery Account”), which will have an initial balance of zero and will be (i) increased upon the close of each calendar quarter of the Fund by the amount of the net losses of the Fund for the quarter, and (ii) decreased (but not below zero) upon the close of each calendar quarter by the amount of the net profits of the Fund for the quarter. Shareholders will benefit from the Loss Recovery Account in proportion to their holdings of Shares. For the year ended March 31, 2021, the Fund incurred $3,209,563 in incentive fees.

The Adviser has entered into an expense limitation agreement (the “Expense Limitation Agreement”) with the Fund, whereby the Adviser has agreed to waive fees that it would otherwise be paid, and/or to assume expenses of the Fund (a “Waiver”), if required to ensure the Total Annual Expenses (excluding taxes, interest, brokerage commissions, certain transaction-related expenses, extraordinary expenses, and the Incentive Fee) do not exceed 1.95% on an annualized basis (the “Expense Limit”). For a period not to exceed three years from the date on which a Waiver is made, the Adviser may recoup amounts waived or assumed, provided it is able to effect such recoupment without causing the Fund’s expense ratio (after recoupment) to exceed the lesser of (a) the expense limit in effect at the time of the Waiver, and (b) the expense limit in effect at the time of recoupment. The Expense Limitation Agreement also provides that, from the commencement of operations (August 30, 2019) through December 31, 2020, the Adviser agreed to waive fees payable to it by the Fund on assets held in cash or cash equivalents less the total amount of capital committed by the Fund and not yet drawn for investment. The Expense Limitation Agreement will continue until at least August 29, 2021, and will automatically renew thereafter for consecutive twelve-month terms, provided that such continuance is specifically approved at least annually by a majority of the Trustees. The Expense Limitation Agreement may be terminated by the Fund’s Board of Trustees upon thirty days’ written notice to the Adviser.

For the year ended March 31, 2021, the Adviser waived fees in the amount of $756,869, of which $550,351 is subject to recoupment. At March 31, 2021, $1,043,975 is eligible for recoupment, of which $60,667 expires on September 30, 2022, $171,815 expires on December 31, 2022, $261,142 expires on March 31, 2023, $155,621 expires on June 30, 2023, $266,790 expires on September 30, 2023, $51,332 expires on December 31, 2023, and $76,608 expires on March 31, 2024. The waiver of $206,518 is not eligible for recoupment. Previously waived organizational fees of $141,500 are subject to recoupment and expire on August 29, 2022.

B) Administration, Accounting, and Transfer Agent Fees - Pursuant to an agreement between the Fund and UMB Fund Services (the “Administrator”), the Administrator provides administration, fund accounting, and assists with compliance services to the Fund. The Fund pays the Administrator a basis point fee, subject to fee minimums, for various administration, fund accounting, and investor accounting and taxation services to the Fund, as well as certain out of pocket expenses.

15

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2021 (Continued)

C) Distribution - Foreside Fund Services, LLC (the “Distributor”) serves as the distributor of the Fund’s Shares on a best effort basis, subject to various conditions. The Distributor may retain additional unaffiliated broker-dealers to assist in the distribution of Fund shares.

D) Chief Compliance Officer and Chief Financial Officer Fees - Foreside Fund Officer Services, LLC provides chief compliance officer and chief financial officer services to the Fund under a Fund CCO Agreement and a Fund CFO Agreement.

E) Custodian Fees - UMB Bank N.A. serves as the custodian for the Fund’s assets and is responsible for maintaining custody of the Fund’s cash.

8. Offering Costs

Offering costs include registration fees and fees regarding the preparation and printing of the initial registration statement. Offering costs are accounted for as deferred costs until operations begin and are then amortized over twelve months on a straight-line basis. As of March 31, 2021, $0 of offering costs remains as an unamortized deferred asset, while $127,835 has been expensed during the year subject to the Fund’s Expense Limitation Agreement.

9. Federal Income Taxes

It is the Fund’s intention to meet the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), that are applicable to a regulated investment company (“RIC”). The Fund intends to continue to operate so as to qualify to be taxed as a RIC under the Code and, as such, to not be subject to federal income tax on the portion of its taxable income and gains distributed to stockholders. To qualify for RIC tax treatment, among other requirements, the Fund is required to distribute at least 90% of its investment company taxable income, as defined by the Code. Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. While the Fund intends to distribute substantially all of its taxable net investment income and capital gains, if any, in a manner necessary to minimize the imposition of a 4% excise tax, there can be no assurance that it will avoid any or all of the excise tax. In such event, the Fund will be liable only for the amount by which it does not meet the foregoing distribution requirements. The Fund has adopted September 30 as its tax year end.

If the Fund were to fail to meet the requirements of Subchapter M to qualify as a RIC, and if the Fund were ineligible to or otherwise were not to cure such failure, the Fund would be subject to tax on its taxable income at corporate rates, whether or not distributed to Shareholders, and all distributions out of earnings and profits would be taxable to Shareholders as ordinary income. In addition, the Fund could be required to recognize unrealized gains, pay substantial taxes and interest and make substantial distributions before requalifying as a RIC that is accorded special tax treatment under Subchapter M.

In accounting for income taxes, the Fund follows the guidance in FASB ASC Codification 740, as amended by ASU 2009-06, “Accounting for Uncertainty in Income Taxes” (“ASC 740”). ASC 740 prescribes the minimum recognition threshold a tax position must meet in connection with accounting for uncertainties in income tax positions taken or expected to be taken by an entity before being measured and recognized in the financial statements. Management has concluded, there were no uncertain tax positions as of March 31, 2021 for federal income tax purposes or in, the Fund’s major state and local tax jurisdiction of Delaware.

Because U.S. federal income tax regulations differ from GAAP, distributions in accordance with tax regulations may differ from net investment income and realized gains recognized for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect the applicable tax characterization. Temporary differences arise when certain items of income, expense, gain or loss are recognized at some time in the future. The tax basis components of distributable earnings may differ from the amounts reflected in the Statement of Assets, Liabilities and Shareholders’ Capital due to temporary book/tax differences arising primarily from partnership investments.

16

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2021 (Continued)

At March 31, 2021, gross unrealized appreciation and depreciation of investments owned by the Fund, based on cost for federal income tax purposes were as follows:

Cost of Investments |

$ | 105,284,242 | ||

Gross Unrealized Appreciation |

$ | 35,637,492 | ||

Gross Unrealized Depreciation |

(3,682,582 | ) | ||

Net Unrealized Appreciation/(Depreciation) |

$ | 31,954,910 |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in security transactions.

GAAP requires that certain components of net assets be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share. For the tax year ended September 30, 2020, permanent differences in book and tax accounting have been reclassified to paid-in capital, undistributed net investment income (loss) and accumulated realized gain (loss) as follows:

Increase (Decrease) |

||||||

Paid-In Capital |

Total |

|||||

| $(1,490,248) | $1,490,248 | |||||

As of September 30, 2020 the components of accumulated earnings (deficit) on a tax basis were as follows:

Undistributed ordinary income |

$ | — | ||

Undistributed long-term gains |

— | |||

Tax accumulated earnings |

— | |||

Accumulated capital and other losses |

— | |||

Unrealized appreciation on investments |

31,954,910 | |||

Total accumulated earnings/(deficit) |

$ | 31,954,910 |

The tax character of the distributions paid during the fiscal year ended September 30, 2020 and September 30, 2019 were as follows:

Distributions paid from: |

2020 |

2019 |

||||||

Ordinary income |

$ | 9,591 | $ | — | ||||

Net long term capital gains |

— | — | ||||||

Total distributions paid |

$ | 9,591 | $ | — | ||||

10. Investment Transactions

Purchases and sales of investments, excluding short-term investments, for the year ended March 31, 2021 were $39,918,969 and $0, respectively.

11. Indemnification

Under the Fund’s organizational documents, its officers and Board are indemnified against certain liabilities arising out of the performance of their services to the Fund. In addition, in the normal course of business, the Fund may enter into contracts and agreements that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

17

FlowStone Opportunity Fund

Notes to the Financial Statements

March 31, 2021 (Continued)

12. Commitments

As of March 31, 2021, the Fund had outstanding investment commitments to Investment Funds totaling approximately $11,870,311.

13. Recent events impacting the securities markets

The recent spread of an infectious respiratory illness caused by a novel strain of coronavirus (known as COVID-19) has caused volatility, severe market dislocations and liquidity constraints in many markets and may adversely affect the Fund’s and Investment Funds’ investments and operations. The transmission of COVID-19 and efforts to contain its spread have resulted in, among other things: quarantines and travel restrictions, including border closings, strained healthcare systems, event cancellations, disruptions to business operations and supply chains, and a reduction in consumer and business spending, as well as general concern and uncertainty that has negatively affected the economy. These disruptions have led to instability in the market place, including equity and debt market losses and overall volatility, and the jobs market. The impact of COVID-19, and other infectious illness outbreaks, epidemics or pandemics that may arise in the future, could adversely affect the economies of many nations or the entire global economy, the financial well-being and performance of individual issuers, borrowers and sectors and the health of the markets generally in potentially significant and unforeseen ways. In addition, the impact of infectious illnesses, such as COVID-19, in emerging market countries may be greater due to generally less established healthcare systems. This crisis or other public health crises may exacerbate other pre-existing political, social and economic risks in certain countries or globally.

14. Subsequent Events

Management has evaluated subsequent events through the date the financial statements were issued, and has determined that there were no other subsequent events that require disclosure in or adjustment to the financial statements.

18

FlowStone Opportunity Fund

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of FlowStone Opportunity Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets, liabilities and shareholders’ capital, including the schedule of investments, of FlowStone Opportunity Fund (the “Fund”) as of March 31, 2021, and the related statements of operations and cash flows for the year then ended and the statement of changes in shareholders’ capital and the financial highlights for the year ended March 31, 2021 and for the period August 30, 2019 (commencement of operations) to March 31, 2020, including the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2021, and the results of its operations and its cash flows for the year ended March 31, 2021 and the changes in its shareholders’ capital and the financial highlights for the year ended March 31, 2021 and for the period August 30, 2019 (commencement of operations) to March 31, 2020 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of March 31, 2021 by correspondence with the custodian and underlying investment fund managers; when replies were not received from the underlying investment fund managers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Chicago, Illinois

June 1, 2021

We have served as the Fund’s auditor since 2018.

19

FlowStone Opportunity Fund

Other Information

March 31, 2021 (Unaudited)

Proxy Voting

The Fund is required to file Form N-PX, with its complete proxy voting record for the twelve months ended June 30, no later than August 31. The Fund’s Form N-PX filing is available: (i) without charge, upon request, by calling the Fund c/o UMB Fund Services, by telephone at 1-888-799-0799 or (ii) by visiting the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT is available, without charge and upon request, on the SEC’s website at www.sec.gov.

Tax Information

For the tax year ended September 30, 2020, 0% of the dividends to be paid from net investment income, including short-term capital gains from the Fund (if any), are designated as qualified dividend income.

For the tax year ended September 30, 2020, 0% of the dividends to be paid from net investment income, including short-term capital gains from the Fund (if any), are designated as dividends received deduction available to corporate shareholders.

For the tax year ended September 30, 2020, the Fund designates $0 as long-term capital gain distributions.

Approval of Investment Management Agreement

At a meeting of the Board of Trustees (the “Board” or the “Trustees”) of FlowStone Opportunity Fund (the “Fund”) held on November 24, 2020, the Board, including all of the Trustees who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the Fund (the “Independent Trustees”) voting separately, approved the renewal for an additional one-year term of the Investment Management Agreement between the Fund and FlowStone Partners, LLC (as successor to Cresset SPG, LLC) (the “Adviser”) dated January 3, 2019 (the “Agreement”).

In advance of the meeting, the Independent Trustees requested and received extensive materials from the Adviser to assist them in considering the renewal of the Agreement. The materials provided by the Adviser included, among other information: (1) comparative information regarding the fees charged by other investment managers to funds that are similar in structure and investment strategy to the Fund, (2) the Fund’s investment performance compared to other similar funds, (3) the Adviser’s personnel, their roles with the Adviser and services provided to the Fund, (4) the Fund’s expenses, including compensation received by the Adviser from the Fund and the Adviser’s profitability with respect to the services it provides to the Fund, and (5) matters related to the Fund’s administration and compliance with its investment policies and the federal securities laws.

The Board engaged in a detailed discussion of the materials with management of the Adviser. The Independent Trustees then met separately in executive session with independent counsel to the Independent Trustees for a full review of the materials. During the executive session, the Independent Trustees further reviewed the information presented in the materials regarding the Agreement. The Independent Trustees considered, among other things: (1) the terms of the Agreement, (2) the nature and quality of the advisory services rendered, including the complexity of the services provided; (3) the experience and qualifications of the personnel that provide such services; (4) the Fund’s fee structure and the expense ratios in relation to those of other investment companies having comparable investment policies and limitations; (5) the direct and indirect costs incurred by the Adviser and its affiliates in performing advisory services for the Fund, the basis of determining and allocating these costs, and the profitability to the Adviser and its affiliates in performing such services; (6) possible economies of scale arising from anticipated growth of the Fund and the extent to which these would be passed on to the Fund; (7) the compensation or possible benefits to the Adviser and its affiliates that may arise from their advisory and other relationships with the Fund; (8) possible alternative fee structures or bases for determining fees; (9) the fees to be charged by the Adviser in comparison to the fees charged by other investment advisers to similar clients and in comparison to industry fees for similar services; and (10) possible conflicts of interest that the Adviser may have with respect to the Fund. The Board determined that the information presented provided a sufficient basis upon which to approve renewal of the Agreement for an additional one-year term.

20

FlowStone Opportunity Fund

Other Information

March 31, 2021 (Unaudited) (Continued)

Discussion of Factors Considered

The Independent Trustees considered, as part of their review, the nature, quality and extent of services provided to the Fund by the Adviser. In this regard, they took into account the scope of investment advisory services provided to the Fund by the Adviser and the complexity of the Fund’s underlying investments. The Trustees also noted that on a regular basis they received and reviewed information from Fund’s Chief Compliance Officer regarding the Fund’s compliance policies and procedures pursuant to Rule 38a-1 under the 1940 Act. The Independent Trustees also took into account that the Adviser had sufficient personnel with the appropriate education and experience to serve the Fund effectively and has devoted sufficient resources to enable it to attract and retain qualified personnel, including the addition of new personnel since the Fund’s inception. The Independent Trustees noted that the Adviser is part of a larger investment advisory group that advises individual investors with respect to private equity and other investments and that relationship may make available to the Fund investment opportunities that would not be available to the Fund if the Adviser was not the Fund’s investment adviser.

The Independent Trustees concluded that the nature, extent and quality of the services provided by the Adviser to the Fund are appropriate and consistent with the terms of the Declaration of Trust of the Fund, that the quality of those services is consistent with industry norms and that the Fund benefits from the Adviser’s management of the Fund’s investment program.

The Independent Trustees considered that, as of June 30, 2020, the Fund’s quarter-to-date, year-to-date and since inception performance was positive. They considered the performance information provided for other similar funds and concluded, in light of the Fund’s short history of operations and on the basis of the information provided by the Adviser, that the Fund’s performance was satisfactory.

The Independent Trustees considered the costs of the services provided by the Adviser, and the compensation and benefits received by the Adviser in providing services to the Fund. The Independent Trustees reviewed financial information about the Adviser, considered any direct or indirect revenues that could be received by affiliates of the Adviser, and concluded that the Adviser’s fees a were reasonable in relation to the nature and quality of the services provided, taking into account the fees charged by other advisers for managing comparable funds. The Independent Trustees also concluded that the overall expense ratio of the Fund was reasonable, taking into account the quality of services provided by the Adviser. In this regard, the Independent Trustees considered that the Adviser had waived fees and/or reimbursed expenses of the Fund pursuant to a contractual expense reimbursement agreement, and was waiving fees payable to it by the Fund on cash and cash equivalents less amounts already committed for investment through December 31, 2020.

The Independent Trustees considered the extent to which economies of scale could be realized and whether fee levels would reflect those economies, noting that as the Fund grows, economies of scale would be realized.

The Independent Trustees considered all factors and no one factor alone was deemed dispositive.

Conclusion

The Independent Trustees determined that the information presented provided a sufficient basis upon which to approve the continuation of the Agreement and that continuation of the Agreement was in the best interests of the Fund and its shareholders.

21

FlowStone Opportunity Fund

Fund Management

March 31, 2021 (Unaudited)

INDEPENDENT TRUSTEES |

|||||

NAME, ADDRESS^ |

POSITION(S) |

LENGTH |

PRINCIPAL |

PORTFOLIOS |

OTHER DIRECTORSHIPS |

Jason S. Gull |

Trustee |

Since Inception |

Retired (since 2016); Partner, Head of Secondary Investments, and Member of the Executive Committee at Adams Street Partners, LLC (2004-2016). |

1 |

Trustee, Utah School & Institutional Trust Funds Office; Advisory Board Member, Cougar Capital, a Brigham Young University affiliated investment fund; Member of the Brigham Young University Marriott School of Business National Advisory Council. |

Michael H. Moskow |

Trustee |

Since Inception |

Retired (since 2014); Consultant, Board and Advisory Board Member, and Board Member, Taylor Capital Group (since 2008-2014). |

1 |

CityBase, Board Member; Discover Financial, Inc., Board Member; Educational Corporation of America, Board Member; National Futures Association, Board Member; and Commonwealth Edison, a subsidiary of Exelon, Board Member. |

Marek Herchel |

Trustee |

Since Inception |

Head of Americas, MLC Private Equity, nabSecurities, LLC since June 2017; Managing Director, AlpInvest Partners, The Carlyle Group (from 2011-2017). |

1 |

None |

|

^ |

The address for each Independent Trustee is c/o Joshua Deringer, Faegre Drinker Biddle & Reath LLP, 1177 Avenue of the Americas, 41st Floor, New York, New York 10036. |

|

* |

Each Trustee serves an indefinite term, until his or her successor is elected. |

|

* |

Each Trustee who is not an “interested person” of the Trust (“Independent Trustee”) receives an annual retainer of $5,000 per year. In addition, the Fund pays an additional retainer of $5,000 per year to the Chairman of the Board, Chairman of the Audit Committee, and to the Chairman of the Valuation Committee. Trustees will also receive $2,500 for each in-person quarterly meeting. Trustees that are interested persons will not be compensated by the Fund. The Trustees do not receive any pension or retirement benefits. Collectively, the Independent Trustees were paid $100,000 in retainer and meeting fees during the fiscal year ended March 31, 2021. |

|

** |

Includes any company with a class of securities registered pursuant to Section 12 of the Exchange Act of 1934, as amended (the “Exchange Act”), or subject to the requirements of Section 15(d) of the Exchange Act or any company registered under the Investment Company Act. |

22

FlowStone Opportunity Fund

Fund Management

March 31, 2021 (Unaudited) (Continued)

INTERESTED TRUSTEES AND OFFICERS |

|||||

NAME, ADDRESS |

POSITION(S) |

LENGTH |

PRINCIPAL |

PORTFOLIOS |

OTHER DIRECTORSHIPS |

Scott P. Conners

29 Lucy Way |

Trustee; President |

Since Inception |

President and Managing Director, FlowStone Partners, LLC (since March 2019); Managing Director, Cresset SPG, LLC, from 2017 to 2019; Partner and Member of the Private Equity Investment Committee at Landmark Partners, LLC from 2003-2015 (employee since 1993) |

1 |

Board Chair and Board Member, Hartford Youth Scholars; Board Member, University of Maine at Farmington Board of Visitors. |

Eric Becker

c/o Cresset Capital Management, LLC |

Trustee |

Since Inception |

Co-Chairman at Cresset Capital Management (since 2017); Chairman at Caretta Group (since 2014); Chairman at Vennpoint Real Estate (since 2014); Senior Managing Director and Co-Founder at Sterling Partners |

1 |

Board Member, Kuvare Holdings; Advisory Board Member, Chesapeake Spice Company; Advisory Board Member, Dorsar Family Office; Board Member, Roti Modern Mediterranean Restaurants, Board Member, Eastman Egg Company; Board Member, HiTech Corp.; Board Member, Viewpost; Board Member, Living Classrooms Foundation; Board Member, Karma for Cara Foundation; Board Member, Admirals Cove Foundation; Board Member, Chicago Ideas Week |

23

FlowStone Opportunity Fund

Fund Management

March 31, 2021 (Unaudited) (Continued)

INTERESTED TRUSTEES AND OFFICERS (CONTINUED) |

|||||

NAME, ADDRESS |

POSITION(S) |

LENGTH |

PRINCIPAL |

PORTFOLIOS |

OTHER DIRECTORSHIPS |

Trent Statczar^

690 Taylor Road |

Chief Financial Officer; Treasurer |

Since Inception |

Fund Principal Financial Officer at Foreside Fund Officer Services, LLC (since 2016); Director, PFO Services at Beacon Hill Fund Services (2008-2016) |

1 |

N/A |

Brandon Kipp^

690 Taylor Road |

Chief Compliance Officer |

Since May 2019 |

Director, Foreside Financial Group, LLC (since 2019); Senior Fund Compliance Officer, Ultimus Fund Solutions, LLC (from July 2017 to May 2019); Assistant Vice President and Compliance Manager, UMB Fund Services, Inc. (March 2014 to July 2017). |

1 |

N/A |

|

* |

Each Trustee/Officer serves an indefinite term, until his or her successor is elected. |

|

** |