0001739942DEF 14AFALSE00017399422023-01-012023-12-31iso4217:USD00017399422022-01-012022-12-3100017399422021-01-012021-12-3100017399422020-01-012020-12-310001739942swi:KevinBThompsonMember2020-01-012020-12-310001739942swi:SudhakarRamakrishnaMember2021-01-012021-12-310001739942swi:SudhakarRamakrishnaMember2022-01-012022-12-310001739942swi:SudhakarRamakrishnaMember2023-01-012023-12-310001739942swi:KevinBThompsonMemberswi:AdjustmentGrantDateFairValueOfStockAwardsAndOptionAwardsGrantedInFiscalYearMember2020-01-012020-12-310001739942swi:SudhakarRamakrishnaMemberswi:AdjustmentGrantDateFairValueOfStockAwardsAndOptionAwardsGrantedInFiscalYearMember2021-01-012021-12-310001739942swi:SudhakarRamakrishnaMemberswi:AdjustmentGrantDateFairValueOfStockAwardsAndOptionAwardsGrantedInFiscalYearMember2022-01-012022-12-310001739942swi:SudhakarRamakrishnaMemberswi:AdjustmentGrantDateFairValueOfStockAwardsAndOptionAwardsGrantedInFiscalYearMember2023-01-012023-12-310001739942swi:AdjustmentFairValueAtFiscalYearEndOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInFiscalYearMemberswi:KevinBThompsonMember2020-01-012020-12-310001739942swi:AdjustmentFairValueAtFiscalYearEndOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInFiscalYearMemberswi:SudhakarRamakrishnaMember2021-01-012021-12-310001739942swi:AdjustmentFairValueAtFiscalYearEndOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInFiscalYearMemberswi:SudhakarRamakrishnaMember2022-01-012022-12-310001739942swi:AdjustmentFairValueAtFiscalYearEndOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInFiscalYearMemberswi:SudhakarRamakrishnaMember2023-01-012023-12-310001739942swi:AdjustmentChangeInFairValueOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsMemberswi:KevinBThompsonMember2020-01-012020-12-310001739942swi:AdjustmentChangeInFairValueOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsMemberswi:SudhakarRamakrishnaMember2021-01-012021-12-310001739942swi:AdjustmentChangeInFairValueOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsMemberswi:SudhakarRamakrishnaMember2022-01-012022-12-310001739942swi:AdjustmentChangeInFairValueOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsMemberswi:SudhakarRamakrishnaMember2023-01-012023-12-310001739942swi:KevinBThompsonMemberswi:AdjustmentFairValueAtVestingOfStockAwardsAndOptionAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2020-01-012020-12-310001739942swi:SudhakarRamakrishnaMemberswi:AdjustmentFairValueAtVestingOfStockAwardsAndOptionAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2021-01-012021-12-310001739942swi:SudhakarRamakrishnaMemberswi:AdjustmentFairValueAtVestingOfStockAwardsAndOptionAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2022-01-012022-12-310001739942swi:SudhakarRamakrishnaMemberswi:AdjustmentFairValueAtVestingOfStockAwardsAndOptionAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2023-01-012023-12-310001739942swi:AdjustmentChangeInFairValueAsOfVestingDateOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMemberswi:KevinBThompsonMember2020-01-012020-12-310001739942swi:AdjustmentChangeInFairValueAsOfVestingDateOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMemberswi:SudhakarRamakrishnaMember2021-01-012021-12-310001739942swi:AdjustmentChangeInFairValueAsOfVestingDateOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMemberswi:SudhakarRamakrishnaMember2022-01-012022-12-310001739942swi:AdjustmentChangeInFairValueAsOfVestingDateOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMemberswi:SudhakarRamakrishnaMember2023-01-012023-12-310001739942swi:AdjustmentFairValueAsOfPriorFiscalYearEndOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMemberswi:KevinBThompsonMember2020-01-012020-12-310001739942swi:AdjustmentFairValueAsOfPriorFiscalYearEndOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMemberswi:SudhakarRamakrishnaMember2021-01-012021-12-310001739942swi:AdjustmentFairValueAsOfPriorFiscalYearEndOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMemberswi:SudhakarRamakrishnaMember2022-01-012022-12-310001739942swi:AdjustmentFairValueAsOfPriorFiscalYearEndOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMemberswi:SudhakarRamakrishnaMember2023-01-012023-12-310001739942swi:AdjustmentGrantDateFairValueOfStockAwardsAndOptionAwardsGrantedInFiscalYearMember2020-01-012020-12-310001739942swi:AdjustmentGrantDateFairValueOfStockAwardsAndOptionAwardsGrantedInFiscalYearMember2021-01-012021-12-310001739942swi:AdjustmentGrantDateFairValueOfStockAwardsAndOptionAwardsGrantedInFiscalYearMember2022-01-012022-12-310001739942swi:AdjustmentGrantDateFairValueOfStockAwardsAndOptionAwardsGrantedInFiscalYearMember2023-01-012023-12-310001739942swi:AdjustmentFairValueAtFiscalYearEndOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInFiscalYearMember2020-01-012020-12-310001739942swi:AdjustmentFairValueAtFiscalYearEndOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInFiscalYearMember2021-01-012021-12-310001739942swi:AdjustmentFairValueAtFiscalYearEndOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInFiscalYearMember2022-01-012022-12-310001739942swi:AdjustmentFairValueAtFiscalYearEndOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInFiscalYearMember2023-01-012023-12-310001739942swi:AdjustmentChangeInFairValueOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsMember2020-01-012020-12-310001739942swi:AdjustmentChangeInFairValueOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsMember2021-01-012021-12-310001739942swi:AdjustmentChangeInFairValueOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsMember2022-01-012022-12-310001739942swi:AdjustmentChangeInFairValueOfOutstandingAndUnvestedStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsMember2023-01-012023-12-310001739942swi:AdjustmentFairValueAtVestingOfStockAwardsAndOptionAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2020-01-012020-12-310001739942swi:AdjustmentFairValueAtVestingOfStockAwardsAndOptionAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2021-01-012021-12-310001739942swi:AdjustmentFairValueAtVestingOfStockAwardsAndOptionAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2022-01-012022-12-310001739942swi:AdjustmentFairValueAtVestingOfStockAwardsAndOptionAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2023-01-012023-12-310001739942swi:AdjustmentChangeInFairValueAsOfVestingDateOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMember2020-01-012020-12-310001739942swi:AdjustmentChangeInFairValueAsOfVestingDateOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMember2021-01-012021-12-310001739942swi:AdjustmentChangeInFairValueAsOfVestingDateOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMember2022-01-012022-12-310001739942swi:AdjustmentChangeInFairValueAsOfVestingDateOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMember2023-01-012023-12-310001739942swi:AdjustmentFairValueAsOfPriorFiscalYearEndOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMember2020-01-012020-12-310001739942swi:AdjustmentFairValueAsOfPriorFiscalYearEndOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMember2021-01-012021-12-310001739942swi:AdjustmentFairValueAsOfPriorFiscalYearEndOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMember2022-01-012022-12-310001739942swi:AdjustmentFairValueAsOfPriorFiscalYearEndOfStockAwardsAndOptionAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMember2023-01-012023-12-31000173994212023-01-012023-12-31000173994222023-01-012023-12-31000173994232023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | |

¨

| Preliminary Proxy Statement |

| | | | | |

¨

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | | | |

| ý | Definitive Proxy Statement |

| | | | | |

¨

| Definitive Additional Materials |

| | | | | |

¨

| Soliciting Material under §240.14a-12 |

SOLARWINDS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| ¨ | Fee paid previously with preliminary materials. |

| | | | | |

| ¨ | Fee computed on table in exhibit required by Item 25(b) Per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Dear Stockholders:

2023 was a positive year for us in a tough macro environment. Our mission of helping customers accelerate their business transformations in an increasingly hybrid world through our simple, powerful, secure solutions has served us well and has enabled us to participate in a growing market.

Strong financial performance and foundation

Our 2023 financial performance was a testament to the relevance of our solutions and the resiliency of our business model. We increased our recurring revenue, continued to maintain strong margins and excellent customer retention, and delivered compelling product and service offerings, introducing new capabilities in observability, database, and enterprise service management solutions. These solutions aim to reduce complexity, improve productivity, and lower costs in customer’s multi-cloud and hybrid environments. We believe our efforts in 2023 serve as a strong foundation from which we can continue to deliver customer success and growth in our business.

Macro challenges persist but we are committed to our purpose

Despite the continuing war in Europe, conflict in the Middle East, emerging pressures in energy and infrastructure as cloud migrations and artificial intelligence (AI) demand accelerate, increasingly stringent regulations across industries, security professional shortages, and continued human capital pressures, we remained resolute in our purpose of enriching the lives of the people we serve—our employees, customers, partners, and community.

As we celebrate 25 years at SolarWinds, we see these challenges as opportunities to provide greater value to our customers. We continue to hear from customers of their needs to have greater visibility in hybrid and multi-cloud environments, faster time to detect and resolve issues all while reducing their costs. While there are different observability solutions rooted in various vendors’ legacy (APM, logging, infrastructure etc.) offerings, customers need full-stack observability and enterprise service management to experience best time to value (TTV), time to detect (TTD) and time to remediate (TTR) issues. Our solutions are intended to address our customers’ growing and complex needs with simple, powerful, secure solutions.

Accelerating SolarWinds platform and solution capabilities

The SolarWinds Platform is the basis for all innovation at SolarWinds. Following the launch of our observability offerings in 2022, we continued to enhance and enrich with AI and machine learning (ML). Our approach aims to deliver integrated visibility regardless of deployment model—while helping prevent potential issues from ever becoming problems. We aim to deliver the best time to value while reducing the time to detect and remediate issues with simple and advanced AI-powered solutions.

Beyond delivering a more modern and complete definition of observability to the market, and through more flexible deployment options, we meet our customers where they are today and support them as their needs evolve. This flexibility allows them to future-proof their observability investments while consolidating fragmented tools and vendors on a platform built to take them where they need to grow—without the need to rip and replace or re-platform.

The SolarWinds Platform is also the foundation for our world-class database performance monitoring and enterprise service management solutions. By unifying observability, database performance, and service management on the SolarWinds Platform, we believe we are establishing a strong foundation to deliver great customer value for years to come.

Customer centricity and community

Since our beginning a quarter of a century ago, we have remained committed to open and ongoing communication with our customers. Whether by engaging with them in our THWACK community of more than 195,000 registered members, meeting with them at industry events and SolarWinds User Groups (SWUGs) or chatting in one of our SolarWinds Day virtual events or at THWACKcamp, the conversations we have with our users continue to power the products we build, the innovations we deliver, and the successes we achieve.

As part of our ongoing efforts to achieve an even stronger growth and profitability profile, we expect to take the following actions in 2024:

•Accelerate our observability offerings to provide world-class flexibility and value to customers seeking to close visibility gaps across their hybrid infrastructure;

•Continue our focus on customer success and retention;

•Streamline our unique high-velocity GTM motion while continuing to expand and nurture our enterprise and partner (channels, GSIs, MSPs, CSPs) motions.

•Continue our Secure-by-Design (SBD) initiatives that we launched in 2021 and proliferate best practices in support of our customers and broader communities;

•Continue our People Success initiatives to attract and nurture talent to help accelerate business growth; and

•Continue balancing growth and profitability.

Well-positioned to capture future growth opportunities

As we look to 2024, we believe our customers’ environments will only continue to deepen in complexity while their budgets fail to keep pace. Customers crave value from solutions designed to improve their productivity, lower their costs, and do so securely. We believe we are the best suited to offer them the most comprehensive solutions to achieve these goals while targeting strong growth across all financial metrics.

Every day, our dedicated and talented team works to provide customers with simple, powerful, secure solutions to address the challenges of today’s hybrid and multi-cloud world. I remain very optimistic about our future.

We thank you for your continued support of SolarWinds.

Sudhakar Ramakrishna

SolarWinds Corporation

7171 Southwest Parkway

Building 400

Austin, Texas 78735

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 23, 2024

To the Stockholders of SolarWinds Corporation:

The annual meeting of stockholders for SolarWinds Corporation will be held on Thursday, May 23, 2024 at 9:00 a.m. Central Time. The annual meeting of stockholders will be a completely “virtual” meeting. You will be able to attend the meeting, as well as vote and submit your questions during the live webcast of the meeting, by visiting www.virtualshareholdermeeting.com/SWI2024 and entering the company number and control number included on your proxy card or in the instructions that accompany your proxy materials.

The purposes of the meeting are:

| | | | | |

| 1. | To elect three Class III directors named in the accompanying proxy statement (Proposal One); |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal Two); |

| 3. | To vote on a non-binding advisory basis to approve the compensation of our named executive officers (Proposal Three); and |

| 4. | To transact such other business as may properly come before the annual meeting. |

Our board of directors has fixed the close of business on March 28, 2024 as the record date for determining holders of our common stock entitled to notice of, and to vote at, the annual meeting or any adjournments or postponements thereof. This notice of annual meeting of stockholders and accompanying proxy statement are being distributed or made available to stockholders beginning on or about April 11, 2024.

YOUR VOTE IS IMPORTANT!

Whether or not you expect to attend the meeting, please promptly vote your shares either over the Internet, by telephone, or by mail so that your shares may be represented at the meeting.

| | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 23, 2024 AT 9:00 A.M. CENTRAL TIME IN A LIVE WEBCAST AT www.virtualshareholdermeeting.com/SWI2024: THIS PROXY STATEMENT AND 2023 ANNUAL REPORT ARE AVAILABLE AT www.proxyvote.com. |

By order of the Board of Directors,

Sudhakar Ramakrishna

President, Chief Executive Officer and Director

Austin, Texas

Date: April 11, 2024

SolarWinds Corporation

Proxy Statement

For the Annual Meeting of Stockholders

To Be Held on May 23, 2024

TABLE OF CONTENTS

Cautionary Statement Regarding Forward-Looking Statements

Certain statements in this proxy statement are, or may be considered, forward-looking statements for purposes of the Private Securities Litigation Reform Act of 1995. The words "believe," "expect," "anticipate," "project" and similar expressions and uses of future or conditional verbs, generally identify forward-looking statements. Forward-looking statements include those in the Commitment to Sustainability and Executive Compensation sections of this proxy statement, among others. SolarWinds cautions that these forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those expressed or implied in the forward-looking statements. Information about the economic, competitive, governmental, technological and other factors that may affect SolarWinds’ operations and future results is set forth in Item 1A, "Risk Factors," of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, which has been filed with the Securities and Exchange Commission, as updated by its Quarterly Reports on Form 10-Q and in other documents that SolarWinds subsequently files with the Securities and Exchange Commission that update, supplement or supersede such information. SolarWinds undertakes no obligation, and specifically declines, to release publicly any revisions to forward-looking statements as a result of subsequent events or developments, except as required by law.

SOLARWINDS CORPORATION

7171 Southwest Parkway

Building 400

Austin, Texas 78735

(512) 682-9300

PROXY STATEMENT

FOR THE

2024 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement is furnished in connection with the solicitation of proxies to be voted at our annual meeting of stockholders, which will be held virtually at www.virtualshareholdermeeting.com/SWI2024 on Thursday, May 23, 2024 at 9:00 a.m. Central Time. On April 11, 2024, we began mailing to stockholders of record a Notice of Internet Availability of Proxy Materials, or Notice, or a full set of the proxy materials for our annual meeting, including this proxy statement, our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, or the 2023 Annual Report on Form 10-K, and an accompanying proxy card.

In this proxy statement, “Company,” “we,” “us” and “our” refer to SolarWinds Corporation and its consolidated subsidiaries. The term “Silver Lake Funds” refers to Silver Lake Partners IV, L.P., Silver Lake Technology Investors IV, L.P., and SLP Aurora Co-Invest, L.P., and the term “Silver Lake” refers to Silver Lake Group, L.L.C., the ultimate general partner of the Silver Lake Funds. The term “Thoma Bravo Funds” refers to Thoma Bravo Fund XI, L.P., Thoma Bravo Fund XI-A, L.P., Thoma Bravo Fund XII, L.P., Thoma Bravo Fund XII-A, L.P., Thoma Bravo Executive Fund XI, L.P., Thoma Bravo Executive Fund XII, L.P., Thoma Bravo Executive Fund XII-A, L.P., Thoma Bravo Special Opportunities Fund II, L.P. and Thoma Bravo Special Opportunities Fund II-A, L.P., and the term “Thoma Bravo” refers to Thoma Bravo UGP, LLC, the ultimate general partner of the Thoma Bravo Funds, and, unless the context otherwise requires, its affiliated entities, including Thoma Bravo, L.P., the management company of the Thoma Bravo Funds. The term “Sponsors” refers collectively to Silver Lake and Thoma Bravo, together with the Silver Lake Funds and the Thoma Bravo Funds.

Why am I receiving these materials?

You have received these proxy materials because our board of directors, or Board, is soliciting your proxy to vote your shares at the annual meeting of stockholders. You are invited to attend the annual meeting (which will take place through a live webcast, by visiting www.virtualshareholdermeeting.com/SWI2024) to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting through the webcast to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to vote by proxy over the telephone or through the Internet prior to the annual meeting.

Why did I receive a Notice of Internet Availability of Proxy Materials in the mail instead of a printed set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission, or SEC, we are permitted to furnish our proxy materials to our stockholders over the Internet by delivering the Notice in the mail to notify our stockholders that such materials are available. As a result, most of our stockholders have not been provided a printed copy of the proxy materials in the mail. Instead, the Notice instructs you on how to access and review the proxy statement and the 2023 Annual Report on Form 10-K over the Internet at www.proxyvote.com. The Notice also instructs you on how you may submit your proxy over the Internet. If you would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting these materials contained in the Notice.

How can I attend the annual meeting?

The meeting will be held virtually on Thursday, May 23, 2024 at 9:00 a.m. Central Time, through a live webcast on the website www.virtualshareholdermeeting.com/SWI2024. You will need to enter the company number and the control number included on your proxy card or in the instructions that accompany your proxy materials to enter the virtual meeting.

Why are we holding the annual meeting virtually?

We are excited to be using the latest technology to provide expanded access, improved communication and cost savings for our stockholders while providing stockholders the same rights and opportunities to participate as they would have at an in-person meeting. Furthermore, we believe that hosting a virtual meeting is in the best interests of the Company and its stockholders since it enables increased stockholder attendance and participation because stockholders can participate from any location around the world.

Who is entitled to vote?

Holders of our common stock at the close of business on March 28, 2024 are entitled to vote. We refer to March 28, 2024 in this proxy statement as the “record date.”

To how many votes is each share of common stock entitled?

Holders of common stock are entitled to one vote per share. On the record date, there were 168,161,987 shares of our common stock outstanding and entitled to vote.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with the Company’s transfer agent, Equiniti Trust Company, LLC, you are considered, with respect to those shares, to be a “stockholder of record.” The Notice or a printed copy of our proxy materials has been or will be sent directly to you.

If your shares are held in a brokerage account or by a bank or other holder of record, then your shares are held in “street name” and you are considered the “beneficial owner” of those shares. In this case, the Notice or a printed copy of our proxy materials has been or will be sent to you by your bank, broker or other holder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote the shares in your account. You are also invited to attend the annual meeting via live webcast on the website: www.virtualshareholdermeeting.com/SWI2024. However, since you are not the stockholder of record, you may not vote your shares at the meeting unless you request and obtain a valid proxy from your broker, bank or other holder of record.

How do I vote?

If you are a stockholder of record, you may vote at the annual meeting, vote by proxy using the enclosed proxy card and return envelope, or vote by proxy over the telephone or through the Internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting via webcast, even if you have already voted by proxy.

•By Internet. To vote by proxy through the Internet, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number included on the enclosed proxy card. To be counted, we must receive your vote by 11:59 p.m. Eastern Time on May 22, 2024, the day prior to the annual meeting.

•By telephone. To vote by proxy over the telephone, dial toll-free, 1-800-690-6903, using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number included on the enclosed proxy card. To be counted, we must receive your vote by 11:59 p.m. Eastern Time on May 22, 2024, the day prior to the annual meeting.

•By mail. To vote using the enclosed proxy card, simply complete, sign, date, and return it promptly in the envelope provided. To be counted, we must receive your signed proxy card by 11:59 p.m. Eastern Time on May 22, 2024, the day prior to the annual meeting.

•At the annual meeting. To vote virtually during the live webcast of the annual meeting, please follow the instructions for attending and voting at the annual meeting posted at www.virtualshareholdermeeting.com/SWI2024. You will need the company number and control number included on the enclosed proxy card. All votes must be received by the inspectors of election appointed for the meeting before the polls close at the annual meeting.

If you hold shares in street name through a bank, broker or other holder of record, please refer to the Notice or other information forwarded by your bank, broker or other holder of record to see which voting options are available to you. To vote virtually during the live webcast of the annual meeting, you must obtain a valid proxy from your bank, broker or other holder of record. Follow the instructions from your bank, broker or other holder of record, included with these proxy materials, or contact your bank, broker or other holder of record to request a proxy form.

Can I ask questions at the annual meeting?

Yes. You will be afforded the opportunity to participate in the annual meeting by asking questions via the Internet at www.virtualshareholdermeeting.com/SWI2024. Through the online forum, you will be able to submit questions in writing in advance of the day of the annual meeting, vote and obtain copies of the proxy materials. You will also be able to submit questions live during the annual meeting. In order to submit questions via the online forum, you will need your company number and control number included

on your proxy card or in the instructions that accompany your proxy materials. As part of the annual meeting, we will hold a Q&A session, during which we intend to answer pertinent questions submitted both live and prior to the annual meeting, as time permits.

What if during the check-in time or during the annual meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call the technical support number that will be posted on the annual meeting login page.

What if I change my mind after I return my proxy?

You may revoke your proxy and change your vote at any time before the polls close at the annual meeting. If you are a record holder, you may do this by:

•submitting a subsequent proxy by using the Internet, by telephone or by mail with a later date;

•sending a timely written notice of revocation to Corporate Secretary, SolarWinds Corporation, 7171 Southwest Parkway, Building 400, Austin, Texas 78735; or

•attending the annual meeting and voting virtually during the live webcast.

If you hold shares in street name, you may do this by:

•submitting new voting instructions in the manner provided by your bank, broker or other holder of record; or

•obtaining a “legal proxy” from your bank, broker or other holder of record in order to vote your shares virtually at the annual meeting.

Please note that simply attending the meeting will not, by itself, revoke your proxy.

How many votes are needed to hold the annual meeting?

The presence, in person or by proxy, of the holders of a majority of the votes entitled to be cast at the annual meeting will constitute a quorum. If a quorum is present, we can hold the annual meeting and conduct business. If a quorum is not present, we may adjourn the annual meeting to solicit additional proxies.

On what items am I voting?

You are being asked to vote on three items:

•the election of three Class III directors nominated by the Board and named in the proxy statement to serve a term of three years until our 2027 annual meeting of stockholders (Proposal One);

•the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal Two); and

•the approval, on a non-binding advisory basis, of the compensation of our named executive officers (Proposal Three).

No cumulative voting rights are authorized, and dissenters’ rights are not applicable to these matters.

How may I vote for the nominees for director, and how many votes must the nominees receive to be elected?

With respect to the election of each of the nominees for director, you may:

•vote FOR the election of the director nominee; or

•vote WITHHOLD with respect to the election of the director nominee.

The three nominees for director receiving the most FOR votes shall be elected to the Board. A properly executed proxy marked WITHHOLD as to the election of one or more directors will not be voted with respect to the director or directors indicated. Abstentions and broker non-votes are not votes cast and will not be counted in determining the outcome of the election of directors.

What happens if a nominee is unable or unwilling to stand for election?

If a nominee is unable or unwilling for good cause to stand for election, the Board may either:

•reduce the number of directors that serve on the Board; or

•designate a substitute nominee.

If the Board designates a substitute nominee, shares represented by proxies voted for the nominee who is unable to stand for election or unwilling for good cause will be voted for the substitute nominee.

How may I vote for the ratification of the appointment of our independent registered public accounting firm, and how many votes must the proposal receive to pass?

With respect to the proposal to ratify the appointment of our independent registered public accounting firm, you may:

•vote FOR the proposal;

•vote AGAINST the proposal; or

•ABSTAIN from voting on the proposal.

The ratification of the appointment of our independent registered public accounting firm must receive the affirmative vote of a majority of the shares of our common stock represented in person or by proxy at the annual meeting and entitled to vote on the proposal. If you abstain from voting on the proposal, it will have the same effect as a vote against the proposal. Because the approval of this proposal is a routine matter on which a broker is generally empowered to vote, if you do not submit voting instructions, your broker may exercise its discretion to vote your shares on this proposal.

How may I vote on the proposal to approve, on a non-binding advisory basis, the compensation of our named executive officers, and how many votes must the proposal receive to pass?

With respect to the proposal to approve, on a non-binding advisory basis, the compensation of our named executive officers, you may:

•vote FOR the proposal;

•vote AGAINST the proposal; or

•ABSTAIN from voting on the proposal.

The approval of the compensation of our named executive officers must receive the affirmative vote of a majority of the shares of our common stock represented in person or by proxy at the annual meeting and entitled to vote on the proposal. If you abstain from voting on the proposal, it will have the same effect as a vote against the proposal. Broker non-votes are not votes cast and will not be counted in determining the outcome of this proposal.

How does the Board recommend that I vote?

The Board recommends a vote:

•FOR each of the director nominees;

•FOR the ratification of the appointment of our independent registered public accounting firm; and

•FOR the approval, on a non-binding advisory basis, of the compensation of our named executive officers.

What happens if I do not give specific voting instructions?

If you either:

•indicate when voting on the Internet or by telephone that you wish to vote as recommended by the Board; or

•sign and return a proxy card without giving specific voting instructions,

then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the annual meeting. See the section entitled “Other Matters” below.

If I hold my shares in a brokerage account, what happens if I do not provide voting instructions to my broker?

If your shares are held in street name through a broker and you do not provide voting instructions to your broker, your broker will have discretion to vote your shares only on “routine matters,” such as the ratification of the appointment of our independent registered public accounting firm described in Proposal Two. Proposal One and Proposal Three in this proxy statement are considered “non-routine matters.” If the broker that holds your shares does not receive instructions from you on how to vote your shares, your broker will not have the authority to vote your shares on Proposal One and Proposal Three. Therefore, if you do not submit voting instructions, your broker may exercise its discretion to vote your shares on Proposal Two and your shares will constitute “broker non-votes” with respect to Proposal One and Proposal Three and will have no effect on the election of directors or the non-binding advisory vote on our named executive officers' compensation.

We encourage you to provide instructions to your brokerage firm through one of the voting methods they have provided. This action ensures your shares will be voted at the meeting in accordance with your wishes.

I share an address with another stockholder and we received only one paper copy of the proxy materials. How may I obtain a separate copy of the proxy materials?

We have adopted a procedure, approved by the SEC, called “householding.” Under this procedure, if you have elected to receive a full set of the proxy materials by mail, we deliver a single copy of this proxy statement and the 2023 Annual Report on Form 10-K, to stockholders of record who have the same address unless we are notified that one or more of these stockholders wishes to receive individual copies. This procedure reduces our printing costs and postage fees.

If you participate in householding, upon oral or written request, we will deliver promptly a separate copy of the proxy materials to a stockholder at a shared address to which a single copy of proxy materials was delivered. If you wish to receive a separate copy of this proxy statement and the 2023 Annual Report on Form 10-K, or if you do not wish to continue to participate in householding and prefer to receive separate copies of these documents in the future, please contact the Householding Department of Broadridge Financial Solutions, Inc. at 51 Mercedes Way, Edgewood, New York 11717; or by telephone

at 1-866-540-7095. If you are eligible for householding, but you and other stockholders of record with whom you share an address currently receive multiple copies of this proxy statement and the 2023 Annual Report on Form 10-K, or if you hold our common stock in more than one account, and in either case you wish to receive only a single copy of each of these documents for your household, please contact Broadridge Financial Solutions, Inc. as indicated above.

If your shares are held in street name through a broker, bank or other nominee, please contact your broker, bank or nominee directly if you have questions, require additional copies of the Notice, this proxy statement or the 2023 Annual Report on Form 10-K or wish to receive a single copy of such materials in the future for all beneficial owners of shares of our common stock sharing an address.

How can I submit a proposal for the 2025 annual meeting?

Requirements for Stockholder Proposals to be Considered for Inclusion in the Company’s Proxy Materials. Stockholders interested in submitting a proposal for inclusion in the proxy materials distributed by us for the 2025 annual meeting of stockholders may do so by following the procedures prescribed in Rule 14a-8 under the Securities Exchange Act of 1934, or the Exchange Act. To be eligible for inclusion, stockholder proposals must be submitted in accordance with Rule 14a-8 and received by us not later than December 12, 2024. Stockholder proposals received after the close of business on December 12, 2024 would be untimely. Stockholder proposals must be in writing and received by the deadline described above at our principal executive offices at SolarWinds Corporation, 7171 Southwest Parkway, Building 400, Austin, Texas 78735, Attention: Corporate Secretary. If we do not receive a stockholder proposal by the deadline described above, the proposal may be excluded from our proxy statement for our 2025 annual meeting.

In addition, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than March 24, 2025, which is 60 days prior to the anniversary date of the annual meeting of stockholders.

Requirements for Stockholder Proposals or Director Nominations to Be Brought Before the 2025 Annual Meeting of Stockholders. Notice of any proposal or director nomination that you intend to present at the 2025 annual meeting of stockholders, but do not intend to have included in the proxy statement and form of proxy relating to the 2025 annual meeting of stockholders, must be delivered to our Corporate Secretary by mail at 7171 Southwest Parkway, Building 400, Austin, Texas 78735, Attention: Corporate Secretary not less than 90 days nor more than 120 days in advance of the anniversary of our 2024 annual meeting. In addition, to be properly brought before the annual meeting your notice must set forth the information required by the Company’s bylaws with respect to each director nomination or other proposal that you intend to present at the 2025 annual meeting of stockholders. Our bylaws are available on the “Investors” portion of our website at www.solarwinds.com or may be obtained by writing to our Corporate Secretary. Such requests and all notices of proposals and director nominations by stockholders should be in writing and sent to SolarWinds Corporation, 7171 Southwest Parkway, Building 400, Austin, Texas 78735, Attention: Corporate Secretary.

PROPOSAL ONE: ELECTION OF DIRECTORS

Our Board is currently comprised of nine directors and is divided into three classes with staggered three-year terms. The Board currently has three directors in Class I, three directors in Class II and three directors in Class III. The term of office of our Class III directors, Cathleen Benko, Dennis Howard and Douglas Smith, will expire at this year’s annual meeting of stockholders. Each of our current Class III directors is standing for election. The term of office of our Class I directors, Sudhakar Ramakrishna, William Bock and Kenneth Y. Hao, will expire at the 2025 annual meeting. The term of office of our Class II directors, Catherine R. Kinney, Easwaran Sundaram and Michael Widmann, will expire at the 2026 annual meeting. There are no family relationships between any of our directors or executive officers.

Nominees for Election as Class III Directors at the Annual Meeting

Listed below are this year’s nominees for election to the Board as Class III directors. Each of the director nominees has consented to be named in this proxy statement and to serve if elected. If elected, each nominee will serve for a term of three years expiring at the 2027 annual meeting of stockholders or until a successor has been duly elected and qualified or until the nominee’s earlier death, resignation or removal. The age of each director is as of the date of this proxy statement.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Positions and Offices Held with Company | | Director Since |

| Cathleen Benko | | 65 | | Director | | November 2021 |

| Dennis Howard | | 55 | | Director | | September 2020 |

| Douglas Smith | | 72 | | Director | | May 2021 |

CATHLEEN BENKO | Former Vice Chairman and Managing Principal of Deloitte LLP

| | | | | | | | |

Director Since: 2021 | | Career Highlights Cathleen Benko has served on our board of directors since November 2021. A former Vice Chairman and Managing Principal of Deloitte LLP from 2011 to 2018, Ms. Benko was previously Deloitte Consulting’s first global e-Business leader from 2003 to 2009, and first Chief Talent Officer from 2006 to 2010, where she devised more agile and inclusive career development models. Ms. Benko is also a member of the Board of Directors and compensation committee of NIKE, Inc. (NYSE: NKE) and member of the Board of Directors of WorkBoard. She serves as chair of the Harvard Business School/NC Advisory Council and a member of the board of directors for several nonprofit organizations including Stanford’s Institute for Research in the Social Sciences, Santa Clara University’s Markkula Center for Applied Ethics, National Association of Corporate Directors, the International Women’s Forum and Life Skills For Soldiers. Ms. Benko holds an M.B.A. from Harvard Business School and B.S. from Ramapo College of New Jersey where she was awarded the President’s Award of Merit, the school’s highest distinction.

Qualifications Our Board believes that Ms. Benko’s management and digital transformation experience and her industry knowledge qualify her to serve as a director. |

DENNIS HOWARD | Managing Director and Chief Information Officer of Charles Schwab & Co, Inc.

| | | | | | | | |

Director Since: 2020 | | Career Highlights Dennis Howard has served on our Board since September 2020. Mr. Howard has served as the Managing Director and Chief Information Officer of Charles Schwab & Co, Inc. since 2016 and previously served as its Senior Vice President, Core Technology Services from 2014 to 2016. Prior to Charles Schwab, he served as Senior Vice President and Chief Information Officer of Visa Inc. and in various other information technology roles at Visa across a number of disciplines, including development of enterprise systems, data and analytics and client-facing product development. Prior to Visa, Mr. Howard worked in technology at Commerce One, Inc. and other firms and served in several roles in the public sector. Mr. Howard holds a B.A. from the University of Texas at San Antonio and a Masters of Public Policy and Administration from Baylor University.

Qualifications Our Board believes that Mr. Howard’s industry experience and overall knowledge of our business qualify him to serve as a director. |

DOUGLAS SMITH | Industry Partner of Motive Partners GP, LLC

| | | | | | | | |

Director Since: 2021 Director Since: 2021

| | Career Highlights Douglas Smith has served on our Board since May 2021. Mr. Smith has been an Industry Partner of Motive Partners GP, LLC, an investment firm focused on technology enabled companies that power the financial services industry, since June 2020 and previously served as an Adviser from September 2019 to June 2020. Mr. Smith also served as a senior advisor to Silver Lake from 2016 to 2019. Prior to that, Mr. Smith was the Co-Founder of Anaplan, Inc. where he held a variety of roles from 2009 to 2018. Previously, he was Global Chief Operating Officer of Capco. Prior to Capco, Mr. Smith served as an Operating Partner with Symphony Technology Group. Earlier in his career, he held positions including Executive Vice President and Chief Financial Officer of Mercury Interactive, co-head of the software practice at Hambrecht & Quist Capital Management, LLC, and Executive Vice President and Chief Financial Officer of Computervision, Inc. Mr. Smith currently serves on the board of directors of InvestCloud, Inc. and ServiceMax, Inc. and previously served on our Board from January 2018 to May 2018. Mr. Smith holds an M.A. in International Relations and Affairs from Northeastern University and a B.A. in Economics from Union College.

Qualifications Our Board believes that Mr. Smith’s industry experience and overall knowledge of our business qualify him to serve as a director. |

Continuing Directors Not Standing for Election

Certain information about those directors whose terms do not expire at the annual meeting is furnished below. The ages of each director are as of the date of this proxy statement.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Positions and Offices Held with Company | | Director Since |

| Sudhakar Ramakrishna | | 56 | | President, Chief Executive Officer and Director | | December 2020 |

| William Bock | | 73 | | Director | | October 2018 |

| Kenneth Y. Hao | | 55 | | Director | | February 2016 |

| Catherine R. Kinney | | 72 | | Director | | October 2018 |

| Easwaran Sundaram | | 53 | | Director | | February 2020 |

| Michael Widmann | | 35 | | Director | | February 2020 |

Class I Directors (Terms Expire in 2025)

SUDHAKAR RAMAKRISHNA | President and Chief Executive Officer

| | | | | | | | |

Director Since: 2020

| | Career Highlights Sudhakar Ramakrishna has served on our Board since December 2020 and has served as our President and Chief Executive Officer since January 2021. He is a global technology leader with nearly 25 years of experience across cloud, mobility, networking, security and collaboration markets. Prior to becoming our CEO, Mr. Ramakrishna served as the CEO of Pulse Secure, LLC, a leading provider of secure and zero trust access solutions for Hybrid IT environments, where he was responsible for all aspects of business strategy and execution since joining in July 2015. Prior to Pulse Secure, Mr. Ramakrishna served as the Senior Vice President and General Manager for the Enterprise and Service Provider Division at Citrix Systems, Inc., where he had responsibility for Citrix’s portfolio of virtualization, cloud networking, mobile platforms and cloud services solutions. Mr. Ramakrishna also has held senior leadership roles at Polycom, Inc., Motorola, Inc., Stoke, Inc., 3COM Corporation and U.S. Robotics. Mr. Ramakrishna is an experienced public and private company board member. Mr. Ramakrishna previously served on the board of directors of SailPoint Technologies Holdings, Inc. until it was taken private in August 2022. Mr. Ramakrishna is a partner at Benhamou Global Ventures, a leading venture capital firm investing in emerging startups in the fields of security, analytics and applications. Mr. Ramakrishna earned a master’s degree in computer science from Kansas State University and a master’s of management degree from Northwestern University’s Kellogg School of Management.

Qualifications Our Board believes that Mr. Ramakrishna’s business and industry expertise, his extensive experience working with technology companies and his daily insight into our corporate matters as principal executive officer of the Company make him well-qualified to serve as a director. |

WILLIAM BOCK | Chairman of the Board

| | | | | | | | |

Director Since: 2018

| | Career Highlights William Bock has served on our Board since October 2018 and as our Chairman of the Board since August 2020. Mr. Bock has served as a board director and advisor for a number of technology companies, since his retirement from Silicon Laboratories Inc., or Silicon Labs, (NASDAQ: SLAB) in 2016. Mr. Bock served as President of Silicon Labs from 2013 to 2016 and as Chief Financial Officer and Senior Vice President of Silicon Labs from 2006 to 2011. From 2001 to 2006, Mr. Bock participated in the venture capital industry, principally as a partner with CenterPoint Ventures. Before his venture career, Mr. Bock held senior executive positions with three venture-backed companies, Dazel Corporation, Tivoli Systems and Convex Computer Corporation. Mr. Bock began his career with Texas Instruments. Mr. Bock currently serves on the board of directors of Silicon Labs and serves as board chairman of N-able, Inc. (NYSE: NABL). He previously served on the boards of directors of Convio, Inc., Entropic Communications, Inc. and Borderfree, Inc. Mr. Bock also serves on the board of directors of Sailpoint Technologies Holdings, Inc. which was taken private in August 2022. Mr. Bock holds a B.S. in computer science from Iowa State University and a M.S. in industrial administration from Carnegie Mellon University.

Qualifications Our Board believes that Mr. Bock’s extensive board and industry experience and overall knowledge of our business qualify him to serve as a director. |

KENNETH Y. HAO | Chairman and a Managing Partner of Silver Lake

| | | | | | | | |

Director Since: 2016

| | Career Highlights Kenneth Y. Hao has served on our Board since February 2016. Mr. Hao joined Silver Lake in 2000 and is its Chairman and a Managing Partner, a position he has held since 2019. Mr. Hao has led investments in a range of technology industry leaders across a range of sectors and geographies. His portfolio companies have included Alibaba Group and ANT Financial, Broadcom (and its predecessor Avago), Network General (acquired by Net Scout), Seagate, ServiceMax, Smart Global Holdings, Symantec/NortonLifeLock and UGS (acquired by Siemens). Mr. Hao currently serves on the board of directors of Broadcom Inc. (Nasdaq: AVGO) and previously served on the board of Splunk Inc. prior to its acquisition by Cisco Systems, Inc. in March 2024. Prior to joining Silver Lake at its launch in 2000, Mr. Hao was with Hambrecht & Quist (now part of JP Morgan) from 1990-1999, where he served as a Managing Director. Outside of Silver Lake, Mr. Hao serves on the boards of UCSF and UTR Sports. Mr. Hao graduated from Harvard College with an A.B. in Economics.

Qualifications Our Board believes that Mr. Hao’s board and industry experience and overall knowledge of our business qualify him to serve as a director. |

Class II Directors (Terms Expire in 2026)

CATHERINE R. KINNEY | Former President and Co-Chief Operating Officer of the NYSE Euronext

| | | | | | | | |

Director Since: 2018 | | Career Highlights Catherine R. Kinney has served on our Board since October 2018. Ms. Kinney has over 35 years of experience in securities regulation and management. Ms. Kinney retired from NYSE Euronext in March 2009, having served as the president and co-chief operating officer of the NYSE Euronext from 2002 to 2008. From 2007 to 2009, she served in Paris, overseeing global listings, marketing and branding and served as part of the integration team following the merger of The New York Stock Exchange and Euronext in April 2007. Ms. Kinney joined the NYSE in 1974 and held management positions with responsibility for several divisions, which include client relations from 1996 to 2007, trading floor operations and technology from 1987 to 1996 and regulation from 2002 to 2004. Ms. Kinney currently serves on the boards of directors of MetLife, Inc. (NYSE: MET) and MSCI Inc. (NYSE: MSCI). Ms. Kinney previously served as a director of NetSuite Inc. and QTS Realty Trust, Inc. Ms. Kinney holds a Bachelor of Arts degree from Iona College. Ms. Kinney has also received honorary degrees from Georgetown University, Fordham University and Rosemont College.

Qualifications Our Board believes that Ms. Kinney’s financial and industry experience and overall knowledge of our business qualify her to serve as a director. |

EASWARAN SUNDARAM | Operating Executive at Tailwind Capital

| | | | | | | | |

Director Since: 2020

| | Career Highlights Easwaran Sundaram has served on our Board since February 2020. Mr. Sundaram has served as Operating Executive at Tailwind Capital since March 2021. Previously, Mr. Sundaram served as the Executive Vice President, Chief Digital & Technology Officer of JetBlue Airways Corporation from 2017 to February 2021 and previously served as its Executive Vice President of Innovation and Chief Information Officer from 2012 to 2017. Since January 2016, Mr. Sundaram has served as Oversight Officer & Investment Committee Member for JetBlue Technology Ventures, a wholly owned subsidiary of JetBlue Airways Corporation that incubates, invests in and partners with early stage startups. Previously, he was Senior Vice President of Global Supply Chain Operations and Global Chief Information Officer at Pall Corporation and served in a senior supply chain management role at PSS World Medical, Inc. (now McKesson Corporation). Mr. Sundaram also serves as a director of WESCO International, Inc. (NYSE: WCC). Mr. Sundaram holds a Bachelor of Science degree in Chemistry from Madurai Kamaraj University, a Supplemental Degree in Logistics Management from the Institute of Rail Transport, India and a Masters of Science in International Transportation Management from State University of New York Maritime College.

Qualifications Our Board believes that Mr. Sundaram’s experience as a technology executive of a Fortune 500 company and his expertise in digital tools and applications and cybersecurity and overall knowledge of our products and industry qualify him to serve as a director. |

MICHAEL WIDMANN | Managing Director of Silver Lake

| | | | | | | | |

Director Since: 2020

| | Career Highlights Michael Widmann has served on our Board since February 2020. Mr. Widmann is currently a Managing Director of Silver Lake, which he joined in 2011. Previously, he worked in the Technology Investment Banking Group at Credit Suisse. He currently serves on the board of directors of N-able, Inc. (NYSE: NABL) and TEG Pty Ltd. Mr. Widmann received a B.A. in Economics from Claremont McKenna College.

Qualifications Our Board believes that Mr. Widmann’s industry experience and overall knowledge of our business qualify him to serve as a director. |

Required Vote and Recommendation of the Board for Proposal One

You may vote “FOR,” or “WITHHOLD” on this proposal. The election of directors requires a plurality vote of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote thereon to be approved. Abstentions and broker non-votes are not votes cast and will not be counted in determining the outcome of the election of directors.

Our nominating and corporate governance committee has recommended, and our Board has approved, Cathleen Benko, Dennis Howard and Douglas Smith as nominees for election as Class III directors at the annual meeting. If elected, Ms. Benko and Messrs. Howard and Smith will serve as Class III directors until the 2027 annual meeting of stockholders or until their successors are duly elected and qualified.

| | |

Our Board recommends that you vote FOR Ms. Benko and Messrs. Howard and Smith. |

COMMITMENT TO SUSTAINABILITY

SolarWinds is a leading provider of simple, powerful, and secure IT management software built to enable organizations to accelerate their digital transformation. While our core competency is end-to-end hybrid IT observability and performance management, ultimately our business is about serving our stakeholders, and our team leads a focused effort to integrate sustainability and corporate social responsibility into day-to-day operations. By incorporating environmental, social and governance (“ESG”) principles into how we do business, we address the issues that matter most.

Our mission is to help customers accelerate business transformation through simple, powerful, and secure solutions designed for hybrid IT multi-cloud environments. We endeavor to be a people-first company, serving and supporting all of our customers and communities, and valuing all of our employees. As part of this overall mission, we focus on integrating our CARE Values (collaboration, accountability, ready and empathy) into how we conduct business.

Our executive leadership team and our Board recognize the importance of these responsibilities, and we have established an internal cross-functional working group that is tasked with driving additional progress in initiatives that promote sustainability. In 2023, we continued to further evolve our strategy with ongoing review and analysis of areas of ESG improvement within the organization. We believe in focusing our efforts on where we can have the most impact. Against this backdrop, we have determined that our ESG areas of focus include: (1) Environmental Responsibility (2) Social Impact and (3) Governance.

Environmental Responsibility

We embed the principles of advancing sustainability into our practices through green investments and long-term implementation of new technologies. We are devoted to operating our business in a sustainable manner and have undertaken a number of initiatives designed to reduce our impact on the environment and to promote environmentally friendly projects. With a view to increasing efficiency and reducing waste, we are continuing to digitize manual back office functions. Notably, we:

•Have increased the use of e-records and e-signing technology resulting in paper waste and carbon emissions reduction;

•Continue to prioritize sustainability in our business by migrating technology infrastructure to cloud-based environments, which reduce our energy usage and carbon footprint, and in 2023 we completed the migration of over 90% of our corporate application environment from on premises servers to the cloud; and

•Encourage environmentally friendly work practices by supporting the recycling of plastic, glass and paper; in Ireland, we have aligned to the Deposit Return Scheme to improve plastic and aluminum recycling rates. In Austin, employees have access to multiple composting and recycling bins, and we provide compostable cups, washable mugs, and washable water bottles while we also work with our catering partners to limit food waste. In addition, for our April 2023 Global Earth Day event, 6 SolarWinds sites hosted volunteer events centered around sustainability and giving back to local communities, such as tree planting and park clean-up with 150 Solarians participating globally.

We continuously monitor and improve the operational and environmental performance of our properties including our headquarters. We engage qualified energy professionals to conduct regular third-

party inspections and provide utility and financial savings information to relevant decision makers. We are also continuously researching and designing innovative ways to boost efficiency, such as utilizing high-efficiency electrical equipment, including LED and motion detector lighting, alternative energy sources, and high-efficiency HVAC units. Further, water management is a priority for SolarWinds, since water is becoming a scarce resource in many locations around the globe. Beyond compliance with local water laws and regulations, our offices have demonstrated a commitment to water efficiency and conservation by utilizing hands-free faucets, toilets and water fill stations to limit water usage, among other methods. In addition, our headquarters utilizes a water harvesting system (rainwater and HVAC condensate) in order to provide 10% of the total chiller water use and 100% total irrigation use.

We believe that our focus on environmental sustainability, with the objective of reducing costs and improving sustainability of our operations will provide a strategic benefit to the Company. Furthermore, we recognize that climate change is a growing risk for our planet, and we are committed to doing our part to mitigate this risk by placing increased focus and emphasis on environmental consciousness.

Social Impact

We believe in upholding the principle of human rights, worker safety and observing fair labor practices within our organization and within our supply chain. We are committed to ensuring wellness and embracing diversity and inclusion throughout the organization. Our social initiatives are focused on a people first model.

We continue to transform and modernize our culture and talent management by implementing human capital management (“HCM”) reporting and practices. We believe these initiatives empower our leaders to effectively recruit top talent and optimize team performance. Our talent management framework is designed to be equitable and transparent, encompassing clear standards for goal-setting, impartial performance evaluations with succession planning and robust learning and development opportunities. Our objective is to establish a talent management process that is not only fair but also rooted in objectivity, ensuring equal opportunities for all individuals within our organization. We are committed to pay parity and regularly evaluate and refine our compensation model to promote fairness and inclusivity across all sectors of our business. To uphold this commitment, we conduct annual pay equity analyses by an independent, third-party vendor.

We believe the wellness and development of our employees is paramount, and the Company’s success is fundamentally connected with the well-being of our team members. Additionally, the health and well-being of our employees is our top priority and in recognition of this, we aim to provide a robust health and wellness package. We continually evolve our health and welfare benefits plans to remain competitive and to meet the needs of our workforce to include health and medical insurance, paid vacation, sick leave, bereavement leave, standard maternity, as well as an education reimbursement. We support the wellness of all colleagues through various programs, including online health engagement.

In addition, in December 2023, we adopted a corporate social responsibility policy in India in compliance with local regulations which is focused on community development through various initiatives in the best interests of marginalized populations. We have initially pursued programs that improve the lives of visually impaired individuals and provide housing for the homeless, and we will continue to evaluate other opportunities.

Inclusion and Belonging

Our goal is to attract, retain and develop a workforce that is diverse in background, knowledge, skill and experience. We are committed to providing equal employment opportunities for training, compensation, transfer, promotion and other aspects of employment for all qualified applicants and employees without regard to sex, race, color, religion, national origin, age, disability, sexual orientation or veteran status. We conduct engagement surveys with our employees, who we refer to as Solarians, to elicit feedback, address unique need of our Solarians and develop action plans for continuous improvement in all areas of employment, including career development plans.

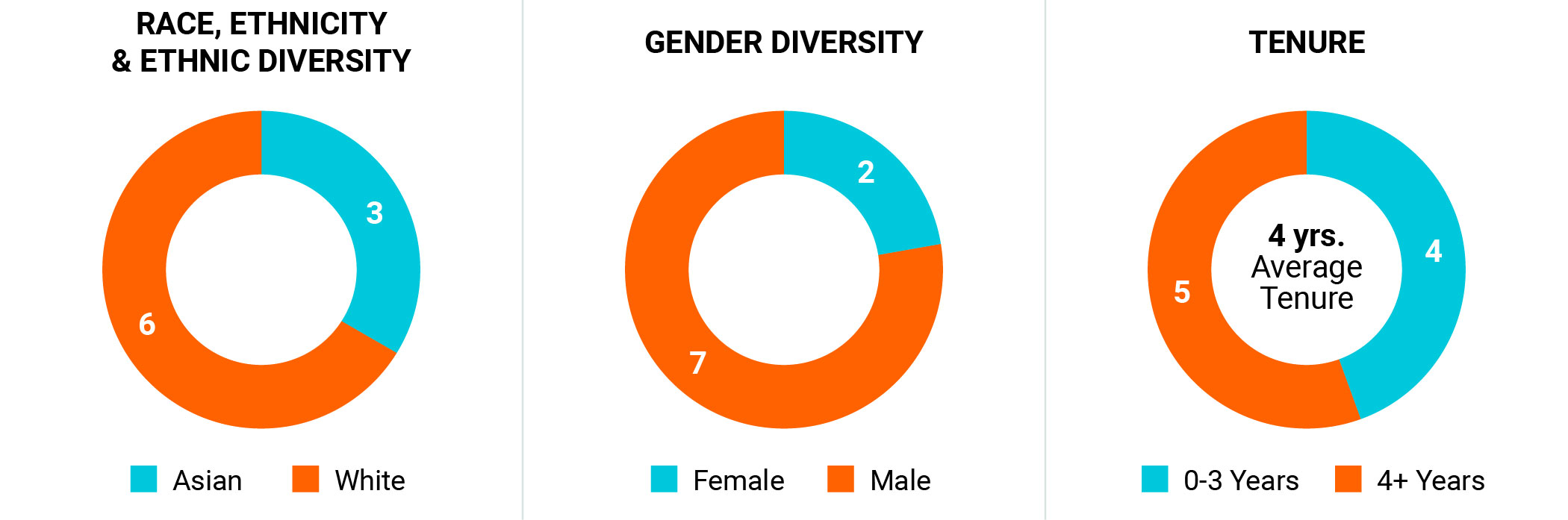

Inclusion and belonging is core to our CARE values and purpose and important to who we are as a Company. It helps us to bring diverse perspectives to create enriching experience for our communities. Our Inclusion and Belonging (I&B) approach focuses on inclusion first, fostering a sense of belonging, and improving diverse representation. To advance our objectives, we have increased the availability of training on topics such as anti-harassment, anti-discrimination and unconscious bias. In 2023, we strengthened our inclusion culture by introducing I&B learning paths for all employees, conducting inclusive leadership sessions for managers and embedding objectivity into our hiring and performance management process. We also continued to foster a culture of belonging as we expanded our I&B Solarians communities to add a new community for persons with disabilities, established an I&B Committee to collaboratively drive our I&B agenda, hosted 8 seminars featuring diverse Solarian speakers and provided mentorship opportunities and facilitated participation in external conferences such as Women in Tech and Afrotech. Finally, we continued building a diverse workplace by holding leaders and managers accountable for maintaining diverse teams by emphasizing thoughtful hiring slates and collaboration with local community partners globally to source and develop a potential talent pipeline, including initiatives like Hiring Our Heroes, She Stem Awards, Philippines Business and Disabilities Network (PBDN) and Pride Parades.

We are also focused on making a positive impact with all our diverse stakeholders through charity and fundraising, educational sponsorship, and local community development that drive an inclusive culture. 2023 highlights include:

•SolarService Days provided our communities with 1,834 hours of service; and

•Continued support of many non-profits, including Geeks that Give platform that allows for matching of our employees’ donations to many local and international non-profits, resulting in a total of $33,241 in matching donations.

ESG Governance

Our Board and senior leadership actively support and promote sound corporate governance and risk management across the Company. This culture of accountability, integrity and transparency affirms our unwavering commitment to building sustainable value. We have a long history of excellence in corporate governance and compliance practices, including an emphasis on accountability and authenticity in-line with our CARE values. Key ESG governance priorities include:

• Integrating ESG matters into our overall governance structure and enterprise risk management;

• Advancing cybersecurity and risk management frameworks; and

• Proactively engaging stakeholders.

Our Code of Conduct is designed to ensure that our directors, officers and employees comply with applicable rules and regulations. Our Supplier Code of Conduct promotes the fair and ethical treatment of suppliers, contractors, independent consultants, and other parties that SolarWinds works with through a set of guidelines focusing on social impact, equal opportunity, protection of the environment and proprietary information, and requires the protection of human rights. We have adopted a robust Technology and Cyber Committee Charter and Corporate Governance Guidelines, which are available on our website.

Our internal cybersecurity risk management team, headed by our Chief Information Security Officer, oversees compliance with applicable laws and regulations and coordinates with subject matter experts throughout the business to identify, monitor, and mitigate risk including information security risk management and cyber defense programs. These teams maintain rigorous testing programs and regularly provide updates to the Company leadership as well as our Board. We have a robust Information Security program that incorporates multiple layers of physical, technical and administrative controls. We leverage the latest security configurations and technologies on our systems, devices, and third-party connections and further vet third-party vendors’ security capabilities and controls, as required, through the organization’s vendor management process.

Secure by Design is our IT guiding principle for how we approach security and cyber resiliency. Consisting of several key tenets, we work to create a more secure environment and build a system centered around transparency and maximum visibility. Some of this principle’s highlights include developing a resilient build environment called our Next-Generation Build System; developing a community approach to support cyber resiliency; and going beyond zero trust with an “assume breach” mindset. Going forward, we will continue to leverage the latest security configurations and technologies on our systems, devices and third-party connections and further vet third-party vendors’ security capabilities and controls, as required, through the organization’s vendor management process.

| | |

| We routinely engage with our stakeholders to better understand their views on ESG matters, carefully considering the feedback we receive and acting when appropriate. For more information, please visit our corporate website: www.solarwinds.com. |

CORPORATE GOVERNANCE

Board of Directors

Our business and affairs are managed under the direction of our Board. Currently, our Board consists of nine directors, eight of whom qualify as “independent” under the listing standards of the New York Stock Exchange, or NYSE. The number of directors is fixed by our Board, subject to the terms of our third amended and restated certificate of incorporation, as amended, or charter, amended and restated bylaws, or bylaws, and amended and restated stockholders’ agreement dated October 18, 2018, as amended, or the stockholders’ agreement. Our charter, bylaws and stockholders’ agreement are available as exhibits to our 2023 Annual Report on Form 10-K.

Certain Sponsor Rights

We have a valuable relationship with our Sponsors, who acquired us in February 2016 in a take private transaction prior to our initial public offering in October 2018. As of March 28, 2024, the Sponsors beneficially owned in the aggregate 66.34% of our common stock. Our Sponsors have certain voting and director nomination rights under the stockholders’ agreement.

Pursuant to the terms of the stockholders’ agreement, the Sponsors are entitled to nominate members of our Board as follows:

•so long as the Silver Lake Funds own, in the aggregate, (i) at least 20% of the aggregate number of then outstanding shares of common stock, affiliates of Silver Lake will be entitled to nominate three directors, (ii) less than 20% but at least 10% of the then outstanding shares of common stock, affiliates of Silver Lake will be entitled to nominate two directors, and (iii) less than 10% but at least 5% of the aggregate number of then outstanding shares of common stock, affiliates of Silver Lake will be entitled to nominate one director;

•so long as the Thoma Bravo Funds and their co-investors own, in the aggregate, (i) at least 20% of the aggregate number of then outstanding shares of common stock, Thoma Bravo will be entitled to nominate three directors, (ii) less than 20% but at least 10% of the aggregate number of then outstanding shares of common stock, Thoma Bravo will be entitled to nominate two directors, and (iii) less than 10% but at least 5% of the aggregate number of then outstanding shares of common stock, Thoma Bravo will be entitled to nominate one director; and

•so long as (i) the Silver Lake Funds own, in the aggregate, at least 20% of the aggregate number of then outstanding shares of common stock, and (ii) the Thoma Bravo Funds and their co-investors own, in the aggregate, at least 20% of the aggregate number of then outstanding shares of common stock, Silver Lake and Thoma Bravo will be entitled to mutually nominate one director.

Messrs. Hao, Smith and Widmann were elected as designees of affiliates of Silver Lake. Currently, the board seats for designees of Thoma Bravo, as well as the director seat mutually designated by Silver Lake and Thoma Bravo, remain vacant. However, as of March 28, 2024, each of the Silver Lake Funds and the Thoma Bravo Funds and their co-investors, respectively, continued to own more than 20% of the aggregate number of then outstanding shares of common stock and, accordingly, retain their respective right to each nominate three directors under the stockholders’ agreement as well as their right to collectively nominate one mutual director. Of the Class III director nominees up for election at the annual meeting, Mr. Smith is the designee of affiliates of Silver Lake.

For additional information regarding the terms of the stockholders’ agreement see “Certain Relationships and Related Party Transactions—Stockholders’ Agreement.”

Board Leadership

Although our corporate governance guidelines do not require the separation of our Chairman of the Board and Chief Executive Officer positions, the Board separated the roles of Chairman and Chief

Executive Officer in August 2020. Mr. Bock serves as the Company’s non-executive Chairman. By separating these roles, the Board believes that Mr. Ramakrishna can focus on executing the Company’s strategy as our President and Chief Executive Officer, and Mr. Bock can devote his attention to matters of Board oversight and governance. Mr. Bock brings considerable skills and experience to the role of Chairman. In this capacity, he has significant responsibilities, including calling and presiding over Board meetings, including meetings of the independent directors, setting meeting agendas and determining materials to be distributed to the Board. Following an executive session of independent directors, the non-executive Chairman acts as a liaison between the independent directors and the Board regarding any specific feedback or issues. Our non-executive Chairman also provides management with input regarding schedule and agenda items for Board and committee meetings and the information to be provided to the independent directors in performing their duties. In addition, each of the committees of the Board is chaired by an independent director. We believe that having an independent Chairman currently provides the most effective leadership model for the Company and when combined with the role of our independent committee chairs, creates an environment that is conducive to objective evaluation and oversight of management’s performance.

We offer all of our directors membership in the National Association of Corporate Directors (NACD), which provides each director with access to continuing education, research materials, and publications relating to corporate governance, board leadership, and other topical information. A number of our directors are participating in continuing education and certification programs, including the NACD Cyber-Risk Oversight Program.

Risk Oversight

Our Board is responsible for overseeing our risk management process. The Board administers its risk management oversight through our audit committee, nominating and corporate governance committee, compensation committee and technology and cybersecurity committee. The Board is also apprised of particular risk management matters in connection with its general oversight and approval of corporate matters and significant transactions.

Our audit committee is responsible for our general risk management strategy, discussing guidelines and policies to govern the process by which risk assessment and management is undertaken and handled. Our audit committee also receives reports from management, the internal audit team, and the Company’s independent registered public accounting firm relating to financial and other major risks, and also monitors the Company’s risk management policies and implementation. Our nominating and corporate governance committee monitors and assesses the effectiveness of our corporate governance guidelines and reviews our corporate governance risks, including environmental, social and governance risks. Our compensation committee monitors and evaluates whether any of our compensation policies and programs have the potential to encourage excessive or unnecessary risk-taking. Our technology and cybersecurity committee is responsible for overseeing our information technology systems and cybersecurity risks.

Our management is responsible for day-to-day risk management. This oversight includes identifying, evaluating and addressing potential risks that may exist at the enterprise, strategic, financial, operational, compliance or reporting levels.

Committees of Our Board of Directors