Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Resideo Technologies, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Table of Contents

April 26, 2022

Dear Resideo Shareholders:

It is my pleasure to invite you to attend the 2022 Annual Meeting of Shareholders of Resideo Technologies, Inc. (“Resideo” or the “Company”), which will be held via a live virtual meeting on Wednesday, June 8, 2022, at 1:00 p.m. Eastern Daylight Time.

2021 was a year of significant accomplishment for Resideo. The business built on the momentum of the second half of 2020 to deliver record financial performance and continue to strengthen the foundation for long-term, sustainable success. Both ADI Global Distribution and Products & Solutions delivered double digit year-over-year revenue growth and operating margin expansion. At the same time, we accelerated investment in areas key to our long-term strategy. This was accomplished against a backdrop of significant supply chain, inflationary and logistical challenges. I would like to thank the entire Resideo team for their tremendous efforts in 2021. The hard work across the organization enabled Resideo to manage through this challenging environment to deliver for customers and partners while generating record financial results.

During the year we unveiled our vision, purpose and values and undertook comprehensive strategic planning initiatives at the corporate level and within each business. Organizationally, we continued to strengthen the leadership team. This included additions to support our Environmental, Social, and Governance (“ESG”) initiatives. We brought onboard a global leader for ESG and added a sustainability leader in the Products & Solutions business. Sustainability is core to our products, which are designed to help our customers to save energy, water and carbon and make their homes more comfortable, efficient and secure.

At ADI, revenue grew 15% in 2021 to $3.4 billion. This is a continuation of the consistent above-market growth ADI has delivered over the past decade. At the same time, ADI continued to invest in building a true omni-channel experience for its professional customers. This includes enhanced touchless transaction options that simplify the customer experience and free up sales associates for more value-added selling. We also saw initial success from the rollout of pricing optimization tools that provide the ADI sales team better real-time customer insight. These tools and an unrelenting focus on execution enabled the business to deliver 100 basis points of year-over-year gross margin expansion.

Within Products & Solutions, revenue grew 16% in 2021 to $2.5 billion as demand was strong across product categories and channels. The business completed critical foundational work including investments in sales operations and business development, systems consolidations, introduction of a comprehensive integrated business planning process, and digital efforts to consolidate and refresh our web presence. This work solidifies systems and processes to ensure we are more deeply engaged with key customers and partners, and we have the visibility to better plan and meet their needs.

We stepped up our investment in engineering and development at Products & Solutions in 2021. This included consolidating software development efforts under one leader, which generated significant progress in development and platforming initiatives. Our product roadmap has evolved meaningfully over the past year and our development pipeline is building across our portfolio. This includes specific programs targeting the expansion of our services offerings for enabling the professional and leveraging our broad portfolio with partners across our ecosystem, including utilities and in residential new construction.

As we look to 2022 and beyond, we see tremendous opportunity for Resideo across the residential and commercial markets we serve. People continue to invest in their homes as they look for a more comfortable, connected and simplified home experience. There is increasing awareness around personal security inside and outside the home, which we see benefiting both ADI and Products & Solutions. We believe the breadth of our product portfolio and relationship with professional contractors uniquely positions us to be a leading player as our markets continue to develop.

ADI remains focused on being an indispensable partner of choice for customers and suppliers. This begins with delivering the leading omni-channel user experience for the professional contractor. ADI will continue to broaden its offering of exclusive brands and technologies, not only in security categories but also with the organic and inorganic expansion into audio visual and data communications.

Within Products & Solutions, the team is focused on leveraging its significant footprint in the home through product innovation, and over time increased value-added services. We are excited by our recent acquisition of First Alert and the unique position its products occupy within the home and the tight fit with our long-term strategy.

Our performance in 2021 showed the potential of the business and the team we have assembled. We are steadfastly focused on execution to bring enhanced value to our customers and returns for our shareholders.

Sincerely,

|

|

||

| Jay Geldmacher | ||

| President and Chief Executive Officer |

16100 N. 71st St., Suite 550, Scottsdale, AZ 85254

|

2022 PROXY STATEMENT |

Table of Contents

Notice of 2022 Annual Meeting of Shareholders

|

|

|

| ||||||

| DATE | TIME | PLACE | ||||||

|

Wednesday, June 8, 2022

|

1:00 p.m. Eastern Daylight Time

|

Via the internet at www.virtualshareholdermeeting.com/ REZI2022

| ||||||

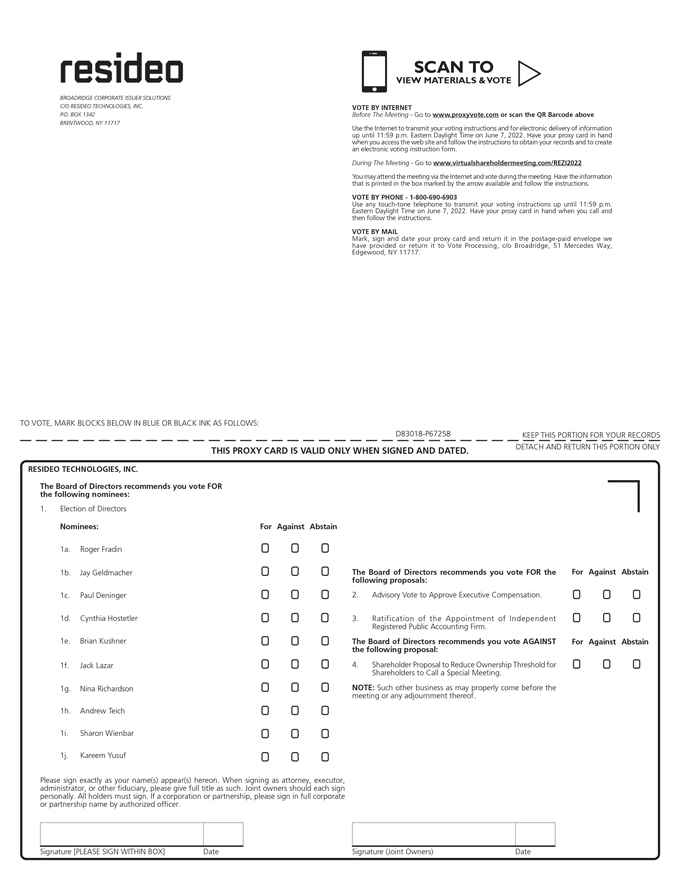

Our 2022 annual meeting will be a live virtual meeting. There will be no physical location for the annual meeting. You will be able to participate in the annual meeting, vote your shares electronically and submit your questions during the live virtual meeting by visiting www.virtualshareholdermeeting.com/REZI2022 and entering the 16-digit control number provided in your proxy materials. You may also submit questions in advance of the meeting by visiting www.proxyvote.com. For more information on accessing the virtual annual meeting, see Question 5 in the section entitled “Questions and Answers About the Annual Meeting and Voting” on page 69.

Agenda:

|

Election of Directors |

|

Advisory vote to approve executive compensation |

|

Ratification of the appointment of independent registered public accounting firm |

|

Act on a shareholder proposal described in this Proxy Statement, if properly presented |

|

Transact such other business as may properly come before the meeting |

How to Vote: Your vote is important to us. Unless you vote live at the virtual annual meeting, the deadline for receiving your vote is 11:59 p.m. Eastern Daylight Time, on June 7, 2022.

|

|

|

|

| |||||||||

|

VIA INTERNET

|

BY PHONE

|

BY MAIL

|

VIA VIRTUAL MEETING

| |||||||||

|

Visit www.proxyvote.com to vote your shares via the internet. You will need the 16-digit control number provided in your proxy materials when you access the web page.

|

If your shares are held in the name of a bank, brokerage firm or similar organization, follow the telephone voting instructions, if any, provided on your voting instruction card. If your shares are registered in your name, call 1-800-690-6903. You will need the 16-digit control number provided in your proxy materials when you call.

|

Complete and sign the proxy card or voting instruction form and return it in the enclosed postage pre-paid envelope.

|

You may vote your shares live at the virtual annual meeting by visiting www.virtualshareholdermeeting.com/ REZI2022. You will need to enter the 16-digit control number provided in your proxy materials to vote your shares at the virtual annual meeting.

| |||||||||

This Notice of 2022 Annual Meeting of Shareholders and related proxy materials are being distributed or made available to shareholders beginning on April 26, 2022.

On behalf of Resideo’s Board of Directors,

JEANNINE LANE

EXECUTIVE VICE PRESIDENT,

GENERAL COUNSEL AND CORPORATE SECRETARY

Important Notice Regarding the Availability of Proxy Materials for the 2022 Annual Meeting of Shareholders to be held on Wednesday, June 8, 2022: our Proxy Statement and 2021 Annual Report are available free of charge on our Investor Relations website at investor.resideo.com.

|

2022 PROXY STATEMENT |

Table of Contents

|

|

2022 PROXY STATEMENT |

Table of Contents

Below are highlights of certain information in this Proxy Statement. As it is only a summary, it may not contain all of the information that is important to you. For more complete information, please refer to the complete Proxy Statement and Resideo’s 2021 Annual Report before you vote. References to “Resideo,” the “Company,” “we,” “us” or “our” refer to Resideo Technologies, Inc.

2022 Annual Meeting of Shareholders

|

Date and Time:

|

June 8, 2022, 1:00 p.m. EDT

| |

|

Place:

|

Via the internet at www.virtualshareholdermeeting.com/REZI2022

| |

|

Record Date:

|

April 11, 2022

| |

|

Voting: |

Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on.

| |

|

Admission: |

To enter Resideo’s virtual annual meeting via www.virtualshareholdermeeting.com/REZI2022, you will need the 16-digit control number provided in your proxy materials.

| |

How to Cast Your Vote

Your vote is important! Please cast your vote and play a part in the future of Resideo.

Shareholders of record on the Record Date can vote through any of the following ways:

|

|

|

|

|

|

|

| ||||||

| INTERNET | PHONE | VIRTUAL MEETING | ||||||||||

|

Visit www.proxyvote.com

|

Call 1-800-690-6903 toll-free from the U.S. or Canada

|

Return the signed proxy card

|

Vote your shares live at the virtual annual meeting

| |||||||||

|

2022 PROXY STATEMENT | 1 |

Table of Contents

The deadline for voting via the internet or by telephone is 11:59 p.m. EDT on June 7, 2022. If you vote by mail, your proxy card must be received before the virtual annual meeting.

Beneficial owners who own shares through a bank, brokerage firm or similar organization can vote by returning the voting instruction form, or by following the instructions for voting via the internet or by telephone, as provided by the bank, brokerage firm or similar organization. If you own shares in different accounts or in more than one name, you may receive different voting instructions for each type of ownership. Please vote all of your shares.

If you are a shareholder of record or a beneficial owner, you may choose to vote at the virtual annual meeting. Even if you plan to attend our virtual annual meeting, please cast your vote as soon as possible. For more information on voting your shares, please see “Questions and Answers About the Annual Meeting and Voting” beginning on page 69.

About Resideo

Resideo is a leading global manufacturer and developer of technology-driven products and solutions that provide comfort, security, energy efficiency and control to over 150 million homes globally. We are also the leading wholesale distributor of security, AV and low-voltage products with a global footprint serving commercial and residential end markets. Our primary focus is on the professional channel where we are a trusted partner to over 110,000 professional installers. Our global scale, breadth of product offerings, innovation heritage, and differentiated service and support has enabled our trusted relationship with professional installers and has been a key driver of our success. Leveraging our underlying strengths, we are transforming our business with a strategy that includes operational improvements, product innovation, and investments to drive future growth and value creation.

Voting Matters and Board Recommendations

|

VOTING MATTERS |

BOARD RECOMMENDATIONS |

PAGE REFERENCE (FOR MORE DETAIL) | ||||

|

Proposal 1. |

Election of Directors

|

FOR Each Nominee

|

6

| |||

|

Proposal 2. |

Advisory Vote to Approve

|

FOR |

37 | |||

|

Proposal 3. |

Ratification of the Appointment of

|

FOR |

63 | |||

|

Proposal 4. |

Shareholder Proposal to Reduce Ownership Threshold for Shareholders to Call a Special Meeting

|

AGAINST |

66 | |||

| 2 | 2022 PROXY STATEMENT |

|

Table of Contents

Director Dashboard

Our Board of Directors

| Name |

Age | Independent | Board Committee Memberships |

Other Public Company Board Service | ||||

| Roger Fradin (Chairman) |

68 | No | Finance Innovation and Technology |

Janus International Group Juniper II Corp. L3Harris Technologies, Inc. Vertiv Holdings Co | ||||

| Jay Geldmacher |

66 | No | None | Seagate Technology plc | ||||

| Paul Deninger |

63 | Yes | Audit Finance (Chair) Innovation and Technology |

Epiphany Technology Acquisition Corp. EverQuote | ||||

| Cynthia Hostetler |

59 | Yes | Finance Nominating and Corporate Governance |

Textainer Group Holdings Limited Vulcan Materials Company | ||||

| Brian Kushner |

63 | Yes | Audit Finance Innovation and Technology |

Cumulus Media Inc. Corporation II | ||||

| Jack Lazar |

56 | Yes | Audit (Chair) Innovation and Technology |

Box, Inc. GLOBALFOUNDRIES Inc. thredUP | ||||

| Nina Richardson |

63 | Yes | Compensation and Human Capital Management Nominating and Governance (Chair) |

Cohu, Inc. Eargo, Inc. Silicon Laboratories, Inc. | ||||

| Andrew Teich (Lead Independent Director) |

61 | Yes | Compensation and Human Capital Management Innovation and Technology (Chair) Nominating and Governance |

Juniper II Corp. Sensata Technologies Holding PLC | ||||

| Sharon Wienbar |

60 | Yes | Compensation and Human Capital Management (Chair) Nominating and Governance |

Colfax Corporation Covetrus, Inc | ||||

| Kareem Yusuf |

50 | Yes | Compensation and Human Capital Management Innovation and Technology |

|||||

Corporate Governance Highlights

We are committed to strong corporate governance practices and policies, as described below, that support effective Board leadership and prudent management practices.

|

Annual election of all directors |

|

Majority voting for directors in uncontested elections |

|

Lead Independent Director with specified duties and responsibilities |

|

Robust risk oversight by full Board and Committees |

|

Annual review of key Committee charters and Corporate Governance Guidelines |

|

2022 PROXY STATEMENT | 3 |

Table of Contents

|

Independent Audit, Compensation and Human Capital Management and Nominating and Governance Committees |

|

Finance Committee that reviews and oversees Resideo’s capital structure and opportunities for maximizing shareholder value |

|

Innovation and Technology Committee that oversees Resideo’s overall strategic direction and investment in technology initiatives |

|

Rigorous risk oversight of cybersecurity programs by the Audit and Innovation and Technology Committees |

|

Annual Board and Committee evaluations |

|

Proposed annual advisory vote to approve executive compensation |

|

Meaningful stock ownership guidelines for directors and executives |

|

Adoption of proxy access |

|

Limits on memberships on other boards |

|

A Board that is actively engaged in recruiting qualified, diverse director candidates |

|

Commitment to health, safety and environmental sustainability |

|

Oversight of human capital management, including diversity, equity and inclusion, by Compensation and Human Capital Management Committee |

|

Oversight of our code of business conduct and our role as a responsible corporate citizen, including our environmental, social and governance (ESG) programs, by the Nominating and Governance Committee |

|

Policies prohibiting short sales, hedging, margin accounts and pledging |

|

Shareholders holding at least 25% of the outstanding stock of the Company have the right to call a special meeting |

Executive Compensation Preview

The Compensation Discussion and Analysis section of this Proxy Statement provides a focused discussion of our executive compensation philosophy and the pay programs applicable to our named executive officers. Our compensation program design directly links compensation to the performance of our business and rewards fiscal year results through our annual incentive plan and long-term performance with equity awards.

Our Named Executive Officers

Our leadership team during fiscal 2021 included the following Named Executive Officers (“NEOs”):

| NAME |

POSITION | |

| Jay Geldmacher |

President and Chief Executive Officer | |

| Anthony L. Trunzo |

Executive Vice President, Chief Financial Officer | |

| Robert Aarnes |

President, ADI Global Distribution | |

| Phillip Theodore |

President, Products & Solutions | |

| Travis Merrill |

Executive Vice President, Chief Strategy & Commercial Officer | |

| 4 | 2022 PROXY STATEMENT |

|

Table of Contents

Forward-Looking Statements

This Proxy Statement and the cover letter contain “forward-looking statements” regarding expectations about future business and financial results, which speak only as of the date of this Proxy Statement. Although we believe that the forward-looking statements contained in this Proxy Statement are based upon reasonable assumptions, such statements involve known and unknown risks, uncertainties, and other factors, which may cause the actual results or performance of the Company to be materially different from any future results or performance expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, those described under the headings “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements” in our Annual Reports on Form 10-K for the year ended December 31, 2021. You are cautioned not to place undue reliance on these forward-looking statements, which are not guarantees of future performance, and actual results, developments and business decisions may differ from those envisaged by our forward-looking statements. Except as required by law, we undertake no obligation to update such statements to reflect events or circumstances arising after the date of this presentation, and we caution investors not to place undue reliance on any such forward-looking statements.

|

2022 PROXY STATEMENT | 5 |

Table of Contents

Proposal 1: Election of Directors

Our Board currently consists of ten directors, and the Board has set the size of the Board as of this year’s Annual Meeting at ten. All directors will stand for election each year for annual terms. Our Board has nominated the director nominees for re-election to the Board. We do not know of any reason why any nominee would be unable to serve as a director. If any nominee should become unavailable to serve prior to the Annual Meeting, the shares represented by proxy will be voted for the election of such other person as may be designated by the Board. The Board may also determine to leave the vacancy temporarily unfilled or reduce the authorized number of directors in accordance with the By-Laws. Resideo’s By-Laws provide that in any uncontested election of directors (an election in which the number of nominees does not exceed the number of directors to be elected), any nominee who receives a greater number of votes cast “FOR” his or her election than votes cast “AGAINST” his or her election will be elected to the Board.

Resideo’s By-Laws provide a majority voting standard for election of directors in uncontested elections. Each director will be elected by the affirmative vote of a majority of the votes cast, meaning that the number of votes cast “FOR” a director nominee exceeds 50% of the number of votes cast with respect to that director’s election.

No incumbent director nominee shall qualify for service as a director unless he or she agrees to submit upon re-nomination to the Board an irrevocable resignation effective upon such director nominee’s failure to receive a majority of the votes cast in an uncontested election. The Nominating and Governance Committee (excluding the nominee, if applicable) will make a recommendation to the Board as to whether to accept or reject the resignation, or whether other action should be taken. The Board, excluding the nominee, will act on the resignation and publicly disclose its decision in accordance with the By-Laws.

An election of directors is considered to be contested if there are more nominees for election than positions on the Board to be filled by election at the meeting of shareholders. In a contested election, the required vote would be a plurality of votes cast.

The Board has affirmatively determined that each of the nominees qualifies for election under the Company’s criteria for evaluation of directors. See “Nominating Board Candidates – Procedures and Qualifications” on page 23 for more information on qualifications for director nominees. The Nominating and Governance Committee is responsible for nominating a slate of director nominees who collectively have the complementary experience, qualifications, skills and attributes to guide the Company and function effectively as a Board. The committee believes that each of the nominees has key personal attributes that are important to an effective board, including integrity, industry background, contribution to the composition, diversity and culture of the Board, educational background, the ability and willingness to constructively challenge management and the ability and commitment to devote sufficient time to Board duties. Set forth below is biographical information about the director nominees and their specific experience, qualifications and skills that have led the Board and the Nominating and Governance Committee to conclude that they should continue to serve as directors of Resideo. In addition, the Board has determined that each non-employee director nominee, other than Roger Fradin, qualifies as an independent director under NYSE corporate governance listing standards and the Company’s director independence standards as further described under “Director Independence” on page 18.

The Board has established a director retirement policy whereby, unless the Board otherwise determines, non-employee directors shall serve only until the Annual Meeting of Shareholders immediately following their 75th birthday.

| 6 | 2022 PROXY STATEMENT |

|

Table of Contents

Director Qualifications and Skills

Our directors have a broad range of experience that spans different industries and encompasses the relevant business and technology sectors. Directors bring a variety of qualifications, skills and viewpoints to our Board that both strengthen their ability to carry out their oversight responsibilities on behalf of our shareholders and bring richness to Board deliberations. As described above and in the director biographies, our directors have key experiences, qualifications and skills that are relevant and important in light of our business, structure and growth strategy and include the following:

| DIRECTOR QUALIFICATIONS AND SKILLS CRITERIA |

|

Senior Leadership Experience

Experience serving as CEO or a senior executive that provides a practical understanding of how complex organizations function and ability to support our commercial strategy, growth and performance

|

|

Consumer Products

Experience with the retail consumer industry, e-commerce, customer service and consumer dynamics that aligns with our business strategies and opportunities

|

|

Manufacturing

Experience with the operations of manufacturing facilities that provide critical perspectives in understanding and evaluating operational planning, management and risk mitigation of our business

|

|

Technology

Experience developing and adopting new technologies as well as leading innovation initiatives that support the execution of our vision in the smart home market

|

|

Global Relations

International business strategy, operations and substantive expertise in international matters relevant to our global business

|

|

Finance

Experience with finance and financial reporting processes, including monitoring and assessing a company’s operating performance to ensure accurate financial reporting and robust controls

|

|

Public Company Board Service

Service on the boards and board committees of public companies that provides an understanding of corporate governance practices and risk management oversight as well as insights into board management and relations between the board, the CEO and senior management that will support our commitment to maintain a strong governance framework as an independent public company

|

|

Marketing

Expertise in brand development, marketing and sales in local markets on a global scale relevant to our global business

|

|

Operations

Managing the operations of a business and possessing a deep understanding of the end-markets we serve

|

|

Strategy

Practical understanding of the development and implementation of strategic priorities and of the risks and opportunities that can impact a company’s operations and strategies which will serve to drive our long-term growth

|

|

Mergers & Acquisitions

Experience in business development and mergers and acquisitions to support our initiatives to identify and execute on tuck-in acquisitions and investments

|

|

2022 PROXY STATEMENT | 7 |

Table of Contents

The table below is a summary of the range of qualifications and skills that each director brings to the Board. The table does not include all of the qualifications that each director offers, and the fact that a particular experience, skill, or qualification is not checked for a specific director does not mean that the director does not possess it.

| NAME |

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Roger Fradin (Chairman) |

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Jay Geldmacher (President & CEO) |

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Paul Deninger |

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Cynthia Hostetler |

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Brian Kushner |

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Jack Lazar |

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Nina Richardson |

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Andrew Teich (Lead Independent Director) |

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Sharon Wienbar |

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Kareem Yusuf |

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| 8 | 2022 PROXY STATEMENT |

|

Table of Contents

The Board of Directors unanimously recommends a vote “FOR” Proposal 1 to

elect each of the following director nominees.

Nominees for Election

Included in each biography are the key qualifications that led to the conclusion that such directors should serve on our Board.

| ROGER FRADIN, Age 68 | ||

|

Non-Executive Chairman of the Board

Director since 2018

Committee Memberships:

• Finance

• Innovation and Technology |

Key Qualifications:

• Extensive experience as an executive at Honeywell

• In-depth knowledge of the fire and security solutions and automation and control solutions industries

• Significant operational and product development experience

• Financial expertise and experience in capital markets

• Broad experience in marketing, including international markets

Other Current Public Company Directorships:

• Janus International Group

• Juniper II Corp.

• L3Harris Technologies, Inc. (formerly Harris Corporation)

• Vertiv Holdings Co (formerly GS Acquisition Holdings)

| |

|

Background

Mr. Fradin joined Honeywell in 2000 when Honeywell acquired Pittway Corporation, where he served as president and chief executive officer of the Security and Fire Solutions segment. Mr. Fradin served as president and chief executive officer of Honeywell’s Automation and Control Solutions business from January 2004 to April 2014 and served as vice chairman of Honeywell from April 2014 to February 2017. Mr. Fradin served as an independent contractor to Honeywell from March 2018 to September 2018. Mr. Fradin currently serves as executive chairman of Victory Innovation, a Carlyle company. He has also served an advisor to Seal Rock Partners since 2014 and as a consultant of The Carlyle Group, which he served as an operating executive from 2016 to 2019. Mr. Fradin received his M.B.A. and B.S. degrees from The Wharton School at the University of Pennsylvania. While a student at Wharton, Mr. Fradin also served as a member of its faculty. He previously served as a director of MSC Industrial Direct (1998-2019) and currently serves as an advisor to the board of MSC Industrial Direct, and previously served as a director of Goldman Sachs Acquisition Holdings (2018-2020) and Pitney Bowes (2012-2019). | ||

|

2022 PROXY STATEMENT | 9 |

Table of Contents

| JAY GELDMACHER, Age 66 | ||

|

President, Chief Executive Officer and Director

Director since 2020

Committee Memberships: • None

|

Key Qualifications:

• Extensive experience leading a complex industrial and technology spinout

• Expert on both public and private equity backed companies

• Extensive background in the technology sector

Other Current Public Company Directorships:

• Seagate Technology plc

| |

|

Background

Prior to joining Resideo, Mr. Geldmacher served as president and CEO of Electro Rent, a leader in testing and technology solutions and a Platinum Equity portfolio company since September 2019. From November 2013 to August 2019, Mr. Geldmacher served as president and CEO of Artesyn Embedded Technologies, a joint venture between Emerson Electric Company and Platinum Equity. Between 2007 and 2013, Mr. Geldmacher served as Executive Vice President of Emerson Electric Company and President of Emerson Network Power’s Embedded Computing & Power Group, which designed, manufactured and distributed embedded computing and power products, systems and solutions. From 1996 to 2007, he served in a variety of roles of progressive responsibility at Emerson Electric. Mr. Geldmacher received his bachelor’s degree in marketing from the University of Arizona and an executive MBA degree from the University of Chicago. Mr. Geldmacher previously served on the board of directors of Verra Mobility Corporation (2018-2020) and Owens-Illinois, Inc. (2008-2015).

| ||

| PAUL DENINGER, Age 63 | ||

|

Independent Director

Director since 2018

Committee Memberships:

• Audit

• Finance (Chair)

• Innovation and |

Key Qualifications:

• Extensive senior management experience in operations and strategy

• Extensive experience in banking, capital markets and merger and acquisition strategies

• Deep knowledge of the technology sector

Other Current Public Company Directorships:

• Epiphany Technology Acquisition Corp.

• EverQuote

| |

|

Background

Mr. Deninger is a venture partner with Material Impact, an early stage venture firm focused on identifying and supporting groundbreaking material science technologies and companies, and a senior managing director of Davis Partners Group, a c-suite advisory firm. He is also vice chairman of the board of Epiphany Technology Acquisition Corp., having previously served as a senior advisor to Evercore Inc., a publicly held investment banking advisory firm, from June 2016 to February 2020. Mr. Deninger served as a senior managing director with Evercore from February 2011 to June 2016. From December 2003 to October 2010, Mr. Deninger served as a vice chairman at Jefferies Group LLC, a wholly-owned subsidiary of Jefferies Financial Group Inc., a diversified financial services company. Prior to that, he served as chairman and chief executive officer of Broadview International LLC, a mergers and acquisitions advisory firm focused on the technology industry. Mr. Deninger received his B.S. from Boston College and his M.B.A. from Harvard Business School. He previously served as a director at Iron Mountain Inc. (2010-2021). | ||

| 10 | 2022 PROXY STATEMENT |

|

Table of Contents

| CYNTHIA HOSTETLER, Age 59 | ||

|

Independent Director

Director since 2020

Committee Memberships:

• Finance

• Nominating and Governance |

Key Qualifications:

• Broad investment, financial and risk management skills

• Experienced public and investment company board member

• Significant experience with investment management, including ESG and investor relations issues

Other Current Public Company Directorships:

• Textainer Group Holdings Limited

• Vulcan Materials Company

| |

|

Background

Ms. Hostetler is a professional director of public companies and investment funds in the United States. She currently serves on the boards of public companies Textainer Group Holdings Limited (shipping container leasing) since 2021 and Vulcan Materials Company (construction materials) since 2014. Ms. Hostetler also serves as Trustee of Invesco Funds (global mutual funds) since 2017 and as Director of TriLinc Global Impact Fund, LLC (international investment fund) since 2013. Ms. Hostetler has served on the Investment Company Institute Board of Governors since 2018 and on the Independent Directors Council board since 2014. Previously, Ms. Hostetler served as a Trustee of Aberdeen International Funds, New York, New York (global mutual funds) from 2013 to 2017; Director of Artio Global Funds, New York, New York (global mutual funds) from 2010 to 2013; Director of Genesee & Wyoming, Inc. (short line railroads) from 2018 to 2019; and Director of Edgen Group Inc., Baton Rouge, Louisiana (energy infrastructure) from 2013 to 2014. Ms. Hostetler served as the Head of Private Equity and Investment Funds of Overseas Private Investment Corporation from 2001 to 2009 and as a board member and President of First Manhattan Bancorporation from 1991 to 2006. Ms. Hostetler began her career as a corporate lawyer with Simpson Thacher & Bartlett in New York. Ms. Hostetler earned her bachelor’s degree from Southern Methodist University and holds a Juris Doctor from the University of Virginia School of Law. | ||

|

2022 PROXY STATEMENT | 11 |

Table of Contents

| BRIAN KUSHNER, Age 63 | ||

|

Independent Director

Director since 2019

Committee Memberships:

• Audit

• Finance

• Innovation and

|

Key Qualifications:

• Decades of experience leading corporate transformation efforts

• Proven expertise in corporate performance improvement, including financial expertise

• Served in roles that include chairman, director, chief executive officer and chief restructuring officer at more than 35 public and private companies

Other Current Public Company Directorships:

• Cumulus Media Inc.

• Mudrick Capital Acquisition Corporation II

| |

|

Background

Mr. Kushner has served as a senior managing director at FTI Consulting, Inc., a global business advisory firm, since 2009, where he serves as leader of the Private Capital Advisory Services practice and as the co-leader of the Technology practice, the Aerospace, Defense and Government Contracting practice and the Activism and M&A Solutions practice. Prior to joining FTI, Mr. Kushner was the co-founder of CXO, L.L.C., a boutique interim and turnaround management consulting firm that was acquired by FTI at the end of 2008. Over the past three decades, Mr. Kushner has served as a director, chief executive officer (“CEO”) or chief restructuring officer (“CRO”) of over 35 public and private technology, manufacturing, telecom and defense companies, during which time he worked on the acquisition or disposition of more than 25 companies. Mr. Kushner has also periodically served as the CEO, interim CEO, or the CRO of companies that elected to utilize bankruptcy proceedings as part of their financial restructuring process and, as such, he served as an executive officer of various companies that filed bankruptcy petitions under federal law, including, most recently, Relativity Media LLC and its affiliates in 2015. Mr. Kushner received his B.S. and M.S. degree in Applied and Engineering Physics from Cornell University and his Ph.D. in Applied Physics with a minor in Electrical Engineering, also from Cornell University. He previously served as a director at Thryv, Inc. (2016-2020), Hycroft Mining Corp. (formerly Mudrick Capital Acquisition Corporation) (2018-2020), Luxfer Holdings PLC (2016-2018) and EveryWare Global, Inc. (2015-2016). | ||

| JACK LAZAR, Age 56 | ||

|

Independent Director

Director since 2018

Committee Memberships:

• Audit (Chair)

• Innovation and Technology |

Key Qualifications:

• Strong financial, technological and operational expertise

• Experienced technology company executive and consultant

• Expertise in best practices for a public company on a global scale

Other Current Public Company Directorships:

• Box, Inc.

• GLOBALFOUNDRIES Inc.

• thredUP

| |

|

Background

Mr. Lazar has been an independent business consultant since March 2016. From January 2014 to March 2016, he served as the chief financial officer of GoPro, Inc., a provider of wearable and mountable capture devices. From January 2013 to January 2014, he was an independent business consultant. From May 2011 to January 2013, Mr. Lazar served as senior vice president, corporate development and general manager of Qualcomm Atheros, Inc., a developer of communications semiconductor solutions. From September 2004 to May 2011, Mr. Lazar served in a variety of roles at Atheros Communications, most recently as Atheros’ chief financial officer and senior vice president of corporate development. Mr. Lazar is a certified public accountant (inactive) and received his B.S. degree in commerce with an emphasis in accounting from Santa Clara University. He previously served as a director at Silicon Laboratories Inc. (2013-2022), Casper Sleep, Inc. (2019-2022), Mellanox Technologies, Ltd (2018-2020), Quantenna Communications (2016-2019) and TubeMogul, Inc. (2013-2016). | ||

| 12 | 2022 PROXY STATEMENT |

|

Table of Contents

| NINA RICHARDSON, Age 63 | ||

|

Independent Director

Director since 2018

Committee Memberships:

• Compensation and Human Capital Management

• Nominating and

|

Key Qualifications:

• Extensive global operational and leadership experience in the technology sector

• Experience ranging from start-up companies to multi-billion-dollar corporations

• In-depth knowledge of human resources

Other Current Public Company Directorships:

• Cohu, Inc.

• Eargo, Inc.

• Silicon Laboratories, Inc.

| |

|

Background

Ms. Richardson served as chief operating officer of GoPro, Inc. from February 2013 to February 2015. Prior to that, she held several executive positions of increasing responsibility at Flextronics, Inc., a global electronics and manufacturing service provider. She has been an independent consultant and served on several private technology company boards since 2015. Currently, she serves as managing director of Three Rivers Energy, Inc., a company she co-founded in 2004. Ms. Richardson received her B.S. degree in industrial engineering from Purdue University and an executive M.B.A. from Pepperdine University. She previously served as a director at Zayo Group Holdings, Inc. (2015-2018), Callidus Software, Inc. (2017-2018) and Silicon Graphics International Corp. (2016). | ||

| ANDREW TEICH, Age 61 | ||

|

Lead Independent Director

Director since 2018

Committee Memberships:

• Compensation and Human Capital Management

• Innovation and

• Nominating and

|

Key Qualifications:

• Seasoned executive with experience in acquisitions and operational integration

• Extensive product/technology and sales/marketing skills

• Expertise in artificial intelligence technology

Other Current Public Company Directorships:

• Juniper II Corp.

• Sensata Technologies Holding PLC

| |

|

Background

Mr. Teich has been a private technology consultant since June 2017. From May 2013 until June 2017, he served as the chief executive officer and president of FLIR Systems, Inc., a public multinational imaging and sensing company, and a director from July 2013 to June 2017. Mr. Teich joined FLIR Systems, Inc. in 1999 and held various positions of increasing responsibility within the company including president of the Commercial Systems, Commercial Vision Systems and Thermography divisions throughout his tenure. Mr. Teich received his B.S. degree in marketing from Arizona State University and is an alumnus of the Harvard Business School Advanced Management Program.

| ||

|

2022 PROXY STATEMENT | 13 |

Table of Contents

| SHARON WIENBAR, Age 60 | ||

|

Independent Director

Director since 2018

Committee Memberships:

• Compensation and Human Capital Management (Chair)

• Nominating and |

Key Qualifications:

• Extensive experience as an operating executive and strategist in the software and technology sectors

• Leadership in technology investments and partnerships

• Expertise in start-up operations and venture capital investing

Other Current Public Company Directorships:

• Colfax Corporation

• Covetrus, Inc.

| |

|

Background

Ms. Wienbar was chief executive officer of Hackbright Academy, a technology training firm, from 2015 to 2016. From 2001 to 2015, she served as a partner at Scale Venture Partners (known as BA Venture Partners prior to 2007), a technology and healthcare venture capital firm. Prior to her venture capital career, Ms. Wienbar was an executive in several software companies, including Adobe Systems, and a consultant at Bain & Company. Ms. Wienbar received her S.B. and S.M. degrees in engineering from Harvard University and her M.B.A. from Stanford University. She previously served on Microsoft Inc.’s venture advisory committee and as a director at Everyday Health, Inc. (2014-2016) and Glu Mobile, Inc. (2007-2008).

| ||

| KAREEM YUSUF, Age 50 | ||

|

Independent Director

Director since 2021

Committee Memberships:

• Compensation and Human Capital Management

• Innovation and Technology

|

Key Qualifications:

• Extensive experience with critical technologies, including artificial intelligence, the internet-of-things, hybrid cloud and blockchain

• Leadership of management and growth of market-leading brands and applications

• Extensive experience managing large, cross-functional organizations and providing strategic direction

Other Current Public Company Directorships:

• None

| |

|

Background

Dr. Yusuf is a general manager, AI Applications, of International Business Machines Corporation (IBM), a provider of integrated technology solutions and products, a position he has held since 2018. Prior to his current position, Dr. Yusuf was the chief product officer and chief technology officer for product direction and technology infrastructure of a business unit of IBM from 2016 to 2018. Dr. Yusuf joined IBM in 1998 and has held positions of increasing responsibility in technical sales and support, product management, mergers and acquisitions strategy and software development. Dr. Yusuf received his bachelor’s degree in civil engineering from the University of Berlin, his master’s of science degree in structural engineering from the University of Manchester and his Ph.D. in civil engineering from the University of Leeds. | ||

| 14 | 2022 PROXY STATEMENT |

|

Table of Contents

Our corporate governance framework is a set of principles, guidelines and practices that support strong performance and long-term value creation for our shareholders. Our commitment to good corporate governance is integral to our business and reflects not only regulatory requirements, NYSE listing standards and broadly recognized governance practices, but also effective leadership by our senior management team and oversight by our Board.

Our Board is committed to maintaining the highest standards of corporate governance. Our Board is guided by our Corporate Governance Guidelines, which address director responsibilities, director skills and characteristics, memberships on other boards, director access to management and other employees, director orientation and continuing education, director retirement and the annual performance evaluations of the Board and Committees. Because corporate governance practices evolve over time, our Board will review and approve our Corporate Governance Guidelines, Committee charters and other governance policies at least once a year and update them as necessary and appropriate.

Our Board is deeply engaged, provides informed and meaningful guidance and feedback, and maintains an open dialogue with management based on a clear understanding of our strategic plans. At each Board meeting, we review components of our long-term strategy with our directors and engage in constructive dialogue which our leadership team embraces. Our directors have access to our officers and employees to address questions, comments or concerns. Additionally, the Board and Committees have the power to hire independent legal, financial or other advisors without approval from, or consultation with, Resideo management.

Our Board also takes an active role in ensuring we embrace “best practices” in corporate governance. The partnership and oversight of a strong and multi-faceted Board with diverse perspectives rooted in deep experience in global business, finance, technology and strategy are essential to creating long-term shareholder value.

Presented below are some highlights of our corporate governance program. You can find details about these and other corporate governance policies and practices within this Proxy Statement.

| KEY GOVERNANCE PRACTICES | ||

|

CORPORATE GOVERNANCE GUIDELINES

|

• Our Corporate Governance Guidelines have been designed to assist the Board in the exercise of its duties and responsibilities to our Company. They reflect the Board’s commitment to monitor the effectiveness of decision-making at the Board and management levels with a view to achieving our strategic objectives.

• The guidelines are reviewed annually and subject to modification by the Board at any time. | |

|

INDEPENDENT |

• Eight of our 10 directors are independent as defined by the listing standards of the NYSE. | |

|

BOARD |

• Currently, the Board has fixed the number of directors at 10.

• The Board will regularly assess its performance and can adjust the number of directors according to the needs of the Board and the Company.

• As shown under “Director Qualifications and Skills” beginning on page 7 and in the biographies of the directors beginning on page 9, our Board has a diverse mix of skills, experience and backgrounds that support our growth and commercial strategy. | |

|

2022 PROXY STATEMENT | 15 |

Table of Contents

| KEY GOVERNANCE PRACTICES | ||

|

LEAD INDEPENDENT |

• The Board has appointed Mr. Teich as Lead Independent Director. Mr. Teich possesses the attributes that the Board believes will ensure independent oversight of management. See “Board Leadership Structure” on page 17 for additional information. | |

|

BOARD |

• The Board consists of five standing committees:

• Audit,

• Compensation and Human Capital Management,

• Nominating and Governance,

• Finance, and

• Innovation and Technology.

• Each of the Audit, Compensation and Human Capital Management, and Nominating and Governance Committees is composed entirely of independent directors.

• Each Board Committee has a written charter and key Board Committee charters are reviewed and re-assessed annually.

• Each committee charter is posted and available on our Investor Relations website at investor.resideo.com. | |

|

MEMBERSHIPS ON |

• Under our Corporate Governance Guidelines, directors who serve as chief executive officers of public companies should not serve on more than three public company boards (including their own); provided, however, that solely with respect to the Company’s CEO, such CEO may not sit on more than two public company boards (including service on the Company’s Board).

• Other directors should not serve on more than five public company boards (including service on our Board). | |

|

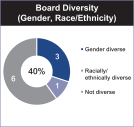

BOARD DIVERSITY |

• Three of our 10 Board members are women and one of our Board members is racially/ethnically diverse. The Nominating and Governance Committee actively considers diversity when evaluating new candidates. | |

|

ROBUST RISK OVERSIGHT |

• Our full Board is responsible for risk oversight and has designated committees to have particular oversight of certain key risks. Our Board oversees management as it fulfills its responsibilities for the assessment and mitigation of risks and for taking appropriate risks. | |

|

BOARD AND COMMITTEE |

• The Board conducts an annual self-evaluation led by the Nominating and Governance Committee to determine whether it and its committees are functioning effectively and to solicit feedback from directors as to whether the Board is continuing to evolve and be refreshed in a manner that serves the needs of the Company. | |

|

MAJORITY VOTING OF DIRECTORS |

• Our By-Laws provide for majority voting in uncontested elections of directors. Any directors standing for re-nomination to the Board must agree to submit an irrevocable resignation effective upon that director’s failure to receive a majority vote and the acceptance of the resignation by the Board. | |

|

INTEGRITY & COMPLIANCE PROGRAM |

• The Audit Committee regularly reviews the Company’s integrity and compliance program, and the Nominating and Governance Committee provides oversight of the Company’s policies related to its Code of Business Conduct.

• The Company provides several mechanisms for employees and third parties to report concerns (including anonymously), enforces a strict non-retaliation policy, and ensures prompt, thorough and objective investigations.

• All employees are required to complete integrity and compliance training, and the Company provides comprehensive training on additional key compliance topics, available in over 15 languages.

• All employees and members of the Board are subject to the Code of Business Conduct.

• Regional integrity and compliance councils meet quarterly to discuss key compliance topics and to provide feedback with regard to the integrity and compliance program. | |

| 16 | 2022 PROXY STATEMENT |

|

Table of Contents

| KEY GOVERNANCE PRACTICES | ||

|

OVERSIGHT OF ESG AND HUMAN CAPITAL |

• Our Nominating and Governance Committee oversees our role as a responsible corporate citizen, including key aspects of our ESG programs.

• Our Compensation and Human Capital Management Committee oversees our human capital management, including diversity, equity and inclusion. Management regularly reports to the committee regarding diversity, equity and inclusion initiatives, our total rewards philosophy, and our plans, policies and programs related to hiring, development and retention. | |

|

BOARD OVERSIGHT OF |

• The Nominating and Governance Committee oversees our policies and practices relating to political contributions. | |

|

SHAREHOLDER RIGHTS |

• Subject to certain terms and conditions, our By-Laws provide that shareholders who have maintained continuous qualifying ownership of at least 3% of our outstanding common stock for at least three years may use our annual meeting proxy statement to nominate a number of director candidates not to exceed the greater of two candidates or 20% of the number of directors then in office.

• Shareholders holding at least 25% of the outstanding stock of the Company have the right to call a special meeting. • We do not have a poison pill, nor do we have supermajority voting provisions. | |

|

SUCCESSION |

• Our Board oversees and annually reviews leadership development and assessment initiatives, as well as short- and long-term succession plans for the CEO and other senior management. | |

|

HEDGING AND |

• All of our directors, officers and employees are prohibited from engaging in short sales of Resideo securities and selling or purchasing puts or calls or otherwise trading in or writing options on Resideo securities and using certain financial instruments (including forward sale contracts, equity swaps, collars and exchange funds), holding securities in margin accounts or pledging Resideo securities as collateral, in each case, that are designed to hedge or offset any decrease in the market value of Resideo securities. | |

| STOCK OWNERSHIP

|

• We have meaningful stock ownership guidelines:

• CEO: 6x base salary

• Other Executive Officers: 3x base salary

• Non-employee directors: 5x annual cash retainer

• Five-year period from appointment or election to meet the ownership requirement | |

|

CLAWBACK POLICY |

• We have a clawback policy pursuant to which our Board will seek to recover excess incentive compensation paid to senior executives in the event of a material restatement of our financial results involving misconduct by the senior executive. | |

| Our Certificate of Incorporation, By-Laws, Committee Charters, Corporate Governance Guidelines and Code of Business Conduct are available on our Investor Relations website at investor.resideo.com. Paper copies of these documents can be obtained by writing to Resideo Technologies, Inc., 16100 N 71st St., Suite 550, Scottsdale, AZ 85254, Attention: Corporate Secretary. |

The Company’s current Board leadership structure consists of a non-executive Chairman of the Board, and, because the Board has determined that the Chairman is not independent, a Lead Independent Director who was appointed by the independent directors of the Board. The Board believes the current structure of separating the roles of Chairman and CEO, as well as having a Lead Independent Director, allows for alignment of corporate governance with the interests of shareholders. The Board believes that this structure allows our CEO to focus on operating and managing the Company, leverages our Chairman’s experience in guidance and oversight, and ensures overall independence of the Board through clearly defined roles and responsibilities of the Lead Independent Director. While the Board believes

|

2022 PROXY STATEMENT | 17 |

Table of Contents

that this structure currently is in the best interests of Resideo and its shareholders, it does not have a policy with respect to separating the roles of Chairman and CEO and appointing a Lead Independent Director if the Chairman is independent and could adjust the structure in the future as it deems appropriate.

Lead Independent Director

The Board has determined that Mr. Fradin, a former employee of Honeywell, may not currently be independent and has appointed Mr. Teich as the Lead Independent Director in accordance with our Corporate Governance Guidelines. In electing Mr. Teich, the independent directors of the Board considered Mr. Teich in light of the following selection criteria:

| • | Qualifies as independent, in accordance with relevant listing standards; |

| • | Able to commit the time and level of engagement required to fulfill the substantial responsibilities of the role; and |

| • | Possesses effective communication skills to facilitate discussions among members of the Board, including among the independent directors, Mr. Geldmacher and Mr. Fradin, and engage with key stakeholders. |

As the Lead Independent Director, Mr. Teich has the following duties and responsibilities:

| • | Review Board meeting agendas and Board meeting schedules to ensure there is sufficient time for discussion of all agenda items; |

| • | Provide input regarding presentation materials and other written information provided to directors for Board meetings; |

| • | Preside at all meetings at which the Chairperson is not present, including executive sessions of the independent directors; |

| • | Be available for consultation and direct communications with the Company’s shareholders; and |

| • | Perform such other duties as the Board may determine from time to time. |

Providing objective, independent judgment is at the core of the Board’s oversight function. The Nominating and Governance Committee conducts an annual review of the independence of the directors and reports its findings to the full Board. The Board has affirmatively determined that all non-employee directors, other than Mr. Fradin who is a former employee of Honeywell, satisfy the independence criteria in the applicable NYSE listing standards and SEC rules (including the enhanced criteria with respect to members of the Audit Committee and the Compensation and Human Capital Management Committee). Regarding Mr. Fradin, the Board considered that more than four years have elapsed since Mr. Fradin was employed by Honeywell, but acknowledges that other relationships described in this Proxy Statement currently suggest that Mr. Fradin may not be fully independent.

For a director to be considered independent, the Board must determine that the director does not have any material relationships with Resideo, either directly or as a partner, shareholder or officer of an organization that has a relationship with Resideo, other than as a director and shareholder. Material relationships can include vendor, supplier, consulting, legal, banking, accounting, charitable and family relationships, among others. In addition to Mr. Fradin, Mr. Geldmacher as an employee of Resideo, does not satisfy the independence criteria described below.

Criteria for Director Independence

The Board considered all relevant facts and circumstances in making its determination that all of our directors are independent other than Mr. Fradin and Mr. Geldmacher, including the following:

| • | No such director or nominee receives any direct compensation from Resideo other than under the non-employee director compensation program described beginning on page 26. |

| • | No immediate family member (within the meaning of the NYSE listing standards) of any such director or nominee is an employee of Resideo or otherwise receives direct compensation from Resideo. |

| • | No such director or nominee is affiliated with Resideo or any of its subsidiaries or affiliates. |

| 18 | 2022 PROXY STATEMENT |

|

Table of Contents

| • | No such director or nominee is an employee of Resideo’s independent accountants and no such director or nominee (or any of their respective immediate family members) is a current partner of Resideo’s independent accountants, or was within the last three years, a partner or employee of Resideo’s independent accountants and personally worked on Resideo’s audit. |

| • | No such director or nominee is a member, partner or principal of any law firm, accounting firm or investment banking firm that receives any consulting, advisory or other fees from Resideo. |

| • | No Resideo executive officer is on the compensation committee of the board of directors of a company that employs any of our non-employee directors or nominees (or any of their respective immediate family members) as an executive officer. |

| • | No such director or nominee (or any of their respective immediate family members) is indebted to Resideo, nor is Resideo indebted to any such director or nominee (or any of their respective immediate family members). |

| • | No such director or nominee serves as an executive officer of a charitable or other tax-exempt organization that received contributions from Resideo. |

| • | While a non-employee director’s or nominee’s service as an outside director of another company with which Resideo does business would generally not be expected to raise independence issues, the Board also considered those relationships and confirmed the absence of any material commercial relationships with any such company. Specifically, those commercial relationships were in the ordinary course of business for Resideo and the other companies involved and were on terms and conditions available to similarly situated customers and suppliers. |

The above information was derived from Resideo’s books and records and responses to questionnaires completed by the directors and officers in connection with the preparation of this Proxy Statement.

In assessing Dr. Yusuf’s independence, the Board considered that, in the ordinary course of business, the Company purchases products and services from IBM, Dr. Yusuf’s employer. These transactions were entered into before Dr. Yusuf joined the Board, and he has no personal involvement in them, nor does he derive any material benefit from them. The amounts involved are immaterial to both the Company and IBM.

Our Board consists of five standing Committees: Audit, Compensation and Human Capital Management, Nominating and Governance, Finance and Innovation and Technology. The Board has adopted written charters for each Committee, which are available on our Investor Relations website at investor.resideo.com. All Board members are invited to attend the meetings of each Committee, except as restricted by independence standards.

The following table sets forth the Board Committees and the current members of each of the Committees.

|

|

Independent | Audit | Compensation and Human Capital Management |

Nominating and Governance |

Finance | Innovation and Technology | ||||||

| Roger Fradin |

|

|

|

|

Member | Member | ||||||

| Jay Geldmacher |

|

|

|

|

|

| ||||||

| Paul Deninger |

|

Member |

|

|

Chair | Member | ||||||

| Cynthia Hostetler |

|

|

|

Member | Member |

| ||||||

| Brian Kushner |

|

Member |

|

|

Member | Member | ||||||

| Jack Lazar |

|

Chair |

|

|

|

Member | ||||||

| Nina Richardson |

|

|

Member | Chair |

|

| ||||||

| Andrew Teich |

|

|

Member | Member |

|

Chair | ||||||

| Sharon Wienbar |

|

|

Chair | Member |

|

| ||||||

| Kareem Yusuf |

|

|

Member |

|

|

Member | ||||||

| 2021 Meetings |

|

5 | 5 | 6 | 8 | 4 | ||||||

|

2022 PROXY STATEMENT | 19 |

Table of Contents

Each of the Audit, Compensation and Human Capital Management and Nominating and Governance Committees consists solely of directors who have been determined by the Board to be independent in accordance with SEC regulations, NYSE listing standards and the Company’s director independence standards (including the heightened independence standards and considerations for members of the Audit and Compensation and Human Capital Management Committees).

| COMMITTEE |

RESPONSIBILITIES | |

| AUDIT COMMITTEE

Jack Lazar, Chair Paul Deninger Brian Kushner |

• Appoint and recommend to the shareholders for approval the firm to be engaged as the Company’s independent auditor and be directly responsible for the compensation, retention and oversight of the independent auditor, including the resolution of disagreements between management and the independent auditor regarding financial reporting; • Review the results of each external audit and other matters related to the conduct of the audit and advise the Board on whether it recommends that the audited financial statements be included in the Annual Report on Form 10-K; • Review with management and the independent auditors, prior to filing, the interim financial results to be included in quarterly reports on Form 10-Q; • Review and discuss with the independent auditors any identified critical audit matters; • Evaluate the independent auditor’s performance at least annually; • Approve all non-audit engagements with the independent auditor; • Review reports of the independent auditor and the chief internal auditor related to the adequacy of the Company’s internal accounting controls, disclosure processes and its procedures designed to ensure compliance with laws and regulations; • Consider and review, in consultation with the independent auditor and the chief internal auditor, the scope and plan for forthcoming external and internal audits; • Review annually the performance of the internal audit group; • Review management’s assessment of the effectiveness of the Company’s internal control over financial reporting; • Review, approve and establish procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls, auditing matters and for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters or other legal, ethical, reputational or regulatory concerns; • Produce the annual Report of the Audit Committee included in the Proxy Statement; and • Oversee major financial risks and enterprise exposures and risk assessment and risk management policies. | |

|

Each member of the Audit Committee is an independent director under applicable SEC rules and NYSE listing standards and is “financially literate” under NYSE listing standards. The Board has determined that Messrs. Lazar, Deninger and Kushner each qualify as an “audit committee financial expert” under applicable SEC rules. In addition to Resideo, Mr. Lazar serves on the audit committee of three other public reporting companies. The Board has determined that Mr. Lazar’s simultaneous service on these other boards does not impair his ability to serve effectively on the Company’s Audit Committee.

| ||

| COMPENSATION AND HUMAN CAPITAL MANAGEMENT COMMITTEE

Sharon Wienbar, Chair Nina Richardson Andrew Teich Kareem Yusuf |

• Review and approve the corporate goals and objectives relevant to the compensation of the CEO, evaluate the CEO’s performance relative to these goals and objectives and determine and approve the CEO’s compensation level; • Review and approve the annual salary and other remuneration of the executive officers; • Periodically review the operation and structure of the Company’s compensation programs; • Review proposals for and determine total share usage under the Company’s equity compensation programs; • Oversee the Company’s plans, policies and programs related to hiring, development and retention of talent; • Review or take such action in connection with the bonus, stock, retirement and other benefit plans of the Company and its subsidiaries; • Establish and review annual stock ownership guidelines applicable to directors and senior management; • Review and discuss with management the Compensation Discussion and Analysis and other executive compensation disclosure included in the Proxy Statement; • Assist the Board in oversight of the Company’s policies and strategies relating to human capital management, including diversity, equity and inclusion; • Produce the annual Compensation and Human Capital Management Committee Report included in the Proxy Statement; and • Exercise sole authority to retain and terminate a compensation consultant, as well as to approve the consultant’s fees and other terms of engagement. See “Oversight of Compensation Consultant” on page 21 regarding the Compensation and Human Capital Management Committee’s engagement of a compensation consultant. | |

|

The Compensation and Human Capital Management Committee may form and delegate its authority to subcommittees and management, when appropriate, including delegation to the CEO to determine and approve annual incentive and long-term incentive awards for non-executive employees of the Company as prescribed by the Compensation and Human Capital Management Committee. For more information on the responsibilities and activities of the Compensation and Human Capital Management Committee, including its processes for determining executive compensation, see “Compensation Discussion and Analysis” beginning on page 38. | ||

| 20 | 2022 PROXY STATEMENT |

|

Table of Contents

| COMMITTEE |

RESPONSIBILITIES | |

|

NOMINATING AND GOVERNANCE COMMITTEE

Nina Richardson, Chair Cynthia Hostetler Andrew Teich Sharon Wienbar |

• Make recommendations to the Board concerning size, composition and organization of the Board, qualifications and criteria for election to the Board, nominees to be proposed by the Company for election to the Board, retirement from the Board, whether to accept any resignation tendered by a director and Board Committee assignments; • Actively seek individuals qualified to become Board members and recommend them to the full Board for consideration, including evaluating all potential candidates, including those suggested or nominated by third parties; • Consider director candidates holistically to ensure a diversity of perspectives, taking into consideration factors such as skills, experience, gender, ethnicity, race, nationality and age; • Make recommendations to the Board on the disclosures in the Proxy Statement on director independence, governance and director nomination matters; • Oversee the Company’s new director orientation program and continuing education program for incumbent directors; • Review and reassess the adequacy of the Company’s Corporate Governance Guidelines; • Oversee and report to the Board on the Company’s compliance with its programs relating to the Code of Business Conduct; • Oversee and report to the Board on the Company’s role as a responsible corporate citizen, including its ESG programs; and • Oversee the annual performance review of the Board and its Committees.

| |

| FINANCE COMMITTEE

Paul Deninger, Chair Roger Fradin Cynthia Hostetler Brian Kushner |

• Review matters related to the Company’s capital structure and allocation, financial condition, leverage and financial strategies, interest rate risk, expense management, strategic investments and dispositions such as significant mergers, acquisitions, divestitures, joint ventures, real estate purchases and other debt and equity investments; • Consider, review and recommend to the Board any Company dividend and share repurchase policies and programs; • Approve the Company’s derivatives and hedging policies and strategies for managing interest rate and foreign exchange rate exposure; • Review the Company’s investment policies and practices, credit ratings and ratings strategy; • Review the Company’s investor relations strategy; and • Review the types of information to be disclosed in connection with earnings releases and earnings guidance provided to analysts and rating agencies.

| |

|

INNOVATION AND TECHNOLOGY COMMITTEE

Andrew Teich, Chair Paul Deninger Roger Fradin Brian Kushner Jack Lazar Kareem Yusuf |

• Facilitate the Board’s oversight, review, discussion and understanding of the Company’s major technology and innovation strategies and plans in the following key areas: – investments in technology and software; – development and execution of technology strategies; – overall strategy, effectiveness and risk profile of its product technology and software cybersecurity programs; – technology trends with significant impacts on the Company’s business; and – research and development operations. | |

Compensation and Human Capital Management Committee Matters

Compensation and Human Capital Management Committee Interlocks and Insider Participation

No current member of the Compensation and Human Capital Management Committee has served as one of our officers or employees at any time. None of our executive officers serves as a member of the compensation committee of any other company that has an executive officer serving as a member of our Compensation and Human Capital Management Committee or Board.

Oversight of Compensation Consultant

The Compensation and Human Capital Management Committee has sole authority to retain a compensation consultant to assist the Compensation and Human Capital Management Committee in the evaluation of director, CEO or senior management compensation, but only after considering all factors relevant to the consultant’s independence from management. In addition, the Compensation and Human Capital Management Committee is directly responsible for approving the consultant’s compensation, evaluating its performance and terminating its engagement.

|

2022 PROXY STATEMENT | 21 |

Table of Contents

The Compensation and Human Capital Management Committee has retained Frederic W. Cook & Co. (“FW Cook”) as its independent compensation consultant to assist the Compensation and Human Capital Management Committee with the design of our executive compensation programs as well as to provide objective advice on compensation practices and the competitive landscape for the compensation of Resideo’s executive officers. FW Cook reports to the Compensation and Human Capital Management Committee, has direct access to Compensation and Human Capital Management Committee members, interacts with Resideo management when necessary and appropriate and attends Compensation and Human Capital Management Committee meetings either in person or by telephone. FW Cook provides services only to the Compensation and Human Capital Management Committee as an independent consultant and does not have any other consulting engagements with, or provide any other services to, Resideo, other than assisting Resideo’s human resources department by providing and reviewing market data. The independence of FW Cook has been assessed according to factors stipulated by the SEC and the Compensation and Human Capital Management Committee concluded that no conflict of interest exists that would prevent FW Cook from independently advising the Compensation and Human Capital Management Committee.

FW Cook compiles information and provides advice regarding the components and mix (short-term/long-term; fixed/variable; cash/equity) of the executive compensation programs of Resideo and its peer group (see page 40 for further details regarding the compensation peer group) and analyzes the relative performance of Resideo and the compensation peer group with respect to the financial metrics generally used in the programs. FW Cook also provides information regarding emerging trends and best practices in executive compensation.

Compensation Input from Senior Management