aca-202312310001739445false2023FYhttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligations00017394452023-01-012023-12-3100017394452023-06-30iso4217:USD00017394452024-01-12xbrli:shares0001739445aca:ConstructionProductsMember2023-12-3100017394452022-01-012022-12-3100017394452021-01-012021-12-31iso4217:USDxbrli:shares00017394452023-12-3100017394452022-12-3100017394452021-12-3100017394452020-12-310001739445us-gaap:CommonStockMember2020-12-310001739445us-gaap:AdditionalPaidInCapitalMember2020-12-310001739445us-gaap:RetainedEarningsMember2020-12-310001739445us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001739445us-gaap:TreasuryStockCommonMember2020-12-310001739445us-gaap:RetainedEarningsMember2021-01-012021-12-310001739445us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001739445us-gaap:CommonStockMember2021-01-012021-12-310001739445us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001739445us-gaap:TreasuryStockCommonMember2021-01-012021-12-310001739445us-gaap:CommonStockMember2021-12-310001739445us-gaap:AdditionalPaidInCapitalMember2021-12-310001739445us-gaap:RetainedEarningsMember2021-12-310001739445us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001739445us-gaap:TreasuryStockCommonMember2021-12-310001739445us-gaap:RetainedEarningsMember2022-01-012022-12-310001739445us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001739445us-gaap:CommonStockMember2022-01-012022-12-310001739445us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001739445us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001739445us-gaap:CommonStockMember2022-12-310001739445us-gaap:AdditionalPaidInCapitalMember2022-12-310001739445us-gaap:RetainedEarningsMember2022-12-310001739445us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001739445us-gaap:TreasuryStockCommonMember2022-12-310001739445us-gaap:RetainedEarningsMember2023-01-012023-12-310001739445us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001739445us-gaap:CommonStockMember2023-01-012023-12-310001739445us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001739445us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001739445us-gaap:CommonStockMember2023-12-310001739445us-gaap:AdditionalPaidInCapitalMember2023-12-310001739445us-gaap:RetainedEarningsMember2023-12-310001739445us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001739445us-gaap:TreasuryStockCommonMember2023-12-310001739445aca:UtilityWindAndRelatedStructuresMemberaca:EngineeredStructuresMember2023-12-31xbrli:pure0001739445aca:TransportationProductsMemberaca:InlandBargeMember2023-12-310001739445srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310001739445srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310001739445us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2023-12-310001739445srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2023-12-310001739445srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2023-12-310001739445us-gaap:CustomerRelationshipsMembersrt:MinimumMember2023-12-310001739445us-gaap:CustomerRelationshipsMembersrt:MaximumMember2023-12-310001739445us-gaap:ConstructionPermitsMembersrt:MinimumMember2023-12-310001739445us-gaap:ConstructionPermitsMembersrt:MaximumMember2023-12-310001739445srt:MinimumMemberus-gaap:OtherIntangibleAssetsMember2023-12-310001739445srt:MaximumMemberus-gaap:OtherIntangibleAssetsMember2023-12-310001739445srt:MinimumMember2023-01-012023-12-310001739445srt:MaximumMember2023-01-012023-12-310001739445aca:ConstructionProductsMemberaca:LakePointMember2023-01-012023-12-310001739445us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-01-012023-12-310001739445aca:ConstructionProductsMemberaca:LakePointMember2023-12-310001739445us-gaap:ConstructionPermitsMemberaca:ConstructionProductsMemberaca:LakePointMember2023-12-310001739445aca:ConstructionProductsMemberaca:RAMCOMember2022-01-012022-12-310001739445us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-01-012022-12-310001739445us-gaap:ConstructionPermitsMemberaca:ConstructionProductsMemberaca:RAMCOMember2023-12-310001739445us-gaap:ConstructionPermitsMemberaca:ConstructionProductsMemberaca:RAMCOMember2022-01-012022-12-310001739445aca:ConstructionProductsMemberaca:RAMCOMember2023-12-310001739445aca:ConstructionProductsMemberaca:RAMCOMember2023-01-012023-12-310001739445aca:ConstructionProductsMemberaca:SouthwestRockMember2021-01-012021-12-310001739445us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-08-042021-08-040001739445aca:ConstructionProductsMemberaca:SouthwestRockMember2022-12-310001739445aca:ConstructionProductsMemberaca:StonePointMember2021-01-012021-12-310001739445us-gaap:SeniorNotesMemberus-gaap:UnsecuredDebtMember2021-04-060001739445aca:ConstructionProductsMemberaca:StonePointMember2023-01-012023-12-310001739445aca:ConstructionProductsMemberaca:StonePointMember2022-12-310001739445us-gaap:CustomerRelationshipsMemberaca:ConstructionProductsMemberaca:StonePointMember2022-12-310001739445aca:ConstructionProductsMemberaca:StonePointMember2020-01-012020-12-31aca:businesses_divested0001739445aca:EngineeredStructuresMemberaca:StorageTanksMember2022-01-012022-12-310001739445aca:EngineeredStructuresMemberaca:StorageTanksMember2022-01-012022-12-310001739445aca:EngineeredStructuresMemberaca:StorageTanksMember2021-01-012021-12-310001739445aca:EngineeredStructuresMemberaca:StorageTanksMember2021-01-012021-12-310001739445aca:ConstructionProductsMemberaca:AsphaltOperationMember2021-01-012021-12-310001739445us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001739445us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001739445us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001739445us-gaap:FairValueMeasurementsRecurringMember2023-12-310001739445us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001739445us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001739445us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001739445us-gaap:FairValueMeasurementsRecurringMember2022-12-310001739445us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2022-12-310001739445us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2022-12-310001739445us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2022-12-310001739445us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2022-12-31aca:segment0001739445aca:ConstructionProductsMemberaca:AggregatesAndSpecialtyMaterialsMember2023-01-012023-12-310001739445aca:ConstructionProductsMemberaca:ConstructionSiteSupportMember2023-01-012023-12-310001739445us-gaap:OperatingSegmentsMemberaca:ConstructionProductsMember2023-01-012023-12-310001739445us-gaap:OperatingSegmentsMemberaca:ConstructionProductsMember2023-12-310001739445aca:UtilityWindAndRelatedStructuresMemberaca:EngineeredStructuresMember2023-01-012023-12-310001739445aca:EngineeredStructuresMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001739445aca:EngineeredStructuresMemberus-gaap:OperatingSegmentsMember2023-12-310001739445aca:TransportationProductsMemberaca:InlandBargeMember2023-01-012023-12-310001739445aca:SteelComponentsMemberaca:TransportationProductsMember2023-01-012023-12-310001739445us-gaap:OperatingSegmentsMemberaca:TransportationProductsMember2023-01-012023-12-310001739445us-gaap:OperatingSegmentsMemberaca:TransportationProductsMember2023-12-310001739445us-gaap:OperatingSegmentsMember2023-01-012023-12-310001739445us-gaap:OperatingSegmentsMember2023-12-310001739445us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001739445us-gaap:CorporateNonSegmentMember2023-12-310001739445srt:ConsolidationEliminationsMemberus-gaap:IntersegmentEliminationMember2023-01-012023-12-310001739445srt:ConsolidationEliminationsMemberus-gaap:IntersegmentEliminationMember2023-12-310001739445aca:ConstructionProductsMemberaca:AggregatesAndSpecialtyMaterialsMember2022-01-012022-12-310001739445aca:ConstructionProductsMemberaca:ConstructionSiteSupportMember2022-01-012022-12-310001739445us-gaap:OperatingSegmentsMemberaca:ConstructionProductsMember2022-01-012022-12-310001739445us-gaap:OperatingSegmentsMemberaca:ConstructionProductsMember2022-12-310001739445aca:UtilityWindAndRelatedStructuresMemberaca:EngineeredStructuresMember2022-01-012022-12-310001739445aca:EngineeredStructuresMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001739445aca:EngineeredStructuresMemberus-gaap:OperatingSegmentsMember2022-12-310001739445aca:TransportationProductsMemberaca:InlandBargeMember2022-01-012022-12-310001739445aca:SteelComponentsMemberaca:TransportationProductsMember2022-01-012022-12-310001739445us-gaap:OperatingSegmentsMemberaca:TransportationProductsMember2022-01-012022-12-310001739445us-gaap:OperatingSegmentsMemberaca:TransportationProductsMember2022-12-310001739445us-gaap:OperatingSegmentsMember2022-01-012022-12-310001739445us-gaap:OperatingSegmentsMember2022-12-310001739445us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001739445us-gaap:CorporateNonSegmentMember2022-12-310001739445aca:ConstructionProductsMemberaca:AggregatesAndSpecialtyMaterialsMember2021-01-012021-12-310001739445aca:ConstructionProductsMemberaca:ConstructionSiteSupportMember2021-01-012021-12-310001739445us-gaap:OperatingSegmentsMemberaca:ConstructionProductsMember2021-01-012021-12-310001739445us-gaap:OperatingSegmentsMemberaca:ConstructionProductsMember2021-12-310001739445aca:UtilityWindAndRelatedStructuresMemberaca:EngineeredStructuresMember2021-01-012021-12-310001739445aca:EngineeredStructuresMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001739445aca:EngineeredStructuresMemberus-gaap:OperatingSegmentsMember2021-12-310001739445aca:TransportationProductsMemberaca:InlandBargeMember2021-01-012021-12-310001739445aca:SteelComponentsMemberaca:TransportationProductsMember2021-01-012021-12-310001739445us-gaap:OperatingSegmentsMemberaca:TransportationProductsMember2021-01-012021-12-310001739445us-gaap:OperatingSegmentsMemberaca:TransportationProductsMember2021-12-310001739445us-gaap:OperatingSegmentsMember2021-01-012021-12-310001739445us-gaap:OperatingSegmentsMember2021-12-310001739445us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001739445us-gaap:CorporateNonSegmentMember2021-12-310001739445srt:ConsolidationEliminationsMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001739445srt:ConsolidationEliminationsMemberus-gaap:IntersegmentEliminationMember2021-12-310001739445aca:EngineeredStructuresMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001739445aca:EngineeredStructuresMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001739445aca:EngineeredStructuresMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001739445country:MXaca:ExternalCustomersMember2023-01-012023-12-310001739445country:MXaca:ExternalCustomersMember2022-01-012022-12-310001739445country:MXaca:ExternalCustomersMember2021-01-012021-12-310001739445country:MXaca:IntercompanyMember2023-01-012023-12-310001739445country:MXaca:IntercompanyMember2022-01-012022-12-310001739445country:MXaca:IntercompanyMember2021-01-012021-12-310001739445country:MX2023-01-012023-12-310001739445country:MX2022-01-012022-12-310001739445country:MX2021-01-012021-12-310001739445country:MX2023-12-310001739445country:MX2022-12-310001739445us-gaap:LandMember2023-12-310001739445us-gaap:LandMember2022-12-310001739445us-gaap:ProductiveLandMember2023-12-310001739445us-gaap:ProductiveLandMember2022-12-310001739445us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001739445us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001739445us-gaap:MachineryAndEquipmentMember2023-12-310001739445us-gaap:MachineryAndEquipmentMember2022-12-310001739445us-gaap:ConstructionInProgressMember2023-12-310001739445us-gaap:ConstructionInProgressMember2022-12-310001739445aca:ManufacturingFacilityNonoperatingMember2023-12-310001739445aca:ManufacturingFacilityNonoperatingMember2022-12-310001739445aca:ConstructionProductsMember2022-12-310001739445aca:EngineeredStructuresMember2023-12-310001739445aca:EngineeredStructuresMember2022-12-310001739445aca:TransportationProductsMember2023-12-310001739445aca:TransportationProductsMember2022-12-310001739445us-gaap:CustomerRelationshipsMember2023-12-310001739445us-gaap:CustomerRelationshipsMember2022-12-310001739445us-gaap:ConstructionPermitsMember2023-12-310001739445us-gaap:ConstructionPermitsMember2022-12-310001739445us-gaap:OtherIntangibleAssetsMember2023-12-310001739445us-gaap:OtherIntangibleAssetsMember2022-12-310001739445us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001739445us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-12-310001739445aca:TermLoanMember2023-12-310001739445aca:TermLoanMember2022-12-310001739445us-gaap:SeniorNotesMember2023-12-310001739445us-gaap:SeniorNotesMember2022-12-310001739445us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2018-11-010001739445us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-01-020001739445aca:TermLoanMember2020-01-020001739445us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-08-230001739445us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2023-12-310001739445us-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMember2023-01-012023-12-310001739445us-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMember2023-01-012023-12-310001739445us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:LineOfCreditMember2023-01-012023-12-310001739445us-gaap:SeniorNotesMember2021-04-060001739445us-gaap:SeniorNotesMember2021-04-062021-04-060001739445us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2019-01-020001739445us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2023-12-310001739445us-gaap:AccountsReceivableMember2023-01-012023-12-310001739445us-gaap:OtherNoncurrentAssetsMember2023-01-012023-12-310001739445us-gaap:OtherAssetsMember2023-12-310001739445us-gaap:OtherLiabilitiesMember2023-12-310001739445aca:BoilermakerBlacksmithNationalPensionTrustMember2023-01-012023-12-310001739445aca:BoilermakerBlacksmithNationalPensionTrustMember2022-01-012022-12-310001739445aca:BoilermakerBlacksmithNationalPensionTrustMember2021-01-012021-12-310001739445us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001739445us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-12-310001739445us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-12-310001739445us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-01-012021-12-310001739445us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001739445us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-12-310001739445us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310001739445us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-01-012022-12-310001739445us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001739445us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-12-310001739445us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310001739445us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-01-012023-12-310001739445us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001739445us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-12-310001739445srt:MinimumMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001739445srt:MaximumMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001739445us-gaap:PerformanceSharesMembersrt:MinimumMember2023-12-310001739445us-gaap:PerformanceSharesMembersrt:MaximumMember2023-12-310001739445aca:RestrictedShareAwardsMemberus-gaap:CommonStockMember2022-12-310001739445aca:TrinityCommonStockMemberaca:RestrictedShareAwardsMember2022-12-310001739445aca:RestrictedShareAwardsMember2022-12-310001739445aca:RestrictedShareAwardsMemberus-gaap:CommonStockMember2023-01-012023-12-310001739445aca:TrinityCommonStockMemberaca:RestrictedShareAwardsMember2023-01-012023-12-310001739445aca:RestrictedShareAwardsMember2023-01-012023-12-310001739445aca:RestrictedShareAwardsMemberus-gaap:CommonStockMember2023-12-310001739445aca:TrinityCommonStockMemberaca:RestrictedShareAwardsMember2023-12-310001739445aca:RestrictedShareAwardsMember2023-12-310001739445us-gaap:AccruedLiabilitiesMember2023-12-310001739445aca:EnvironmentalAndWorkplaceMattersMember2023-12-310001739445aca:EngineeredStructuresAndTransportationProductsMemberus-gaap:InventoriesMember2023-12-3100017394452023-10-012023-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | | |

| (Mark One) |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended DECEMBER 31, 2023

| | | | | |

| OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-38494

Arcosa, Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | |

| Delaware | 82-5339416 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

| 500 N. Akard Street, Suite 400 | |

| Dallas, | Texas | 75201 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (972) 942-6500

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock ($0.01 par value) | ACA | New York Stock Exchange |

Securities registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨

Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report. þ

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant's most recently completed second fiscal quarter (June 30, 2023) was $3.7 billion.

At January 12, 2024 the number of shares of common stock outstanding was 48,562,279.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report, to the extent not set forth herein, is incorporated by reference from the registrant's definitive 2024 Proxy Statement.

ARCOSA, INC.

FORM 10-K

TABLE OF CONTENTS

PART I

Item 1. Business.

General Description of Business. Arcosa, Inc. and its consolidated subsidiaries (“Arcosa,” “Company,” “we,” or “our”), headquartered in Dallas, Texas, is a provider of infrastructure-related products and solutions with leading brands serving construction, engineered structures, and transportation markets in North America. Our individual businesses have built reputations for quality, service, and operational excellence over decades. Arcosa serves a broad spectrum of infrastructure-related markets and is strategically focused on driving organic and disciplined acquisition growth to capitalize on the fragmented nature of many of the industries in which we operate. With Arcosa’s current platform of businesses and additional growth opportunities, we are well-aligned with key market trends, such as the replacement and growth of aging transportation infrastructure, the continued shift to renewable power generation, and the expansion of new transmission, distribution, and telecommunications infrastructure.

Arcosa is a Delaware corporation and was incorporated in 2018 as an independent, publicly-traded company listed on the New York Stock Exchange.

Our principal executive offices are located at 500 N. Akard Street, Suite 400, Dallas, Texas 75201. Our telephone number is 972-942-6500, and our Internet website address is www.arcosa.com. We make available free of charge on our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments thereto, as soon as reasonably practicable after such material is filed with, or furnished to, the Securities and Exchange Commission (“SEC”). Information on our Investor Relations page and on our website is not part of this Annual Report on Form 10-K or any of our other securities filings unless specifically incorporated herein by reference.

Long-Term Vision. We are united in our shared purpose to fulfill the four pillars of our long-term vision.

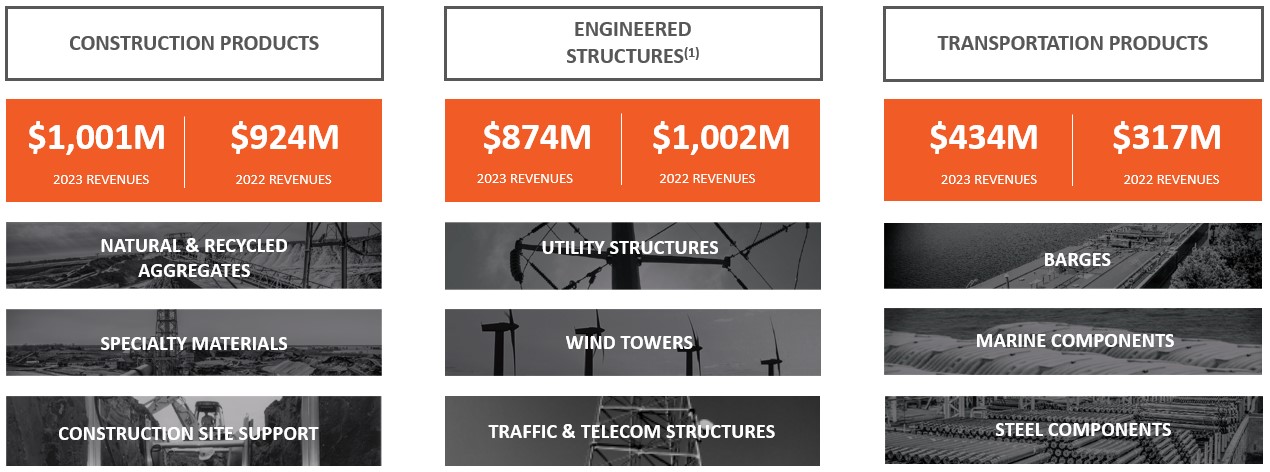

Overview. Arcosa's three segments are made up of leading businesses that serve critical infrastructure markets:

(1) Revenues for the year ended December 31, 2022 include $188.9 million from the storage tanks business that was sold on October 3, 2022.

Our Segments. The Company reports operating results in three principal business segments. For additional information regarding revenues, operating profit, and identifiable assets by segment, please refer to Note 4 to the Consolidated Financial Statements.

Construction Products.

Products

Through wholly owned subsidiaries, our Construction Products segment produces and sells natural and recycled aggregates, specialty materials, and construction site support equipment, including trench shields and shoring products. See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for revenues attributable to aggregates and specialty materials, and construction site support.

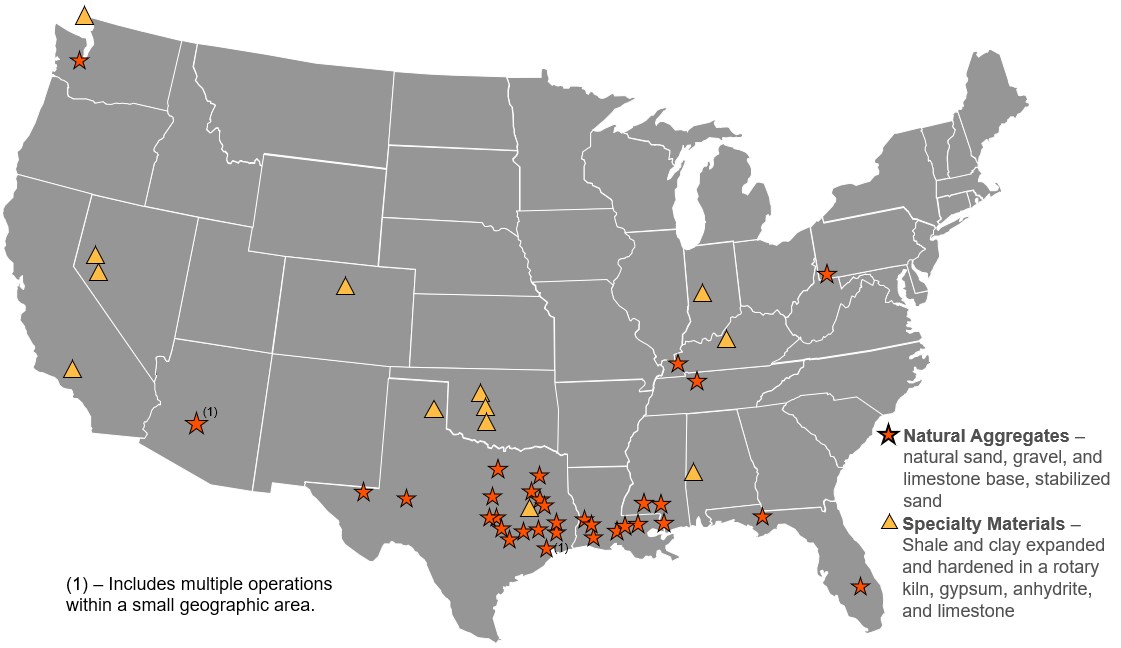

•Natural Aggregates: We are an established producer and distributor of natural aggregates serving both public infrastructure and private construction markets and operate in Texas, our largest geographic exposure, and eight other states. We manage the business from the four regions of Texas, the Ohio River Valley, the Gulf Coast, and the West. We operate primarily from open pit quarries and have one underground mine. Our natural aggregates products include sand, gravel, limestone, stabilized material, and various other products used in the production of ready mixed concrete, cement, and other precast concrete products, roads, municipal and private water, sewer and drainage projects, oil and gas well pads, wind farms, as well as various other building products.

•Recycled Aggregates: We are the largest producer of recycled aggregates in the U.S. with operations in Texas, California, Florida, and Arizona. Recycled aggregates are a complement to our natural aggregates platform and are produced by crushing concrete reclaimed from demolished highways, buildings, and other structures. The raw product material is processed to remove debris, primarily rebar, and screened to appropriate sizes for use as a road base, erosion control, building foundations, and as a backfill for utility trenches. Recycled aggregates currently supply a small percentage of total aggregates supplied nationwide. We believe the use of recycled aggregates will continue to grow due to resource scarcity and associated sustainability benefits, reduced disposal and acceptance of concrete in landfills, and energy savings from less processing and transportation costs. Recycled aggregates are a substitute to natural aggregates, primarily for hard rock uses.

•Specialty Materials: Our specialty materials, including lightweight aggregates, select natural aggregates, and milled or processed specialty building products and agricultural products, are produced and distributed nationwide. We currently operate in ten states and British Columbia, with several of our production facilities operating at the quarries that produce the raw material inputs, which include shale, clay, limestone, and gypsum. Lightweight aggregates are select shales or clays that are expanded and hardened by high temperatures in a rotary kiln and possess a bulk density that can be less than half the density of natural aggregates. Product applications include structural lightweight concrete, lightweight masonry block, and road surface treatments. Our specialty building products and agricultural products are processed at several production facilities across the U.S., mostly using our natural aggregates as a component of raw material supply. Product applications include plasters, prills, agricultural supplements and fertilizers, paints, flooring, glass, ingredients for food and feed, cement, energy infrastructure, and other products.

•Construction Site Support: We hold a strong market position in the manufacturing of trench shields and shoring products for the U.S. construction industry. Trench shields and shoring products are used for water and sewer construction, utility installations, manhole work, oil and gas pipeline construction, and other underground applications. Additionally, we participate in certain regional rental markets for trench shoring equipment.

Markets

Over a multi-year period, we believe that approximately half of our current portfolio of construction materials are used in infrastructure projects and the other half is split across residential, non-residential, and specialty/other end markets.

•Infrastructure Construction: Infrastructure construction includes construction spending by federal, state, and local governments for roads, highways, bridges, airports, and other public infrastructure, as well as private spending on road and utility construction. Public infrastructure spending is typically supported by federal and state legislation and programs. On December 4, 2015, the Fixing America's Surface Transportation Act (“FAST Act”) was signed into law. The FAST Act authorized $305 billion of public infrastructure funding from 2016 to 2020. It was subsequently extended to provide an additional $13.6 billion in 2021. On November 15, 2021, the Infrastructure Investment and Jobs Act (“IIJA”) was signed into law, which provides approximately $350 billion for federal highway programs from 2022 through 2026 by extending many of the programs in the FAST Act at higher funding levels, as well as supplemental funding for roads, bridges, and other major projects. Most of this funding is apportioned to states, based on formulas specified in the IIJA and provides funding through a wide range of competitive grant programs.

•Residential Construction: Residential construction includes single family homes and multi-family units such as apartments and condominiums. Demand for residential construction is influenced primarily by population growth, new household formation, and mortgage interest rates.

•Non-Residential Construction: Non-residential construction includes a wide variety of privately financed construction, including manufacturing and distribution facilities, industrial complexes, office buildings, and large retailers and wholesalers. Demand for non-residential construction is driven primarily by population and economic growth, in addition to segment-specific factors such as the growth of e-commerce, changes in retail patterns, changes in office occupancy trends, financing costs and numerous other factors.

•Specialty/Other: Our products are used in various other end markets including energy-related activities, such as drilling pads, roads and major downstream projects, agriculture/horticulture, and industrial uses.

In 2023, we had shipments of approximately 38 million tons of aggregates and specialty materials, including approximately 5 million tons of recycled aggregates. Texas is our largest geographic market, representing approximately 45% of the segment's revenues in 2023. All other states each are less than 10% of segment revenues. Within Texas, we primarily serve the Texas Triangle formed by the Dallas-Fort Worth metro at its northern point in North Texas; the Houston metro at its southeastern edge on the Gulf Coast; and Austin-San Antonio at its western tip in Central Texas. The outlook for construction spending in Texas is favorable with 2024 fiscal year planned Texas Department of Transportation (“TxDOT”) lettings of approximately $13 billion. The TxDOT annual update to its 10-year Unified Transportation Program ("UTP") approved in 2023 identified a record $100 billion of infrastructure projects, an increase of $15 billion from the prior year's UTP update. Population and household formation growth have contributed to a strong residential housing market in recent years, however, the recent rise in interest rates has caused a near term slow down, with housing permits, an indication of future construction activity, down approximately 13% in Texas in 2023 compared to the previous year. Non-residential construction activity, while showing signs of recent slowing in the U.S., has remained healthy in our markets supported by heavy industrial activity and the lagged effect of a strong residential construction cycle.

Customers and Competitors

For natural and recycled aggregates and specialty materials, our customers include concrete producers; commercial, residential, highway, and general contractors; manufacturers of masonry and building products; and state and local governments.

Shipments of natural and recycled aggregates from an individual quarry or stationary crushing location are generally limited in geographic scope because the cost of transportation to customers is high relative to the value of the product itself. Where practical, we have operations located close to our local markets and, in certain locations, offer portable crushing services at a job site for re-use onsite. Proximity of our active quarries, stationary crushing locations, and strategic reserves to demand centers serve as barriers to entry.

The U.S. aggregates industry is a highly fragmented industry with more than 5,000 producers nationwide. We compete, in most cases, with natural and recycled aggregates producers in the regions where we operate. Many opportunities for consolidation exist. Therefore, companies in the industry tend to grow by acquiring existing facilities to extend their current market positions or enter new markets.

Our specialty materials products enjoy higher barriers to entry than our natural and recycled aggregates due to specific mineral properties, specialized manufacturing, or additional processing. Due to the added value in processing, specialty materials have a much wider, multi-state distribution area due to their higher value relative to their distribution costs as compared to natural and recycled aggregates. We compete with specialty materials producers nationwide.

For trench shields and shoring products, our customers are equipment rental dealers and commercial, residential, and industrial contractors. We compete with shoring products manufacturers nationwide.

Raw Material and Suppliers

The primary raw material for our natural aggregates and specialty materials comes from quarries. Natural aggregates and specialty materials can be found throughout the U.S. We have a proven and successful record of securing long-term reserve positions for both current and future mine locations through our employment of exploration teams and the use of professional third parties. Our reserves are critical to our raw material supply and long-term success. We currently estimate that we have 1.2 billion tons of proven and probable natural aggregates and specialty materials reserves strategically located in favorable markets that are expected to require large amounts of aggregates to meet future construction demand. For further discussion of our natural aggregates and specialty materials reserves, please refer to Item 2. “Properties.”

Recycled aggregates are not dependent on reserves and the primary raw material is demolished concrete which is processed into recycled aggregates. We source raw material both internally and externally primarily from demolition and road removal projects. We control a portion of our raw material needs through demolition services that we provide, and we source the remainder in competitive markets from third parties. Due to increasing landfill scarcity, the acceptance of demolished concrete may be restricted, increasing the availability of raw product at our crushing locations. In certain markets, we are paid a fee to accept raw product. Our competitive advantages include our operating permits, which allow recycling activities, and the strategic location of our stationary crushing sites.

Engineered Structures.

Products

Through wholly owned subsidiaries, our Engineered Structures segment primarily manufactures and sells steel structures for infrastructure businesses, including utility structures for electricity transmission and distribution, structural wind towers, traffic structures, and telecommunication structures. These products share similar manufacturing competencies and steel sourcing requirements and can be manufactured across our North American footprint. This segment also historically manufactured and sold storage and distribution tanks. See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for revenues attributable to our Engineered Structures products.

•Utility Structures: We are a well-established manufacturer in the U.S. and Mexico of engineered steel utility structures, including tapered steel, lattice, and sub-station structures, for electricity transmission and distribution. We also manufacture pre-stressed concrete poles for utility, lighting, transportation, and telecommunications markets. We have six manufacturing plants in the U.S. and Mexico dedicated to steel structures. We have two manufacturing plants in the U.S. dedicated to concrete structures, including a new plant in Florida that was completed in December 2023.

•Wind Towers: We are one of the leading manufacturers of structural wind towers in the U.S. and Mexico with three manufacturing plants strategically located in wind-rich regions of North America. In March 2023, we began construction of a new wind tower plant in New Mexico to support the growing wind investment in the Southwest.

•Traffic Structures: We manufacture steel traffic structures for use in the U.S. highway and road system primarily serving Florida and adjacent states. Our products include overhead steel sign structures, tolling gantry structures, mast and sign arms, and other custom solutions. We have one dedicated manufacturing plant in Florida and have the capability to manufacture traffic structures in our other Engineered Structures plants.

•Telecommunication Structures: We manufacture telecom structures, including self-supporting lattice towers, monopole towers, and guyed towers. We have one manufacturing plant in Oklahoma and have the capability to manufacture telecom structures in our other Engineered Structures plants.

In October 2022, we completed the sale of our storage tanks business.

Markets

Our Engineered Structures segment serves a broad spectrum of infrastructure markets, including electricity transmission and distribution, wind power generation, highway road construction, and wireless communication. We believe we are well-positioned to benefit from significant upgrades in the electrical grid to support enhanced reliability, policy changes encouraging more generation from renewable energy sources, the expansion of new transmission, distribution, and telecommunication infrastructure, and the replacement and growth of the U.S. highway and road system.

Our utility structures business is well-positioned to benefit from significant investment in utility infrastructure. There is strong demand for transmission and distribution structures across the U.S. as much of the utility infrastructure has aged and needs replacement. Global concerns regarding emissions have increased consumer demand for electricity. Upgrades to utility structures are needed to support larger equipment that is required to withstand growing load demand and to allow for connectivity of the grid to renewable energy sources. The IIJA authorized $73 billion in additional federal funding to support the investment needed in the U.S. power grid.

We believe our traffic structures business is well-positioned to benefit from public infrastructure spending in Florida and adjacent states, and has opportunities to grow organically into new geographies as well. Additionally, we expect to benefit from continued spending on the buildout of 5G and other wireless networks in North America within our telecommunication structures business. We anticipate that the IIJA will continue to be beneficial for these businesses as well due to the increased level of highway spending and the provision for $65 billion in federal funding for broadband infrastructure.

Demand for new wind energy projects in the U.S. has been supported by the Renewable Electricity Production Tax Credit (“PTC”) that was first introduced in 1992, providing a tax credit for electricity produced at each qualifying wind project. Since inception, the PTC has undergone numerous extensions and received varying levels of legislative support, contributing to volatility in the demand for new wind energy installations. Following a multi-year extension in 2015 and a series of annual extensions in 2020 and 2021, the PTC expired at the end of 2021 creating a lapse in support for new wind farm projects beginning in 2022. In August 2022, the Inflation Reduction Act (“IRA”) passed, providing a long-term extension of the PTC for new wind farm projects and introduced a new Advanced Manufacturing Production (“AMP”) tax credit for companies that domestically manufacture and sell clean energy equipment in the U.S. from 2023 to 2032. The wind industry is currently awaiting finalization of the IRA's tax credit rules from the Internal Revenue Service (“IRS”). We believe these tax incentives provide a significant multi-year catalyst for our wind towers business, as demonstrated by more than $1.1 billion of new orders for delivery through 2028 we have received since the passage of the IRA. Together with the increased cost competitiveness of wind energy, state renewable fuel mandates, and increasing business acceptance of long-term decarbonization goals, we believe we are well-positioned to benefit from these wind energy incentives.

Customers and Competitors

Through our recognized brands in our utility structures business, we have developed strong relationships with our primary customers, public and private utilities. We compete with both domestic and foreign manufacturers on the basis of product quality, engineering expertise, customer service, and on-time delivery of the product. Sales to our customers, particularly certain large utility customers, are often made through alliance contracts that can extend several years. We also sell into the competitive-bid market, whereby the lowest bidder is awarded the contract, provided all other qualifying criteria are met.

Within our wind towers business, our primary customers are wind turbine producers. We compete with both domestic and foreign producers of towers. Revenues from GE Renewable Energy (“GE”) included in our Engineered Structures segment constituted 8.1%, 9.3%, and 9.5% of consolidated revenues for the years ended December 31, 2023, 2022, and 2021, respectively.

Our traffic structures business primarily sells to individual state Departments of Transportation and highway contractors typically in a competitive-bid market.

Our telecom structures business sells to wireless communication carriers and third-party tower lessors and developers.

Raw Materials and Suppliers

The principal material used in our Engineered Structures segment is steel. During 2023, the supply of steel was sufficient to support our manufacturing requirements. Overall steel prices began to rise sharply in late 2020, reaching record levels in 2021. While hot rolled coil prices normalized to more historic levels during 2022, plate steel prices reached new highs. In 2023, pricing for hot rolled coil was volatile while plate steel prices remained elevated, with a slight decline throughout the year. Steel prices may be volatile in the future in part as a result of market conditions. We use contract-specific purchasing practices, existing supplier commitments, contractual price escalation provisions, flexing between steel type, and other arrangements with our customers to mitigate the effect of steel price volatility on our operating profit for the year. Arcosa’s manufacturing operations also use component parts such as flanges for wind towers. In general, we believe there is enough capacity in the supply industries to meet current production levels without any material impacts. We anticipate our existing contracts and other relationships with multiple suppliers will meet our current production forecasts.

Transportation Products.

Products

Through wholly owned subsidiaries, our Transportation Products segment manufactures and sells inland barges, fiberglass barge covers, winches, marine hardware, and steel components for railcars and other transportation and industrial equipment. See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for revenues attributable to inland barges and steel components products.

•Inland Barges: We have a leading position in the U.S. market for the manufacture of inland barges and fiberglass barge covers. We manufacture a variety of hopper barges, tank barges, deck barges, other specialized barges, and fiberglass covers, and provide a full line of deck hardware to the marine industry, including hatches, castings, and winches for barges, towboats, and dock facilities. Dry cargo barges transport various commodities, such as grain, coal, and aggregates. Tank barges transport liquids, including refined products, chemicals, and a variety of petroleum products. Deck barges are used for transportation of heavy, oversized cargo and construction support. Our fiberglass reinforced lift covers are used primarily for grain barges.

•Steel Components: We are a recognized manufacturer of steel components for railcars and other transportation equipment. We manufacture axles, circular forgings, and coupling devices for freight, tank, locomotive, and passenger rail transportation equipment, as well as other industrial uses, and provide cast components for use in the industrial and mining sectors.

Markets

Our Transportation Products segment consists of established companies that supply manufactured steel products to the transportation industry.

Our inland barge business serves numerous end-markets through a base of established customers who support the transportation of staple commodities such as grain, coal, aggregates, chemicals, fertilizers, petrochemicals, and refined products. Despite recent declines, the dry and liquid barge replacement cycles are expected to remain fundamentally strong as investments in the aging barge fleet over the last 5 to 6 years have been below long-term average replacement rates (with the exception of 2019 for liquid barges). Approximately 40% of the hopper fleet and 25% of the tank fleet are more than 20 years old. The replacement of these fleets is expected to drive healthy demand based on an assumed 25 to 30-year useful life. In the dry barge industry, scrapping has exceeded new builds since 2016 suggesting a strong deferred replacement cycle that we expect will be supported by a recovery in agriculture once plate steel prices normalize after increasing sharply over the last two years. The liquid barge industry is poised to benefit from expected growth in the U.S. petrochemical industry and difficulty in new pipeline permitting and construction.

Our steel component business primarily serves the North American railcar industry, both the new car and maintenance markets, as well as various mining and industrial markets. Demand for steel components is increasing relative to cyclical lows in 2020 and 2021 as the outlook for the new railcar market has improved and reflects a stable level of replacement demand.

Customers and Competitors

Our barge manufacturing facilities are located along the U.S. inland river systems, which allows for rapid delivery to our customers. Our inland barge customers are primarily commercial marine transportation companies, lessors, and industrial shippers. While we compete with several other manufacturers in the U.S., we hold a majority share of the inland barge manufacturing market. We believe we are well-positioned to benefit from the expected fleet replacement cycle in both dry and liquid barges.

Our customers for our steel components businesses are primarily freight and passenger railcar manufacturers, rail maintenance and repair facilities, railroads, steel mills, and mining equipment manufacturers. We compete with both domestic and foreign manufacturers.

Raw Materials and Suppliers

The principal material used in our Transportation Products segment is steel. During 2023, the supply of steel was sufficient to support our manufacturing requirements. Overall steel prices began to rise sharply in late 2020, reaching record levels in 2021. While hot rolled coil prices normalized to more historic levels during 2022, plate steel prices reached new highs. In 2023, pricing for hot rolled coil was volatile, while plate steel prices remained elevated, with a slight decline throughout the year. Steel prices may be volatile in the future in part as a result of market conditions. We use contract-specific purchasing practices, existing supplier commitments, contractual price escalation provisions, flexing between steel type, and other arrangements with our customers to mitigate the effect of steel price volatility on our operating profit for the year. Arcosa’s manufacturing operations also use component parts such as pumps, engines, and hardware for tank barges. In general, we believe there is enough capacity in the supply industries to meet current production levels without any material impacts. We anticipate our existing contracts and other relationships with multiple suppliers will meet our current production forecasts.

Unsatisfied Performance Obligations (Backlog). As of December 31, 2023 and 2022, our backlog of firm orders was as follows:

| | | | | | | | | | | | | | |

| | December 31, 2023 | | December 31, 2022 |

| | | | |

| | (in millions) |

| Engineered Structures: | | | | |

| Utility, wind, and related structures | | $ | 1,367.5 | | | $ | 671.3 | |

| Transportation Products: | | | | |

| Inland barges | | $ | 253.7 | | | $ | 225.1 | |

Approximately 43% of the unsatisfied performance obligations for our utility, wind, and related structures in our Engineered Structures segment is expected to be delivered during 2024, approximately 27% is expected to be delivered during 2025, and the remainder is expected to be delivered through 2028. All of the unsatisfied performance obligations for inland barges in our Transportation Products segment are expected to be delivered during the year ending 2024.

Marketing. We sell substantially all of our products and services through our own sales personnel operating from offices in multiple locations in the U.S. and Mexico. We also use independent sales representatives and distributors.

Human Capital. The Company employed approximately 6,075 employees as of December 31, 2023. The following table presents the approximate headcount breakdown of employees by segment:

| | | | | |

| December 31, 2023 |

| Construction Products | 2,040 | |

| Engineered Structures | 2,775 | |

| Transportation Products | 1,150 | |

| Corporate | 110 | |

| 6,075 | |

As of December 31, 2023, approximately 4,795 employees were employed in the U.S., 1,260 employees in Mexico, and 20 employees in Canada.

Employee Health and Safety.

Arcosa is committed to safety across our operations. Our highest priority is the health and safety of our employees. We strive to continuously improve our procedures, processes, and management systems with regard to employee health and safety. These efforts are achieved by promoting safe work practices among employees and contractors and maintaining property and equipment in safe operating conditions.

In 2019, we launched a reenergized safety initiative, ARC 100, to build a positive and proactively engaged culture of safety excellence. ARC 100 is inspired by the voices of frontline employees, driven by cross-functional teams, and actively supported by visible commitment from senior leaders. Since its implementation, Arcosa has experienced progress in reducing the severity and frequency of safety incidents as a result of a continued focus on building a strong safety culture through its ARC 100 safety initiative. Arcosa continued to make advancements in our safety culture with various ARC 100 initiatives across the Company, including:

•Refreshed new hire orientation content to promote employee engagement in ARC 100;

•Expansion of safety culture awareness training for all employees;

•Development of leading indicators; and

•Implementation of safety training management system.

These initiatives, as well as many others implemented at Arcosa sites, assist in building a strong safety culture, driven by engaged employee and management teams.

Diversity and Inclusion.

Arcosa values diversity and inclusion within its workforce and is committed to a work environment which promotes professionalism and inclusiveness. One of Arcosa’s core values is “We Win Together”. This belief drives our commitment to a workplace free from discrimination where collaboration, dedication, and unity align to drive favorable results for all stakeholders.

Talent Attraction and Management.

Arcosa believes that its future success is highly dependent upon the Company’s continued ability to attract, retain, and motivate qualified employees. As part of the Company’s effort to attract and motivate employees, Arcosa offers competitive compensation and benefits, including healthcare and retirement benefits, parental and family leave, and holiday and paid time off.

Launched in September 2022, Arcosa's LEAD: Leadership Exploration and Development cohort continued its development track in 2023. Over the course of the program, more than half of the participants received promotions into plant leadership roles. This formal employee development program was created to help identify internal talent, provide skill and competency growth opportunities, and build a deep bench of emerging leaders at the Company.

Arcosa fosters employee development through a variety of leadership and training programs, like LEAD, as well as tuition reimbursement at education institutions, professional society memberships, and relevant conference and symposia attendance.

Seasonality. Results in our Construction Products segment are affected by seasonal fluctuations with the second and third quarters historically being the quarters with the highest revenues.

Intellectual Property. Arcosa owns several patents, trademarks, copyrights, trade secrets, and licenses to intellectual property owned by others. Although Arcosa’s intellectual property rights are important to Arcosa’s success, we do not regard our business as being dependent on any single patent, trademark, copyright, trade secret, or license. For a discussion of risks related to our intellectual property, please refer to Item 1A. “Risk Factors - Risks Related to Technology and Cybersecurity.”

Governmental Regulation.

Construction Products. Arcosa’s Construction Products segment is subject to regulation by the U.S. Mine Safety and Health Administration (“MSHA”), the Health-Safety and Reclamation Code of Ministry of Mines for British Columbia, and various state agencies, and certain specialty materials are regulated by the U.S. Food and Drug Administration (“FDA”).

Engineered Structures. Arcosa’s Engineered Structures segment is subject to the regulations of various state departments of transportation. These agencies promulgate and enforce rules and regulations pertaining, in part, to the manufacture of traffic structures.

Transportation Products. The primary regulatory and industry authorities involved in the regulation of the inland barge industry are the U.S. Coast Guard, the U.S. National Transportation Safety Board, the U.S. Customs Service, the Maritime Administration of the U.S. Department of Transportation ("USDOT"), and private industry organizations such as the American Bureau of Shipping. These organizations establish safety criteria, investigate vessel accidents, and recommend improved safety standards.

Our steel components businesses that serve the railcar industry are regulated by governmental agencies such as the USDOT and the administrative agencies it oversees, including the Federal Railroad Administration, and industry authorities such as the Association of American Railroads. All such agencies and authorities promulgate rules, regulations, specifications, and operating standards affecting rail-related safety standards for railroad equipment.

Occupational Safety and Health Administration and Similar Regulations. In addition to the regulations described above, our operations are subject to regulation of health and safety matters by the U.S. Occupational Safety and Health Administration (“OSHA”) and, within our Construction Products segment, MSHA. We believe that we employ appropriate precautions to protect our employees and others from workplace injuries and harmful exposure to materials handled and managed at our facilities. However, claims that may be asserted against Arcosa for work-related illnesses or injuries and the further adoption of occupational and mine safety and health regulations in the U.S. or in foreign jurisdictions in which we operate could increase our operating costs. While we do not anticipate having to make material expenditures in order to remain in substantial compliance with health and safety laws and regulations, we are unable to predict the ultimate cost of compliance.

International Regulations. We ship raw materials to Mexico and manufacture products in Mexico that are sold in the U.S. or elsewhere, which are subject to customs and other regulations. In addition, we are subject to other governmental regulations and authorities in Mexico and other countries where we conduct business that regulate products manufactured, sold, or used in those countries.

Environmental, Health, and Safety. We are subject to federal, state, and international environmental, health, and safety laws and regulations in the U.S., Mexico, and each country in which we operate, including regulations promulgated by the U.S. Environmental Protection Agency (“USEPA”). These include laws regulating air emissions, water discharge, hazardous materials, and waste management. We have an environmental management structure designed to facilitate and support our compliance with these requirements globally. Although it is our intent to comply with all such requirements and regulations, we cannot provide assurance that we are at all times in compliance. Environmental requirements are complex, change frequently, and have tended to become more stringent over time. Accordingly, we cannot assure that environmental requirements will not change or become more stringent over time or that our eventual environmental costs and liabilities will not be material.

Certain environmental laws assess liability on current or previous owners or operators of real property for the cost of removal or remediation of hazardous substances. At this time, we are involved in various stages of investigation and cleanup related to environmental remediation matters at certain of our facilities. In addition, soil or groundwater contamination may be present at several of our properties as a result of historical, ongoing, or nearby activities.

We cannot ensure that our eventual environmental remediation costs and liabilities will not exceed the amount of our current reserves. In the event that such liabilities were to significantly exceed the amounts recorded, our results of operations could be materially adversely affected. See “Critical Accounting Policies and Estimates” in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 15 of the Consolidated Financial Statements for further information regarding reserves for environmental matters.

See Item 1A for further discussion of risk factors with regard to environmental, governmental, and other matters.

Information About Our Executive Officers. The following table sets forth the names and ages of all our executive officers, their positions and offices presently held by them, and the year each person first became an officer.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Office | | Officer Since |

| Antonio Carrillo | | 57 | | President and Chief Executive Officer | | 2018 |

| Gail M. Peck | | 56 | | Chief Financial Officer | | 2018 |

| Reid S. Essl | | 42 | | Group President | | 2018 |

| Kerry S. Cole | | 55 | | Group President | | 2018 |

| Jesse E. Collins, Jr. | | 57 | | Group President | | 2018 |

| Bryan P. Stevenson | | 50 | | Chief Legal Officer | | 2018 |

| Eric D. Hurst | | 40 | | Vice President, Controller | | 2023 |

| | | | | | |

Antonio Carrillo serves as Arcosa’s President and Chief Executive Officer, as well as a member of Arcosa's Board of Directors. From April 2018 until November 2018, Mr. Carrillo served as the Senior Vice President and Group President of Construction, Energy, Marine and Components of Trinity Industries, Inc. ("Trinity"). From 2012 to February 2018, Mr. Carrillo served as the Chief Executive Officer of Orbia Advance Corporation (formerly known as Mexichem S.A.B. de C.V.), a publicly traded global specialty chemical company. Prior to joining Orbia, Mr. Carrillo spent 16 years at Trinity where he served as Senior Vice President and Group President of Trinity’s Energy Equipment Group and was responsible for Trinity’s Mexico operations. Mr. Carrillo previously served as a director of Trinity from 2014 until 2018 and served as a director of Dr. Pepper Snapple Group, Inc. from 2015 to 2018. Mr. Carrillo currently serves as a director of NRG Energy, Inc. where he was appointed in 2019.

Gail M. Peck was appointed as Arcosa’s Chief Financial Officer in May 2021. Previously, she served as the Senior Vice President, Finance and Treasurer at Arcosa. From 2010 until 2018, Ms. Peck served as Vice President, Finance and Treasurer of Trinity. From 2004 to 2009, she served as Vice President and Treasurer for Centex Corporation, a diversified building company.

Reid S. Essl serves as a Group President at Arcosa. From 2016 until 2018, Mr. Essl served as the President of Trinity Construction Materials and from 2013 to 2016, Mr. Essl served as the Group Chief Financial Officer of the Construction, Energy, Marine, and Components businesses of Trinity. In his 14 years at Trinity, Mr. Essl held a variety of operational, financial, strategic planning, and business development positions.

Kerry S. Cole serves as a Group President at Arcosa. From 2016 until 2018, Mr. Cole served as President of Trinity Electrical Products which included oversight for the Trinity Structural Towers and Trinity Meyer Utility Structures business units. Prior to this role, Mr. Cole served as President of Trinity Structural Towers business unit from 2007 to 2016. From 2000 to 2007, he served in a variety of operations and manufacturing leadership positions at Trinity spanning Mining and Construction Equipment, Heads, and Structural Bridge business units.

Jesse E. Collins, Jr. serves as a Group President at Arcosa. From 2016 until 2018, Mr. Collins served as the President of Trinity Parts and Components, which included McConway & Torley, Standard Forged Products, and the business of McKees Rocks Forgings. From 2014 to 2016, he served as President of Trinity Cryogenics. From 2008 to 2013, Mr. Collins served as Executive Vice President and Chief Operating Officer at Broadwind Energy serving wind energy, transportation, and infrastructure markets, prior to which he held various management and executive positions at Trinity from 1993 to 2007.

Bryan P. Stevenson serves as the Chief Legal Officer at Arcosa. From 2015 until 2018, Mr. Stevenson was the Vice President, Associate General Counsel and Corporate Secretary for Trinity. Prior to joining Trinity, Mr. Stevenson was Vice President, General Counsel and Secretary for CarParts, Inc. (formerly known as U.S. Auto Parts Network, Inc.), an online provider of automotive parts, from 2011 to 2015.

Eric D. Hurst has served as Arcosa's Corporate Controller since 2018 and was appointed Vice President, Controller in 2021 and Principal Accounting Officer in 2023. From 2012 until 2018, Mr. Hurst held several roles at Trinity, including Director of Leasing Analysis and Director of Technical Accounting. From 2006 to 2012, Mr. Hurst worked in the audit practice of Ernst & Young.

Item 1A. Risk Factors.

Arcosa's business, liquidity and financial condition, results of operations, and stock price may be impacted by a number of factors. In addition to the factors discussed elsewhere in this report, the following risks and uncertainties could materially harm its business, liquidity and financial condition, results of operations, or stock price, including causing its actual results to differ materially from those projected in any forward-looking statements. The following list of material risk factors is not all-inclusive or necessarily in order of importance. Additional risks and uncertainties not presently known to Arcosa or that it currently deems immaterial also may materially adversely affect it in future periods.

Risks Related to our Business and Operations.

The seasonality of Arcosa's business and its susceptibility to severe and prolonged periods of adverse weather and other conditions could have a material adverse effect on us.

Demand for Arcosa's products in some markets is typically seasonal, with periods of snow or heavy rain negatively affecting construction activity. For example, sales of Arcosa's products are somewhat higher from spring through autumn when construction activity is greatest. Construction activity declines in these markets during the winter months in particular due to inclement weather, frozen ground, and fewer hours of daylight. Construction activity and Arcosa's ability to deliver products on time or at all to its customers can also be affected in any period by public holidays, vacation periods, and adverse seasonal weather conditions such as extreme temperature, hurricanes, severe storms, torrential rains and floods, low river levels, and similar events, any of which could reduce demand for Arcosa's products, push back existing orders to later dates or lead to cancellations.

Additionally, the seasonal nature of Arcosa's business has led to variation in Arcosa's quarterly results in the past and is expected to continue to do so in the future. This general seasonality of Arcosa's business and any severe or prolonged adverse weather conditions or other similar events could have a material adverse effect on Arcosa's business.

Delays in construction projects and any failure to manage Arcosa’s inventory could have a material adverse effect on us.

Many of Arcosa’s products are used in large-scale projects which generally require a significant amount of planning and preparation and which can be delayed and rescheduled for a number of reasons, including customer labor availability, difficulties in complying with environmental and other government regulations or obtaining permits, financing issues, changes in project priorities, additional time required to acquire rights-of-way or property rights, unanticipated soil conditions, or health-related shutdowns or other work stoppages. These delays may create unplanned downtime, increasing costs and inefficiencies in Arcosa’s operations, and increased levels of excess inventory.

Additionally, Arcosa maintains an inventory of certain products that meet standard specifications and are ultimately purchased by a variety of end users. Arcosa forecasts demand for these products to ensure that it keeps sufficient inventory levels of certain products that Arcosa expects to be in high demand and limits its inventory for which Arcosa does not expect much interest. However, Arcosa’s forecasts are not always accurate and unexpected changes in demand for these products, whether because of an unexpected delay, a change in preferences or otherwise, can lead to increased levels of excess inventory. Any delays in construction projects and Arcosa’s customers’ orders or any inability to manage Arcosa’s inventory could have a material adverse effect on Arcosa's business.

Arcosa operates in highly competitive industries. Arcosa may not be able to sustain its market positions, which may impact its financial results.

Arcosa faces intense competition in all geographic markets and each industry sector in which it operates. In addition to price, Arcosa faces competition with respect to product performance and technological innovation, substitution, quality, reliability of delivery, customer service, and other factors. If Arcosa is unable to successfully compete or if the cost of successfully competing is significant, the effects of such competition, which is often intense, could reduce Arcosa’s revenues and operating profits, limit Arcosa’s ability to grow, increase pricing pressure on Arcosa’s products, and otherwise affect Arcosa’s financial results.

Arcosa's inability to deliver its backlog on time could affect its revenues, future sales and profitability and its relationships with customers.

At December 31, 2023, Arcosa's backlog was approximately $1.4 billion within our Engineered Structures and $253.7 million within our Transportation Products segments. Arcosa's ability to meet customer delivery schedules for backlog is dependent on a number of factors including, but not limited to, sufficient manufacturing plant capacity, adequate supply channel access to raw materials and other inventory required for production, an adequately trained

and capable workforce, engineering expertise, and appropriate planning and scheduling of manufacturing resources. We may also encounter capacity limitations due to changes in demand despite our forecasting efforts. Some of the contracts we enter into with our customers, such as for barges, traffic structures and wind towers, require long manufacturing lead times and contain penalty clauses or liquidated damages provisions related to late delivery. Failure to deliver in accordance with contract terms and customer expectations could subject us to financial penalties, damage existing customer relationships, increase our costs, reduce our sales and have a material adverse effect on Arcosa's business.

Arcosa depends on its key management employees, and Arcosa may not be able to retain their services in the future.

Arcosa’s success depends on the continued services of its executive team and key management employees, none of whom currently have an employment agreement with Arcosa. Arcosa may not be able to retain the services of its executives and key management in the future. The loss of the services of one or more executives or key members of Arcosa’s management team, or Arcosa’s inability to successfully develop talent for succession planning, could result in increased costs associated with attracting and retaining a replacement and could disrupt Arcosa’s operations and result in a loss of revenues.

The inability to hire and retain skilled or professional labor could adversely impact Arcosa’s operations.

Arcosa depends on professional labor across its businesses and skilled labor in the manufacture, maintenance, and repair of Arcosa’s products. Some of Arcosa’s facilities are located in areas where demand for skilled laborers, such as welders, complex machine operators, and equipment maintenance workers, may exceed supply. Arcosa competes for such personnel with other companies, including public and private company competitors who may periodically offer more favorable terms of employment. If Arcosa is unable to hire and retain these skilled laborers, Arcosa may be limited in its ability to maintain or increase production rates and costs to replace or retain skilled laborers may increase.

Failure to maintain safe work sites could result in losses, which could adversely affect our business and reputation.

Our operational sites include mining, processing and manufacturing facilities, where our employees and others are often in close proximity with mechanized equipment, moving vehicles, chemical substances, and dangerous manufacturing processes or natural conditions. Sites such as these are subject to potentially dangerous workplace risks. For example, Arcosa operates an underground limestone mine in Pennsylvania, which involves unique potential safety risks and hazards inherent to underground mining operations. Safety is a primary focus of our business and is critical to our reputation and performance. Unsafe work conditions, or any perceived failure to protect the health and safety of our employees, can also increase employee turnover, which increases our overall operating costs. If we fail to implement effective safety procedures, our employees and others could be injured, the completion of a project could be delayed, or we could be exposed to investigations and possible litigation, which may be significant. Our failure to maintain adequate safety standards through our safety programs could also result in reduced profitability or the loss of customers.

Some of Arcosa’s employees belong to labor unions and strikes or work stoppages could adversely affect Arcosa’s operations.

Arcosa is a party to collective bargaining agreements with various labor unions at some of Arcosa’s operations in the U.S. and Canada and all of Arcosa’s operations in Mexico. Disputes with regard to the terms of these agreements or Arcosa’s potential inability to negotiate acceptable contracts with these unions in the future could result in, among other things, strikes, work stoppages, or other slowdowns by the affected workers and Arcosa could experience a significant disruption of its operations and higher ongoing labor costs. In addition, Arcosa could face higher labor costs in the future as a result of severance or other charges associated with lay-offs, shutdowns, reductions in the size and scope of its operations or difficulties of restarting Arcosa’s operations that have been temporarily shuttered. Negative publicity, work stoppages, or strikes by unions could have a material adverse effect on Arcosa's business.

Equipment failures or other material disruption at one or more of Arcosa’s manufacturing facilities or other facilities or in Arcosa’s supply chain could have a material adverse effect on us. In some instances, Arcosa relies on a limited number of suppliers for certain raw materials, parts, and components needed in its production.

Arcosa owns and operates manufacturing facilities of various ages and levels of automated control and relies on a number of third parties as part of Arcosa’s supply chain, including for the efficient distribution of products to Arcosa’s customers. Any disruption at one of Arcosa’s manufacturing facilities or within Arcosa’s supply chain could prevent Arcosa from meeting demand or require Arcosa to incur unplanned capital expenditures. In addition, some of the

equipment that Arcosa operates is old and some is highly technical. Both older equipment and more complex equipment may break down, resulting in unplanned downtime. Any unplanned downtime at Arcosa’s facilities may cause delays in meeting customer timelines, result in liquidated damages claims, or cause Arcosa to lose or harm customer relationships.

Arcosa's manufacturing operations partially depend on Arcosa's ability to obtain timely deliveries of raw materials, parts, and components in acceptable quantities and quality from Arcosa's suppliers. Certain raw materials, parts, and components for Arcosa's products are currently available from a limited number of suppliers and, as a result, Arcosa may have limited control over pricing, availability, and delivery schedules. If Arcosa is unable to purchase a sufficient quantity of raw materials, parts, and components on a timely basis, Arcosa could face disruptions in its production and incur delays while it attempts to engage alternative suppliers. Fewer suppliers could require Arcosa to source unproven and distant supply alternatives. In addition, meeting certain production demands is dependent on Arcosa's ability to obtain a sufficient amount of steel. An unanticipated interruption in Arcosa's supply chain could have an adverse impact on both Arcosa's margins and production schedules. Any such disruption or supply shortage could harm Arcosa's business.

Furthermore, any shortages in trucking, rail, barge, or container shipping capacity, any increase in the cost thereof, or any other disruption to those transportation systems could limit Arcosa’s ability to deliver its products in a timely manner or at all. Any material disruption at one or more of Arcosa’s facilities or those of Arcosa’s customers or suppliers or otherwise within Arcosa’s supply chain, whether as a result of downtime, facility damage, an inability to deliver Arcosa’s products or otherwise, could prevent Arcosa from meeting demand, require Arcosa to incur unplanned capital expenditures, or cause other material disruption to Arcosa’s operations, any of which could have a material adverse effect on Arcosa’s business.

Extensive damage to Arcosa’s facilities, including as a result of natural disasters or similar incidents, could lead to production, delivery or service curtailments or shutdowns, loss of revenue or higher expenses.